Empirical Analysis of Financial Inclusion: Case Study of Madhya

Pradesh and Chhattisgarh

Reshma Udhani

1

, Sunita Ramchandani

2

and Marrium Khan

1

1

Department of Business Management & Studies, IES University, Bhopal, M.P. 462044, India

2

Sant Hirdaram Institute of Management, Barkatullah University, Bhopal, India

Keywords: Financial Exclusion/Inclusion, Financial Services, Credit, Saving.

Abstract: The sustainable growth requires a holistic approach, where all members of the society grow equally. This

study compares two states—Madhya Pradesh and Chhattisgarh in an effort to analyze financial inclusion,

including the use of banking and other regulated products at an affordable price. To support the study, primary

data has been gathered from different rural areas in both states during 2023. Primary information was collected

from 200 households for each state. Financial inclusion is receiving attention from all around the world since

it has been identified as one of the main causes of poverty. The findings of the study show Madhya Pradesh

has performed a little better as compared to Chhattisgarh in making the population of the state financially

inclusive.

1 INTRODUCTION

Financial inclusion refers to offering conveniently

accessible and reasonably priced financial services to

commercial and retail clients who are shut out of the

system. The financial sector, which includes banks

and other financial organizations like the post office,

insurance providers, brokers, investment funds, and

so forth, is responsible for providing the majority of

financial services. Although there are many different

definitions of financial inclusion, the majority of

research focused on using basic banking services such

deposits, loans, microfinance, payment services,

money transfers, insurance, and financial literacy.

Madhya Pradesh, which has the 10th largest

economy in India, ranks 26th in terms of per capita

income, with an annual gross domestic product

(GDP) of $9.17 trillion (US$130 billion). The state's

growth rate for GDP is 8.22%. One of the Indian

states with the quickest rates of growth is thought to

be Chhattisgarh. With a GSDP per capita of

Rs.102,762, its Gross State Domestic

Product (GSDP) is currently *3.63 lakh crores.

Despite significant progress, many populations in

these states remain underserved by formal financial

institutions due to geographical remoteness,

inadequate infrastructure, low literacy rates, and

cultural barriers. However, governmental policies,

technological innovations, and collaboration between

public and private stakeholders have led to significant

advancements.

2 LITERATURE REVIEW

Radhika K. and Dr. P. Indrasena Reddy (Oct’2021) in

their study, they came to the conclusion that the

Indian government is committed to raising the

country's financial inclusion. Initiative programs

from the government and RBI are improving people's

access to financial services.

Usha Srivastava, (Feb’2018), evaluated the

expanding financial literacy initiatives in

Chhattisgarh and found that HDFC Bank Ltd.

launched its rural financial literacy program in the

Chhattisgarh village of Jamgaon under the direction

of the RBI.

C. Annamalai and K.Vijayarani (2014) the study

came to the conclusion that, in spite of the scheme's

strong social objective of financial inclusion, the

partial inclusion of the plan had prevented the tribal

community region's understanding of financial

inclusion from being fully converted into satisfactory

action.

546

Udhani, R., Ramchandani, S. and Khan, M.

Empirical Analysis of Financial Inclusion: Case Study of Madhya Pradesh and Chhattisgarh.

DOI: 10.5220/0012879100003882

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd Pamir Transboundary Conference for Sustainable Societies (PAMIR-2 2023), pages 546-550

ISBN: 978-989-758-723-8

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

2.1 Objectives of the Study

1. To study the variables responsible for Financial

Inclusion in Madhya Pradesh and Chhattisgarh.

2. To assess the progress and impact of Financial

Inclusion measures at ground level in Madhya

Pradesh and Chhattisgarh.

2.2 Data Collection

For the purpose of this study, the population consists

of all adults in Madhya Pradesh and Chhattisgarh.

Since, it is not possible to collect the data regarding

financial inclusion from all the citizens of Madhya

Pradesh and Chhattisgarh. Random and convenient

sampling technique was used for collecting Primary

Data.

The method used for the present study is

probabilistic sampling method, in which the chosen

population for the study is randomized and surveyed

is not known to the researcher. Five districts were

selected from each state, two villages from each state,

were selected randomly and 20 questionnaires were

got filled from every village selected. Table - 1

elaborates in detail the districts and villages selected

for data collection.

2.3 Population and Sample Design

The present research analysis, therefore, is an attempt

to carry out a comprehensive household survey to

assess the various dimensions of financial

inclusion/exclusion.

Table 1: Details of primary data collection locations.

States

Districts

Villages

MP

Bhopal

Barkheda Salam

Bairagarh Kalan

Indore

Madhopur

Jamalpura

Ujjain

Budhaniya

Hathod

Sehore

Devli

Magarda

Jabalpur

Jhurjhuru

Mohniya

CG

Raipur

Sarora

Hathkhoj

Bilaspur

Chakarbhatha

Amtara

Korba

Girari

Basin

Dhamtri

Akla Dongri

Barari

Durg

Piperchedi

Gorpa

The study covers five districts of each state i. e.

Madhya Pradesh and Chhattisgarh. Since the study

aims at looking at the reality of financial inclusion

and its determinant at ground level, villages nearby

the districts have been selected. Two separate lists of

villages from the five districts were first prepared and

then the villages have been numbered and a random

draw of two villages each from the five districts has

been selected for survey. 20 households have been

selected on random basis for primary survey from

each village. Primary information was collected from

200 households for each state. The primary data on

number of saving and loan accounts, Kisan Credit

Card, Money Transfer, health, life and general

insurance, Mutual Fund Scheme, and Post office

Banking, were collected from the sample households

of both the states.

In selected villages almost all selected households

studied have reported their awareness of the existence

of bank branch in their village or in nearby districts.

A similar response is also observed in the case of

awareness of saving facility and awareness of loan

facility. But opposite response is observed in case of

awareness to access loan are low in Chhattisgarh as

compared to Madhya Pradesh, so it can also be said

that people are less interested for loan facility when it

comes to financial inclusion. As regards awareness of

the money transfer facility, mutual fund schemes,

post office banking and other banking facility less

than 50 per cent of the respondents from both the

states Madhya Pradesh and Chhattisgarh.

Empirical Analysis of Financial Inclusion: Case Study of Madhya Pradesh and Chhattisgarh

547

Table 2: Access to and Availability of Financial Services

in Survey Areas.

Access to and

Availability of

Financial Service

Madhya

Pradesh

Chhattisgarh

No. % No. %

Saving Account 170 85 164 82

Loan Borrowed 102 51 92 46

Kisan Credit Card 30 15 34 17

Money Transfer 6 3 8 4

Health Insurance 130 65 114 57

Life Insurance 16 8 22 11

General insurance 6 3 10 5

No access to any 10 5 16 8

Source – Field survey

The analysis of the data presented in the Table above

discloses that, there are very minor differences in

access problems in both the states and for different

products. But savings and loan products, 5% of the

respondents in Madhya Pradesh and 8% of the

respondents in Chhattisgarh have no access problem.

Figure 1. Field survey results- Access to financial services.

As regards access to other financial

products/services, while in Madhya Pradesh, 15% of

the households have reported access to Kisan Credit

Card (KCC), in Chhattisgarh 17% of the households

had access to KCC. In the case of all other financial

products and services except insurance the majority

of households have indicated access problems, as

majorly have reported about the Ayushman Bharat

Heath Insurance Scheme is utilised by them.

In the case of money transfer, 3% households of

Madhya Pradesh and 4% households of Chhattisgarh

have reported easy access to money transfer (because

of they are educated).

Table 3: Sources of Information for Financial Inclusion.

Sources of

Information

Madhya

Pradesh

Chhattisgarh

No. % No. %

Village Panchayat

Officials

20 10 10 5

Neighbour 24 12 20 10

Family members 20 10 24 12

Friends/Relatives 26 13 16 8

Bank

employee/Insurance

agen

t

24 12 30 15

Government

officials

16 8 10 5

Self Help Group

(SHG)

30 15 50 25

Others 10 5 4 2

Total 170 85 164 82

Figure 2. Sources of financial inclusion.

Above table 2 provides details of the source of

information which led the household’s entry into the

financial sector, it is important to note that only 13%

respondents in Madhya Pradesh and 8% in

Chhattisgarh reported friends/ relatives as their

source of information about financial services and

products. On the other hand 10% in Madhya Pradesh

and 12% households of Chhattisgarh reported family

members / acquaintance as the source of information

about financial inclusion. 5% and 2% households in

both the states have reported other sources as the main

source of information about financial services

respectively. The major and important source of the

information mentioned is Self-help Group which

0

20

40

60

80

100

Madhya Pradesh % Chhattisgarh %

-15

10

35

60

85

Madhya Pradesh % Chhattisgarh %

PAMIR-2 2023 - The Second Pamir Transboundary Conference for Sustainable Societies- | PAMIR

548

contributed 15% in Madhya Pradesh and 25% in

Chhattisgarh.

Figure 3. Sources of financial inclusion(extended).

At the onset, it should still be noted that the access of

the household to loan facility depends upon the nature

of work of the household, mentality of the members

of household, intensity of need (it is high at the time

of medical emergency) and also the easy availability

of credit facility.

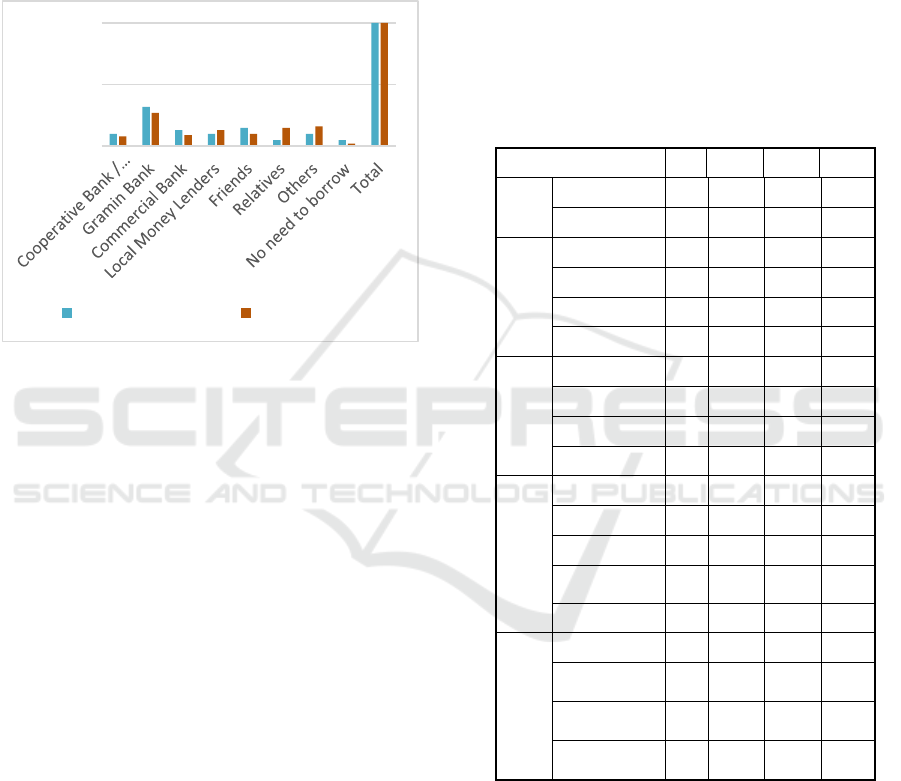

The above Table no – is, an attempt

made to evaluate the responses of the households

relating to the agencies from which they have

borrowed for their credit requirements. From the

table, it appears that Gramin Banks have good

network in Madhya Pradesh as compared to that in

Chhattisgarh. Access to informal sources for loan is

higher in Chhattisgarh as compared to Madhya

Pradesh.

The main implication emerging from

this analysis of the data shows that formal and

informal both agencies are equally important source

in providing financial services in remote areas, which

should be a matter of concern as for achieving

Financial Inclusion we need to increase the scope of

formal sector in money lending in rural areas.

Madhya Pradesh is showing results of more formal

sources preferred for borrowing i.e. 50% whereas

Chhattisgarh is showing 44% of formal sources of

borrowing.

It is clear from the above figures 1-3 that there is very

minute difference between the sexual ratio of the

respondents in both states, Madhya Pradesh and

Chhattisgarh.

The table 4 shows that majority of the respondents

belong to 20-40 years of age group that is 40% in

Madhya Pradesh and 60% in Chhattisgarh. Similarly,

Madhya Pradesh has more senior citizen respondents

as compared to Chhattisgarh i.e. 30% and 10%

respectively.

From the above charts it can be clearly concluded that

majority of the respondents that is 62.5% in Madhya

Pradesh and 55% in Chhattisgarh are farmers and

second major that is 25% in Madhya Pradesh and

40% in Chhattisgarh are from labour class. Business

and other occupation is followed by very a smaller

number of respondents. The chart above shows that

the respondents are not well educated, majority of the

respondents from both the states have only completed

primary education.

Table 4: Socio-Economic Profile of Respondents

Indicators MP % CG %

Sex

Male 125 62.5 140 70

Female 75 37.5 60 30

Age

0-20 20 10 10 5

21-40 80 40 120 60

41-60 40 20 50 25

above 60 60 30 20 10

Occup

ation

Laboure

r

50 25 80 40

Farme

r

125 62.5 110 55

Business 5 2.5 2 1

Others 20 10 8 4

Literac

y

None 25 12.5 30 15

upto Primary 75 37.5 80 40

upto Middle 20 10 40 20

upto High

School 70 35 45 22.5

Graduate 10 5 5 2.5

Annua

l

Incom

e

Below 70,000 90 45 95 47.5

70,000-

100,000 80 40 80 40

100,000-

1,50,000 20 10 20 10

Above

1,50,000

10 5 5 2.5

3 CONCLUSIONS

States like Madhya Pradesh and Chhattisgarh are

examples which can prosper economically and

socially, provided their less fortunate populations can

achieve financial independence. Because of this,

financial inclusion plays a crucial role in accelerating

the process of growth and development.

0

50

100

Madhya Pradesh % Chhattisgarh %

Empirical Analysis of Financial Inclusion: Case Study of Madhya Pradesh and Chhattisgarh

549

It can also be concluded that there is a significant

connection between literacy rates and financial

exclusion. It is observed that money transfer, 3%

households of Madhya Pradesh and 4% households of

Chhattisgarh have reported easy access to money

transfer (because of they are educated). Madhya

Pradesh is showing results of more formal sources

preferred for borrowing i.e. 50% whereas

Chhattisgarh is showing 44% of formal sources of

borrowing. In recent years, the government and other

responsible authorities have launched numerous

initiatives aimed at achieving financial inclusion,

which has created a strong foundation and created a

strong demand for additional research on the topic.

REFERENCES

Agrawal, M., & Agrawal, N. (2019). Basic Income and

Financial Inclusion. Research Journal of Humanities

and Social Sciences, 10(2), 433-435.

C. Annamalai and Dr. K. Vijayarani (2014). Awareness of

financial inclusion on tribal people in Dharmapuri

district. Asia Pacific Journal of Research Vol: I Issue

XVII.

Das, D. and Tiwari, R. K., (2012), Fundamentals of

Microfinance. India, Global Publishing House, New

Delhi.

Lalitagauri Kulkarni and Anandita Ghosh,

(Jul’2021).Gender disparity in the digitalization of

financial services: challenges and promises for women

& financial inclusion in India. Gender, Technology and

Development.

NABARD, (2012), Status of Microfinance in India,

National Bank for Agriculture and Rural Development,

Mumbai.

Planning Commission. (2009). Report on Financial Sector

Reforms. (Chairman: Raghuram G. Rajan).

Government of India, New Delhi.

Radhika K. and Dr. P. Indrasena Reddy (Oct’2021).

Progress and Status of Financial Inclusion in India – A

Study International Journal of Research Culture

Society.

Usha Srivastava, (Feb’2018). Financial Literacy in

Chhattisgarh-An overview of growing efforts.

International Journal of Latest Engineering and

Management Research.

Vaishali Waikar, Yamini Karmarkar (2018). Financial

Inclusion- A Study of Awareness Level of People in

Indore District. Asian Journal of Management.

PAMIR-2 2023 - The Second Pamir Transboundary Conference for Sustainable Societies- | PAMIR

550