Bridging Human and AI Decision-Making with LLMs: The RAGADA

Approach

Tapio Pitk

¨

aranta

1

and Leena Pitk

¨

aranta

2

1

Department of Computer Science and Engineering, Aalto University, Finland

2

Department of Industrial Engineering and Management, Aalto University, Finland

fi fi

http://www.aalto.fi

Keywords:

RAG: Retrieval Augmented Generation, RAGADA: Retrieval Augmented Generation Algorithmic Decision

Alignment, LLM Large Language Models, IR Information Retrieval, Multi-Agent Systems (MAS).

Abstract:

The Retrieval Augmented Generation Algorithmic Decision Alignment (RAGADA) architecture is an ad-

vancement in AI-augmented decision-making for corporate environments. This paper discusses RAGADA’s

innovative architecture that merges RAG and Multi-Agent System (MAS) with sophisticated business algo-

rithms and dynamic interfaces, enhancing natural language interaction between AI systems and users. This fu-

sion extends AI’s reach, facilitating adaptable decision-making tools for leaders, in line with evolving business

strategies and ethical standards. Experimental validation of RAGADA within the banking sector, involving di-

verse stakeholder groups ranging from customers to business and ethical managers, confirms its effectiveness.

The system adeptly translates natural language inquiries into actionable insights, thereby improving the user

experience and decision-making transparency. This validation underscores RAGADA’s potential to transform

stakeholder engagement and demonstrates a leap in utilizing AI for strategic and ethical business management.

1 INTRODUCTION

The recent enhancements of Large Language Mod-

els (LLMs) like ChatGPT has marked a significant

shift in artificial intelligence (AI), establishing a

new paradigm in human-machine interaction. These

LLMs have transitioned from academic innovations

to a ’killer application in AI’ with wide variety of use

cases across various industries, offering intuitive and

adaptable interfaces for diverse applications. Their

advancement in natural language processing has rev-

olutionized machine comprehension, enabling com-

plex dialogue and task execution.

LLMs are evolving beyond sophisticated chatbots

to offer a platform that transforms interaction with

machines, democratizing AI access for users with var-

ied technical expertise. A pressing research question

is aligning these algorithms with human values and

objectives (Christian, 2020), highlighting the need for

a multidisciplinary approach in AI (Wilson, 1999). AI

now merges data science and mathematics with ethics

and leadership, ensuring a holistic development and

deployment of technologies like LLMs.

This paper presents RAGADA, an innovative soft-

ware architecture integrating Retrieval Augmented

Generation with dynamic, user-friendly interfaces for

both customers and executives. RAGADA aims to

revolutionize AI systems’ user interaction, focusing

on natural language processing to enhance customer

experience and allow executives to transparently ad-

just algorithmic decisions, thereby improving user

satisfaction and strategic agility in corporate environ-

ments.

2 RELATED RESEARCH

STUDIES

2.1 LLMs and RAG

The advent of the Transformer model (Vaswani et al.,

2017) catalyzed significant advancements in Natu-

ral Language Processing (NLP) and Large Language

Models (LLM), as seen in models like BERT (Devlin

et al., 2018), GPT-3 (Brown et al., 2020), and GPT-

4. These LLMs have demonstrated remarkable text

generation abilities, applicable in various domains

including automated decision-making (Brown et al.,

2020).

812

Pitkäranta, T. and Pitkäranta, L.

Bridging Human and AI Decision-Making with LLMs: The RAGADA Approach.

DOI: 10.5220/0012705000003690

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 26th International Conference on Enterprise Information Systems (ICEIS 2024) - Volume 1, pages 812-819

ISBN: 978-989-758-692-7; ISSN: 2184-4992

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

The integration of LLMs with Retrieval Aug-

mented Generation (RAG) represents a key devel-

opment in enhancing NLP and AI. RAG effec-

tively combines pre-trained language models with ex-

ternal knowledge retrieval, significantly improving

LLMs’ adaptability and accuracy (Karpukhin et al.,

2020). It mitigates the constraints of LLMs’ static

knowledge bases by dynamically incorporating exter-

nal data, thus boosting the models’ contextual rele-

vance (Lewis et al., 2020).

Research underscores the utility of LLMs in com-

plex decision-making (Petroni et al., 2019), and

RAG’s ability to update these models with current

information is especially valuable in dynamic corpo-

rate scenarios (Guu et al., 2020), (Borgeaud et al.,

2022). The LLM-RAG synergy augments automated

decision-making in businesses by addressing chal-

lenges in managing real-time, context-specific data.

2.2 AI Safety and Management

Literature

The integration of large language models in decision-

making processes necessitates careful consideration

of ethical aspects (Christian, 2020). Studies have crit-

ically examined the risks associated with these mod-

els, emphasizing ethical dilemmas, potential biases,

and environmental concerns due to their scale and

complexity (Bender et al., 2021). The call for a re-

sponsible and deliberate approach in the development

and application of these models is driven by their ex-

tensive societal implications (Bender et al., 2021).

This discussion underscores the need for balancing

technological progress with ethical responsibility in

AI advancements (Christian, 2020).

Applying AI and ML for decision making ratio-

nalizes decision making criteria and needs objectives

in digital format. Balanced Scorecard is one frame-

work for performance measurement that integrates fi-

nancial and non-financial metrics (Kaplan, 1992).

In our study, we provide details on an experi-

mental implementation concerning decision-making

within the banking sector. The implementation in the

banking sector, particularly from an organizational

capability perspective, is further elaborated in (Dash

et al., 2021).

2.3 Metadata Management and Data

Catalogues

Effective metadata management is crucial for or-

ganizations handling extensive data assets (Olesen-

Bagneux, 2023). It consolidates data storage, search,

and management, thereby facilitating efficient ac-

cess and comprehension of organizational data. By

employing machine learning and AI, these systems

enhance data governance and quality through auto-

mated classification and improved dataset accessibil-

ity. Such tools play a key role in democratizing data

within organizations, ensuring regulatory compliance

and preserving data integrity with transparent audit

trails. As data complexities grow, the strategic imple-

mentation of data catalogs becomes increasingly im-

portant for maximizing data resource utilization and

meeting regulatory standards.

A wide array of both open-source and com-

mercial data catalog software is available. Ex-

amples of open-source software include Open-

Metadata: https://open-metadata.org/, Apache Atlas:

https://atlas.apache.org/, Datahub: https://datahub.io/,

Metacat: https://github.com/Netflix/metacat, Amund-

sen: https://www.amundsen.io/, and CKAN:

https://ckan.org/.

2.4 Multi-Agent Systems

Multi-agent systems (MAS) are collections of au-

tonomous, interacting agents that work together to

solve complex problems that are beyond the capabil-

ities of individual agents acting alone (Wooldridge,

2009). Research in MAS covers a wide range of top-

ics including coordination mechanisms, communica-

tion protocols, and collective decision-making strate-

gies. Notable advancements in the field have demon-

strated that MAS can effectively handle dynamic and

uncertain environments, which are common in real-

world scenarios such as traffic management, robotic

teams, and distributed control systems (Stone and

Veloso, 2000).

One of the fundamental challenges in MAS is the

design of cooperation strategies that enable agents to

work together harmonously. This requires sophis-

ticated negotiation protocols and conflict resolution

techniques, which are crucial for maintaining coher-

ent behavior among agents (Rosenschein and Zlotkin,

1994).

2.5 Agent Interaction Protocols and

Chat Templates

Software agents adhere to interaction protocols,

notably those established by FIPA standards (

http://www.fipa.org/repository/ips.php3 ), focusing

on communication-centric design for context-aware

responses. Similarities are evident in the way LLM-

based chatbots manage conversational flow. They

blend preset and adaptive responses, evolving with

Bridging Human and AI Decision-Making with LLMs: The RAGADA Approach

813

user preferences and external data integration, which

results in enhanced accuracy and improved customer

interaction experiences.

3 METHODOLOGY AND

SYSTEM DESIGN

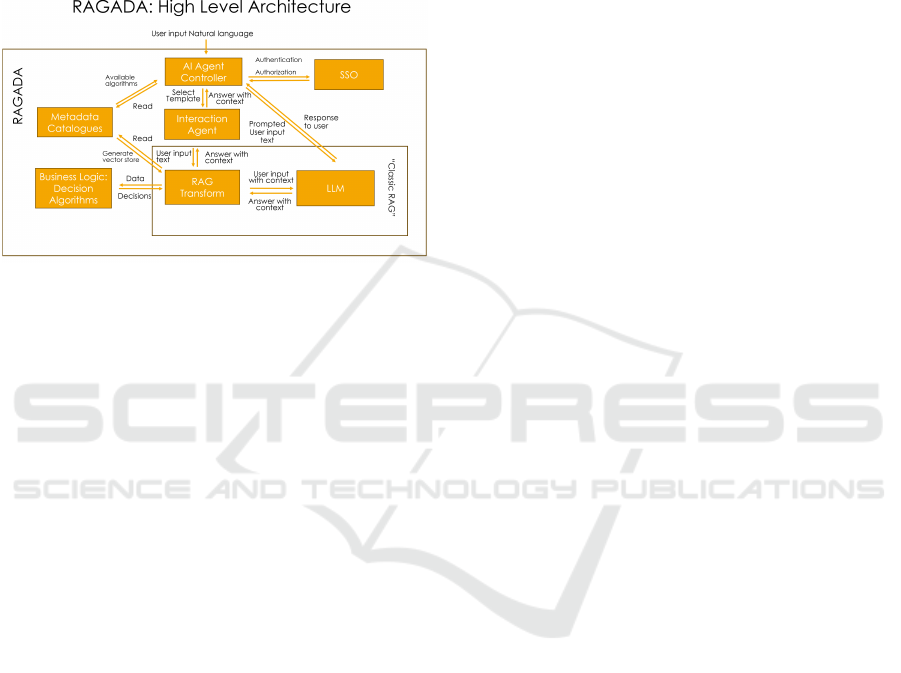

Figure 1: RAGADA High Level Architecture: interactions

between human input and software components.

This section describes Innovative Software Architec-

ture for Retrieval Augmented Generation Algorithmic

Decision Alignment (RAGADA).

3.1 Architecture: Interaction Model

The Figure 1 describes the high-level components of

the RAGADA architecture. In this section we discuss

the main roles and interactions of the components in

this architecture.

In the RAGADA architecture, the AI Agent Con-

troller plays a pivotal role in orchestrating interactions

between users and the decision-making logic. It be-

gins by assimilating the initial text provided by the

user and then identifies the specific chat template or

interaction protocol the user is engaging with. The

AI Agent Controller carefully selects the most suit-

able interaction agent, based on the user’s context and

intent, and ensures that the user has the necessary

permissions for it. This careful selection is crucial

for ensuring that the system’s responses are coher-

ent and consistent, adhering to a uniform interaction

paradigm.

In the RAGADA architecture, the Interaction

Agent serves as the central conversational AI inter-

face that facilitates the dialogue between the human

user and the system. This agent is responsible for in-

terpreting user input in natural language and generat-

ing appropriate responses that are contextually rele-

vant to the user’s requests or inquiries. By leverag-

ing a selection template and a repository of available

algorithms, the Interaction Agent dynamically con-

structs replies that not only provide information but

also guide the user through the system’s functional-

ities. The Interaction Agent can handle a variety of

inputs, transforming user queries into structured data

that can be processed by the Business Logic: Deci-

sion Algorithms. Moreover, it ensures that user in-

teractions are intuitive and efficient, enhancing user

engagement and satisfaction with the system.

The middle level components in this structure are

RAG Transform and the Language Model (LLM),

key components of the classic Retrieval-Augmented

Generation (RAG) model that elevates response qual-

ity by weaving in external data. The RAG Trans-

form is pivotal, acting as the analytic engine where

user inputs undergo initial processing and enhance-

ment. It ingests raw user queries and augments them

with context derived from the Catalogues—a reposi-

tory replete with domain-specific data. This context-

enrichment empowers the RAG Transform to inter-

pret the queries with precision, significantly refining

the system’s output in terms of relevance and speci-

ficity.

Next to the RAG Transform resides the Language

Model (LLM), presumably a Large Language Model

akin to GPT. The LLM employs the enriched inputs

from the RAG Transform to create nuanced and con-

textually informed responses. It taps into a vast re-

serve of learned patterns to formulate replies that ex-

hibit a high degree of linguistic finesse, akin to human

conversation.

The system’s decision-making prowess is further

enhanced by integrating Business Logic with Deci-

sion Algorithms, which operate in concert with the

RAG components. They leverage both the founda-

tional data and the context processed by the AI to

implement domain-specific directives and heuristics.

These algorithms are indispensable in scenarios that

necessitate not just information retrieval but also au-

tonomous decision-making, such as in financial ser-

vices or healthcare.

In essence, RAGADA’s architecture is a har-

monious fusion of traditional RAG elements with

cutting-edge AI decision-making mechanisms. It

combines the RAG Transform’s contextual acuity, the

LLM’s generative capabilities, and the AI Agent Con-

troller’s ability to select the right interaction agent,

all underpinned by robust Business Logic. This con-

fluence results in a system adept at addressing com-

plex user inquiries with remarkable precision and ef-

ficiency, positioning RAGADA as a formidable tool

across a multitude of automated, intelligent interac-

tion domains.

A very important component is the catalogue,

ICEIS 2024 - 26th International Conference on Enterprise Information Systems

814

which consists of multiple sub-components and will

be discussed in the subsequent section. The catalogue

serves both as an input for the RAG Transform and as

a modeling instrument to bridge the concepts.

3.2 Architecture: Catalogue Layer

Figure 2: RAGADA Architecture: Metadata catalogue re-

lationships and high level description.

The depicted Figure 2 illustrates an interconnected

framework of metadata catalogues that serve as the

backbone for a data-driven decision-making system.

This systematic arrangement ensures that every step

in the algorithmic process is underpinned by a struc-

tured repository of information, spanning from raw

data to core business values.

Central to this framework is the ’Data Catalog’,

which meticulously details the datasets available for

use. This catalogue is instrumental in providing the

foundational data inputs to the ’Algorithm Catalog’,

which, in turn, specifies the algorithms that will pro-

cess the input data. The Algorithm Catalog is a com-

prehensive directory that not only lists the algorithms

but also delineates their data requirements, expected

outputs, and the relevant business objectives they are

designed to achieve. It ensures a seamless flow of

information by creating explicit links to the Data Cat-

alog and the Decision Catalog.

The ’Decision Catalog’ is a critical component

that collates the various decisions or recommenda-

tions generated by the algorithms. It acts as a refer-

ence point for the end outputs of the decision-making

process, encapsulating the inferences drawn from the

data through the algorithms. This catalogue is directly

informed by the outputs of the Algorithm Catalog, en-

suring that decisions are traceable back to their algo-

rithmic origins.

Moreover, the ’Business Objectives Catalog’

aligns the algorithmic decisions with the strategic

goals of the organization. It provides a clear linkage

between the algorithms’ functions and the overarch-

ing objectives they are meant to serve, guaranteeing

that algorithmic outputs are not only data-driven but

also strategically focused.

Lastly, the ’Values Catalog’ upholds the ethical

and value-based considerations that should guide ev-

ery decision. This catalogue ensures that the data in-

puts, algorithmic processes, and business objectives

are all in alignment with the organization’s core val-

ues. It acts as a moral compass, steering the decision-

making process towards outcomes that are not only

effective but also ethically sound.

Together, these catalogues create a robust and

ethically-grounded architecture that integrates diverse

sets of information into a coherent system, designed

to facilitate informed and value-aligned decision-

making in a corporate environment.

4 EXPERIMENTAL VALIDATION

We are not aware of any standard conversational AI

RAG benchmark dataset suitable for evaluating RA-

GADA architecture. Our research evaluates the RA-

GADA model, specifically within the banking sector,

known for its complex decision-making processes.

We also compare the performance to fine tuned GPT-4

and custom GPT-4 implementations.

Experimental Implementation. The experimental

validation of RAGADA within the banking sector

involved a series of user stories designed to assess

the system’s decision-making capabilities. We con-

structed a comprehensive algorithm catalogue from

banking sector use cases portion of which is illus-

trated in Figure 3.

The experimental phase focused on the detailed

exploration of the getLoanDecision algorithm, a piv-

otal component of our algorithmic catalogue, as de-

picted in Figure 3. This choice was made to thor-

oughly illustrate the customer interaction process

from multiple stakeholder perspectives. The ‘get-

LoanInterestRate‘ algorithm stands out due to its

complexity in balancing diverse inputs, such as credit

scores and market rates, and its direct impact on

customer satisfaction and financial product perfor-

mance. Our implementation simulated various real-

world scenarios to evaluate the algorithm’s robustness

and adaptability, scrutinizing its decision-making pro-

cess in dynamically adjusting interest rates in re-

sponse to fluctuating economic indicators and cus-

tomer credit profiles.

4.1 Focus on One Algorithm

Focusing on a single decision algorithm, we explored

the model’s capabilities in a controlled yet intricate

environment, representing broader banking decision

frameworks. This approach facilitated an in-depth

Bridging Human and AI Decision-Making with LLMs: The RAGADA Approach

815

Figure 3: Example algorithm catalogue.

analysis and provided insights into stakeholder inter-

actions within real-world banking scenarios.

In this paper, we will explain how we integrated

the ’getLoanDecision’ algorithm into the Algorithm

Catalog, along with the necessary additional catalog

definitions as defined in Figure 2, and how stakehold-

ers interact with the algorithm. Although we created

several other similar algorithms for the catalog (get-

CreditCardDecision, getBankAccountDecision, get-

MortgageLoanDecision, etc.), we will not focus on

those in this paper.

We assume that the bank employs role-based au-

thentication and authorization for users, and we will

omit these aspects from this experiment.

The study’s next section examines user stories

from bank employees, customers, and management,

revealing how each group interacts with and perceives

the algorithm. This analysis aims to showcase the

algorithm’s functionality and its impact on diverse

stakeholders, underscoring RAGADA’s potential to

transform decision-making in complex organizational

contexts.

4.2 User Stories

User stories used in this implementation:

• As a bank user, I would like to apply for a short-

term loan.

• As a bank user, I would like to complain to the

ethical value alignment algorithm that I am being

asked ethically questionable information while

applying for a loan.

• As a bank compliance department manager, I

would like to remove ethically questionable data

points from loan decision making.

• As a bank loan business department manager, I

would like to change the business target for short-

term loan decisions from minimizing credit prob-

lems to acquiring new customers.

Figure 4: Example Algorithm: getLoanDecision(Input):

Decision.

4.3 Example Algorithm:

getLoanDecision(Input): Decision

In the modern corporate environment, particularly

within large organizations, the plethora of decision-

making processes constitutes a complex landscape,

often involving hundreds or thousands of decisions

ripe for algorithmic transformation. Our research

delved into this realm, focusing on the experimen-

tal application of algorithms in a practical setting.

We developed ’getLoanDecision’, an algorithm tai-

lored to streamline the loan approval process. This

algorithm processes various customer profile inputs

to generate loan decisions.

For a realistic implementation, we

utilized a Kaggle dataset specifically

designed for bank loan scenarios (

https://www.kaggle.com/datasets/ninzaami/loan-

predication/data ). This dataset, encompassing a

wide range of customer scenarios typical in the

financial sector, served as the training ground for

our algorithm, ensuring it reflects real-world banking

decision-making.

We trained a decision tree logic from the data, as

illustrated in Figure 4, along with some exploratory

analysis. We opted for decision trees because their

logic can be relatively easily understood by humans,

which aids in analyzing ethical compliance and un-

derstanding how the algorithm aims to achieve the

business targets.

4.4 RAGADA Experimental

Implementation

In our research, we combined advanced technological

tools and programming languages to operationalize

our algorithm and user stories. We used Apache Atlas

for data management and cataloging, a tool crucial

for maintaining data integrity and compliance in the

banking sector. For processing at the Retrieval Aug-

ICEIS 2024 - 26th International Conference on Enterprise Information Systems

816

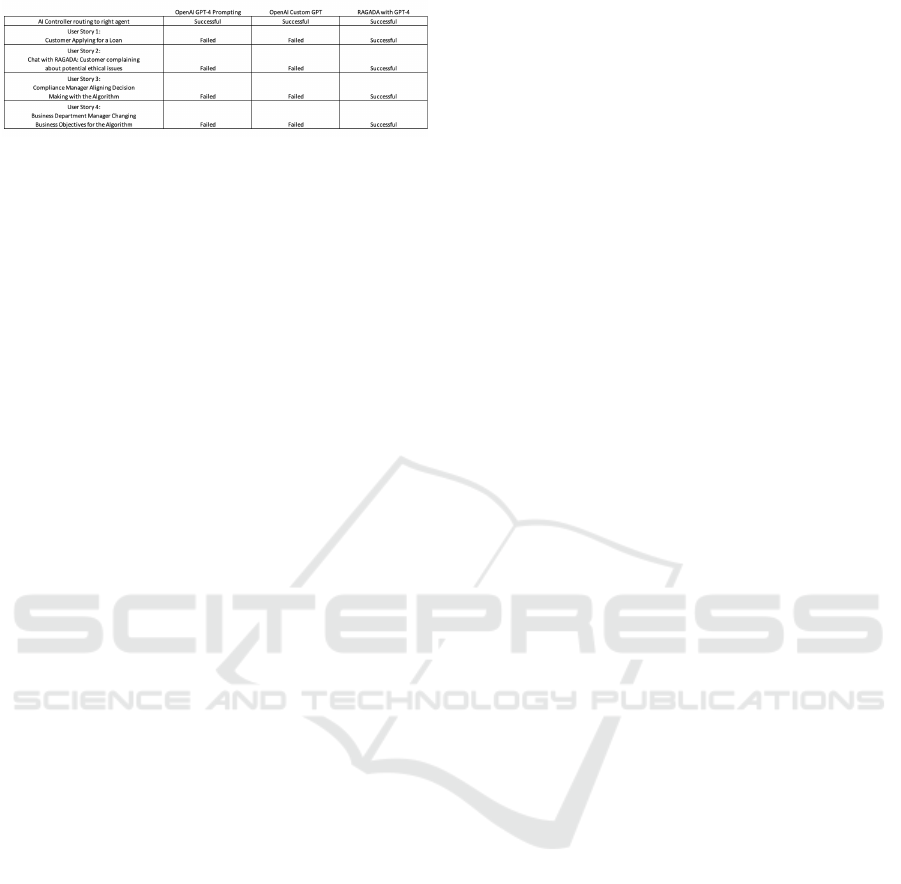

Figure 5: Comparison between: Propted LLM, Custom

GPT and RAGADA.

mented Generation (RAG) level, Python Langchain

was employed, known for its effectiveness in handling

complex language models. This choice allowed for

nuanced interpretation of language patterns, enhanc-

ing user-algorithm interaction. Additionally, Python

Scikit-learn was utilized for training the algorithm,

selected for its comprehensive data analysis tools and

user-friendly interface. Its capability to manage large

datasets and diverse algorithms ensured our model’s

accuracy and adaptability, aligning with our objective

to develop an efficient, user-friendly, and adaptable

algorithm.

4.5 RAGADA Comparison

The performance of RAGADA, integrated with GPT-

4, was compared against other AI configurations, in-

cluding those OpenAI’s GPT models. The results,

as summarized in Figure 5, illustrate RAGADA’s su-

perior performance, achieving successful outcomes

across various scenarios. These ranged from cus-

tomer interactions, such as loan applications and

complaints about ethical considerations, to internal

managerial decisions affecting the system’s business

logic. The success of RAGADA in these user sto-

ries confirms its potential to revolutionize decision-

making processes by leveraging advanced natural lan-

guage understanding and contextually aware AI inter-

actions.

4.6 Role Playing Users Stories with the

System

In developing our system, we focused on natural

language dialogue for intuitive interaction, ensur-

ing user-friendliness across various technical skills.

Comprehensive testing confirmed the interface’s ef-

fectiveness and adaptability, demonstrating the sys-

tem’s ability to dynamically respond to diverse user

inputs and offer tailored solutions in complex scenar-

ios. Next we will go through a couple of previously

described user stories as chat prompts with our RA-

GADA.

4.7 Discussion: Customer Applying for

a Loan

Client: I would like to apply for a short term

loan.

RAGADA: May I confirm that you are inter-

ested in applying for a short-term loan and

wish to proceed with this application? The

interest rate for this loan would be 12 month

EURIBOR + 0.5 percent as bank margin. I

can make an automatic decision once I receive

the necessary input data from you. First, I will

verify the information we have on file from the

CRM system to ensure it is current.

Client: Sounds good!

RAGADA: Certainly, based on our CRM sys-

tem, here are the details we have on record for

your loan application: 1.) Gender: Male 2.)

Married: Yes 3.) Education: Bachelor’s De-

gree 4.) SelfEmployed: No 5.) ApplicantIn-

come: $4,500 per month 6.) CreditHistory:

Yes (indicating a positive credit history) 7.)

PropertyArea: Zip code 10007 (New York)

Please confirm if these details are accurate and

up-to-date.

Client: These are correct!

RAGADA: Excellent, thank you for confirm-

ing. Now, let’s proceed with collecting the re-

maining information needed for your loan ap-

plication. Could you please provide the fol-

lowing details? 1.) Dependents: How many

individuals rely on your income for support?

2.) CoapplicantIncome: If applicable, what

is the monthly or annual income of the co-

applicant? 3.) LoanAmount: How much are

you looking to borrow? 4.) LoanAmount-

Term: Over how many months or years do you

wish to repay this loan?

Once you provide this information, we’ll be

able to complete your loan application pro-

cess.

Client: Here is the information: 1.) De-

pendents: I have one boy who is seven

years old 2.) CoapplicantIncome: my wife

makes $50,000 per year 3.) LoanAmount: I

need $27,500 for new Tesla Model 3 car 4.)

LoanAmountTerm: We were thinking three

years.

RAGADA: Thank you for providing the nec-

essary details. I have now updated your loan

application with the following information:

1.) Dependents: 1 (a seven-year-old boy)

Bridging Human and AI Decision-Making with LLMs: The RAGADA Approach

817

2.) CoapplicantIncome: $50,000 per year (as

contributed by your wife) 3.) LoanAmount:

$27,500 (for the purchase of a new Tesla

Model 3 car) 4.) LoanAmountTerm: 3 years

Could you confirm this data is correct? Af-

ter that I will now call the automatic decision

logic with this information.

Client: Yes, information is correct.

RAGADA: We are pleased to inform you that

your loan application has been successfully

processed and approved through our advanced

automatic decision-making algorithm. As a

result of this approval, the requested funds

have been deposited directly into your bank

account. Should you have any questions or re-

quire further assistance, please do not hesitate

to contact us.

Client: Thank you! This was excellent cus-

tomer service!!!

4.8 Discussion: Customer Complaining

About Potential Ethical Issues

Client: I was recently granted a short term

loan. Thank you for that. However, what

bothers me is that it seems you also used my

address and Zip code in the decision making.

Could you confirm this.

RAGADA: Yes, I can confirm that our

Bank Automatic Algorithm Decision Cata-

logue mentions that Zip Code is used as an

input for short term loan decision making.

Client: I think there are ethical problems us-

ing ZIP code in the automatic decision mak-

ing. Zip code might contain racial signals and

discriminating people who apply for a loan

based on their race.

RAGADA: Thank you for the comment. In

our bank algorithms are not allowed to change

input datasets to decision making automati-

cally. Would you like me to post this ethical

concern to our ethical committee to process?

Client: Yes. Can you also ask your committee

to let me know what they decided?

RAGADA: Of course! I have now created a

ticket for the ethical committee and added you

into the distribution list of the outcome.

Client: Thank you!

4.9 Discussion: Compliance Manager

Aligning Decision Making with the

Algorithm

Compliance Manager: The short-term loan

algorithm currently uses the customer’s Zip

code in the decision-making process. This

data point cannot be used due to potential ethi-

cal issues. Please remove it from the decision-

making process.

RAGADA: I have added a filter to the ’get-

LoanDecision’ algorithm that excludes the

Zip code from the input parameters. This

change has been documented as an audit trail

in the Algorithm Catalog. Currently, I am not

authorized to retrain the model automatically.

If you have concerns about the impact of this

change, I can create a ticket for our data sci-

ence department to analyze the effect.

Compliance Manager: Thank you. Please

proceed with that and include me in the ticket

so I can be informed about the outcome.

RAGADA: Done!

4.10 Discussion: Business Department

Manager Changing Business

Objectives for the Algorithm

Business Department Manager: I have

changed the business objectives of the short-

term loan algorithm from minimizing credit

losses to including a weighted customer ac-

quisition objective. Could you retrain the

model?

RAGADA: Currently, I am not authorized to

retrain the model automatically. However, I

can create a ticket for our data science depart-

ment to analyze the effect.

Business Department Manager: Thank you.

Please proceed with that and include me in the

ticket so I can be informed about the outcome.

RAGADA: Done!

5 DISCUSSION

Our research on the RAGADA model marks a sig-

nificant advancement in bridging gap between hu-

man stakeholders communicating with natural lan-

guage with automatic algorithmic decision-making.

ICEIS 2024 - 26th International Conference on Enterprise Information Systems

818

Focusing on the banking ’getLoanDecision’ algo-

rithm, we’ve unveiled the complexities of algorith-

mic decisions and different stakeholders in finance.

This model handles diverse scenarios, from loan ap-

plications to ethical dilemmas, exemplifying its abil-

ity to streamline customer service and operational ef-

ficiency. However, it also raises ethical issues, like

the use of ZIP codes in decision-making, highlighting

the importance of ethics in algorithm development.

Addressing such concerns proactively, including re-

ferring them to an ethical committee, demonstrates

RAGADA’s potential in managing sensitive matters,

crucial for trust and transparency in banking. Over-

all, RAGADA’s nuanced decision-making approach

offers promising prospects for evolving financial ser-

vices.

6 CONCLUSION AND FUTURE

WORK

This research introduces and validates the RAGADA

model, a novel AI-based software architecture en-

hancing corporate decision-making. Successfully im-

plemented in the banking sector, RAGADA leverages

natural language interfaces to facilitate complex deci-

sions, demonstrating significant advancements in AI

and corporate governance. It has shown potential in

improving decision accuracy, user satisfaction, and

strategic adaptability. Future exploration includes ex-

tending RAGADA’s applicability to various sectors

and enhancing its capabilities for more complex sce-

narios. Emphasizing ethical AI and user-centric de-

sign, the model presents a substantial progression in

AI-integrated corporate decision-making, offering a

blueprint for future advancements in AI-augmented

governance.

REFERENCES

Bender, E. M., Gebru, T., McMillan-Major, A., and

Shmitchell, S. (2021). On the dangers of stochastic

parrots: Can language models be too big? In Pro-

ceedings of the 2021 ACM conference on fairness, ac-

countability, and transparency, pages 610–623.

Borgeaud, S., Mensch, A., Hoffmann, J., Cai, T., Ruther-

ford, E., Millican, K., Van Den Driessche, G. B.,

Lespiau, J.-B., Damoc, B., Clark, A., et al. (2022).

Improving language models by retrieving from tril-

lions of tokens. In International conference on ma-

chine learning, pages 2206–2240. PMLR.

Brown, T., Mann, B., Ryder, N., Subbiah, M., Kaplan, J. D.,

Dhariwal, P., Neelakantan, A., Shyam, P., Sastry, G.,

Askell, A., et al. (2020). Language models are few-

shot learners. Advances in neural information pro-

cessing systems, 33:1877–1901.

Christian, B. (2020). The alignment problem: Machine

learning and human values. WW Norton & Company.

ISBN: 9781786494306.

Dash, R., Kremer, A., and Petrov, A. (2021). Designing

next-generation credit-decisioning models. McKinsey

& Company, White paper, Dec.

Devlin, J., Chang, M.-W., Lee, K., and Toutanova, K.

(2018). Bert: Pre-training of deep bidirectional trans-

formers for language understanding. arXiv preprint

arXiv:1810.04805.

Guu, K., Lee, K., Tung, Z., Pasupat, P., and Chang, M.

(2020). Retrieval augmented language model pre-

training. In International conference on machine

learning, pages 3929–3938. PMLR.

Kaplan, R. S. (1992). The balanced scorecard measures

that drive performance. Harvard business review.

Karpukhin, V., O

˘

guz, B., Min, S., Lewis, P., Wu, L.,

Edunov, S., Chen, D., and Yih, W.-t. (2020). Dense

passage retrieval for open-domain question answer-

ing. arXiv preprint arXiv:2004.04906.

Lewis, P., Perez, E., Piktus, A., Petroni, F., Karpukhin,

V., Goyal, N., K

¨

uttler, H., Lewis, M., Yih, W.-t.,

Rockt

¨

aschel, T., et al. (2020). Retrieval-augmented

generation for knowledge-intensive nlp tasks. Ad-

vances in Neural Information Processing Systems,

33:9459–9474.

Olesen-Bagneux, O. (2023). Enterprise Data Catalog.

O’Reilly Media. ISBN: 149209871X.

Petroni, F., Rockt

¨

aschel, T., Lewis, P., Bakhtin, A., Wu,

Y., Miller, A. H., and Riedel, S. (2019). Lan-

guage models as knowledge bases? arXiv preprint

arXiv:1909.01066.

Rosenschein, J. S. and Zlotkin, G. (1994). Rules of en-

counter: designing conventions for automated nego-

tiation among computers. MIT press.

Stone, P. and Veloso, M. (2000). Multiagent systems: A sur-

vey from a machine learning perspective. Autonomous

Robots, 8:345–383.

Vaswani, A., Shazeer, N., Parmar, N., Uszkoreit, J., Jones,

L., Gomez, A. N., Kaiser, Ł., and Polosukhin, I.

(2017). Attention is all you need. Advances in neural

information processing systems, 30.

Wilson, E. O. (1999). Consilience: The unity of knowledge.

Vintage; Reprint edition. ISBN: 978-0679768678.

Wooldridge, M. (2009). An introduction to multiagent sys-

tems. John wiley & sons.

Bridging Human and AI Decision-Making with LLMs: The RAGADA Approach

819