Exploring the Impact of Competing Narratives on Financial Markets I:

An Opinionated Trader Agent-Based Model as a Practical Testbed

Arwa Bokhari

1,2 a

1

Department of Computer Science, University of Bristol, Bristol BS8 1UB, U.K.

2

Information Technology Department, College of Computers and Information Technology, Taif University, Saudi Arabia

Keywords:

Agent-Based Models, Narrative Economics, Opinion Dynamics, Financial Markets.

Abstract:

This paper introduces a framework to empirically investigate the influence of competing narratives on financial

market dynamics. We present an agent-based model of traders in a financial market, where traders are driven

by opinion dynamics and are subject to self-reinforcement, herding behaviors, and an accumulative response

to new information. Our systematic approach includes isolating these factors, enabling a parametric analysis

within the collective opinion dynamics of the market. Our simulation provides a testbed to evaluate various

market scenarios. While our findings are based on simulated data and thus warrant caution in real-world

interpretation, they offer important insights into market fluctuations. This study lays groundwork for further

research on trader behavior and market dynamics, and we have made the source-code publicly available for

replication and extension.

1 INTRODUCTION

With the advent of instantaneous information dissem-

ination, narratives play a significant role in shaping

market dynamics (Shiller, 2019; Hirshleifer, 2020).

Narrative economics, an emerging field championed

by Nobel laureate Robert Shiller (Shiller, 2017;

Shiller, 2019), investigates the influence of preva-

lent stories on individual economic actions. Rather

than merely reporting economic events, these narra-

tives actively shape market behaviors by influencing

collective sentiment. Investing in speculative assets

is not only a matter of individual psychology; it is

fundamentally rooted in social activity (Kim et al.,

2023). Individual traders often make investment de-

cisions based on information shared by others. This

behavior is recognized by investment experts, institu-

tions, and fund managers (Kim et al., 2023). Shiller

notes that stories blending truth and fiction can cre-

ate uncertainty and varied interpretations. When they

go viral, these stories can influence asset prices in

ways that deviate from traditional market fundamen-

tals. The impact of such narratives can be ampli-

fied by social media, where enthusiastic groups cre-

ate and spread these stories, wielding significant mar-

ket power. When such narrative-driven activities are

a

https://orcid.org/0000-0003-2987-4601

combined with user-friendly trading platforms like

Robinhood, stock prices can skyrocket to irrational

heights and/or drop significantly. There is a belief

that coordinated actions on social media played a role

in the fluctuations seen in GameStop price and trad-

ing volume in January 2021 (Kim et al., 2023; Jakab,

2022; Aliber et al., 2015).

Narratives’ influence on the market is not solely

due to their existence but also depends on their inter-

play. Tesla’s stock price rise in 2013 was driven by

a prevailing narrative about the promise of a sustain-

able future powered by electric vehicles. However,

a counternarrative cast doubts over Tesla’s valuation

(Liu, 2021). Similarly, Bitcoin’s ascent in 2017 was

powered by stories about the era of decentralized cur-

rencies but was counterbalanced by narratives point-

ing to potential misuse and volatility. Conflicting nar-

ratives about a company’s business prospects can trig-

ger pronounced market fluctuations, as illustrated by

the 2021 GameStop episode, and the November 2022

collapse of the crypto-currency exchange FTX.

In this exploratory study, we use group opinion

dynamics to construct a testbed model that eluci-

dates the interplay between two competing narratives

within social networks. The preliminary findings lay

the foundation for subsequent exploration into the in-

tricate dynamics of narrative competition and consen-

sus formation in social networks and their effect on

Bokhari, A.

Exploring the Impact of Competing Narratives on Financial Markets I: An Opinionated Trader Agent-Based Model as a Practical Testbed.

DOI: 10.5220/0012429500003636

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 16th International Conference on Agents and Artificial Intelligence (ICAART 2024) - Volume 1, pages 127-137

ISBN: 978-989-758-680-4; ISSN: 2184-433X

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

127

financial markets.

My model examines the concurrent dynamics in

a bifurcated financial system, marked by bearish sen-

timents anticipating market declines on one side and

bullish expectations forecasting market rises on the

other. We outline three pivotal mechanisms that shape

the complex process of financial decision-making and

the formation of underlying opinions. These mecha-

nisms are detailed in the following section.

1.1 Key Drivers of Market Dynamics

In understanding financial market dynamics amid

competing narratives, it is vital to pinpoint the be-

havioral and cognitive drivers that influence individ-

ual and collective behaviors within the market. In this

paper, we report on an agent-based model (ABM) that

allows for the exploration of the interplay of three

dynamics between two groups of traders: one ad-

vocating positive narratives and the other emphasiz-

ing negative ones. We first examine the impact of

the positive feedback mechanism on collective behav-

ior, a concept from the literature that explains self-

reinforcement among social groups. Next, we exam-

ine the influence of herding behavior, another well-

documented characteristic in social contexts, on col-

lective outcomes. Lastly, we address scenarios where

an external factor additively sways group behavior, re-

gardless of internal interactions.

• Self-Reinforcement. This behavioral phe-

nomenon occurs when narratives, consistently re-

peated within a community or environment, am-

plify and intensify over time. This amplification

can lead to escalating confidence in specific be-

liefs or behaviors, often resulting in a progres-

sively entrenched stance.

A tangible representation of self-

reinforcement is observed within “echo chamber”

dynamics. These enclosed environments,

prevalent on digital platforms, facilitate the un-

interrupted circulation of congruent viewpoints,

largely shielded from external challenges or

alternative perspectives. Consistent exposure to

these conforming opinions within such chambers

acts as a recursive feedback mechanism. Each

reaffirmation serves to reinforce the pre-existing

belief, making it more robust with each iteration.

Many market phenomena exemplify the self-

reinforcing logic in action. As market trends

intensify, they can trigger a cascade of investor

behavior aligning with the prevailing direction.

This positive feedback loop, where market be-

haviors reinforce and intensify existing trends,

further underscores the pervasive nature of self-

reinforcement in socio-digital and economic con-

texts.

• Herding Behavior. Herd behavior refers to the

tendency of individuals in a group to instinctively

mimic each other’s actions or beliefs, often influ-

enced by mutual interactions rather than explicit

instructions (Kameda et al., 2014). Herd behavior

is particularly evident in financial markets, as in-

vestors frequently imitate the decisions of others,

often presuming that those they follow have done

their due diligence.

The GameStop short squeeze event serves as

a prime example of this behavior. Informed in-

vestors, such as Keith Gill, a financial advisor

from Massachusetts

2

, played pivotal roles. In

January 2021, Keith Gill’s bullish view on the

GME stock and his subsequent gains were cited as

key factors contributing to the GME short squeeze

(Anand and Pathak, 2021). As Gill identified a

potential profit opportunity in GameStop, noting

its significantly high short interest. Based on this

observation, these investors began amassing con-

siderable shares. As the stock’s price began to

climb, a surge of other investors, motivated more

by a fear of missing out than by understanding

market intricacies, joined the fray. This initiated

a feedback loop, propelling the stock price well

beyond GameStop’s intrinsic value. Amidst this

surge, hedge funds and institutional investors that

had shorted the stock felt the heat to buy back

at higher prices, intensifying the rise. Numer-

ous subsequent retail investors seemed influenced

less by market fundamentals and more by these

early participants, underscoring the influence of

herd behavior in financial contexts (Andreev et al.,

2022).

Surowiecki (Surowiecki, 2004) pointed out

that these market trends can lead investors incor-

rectly, resulting in irrational bubbles where collec-

tive actions drive up asset prices. Even though the

“wisdom of crowds” relies on diverse opinions,

participants often end up imitating each other, fa-

voring group consensus over individual, indepen-

dent thought (Kim et al., 2023).

• Additive Response. Defined as a direct reac-

tion to an external stimulus or input, an additive

response remains independent of external influ-

ences, feedback mechanisms, or surrounding cir-

cumstances. In the context of financial markets,

this response indicates that investors might adjust

their positions based purely on these external sig-

nals, separate from prevailing market data or col-

2

See the archived news story here

ICAART 2024 - 16th International Conference on Agents and Artificial Intelligence

128

lective sentiment.

During the GameStop frenzy, this phe-

nomenon was evident. Despite vast unrealized

profits, influencer Keith Gill’s decision not to sell

acted as an external signal, prompting many to

adopt the stance, “If he is holding, I am hold-

ing”. Such behavior wasn’t rooted in market fun-

damentals but was a market dynamic propelled by

coordinated additive stimuli. Rallying cries like

“diamond hands” and “YOLO” during this period

further emphasize the power of these external sig-

nals, pushing many to act in ways perhaps con-

trary to standard market wisdom.

1.2 Structure of the Paper

This paper is the first of two, a pair of papers in which

the first (this paper) presents my agent-based model

(ABM) in full detail, and the second presents an ex-

tension of the model and application to real-world

data. To make each paper self-contained, illustrative

results are presented in this paper, and similarly, the

second paper includes a brief summary of the main

aspects of my model. The rest of this paper is or-

ganized as follows: Section 2 summarizes the theo-

retical background; Section 3 outlines the design and

functioning of my ABM; Section 4 then presents il-

lustrative results; and Section 5 concludes the dis-

course.

2 BACKGROUND

Experimental economics, established by the seminal

works of (Smith, 1962), has been essential in under-

standing economic behaviors, particularly within con-

tinuous double auction (CDA) markets. In a CDA,

participants can submit bids or offers at any time, cre-

ating a dynamic environment where trades execute as

soon as matching bids and offers are found, without

needing a centralized auctioneer. This market mech-

anism is continuous and asynchronous, allowing for

the immediate execution of trades and making it a fo-

cal point for economic research (Cliff, 2012). Smith’s

experiments in 1963 laid the foundation for using con-

trolled laboratory settings to analyze economic prin-

ciples, contributing to his Nobel Prize in 2002. This

empirical approach has significantly informed the de-

velopment of agent-based computational economics

(ACE), characterized by the simulation of market dy-

namics through autonomous trading agents.

These ABMs frequently implement zero-

intelligence (ZI) and minimal-intelligence (MI)

trader-agent algorithms. Despite their simplicity,

these algorithms effectively replicate complex market

behaviors. Prominent ZI trading strategies within the

ACE framework include ZIC, SHVR, and GVWY:

• Zero-Intelligence-Constrained (ZIC) Traders:

Functioning without any forecast of market trends

or strategic intricacies, ZIC traders produce ran-

dom price quotes within a predefined range to

avoid loss-making trades, in compliance with

their individual constraints (Gode and Sunder,

1993b).

• Shaver (SHVR) Traders: SHVR traders incre-

mentally improve upon existing market quotes in

a deterministic fashion. A SHVR buyer will issue

a bid just above the current best, while a SHVR

seller will set an ask just below the lowest present

ask, with both adhering to their limit prices (Cliff,

2012).

• Giveaway (GVWY) Traders: GVWY traders

passively match their quotes to their limit prices,

foregoing active market spread exploitation. They

can, nonetheless, realize gains if market fluctua-

tions are more favorable than their quoted prices

(Cliff, 2012).

In the context of ACE and market simulations,

understanding the narratives that drive trader behavior

becomes essential. This consideration is particularly

relevant in the development of advanced algorithms

like (Parameterised-Response Zero Intelligence)

PRZI and (Parameterized-Response Differential

Evolution) PRDE, which are ZI strategies that can

adapt to market conditions. Cliff introduced the

PRZI (Cliff, 2023) algorithm, enabling adaptive

strategy changes in response to market dynamics

(Cliff, 2022a). PRZI traders adjust their bids based

on a real-valued strategy parameter and are capable

of operating as ZIC, SHVR, GVWY, or hybrid strate-

gies. The subsequent PRDE algorithm, as introduced

by Cliff (2022), further extends these capabilities

through differential evolution optimization (Cliff,

2022b).

Integrating narrative economics into these models

offers new insights into the interplay of market me-

chanics, trader behaviors, and prevailing narratives.

The first work in this field is by Lomas and Cliff (Lo-

mas and Cliff, 2021), combining opinion dynamics

with ABM to understand how narratives impact fi-

nancial market prices. However, they did not con-

sider how price dynamics affect market narratives,

a gap addressed by (Bokhari and Cliff, 2022) in the

BFL-PRDE model: this involved an extension of the

Bizyaeva, Franci, and Leonard (BFL) model, build-

ing on recent research (Bizyaeva et al., 2020) which

integrates continuous-time opinion dynamics with the

Exploring the Impact of Competing Narratives on Financial Markets I: An Opinionated Trader Agent-Based Model as a Practical Testbed

129

PRDE (Cliff, 2022b) strategy. This approach dynam-

ically represents the influence of narratives and opin-

ions on traders’ actions and market prices. Traders

in the BFL-PRDE model have opinion variables in-

fluenced by other agents and market observations, of-

fering a nuanced view of narrative dynamics interplay

with market dynamics.

The evolution from PRZI to its successor PRDE,

and the advanced BFL-PRDE, are elaborated in the

following section.

3 MODEL

3.1 BFL-PRDE Trader Model

In the evolution of trading strategies, PRZI laid the

groundwork for adaptive ZI traders, paving the way

for its descendant, PRDE. While PRDE equipped

traders with means for adapting to market fluctua-

tions, it inherently lacked the capability to antici-

pate market trends. Traders, operating within the

PRDE domain draw upon their specific strategies

to determine quote prices. The dynamic nature of

these strategies stems from a dual interaction: in-

trinsic strategy values and the prevailing strategies

of peer traders in the market. (Bokhari and Cliff,

2022) extend the PRDE framework by incorporating

a real-valued opinion variable, utilizing the opinion

dynamics model proposed by Bizyaeva et al., 2020

(Bizyaeva et al., 2020). This integration yields a

more sophisticated trading model called (BFL-PRDE)

where buyers and sellers, informed by their opinions,

demonstrate contrasting market behaviors. Under a

bullish consensus, BFL-PRDE buyers, a hybrid of

GVWY (Cliff, 2012; Cliff, 2018) and ZIC(Gode and

Sunder, 1993a), manifest heightened urgency, influ-

encing their quote prices. Conversely, sellers lean to-

wards a more relaxed position in the form of a hybrid

between ZIC and SHVR (Cliff, 2012; Cliff, 2018),

especially when bearish sentiments dominate.

This development requires a mapping function,

translating trader opinion into its PRDE trading strat-

egy. Elaborating on the intrinsic mechanics, as de-

tailed in (Cliff, 2022a), Each PRDE trader holds a

private local set of potential strategy-values with a

population size NP ≥ 4. For trader i, this set can

be denoted as s

i,1

,s

i,2

,...,s

i,NP

. Given that PRDE

traders rely solely on a singular real scalar value to

characterize their bargaining approach, every indi-

vidual in the differential evolution population repre-

sents a single value. Thus, the traditional differen-

tial evolution mechanism of crossover (i.e., select-

ing genes from a pair of parents, one gene for each

genome dimension) isn’t relevant: PRDE creates a

genome exclusively based on the base vector. In its

present version, PRDE adopts the standard “vanilla”

DE/rand/1 (Storn and Price, 1997). After evaluat-

ing a strategy s

i,x

, three distinct s-values are chosen

at random from the population: s

i,a

,s

i,b

, and s

i,c

en-

suring x 6= a 6= b 6= c. This results in the genera-

tion of a new candidate strategy s

i,y

defined as s

i,y

=

max(min(s

i,a

+F

i

(s

i,b

−s

i,c

),+1),−1), where F

i

sym-

bolizes the trader’s differential weight coefficient (in

the outlined experiments, F

i

= 0.8;∀i). Utilizing the

min and max functions, the candidate strategy’s range

is limited between [−1.0,+1.0]. Within BFL-PRDE,

the trader’s opinion s

i,o

emerges as an additional can-

didate strategy. The performances of s

i,y

and s

i,o

are

then compared; the superior strategy becomes the new

parent strategy s

i,x

. If not, it’s replaced with the sub-

sequent strategy s

i,x+1

.

3.2 BFL Opinion Dynamics Model

We use a social network model to represent traders

with competing narratives interacting and potentially

altering their opinions. In this model, traders can be

categorized into two communities: those with posi-

tive opinions and those with negative ones. Negative

traders will uniformly share one narrative, whereas

positive traders will promote a contrasting narrative

(Long et al., 2023). Consider a network of N

a

trad-

ing agents forming opinions x

1

,...,x

N

a

∈ R about the

price of a tradable asset. Let x

i

be the opinion state of

agent i. This real-valued scalar opinion variable indi-

cates that a negative x

i

indicates an expected decline

in prices, while a positive x

i

implies an anticipated

increase. The vector X = (x

1

,...,x

N

a

) represents the

opinion state of the agent network. Agent i is neutral

if x

i

= 0. The origin X = 0 is called the network’s

neutral state. Agent i is unopinionated if its opinion

state is small, i.e., |x

i

| ≤ ϑ for a fixed threshold ϑ ≈ 0.

Agent i is opinionated if |x

i

| ≥ ϑ. Agents can agree

and disagree. When two agents have the same qual-

itative opinion state (e.g., they both favor the same

option), they agree. When they have qualitatively dif-

ferent opinions, they disagree.

We utilize the BFL opinion dynamics from (Franci

et al., 2019), which are simplified to the dynamics of

N

c

clusters or communities, as described in (Bizyaeva

et al., 2020). Each cluster, indexed by q = 1,...,N

c

,

comprises N

q

agents out of a total of N

a

, such that

∑

N

c

q=1

N

q

= N

a

. These agents form opinions collec-

tively.

Consider two clusters, p and n, representing com-

munities of positive (bullish) and negative (bearish)

traders, respectively. For a given cluster q, let the set

ICAART 2024 - 16th International Conference on Agents and Artificial Intelligence

130

of all agent indices in that cluster be denoted by I

q

.

With q ∈

{

p,n

}

, p 6= n, then, each agent i ∈ I

q

has an

opinion that evolves according to the dynamics pre-

sented in (Bizyaeva et al., 2020), which can be sum-

marized by the following differential equation:

˙x

i

= −d

i

x

i

+ u

i

(

ˆ

S

1

(α ˆx

p

+ γ

i

ˆx

n

) −

ˆ

S

2

(β ˆx

p

+ δ

i

ˆx

n

)) + b

q

(1)

where ˆx

q

is the average opinion of cluster q:

ˆx

q

=

1

N

q

∑

i∈I

q

x

i

(2)

and

ˆ

S

z

(x), z ∈

{

1,2

}

are saturation functions de-

fined as

ˆ

S

z

(x) =

1

2

(S

z

(x) − S

z

(−x)), where S

z

are odd sigmoids.

(3)

The model in (1) is suitable for testing the aforemen-

tioned market’s price drivers by considering the pa-

rameters as follows:

• d > 0 is a resistance parameter that drives the

rate of change ˙x

i

towards the neutral point over

time. Intuitively, a larger value of d implies the

agent is less inclined to change its opinion. Within

the context of social sciences, this parameter can

symbolize an individual’s level of “stubbornness”.

• u ≥ 0 is an attention parameter; it affects how ˙x

i

changes in response to social interactions. Intu-

itively, a larger value of u indicates greater atten-

tion or sensitivity of the agent to other agents’

opinions. Thus, the two parameters d and u

weigh the relative influence of the linear damp-

ing term and the opinion exchange term, respec-

tively; when the influence of d outweighs that

of u, the agent pays minimal attention to others.

Conversely, if u dominates d, the agent becomes

more attentive to others’ opinions. The dynamics

governing the evolution of the agent’s attention

parameter, as detailed in (Bizyaeva et al., 2020),

are given by:

τ

u

˙u

i

= −u

i

+ S

u

(

N

a

∑

l=1

( ¯a

il

x

l

)

2

) (4)

let the feedback weight be

¯

A

i

= ¯a

i j

∈

{

0,1

}

. If

¯a

i j

= 1, it indicates that agent i is influenced by

the status of agent j. The matrix

¯

A can either cor-

respond to a predefined social network or be de-

termined independently. The saturation function

S

u

is then decomposed as:

S

u

(y) = u

f

(F (g (y − y

m

)) − F(−gy

m

)) (5)

S

u

is defined with F(x) =

1

1+e

−x

.

• α ≥ 0 is the self-reinforcement of the cluster’s

averaged opinions ˆx

q

. This parameter quantifies

the degree of dependency of an agent’s tempo-

ral evolution in opinion on the average of its en-

compassing cluster. For an elevated α, there’s a

pronounced amplification of the intrinsic histori-

cal or mean consensus of the cluster, potentially

driving the system towards a state of reduced ex-

ternal influence and susceptibility to becoming an

echo chamber. Conversely, a diminished α results

in a diminished anchoring to past consensus, ren-

dering the system more susceptible to external in-

fluences.

• β is the intra-agent interaction weight, repre-

senting how an agent processes and weights op-

posing opinions within its own decision-making

paradigm. This becomes particularly relevant

when an agent is faced with multiple choices,

such as when formulating opinions on a variety

of tradable assets like different stocks, in this

case the state of its opinion would be a vector

ˆ

X

p

. However, given that there’s only one object

for decision-making in my system, this parameter

will take a value opposite to α as the second term

of the dynamics in (1) is subtracted from the first,

making the opinion more emphasized by ˆx

p

.

• γ and δ are the inter-agent interaction weights,

which determine whether cluster p and cluster n

form a consensus γ − δ > 0 or a dissensus γ − δ <

0. The state feedback dynamics of these parame-

ters take the form of a leaky nonlinear integrator

(Bizyaeva et al., 2020):

τ

γ

˙

γ

i

= −γ

i

+ σ

q

S

γ

( ˆx

p

ˆx

n

) (6)

τ

δ

˙

δ

i

= −δ

i

− σ

q

S

δ

( ˆx

p

ˆx

n

) (7)

where σ

q

∈

{

1,−1

}

is the design parameter

and τ

γ

,τ

δ

> 0 are time scales, and the saturation

function is

S

c

(y) = c

f

tanh (g

c

y) c ∈

{

γ,δ

}

(8)

where c

f

,g

c

> 0. In any configuration of opin-

ions where the product ˆx

p

ˆx

n

is notably non-neutral

and significantly large, it prompts γ

i

to gravi-

tate towards σγ

f

and δ

i

to move towards −σδ

f

(Bizyaeva et al., 2020).

• b is the input parameter, potentially derived from

environmental factors, such as market fluctua-

tions, or it could signify inherent biases. For

traders with a bearish (or negative) opinion, we

designate b

n

≤ 0 to convey a predominant senti-

ment predicting a price decrease. Conversely, for

those holding bullish (or positive) opinions, we

Exploring the Impact of Competing Narratives on Financial Markets I: An Opinionated Trader Agent-Based Model as a Practical Testbed

131

assign b

p

≥ 0 to signify an expectant bias towards

a price ascent.

For non-negative α and β, the terms α ˆx

p

and

β ˆx

p

in Equation (1) exemplify the self-reinforcement

mechanism within cluster p. Similarly, the dynamics

of cluster n can be described by interchanging ˆx

p

with

ˆx

n

in the same equation, indicating analogous self-

reinforcement. To understand the dynamics in the

context of opposing narratives, consider that ˆx

p

> 0

and ˆx

n

< 0. In this situation, α ˆx

p

> 0 and β ˆx

p

> 0

will reinforce cluster p to adopt a more positive view,

while α ˆx

n

< 0 and β ˆx

n

< 0 will push cluster n towards

a more negative direction. Such parameterization ef-

fectively captures self-reinforcement’s role in shaping

opposing perspectives.

Herding behavior is modeled by embedding feed-

back mechanisms into the social influence parameters

γ and δ. The system’s tendency—towards consensus

or dissensus—is dictated by the sign of the parameter

σ in the dynamics of Equations (6) and (7). A rever-

sal in σ’s sign triggers a shift between consensus and

dissensus states: σ = 1 aligns both clusters towards

consensus, whereas σ = −1 drives them to dissensus.

In the case where α = β = γ = δ = 0, the dynam-

ics in (1) are linear. Then, ˙x

i

responds additively to

b

q

, where b

q

is interpreted as an environmental sig-

nal. We can model additive response by setting the

value of b

q

.

4 ILLUSTRATIVE RESULTS

4.1 Trading Dynamics

In the financial market simulation under discussion,

we utilize the open-source BSE platform (Cliff, 2012)

to model a single-commodity market with N = 100

traders, equally divided into buyers and sellers (N

B

=

N

S

= 50 each). These traders are restricted to their ini-

tial roles, unable to switch between buyer and seller

positions. Their sole decision-making capability is in

setting their quoting price, and each adopts the BFL-

PRDE strategy with a NP = 5 parameter. The simu-

lation features a pricing schedule based on symmetric

supply and demand curves, ranging from $60 to $250.

To emulate continuous time, the BSE platform adopts

a discrete time-slicing technique with a temporal step-

size of ∆t = 1/N, ensuring at least one market inter-

action per trader per second. The experiments run for

one continuous week of round-the-clock, 24/7 trad-

ing, each experiment were repeated 50 times. In these

experiments, traders are integrated into a fully con-

nected network, facilitating direct interactions among

them all.

In my analysis, I attempted to elucidate the un-

derlying trend of transaction prices over time, which

Ire initially represented as an agglomeration of indi-

vidual data points from fifty trials. To achieve this,

I implemented a polynomial regression model, rec-

ognizing its capacity to adapt to the non-linear na-

ture of my data. Specifically, I chose at least second-

degree polynomial regression, which allows for the

curvature. This model fits the aggregated data, en-

capsulating the collective trends across all trials while

balancing the need to reflect general tendencies with-

out overfitting the noise inherent in the dataset. The

resulting polynomial trend line, plotted against the

transaction prices, provided a visual representation of

the average directional movement, revealing a more

nuanced trajectory of price changes over time and of-

fering a compelling graphical narrative of the price’s

dynamics.

4.1.1 Self-Reinforcing Dynamics

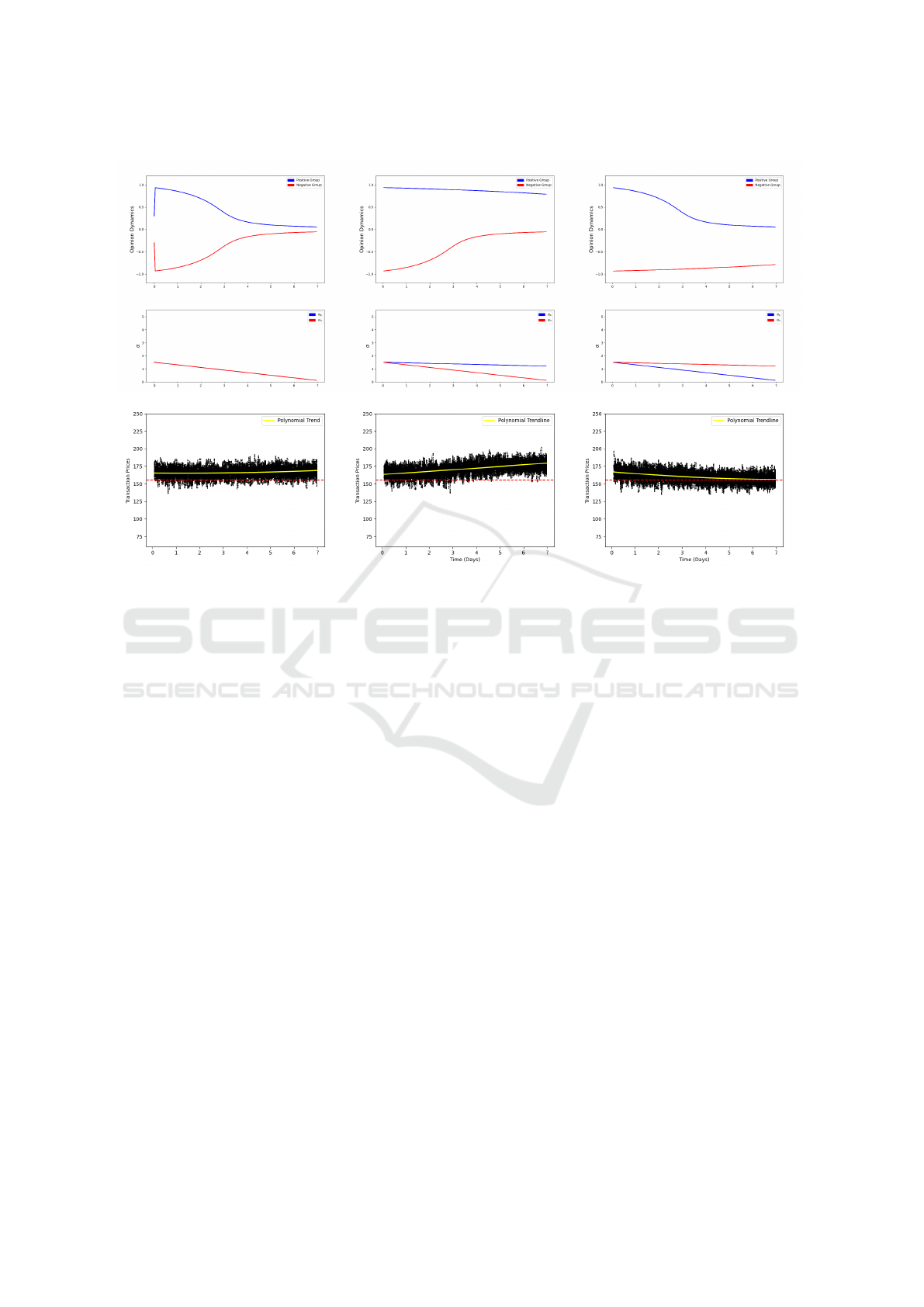

In Figures 1, 2, 3 and 4, I use the opinion dynamics

outlined in equation (1) to model the three key factors

affecting traders’ strategies in response to competing

narratives and how these influence traders’ decisions

in the market, potentially leading to market price fluc-

tuations.

Figures 1 and 2 illustrate the temporal evolution of

ˆx

p

and ˆx

n

. This aligns with studying the influence of

the first factor, which investigates how a linear change

in each group’s self-reinforcement level, denoted by

α

p

for cluster p and α

n

for cluster n, impacts the mar-

ket price dynamic. For the context of this study, the

parameters are configured with γ = δ = 0, and the bi-

ases are set at b

p

= 0.05 and b

n

= −0.05.

Figure 1A illustrates the scenario where both

groups exhibit linearly increasing self-reinforcing

with α

p

= α

n

, both groups exhibit equal self-

reinforcement. This equality leads to a pronounced

polarization in the opinion distributions, causing each

group to distance from the other. Consequently, the

transaction prices stabilize, reflecting the equal influ-

ence from both sides. Figure 1B captures the scenario

where α

p

> α

n

. In this situation, the positive group

assumes a dominant role, causing the negative group

to lean towards a weaker negative stance. This dy-

namic results in an increase in transaction prices dur-

ing the period where the negative group is gravitated

by the positive one; however, as both α

p

and α

n

are

linearly increasing, both groups will eventually move

away from each other. In contrast, Figure 1C presents

the case of α

p

< α

n

. Here, the negative group’s influ-

ence is more significant, drawing the positive group

towards a weaker positive position. This leads to a

decrease in transaction prices during the period where

ICAART 2024 - 16th International Conference on Agents and Artificial Intelligence

132

A B C

Figure 1: Comparison of system dynamics over three scenarios based on differing self-reinforcement levels (α) in the model

(1) of two competing groups. Over a seven-day around-the-clock trading period, the plots display: (A-C, Top) Opinions

ˆx

p

(blue) and ˆx

n

(red); (A-C, Middle) Self-reinforcement levels α

p

(blue) and α

n

(red); (A-C, Bottom) Transaction prices

from 50 IID experiments (black dots, with the market’s theoretical equilibrium price indicated by dashed red line). Ini-

tial conditions: x

p

(t0) = 0.3, x

n

(t0) = −0.3, γ

p

= γ

n

= δ

p

= δ

n

= 0, with biases b

p

= 0.05 and b

n

= −0.05. (A) Equal

self-reinforcement: α

p

(t) = α

n

(t) = 0.5 + (1.0)(t − t

0

/D). This results in symmetrical opinion dynamics, and transaction

prices remain close to equilibrium. (B) The positive group is more self-reinforcing with α

p

(t) = 0.5 + (5.0)(t −t

0

/D) and

α

n

(t) = 0.5 +(1.0)(t −t

0

/D). Here, the negative group’s opinions are swayed by the stronger positive group, leading to trans-

action prices above equilibrium. (C) Greater self-reinforcement in the negative group with α

n

(t) = 0.5 + (5.0)(t − t

0

/D) and

α

p

(t) = 0.5 + (1.0)(t −t

0

/D) leads to the positive group’s opinions being influenced more by the negative group, resulting in

transaction prices below equilibrium.

the negative group is attracting the positive one.

Based on this model of self-reinforcement, I can

conclude that when one group is at least five times

more self-reinforcing than another, it can influence

transaction prices. As both groups increasingly rein-

force their own opinions, their views tend to polarize

over time

Figure 2A illustrates the scenario where both

groups exhibit linearly decreasing self-reinforcing

with α

p

= α

n

, both groups exhibit equally decreas-

ing self-reinforcement. This equality leads to both

groups moving toward the neutral point in the opin-

ion distributions, causing each group to get close to

the other. Consequently, the transaction prices sta-

bilize, reflecting the equal influence from both sides.

Figure 2B captures the scenario where the negative

group becomes linearly less self-reinforcing α

p

> α

n

.

In this situation, the positive group assumes a domi-

nant role, causing the negative group to lean towards

a weaker negative stance. This dynamic results in an

increase in transaction prices as both α

p

and α

n

are

linearly decreasing, and both groups will eventually

move close to each other in the direction of the less

decreasing self-reinforcement group. In contrast, Fig-

ure 2C presents the case of α

p

< α

n

. Here, the neg-

ative group’s influence is more significant, drawing

the positive group towards a weaker positive position.

This leads to a decrease in transaction prices as the

negative group attracts the positive one.

The model indicates that a group with at least a

five times lower self-reinforcement rate exerts a dis-

proportionate influence on transaction prices by being

more susceptible to the opposing group’s opinion.

4.1.2 Herding Dynamics

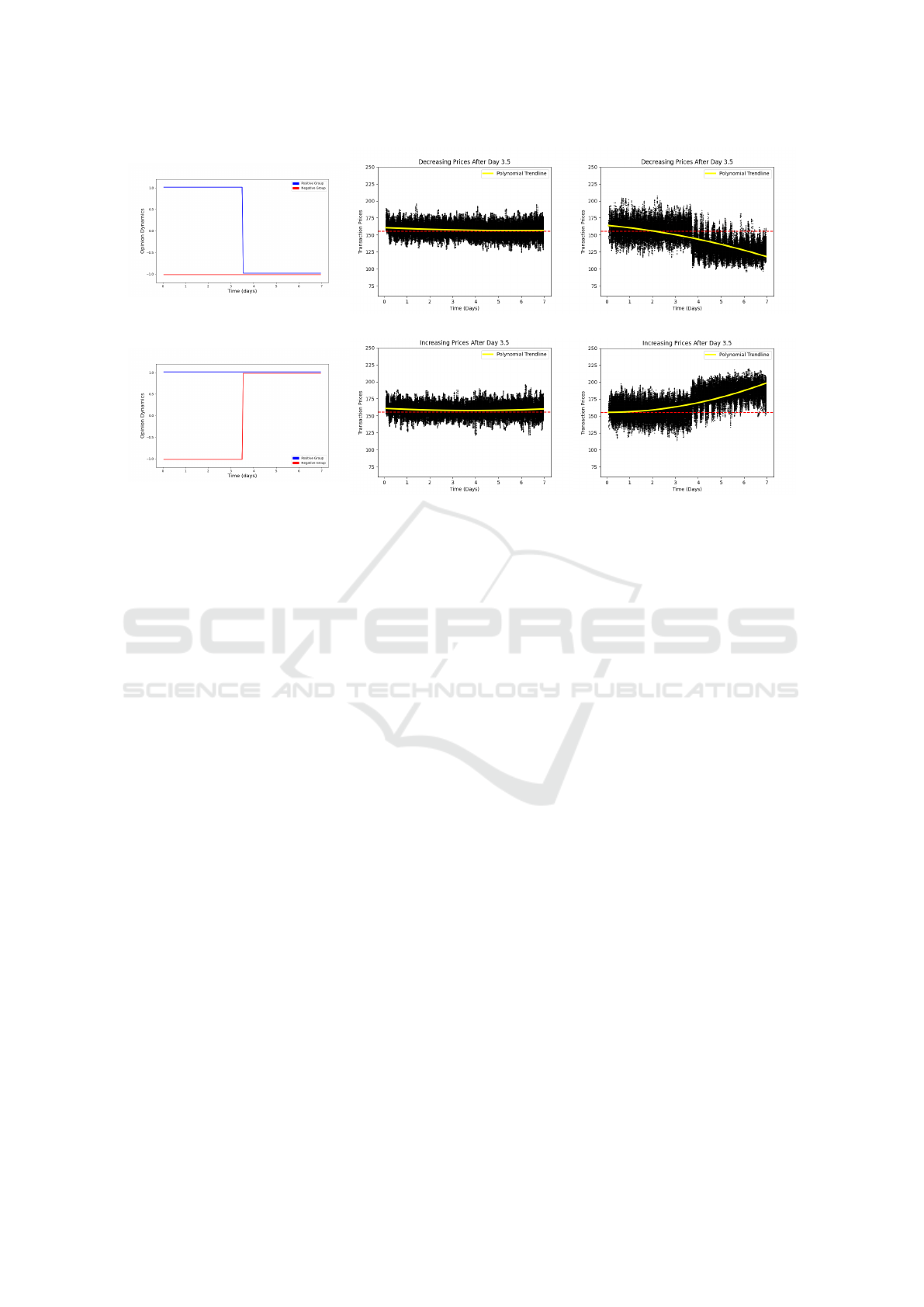

Figure 3 demonstrates the impact of the relationship

between the opinion network weights γ and δ on mar-

ket price dynamics, as per the second factor. For this

illustration, the setup is divided into two phases. Dur-

Exploring the Impact of Competing Narratives on Financial Markets I: An Opinionated Trader Agent-Based Model as a Practical Testbed

133

A B C

Figure 2: Comparison of system dynamics over three scenarios based on differing self-reinforcement levels (α) in the model

(1) of two competing groups. Over a seven-day around-the-clock trading period, graph format and initial conditions are as in

figure 1. (A) Equal linearly decreasing self-reinforcement: α

p

(t) = α

n

(t) = 1.5 −(1.4)(t − t

0

/D). This results in symmetrical

opinion dynamics, and transaction prices remain close to equilibrium. (B) The positive group is more self-reinforcing with

α

p

(t) = 1.5 − (1.4)(t − t

0

/D) and α

n

(t) = 1.5 + (0.3)(t − t

0

/D). Here, the negative group’s opinions are swayed by the

stronger positive group, leading to transaction prices above equilibrium. (C) Greater self-reinforcement in the negative group

with α

n

(t) = 1.5 − (1.4)(t −t

0

/D) and α

p

(t) = 1.5 − (0.3)(t −t

0

/D) leads to the positive group’s opinions being influenced

more by the negative group, resulting in transaction prices below equilibrium.

ing the first half of the period, γ − δ < 0, leading the

group to a state of dissensus (or anti-herding). In the

latter half, γ − δ > 0 drives the two groups towards

consensus (herding). The additional parameters are

configured as α = β = 0 with biases set at b

p

= 0.05

and b

n

= −0.05.

From Figure 3(a) and (d), it’s evident that the

opinion distribution either leans positively or nega-

tively, an outcome closely tied to the opinion forma-

tion process. Specifically, when herding gravitates to-

wards the positive, transaction prices are above equi-

librium. Conversely, when the trend is negative, trans-

action prices are below the equilibrium. Particularly,

in (b) and (c), herding towards a positive consensus

leads to transaction prices that exceed the equilibrium

value. In contrast, (e) and (f) show that negative herd-

ing results in transaction prices falling below equilib-

rium.

Figures 3(b) and (e) portray the transaction prices

within a market consisting of 100 trades. Despite

the existence of price shifts, their magnitude ap-

pears minimal. On the other hand, Figures 3(c) and

(f) demonstrate transactions in a smaller market of

10 traders, where the shifts in prices are more pro-

nounced, underscoring the influence of market size on

price volatility.

To determine whether there was a statistically sig-

nificant effect between the herding and anti-herding

phases of both experiments displayed in Figure 3,

we used the Wilcoxon-Mann-Whitney U test to deter-

mine whether the distribution of transaction prices in

the first three days of the 7-day experiment had a dif-

ferent central tendency from the distribution of prices

over days 5, 6 and 7. As my system is inherently

stochastic, we repeated 50 i.i.d. trials at each set of

initial conditions. Typically, around 40 of the 50 trials

would result in highly significant distributional differ-

ences (p ≤ 0.001), 3 or 4 would be moderately signif-

icant (p ≤ 0.01) and the remainder would show no

significant difference. In doing this analysis, we no-

ticed that the p-values decline as the number of traders

in the market increases, but even when N= 100 the p-

values are in order of 1 × 10

−10

. In further work we

plan to explore this ’fall-off’ in more detail, looking

at ever-large populations of traders.

ICAART 2024 - 16th International Conference on Agents and Artificial Intelligence

134

(a)

(b) (c)

(d)

(e)

(f)

Figure 3: Comparison of system dynamics over two scenarios of herding behavior among the two competing groups is

presented. In models 6 and 7, the control parameter σ is set to σ = −1 for the first half of the period and σ = +1 for the

second half. Over a seven-day around-the-clock trading period, the plots (a) and (d) display herding trends in opinions ˆx

p

(blue) and ˆx

n

(red), with negative and positive herding respectively; Plots (b) and (e) show transaction prices —(black dots,

with the market’s theoretical equilibrium price indicated by dashed red line)— for 50 IID experiments in a market with 100

traders, while (c) and (f) depict transaction prices for 50 IID experiments in a market consisting of 10 traders; all parameters

were held constant at α = β = 0, with biases b

p

= 0.05 and b

n

= −0.05 for each respective group.

4.1.3 Additive Response Dynamics

Figure 4 illustrates simulations of the effects of the

additive response, denoted by b, where input magni-

tudes linearly increase over time. Each group’s in-

put is directionally represented, with b

p

(t) > 0 and

b

n

(t) < 0. These simulations were conducted with

the self-reinforcement and herding parameters set to

zero (α = β = γ = δ = 0) and initial opinions at equi-

librium.

Subfigure A of Figure 4 depicts the results when

|b

p

(t)| = |b

n

(t)|, meaning both inputs have identi-

cal magnitudes but opposite directions, increasing lin-

early with time. The simulation indicates that when

inputs have the same magnitude but are diametrically

opposed, they impact the opinion dynamics, resulting

in both groups moving away from one another. This

creates an equilibrium with equal forces, leading to

the stabilization of transaction prices.

Subfigure B of Figure 4 demonstrates the dynam-

ics when the positive group is influenced by a stronger

additive sentiment, denoted by |b

p

|, which surpasses

that of the negative group, |b

n

|. The simulation re-

sults show a pronounced intensification in the posi-

tive group’s opinions, paralleled by a noticeable in-

crease in transaction prices. This signifies that domi-

nant positive sentiments bolster the group’s collective

stance, pushing the market trends upward.

Conversely, Subfigure C of Figure 4 illustrates a

scenario where the negative group is affected by a

prevailing additive negative sentiment. This situation

leads to a marked decrease in transaction prices. The

graphical results underscore the impact of negative

group sentiment in swaying price dynamics, which

manifests as a downward pressure on market valua-

tions, reflecting a pessimistic outlook by the group.

5 DISCUSSION AND

CONCLUSION

The GameStop episode is an illustrative case of

the multifaceted interplay among diverse narratives

within financial markets. It clearly demonstrates

the potent impact of varied market sentiments, par-

ticularly when amplified through social media plat-

forms such as Reddit. This confluence can give

rise to abnormal market phenomena, such as short

squeezes, underscoring the substantial influence of

collective narratives on market functioning. This sce-

nario presents a significant challenge, necessitating

the introduction of rational regulatory measures to

Exploring the Impact of Competing Narratives on Financial Markets I: An Opinionated Trader Agent-Based Model as a Practical Testbed

135

A B C

Figure 4: Comparison of system dynamics over three scenarios based on differing the levels of inputs (b) in the model (1) of

two competing groups from 50 IID experiments running over a seven-day around-the-clock trading period, the plots display:

(A-C, Top) Opinions ˆx

p

(blue) and ˆx

n

(red); (A-C, Middle) b values b

p

(blue) and b

n

(red); (A-C, Bottom) Transaction

prices (black dots, with the market’s theoretical equilibrium price indicated by dashed red line). Initial conditions: x

p

(t0) =

x

n

(t0) = 0, α

p

= α

n

= β

p

= β

n

= γ

p

= γ

n

= δ

p

= δ

n

= 0. (A) Equal additive inputs: |b

p

(t)| = |b

n

(t)| = 0.1 +(1.0)(t −t

0

/D).

This results in symmetrical opinion dynamics, and transaction prices remain close to equilibrium. (B) The positive group

is receiving more input with b

p

(t) = 0.1 + (1.0)(t −t

0

/D) and b

n

(t) = 0.1 + (0.15)(t −t

0

/D). Here, the positive group is

receiving a stronger input, leading to transaction prices above equilibrium. (C) Greater inputs to the negative group with

b

n

(t) = 0.1 + (1.0)(t − t

0

/D) and b

p

(t) = 0.1 + (0.15)(t − t

0

/D) leads the negative group to have stronger opinions, resulting

in transaction prices decreasing.

mitigate market imbalances.

In this paper I have developed a testbed to exam-

ine the principal factors influencing group dynamics

amidst conflicting narratives in financial markets: col-

lective self-reinforcement; herding behavior; and the

assimilation of new information. With its adaptable

parameters, this testbed provides a valuable tool for

assessing the impact of these factors on market be-

havior in various scenarios.

The research presented here is significant in that it

offers a method to quantify and model the effects of

competing narratives on financial markets. I introduce

a framework that integrates qualitative narrative dy-

namics with quantitative decision-making. Our pro-

posed model enhances the financial analyst’s toolkit

by providing an empirical approach to anticipate the

market volatility resulting from narrative shifts. With

financial markets becoming ever more sensitive to the

rapid flow of information, the ability to understand the

role of narratives is crucial for comprehensive market

analysis, highlighting the importance and relevance

of our research. To facilitate replication and further

advancement of this work, I will provide the system’s

source code as an open-source repository on GitHub

3

.

I look forward to the diverse applications and en-

hancements the research community will derive from

this resource.

REFERENCES

Aliber, R. Z., Kindleberger, C. P., and McCauley, R. N.

(2015). Manias, Panics, and Crashes: A History of

Financial Crises. Springer.

Anand, A. and Pathak, J. (2021). WallStreetBets against

Wall Street: The Role of Reddit in the Gamestop

Short Squeeze. Technical Report IIMB Working

Paper-644, Indian Institute of Management Banga-

lore.

Andreev, B., Sermpinis, G., and Stasinakis, C. (2022).

Modelling Financial Markets during Times of Ex-

treme Volatility: Evidence from the GameStop Short

Squeeze. Forecasting, 4(3):654–673.

Bizyaeva, A., Franci, A., and Leonard, N. E. (2020). A

3

See my NarrativeEconomics Repository for source

code and more details.

ICAART 2024 - 16th International Conference on Agents and Artificial Intelligence

136

general model of opinion dynamics with tunable sen-

sitivity. arXiv preprint arXiv:2009.04332.

Bokhari, A. and Cliff, D. (2022). Studying Narrative

Economics by Adding Continuous-Time Opinion Dy-

namics to an Agent-Based Model of Co-Evolutionary

Adaptive Financial Markets. In Proceedings of the

15th International Conference on Agents and Artifi-

cial Intelligence.

Cliff, D. (2012). Bristol Stock Exchange: open-source

financial exchange simulator. https://github.com/

davecliff/BristolStockExchange.

Cliff, D. (2018). BSE: A Minimal Simulation of a Limit-

Order-Book Stock Exchange. In Bruzzone, F., edi-

tor, Proc. 30th Euro. Modeling and Simulation Sym-

posium (EMSS2018), pages 194–203.

Cliff, D. (2022a). Metapopulation Differential Co-

Evolution of Trading Strategies in a Model Financial

Market. In 2022 IEEE Symposium Series on Compu-

tational Intelligence (SSCI), pages 1600–1609.

Cliff, D. (2022b). Metapopulation Differential Co-

Evolution of Trading Strategies in a Model Financial

Market. SSRN: 4153519.

Cliff, D. (2023). Parameterised Response Zero Intelligence

Traders. Journal of Economic Interaction and Coor-

dination, pages 1–54.

Franci, A., Golubitsky, M., Bizyaeva, A., and Leonard,

N. E. (2019). A Model-Independent Theory of

Consensus and Dissensus Decision Making. arXiv

preprint arXiv:1909.05765.

Gode, D. and Sunder, S. (1993a). Allocative Efficiency of

Markets with Zero-Intelligence Traders: Market as a

Partial Substitute for Individual Rationality. Journal

of Political Economy, 101(1):119–137.

Gode, D. K. and Sunder, S. (1993b). Allocative Efficiency

of Markets with Zero-Intelligence Traders: Market as

a Partial Substitute for Individual Rationality. Journal

of Political Economy, 101(1):119–137.

Hirshleifer, D. (2020). Presidential Address: Social Trans-

mission Bias in Economics and Finance. The Journal

of Finance, 75(4):1779–1831.

Jakab, S. (2022). The Revolution That Wasn’t: GameStop,

Reddit, and the Fleecing of Small Investors. Penguin.

Kameda, T., Inukai, K., Wisdom, T., and Toyokawa, W.

(2014). The concept of herd behaviour: its psycho-

logical and neural underpinnings. Sciences, 420(8).

Kim, K., Lee, S.-Y. T., and Kauffman, R. J. (2023).

Social Informedness and Investor Sentiment in the

GameStop Short Squeeze. Electronic Markets,

33(1):23.

Liu, S. (2021). Competition and Valuation: A Case Study

of Tesla Motors. IOP Conference Series: Earth and

Environmental Science, 692(2):022103.

Lomas, K. and Cliff, D. (2021). Exploring Narrative Eco-

nomics: An Agent-Based Modeling Platform that In-

tegrates Automated Traders with Opinion Dynamics.

In Rocha, A.-P., Steels, L., and van den Herik, J., edi-

tors, Proceedings of the 13th International Conference

on Agents and Artificial Intelligence (ICAART2021),

volume 1, pages 137–148. SciTePress.

Long, S., Lucey, B., Xie, Y., and Yarovaya, L. (2023). “I just

like the stock”: The role of Reddit sentiment in the

GameStop share rally. Financial Review, 58(1):19–

37.

Shiller, R. (2017). Narrative Economics. American Eco-

nomic Review, 107(4):967–1004.

Shiller, R. (2019). Narrative Economics: How Stories Go

Viral & Drive Major Economic Events. Princeton.

Smith, V. L. (1962). An Experimental Study of Competi-

tive Market Behavior. Journal of Political Economy,

70(2):111–137.

Storn, R. and Price, K. (1997). Differential Evolution–A

Simple and Efficient Heuristic for Global Optimiza-

tion over Continuous Spaces. Journal of Global Opti-

mization, 11:341–359.

Surowiecki, J. (2004). The Wisdom of Crowds: Why the

Many Are Smarter Than the Few and How Collective

Wisdom Shapes Business, Economies, Societies, and

Nations. Doubleday, Anchor Press.

Exploring the Impact of Competing Narratives on Financial Markets I: An Opinionated Trader Agent-Based Model as a Practical Testbed

137