The Future of Oil and Gas Offloading: Leveraging Blockchain for

Enhanced Transparency and Efficiency

Paulo Henrique Alves

1 a

, Isabella Frajhof

1

,

´

Elisson Michael Ara

´

ujo

1

, Rafael Nasser

1 b

,

Gustavo Robichez

1

, Cristiane Lodi

2

, Carlos Henrique Fernandes

2

, Rhenan Borges

2

and Gilson Lopes

2

1

ECOA Institute, Pontificial University Catholic of Rio de Janeiro, RJ, Brazil

2

Petrobras, Rio de Janeiro, Brazil

Keywords:

Blockchain, Offloading, Lifting, Loan, Refund.

Abstract:

In the dynamic and complex arena of the oil and gas sector, the management of offloading activities presents

considerable challenges, particularly regarding data transparency, distribution, security, and financial transac-

tions involving multiple parties, e.g., companies in a joint venture. The nature of multiple-party environments

requires a high level of systematization, transparency, and activity orchestration to manage these challenges

effectively. To address these challenges, this paper explores an innovative solution employing blockchain

technology, creating efficient mechanisms to enhance transparency and the security of recorded transaction.

The solution specifically focuses on the processes of oil production recording, lifting schedule management,

and the intricate handling of loans and refunds. We underscore the criticality of managing loans and refunds

to facilitate the lifting process, ensuring equitable oil volume distribution among consortium members. Thus,

this work presents a comprehensive blockchain-based system that provides the accuracy and integrity of data,

enhancing transparency and trust among consortium participants. This system seamlessly integrates all stages

of offloading operations, from planning to execution, thereby revolutionizing crucial data management prac-

tices in the oil and gas sector by applying blockchain technology. Our findings suggest that implementing such

technology in this context fosters a collaborative, trustworthy, secure, and efficient operational environment.

1 INTRODUCTION

FPSO (Floating Production, Storage and Offloading)

technology is a widely used method for extracting

offshore oil and gas (O&G) reserves (Gaidai et al.,

2021). The offloading process in an O&G consor-

tium gathers activities from lifting planning to lift-

ing execution. This process faces a variety of chal-

lenges in integrating not only internal data, but also

data from other companies. These challenges mirror

the complexities found in ERP (Enterprise Resource

Planning) systems, where the integration of diverse

data streams across departments is crucial (LaGrange

and Maisey, 2019; Son and Lee, 2019). In the of-

floading process, this integration encompasses coor-

dinating approvals, auditing activities, and managing

the flow of process of data across multiple companies

(Ara

´

ujo et al., 2019). This intricate task requires a

a

https://orcid.org/0000-0002-0084-9157

b

https://orcid.org/0000-0002-6118-0151

system capable of handling diverse expectations and

operational protocols.

In 2013, the exploration of the Mero unitized field

in Brazil’s pre-salt area commenced under the Pro-

duction Sharing Agreement (PSA). This marked a

crucial milestone in Brazil’s oil sector and it was

a key aspect of the government’s inaugural bidding

round (Carlotto et al., 2017). Libra was the win-

ning consortium to explore the Mero unitized field.

Such consortium is formed by Petrobras, respon-

sible for operating the joint venture, Shell Brasil,

TotalEnergies, China National Petroleum Corpora-

tion (CNPC) and CNOOC as partners, and Pre-Sal

Petr

´

oleo S.A (PPSA), representing the Federal Gov-

ernment (de Melo et al., 2019; Nasser et al., 2020).

Petrobras recently achieved a milestone with FPSO

Guanabara, recording its highest monthly production

on a pre-salt platform with 179 thousand barrels per

day

1

. Such achievement is a strong evidence of the

1

https://www.presalpetroleo.gov.br/eng/noticias/fpso-

366

Alves, P., Frajhof, I., Araújo, É., Nasser, R., Robichez, G., Lodi, C., Fernandes, C., Borges, R. and Lopes, G.

The Future of Oil and Gas Offloading: Leveraging Blockchain for Enhanced Transparency and Efficiency.

DOI: 10.5220/0012721400003690

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 26th International Conference on Enterprise Information Systems (ICEIS 2024) - Volume 1, pages 366-373

ISBN: 978-989-758-692-7; ISSN: 2184-4992

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

production potential of this field, which means a con-

siderable high amount of generated data.

In regards to offloading activities, efficiently man-

aging and transparently distributing critical data re-

lated to oil production, lifting schedules, and exe-

cution, including financial aspects like loans and re-

funds, presents a significant challenge. The involve-

ment of numerous consortium members, operators

and non-operators, often results in high human re-

source costs for recording and managing these ac-

tivities, as well as keeping consortium companies in-

formed.

In this sense, blockchain technology emerges as

a solution to these challenges. Its decentralized ap-

proach and immutable ledger provide a framework

for transparent and efficient process management, ad-

dressing transparency, data integrity, and trust among

consortium members. Moreover, the oil and gas

industry has implemented blockchain technology in

several instances. This indicates the recent adoption

of this technology in this sector (Miranda et al., 2023;

Alves et al., 2022; Batista et al., 2023).

OffloadingBR was developed to leverage

blockchain technology for offloading operations in

the O&G sector. This system, built on the Hyper-

ledger Fabric (HF) platform (Kumar and Barua,

2023), offers a permissioned network for secure

and transparent data management. It integrates key

offloading operations, including production volume

recording, lifting schedule management, and handling

loans and refunds. With smart contract functionality,

OffloadingBR automates contractual obligations

and operational rules to improve transparency and

efficiency.

This paper is structured as follows. Section 2 fo-

cuses on the Libra consortium application context,

and section 3 discusses the related work. Section

4 presents the OffloadingBR solution, while section

5 discusses the use of a private blockchain network.

Section 6 presents the solution limitations. Finally,

section 7 presents the conclusion and future work.

2 APPLICATION DOMAIN

As mentioned before, the Mero field model, formal-

ized under the PSA, was part of the first bidding round

of the pre-salt organized by the Brazilian government

(Carlotto et al., 2017).

The Mero unitized field is explored by the Li-

bra consortium, composed by Petrobras, serving as

the Operator with a 38.6% stake, Shell Brasil and

guanabara-breaks-pre-salt-production-record/

TotalEnergies, each holding 19.3%, and CNPC and

CNOOC, each with a 9.65% share, and PPSA with a

3.5% of participation.

According to the PSA, the distribution of pro-

duced oil volume follows a defined structure. Each

cubic meter (m³) of oil produced in an FPSO is pro-

portionally divided, with PPSA entitled to its share

of oil profit, and the remaining volume following the

proportion foreseen in the PSA.

A collaborative research, development and in-

novative project was initiated with the Pontifical

Catholic University of Rio de Janeiro (PUC-Rio), in

compliance with the research and development obli-

gation foreseen on the PSA

2

. Aiming to pursue tech-

nological innovation within the Libra consortium, this

project focuses on leveraging blockchain technology

to enhance operational efficiency and transparency.

This collaboration resulted in the development of the

OffloadingBR, a blockchain-based offloading system,

which will be presented on the following sections.

3 RELATED WORK

This section provides an overview of the current state

of the art in digital innovations in the O&G sec-

tor. It particularly focuses on core industry activities,

such as offloading, consortia deliberation process, and

other activities associated with FPSO’s. The goal is to

highlight the advancements and identify possible gaps

compared to our solution.

Yasseri and Bahai present a system, with an engi-

neering approach, emphasizing the need for efficient

interface management (IM) during the design phase to

minimize late changes and ensure cost-effectiveness

(Yasseri and Bahai, 2019). This paper also mentions

that an effective IM system shall handle the complex

data requirements of FPSO projects. These systems

must be capable of capture, store, and process large

volumes of diverse data to support decision-making

and project management. In this sense, OffloadingBR

represents an advancement in coordinating the plan-

ning, execution, and oversight of loan and refund op-

2

The RD&I Clause is an obligation foreseen in explo-

ration, development, and production of oil and natural gas

agreements. Such obligation is regulated by the National

Petroleum Agency (ANP). Under concession agreements,

the RD&I clause establishes that the concessionaire must

disburse expenses qualified as research and development,

corresponding from 1% to 0.5% of the gross revenue of the

camp production due to Special Participation. Regarding

the sharing agreement and onerous concession, the value

varies from 1% to 0.5% of the annual gross revenue of the

oil camp

The Future of Oil and Gas Offloading: Leveraging Blockchain for Enhanced Transparency and Efficiency

367

erations, contributes to managing FPSO data effec-

tively.

Affonso et al. highlight how traditional document-

centric processes in engineering can be replaced by

a data-centric approach, enhancing quality, consis-

tency, and reducing design costs and time (Affonso

et al., 2020). The authors discuss the significance

of R&D and digital innovation across many organi-

zational sectors, emphasizing the need for workforce

engagement and mindset change to appreciate digi-

tal technologies. In this sense, blockchain technolo-

gies can address these needs in R&D projects with

the collaboration between the university and industry,

e.g., OffloadingBR built under the Libra Consortium

collaboration with a Brazilian university.

Duggal and Minnebo detail the adaptability of FP-

SOs in various offshore oil-producing basins, high-

lighting technological advancements, key projects,

and future trends, including digitalization and car-

bon footprint reduction (Duggal and Minnebo, 2020).

In this sense, OffloadingBR proposes digitalization

by developing a blockchain-based solution, allowing

data persistence, transparency, and distribution.

The authors in (Cotrim et al., 2022) show im-

provements in data simulation in offloading activities.

The study demonstrates that Artificial Neural Net-

work (ANN) models trained on actual metocean con-

ditions

3

can provide increased accuracy and reduce

computational time compared to traditional methods.

This approach also allows for continuous fine-tuning

and updating models with new data, improving ac-

curacy over time. The authors also highlight the im-

portance of data acquisition, specifically concerning

the sensitivity and restrictions on the complete dataset

used in the research. Thus, OffloadingBR is a first

step towards a data lake construction related to of-

floading activities.

These studies highlighted the evolution from tra-

ditional, document-centric processes to innovative

data-centric approaches with the use of blockchain

technology in O&G consortia. Systems such as Of-

floadingBR represent a milestone regarding registra-

tion and distribution of complex data, as well as coor-

dination of operations in a multiparty environment.

3

Metocean conditions refer to the combined wind,

wave, and climate conditions in a particular location.

4 A BLOCKCHAIN-BASED

SOLUTION FOR OFFLOADING

ACTIVITIES

In the contemporary O&G sector, a significant chal-

lenge lies in the efficient management and transparent

distribution of critical data regarding (i) oil produc-

tion, (ii) lifting schedule, and (iii) lifting execution,

which includes financial transactions such as loans

and refunds. The complexity of these operations, in-

volving multiple consortium members with different

roles, often leads to high human resource costs, spe-

cially for the Operator, responsible for leading this

process.

The complexity involved in the lifting and offload-

ing life cycle happens because when a lifting oc-

curs, each cubic meter (m³) of oil must be proportion-

ally distributed among its members according to each

member’s participation as foreseen in the PSA. With

some exceptions, the withdrawal of the produced oil

is commonly carried out by one company at a time.

Considering that, as a rule, only a single ship will per-

form the offloading. However, such ship has a limited

cargo capacity. Also, each cubic meter belongs pro-

portionally to each company in the consortium, there-

fore, the oil lifting involves, simultaneously, a relief

and a mutual action. For example, let’s consider a

scenario where a ship has a capacity of 80,000 m³, but

Company A only possesses 40,000 m³ of produced

oil. To address this imbalance and optimize shipping

efficiency, the Operator plays a crucial role in manag-

ing loans between consortium companies. This pro-

cess enables Company A to borrow the required vol-

ume of oil from other members, thereby fully utilizing

the ship’s capacity of 80,000 m³..

The lifting process involves recording oil produc-

tion and management of lifting, loan, and refund, such

as: importing production and stock values, organiz-

ing dates and ships’ authorization for oil lifting, cal-

culating and predicting loan and refund values, and

informing other consortium companies. Considering

that this involves crucial business information, the

process and calculus must be flawless, since any er-

ror can seriously impact the lifting, causing relevant

money loss.

To facilitate the management of the lifting and

offloading process, we conducted several meetings

with the Operator’s stakeholders in 2022 and 2023

to address these challenges. These meetings accel-

erated the agile development of the system, by en-

abling rapid stakeholder feedback and fast system de-

velopment. Two challenges emerged during these

meetings: the need to automate the process and data

sharing with consortium members. The automation

ICEIS 2024 - 26th International Conference on Enterprise Information Systems

368

was important to increase efficiency, security and data

availability, since most of the activities were man-

ually done. Data sharing was important to assure

transparency of core business data between consor-

tium members, enhancing trust between them.

Using blockchain technology in this context pro-

vides a transparent, secure, and efficient mechanism

for recording these transactions. Each loan and vol-

ume of oil exchanged are recorded on the blockchain

ledger. This ensures that all transactions are trans-

parent and immutable, thus maintaining the integrity

of the PSA and fostering trust among the consortium

members.

The blockchain’s ability to provide a transparent

and auditable trail of these transactions is pivotal in

these complex logistical operations. The intricate pro-

cess of managing oil production, lifting, loans, and

refunds within the consortium lends itself perfectly to

the capabilities of blockchain technology.

Furthermore, the blockchain smart contracts en-

sure that all actions, from loan issuance to oil volume

distribution, strictly adhere to the PSA. Thus, com-

pliance is assured by the agreed-upon terms imple-

mented in the smart contracts.

The decentralized nature of blockchain requires

that any creation or modification of these smart con-

tracts must receive the consensus of all network par-

ticipants, thereby ensuring unanimous agreement and

commitment to the terms set forth. By embedding

these operational rules within the blockchain, the

technology ensures transparency, efficiency, and se-

curity, eliminating the potential for disputes and dis-

crepancies. The immutable and transparent nature

of blockchain, combined with the enforceability of

smart contracts, revolutionizes how consortium mem-

bers interact, transact, and maintain compliance.

4.1 Recording Oil Production

The first step towards offloading activities in the O&G

consortium involves registering oil production data in

a daily basis. In this phase, the consortium Operator

is responsible for registering production data and dis-

tributing the oil m³ for each member company. This

information includes the volume of oil produced by

each company. The latter forms the basis for deter-

mining subsequent lifting schedules and allocations.

Leveraging blockchain technology in this context is

particularly advantageous. Once the Operator inputs

the production data into the blockchain system, it is

instantly and automatically disseminated across the

entire network, becoming immutable.

Consortium members, including non-operators,

can access the blockchain ledger to verify production

volumes, ascertain which company is scheduled for

lifting, and understand the quantity of oil allocated

for each lift. The blockchain’s immutable ledger en-

sures that, once recorded, the production data cannot

be altered, thus confirming its accuracy and reliabil-

ity. This process not only streamlines the decision-

making regarding oil lifting but also fosters a high

degree of trust among consortium members by pro-

viding a transparent and indisputable oil production

record.

4.2 Lifting Schedule Steps

The second stage is related to lifting schedule man-

agement. This comprises four major steps: (i) entitle-

ment determination, (ii) cargo nomination, (iii) provi-

sional lifting schedule, and (iv) final lifting schedule,

as depicted in Figure 1.

Figure 1: Lifting planning steps.

The entitlement determination involves the Oper-

ator disclosing to the consortium members the lifting

activities. This includes three key information com-

ponents: (i) an estimate of the oil production for the

upcoming two months, (ii) planned liftings for the

current month, and (iii) a balance of the oil stock of

the past three months. This information is crucial for

all subsequent decisions regarding lifting schedules.

The entitlement determination process is designed to

give all consortium members a clear and comprehen-

sive overview of available resources, upcoming pro-

duction, and current stock. This ensures that all par-

ties are equally informed and that the lifting process

can be planned efficiently and equitably.

Following the entitlement determination, the next

step involves consortium members setting cargo nom-

ination values for the Operator individually, i.e., the

values are not public; only the Operator can access

the suggested values. The cargo nomination includes

details about the date and volume of oil available for

lifting. Upon receiving these nominations, the Oper-

ator initiates the next step, i.e., the provisional lift-

ing schedule. In this step, the Operator reviews and

publishes the lifting schedule. All consortium mem-

bers can also review and, if necessary, request updates

while justifying the reasons for the change. This step

is crucial for maintaining transparency and fairness in

The Future of Oil and Gas Offloading: Leveraging Blockchain for Enhanced Transparency and Efficiency

369

the allocation process, confirming the requested cargo

nominations and ensuring compliance with the agree-

ment rules. In cases where updates are required, the

Operator review the nominations to reflect accurate

dates and volumes before sending the provisional lift-

ing schedule. This schedule is an initial plan, laying

out the framework for how and when the lifting activ-

ities shall be executed according to the current knowl-

edge of oil production and contract rules.

The final phase in the lifting schedule manage-

ment involves the Operator finalizing and sharing the

lifting schedule. This final schedule is informed by

the current production volume data and projections

for the following months, up until when the lifting is

executed. It is essential for this schedule to be both

accurate and adaptable, as it guides the operational

planning for all consortium members. Recognizing

the dynamic nature of oil production, the Operator pe-

riodically updates the final lifting schedule. These up-

dates are particularly important when the actual vol-

ume of oil produced deviates from initial forecasts.

By continuously adjusting the schedule to reflect the

most updated production data, the Operator ensures

that the lifting process remains aligned with the ac-

tual output, thereby maximizing efficiency and mini-

mizing discrepancies.

A pivotal element in managing the lifting schedule

is the requirement of digital signatures at each step,

ensuring the authenticity and non-repudiation of the

agreed-upon schedules and transactions. To address

this need, our proposed solution supports compatibil-

ity with two distinct digital signature solutions: Assi-

nadorBR (Paskin et al., 2020) and Adobe Sign

4

.

AssinadorBR is a cutting-edge, blockchain-based

application that offers integration with HF, Hyper-

ledger Besu, Ethereum, and Amazon Quorum DB.

The financial implications of using AssinadorBR vary

depending on the chosen blockchain platform. For in-

stance, choosing HF incurs no transaction cost. On

the other hand, Adobe Sign presents a more tradi-

tional digital signature approach, anchoring user iden-

tity to email addresses. It operates on a different

cost structure based on the signature package selected

from Adobe. Providing these two diverse digital sig-

nature options empowers the consortium Operator

with the flexibility to choose the solution that best

aligns with their operational needs and cost consid-

erations.

4

https://www.adobe.com/sign.html

4.3 Lifting Execution with Loans and

Refunds

The success of O&G lifting depends on the efficient

management of loans and refunds during execution.

In this phase, the Operator orchestrates loans to en-

able the lifting company to match the capacity of its

ship with the production volume of the FPSO. These

loans are proportionately distributed among partners

holding a positive oil stock relative to their produc-

tion volume.

As presented in Eq. 1, PSLV (Partners Suggested

Loan Volume) is a result of the lifter required vol-

ume (V

Req

) times the volume available to lend (VAL

i

)

divided by the sum of all partner produced volume

(PPV), where i is a specific company and n is the num-

ber of consortium members. This calculus guarantees

that all partners are lending the proportional oil vol-

ume related to how much was produced. Moreover,

the data integration between produced volumes with

lifting execution allows the system to suggest volume

values so that the Operator can register it, enhancing

process transparency and activities efficiency.

PSLV

i

= V

Req

×

VAL

i

n

∑

j=1

PPV

j

(1)

A vital aspect of this system is the timely repay-

ment of loans. Ideally, it shall happen before sub-

sequent lifting activities, to steadily clear any out-

standing balances. Eq. 2 presents how refunds are

calculated. PSRV (Partner Suggested Refund Vol-

ume) is a result of the Volume Produced by the Lifter

(V

ProducedByLi fter

) in a certain time range times the

Partner’s Pending Loan Volume (PPLV

i

) divided by

the sum of Partners Borrowed Volume (PBV), where

i is a specific company and n is the number of consor-

tium members.

PSRV

i

=

(

PSRV

i

, if PSRV

i

≤ PPLV

i

PPLV

i

, otherwise

(2)

where PSRV

i

= V

ProducedByLi fter

×

PPLV

i

n

∑

j=1

PBV

j

.

The refund process is equally intricate, where pay-

ments are distributed proportionally among loaners,

except in cases where the next lifter has open loans,

i.e., loans that were not paid off completely. In such

scenarios, the lifter with open loans is prioritized for

maximum refund, while the remaining volume is re-

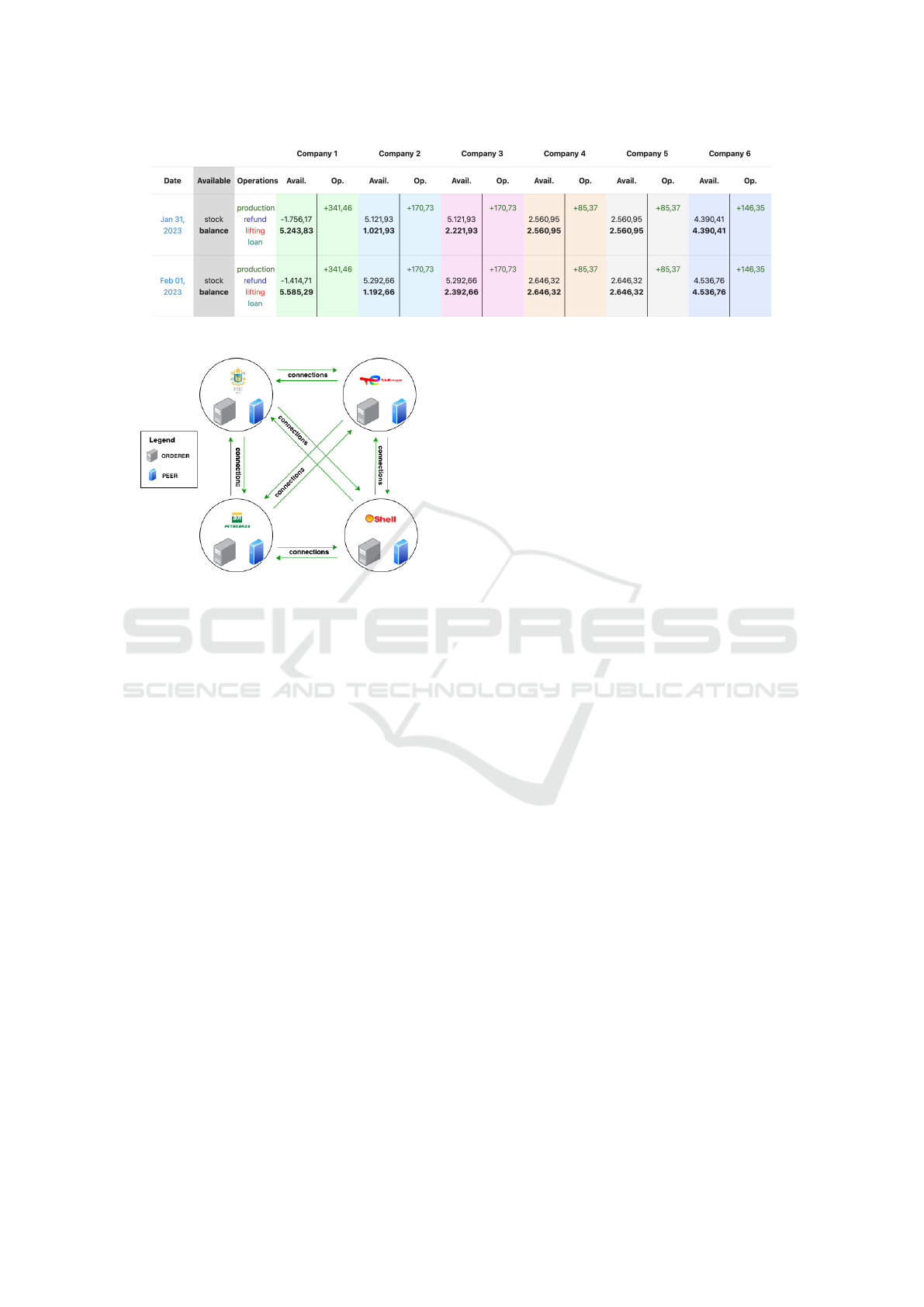

distributed among other loaners. Figure 2 presents an

ICEIS 2024 - 26th International Conference on Enterprise Information Systems

370

example of multiple calculus that can occur on the

same day and the need to integrate all these data to

consider all variables when planning the offloading

activities

5

.

In this figure, each company is represented by a

specific color, and information about the company ap-

pears in two columns. The first column shows the

stock and balance volumes of the company on a par-

ticular date. The second column displays the produc-

tion, loan, refund, and lifting volumes. These values

are indicated by a plus or minus sign, which repre-

sents the operation carried out in the company’s bal-

ance.

The Company Balance Volume (CBV ) encapsu-

lates the available oil volume for each company in the

consortium on a given date. It is calculated consid-

ering Previous Day’s Balance (B

DayBe f ore

), Produced

Volume (PV ), Borrowed Volume (BV ), Lent Volume

(LV ), Refund Received Volume (RRV ), Sent Refund

Volume (SRV ), and Executed Lifting Volume (ELV ).

Eq. 3 consolidates transactional volumes to represent

the company’s available oil stock.

At the initial point of calculation, B

DayBe f ore

is

equal to the company’s existing stock. The inclusion

of PV in the formula accounts for new oil production,

BV and LV represent the volumes of oil borrowed and

lent, respectively, while RRV and SRV account for the

volumes of refunds received and sent. CBV is an in-

dispensable metric for decision-making and planning

in the O&G consortium, ensuring that each member

accurately understands their available resources for

operational activities.

CBV = B

DayBe f ore

+ PV + (BV − LV )+

(RRV − SRV ) − ELV

(3)

This complex management of loans and refunds,

currently managed through manual data sheets, un-

derscores a significant challenge in data coherence

and accessibility. It is critical to have an integrated so-

lution that covers all aspects of the lifting process, in-

cluding schedule planning, execution, and even loans

and refunds. By ensuring that all relevant data is co-

hesively integrated and easily accessible, the consor-

tium can move towards a more efficient, transparent,

and reliable operational framework, thereby enhanc-

ing overall effectiveness in the O&G sector.

5

These data do not reflect the real data, only for example

purposes.

5 OIL AND GAS BLOCKCHAIN

NETWORK

5.1 Technical Infrastructure and

Functionality

OGBN was built on the HF platform. This platform

allows the creation of private channels, allowing sub-

sets of network participants to engage in confidential

transactions and data sharing. This feature is par-

ticularly beneficial in the O&G sector, where oper-

ations often involve business sensitive data and re-

quire selective disclosure among various stakehold-

ers. The flexibility to establish private channels en-

ables OGBN members to use a common infrastructure

while maintaining the confidentiality and integrity

of their individual operations. Figure 3 depicts the

OGBN architecture.

This architecture illustrates that each participant

possesses an instance of both the Peer and Orderer

nodes. Peer nodes are responsible for maintaining

the ledger and executing the smart contracts (known

as chaincode in HF). These nodes enable consor-

tium members to submit transactions, interact with

the ledger, and ensure that their copy of the ledger

is up-to-date and consistent with the network’s state.

The significance of Peer nodes lies in their ability to

facilitate transparency and immutability, ensuring that

all transactions and data within the OffloadingBR sys-

tem are verifiable and trustworthy.

In contrast, Orderer nodes are essential for main-

taining the overall health and consensus of the

blockchain network. These nodes take on the respon-

sibility of ordering transactions into blocks and dis-

tributing them to all Peer nodes in the network. The

Orderer nodes ensure that transactions are processed

in an orderly and efficient manner, thereby prevent-

ing potential conflicts and maintaining the integrity

of the blockchain. This ordered sequence of transac-

tions is critical in scenarios like offloading operations,

where the accuracy and chronological order of trans-

actions, such as lifting schedules and loan payments,

are paramount.

Moreover, HF’s capacity for creating private chan-

nels is particularly advantageous for OffloadingBR.

It allows different consortia to engage in confidential

transactions and data sharing, in a common infrastruc-

ture. This feature is crucial for managing the diverse

and often confidential data involved in offloading op-

erations, such as production volumes, lifting sched-

ules, and financial transactions related to loans and

refunds in different consortia.

Another significant benefit of HF is its scalabil-

ity and performance efficiency. Given the volume of

The Future of Oil and Gas Offloading: Leveraging Blockchain for Enhanced Transparency and Efficiency

371

Figure 2: Example of companies’ balance.

Figure 3: OGBN architecture.

transactions and the complexity of data in offload-

ing operations, HF’s ability to handle high transac-

tion with minimal latency is key to maintaining op-

erational efficiency. This ensures that OffloadingBR

can operate smoothly under demanding conditions.

5.2 Applications and Potential Impact

The deployment of OGBN creates relevant opportu-

nities for numerous applications, ranging from im-

proving the efficiency of supply chain logistics to en-

hancing the transparency of transactions and opera-

tions. By providing a shared, yet secure and cus-

tomizable platform, OGBN facilitates seamless data

exchange and process coordination among its mem-

bers. The potential impact of OGBN extends be-

yond operational efficiencies to include advancements

in regulatory compliance, environmental monitoring,

and resource optimization, thereby contributing to the

overall sustainability and progress of the O&G sector.

OGBN already supports other applications in the

O&G sector, such as BallotBR (Alves et al., 2022).

The latter is a solution designed to support voting and

communication actions in a consortium environment.

The implementation of BallotBR within the OGBN

ecosystem indicates the network’s versatility and ca-

pacity to support a diverse range of blockchain appli-

cations, which includes the OffloadingBR solution.

Thus, in the context of the offloading use case

within the O&G sector, a permissioned blockchain

model is the most appropriate approach. This pref-

erence is rooted in the industry’s unique requirements

for confidentiality, control, and compliance. A per-

missioned blockchain, unlike its public counterpart,

allows for selective access control, meaning that only

authorized participants can join the network, which is

crucial in the O&G industry.

Furthermore, the ability to enforce specific gov-

ernance rules and protocols within a permissioned

blockchain aligns with the industry’s need for strin-

gent regulatory adherence and operational consis-

tency. This controlled environment not only fortifies

security and trust among participants but also enables

a more efficient and coordinated approach to offload-

ing operations. By ensuring that each member ad-

heres to the agreed-upon rules and processes, the per-

missioned blockchain model facilitates a harmonious

and transparent operational framework.

6 LIMITATIONS

The proposed solution, while effective, encounters

limitations in its integration with the Operator’s Pro-

duction Import System (SIP) and SAP systems. These

systems are used to collect data from FPSO and man-

age invoices regarding the lifted oil, loans, and re-

funds. Currently, production data is manually im-

ported using Excel sheets. Despite this limitation,

once data is uploaded into the system, it adheres to

a write-only protocol. This means any subsequent

changes to the data are recorded, maintaining a histor-

ical record on the blockchain, ensuring data integrity

and traceability.

Additionally, while the system has been primarily

developed from the perspective of the Operator, who

plays a central role in the offloading environment, it

is also designed for use by non-operator companies.

Thus, their participation and feedback are crucial, as

they provide diverse insights and contribute to the sys-

tem’s continuous improvement, ensuring it meets the

broader needs of all consortium members.

ICEIS 2024 - 26th International Conference on Enterprise Information Systems

372

7 CONCLUSION AND FUTURE

WORK

In conclusion, our study demonstrates the potential

of blockchain technology in the O&G offloading ac-

tivity. By enhancing transparency and efficiency,

blockchain offers a transformative solution to long-

standing challenges in this industry. Our findings

suggest significant improvements in operational pro-

cesses and management, which are manually made,

laying the groundwork for more reliable and stream-

lined operations.

However, the adoption of this technology also

presents limitations and challenges that warrant fur-

ther investigation. This study serves as a stepping

stone toward a broader discussion on technologi-

cal advancements in the energy sector, underscoring

the need for continuous innovation and adaptation.

Moreover, integrating offloading data, which links oil

production, lifting planning and execution, and loan

and refund processes, marks a significant advance in

digitalization and efficiency enhancement within the

O&G industry.

In future work, we expect to perform qualitative

studies and execute a Technology Acceptance Model

(TAM) methodology to receive the non-operator part-

ner’s feedback structure. Finally, we aim to enhance

the OffloadingBR data integration, connecting with

SIP and SAP systems.

REFERENCES

Affonso, I. D., Santos, M. B. d., Arag

˜

ao, R. R., Vieira,

P. F., Diniz, F. C., Rodrigues, B. A., and Queiroz, J. L.

(2020). Digital Transformation as a Tool for FPSO

Project Acceleration. volume Day 4 Thu, May 07,

2020 of OTC Offshore Technology Conference, page

D041S055R003.

Alves, P. H., Frajhof, I. Z., Ara

´

ujo,

´

E. M., Miranda, Y. R.,

Nasser, R., Robichez, G., Paskin, R., Garcia, A., Lodi,

C., Pacheco, F., Moreno, M., Flach, E., and Cav-

alcante, M. A. (2022). Blockchain-based enterprise

ballots in an oil and gas consortium. In Filipe, J.,

´

Smiałek, M., Brodsky, A., and Hammoudi, S., edi-

tors, Enterprise Information Systems, pages 211–235,

Cham. Springer International Publishing.

Ara

´

ujo, J. B., Fernandes, A. C., Jr., J. S. S., Thurler, A. C.,

and Vilela, A. M. (2019). Innovative Oil Offloading

System for Deep Water. volume Day 2 Tue, May 07,

2019 of OTC Offshore Technology Conference, page

D022S057R006.

Batista, D., Mangeth, A. L., Frajhof, I., Alves, P. H., Nasser,

R., Robichez, G., Silva, G. M., and Miranda, F. P. d.

(2023). Exploring blockchain technology for chain

of custody control in physical evidence: A systematic

literature review. Journal of Risk and Financial Man-

agement, 16(8).

Carlotto, M. A., da Silva, R. C. B., Yamato, A. A., Trindade,

W. L., Moreira, J. L. P., Fernandes, R. A. R., Ribeiro,

O. J. S., Gouveia Jr, W. P., Carminati, J. P., Qicai, D.,

et al. (2017). Libra: A newborn giant in the brazilian

presalt province.

Cotrim, L. P., Barreira, R. A., Santos, I. H. F., Gomi, E. S.,

Costa, A. H. R., and Tannuri, E. A. (2022). Neu-

ral network meta-models for fpso motion prediction

from environmental data with different platform loads.

IEEE Access, 10:86558–86577.

de Melo, R. T., dos Santos, T. M., Valenc¸a, C. J. G. M.,

Buk Jr, L., Pereira, R. M., Passarelli, F. M., and

Hoelz, F. R. (2019). Libra Subsea Achievements and

Future Challenges. volume Day 1 Mon, May 06,

2019 of OTC Offshore Technology Conference, page

D011S009R005.

Duggal, A. and Minnebo, J. (2020). The Floating

Production, Storage and Offloading System – Past,

Present and Future. volume Day 2 Tue, May 05,

2020 of OTC Offshore Technology Conference, page

D021S017R005.

Gaidai, O., Xu, X., Sahoo, P., Ye, R., and Cheng, Y. (2021).

Extreme hawser tension assessment for fpso vessel

during offloading operation in bohai bay. Marine

Structures, 76:102917.

Kumar, S. and Barua, M. K. (2023). Exploring the hyper-

ledger blockchain technology disruption and barriers

of blockchain adoption in petroleum supply chain. Re-

sources Policy, 81:103366.

LaGrange, E. and Maisey, J. (2019). New Concepts for a

Normally Unattended Installation NUI – Design, Op-

eration, Automation, and Digitalization. volume Day

3 Wed, May 08, 2019 of OTC Offshore Technology

Conference, page D031S032R002.

Miranda, Y., Alves, P., Paskin, R., Nasser, R., Robichez, G.,

Faria, L., Trindade, R., Silva, J., Peixoto, L., and Mi-

randa, F. (2023). Enhancing corporate social responsi-

bility with blockchain-based trackable esg tokens. In

Anais do VI Workshop em Blockchain: Teoria, Tec-

nologias e Aplicac¸

˜

oes, pages 112–125, Porto Alegre,

RS, Brasil. SBC.

Nasser, R. B., Lodi, C., Alves, P. H. C., Frajhof, I. Z., Mi-

randa, Y. R., Araujo, E. M. F., Silva, F. P. T., Vianna,

R., and Moreno, M. V. B. (2020). Distributed ledger

technology in the oil and gas sector: Libra ballot use

case. Rio Oil and Gas.

Paskin, R., Jardim, J. G., Miranda, Y. R., Frajhof, I., Alves,

P. H. C., Miranda, F. P., Gama, C., Ladeira, R., Nasser,

R. B., and Robichez, G. (2020). Blockchain digital

signatures in a big corporation: a challenge for costs

management sector. Rio Oil and Gas.

Son, B.-Y. and Lee, E.-B. (2019). Using text mining to

estimate schedule delay risk of 13 offshore oil and gas

epc case studies during the bidding process. Energies,

12(10).

Yasseri, S. F. and Bahai, H. (2019). Interface and inte-

gration management for fpsos. Ocean Engineering,

191:106441.

The Future of Oil and Gas Offloading: Leveraging Blockchain for Enhanced Transparency and Efficiency

373