Cryptocurrency Analysis: Price Prediction of Cryptocurrency Using

User Sentiments and Quantitative Data

Dayan Perera, Jessica Lim, Shuta Gunraku and Wern Han Lim

School of Information Technology, Monash University Malaysia, Malaysia

Keywords:

Cryptocurrency, Price Prediction, User-Generated Content (UGC), Long Short-Term Memory (LSTM),

Recurrent Neural Network (RNN), Gated Recurrent Unit (GRU), Bidirectional-LSTM, Deep Learning.

Abstract:

This research introduces an innovative approach to forecasting cryptocurrency prices by combining user-

generated content (UGC) and sentiment analysis with quantitative data. The primary goal is to overcome

limitations in existing methods for market forecasting, where accurate forecasting is crucial for informed

decision-making and risk mitigation. The paper suggests a robust prediction methodology by integrating sen-

timent analysis and quantitative data. The study reviews prior research on sentiment analysis and quantitative

analysis of cryptocurrency and stock price prediction. It explores the integration of machine learning and

deep learning techniques, an area not extensively explored before. The methodology employs Long Short-

Term Memory (LSTM), Recurrent Neural Network (RNN), Bidirectional LSTM and Gated Recurrent Unit

(GRU) models to capture temporal dependencies. Prediction accuracy is assessed using metrics including

Mean Squared Error (MSE), Root Mean Squared Error (RMSE), and a confusion matrix. Results show that

GRU models excel in prediction, while RNN models outperform in predicting price movements; with an em-

phasis on the significance of a suitable data preprocessing pipeline towards improving model performance. In

summary, this study demonstrates the effectiveness of integrating sentiment analysis and quantitative data for

cryptocurrency price forecasting using UGC data.

1 INTRODUCTION

Cryptocurrencies have disrupted the financial land-

scape, ushering in a new era of digital assets that cap-

tivate investors and traders worldwide. Cryptocur-

rencies recorded peak total market capitalization at

USD 2, 953 billion in November 2021

1

. As these

decentralised digital currencies gain popularity and

are under the observation of regulators, predicting

their prices accurately becomes crucial for making in-

formed investment decisions and optimising trading

strategies.

The volatility [Mu

ˇ

zi

´

c and Gr

ˇ

zeta(2022)] and un-

predictability of the cryptocurrency market [Boukhers

et al.(2023)] pose formidable challenges to analysts

and investors alike. Current approaches for tradi-

tional fiat currencies or stock markets [Tang and

Chen(2018)] including quantitative analysis and news

article reactions on their own struggled to capture the

dynamics of these digital assets. Users do not con-

sume traditional news of cryptocurrencies much while

1

As reported by Statista https://www.statista.com/

statistics/730876/cryptocurrency-maket-value/.

discussions were found to be prevalent on social me-

dia [Beck et al.(2019)].

In this paper, we delve into a novel method-

ology that integrates UGC sentiment analysis with

quantitative data to overcome the limitations of ex-

isting prediction methods. By combining (1) senti-

ment analysis, which reflects the emotions and opin-

ions of market participants; and (2) with quantitative

data representing market fundamentals and price pat-

terns – we seek to create a more holistic, accurate

and robust prediction model. The synergistic effects

of these two distinct information sources can lead

to enhanced predictions, better risk assessment, and

improved decision-making for investors and traders.

Given the unstructured and noisy data, this research

also propose a data preprocessing pipeline.

This paper is structured as follows – section 2 pro-

vides a succinct overview of relevant works and their

findings, contextualising the purpose of this study. In

section 3, we outline our research objectives and elab-

orate on the approach taken, complemented by ex-

ploratory data analysis (EDA) on a collected dataset.

Subsequently, section 4 elucidates the experimental

210

Perera, D., Lim, J., Gunraku, S. and Lim, W.

Cryptocurrency Analysis: Price Prediction of Cryptocurrency Using User Sentiments and Quantitative Data.

DOI: 10.5220/0012315100003636

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 16th International Conference on Agents and Artificial Intelligence (ICAART 2024) - Volume 3, pages 210-217

ISBN: 978-989-758-680-4; ISSN: 2184-433X

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

setup and rationale. The results and discussion are

presented in section 5, critically evaluating the out-

comes of the experiment. Finally, section 6 presents a

cohesive summary of key findings, achievements, and

implications for future research.

2 RELATED WORKS

Most research on cryptocurrency and stock price pre-

diction can be categorised into one of two main ap-

proaches: (1) market sentiment analysis and (2) quan-

titative analysis. Another notable point of contrast in-

volves the comparison between machine learning and

deep learning techniques; however, only a few papers

have explored the combination of both approaches. In

this systematic literature review, we organise the sec-

tions to form an integral part of the system architec-

ture to provide a comprehensive overview of the rele-

vant research.

2.1 Price Prediction Models

Various methods have been employed to forecast

cryptocurrency values, including Logistic Regression

and LSTM models [Ammer and Aldhyani(2022)].

With the advancements in machine learning, par-

ticularly the deep learning models of today, atten-

tion has shifted towards the use of such technolo-

gies to build complex predictive models. One promi-

nent technology in this domain is a recurrent neural

network (RNN) variant known as the Long Short-

Term Memory (LSTM) [Hochreiter and Schmidhu-

ber(1997)]. LSTM is commonly used due to its effec-

tiveness in learning from long-term data, overcoming

the vanishing gradient problem found in traditional

RNNs. Furthermore, it has been discovered to excel

in forecasting price alterations [Armin et al.(2022)].

As a result, LSTM is widely used to train predictive

models, often in conjunction with other approaches

[Bin Mohd Sabri et al.(2022)] such as logistic re-

gressions [Ammer and Aldhyani(2022)], Ridge re-

gression [Armin et al.(2022)] and ARIMAX [Ser-

afini et al.(2020)]. Many of these approaches utilise

LSTM, with various architectures, particularly in the

dropout layers. Despite cryptocurrency prices be-

ing more volatile than stock prices, especially in the

absence of fixed trading windows or strict regula-

tions [Pervaiz et al.(2020)], an extension of LSTM

known as Stochastic LSTM can effectively account

for the randomness and fluctuations in prices [Jay

et al.(2020)].

2.2 Predictive Model Features

Various research studies make use of a wide variety

of features when attempting to predict stock or cryp-

tocurrency prices. Traditionally, financial attributes

such as the opening price, peak price, number of

transactions, and other related financial indicators are

commonly employed as features to train predictive

models [Awoke et al.(2020)]. The internet has made

information easily accessible, leading to the utili-

sation of new sources like Google Trends [Pervaiz

et al.(2020)] in predictive models. Cryptocurrency-

specific attributes, such as blockchain data, can also

be incorporated as features in the prediction process,

in addition to the traditional financial attributes [Ji

et al.(2019)].

The advent of social media has emerged as a

significant catalyst, generating a substantial amount

of commotion through the prolific creation of con-

sumable content on platforms like Twitter [Jay

et al.(2020)]. This phenomenon can serve as a

feature to assess the influence of social media on

both predicting and driving price movements espe-

cially when generated by key opinion leaders (KOL)

[Jiang(2022)].

It is important to acknowledge the consistent find-

ings across various studies, revealing a correlation be-

tween stock prices and public sentiment expressed on

both traditional and social media platforms [Smith

and O’Hare(2022)]. Consequently, this research ex-

tends prior investigations to integrate public senti-

ments from social media [Sattarov et al.(2020)] as

features for price prediction models. This extension

is particularly pertinent for cryptocurrencies, charac-

terised by high volatility and inherent difficulty in pre-

diction. The extraction of such sentiments will be fa-

cilitated through the utilisation of state-of-the-art sen-

timent analysers as detailed in subsection 2.3.

2.3 Sentiment Analysis on Social Media

Content

Sentiment analysis is a field that has been thor-

oughly researched and has its own set of estab-

lished approaches, including a variety of highly ef-

fective lexicon-based models [Adwan et al.(2020)].

These advancements have led to the widespread

use of popular pre-trained models such as VADER

[Hutto and Gilbert(2014)], enabling swift sentiment

analysis computation without compromising accu-

racy [Ibrahim(2021),Sattarov et al.(2020),Mohapatra

et al.(2019)]. It is worth noting that the inclusion of

sentiment analysis [Smith and O’Hare(2022)] has the

potential to enhance the models’ prediction perfor-

Cryptocurrency Analysis: Price Prediction of Cryptocurrency Using User Sentiments and Quantitative Data

211

mance of market movements. Since the primary focus

of this research is not on enhancing sentiment analy-

sis itself, we will utilise existing pre-trained models

for extracting sentiment features.

A challenge in extracting sentiments from social

media is the unstructured nature of UGC on such

platforms [Sasmaz and Tek(2021)]. Data prepro-

cessing is often necessary, which may include tech-

niques like stemming and removal of stop words.

[Ibrahim(2021)]. Moreover, platform-specific addi-

tions need to be handled with care such as the use

of hashtags as annotations on Twitter [Sasmaz and

Tek(2021)] or mentions creates a complex network

of content on the platform. Thus, researchers such

as Sebesti

˜

ao H et al. [Sebasti

˜

ao and Godinho(2021)]

have employed varying statistical methods, including

the Dickey-Fuller test, to perform enhanced data pre-

processing.

3 METHODOLOGY

Based on the literature review discussed in section 2,

it was hypothesised that sentiment analysis on social

media content could serve as a reliable predictor for

cryptocurrency price trends. However, there is a need

for additional concrete data regarding the implemen-

tation and performance of sentiment analysis on so-

cial media content within the dataset. To confirm this

hypothesis, two-tailed t-tests were conducted to com-

pare the means of two groups, and simple linear re-

gression was employed to evaluate relationships be-

tween continuous variables.

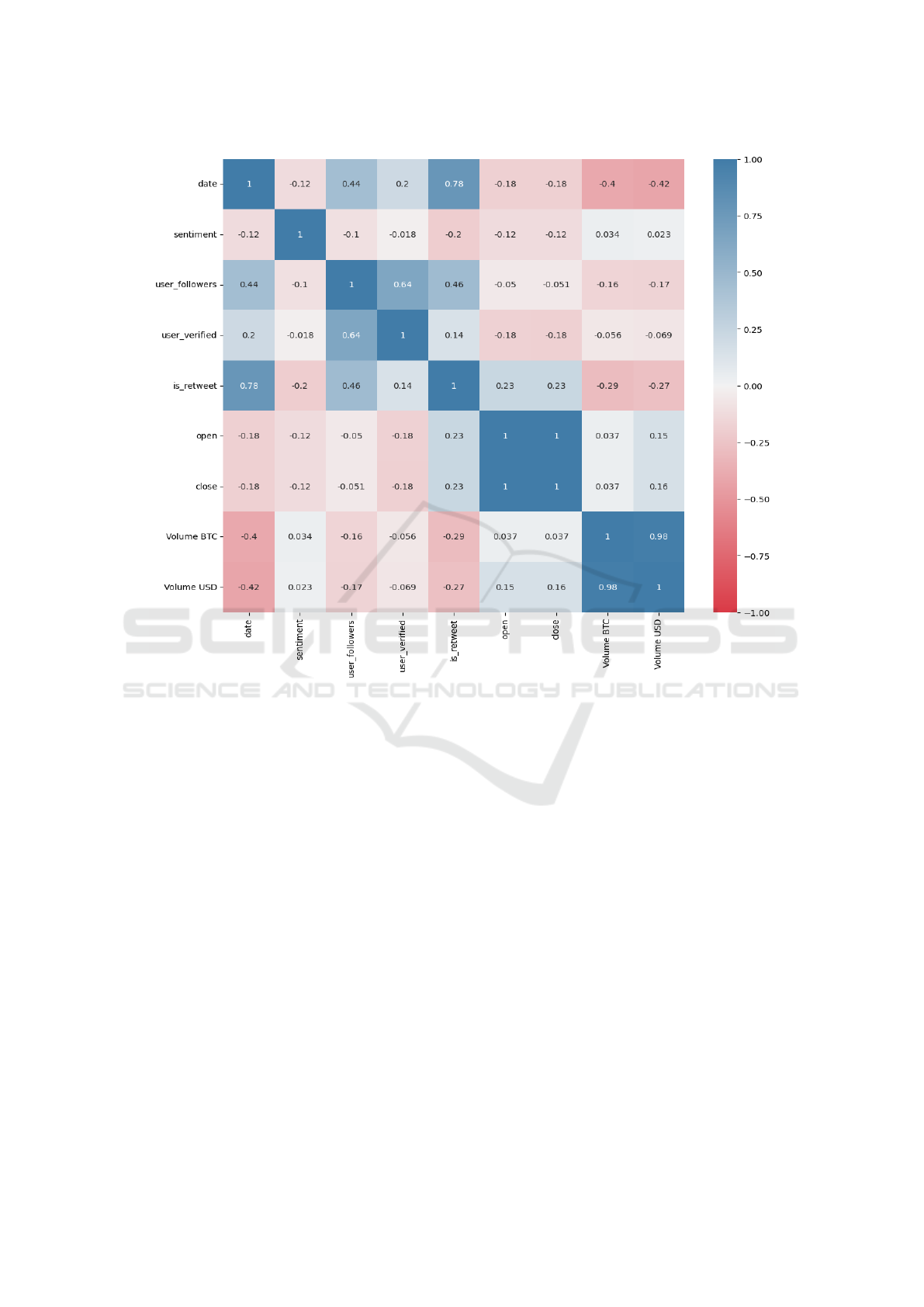

Figure 1 visualised the correlations observed be-

tween the variables on the collected datasets outlined

in subsection 4.1

2

. Past research indicates that sen-

timent analysis can offer valuable insights into mar-

ket sentiment and its impact on cryptocurrency prices,

as discussed in the related works section. However,

sentiments alone may not be sufficient, as the find-

ings from Figure 1 reveal a positive relation yet weak

correlation (−0.12) between sentiments and open or

close price. Similarly, a weak potential (0.037) was

observed in the volume variable for predicting the Bit-

coin prices. Thus in our research, both volumes and

sentiments have been employed in Bitcoin prediction

with the aim of enhancing and maximising the accu-

racy of our predictions.

Consequently, a new approach is proposed for our

experiment, combining sentiment analysis and vol-

ume to predict cryptocurrency trends. Equation 1

2

The dataset mainly retrieved and sourced from

https://www.kaggle.com/datasets/ilariamazzoli/3-million-

tweets-cryptocurrencies-btc-eth-bnb

describes the output gate of LSTM layers used in

our primary algorithms designed for sequence pre-

diction. These models are engineered to process

input sequences and generate predictions by lever-

aging patterns and dependencies within the data,

utilising their internal states. The LSTM model,

equipped with its specialised memory cell and gat-

ing mechanisms, excels at capturing long-term depen-

dencies in sequences, making it particularly effective

for modelling intricate temporal relationships [Sak

et al.(2014)]. We posit that its consideration of long-

term data contributes to improved predictions, align-

ing with our hypothesis.

o

t

= σ(W

xo

· x

t

+W

tho

·th

t−1

+ b

o

) (1)

Conversely, the RNN model relies on recurrent

connections to propagate information across time

steps and formulate predictions based on both cur-

rent and previous inputs. This characteristic is advan-

tageous when predicting price trends based on Vol-

ume [Valendin et al.(2022)]. Additionally, the RNN is

well-suited for price prediction when employing sen-

timent analysis, as it emphasizes the use of current

data. The GRU and the Bidirectional-LSTM are vari-

ants of the RNN and LSTM that perform more effi-

ciently and make use of other tricks to improve per-

formance. Therefore our approach incorporates RNN,

LSTM, Bidirectional-LSTM and GRU models opti-

mised through a basic Grid Search. Table 1 outlines

our best-performing models and their associated pa-

rameters.

4 EXPERIMENT SETUP

4.1 Datasets

The data used in this study was obtained from

two primary sources: Twitter and Kaggle datasets.

Specifically, our data training approach encom-

passed the time period from ’05/02/2021 10:00:00’ to

’05/10/2021 23:00:00,’ marked by a significant surge

in demand and the growing popularity of cryptocur-

rencies. We selected this timeframe with the expecta-

tion that it would provide a wealth of data and relevant

variables for our research. The combination of these

two sources resulted in a substantial dataset, compris-

ing more than 5799 observations. To maintain con-

sistency and coherence in the data, we conducted a

series of pre-processing steps to align their temporal

aspects. Given the diversity of data sources, this pro-

cess involved thorough data cleaning.

The Twitter data provided valuable insights into

sentiment dynamics, while the Kaggle dataset offered

ICAART 2024 - 16th International Conference on Agents and Artificial Intelligence

212

Figure 1: Correlation between Variables retrieved from Twitter and Kaggle.

information on cryptocurrency pricing trends. We fo-

cused on Twitter, motivated by its potential as a plat-

form housing reliable sources and extensive discus-

sions about cryptocurrencies, thereby enhancing the

value of our sentiment analysis. Employing a well-

structured pipeline, we utilised lemmatisation mod-

els to systematically process the content of tweets,

ultimately generating sentiment scores for individual

tweets. The resulting dataset, which formed the foun-

dation for subsequent training and testing, underwent

rigorous model training and testing procedures, con-

stituting the core of our analytical endeavours. The

dataset consisted of a total of nine variables, as indi-

cated in Table 2.

4.2 Data Cleaning

A proper data splitting method needed to be utilised

as simply using Scikit-learn’s TrainTestSplit led to er-

roneous results, as the method randomised the data.

This is incorrect given the sequential ordering nature

of the time series data. Moreover, handling missing

values required careful consideration due to the sig-

nificant number of data points with missing values.

Using a conventional imputer proved ineffective, as it

imputed the same value for all missing values in the

column. This approach is not suitable for time-series

datasets, which are prone to high variance. Therefore,

this research suggested the use of iterative imputer to

be used.

4.3 Data Scaling

Scaling is crucial, especially when the range of values

in columns differs. If left uncorrected, this discrep-

ancy can result in some variables having a dispropor-

tionately greater impact on the results simply because

they have larger values. Scaling brings all the vari-

ables to a similar range, allowing their true effect on

the results to be observed. Both Min-Max Normalisa-

tion and Standardisation were utilised, and the results

for each are presented in Table 3 for comparison.

Cryptocurrency Analysis: Price Prediction of Cryptocurrency Using User Sentiments and Quantitative Data

213

Table 1: Best Performing Models as Identified through Grid

Search.

LSTM LSTM

(1st)

Units: 64,

Return Sequences: True,

Activation: tanh

LSTM

(2nd)

Units: 64,

Return Sequences: True,

Activation: tanh

LSTM

(3rd)

Units: 64,

Activation: tanh

Dense Units: 1

RNN RNN

(1st)

Units: 64,

Return Sequences: True,

Activation: tanh

RNN

(2nd)

Units: 64,

Return Sequences: True,

Activation: relu

RNN

(3rd)

Units: 64,

Activation: tanh

Dense Units: 1

GRU GRU

(1st)

Units: 64,

Return Sequences: True,

Activation: tanh

GRU

(2nd)

Units: 64,

Return Sequences: True,

Activation: relu

GRU

(3rd)

Units: 64,

Activation: relu

Dense Units: 1

Bi-

directional

LSTM

Bi-

directional

(1st)

Units: 64,

Return Sequences: True,

Activation: relu

Bi-

directional

(2nd)

Units: 64,

Return Sequences: True,

Activation: relu

Bi-

directional

(3rd)

Units: 64,

Activation: relu

Dense Units: 1

4.4 Evaluation Measures

The models are evaluated using the following metrics:

Root Mean Squared Error(RMSE), Mean Squared Er-

ror(MSE) and a confusion matrix. This is achieved

through a row-by-row comparison, with the value of

0 indicating a price increase and the value of 1 in-

dicating a decrease. Meanwhile, RMSE and MSE

are utilised to assess the actual prices themselves.

The confusion matrix serves as a visual performance

assessment of the classification algorithm, evaluat-

ing how well the model predicts the price changes

[Ibrahim(2021)]. RMSE and MSE were chosen for

their effectiveness with regression-type data.

Table 2: Datasets Training Variables.

Variable Description

Date Date and time of the data point

(e.g., 2021-02-05 10:00:00)

Sentiment Sentiment score (range: 0 to 1)

User Follow-

ers

Number of followers of the user

User Verified Whether the user is verified (0 or

1)

Is Retweet Whether the data point is a

retweet (0 or 1)

Open Opening price of the financial in-

strument

Close Closing price of the financial in-

strument

Volume BTC Trading volume in Bitcoin

(BTC)

Volume USD Trading volume in U.S. dollars

(USD)

5 RESULTS AND ANALYSIS

We conducted experiments on four models: LSTM,

GRU, RNN, and Bidirectional-LSTM, evaluating

their performance through a combination of error

measures, a confusion matrix and graphs. The re-

sults are displayed in Table 3, indicating that the GRU

performed the best when considering both normalisa-

tion and standardisation with normalisation perform-

ing outperforming standardisation. This superiority

can be attributed to the GRU’s computational effi-

ciency compared to the other models, along with its

ability to better remember short-term data, which is

crucial for predicting cryptocurrency prices greatly

influenced by short-term events as well as a reac-

tionary market on social network sentiment. The visu-

alisations of the actual and predicted values over time

by RNN and GRU are illustrated in Figure 2, show-

casing GRU’s behaviour to be less volatile.

Table 3: RMSE values for RNN and LSTM variants. The

best-performing result is in bold.

Model Scaling RMSE MSE

LSTM Standardisation 1866 3482464

LSTM Normalisation 1214 1472836

RNN Standardisation 1185 1403514

RNN Normalisation 1099 1207855

Bi-LSTM Standardisation 1239 1534512

Bi-LSTM Normalisation 1020 1041181

GRU Standardisation 937 877861

GRU Normalisation 659 433958

ICAART 2024 - 16th International Conference on Agents and Artificial Intelligence

214

(a) RNN

(b) GRU

Figure 2: Price prediction for RNN and GRU. Blue for the

predicted value and green for the actual value.

The preference for normalisation arises from the

fact that standardisation assumes a Gaussian distribu-

tion in the data. Additionally, our dataset lacks ex-

treme outliers, as Bitcoin prices in a short time win-

dow generally fall within a small range. This con-

dition favours normalisation, as standardisation typ-

ically excels when dealing with datasets containing

extreme outliers.

Figure 3 depicts experiments performed to deter-

mine the optimal window size, where window size

refers to the number of time steps (hours) the models

predict in advance. The number of time steps tested

ranged from 1 to 24 hours, and the results revealed

that the best-performing window size varied depend-

ing on the model. Interestingly, the window sizes of

24 and 17 appeared twice each in the optimal config-

uration of models. This variability in optimal win-

dow sizes is attributed to the models encoding differ-

ent amounts of long-term and short-term information.

Figure 3: Prediction accuracy for price increase or decrease

for each model. Only the best performing window size and

accuracy is shown due to space constraint.

In Figure 4, the confusion matrix for the optimal

models, identified by Table 3 and using a window size

of 17, is depicted. It is evident that when predicting

the price changes based on the polarity of prices, all

four models exhibit similar performance, with RNN

standing out in accurately predicting price increases.

This success can be attributed to the RNN’s reliance

on short-term memory, aligning well with the nature

of cryptocurrency prices that are predominantly influ-

enced by short-term events.

Figure 4: Confusion matrices for the price change predic-

tion (increase or decrease) of optimal models using a win-

dow size of 17.

This study also investigates the time of day when

the model performs the best. This categorical vari-

able is derived from the timestamps, corresponding

to specific segments of the day in Coordinated Uni-

versal Time (UTC), spanning from morning to night.

Significantly, the ‘Afternoon‘ category emerges as the

Cryptocurrency Analysis: Price Prediction of Cryptocurrency Using User Sentiments and Quantitative Data

215

most accurate, indicating a notable surge in data vol-

ume during this time frame. This effectiveness can be

hypothesised to stem from its alignment with morning

hours in US time zones, particularly significant mar-

kets for BTC, where heightened trading activity and

increased Twitter engagement are prevalent.

6 CONCLUSIONS

This paper has presented the findings and outcomes

aimed at developing a predictive system for analysing

price trends of the highly volatile cryptocurrencies

such as Bitcoin using user sentiment from Twitter as

a popular User-Generated Content (UGC) platform

for discussion. The UGC dataset was generated from

the scraping of Twitter; temporal-mapped to the cryp-

tocurrency data from Kaggle. To do so, this paper ex-

plores and optimises four models – Long Short-Term

Memory (LSTM), Recurrent Neural Network (RNN),

bidirectional LSTM (bi-LSTM), and Gated Recurrent

Unit (GRU) for the task. The accuracy and relia-

bility of the predictions were then enhanced through

machine learning models and appropriate evaluation

techniques.

GRU is the best-performing model based on Root

Mean Squared Error (RMSE), followed by Bi-LSTM.

This is due to its capabilities in remembering short-

term events. As such, the findings supported the hy-

pothesis for public sentiment as a price prediction fea-

ture. Besides that, the models were found to best

predict 17 to 24 hours in advance where the global

market does react slower despite the volatile nature of

cryptocurrency – thus investors are patient with a ten-

dency to hold and observe further, or it can be inter-

preted as slow reactors to public sentiment on UGC.

As a future work, we aim to explore the inclusion

of other UGC platforms and their sentiments to build

a more robust model. If more micro-economic data is

to be obtained, we would also like to explore smaller

temporal windows for price prediction for a more sen-

sitive model especially when there are anomalies in

the market such as during a rug pull.

REFERENCES

Omar Yousef Adwan, Marwan Al-Tawil, Ammar Huneiti,

Rawan Shahin, Abeer Abu Zayed, and Razan Al-

Dibsi. 2020. Twitter sentiment analysis approaches:

A survey. International Journal of Emerging Tech-

nologies in Learning (iJET) 15, 15 (2020), 79. https:

//doi.org/10.3991/ijet.v15i15.14467

Mohammed Abdullah Ammer and Theyazn H. Aldhyani.

2022. Deep learning algorithm to predict cryptocur-

rency fluctuation prices: Increasing investment aware-

ness. Electronics 11, 15 (2022), 2349. https://doi.org/

10.3390/electronics11152349

Atieh Armin, Ali Shiri, and Behnam Bahrak. 2022. Com-

parison of machine learning methods for cryptocur-

rency price prediction. 2022 8th Iranian Conference

on Signal Processing and Intelligent Systems (IC-

SPIS) (2022). https://doi.org/10.1109/icspis56952.

2022.10043898

Temesgen Awoke, Minakhi Rout, Lipika Mohanty, and

Suresh Chandra Satapathy. 2020. Bitcoin price predic-

tion and analysis using Deep Learning Models. Com-

munication Software and Networks (2020), 631–640.

https://doi.org/10.1007/978-981-15-5397-4 63

Johannes Beck, Roberta Huang, David Lindner, Tian Guo,

Zhang Ce, Dirk Helbing, and Nino Antulov-Fantulin.

2019. Sensing Social Media Signals for Cryptocur-

rency News. In Companion Proceedings of The 2019

World Wide Web Conference (San Francisco, USA)

(WWW ’19). Association for Computing Machinery,

New York, NY, USA, 1051–1054. https://doi.org/10.

1145/3308560.3316706

Muhammad Husaini Bin Mohd Sabri, Amgad Muneer, and

Shakirah Mohd Taib. 2022. Cryptocurrency price

prediction using long short-term memory and Twit-

ter sentiment analysis. 2022 6th International Con-

ference On Computing, Communication, Control And

Automation (ICCUBEA (2022). https://doi.org/10.

1109/iccubea54992.2022.10011090

Zeyd Boukhers, Azeddine Bouabdallah, Cong Yang, and

Jan J

¨

urjens. 2023. Beyond Trading Data: The Hidden

Influence of Public Awareness and Interest on Cryp-

tocurrency Volatility. In Proceedings of the 32nd ACM

International Conference on Information and Knowl-

edge Management (Birmingham, United Kingdom)

(CIKM ’23). Association for Computing Machinery,

New York, NY, USA, 142–151. https://doi.org/10.

1145/3583780.3614790

Sepp Hochreiter and J

¨

urgen Schmidhuber. 1997. Long

short-term memory. Neural Computation 9, 8 (1997),

1735–1780. https://doi.org/10.1162/neco.1997.9.8.

1735

C. Hutto and Eric Gilbert. 2014. Vader: A parsimo-

nious rule-based model for sentiment analysis of so-

cial media text. Proceedings of the International AAAI

Conference on Web and Social Media 8, 1 (2014),

216–225. https://doi.org/10.1609/icwsm.v8i1.14550

Ahmed Ibrahim. 2021. Forecasting the early market move-

ment in bitcoin using Twitter’s sentiment analysis: An

ensemble-based prediction model. 2021 IEEE Inter-

national IOT, Electronics and Mechatronics Confer-

ence (IEMTRONICS) (2021). https://doi.org/10.1109/

iemtronics52119.2021.9422647

Patel Jay, Vasu Kalariya, Pushpendra Parmar, Sudeep

Tanwar, Neeraj Kumar, and Mamoun Alazab. 2020.

Stochastic Neural Networks for cryptocurrency price

prediction. IEEE Access 8 (2020), 82804–82818.

https://doi.org/10.1109/access.2020.2990659

Suhwan Ji, Jongmin Kim, and Hyeonseung Im. 2019. A

comparative study of bitcoin price prediction using

ICAART 2024 - 16th International Conference on Agents and Artificial Intelligence

216

Deep Learning. Mathematics 7, 10 (2019), 898. https:

//doi.org/10.3390/math7100898

Sihao Jiang. 2022. The Relationship between the Cryp-

tocurrency and the KOL of Elon Musk. In Pro-

ceedings of the 2022 13th International Conference

on E-Education, E-Business, E-Management, and

E-Learning (Tokyo, Japan) (IC4E ’22). Association

for Computing Machinery, New York, NY, USA,

454–458. https://doi.org/10.1145/3514262.3514341

Shubhankar Mohapatra, Nauman Ahmed, and Paulo Alen-

car. 2019. Kryptooracle: A real-time cryptocurrency

price prediction platform using Twitter sentiments.

2019 IEEE International Conference on Big Data (Big

Data) (2019). https://doi.org/10.1109/bigdata47090.

2019.9006554

Ivan Mu

ˇ

zi

´

c and Ivan Gr

ˇ

zeta. 2022. Expectations of Macroe-

conomic News Announcements: Bitcoin vs. Tradi-

tional Assets. Risks 10, 6 (2022). https://doi.org/10.

3390/risks10060123

Faizaan Pervaiz, Christopher Goh, Ashley Pennington,

Samuel Holt, James West, and Shaun Ng. 2020. Fear

and volatility in Digital assets. SSRN Electronic Jour-

nal (2020). https://doi.org/10.2139/ssrn.3721304

H. Sak, Andrew Senior, and F. Beaufays. 2014. Long short-

term memory recurrent neural network architectures

for large scale acoustic modeling. Proceedings of the

Annual Conference of the International Speech Com-

munication Association, INTERSPEECH (01 2014),

338–342.

Emre Sasmaz and F. Boray Tek. 2021. Tweet sentiment

analysis for cryptocurrencies. 2021 6th International

Conference on Computer Science and Engineering

(UBMK) (2021). https://doi.org/10.1109/ubmk52708.

2021.9558914

Otabek Sattarov, Heung Seok Jeon, Ryumduck Oh, and

Jun Dong Lee. 2020. Forecasting bitcoin price fluc-

tuation by Twitter sentiment analysis. 2020 Interna-

tional Conference on Information Science and Com-

munications Technologies (ICISCT) (2020). https:

//doi.org/10.1109/icisct50599.2020.9351527

Helder Sebasti

˜

ao and Pedro Godinho. 2021. Forecast-

ing and trading cryptocurrencies with machine learn-

ing under changing market conditions. Financial

Innovation 7, 1 (2021). https://doi.org/10.1186/

s40854-020-00217-x

Giulia Serafini, Ping Yi, Qingquan Zhang, Marco Bram-

billa, Jiayue Wang, Yiwei Hu, and Beibei Li. 2020.

Sentiment-driven price prediction of the Bitcoin based

on statistical and deep learning approaches. 2020

International Joint Conference on Neural Networks

(IJCNN) (2020). https://doi.org/10.1109/ijcnn48605.

2020.9206704

Stephen Smith and Anthony O’Hare. 2022. Comparing

traditional news and social media with stock price

movements; which comes first, the news or the price

change? Journal of Big Data 9, 1 (2022). https:

//doi.org/10.1186/s40537-022-00591-6

Jinqi Tang and Xiong Chen. 2018. Stock Market Prediction

Based on Historic Prices and News Titles. In Proceed-

ings of the 2018 International Conference on Machine

Learning Technologies (Jinan, China) (ICMLT ’18).

Association for Computing Machinery, New York,

NY, USA, 29–34. https://doi.org/10.1145/3231884.

3231887

Jan Valendin, Thomas Reutterer, Michael Platzer, and

Klaudius Kalcher. 2022. Customer base analysis with

recurrent neural networks. International Journal of

Research in Marketing 39, 4 (2022), 988–1018. https:

//doi.org/10.1016/j.ijresmar.2022.02.007

Cryptocurrency Analysis: Price Prediction of Cryptocurrency Using User Sentiments and Quantitative Data

217