Internal Audit: Friend or Foe of Innovation in an Organization:

Case of Czech Banking Sector

Vladimír Petrík

a

Department of Marketing and Management, Czech University of Life Sciences Prague,

Kamýcká 129, Prague, Czech Republic

Keywords: Bank, Innovation, Innovation Audit, Internal Audit.

Abstract: Internal audit should provide objective assurance services regarding the fulfilment of the bank's objectives

and its management and administration, based, among other things, on risk assessment. The aim is to identify,

describe and analyze the current state of application of innovation audit performed by the internal audit

department in banks operating in the Czech Republic. Methods of qualitative research, analysis of bank

documents and interviews with internal audit managers are used. The result of the research is the identification

and description of the current state of tasks and the role of internal audit in relation to innovation management

in banks. Banks in innovation management have been found to face various barriers based on legacy of

unconnected information systems, low innovation appetite (non-perception of competitive threats),

unexposed innovation processes and low decision-making flexibility. It was found that banks do not identify

innovation risk as part of their risk assessment and do not apply specific control processes to it. These facts

have practical implications following the recommendation to systematize the innovation process in banks, to

include innovation risk in the bank's risk assessment and to use the possibilities of the bank's internal audit

department to eliminate this risk and assess related processes.

1 INTRODUCTION

Financial sector and banking sector are recognized as

sector undertaking significant changes in relation to a

disruption challenges and processes. Disruption is

mainly connected to the digitalization of financial

sector (Lee & Shin, 2018; Chanson et al., 2018). It

increases the competition within banking sector and

puts banks’ profits at risks, especially in long-term

horizon (McKinsey, 2016). Digital competitors,

generally known as FinTech, BigTech and platform-

based entities bring many innovations in recent years

with relevant impact on sector, customers and also

regulation. Disruption in financial markets is a matter

of discussion on various international bodies, incl.

OECD or EU. Although new (mainly digital)

solutions and competitors to traditional banks still

have a lack of various aspects in their business, e.g.

brand recognition (OECD, 2020), they provide new,

state-of-the-art alternatives to services provided by

traditional banking sector, current situation imposes

for banks new strategic risks of not adaption to the

a

https://orcid.org/0000-0002-2162-1434

market and losses (Dietz, Khanna, Olanrewaju, &

Rajgopal, 2016). Zalan & Toufaily (2017, p. 416)

assert that “it is precisely this profitable, fee-based,

part of the bank’s value chain that is most vulnerable

to disruption.” Natural answer of banks to disruption

of financial sector is their own way of improving

services, processes and digitalization, through series

of heterogeneous innovations of their governance,

digitalization and business model (Stashchuk &

Martyniuk, 2021). While this innovation activities are

being planned and executed, traditional banks face

their own set of specific innovation problems and

barriers. Within each bank various departments are

included in innovation and besides them, required by

the law and regulation, there is also internal audit

department. By its definition, internal audit should

focus mainly on providing assurance regarding

accomplishing bank’s goals (The Institute of Internal

Auditors, 2017). The main focus of the article is to

discuss, whether internal audit, while providing

aforementioned assurance regarding accomplishing

42

Petrík, V.

Internal Audit: Friend or Foe of Innovation in an Organization: Case of Czech Banking Sector.

DOI: 10.5220/0012564000003717

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 6th International Conference on Finance, Economics, Management and IT Business (FEMIB 2024), pages 42-53

ISBN: 978-989-758-695-8; ISSN: 2184-5891

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

bank’s goals, fulfils its mission in the area of bank’s

innovation efforts.

The first part of the article concentrates on the

theoretical background. This, second chapter of the

article describes methods used for the research. Next,

third chapter of the article provides summarized

description of applied methods and results. Fourth

chapter aims at discussion part of article based on

comparing our results with other research, stating also

opportunities for future research and research

limitations. Last, fifth part of the article consists of

inductive conclusion and generalization of the

identified results not only for the banking sector.

1.1 Internal Audit

To define and describe internal audit and its role,

functions, missions and other relevant aspect,

globally recognized The International Professional

Practices Framework (hereinafter as “The IPPF”),

issued and maintained by The Institute of Internal

Auditors, Inc. (“The IIA”), is used. The IIA, as the

standard-setting body for the internal audit profession

globally, provides this authoritative guidance, The

IPPF. Besides general definitions, this chapter

focuses also on aspects of internal audit that are

connected to the innovation in an organization.

According to the Definition of Internal Auditing,

part of The IPPF’s Mandatory Guidance, internal

auditing is “an independent, objective assurance and

consulting activity designed to add value and improve

an organization's operations. It helps an organization

accomplish its objectives by bringing a systematic,

disciplined approach to evaluate and improve the

effectiveness of risk management, control and

governance processes” (The IIA, 2017). In addition,

the Mission of Internal Audit is “to enhance and

protect organizational value by providing risk-based

and objective assurance, advice, and insight” (The

IIA, 2017).

One of the core principles for professional

practice of internal auditing is internal audit to be

“insightful, proactive, and future-focused” and

promoting “organizational improvement” (The IIA,

2017). The interpretation of The IPPF’s Performance

Standard 2000 states that the internal audit activity is

effectively managed, when “it considers trends and

emerging issues that could impact the organization”

(among others conditions) (The IIA, 2017).

Performed by professionals with an in-depth

understanding of the business culture, systems, and

processes, the internal audit activity provides

assurance that internal controls in place are adequate

to mitigate the risks, governance processes are

effective and efficient, and organizational goals and

objectives are met (Petrík, 2017).

Christ et al. (2021) stated that “internal audit

provides useful and valuable services to organizations,

and academic research has established its importance

in improving corporate governance”. It is a central

pillar of good corporate governance (Gramling et al.

2004; Anderson & Christ, 2014).

It is important to stress out that emphasis of

internal audit does not lie solely in “assurance of the

company’s financial records, but also deliver insights

into the business, which may be leveraged to improve

business processes or gain a competitive advantage”

(Elst, 2022).

With the existence of an adequate internal audit

function, the oversight mechanism for corporate

governance is maximized to increase transparency

and effectiveness of management performance.

Berglund, Herrmann & Lawson (2018) stated that the

effectiveness of management performance can

improve managerial capabilities so that there is no

doubt about the company’s ability to maintain its life

in the future. The internal audit function is important

to minimize the occurrence of fraudulent financial

statements and provide assurance and independent

consultation for decision-making (Dzikrullah,

Harymawan & Ratri, 2020).

Regarding body of research and knowledge in the

area of internal audit, several authors argue, that it

focused on less applicable and very specific areas, not

applicable for internal audit functions (Dechow et al.,

2018; Kaplan, 2019; Burton et al., 2021a, 2021b;

Rajgopal, 2020) and concluded that body of research

in internal audit is insufficient, indicating scarcity of

academic attention (Christ et al., 2021; DeFond &

Zhang, 2014; Behrend & Eulerich, 2019).

1.2 Innovation and Innovation Risk

The large body of knowledge is available regarding

innovation. Various authors concluded that

innovation plays a crucial role in the sustainable

growth, success and competitiveness of organization

or indicated positive relationship between innovation

and organizational performance (Ho et al., 2018;

Anderson, 2020; Anh, Nguyen & Tran, 2021).

Desyatnichenko et al. (2017) believe that

innovations in banks are innovations in all areas of

banking business with a certain positive economic

and strategic effect, i.e., a new banking service, a

product/technology provision, a new/modernized

process. The implementation of innovations implies

having a positive economic effect achieved by means

of modern technologies.

Internal Audit: Friend or Foe of Innovation in an Organization: Case of Czech Banking Sector

43

Financial and banking services are specific type

of service, but by its characteristics, it might be still

considered as a part of service industry. Tether (2005;

in Anh, Nguyen & Tran, 2021) mentioned that

innovation in organizations of service industry is

different from manufacturing industry. Service

industry organizations were “less likely to acquire

knowledge and technology through ‘hard’ sources

such as R&D and the acquisition of advanced

equipment, and will be more likely to source

knowledge and technology through ‘soft’ sources,

such as cooperation with suppliers and customers.”

For example, Seiler and Fanenbruck’s (2021)

customer-oriented survey regarding German “robo

advisors” (digital investment services) resulted into

high customer perception of usefulness and privacy

as the most decisive factors.

Nonetheless, disruption in banking sector is not

based only on non-technological service innovation.

The effectivity and effectiveness of banking services

are directly influenced and based on the state of used

technology. Vital role plays use of new technology,

e.g. big data, artificial intelligence, cloud computing,

etc. (Markert, 2014). A significant barrier of

technological innovation in current banks is the

“legacy of spaghetti-like information systems”

(Westerman, Soule & Eswaran, 2019, p. 64), what

Orton-Jones (2021, p. 16) calls “catchy name for a

terrible problem”, when various, often independent

applications and systems at traditional banks are

patched together and tangled by data streams.

Bouguerra et. al. (2022) indicates that traditional

banks might have also other issues in innovation

efforts that lies in innovation absorptive capacity. As

there are two core components of absorptive capacity

- potential absorptive capacity and realized absorptive

capacity, their research states that there is a need for

collective effort and complementary learning

processes to yield high results.

Considering current state of disruption, academic

and professional expectations of situation

development and uncertainty of market conditions,

researchers focus like Dodgson (2000), Sinkey

(2016), Omarini (2017) pay special attention to the

banks’ innovation risk.

Nazarenko (2014) assesses the innovation risk

level by the degree of uncertainty for attainability of

banks’ innovative evolution goals and losses caused

by the deviation from the identified goal. According

to Eroshkin (2013) innovation risk means the

probability of undesirable deviations from the targets

identified for newly introduced products (services),

which were indicated by the bank for a specific period

of time and further. The comparison of the actual and

planned values of indicators obtained as a result of

introducing innovations in a bank is the parameter

that evaluates risks. Eroshkin (2013), identifying

strategic parameters of innovation activity, admits

that banks’ innovative activity may serve in both

helping to meet regularly changing market

requirements remaining in demand among clients,

and to “work for the future” in a regular mode,

increasing its competitive advantages over time.

According to Manuylenko et al. (2021, p. 118):

“Innovation risk in banks, in our opinion, is a

possibility of wrong strategic innovative decision

making, i.e., taking a wrong choice and the

implementation of a financial and innovative strategy

that excludes dynamic opportunities and flexibility”.

1.3 Innovation Audit

Most of research (out of still not “well-knit” body of

research) in the internal audit is focused on specific

areas of training and competences of internal audit.

Regarding relationship between innovation and

internal audit, research is dominated by “internal

audit innovation”, implementing innovative

procedures, methods and approaches in internal audit,

typically the use of data analysis and computer-aided

audit tools (known as “CAATs”).

In this article, the object of research is not focused

on abovementioned relationship between innovation

and audit, comprehending internal audit innovations,

but it is focused on internal audit of innovation within

an organization (known as “innovation audit”).

Several authors contribute towards the innovation

audit body of research.

Innovation auditing is a well-established practice

used by managers to identify strengths and

weaknesses in organization’s innovation

(Frishammar et al., 2019).

According to Bjorkdahl & Holmén (2016), an

innovation audit allows firms to create and sustain

competitive advantage by building innovative

capabilities. There are several frameworks of

innovation audit, introduced by academics or practice-

oriented entities, usually advisory and consulting firms

(A.T. Kearney's, McKinsey, KPMG, etc.). According

to Frishammar et al. (2019), the early and important

contribution to this area of knowledge was made by

Chiesa et al. (1996) who identified four core processes

to audit, supported by three enabling processes.

Radnor and Noke (2002) developed an auditing

tool named "innovation compass”, which was

formulated through research and aims to understand

innovation process within organizations.

FEMIB 2024 - 6th International Conference on Finance, Economics, Management and IT Business

44

The majority of frameworks originate in

technological innovation or new product development

(Hallgren, 2009), while later studies have expanded

original approach, but innovation process was still the

core of the innovation audit framework.

Tidd and Bessent (2009. 2014) has presented an

auditing tool which looks at the organization from

five factors that affect innovation management

capability: Learning, Strategy, Linkages, Innovative

Organization, and Innovation Process. Their method

was based on a questionnaire composing 40

questions. It was used in later study by AlZawati,

Abdelrahman & AlAli (2017).

Burgelman et al. (2009) proposed a framework

consisting of resource availability, technological

environment, strategic management capacity,

structural and cultural context, and competitors’

strategies and industry evolution.

Abdel-Razak & Al Sanad (2014; in AlZawati,

Abdelrahman & AlAli, 2017) stated that innovation

audit is defined as a tool that can be used to reflect on

how the innovation is managed in a firm and is a

significant breakthrough in the area of technological

innovation management. Goffin & Mitchell (2016)

suggested that innovation auditing should focus on

the innovation process from idea generation to

implementation supported by three core themes:

innovation strategy, people, and organization.

Bjorkdahl & Holmén (2016) suggested different

approach in opposition to structured, predefined audit

aspects from previously mentioned framework – it

begins with active innovation problem screening and

by contextualization of identified shortcomings

auditor proceeds to analysis and evaluation.

Probably newest research by Frishammar et al.

(2019, p. 151) argues that “existing auditing

frameworks fail to account for recent transformations

in how innovation is being pursued by firms. This

transformation is driven by three trends: toward more

open innovation; toward increased servitization; and

toward a more digitalized world”. Moreover, it

provides description and analysis of additional

approaches to aforementioned review of innovation

audit frameworks.

Blackbright (2019) adds process perspective to

innovation management self-assessment audits.

Kovács & Stion (2016, p. 229) defined possible

areas of innovation audit:

• “Analyzing the current innovation practice

and performance.

• Identifying the differences between the

current and the targeted practice and

performance and the reasons for them.

• Increasing an organization’s innovation

power.

• Dismantling barriers to innovation.

• Ensuring the necessary motivation for the

innovation activity.

• Encouraging the creativity of those involved

in the innovation process.

• Making an action plan about the directions

of the necessary changes.”

Therefore, according to Frishammar et al. (2019,

p. 152), innovation audit should “complement and

improve existing innovation auditing practices, thus

allowing managers to assess and evaluate their

innovation activities more effectively against the new

innovation landscape. As such, it may help firms and

managers improve innovation auditing and, by

extension, improve innovation management.”

Based on literature review, there are studies,

definitions and frameworks to conduct innovation

audit in an organization, but innovation audit is not

reviewed, interpreted and researched in a connection

to internal audit function within an organization.

Studies present it as a stand-alone audit activity, often

executed by unspecified organization’s managers or

third party advisors rather than intentional scope of

internal audit function and part of internal audit

activity.

2 MATERIAL AND METHODS

The goal of the paper is to identify and analyze

current state of innovation audit conducted by internal

audit departments of banks providing banking

services in Czech Republic.

As the goal is mostly related to mapping current

situation of internal audit of innovation in banks in

Czech Republic, the paper utilizes mainly exploratory

research. The article is practice-oriented.

The novelty of this paper lies in research focusing

through lens of three specific conditions: a)

geographical focus on Czech Republic; b) focus on

internal audit role, function and activities within

general “innovation audit”; and c) focus on banking

entities, as parts of specific, highly regulated and

significantly disrupted financial service industry.

According to the data of Czech National Bank,

there were 44 banks providing banking services in

Czech Republic, consisting of 22 banks that have

been granted local single passport in financial

services under the Czech legislation and 22 banks that

have been granted single passport in financial

services from other member state of the EU or by

Internal Audit: Friend or Foe of Innovation in an Organization: Case of Czech Banking Sector

45

third-country access to the single market of financial

services in the EU.

Under the provisions of Act no. 21/1992 Coll. on

Banks as amended, internal audit department and

audit committee are always part of the bank.

Therefore, it is reasonably expected that all 44 banks

have internal audit department providing internal

audit functions to these banks and theoretical

population parameter of research is 44 internal audit

departments. As 2 or more entities with banking

license in Czech Republic are part of one banking

group, the population of audit departments is smaller,

because internal audit for these banking entities

sharing one ownership is provided by one internal

department within financial group (e.g. 3 subjects

from the list are the part of the same group sharing the

one internal audit function).

Research question is following: How are internal

audit departments of banks in Czech Republic included

in banks’ innovation? Methods of qualitative research

approach were chosen for this article.

Document Analysis (Phase 1):

Analysis of internal legislation of 3 different

banks with local banking license in order to

identify innovation procedures or innovation

audit procedures;

Analysis of internal audit plans for years 2020

and 2021.

Conducted in November 2022.

Semi-structured interviews (Phase 2):

Semi-structured interviews;

Digital means of video conferencing;

3 internal audit managers from 3 banks from

phase 1 (n=3);

Conducted in December 2022.

In order to characterize general model of

innovation internal audit assignment, the chosen

methods were applied in three different companies.

As the article includes business-sensitive information

about internal processes, the banks remained

anonymous.

Research sample included 3 banks from Czech

Republic. These banks service more than 5 million

clients in total. In total 7 banks were addressed with

an opportunity to participate at research, 4 of them

refused and 3 agreed (included in the sample).

Available sampling was applied. The sample of 3

banks in comparison with 44 subject in the population

might seems as strongly inappropriate, but at least 13

subjects from the population do not provide services

to general public and retail and have more the

character of specialized geographically oriented

banks helping with penetration of local markets (e.g.

China or Japan) and several subjects share one

internal audit function (department), the sample is

sufficient for exploratory research as banks in the

sample are amongst top 5 banks by assets and

customer base in Czech Republic.

Respondent applicability conditions were:

Internal audit management experience at least

5 years;

Current position in internal audit management

at least 3 years.

General internal audit experience at least 10

years. These conditions and thresholds were

applied to include only respondents with

significant, both expert and managing,

experience. Respondents are on positions of

higher internal audit management in banks that

decided to participate in research.

Semi-structured interviews were conducted in 3

parts:

In part 1, respondents were asked to describe

innovation policy and strategy in their banks

and its relation to internal audit, than if they

participated directly or indirectly in innovation

process, conducted innovation audit, general

and specific details on involvement of internal

audit in innovation within a bank, etc.

Questions were mainly open-ended.

Part 2 focused on gaining deeper and detailed

insights into current state of including

innovation practice of a bank to internal audit

functions, role and mission. Additional

questions were formulated and clarified via e-

mail or by phone.

In part 3, survey responses were coded,

analyzed and by generalization formulated into

results. Following Barrett et al. (2005, p. 2), the

analysis “is not intended to celebrate the

empirical detail” but rather to identify new and

emerging issues for study. Valuable insights to

guide additional research investigation are

provided through this data collection

procedure, including surveys, interviews, and

discussions.

3 RESULTS

This chapter provides a summarized view on results

obtained by applying research methods.

3.1 Document Analysis

Analysis of internal legislation led to following

aggregated results for all 3 banks:

FEMIB 2024 - 6th International Conference on Finance, Economics, Management and IT Business

46

Innovation process is not governed by one

single part of internal legislation providing

“umbrella” approach. Innovation areas are

divided into several internal legislation acts

(typically development of new product,

development of new application/IT system).

These acts are more focused on compliance

issues (ensuring control over process and

documenting its features for possible

regulatory supervision). For instance, in case of

development of new investment product, the

emphasis is put on compliance issues like

product governance regulation or managing of

conflict of interests. At the top level of internal

regulation (strategic level), the general

commitment to innovation and competitiveness

is absent.

Innovation process, scattered to various

organizational lines and flows, as it was

mentioned in previous paragraph, does not

necessarily share same process steps and level

of monitoring.

There is no formal coordination between

innovation processes of various products, it is

based on knowledge and effort of dedicated

project manager, although bank-wide

implications of innovation are considered in

project meetings.

Internal audit plans did not include any direct

innovation related audit.

Indirectly, some aspects of innovation process

in banks were included in various internal audit

assignments, considering documentation of

this process in line with rules stated in internal

legislation.

Focus on innovation performance, innovation

motivation and innovation barriers was not

covered.

Full picture regarding bank’s innovations was

not assessed.

Innovation risk was absent form risk mapping,

risk identification and audit plans.

3.2 Interviews

Analysis of interviews with internal audit managers

provided following aggregated results for all 3 banks:

Respondents stated that innovation is a core

part of banks’ business. Banks are aware of

disruption of highly competitive market, but on

the other hand, their innovation appetite is

focused solely on incremental innovations.

Radical innovation are not in the focus of

banks.

Regarding barriers to innovation, respondents

generally defined following barriers:

Legacy of existing information systems – the

change of existing, especially core systems,

would bear huge costs and risks), therefore core

systems are not a subject to innovation, banks

focus more on innovation of user interface of

existing systems;

Low innovation appetite – despite statements

of respondents that they are aware of disruption

in financial services, they do not consider

current level of disruption as significant real

threats to existing of bank;

Implicit perception of innovation risk – very

low risk-appetite towards any significant

change of internal processes and organizational

structure that may bear significant financial

losses from such innovation.

Slow decision-making regarding innovation

connected to foreign ownership.

Generally, thinking within barriers of

traditional banking business, without will to

“think-out-of-the-box”.

There is no clear department dedicated to

innovation. Innovation ideas come usually

from various sources:

External sources: competition and market

monitoring, other decision from financial

ownership group;

Internal sources: IT project managers,

marketing departments;

Considering size of potential investment into

innovation implementation, the main decision

maker is usually at the level of board of

directors.

Standard innovation process in banks differs, in

line with results of document analysis,

depending on the topic of innovation.

Innovations implemented, but also needed in

current banks, have both technological and

non-technological character. Non-

technological innovation prevail and

technological innovation are usually necessary

adjustments in IT infrastructure.

Innovation risk is not directly monitored or

measured within self-risk assessment of a bank.

It is understood in decision making and as in

any project, it is considered in feasibility study.

It is usually considered as a financial loss from

unsuccessful project.

There was no direct innovation audit regarding

innovation process, innovation performance or

innovation barriers.

Internal Audit: Friend or Foe of Innovation in an Organization: Case of Czech Banking Sector

47

Innovation motivation, translated as “will to

share innovative ideas for improvement”, was

indirectly and very slightly part of human

resources audit.

All 3 respondents expressed opportunity, based

on their participation in interviews, to include

innovation governance to audit assignment.

Through “follow-ups” (follow up of

recommendations for improvement of auditee),

internal audit can identify potential for

innovation within a bank. Moreover, by

specifically focused internal audit assignment

on innovation, the governance, control and

performance of innovation within a bank can be

identified and shared.

One respondent indicated that consideration of

innovation potential within audited areas might

be a part of internal audit reports.

None of internal audit departments of

interviewed respondents provided innovation-

related consultancy service.

According to respondents, internal audit’s

added value lies in internal auditors

themselves, as they have great working

knowledge of bank processes, incl. law and

regulatory requirements. Internal auditors

have, according to respondents, sufficient

knowledge to help innovation initiative within

a bank.

On the other hand, respondents stated, that

innovation internal audit assignment would require

not only good working knowledge of bank itself and

deep expertise, but also an open-minded thinking and

possible orientation within state-of-art innovation

knowledge, incl. multidisciplinary thinking. Current

internal auditors are not fully prepared in these topics.

4 DISCUSSION

In the current economic climate, businesses face

major competitiveness challenges. Banking services

are not an exemption, in contrary, disruption is typical

for today’s financial services. Banks need to respond

flexibly to the changing business environment and

customer requirements. Meeting such variable

requirements brings constant pressure on innovation.

While there is much apocalyptic hype about

financial services industry “disruption” by FinTech in

the media, we have little doubt that digital entrants

will change the industry in profound ways (Mills &

McCarthy, 2017). One of the key issues at the heart

of current academic, practitioner, and policy debate

on banking and FinTech (Chiu, 2016; Gurdgiev,

2016; Zetzsche, Buckley, Arner, & Barberis, 2017) is

whether these new entrants will eventually displace

traditional banking institutions much in the same way

as digital media has disrupted traditional publishing

and advertising or, alternatively, hurt banks’

profitability, as is currently the case with online

education eroding higher education industry profits.

While results of Zhao et al. (2022, p. 456) show

that FinTech innovation truly reduces profitability of

traditional banks, according to these authors banks

have their own FinTech capabilities and focus more

on “the rising capabilities of FinTech technology than

its difficulties and what the competition is doing”.

Even in conditions of banking sector of Czech

Republic it might be truly seen that “small banks can

particularly achieve business process reengineering

and innovation more reliably by actively cooperating

with FinTech companies.”

Own set of innovation barriers in banks has been

described in the article. The key areas/themes

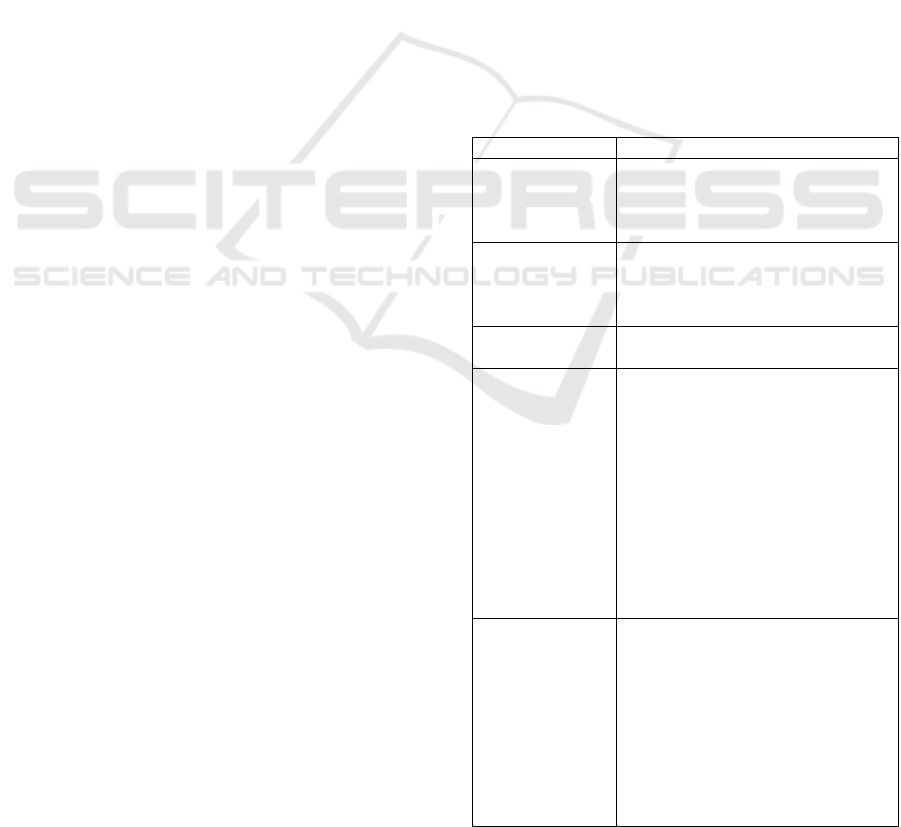

identified from the document analysis of audit plans

are in the Table 1.

Table 1: Key areas identified by analysis of audit plans.

Area Commentar

y

Innovation focus

Missing umbrella approach;

fragmented innovation process,

lower level of fostering culture of

innovation.

Lack of strategic

commitment to

innovation

Notable absence of a general

commitment to fostering innovation

and competitiveness within the

or

g

anization.

Innovation

process

Weak formal coordination between

p

rojects.

Limited role of

internal audit in

innovation

Internal audit plans do not explicitly

include audits related to the

innovation process.

While some aspects of the

innovation process may be

indirectly included in various

internal audit assignments, these

typically focus on documenting the

process in accordance with internal

regulations rather than assessing

innovation performance, motivation,

or barriers.

Oversight of

innovation

performance and

risks

Comprehensive evaluations of the

bank’s innovations, encompassing

innovation performance, motivation,

and barriers, are not conducted.

Innovation risk is not incorporated

into risk mapping, identification, or

audit plans, indicating a gap in

recognizing and managing potential

risks associated with innovation

activities.

FEMIB 2024 - 6th International Conference on Finance, Economics, Management and IT Business

48

In banks, both technological and non-

technological innovation (Camisón & Villar-López,

2011, 2014; Gunday et al., 2011) are relevant and

needed to cope with competition emerging from

financial market disruption. Without technological

innovation, in our opinion, banks will not be able to

overcome legacy of tangled and problematic

information systems (Westerman, Soule & Eswaran,

2019). Banks have focused mainly on customer-

oriented non-technological innovation, what

corresponds with opinion Aboal & Garda (2016) that

non-technological innovation played more important

role in service sector.

Since banks will be probably, based on

aforementioned opinions, sooner or later forced to

innovate, the question is whether these innovations

will be successful. Innovation activities of banks, just

like any other activity, bears a special type of risk, an

innovative risk. Although the term innovation risk has

become a part of risk-related research (Manuylenko

et al., 2021), our research shows it has not been

incorporated to risk assessment and risk mapping of

researched banks and was also missing as scope of

internal audit assignments.

In our view, the fact that internal audit

departments were not involved in mitigation of

innovation risk is a lost opportunity for business and

also internal audit profession. Innovation internal

audit department might increase added value of

internal audit to business and also help to mitigate this

risk for bank. Internal auditors are, after all, risk

professionals with strong emphasis on governance

processes (The IIA, 2017).

Absence of researched connection between

internal audit and conducting innovation audit and

mitigation of innovation audit was palpable, but not

unexpected. Christ (2021) and other authors like

Dechow et al. (2018) concluded, that body of

knowledge of internal audit is in its infancy. Hazaea

et al. (2021, p. 287) added that “literature did not

contribute significantly to the knowledge of IA

functions in the form specified by the Institute of

Internal Auditors.” Authors argue that current state of

literature did not contribute significantly to the

knowledge of internal audit functions in the form

specified by The IIA and while descriptive research

was prevalent, interpretative research focused mainly

on case studies, questionnaires and interviews,

although share of empirical, interpretative research

was scarce. Our literature reviews confirms these

statements. For instance, innovation audit is an object

of research of several authors (comprehensive study

provided by Frishammar et al., 2019), but it has not

been sufficiently approached through lens of internal

audit functions, although, in our opinion, it is internal

audit that should deal with conducting innovation

audit in an organization.

Respondents identified that internal auditors have

good working knowledge of company itself and its

processes and goals, but they might be missing

broader innovation-oriented vision. The key

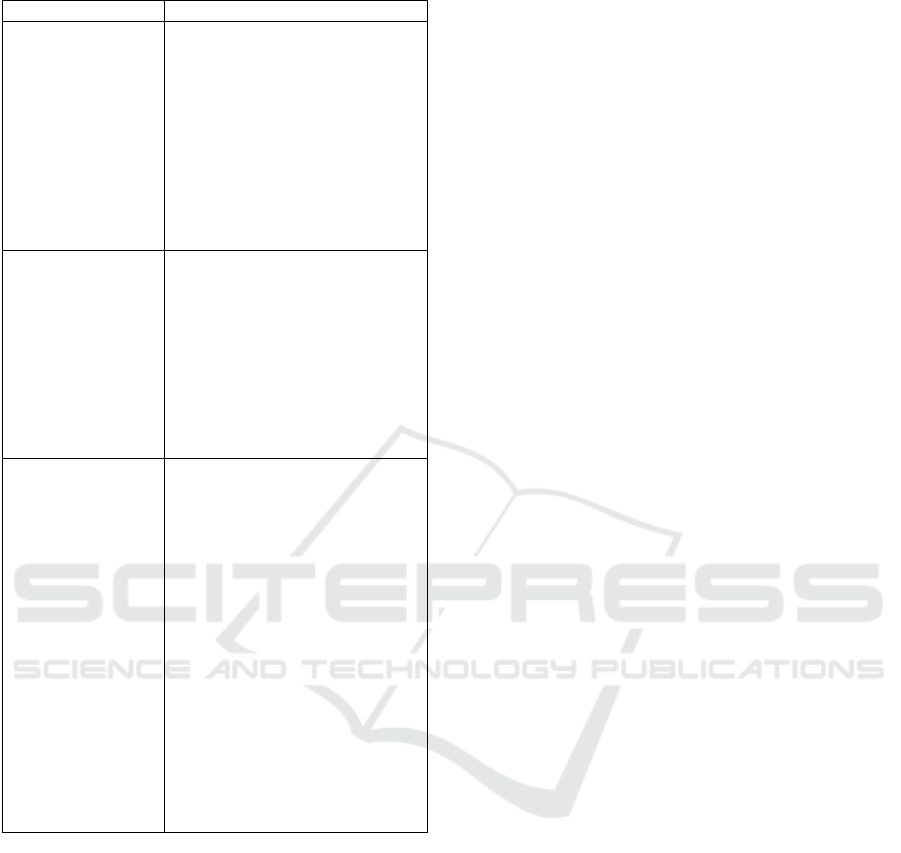

areas/themes identified from the interviews are in the

Table 2.

Table 2: Key areas identified by interviews.

Area Commentar

y

Innovation strategy

and focus

Banks recognize innovation as a

critical component of their

business strategy, yet their

innovation efforts are primarily

geared towards incremental rather

than radical innovations. This

highlights a cautious approach to

innovation, prioritizing

enhancements within existing

frameworks over groundbreaking

chan

g

es.

Barriers to

innovation

Legacy Systems: The high cost

and risk associated with changing

core banking systems discourage

innovation in these areas, leading

banks to focus on user interface

improvements instead.

Low Innovation Appetite: Despite

acknowledging the disruptive

potential in the financial sector,

banks do not see current

disruptions as significant threats,

reflecting a complacency or risk-

averse stance towards innovation.

Perception of Innovation Risk:

There's a general aversion to

undertaking significant changes

in internal processes and

organizational structures due to

the potential financial losses from

failed innovations.

Slow Decision-Making:

Innovation decisions can be

delayed due to foreign ownership

and the associated bureaucratic

processes.

Traditional Mindset: Banks often

operate within the confines of

traditional banking business

models, showing little willingness

to "think outside the box".

Sources of

innovation

Usually it is the market and

competitive pressure that lead to

innovation activities instead of

internal effort.

Internal Audit: Friend or Foe of Innovation in an Organization: Case of Czech Banking Sector

49

Table 2: Key areas identified by interviews (cont.).

Area Commentar

y

Innovation

implementation

The process of innovation varies

depending on the focus area, with

a mix of technological and non-

technological innovations being

implemented. Non-technological

innovations predominate, and

technological innovations are

often adjustments in IT

infrastructure. There is no

significant (radical) innovation

focus.

Risk management

and internal audit

Innovation risk is considered in

decision-making processes and

feasibility studies but is not

directly monitored or measured as

part of the bank's self-risk

assessment. Additionally, there

has been no direct innovation

audit on the process,

performance, or barriers to

innovation.

Innovation

governance and

internal audit role

There's an opportunity for

internal audit functions to include

innovation governance in their

audit assignments, potentially

enhancing the bank's innovation

capabilities by identifying and

sharing insights on innovation

governance, control, and

performance.

Internal auditors, with their in-

depth knowledge of bank

processes and regulations, are

seen as valuable assets for

supporting innovation initiatives

within the bank, despite the

current lack of innovation-related

consultancy services provided by

internal audit de

p

artments.

Innovation internal audit assignment will require

new set of skills from auditor to be able think outside-

the-box. Betti & Sarens (2021) stated, that there is a

new set of skills need from internal auditors

considering changing business, and therefore also, an

internal audit landscape, as they identified the new

scope of internal audit assignments and demand for

consulting activities performed by internal auditors to

come.

This practice-oriented exploratory research was

supposed to open research of internal audit functions

in banks. The answer to stipulated research question:

“How are internal audit departments of banks in

Czech Republic included in banks’ innovation?”, it

could be concluded, that internal audit was quite

indifferent to innovation processes in researched

banks. Therefore, in words of a title of the article,

internal audit was neither friend, nor foe of innovation

in Czech banks, but our research indicated that it

under including properly trained internal auditors to

mitigation of innovation risk and assessment of

governance of innovation process, internal audit

could become an enabler of innovation.

5 CONCLUSION AND FUTURE

RESEARCH

Article focused on relation between internal audit of

3 banks in Czech Republic and innovation processes

of these banks. Acquired results indicated that

internal audit departments do not monitor innovation

risk as part of risk evaluation and assessment and did

not directly and intentionally focused scope of their

mission on innovation processes and innovation

governance.

Article includes entrance to the internal audit as a

research object under conditions of banking system of

Czech Republic. By usage of qualitative research it

proposes future, more detailed, research, as there

were identified several limitations of conducted

research. Despite that, by its form of exploratory

research, it brings proposes several new findings

worth future research. In future, it recommends

several changes to research approach to ensure

objective findings, especially triangulation of

research methods and enlargement of sample of

banks.

Regarding generalization of research findings, by

application inductive method, it could be asserted that

internal audit department should expand its scope

significantly towards innovation efforts in any type of

organization and ensure monitoring of innovation

risk.

Maybe there is one pressing question to answer

and it is why bank's audit committee (internal audit

function) should even focus on internal audit

assignment of innovation in a bank? The audit

committee and internal audit function of a bank

should focus (or be present) on innovation for several

compelling reasons like ensuring risk management,

regulatory compliance, operational efficiency,

strategic alignment, safeguarding assets and

sustainability and ethics concerns.

Pertinent to presented research, there are several

research limitations in this research:

Potential lack of training and knowledge –

despite the fact that author studied required

literature to conduct the research, there is still a

FEMIB 2024 - 6th International Conference on Finance, Economics, Management and IT Business

50

possibility of lack of training and knowledge to

provide deep results as in case of scientific

teams. Potential misunderstanding and lack of

interaction – we tried to provide help and better

description of questions, but considering the

broad scope of the topic, some respondents

could not understand it properly.

Small sample – we are aware of small sample

which did not represent the whole population

of banks, but in line with the intention and

objective of research provides some initial

information on the topic for further

investigation.

Lack of confidence - the majority of the

businesses are of the viewpoint that,

researchers can misuse the data given by them.

As a result, they’re unwilling to reveal

information about their business.

First areas of future research opportunity lies in

mitigation of research limitations mentioned

previously:

Enlargement of sample is needed and ensuring

representative sample.

Implementation of triangulation of qualitative

research and strengthen the validation of

research – besides document analysis and

interviews, it is expected to conduct also

questionnaire survey.

Elimination of non-responsive bias and

socially-desirable bias.

To suggest real topics for future research, not

based on only alleviation of research limitations of

this paper, it seems that suitable areas of research are:

Interplay between jurisdiction audit committee

and innovation in banks.

Error management climate in a bank and its

influence on innovation activities.

Designing and testing of internal audit

assignment in the area of innovation.

The inclusion of internal audit departments in

banks' innovation processes should reflect an

evolving approach towards integrating risk

management, regulatory compliance, and strategic

alignment into innovative practices. Traditionally,

internal audit functions in Czech banks have focused

on ensuring compliance, assessing risks, and

evaluating the operational effectiveness of various

banking processes. However, with the rapid pace of

technological advancement and the increasing

emphasis on digital transformation within the

financial sector, the role of internal audit departments

should expand to encompass innovation activities

more directly.

REFERENCES

Aboal, D. & Garda, P. (2016). Technological and non-

technological innovation and productivity in services

vis-à-vis manufacturing sectors. Economics of

Innovation and New Technology, 25(5), 435–454.

Alzawati, O., Alali, A. & Abdelrahman, G. (2017).

Auditing and Comparing Innovation Management

Capability in the Municipal Field: A Case Study.

Springer Proceedings in Business and Economics, In

Rachid Benlamri & Michael Sparer (eds.), Leadership,

Innovation and Entrepreneurship as Driving Forces of

the Global Economy, p. 353-360.

Anderson, A. W., (2020). 4 keys to the future of audit,

Thomson Reuters White paper. [online]. Washington:

Thomson Reuters, 2020. [cited 2023-01-08].

https://tax.thomsonreuters.com/site/wp-

content/private/pdf/checkpoint/whitepapers/Checkpoin

t-Al-Anderson-Whitepaper.pdf

Anderson, U., L., & Christ, M., H. (2014). Internal audit. In

The Routledge Companion to Auditing, D. Hay, W. R.

Knechel & M. Willekens (eds), p. 230–239.

Anh, L., T. Nguyen, T. & Tran, L. (2021). Relationships

between innovation, its antecedents, and organisational

performance: evidences from auditing service industry.

Knowledge Management Research & Practice, 16(4),

98-114.

Barret, M., et al. (2005). Globalization and the coordination

of work in multinational audits. Accounting,

Organizations and Society, 30(1), 1-24.

Behrend, J. & Eulerich, M. (2019). The evolution of

internal audit research: A bibliometric analysis of

published document (1926-2016). Accounting History

Review, 29(1), 103-139.

Betti, N. & Sarens, G. (2021). Understanding the internal

audit function in a digitalised business environment.

Journal of Accounting & Organizational Change,

17(2), 239-257.

Bjorkdahl, J., & Holmén, M. (2016). Innovation audits by

means of formulating problems. R&D Management,

46(5), 842-856.

Blackbright, H. (2019). The Importance of Taking a

Process Perspective on the Use and Application of an

Innovation Management Self-Assessment Audit.

Journal of Innovation Management, 7(4), 47-76.

Bouguerra, A., et al. (2022). Absorptive capacity and

organizational performance in an emerging market

context: Evidence from the banking industry in turkey.

Journal of Business Research, 139, 1575-1587.

Burgelman, R. A., Christensen, C. M., & Wheelwright, S.

C. (2009). Strategic management of technology and

innovation. New York, NY: McGraw-Hill, 2009.

Burton, F., G. et al. (2021a). Do we matter? The attention

policy makers, academics, and the general public give

to accounting research. Issues in Accounting Education,

36(1), 1-22.

Burton, F., G. et al. (2021b). Creating relevance of

accounting research (ROAR) scores to evaluate the

relevance of accounting research to practice.

Accounting Horizons 39(2), 1-26.

Internal Audit: Friend or Foe of Innovation in an Organization: Case of Czech Banking Sector

51

Camisón, C. & Villar-López, A. (2011). Non-technical

innovation: Organizational memory and learning

capabilities as antecedent factors with effects on

sustained competitive advantage. Industrial Marketing

Management, 40(8), 1294-1304.

Camisón, C. & Villar-López, A. (2014). Organizational

innovation as an enabler of technological innovation

capabilities and firm performance. Journal of Business

Research, 67(1), 2891–2902.

Chiesa, V., et al. (1996). Development of a technical

innovation audit. Journal of Product Innovation

Management, 13(2), 105-136.

Chiu, I., H., Y. (2016). The disruptive implications of

fintech-policy themes for financial regulators. Journal

of Technology Law & Policy, 21(1), 389-403.

Christ, M., et al. (2021). New Frontiers for Internal Audit

Research. Accounting Perspectives, 20(4), 449-475.

Dechow, P., et al. (2018). AAA Research Relevance Task

Force: Recommendation. [online]. Washington:

American Accounting Association, 2018. [cited 2023-

01-08]. https://aaahq.org/Portals/0/documents/Task-

Force/AAA%20research%20relevance%20task%20for

ce%203%20now%20recommendations.pdf?ver=2018-

07-26-140718-263

Defond, M., & Zhang, J. (2014). A review of archival

auditing research. Journal of Accounting and

Economics, 58(2/3), 275–326.

Desyatnichenko, D., et al. (2017). Electronic Innovation in

Banking. Journal of Economy and Business, 5(1), 41–

48.

Dietz, M., et al. (2016). Cutting through the noise around

financial technology [online]. London: McKinsey &

Company Finacial Services. [cited 2023-08-01].

https://www.mckinsey.com/industries/financial-

services/our-insights/cutting-through-the-noise-

around-financial-technology

Dodgson, M. (2000). The Management of Technological

Innovation. Oxford: Oxford University Press, 2000.

Dzikrulah, A., D. Harymawan, I. & Ratri, C, M. (2020).

Internal audit functions and audit outcomes: Evidence

from Indonesia. Cogent Business, 7(1), 1-23.

Dzikrullah, A.D., Harymawan, I. & Ratri, M.C., 2020.

Internal audit functions and audit outcomes: Evidence

from Indonesia, Cogent Business & Management,

Taylor & Francis Journals, vol. 7(1), 1750331-175

Elst, O., (2022). Internal Audit of the Innovation

Management. [online]. Brussels: KPMG Belgium,

2022. [cited 2023-11-01]. https://home.kpmg/be/en/

home/insights/2020/11/rc-internal-audit-of-the-innova

tion-management-system.html

Eroshkin, Y., V. (2013). Methodological Support for

Strategic Risk Assessment of Innovative Activities in

Commercial Bank. Forestry Journal, 12(4), 177–185.

Frishammar, J. (2019). Opportunities and challenges in the

new innovation landscape: Implications for innovation

auditing and innovation management. European

Management Journal, 37(4), 151-164.

Goffin, K., & Mitchell, R. (2016). Innovation management.

Houndmills, UK: Palgrave Macmillan, 2016.

GRAMLING, A. et al. (2004). The role of the internal audit

function in corporate governance: A synthesis of the

extant internal auditing literature and directions for

future research. Journal of Accounting Literature,

23(1), 194-244.

Gunday, G., et al. (2011). Effects of innovation types on

firm performance. International Journal of Production

Economics, 133(2), 662-676.

Gurdgiev, C. (2016). Is the rise of financial digital

disruptors knocking traditional banks off the track?

International Banker, June 2016, 9 pp.

Hallgren, E, W. (2009). Opportunities and challenges in the

new innovation landscape: Implications for innovation

auditing and innovation management. Creativity and

Innovation Management, 18(1), 48-58.

Hazaea, A., S., et al. (2021). Mapping of internal audit

research in China: A systematic literature review and

future research agenda. Cogent Business &

Management, 2021(8), 1-24.

Kovács, G. & Stion, Z. (2016). Innovation Audit as a Tool

for Boosting Innovation Power of Universities.

Zarządzanie Publiczne, 3(35), 221–235.

Lee, I. & Shin, Y.J. (2018). Fintech: Ecosystem, Business

Models, Investment Decisions, and Challenges.

Business Horizons, 61, 35-46.

Manuylenko, V, V., et al. (2021). Development and

Validation of a Model for Assessing Potential Strategic

Innovation Risk in Banks Based on Data Mining-

Monte-Carlo in the “Open Innovation” System. Risks,

9(118), 1-19.

Markert, CH. (2014). Establishing Payment Hubs—

Unwind the Spaghetti? American Journal of Industrial

and Business Management, 4(4), 175-181.

Mckinsey Global Institute. (2016). Digital Europe: Pushing

the Frontier, Capturing the Benefits. [online]. London:

McKinsey & Company, 2016. [cited 2023-08-01].

https://www.mckinsey.com/~%7B%7D/media/mckins

ey/business%20functions/mckinsey%20digital/our%2

0insights/digital%20europe%20pushing%20the%20fr

ontier%20capturing%20the%20benefits/digital-

europe-full-report-june-2016.ashx

Nazarenko, N. V. (2014). Bank Innovations as a Result of

Innovative Banking in Competitive Environment.

Financial Research, 20(2), 66–75.

OECD. (2020). Digital disruption in financial markets.

[online]. Paris: Organization for Economic Co-

operation and Development, 2020. [cited 2022-09-01].

https://www.oecd.org/daf/competition/digital-

disruption-in-financial-markets.htm

Omarini, A. (2017). The Digital Transformation in Banking

and the Role of FinTechs in the New Financial

Intermediation Scenario. [online]. Basel: Bank for

International Settlement, 2017. [cited 2023-08-10].

https://www.bis.org/review/r151113d.htm

Orton-Jones, CH. (2021). Why banks are struggling to

update their ageing IT [online]. London, UK:

Raconteur, 2021. [cited 2023-11-01]. https://www.

raconteur.net/finance/financial-services/banks-struggli

ng-update-ageing-it/

FEMIB 2024 - 6th International Conference on Finance, Economics, Management and IT Business

52

Petrík, V. (2017). Internal Audit Assignment in the area of

Enterprise Knowledge Management. Conference

Paper. 12th IWKM 2017, 12 – 13 October 2017,

Trenčín, Slovakia.

Radnor, Z. J., & Noke, H. (2002). Innovation compass:

Self-audit tool for the new product development

process. Creativity and Innovation Management, 11(2),

122-132."

Rajgopal, S. (2020). Integrating practice into accounting

research. Management Science, 67(9), 5430-5454.

Seiler, V. & Fanenbruck, K. M. (2021). Acceptance of

digital investment solutions: The case of robo advisory

in Germany. Research in International Business and

Finance, 58(4), 348-364.

Stashchuk, A. & Maryniuk, R. (2021). Banking

innovations: security technology solution. VUZF

review, 6(1), 79-86.

Tether, B., S. (2005). Do services innovate (differently)?

Insights from the European innobarometer survey.

Industry and Innovation, 12(2), 153-184.

The Institute of Internal Auditors. (2017). The International

Professional Practices Framework (IPPF). Lake Mary,

USA: The Institute of Internal Auditors, Inc., 2017. 324

p. ISBN 978-8086689-55-5.

Tidd, J. & Bessant, J. (2014). Managing Innovation:

Integrating Technological. Market and Organizational

Change, 5th ed. John Wiley & Sons, West Essex, UK

Westerman, G., Soule, L., D. & Eswaran, A. (2019).

Building Digital-Ready Culture in Traditional

Organizations. MIT Sloan Management Review,

Summer 2019, 59-68.

Zalan, T. & Toulafi, E. (2017). The Promise of Fintech in

Emerging Markets: Not as Disruptive. Contemporary

Economics, 11(4), 415-430.

Zetzsche, D., et al. (2017). From FinTech to TechFin: The

regulatory challenges of data-driven finance. New

York University Journal of Law and Business,

Forthcoming, European Banking Institute Working

Paper Series 2017 - No. 6, University of Hong Kong

Faculty of Law Research Paper No. 2017/007,

University of Luxembourg Law Working Paper No.

2017-001. 41 pp.

Zhao, J., et al. (2022). Riding the FinTech innovation wave:

FinTech, patents and bank performance. Journal of

International Money and Finance, 12(2), 714-729.

Internal Audit: Friend or Foe of Innovation in an Organization: Case of Czech Banking Sector

53