A Comparative Analysis of Business Perspectives and Marketing

Engagement in the Market

Sunil Kumar Vohra

1

, Shashi Kant Gupta

2

, Susheel Kumar Singh

3

and Prabhdeep Singh

4

1

Amity University, Noida, Uttar Pradesh, India

2

Eudoxia Research University, New Castle, U.S.A.

3

Heera Lal Yadav Balika Degree College, Lucknow, UP, India

4

Shri Ramswaroop Memorial University, Lucknow, UP, India

Keywords: Marketing Engagement, Finance, Marketing, ROMI, ROI, Company Performance.

Abstract: The assessment of the value that marketing brings to a company is a challenging issue, both in terms of its

principles and its applications. Especially for project firms, there is a lack of study on decision-making at the

finance-marketing interaction. The study investigates the quantity and quality of conversation in financial

decision in reaction to accountability requirements for allocation of resources to deal with competing

difficulties. The marketing-finance interface contains crucial aspects like return on investments (ROI) and

return on marketing investments (ROMI). A statistical and a qualitative analysis of ROMI/ROI are conducted.

According to empirical data, project businesses and business units are mostly evaluated on the basis of brief

financial criteria, which are out of step with their long-term performance. Project marketplaces make

marketing investment difficult. Customer lifetime value and ROMI project data sets can aid in pleasant

conversations between financial services interfaces.

1 INTRODUCTION

The significance advertisement and advertising

activities continues to be a challenging topic for

managers to discuss, both in terms of their concepts

and their applications. Particularly from the

perspective of finance management, where specific

justifications for marketing function spending on

advertising capabilities are expected (Vezina, et al.,

2019). This article examines the connection between

marketing and finance on three levels since each is

significant. (Eaton, et al., 2020). Market value,

shareholder value, company level, and, eventually,

advertising interaction dynamics all play a role.

Evaluations of investment in and by businesses,

decisions made in terms of budgeting, and the results

of investments made specifically for advertising (ROI

and ROMI) are all connected to these three levels.

There is a lack of research on ROI and ROMI in

principles and application in businesses

manufacturing underlying asset, notably projects

companies (Liptak et al., 2022).

Engaging customers and fostering brand loyalty

require a strategy and content called engagement

marketing. This inbound marketing strategy uses a

cross-channel approach and includes email

marketing, content marketing, social media

marketing, marketing automation (Rather, et al.,

2019). Brand recognition can be distributed very

effectively for a lot less money than traditional

advertising if an engagement marketing campaign is

successful. For instance, a carefully and focused

content marketing campaign may put the company in

the powerful position of being a thought leader,

creating trust and brand preference as you assist

customers in educating themselves on upcoming

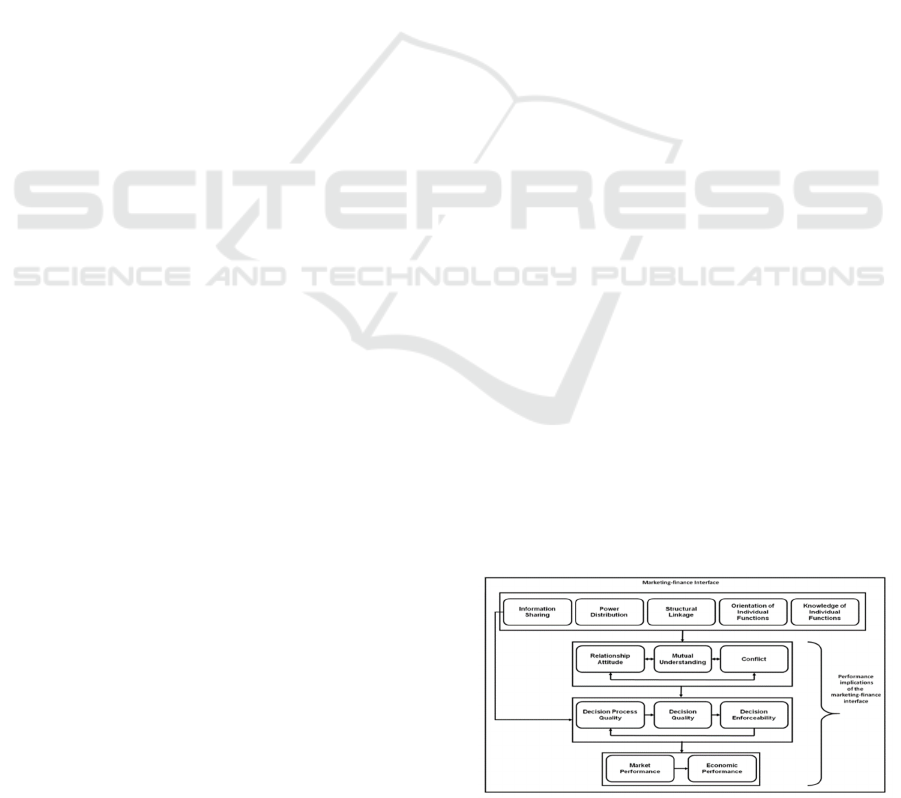

purchases (Terason, et al., 2021). Figure 1 depicts the

integrative framework of the marketing–finance

interface and its performance implications.

Figure 1: Integrative framework of the marketing–finance.

748

Vohra, S., Gupta, S., Singh, S. and Singh, P.

A Comparative Analysis of Business Perspectives and Marketing Engagement in the Market.

DOI: 10.5220/0012915200003882

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd Pamir Transboundary Conference for Sustainable Societies (PAMIR-2 2023), pages 748-751

ISBN: 978-989-758-723-8

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

The coordination of specialized roles with

objectives and timetables, knowledge of specific

goals and talents, wisdom and information sharing

across specialties in the industry. The structures

address the lack of communication and

comprehension that impedes organizational

effectiveness. There have long been calls for

increased communication between finance and

marketing. To resolve the discrepancies between

complementary approaches for evaluating business

performance and investment, finance and marketing

need two general things, with ROMI serving as one

place to start. The operational interaction and the

capacity to describe the interaction are impacted by

quantitative and qualitative methods. Given the

aforementioned concerns, these are quickly

examined.

2 LITERATURE SURVEY

Chopra et al. 2021 presents the peer pressure had no

impact on consumer behaviour, but sentiments

towards influencer and the notion of behavioural

control that allowed for domain specific development

did. Saad, et al., 2018 mentions that digital marketing

techniques like search engine optimization (SEO),

search engine marketing (SEM), content marketing,

influencer marketing, content automation, e-

commerce marketing, campaign marketing, social

media marketing, social networking optimization, e-

mail direct marketing, display advertising, e-books,

optical discs, and sports can be very beneficial for

businesses. These strategies are becoming

increasingly popular in our quickly evolving

technological world. Yoon et al. 2018 mentions that

looks at how user feedback on business Face book

posts affects sales. Economic panel data studies are

used to evaluate the hypotheses using both static fixed

effects (FE) and random effects (RE) and dynamic

generalised method of moments (GMM)

methodologies. Irudayasamy et al. 2022 mentions

that in the future, immunised, ignorant, and partially

vaccinated questionable individual traits will be used

to forecast illnesses and mortality outcomes. Last but

not least, to offer a pertinent evaluation of probable

traits' predictive abilities for lethality, severity, and

mild symptoms (asymptotic). They looked at each

perpetrator's patient data from the

admission/diagnosis date, lab tests, and personal

information.

3 RESEARCH METHODOLOGY

The project goal is to look into the suitability of

ROMI in order to develop a foundation for deploying

ROMI and to stimulate a common discussion in order

to enable choice at the finance-marketing interface. A

strong correlation between capacity growth and

financial success, according to research, calls for

more research linking quantitative measures to

business performance. There hasn't been much

research done up to this point to close this gap,

particularly none for contract enterprises. We suggest

examining initial report from introspective research

done via interviews and observation.

The qualitative data helps to clarify the distinctive

characteristics of the financial-marketing interface

and the degree of involvement throughout that

contact. It also discusses how managers view ROMI

as a tool for promoting fruitful discussion and

decision-making.

Understanding the stated practical challenges

required some interpretations, which was in elements

of sustainability by the research study. This

perception served to clarify the issues rather than

establish the research goals for this study. Large

organisations' project business units were chosen

because they are thought to be more inclined than

projective companies to employ ROMI.

To determine level of organisational

dependability, analysis of documents and in-person

observation were used to define individual, group,

and organization cognitive processes. Patterns with

greater consequences are discovered as a result of the

data's contextual specificity, yet not on a mechanical

basis. Although respondents' requests for

confidentiality prevent us from disclosing more about

the specific content and assigning quotes and material

to specific players, doing so is unnecessary to achieve

the goals and objectives stated.

The approach that was taken to evaluate the

material gleaned from the interviews was an iterative

one, in which the findings were read over, notes were

taken, and key issues that kept coming up were coded

(cf. categorised) until a point of saturation was

reached.

4 RESULT AND ANALYSIS

The investigation's goal is to ascertain whether ROMI

is appropriate in order to provide a foundation for its

use and to foster communication among participants

to aid in decision-making at the interface between

A Comparative Analysis of Business Perspectives and Marketing Engagement in the Market

749

finance and marketing. According to research,

capacity development and financial performance

have a meaningful correlation, and further research is

required to establish a connection between

advertising indicators and firm performance.

It was discovered that several ROMI-oriented

tools are created in compliance with internal

standards in order to give performance metrics to a

portion of programme product offerings. The

majority of responders claimed that in practise,

ROMI is complicated and challenging to interpret

(See Table 1).

Table 1. Decision-maker evidence and the research issues.

Research questions Concepts for coding

and cate

g

orization

To what extent ROI/ROMI

provide a base; further notion

development is needed,

supported by an agreeable and

shared dialogue, for application

throughout many different kinds

of project contexts.

Servicing stock system

and administration

over assisting

customers in the short

term Back Credit

The level of common

conversation

CLV and efficiency

To what amount is ROI/ROMI a

valuable tool that requires

careful use in light of sense?

Financial

considerations in

decision-making

Mitigation

Back Credit

The level of common

conversation

To what level is ROMI/ROI

ineffective?

Productivity

investments versus

restless resources

scarce funds

Economic decision-

making heuristics

The level of mutual

conversation

To what degree is a mixture of

the above suitable for

ROI/ROMI?

Assimilation

Conversation and

shared trust

A posterior use of ROMI limited the convergence of

data used by financiers to make predicts for short-

term evaluation Table 1. At company's marketing

meeting, the power of financial inspectors was used

to shift accountability from of the financial

department to marketing, so restricting spending.

Instead of assisting and leading approach the business

efficient financial performance in regard to marketing

and likely other departments as well, finance

generally dictated business decisions around

efficiency measures. It showed a lack of

communication between parties. Heuristics and

qualitative considerations were crucial, but they took

a back seat in the decision-making process.

Analyzing at a finer level, marketing departments in

the majority of businesses provided ROMI/ROI

calculations to support their investment

recommendations.

There wasn't a unified strategy for handling the

marketing-finance interaction or using ROMI. The

overall picture was variable, frequently partial, and

mixed between partial practises that were in line with

good practise and partial practises that weren't

functioning for decision-makers on their own terms.

Even when the client was an internal company, ROMI

was never used at the programme or client level. CLV

wasn't taken into account.

5 DISCUSSION

The history's intellectual promise hasn't been realised.

As it was discovered that money dominated decision-

making, the usage of ROMI/ROI in reality is still up

in the air, and it is still unclear how much conceptual

development is required. The finance department

doesn't seem willing to give up control in favour of a

productive discourse, despite the fact that ROMI still

has a basis for doing so. This topic of conversation

could have greater ramifications than just project

firms.

The analysis suggests that ROMI/ROI still has

promise, particularly as an extensive quantitative

aggregation tool to evaluate the monetary advantages

of marketing efforts. The evidence does not support

the practise of prioritising marketing expenditure on

a "scientific backing" utilising short-term ROMI-type

devices.

6 CONCLUSION

The main conclusion is that marketing must continue

to meet financial needs until financial supremacy is

challenged by creating a suitable collection of

parameters used for discussion and decision-making,

which will then be used for data gathering and return

attribution. Accounting may need to reduce its

demands, take on more responsibility for regulating

its interaction with advertising, and develop a larger

range of social and economic evaluation techniques.

ROMI provides a medium-term and long-term

instrument at the company and business unit levels to

encourage such a discussion. But, for this

conversation to move further, it must first agree to

obtain the required data at the CLV and project levels

PAMIR-2 2023 - The Second Pamir Transboundary Conference for Sustainable Societies- | PAMIR

750

of analysis. Hence, CLV and plan foci for ROMI data

sets along with require a bit provide ways to move

forward good interaction at the finance-marketing

interaction.

The broad examination of ROMI for project firms

has made a most significant addition to our

knowledge. Surprisingly, little study has been

conducted in the management and project

management fields. The primary limitation of the

study is its exploratory nature; nonetheless, the

findings are confirmed by the participants' recurring

patterns of responses.

REFERENCES

Vézina, M., Ben Selma, M., & Malo, M. C. (2019).

Exploring the social innovation process in a large

market-based social enterprise: A dynamic capabilities

approach. Management Decision, 57(6), 1399-1414.

Cella, C. (2009). Institutional investors and corporate

investment. Indiana University, Kelley School of

Business.

Liptak, K., Hajdu, N., Markovics, K. S., & Musinszki, Z.

(2022, April). Innovative financial indicators:

Marketing ROI. In Proceedings of the 35th Eurasia

Business and Economics Society Conference (pp. 137-

147). Springer International Publishing.

Rather, R. A. (2019). Consequences of consumer

engagement in service marketing: An empirical

exploration. Journal of Global Marketing, 32(2), 116-

135.

Terason, S., Zhao, S., & Pattanayanon, P. (2021). Customer

value and customer brand engagement: Their effects on

brand loyalty in the automobile business. Innovative

Marketing, 17(2), 90.

Chopra, A., Avhad, V., & Jaju, A. S. (2021). Influencer

marketing: An exploratory study to identify antecedents

of consumer behavior of millennial. Business

Perspectives and Research, 9(1), 77-91.

Saad, G. B., & Abbas, M. (2018). The impact of

organizational culture on job performance: A study of

Saudi Arabian public sector work culture. Problems and

Perspectives in Management, 16(3), 207-218.

Yoon, G., Li, C., Ji, Y., North, M., Hong, C., & Liu, J.

(2018). Attracting comments: Digital engagement

metrics on Facebook and financial performance.

Journal of Advertising, 47(1), 24-37.

Han, K. C., & Suk, D. Y. (1998). The effect of ownership

structure on firm performance: Additional evidence.

Review of Financial Economics, 7(2), 143-155.

Parameshachari, B. D., Siddesh, G. M., Sridhar, V., Latha,

M., Sattar, K. N. A., & Manjula, G. (2022). Prediction

and analysis of air quality index using machine learning

algorithms. In 2022 IEEE International Conference on

Data Science and Information System (ICDSIS), 1-5.

Irudayasamy, A., Ganesh, D., Natesh, M., et al. (2022). Big

data analytics on the impact of OMICRON and its

influence on unvaccinated community through

advanced machine learning concepts. International

Journal of System Assurance Engineering and

Management.

A Comparative Analysis of Business Perspectives and Marketing Engagement in the Market

751