Applications of Artificial Intelligence in Sustainability Assessment

and Risk Management in European Banking

Dominic Strube

1a

, Christian Daase

2b

and Jennifer Schietzel-Kalkbrenner

3c

1

Hochschule Wismar, University of Applied Sciences, Technology, Business and Design, Wismar, Germany

2

Institute of Technical and Business Information Systems, Otto-von-Guericke University, Magdeburg, Germany

3

Berufliche Hochschule Hamburg, Hamburg, Germany

Keywords: Credit Risk, Artificial Intelligence, ESG Assessments, Data Analysis, Sustainability.

Abstract: This article addresses the evolving dynamics of sustainability risks in the banking sector, with a particular

focus on the integration of artificial intelligence (AI) in risk assessment and management. The impact of

environmental, social, and governance (ESG) factors on creditworthiness evaluation is examined and

highlights the complexities and challenges that financial institutions face in adapting their risk management

frameworks to accommodate these sustainability risks. The paper underscores the difficulties banks face in

effectively incorporating ESG considerations, primarily due to the absence of standardized methodologies

and the intricate interplay between ESG components and banking risk elements. In this context, the potential

of AI applications is critically assessed, especially those utilizing large datasets, to identify complex patterns

and correlations that often elude human analysts. This investigation includes both the opportunities AI

presents in enhancing the precision of risk assessments and the associated challenges, including issues related

to the opacity and control of complex, self-learning AI models, as well as regulatory and privacy concerns.

Finally, the article presents a schematic approach through which banks can actively integrate sustainability

risks into their risk management strategies, emphasizing the need for ongoing research and development in

this crucial area.

1 INTRODUCTION

In Europe, banks are increasingly facing the

challenge of considering so-called sustainability

risks. These risks, originating from environmental,

social, or corporate governance sectors, can have

negative impacts on a company's assets, finances,

earnings, and reputation (BaFin, 2020). Due to these

potential impacts, regulatory requirements demand

that banks systematically identify, assess, manage,

and monitor these risks. The European Banking

Authority (EBA), as the overarching body, sets

binding standards and guidelines for the banking

sector. As early as 2020, the EBA published a guide

on environmental and climate risks (European

Central Bank, 2020). National supervisory authorities

such as the German Federal Financial Supervisory

Authority (BaFin) or the French Prudential

a

https://orcid.org/0000-0003-3017-5189

b

https://orcid.org/0000-0003-4662-7055

c

https://orcid.org/0009-0009-3782-4963

Supervision and Resolution Authority (ACPR) issue

their own standards and regulations, some of which

are still optional, others mandatory. A central

challenge for many banks is the lack of uniformity in

these methods and a scarcity of robust data allowing

for reliable assessment. Especially for smaller banks,

these methods are particularly challenging due to

insufficient data (Strube et al., 2023). Against this

backdrop, this article explores how AI can contribute

to assessing sustainability risks, particularly in terms

of credit default risks. The goal is to optimize

decision-making processes in credit granting and to

identify at-risk credits early on. Our research

questions (RQs) are:

RQ1: How do sustainability risks influence the

creditworthiness of companies?

Strube, D., Daase, C. and Schietzel-Kalkbrenner, J.

Applications of Artificial Intelligence in Sustainability Assessment and Risk Management in European Banking.

DOI: 10.5220/0012498700003717

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 6th International Conference on Finance, Economics, Management and IT Business (FEMIB 2024), pages 25-32

ISBN: 978-989-758-695-8; ISSN: 2184-5891

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

25

RQ2: To what extent is AI used in banks, and what

challenges and potentials does the integration of AI

offer in the risk management of banks?

RQ3: What might an AI-based model look like to

effectively identify sustainability risks?

Section 2 begins with an introduction to the definition

and typology of sustainability risks. This is followed

in section 3 by an examination of the application of

AI in banking and its specific use in capturing

sustainability risks. The advantages and

disadvantages of these technologies, especially in the

context of banking data, are discussed in section 4.

The fourth section presents which data can be used

for an AI-supported assessment and concretize some

use cases. The article concludes with a summary of

the key findings.

2 BACKGROUND

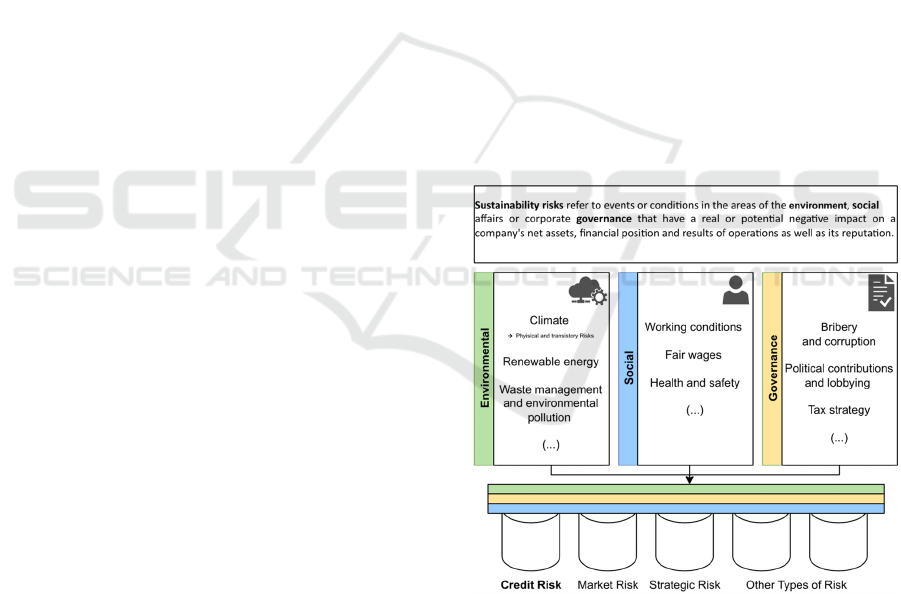

Sustainability risks pertain to events or conditions

associated with environmental, social, or corporate

governance sectors (BaFin, 2020). The manifestation

of these risks may have real or potential adverse

effects on the net assets, financial condition, and

operating results, as well as on the reputation of a

company. The general consensus in science and

practice for quantifying sustainability aspects

includes consideration of the following criteria

(Gleißner and Romeike, 2021):

Environment: This refers, among other things, to the

eco-friendliness of a company's activities, including

energy consumption, use of renewable energy,

climate change strategies, and emission reduction.

Social: This includes the social impact of a company,

both internally and external which examples. Such as

human rights standards, prohibition of child and

forced labor, equal opportunities, diversity, and

promotion of further education.

Governance: This involves the structure and

management of a company with respect to sustainable

practices, including issues such as sustainability

management, anti-corruption measures, quality

management systems, financial sustainability, and

risk management.

Sustainability risks are not a separate type of risk,

but factors that influence existing risks such as credit

risk, market price risk, liquidity risk, operational risk,

, strategic risk or reputational risk (BaFin, 2020). In

this article, the focus lies on analyzing credit default

risk in the context of these interdependencies.

Sustainability risks in the areas of climate and

environment are also divided into physical risks and

transition risks. Physical risks arise directly or

indirectly from climatic changes, such as those

immediately resulting from extreme weather events

like storms, floods, or prolonged drought periods

(Salisu et al., 2023). According to the latest estimates

from the PESETA IV project (Projection of

Economic impacts of climate change in Sectors of the

European Union based on bottom-up Analysis) for

instance, the economic losses due to drought periods

in the European Union and the United Kingdom

amount to about 9 billion euros annually. Spain

suffers the greatest losses, with 1.5 billion euros per

year, followed by Italy with 1.4 billion euros and

France with 1.2 billion euros. Transition risks, on the

other hand, are associated with political, legal, or

technological changes aimed at mitigating climate

change (Salisu et al., 2023). The pricing of CO²,

which can lead to increased operating costs,

especially for companies with high emissions, is cited

here as an example (Cammalleri et al., 2020). These

discussed relationships are summarized in Figure 1.

Figure 1: Exemplary presentation of the impact of ESG

aspects on traditional risk categories.

Recently, political players in Europe have stepped

up their efforts to create a regulatory framework to

integrate sustainability risks into banks. In particular,

the European Union (EU) and national financial

regulators require banks to actively integrate

sustainability risks into risk management using a wide

range of methods. A study by Strube et al. (2023)

FEMIB 2024 - 6th International Conference on Finance, Economics, Management and IT Business

26

which 112 regional banks in Germany were surveyed

on the topic of sustainability integration, shows that

many banks still have considerable difficulties in

effectively integrating sustainability risks into their

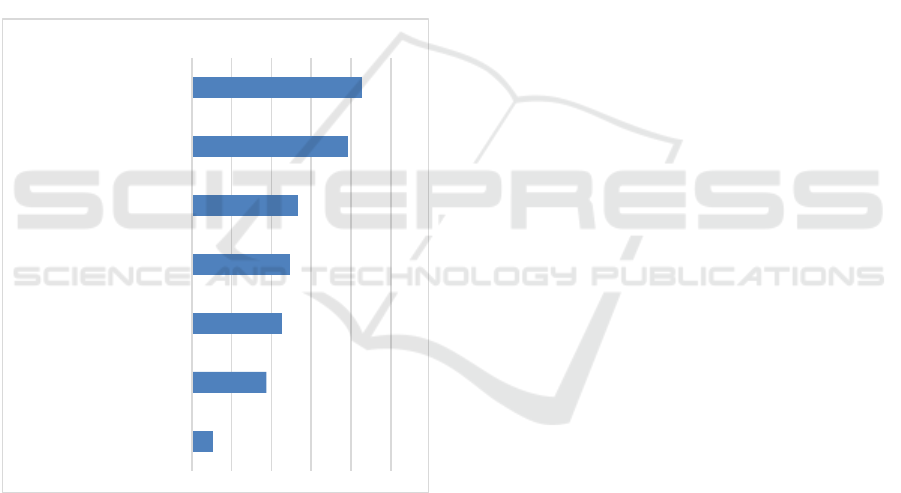

risk management. Figure 2 indicates that 85.7% of

respondents see the lack of standardized methods for

identifying and assessing sustainability risks as the

main obstacle. In addition to a lack of employee

expertise (53.6%) and staff shortages (49.1%), the

unwillingness of loan customers to cooperate (45.5%)

and a lack of obligations to cooperate (37.5%) are

also seen as obstacles to risk assessment. In addition,

the participants emphasize a lack of general

sustainability data and good technical systems for

data collection and analysis. Overall, it is clear that

the main barriers lie primarily in the complexity of

the (still) difficult to grasp correlations between

sustainability aspects and banking risks, as well as in

a lack of data.

Figure 2: Challenges in the measurement of sustainability

aspects (Strube et al., 2023).

Regarding RQ1, no conclusive evidence has been

found to support the assertion that there is a direct

correlation between sustainability aspects and the

probability of default. Some studies indicate a

positive correlation between a rating-score and

financial performance indicators (Friede et al., 2015;

Whelan et al., 2020). Also regarding small and

medium enterprises (SME), a study with a 20-year

data set from the Web of Science shows a positive

correlation between sustainability and financial

performance, a result confirmed by further research

(Bartolacci et al., 2020; Hammann et al., 2009;

Herrera Madueño et al., 2016). Additional

investigations, such as those by Lucia et al. (2020),

employing complex statistical models like random

forests and inferential approaches, confirm a positive

relationship between sustainable corporate practices

and financial performance metrics, particularly equity

and total capital returns. In addition, (Gupta et al.,

2021) demonstrated, through the use of machine

learning algorithms, that higher ESG performance

correlates with improved profitability, as reflected in

superior profit margins. These metrics significantly

influence banks' accuracy of default calculations.

Furthermore, many studies identify not only a

positive impact on financial indicators but also a

positive correlation between the probability of default

on loans and bonds and companies with a sustainable

orientation tend to pay lower risk premiums when

borrowing, thus being more creditworthy (Bauer and

Hann, 2010; Höck et al., 2020; Schneider, 2011;

Weber et al., 2008). A study by Meles et al. (2023)

examines the relationship between green innovation

and lower default risk using a sample of European

companies from 2003 to 2019, finding that green

innovations reduce risk, especially in market-oriented

countries and for non-publicly traded companies.

However, much of this research is based on

evaluations by sustainability rating agencies, whose

aim is to present the sustainability level of companies

on the basis of a rating grade. Although the financial

supervisory authorities recommend the use of such

ratings, they do so with reservations (European

Central Bank, 2020). There is a low concurrence

between the various ratings, mainly due to the lack of

standardized measurement procedures for ESG (Berg

et al., 2019; Dimson et al., 2020; Strube and Daase,

2023). Therefore, the direct link between high ESG

ratings and actual sustainability is uncertain.

Additionally, studies show that larger companies tend

to achieve higher ESG scores, which may reflect their

more extensive resources and imply a systematic

disadvantage for smaller firms in the rating process

(Drempetic et al., 2020). This makes it difficult for

banks, which often have a large number of SMEs in

their loan portfolios. Moreover, it is questionable

which aspects of the rating precisely influence the

probability of default and to what extent. For

example, a balanced gender quota leads to an

improved rating (in the Governance category), but the

direct link to financial stability is uncertain.

In summary, it is evident that sustainability

aspects almost certainly have a significant impact on

the probability of default on loans, but the specific

connection between these factors is very unclear. The

85.71%

78.57%

53.57%

49.11%

45.54%

37.50%

10.71%

0% 20% 40% 60% 80% 100%

Lack of uniform methods for

measuring sustainability

: Insufficient data availability

(e.g., probability of extreme

weather events)

Employees' lack of expertise

Staff shortage

Lack of cooperation from

credit customers

Lack of cooperation

requirements from credit

customers

Others

Applications of Artificial Intelligence in Sustainability Assessment and Risk Management in European Banking

27

following will illustrate how AI can enhance the

analysis and assessment of sustainability factors as

well as the estimation of default risks by processing

large volumes of data, recognizing patterns in

complex information, and developing predictive

models.

3 STATUS QUO OF AI

IMPLEMENTATION IN

BANKING: POTENTIAL AND

LIMITATIONS

This chapter addresses the question of why and how

AI is currently being used in banks. Given the

abundance of data available in banks, such as

economic indicators, account movements, and

customer-specific data, banks are ideally suited for

the use of AI to train algorithms for identifying

patterns and connections. This includes applications

like detecting criminal activities, customer-centric

marketing, or improving the accuracy of credit ratings

(Sadok et al., 2022). According to a study of

PricewaterhouseCoopers (PwC) conducted in 2023,

which surveyed 114 financial sector companies,

including half banks, it was found that the financial

services industry sees the greatest benefits in practical

and operational improvements, with a clear focus on

efficiency and cost reduction (Dagianis et al., 2023).

Many processes in banks are very resource and labor-

intensive. For instance, the credit granting process is

a complex procedure that requires various

interactions between the front and back-office areas

and the credit customer, depending on the type of

loan. The use of AI in the banking industry primarily

offers the potential to reduce costs and increase

revenues by automating repetitive processes.

According to the study, AI applications in banks are

primarily used in the areas of marketing, sales, IT,

and risk management, particularly in managing social

media channels (31%), analyzing network threats and

malware detection (22%), and in fraud management

and anti-money laundering checks (39% and 33%,

respectively). In the credit granting process, it

accounts for 19%. The integration of AI-based

systems in risk modeling, which also includes the

incorporation of sustainability aspects, is still in its

early stages (14%). In traditional banks, the use of AI

in the credit process is not yet particularly

pronounced and is conducted through classical,

statistical rating systems. Current initiatives

regarding the use of AI to capture sustainability

Figure 3: Reasons for not integrating AI (Berns, 2020).

aspects are few, including one by Deutsche Bank

(2023), which is working on the introduction of

machine learning procedures to classify its business

operations as green through an auto-classification

system, thereby relieving employees. BNP Paribas

has made a database with various sustainability data

available as open source and already recommends and

uses the use of AI to analyze sustainability (Geng,

2023). The use of AI, despite its numerous

application possibilities, also brings several

challenges. Firstly, it is essential that in complex, self-

learning models, the key parameters are made clearly

understandable and controllable (Friedrich et al.,

2021). However, with complex algorithms, it is often

difficult to understand exactly how they come to a

particular decision. This can pose a problem,

especially in areas such as creditworthiness

assessment, where decisions can have significant

impacts on individuals or companies (Sadok et al.,

2022). Moreover, banks are under strict regulatory

supervision, which expects the internal logic of a

rating system to be clear and transparent. If banks use

systems that they cannot fully explain, this can lead

to compliance issues. There is also the risk of making

incorrect decisions. If the system is not fully

understandable, there is a danger that faulty or biased

decisions are made without being recognized (Sadok

et al., 2022). If an algorithm overweights certain

indicators of sustainability, such as CO² emissions,

while neglecting other important aspects like water

consumption, biodiversity preservation, or social

responsibility, this can lead to a distorted assessment

of sustainability. This could favor companies or

projects that perform well in certain areas but have

deficits in other dimensions of sustainability. For

example, Amazon encountered a problem with its AI

27%

44%

44%

47%

63%

64%

67%

69%

0% 20% 40% 60% 80%

Lack of transparency of AI

algorithms ("black box")

Lack of management support

Lack of available platform and

tools

Lack of trust in AI benefits

Data privacy concerns

Lack of AI skills of employees

Budget constraints

Lack of available data

FEMIB 2024 - 6th International Conference on Finance, Economics, Management and IT Business

28

recruitment tool, which exhibited gender biases. It

was discovered that this tool, intended to optimize the

hiring process by identifying best resumes, favored

men over women. The algorithm apparently detected

and then optimized a gender imbalance in technical

roles, thereby replicating a societal bias towards men

in these positions a (Dastin, 2018).

In a further PwC study, financial companies were

surveyed about the challenges they face in

implementing AI. As illustrated in Figure 3, the

dominant problems are data scarcity and financial

constraints. It is somewhat unexpected that banks

report a deficiency in data, considering their access to

extensive datasets. Nonetheless, it is conceivable that

a significant proportion of data within banking

institutions may be present in an unstructured format,

such as within text documents, electronic mails, or

descriptions of transactions. Specifically in the

context of sustainability data, there is an

acknowledged shortfall, given that banks usually

acquire only a restricted range of sustainability-

related information directly from their credit

recipients. This suggests that the institutions are

struggling to acquire the large datasets needed for AI

systems and to make the investments required for

such technologies. Moreover, the survey reveals that

internal expertise and data privacy concerns are

significant internal barriers, while external factors

such as trust in AI and the opacity of algorithms are

weighted less, but remain important concerns for the

acceptance and management of AI solutions (Berns,

2020).

4 APPLICATIONS OF

AI-SUPPORTED RECORDING

IN BANKS

4.1 Technical Requirements

In the previous two sections, we explored the

important but complex interplay between

sustainability factors, financial risk and AI in

banking. It was shown that sustainability-related

risks, particularly those related to climate change,

almost certainly have an impact on the probability of

default on bank loans. However, a systematic and

comprehensive understanding of these relationships

remains elusive. Artificial intelligence is proving to

be an effective tool for deciphering these complex

relationships. To date, the use of AI in banks has

primarily focused on improving process efficiency,

while its integration into risk modeling is a relatively

under-researched avenue. This section aims to present

different methods that could be used to address the

challenges of incorporating sustainability factors into

the risk management of European banking

institutions.

Data Collection: As mentioned above, many

financial institutions face the challenge of providing

adequate ESG data. In the initial phase of ESG data

collection, the focus is on obtaining relevant data.

This is primarily documents and information

provided by borrowers, usually in response to regular

sustainability requests from financial institutions. In

addition, both manual collection and automated web

crawling and scraping enable the procurement of

company data (Sadok et al., 2022). This includes the

automated collection of standardized sustainability

reports, information on corporate strategy and

reputation. However, the integration of social media

activities is not considered practicable, as these

sources can be distorted or manipulative in the

context of greenwashing. In addition, artificial

intelligence can aggregate external data on physical

risk indicators such as flood probabilities,

meteorological data, groundwater levels and soil

conditions. This data is available free of charge in

many countries. The recording of potential

transitional values, such as upcoming regulatory

changes, can also be taken into account.

Data Storage: Cloud computing and related

technologies are pioneers of big data applications.

The provision of computing and storage resources has

itself developed into a business model in recent years.

The growing demands associated with big data

analytics are increasingly exceeding the technical and

financial capabilities of companies (Arostegi et al.,

2018) and even scientific institutes (Dai et al., 2012).

The motivation for a shift from the infrastructure-as-

an-asset scheme, in which a company owns the

required hardware, to infrastructure-as-a-service

(IaaS), in which the computing power of external

providers is used by transferring inputs and outputs

over a network, is recognizable (Arostegi et al.,

2018). The market mechanism behind this paradigm

shift is a pay-as-you-go model, as only the service

provided has to be paid for (Dai et al., 2012;

Mashayekhy et al., 2014). For example,

Commerzbank AG already uses cloud services to

store and process large volumes of data (Tomak,

2019).

Applications of Artificial Intelligence in Sustainability Assessment and Risk Management in European Banking

29

Data Evaluation and Analysis: An innovative

approach would be to use AI to calculate the default

probabilities of loans using both traditional rating

data and sustainability data. The idea behind this is

that AI can better identify and predict the links

between a company's sustainability practices and its

credit risk. This would mean that the AI would not

only look at financial metrics but also ESG-related

indicators to provide a more holistic assessment of

creditworthiness. This approach could potentially

provide more accurate predictions as it takes into

account a broader range of risk factors. ESG factors

such as environmental behavior, social responsibility

and corporate governance can provide important

indications of a company's long-term stability and

risk profile. By combining this data with traditional

financial metrics, AI could create a more

comprehensive picture of credit risks, leading to more

accurate and reliable default probabilities.

Transparency: As AI is increasingly used in

applications that rely on private data of people in a

society and impact human lives, the issue of trust in

such systems led to the emergence of the term

explainable AI or responsible AI (Daase and

Turowski, 2023). Jobin et al. (2019) identify five

principles for responsible AI with the ultimate goal of

not only making AI applications understandable to

the target audience, but also imposing general ethical

rules on them. The principles include transparency,

justice, non-maleficence, accountability, and privacy.

Following these guidelines, data and solutions should

avoid any kind of discrimination or bias, comply with

legal regulations and ensure that private information

is stored and processed in a way that makes people

feel safe.

Data Augmentation: In order to make accurate

predictions, ML models must be trained with suitable

datasets from sufficiently large sample data.

However, especially in the early phases of AI

implementation, historical data in a suitably prepared

form may only be sparsely available. Data

augmentation is one way to close the gap between

small datasets and sufficiently large training data for

sophisticated ML models (Moreno-Barea et al.,

2020). With this technique, the structure and

statistical characteristics of real historical data can be

modeled to generate new data that could also be real

based on their properties.

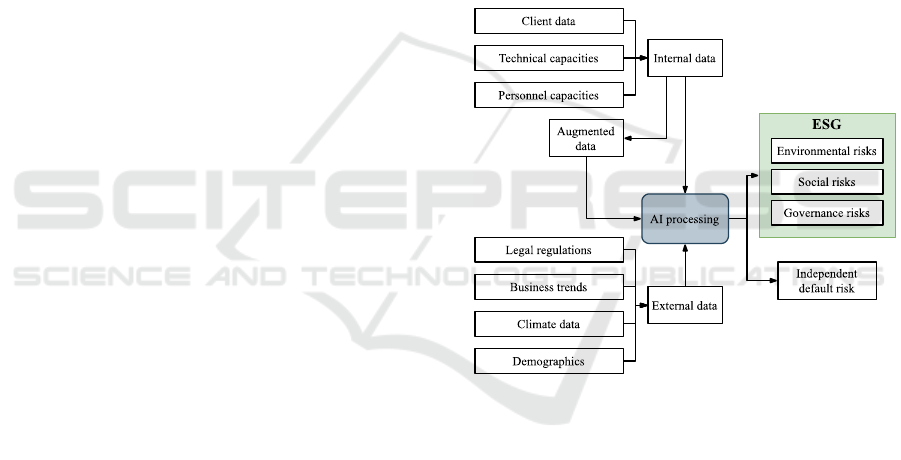

4.2 Credit Risk Analysis Model

The technical prerequisites for using AI applications to

evaluate credit default probabilities are illustrated in

simplified form in Figure 4. Financial institutions may have

access to internal data such as client information, technical

capacities and personnel development. If the amount of data

is not sufficient to train AI systems, these can be expanded

in volume through augmentation. External data can also be

included, which is particularly important with regard to

ESG risks. This includes legal regulations, business trends

that can influence the purchasing behavior of clients,

climate data and demographics. After careful evaluation,

the AI processing unit at the center, shown here

schematically, can provide information on additional ESG

risks alongside predictions on traditional credit default

risks. Environmental changes, social upheavals and

governance risks can thus be made comprehensible to the

banking institution, thereby improving the evaluation

process for the appropriateness of granting credits.

Figure 4: Schematic model for ESG risk predictions.

5 CONCLUSION

In conclusion, the integration of sustainability factors

into the risk management practices of European banks

presents a complex but increasingly essential

challenge. As the awareness of sustainability risks

grows, particularly in relation to climate change, their

impact on the probability of default on loans becomes

more evident. AI emerges as a promising tool in this

context, offering innovative ways to decipher the

intricate relationships between sustainability factors

and financial risk. While the current usage of AI in

banks mainly focuses on process efficiency, there is

significant potential for its application in risk

modeling, especially with respect to ESG data. This

FEMIB 2024 - 6th International Conference on Finance, Economics, Management and IT Business

30

approach, however, is not without challenges. The

scarcity of standardized and comprehensive ESG

data, the complexity of AI models, and regulatory

compliance issues pose significant barriers. Despite

these challenges, AI can enhance the analysis and

assessment of sustainability factors and improve the

accuracy of default risk estimations by processing

large data volumes and identifying patterns in

complex information. AI offers a way to better

understand and integrate these aspects into financial

risk management, but its effective implementation

requires the courage of banks to use these systems.

Further research should focus on developing and

validating AI models aimed at accounting for

sustainability risks and assessing their impact on

creditworthiness. Efforts to standardize ESG data for

reliable comparability and thereby strengthen

confidence in risk assessment are also necessary.

Moreover, investigations into improving the

explainability and transparency of AI applications in

banks for credit granting decisions should be the

subject of further research activities.

REFERENCES

Arostegi, M., Torre‐Bastida, A., Bilbao, M. N., & Del Ser,

J. (2018). A heuristic approach to the multicriteria

design of IaaS cloud infrastructures for Big Data

applications. Expert Systems, 35(5), Article e12259.

BaFin (2020). Merkblatt zum Umgang mit Nachhaltig-

keitsrisiken, 2020. https://www.bafin.de/SharedDocs/

Downloads/DE/Merkblatt/dl_mb_Nachhaltigkeitsrisik

en.pdf;jsessionid=E2FE3115144C8D0270ED0167BC

4ED2AF.internet941?__blob=publicationFile&v=2

Bartolacci, F., Caputo, A., & Soverchia, M. (2020).

Sustainability and financial performance of small and

medium sized enterprises: A bibliometric and

systematic literature review. Business Strategy and the

Environment, 29(3), 1297–1309.

Bauer, R., & Hann, D. (2010). Corporate Environmental

Management and Credit Risk. SSRN Electronic Journal.

Advance online publication.

Berg, F., Kö, lbel, J., & Rigobon, R. (2019).

Aggregate Confusion: The Divergence of ESG Ratings.

SSRN Electronic Journal. Advance online publication.

Berns, M. (2020). How mature is AI adoption in financial

services? https://www.pwc.de/de/future-of-finance/

how-mature-is-ai-adoption-in-financial-services.pdf

Cammalleri, C., Naumann, G., Mentaschi, L., & Formetta

(2020). Global warming and drought impacts in the EU.

https://joint-research-centre.ec.europa.eu/system/files/

2020-05/pesetaiv_task_7_drought_final_report.pdf

Daase, C., & Turowski, K. (2023). Conducting Design

Science Research in Society 5.0 – Proposal of an

Explainable Artificial Intelligence Research

Methodology. In A. Gerber & R. Baskerville (Eds.),

Lecture Notes in Computer Science. Design Science

Research for a New Society: Society 5.0 (Vol. 13873,

pp. 250–265). Springer Nature Switzerland.

Dagianis, K., Hecker, F., & Arbib, S. (2023). Einblicke zur

Künstlichen Intelligenz im deutschen Finanzsektor.

https://www.pwc.de/de/content/a57625e7-4f1e-4cda-a

79e-428db2c9ac24/pwc-studie-ki-im-deutschen-finanz

sektor.pdf

Dai, L., Gao, X., Guo, Y., Xiao, J., & Zhang, Z. (2012).

Bioinformatics clouds for big data manipulation.

Biology Direct, 7, 43; discussion 43.

Dastin, J. (2018, October 10). Amazon ditches AI recruiting

tool that didn’t like women. Global News. https://global

news.ca/news/4532172/amazon-jobs-ai-bias/#:~:text=

Amazon%20has%20scrapped%20an%20AI,machine

%20favoured%20men%20over%20women

Deutsche Bank. (2023, November 13). Wie Künstliche

Intelligenz das Bankgeschäft verändert. https://www.

db.com/what-next/digital-disruption/better-than-huma

ns/how-artificial-intelligence-is-changing-banking/ind

ex?language_id=3

Dimson, E., Marsh, P., & Staunton, M. (2020). Divergent

ESG Ratings. The Journal of Portfolio Management,

47

(1), 75–87.

Drempetic, S., Klein, C., & Zwergel, B. (2020). The

Influence of Firm Size on the ESG Score: Corporate

Sustainability Ratings Under Review. Journal of

Business Ethics, 167(2), 333–360.

European Central Bank. (2020). Guide on climate-related

and environmental risks. https://www.bankingsuper

vision.europa.eu/ecb/pub/pdf/ssm.202011finalguideon

climate-relatedandenvironmentalrisks~58213f6564.en.

pdf

Friedrich, L., Hiese, A., Dreßler, R., & Wolfenstetter, F.

(2021). Künstliche Intelligenz in Banken – Status quo,

Herausforderungen und Anwendungspotenziale. In P.

Buxmann & H. Schmidt (Eds.), Künstliche Intelligenz

(pp. 49–63). Springer Berlin Heidelberg.

Geng, C. (2023). Accounting for AI risk in ESG investing –

It’s a black box. https://www.bnpparibas-am.com/en-

us/forward-thinking/accounting-for-ai-risk-in-esg-

investing-its-a-black-box/

Gleißner, W., & Romeike, F. (2021). ESG-Risiken und ihre

Quantifizierung. In O. Everling (Ed.), Social credit

rating: Reputation und vertrauen beurteilen (1st ed., pp.

391–433). Springer Nature.

Gupta, A., Sharma, U., & Gupta, S. K. (2021). The Role of

ESG in Sustainable Development: An Analysis

Through the Lens of Machine Learning. In 2021 IEEE

International Humanitarian Technology Conference

(IHTC) (pp. 1–5). IEEE.

Hammann, E.‑M., Habisch, A., & Pechlaner, H. (2009).

Values that create value: socially responsible business

practices in SMEs – empirical evidence from German

companies. Business Ethics: A European Review, 18(1),

37–51.

Herrera Madueño, J., Larrán Jorge, M., Martínez Conesa, I.,

& Martínez-Martínez, D. (2016). Relationship between

corporate social responsibility and competitive

performance in Spanish SMEs: Empirical evidence

Applications of Artificial Intelligence in Sustainability Assessment and Risk Management in European Banking

31

from a stakeholders’ perspective. BRQ Business

Research Quarterly, 19(1), 55–72.

Höck, A., Klein, C., Landau, A., & Zwergel, B. (2020). The

effect of environmental sustainability on credit risk.

Journal of Asset Management, 21(2), 85–93.

Jobin, A., Ienca, M., & Vayena, E. (2019). The global

landscape of AI ethics guidelines. Nature Machine

Intelligence, 1(9), 389–399.

Lucia, C. de, Pazienza, P., & Bartlett, M. (2020). Does

Good ESG Lead to Better Financial Performances by

Firms? Machine Learning and Logistic Regression

Models of Public Enterprises in Europe. Sustainability,

12(13), 5317.

Mashayekhy, L., Nejad, M. M., & Grosu, D. (2014). A two-

sided market mechanism for trading big data computing

commodities. In 2014 IEEE International Conference

on Big Data (Big Data) (pp. 153–158). IEEE.

Meles, A., Salerno, D., Sampagnaro, G., Verdoliva, V., &

Zhang, J. (2023). The influence of green innovation on

default risk: Evidence from Europe. International

Review of Economics & Finance, 84, 692–710.

Moreno-Barea, F. J., Jerez, J. M., & Franco, L. (2020).

Improving classification accuracy using data

augmentation on small data sets. Expert Systems with

Applications, 161, 113696.

Sadok, H., Sakka, F., & El Maknouzi, M. E. H. (2022).

Artificial intelligence and bank credit analysis: A

review. Cogent Economics & Finance, 10(1), Article

2023262.

Salisu, A. A., Ndako, U. B., & Vo, X. V. (2023). Transition

risk, physical risk, and the realized volatility of oil and

natural gas prices. Resources Policy, 81, 103383.

Schneider, T. E. (2011). Is Environmental Performance a

Determinant of Bond Pricing? Evidence from the U.S.

Pulp and Paper and Chemical Industries Contemporary

Accounting Research, 28(5), 1537–1561.

Strube, D., & Daase, C. (2023). The Correlation of ESG

Ratings and Abnormal Returns: An Event Study Using

Machine Learning. In Proceedings of the 5th

International Conference on Finance, Economics,

Management and IT Business (pp. 76–81).

SCITEPRESS - Science and Technology Publications.

Strube, D., Mayer-Fiedrich, M. D., & Streuer, O. (2023).

Quo Vadis, Nachhaltigkeit? Eine empirische

Untersuchung der Nachhaltigkeitsintegration im

Kreditmanagement von Volksbanken und Sparkassen.

Corporate Finance(09/10), 221–226.

Tomak, K. (2019). Wie die Commerzbank aus Daten neue

Produkte für ihre Kunden macht. https://www.der-

bank-blog.de/commerzbank-daten-bankprodukte/digit

al-banking/37655791/

Weber, O., Scholz, R. W., & Michalik, G. (2008).

Incorporating sustainability criteria into credit risk

management. Business Strategy and the Environment,

n/a-n/a.

FEMIB 2024 - 6th International Conference on Finance, Economics, Management and IT Business

32