CRM Strategies in Commercial Banks: Fostering Long-Term

Customer Relationships

Ajatashatru Samal

1

, N. Manasa

2

, Priya Vinod

2

and Hemalata Radhakrishna

3

1

Visvesvaraya Technological University, India

2

Christ University, India

3

Reva University, Bengaluru, India

Keywords: Data Privacy, Long Term Relationship, Retention, Acquires Quick Service.

Abstract: The research paper investigates the impact of socio-economic characteristics on Customer Relationship

Management (CRM) practices within private banks, highlighting CRM's role as a customer-centric, holistic

approach. In the context of economic uncertainties, rapid technological advancements, swift market dynamics,

and intensifying competition, CRM technologies are critical for coordinating sales, marketing, and support

services. The study reveals significant variability in socio-economic factors across different bank branches,

with these factors correlatively influencing customer accounts. Notably, elements such as customer

satisfaction, robust privacy policies, and prompt service are pivotal in fostering enhanced relationships

between private banks and their clientele. The analysis confirms that effective CRM not only safeguards data

privacy but also strengthens customer relationships and proactively anticipates customer needs, thereby

underpinning the strategic importance of CRM in retaining loyalty and driving bank revenues.

1 INTRODUCTION

The idea of CRM in private banks has attracted the

attention of academicians, experts and bankers in the

financial area. The organizations have extensively

recognized that customers are profitable now-a-days.

CRM develops life time customers. It allows

developing customer base. It manages all aspects of

customer interaction in a manner that enables banks

to maximize profitability from every customers.

CRM is a business model that aligns product and

sales strategic with needs of customers and

preferences (Sampath et al. 2014). CRM has been

viewed as a process aimed at collecting customer

data, find profiles of customers and use the customer

knowledge in specific marketing activities (Anu

Putney et al. 2013). Indian private banks are facing a

dual challenge of building customer base and

performance maintenance. CRM helps to build

customer base through IT and helps in the building of

long term relationship and sustainability. CRM can be

viewed as a process geared towards increasing the

value of a customer order life time (Farress P. 2001).

Banks need to focus for creating added value and

establishing forever relationship with customer. For

the last two decades there is a significant changes in

the banking industries for business process like

mobile banking, ATMC, cost reduction in transaction

and delivering better service for managing the

supplier- CRM is continuously the important critical

issue in the banking sector (Ndubisi et al. 2007)

customers have also started demanding more and

more, more knowledgeable, aware of alternatives and

capable of negotiating with different service

providers (Heinonen 2014).

2 LITERATURE REVIEW

Dr S Sudhakar, Dr Thomas Michael, Mrs V

Santhiya(2023) focus that Customer relationship

management establish a long term relationship with

customers by analysing the need and wants for their

immediate services which is the essential components

of banking CRM . He also focus through the process

of CRM helps the customer complaint resolution in

banks with a timely and effective manner . As a result

it solved the immediate issues of customer complaints

in a fast way and retain customer loyalty.

Dr G Manoj, Dr Leena Jenefa(2022) refers CRM

maintain a long relationship with the process and

722

Samal, A., Manasa, N., Vinod, P. and Radhakrishna, H.

CRM Strategies in Commercial Banks: Fostering Long-Term Customer Relationships.

DOI: 10.5220/0012914600003882

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd Pamir Transboundary Conference for Sustainable Societies (PAMIR-2 2023), pages 722-726

ISBN: 978-989-758-723-8

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

enhance the banking instrument and services in

current scenario of present situation.

K.P Anjana(2021) indicates the vital role of CRM

practises in the present environment which influence

the better functioning in the banking sector. core

benefits in banking business process and customers

by using better tools and techniques in the banking

sectors.

The authors suggested that Indian banking need to

focus new services and develop new marketing

strategy for the betterment of banking sectors.

3 STUDY OBJECTIVE

• To understand the socio-economic feature of

respondents.

• To understand CRM as a customer-centric

approach.

• To examine the CRM practices in private

banks.

• To identify the factors influencing long-term

relationships between private banks and

customers.

4 PROBLEM STATEMENT

Customer switching to others banks and effective

retention and attraction of customers can be

effectively managed by CRM strategies. On account

of severe competition among banks CRM came into

existence with much focus on customers. Consumer

attraction and retention has become a complex

impressing factors banks here introduced different

strategies to retain the existing customers or attract

new customers. The strategies followed by different

private banks speak about the significance of CRM in

banks. CRM is a approach for management that gives

the firm to get, attract and retain the customer

profitability through the process of CRM. The CRM

achievement depends upon the needs and desires of

the customers and by integrating them by using

organizing strategy, people technology and business

process.

CRM in banks in banks must maintain good

relationship with customers. This makes the banks to

take up branch expansion all over the country.

Further, maintenance customers loyalty and trust is

utmost important in addition to providing different

products and services.

Customer will never switch to other banks if they

are fully satisfied with quality of service.

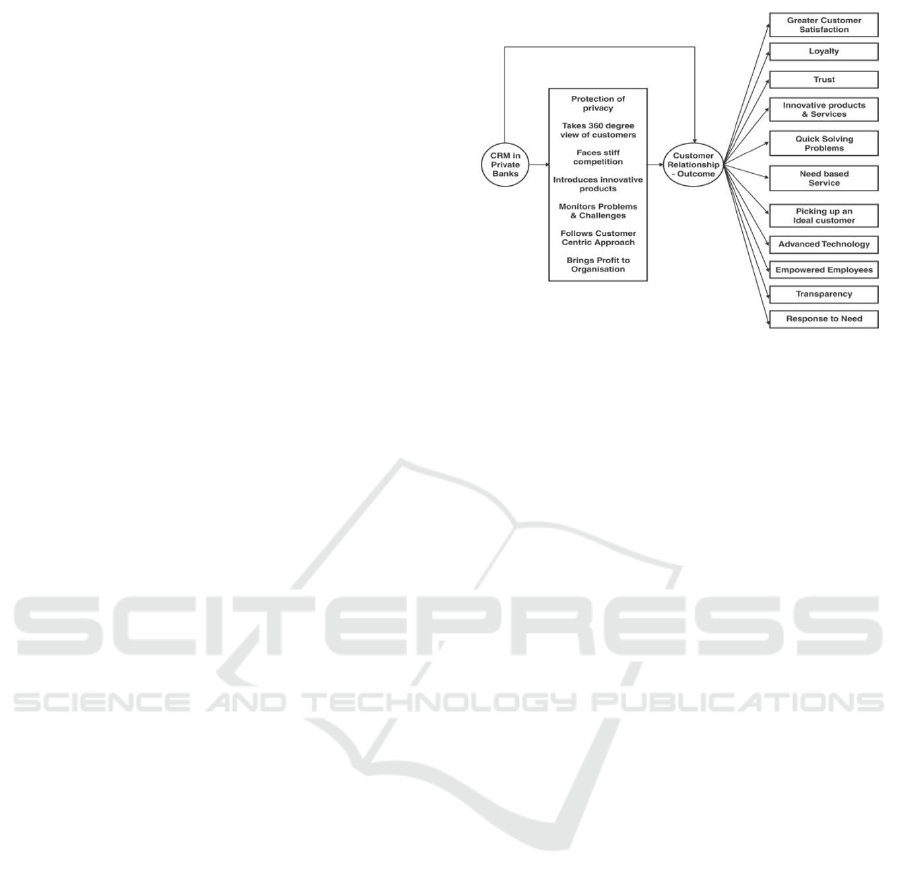

Figure 1: Conceptual Model of the Study.

5 HYPOTHESES

• H

0

: The socio-economic characteristics are

not impacting on the study.

• H

1

: The socio economic characteristics are

impacting the study.

• H

2

: Private commercial banks do not

practice CRM.

• H

3

: There is no customer centric approach in

private banks.

• H

4

: There exist significant variation in the

customer centric approach followed by

banks.

6 LIMITATIONS

• The study is restricted only to Yelahanka

Sub-district and covered only the private

banks.

• The study considers only 200 respondents.

7 RESEARCH METHODOLOGY

The current study adopts a customer-centric approach

to explore Customer Relationship Management

(CRM) practices within the banking sector. Drawing

inspiration from academic contributions in the field,

the research aims to identify factors influencing long-

term relationships between banks and their customers

and to analyse CRM strategies through the lens of

customer-centricity. The research was conducted

within the naturalistic settings of bank premises in the

CRM Strategies in Commercial Banks: Fostering Long-Term Customer Relationships

723

Yelahanka subdistrict of Bengaluru Urban district,

capturing insights from customers either before or

after their banking transactions. This method ensures

that the data reflects genuine customer experiences

and attitudes towards the CRM practices of their

respective banks.

The study encompasses a sample of 200

customers from diverse backgrounds, ranging from

agriculture to homemaking, residing in the Yelahanka

subdistrict. To ensure a comprehensive

understanding, four bustling localities were chosen:

Yelahanka Old Town, Hunusamaranahalli,

Yelahanka New Town, and the broader Bengaluru

area. The banks involved in the study included major

players like ICICI, HDFC, Axis, Indusind, and Citi

Bank. Participants were selected using a convenience

sampling technique, which involved approaching

customers at different branches of these banks,

ensuring each bank had equal representation of 40

participants.

Data collection was conducted through a

structured questionnaire, designed as the primary

research instrument. This questionnaire employed a

bipolar Likert 5-point scale to measure the intensity

of customer opinions regarding various aspects of

CRM practices. The choice of a bipolar scale

facilitated the capture of a spectrum of customer

attitudes, from strongly agree to strongly disagree,

thus enabling a nuanced analysis of customer

satisfaction and engagement. Additionally, the study

utilised secondary data sources, including academic

books, e-journals, and relevant websites, to enrich the

analysis and contextualise the findings within

existing literature.

Data analysis was carried out using robust

statistical tools such as the chi-squared test and

contingency coefficient, aimed at assessing the

relationships and dependencies between the variables

under study. The Garrett Ranking method was also

utilised to prioritise the factors as per their influence

on customer satisfaction and loyalty. The findings

were systematically presented, with a focus on the

socio-economic characteristics of the respondents,

such as gender, marital status, age, education,

occupation, monthly income, account types, and the

duration of their relationship with the banks. This

comprehensive methodological approach ensured a

thorough exploration of CRM practices, offering

valuable insights into how banks can enhance their

customer relationships in a competitive sector.

8 RESULT AND ANALYSIS

In examining the influence of socio-economic factors

on the study of Customer Relationship Management

(CRM) practices within private commercial banks, a

rigorous analysis has been conducted, as evidenced

by the findings presented in Table I. This analysis

categorises the respondents based on various socio-

economic characteristics, including gender, marital

status, age, education, occupation, and monthly

income, as well as their tenure with the bank and

whether they hold accounts with different financial

institutions. The chi-square (χ²) test was utilised to

determine the statistical significance of the

differences observed in these categories. It is

noteworthy that except for two categories—namely,

the presence of multiple bank accounts and the

duration of the relationship with the bank—

significant and substantial relationships have been

identified across all other demographics,

demonstrating a high degree of variance.

The implications of these findings are profound,

suggesting that socio-economic parameters indeed

play a pivotal role in the application and efficacy of

CRM practices. For instance, the significant

differences observed across age groups and

educational levels indicate that CRM strategies may

need to be tailored to meet the specific needs and

preferences of distinct demographic cohorts.

Similarly, variations in occupation and income levels

may influence customers' expectations and their

perceptions of value, which are critical components

in establishing and maintaining long-term customer

relationships. This supports the alternative hypothesis

(H₁) that socio-economic characteristics do impact

CRM studies, thus challenging the null hypothesis

(H₀) which posited that these factors do not influence

CRM.

Ultimately, the research underscores the necessity

for banks to adopt a customer-centric approach that

recognises and addresses the diverse backgrounds

and needs of their clientele. This approach not only

enhances customer satisfaction and loyalty but also

positions the banks to better manage their customer

relationships in a dynamic and competitive

environment. These insights are particularly valuable

for formulating strategic decisions and refining CRM

practices that are inclusive and effective, thereby

fostering enduring customer relationships that

contribute to sustained business success.

PAMIR-2 2023 - The Second Pamir Transboundary Conference for Sustainable Societies- | PAMIR

724

Table 1: Factors Impacting CRM as a Customer Centric

Approach.

Factors impacting CRM as a

customer centric approach

SA

A

SDA

RT

RT2

Establishes and maintains

strong relationship

14

6

4

24

576

CRM understand all customers

and better the understand

stronger will be relationship

8

2

1

11

121

CRM understands customer

base and hence renders better

service

7

3

2

12

144

Stabilised customer

satisfaction leads to strong

implement in the business

6

3

1

10

100

CRM understands customer

interactions

15

2

1

18

324

CRM prefer to schedule tasks

and set up reminders which

leads to better business

8

4

2

14

196

CRM strategies helps to retain

the existing customer and

thereby enhances better

performance

20

6

4

30

900

CRM anticipates needs to

customers

16

4

2

22

484

CRM protects data privacy

26

10

5

41

1681

CRM ensures faster

communication

10

5

3

18

324

Total

130

45

25

200

4750

The study in question utilises the customer

relationship management (CRM) framework to

investigate its efficacy as a customer-centric

approach within private commercial banks. The data

outlined in Table II focuses on various factors that

purportedly enhance CRM's role as a customer-

centric tool. These factors range from establishing

robust customer relationships to ensuring the

protection of customer data privacy. The responses

collected were categorised under strongly agree (SA),

agree (A), and strongly disagree (SDA), alongside

their respective totals (RT) and the square of these

totals (RT2). It is evident from the higher scores

associated with certain factors—particularly the

protection of data privacy—that there is a strong

inclination towards acknowledging CRM’s pivotal

role in fostering a customer-centric environment. The

statistical method employed here, Kendall’s

coefficient of concordance, helps in quantifying the

consensus among the variables studied.

The analysis confirms a significant alignment

among the variables impacting CRM’s effectiveness

in centring customer needs. This is underlined by the

rejection of the null hypothesis (H0), which posited

no significant variance in customer approaches

amongst different banks. The results compellingly

advocate for a customer-centric orientation in CRM

practices, with high priority given to data privacy and

customer retention strategies. By confirming the

alternate hypothesis (H1), the study substantiates the

considerable relationship between CRM strategies

and a customer-centric approach. Thus, it is

justifiable to assert that CRM, when effectively

implemented, is intrinsically geared towards

enhancing customer relationships and satisfaction,

thereby solidifying its standing as a fundamentally

customer-centric approach.

9 DISCUSSION

This paper is to focus how far the socio-economic

factors impress the study on CRM practices, factors

shape the long term relationship, and to know about

customer centric approach followed by private

commercial banks. The different experts opinions

were considered in order to give the present work an

appropriate context. The present study followed

research design. A open end organized questionnaire

was administered as schedule after considering delay,

non-response, incompleteness and raising Covid-19.

Internet was referred to arrive at the private banks and

their branches in Yelahanka sub district. Further, the

study revealed about long term factors like customer

satisfaction, developed policy and quick service are

impressing long term policy between bank and

customer. Finally the study also asserts that CRM, a

customer centric holistic approach. The factors decide

customer centric approach includes CRM protects

data piracy, retention of existing customers and

establishing and maintaining strong relationship.

Depending upon the views stated by the Yelahanka

sub-district respondents of Bengaluru Urban district,

it was found that the socio economic characteristics

are impacting the study. The execute CRM followed

by the banks helps to survive in the competitive

situation, and variable impresses long term

relationship indicates banks can follow and consider

variables impacts relationship.

10 CONCLUSION

The main focus of this paper is to examine whether

demographic profile impacts in CRM or not. The

CRM Strategies in Commercial Banks: Fostering Long-Term Customer Relationships

725

study also probed about CRM practices in banks.

Factors influencing long term relationship, CRM – a

customer centric holistic approach. The result of the

study reveals that demographic profile of the

respondent’s significant and high relationship

between the characters and CRM except account of

different bank branches. Further, the study reveals

ranked CRM practices which include prioritizing

security of funds, transparency in banking services

and providing.

greater value for money. The factors as per the

study which influences long term relationship

includes customer satisfaction, developed private

policy and quick service. The study also asserts that

factors like CRM protect data privacy, retention of

existing customers and maintenance of strong

relations. Bank should use the existing favorable

socio economic factors and other issues which are

highlighted in the present study.

REFERENCES

Sudhakar, S., et al. (2023). An empirical analysis of factors

influencing customer relationship management

practices pursued by select private sector banks in

Tamil Nadu. European Chemical Bulletin, 12(4), 8280-

8291.

Manoj, G., & Jenefa, L. (2022). CRM practices and its

effects on public and private sector banks across

Chennai. Journal of Contemporary Issues in Business

and Government, 20(4), 1848-1863.

Anjana, K. P. (2021). A study on the impact of customer

relationship management of South Indian Bank in

Bangalore City. International Journal of Research in

Engineering, Science and Management, 4(11), 64-68.

Putney, A. M. M. (2013). A study on the role of customer

relationship management in the Indian banking sector.

International Journal of Management and Business

Studies, 3(2), 88-89.

Sampath, L., & Narender. (2014). CRM practices in

banking sector. Global Journal of Commerce and

Management Perspective, 3(5), 141-145.

Pal, S. (2018). A study on CRM practices in banking sector.

Multidisciplinary International Journal, 2(2), 70-79.

PAMIR-2 2023 - The Second Pamir Transboundary Conference for Sustainable Societies- | PAMIR

726