Understanding the Interplay Between Startups and Accelerators for

Early-Stage Resource Mobilization

Davide Moiana, Jacopo Manotti, Antonio Ghezzi and Andrea Rangone

Politecnico di Milano, Department of Management, Economics and Industrial Engineering,

Via Lambruschini 4B, 20156 Milan, Italy

Keywords: Accelerators, Entrepreneurial Resource Mobilization, Entrepreneurial Support Organizations.

Abstract: Startups, representing the engine of innovation and technology entrepreneurship, face the challenge of

securing resources for sustainable growth while generating innovative solutions. Startup accelerators have

rapidly emerged as prominent players in the entrepreneurial ecosystem, providing resources, mentorship and

training to startups. However, a deeper analysis of how startups approach accelerator programmes is often

overlooked in the literature. Drawing on a multiple case study of 9 AI-based startups located in Italy that

participated in different acceleration programmes, we explore how startups’ teams engage with acceleration

programs. We find that early-stage startups engage with accelerators that focus on learning and validation

mechanisms with the aim of searching for and accessing human capital, while they turn to accelerators that

focus on access and reach mechanisms with the aim of pursuing market access and scaling objectives. The

implication of these research could benefit both theory and practice by enhancing the understanding of the

interplay between startups and accelerator programs, and by offering insights to founders to align participation

with the stage and goals of their startups.

1 INTRODUCTION

The startup ecosystem represents the heartbeat of

innovation and productive entrepreneurship (Stam,

2015). Characterized by novel business models and

innovative ideas, startups distinguish themselves for

their rapid growth and ambition to revolutionize

existing markets, often by leveraging disruptive

digital technologies (e.g., Ghezzi, 2019; Paul,

Alhassan, Binsaif, & Singh, 2023). In this rapidly

evolving context, the primary challenge for these

young enterprises is not only to devise innovative

solutions but also to acquire the necessary resources

for growth, including human, social and financial

capital (Aldrich & Auster, 1986; Freeman, Carroll, &

Hannan, 1983).In recent years, the remarkable growth

in startups and increased venture activity has been

accompanied by the rise of new intermediaries within

startup ecosystems. Among these, accelerators

emerge as a particularly influential and widely

adopted organizational form (Bergman & McMullen,

2022; Clayton, Feldman, & Lowe, 2018; Hathaway,

2016). We refer to accelerators as “fixed-term,

cohort-based programs that includes mentorship and

training components and culminates in a public event

or demo-day” (S. Cohen & Hochberg, 2014).

Originating with Y Combinator in 2005, the global

prominence of accelerators is witnessed by numbers,

with over 3000 worldwide as of 2023, over 1000 of

which are in the United States alone (Betaboom,

2023). While the importance of accelerators is widely

acknowledged, a substantial gap exists in

understanding the dynamics between startups and

these entrepreneurial support programs (Bergman &

McMullen, 2022; Crișan, Salanță, Beleiu, Bordean, &

Bunduchi, 2021).

This study contributes to prior entrepreneurship

literature in two ways. First, it observes the interplay

between the characteristics of the acceleration

program and accelerator and the intent of the

participating startups, in relation to their stage of

development. Second, it unveils the role of different

accelerators mechanisms in facilitating the Search,

Access, and Transfer of resources necessary for

startups’ sustaining growth (Clough, Fang, Vissa, &

Wu, 2019).

688

Moiana, D., Manotti, J., Ghezzi, A. and Rangone, A.

Understanding the Interplay Between Startups and Accelerators for Early-Stage Resource Mobilization.

DOI: 10.5220/0012614300003690

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 26th International Conference on Enterprise Information Systems (ICEIS 2024) - Volume 2, pages 688-695

ISBN: 978-989-758-692-7; ISSN: 2184-4992

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

2 THEORETICAL

BACKGROUND

2.1 Startups and Resource

Mobilization

Startups face challenges known as "liabilities of

newness”, referring to the challenges arising from

their youth such as limited size, and resource

constraints, hindering legitimacy and competitiveness

(Aldrich & Auster, 1986; Freeman et al., 1983).

Therefore, Entrepreneurial Resource Mobilization is a

pivotal aspect of entrepreneurship, focusing on

acquiring and utilizing resources efficiently to seize

entrepreneurial opportunities (Hallen & Eisenhardt,

2012). Rooted in resource mobilization theory, this

concept emphasizes the process of acquiring tangible

and intangible assets, critical for entrepreneurs.

Entrepreneurial success relies on the strategic

mobilization of diverse forms of capital, including

human capital for innovation, social capital for

network-driven resource acquisition, and financial

capital for investments (Davidsson & Honig, 2003;

Lerner & Nanda, 2020; Portes, 1998).

Clough and colleagues (2019) propose three

distinct phases – Search, Access, and Transfer – that

form a comprehensive framework for understanding

how these resources are mobilized by entrepreneurs.

The Search phase pertains to the cognitive aspects

related to the aspiration-driven identification of

potential resource providers amidst uncertainty (e.g.,

Aldrich & Kim, 2012; Hallen & Eisenhardt, 2012).

The Access phase centers on convincing resource

owners to allocate their assets to the new business

endeavor, covering skills, relationships, and financial

resources (e.g., Baker & Nelson, 2005).

Lastly, the Transfer phase encompasses

negotiation and agreement between entrepreneurs

and resource owners regarding management, property

rights, and value distribution, all influenced by

transaction costs that can impact resource exchange

(e.g., Villanueva, Van De Ven, & Sapienza, 2012).

2.2 Accelerators

Accelerators offer intensive, time-limited programs,

bridging startups to vital resources and positioning

themselves as brokers within the broader

entrepreneurial ecosystem (S. Cohen & Hochberg,

2014; Crișan et al., 2021).

Accelerators substantially differ according to the

array of interventions they deliver through a diverse

range of services to startups (e.g., mentoring, training,

financial support, etc.) (Crișan et al. 2021). Therefore,

the effectiveness of startup accelerators varies

according to accelerator design, mentor interactions,

and peer networking offered. Given a set of services

provided by accelerators (Pauwels, Clarysse, Wright,

& Van Hove, 2016), research identifies four

fundamental mechanisms that accelerators enable, and

that connect services to outcomes: Validation (i.e.,

acceptance/validation of business ideas), Learning

(i.e., possibility to acquire entrepreneurial skills),

Access and Growth (i.e., access to resources and

capital), and Innovation (i.e., support to product

development). These mechanisms emerge as the

primary explanatory characteristics of accelerators,

outlining how services lead to outcomes. While speci-

fic contexts are associated with certain interventions,

such as globally recognized accelerators prioritizing

top-level tangible outcomes, an accelerator's modus

operandi may be better explained by the link between

interventions and outcomes (Pauwels et al. 2016).

The intentions of founders when participating in an

acceleration program add an additional layer of

complexity. For example, prior research examines how

startups approach accelerator programs, and how their

interaction with the temporal structure of accelerators

impact on venture development (Qin, Wright, & Gao,

2019). They discovered that startups may either try to

engage concurrently on multiple tasks leveraging the

different services offered by the program, or they focus

with intensity on a primary task at time.

Few studies investigate startup participation in

these programs from the startup's perspective,

particularly exploring how startups strategically

approach participation within a program. Therefore,

the research questions investigated in this study is

“How do entrepreneurs strategically leverage

startup accelerators participation to support their

ventures’ early-stage resource mobilization?".

3 METHODOLOGY

3.1 Research Design

We selected startups’ teams approaches to

acceleration programs as our unit of analysis. As this

new angle of research field is mostly unexplored, we

believe that new theory can emerge (Bansal & Corley,

2011). Therefore, we adopted an empirical qualitative

multiple-case study approach, which is helpful for

theory building based on in-depth field investigation

that seek to understand certain manifestations of the

phenomenon (Eisenhardt & Graebner, 2007;

Meredith, 1998).

Understanding the Interplay Between Startups and Accelerators for Early-Stage Resource Mobilization

689

3.2 Empirical Setting and Case

Sampling

The cases were selected by the mean of theoretical

sampling, for the likelihood they would have offered

theoretical insights (Eisenhardt and Graebner, 2007).

For this reason, we decided to focus on early-stage

startups participating in Italian accelerator programs.

For the case selection, we draw from a proprietary

database listing Italian accelerator, and from

Pitchbook, a subscription-based website covering

private capital markets such as venture capital and

private equity. To maintain consistency and relevance

in the sample, we applied the following criteria: (i)

artificial intelligence was selected as the focus sector,

in order to reduce the potential biases of

environmental heterogeneity (Eisenhardt and

Graebner, 2007); (ii) we considered only early-stage

startups born from 2020 to 2022, in order to be able

to investigate entrepreneurial resource mobilization

mechanism in an early stage of development; (iii) As

we progressed through the sampling process, a

noteworthy observation emerged – many startups

participated in multiple acceleration programs.

Recognizing the significance of the phenomenon, we

found it to be an excellent springboard for answering

to our research question. Consequently, we made the

deliberate decision to include only startups that meet

this criterion, adding depth and relevance to our

study. Once a sufficiently large initial sample was

gathered, the cases were filtered to select the most

notable examples for examination, ensuring the

alignment with the research’s design. As a result, the

final sample consisted of 9 AI-based startups: Startup

A, Startup B, Startup C, Startup D, Startup E, Startup

F, Startup G, Startup H, and Startup I.

By building on Crișan and colleagues (2021), we

categorized all the accelerator programs in which the

startups in our sample have participated into two

distinct groups, according to the type of services

offered, by relying on secondary data (e.g., websites,

with or without wayback machine). The first group of

accelerator programs places a strong emphasis on

Learning and Validation mechanisms, achieved

through dedicated efforts in team building, training

sessions, and mentorship, among the others. The

second group of accelerator programs prioritizes

Access and Growth mechanisms, typically

welcoming within their cohorts only startups that

have already identified a product-market fit and are

poised for scaling.

3.3 Data Collection and Analysis

Multiple sources of information were used, including

primary and secondary sources, such as semi-

structured interviews with founders and accelerators

C-levels – having substantial and exclusive

knowledge pertaining to the subject under

investigation (Aguinis & Solarino, 2019) – as well as

information from the startups’ and accelerators’

websites, podcasts and video-interviews, and third-

party articles (Yin, 1984). The researchers conducted

21 semi-structured interviews over two distinct

waves, with a total of 953 minutes of material was

recorded, and the results were transcribed into 288

pages. To improve the overall rigor of the case study,

as recommended by (Eisenhardt, 1989) and Yin

(1984), the final outcome of primary data was

triangulated with secondary sources.

After the data collection phase, we conducted a

within-case study analysis. The Gioia Methodology

(Gioia, Corley, & Hamilton, 2013) was adopted to

study each case according to an open coding practice,

allowing to investigate complex phenomena using

labels, thus generating theory from data (Gioia et al.,

2013).

As our data analysis unfolded, we have

recognized three different layers across which the

data could be classified according to resource

mobilization theory (Clough et al., 2019), namely (1)

search, (2) access, (3) transfer.

Subsequently, we articulated data according to

these two dimensions: on the one hand, we clustered

the data according to the two clusters of accelerators

(i.e., learning and validation, access and reach), and

then we articulated the data across the tree resource

mobilization mechanisms (i.e., search, access,

transfer). Table 1 offers a selection of categories

explaining the connection between the two

dimensions described above. We further considered

a third overarching dimensions of analysis related to

the startup approach across acceleration programs.

4 RESULTS

We adopt a narrative approach to describe our

findings (Berends & Deken, 2021), following the

different overarching dimensions we have developed.

Cluster 1: Participation in Learning and

Validation Accelerators

Search. The startup’s participating in these programs

were still in an embryonic stage, often still seeking to

ICEIS 2024 - 26th International Conference on Enterprise Information Systems

690

fill a perceived gap in entrepreneurial skills, and to

validate their business idea. As an interviewee from

Startup F reported: “On the technological level, we

were prepared, but on the business, marketing and

sales side we had no experience or expertise”.

Moreover, these startups have often objectives

related to the need of validating a concept, conducting

tests, and determining whether the business idea is

feasible and has potential utility (“we had an idea and

we wanted to see whether it could have become a

product” – an interviewee from Startup G reported).

Access. A big concern of participants within

Learning and Validation programs is to find to attract

crucial early team members. These attention securing

mechanisms were facilitated by the acceleration

programs. For example, as an interviewee from

Startup B explained: “[thanks to the acceleration

program] we hired as our first employee a human

resources expert who became our Head of People and

took care of the whole recruiting part”.

Secondly, the training services offered by

Learning & Validation acceleration programs bridges

the knowledge gap of entrepreneurs related to their

inexperience. As reported by an interviewee from

startup A, training and mentoring sessions were

provided by industry experts on “how to do the pitch,

how to open the company, and how to do due

diligence", thus reinforcing the set of skills and

knowledge of the entrepreneurial team. Moreover,

participants were supported in designing and

conducting test to validate their business model (“we

received constant training and feedback throughout

the process, receiving extensive training on what

would have been the problems and issues in the

startup world (…) it's all based on: building the idea,

training, heavy validation of what your idea is.” – an

interviewee from Startup B reported).

Third, Learning and Validation accelerators

facilitate meaningful connections with a community

of inquiry for your business. As reported by an

interviewee from Startup D: “when they feel that a

person from their network could be very useful to

your business, instead they send you an email, put you

in touch and then let you kind of continue the

conversation”.

Finally, startups are kicked out of the nest only in

the final stages of the program, where they often

approach investors in the Demo Day. As reported by

an interviewee from Startup F: “During the Demo

Day, we had the opportunity to be introduced to

various investment funds”.

Transfer. The main transfer mechanisms in

Learning and Validation accelerators are related to

team formation, as the acceleration program actively

nurture the collaborative processes that lead to the

creation of high-functioning teams. As an interviewee

of Startup B reported: “We were able to get to know

other people, understand each other, and be guided

in creating a team that was functional.”

Cluster 2: Participation in Access and Growth

Accelerators

Search. Startups that enter an Access and Growth

accelerator program are typically in a more advanced

stage of development and possess distinct objectives.

First, they are searching for valuable partners,

investors and market access. As referred by an

interviewee from Startup D:“[the objectives were]

getting money, industrial partners that allow us to

scale the market, so that gives us firepower in terms

of business development”. Many interviewees

reported that they participate in the access and growth

acceleration program with the specific aim to find a

main investor. Another common goal within these

programs is the desire to establish connections with

the aim of entering untapped markets. This goal is

often exemplified by participation in international

accelerators in order to establish international

relationships. As an interviewee from Startup A

explained: “the goal was to start getting to know the

UK market (…) in order to understand the dynamic

of a new and foreign market”.

Access. When participating in Access and Growth

accelerators, participants main concern is to be able

to access the social network of the accelerator

program. To this extent, the accelerator act as a

facilitator, performing introductions and creating

trust between the resource seeker and potential

resource holder (“Getting to large realities such as

banks and insurance companies is extremely difficult

for a start-up without someone introducing you, and

many of the larger customers we have were

introduced to us by the network of investors we have”

– an interviewee from Startup G reported. Interaction

with accelerator’s network of resource holders is also

often structured on a time basis, and accelerator

partners are often companies that sponsor the

programs to gain access to innovative ideas and

teams. As explained by an interviewee from an

accelerator program attended by many of the startups

in our sample: “Once a week there's a meeting with at

least one of the partners to put something together,

get to know each other, deepen talks, and carry on

any possible form of collaboration and interaction

with the startups.” Access and Growth accelerator

programs also facilitate the interaction with financial

resource holders. Accelerators have a network of

investors and when they see that start-ups are ready,

Understanding the Interplay Between Startups and Accelerators for Early-Stage Resource Mobilization

691

they are willing to make introductions. As reported by

an interviewee from Startup D:“Since we have been

in the program, we have talked with 4-5 funds that we

clearly could have talked to before, but it would have

been more difficult to get there”.

Transfer. Access and Growth accelerators act

also as resource providers, providing a financing

ticket to the startup participating in the program (“we

receive from the accelerator 100.000 euros, plus

another potential 180.000 euros of follow-on”– an

interviewee from Startup D explained). Moreover,

these accelerators also favor the transfer of other

forms of financial capital such as access to software

from crucial service providers. For example, an

interviewee from Startup A reported “[the

accelerator] have AWS as a partner, and we have

over 200.000 euros in credits, which is crucial for us

because our whole AI model is based on AWS”.

Finally, access and growth accelerators also foster

transfer mechanisms by actively supporting startups

in fundraising with external funding providers,

helping them finalizing the round.

Acceleration Approach

Our analysis reveals that start-ups try to strategically

approach participation in accelerators by taking a

more or less targeted approach to the services

provided by accelerators.

Startups participate in Learning and Validation

accelerators adopting a more comprehensive

approach to the different services offered, due to the

higher degree of uncertainty and inexperience they

face. Here, startups have the possibility to learn and

validate their business models, thus reducing the

uncertainty and refining their strategy (“In the early

stages, the added value is that it really makes you

make the effort to put yourself there and pull down the

company vision for the next one or two years.” – an

interviewee from Startup A reported).

On the other side, the results highlight how startup

adopt a more focused approach in their subsequent

participation in Access and Growth accelerators. As

reported by an interviewee of Startup E “We came

into the accelerator already with a viable product on

the market and with paying customers, so actually we

have our own road and we know what we have to do

[enlarge market access]”.

Table 1: Interplay between Entrepreneurial Resource

Mobilization mechanisms and Acceleration mechanisms.

Cluster Learning and

Validation

Accelerators

Access and Growth

Accelerators

Layer

Search

Complete initial

team composition

Fill entrepreneurial

skills gaps

Validate business

ideas

Find investors,

partners and market

access

Secure funding ticket

Access

Connect with

potential team

members

Connect with

community of

inquiry

Build legitimacy

toward investors

Learn through

training, mentoring

programmes, and

feedback sessions

Connect with

investors, partners

and market access

Build legitimacy

toward investors

Transfer

Nurture the

formation of the team

Obtain financing

ticket and perks

Receive support in

fundraising

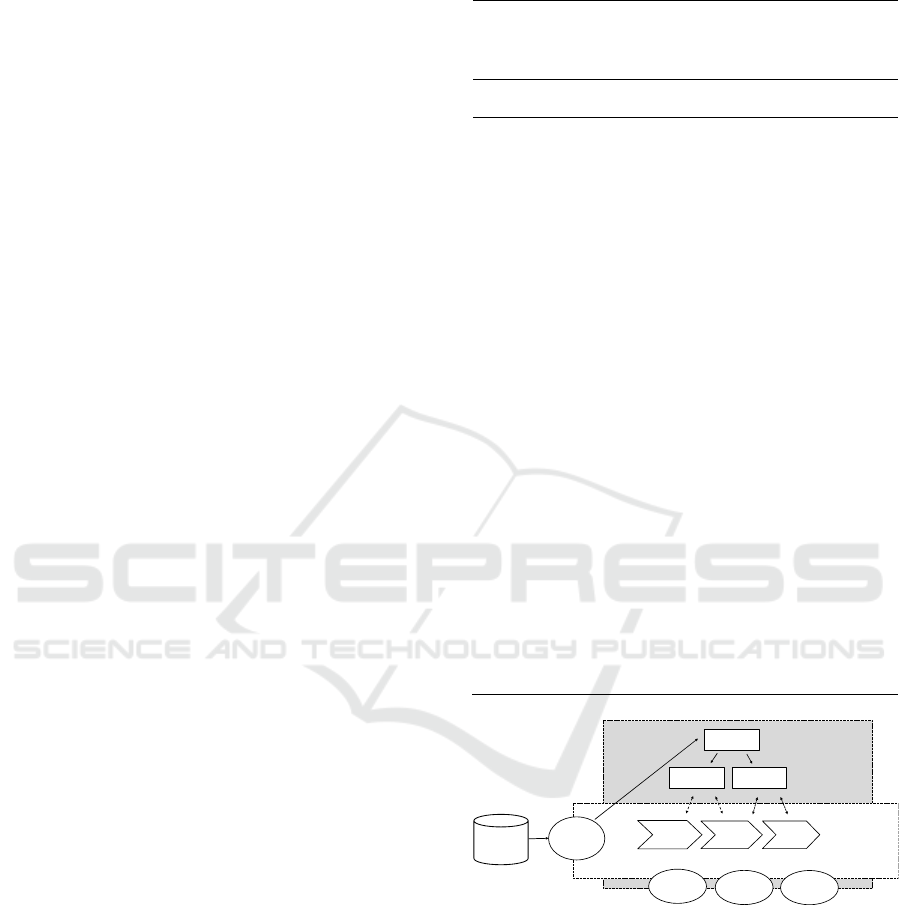

Figure 1: Empirical Model.

5 DISCUSSION AND

CONCLUSIONS

This research proposes a new angle to studying

accelerators by changing the unit of analysis

(Makadok, Burton, & Barney, 2018). In particular, it

observes how the process entrepreneurial resource

mobilization process evolves throughout the

Startup

Liabilities

Acceleration Program

Startup

Resource

Mobilization

Mechanisms

Learning &

Val ida ting

Access &

Growth

Program

services

Search

Access

Tra nsf er

Startup

Approach

Acceleration

Mechanisms

Human

Capital

Social

Capital

Financial

Capital

ICEIS 2024 - 26th International Conference on Enterprise Information Systems

692

subsequent programs’ participation. The combination

of these findings leads us to the empirical model

illustrated in Figure 1.This paves the way for a

twofold contribution.

First, this study expands upon existing research on

the acceleration strategies employed by

entrepreneurs, by showing the relation between the

degree of focus on a limited number of services and

the early involvement in different types of

accelerators.

Second, this research provides a fine-grained view

of the entrepreneurial resource mobilization

mechanisms within accelerator programs, and how

they differ in the light of the startup development

stage.

Startup Approaches to Acceleration Programs

For effective participation in an acceleration program,

a startup must be capable of efficiently acquiring

resources, overcoming time compression

diseconomies arising from the compression of the

venture development process (Qin et al. 2019). This

research observes the relationship between the

characteristics of the program offered by an

accelerator and the intent of the participating startups,

observing how the efficacy of a program goes beyond

the intrinsic characteristics and set of services offered

from the accelerator (Chan, Patel, & Phan, 2020; S.

L. Cohen, Bingham, & Hallen, 2019). Startups that

participate in acceleration programs that focus on

learning and validation mechanisms (often the first

participations in acceleration programs) exhibit an

interest in leveraging all available services to

establish foster their venture development (Qin et al.,

2019). Conversely, startups later participation within

accelerators whose main focus is on access and

growth mechanisms, where startups are solely

interested in a limited range of services and have

targeted resource objectives related to market access

and scaling, are characterized by focused approaches.

Entrepreneurial Resource Mobilization

Mechanisms within Accelerators

This study contributes to the existing literature on

resource mobilization by analyzing the role of different

accelerators programs at various stages of startup

development in facilitating the Search, Access, and

Transfer of resources necessary for sustaining growth

(Clough et al., 2019). Both accelerator programs

identified in this study place a focus on the resource

mobilization phase, but the mechanisms of

entrepreneurial resource mobilization vary depending

on the type of acceleration program considered.

The search for resources by startups varies based

on their stage of development and their objectives

related to participation in the acceleration program.

Startups that take part into Learning and Validation

accelerators seek to fill entrepreneurial skills gaps,

validate their business idea, and acquire human

capital (Gabrielsson, Politis, Persson, & Kronholm,

2018). On the other hand, Access and Growth

accelerators provide support to startups during the

stages of product commercialization and company

growth (Del Sarto, Cruz Cazares, & Di Minin, 2022).

Startups that take part in these accelerator programs

are more mature and seek mainly for the social and

financial capital that can stimulate their growth

(Lerner & Nanda, 2020; Portes, 1998).

For the access stage, accelerators focused on

Learning and Validation mechanisms mainly assist

team formation and matching between human capital

requirements. Moreover, they facilitate the

development of entrepreneurial skills within with the

provision of training programs and mentoring

sessions (Davidsson & Honig, 2003). On the other

side, accelerators focused on access and growth

mechanism center on favoring the connections with

potential customers, partners and investors with the

specific aim of commercialize their products and

acquire financial resources (Shankar & Shepherd,

2019).

Finally, the degree of emphasis on the transfer

stage varies significantly among accelerator types.

being especially present within Access and Growth

accelerators, where startup receive directly from the

accelerators financial resources, or it is supported in

building agreements with external financial resources

providers (Gibbons & Henderson, 2012).

Practical Contributions

The results of our study can help founders navigating

the complex landscape of accelerator programs. Our

research emphasizes the importance of making

"conscious" participations in line with one's stage of

development and verifying the fit between sought and

offered resources. In this regard, the research argues

that the impact of an accelerator depends on the

characteristics of both the accelerators and the

participants, showing the relevance of the approach in

the matter.

Limitations and Future Developments

This study possesses some limitations. Specifically,

the limited sample size, consisting of only ten

startups, hampers the generalizability of the findings.

Additionally, this study exclusively focuses on

Understanding the Interplay Between Startups and Accelerators for Early-Stage Resource Mobilization

693

startups operating within the artificial intelligence

sector in Italy. Subsequent research endeavors could

investigate sectors beyond artificial intelligence and

explore diverse geographical regions apart from Italy.

Employing a quantitative approach could further

enhance the generalizability of the results.

REFERENCES

Aguinis, H., & Solarino, A. M. (2019). Transparency and

replicability in qualitative research: The case of

interviews with elite interviewees. Strategic

Management Journal, 40, 1291–1315.

Aldrich, H., & Auster, E. R. (1986). Even dwarfs started

small: Liabilities of age and size and their strategic

implications. Research in organizational behavior.

Aldrich, H., & Kim, P. (2012). Small worlds, infinite

possibilities? How social networks affect

entrepreneurial team formation and search. IEEE

Engineering Management Review, 40, 3–23.

Baker, T., & Nelson, R. E. (2005). Creating Something

from Nothing: Resource Construction through

Entrepreneurial Bricolage. Administrative Science

Quarterly, 50, 329–366.

Bansal, P. (Tima), & Corley, K. (2011). The Coming of Age

for Qualitative Research: Embracing the Diversity of

Qualitative Methods. Academy of Management

Journal, 54, 233–237.

Berends, H., & Deken, F. (2021). Composing qualitative

process research. Strategic Organization, 19, 134–146.

Bergman, B. J., & McMullen, J. S. (2022). Helping

Entrepreneurs Help Themselves: A Review and

Relational Research Agenda on Entrepreneurial

Support Organizations. Entrepreneurship Theory and

Practice, 46, 688–728.

Betaboom. (2023). Top 40 startup accelerators based on

data—Updated for 2023. Recuperato da

https://betaboom.com/blog/best-startup- accelerators/

Cavallo, A., Ghezzi, A., & Rossi-Lamastra, C. (2021).

Small-medium enterprises and innovative startups in

entrepreneurial ecosystems: exploring an under-

remarked relation. International Entrepreneurship and

Management Journal, 17, 1843-1866.

Chan, C. S. R., Patel, P. C., & Phan, P. H. (2020). Do

differences among accelerators explain differences in

the performance of member ventures? Evidence from

117 accelerators in 22 countries. Strategic

Entrepreneurship Journal, 14, 224–239.

Clayton, P., Feldman, M., & Lowe, N. (2018). Behind the

Scenes: Intermediary Organizations that Facilitate

Science Commercialization Through Entrepreneurship.

Academy of Management Perspectives, 32, 104–124.

Clough, D. R., Fang, T. P., Vissa, B., & Wu, A. (2019).

Turning Lead into Gold: How Do Entrepreneurs

Mobilize Resources to Exploit Opportunities? Academy

of Management Annals, 13, 240–271.

Cohen, S., & Hochberg, Y. V. (2014). Accelerating

Startups: The Seed Accelerator Phenomenon. SSRN

Electronic Journal

. https://doi.org/10.2139/ssrn.24180

00

Cohen, S. L., Bingham, C. B., & Hallen, B. L. (2019). The

Role of Accelerator Designs in Mitigating Bounded

Rationality in New Ventures. Administrative Science

Quarterly, 64, 810–854.

Crișan, E. L., Salanță, I. I., Beleiu, I. N., Bordean, O. N., &

Bunduchi, R. (2021). A systematic literature review on

accelerators. The Journal of Technology Transfer, 46,

62–89.

Davidsson, P., & Honig, B. (2003). The role of social and

human capital among nascent entrepreneurs. Journal of

Business Venturing, 18, 301–331.

Del Sarto, N., Cruz Cazares, C., & Di Minin, A. (2022).

Startup accelerators as an open environment: The

impact on startups’ innovative performance.

Technovation, 113, 102425.

Eisenhardt, K. (1989). Building Theories from Case Study

Research. The Academy of Management Review, Vol.

14, No. 4, 532–550.

Eisenhardt, K., & Graebner, M. (2007). Theory Building

From Cases: Opportunities And Challenges. Academy

of Management Journal, Vol. 50, No. 1.

Freeman, J., Carroll, G. R., & Hannan, M. T. (1983). The

Liability of Newness: Age Dependence in

Organizational Death Rates. American Sociological

Review, 48, 692.

Gabrielsson, J., Politis, D., Persson, K. M., & Kronholm, J.

(2018). Promoting water-related innovation through

networked acceleration: Insights from the Water

Innovation Accelerator. Journal of Cleaner Production,

171, S130–S139.

Ghezzi, A. (2019). Digital startups and the adoption and

implementation of Lean Startup Approaches:

Effectuation, Bricolage and Opportunity Creation in

practice*.* Technological Forecasting and Social

Change, 146, 945-960.

Ghezzi, A., Georgiades, M., Reichl, P., LeSauze, N., Di

CairanoGilfedder, C., & Managiaracina, R. (2013).

Generating innovative interconnection business models

for the future internet. info, 15(4), 43-68.

Ghezzi, A. (2020). How Entrepreneurs make sense of Lean

Startup Approaches: Business Models as cognitive

lenses to generate fast and frugal Heuristics.

Technological Forecasting and Social Change, 161,

120324.

Gibbons, R., & Henderson, R. (2012). Relational Contracts

and Organizational Capabilities. Organization Science,

23, 1350–1364.

Gioia, D. A., Corley, K. G., & Hamilton, A. L. (2013).

Seeking Qualitative Rigor in Inductive Research: Notes

on the Gioia Methodology. Organizational Research

Methods, 16, 15–31.

Gonzalez-Uribe, J., & Leatherbee, M. (2018). The Effects

of Business Accelerators on Venture Performance:

Evidence from Start-Up Chile. The Review of Financial

Studies, 31, 1566–1603.

Hallen, B. L., Bingham, C. B., & Cohen, S. (2014). Do

Accelerators Accelerate? A Study of Venture

ICEIS 2024 - 26th International Conference on Enterprise Information Systems

694

Accelerators as a Path to Success? Academy of

Management Proceedings, 2014, 12955.

Hallen, B. L., & Eisenhardt, K. M. (2012). Catalyzing

Strategies and Efficient Tie Formation: How

Entrepreneurial Firms Obtain Investment Ties.

Academy of Management Journal, 55, 35–70.

Hathaway, I. (2016). What startup accelerators really do.

Harvard Business Review, 7.

Lerner, J., & Nanda, R. (2020). Venture Capital’s Role in

Financing Innovation: What We Know and How Much

We Still Need to Learn. Journal of Economic

Perspectives, 34, 237–261.

Makadok, R., Burton, R., & Barney, J. (2018). A practical

guide for making theory contributions in strategic

management. Strategic Management Journal, 39,

1530–1545.

Meredith, J. (1998). Building operations management

theory through case and field research. Journal of

Operations Management, 16, 441–454.

Paul, J., Alhassan, I., Binsaif, N., & Singh, P. (2023).

Digital entrepreneurship research: A systematic review.

Journal of Business Research, 156, 113507.

Pauwels, C., Clarysse, B., Wright, M., & Van Hove, J.

(2016). Understanding a new generation incubation

model: The accelerator. Technovation, 50–51, 13–24.

Portes, A. (1998). Social Capital: Its Origins and

Applications in Modern Sociology. Annual Review of

Sociology, 24, 1–24.

Qin, F., Wright, M., & Gao, J. (2019). Accelerators and

intra-ecosystem variety: How entrepreneurial agency

influences venture development in a time-compressed

support program. Industrial and Corporate Change, 28,

961–975.

Sanasi, S., & Ghezzi, A. (2022). Pivots as strategic

responses to crises: Evidence from Italian companies

navigating Covid-19. Strategic Organization,

14761270221122933.

Sanasi, S., Manotti, J., & Ghezzi, A. (2021). Achieving

agility in high-reputation firms: Agile experimentation

revisited. IEEE Transactions on Engineering Manage-

ment, 69(6), 3529-3545.

Shankar, R. K., & Shepherd, D. A. (2019). Accelerating

strategic fit or venture emergence: Different paths

adopted by corporate accelerators. Journal of Business

Venturing, 34, 105886.

Stam, E. (2015). Entrepreneurial Ecosystems and Regional

Policy: A Sympathetic Critique. European Planning

Studies, 23, 1759–1769.

Villanueva, J., Van De Ven, A. H., & Sapienza, H. J.

(2012). Resource mobilization in entrepreneurial firms.

Journal of Business Venturing, 27, 19–30.

Yin, R. K. (1984). Case study research: Design and

methods. Beverly Hills, Calif.: Sage Publications.

Understanding the Interplay Between Startups and Accelerators for Early-Stage Resource Mobilization

695