Metasurance: A Blockchain-Based Insurance Management Framework

for Metaverse

Aritra Bhaduri

1 a

, Ayush Kumar Jain

1

, Swagatika Sahoo

1,2 b

, Raju Halder

1 c

and Chandra Mohan Kumar

1

1

Indian Institute of Technology Patna, India

2

Kalinga Institute of Industrial Technology, India

Keywords:

Metaverse, Virtual Assets, Insurance, Blockchain, Hyperledger Fabric.

Abstract:

The worlds of commerce, business, entertainment, education, and healthcare are set for a transition into the

Metaverse, enabling people to socialize, shop, invest, manufacture, buy, and sell in the virtual world. This

paradigm shift introduces a myriad of risks and threats to the virtual assets, unveiling new avenues for the

insurance marketplace to thrive. This paper presents Metasurance, a blockchain-based decentralized platform

that enables insurance organizations in crafting and administering tailored insurance products for various vir-

tual assets across different Metaverse platforms. Our solution supports automated management of the complete

life cycle, starting from insurance shopping and purchase, premium payments, maturity and claim settlement

without any hassle by establishing an interoperability among different Metaverse ecosystems. Moreover, we

leverage dynamic price prediction through federated learning, enabling insurance companies to optimize pre-

miums effectively. We present our working prototype developed based on the Hyperledger Fabric blockchain

platform, supported by empirical evidence from system benchmarks and load testing, demonstrating enhanced

transaction throughput. To the best of our knowledge, this is the first proposal for an insurance solution within

the Metaverse ecosystem.

1 INTRODUCTION

In the ever-evolving landscape of technology, the

Metaverse’s emergence as a symbol of digital inno-

vation highlights its transformative potential spanning

over various sectors, including banking, education, e-

commerce, entertainment, business, and many more

(Wang et al., 2023). In essence, the Metaverse rep-

resents a digital universe where individuals immerse

themselves in virtual experiences, social interactions,

and economic activities. It serves as a bridge between

the physical and digital worlds, offering endless pos-

sibilities for creativity, collaboration, and innovation.

As per the report (met, ), Metaverse market is pro-

jected to reach a value of US$74.4 billion in 2024 and

is expected to grow at an annual growth rate (Com-

pound Annual Growth Rate (CAGR) 2024-2030) of

37.73%, resulting in a projected market volume of

US$507.8 billion by 2030. Moreover, by 2024, it is

a

https://orcid.org/0009-0000-8352-9994

b

https://orcid.org/0000-0002-8572-9348

c

https://orcid.org/0000-0002-8873-8258

anticipated that there will be over 34 million virtual

reality (VR) headset installations worldwide, with 1.7

billion mobile augmented reality (AR) users globally.

As a result, such dynamic nature of this environment

may introduce various risks and threats where acci-

dents or losses loom. Few examples include cyber-

attack, failure due to technical glitches, server down-

time, physical and mental health (both real body and

virtual avatar), and unintentional infringement of real-

world rights (Di Pietro and Cresci, 2021). These

emphasize the importance for Metaverse residents to

safeguard their virtual assets from unforeseen events,

highlighting the need for tailored insurance coverage.

Furthermore, the inherent complexities of the

Metaverse demand a blockchain-based (Nakamoto,

2019) insurance system which offers unparalleled se-

curity and efficiency through the utilization of smart

contracts. These self-executing contracts not only

automate claims processing but also ensure a level

of transparency and trust that traditional insurance

mechanisms often struggle to attain. As we navigate

this epoch of the Metaverse, it becomes evident that

insurance, augmented by blockchain technology, is

190

Bhaduri, A., Jain, A., Sahoo, S., Halder, R. and Kumar, C.

Metasurance: A Blockchain-Based Insurance Management Framework for Metaverse.

DOI: 10.5220/0012722100003687

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 19th International Conference on Evaluation of Novel Approaches to Software Engineering (ENASE 2024), pages 190-201

ISBN: 978-989-758-696-5; ISSN: 2184-4895

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

poised to play a pivotal role in shaping the future of

risk management in the digital realm.

1.1 Motivation and Contributions

Even though there have been a number of blockchain-

based insurance systems (Amponsah et al., 2021;

Brophy, 2020; Kar and Navin, 2021; Popovic et al.,

2020; Raikwar et al., 2018; Kalsgonda and Kulka-

rni, 2022; Hassan et al., 2021; Loukil et al., 2021)

in the literature, they have not addressed the unique

challenges of the Metaverse, including: (1) Metaverse

is very new - lack of understanding among insurers,

insured, and products to cover in the metaverse, (2)

highly dynamic pricing behaviour of the metaverse

assets, (3) interoperability - capability to connect with

multiple metaverse platforms, (4) requirement of uni-

versal ID for metaverse objects across the platforms,

(5) identity management for the participants and in-

formation flow, (6) achieving scalability through a

careful design of the platform (on-chain vs. off-chain

components), and (7) secure payment system.

Now, let us explore potential failure scenarios

within the Metaverse, prompting users to seek insur-

ance coverage for potential losses:

• Virtual Asset Loss. Users may face loss or theft

of virtual assets like in-game items or digital cur-

rencies due to hacking or unauthorized access. In-

surance policies such as virtual asset insurance of-

fer financial recovery by compensating for the lost

items.

• Decentralized Finance (DeFi) Risks. Partici-

pants in DeFi activities within the Metaverse are

exposed to risks like smart contract exploits or liq-

uidity pool failures. Insurance solutions like DeFi

Risk Insurance provide a safety net, ensuring fi-

nancial security in such scenarios.

• Network Downtime or Technical Failures.

Technical glitches or network downtime can dis-

rupt user experiences in the Metaverse. Insurance

options like Network Downtime Insurance offer

financial recovery, allowing users to navigate dis-

ruptions confidently.

• Virtual Property Damage. Events causing vir-

tual property destruction or damage can lead to fi-

nancial threats. Insurance options such as Virtual

Property Insurance compensate users for the loss,

empowering them to innovate within the virtual

realm.

• Marketplace Fraud. Virtual marketplaces may

involve fraudulent activities risking financial

losses. Insurance solutions like Marketplace

Fraud Insurance provide coverage, fostering trust

and security among users.

• Identity Theft in the Metaverse. Instances of

identity theft within the Metaverse can compro-

mise user accounts and assets. Identity theft pro-

tection in insurance policies, like Identity Theft

Insurance, ensures a secure Metaverse experience.

• Virtual Events and Experiences Cancellations.

Unforeseen cancellations of virtual events or ex-

periences can lead to financial losses. Insurance

policies offer coverage for such cancellations, en-

couraging users to explore the Metaverse confi-

dently.

• Cross-Metaverse Transactions. Users engaging

in transactions across different Metaverse plat-

forms may encounter complexities and risks. In-

surance coverage provides assurance, allowing

users to navigate cross-Metaverse transactions

confidently.

• Regulatory Changes and Compliance Risks.

Evolving regulations may pose legal risks to

Metaverse activities. Insurance policies act as le-

gal allies, offering protection and support amidst

changing regulatory environments.

To achieve comprehensive coverage, our research ad-

vocates for tailored insurance products for Metaverse

assets. Motivated by the identified risks, our research

aims to leverage blockchain technology for the fol-

lowing desired goals:

• Enhanced Security and Transparency. Imple-

ment a blockchain-based insurance system to en-

sure secure and transparent record-keeping, re-

duce fraud, and enhance trust in the Metaverse in-

surance ecosystem.

• Efficient Claims Processing. Utilize

blockchain’s decentralized nature for efficient

and tamper-resistant claim processing, ensuring a

streamlined and trustworthy mechanism for users

to access insurance benefits.

• Flexibility and Adaptability. Leverage

blockchain’s flexibility to design insurance

policies that can adapt to the evolving risks and

complexities of the Metaverse, offering users

tailored and up-to-date coverage.

• Smart Contract Automation. Employ smart

contracts to automate insurance processes, en-

hancing efficiency and reducing the likelihood

of errors in policy execution by eliminating un-

trusted third party.

• Seamless Interactions among Various Meta-

verse Platforms. Design a blockchain-based in-

surance system that is compatible across various

Metasurance: A Blockchain-Based Insurance Management Framework for Metaverse

191

Metaverse platforms, providing users with seam-

less coverage in a multi-platform environment.

To summarize, this paper makes the following contri-

butions:

1. We propose Metasurance, a novel approach which

provides insurance solutions to adeptly address

and mitigate the emerging risks of Metaverse

by leveraging the power of blockchain technol-

ogy. By introducing this system into the dynamic

Metaverse landscape, users gain assurance regard-

ing the security of their digital assets. Insurance

companies and third-party verifiers collaborate to

assess and compensate for losses incurred in the

Metaverse, mirroring real-world insurance mech-

anisms.

2. Our proposed system captures the entire spectrum

of activities which encompasses registration, poli-

cies marketplace, policy purchase, paying premi-

ums, claiming policies, claim verification, claim

settlement, and interoperability using tokens. This

ensures interactive experiences for customers and

facilitates streamlined claim processing for insur-

ers.

3. We present our working prototype using Hyper-

ledger Fabric and NodeJS. The empirical evi-

dence acquired from system benchmarks and load

testings is encouraging, and shows us the effec-

tiveness of such a framework in the Metaverse set-

ting.

The structure of the paper is organized as follows:

The related work are discussed in Section 2. The de-

tailed descriptions of our proposed approach are pre-

sented in Section 3. Section 4 provides discussion on

dynamic price prediction using Federated Learning

(FL), highlighting its significance in our framework.

The communication process with various Metaverse

platforms for asset verification is discussed in Sec-

tion 5. The security threats and their possible counter-

measures are discussed in Section 6. We present the

proof-of-concept and its detailed experimental evalu-

ation in Sections 7 and 8. Finally, Section 9 concludes

our work.

2 RELATED WORK

There have been a number of proposals (Amponsah

et al., 2021; Brophy, 2020; Kar and Navin, 2021;

Popovic et al., 2020; Raikwar et al., 2018; Kalsgonda

and Kulkarni, 2022; Hassan et al., 2021; Loukil et al.,

2021) which explored the potential of blockchain to

revolutionize trusted insurance frameworks. Anokye

et al. in (Amponsah et al., 2021) conducted a com-

prehensive analysis of blockchain’s implications for

the insurance sector, examining both its advantages

and potential threats. In (Brophy, 2020), Brophy ex-

plored blockchain’s role in insurance from commer-

cial and regulatory perspectives. Kar et al. in (Kar

and Navin, 2021) discussed blockchain’s pivotal role

in addressing scalability and adoption challenges in

the insurance sector. Popovic et al. in (Popovic et al.,

2020) provided guidance on blockchain for actuaries,

risk professionals, and insurance companies, detail-

ing its use cases. In (Raikwar et al., 2018), Raik-

war et al. designed a blockchain-enabled platform for

processing insurance transactions with an experimen-

tal prototype on Hyperledger Fabric. Kalsgonda et

al. in (Kalsgonda and Kulkarni, 2022) proposed a re-

search framework and overviewed Hyperledger Fab-

ric’s use cases in insurance. The authors in (Hassan

et al., 2021) introduced a framework leveraging smart

contracts on a private Ethereum network for insurance

contracts. Loukil et al. in (Loukil et al., 2021) pre-

sented CioSy, a collaborative blockchain-based insur-

ance system for monitoring and processing transac-

tions.

There are some proposals (Sedkaoui and Chicha,

2021; Demir et al., 2019; Liu et al., 2021; Niza-

muddin and Abugabah, 2021; Bader et al., 2018;

Roriz and Pereira, 2019; Pagano et al., 2019; Shar-

ifinejad et al., 2020), designed for specifically for

providing insurance for certain application domains,

such as flight (Sedkaoui and Chicha, 2021), automo-

bile (Vo et al., 2017; Demir et al., 2019; Liu et al.,

2021; Nizamuddin and Abugabah, 2021; Bader et al.,

2018; Roriz and Pereira, 2019) and more (Pagano

et al., 2019; Sharifinejad et al., 2020). Sedkaoui

et al. in (Sedkaoui and Chicha, 2021) introduced

Axa’s Fizzy platform for blockchain-based travel in-

surance. In (Vo et al., 2017), authors proposed a

blockchain solution for managing data in pay-as-you-

go car insurance systems. Demir et al. in (Demir

et al., 2019) proposed a tamper-free ledger for mo-

tor vehicle insurance records. Liu et al. in (Liu

et al., 2021) proposed a blockchain-based auto in-

surance data-sharing scheme. In (Nizamuddin and

Abugabah, 2021), Nishara et al. developed a decen-

tralized framework for regulating automobile insur-

ance claims. Bader et al. in (Bader et al., 2018) pre-

sented a smart contract-based platform for car insur-

ance. The authors in (Roriz and Pereira, 2019) ad-

dressed fraud prevention in vehicle insurance using

Ethereum. Pagano et al. in (Pagano et al., 2019)

outlined a methodology for blockchain-based digi-

tal insurance contracts against natural hazards. Shar-

ifinejad et al. in (Sharifinejad et al., 2020) demon-

ENASE 2024 - 19th International Conference on Evaluation of Novel Approaches to Software Engineering

192

strated blockchain’s applicability in smart city insur-

ance, showcasing reduced delays compared to con-

ventional methods.

3 METASURANCE: PROPOSED

BLOCKCHAIN BASED

INSURANCE MANAGEMENT

FRAMEWORK

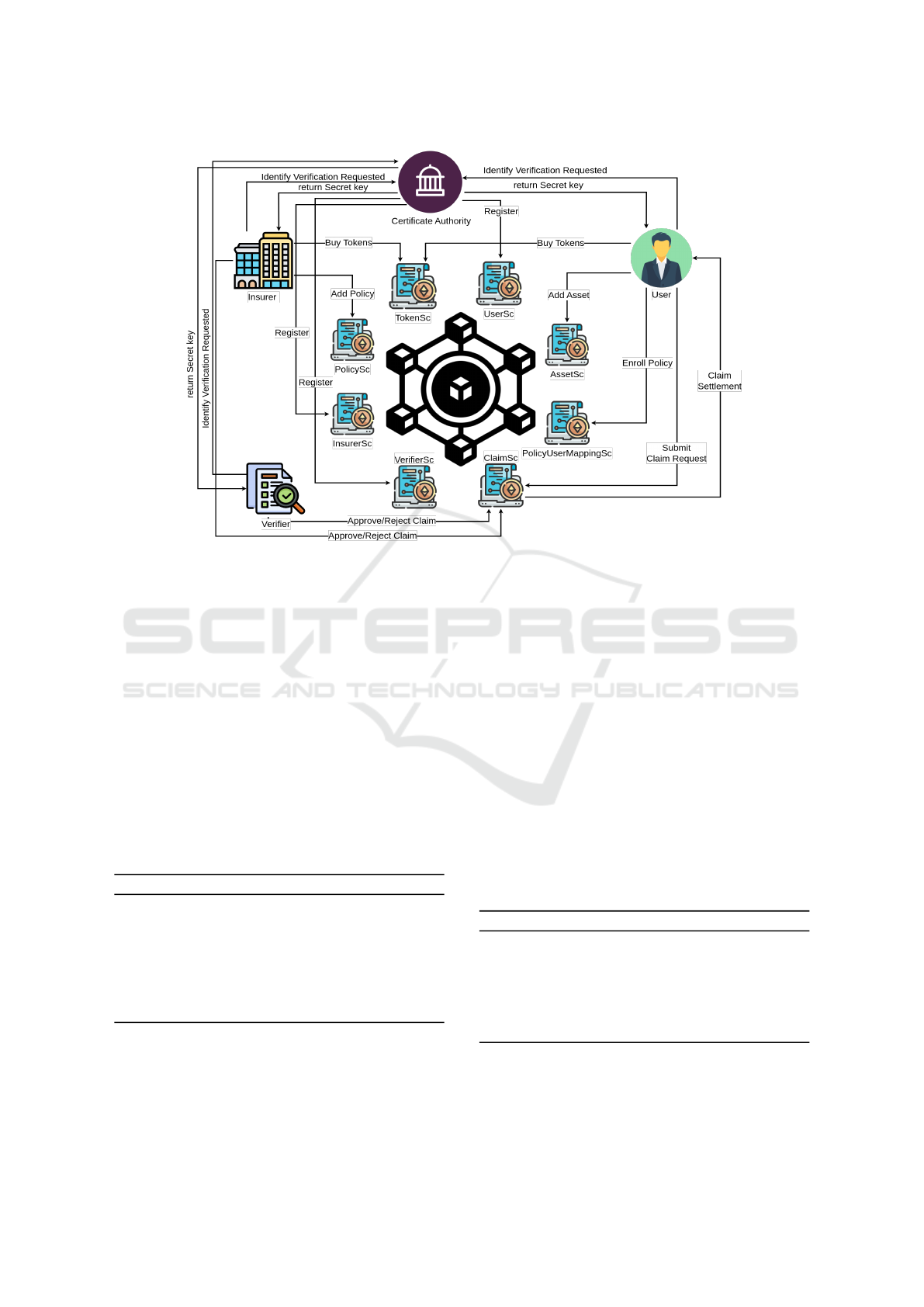

This section elucidates our proposed blockchain-

based insurance management framework, called

Metasurance, for various Metaverse assets including

Virtual Lands, NFTs, Gadgets, and Avatars. Metasur-

ance involves a number of stakeholders, such as users,

insurers, and third-party claim verifiers, and it hosts a

set of smart contracts offering services such as reg-

istration, policy initiation, purchase, claim, and veri-

fication. Figure 1 depicts the overall system compo-

nents of the proposed Metasurance, which comprises

the following phases: (1) Stakeholder registration,

(2) Adding assets/creation of policies, (3) Purchasing

policies, (4) Paying premiums, (5) Claim request, (6)

Request verification, and (7) Claim approval.

We use a number of smart contracts in the pro-

posed framework, as follows: (1) UserSc: This smart

contract us used to register a user who wishes to get

insured for his assets, (2) InsurerSc: This smart con-

tract us used to register a insurer who wishes to pro-

vide insurance services, (3) VerifierSc: This smart

contract us used to register a insurer who wishes to

verify various claim requests, (4) PolicySc: This

smart contract is used by Insurers to create their

policy schemes and by users to view all avail-

able policies, (5) AssetSc: This smart contract is

used by users to register their blockchain assets, (6)

PolicyUserMappingSc: This smart contract is used

by users to register their asset with a policy, and pay

premiums of the policy, (7) ClaimSc: This contract is

used by users to claim a policy in case of any dam-

age of the asset that is covered in the insurance, (8)

TokenSc: This smart contract serves as the currency

and carries out the transactions between the different

parties.

Let us now provide a detailed description of each

of above-mentioned phases.

3.1 Registration

In order to access the system, stakeholders initiate the

registration process through their respective contracts

UserSc, InsurerSc, VerifierSc. This step enables

the involved parties (User, Insurer and Verifier) to

formally register themselves, acquiring the necessary

credentials for subsequent authentication procedures.

Once registered, the users, verifiers, and insurers gain

extended access to the system’s functionalities, allow-

ing them to register assets and create policies, respec-

tively. Note that each peer node is equipped with a

unique cryptographic key pair via trusted authority

(say, certificate authority), ensuring the security of all

transactions within the system. Let us now describe

the registration phase for stakeholders, policies and

virtual assets.

3.1.1 Stakeholder Registration

The stakeholder registration consists of three phases,

namely set up, key generation and authentication, for

user U, verifier V , and insurer I . Let us now discuss

each of these steps in detail.

• Setup. The setup algorithm works in a manner

similar to (Goyal et al., 2006). This phase is initi-

ated by trusted authority T A (e.g. Certificate Au-

thority). Initially, T A selects a security param-

eter λ

′

. It then selects two multiplicative cyclic

groups G

1

, G

2

of prime order p, where p ≥ 2

λ

′

.

Let e : G

1

× G

1

→ G

2

be a bilinear map and g be

the generator of G

1

.

• Keygen. T A runs keygen algorithm (Shamir,

1985) to generate secret keys for insurer I , verifier

V , and user U. It chooses a random unique num-

bers (i.e. id ∈ Z

p

) for each of the insurers, veri-

fiers, and users as their unique identities (BLAK-

LEY, 1979). Next, T A randomly selects r, y ∈ Z

p

and computes KU

0

= g

y+r

(id)

r

, KU

1

= g

r

. Fi-

nally, it returns secret key SK = {KU

0

, KU

1

} to

I , V , and U. Then, for public key computation,

T A computes PK = e(g, g)

y

.

• Verify and Signing Phase. After verification of

the identity of the stakeholders through proper

KYC documents, the T A signs the public key PK

of the corresponding I , V , and U, and publishes

it on the ledger. The secret key SK is then sent to

the respective I , V , and U through a secret chan-

nel.

3.1.2 Policy Registration

In this phase, the registered insurers can use their lo-

gin credentials to log back into their respective ac-

counts and finally, based on their organizational prin-

ciples, they can register various policies related to the

virtual assets. There are several field values which

are necessary and need to be provided by the insurers

based on which policies can only be listed for the fur-

ther processes. These field values include: (1) unique

Metasurance: A Blockchain-Based Insurance Management Framework for Metaverse

193

Figure 1: Overview of the proposed system.

policy ID p

id

, (2) policy name p

name

, (3) policy type

p

type

, (4) insurer p

insurer

, (5) insurance coverage A

inc

,

(6) premium amount A

p

, (7) claims per year T , and

(8) policy owner p

own

(which is set ‘NULL’ initially).

Each policy has a unique policy ID (p

id

) that is se-

curely generated using randomized UUID generators

(Leach et al., 2005). The algorithm for policy regis-

tration in PolicySc smart contract is detailed in Algo-

rithm 1. The policy can encompass additional param-

eters such as custom terms and conditions mandated

by the company, coverage limits, exclusions, cancel-

lation provisions, and endorsements. These elements

are intentionally excluded from the current solution

for the sake of simplicity. However, they can be seam-

lessly incorporated if the specific use case necessitates

their inclusion.

Algorithm 1: PolicyRegistration.

Data: p

name

, p

type

, A

inc

, A

p

, T , I

Result: Policy ID p

id

1: r = random();

2: p

id

= IdGen(r);

3: p

own

= NULL;

4: p

insurer

= I ;

5: createPolicy(p

id

, p

name

, p

type

, p

insurer

, A

inc

, A

p

, T , p

own

);

6: return p

id

;

3.1.3 Asset Registration

In Metaverse, users can own multiple digital assets

such as virtual lands, avatars, NFTs, Gadgets, etc.

While these assets have different roles in the virtual

ecosystem, they are prone to various kinds of risks

and threats, such as cyberattack, failure due to tech-

nical glitches, server downtime, physical and mental

health (both real body and virtual avatar), and un-

intentional infringement of real-world rights. Keep-

ing these facts in mind, Metaverse residents therefore

need to protect their digital assets with appropriate in-

surance products. In order to avail this service, the

users first need to register their virtual assets through

AssetSc smart contract for which they intend to pur-

chase insurance products. This requires the following

details: (1) asset name a

name

, (2) asset owner a

own

, (3)

asset type a

type

, (4) asset value a

val

, and (5) asset-age

a

age

. Once the process is done, asset gets registered

and is ready for further process. The asset registra-

tion algorithm is similar to policy registration and is

depicted in Algorithm 2.

Algorithm 2: AssetRegistration.

Data: a

name

, a

own

, a

type

, a

val

, a

age

, U

Result: Asset ID a

id

1: r = random();

2: a

id

= IdGen(r);

3: a

own

= U;

4: createAsset(a

id

, a

name

, a

own

, a

type

, a

val

, a

age

);

5: return a

id

;

ENASE 2024 - 19th International Conference on Evaluation of Novel Approaches to Software Engineering

194

3.2 Policies Marketplace

In this phase, users can easily check out different in-

surance policies from various insurers. Our interface

allows for easy filtering based on the supported asset

types and the specific insurers providing appropriate

policy. Registering for a policy is contingent on its

alignment with the asset type, and successful registra-

tion necessitates the payment of a purchase fee. The

querying policies based on different filters is shown

in Algorithm 3. The details of all policies are stored

in the levelDB database which is refered to as D B in

algorithm.

Algorithm 3: SearchPolicy.

Data: Search Keywords: Asset name x, Policy type y, Insurer-ID

I

Result: List of policies found

1: i list = DB .find({insurer = I });

2: p list = i list.filter({type = y});

3: return p list;

3.3 Policy Purchase

As mentioned earlier, the smart contract PolicySc

houses a comprehensive list of insurance policies re-

lated to the Metaverse world. To sign up for a

policy, user utilizes the function AssignPolicy in the

smart contract PolicyUserMappingSc by providing

the policyID (p

id

) and assetID (a

id

). The user is then

required to pay the initial amount which will be the

first premium for the insurance, which is a mandatory

amount. This action internally generates a policyMap

structure instance with unique ID m

id

, indicating the

association of the new policy p

id

with the user’s asset

a

id

, along with additional attributes ‘premium paid’

(p paid), ‘claim count’ (c count), and ‘claim amount’

(c amt) initialized to 0. The resulting structure is then

stored in an array linked to the user’s U. The policy

purchase algorithm is depicted in Algorithm 4.

Algorithm 4: PolicyPurchase.

Data: a

id

, p

id

, U

Result: Policy-Asset Map ID m

id

1: asset = getAsset(a

id

);

2: policy = getPolicy(p

id

);

3: if (asset.a

own

!= U)

4: exit;

5: p paid = 0, c count = 0, c amt = 0;

6: success = PayAmount(asset, policy, amount);

7: if (!success)

8: exit;

9: r = random();

10: m

id

= IdGen(r);

11: AssignPolicy(m

id

, p

id

, a

id

, p paid + +, c count, c amt);

12: return m

id

;

3.4 Paying Premiums

Upon acquiring a policy for an asset, users engage

in a streamlined premium payment process. This ap-

proach incorporates token utilization at the time of

payment, enhancing security and efficiency. Users

are presented with flexible premium payment options,

ranging from installment plans to convenient one-

time payments, all tailored to the insurer’s proposed

model. This novel premium payment system mir-

rors traditional insurance frameworks while incorpo-

rating advanced features for an enhanced user expe-

rience. Within the comprehensive user data model,

meticulous tracking of premium payments is ensured

through a dedicated ‘premium paid’ counter. This

counter serves as a reliable indicator, keeping users

informed about the number of premiums already set-

tled. The algorithmic steps are depicted in Algorithm

5.

Algorithm 5: PremiumPayment.

Data: m

id

, U

Result: Confirmation of payment

1: ⟨p

id

, a

id

⟩ = GetState(m

id

, U);

2: asset = getAsset(a

id

);

3: policy = getPolicy(p

id

);

4: success = PayAmount(asset, policy, amount);

5: if (!success)

6: exit;

7: m

id

. p paid ++;

8: return success;

3.5 Policy Claim, Verification, and

Settlement

Upon purchasing a policy and fulfilling of premiums

according to policy agreement, users are able to ini-

tiate a claim. The process involves furnishing neces-

sary details and securely storing documents through

the InterPlanetary File System (IPFS)

1

, as depicted

in Figure 3. The details required for initiating a claim

request include (1) issuance id m

id

, (2) user ID U,

(3) issuing insurer ID I , and (4) claim evidence CE.

Initiating a claim prompts the request to be sent to

I and subsequently to an independent verifier V , as

depicted in Algorithms 6 and 7. These entities au-

tonomously assess the claim, verify claim evidences

and uploads verification-reports on IPFS, deciding to

accept or reject. Accepted claims proceed to the set-

tlement phase, where the issuing insurer determines

and automatically adds the settlement amount to the

user’s account using backend chaincode logic. The

main steps in claim settlement, depicted in Figure 2,

1

https://ipfs.tech/

Metasurance: A Blockchain-Based Insurance Management Framework for Metaverse

195

User

ClaimSc

1(c). Claim Request along with H

CE

(CR)

1(a). Upload Claim Evidence (CE)

3(b). Return HashLink (H

VR

)

2. Verify Claim Request (CR)

4. Approval Result along with H

VR

(AR)

1(b). Return HashLink (H

CE

)

Verifier

VerifierSc

Insurer

5. If status (AR) = OK,

Claim Refund Initiated

6. Return Acknowledgement

IPFS

3(a). Upload Verification Report (VR)

Figure 2: Flow diagram of policy claim, verification, and

settlement.

are: (1) User uploads claim evidence (CE) to IPFS

and receives the hash link, (2) User calls the ClaimSc

contract to submit the claim, providing all the nec-

essary details given above with the hash link as the

claim evidence, (3) The contract stores the details as

a submitted claim request, and waits for a verifier to

verify, (4) Verifier verifies the claim request off chain

and uploads a Verification Report (VR) to IPFS, re-

ceives the hash link and sends the approve/decline re-

sult along with the report link, and (5) Insurer, on ap-

proval of claim request, processes the transaction and

sends the claimed amount decided by the verifier in its

report to insured user with a claim acknowledgement.

Algorithm 6: ClaimPolicy.

Data: m

id

, U, I , CE

Result: Claim Request

1: ⟨p

id

, a

id

⟩ = getState(m

id

, U, I );

2: asset = getAsset(a

id

);

3: policy = getPolicy(p

id

);

4: H

CE

= IPFSupload(CE);

5: CR = generateClaim(asset, policy, U, I , H

CE

);

6: Call ProcessClaim(CR, U, I );

Algorithm 7: ProcessClaim.

Data: CR, U, I

Result: Claim settlement

1: V = selectVerifier(CR);

2: AR = verifyClaimRequest(CR, V ) ;

/* Verificationperformed by V using VerifierSc smart

contract */

3: if status(AR) == OK and CR.claimed == false

4: SendAmount(I , U, CR.Claim Amount) ;

/* Send amount CR.Claim

Amount from I to U. */

5: CR.claimed = true;

4 FL-DRIVEN DYNAMIC

PRICING PREDICTION FOR

INSURANCE PRODUCTS IN

THE METAVERSE

Navigating the complexities of pricing in the Meta-

verse is akin to charting unexplored territory. Unlike

physical products, whose values tend to remain rela-

tively stable, Metaverse assets (such as virtual land,

Upload Local Model

Download Global Model

Metaverse 1

Download Local Model

Upload Global Model

Clients

Workers

Verification and Agrregation

Metasurance

Blockchain-based

System

AuditSc

Metaverse 2 Metaverse 3

Metaverse 4

Metaverse 5

Metaverse N

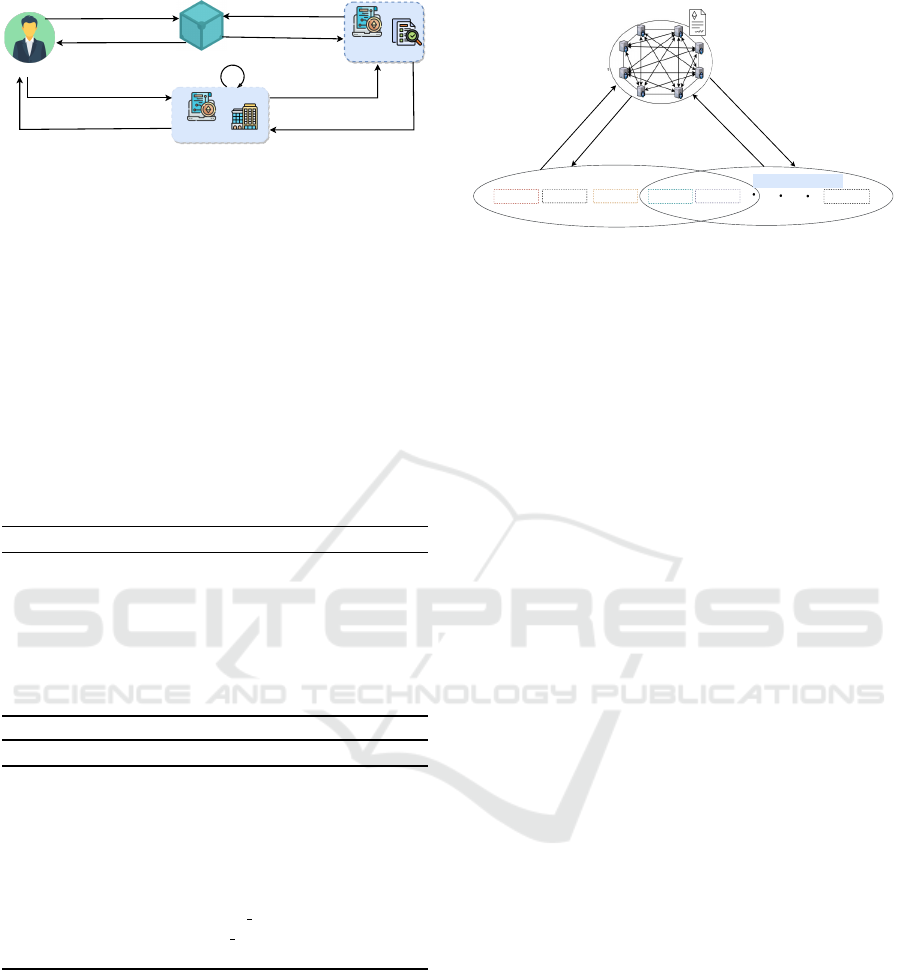

Figure 3: FL framework and global model training process

for dynamic pricing prediction.

cryptocurrencies, etc.) are prone to rapid and unpre-

dictable fluctuations. This presents a formidable chal-

lenge for insurance companies striving to set consis-

tent premiums and claims costs to offer reliable ser-

vices to users.

Our system addresses this challenge by estab-

lishing a collaborative framework wherein insurance

firms collaborate with various Metaverse platforms to

tailor premiums and claims costs. Leveraging fed-

erated learning (FL), our system facilitates seamless

collaboration and information exchange across di-

verse Metaverse platforms while safeguarding data

confidentiality and privacy.

Within our architecture, as depicted in Figure

3, multiple Metaverse platforms operate independent

blockchain networks and train local neural networks.

Acting as an intermediary, our blockchain-based plat-

form audits and supervises the interaction process

(parameter exchange) between clients and workers,

ensuring transparency and accountability in informa-

tion exchange. Clients, which include Metaverse plat-

forms, upload their local model parameters to the

Metasurance platform, while workers, also compris-

ing Metaverse platforms, download these local model

parameters for processing. On the worker side, after

aggregating and verifying the local model parameters,

workers upload the resulting global model parame-

ters back to the Metasurance platform. Subsequently,

clients download these global model parameters from

the Metasurance to inform their decision-making pro-

cesses.

Through this seamless exchange facilitated by our

Metasurance platform, our system ensures the effi-

cient aggregation and verification of local model pa-

rameters, enabling accurate predictive modeling. This

process empowers insurance companies to make in-

formed decisions on premiums and claims costs, in-

stilling confidence in the Metaverse economy while

paving the way for sustainable growth and innovation

within the digital landscape.

ENASE 2024 - 19th International Conference on Evaluation of Novel Approaches to Software Engineering

196

5 INTEROPERABILITY AMONG

METAVERSE PLATFORMS

AND METASURANCE

In the realm of verifying user claims concerning

Metaverse assets, establishing connections with the

respective Metaverse platforms is crucial for valida-

tion. Our system must seamlessly integrate with these

platforms, which calls for the adoption of interoper-

ability protocol solutions. The hash-locking protocol

(Dai et al., 2020) emerges as a promising solution for

this task.

Through the hash-locking protocol, tokens repre-

senting ownership or attributes of Metaverse assets

can be securely exchanged between our framework

and the Metaverse platforms. When a verification re-

quest is initiated by an insurance company, our system

can generate a unique hash value based on the rele-

vant asset information. This hash value is then locked

within a token along with additional metadata, ensur-

ing the integrity and authenticity of the verification

process.

Upon receiving the token from our framework, the

Metaverse platform verifies the hash value to ensure

its consistency with the asset information stored on

the platform. Once validated, the token is unlocked,

granting access to the requested asset details or con-

firming its ownership. This mechanism not only en-

sures the security of the verification process but also

provides a tamper-proof method for validating Meta-

verse assets.

So, this protocol offers a robust solution for

achieving interoperability using tokens and validating

through tokens in the context of Metaverse asset veri-

fication. By leveraging cryptographic hashing and se-

cure token exchange mechanisms, our framework can

establish a reliable and tamper-proof method for ver-

ifying Metaverse assets, enhancing the integrity and

trustworthiness of insurance claims within the Meta-

verse ecosystem.

6 SECURITY ANALYSIS

This section highlights the core security and privacy

features of our Metasurance framework. Designed to

resist potential threats, our approach ensures that only

authorized users can access and communicate within

the system securely. In the dynamic Metaverse land-

scape, attackers may exploit vulnerabilities, making a

robust security infrastructure crucial.

The following discussions delve into specific at-

tacks and the robust solutions implemented to coun-

teract them effectively.

• Eavesdropping Attack: To counter eavesdropping

attacks, the Metasurance framework implements

end-to-end encryption. This ensures that sensi-

tive information, such as user credentials and pol-

icy details, remains confidential during transmis-

sion. The use of cryptographic protocols protects

against unauthorized interception of data, provid-

ing a secure communication channel.

• Data Manipulation Attacks: The Metasurance

framework safeguards against data manipulation

attacks through the use of blockchain technology.

Immutable and transparent ledger records ensure

that once data is added to the blockchain, it can-

not be altered without consensus. This feature en-

hances the integrity of critical information, such

as policies, claims, and transactions.

• Token System Vulnerabilities: The token system

embedded in the TokenSc contract of the frame-

work prioritizes security as its core design prin-

ciple. Employing advanced cryptographic tech-

niques, it safeguards both the generation and val-

idation processes of tokens. Periodic security as-

sessments are diligently carried out to pinpoint

and rectify any potential vulnerabilities.

By integrating these security measures, the Metasur-

ance framework establishes a robust defense against a

spectrum of potential threats, ensuring the safety and

confidentiality of user interactions and data within the

dynamic Metaverse environment.

7 PROOF OF CONCEPT

In this section, we provide an in-depth overview of

the prototype implementation for our platform. The

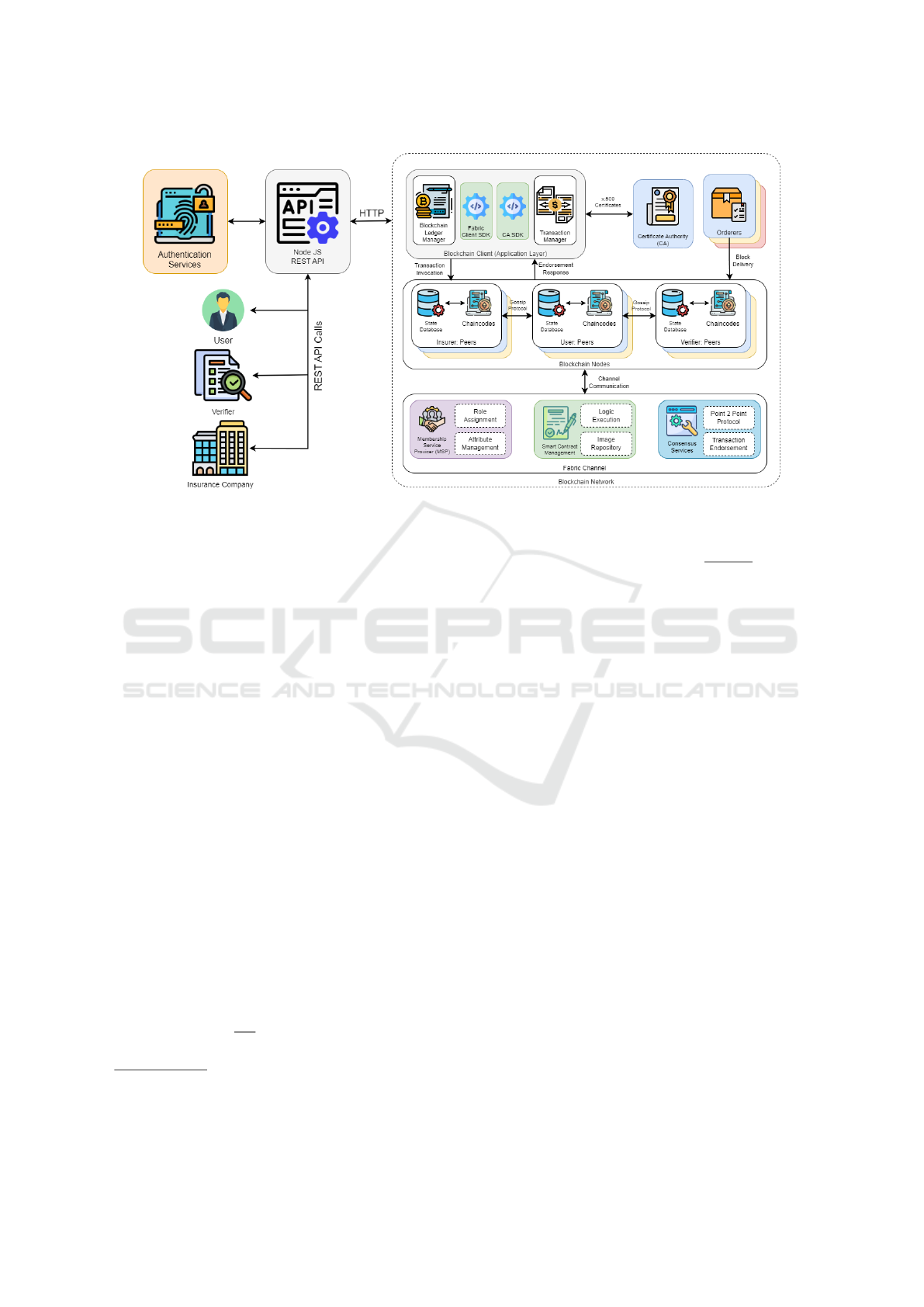

prototype comprises three key components: (1) the

blockchain network, (2) the Fabric backend, and (3)

the client application. For the implementation of our

blockchain solution, we opted for Hyperledger Fabric

v1.4, with GoLang serving as the programming lan-

guage for our smart contract applications. In the back-

end, the client application utilizes the Hyperledger

Fabric, NodeJS SDK, and communication between

the backend and the client interaction occurs through

REST APIs, employing the HTTP protocol. We have

used the IPFS to store the documents uploaded by

users for making policy claims. Figure 4 depicts a

concise representation of the system architecture. The

organizations we have created are (1) User, (2) Insurer

and (3) Verifier. For every organization, we provide a

single peer and certificate authority (CA) node. Each

organization also has a couchDB instance running as

Metasurance: A Blockchain-Based Insurance Management Framework for Metaverse

197

Figure 4: Proof-of-Concept System Architecture.

the state database. The blockchain has a orderer or-

ganization with the raft ordering service. Here, we

consider a single instance of the peer node and a sin-

gle channel through which the peers interact. The au-

thentication module is there for insurers and users and

uses cookie-based authentication. The cookie can be

generated using any algorithm like JSON Web To-

kens (JWT), and here we used a randomized salt-

based hashing algorithm to generate session tokens

from usernames that can be stored in any database

like MySQL, PostgreSQL, or MongoDB throughout

the session. The same can even be done with JWT.

8 EXPERIMENTAL RESULTS

Let us now manifest the experiments we conducted

to quantify and evaluate the performance of the pro-

totype implementation of our proposal. In order to

evaluate, we cover a range of experiments where we

measure the read-write output of various operations.

All the experiments were performed on a laptop with

AMD Ryzen 5 7530U processor, 8 GB RAM, and

Ubuntu 23.10. We perform these tests using the Hy-

perledger Caliper benchmarking tool

2

. We use the

following performance metrics

3

in our benchmarking

process, defined below:

• Send rate r

s

=

τ

sent

t

, where τ

sent

is the number of

transactions sent and t is the time in which all of

2

https://hyperledger.github.io/caliper

3

https://www.hyperledger.org/learn/publications/

blockchain-performance-metrics

them were submitted to the blockchain.

• Transaction throughput η =

C

commit

(t)

t

, where

C

commit

(t) is simply the number of transactions

committed to blockchain at time t.

• Transaction latency λ = t

cn f

− t

sub

, where t

cn f

is

the confirmation time of a transaction and t

sub

is

the submit time of a transaction.

We evaluate the transaction latency and through-

put of our system consisting of various transactions

such as readUser, getPolicies, getAssets, viewIssued-

Policies, and payPremium. Let us discuss the exper-

imental findings for both Read and Write operations

pertaining to these transactions. Figure 5 illustrates

our assessment of the system’s throughput and latency

during the readUser transaction, focusing on reading

user profiles under high send rates. We observe that

a linear increase in both the send rate and through-

put over time. However, at higher send rates (above

300), they stabilize, indicating minimal change de-

spite further increases in send rates. Notably, the peak

throughput for reading user profiles occurs at a rate

close to 300 transactions per second (TPS).

In Figure 6, we evaluate the system’s performance

while continuously increasing the rate of requests

from 1 TPS to up to 300 TPS during getPolicies

transaction. We observe that the throughput initially

increases, but then slows the rate of increase after

getting to 300 TPS. Still, the rate keeps increasing

slightly but mostly remains constant with minimal

fluctuations.

In Figure 7, we evaluate the system’s performance

while continuously increasing the rate of requests

ENASE 2024 - 19th International Conference on Evaluation of Novel Approaches to Software Engineering

198

Figure 5: readUser transaction performance.

Figure 6: getPolicies transaction performance.

from 1 TPS to upto 300 TPS during getAssets trans-

actions. We observe that the throughput initially in-

creases, but it begins to slow down once it reaches

300 TPS. Despite some fluctuations, the rate mostly

stabilizes with minimal changes, albeit slightly higher

than the throughput depicted in Figure 6.

Figure 8 shows a similar performance evaluation

while we are increasing send TPS from 1 to 300 for

viewIssuedPolicies transaction. Here also, the send

rate and throughput coincide with each other and be-

come almost flat after 300 TPS.

Let us delve into Write operations. In Figure 9,

we scrutinize the payPremium performance, which

assesses how users pay premiums for their policies.

Initially, both the send rate and throughput escalate

steadily up to 100 TPS. However, beyond this thresh-

old, although the throughput continues to climb, it

does so at a slower pace until it reaches around 175

TPS. Here, the network reaches its maximum capac-

Figure 7: getAssets transaction performance.

Figure 8: viewIssuedPolicies transaction performance.

Figure 9: payPremium transaction performance.

ity, resulting in a stabilized throughput thereafter. De-

spite a slight dip in throughput at the 400 TPS send

rate, the overall change is minimal when increas-

ing the send rates beyond 200 TPS. This decline in

throughput compared to read operations can be at-

tributed to the need for exclusive locks on shared

states during write operations, slowing down trans-

action processing in the blockchain. Additionally, ex-

amining the latency plots, we observe that while Fig-

ures 5, 6, 7, and 8 maintain relatively constant latency,

Figure 9 initially experiences a latency dip as the send

rate increases, eventually stabilizing to an almost hor-

izontal level.

Finally, we assess the performance of the claim-

Policy by gradually increasing the send rate. Notably,

the network’s throughput shows significant fluctua-

tions throughout this evaluation. Initially, it ascends

steadily until reaching 100 TPS, after which the rate

of increase diminishes slightly but continues up to 175

Figure 10: claimPolicy Benchmark.

Metasurance: A Blockchain-Based Insurance Management Framework for Metaverse

199

TPS. Subsequently, network congestion leads to a de-

cline in both the send rate and throughput, even as the

send rate reaches 400 TPS. However, as the network

congestion eases, the throughput begins to rise again

before eventually declining once more after reaching

its peak. This observed trend is depicted in Figure 10.

9 CONCLUSION

In this paper, we introduce Metasurance, a

blockchain-driven decentralized platform designed

to empower insurance organizations for Metaverse

ecosystem. This platform facilitates the creation

and management of insurance products specifically

tailored for Metaverse assets across diverse plat-

forms. We demonstrate a proof-of-concept based on

Hyperledger Fabric, by systematically designing and

implementing various smart contracts. Additionally,

we undertake experiments utilizing Hyperledger

Caliper, a performance benchmark framework, to

meticulously assess the performance of our system.

Our findings conclusively demonstrate the feasibility,

efficiency, and cost-effectiveness of our proposed

system. While our current implementation does not

encompass the FL and interoperability components,

we view them as integral parts of our forthcoming

roadmap.

ACKNOWLEDGEMENT

This research is partially supported by the research

grant provided by IIT Bhilai Innovation and Technol-

ogy Foundation (IBITF).

REFERENCES

Metaverse - worldwide [online]. Available:

https://www.statista.com

/outlook/amo/metaverse/worldwide.

Amponsah, A. et al. (2021). Blockchain in insurance: Ex-

ploratory analysis of prospects and threats. Interna-

tional Journal of Advanced Computer Science and Ap-

plications.

Bader, L. et al. (2018). Smart contract-based car insurance

policies.

BLAKLEY, G. R. (1979). Safeguarding cryptographic keys.

In 1979 International Workshop on Managing Re-

quirements Knowledge (MARK), pages 313–318.

Brophy, R. (2020). Blockchain and insurance: a review for

operations and regulation. Journal of financial regu-

lation and compliance, 28(2):215–234.

Dai, B. et al. (2020). Research and implementation of cross-

chain transaction model based on improved hash-

locking. In Blockchain and Trustworthy Systems,

pages 218–230. Springer.

Demir, M. et al. (2019). Blockchain Based Transparent Ve-

hicle Insurance Management. In 2019 Sixth Interna-

tional Conference on Software Defined Systems (SDS),

pages 213–220.

Di Pietro, R. and Cresci, S. (2021). Metaverse: Security and

privacy issues. In 2021 Third IEEE International Con-

ference on Trust, Privacy and Security in Intelligent

Systems and Applications (TPS-ISA), pages 281–288.

Goyal, V. et al. (2006). Attribute-based encryption for fine-

grained access control of encrypted data. In Proceed-

ings of the 13th ACM conference on Computer and

communications security, pages 89–98. Acm.

Hassan, A., Ali, M. I., Ahammed, R., Khan, M. M., Alsu-

fyani, N., and Alsufyani, A. (2021). Secured insur-

ance framework using blockchain and smart contract.

Scientific Programming, 2021:6787406.

Kalsgonda, V. and Kulkarni, R. (2022). Role of blockchain

smart contract in insurance industry. Available at

SSRN 4023268.

Kar, A. K. and Navin, L. (2021). Diffusion of blockchain

in insurance industry: An analysis through the review

of academic and trade literature. Telematics and In-

formatics, 58:101532.

Leach, P. J. et al. (2005). A Universally Unique IDentifier

(UUID) URN Namespace. RFC 4122.

Liu, X. et al. (2021). A blockchain-based auto insurance

data sharing scheme. Wireless Communications and

Mobile Computing, 2021:1–11.

Loukil, F. et al. (2021). Ciosy: A collaborative blockchain-

based insurance system. Electronics, 10(11).

Nakamoto, S. (2019). Bitcoin: A peer-to-peer electronic

cash system. Technical report, Manubot.

Nizamuddin, N. and Abugabah, A. (2021). Blockchain for

automotive: An insight towards the ipfs blockchain-

based auto insurance sector. International Journal of

Electrical and Computer Engineering, 11:2443–2456.

Pagano, A. J. et al. (2019). Implementation of blockchain

technology in insurance contracts against natural haz-

ards: A methodological multi-disciplinary approach.

Environmental and Climate Technologies, 23.

Popovic, D. et al. (2020). Understanding blockchain for in-

surance use cases. British Actuarial Journal, 25:e12.

Raikwar, M., Mazumdar, S., Ruj, S., Sen Gupta, S., Chat-

topadhyay, A., and Lam, K.-Y. (2018). A Blockchain

Framework for Insurance Processes. In 2018 9th IFIP

International Conference on New Technologies, Mo-

bility and Security (NTMS), pages 1–4.

Roriz, R. and Pereira, J. L. (2019). Avoiding insurance

fraud: A blockchain-based solution for the vehicle

sector. Procedia Computer Science, 164:211–218.

Sedkaoui, S. and Chicha, N. (2021). Blockchain-based

smart contract technology application in the insurance

industry: The case of “Fizzy”.

Shamir, A. (1985). Identity-based cryptosystems and sig-

nature schemes. In Blakley, G. R. and Chaum, D.,

ENASE 2024 - 19th International Conference on Evaluation of Novel Approaches to Software Engineering

200

editors, Advances in Cryptology, pages 47–53, Berlin,

Heidelberg. Springer Berlin Heidelberg.

Sharifinejad, M. et al. (2020). BIS- A blockchain-based so-

lution for the insurance industry in smart cities. CoRR,

abs/2001.05273.

Vo, H. T. et al. (2017). Blockchain-based data manage-

ment and analytics for micro-insurance applications.

In Proceedings of the 2017 ACM on Conference on In-

formation and Knowledge Management, pages 2539–

2542.

Wang, H. et al. (2023). A survey on the meta-

verse: The state-of-the-art, technologies, applications,

and challenges. IEEE Internet of Things Journal,

10(16):14671–14688.

Metasurance: A Blockchain-Based Insurance Management Framework for Metaverse

201