Leveraging Multimodal Large Language Models and Natural Language

Processing Techniques for Comprehensive ESG Risk Score Prediction

Abhiram Nandiraju

1

and Siddha Kanthi

2

1

Frisco High School, Frisco, U.S.A.

2

Reedy High School, Frisco, U.S.A.

Keywords:

Natural Language Processing, ESG Risk Assessment, S&P 500, Corporate Sustainability, Financial Decision

Making.

Abstract:

Companies are subject to stringent expectations in terms of social responsibility, particularly in managing risks

associated with their environmental, social, and governance (ESG) practices. These practices are evaluated us-

ing ESG risk scores. Traditionally, ESG risk scores are generated by firms like Sustainalytics and MSCI, which

primarily focus on larger corporations. Consequently, entities investing in smaller companies, such as venture

capital firms, private equity firms, and individual investors, face a challenging and resource-intensive process

for initial risk assessment. However, our research has uncovered a novel approach through the application

of machine learning techniques and the use of multimodal large language models based on publicly released

company reports. This approach enables the prediction of ESG risk scores with an accuracy of 68.09%, offer-

ing a viable tool for preliminary analysis. Significantly, this research introduces a pioneering framework that

utilizes a new architecture for analyzing ESG practices, transforming the traditional assessment process for

both large and small companies alike. Our research shows high accuracy in predicting risk assessments and

simplifies the evaluation process. Nonetheless, there is potential for enhancing this accuracy through further

refinement of the models, improvements in data extraction, and continued exploration of additional modeling

techniques.

1 INTRODUCTION

Environmental, Social, and Governance (ESG) cri-

teria have become increasingly pivotal in assessing

a company’s impact on environmental, societal, and

corporate sustainability. Alongside the rise of ESG is

the transformative field of artificial intelligence (AI),

particularly the development of chatbots, which have

revolutionized numerous sectors by automating in-

teractions and processing large volumes of data ef-

ficiently. Their role in business and finance is no ex-

ception, offering new avenues for data analysis and

customer engagement. One of the most significant

developments in the domain of ESG assessment has

been the introduction of ESG Risk Scores, which pro-

vide a quantitative measure of a company’s exposure

to and management of ESG-related risks. However,

the current process of calculating these scores faces

several challenges: a limitation to larger companies

due to resource constraints, a lack of standardization

across different scoring systems, and a time-intensive

and expensive evaluation process. Additionally, the

calculation of these scores has not fully embraced

automation, making the process less efficient than it

could be. This paper seeks to address these limita-

tions by proposing an automated, machine learning,

and Chat-GPT 4-based approach to predict ESG risk

scores using publicly available company reports, such

as annual reports, from S&P 500 companies. Through

this, we aim to extend the applicability of ESG risk as-

sessment to a broader range of companies, including

smaller firms often overlooked in current methodolo-

gies. By leveraging AI and machine learning, there

is potential to not only democratize ESG risk assess-

ment but also enhance its accuracy and efficiency,

paving the way for more inclusive and sustainable

corporate practices. It is important to note the sub-

jectivity and inconsistencies in ESG scoring, which

could hinder the accuracy of traditional AI models

trained on ESG data, as seen with different firms pro-

viding vast analyses of the same data and information

on the same company. The remainder of the paper

is structured as follows: Section 2 presents a review

of the literature, Section 3 outlines the methodology

Nandiraju, A. and Kanthi, S.

Leveraging Multimodal Large Language Models and Natural Language Processing Techniques for Comprehensive ESG Risk Score Prediction.

DOI: 10.5220/0012725700003717

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 6th International Conference on Finance, Economics, Management and IT Business (FEMIB 2024), pages 69-78

ISBN: 978-989-758-695-8; ISSN: 2184-5891

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

69

we used, Section 4 presents our results, Section 5 dis-

cusses the implications and limitations of our find-

ings, and Section 6 concludes our research paper.

2 LITERATURE REVIEW

2.1 Machine Learning Techniques in

Finance

Machine Learning’s ability to “learn” and then pre-

dict based on data especially suits the financial indus-

try which is all about strategic use of data to make

predictions that will beat the competition (Rundo et

al., 2019). Thus, it is not outlandish to visualize a

future in finance where firms are competing to create

models with the highest accuracy and lowest loss to

outplay their competitors. Previously, some machine

learning applications for finance included: algorith-

mic trading (Hansen, 2020), credit scoring (Dastile

et al., 2020), fraud detection (Dornadula & Geetha,

2019), regulatory compliance (Bauguess, 2017), and

portfolio management (Aithal et al., 2023).

2.2 Machine Learning Techniques for

ESG Risk Assessment

Similar to the rest of the financial industry, machine

learning has been utilized for ESG Risk Assessments

as well. What’s unique about machine learning is that

it gives a degree of creativity to the user as to which

model they specifically want to use that will be the

most effective given their goal and the data available.

In our previous review of ESG Risk score predicting

research, the most common types of machine learn-

ing algorithms were random forest classifiers (Chen

& Liu, 2021; Chowdhury et al., 2023; D’Amato et

al., 2021, 2022; D’Amato et al., 2023; Del Vitto et al.,

2023; Teoh et al., 2019), linear regression (D’Amato

et al., 2023; Del Vitto et al., 2023; Dwivedi et al.,

2023; Zhang, 2023), and LSTMs (Teoh et al., 2019).

Each model provides a different approach to analyz-

ing the data and can yield different accuracies and

losses. Furthermore, to determine our model, we must

first determine our data.

2.3 Natural Language Processing (NLP)

in ESG Risk Assessment

Natural Language Processing is a machine-learning

technique that can derive conclusions from a given

piece of text in the same way a human analyzes texts.

Historically, natural language processing has been uti-

lized to analyze tweets on Twitter and associate them

with a movement in the stock market depending on

the content of the tweet. In essence, natural lan-

guage processing is used to take unstructured data,

such as public company reports, and make sense of

it. Throughout ESG Risk Score prediction research,

a vast majority focuses on the analysis of financial

statements of companies and trying to derive an ESG

Risk Score from the profitability of the company.

Research papers exploring this intersection have

been published, yet none focus on the intersection of

NLP & ESG in the United States while utilizing mul-

timodal large language models. For example, Zhang

(Zhang, 2023) explores the use of NLP on 100 Chi-

nese ESG reports to predict ESG Market Risk. Sim-

ilarly, Dwivedi et al. (Dwivedi et al., 2023) utilized

a sample of 90 companies’ publicly released reports,

which were included in the National Stock Exchange

(NSE), based in India. However, neither utilized

American-based companies, such as those listed on

the S&P 500. Uniquely, D’Amato et al. (D’Amato et

al., 2021) assessed a company’s ESG Risk profile uti-

lizing their fundamental ratios found on the balance

sheet and other financial statements.

2.4 Data Source Considerations and

Methodology

Considering the preceding focus on financial state-

ments and profitability to predict ESG Risk Scores,

we decided to explore the relationship between pub-

licly released reports of a company and its ESG Risk

Scores. Since we are analyzing reports, which are

predominantly text, we will have to use some sort of

Natural Language Processing technology. Although

we considered other forms of text-based data, such as

specific ESG-focused reports, we ultimately decided

against them because of the lack of data on the in-

ternet, which would have resulted in a poorly trained

model.

Dwivedi et al. (Dwivedi et al., 2023) constructed

a study with data from the NIFTY100 ESG Index,

comprising 84 companies, which was utilized, with

ESG risk scores obtained from S&P Global and other

corporate attributes from Moody’s Orbis. The study

applied machine learning techniques, including Gra-

dient Boosting, to develop an ESG risk score model

using a dataset with 47 corporate attributes, focusing

on analyzing the impact of these attributes on ESG

risk scores.

Krappel et al.’s (Krappel et al., 2021) study used

a dataset comprising 7413 companies from Refinitiv

Eikon, spanning from 2002 to 2019. It included fun-

FEMIB 2024 - 6th International Conference on Finance, Economics, Management and IT Business

70

damental financial data and ESG ratings, focusing on

how a company’s fundamental data over time reflects

in its ESG ratings. The analysis incorporated a broad

range of financial and non-financial data to predict

ESG performance.

D’Amato et al.’s (D’Amato et al., 2022) study an-

alyzed the STOXX Europe 600 Index constituents.

This study collected ESG risk scores and balance

sheet information for 401 companies from Thomson

Reuters Refinitiv ESG. The research aimed to under-

stand the relationship between various balance sheet

items and ESG risk scores, using a dataset that also

detailed the ESG performance across different indus-

try sectors.

T.-T. et al’s (Teoh et al., 2019) research utilized

Thomson Reuters ESG Scores to assess the CSR ef-

forts of companies. It combined ESG risk scores with

financial performance indicators like ROE, analyzing

the year-on-year changes in these metrics. Several

machine learning models, including SVM, Random

Forest, and LSTM, were developed to classify the

changes in ESG risk scores and their correlation with

financial performance.

Chowdhury et al.’s (Chowdhury et al., 2023) study

aims to develop a machine learning-based ESG rat-

ing prediction model using firm-specific and macroe-

conomic predictors, involving steps like feature se-

lection, data cleaning, and model validation. Data

sources include Thomson Reuters Datastream and the

World Bank, with variables like ESG risk score, com-

pany size, and macroeconomic indicators. Various

machine learning models, including Neural Networks

and Random Forests, were evaluated for predicting

ESG ratings, employing cross-validation and ROC

curve analysis for model selection.

2.5 Practical Applications and

Implications

Our findings will pave the way for investors to derive

holistic findings for companies regardless of whether

or not they have publicly released ESG risk scores.

This approach aligns with the growing trend in fi-

nance to leverage machine learning for more accurate

predictions and novel measure construction (Ahmed

et al., 2022). Not only will this help investors, such

as those in corporate finance evaluate smaller com-

panies, whose actions may not be as magnified as

larger companies, but it will also hold every single

company accountable for their actions in the environ-

mental, social, and governance spaces. Furthermore,

the application of machine learning in developing su-

perior measures and reducing prediction errors in fi-

nance underscores the potential of these technologies

in enhancing corporate governance and accountability

(Chen & Liu, 2021).

3 METHODOLOGY

3.1 Dataset Selection

Since our study is targeted to S&P 500 company

information, we acquired an open-source Kaggle

dataset with S&P 500 companies’ ESG metrics

(Dugar, n.d.). To accurately account for differences

in model input, we kept the following attributes in our

data:

• Symbol: The unique stock symbol associated

with the company.

• Name: The official name of the company.

• Total ESG Risk Score: An aggregate score eval-

uating the company’s overall ESG risk.

• Environment Risk Score: A score indicating the

company’s environmental sustainability and im-

pact.

• Social Risk Score: A score assessing the com-

pany’s societal and employee-related practices.

• Governance Risk Score: A score reflecting the

quality of the company’s governance structure.

• ESG Risk Level: A categorical indication of the

company’s ESG risk level.

The next step was to add 3 columns to our

dataset: “Environmental Description”, “Social De-

scription”, and “Governance Description”. These

columns would eventually include direct quotes re-

garding environmental, social, and governance fac-

tors from each company’s 2022 annual report and any

other publicly released reports. The steps to fill in

these columns required a 3 step approach. Firstly, to

access each company’s annual report we web-scraped

text from the URL structured as follows:

https://www.annualreports.com/HostedData/Ann

ualReports/PDF/{Stock Exchange} {Company Tick

er Symbol} 2022.pdf}

We iterated through a 2D array structured as fol-

lows to attribute the Stock Exchange to the Company

Ticker Symbol:

[(Stock Exchange, Company Ticker Symbol),

(Stock Exchange, Company Ticker Symbol),

...,

(Stock Exchange, Company Ticker Symbol)]

Secondly, after iterating through each company’s

pdf file, we extracted the respective report’s text and

Leveraging Multimodal Large Language Models and Natural Language Processing Techniques for Comprehensive ESG Risk Score

Prediction

71

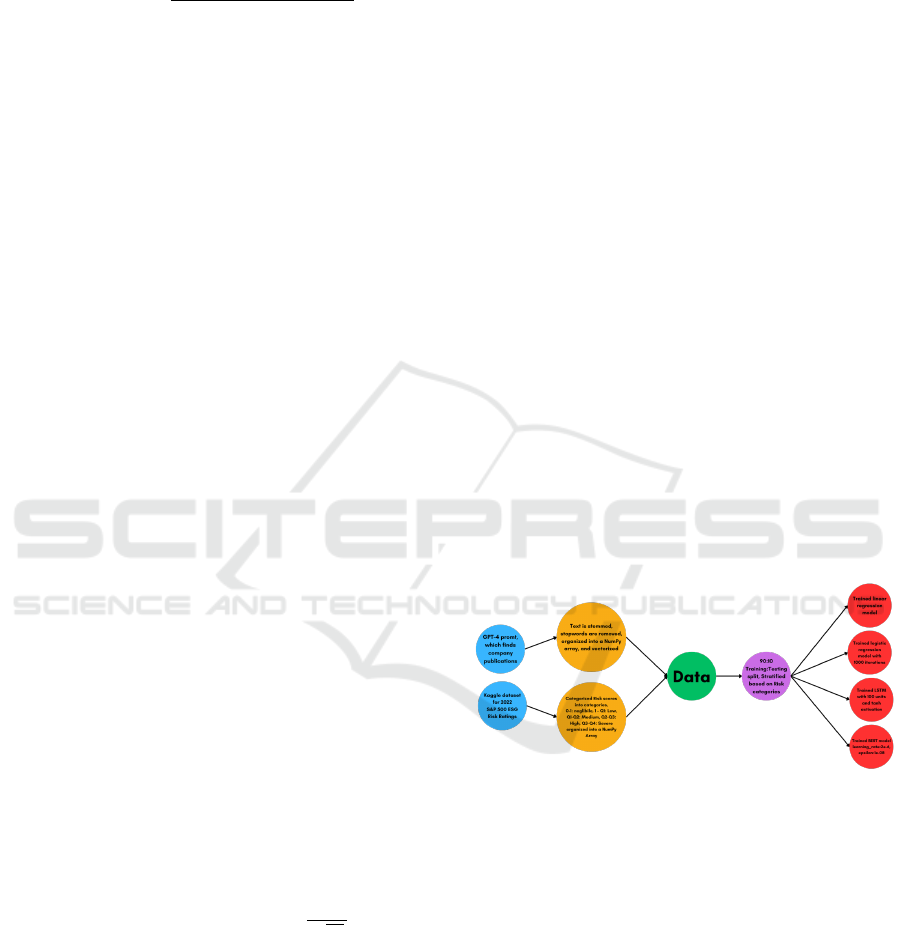

Figure 1: Prompt Given To ChatGPT-4.

sent a request to OpenAI’s ChatGPT API utilizing the

“gpt-4-1106-preview” model. We structured the re-

quest input as shown in Figure 1.

Lastly, after formatting the API’s output data into

“Environmental Description”, “Social Description”,

and “Governance Description” categories, we added

all categories to our dataset under each company.

3.2 Pre-Processing Measures

Before our data was ready to use within our models,

we had to pre-process our aggregated dataset. Our

pre-processing measures are as follows:

• Missing Values: In some cases, we had issues

with web scraping content and OpenAI API re-

sponses. Therefore, we implemented Python’s

“.fillna(”)” method to fill in NaN inputs to values

that are recognizable by our model.

• Stemming: Stemming is a text normalization

technique that involves reducing words to their

base or root form, which helps minimize the com-

plexity of the textual data by consolidating dif-

ferent forms of a word into a single representa-

tion. For example, the words ”connect”, ”con-

necting”, ”connected”, and “connection” are all

reduced to the stem ”connect”. This is partic-

ularly beneficial in our analysis as it decreases

the variability within the text data, allowing our

machine-learning models to focus on the essence

of the content rather than getting bogged down

by the nuances of language. We utilized “Porter

Stemmer”, a widely-used algorithm for stemming

English words. The choice of the algorithm was

guided by the balance between aggressive stem-

ming, which might oversimplify the text, and gen-

tle stemming, which retains more of the word’s

original form.

• Training and Testing Split: In our study, we di-

vided our dataset into two distinct sets: the train-

ing set and the testing set. This division is a fun-

damental practice in machine learning to evalu-

ate the performance of our models. Typically, the

training set is larger and used to train the model,

allowing it to learn the underlying patterns in the

data. The testing set, on the other hand, is used to

evaluate the model’s performance on unseen data,

ensuring that our model can generalize well to

new, unobserved data. We adhered to a training-

focused ratio, allocating 90% of the data for train-

ing and the remaining 10% for testing. This split

was performed randomly to ensure a representa-

tive and unbiased distribution of data across both

sets. We separated the data in this manner to min-

imize the effects of model underfitting, wherein

the model would not learn the inherent patterns

within the training data.

3.3 Model Building

Before delving into the specifics of each model uti-

lized in our study, it is crucial to contextualize the

application of sentiment analysis within the scope of

our research objectives. Sentiment analysis, a com-

putational technique, aims to identify and categorize

opinions within the text to ascertain the writer’s at-

titude towards a particular subject, product, etc., as

positive, negative, or neutral. In the context of our re-

search, we seek to gauge the sentiment of company

reports regarding Environmental, Social, and Gov-

ernance (ESG) factors. Our model-building process

incorporates four distinct machine learning models:

Linear Regression, Logistic Regression, Long Short-

Term Memory (LSTM) networks, and Bidirectional

Encoder Representations from Transformers (BERT),

each offering unique benefits for predicting the ESG

Risk Score.

3.3.1 Linear Regression Model

The Linear Regression model is adopted for its sim-

plicity and efficacy in predicting numerical outcomes.

Mathematically, it is expressed as:

y = β

0

+ β

1

x

1

+ β

2

x

2

+ ···+ β

n

x

n

+ ε (1)

where y represents the ESG Risk Score, β

0

is the in-

tercept, β

1

, β

2

, . . . , β

n

are the coefficients of the pre-

processed text features x

1

, x

2

, . . . , x

n

, and ε is the error

term. This model establishes a linear correlation be-

tween the textual data from reports and quantifiable

ESG risk scores, facilitating straightforward interpre-

tation and efficient prediction.

3.3.2 Logistic Regression Model

Logistic Regression is leveraged for its proficiency

in classifying outcomes, ideal for predicting categori-

cal ESG risk levels (negligible risk, low risk, medium

FEMIB 2024 - 6th International Conference on Finance, Economics, Management and IT Business

72

risk, high risk, and severe risk). It employs the logis-

tic function to estimate probabilities that then dictate

class membership:

p(y = 1) =

1

1 + e

−(β

0

+β

1

x

1

+···+β

n

x

n

)

(2)

where p(y = 1) represents the probability of the ESG

risk score falling into a specific category (e.g., high

risk). This model effectively links pre-processed text

features from reports to categorical ESG risk scores.

3.3.3 LSTM (RNN) Model

LSTMs, a special kind of RNN, are adept at process-

ing sequence data, making them particularly suitable

for text. The core concept of an LSTM is its ability

to maintain a cell state and apply gating mechanisms,

which include:

• Forget Gate: f

t

= σ(W

f

·[h

t−1

, x

t

] + b

f

)

• Input Gate: i

t

= σ(W

i

·[h

t−1

, x

t

] + b

i

)

• Cell State Update:

˜

C

t

= tanh(W

C

·[h

t−1

, x

t

] + b

C

)

• Output Gate: o

t

= σ(W

o

·[h

t−1

, x

t

] + b

o

)

• Updated Cell State: C

t

= f

t

∗C

t−1

+ i

t

∗

˜

C

t

• Output: h

t

= o

t

∗tanh(C

t

)

Here, σ denotes the sigmoid function, W and b

represent weights and biases for each gate, respec-

tively, and h

t

and C

t

are the hidden state and cell

state at time t. This sophisticated mechanism enables

LSTMs to capture long-term dependencies within

textual data, essential for understanding the complex

nuances associated with ESG factors.

3.3.4 BERT Model

The Bidirectional Encoder Representations from

Transformers (BERT) model represents a paradigm

shift in how machines understand textual information.

Its architecture is grounded in the transformer model,

which relies on attention mechanisms to weigh the

significance of different words in a sentence. For-

mally, the transformer uses self-attention mecha-

nisms, which can be described as follows:

Attention(Q, K, V ) = softmax

QK

T

√

d

k

V (3)

where Q, K, and V represent the queries, keys, and

values matrices, respectively, and d

k

is the dimension

of the key vectors. This mechanism allows BERT to

consider the context of each word in the entire doc-

ument bidirectionally, as opposed to previous models

that processed text in one direction.

BERT’s training comprises two main tasks:

Masked Language Modeling (MLM) and Next Sen-

tence Prediction (NSP). The MLM task randomly

masks words in a sentence and trains the model to

predict these masked words, thereby learning context.

The NSP task trains the model to predict whether a

sentence logically follows another, enhancing its un-

derstanding of sentence relationships.

For fine-tuning BERT on specific datasets, such

as those related to ESG factors, the pre-trained BERT

model is adapted as follows:

1. The final output layer of BERT is replaced with

a new layer, tailored to the specific classification

task (e.g., predicting ESG risk scores).

2. The entire model is then trained on the domain-

specific dataset, allowing the model to adjust its

internal weights to better understand and classify

the new data.

This fine-tuning process enables BERT to extract

meaningful features from ESG-related text, leverag-

ing its deep contextualized representations to under-

stand the nuances and complexities of natural lan-

guage. The advantage of using BERT lies in its ability

to capture both sentiment and thematic content rele-

vant to ESG factors, providing a nuanced analysis of

textual data. This approach significantly enhances our

methodology, allowing for a more insightful and ac-

curate derivation of ESG Risk Scores.

3.4 Conclusion

Figure 2: Visual Representation of our Methodology Pro-

cess.

Figure 2 shows a visual representation of our method-

ology process. The next section will detail the results

obtained from applying these methodologies.

4 RESULTS

4.1 Linear Regression Model Results

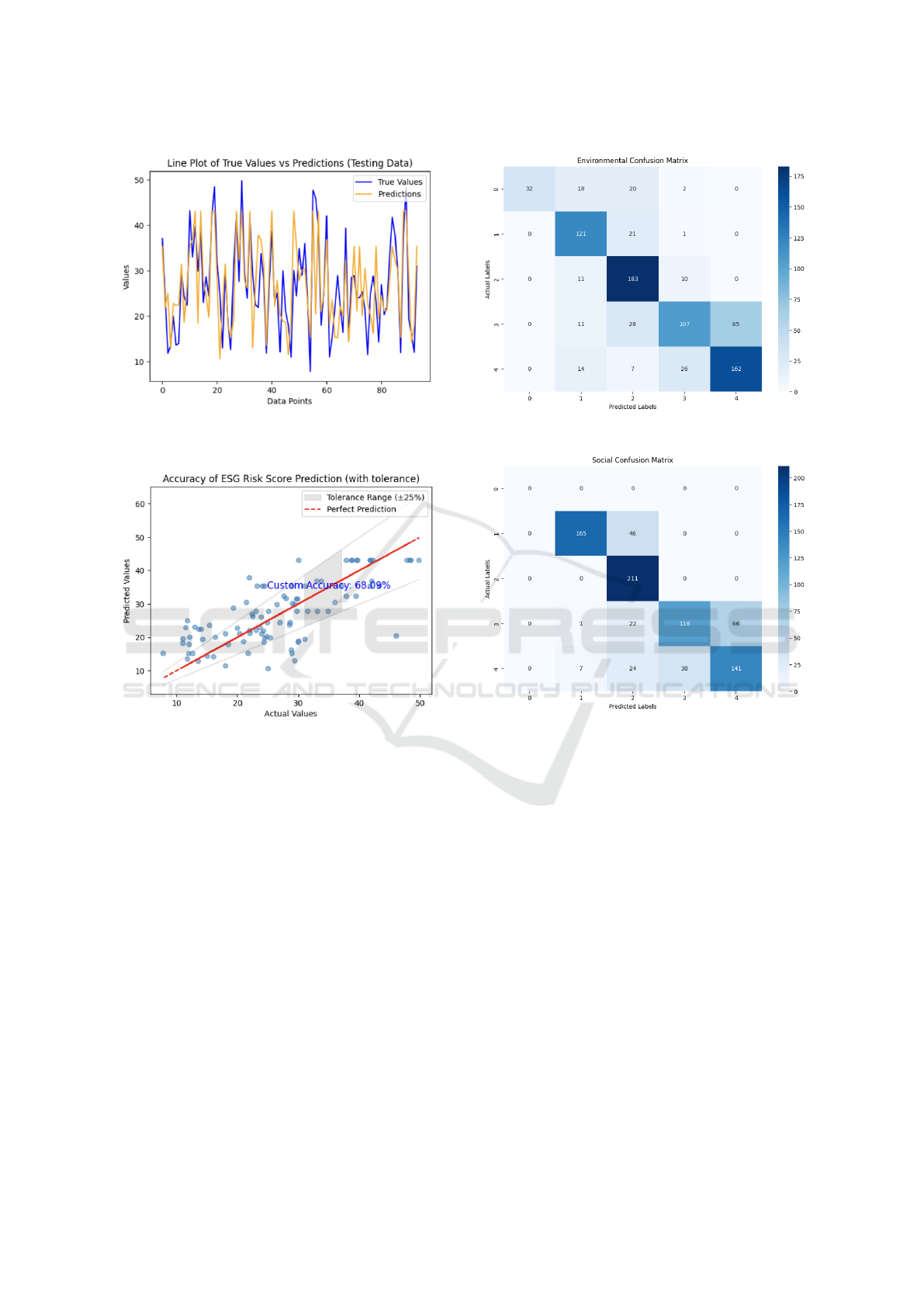

Considering the nature of traditional linear regres-

sion evaluation metrics, we instead decided to inter-

pret our results with a 25 percent tolerance to pro-

vide a consistent evaluation approach between models

Leveraging Multimodal Large Language Models and Natural Language Processing Techniques for Comprehensive ESG Risk Score

Prediction

73

Figure 3: True ESG risk score vs Predicted ESG risk score

on Testing Data (Linear Regression).

Figure 4: Linear Regression Model Results with ±25% Tol-

erance.

(Figure 4). As a result, the Linear Regression model

shows a moderately high level of accuracy. This sug-

gests it can relatively effectively predict ESG Risk

Scores based on the textual data extracted from com-

pany reports. Given the model’s simplicity and ease

of interpretation, these results are promising, espe-

cially for initial assessments or in situations where

computational resources are limited. However, the

model might not fully capture the complex relation-

ships and nuances inherent in the textual descriptions

of ESG factors.

4.2 Logistic Regression Model Results

Figure 5, Figure 6, and Figure 7 are our confusion

matrices, which outline the success of the logistic re-

gression model in predicting environmental, social,

and governance levels respectively. The varied per-

formance of the Logistic Regression model across dif-

Figure 5: Environmental Model Confusion Matrix.

Figure 6: Social Model Confusion Matrix.

ferent ESG categories (environmental, social, gover-

nance) could indicate that the model is more attuned

to certain aspects of ESG risk than others. The rel-

atively moderate accuracy in each category, partic-

ularly in governance, suggests that the model may

struggle with the complexity and variability of lan-

guage used in ESG reporting. With the similarity in

excerpts within the data across ESG risk levels, a lo-

gistic regression, which utilized the bag of words NLP

technique may struggle.

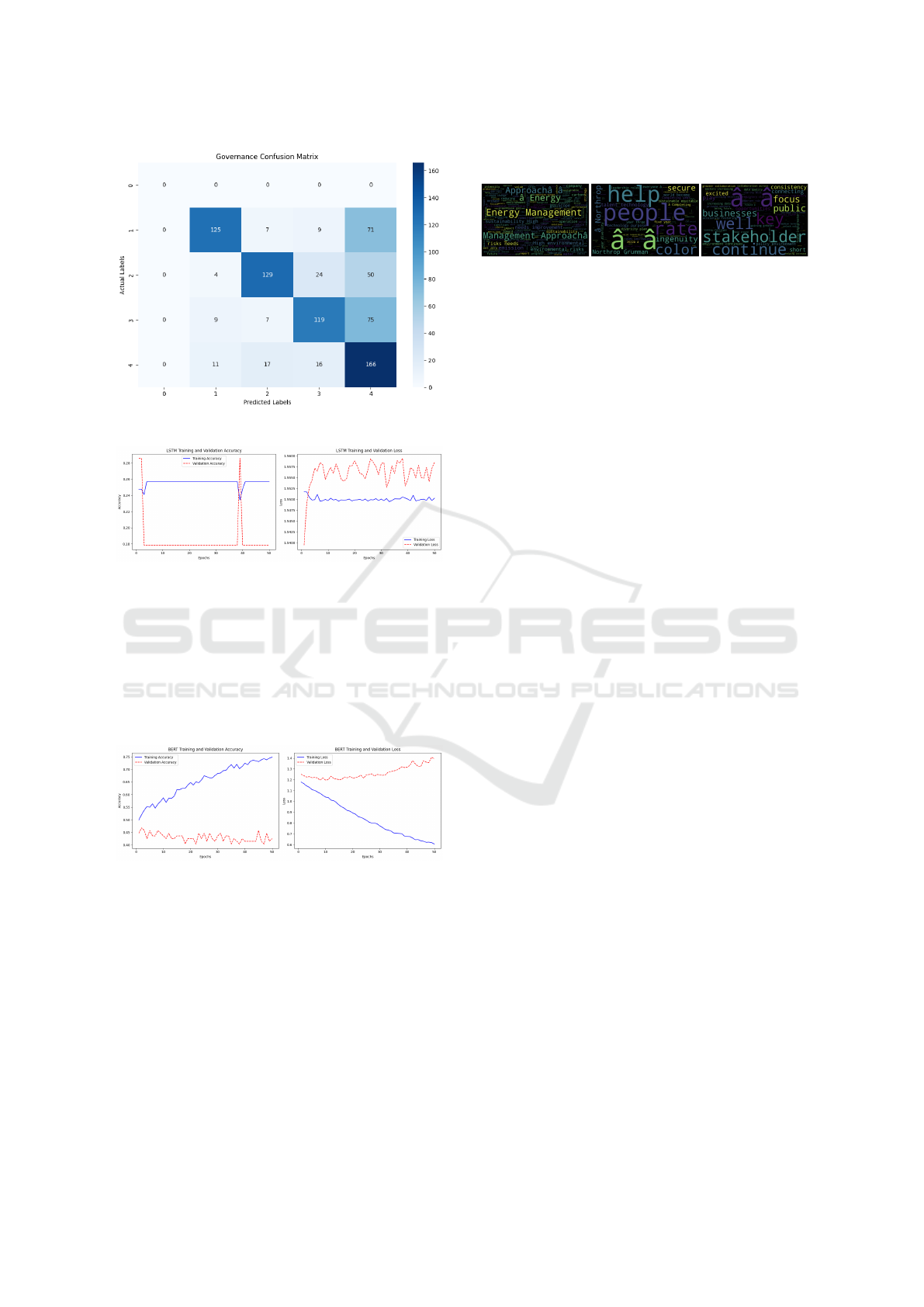

4.3 LSTM Model Results

The low accuracy of the LSTM model is surpris-

ing, given its capability to process sequence data and

its effectiveness in natural language processing tasks

(Figure 8). This might indicate challenges in the

model’s configuration or the nature of the data. It

could suggest that the LSTM is either overfitting or

underfitting the training data or that the sequential

FEMIB 2024 - 6th International Conference on Finance, Economics, Management and IT Business

74

Figure 7: Governance Model Confusion Matrix.

Figure 8: Training & Validation Accuracy Over Epochs and

Training & Validation Loss Over Epochs (LSTM Model).

aspects of the text are not as predictive of ESG risk

scores as hypothesized. This result might necessitate

a review of the model architecture, data preprocess-

ing, or feature selection.

4.4 BERT Model Results

Figure 9: Training & Validation Accuracy Over Epochs and

Training & Validation Loss Over Epochs (BERT Model).

While BERT models are proficient in understanding

language context, the moderate accuracy in this ap-

plication suggests that the model may not have been

fully optimized for this specific task (Figure 9). The

complexity of ESG reporting text and the subtleties

of risk assessment might require more fine-tuning of

the model, or additional contextual features may be

needed to improve its predictive power. This result

underscores the challenges of applying advanced NLP

models to specialized domains like ESG risk assess-

ment.

4.5 General Results

Figure 10: The image on the left is the Environmental Word

Cloud. The image in the middle is the Social Word Cloud.

The image on the right is the Governance Word Cloud.

Reflecting on the results of our research on ESG risk

scores, it becomes evident that each model we em-

ployed has its unique strengths and limitations in this

task. Interestingly, despite the advanced capabilities

of LSTM and BERT models, it is both the Linear and

Logistic regression models that stand out with their

effectiveness. Achieving an accuracy of 68.09% for

Linear Regression and 51.05% for Logistic Regres-

sion, this model’s simplicity, ease of interpretation,

and decent performance make it a surprisingly viable

option for predicting ESG Risk Scores. This is par-

ticularly significant in scenarios where stakeholders

prefer models that are transparent and easy to under-

stand.

5 DISCUSSION AND

LIMITATIONS

5.1 Discussion of Data Findings

The lower accuracy rates of the LSTM and BERT

models, 25.53% and 46.81% respectively, indicate

possible challenges in their configuration and train-

ing, or perhaps the inherent complexity of analyzing

the nuances in ESG reporting. While powerful in

handling sequential and contextual data, these sophis-

ticated models require more in-depth tuning and an

enhanced understanding of ESG report subtleties to

fully utilize their potential. The varied performance of

the Logistic Regression model across different ESG

categories also offers valuable insights. It suggests a

sensitivity to the specifics of each category, though its

overall effectiveness seems to lag behind that of Lin-

ear Regression for this particular task. These results

collectively underscore the complexity of assessing

ESG risks from textual data and the importance of

careful model selection and tuning. The success of

the Linear Regression model in our study is particu-

larly intriguing, as it suggests that in certain aspects of

ESG risk assessment, simpler models can be quite ef-

fective, especially for initial screenings or situations

where interpretability is crucial. However, there are

limitations faced throughout our process.

Leveraging Multimodal Large Language Models and Natural Language Processing Techniques for Comprehensive ESG Risk Score

Prediction

75

5.2 Implications for Stakeholders

The upside of our results is undeniable for stake-

holders. With a machine learning algorithm that can

provide an enterprise risk score on ESG factors ef-

ficiently, investors can now conduct a holistic risk

analysis of companies that do not already have ESG

risk scores/analysis. For a vast majority of compa-

nies, especially those with a market cap under $500

million, an ESG risk score is not provided, mean-

ing that our system could provide an analysis within

seconds. This form of analysis is especially useful

for private equity firms who tend to acquire compa-

nies that are not publicly traded, much less assigned

an ESG risk score. Considering that ESG initiatives,

which comprise ESG risk scores, correlate with mar-

ket risk and returns as described by Zhang, being able

to efficiently analyze ESG risk will help investors dif-

ferentiate sound companies from unsound companies.

5.3 Data Limitations

Our research, focusing exclusively on S&P 500 com-

panies, as opposed to Teoh who focused on major

technological stocks and the NASDAQ index, and

Zhang who focused exclusively on Chinese compa-

nies, presented both strengths and constraints. While

this focus allowed us to work with a consistent and

relatively homogenous dataset, it also limited the gen-

eralizability of our findings. Expanding our data be-

yond the S&P 500 could have potentially introduced

a more diverse range of ESG practices and report-

ing standards, reflecting a broader spectrum of cor-

porate behaviors and policies. This expansion could

have provided a richer and more nuanced understand-

ing of ESG risk assessments, enabling our models to

capture a wider array of ESG factors and their im-

pact. Additionally, including smaller or international

firms, which often have different ESG reporting stan-

dards and challenges, might have revealed additional

insights into the variability and complexity of ESG

practices globally. Next, our specific data source,

company reports, may have led to poor, monotonous

data as companies tend to provide standard responses

for certain issues, making it difficult for our mod-

els to differentiate companies experiencing high risk

from those experiencing low risk. Finally, ChatGPT’s

response algorithm tends to follow a specific format

that may have introduced unintended patterns within

our dataset that the models tried to recognize. This

may be another reason why our linear and logistic re-

gression models may have performed better than our

BERT or LSTM models, as linear regression is more

adept at capturing these consistent, systematic pat-

terns in data, while more complex models like BERT

might overfit to the nuances in language, missing out

on these broader, more uniform trends.

5.4 Enhancing the Process

To enhance the effectiveness of our process, several

strategies could be considered. Firstly, our strat-

egy could have focused solely on either annual re-

ports or even sustainability reports as opposed to data

from a diverse range of publicly released company

reports to enhance and streamline the data retrieval

process. Secondly, exploring alternative data sources,

like news articles, social media, or consumer reviews,

could provide additional context and depth to the ESG

assessments. Furthermore, continuously updating the

dataset with the latest reports and data would ensure

that the models stay relevant and accurate over time.

Another aspect to consider is improving data prepro-

cessing techniques, such as more advanced natural

language processing methods, to better capture the

nuances and subtleties in the textual data. Lastly,

as independent researchers, we faced financial con-

straints that inhibited our data retrieval process and

our machine-learning capabilities. Specifically, up-

grading the LLM model we used requires more finan-

cial flexibility. Our process could incorporate inter-

disciplinary approaches, such as integrating insights

from behavioral economics to understand the impact

of corporate governance on ESG performance. This

draws inspiration from D’Amato et al.’s exploration

of balance sheet items and their correlation with ESG

scores, suggesting a nuanced approach to feature se-

lection in our model. Further, Krappel et al.’s work

on the temporal dynamics of company fundamentals

in reflecting ESG ratings underlines the importance of

including longitudinal data analysis in our methodol-

ogy. This could ensure our model adapts to tempo-

ral changes in ESG criteria, much like the dynamic

models suggested by T.-T. et al. and Chowdhury

et al., who assessed year-on-year changes in ESG

risk scores and their correlation with financial perfor-

mance using various machine learning models.

5.5 Subjectivity in ESG Risk Scores

A limitation in our study, and indeed in the field of

ESG risk assessment in general, is the intrinsic sub-

jectivity of ESG risk scores. ESG scoring is an ex-

tensive process, often involving qualitative judgments

and varying interpretations of what constitutes good

environmental, social, and governance practices. This

subjectivity can lead to inconsistencies and variability

in ESG risk scores, even among similar companies. It

FEMIB 2024 - 6th International Conference on Finance, Economics, Management and IT Business

76

also poses a challenge for machine learning models,

which rely on consistent and objective data to make

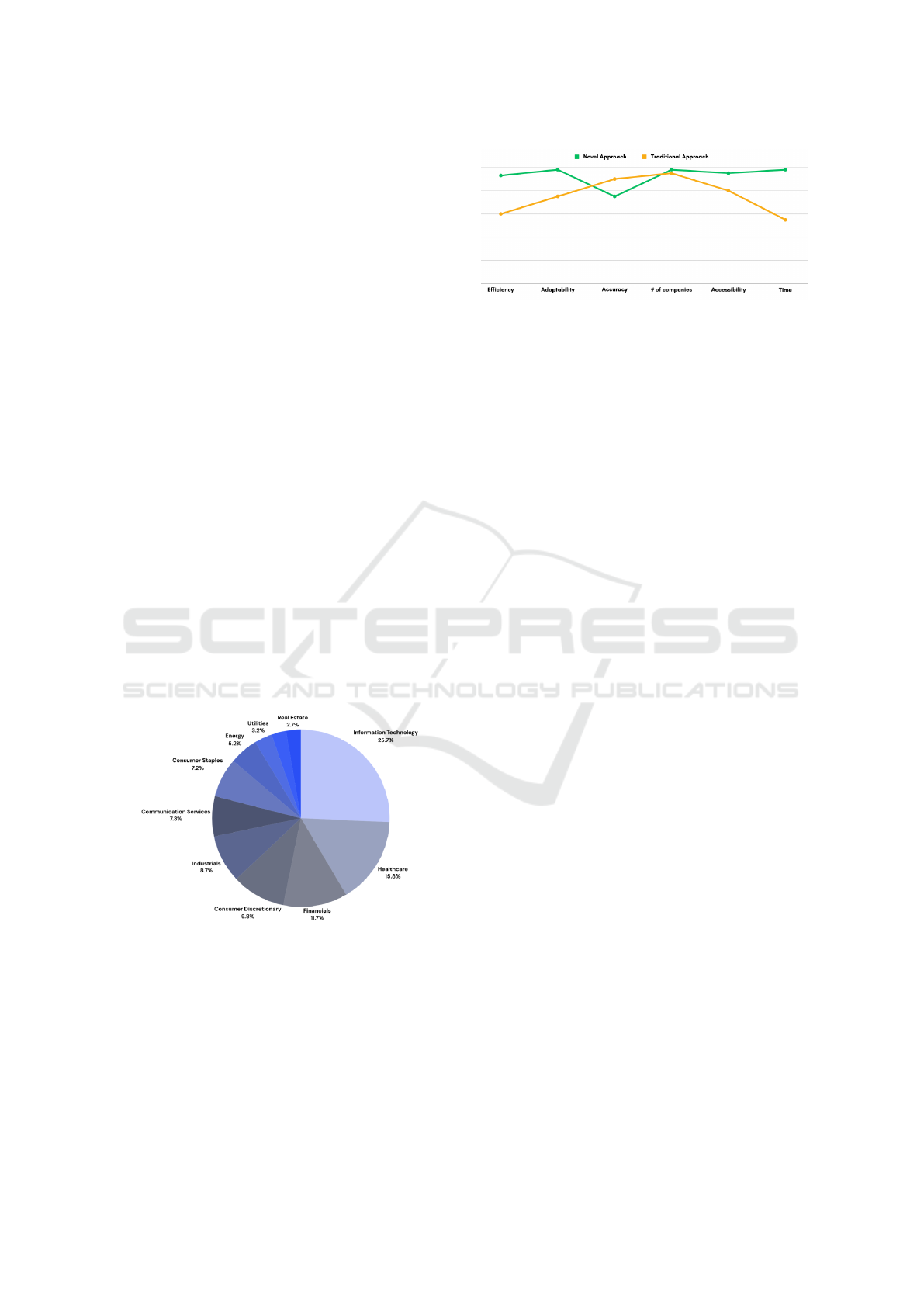

accurate predictions. Furthermore, we must take into

consideration the uneven distribution of companies

within the S&P 500 company portfolio. As shown by

Figure 11, in 2022 the Information Technology (IT)

sector and the Healthcare sector comprised 25.7%

and 15.8% of the S&P 500 companies, respectively.

This skew towards IT and Healthcare may raise con-

cerns about the representativeness of the dataset used

for machine learning models. Such dominance could

lead to models that are inadvertently tailored to the

ESG reporting standards, challenges, and practices

prevalent in these sectors, potentially overlooking the

unique environmental, social, and governance issues

pertinent to other industries.

5.6 Ethical Considerations

Critical ethical issues are brought up by using ma-

chine learning and natural language processing to

predict ESG risk scores. These issues include the

need to address biases in data sources and algo-

rithms to guarantee impartial and accurate assess-

ments in all industries. Robust data handling and

anonymization protocols are imperative to ensure pri-

vacy and protect sensitive information found in an-

alyzed texts. Furthermore, to promote accountabil-

ity and trust among stakeholders and enable well-

informed decision-making based on ESG evaluations,

models must remain transparent and interpretable.

Figure 11: S&P 500 Market Representation by Sector.

6 CONCLUSION AND FUTURE

WORKS

6.1 Conclusion

In conclusion, our research explores the use of var-

ious machine learning and natural language process-

Figure 12: Holistic Representation of our Novel Approach

vs Traditional Approaches.

ing techniques with public company reports to predict

their respective ESG risk scores. Specifically, venture

capital firms, private equity firms, and relatively mod-

est investors who can not afford the labor and capital-

intensive process of doing an in-depth corporate so-

cial responsibility analysis on each venture can use

our discovery to bridge this gap. Our research intro-

duces a pioneering framework that utilizes a new ar-

chitecture for analyzing ESG practices, transforming

the traditional assessment process for both large and

small companies alike.

6.2 Future Works

Future research in the area of machine learning mod-

els for ESG risk assessment has several promising av-

enues to pursue. Including companies that are not

listed on the S&P 500 in the research is a particularly

promising direction. This expansion would improve

the findings’ inclusivity and suitability for a wider

range of businesses, including startups and smaller

enterprises, in addition to diversifying the dataset.

These businesses frequently face distinct operating

constraints and could present particular ESG issues

and behaviors, providing a wealth of material for ad-

ditional research. An important topic for further study

is the examination of global ESG risk scores. A com-

pany’s ESG practices and reporting may be greatly

impacted by the differing ESG standards, laws, and

cultural viewpoints of various nations and areas. Fu-

ture research can also offer a more global perspec-

tive on ESG risk assessment by incorporating inter-

national data, which will help to create a more thor-

ough understanding of global ESG practices and their

implications. A more comprehensive understanding

of a company’s ESG impact could be obtained by in-

corporating a wider range of data sources, including

news articles, social media sentiment, and even re-

gional and political variables. Furthermore, we can

also find more relationships in our data and findings

by using more machine learning algorithms and tech-

niques like principal component analysis (PCA), sup-

Leveraging Multimodal Large Language Models and Natural Language Processing Techniques for Comprehensive ESG Risk Score

Prediction

77

port vector machines (SVM), random forests, deci-

sion trees, and neural networks.

REFERENCES

Ahmed, S., Alshater, M. M., El Ammari, A., and Ham-

mami, H. (2022). Artificial intelligence and machine

learning in finance: A bibliometric review. Research

in International Business and Finance, 61.

Aithal, P. K., Geetha, M., U, D., Savitha, B., and Menon,

P. (2023). Real-time portfolio management system

utilizing machine learning techniques. IEEE Access,

11:32595–32608.

Bauguess, S. W. (2017). The role of big data, machine

learning, and ai in assessing risks: a regulatory per-

spective. SSRN. Presented at OpRisk North America

2017, New York, NY.

Chen, Q. and Liu, X.-Y. (2021). Quantifying esg alpha us-

ing scholar big data: an automated machine learning

approach. In Proceedings of the First ACM Interna-

tional Conference on AI in Finance (ICAIF ’20), pages

1–8, New York, NY, USA. ACM.

Chowdhury, M. A. F., Abdullah, M., Azad, M. A. K., Su-

long, Z., and Islam, M. N. (2023). Environmental so-

cial and governance (esg) rating prediction using ma-

chine learning approaches. Annals of Operations Re-

search.

D’Amato, V., D’Ecclesia, R., and Levantesi, S. (2023).

Firms’ profitability and esg score: A machine learn-

ing approach. Applied Stochastic Models in Business

and Industry, pages 1–19.

Dastile, X., Celik, T., and Potsane, M. (2020). Statisti-

cal and machine learning models in credit scoring: A

systematic literature survey. Applied Soft Computing

Journal, 91.

Del Vitto, A., Marazzina, D., and Stocco, D. (2023). Esg

ratings explainability through machine learning tech-

niques. Annals of Operations Research.

Dornadula, V. N. and Geetha, S. (2019). Credit card fraud

detection using machine learning algorithms. In Pro-

cedia Computer Science, volume 165, pages 631–641.

Elsevier.

Dugar, P. S and p 500 esg risk ratings. Kaggle.

Dwivedi, D., Batra, S., and Pathak, Y. K. (2023). A ma-

chine learning based approach to identify key drivers

for improving corporate’s esg ratings. Journal of Law

and Sustainable Development, 11(1).

D’Amato, V., D’Ecclesia, R., and Levantesi, S. (2021). Fun-

damental ratios as predictors of esg scores: a machine

learning approach. Decisions in Economics and Fi-

nance, 44:1087–1110.

D’Amato, V., D’Ecclesia, R., and Levantesi, S. (2022). Esg

risk score prediction through random forest algorithm.

Computational Management Science, 19:347–373.

Hansen, K. B. (2020). The virtue of simplicity: On machine

learning models in algorithmic trading. Big Data &

Society, 7(1).

Krappel, T., Bogun, A., and Borth, D. (2021). Hetero-

geneous ensemble for esg ratings prediction. arXiv.

CoRR.

Rundo, F., Trenta, F., di Stallo, A. L., and Battiato, S.

(2019). Machine learning for quantitative finance ap-

plications: A survey. Applied Sciences, 9(24):5574.

Teoh, T.-T., Heng, Q. K. J. J., Chia Shie, J. M., Liaw,

S. W., Yang, M., and Nguwi, Y.-Y. (2019). Machine

learning-based corporate social responsibility predic-

tion. In Proc. IEEE Conf. on Cybernetics and Intel-

ligent Systems (CIS) and Robotics, Automation and

Mechatronics (RAM), pages 501–505. IEEE.

Zhang, Y. (2023). Esg-based market risk prediction and

management using machine learning and natural lan-

guage processing. Bachelor’s thesis, Business and

Economics Honors Program, NYU Shanghai, May

2023.

FEMIB 2024 - 6th International Conference on Finance, Economics, Management and IT Business

78