Digital Payment Dynamics in Gig Economy Integration

V. Shobha and B. Vinnarasi

CHRIST (Deemed to be University), Bengaluru, India

Keywords: Digital Payment Systems, Gig Economy, Implementation, Integration, Technological Infrastructure.

Abstract: The gig economy, characterized by short-term employment and a reliance on independent workers, has

witnessed significant growth in recent years, making the integration of digital payment systems a vital aspect

of its functioning. This review paper critically examines the multifaceted factors that influence the adoption

and integration of digital payment systems within the gig economy. Drawing upon a comprehensive analysis

of 30 selected research papers out of 88, this review explores the key drivers and implications related to the

implementation of digital payment systems. The synthesis of these findings provides a holistic understanding

of the complexities surrounding the adoption of digital payment systems in the gig economy and offers

insights into their future development and implications.

1 INTRODUCTION

In the modern era of technological advancements and

digitalisation, the nature of work and the demand for

workers have profoundly transformed. On one hand,

the introduction of artificial intelligence, algorithms,

robots, and machine learning has certainly improved

the efficiency and ease of many tasks for human

workers. However, it has also led to the displacement

of certain jobs as machines increasingly take over,

reducing traditional job opportunities within the

economy adapt to these changes, companies have

been reevaluating their workforce models. The

demand for full-time workers has, in many cases,

shifted towards independent workers or gig workers.

This shift represents the emergence of a "gig

economy," where a significant portion of work is

performed by gig workers or freelancers (Altenried,

2021). These individuals work as independent, short-

term contractors and are compensated based on each

specific task or project they undertake. The Gig

economy, often described as a free market system,

revolves around the execution of temporary contracts

with independent workers for short-term

engagements. However, what sets this economic

model apart is its profound reliance on digital

technologies for both work arrangements and

payments. Platforms like Uber, which provide ride-

sharing services, epitomize this digital shift. In such

ecosystems, drivers not only receive work but also

payment through digital channels (Behl et al., 2022).

Consequently, the integration of digital payment

systems assumes a pivotal role, while also raising

significant concerns. The endeavour to streamline

these payment mechanisms encompasses a

multifaceted challenge, addressing technological,

security, human resource, and economic

considerations.

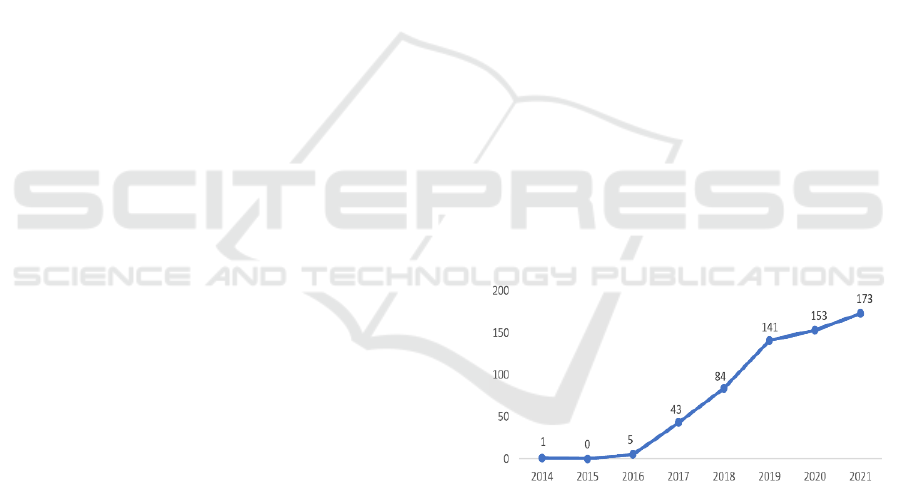

Figure 1: The rise of the Gig Economy in India (Source:

MDPI, 2022).

India's gig economy boasts a staggering 15 million

workers, involved in various sectors, according to a

report by the Boston Consulting Group. The 2019

report by the India Staffing Federation positions India

as the fifth-largest country globally in flexi-staffing,

indicating substantial growth. However, a significant

urban-rural digital divide is apparent, making the gig

economy predominantly urban-centric. With

regulations still in the drafting stage, there's a pressing

need for authorities to establish robust digital

payment systems to bridge the divide and foster

Shobha, V. and Vinnarasi, B.

Digital Payment Dynamics in Gig Economy Integration.

DOI: 10.5220/0012909500003882

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd Pamir Transboundary Conference for Sustainable Societies (PAMIR-2 2023), pages 657-660

ISBN: 978-989-758-723-8

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

657

economic growth. Major food delivery platforms like

Zomato and Swiggy rely on gig workers for food

deliveries, utilizing digital payments for transactions.

Fostering financial inclusion requires simplified

processes for gig workers to access banking services

and dedicated apps for managing insurance, social

security, and taxes. Robust digital integration on the

customer side is vital for transparency, security, and

accessibility. To overcome geographical disparities,

integrating digital payment systems with apps

supporting offline digital payments will enhance

inclusivity in the gig economy.

2 LITERATURE REVIEW

Table 1: Digital Payment Revolution: Transforming the Gig Economy.

Author

Findings

Harvard Business

Review (2021)

Integrating digital payments in the gig economy can free up resources for other business aspects.

Altenried (2021)

Digital payment integration should occur at all levels of the gig economy.

World Bank (2022)

Digital payments streamline processes, ensuring timely compensation for gig workers and

reducing administrative burdens.

Álvarez Cuesta (2018)

Digital payments enhance financial security for gig workers and reduce administrative burdens

for employers.

Behl et al. (2022)

Evolving digital payment systems require substantial investments in technology to keep pace

with security advancements and transaction volumes.

Vyas (2020)

Regulators must adapt to emerging technologies and business models as digital payments

become more integrated into daily life.

3 OBJECTIVE

• To Identify Key Factors Influencing the

Adoption of Digital Payment Systems in the

Gig Economy.

• To Assess the Impacts and Implications of

Digital Payment System Integration in the

Gig Economy.

4 RESEARCH METHODOLOGY

For this review paper, a comprehensive research

methodology was employed, involving the initial

selection of 88 relevant papers. A careful screening

process based on key keywords led to the inclusion of

50 papers. Subsequently, 30 of these papers were

meticulously examined to analyze the multifaceted

factors influencing the implementation and

integration of digital payment systems in the gig

economy. The review laid a robust foundation for

understanding the interconnections among these

factors and their profound implications for the gig

economy and its stakeholders.

5 RESULT AND ANALYSIS

According to Behl et al. (2022), the gig -economy has

been a fruit of disruptive innovation where the digital

revolution has created access to on-demand services

like Food delivery and transport logistics like Uber,

and OLA. However, the product of disruptive

innovations, like start-up culture, has been highly

questioned for its unstructured network and

sustainability (Basadur,2016). The integration &

implementation of a digital payment system creates

the scope for discussion on its effect on the various

aspects of the gig economy (Álvarez Cuesta, 2018).

Hence the coming sections will discuss the issues in

the Gig economy from various perspectives and its

prospective resolution with the integration and

implementation of a digital payment system.

5.1 Factors Influencing the Adoption of

Digital Payment Systems in the Gig

Economy

Kim, L. (2018) in the artcile, “Capability Building in

Catching-up at Hyundai Motor & Gig Economy” has

argued that the initialization is the foundation of the

gig economy. Hence the adoption of digital payment

should be at various levels for a holistic inclusivity

PAMIR-2 2023 - The Second Pamir Transboundary Conference for Sustainable Societies- | PAMIR

658

and sustainability of the gig culture. Hence following

factors have been considered for discussion on digital

payment integration in the Gig economy based on the

review of journal papers (Cherry et al.,2020).

Technological Infrastructure

The backbone for seamless digital fund exchange, its

challenges include ensuring universal access and

sustainability, addressing digital divide issues, and

considering environmental concerns. Future

expansions like 5G, IoT, and edge computing present

opportunities and data security challenges.

Regulatory Framework

Clear regulations fostering trust and security while

encouraging innovation are vital. Striking a balance

between safety and innovation is key, as overly

complex regulations may hinder growth.

International cooperation in regulating cross-border

payments might become more crucial.

Trust and Security

Paramount in digital payment adoption, trust is

established through robust security measures such as

encryption, two-factor authentication, and fraud

detection systems. Users need to feel confident that

their financial data is secure.

User Experience

A positive user experience through intuitive design,

functionality, and excellent customer support

encourages adoption. Conversely, poor user

experiences, like confusing interfaces or glitches, can

deter users from embracing digital payments.

Financial Considerations

Affordability, transparency in transaction costs, and

accessibility are critical factors influencing adoption.

Users seek cost-effective alternatives to traditional

payment methods. Achieving reasonable transaction

costs while ensuring sustainable revenue streams for

service providers is a challenge.

In summary, the integration of digital payments

into the gig economy requires robust technological

infrastructure, balanced regulatory frameworks,

emphasis on trust and security, a positive user

experience, and addressing financial considerations

for affordability and transparency in transaction costs.

These factors together contribute to the holistic

inclusivity and sustainability of digital payment

adoption in the gig culture.

5.2 Impacts and Implications of Digital

Payment System Integration in the

Gig Economy

Economic Sustainability

Koutsimpogiorgos et al. (2020) emphasize economic

sustainability at micro and macro levels concerning

gig workers' reliance on digital payments for income

stability. For individuals, it provides predictable cash

flows, while on a broader scale, it increases financial

inclusion and stimulates economic growth.

Social Inclusivity

Langley (2021) highlight digital payments' role in

fostering social inclusivity by breaking traditional

barriers for individuals from diverse backgrounds,

including the underbanked and unbanked. It

contributes to gender inclusivity and transcends

geographical boundaries, enabling opportunities for

remote or rural dwellers.

Innovative Sustainability

Friedman (2021) stress how innovative features like

real-time tracking and digital wallets empower gig

workers. These tools address challenges such as

income volatility, offering better financial

management and control, ensuring sustainability in

the gig economy.

6 DISCUSSION

The Gig economy, reliant on technological

infrastructure for digital transactions, underscores its

vital role in shaping the landscape of digital payment

systems. Accessibility and reliability are crucial for

seamless transactions, essential for the thriving

existence of gig work ecosystems (Doucette,2019) .

Regulatory frameworks strike a balance between

innovation and user safeguarding, significantly

impacting the adoption of digital payments. Trust and

security are pivotal; any breach disrupts the entire gig

economy ecosystem.

Innovative sustainability features in digital

payments address income volatility for gig workers,

providing real-time tracking, budgeting aid, and

tailored financial services, ensuring economic

stability (Cherry,2016). Market dynamics,

Digital Payment Dynamics in Gig Economy Integration

659

intertwined with these factors, foster competition,

driving innovation and service enhancement. Yet, this

competition can lead to complexities and

fragmentation, necessitating a vigilant and adaptable

approach for the evolving gig economy's continued

relevance.

7 CONCLUSION

In conclusion, the implementation and integration of

digital payment systems in the gig economy are

subject to a multitude of interconnected factors.

These factors, including technological infrastructure,

regulatory frameworks, trust and security, user

experience, financial considerations, economic

sustainability, social inclusivity, innovative features,

and market dynamics, collectively shape the digital

financial landscape within the gig economy. Hence,

Continuous evaluation and adaptation are vital in this

dynamic landscape. The ever-evolving gig economy

necessitates a vigilant and flexible approach to ensure

the digital financial landscape's relevance and

effectiveness. Understanding the interconnected

nature of these factors is essential in crafting

strategies that leverage these elements to foster a

more resilient and inclusive gig economy, ensuring its

continued success in an ever-changing world of work.

REFERENCES

Altenried, M. (2021). Mobile workers, contingent labour:

Migration, the gig economy and the multiplication of

labour. Environment and Planning A: Economy and

Space, 2(5).

Álvarez Cuesta, H. (2018). The gig economy and the

obligation to coordinate the security and health of their

self-employed. Revista Jurídica de La Universidad de

León, 2(5), 83.

Basadur, M., & Hausdorf, P. A. (2016). Gig Economy &

Measuring Divergent Thinking Attitudes Related to

Creative Problem Solving and Innovation

Management. Creativity Research Journal, 9(1), 21–32.

Behl, A., Rajagopal, K., Sheorey, P., & Mahendra, A.

(2022). Barriers to entry of gig workers in the gig

platforms: exploring the dark side of the gig economy.

Aslib Journal of Information Management, ahead-of-

print(ahead-of-print).

Cherry, M. A. (2016). Gig Economy: Settlements Leave

Labor Issues Unsettled. SSRN Electronic Journal, 5(2).

Doucette, M. H., & Bradford, W. D. (2019). Dual Job

Holding and the Gig Economy: Allocation of Effort

across Primary and Gig Jobs. Southern Economic

Journal, 85(4), 1217–1242.

Friedman, G. (2014). Workers without employers: shadow

corporations and the rise of the gig economy. Review

of Keynesian Economics, 2(2), 171–188.

Koutsimpogiorgos, N., Slageren, J., Herrmann, Andrea M.,

& Frenken, K. (2020). Conceptualising the Gig

Economy and Its Regulatory Problems. Policy &

Internet, 12(4).

Langley, P., & Leyshon, A. (2017). Platform capitalism:

The intermediation and capitalisation of digital

economic circulation. Finance and Society, 3(1), 11–

31.

Vyas, N. (2020). “Gender inequality- now available on

digital platform”: an interplay between gender equality

and the gig economy in the European Union. European

Labour Law Journal, 12(1).

PAMIR-2 2023 - The Second Pamir Transboundary Conference for Sustainable Societies- | PAMIR

660