Comparative Analysis of SBI and PNB Banks Using Compound

Annual Growth Rate

Shipra Gupta, Vijay Kumar, Vishal Sagar

and Kapil Ahalawat

Graphic Era Hill University, Dehradun, Uttrakhand, India

Keywords: Compound Annual Growth Rate, Sbi, Pnb, Financial Performance, Comparative Analysis, Banking Sector.

Abstract: Banking is the backbone of economies, and therefore banking performance is a critical issue. Banks are not

only vital for a monetary system to enhance the flow of money, but they are also directly responsible for credit

allocation, interest rate determination, and the overall creation of money in a monetary system. With 86,311

operational bank branches and 1,37,113 ATMs in the country till March 2021, India has a large banking sector.

This sector is highly regulated, and the regulator is the Reserve Bank of India (RBI) which mandates the

formulation and disclosure of various ratios that are used to assess the health of a bank. In this often-requested

analysis, we evaluate and compare the financial performance of the most important bank of India — State

Bank of India (SBI); to that of the less prominent Punjab National Bank (PNB). The analysis includes the

comparison of the growth trends of SBI and PNB over nine years that ended with the year for which the

numbers could be found for both banks. Because the only method available for the comparison of growths of

all such numbers is the Compound Annual Growth Rate (CAGR) method, we compared their CAGR over the

said period which was for the revenue, net income, total assets, and total liabilities. This evaluation is carried

out using the most recent five years of the annual reports of SBI and PNB, i.e., 2019-2023. Different ratios

like basic EPS, ROA, net interest margin, operating profit margin, and ROCE for SBI and PNB over the

mentioned period are provided in the results. The results of this analysis lead the viewer into the financial

health and performance trajectory of SBI and PNB. The findings are discussed further in the Discussion

section, where the close or distant growth patterns of SBI and PNB are carefully discussed. The contribution

of factors like market dynamics, general economic conditions, and regulatory changes are analysed by the

authors next. Finally, the results can be drawn and the vital insight that these results lay bare regarding the

financial performance of SBI and PNB are duly highlighted. Quantitative methods like the CAGR in this case

must be more extensively adopted to understand the financial performance of banks which will also be useful

to investors, policymakers, and other stakeholders.

1 INTRODUCTION

The banking sector is an inevitable component in the

progress of an economy. The main actors in the

Indian Banking sector are the State Bank of India

(SBI) and Punjab National Bank (PNB). Both of these

banks have their individual characteristics, market

reach, and operational strategies. The assessment of

the performance credit of these banks is imperative

for a variety of stakeholders including investors,

policymakers, and others. One of the pivotal statistics

that highlights the financial performance and growth

path of the banks together is the Compound Annual

Growth Rate (CAGR) - Gupta, S, et al., (2019). It

represents a standard rate-of-growth over events; and

is an imaginary number that infers a consistent price

of growth over a specific time frame, i.e., it does not

infer that the investment increased, say, at any time

quicker after it expanded slower in the interim.

In this comparative case study, we will dig out the

CAGR figures of SBI, and PNB banks over a

specified time horizon. We will ostensibly rustle the

overall current of their growth paths employing the

assistance of CAGR. This will deliver knowledge into

how these moves have been executed in the eternity

past and that will be get-at-able to guess about how

their CAGR is running file can be made to judge

where their CAGR stands and make the level best

judgments about their prospects. In our financial

analysis, we will embrace a multitude of financial

parameters including particularly fundamental

earning per share, return on assets, net interest

Gupta, S., Kumar, V., Sagar, V. and Ahalawat, K.

Comparative Analysis of SBI and PNB Banks Using Compound Annual Growth Rate.

DOI: 10.5220/0012874500003882

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd Pamir Transboundary Conference for Sustainable Societies (PAMIR-2 2023), pages 519-523

ISBN: 978-989-758-723-8

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

519

margin, operating profit margin, and return on capital

employed, stamped-downing the banks' overall

growth and stability.

2 OBJECTIVES OF THE STUDY

There are two objectives of the study:

To calculate the compound annual growth

rate of different ratios from the 2019-23 time

period for both the banks SBI and PNB.

To compare the financial performance

between the two banks

3 LITERATURE REVIEW

Based on an in-depth analysis of CAGR facts on SBI

and PNB, the study endeavours to present a faithful

picture of relative performance and will provide

resources for more measured decisions in the rapidly

transforming banking sector.

The present literature review on comparative

analysis of SBI and PNB on Compound Annual

Growth Rate (CAGR), past origin through present

studies, articles, and research papers would

encompass the following - Aspal, P K, et al., (2014).

In the present literature review researcher would

include papers where CAGR is applied in bank

financial performance analysis. A wide range of

studies have employed CAGR to compare the growth

trajectories of different banks or financial institutions

- Mohiuddin, G (2014).

Current methodologies used in these papers. This

may encompass the process of data collection, criteria

used to select samples, and analytical techniques used

in calculating CAGR. Further, some of the studies

have also applied the method of financial report

analysis, databases covering annual reports, and

scholarly publications. Conducting a comprehensive

review of literature in these areas of research

knowledge researchers may begin to identify salient

issues, contested areas, and areas for further research

in comparative analysis of SBI and PNB using CAGR

- Thaddeus, E O, et al., (2012).

Clients in Malaysia's banking sector increasingly

prefer e-banking. This study attempts to examine the

adoption of electronic banking and the factors

influencing it. This report suggests that there are some

extremely positive arguments concerning the use of

e-banking in Malaysia. Clients' ease of access to the

Web, as well as their awareness of e-banking, appears

to be highly effective because they significantly alter

their behaviour - Gupta, S, et al., (2019).

Over the 2007-2011 period, the Gulf Cooperative

Council (GCC) states examined the price, revenue,

and efficiency aspects of 74 banks (47 conventional

and 27 Islamic banks) using the DEA approach; it was

discovered that revenue efficiency alone had

influenced the good profitability aspect of Islamic

banks. The US banking industry employs the

Stochastic Frontier Approach (SFA) to analyse the

production structure of both merged and non-merged

banks - Gupta, S (2012).

This study is conducted for Malaysian banks and

includes merged banks. The primary, technical,

locative, and mixed tolls have been determined, with

Middle Eastern banks accounting for 13%, 21%, and

30% of social waste - Gupta, S (2012).

The noise efficiency distributed itself throughout

the episodes is relevant in addition to 18% to 39%

provided by the coefficient of variety and the measure

of proficiency scrutinized is technical efficiency; the

efficiency safeguarded by the index is about 2.44%

and 1.79% in that order has improved, however, this

improvement is good performance uses under the

positive variety in the technical progress, while the

component - Marugan, V G (2012).

A distributive free approach was utilized to

analyse tax efficiency in a sector of Greek banks from

1993 to 1999. Differences in the scope of features

measuring tax efficiency are services that explain a

significant impact of bank characteristics such as

bank size, possession type, and market behaviour.

Scale economies in the Greek banking business

demonstrate their conclusions in the Greek banking

industry.

The CAMEL Model has been used to assess the

overall financial performance of selected large

private sector banks in India. The performance of

banks in India has analysed and approved two

monitoring models (Capital Adequacy, Asset

Quality, Earnings, Liquidity Ratio, Systems and

Controls) and CACS - Ally, Z (2013).

CAMS are an instant program to decide the

performance of banking sectors. A CAMEL stands

for C-Capital adequacy, A-Asset quality, M-

Management efficiency, E-Earnings, L-Liquidity

position, and S. The multiplied figure depicts the

overall performance of the banking sector, and this

method includes an analysis and examination of the

five most important parameters of banking

operations. The CAMELs consist of a series of

performance measurements that provide an overall

picture of the banks. The model includes five critical

PAMIR-2 2023 - The Second Pamir Transboundary Conference for Sustainable Societies- | PAMIR

520

parameters: capital adequacy, asset quality, and

management efficiency - Usman, A, et al., (2012).

The financial performance and total risk

management of a bank indicate its solvency and long-

term financial viability. The study was done to assess

the financial performance of Bangladesh's two

biggest banks, NCB and PCB. The financial

performance of any bank cannot be adequately

analysed using simply one ratio. Earnings per Share

are used to assess a bank's overall profitability since

a larger return to investors or shareholders encourages

them to invest in other entities with similar expected

returns. Earnings per share only consider profit from

capital spent; otherwise, all money available to

stockholders is free capital - Aspal, P K, et al., (2014).

Enough capital is sufficient to indicate that with

enough capital, the bank can grow. From another

perspective, having adequate net worth demonstrates

that it is capable of absorbing any financial crisis

without going bankrupt. The net worth ratio reveals

how much of the total assets are owned by the fund.

This ratio assesses the bank's solvency for timely

payment as well as other risks such as operational

risk, market risk, credit risk, and whether or not it is

cost-effective to prevent these risks, among others.

The profitability of commercial banks is assessed by

Return on Equity (ROE) and Net Interest Margin ratio

(NIM) - Mohiuddin, G (2014).

Leverage ratios are the greatest ratios for a bank

since they demonstrate how leverage ratios can be

advantageous in different public sector banks and

how they can be compared. During the current

scenario, customer happiness with service quality is

the key task everywhere. Customers' contentment

with service quality is compared between different

public and private sector banks in the Tirupati region

- Thaddeus, E O, et al., (2012).

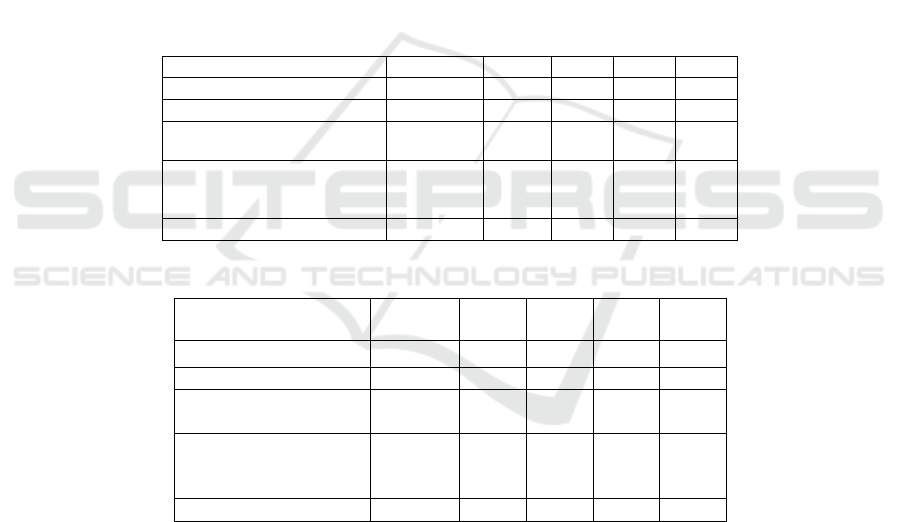

Table 1: SBI

Ratios name Year 2019 2020 2021 2022 2023

Basic EPS 0.97 16.23 22.87 35.49 56.29

ROA

(

%

)

0.02 0.36 0.45 0.63 0.91

Net Interest margin 2.40 2.48 2.44 2.42 2.62

Operating Profit Margin(%) -14.14 -11.94 -8.70 -3.22 4.10

ROCE(%) 0.0 1.79 1.64 1.42 1.59

Table 2. PNB

Ratios name Year

2019

2020 2021 2022 2023

Basic EPS -30.94 0.62 2.08 3.16 2.28

ROA(%) -1.28 0.04 0.16 0.26 0.17

Net Interest margin 2.21 2.09 2.41 2.18 2.35

Operating Profit

Margin(%)

-33.81 -

16.61

-

13.36

-

11.83

-

11.31

ROCE(%) 1.70 1.80 1.85 1.61 1.57

SBI

To calculate the Compound Annual Growth Rate

(CAGR) for each ratio of the State Bank of India

(SBI) from 2019 to 2023, the following formula is

used:

[ CAGR = \left( \dfrac{End Value}{Start Value}

\right)^{\dfrac{1}{n}} - 1 ]

Where:

Ending Value = Value of the ratio in 2023

Beginning Value = Value of the ratio in 2019

n = Number of years (2023 - 2019 = 4)

By the help of the above formula, CAGR for each

ratio is calculated.

Basic EPS: CAGR ≈ 97.00 %

ROA (%): CAGR ≈ 29.00%

Net Interest Margin: CAGR ≈ 2.39%

Operating Profit Margin (%): CAGR ≈ 171.00%

ROCE (%): CAGR ≈ 0.00%

Result and Discussion for SBI

State Bank of India Basic EPS is performing

positively as per the CAGR of approximately 97.00%

Comparative Analysis of SBI and PNB Banks Using Compound Annual Growth Rate

521

indicating a significant improvement in the earnings

per share within the period. ROA is also performing

well with a CAGR of about 29.00% showing the

efficiency of management in using its assets to

generate profits. Net Interest Margin is fair

considering it has an average CAGR of

approximately 2.39% which shows that the managing

ability in manipulating the interest income in relation

to the interest expenses is fair. The Operating Profit

Margin is on another level with the CAGR of about

171.00% above the performance as it shows

significant improvement in operational efficiency and

profitability. However, the returns on capital

employed, ROCE is poor with no growth at CAGR of

approximately 0.00%. These calculations provide

analytical information on the growth or decrease in

different financial ratios of SBI during the given

period. However, it is important to supplement these

trends with an extensive amount of financial and

contextual data to accurately evaluate an

organization’s performance and financial condition.

PNB

The formula to calculate the Compound Annual

Growth Rate of each ratio, from 2019 to 2023 of PNB

is as follows:

[CAGR = \left( \frac{Ending Value}{Beginning

Value} \right)^{\frac{1}{n}} - 1\]

Here Ending Value is the value of ratios at the end

of the period, which is 2023 in this case. While the

Beginning Value is the value at the beginning of the

period, 2019 in this case, and; n is the number of years

used to calculate the growth, which 2023-2019= 4

year, used to calculate CAGR with the help of the

above formula.

Basic EPS: CAGR ≈ 162.84%

ROA (%): CAGR ≈ 23.21%

Net Interest Margin: CAGR ≈ 2.87%

Operating Profit Margin (%): CAGR ≈ 42.48%

ROCE (%): CAGR ≈ -3.42%

Result and Discussion for PNB

However, the basic EPS of PNB bank has also

increased over the period with the higher CAGR at

around 162.84%. It means that earning per share is

increasing substantially. Likewise, the same pattern

can be seen in the ROA. ROA is the ability of a

company to generate profit relative to its total assets.

Therefore, PNB’s ROA has the CAGR of 23.21%.

This indicates that the firm was able to generate more

profit from each of its total assets. The net interest

margin had a CAGR of about 2.87; the increment was

minimal and showed a slightly improved

performance in terms of its ability to generate interest

income. Similarly, the operating profit margin

depicted an improved performance with a CAGR of

about 42.48. The company’s core operations have

been able to generate profits. On the other hand,

ROCE signified a negative CAGR of about -3.42; it

implies that the performance was negative. Hence, the

company was less efficient in generating a greater

return from the capital employed. The trend raises

concerns regarding the allocation strategies in terms

of capital or the operational performance of the

company.

4 CONCLUSION

In conclusion, the comparative results of the CAGR

for the State Bank of India and Punjab National Bank

within the specified period are summarized as

follows:

A CAGR of basic EPS of PNB has a dramatic

improvement within the period thus surpasses SBI in

this parameter.

ROA is struggling yet meeting the set target with

the CAGR in which case shows the efficiency of

management in using its assets to generate profits is

slightly poor than SBI.

SBI Net Interest Margin has increased modestly,

with a CAGR of approximately 2.39%, suggesting

stable performance in managing interest income

relative to interest expenses. While Net Interest

Margin has increased slightly more than SBI, with a

CAGR of approximately 2.87%, indicating stable

performance in managing interest income relative to

interest expenses.

Operating Profit Margin has exhibited exceptional

growth, with a CAGR of approximately 171.00%,

indicating significant improvement in operational

efficiency and profitability. While Operating Profit

Margin has grown at a lower rate compared to SBI,

with a CAGR of approximately 42.48%, indicating a

relatively slower improvement in operational

efficiency and profitability.

ROCE has shown no growth, with a CAGR of

approximately 0.00%, suggesting stagnant returns on

capital employed. While ROCE has experienced a

decline, with a negative CAGR of approximately -

3.42%, suggesting a decrease in returns on capital

employed, which could be a concerning trend.

Overall, both banks have shown significant

growth in earnings per share and return on assets,

indicating improved profitability and efficiency.

However, SBI has demonstrated exceptionally high

growth in operating profit margin, while PNB has

outperformed in terms of EPS growth. Nevertheless,

PAMIR-2 2023 - The Second Pamir Transboundary Conference for Sustainable Societies- | PAMIR

522

PNB's declining ROCE raises concerns about its

capital efficiency, which may require further analysis

and strategic adjustments.

REFERENCES

Gupta, S and Khanna, R (2019). Comparison of selected

public sector banks in different aspects by using CAGR

method, International Journal of Recent Technology

and Engineering, 8(2S12), 77-83.

Gupta, S (2012). Comparative analysis of per share ratio of

some selected Indian public sector banks, International

Journal of Research in Commerce, Economics and

Management, 2 (4), 89-96.

Gupta, S (2012). Analysis of leverage ratio in selected

Indian public sector banks, Asian Journal of

Management Research, 2 (4), 111- 120.

Marugan, V G (2012). Customer satisfaction with service

quality: An empirical study of public and private sector

banks in Triputi region. International Journal of

Research in Commerce & Management, 3 (1), 106-109.

Washington, D C Joint Forum, Credit Risk Transfer. Basel

Committee on banking supervision (2005).

Ally, Z (2013). Comparative Analysis of Financial

Performance of Commercial Banks in Tanzania.

Research Journal of Finance and Accounting 4, 133-

143.

Usman, A and Khan, MK (2012). Evaluating the financial

performance of Islamic and conventional banks of

Pakistan: A comparative analysis. International Journal

of Business and Social Science 3, 253-257.

Aspal, P K and Dhawan, S (2014). Financial performance

assessment of banking sector in India: A case study of

old private sector banks. The Business & Management

Review, 5, 1-196.

Mohiuddin, G (2014). Use of CAMEL Model: A Study on

Financial Performance of Selected Commercial Banks

in Bangladesh, Universal Journal of Accounting and

Finance 2, 151-160.

Thaddeus, E O and Chigbu, E E (2012). Analysis of Effect

of Financing Leverage on Bank Performance: Evidence

from Nigeria. Journal of Public Administration and

Governance 2, 178-187.

Comparative Analysis of SBI and PNB Banks Using Compound Annual Growth Rate

523