Enhancing Returns Management in Fashion E-Commerce: Industry

Insights on AI-Based Prediction and Recommendation Systems

Soeren Gry

a

, Marie Niederlaender

b

and Dirk Werth

c

August-Wilhelm Scheer Institut, Uni Campus D 5 1, Saarbr

¨

ucken, Germany

fi

Keywords:

Returns Prediction, Returns Prevention, Survey Results, Expert Interviews, Fashion E-Commerce,

Recommendation System, Machine Learning, Sustainable Return Management, Sustainable Supply Chain.

Abstract:

The fashion industry is one of the most problematic sectors in terms of sustainability. The fashion e-commerce

sector is experiencing a surge in sales, which is leading to a significant increase in returns. This, in turn, is

placing a considerable burden on the environment. High transport volumes or even the destruction of garments

through returns pose major environmental and also economic problems. This study is based on a survey and

expert interviews with decision-makers from the fashion industry. It provides indications of how an AI-based

prediction and recommendation system could be used to avoid returns and manage them in an ecologically

and economically sensible way. On the one hand, use cases are discussed that can be applied in the webshop

system before the customer places an order, and on the other hand, ways are shown how returns predictions can

support planning in the reverse logistics network.

1 INTRODUCTION

E-commerce grew rapidly during the coronavirus pan-

demic. The share of e-commerce in total retail sales

increased from 15% in 2019 to 22% in 2022 (Mor-

gan Stanley, 2022). This growth will continue after

the coronavirus pandemic. Annual growth of 9.91%

is expected for the years 2024 (C3,334.00 billion) to

2028 ( C4,865.00 billion) (Statista Market Insights,

2024). Growing e-commerce sales are accompanied

by increasing transport volumes and higher volumes of

returns. As a result, e-commerce is focusing more and

more on reducing returns and managing them more sus-

tainably. This can be done, for example, by using size

finders which help customers find a garment that fits

their individual body shape. In fashion e-commerce,

the fitting room is often moved from the store to the

consumer’s home to overcome a major drawback of

e-commerce compared to bricks-and-mortar retail: the

customer wants to see, touch and try on the product.

It is therefore difficult to eliminate returns completely

(Asdecker and Karl, 2018; Lohmeier, 2024).

The fashion industry accounts for most of the re-

turns in the e-commerce sector. Of the 1.3 billion items

a

https://orcid.org/0000-0002-4441-0517

b

https://orcid.org/0009-0008-1935-821X

c

https://orcid.org/0000-0003-2115-6955

returned in Germany in 2021, 91% were clothing and

footwear. Comparable patterns of consumer behaviour

can be observed at the European level (Forschungs-

gruppe Retourenmanagement, 2022). The issue of

increasing product returns is adding to the pressure on

an industry that has long been criticised for its poor

environmental performance. This is the starting point

for this research project. To tackle the problem of high

returns, manufacturers and retailers have the opportu-

nity to work on preventing returns through preventive

measures such as sizefinders, or to improve the en-

vironmental and economic impact of returns through

reactive measures such as adjustments to returns lo-

gistics or a suitable second life plan for the returned

garment (Deges, 2021; Gry et al., 2023). As studies

have already demonstrated, AI-based returns predic-

tions at the shopping basket level afford manufacturers

and retailers a multitude of options: These include

both 1) preventive measures to avoid returns and 2)

reactive measures in the form of adjustments to the

reverse logistics network or the second life cycle of the

garment (Gry et al., 2023). The corresponding poten-

tial applications of an AI-based prediction and recom-

mendation system are discussed in expert interviews

with decision makers from the fashion e-commerce

sector. The findings of these expert interviews will be

integrated into the design of an AI-based prediction

and recommendation system. This will provide valu-

66

Gry, S., Niederlaender, M. and Werth, D.

Enhancing Returns Management in Fashion E-Commerce: Industry Insights on AI-Based Prediction and Recommendation Systems.

DOI: 10.5220/0012759900003764

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 21st International Conference on Smart Business Technologies (ICSBT 2024), pages 66-73

ISBN: 978-989-758-710-8; ISSN: 2184-772X

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

able insights into the optimal points in the ordering

or returns process, and thus in which system (e.g. in

the webshop system or in the ERP or PDM system)

AI-based predictions can be most beneficial. Previ-

ous research has shown that AI-based predictions have

advantages over mathematical models or simple data

mining models when it comes to predicting returns, for

example (Gry et al., 2023; Niederlaender et al., 2024).

In particular, Niederlaender et al. (2024) have shown

that machine learning approaches deliver promising

results in predicting returns in fashion e-commerce. In

light of the aforementioned considerations, it is simi-

larly assumed in this paper that AI-based predictions

will be employed.

The structure of the paper is as follows. First, a

brief literature review presents the factors known to

influence the likelihood of returns when customers

place orders. Secondly, the results of a survey on

returns management among fashion retailers and man-

ufacturers with e-commerce activities are presented.

Then, key findings from expert interviews with fash-

ion e-commerce decision makers regarding the use of

AI-based predictions to avoid and manage returns are

provided. Finally, the implications of the survey and

expert interviews for the development and possible sys-

tem integration of AI-based prediction and recommen-

dation systems in the context of returns (avoidance)

are discussed. The paper concludes with a summary of

the findings, identified research gaps and an outlook.

2 METHODOLOGY

In the first part a literature review reflects the current

state of research on the factors that influence consumer

return behaviour. This knowledge can be used to sup-

port the selection of relevant variables and the cre-

ation of features in the context of machine learning

for AI-based returns predictions and to create a basic

understanding of the relationships between returns and

consumer behaviour (Niederlaender et al., 2024). This

knowledge also serves as a basis for discussion in the

following expert interviews.

To this end, a literature review was conducted, fo-

cusing on a period between 2018 and 2023, and was

carried out in November and December 2023. Springer

Link, ScienceDirect, Wiley Online Library and Google

Scholar were used, supplemented by snowballing tech-

niques to include relevant older sources outside the pri-

mary time window. The following keywords were used

in combination with the keywords Fashion, Apparel

and E-Commerce: Consumer Return Behaviour, Prod-

uct Return Prediction, Consumer Return Behaviour,

Prediction of Consumer Returns.

In order to subsequently contribute to answering

the question of how AI-based predictions can be used

in practice by manufacturers and retailers in fashion

e-commerce, a survey was conducted among man-

ufacturers and retailers on the one hand and expert

interviews with decision-makers on the other. The re-

sults and implications of which were analysed with

regard to an AI-based recommendation system based

on returns predictions.

3 LITERATURE REVIEW

The following brief literature review serves to high-

light the relationships between possible independent

variables, such as customer or product-related data

or payment methods, and the dependent variable of

the probability of returns. This was done in order to

build up a sound knowledge base on the occurrence

of returns and to be able to use this knowledge for

the expert interviews and for the development of the

AI-based recommendation system.

Product and Customer Related Data. Asdecker

et al. (2017) found that the most important factor in de-

termining the likelihood of returns is historical returns

data at the item and customer level. If a particular item

has a history of frequent returns, this, together with

historical returns behaviour on an individual customer

basis, is the most important variable in determining

the likelihood of returns.

Shipping Costs. Studies have shown that eliminat-

ing shipping costs as part of promotions encourages

consumers to order more goods for which they feel

uncertain about the purchase decision (Saarij

¨

arvi et al.,

2017). This in turn leads to a higher rate of returns

(Shehu et al., 2020). Many online retailers waive re-

turn fees above a certain turnover threshold. This has

also been shown to increase return rates, as Lepthien

and Clement (2019) found in a study conducted with a

streetwear and sportswear retailer.

Payment Methods, Price and Promotions. In their

study, Yan and Cao (2017) found that payment meth-

ods that exclude prepayment lead to higher return rates

than payment methods that require prepayment for

goods. For example, using data from an online retailer

of shoes, clothing and accessories, they showed that

credit card payment leads to a ”buy-now-pay-later”

attitude, which encourages impulsive buying and in-

creases the return rate. Customers also perceive it as a

Enhancing Returns Management in Fashion E-Commerce: Industry Insights on AI-Based Prediction and Recommendation Systems

67

lower risk if they do not have to pay in advance (Su-

tinen et al., 2022). Paying in advance is more likely

to be associated with a deliberate purchase decision,

which is reflected in lower return rates. Similar results

were found by Asdecker et al. (2017) and Makkonen

et al. (2021). Sahoo et al. (2018) show that the price

of the garments sold also influences the likelihood of

returns. They found that more expensive garments

are less likely to be returned than cheaper ones. One

reason for this could be that more mental effort is in-

vested in the purchase decision, which is reflected in

lower return rates. On the other hand, coupons lead to

customers being urged to make what they consider to

be riskier purchasing decisions, which in turn result in

higher return rates (Asdecker et al., 2017).

4 SURVEY

In the context of the returns problem described above,

a survey was created which was sent to contacts from

the fashion industry in Germany via LinkedIn and

newsletters. The aim of the survey is to find out the

status quo of the companies with regard to their online

business and their returns volume and to find out about

strategies that have already been applied to improve

the handling of returns.

4.1 Methodology and Data Set

The survey was conducted in German language and

consisted of 30 questions in total. The survey con-

sisted of a total of 20 checkbox questions with pre-

defined answers and the option of manually entering

additional answers. Cocurring manual responses were

summarized as part of the analysis. The 20 checkbox

questions included:

1.

The perspective of the respondent: retailer or

manufacturer/brand?

2. − 4.

Are the products offered via a marketplace

such as Zalando, Amazon or About You? Are the prod-

ucts exclusively offered via a marketplace? Which

marketplaces are used for selling the products? Op-

tions include Amazon, Zalando, AboutYou, Otto and

manual input fields

5.

Which fulfillment components are utilized via

the marketplaces used? Options include storage, pick-

ing, shipping, processing of returns and manual input

options

6.

The product categories offered for sale at the

market place or own store

7. − 10.

Does the shipment via the shop or market-

place include a returns label? Does the shop or mar-

ketplace collect data on the specific return reasons?

Which specific return reasons are collected? Are re-

turns reused by the shop or the marketplaces that serve

as a sales platform (e.g. in the sense of reshipment)?

11.

What specific reuse options are employed by

the shop or the marketplaces?

12.

Are customers charged for the return shipment

of their returns?

13. − 15

. Does the store or marketplace used de-

termine return rates by product category? Are the

costs incurred in the context of a return (shipping, pro-

cessing, refurbishment, etc.) being calculated? Is a

shop-internal or an existing analytics solution within

the framework of the marketplace used in the returns

context?

16. − 18.

Are return probabilities determined de-

pending on the contents of the shopping cart? Is a

returns history kept on a customer basis with items

returned in the past? Are returns probabilities deter-

mined on a customer basis?

19.

Which of the following evaluation options are

used in the context of returns management? Correla-

tion between fit forms, correlation between customer

group and probability of returns, correlation between

product group and probability of returns, or no further

evaluations

20.

Are there plans to address the issue of re-

turns processes through initiatives, projects or process

changes in your company?

In addition, 4 questions were asked to estimate the

returns rate and the reuse rate of various clothing cat-

egories, the customer friendliness of the particular

returns process currently in use, and the share of on-

line business in total sales. Remaining 6 questions

were posed with an input field to enter missing prod-

uct categories or to enter values like the number of

employees and year of foundation, time frame of the

right of return, the return fees the customer is being

charged, the costs of a single return for the company,

or to enter specific plans to improve the returns process.

The answers were analysed using histogram plots, and

both the percentage distribution of responses and the

number of participants were taken into account. In the

case of estimation questions on the return rate and re-

use rate of various product categories, the aggregated

percentage of all participant responses was evaluated

for each category.

4.2 Main Results

60 people from companies in the fashion industry took

part in the survey. The response rate varies from ques-

tion to question and is therefore stated for each of the

mentioned results in terms of the number

n

of par-

ticipants on that particular question. Although

n

is

ICSBT 2024 - 21st International Conference on Smart Business Technologies

68

too low in some cases to make a statistically signif-

icant statement, the authors decided to present these

subjective estimations by experts from the industry as

a qualitative insight and as preliminary findings that

draw attention to possibly emerging trends.

The participants in the survey are working in fash-

ion companies with a large share of online business

in total sales (

n = 11

): 33% of respondents state the

share of online business to be above 90%. The aver-

age share of online business over all respondents is

80%. The average number of employees is around 200

(

n = 10

).The participating companies range from long-

established companies to young companies, founded

between 1916 and 2015, with an average company age

of 50 years.

62% of respondents belong to a manufacturer or

brand, while 38% are retailers (

n = 34

). 76% offer

their products via a marketplace (

n = 34

), while only

4% are exclusively using marketplaces to sell their

products (

n = 26

). The most frequently named market-

places are given by Amazon (24%), Zalando (19%),

Otto (18%), AboutYou (10%), and Breuninger (4%)

(

n = 20

). All of the respondents working with a mar-

ketplace utilize storage and shipping as part of the

fulfillment offered by the marketplace, while 80% of

them also utilize picking and processing of returns

(

n = 10

). The mentioned product categories sold via

the online shops and marketplaces include, but are not

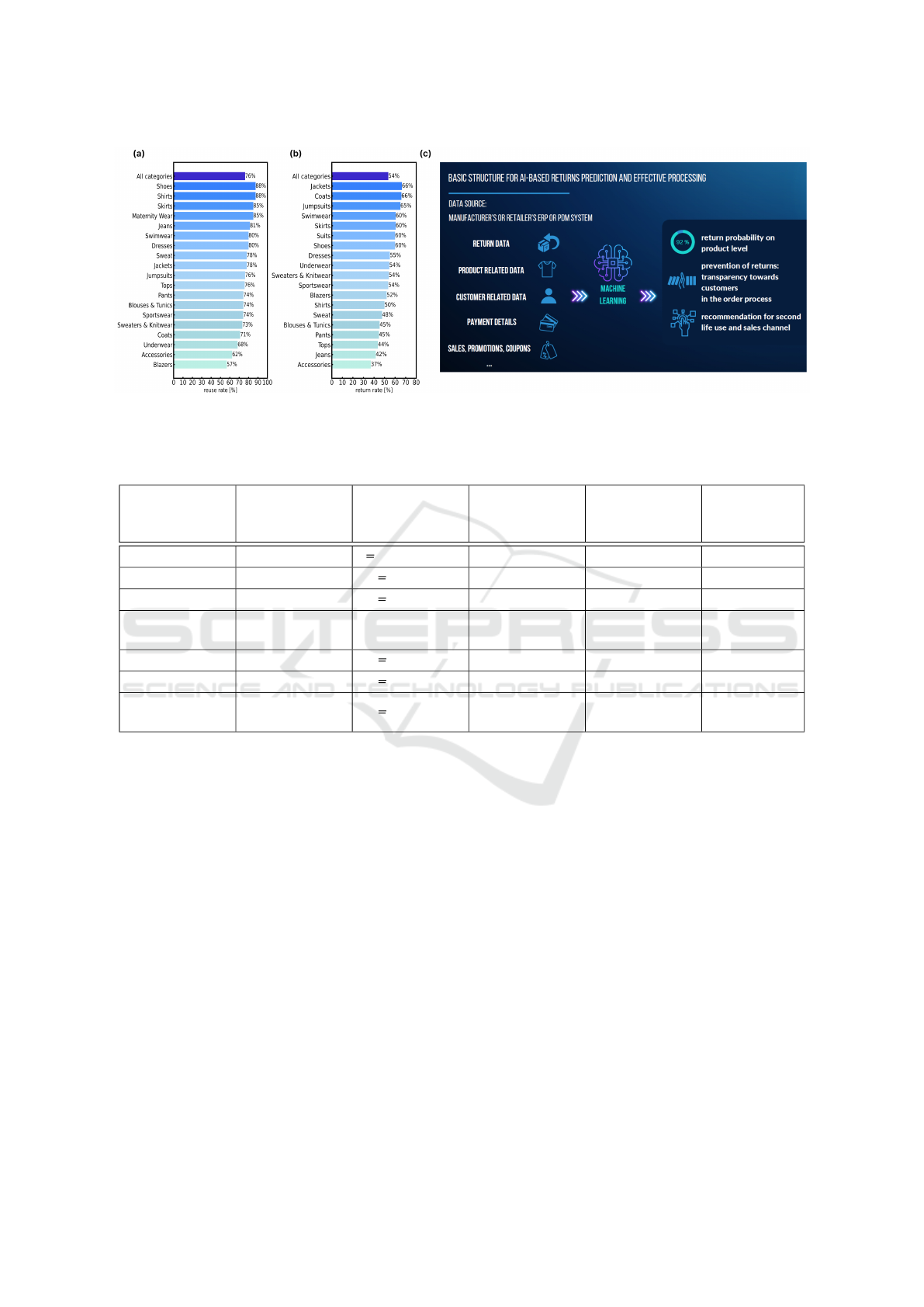

limited to the categories mentioned in Figure 1 a) and

b). Even though including a return label in the pack-

age may be a restriction on the further processing of

the return, 60% of shops or marketplaces decided for

this option (

n = 20

), which might be due to improved

convenience for the customer in the returns process or

because options to route the package flexibly is pos-

sible even with a given returns address on the label.

This is in accordance with the fact that 25% of respon-

dents (

n = 20

) rate their returns process as extremely

customer-friendly. The average rating of customer

friendliness is at 3.5 out of 5, where 5 marks an ex-

tremely customer friendly process. The large majority

(80%,

n = 20

) of shops and marketplaces also collect

the reason for return. Return reasons collected and

their share over all answers are the following (

n = 15

):

Product too large or too small: 24%; product is defec-

tive: 23%; product is different than described: 16%;

bad purchase: 16%; poor quality: 13%; better offer

discovered: 5%; price: 2%; wrong item received: 2%.

11% of respondents state that returns are not being

reused by the shop or the marketplaces that serve as

a sales platform in the sense of reshipment (

n = 18

).

Types of reuse and processing of returned items and

their share over all answers are the following (

n = 16

):

Reshipment: 55%; Recycling of goods: 17%; Disposal

of goods: 14%; Repair: 3%; Second life in own stores:

3%; Secondary marketing: 3%; B2B warehouse mar-

keting: 3%.

The aggregated estimates of reuse rates for dif-

ferent clothing categories are shown in Figure 1 a)

(

n = 10

). According to these results the estimated

amount of non-reused returns can have a high impact

on the resource efficiency of companies, depending

on the amount of products sold, which should not be

ignored in the future strategy of the companies. Also,

it becomes clear that the estimates fall below the mea-

sured values of Forschungsgruppe Retourenmanage-

ment (2022). The time frame for the right of return

is between 14 and 60 days for 79% of respondents

(

n = 14

), where the average time frame is at about 60

days, which may be due to the comparably long time

windows offered by marketplaces, exceeding the 100

day mark. In Germany, it is common practice for fash-

ion e-commerce companies, especially marketplaces,

not to charge return fees. The findings are consistent

with this: 94 % of respondents (

n = 16

) do not charge

return fees. If return fees are being charged, it ranges

around the standard shipping costs of a parcel, which

at the point of writing this paper spans around C4-5.

The survey respondent charging return fees has quoted

C4.20 as the return fee.

Based on question 13, the vast majority of respon-

dents (69% (

n = 16

)) do not collect return rates by

product category. The aggregated estimates of the re-

turn rates for different clothing categories are shown

in Figure 1 b) (

n = 3

). However, the return rate is

highly dependent on the specific company and their

unique operation setting. Half of respondents do not

calculate the costs incurred in the context of a return

in the sense of shipping, processing, refurbishment

and other processing steps (

n = 16

), while 12% do

so exclusively via the marketplace. The remaining

38% also calculate the costs of a return in the scope

of their own online business. The stated costs of a

single return span from C6 to C20 with an average

value of C10, which stresses the point that for many

companies, it may not be economically feasible to

process and reship returns. Most respondents (67%)

are using a shop internal analytics solution for returns,

33% use an existing analytics tool provided by the mar-

ketplace (

n = 10

). Nevertheless, only 14% (

n = 14

)

state that they determine return probabilities depend-

ing on the contents of the shopping cart, which is an

important indicator for bracketing behaviour, where

customers order a selection of items with the inten-

tion of only keeping a subset of them (Bimschleger

et al., 2019). Nevertheless, 64% (

n = 14

) collect a

customer-dependent returns history, which is an impor-

tant factor for estimating future returns behavior and

Enhancing Returns Management in Fashion E-Commerce: Industry Insights on AI-Based Prediction and Recommendation Systems

69

for determining a returns probability (Niederlaender

et al., 2024). An overview of which kind of evaluation

is being performed is given by the responses on ques-

tion 19 (n = 8):

Correlation between fit forms: 7%; Correlation be-

tween customer group and probability of returns: 7%;

correlation between product group and probability of

returns: 33%; no further evaluations: 53%. Based

on the answers in this paragraph on analytics meth-

ods currently used, we can see a trend towards partial

data aggregation. The answers also suggest that there

is no large focus on further evaluation, the results of

which could potentially be incorporated into current

strategies for actions in the context of avoiding or

processing returns. Based on the responses on ques-

tion 20, 64% (

n = 14

) plan to address the issue of

returns processes through initiatives, projects or pro-

cess changes, while 29% do not have any plans doing

so. The remaining 7% employ strategies exclusively

via the marketplace. Some of the initiatives planned by

respondents to improve the returns process or decrease

returns are (n = 8):

Better fit guide; flyer in the parcel for a more conscious

online shopping; introduce a return management sys-

tem; more repairs in retail; automated product sales

channel selection controlled by excessive returns; im-

provement of shipping process: Speed, better package

material, including benefits.

5 EXPERT INTERVIEWS

To complement the mainly quantitative results from

the manufacturer and retailer survey, expert interviews

were conducted to provide qualitative insights that can

be used to inform the development of an AI-based

prediction and recommendation system, and as an im-

portant basis for where this system could be integrated

(ERP or PDM system, webshop system).

5.1 Methodology and Companies

Included

The expert interviews were mainly conducted in Jan-

uary and February 2024 with decision makers from

seven fashion retailers with a strong connection to

fashion e-commerce. Four of the seven retailers also

have bricks and mortar stores. This is particularly rele-

vant in the context of adjusting returns logistics based

on AI-based predictions, for example, when a return

should be sent directly from a customer to a particular

store rather than back to the central warehouse. Each

interviewee was presented with the basic idea (Figure

1 c)) of how returns predictions are determined and

what they can be used for, for example.

Using an interview technique, the main principles

of which can be traced back to the so-called Mom Test

by Fitzpatrick (2013), the interviewees were asked

to reflect on the use of AI-based return forecasts in

their respective companies. This open-ended interview

technique was designed to minimise priming. The in-

terviews were all scheduled for a period of 45 minutes.

Further details on the companies and decision makers

interviewed can be found in Table 1. In order to cover

as broad a spectrum as possible, the expert interviews

were conducted with companies of different sizes and

with different product ranges. In the following expla-

nations, the key findings from the expert interviews

regarding the use of AI-based returns prediction in

fashion e-commerce are considered from the perspec-

tive of returns avoidance and the adaptation of reverse

logistics in terms of a sustainable supply chain. The ex-

perts’ comments are also used to illustrate the systems

into which the return forecasts can be integrated.

5.2 Main Results

Avoiding Returns Through Transparency. In the

expert interviews, making the likelihood of returns

transparent to customers during the ordering process

was seen as an interesting application area for AI-

based returns. As five of the seven retailers surveyed

stated that they use a size finder in their webshops

to help customers choose the right garment, they see

a combination of returns prediction and size finder

as particularly attractive. For example, if the system

determines from the contents of the shopping basket

that a particular item has a return probability above a

threshold of a certain percentage, a pop-up in the order

process could recommend the use of the size finder in

the webshop system. Another possible use case from

a practical point of view is the charging of a return

fee if a certain return probability is determined for a

shopping basket. It must be taken into account that cus-

tomers may switch to other sales channels that do not

charge returns fees. As the expert interviews showed,

depending on the estimated likelihood of returns, the

returns fee is particularly suitable for companies that

are exclusively active in online retailing and do not use

other platforms or marketplaces.

Selection of Sales Channels. All companies sur-

veyed consider it extremely important to select distribu-

tion channels for newly launched products on the basis

of return forecasts based on certain product character-

istics. Different sales channels are subject to different

business calculations due to their fee systems, which

erode manufacturers’ margins. This means that selling

ICSBT 2024 - 21st International Conference on Smart Business Technologies

70

Figure 1: a) Aggregated estimate of the average reuse rates of returns for each product category and the mean over all averages.

b) Aggregated estimate of the average return rates for each product category and the mean over all averages. c) Central

document shown to the interview partners.

Table 1: Key data about the field of expertise of the interviewees and the corresponding companies.

Company

Role of the Ex-

pert

Sales of the

Company in

2022

E-commerce

Return Rate

# bricks-and-

mortar stores in

DACH Region

Return Fee

Retailer Data Science C1 billion unknown 13 No

Manufacturer Data Analytics ∼

C100 million

unknown 0 No

Retailer E-Commerce ∼

C200 million

unknown 200 No

Manufacturer

Managing

Director

unknown 5% 0 Yes

Manufacturer Sustainability ∼ C30 million unknown 0 Yes

Manufacturer E-Commerce ∼ C1.8 billion 30% 119 No

Manufacturer

Managing

Director

∼ C40 million 80% 0 No

through platforms and marketplaces only makes sense

for manufacturers up to a certain return rate. If a high

return rate means that some products can no longer be

sold profitably through certain sales channels, these

products could be prioritised for sale in the manufac-

turer’s own online store or in bricks-and-mortar stores,

where positive margins can still be achieved. On the

system side, returns forecasts would need to be inte-

grated into the ERP or PDM system to inform sales

planning and channel selection.

Reverse Logistics Network. Many manufacturers

and retailers in the fashion industry operate both on-

line and bricks-and-mortar stores. Returns prediction

offers the opportunity to link both worlds in a mean-

ingful way in terms of the reverse logistics network.

For example, if it is determined that a customer is

likely to return an item that is selling well in one of

the bricks-and-mortar stores, a returns label can be

sent to the customer with their order that includes the

address of a suitable bricks-and-mortar store. This

means that the garment does not have to be sent to a

central warehouse: If the garment is sent directly from

the returning customer to the store, logistics costs can

be significantly reduced. This results in environmen-

tal and economic benefits for the business. This ap-

plication of returns prediction is particularly suitable

for manufacturers and retailers who operate their own

stores. The transferability of this approach to chain

stores that divert returns from their online business to

bricks-and-mortar stores seems promising.

6 IMPLICATIONS FOR AI-BASED

RECOMMENDATION SYSTEMS

The following main implications for the development

and implementation of an AI-based prediction and rec-

ommendation system for returns (avoidance) emerged

from the expert interviews. With regard to avoidance,

Enhancing Returns Management in Fashion E-Commerce: Industry Insights on AI-Based Prediction and Recommendation Systems

71

the system to be developed can make the likelihood

of returns transparent to the customer by integrating it

into the webshop system and, for example, directing

the customer to the size finder when a certain likeli-

hood of returns is identified. If the customer then uses

the recommended size finder, an incentive could be to

waive the return fee for that order. The design options

in this context are diverse and depend heavily on the

existing ordering and returns modalities of the retailer

or manufacturer.

In addition, the expert interviews revealed that,

from a practical point of view, the returns prediction

system is also particularly suitable for selecting appro-

priate distribution channels, which is also a preventive

approach. To this end, it is necessary to check whether

the probability of returns can already be determined

with sufficient accuracy in relation to product char-

acteristics and sales channels. In this case, it makes

sense to integrate the AI-based prediction and recom-

mendation system into the sales planning area of an

ERP or PDM system.

A reactive approach where returns prediction is

used in the reverse logistics network is, for example,

to deliver parcels with a calculated probability of re-

turns for certain items of clothing to customers with a

returns label containing the address of a store where

the item is selling well. In this case, too, it makes

sense to integrate the AI-based prediction and recom-

mendation system with the ERP or PDM system to

improve reverse logistics planning. This assumes that

other variables, such as sales figures from individual

stores, are also available in the ERP system or that the

AI-based prediction and recommendation system has

access to them via interfaces.

The qualitative survey results reveal that the dis-

posal of returned items is still a common practice in the

fashion e-commerce sector. Return rate estimates ex-

ceed those found in recent studies (Forschungsgruppe

Retourenmanagement, 2022), which may be due to

the high dependency of return rates on the specific

practices of companies that participated in the survey

- return policies, the product range, online sales chan-

nels and realistic presentation and description of items

play a large role. The return process for the surveyed

companies is mostly focused on customer friendliness,

which may be explained by the strong influence of

marketplaces on the overall behaviour of the market in

this direction. A recommendation system would need

to be able to act taking the market dynamics in this

direction into account and be able to avoid migration

of customers to marketplaces if the own online store

charges return fees. The survey also reveals that the

collection of data on possible return indicators is rather

sporadic in a lot of cases and not aimed at a future im-

provement of the process through the evaluation of

the generated insights. An AI-based recommendation

system would be suitable to generate insights on return

drivers and inhibitors on the basis of sales and returns

data, which must be available to a certain extent in

every e-commerce company in order to operate. A

dashboard view of return rates for different product

categories or properties like fit, style, color or size may

help with targeting the specific drivers of returns and

initiate processes to avoid or improve handling.

7 CONCLUSION AND FUTURE

WORK

Growth rates for e-commerce, and fashion e-commerce

in particular, will be high in the coming years. This

will increase the need for action in terms of avoiding

returns and managing returns in the most environmen-

tally and economically sensible way. The survey and

expert interviews highlighted the current handling with

returns, the relevance of returns avoidance and returns

management in fashion e-commerce and provided im-

petus for the development and system integration of

an AI-based prediction and recommendation system.

In particular, the expert interviews showed that eco-

nomic and ecological aspects must go hand in hand

when considering the use of an AI-based prediction

and recommendation system. As avoiding returns can

also lead to a reduction in sales, this requirement is

not trivial. Use cases in which return fees are charged

on a per-customer, per-basket basis, depending on the

return probabilities determined by the system, appear

unattractive from a practical perspective in this con-

text, as there is a fear of customers migrating to sales

channels where there are no return fees. However, this

study has shown that there are ways in which returns

prediction can be used both preventively and reactively,

without fear of economic disadvantage: On the con-

trary, the selection of appropriate distribution channels

on the basis of returns predictions and sales figures

offers far-reaching potential for reducing costs, both

economically and ecologically. In this context, inte-

gration into the webshop system or the ERP or PDM

system can be seen as promising, depending on the

described application. In order to prove its practical

suitability, the next step should be to analyse a spe-

cific use case in which an AI-based prediction and

recommendation system is used in live operation in

the webshop system or in the ERP or PDM system. It

was also not the aim of this study to provide a com-

prehensive literature review of consumer behaviour

in relation to returns, so further research in this area

seems appropriate. Furthermore, the sample of manu-

ICSBT 2024 - 21st International Conference on Smart Business Technologies

72

facturers and retailers included in the survey and the

seven expert interviews was not representative. Al-

though survey and the interviews were conducted with

companies of different sizes and focal points, it would

be beneficial to validate them within a larger sample

in order to achieve more meaningful results for the

development of the AI-based prediction and recom-

mendation system. A field test with customers who are

confronted with the concrete ideas of the present study,

such as the introduction of return fees depending on

the probability of returns determined by the system,

could also be recommended. This would allow the

effectiveness of the proposed measures to be tested.

Nevertheless, AI-based prediction and recommenda-

tion systems are not sufficient to address the issue of

returns alone. Consequently, it is essential that future

research also concentrates on topics such as process

optimisation in the context of returns processes and

reverse logistics.

ACKNOWLEDGEMENTS

This research was funded in part by the Ger-

man Federal Ministry of Education and Research

(BMBF) under the project OptiRetouren (grant num-

ber 01IS22046B). It is a joint project of the August-

Wilhelm Scheer Institut, INTEX, HAIX and h+p.

August-Wilhelm Scheer Institut is mainly entrusted

with conducting research in AI for predicting returns

volume and for recommendations based on AI.

REFERENCES

Asdecker, B. and Karl, D. (2018). Big data analytics in

returns management-are complex techniques necessary

to forecast consumer returns properly? In 2nd Interna-

tional Conference on Advanced Research Methods and

Analytics. Proceedings, pages 39–46.

Asdecker, B., Karl, D., and Sucky, E. (2017). Examining

drivers of consumer returns in e-tailing with real shop

data. In Hawaii International Conference on System

Sciences, pages 4192–4201.

Bimschleger, C., Patel, K., and Leddy, M. (2019). Bringing

it back: Retailers need a synchronized reverse logistics

strategy. Technical report, Deloitte Development LLC.

Deges, F. (2021). Retourencontrolling im online-handel.

Controlling – Zeitschrift f

¨

ur erfolgsorientierte Un-

ternehmenssteuerung, 2/2021:61–68.

Fitzpatrick, R. (2013). The Mom Test: How to talk to cus-

tomers & learn if your business is a good idea when

everyone is lying to you. Robfitz Ltd.

Forschungsgruppe Retourenmanagement (2022).

Ergebnisse des europ

¨

aischen retourentachos

ver

¨

offentlicht. https://www.retourenforschung.de/info-

ergebnisse-des-europaeischen-retourentachos-

veroeffentlicht.html. Online; accessed 2024-03-05.

Gry, S., Niederlaender, M., Lodi, A., Mutz, M., and Werth,

D. (2023). Advances in ai-based garment returns pre-

diction and processing: A conceptual approach for an

ai-based recommender system. In Proceedings of the

20th International Conference on Smart Business Tech-

nologies - ICSBT, pages 15–25. INSTICC, SciTePress.

Lepthien, A. and Clement, M. (2019). Shipping fee sched-

ules and return behavior. Marketing Letters, 30(2):151–

165.

Lohmeier (2024). E-commerce in deutschland:

Daten und fakten zum boomenden onli-

negesch

¨

aft. https://de.statista.com/themen/247/e-

commerce/

♯

topicOverview. Online; accessed

2024-02-29.

Makkonen, M., Frank, L., and Kemppainen, T. (2021).

The effects of consumer demographics and payment

method preference on product return frequency and rea-

sons in online shopping. In Bled eConference, pages

567–580. University of Maribor.

Morgan Stanley (2022). Here’s why e-commerce growth can

stay stronger for longer. https://www.morganstanley.

com/ideas/global-ecommerce-growth-forecast-2022/.

Online; accessed 2024-02-29.

Niederlaender, M., Lodi, A., Gry, S., Biswas, R., and Werth,

D. (2024). Garment returns prediction for ai-based

processing and waste reduction in e-commerce. In

Proceedings of the 16th International Conference on

Agents and Artificial Intelligence - Volume 2: ICAART,

pages 156–164. INSTICC, SciTePress.

Saarij

¨

arvi, H., Sutinen, U.-M., and Harris, L. C. (2017). Un-

covering consumers’ returning behaviour: a study of

fashion e-commerce. The International Review of Re-

tail, Distribution and Consumer Research, 27(3):284–

299.

Sahoo, N., Dellarocas, C., and Srinivasan, S. (2018). The

impact of online product reviews on product returns.

Information Systems Research, 29(3):723–738.

Shehu, E., Papies, D., and Neslin, S. A. (2020). Free shipping

promotions and product returns. Journal of Marketing

Research, 57(4):640–658.

Statista Market Insights (2024). ecommerce - weltweit.

https://de.statista.com/outlook/emo/ecommerce/

weltweit? currency=eur. Online; accessed 2024-02-29.

Sutinen, U.-M., Saarij

¨

arvi, H., and Yrj

¨

ol

¨

a, M. (2022). Shop

at your own risk? consumer activities in fashion e-

commerce. International Journal of Consumer Studies,

46(4):1299–1318.

Yan, R. and Cao, Z. (2017). Product returns, asymmetric

information, and firm performance. International Jour-

nal of Production Economics, 185:211–222.

Enhancing Returns Management in Fashion E-Commerce: Industry Insights on AI-Based Prediction and Recommendation Systems

73