AI Technology Adoption & Sustainability Improvement Though

Cloud Solutions

Maarten Voorneveld

Leiden Institute of Advanced Computer Science Snellius Gebouw, Niels Bohrweg 1, 2333 CA Leiden, The Netherlands

Keywords: AI, ML, Cloud, Industry, Sustainability, Adoption.

Abstract: Cloud and AI are game changers in digital transformation, as it facilitates long-term digital development

and technology adoption. A study of over 1000 organizations in Western Europe was conducted to identify

company adoption of AI technology and cloud computing-based sustainability benefits. This paper offers

the survey results and situates them within the larger context, showing how businesses employ cloud

technology to achieve their AI and sustainability goals. Digital innovations such as AI technology are being

realized

via

cloud

services,

allowing

companies

to

better

develop

their

product

and

services.

1

INTRODUCTION

There's a growing emphasis on artificial intelligence

(AI) and cloud-enabled technologies. Organizations

have doubled their use of AI capabilities, with a

focus on robotic process automation and computer

vision (Quantumblack, 2022). The environmental

impact of technology, particularly data centres, is a

growing concern (Wan, 2019). Cloud plays a critical

role in AI systems' creation, implementation, and

scalability, providing essential resources like

computing power and storage (Hummer, 2019).

Cloud facilitates collaboration for AI development

and enables distributed workloads for faster

processing (Gill, 2019). Cloud services offer a cost-

effective and energy-efficient way to apply AI

(Buyya, 2018). The pay-as-you-go model of cloud

computing benefits businesses in accessing AI

resources on demand (Attaran, 2019).

The flexibility of cloud technologies enhances

AI innovation in various fields. Cloud is the ideal

platform for AI, providing a broad data lake

connection for cognitive capabilities (Montori,

2018). Cloud-based AI solutions leverage machine

learning algorithms and big datasets for

sophisticated decision-making (Allahvirdizadeh,

2019). Robotics also relies on the cloud, using AI

and ML for automation (Lee, 2018). Automation,

powered by cloud-based solutions, enhances

productivity and streamlines operations (Ahmad,

2021). Cloud-hosted analytics solutions process IoT-

generated data for data-driven decision-making

(Antonopoulos, 2020). Cloud-based technologies

collaborate to enable large-scale data gathering,

analysis, and usage for sustainable decision-making.

AI implementation is in early stages, with

companies recognizing its potential but facing social

challenges. Cloud computing accelerates AI and

supports environmental benefits by providing IT

resources without hefty hardware investments

(Ahmad, 2021). AI is making strides in the

sustainable energy industry (Antonopoulos, 2020).

Cloud operations prioritize renewable energy

sources for data centres. However, challenges in AI

implementation, connectivity to cloud technologies,

and sustainability need industry attention (Muhlroth,

2020).

Despite AI's increasing adoption, there's a

knowledge gap on its industry implications.

Research areas include challenges in AI adoption, its

impact on organizational culture, AI-driven

automation in decision-making, organizational

structure changes, AI's influence on value

propositions and sustainability, innovation through

AI, and ethical considerations (Enholm et al., 2021).

An industry-oriented survey can fill these gaps,

offering insights for effective AI implementation.

This study focuses on the deployment of AI with a

foundation in cloud computing and a sustainability

perspective. It will look at how Western European

(WE) businesses are progressing with AI technology

adoption, on cloud-based innovation and its

sustainability footprint. The research question we

Voorneveld, M.

AI Technology Adoption & Sustainability Improvement Though Cloud Solutions.

DOI: 10.5220/0012612500003690

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 26th Inter national Conference on Enterprise Information Systems (ICEIS 2024) - Volume 2, pages 675-687

ISBN: 978-989-758-692-7; ISSN: 2184-4992

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

675

aim to answer is as follows:

How have AI enabling technologies based on

cloud computing on West European companies

been adopted and enabled sustainability?

This paper contributes to theory and practice in

three ways. At first, we contribute to practice as

research findings will be used to provide insights

into the adoption of cloud based technologies IoT,

Analytics, Automation, Robotics, ML, and AI by

companies. This research will be beneficial to

companies, as it will provide them with a better

understanding of the potential of cloud driven AI for

their sectors. Secondly, this paper will also explore

the broader implications of cloud computing

including examining the impact on enabling

technologies as it looks into the impact of AI

technologies and sustainability though cloud

computing

on

industry-specific

sectors,

such

as

automotive and manufacturing. The final

contribution is to the broader societal impact as it

will explore the potential for start-ups and young

companies in terms of innovation and market

positioning, it will examine the state of AI

technologies and sustainability of cloud for energy

efficiency and carbon emission reduction. This paper

continues with a literature review, followed by a

methodology, analysis and conclusions section.

2

BACKGROUND

AI is a scientific discipline, technologies used to

realize AI, and AI capabilities. AI emulates human

performance by acting as an intelligent agent, which

performs actions based on a specific understanding

of input from the environment. This should be

accomplished without relying on preconceived rules

or action sequences throughout the whole procedure.

AI is defined in two ways: as a tool that solves a

specific task that could be impossible or very time-

consuming for a human to complete, and as a system

that mimics human intelligence and cognitive

processes. advancements in AI have produced AI

systems that are capable of persuading humans, even

systems that are not explicitly designed to persuade

may do so in practice,. (Burtell & Woodside, 2023).

Using AI technology improves choice behaviour and

increases perception of decision quality, but it

creates the risk of overreliance, which may be

explained by both a higher level of confidence in the

adviser and the attribution of a more organized

procedure (Keding 2021).

As AI gains prominence in organizations,

research explores its role in achieving organizational

goals, addressing both advantages and constraints

(Kakatkar, 2020). AI capabilities involve leveraging

data, methodologies, processes, and people for

automation, decision-making, and collaboration.

These capabilities encompass technological and non-

technical resources, highlighting the need for holistic

utilization to unlock AI's full strategic potential.

However, the real-world implementation at the firm

level, along with its connection to cloud and

sustainability, remains unclear. A mixed-method

approach, incorporating interviews, is recommended

for future studies to gain comprehensive insights

(Assunta di Vaio, 2020).

Cloud computing has emerged as a game-

changing technology that offers significant benefits

to businesses and is a core enabler for AI

technologies. It allows for virtually unlimited

capacity to process large amounts of data, enabling

the use of new technologies such as machine

learning and big data analytics (Kaisler et al., 2013).

Scalability allows for ramping up or down of

capacity as needed without major adjustments,

increasing flexibility and the ability to handle peak

workloads (Armbrust et al., 2010). The cloud also

facilitates experimental approaches that require

computational power, increasing potential for

innovation (Marston et al., 2011). Additionally,

cloud technology reduces IT costs by eliminating or

reducing hardware purchases, potentially increasing

sales while decreasing costs (Aljabre, 2017). Cloud

technology also strengthens the resilience of

businesses by improving cost control and response

capabilities to changing market events (Cao et al.,

2014). Finally, the cloud contributes to sustainability

by providing better energy balance and data security,

particularly if the provider relies on renewable

energy sources (Bardhan et al., 2010). Despite the

numerous benefits of cloud computing, research

suggests that businesses have been slow to adopt this

technology due to concerns about data security and

privacy (Goscinski et al., 2011). In terms of the

impact of cloud computing on digital

transformation, research has shown that cloud

adoption can enhance digital capabilities,

particularly in terms of data analytics, collaboration,

and mobility (Gupta et al., 2019). Additionally, there

is a lack of understanding about the costs and

benefits of cloud computing and how it can be

effectively integrated into existing IT infrastructure

(Chang et al., 2013). Research has also shown that

the impact of cloud computing on businesses varies

depending on the specific context and industry

(Lacity et al., 2010). Adoption of cloud computing

ICEIS 2024 - 26th International Conference on Enterprise Information Systems

676

had a positive impact on firm performance in the

financial services industry, but not in the

manufacturing industry (Kshetri, 2014). Cost and

energy savings of cloud computing can have a

significant impact on businesses, by reducing the

need for hardware and IT staff, businesses and

increase profitability (Agrawal et al., 2013).

However, it is important to note that the cost savings

associated with cloud computing may not be

immediate, and businesses must carefully consider

the total cost of ownership over the long term (Weill

et al., 2013). AI is rapidly evolving, offering

businesses benefits like sustainability, but also

challenges and risks. Companies must consider their

context, industry, legal, and regulatory requirements

when adopting AI technologies, contributing to the

literature on AI implementation in WE companies.

The present study aims to address this gap in the

literature by examining the impact of cloud

computing on WE companies in terms of digital

transformation, innovation, cost savings, data

security, and resilience.

3

METHODOLOGY

We collected data on the use of AI technologies and

sustainability in WE (Benelux and Germany)

companies in a large-scale digital survey.

Companies are asked about the use of various AI

technologies and sustainability enabled by cloud.

Additionally qualifying questions on revenue and

employee developments as asked. This allows

statistically significant correlations to be revealed

from the context of the survey without revealing

these correlations to the companies during the

survey, to avoid suggestive contexts. As part of the

research project to determine the significance of

cloud, over 1000 WE companies are interviewed in

2022 for this purpose in a digital survey.

Participating companies are sampled in a random

drawing stratified with respect to industry and size

categories. Stratification is necessary to ensure that

even marginally populated classes (firms with more

than 200 employees) have enough cases. The final

data is extrapolated to be representative of the

overall WE are using number weighting so that the

survey results can be interpreted beyond the sample

for the WE economy. The anchor variable here is the

industry class composition in the industries Services

and Production.

In preparation for the extensive survey, case

study interviews were conducted with selected

company representatives who have gained extensive

experience with the use of cloud services in the

recent past. Case study interviews belong to the

group of qualitative research methods. They are

suitable for deep examination. In contrast to the

company survey explained above, the case study

interviews do not aim to determine a representative

picture of cloud use and effects in WE companies

that can be derived on the basis of large numbers but

rather, in the sense of an in-depth investigation, to

explore further effects (which, for example, cannot

be collected in detail as part of the standardized

survey) as well as concrete enrichment in the form

of individual experience reports, concise success

stories, and precise effect descriptions. In this way,

the number-based results of the survey analogous

categories were used for the presumed effects of

cloud use enabling new technologies. These

categories were refined using stimulus questions and

tested for connectivity to the survey questions. As

the WE corporate landscape is largely made up of

service companies with a small number of

employees, it is precisely these companies that are

given greater weight in the survey. Weighting is

used to calibrate the industry and size class

composition of the sample to the composition of the

population. Company information is subjective in

nature. The data collected in the business survey will

be used to approximate reality and make data-based

deductions. The logic of the survey is based on a

top-down approach, including the various survey

blocks (i.e., introduction, company profile, key

points of cloud use, concrete effects and examples,

summary, outlook and further procedure, adoption)

defined. The corresponding text and question

formulations were then created for these individual

blocks.

Identify and recruit interview participants The

pool of interview participants was fed from two

sources. On the one hand, particularly interested

cloud users were approached directly; on the other

hand, a number of participating cloud customers also

agreed to be available for an additional case study

interview during the survey. As a matter of

principle, care was taken to ensure a broad

composition of the participant pool in order to take

into account different perspectives, industries,

company sizes and locations. These participants

were contacted by email and briefly introduced to

the objectives, key points, and content of the case

study interviews in advance. The surveys were

conducted digitally and input lasted approximately

40 to 60 minutes. Participants were encouraged to be

specific about their own experiences, focusing on

the key points of cloud use, and the significance for

AI Technology Adoption & Sustainability Improvement Though Cloud Solutions

677

the company. The answers were then evaluated; for

this purpose, a number-based statistical analysis of

the survey based on the interview logic and the use

of cloud services was used.

4

ANALYSIS

This section focuses on presenting the findings

derived from the data and providing a

comprehensive understanding of the research topic.

We will now present the collected data as examined,

interpreted, and analysed to address the research

objectives. The analysis data has been prepared by

cleaning and organizing the collected data, including

checking for missing values, outliers, and data

inconsistencies. The data has been visualized by

graphs to present the analysed data visually, to help

convey the findings in a concise and accessible

manner. The visualization is accompanied by an

interpretation of findings to explain the meaning and

implications of the analysed data. To connect the

findings back to the research objectives, discusses

any unexpected or significant results. For the

technology adoption questions there are 4 categories

of adoption which are measured in the percentage of

companies are at this level of adoption, very strong

(Company level), Strong (Business level), Limited

(Team level), and Very Limited (PoC). Please find

the results of technology adoption described per

topic.

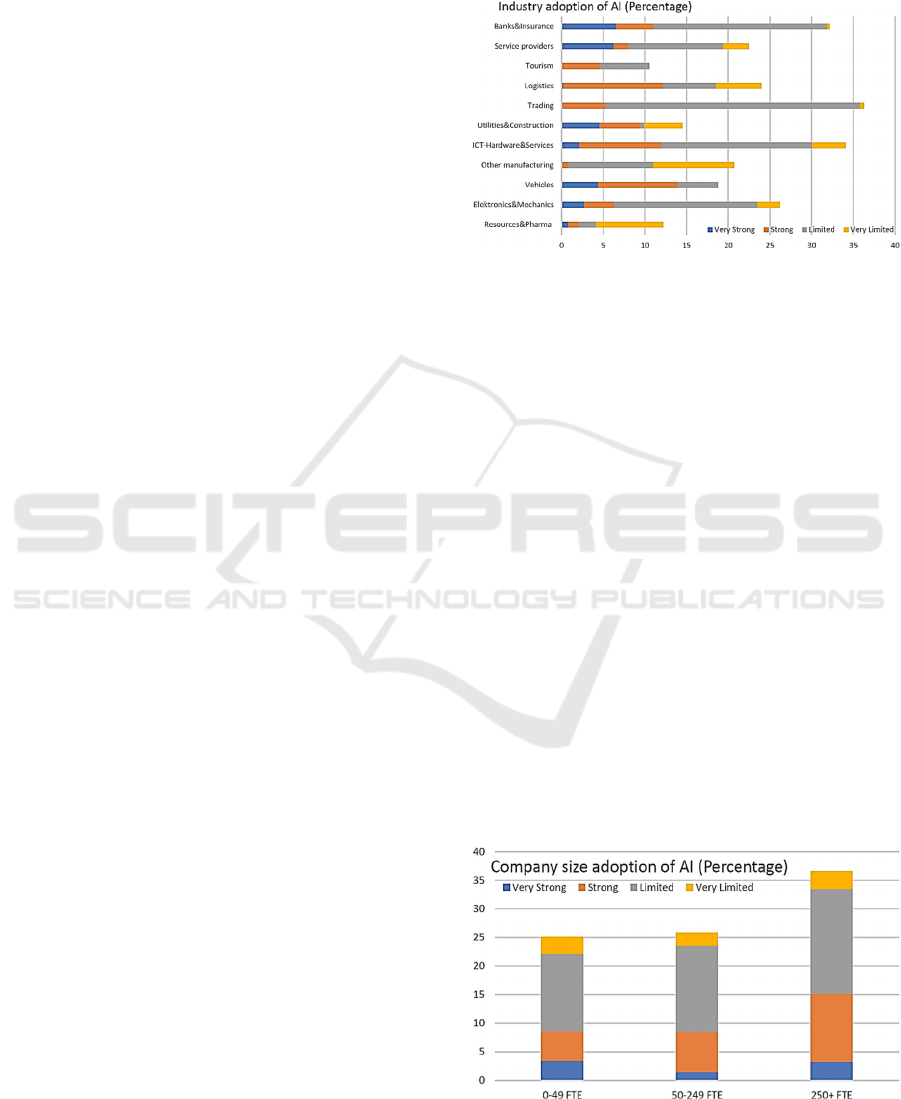

4.1 Industry Adoption of AI

There are many challenges to AI adoption, including

a lack of understanding and competence, privacy

concerns, cost, resistance to change, and ethical and

legal difficulties. The following graph provided

illustrates the percentage of cases where AI adoption

is categorized into different levels of strength within

each industry. The industries represented in the

graph are Resources & Pharma, Electronics &

Mechanics, Vehicles, Other manufacturing, ICT-

Hardware & Services, Utilities & Construction,

Trading, Logistics, Tourism, Service providers, and

Banks & Insurance.

The data presented in graph 1 provides insights

into the levels of AI adoption across different

industries. From the analysis, several observations

can be made. The percentages of AI adoption vary

significantly across industries. Some industries, such

as Electronics & Mechanics and ICT-Hardware &

Services, show higher levels of adoption across all

categories, including "Very Strong," "Strong,"

"Limited," and "Very Limited." On the other hand,

industries like Other Manufacturing and Tourism

exhibit lower levels of adoption, particularly in the

"Very Strong" and "Very Limited" categories.

Figure 1: Industry adoption of AI (%).

There is a dominance of Limited Adoption in

several industries, including Resources & Pharma,

Utilities & Construction, Trading, and Service

Providers; "Limited" adoption appears to be the

most prevalent category. This suggests that many

organizations in these industries have implemented AI

to some extent, but the adoption may not be uniform

across all strength levels. The data also reveals

variations in AI adoption patterns among different

industries, such as the dominance of "Very Strong"

and "Strong" adoption in Electronics & Mechanics,

indicating a more advanced level of implementation.

The Resources & Pharma industry shows lower

percentages across all adoption categories, suggesting

a slower uptake of AI technologies. The following

graph in fig 2 provides an overview of the company

size distribution

of

AI

adoption.

It

shows

that

AI

adoption varies across company size, with larger

companies having higher percentages of "Strong" and

"Limited" adoption. The percentages of "Very

Strong" adoption are relatively low across all

company sizes, indicating a limited implementation of

AI.

Figure 2: Company size adoption of AI (%).

ICEIS 2024 - 26th International Conference on Enterprise Information Systems

678

Lastly we would like to show the company age

distribution for the adoption of AI in fig 3,

showing younger organizations have a higher

likelihood of implementing AI solutions. Whilst the

intensity of implementation does differ much over

age. the data highlights the varying degrees of AI

adoption across industries. It indicates that while

some industries have made significant strides in AI

implementation, others are still in the early stages or

have limited adoption.

Figure 3: Company size adoption of AI (%)

In conclusion, larger and younger organizations tend

to have the highest likelihood of implementing AI,

especially if they are active in Electronics Vehicles

production, Utilities construction or banking

services industries. Understanding these patterns can

help policymakers, researchers, and industry leaders

in identifying opportunities and formulating

strategies to promote AI adoption and its potential

benefits across diverse sectors.

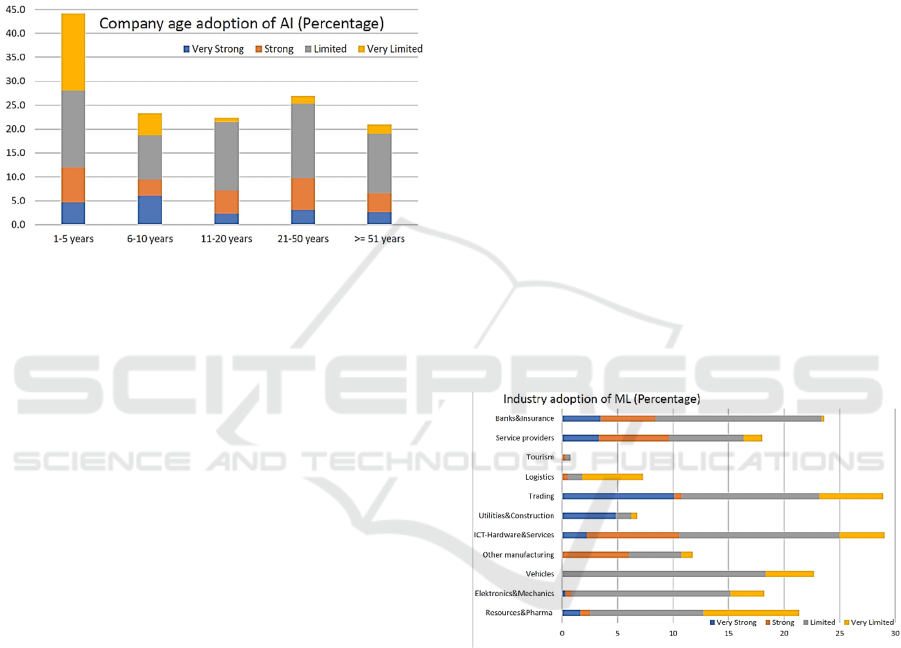

4.2 Industry Adoption of ML

Machine learning has the potential to transform the

way organizations run, but there are significant

barriers to its widespread adoption. These difficulties

include a lack of data quality, a paucity of personnel,

regulatory issues, explainability, and prejudice. The

following graph in fig 4 illustrates the percentage of

cases where ML adoption is categorized into different

levels of strength within each industry. The industries

represented in the graph are Resources & Pharma,

Electronics & Mechanics, Vehicles, Other

manufacturing, ICT- Hardware & Services, Utilities

& Construction, Trading, Logistics, Tourism, Service

providers, and Banks & Insurance.

From the chart the percentages of ML adoption

several conclusions can be drawn. The data reveals

that the distribution of ML adoption varies across

industries. Some industries, such as Resources &

Pharma, Electronics & Mechanics, and ICT-

Hardware & Services, exhibit a wider range of

adoption levels across all categories, including

"Very Strong," "Strong," "Limited," and "Very

Limited." In contrast, industries like Tourism and

Utilities & Construction show lower overall

adoption percentages, with negligible or minimal

ML adoption reported. Limited Adoption

Dominance: In several industries, including

Resources & Pharma, Electronics & Mechanics, and

Banks & Insurance, the "Limited" adoption category

represents the highest percentage. This suggests that

organizations within these industries have adopted

ML technologies to a certain extent but haven't

achieved a widespread or intensive implementation.

Notably, the "Very Limited" adoption category

appears to have low percentages across most

industries, indicating that organizations have either

embraced ML at a higher level or have not yet

started implementing ML solutions with limited

scope. Each industry exhibits its own ML adoption

pattern. For example, the Trading industry stands out

with higher percentages of "Very Strong" and

"Limited" adoption, indicating a more diverse range

of adoption levels. On the other hand, the Tourism

industry shows no reported ML adoption in any of

the categories, indicating a lack of ML

implementation in this sector.

Figure 4: Industry adoption of ML (%).

The following graph in fig 5 provides an overview

of the company size distribution of ML adoption. It

shows that ML adoption varies across company size,

with larger and medium companies having higher

percentages of "Strong" and "Limited" adoption. The

percentages of "Very Strong" adoption are relatively

low across all company sizes, indicating a limited

implementation of ML.

Lastly, we would like to show the company age

distribution for the adoption of ML in fig 6, showing

younger organizations have a higher like-lihood of

implementing ML solutions. The intensity of

implementation does differ strongly over age.

AI Technology Adoption & Sustainability Improvement Though Cloud Solutions

679

Figure 5: Company size ML adoption (%).

Comparative study of ML adoption across

sectors, displaying the distribution of instances

within each degree of adoption strength. various

degrees of ML deployment, with certain industries

having a greater number of examples with

significant acceptance than others. This data can be

useful for assessing the current level of ML usage in

various industries and identifying areas where more

investment may be required.

Figure 6: Company age adoption of ML (%).

Overall, the data demonstrates the various levels of

ML usage across industries, where larger and

younger organizations tend to have the highest

likelihood of implementing AI, especially if they are

active in Utilities/construction, Trading or

banking/services industries. While some industries

have made significant progress in ML deployment,

others continue to lag or have limited acceptance.

Understanding these trends can assist in informing

decision-making processes, resource allocation, and

strategic planning in order to encourage widespread

ML use and its potential advantages in many

industries.

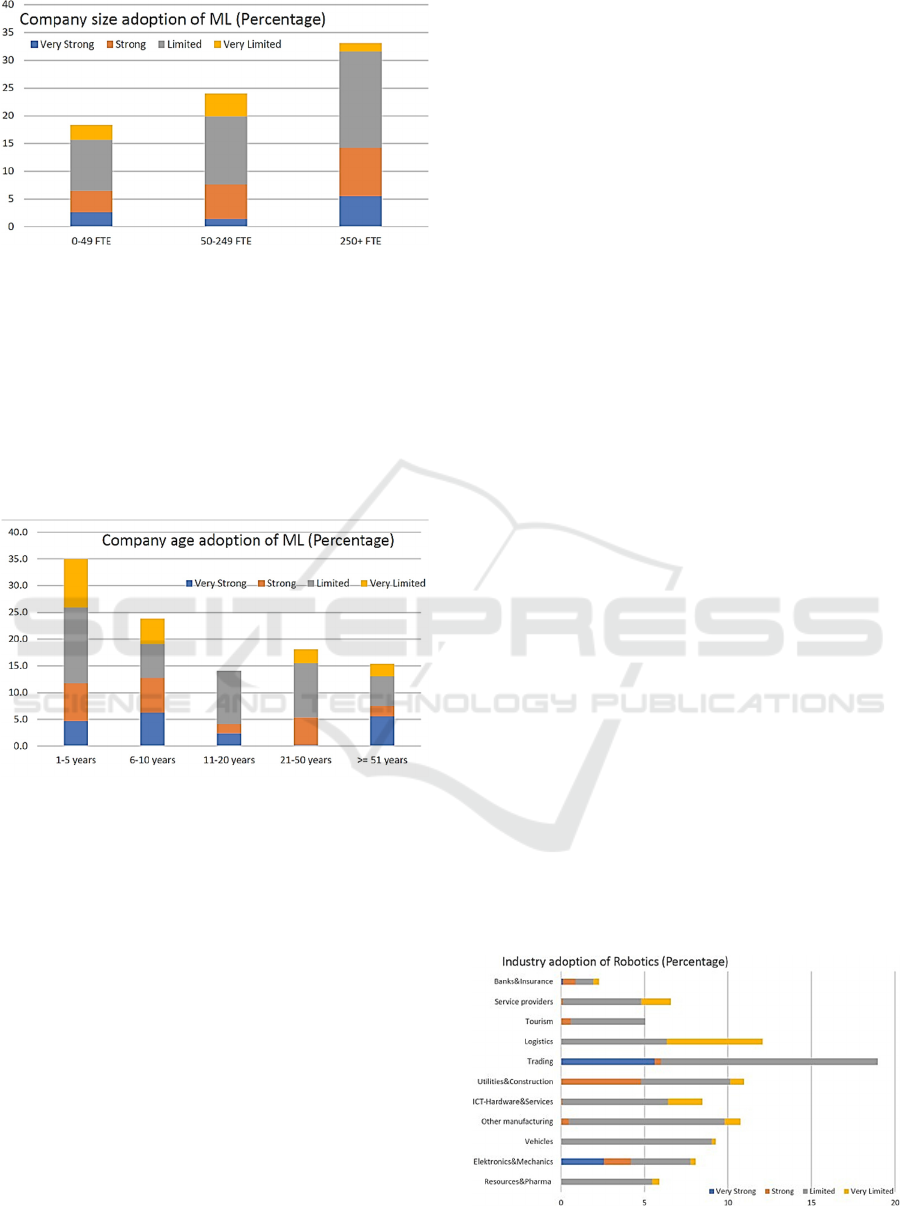

4.3 Industry Adoption of Robotics

Robotics is facing challenges such as human-

oriented interaction, building bio-based robots,

multifunctionality, RPA management, and

communication in swarm robots. Business leaders

should encourage employees to interact with

machines and take initiatives to deploy more human-

friendly robots. Robots require communication

abilities to be integrated into feedback loops,

environment mapping, reasonable AI systems,

privacy and security, implementation of the wrong

RPA solution, and ethical values to be taken into

account. The following illustrates the percentage of

cases where robotics adoption is categorized into

different levels of strength within each industry. The

industries represented in the graph are Resources &

Pharma, Electronics & Mechanics, Vehicles, Other

manufacturing, ICT-Hardware & Services, Utilities

& Construction, Trading, Logistics, Tourism, Service

providers, and Banks & Insurance.

From the chart in fig 7 we can draw the

following conclusions, the dominant category across

most industries is "Limited" adoption, indicating that

organizations have implemented Robotics to some

extent but with restricted scope or scale. Industries

such as Resources & Pharma, Electronics &

Mechanics, Vehicles, Other Manufacturing, ICT-

Hardware & Services, Utilities & Construction,

Trading, Logistics, Service Providers, and Banks &

Insurance exhibit higher percentages in the

"Limited" adoption category. The "Very Limited"

adoption category generally shows lower

percentages across the industries, suggesting that

organizations have either not yet started adopting

Robotics or have only implemented it at a minimal

level. Notable examples of this trend can be seen in

the Resources & Pharma, Electronics & Mechanics,

Vehicles, Other Manufacturing, ICT-Hardware &

Services, Utilities & Construction, Tourism, and

Service Providers industries. The Trading industry

stands out with a relatively higher percentage of

"Very Strong" adoption, indicating a more

significant implementation of Robotics compared to

other industries.

Figure 7: Industry adoption of Robotics (&).

ICEIS 2024 - 26th International Conference on Enterprise Information Systems

680

Similarly, the Utilities & Construction

industry shows a higher percentage of "Strong"

adoption, implying a more advanced level of

adoption in this sector. The data indicates that

Robotics adoption varies across industries, with

some industries reporting higher adoption levels

and others reporting minimal or no adoption. This

suggests that certain industries may have a

higher propensity for leveraging Robotics

technology, possibly due to operational

requirements or their business processes. The

following graph in fig 8 provides an overview

of the company size distribution of Robotics

adoption. It shows that Robotics adoption varies

across company size, with larger companies

having higher percentages of "Strong" and "Limited"

adoption.

The

percentages

of

"Very

Strong"

adoption are relatively low across all company sizes,

indicating a limited implementation of Robotics.

Figure 8: Company size adoption of Robotics (%).

Lastly, the company age distribution for the

adoption of Robotics, showing older organizations

and 6-10 year old companies have a higher

likelihood of implementing Robotics solutions is

being shown in fig 9.

Figure 9: Age company Robotics adoption (%).

Comparative study of Robotics adoption across

sectors, displaying the distribution of instances

within each degree of adoption strength. various

degrees of Robotics deployment, with certain

industries having a greater number of examples with

significant acceptance than others. This data can be

useful for assessing the current level of Robotics

usage in various industries and identifying areas

where more investment may be required.

Overall, the data demonstrates the various levels

of Robotics usage across industries, where larger

and younger organizations tend to have the highest

likelihood of implementing robotics, especially if

they are active in Trading, Utilities/Construction, or

Electronics & Mechanics industries. This data

provides valuable insights into the current landscape

of Robotics adoption in different sectors and can

guide decision-making, investment strategies, and

resource allocation to promote broader adoption and

maximize the potential benefits of Robotics in

various industries.

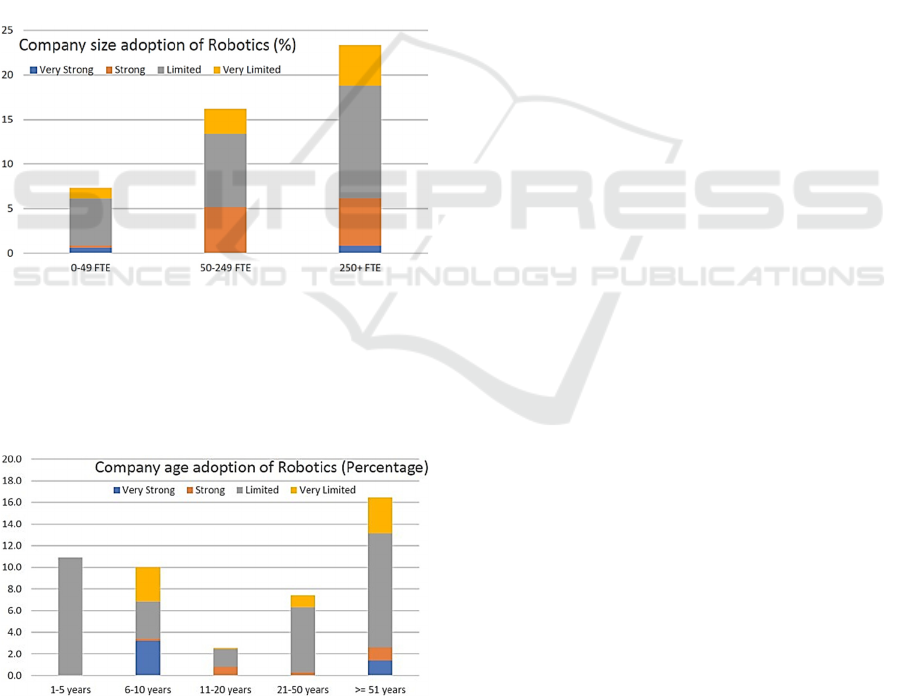

Industry Adoption of Automation. Resource and

talent availability is a major obstacle to automation

adoption, with few having the right skills to

benefit from automation. Mastering digital skills,

and budgetary restraints are the top barrier to

limiting automation. It is important for members of

the C-suite to grow their IT knowledge and

communicate with the frontlines of IT and business

to allocate resources and hands-on support

appropriately. The following graph in fig 10

illustrates the percentage of cases where Automation

adoption is categorized into different levels of

strength within each industry. The industries

represented in the graph are Resources & Pharma,

Electronics & Mechanics, Vehicles, Other

manufacturing, ICT-Hardware & Services, Utilities &

Construction, Trading, Logistics, Tourism, Service

providers, and Banks & Insurance. From the provided

data, several conclusions can be drawn regarding

automation adoption across different industries. The

table demonstrates that the percentages of automation

adoption vary significantly among industries. Some

industries show higher levels of adoption across all

categories, such as Tourism with 22% adoption in the

"Very Strong" category. On the other hand, certain

industries exhibit lower adoption percentages, like

Utilities & Construction with only 6% in the "Strong"

category.

Across most industries, the combined

percentages of "Strong" and "Limited" adoption are

relatively high. This indicates a substantial

implementation of automation technologies in

various sectors, with Electronics & Mechanics, ICT-

Hardware & Services, and Trading industries

displaying notable percentages in both categories.

AI Technology Adoption & Sustainability Improvement Though Cloud Solutions

681

Figure 10: Industry adoption of Automation (%).

The data suggests that the "Very Strong" adoption of

automation technologies is less prevalent across

industries. However, some sectors stand out with

notable percentages in this category, including

Vehicles (18%), Tourism (22%), and Banks &

Insurance (14%). There are instances where

industries have significant percentages of adoption

falling under the "Limited" and "Very Limited"

categories. Notably, the Other Manufacturing

industry demonstrates a substantial proportion of

adoption in these categories, with 27% in the

"Limited" and 9% in the "Very Limited" categories.

Each industry has its own unique pattern of

adoption. For example, the Resources, Pharma,

Electronics & Mechanics, and ICT-Hardware &

Services industries have a higher concentration of

adoption in the "Strong" category. Conversely, the

Logistics industry shows higher adoption in the

"Very Limited" category compared to others.

The following graph fig 11 provides an overview

of the company size distribution of Automation

adoption. It shows that Automation adoption varies

across company size, with larger companies having

higher percentages of "Strong" and "Limited"

adoption. The percentages of "Very Strong"

adoption are relatively low across all company sizes,

indicating a limited implementation of Automation.

Figure 11: Adoption of Automation (%).

Lastly, we would like to show the company age

distribution in fig 12 for the adoption of

Automation, showing organization age not having a

strong influence on the likelihood of implementing

Automation solutions, with a positive outlier on the

6-10 year aged organizations.

In conclusion, the data reveals that automation

adoption varies across industries, with some sectors

demonstrating higher rates of adoption in the

"Strong" and "Limited" categories, while others

have lower adoption levels or a greater percentage of

cases falling into the "Very Limited" category. This

indicates the presence of industry-specific trends and

highlights the need for further investigation into the

factors influencing adoption patterns. Larger

organizations tend to have the highest likelihood of

implementing Automation. Understanding these

variations can help guide decision-making and

resource allocation to promote increased automation

implementation where needed.

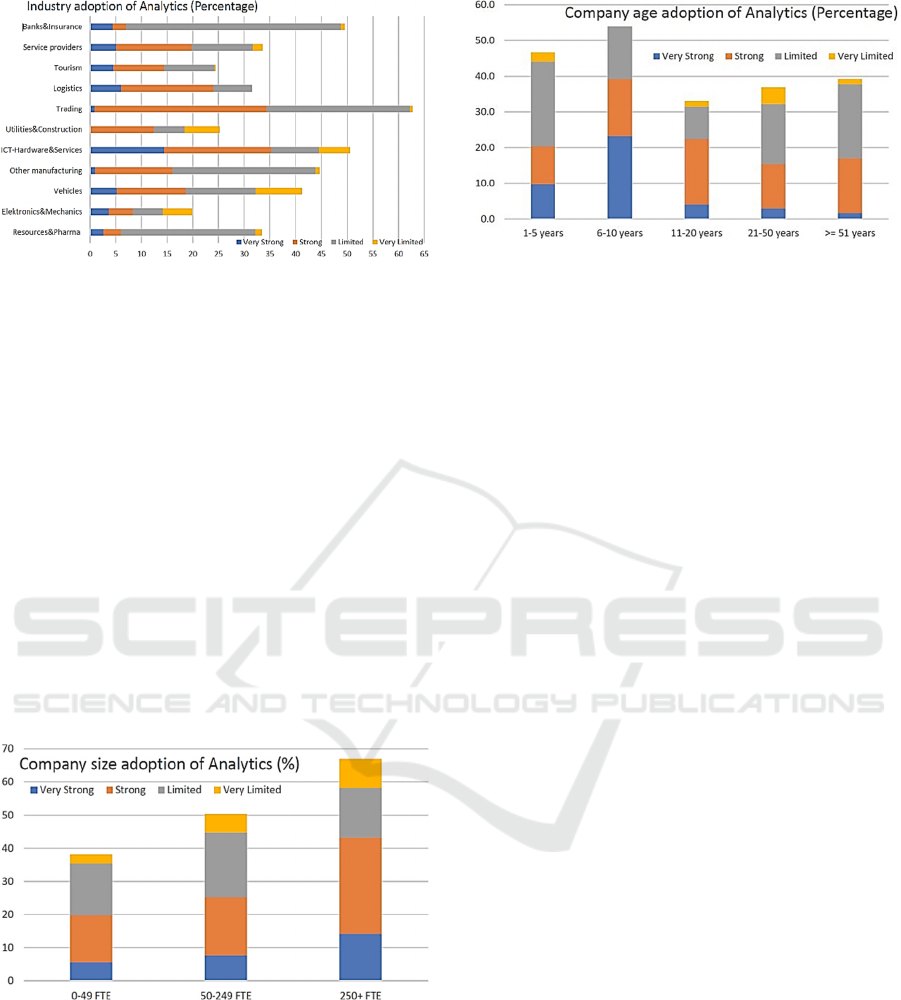

4.4 Industry Adoption of Analytics

To improve decision making, data must be examined

through analytics. However, there are significant

Data problems that businesses face. These include

data quality, storage, a paucity of data science

personnel, data validation, and data aggregation

from many sources. The graph provided illustrates

the percentage of cases where analytics adoption is

categorized into different levels of strength within

each industry. The industries represented in the

graph are Resources & Pharma, Electronics &

Mechanics, Vehicles, Other manufacturing, ICT-

Hardware & Services, Utilities & Construction,

Trading, Logistics, Tourism, Service providers, and

Banks & Insurance. In fig 13 the adoption of

analytics in the Resources, Pharma industry is

shown to be relatively low, with the majority of

cases falling under the "Limited" adoption category.

The Electronics & Mechanics industry has a

balanced distribution of analytics adoption across all

categories, but the percentage of cases with

"Limited" adoption is the highest. The Vehicles

industry shows a moderate level of analytics

adoption, similar to the Vehicles industry. Other

Manufacturing is distributed across all adoption

categories, but the percentage of cases with

"Limited" adoption is the highest. ICT-Hardware &

Services industry stands out with a significant

analytics adoption.

ICEIS 2024 - 26th International Conference on Enterprise Information Systems

682

Figure 13: Industry adoption of Analytics (%).

The Trading industry has a high percentage of cases

with "Limited" and "Very Limited" analytics

adoption. The Logistics industry is relatively

balanced across the "Strong," "Limited," and "Very

Limited" adoption categories. The Tourism industry

demonstrates a distributed adoption of analytics

across all categories, with a significant percentage of

cases falling into the "Limited" adoption category.

The Service Providers industry has a relatively

balanced distribution of analytics adoption.

The following graph provides an overview of the

company size distribution of Analytics adoption. It

shows that Analytics adoption varies across

company size, with larger companies having higher

percentages of "Strong" and "Limited" adoption.

The percentages of "Very Strong" adoption are

relatively low across all company sizes, indicating a

less widespread implementation of Analytics.

Figure 14: Analytics Adoption company size(%).

Lastly, we would like to show the company age

distribution for the adoption of Analytics, showing

younger organizations have a higher likelihood of

implementing Analytics solutions. Whilst the

intensity of implementation does not differ much

over age.

Figure 15: Analytic adoption company size(%).

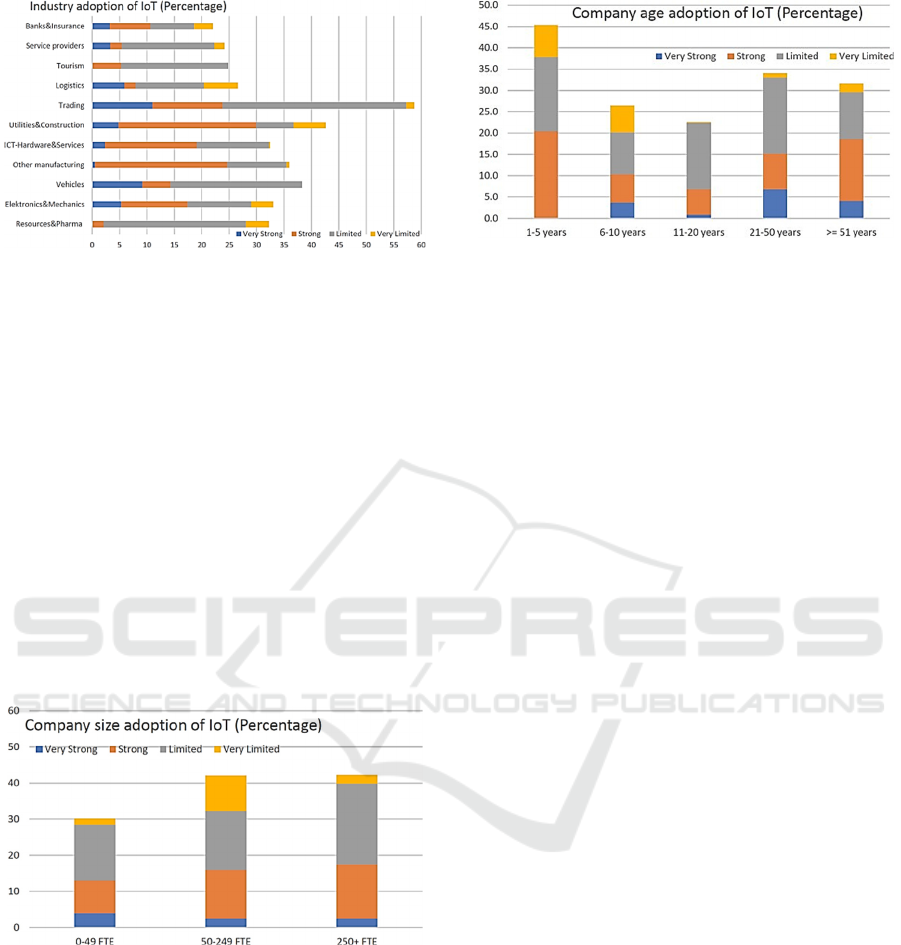

4.5 Industry Adoption of IoT

Data security and privacy are two of the most

serious difficulties associated with IoT. Massive

volumes of data are generated and collected by IoT

devices, which may contain sensitive and personal

information. This information may be subject to

cyberattacks, breaches, theft, or misappropriation by

hackers, rivals, or other parties. The following graph

illustrates the percentage of cases where IoT

(Internet of Things) adoption is categorized into

different levels of strength within each industry. At

the forefront of IoT adoption represented are the

industries Trading and Vehicle-Manufacturing with

near firm-wide adoption around 10 percent, followed

by Electronics/Mechanics and Logistics at 5%.

However at the business unit level also Other-

Manufacturing, Utilities/Construction with near a

quarter adoption, followed by ICT-hardware &

Services are strongly represented at 12-16%. This

level of adoption is reflecting how IoT enables

improved productivity and operational efficiency.

The top reasons companies have adopted IoT are

increased efficiency of operations and increased

employee productivity. Please review Figure 1 and

table 4.2 for more details IoT adoption in Resources

and Pharma is generally low, mostly categorized as

"Limited." There is potential for growth in

implementing IoT technologies. Electronics &

Mechanics show moderate adoption, with a notable

percentage in the "Limited" category, suggesting the

need for further integration. The Vehicles industry

has a mixed pattern, with a significant "Limited"

adoption, indicating potential for more

implementation. Other Manufacturing has a

balanced IoT adoption, with notable cases in both

"Strong" and "Limited" categories, but there is room

for improvement. ICT-Hardware & Services

demonstrate a moderate level of adoption, especially

in the "Limited" category, indicating potential for

further integration.

AI Technology Adoption & Sustainability Improvement Though Cloud Solutions

683

Figure 16: Industry adoption of IoT (%).

Utilities & Construction exhibit relatively high

adoption, particularly in "Strong" and "Limited"

categories. The Trading industry has a high

percentage of "Limited" adoption, indicating a need

for increased utilization. Logistics shows a balanced

adoption, suggesting a moderate level of

implementation.

In Tourism, there's notable "Limited" adoption,

indicating potential for increased utilization. Service

Providers exhibit balanced adoption, with room for

improvement. Banks & Insurance show a moderate

level of adoption across categories, suggesting

further potential. The graph illustrates varied IoT

adoption across company sizes, with larger and

medium companies having higher percentages of

"Strong" and "Limited" adoption. Medium-sized

companies notably show strong implementation

Figure 17: Company size adoption of IoT (%).

Lastly, we would like to show the company age

distribution for the adoption of IoT, showing

younger organizations have a higher likelihood of

implementing IoT solutions.

In summary, the graph provides a comparative

analysis of IoT adoption across different industries,

showcasing the distribution of cases within each

level of adoption strength. It highlights the varying

levels of IoT implementation, with some industries

having a higher proportion of cases with limited

adoption, while others have a more balanced

Figure 18: Company size adoption of IoT (%).

distribution across different adoption categories.

Larger organizations tend to have the highest

likelihood of implementing IoT, especially if they

are active in Vehicles production or Trading

industries. This information can be valuable for

understanding the current state of IoT adoption in

different sectors and identifying areas where furthr

investment and implementation may be needed.

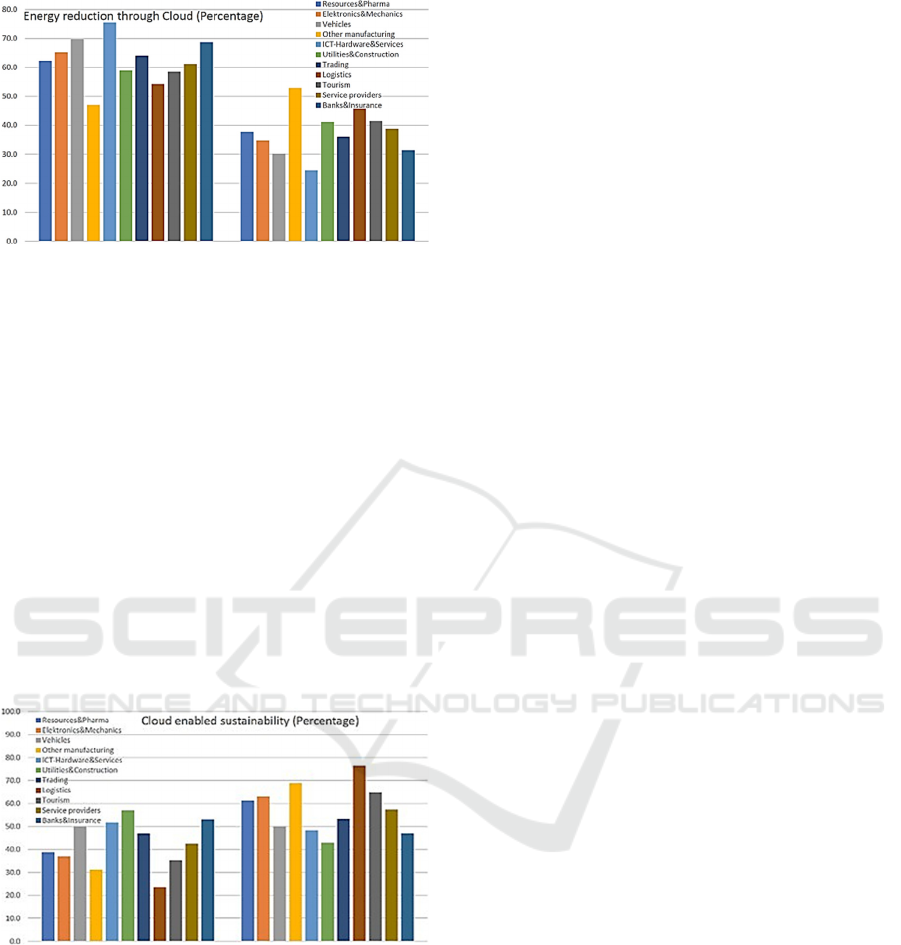

4.6 Cloud-Enabled Sustainability

Cloud computing has the potential to improve

energy efficiency while emitting less greenhouse

gases than on-premises IT systems. The following

graph provided provides a comparative analysis of

the percentage of cases where energy usage has

decreased as a result of cloud usage, categorized by

adoption strength and industry type. In the

Resources & Pharma, Electronics & Mechanics, and

Vehicles industries, most cases reported a reduction

in energy usage, with percentages of 62.2%, 65.2%,

and 69.8% respectively. Other manufacturing had a

lower percentage (47.1%) indicating a decrease,

while ICT-Hardware & Services stood out with a

significantly high proportion (75.5%) reporting a

decrease. The Utilities & Construction, Trading, and

Tourism industries also showed a notable percentage

of cases reporting a decrease in energy usage

through cloud adoption, with percentages of 58.9%,

64.0%, and 58.5% respectively. Logistics and

Service providers had slightly lower percentages

(54.2% and 61.2% respectively), but still showed a

significant reduction in energy usage. In contrast, the

Banks & Insurance industry had a relatively high

percentage (68.7%) indicating a decrease in energy

usage, while the percentage of cases responding with

no change was 31.3%. The fig 19, with YES on the

left and NO on the right, provides a clear

comparison of the percentage of cases reporting a

decrease in energy usage through cloud adoption and

those responding with no change in energy usage

across different industries.

ICEIS 2024 - 26th International Conference on Enterprise Information Systems

684

Figure 19: Cloud energy reduction (%).

We also examined the impact of cloud adoption on

sustainable energy usage across various industries.

One of the primary benefits of cloud storage is that it

eliminates the need for physical infrastructure and

equipment such as servers, cooling systems, and

power supply. As a result, cloud storage can reduce

the quantity of greenhouse gas emissions and waste

produced by your data storage activities. The

analysis shown in fig 20, with YES on the left and

NO on the right, revealed a diverse range of

outcomes, indicating that the relationship between

cloud usage and sustainable energy usage is not

uniform across industries. The following graph

provides a comparative analysis of the percentage of

cases where sustainable energy usage has increased

because of cloud usage, categorized by adoption

strength and industry type.

Figure 20: Cloud-enabled sustainability (%).

Among the industries investigated, Resources

& Pharma exhibited a higher percentage (38.7%)

of cases reporting an increase in sustainable

energy usage due to cloud adoption. However, the

majority (61.3%) responded negatively. Similarly,

Electronics & Mechanics showed a similar trend,

with 37.0% reporting an increase and 63.0%

reporting no change in sustainable energy usage.

Interestingly, the vehicles industry displayed an

equal distribution, with 50.0% of cases reporting an

increase in sustainable energy usage because of

cloud adoption and an equal 50.0% responding

negatively. Other manufacturing had a higher

proportion (31.1%) reporting an increase, but the

majority (68.9%) still responded negatively. In

contrast, ICT-Hardware & Services showed a higher

percentage (51.6%) reporting an increase in

sustainable energy usage due to cloud adoption.

Utilities & Construction followed suit, with 57.0%

reporting an increase. However, both Trading and

Tourism industries had a larger proportion

responding negatively. Notably, Logistics had a

relatively low percentage (23.5%) reporting an

increase, while Service providers and Banks &

Insurance had higher proportions (42.6% and 53.0%

respectively) indicating an increase in sustainable

energy usage. The findings suggest that the impact

of cloud adoption on sustainable energy usage varies

across industries. Factors such as industry-specific

characteristics and implementation strategies likely

contribute to this variation. Further research is

needed to understand the underlying mechanisms

and identify best practices for maximizing the

positive effects of cloud adoption on sustainable

energy usage in each industry. Such insights can

inform decision-making processes and guide future

sustainability initiatives in these sectors.

5

CONCLUSION

Digitization provides society and the economy with

huge opportunities for growth and efficiency. Many

business models, particularly those of new and

innovative enterprises, would not exist without

powerful cloud technologies such as AI. However,

established businesses are increasingly profiting

from digital technology. The increasingly visible

impacts of a skilled labour scarcity can be mitigated

by home offices, which can attract competent people

from all over the world. However, digitalization

incurs costs and has negative externalities. The high-

power usage and related environmental impact can

be major roadblocks here.

Sustainability initiatives should not be used to

undermine digitization; both ideas must exist and

function in tandem. This is where highly specialized

technology firms come in, playing an increasingly

important role in enabling boundary-pushing

technologies while lowering environmental impact.

Process automation solutions are available in 56

percent of businesses, while data analytics are

available in 46.8 percent of businesses that feel very

or moderately supported. Artificial intelligence is

used by 15.2 percent of businesses, while machine

AI Technology Adoption & Sustainability Improvement Though Cloud Solutions

685

learning is used by 14.2 percent and robotics is used

by 6.2 percent, demonstrating how rapidly

technologies are being embraced. There is a definite

technological competence across all firms, and

digital technologies are being implemented in every

area. Cloud is assisting businesses in minimizing

their environmental footprint by lowering energy

requirements for 64.5 percent of businesses.

Renewable energy sources are important to 38.9

percent of businesses. Particularly in view of

additional increases in power use because of

digitalization and the rising greener business models

of cloud, the corporate landscape is projected to

assist the corporate landscape decarbonize even

more in the future.

The utilization of the cloud appears to help

sectors rely on forward-thinking technology. Against

the backdrop of the immense economic potential of

industry's constant digitalization, cloud allows AI

and sustainability, assuring firms have a fair chance

of profiting. Organizations should convene a cross-

functional group to identify and prioritize the

highest-value use cases and enable coordinated and

safe implementation across the organization.

Companies must create scalable data architectures,

upgrade current computing & tooling infrastructure,

and build a "lighthouse" approach to take advantage

of AI. Proof-of-concept is still the best way to

quickly test and refine a valuable business case

before scaling. Business leaders must balance value

creation opportunities with risks associated with AI

and prioritize use cases that align with their risk

tolerance. Organizations need to adapt their working

approach to handle the rapidly evolving regulatory

environment and risks of AI at scale and partner

with the right companies to accelerate execution.

Companies need to experiment with and deploy

innovative technologies at an early stage,

establishing technology-based competitive edge

based on these technologies. As a result, such

businesses not only assure their own long-term

existence but also contribute to the spread of new

technology outside industry lines. Our study

contributes to the literature on innovation

management by putting light on the application of

AI and machine learning algorithms in the future

organization of innovation. Our findings suggest

areas where AI systems may already be used to

benefit organizational innovation.

REFERENCES

Agrawal, A., Gans, J., & Goldfarb, A., (2019) The

Economics of Artificial Intelligence: An Agenda

Agrawal, R., Gopalakrishnan, A., & Gupta, M. (2013).

The impact of cloud computing on IT outsourcing.

MIS Quarterly Executive, 12(2), 61-72.

Ahmad, Tanveer, et al. "Artificial intelligence in

sustainable energy industry: Status Quo, challenges

and opportunities." Journal of Cleaner Production 289

(2021): 125834.

Aljabre, A. (2017). The impact of cloud computing on

business performance: A conceptual framework.

Journal of Economic and Administrative Sciences,

33(1), 22-36.

Allahvirdizadeh, Yousef, Mohsen Parsa Moghaddam, and

Heidarali Shayanfar. "A survey on cloud computing in

energy management of the smart grids." International

Transactions on Electrical Energy Systems 29.10

(2019): e12094.

Antonopoulos, Ioannis, et al. "Artificial intelligence and

machine learning approaches to energy demand-side

response: A systematic review." Renewable and

Sustainable Energy Reviews 130 (2020): 109899.

Armbrust, M., Fox, A., Griffith, R., Joseph, A. D., Katz,

R. H., Konwinski, A., ... & Zaharia, M. (2010). A view of

cloud computing. Communications of the ACM,

53(4), 50-58.

Assunta Di Vaioa, , Rosa Palladino, Rohail Hassan,

Octavio Escobar (2020) Artificial intelligence and

business models in the sustainable development goals

perspective: A systematic literature review

Attaran, Mohsen, and Jeremy Woods. "Cloud computing

technology: improving small business performance

using the Internet." Journal of Small Business &

Entrepreneurship 31.6 (2019): 495-519.

Bardhan, I. R., Jafarizadeh, S., & Talley, W. K. (2010).

Cloud computing: implications for enterprise software

vendors. Proceedings of the 2010 ACM Symposium

on Applied Computing, 1531-1536.

Burtell, M., Woodside, T., (2023) Artificial Influence: An

Analysis Of AI-Driven Persuasion. Computers and

Society a r X i v :2303.08721

Buyya, Rajkumar, et al. "A manifesto for future generation

cloud computing: Research directions for the next

decade." ACM computing surveys (CSUR) 51.5

(2018): 1-38.

Cao, J., Yu, Z., Ma, Y., & He, Y. (2014). Impact of cloud

computing on enterprise innovation: Empirical

evidence from Chinese enterprises. International

Journal of Information Management, 34(5), 626-640.

Chang, V., Walters, R. J., & Wills, G. (2013). The

development that leads to the adoption of cloud

computing in the UK SME sector. Journal of

Small Business and Enterprise Development, 20(2),

296-312. Enholm, Papagiannidis, Mikalef,

Krogstie.(2021) Artificial Intelligence and Business

Value: a Literature Review

Gill, Sukhpal Singh, et al. "Transformative effects of IoT,

Blockchain and Artificial Intelligence on cloud

ICEIS 2024 - 26th International Conference on Enterprise Information Systems

686

computing: Evolution, vision, trends and open

challenges." Internet of Things 8 (2019): 100118.

Goscinski, A., Brock, M., & Tangasova, B. (2011). The

challenges of cloud computing adoption. Proceedings

of the 2011 International Conference on Parallel and

Distributed Processing Techniques and Applications,

409-415.

Gupta, M., Agrawal, R., & Gopalakrishnan, A. (2019).

Cloud computing and digital capabilities: A systematic

review and future research directions.

Hummer, Waldemar, et al. "Modelops: Cloud-based

lifecycle management for reliable and trusted ai." 2019

IEEE International Conference on Cloud Engineering

(IC2E). IEEE, 2019.

Kaisler, S., Armour, F., Espinosa, J. A., & Money, W.

(2013). Big data: issues and challenges moving

forward. Proceedings of the 46th Hawaii International

Conference on System Sciences, 995-1004.

Kakatkar, Chinmay & Bilgram, Volker & Füller, Johann,

2020. "Innovation analytics: Leveraging artificial

intelligence in the innovation process," Business

Horizons, Elsevier, vol. 63(2), pages 171-181.

Keding, Christoph & Meissner, Philip, 2021. "Managerial

overreliance on AI-augmented decision-making

processes: How the use of AI-based advisory systems

shapes choice behavior in R&D investment decisions,"

Technological Forecasting and Social Change,

Elsevier, vol. 171(C).

Kshetri, N. (2014). Cloud computing adoption by SMEs in

the north-central United States. Journal of Global

Information Management, 22(4), 17-34.

Lacity, M. C., Willcocks, L. P., & Kern, T. (2010). The

value of selective IT sourcing. Sloan Management

Review, 51(2), 75-83.

Lee, Ya-Ching. "Adoption intention of cloud computing at

the firm level." Journal of Computer Information

Systems 59.1 (2019): 61-72.

Marston, S., Li, Z., Bandyopadhyay, S., Zhang, J., &

Ghalsasi, A. (2011). Cloud computing—The business

perspective. Decision Support Systems, 51(1), 176-

189.

Montori, Federico, et al. "Machine-to-machine wireless

communication technologies for the Internet of

Things: Taxonomy, comparison and open issues."

Pervasive and Mobile Computing 50 (2018): 56-81.

Mühlroth, Christian & Grottke, Michael. (2020). Artificial

Intelligence in Innovation: How to Spot Emerging

Trends and Technologies. IEEE Transactions on

Engineering Management. PP. 1-18. 10.1109/TEM.20

20.2989214.

Quantumblack (2022), The state of AI in 2022—and a half

decade in review, quantumblack/our-insights/the-state-

of-ai-in-2022-and-a-half-decade-in-

review?cid=app#review

Stephan Schlögl, Claudia Postulka, Reinhard Bernsteiner

& Christian Ploder

Wan, J., Yang, J., Wang, Z., & Hua, Q. (2018). Artificial

intelligence for cloud-assisted smart factory. IEEE

Access, 6, 55419-55430.

Weill, P., Ross, J. W., & Robertson, D. C. (2013).

Enterprise Architecture as Strategy: Creating a

Foundation for Business Execution. Harvard Business

Press.

AI Technology Adoption & Sustainability Improvement Though Cloud Solutions

687