Architecture for Stablecoins with Cross-Chain Interoperability

´

Eric Bastos Costa Machado, Juliana de Melo Bezerra

a

and Celso Massaki Hirata

b

Department of Computing Science, Instituto Tecnol

´

ogico de Aeron

´

autica (ITA), S

˜

ao Jos

´

e dos Campos, Brazil

Keywords:

Stablecoin, Blockchain, Smart Contract, Cross-Chain Interoperability, Architecture for Stablecoin Service.

Abstract:

Blockchain is the enabling technology that implements the operations of cryptocurrencies. Stablecoin is a type

of cryptocurrency designed to reduce price volatility. This stability is achieved by tethering the value of the

stablecoin to a reserve of assets, often in the form of a fiat currency like the US dollar. Implementing a stable-

coin involves various technical challenges related to the design and architecture, which include smart contract

complexity and cross-chain interoperability. This work presents an architecture for the backend of stablecoin

services that address these two challenges. In the architecture, the bridge component enables seamless cross-

chain interoperability, allowing to move of stablecoins from one blockchain to another without the need to be

reverted to fiat currency. We developed a proof of concept, using the stablecoins deployed on both Ethereum

and Polygon testnets. The proof of concept demonstrated that the architecture offers a design reference to

implement other similar stablecoin systems.

1 INTRODUCTION

Blockchain technology has made an impact across

various sectors, including supply chain management,

healthcare, real estate, government and public ser-

vices, and financial services. Blockchain’s key ele-

ments are decentralization, cryptography, distributed

ledger, and chained blocks (Yaga et al., 2018). It has

been shown that this technology can provide trust,

transparency, and shareable information without re-

sorting to intermediaries. Security is provided by the

use of cryptography and the consensus mechanisms

maintain the integrity of the blockchain and record’s

immutability.

Bitcoin (Nakamoto, 2008) laid the way for

many other cryptocurrencies, such as Litecoin and

Ethereum. These currencies offer the advantages of

decentralization, security, and transparency; however,

their values can fluctuate significantly, which poses

challenges for day-to-day transactions and store-of-

value purposes. Stablecoins (Phillips, 2020) address

the currency volatility by pegging their values to an

underlying asset, such as a fiat currency like the US

dollar or a commodity like gold.

Stablecoins built on blockchain technology can fa-

cilitate fast and low-cost cross-border transactions,

and businesses can benefit from faster settlement

a

https://orcid.org/0000-0003-4456-8565

b

https://orcid.org/0000-0002-9746-7605

times, lower fees, and improved cash flow manage-

ment. The idea behind stablecoins of creating pro-

grammable tokens pegged to an asset (tokenization)

has shown huge potential. For instance, the Fed-

eral Reserve (the central bank of the United States)

is studying the implications of a Central Bank Digi-

tal Currency (CBDC) (Infante et al., 2022). Brazil’s

Central Bank is currently developing the Digital Real

(Banco Central do Brasil, 2023).

Fulfilling the stablecoins’ potential is not a simple

task. Stablecoins need to be properly designed and

regulated to offer a compliant and transparent solution

for digital transactions. Regulatory frameworks for

stablecoins are evolving (Bains et al., 2022), and busi-

nesses that operate within established legal frame-

works can gain credibility and build trust with reg-

ulators, financial institutions, and customers.

Two technical challenges that deserve attention in-

clude smart contract complexity and cross-chain in-

teroperability. The majority of stablecoins operate on

blockchain platforms and utilize smart contracts. De-

signing and implementing complex smart contracts to

manage collateral, stability mechanisms, and gover-

nance is challenging and requires careful considera-

tion. Besides, stablecoins face technical challenges in

ensuring seamless integration and communication be-

tween different blockchain networks. This is achieved

by cross-chain interoperability mechanisms.

In this paper, we propose a general architecture to

Machado, É., Bezerra, J. and Hirata, C.

Architecture for Stablecoins with Cross-Chain Interoperability.

DOI: 10.5220/0012628300003690

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 26th International Conference on Enterprise Information Systems (ICEIS 2024) - Volume 1, pages 273-280

ISBN: 978-989-758-692-7; ISSN: 2184-4992

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

273

support the implementation of key functionalities of

stablecoins, dealing with smart contract complexity

and cross-chain interoperability. The key function-

alities include keeping the peg and providing trans-

actions of purchase and sale of tokens. Although

the proposal is agnostic to the currency to which it

is pegged, we choose the Brazilian currency Real

(BRL) as the fiat currency backing the stablecoin re-

serve. The smart contracts are described as consid-

ering Ethereum-virtual-machine (EVM) compatible

chains, for instance, Polygon and Ethereum.

This paper is organized as follows. The next sec-

tion describes the related work. Section 3 introduces

the proposed architecture. The proof of concept is de-

scribed in Section 4. Section 5 concludes our work.

2 RELATED WORK

A comprehensive reference for blockchain can be

found in (Antonopoulos, 2017). In (Yaga et al.,

2018), the general functionality of the blockchain is

described, which includes categories of blockchain,

its core components, such as the blocks and the en-

cryption, and consensus mechanisms.

Blockchain is a decentralized and distributed

ledger technology that enables secure and transpar-

ent record-keeping of transactions across a network

of computers. Consisting of a chain of blocks, each

containing a cryptographic link to the previous block,

this technology ensures the immutability and integrity

of the data stored within. Utilizing consensus mech-

anisms among network participants, such as Proof

of Work (PoW) or Proof of Stake (PoS), blockchain

eliminates the need for a central authority, fostering

trust in the system. Transactions, once added to the

blockchain, become permanent and tamper-resistant,

providing a transparent and verifiable history of all in-

teractions. Beyond its association with cryptocurren-

cies, blockchain finds applications in various indus-

tries, offering solutions for secure data management,

smart contracts, and decentralized applications.

On the topic of stablecoins, the current literature

emphasizes much more on definitions and presents a

more economic view of the subject. In (Baughman

et al., 2022), the authors explain the role of stable-

coins and the rules for the issuance and redeeming of

tokens. Stabilization mechanisms are discussed to-

gether with the most common collateralization mech-

anisms: on-chain collateralized, off-chain collateral-

ized and algorithmic stablecoins.

In (Mell and Yaga, 2022), the authors present

many considerations regarding the security and the

trust of the reserves and bring attention to funds

movement in the secondary market of centralized and

decentralized exchanges, where users trade tokens

amongst themselves and are subject to certain attacks,

such as malicious smart contracts or other exploits.

Regarding technical implementation, in

(Nageswaran et al., 2019), the authors present a

minimum viable product for the implementation of

a custom stablecoin named Digipound. The authors

design the token in the blockchain, a web application

to interact with an API that handles the interaction

with the blockchain and Stripe (Stripe, 2010), a

payment processing system, and also covers an au-

diting mechanism that crosses the information of the

current reserve backing the stablecoin and the current

circulating supply in the blockchain. Their work

touches on some of the necessary steps to implement

and release the custom stablecoin, considering the

implementation of a trading service, constructing the

smart contract, running a local blockchain node, and

potential security concerns. We go a step further

by diving deeper into the smart contract details,

proposing and designing a complete non-monolithic

system architecture, and implementing a cross-chain

solution for deploying and integrating the token

across multiple blockchains.

Finally, on the subject of cross-chain interoper-

ability, in (Pillai et al., 2020), the authors comment

about how different blockchains have different trade-

offs and how the notion of “one blockchain to rule

them all” is simply unreal. The work further discusses

the different strategies for chain interoperation, such

as sidechains (systems inside a blockchain that can

read the state of other blockchains) or hash-locking

(operations set to trigger after the revelation of some

kind of secret), and the theory and implementation

of these techniques from a computer science point of

view.

On more practical terms, a particularly interest-

ing and technical solution is exhibited by (Xie et al.,

2022): a blockchain bridge based on zero-knowledge

proofs (a way of proving the validity of a statement

without revealing the statement itself), focusing on

decentralization and the efficiency of proof valida-

tion. The solution is validated even in a scenario of a

non-EVM-compatible chain (Cosmos) bridging infor-

mation to an EVM-compatible chain (Ethereum). In

our work, we implement a simpler centralized bridge,

since the token issuer entity is naturally centralized in

the case of fiat-backed stablecoins.

Our work aims to contribute to the stablecoin lit-

erature by presenting a technical approach to the sub-

ject. In general, the broader part of the current liter-

ature addresses a more economic perspective on this

topic, focusing on the definitions, implications, and

ICEIS 2024 - 26th International Conference on Enterprise Information Systems

274

use cases whereas our proposal includes the cross-

chain interoperability mechanism and can serve as

the technical reference for developing stablecoin so-

lutions.

3 THE PROPOSED

ARCHITECTURE FOR

STABLECOIN SERVICE

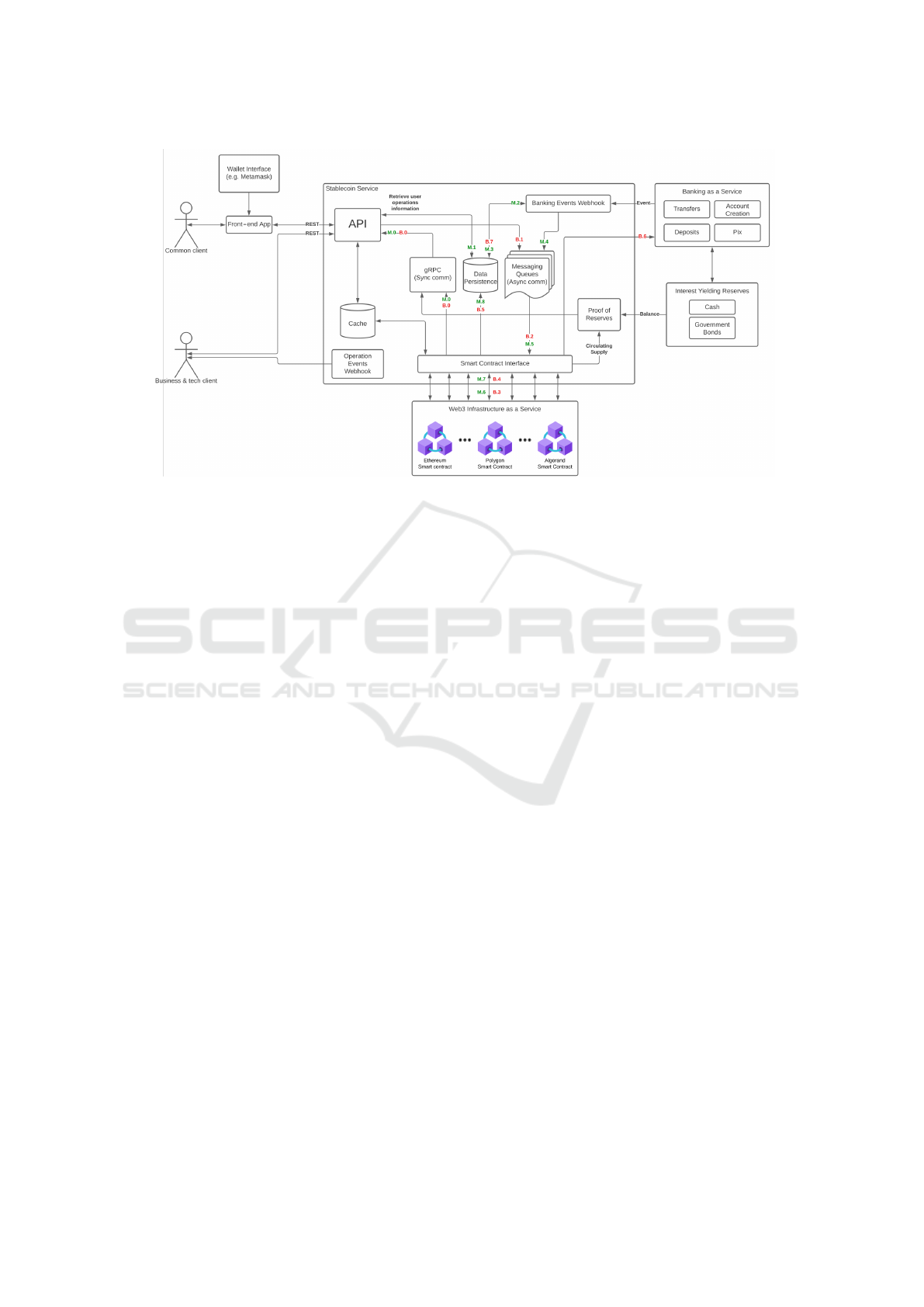

Figure 1 shows the proposed architecture for the

stablecoin service. The architecture counts on mi-

croservices to encapsulate different responsibilities

and ways to communicate with those microservices.

Some components, such as banking as a service, are

outside the stablecoin service since they are seen as

third-party systems.

Since a stablecoin mainly acts as an infrastructure

for the blockchain ecosystem, we expect two main

types of users to consume the service. The first type

is the common user, who buys and sells their tokens.

To allow this access, it is necessary a front-end appli-

cation operating with a friendly wallet service (such

as MetaMask). The second type of user is the busi-

ness or technical user (intermediary). A business user

probably has his platform serving his clients, which

integrates with the stablecoin service.

As follows, we present the microservices of the

stablecoin service, dive deeper into the smart contract

details, and present the centralized bridge solution.

3.1 Stablecoin Service Breakdown

Below we break down the stablecoin service into its

microservices to better explain all the functionalities

and how they support minting and burning operations.

The API gateway exposes all the endpoints of the

stablecoin service, such as the endpoints for creating

accounts and logging in, the endpoints for minting,

burning, and bridging the stablecoins, and the end-

points to retrieve the historic information of opera-

tions. The API is RESTful, and it is the entry point

for all the operations that a user can execute. It is rec-

ommended that the API be public unless the system

has some specific restrictions on access.

The Banking Events Webhook is responsible for

listening to the events that come from the banking ser-

vice. To avoid having to poll the banking service for

information, it is common for the banking services to

allow their clients to register their own server in which

they can listen for real-time events. There are various

tasks executed by the Banking Events Webhook for the

stablecoin service. To describe some of the tasks, we

use the Pix (a real-time electronic funds transfer sys-

tem in Brazil). In September 2023, it reached 41% of

transactions carried out surpassing credit cards, debit

cards, and cash (EBC Agencia Gov, 2023). For in-

stance, a Pix transfer made by the user means that the

user has paid the order and the system must mint the

tokens from the blockchain to the user’s wallet ad-

dress. A Pix transfer event made by the system means

that the system has burned the tokens and the money

has been transferred successfully to the user’s bank-

ing account. Regardless of the event, the final action

usually is either minting or burning tokens.

The Smart Contract Interface is the touchpoint

with the blockchain. It is responsible for sending

the transactions to the blockchain and interacting with

the stablecoin token smart contract. The Smart Con-

tract Interface consumes a message queue in charge

of holding the blockchain interactions, so any other

microservice can enqueue an operation that will even-

tually be handled by this microservice. As important

as sending the transactions to the blockchain is veri-

fying if it executed successfully, if it failed, or if it is

hanging due to an insufficient amount of gas. This

is made by tracking each transaction and checking

its status in the blockchain. When the transaction is

mined, the system must check if it was a success.

The The Data Persistence is a persistent storage

that allows all transactions to be recorded in a way to

ensure the transaction’s durability. This safeguards

the stablecoin issuer against any claims of not de-

livering the tokens when minting, or not transferring

the money when burning. The events that must be

stored are all the blockchain operations and their re-

sults, events from the banking service (e.g. Pix trans-

fer), the entities taking part in the transactions (e.g.

the users), and requests for buying and selling the sta-

blecoin.

The The Communication Infrastructure permits

the internal services communicate by two means:

synchronous and asynchronous. The gRPC, a Re-

mote Procedure Call (RPC) framework implemented

by Google, is used for synchronous communication.

Its main use is querying the Smart Contract Interface

(for example, to check a user’s balance of a certain

token) or querying the Proof of Reserves for the most

recent data it has available. The Messaging Queues,

on the other hand, are used for asynchronous commu-

nication. They are especially important for provid-

ing a way to interact with the Smart Contract Inter-

face, which in turn interacts with the blockchain asyn-

chronously, increasing system’s overall performance,

reliability, and decoupling.

The Operation Events Webhook is useful only to

the users who consume the API through their tech-

Architecture for Stablecoins with Cross-Chain Interoperability

275

Figure 1: General architecture for developing stablecoin solutions considering interoperability mechanism.

nical implementation. Its responsibility is to act

the same way as the banking service acts, sending

real-time updates of events related to the user’s ac-

count. Similarly, the system sends real-time updates

of events related to the minting and the burning oper-

ations to any user that registers a server on which they

are listening.

The Proof of Reserves is responsible for providing

transparency regarding the reserves backing the sta-

blecoin. The task it must accomplish is very simple:

just expose the total circulating supply of the token,

and the current money reserve in the bank, and show

that the reserve is greater than the circulating supply.

By itself, it is not enough. In general, it is a com-

mon practice to have a third-party company audit the

reserves since someone might fake the numbers.

The Cache is a common way to reduce the load on

the server and the database processing, being present

in many APIs in general, and the stablecoin service is

no exception. Some functions that are very usual to

call in the blockchain are the ones related to getting

the current gas price to pay for the transactions. This

is a value that does not change so quickly, so it makes

sense to cache it for multiple transactions instead of

re-evaluating it before each transaction.

When a user buys or sells stablecoins, the flow that

is executed inside the stablecoin service is indicated in

Figure 1 by the green M’s followed by a number and

the red B’s followed by a number. The M stands for

Mint, and the B stands for Burn, whereas the num-

bers indicate the order of the operations. Here we

explain each one of the steps for executing the mint

operation, when stablecoins are bought. The process

begins with input validation (M.0) to ensure the accu-

racy and integrity of the data. Subsequently, an entry

is created in the database (M.1), indicating the sys-

tem’s anticipation of a deposit from the user. Upon

payment of the invoice by the client, verified through

a deposit notification from the Banking Service, the

system verifies the received information (M.2) before

updating the deposit status to ‘paid’ and storing the

payment details (M.3). Following this, a mint opera-

tion is initiated and queued (M.4), and upon receipt,

the operation is executed (M.5). The system proceeds

to create, sign, and broadcast a mint transaction to

the blockchain (M.6) to interact with the Stablecoin

Smart Contract, awaiting confirmation of the transac-

tion’s success (M.7). Finally, the mint result is stored

in the database (M.8) for future reference and auditing

purposes.

3.2 The Stablecoin Smart Contract

This is the smart contract that represents the stable-

coin token in the blockchain. It must be secure, trans-

parent, compliant, and, at the same time, flexible. The

main features of the stablecoin smart contract are pre-

sented in Figure 2, mainly concerned with the ERC-

20 standard implementation. However, other func-

tions are also relevant and shall be incorporated in a

real scenario.

To make the smart contract an actual fungible to-

ken, we need to implement the ERC-20 standard and

that is what the imported libraries do. Regarding the

implemented functions, the mint function allows the

creation of more tokens when anyone buys the to-

ken. The burnFromWithPermit is the function respon-

sible for burning tokens, which is made when some-

ICEIS 2024 - 26th International Conference on Enterprise Information Systems

276

Figure 2: Key features of the stablecoin smart contract.

one wants to sell the tokens.

Due to the way that ERC-20 tokens are imple-

mented, if another address (being a smart contract

or another actual wallet) wants to update the balance

of tokens, effectively subtracting any amount from

it, it must first send an approval transaction to the

blockchain, specifying which address can do so, and

at most how many tokens it can update. Such a feature

is troublesome because sending this approval transac-

tion to the blockchain costs gas, which means that the

user must hold a certain amount of the blockchain’s

native tokens, but we, as the stablecoin issuer, want to

minimize any barriers for our end user to buy and sell

our tokens.

To remove this barrier when the system has to

burn someone’s tokens, the system makes use of the

ERC-2612 standard (Lundfall, 2020). The main idea

behind it is to implement a way to delegate the ap-

proval transaction to someone else. This is made

by generating an off-chain (outside the blockchain)

signature which can be verified on-chain (inside the

blockchain). The function that validates this signature

and executes the approval is called permit. The burn-

FromWithPermit function is simply a concatenation of

a permit operation followed by a burn operation.

The implementation of the stablecoin smart con-

tract shall consider additional functions related to se-

curity, compliance, and upgradeability.

The security functions handle the access control of

the stablecoin smart contract. Only the issuer should

be able to mint and burn tokens, whereas any other

addresses should only be able to transfer tokens they

already have. So the mint and burn functions should

be protected by some logic that checks who is inter-

acting with the smart contract. We can go further and

better separate different concerns into different roles,

such as an Owner role (which grants the ability to

upgrade the smart contract), an Operator role (which

grants the ability to mint and burn tokens), a Pauser

role (which grants the ability to pause and unpause the

smart contract), and a Compliance role (which grants

the ability to blacklist and whitelist addresses).

The compliance functions are related to the neces-

sity of eventually complying with regulations since

the stablecoin is fiat-backed. Some functions are of

interest. The pause function completely stops the

smart contract, disabling any token transfer between

any addresses, and the unpause function returns it to

its operating state. The blockAddress and unblockAd-

dress are the blacklist and whitelist functions, effec-

tively working as the pause and unpause operation but

aimed at a specific address. Finally, the isWhiteListed

is a simple function that returns whether an address is

blacklisted or not.

The upgradeability functions refer to upgrading

the smart contract. When smart contracts are de-

ployed behind a proxy, so they can be upgraded,

they lose the constructor function (which is a func-

tion called as soon as the smart contract is created

and deployed). This is where the initialize function

comes into play. It is a special function that can be

called only once after linking the proxy to the exe-

cution smart contract, effectively acting as the con-

structor. The authorizeUpgrade is a function called

before upgrading the smart contract and should have

any logic regarding the authorization of this upgrade,

such as checking if the function called has the up-

grader role, for example.

3.3 The Centralized Bridge Design

Since implementing a decentralized bridge is much

more complicated and the API for minting and burn-

ing the stablecoins would already be considered a cen-

tralized way to buy the tokens, it makes sense to im-

plement a centralized design for the bridge.

The bridge, from the API point of view, is just an-

other operation, but it is fundamental to cover it apart

because it is the feature that enables cross-chain inter-

operability and allows the users to move their tokens

from one blockchain to another without first return-

ing to the asset backing the stablecoin, in this case,

the Brazilian Real.

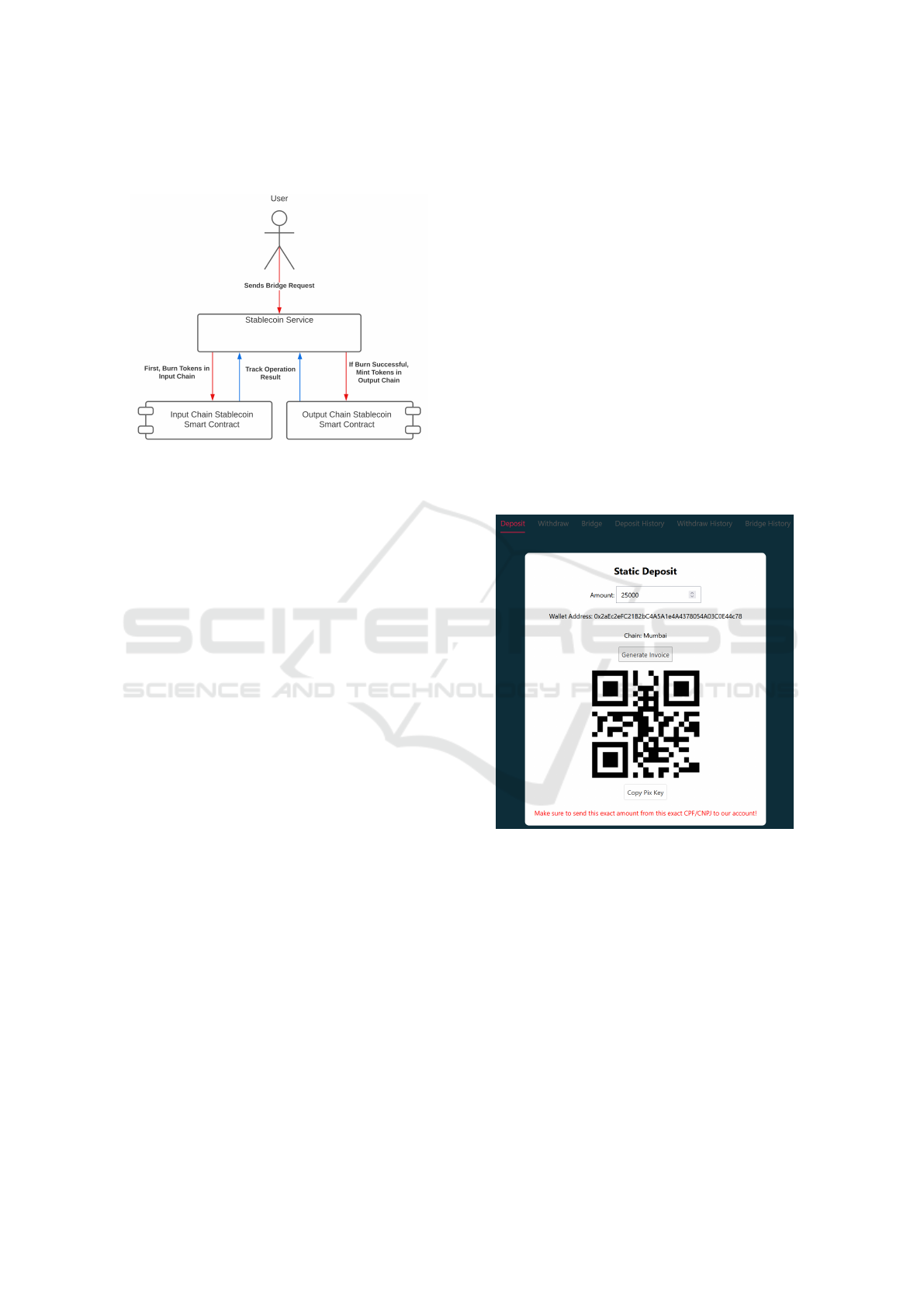

Figure 3 shows, in very basic terms, how the

bridge operation is processed. A user creates a bridge

requisition in the API, and it is executed by first burn-

ing the user’s tokens in the input blockchain, and

minting the same amount in the output blockchain.

It is a two step process, but nothing more than a con-

catenation of two already implemented operations.

Since the mint operation in the output blockchain

must only be made once the burn operation is con-

firmed in the input blockchain, it is important to high-

light, again, the necessity of correctly handling reor-

ganizations in the input chain. If the API does not

properly wait for the finality of the mint operation, by

waiting for enough blocks to be mined after, a reor-

ganization can happen, and the user might have his

Architecture for Stablecoins with Cross-Chain Interoperability

277

tokens returned to his wallet in the input chain while

they were also minted in the output chain.

Figure 3: Centralized bridge operation.

4 A PROOF OF CONCEPT

For a proof of concept, a simpler version of the stable-

coin service and the smart contract was implemented.

The idea was to keep only the essential functionali-

ties related to the minting and burning of the stable-

coin. The supported blockchains were also restricted

to only Ethereum and Polygon to simulate bridge op-

erations. The simplified version of the stablecoin

service is based on the architecture shown in Fig-

ure 1, but without the complementary microservices

as Operation Events Webhook, Proof of Reserves and

Cache.

Interactions with the banking service were simu-

lated in the proof of concept. The simulated banking

service can receive a request for a bank transfer, re-

turn a result, and send events regarding Pix deposits.

This way, both the burning and minting of the tokens

can be properly implemented. We also assume that

the bank operations never fail to further simplify the

implementation. The smart contract was kept with the

essential functions as presented in Figure 2, in a way

to hold the basic functionalities of minting, burning,

and access control, without worrying about compli-

ance, security, and upgradeability.

The repository with all the code supporting the

implementation of this project is available in GitHub

(Bastos, 2023). The deployment of the system is

easy and pretty much plug-and-play due to the con-

tainerization technology (using Docker technology)

and can be customized to some extent by changing

the configurations. A user-friendly interface is avail-

able as a front-end application (written with Javascript

and CSS). The API itself is also fully documented,

using the OpenAPI 3.0 specification, and the stable-

coin smart contract is simple and ready to be de-

ployed in any EVM-compatible blockchain. The API,

Bank Webhook and Smart Contract Interface are writ-

ten in Go language. The Messaging Queues are im-

plemented with RabbitMQ (VMware, 2007), whereas

the Data Persistence uses PostgreSQL. To exemplify

the use of the developed application, we show the

mint, burn, and bridge operations below.

With the user logged in and his MetaMask wallet

connected, he is ready to buy some amount of stable-

coins. This can be made in the Deposit tab, where

the user can input the amount in Brazilian centavos

(basically, amount × 100). The wallet address and

the blockchain are automatically fetched from Meta-

Mask, and he can just click the generate invoice but-

ton, which registers the purchase order in the Sta-

blecoin Service backend, and shows a QR code that

would contain the bank account information for the

user to pay the order. This process is demonstrated in

Figure 4.

Figure 4: Buying stablecoins.

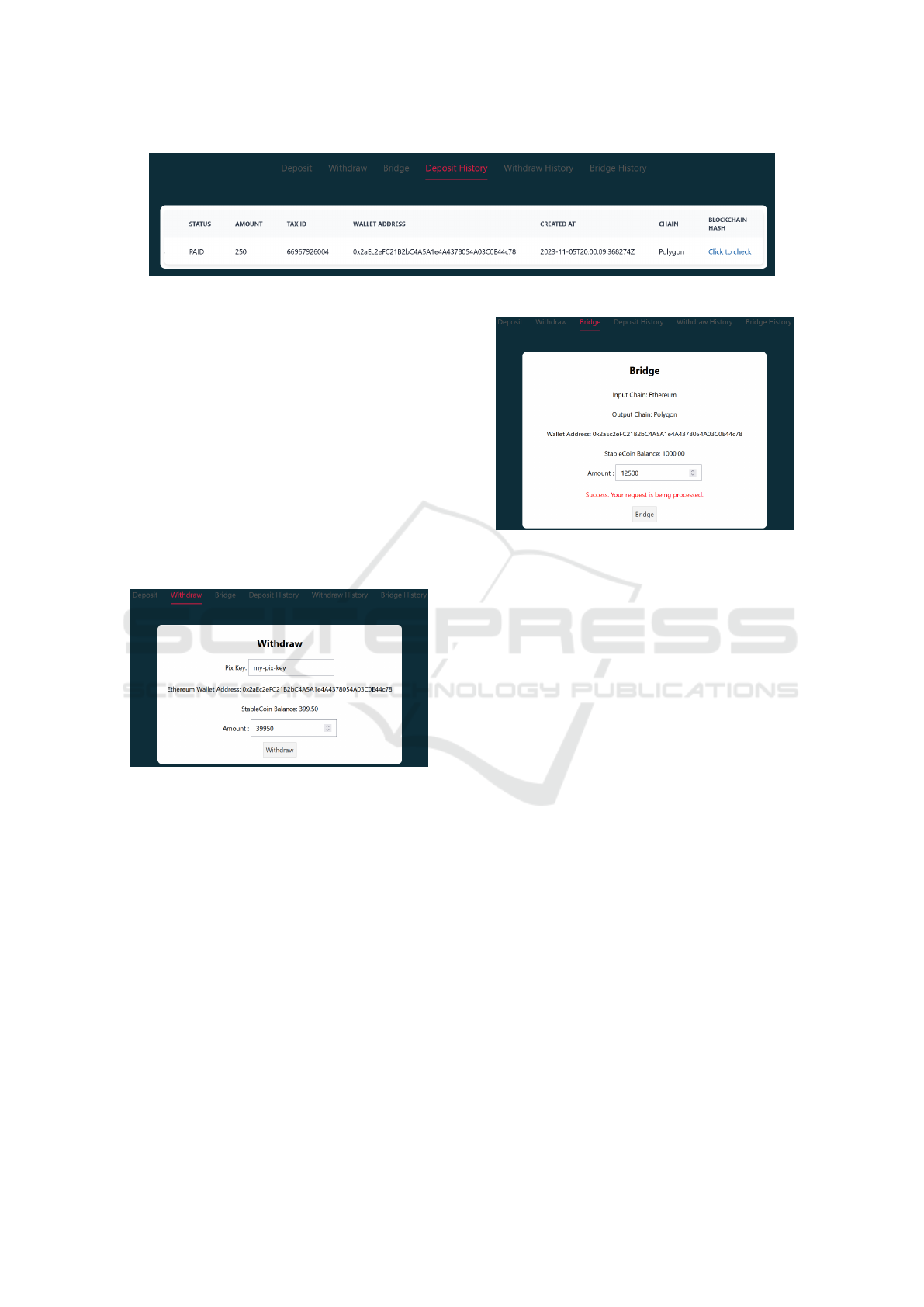

Due to the simulation of the user’s payment in the

backend, after a couple of seconds, the invoice is con-

sidered to be paid and the minting process starts. In

no more than a couple of minutes, the tokens are de-

posited in the user’s wallet, and he is ready to use

them for anything he wants. In the Deposit History

tab, he can track the status of his transaction, includ-

ing the status of the operation in the blockchain. Fig-

ure 5 shows the just executed purchase operation. By

clicking the link in the Blockchain Hash column, the

user can see the actual blockchain transaction that was

responsible for minting his tokens.

With the user logged in and his MetaMask wal-

let connected, he is also able to sell some amount of

ICEIS 2024 - 26th International Conference on Enterprise Information Systems

278

Figure 5: History of purchase operations.

stablecoins. This can be made in the Withdraw tab,

where the user can input the amount he wants to sell,

in Brazilian Centavos, and his Pix Key, which encodes

his bank account information. The wallet address and

the blockchain are automatically fetched from Meta-

Mask. So he can just click the withdraw button, which

starts the burning operation and, if successfully ex-

ecuted, the bank transaction, right after. Figure 6

presents the withdraw interface. After pressing the

withdraw button, MetaMask prompts the user to sign

the permit which is necessary for the API to burn the

user’s tokens. Only after accepting and signing the

message, the burn operation effectively starts. Like-

wise, the Withdraw History tab contains the tabulated

information of past sale transactions.

Figure 6: Selling stablecoins.

The last operation of the proof of concept is

the bridge operation. This operation involves two

blockchain transactions: burn in one blockchain and

mint in the other. It can be started in the Bridge tab,

and the history of past bridge operations can be ver-

ified in the Bridge History tab. Figure 7 presents the

bridge interface. An amount of stablecoins to bridge

is requested from the user, as well as the permit to

burn his tokens in the input chain. Since the API cur-

rently supports only two chains, the front end auto-

matically selects the input and output blockchain ac-

cording to the current blockchain selected in Meta-

Mask.

Figure 7: Bridging stablecoins.

5 CONCLUSIONS

We proposed an architecture for the backend of a sta-

blecoin service with cross-chain interoperability. We

presented the needed microservices and how they deal

with the client’s requests to orchestrate the steps of

the burn, mint, and bridge operations. We also de-

tailed how a stablecoin is created in blockchain by us-

ing a smart contract based on the ERC-20 standard.

Regarding the proof of concept, the proposed archi-

tecture was successfully implemented. The solution

made use of EVM-compatible blockchains, but there

are other types of blockchains with growing ecosys-

tems that could offer even cheaper and faster transac-

tions, being ideal for the development of stablecoins.

In addition to the proposed centralized bridge so-

lution, a promising avenue for future work is to allow

a trustless bridge solution. As the blockchain and de-

centralized finance ecosystems continue to grow, the

need for secure and seamless inter-connectivity be-

tween various blockchain networks becomes increas-

ingly critical. Ensuring transparent and tamper-proof

transactions between these networks, without relying

on centralized intermediaries, holds great potential

for enabling a more robust and decentralized digital

economy.

By simulating the banking service in the proof of

concept, we postponed an important part of the imple-

mentation which is correctly integration with a real

payment system, understanding the format of its re-

Architecture for Stablecoins with Cross-Chain Interoperability

279

sponses and its limitations. The possibility of errors

was not considered, but a real application would have

to be robust to errors in operations. For future work,

we suggest studying the challenges and risks of in-

tegrating other payment methods, such as debit and

credit cards. Pix is a system currently exclusive to

Brazil, and international cards are used in the entire

world, so this would be a great way to increase the

user base.

Our proposal considered a fiat-backed stablecoin,

but it could be extended to a stablecoin backed by

any asset acting as the collateral for the stablecoin re-

serves. Studying and developing stablecoins with a

different pegging mechanism, such as crypto-backed

stablecoins, is another topic to be researched. Algo-

rithmic stablecoins, in particular, still have proven to

be quite challenging to implement with a trusted peg-

ging algorithm.

Another topic of interest is to reason about the real

usage of the stablecoin. Although everything was de-

veloped in a test environment, to avoid any real costs

of using the blockchain, a real stablecoin ready to be

used in production would need many mechanisms to

incentive users to buy stablecoins. These mechanisms

could be anything, from offering forex exchange ca-

pabilities with other stablecoins to any activity that

uses real money, such as sports betting.

REFERENCES

Antonopoulos, A. M. (2017). Mastering Bitcoin: Unlocking

Digital Cryptocurrencies. O’Reilly Media.

Bains, P., Ismail, A., Melo, F., and Sugimoto, N. (2022).

Regulating the crypto ecosystem: the case of sta-

blecoins and arrangements. International Monetary

Fund.

Banco Central do Brasil (2023). BCB selected 14

institutions to collaborate with the development

of the piloto RD. Central Bank of Brazil.

https://www.bcb.gov.br/en/pressdetail/2481/nota Ac-

cessed on 2024-01-02.

Bastos, E. (2023). Project repository.

https://github.com/EricBastos/ProjetoTG Accessed

on 2024-01-02.

Baughman, G., Carapella, F., Gerszten, J., and Mills,

D. (2022). The stable in stablecoins. FEDS

Notes. https://doi.org/10.17016/2380-7172.3224 Ac-

cessed on 2024-01-02.

EBC Agencia Gov (2023). Pix reaches im-

pressive numbers in just three years.

https://agenciagov.ebc.com.br/noticias/202311/pix-

chega-a-numeros-expressivos-em-apenas-tres-anos

Accessed on 2024-01-02 In Portuguese.

Infante, S., Kim, K., Orlik, A., Silva, A. F., and Tetlow,

R. J. (2022). The macroeconomic implications of

CBDC: A review of the literature. Finance and

Economics Discussion Series 2022-076, Board

of Governors of the Federal Reserve System.

https://www.federalreserve.gov/econres/feds/the-

macroeconomic-implications-of-cbdc-a-review-of-

the-literature.htm Accessed on 2024-01-02.

Lundfall, M. (2020). Erc-2612: Permit extension for EIP-20

signed approvals. https://eips.ethereum.org/EIPS/eip-

2612 Accessed on 2024-01-02.

Mell, P. and Yaga, D. (2022). Understanding stablecoin

technology and related security considerations. Tech-

nical report, National Institute of Standards and Tech-

nology. https://nvlpubs.nist.gov/nistpubs/ir/2023/

NIST.IR.8408.pdf Accessed on 2024-01-02.

Nageswaran, S., Knottenbelt, W., and Leung, K. (2019).

Digipound: A proof-of-concept stablecoin audited in

real time.

Nakamoto, S. (2008). Bitcoin: A peer-to-peer electronic

cash system. Decentralized business review, page

21260. https://bitcoin.org/bitcoin.pdf Accessed on

2024-01-02.

Phillips, K. (2020). How stable are stablecoins

and what factors affect volatility? Lukka.

https://lukka.tech/how-stable-are-stablecoins-

and-what-factors-affect-volatility/ Accessed on

2024-01-02.

Pillai, B., Biswas, K., and Muthukkumarasamy, V. (2020).

Cross-chain interoperability among blockchain-based

systems using transactions. The Knowledge Engineer-

ing Review, 35:e23.

Stripe, I. (2010). Stripe. https://stripe.com/ Accessed on

2024-01-02 In Portuguese.

VMware (2007). Rabbitmq. https://www.rabbitmq.com/

Accessed on 2024-01-02.

Xie, T., Zhang, J., Cheng, Z., Zhang, F., Zhang, Y.,

Jia, Y., Boneh, D., and Song, D. (2022). zk-

Bridge: Trustless cross-chain bridges made practi-

cal. https://arxiv.org/pdf/2210.00264.pdf Accessed on

2024-01-02.

Yaga, D., Mell, P., Roby, N., and Scarfone, K.

(2018). Blockchain technology overview NIS-

TIR 8202. https://nvlpubs.nist.gov/nistpubs/ir/2018/

NIST.IR.8202.pdf Accessed on 2024-01-02.

ICEIS 2024 - 26th International Conference on Enterprise Information Systems

280