Is Positive Sentiment Missing in Corporate Reputation?

Peter Mitic

a

Department of Computer Science, UCL, London, U.K.

Keywords:

State-Space, Kalman Filter, Kalman, Forward Filtering Backward Sampling, FFBS, MCMC, TNA,

Reputation, Sentiment, Missing Sentiment, Missing Positive Sentiment, Negative Bias.

Abstract:

The value of a perceived negative bias is quantified in the context of corporate reputation time series, derived

by exhaustive data mining and automated natural language processing. Two methods of analysis are proposed:

State-Space using a Kalman filter time series with a Normal distribution profile, and Forward Filtering Back-

ward Sampling for those without. Normality tests indicate that approximately 92% of corporate reputation

time series do fit the Normal profile. The results indicate that observed positive reputation profiles should

be boosted by approximately 4% to account for negative bias. Examination of the observed balance between

negative and positive sentiment in reputation time series indicates dependence on the sentiment calculation

method, and region. Positive sentiment predominates in the US, Japan and parts of Western Europe, but not in

the UK or in Hong Kong/China.

1 INTRODUCTION

Measuring sentiment and opinion using Natural Lan-

guage Processing (NLP) has been an established pro-

cedure since work on Phase-Structure Grammar in

the 1950s (Chomsky, 1957). Translation of natural

language sentences into a format that can be used by

computers remains the basis of NLP today, including

the recent Large Language Models (OpenAI, 2019).

This paper concerns a particular aspect of the ac-

curacy of sentiment measures, embedded in a much

wider framework: reputation. That aspect is ”miss-

ing positive sentiment”, which is closely related to the

idea of negative bias. Our proposition is that negative

bias exists in the context of reports on corporate af-

fairs, and is due to unexpressed positive content.

Written statements about particular organisations

can be positive (as exemplified by words such as

”good” or ”improved”), or they can be negative (us-

ing words such as ”poor” or ”bad”). The underly-

ing idea of this paper is the possibility that there is a

proportion of positive statement that is not expressed,

possibly because of a lack of emotion associated with

positivity. The analysis presented aims to detect and

quantify the extent of unexpressed content. In doing

so, the overall balance between positive and negative

sentiment is noted.

a

https://orcid.org/0000-0002-9845-4435

1.1 Structure of this Paper

The paper is divided into the following sections.

1. This introduction, including a statement of the

problem to be solved (Section 1).

2. An example of reputation, expressed as a time se-

ries (Section 1.2.1)

3. Related literature (Section 2)

4. Methods used (Section 3)

5. Results (Section 4)

6. Discussion and issues arising (Section 5)

The core of the Methods section is to first assess the

positive/negative balance for reputation time series

using observed reputation time series. Then, assum-

ing that some positive sentiment is ”missing”, we at-

tempt to measure its extent by using State-Space anal-

yses. The purpose is to reveal an underlying relatively

noise-free ’hidden’ reputation time series, from which

it is possible to estimate the missing positive com-

ponent of that reputation. An alternative procedure

which is more widely-applicable but is slower to cal-

culate is proposed for validation of the result.

Mitic, P.

Is Positive Sentiment Missing in Corporate Reputation?.

DOI: 10.5220/0012763100003756

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 13th Inter national Conference on Data Science, Technology and Applications (DATA 2024), pages 71-81

ISBN: 978-989-758-707-8; ISSN: 2184-285X

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

71

1.2 Reputation and Sentiment: A Brief

Overview

The analysis in this paper is heavily dependent on

time series and statistical concepts, so it is impor-

tant to formulate the term ”reputation” in terms that

fit the necessary paradigms. To do that, we separate

the terms ”reputation” and ”sentiment”. The latter is

well-defined in the context of NLP (for example by

(Liu, 2015)), but the former is a relatively new con-

cept. Consequently, both are defined in a formal way

in Section 3.1. Additionally, the term ”opinion” is

also defined.

Details of the reputation measurement process

used to derive the data used in this study can be found

in (Mitic, 2017). Compiling a daily reputation time

series comprises the following stages, targeted upon a

particular organisation, T.

1. Exhaustive data mining of textual records. Text

is derived by setting up dedicated data feeds to

both social and ’traditional’ media sources. Ex-

amples of ’traditional’ media include radio and

TV news channels (e.g. BBC, Sky TV, Fox

Media), newspapers (e.g. the Financial Times,

Wall Street Journal), financial organisations (e.g.

Bloomberg, Reuters), and consumer reviews (e.g.

from Google, Amazon). Social media sources in-

clude X (”Twitter”), Facebook and WhatsApp.

2. NLP to derive sentiment per record.

3. Averaging sentiments received on each day,

weighted by importance/significance. This is the

’observed’ sentiment for day t, denoted by y

t

in

this paper).

4. Conditioning y

t

to remove ’noise’.

5. Forming a time series {y

t

},t = 1,2,... , which is

the ’reputation’ of T

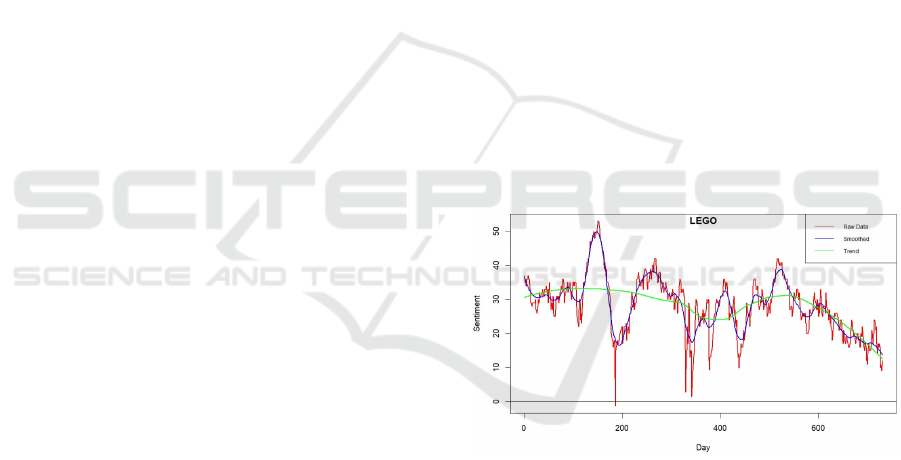

1.2.1 Reputation Examples

To crystallise the ideas of casting reputation as a time

series, and to illustrate the essential characteristics

of those time series, Figures 1, 2 and 3 show recent

views of typical reputation profiles: Lego, NASA and

Singapore Airlines. Each plot shows the sentiment

score y

t

on the vertical axis on a scale of -100 to +100,

for each of 730 days on the horizontal axis. The hori-

zontal line at y

t

= 0 sentiment indicates entirely neu-

tral sentiment. The portions of the plot above that line

indicate positivity (for example, for increased prof-

its recorded on financial statements), whereas the por-

tions of the plot below indicate negativity (for exam-

ple, for negative customer experience). The plots in-

clude Loess-generated smoothed profiles, and Loess-

generated trend curves.

Many reputation plots express mostly positive

sentiment (illustrated by Lego) or mostly negative

sentiment (illustrated by NASA). Plots that straddle

the positive/negative border with a high frequency os-

cillation, similar to that of Singapore Airlines, are less

common. Together, the three plots illustrate features

typical of all reputation time series, listed below.

• A macro-structure of peaks and troughs, with lit-

tle discernable periodic effect or length (in time)

between successive peaks and troughs.

• Large upward or downward moves over short time

periods. The NASA plot has several.

• Small day-to-day variation, representing ’noise’.

• Isolated ’shocks’: extreme (usually negative) sen-

timent lasting one or two days, often due to mul-

tiple reports of the same adverse event. Several

are shown on the Lego plot. Negative ’shocks’ are

more common than positive ’shocks’.

• Sentiment concentration principally within a

broad range (-50,50). Very few instances of sen-

timent outside this range are encountered. This

concentration is most likely due to averaging pro-

cesses in NLP calculations.

Figure 1: Lego (daily) reputation (in red) July 2021-June

2023. Blue line: smoothed sentiments; green line: trend.

Data source: Penta Group.

2 RELATED WORK

In this review, we concentrate specifically on one par-

ticular aspect which is of relevance to our study. That

is the excess of negative sentiment compared to posi-

tive sentiment in instances of daily accumulation and

analysis of sentiment. Most research has concentrated

on the detection and analysis of sentiment bias which

we regard as a precursor for the existence of excess

negative sentiment. For example, (Rozin and Royz-

man, 2001) offer a full discussion of sentiment bias,

DATA 2024 - 13th International Conference on Data Science, Technology and Applications

72

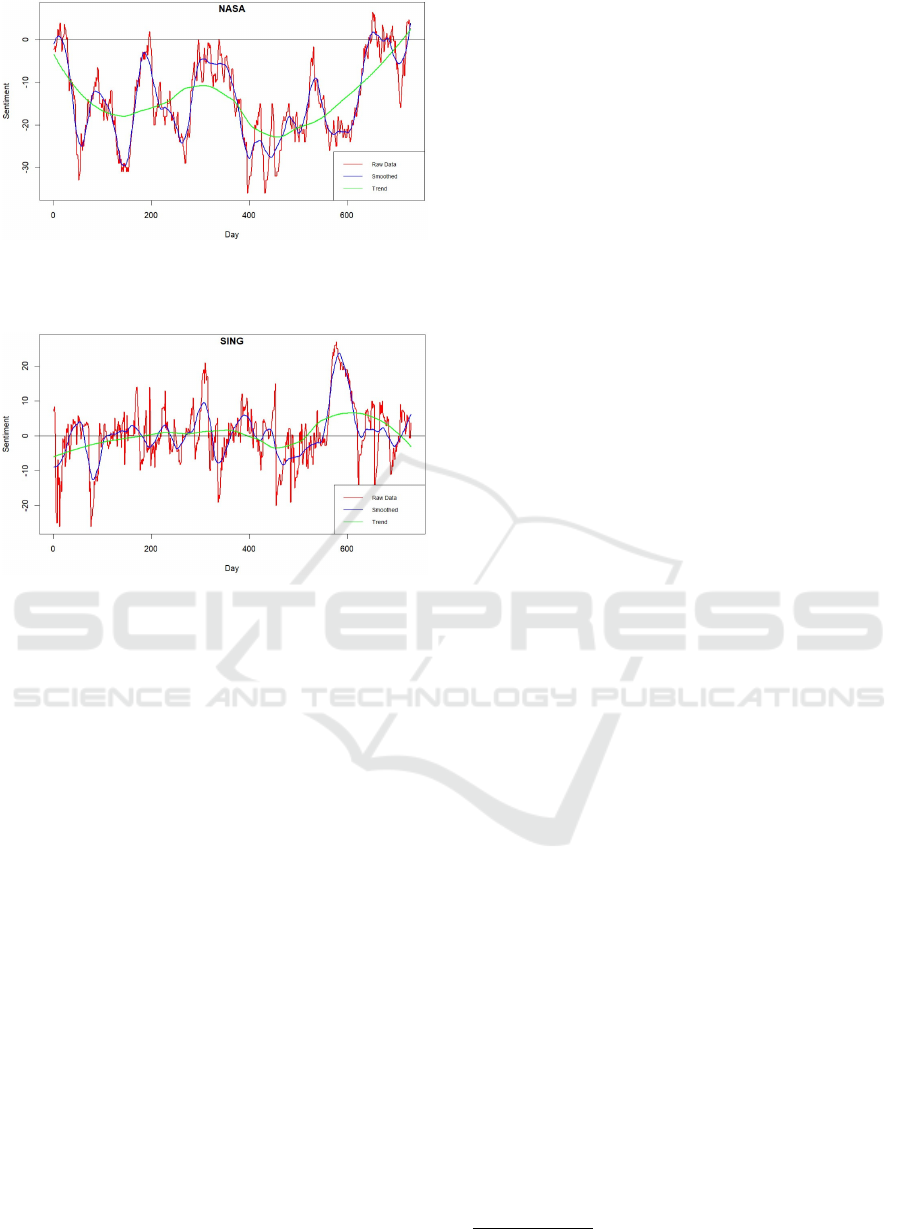

Figure 2: NASA (daily) reputation (in red) July 2021-June

2023. Blue line: smoothed sentiments; green line: trend.

Data source: Penta Group.

Figure 3: Singapore Airlines (daily) reputation (in red) July

2021-June 2023. Blue line: smoothed sentiments; green

line: trend. Data source: Penta Group.

and initiated the term ’negative bias’. Here we con-

sider research on the value of excess negative senti-

ment.

Direct evidence comes from (Zendesk, 2013) in a

study of responses to customer service. They found

that people are more likely to express negative ex-

periences rather than positive. Consequently, there

is an excess volume of negative sentiment. Specif-

ically they report that 95% of users were likely to

share a negative experience, as opposed to 87% per-

cent for a positive experience. Some reasons for these

findings are suggested. First, negative comments are

driven by emotional responses, which last longer in

the mind and appear more urgent than positive com-

ments. Second, for the same reason, negative com-

ments are given unprompted, whereas positive com-

ments often have to be solicited. It is tentatively sug-

gested that customers take more note of negative com-

ments, and are more likely to post negatives in order

to warn other customers.

(Finkelstein and Fishbach, 2012) suggest that a

potential reason for an excess of negative feedback

is that there is a difference in responses from novices

and experts. Novices seek and provide positive feed-

back in order to make decisions, whereas experts are

more likely to provide negative feedback because pos-

itive sentiment is what they already know. Since there

are fewer novices, negative feedback prevails.

The study by (Moe and Schweidel, 2012) (and

summarised in (Moe and Schweidel, 2013)) indicates

an excess of negative comments due to different be-

haviour modes for less active and more active people

who posted online comments. They consider that on-

line opinions are dominated by ’activists’ who offer

negative opinions, and skew sentiment negatively.

(Tsugawa and Ohsaki, 2017) investigated the re-

lationship between message sentiment on social me-

dia and the volume and speed of message diffu-

sion. They analysed 4.1 million tweets and their

retweets, and found that the reposting volume of neg-

ative messages was 20–60% higher than that of pos-

itive and neutral messages. The result is reinforced

by (Ferrara and Yang, 2015), who found that nega-

tive messages spread faster on social media than posi-

tive ones. However, positive messages reached larger

audiences. Their dataset, which was not a random

selection, comprised approximately 36% of positive

tweets, 22% of negative tweets, with 42% neutral.

The opposite effect is reported by (Stieglitz and Dang-

Xuan, 2013), who found, in the context of tweets, no

evidence of sentiment bias.

Two later studies investigated the incidence of

positive and negative sentiment on social media.

(Bellovary and Goldenberg, 2021) investigated the

spread speed of online sentiment. Overall, negativ-

ity was about 15% more prevalent than positivity, and

more users responded to negative tweets than did to

positive tweets. This result is particularly insightful

in the context of reputational analysis. A major (data-

mined) source of reputational data is news reports,

for which, the authors found, negativity is more fre-

quent and more impactful than positivity. (Antypas

and Camacho-Collados, 2023) reached a similar con-

clusion.

An example of intrinsic negative bias is (arguably)

the Net Promoter Score - NPS

1

(Reichheld, 2003),

which is a very simple scoring system based on sub-

jective answers to a single question: On a scale of 0-

10, how likely are you to recommend this company to

a friend or colleague?. The NPS is then the difference

between the percentage of 9-10 (promoter) scores and

the percentage of 0-6 scores (detractors). Scores 7 and

8 are regarded as ”passive”. The numerical imbalance

induces negative bias.

Overall, previous research indicates evidence of

an excess of negative sentiment, particularly on social

media. This result prompts us to consider whether or

not some positive sentiment is ”missing” from repu-

tation time series. The main reason is the emotional

1

Published by Bain and Co., https://www.bain.com/

Is Positive Sentiment Missing in Corporate Reputation?

73

response triggered preferentially by negative feelings,

as surmised in (Zendesk, 2013). We present our own

findings on this topic in section 4.1.

2.1 Positive Bias

Few indications of positive bias are available in the

context of products or organisations. (Park and Rhim,

2018) studied online chat satisfaction surveys, and

concluded that a majority of non-respondents were

likely to be dissatisfied with the chat service. How-

ever, a majority of respondents had positive opinions.

That result agrees with earlier work on Amazon On-

line product reviews by (Hu and Zhang, 2007). Re-

views, expressed as ”star ratings” were significantly

more positive (4* and 5*) than negative (1* and 2*)

for books, DVDs and videos.

Closely related to positive bias is the concept of

Confirmation bias. (Powell and Holyoak, 2017) pro-

vide confirmation bias examples in which people pre-

ferred a product with more reviews to one with fewer

reviews, even though their statistical model indicated

that the latter was likely to be of higher quality than

the former.

3 METHODS

A brief investigation of negative/positive sentiment

balance is outlined. All of the following sub-sections

deal with finding how ”missing positive sentiment”

might be quantified, assuming that it is present.

3.1 Definitions

In this section we give a brief definition of Opinion,

Sentiment and Reputation. There are indications of

the necessary definitions in, for example, (Loke and

Vergeer, 2022) in phrases such as ”collective view”

and ”built over time”. The general idea of the scope of

reputation is summarised in (Loke and Kisoen, 2022):

”a summary of internal and external perceptions of an

organisation”. We argue that reputation should extend

much further. Specifically, it should include broad-

casting, news reports, company statements and social

media.

(Liu, 2015) defines Opinion as a function or

algorithm F of a comment X in text form, provided

by a Holder H, aimed at a target organisation T with

influence U ∈ (0,1), and given at a time t (nominally

one day). F maps X to a subset of the real numbers

[−r,r];r ∈ R

+

. This defines a numeric ”score” for

textual content. Sentiment, S, is a set of opinions

expressed by n

h

holders, in n

x

texts, on the same

target T, all at the same time, using a function Ψ

which forms a weighted average of the opinion hold-

ers using their influences. The idea that Sentiment

should refer to a set of Opinions is unusual, and

differs from the view expressed in (Liu, 2015), where

in the context of NLP, the distinction is not needed.

Reputation, y

t

(T ), is a time series of Sentiments over

an extended time period of length τ. For convenience,

we omit the target T in the equations in Section 3.

Definition: Opinion.

O

t

(X,H,T,U) = F (X | H,T,U) ∈ [−r,r] (1)

Definition: Sentiment.

S

t

(T ) = Ψ({O

t

(X

i

,H

j

,T,U

j

)});

i = 1..n

x

; j ∈ 1..n

h

(2)

Definition: Reputation.

y

t

(T ) = {S

t

(T )}; t = 1..τ (3)

3.2 Negative/Positive Sentiment

Analysis

We first undertake a simple analysis of the balance

between positive and negative sentiment in reputation

time series. Evidence from section 2 indicates that ex-

cess negative sentiment is prevalent in many contexts,

predominantly in social media. For each reputation

time series, the number of days on which positive,

neutral and negative sentiment was recorded, were

noted. In this context, three sentiment categories were

designated as in equation 4. In practice, the results

were insensitive to the ’neutral’ limit 2. There was

little variation in the results by extending the ’neutral’

limit to 5.

Positive: y

t

> 2; t = 1...τ

Neutral: −2 ≤ y

t

≤ 2 t = 1...τ

Negative: y

t

< −2 t = 1...τ

(4)

The results are shown in section 4.1.

3.3 Negative Bias Analysis

We now surmise that excess negative sentiment does

exist in reputational signals. To quantify it, for

any given corporate organisation, we use State-Space

analysis and the Kalman filter (Harvey, 1990) to ex-

tract the state (’hidden’) signal. The state signal pre-

serves the profile of the observed signal, but removes

some of the noise. That extraction also defines a vari-

ance component. Together, the estimate of the state

signal and its variance enable a high quantile of the

DATA 2024 - 13th International Conference on Data Science, Technology and Applications

74

estimated state to be calculated, and the difference

between the high quantile and the observed signal is

taken as the ’missing’ signal. So if y

t

represents the

observed sentiment on day t, x

t

and P

t

are the state

sentiment mean and variance respectively, then the

’missing’ sentiment on day t, m

t

, is given by the first

part of equation 5. The value of z represents either

95% or 99% (2-tailed) confidence. A single figure

measure of the ’missing positive sentiment’, M

z

, for

the organisation is the mean of all values of m

t

over a

day range 1...τ.

m

t

= x

t

+ z

√

P

t

M

z

= m

t

1 ≤ t ≤ τ (5)

3.4 Data

Reputation data is sourced from Penta Group

(https://pentagroup.co). Two data sets were extracted.

The first was used for the ”missing positive senti-

ment” analysis. We selected 261 corporate organisa-

tions representating the principal world industrial and

service sectors: energy, manufacturing, travel, edu-

cation, financial, media, food production, and retail.

The data range was two years: from Q3 2021 to Q3

2023, a total of 730 days. The observed data is pre-

sented on a continuous scale from -100 (worst possi-

ble sentiment) to +100 (best possible sentiment). Zero

(or very near to zero) represents neutral sentiment.

The second data set was used for the posi-

tive/negative sentiment balance analysis. Reputa-

tional time series for constituents of a range of major

stock indices were sourced, together with 40 reputa-

tional time series for organisation that are non stock-

exchange listed. The second selection is nearer to a

random sample than is the first.

Full details of both data sets are given in Sections

4.1 and 4.2.

3.5 Assumptions

• Measurements of the observed data must be inde-

pendent in order to estimate the values of x

t

and P

t

in the Kalman filter calculation (section 3.7). The

method of data collection ensures independence,

because components of the sentiment measure for

day t originates on day t only. The reputation

value therefore starts from zero on each day.

• The set of sentiments must be Normally dis-

tributed. This point is discussed in section 3.6.

The non-normal case is discussed in section 3.8.

3.6 Gaussian Data Requirement

The histograms of the two-year reputation data for

many organisations show that, informally, Normal

distributions might apply. All reputation data series

were tested for normality using the TNA test (Mitic,

2015), which is a generalisation of a Q-Q

2

plot, and

is insensitive to outliers, and to data set size. Apply-

ing the TNA test, the normality null hypothesis was

rejected in only 19 cases. The remaining 19 could be

’normalised’ by at least one of the following transfor-

mations.

• A log transformation, applied separately to posi-

tive and negative sentiment: y

t

[y

t

> 0] → log(y

t

);

y

t

[y

t

≤ 0] → −log(−y

t

)

• A square root transformation, applied separately

to positive and negative sentiment: y

t

[y

t

> 0] →

p

(y

t

); y

t

[y

t

≤ 0] → −

p

( −y

t

)

• A Box-Cox transformation, using the modifica-

tion by (Yeo and Johnson, 2000), which can ac-

commodate negative arguments. For positive α, λ

is selected to ’normalise’ by transforming

y

t

→

(x

λ

+α)−1

λ

;λ ̸= 0 and y

t

→ log(y

t

+ α); λ = 0.

• Removal of extreme outliers.

We use the State-Space method applied to unmodified

reputation data as the primary means of estimating

whether or not negative bias exists in the data. Data

transformations, as described, can be used to generate

normally distributed data, but may have contingent ef-

fects that are undesirable. In particular, proving that

State-Space analysis applied to transformed data has

precisely the same effect as for untransformed data

needs much more analysis. In Section 3.8 a Markov

Chain Monte Carlo (MCMC) method, applicable for

non-normal data, is discussed. The MCMC and State-

Space results are similar (Tables 4 and 5), but State-

Space analysis is much faster. We are therefore con-

tent to apply a State-Space analysis to unmodified

reputational data, and to use MCMC as a comparison.

3.7 State-Space Estimation: Outline

The sequence of equations in this sub-section follows

the exposition by (Shumway and Stoffer, 2016), as

does the R-code to implement it. We start with a rep-

utation time series {y

t

: 1 ≤t ≤ τ} measured in days

from 1 to τ. These are ’noisy’ observations of a ’hid-

den’ signal, which is less noisy. We aim to determine

a parallel series {x

t

} which represents the state of the

system: quantities that are not observed directly, but

2

Quantile-Quantile: a plot of empirical quantiles

against quantiles calculated using a theoretical distribution

Is Positive Sentiment Missing in Corporate Reputation?

75

can only be inferred via the actual observation. The

aim is to estimate an upper limit for the state vector

x

t

given the observations y

t

, and to attribute the dif-

ference between that upper state limit and the corre-

sponding observations as unobserved (or ’missing’)

positive sentiment.

We assume that x

t

and y

t

are related, in a general

case, as in equation 6. In those equations, w

t

and v

t

are stochastic errors, and are functions of matrices Q

and R, which describe the correlation structures of the

stochastic error associated with x

t

and y

t

respectively.

Φ is the correlation matrix for vector x

t

, and has to be

estimated from observations. The matrix A

t

is the ob-

servation matrix and represents a measurement scal-

ing. The time dependency of A

t

distinguishes a State-

Space process from a conventional linear model. The

vector u(t) is an exogenous vector, scaled by matrices

γ and Γ in the two cases.

x

t

= Φx

t−1

+ γu

t

+ w

t

; w

t

∼ N(0,Q); 1 ≤t ≤ τ

y

t

= A

t

x

t

+ Γu

t

+ v

t

; v

t

∼ N(0,R); 1 ≤t ≤ τ (6)

The State-Space exposition in (Shumway and

Stoffer, 2016) describes the development of estima-

tors ˆx

t

of the x

t

, with corresponding variance estima-

tors

ˆ

P

t

via the Kalman filter. The variance estimators

are used to calculate upper confidence limits that rep-

resent the ”missing positive sentiment”. The estima-

tors are, in general:

ˆx

t

=

x

t

|y

y

1 ≤ t ≤ τ

ˆ

P

t

=

(x

t

− ˆx

t

)(x

t

− ˆx

t

)

′

1 ≤ t ≤ τ (7)

The Kalman filter provides a way to update the

state vector x

t

from the previous state vector x

t−1

plus

a new observation y

t

without having to reprocess all

previous observations. The update equations take the

form in equation 8, in which K

t

is the Kalman gain.

K

t

= P

t−1

A

′

t

(A

t

P

t−1

A

′

t

+ R)

−1

x

t

= x

t−1

+ K

t

(y

t

−A

t

x

t−1

−Γu

t

)

P

t

= (I −K

t

A

t

)P

t−1

(8)

The corresponding predictors are shown in equa-

tion array 9, in which µ

0

and s

2

0

are initial mean and

variance values.

ˆx

t

= Φ ˆx

t−1

+ γu

t

1 ≤ t ≤ τ

ˆ

P

t

= Φ

ˆ

P

t−1

Φ

′

+ Q 1 ≤ t ≤ τ

ˆx

0

= µ

0

ˆ

P

0

= σ

2

0

(9)

The sequences in equations 8 and 9 assume the

Normal-Normal conjugacy property: if y

t

|x

t

is nor-

mally distributed and x

t

|y

t−1

is normally distributed,

then the conjugate posterior distribution x

t

|y

t

is also

normally distributed. The entire sequence then com-

prises normally distributed variates, provided that the

initial observation (i.e. the raw data), y

0

, is normally

distributed.

The ”missing positive sentiment” is then calcu-

lated in the following way. The term ˆx

t

in equation

9 defines an estimate of the system state (i.e. the un-

observed, or ”missing”) sentiment. The deviation of

an upper confidence limit of that estimate from the ob-

served sentiment, denoted here by m

t

, represents the

’missing positive sentiment’ for each value of t in the

range 1...τ. The mean of all of those differences, M

z

,

where z defines a confidence level, is then an over-

all measure of the ’missing positive sentiment’ (equa-

tion 10). For 2-tailed confidence, z = 1.975 for 95%

confidence and 2.576 for 99% confidence, assuming

a normal distribution of residuals.

m

t

= ˆx

t

+ z

q

ˆ

P

t

−y

t

1 ≤ t ≤ τ

M

z

= m

t

1 ≤ t ≤ τ (10)

In section 4 we give estimates of the ”missing pos-

itive sentiment” at both confidence levels.

3.8 State-Space Estimation: Extension

to Non-Normal Data

Non-Normal data can be accommodated using a

MCMC analysis. The general technique is to gener-

ate a posterior distribution from data and a prior dis-

tribution, and then to sample from the posterior dis-

tribution. We have used the implementation due to

(Fruehwirth-Schnatter, 1994), and (Carter and Kohn,

1994). Inverse Gamma (IG) priors are used for Q and

R in equation 6, since IG prior-posterior pairs are con-

jugate for a likelihood with unknown variance. They

are: Q ∼ IG(a

0

/2,b

0

/2)) and R ∼ IG(c

0

/2,d

0

/2)),

where the hyper-parameters a

0

,b

0

,c

0

,d

0

are set to

give approximately the same ”missing positive sen-

timent” value as for the State-Space analysis. The

initial state is u

t

= 0. There is sufficient data in the

reputation time series used to be confident that data

will predominate over the priors in the MCMC step.

Then, with these inverse gamma likelihoods, if the

prior on Φ is Normal, the distribution Φ|Q,x

t

,y

t

is

also Normal. The update equations for the variances

take the form

Q|Φ,x

t

,y

t

∼ IG

1

2

(a

0

+t),

1

2

(b

0

+

t

∑

i=1

(x

i

−Φx

i−1

)

2

)

R|x

t

,y

t

∼ IG

1

2

(c

0

+t),

1

2

(d

0

+

t

∑

i=1

(y

i

−x

i

)

2

)

(11)

DATA 2024 - 13th International Conference on Data Science, Technology and Applications

76

With these updates, we sample the state vec-

tors from the posterior density p(x|Θ, y), where Θ

is the set of hyper-parameters a

0

,b

0

,c

0

,d

0

. The

MCMC stage uses a Forward Filtering Backward

Sampling (FFBS) algorithm, summarised by the fol-

lowing equations.

p

Θ

(x

0

,y

1

) = p

Θ

(x

t

|y

t

) × p

Θ

(x

t−1

|x

t

,y

t−1

)

×... × p

Θ

(x

0

,x

1

)

=⇒ p

Θ

(x

t

|x

t+1

,y

t

) ∝ p

Θ

(x

t

|y

t

) × p

Θ

(x

t+1

|x

t

)

(12)

Therefore, using x

t

|y

t

∼N( ˆx

t

,

ˆ

P

t

,Θ) and x

t+1

|x

t

∼

N(Φx

t

,Q, Θ), we calculate the conditional means and

variances

Θ

(x

t+1

|y

t

) and

Θ

(x

t

|y

t

,x

t+1

). That is

done by running the algorithm update step N times,

and accumulated the results of each run in a matrix D.

Each row in D is a draw of the entire time series (i.e.

times 1...τ) from the posterior distribution, so that D

has N rows and τ columns.

To get the measure of ”missing positive senti-

ment”, we extract the upper z-quantile at each col-

umn of D. So if Q

z

is a function that extracts a z-

quantile, the required ’missing positive sentiment’ is

(the equivalent of equation 10):

m

t

= Q

z

(D

it

) −y

t

; i = 1..N,z = 0.975 or 0.995

M

z

= m

t

1 ≤ t ≤ τ (13)

4 RESULTS

We first show results for the negative/positive senti-

ment balance, and then present example results to il-

lustrate the ’shape’ of a reputation profile, with a se-

lection of ”missing positive sentiment” values.

4.1 Negative/Positive Sentiment Results

To gain some idea of the positive/negative sentiment

balance (as distinct from the sentiment bias), we have

examined the proportion of days on which positive

and negative sentiment was registered for organisa-

tions that are the constituents of a range of major

world stock exchanges, plus 40 that are non-listed.

The stock exchange-listed organisations form groups

that give some indication of a geographical effect.

The regions represented are North America (Dow

Jones Industrial Average - DJIA and S&P500 ), Ger-

many (DAX40), France (CAC40), UK (FTSE100),

Japan (Nikkei225) and Hong Kong/China (Hang

Seng). Some stocks were omitted if sufficient repu-

tation data was not available, and only the top 100

stocks by market capitalisation in the S&P500 were

used. The ”Unlisted” category includes some well-

known organisations, such as Lego, LIDL, IKEA,

NASA, Bosch and SpaceX. The results in Table 1 indi-

cate that positive sentiment predominates, in contrast

to many of the results noted in Section 2.

Table 1: Positive/Negative Sentiment balance.

Sample Proportion

Index size + −

Section 3.4

’261’

261 0.60 0.40

FTSE100 94 0.46 0.54

DJIA 30 0.67 0.33

Hang Seng 57 0.21 0.79

DAX 38 0.79 0.21

NIKKEI225 85 0.61 0.39

S&P500 100 0.75 0.25

CAC40 40 0.83 0.17

Unlisted 40 0.53 0.47

Notably, the FTSE and Hang Seng results indicate

negative sentiment bias, in contrast to all of the oth-

ers. Overall, Table 1 shows that whether or not nega-

tive sentiment predominates over positive depends on

what is being measured, and on location. This point

will be taken up in Section 5. Notably, the ”Section

3.4 ’261’” sample, which was specifically selected to

cover industry sectors, had an overall positive senti-

ment balance.

4.2 Missing Positive Sentiment

In order to gain some idea of the results of applying

the State-Space process, Table 2 shows a random se-

lection of organisations, with estimates of their ”miss-

ing positive sentiments”, obtained using upper 95%

and 99% confidence bounds for the state-space repu-

tation signals (Equation 10). Results for both meth-

ods are shown: State-Space (Section 3.7) and MCMC

(Section 3.8.) The interpretation of these figures is

that they should represent, for each organisation, an

amount that should be added to the positive reputa-

tion profile. The 95% and 99% are intended to pro-

vide a range, from which the precise amount to be

added should be taken. We suggest that it should be

nearer to the higher figure, to be more consistent with

the high positive/negative sentiment discrepancies un-

covered in Section 2.

The entries in Table 3 show a clear difference be-

tween the two groups, even though the values shown

for the two groups correspond reasonably well. The

Is Positive Sentiment Missing in Corporate Reputation?

77

Table 2: Examples of ”Missing positive sentiment” values.

State-Space evaluation, based on a 200-point scale [-100,

100].

State-Space

Organisation 95% 99%

Qantas 8.73 11.49

Mercedes-Benz 5.65 7.40

ExxonMobil 6.06 7.89

Walt Disney Corp. 7.43 9.70

HSBC 5.96 7.75

Astra Zeneca 7.89 10.50

Spotify 6.60 8.74

Kellogg 7.59 10.13

Samsung 4.27 5.71

Fedex 7.65 10.00

Thyssen Krupp 4.83 6.44

Antofagasta 7.22 9.51

Table 3: Examples of ”Missing positive sentiment” values.

MCMC evaluation, based on a 200-point scale [-100, 100].

MCMC

Organisation 95% 99%

Qantas 6.37 8.36

Mercedes-Benz 6.23 8.15

ExxonMobil 6.30 8.27

Walt Disney Corp. 6.21 8.14

HSBC 6.26 8.18

Astra Zeneca 6.39 8.38

Spotify 6.19 8.13

Kellogg 6.37 8.36

Samsung 6.17 8.07

Fedex 6.38 8.38

Thyssen Krupp 6.37 8.34

Antofagasta 6.48 8.51

MCMC group are more tightly clustered. This obser-

vation is very clear when one views descriptive statis-

tics for all organisations in this study. Tables 4 and 5

show the results for the 261 organisations in the first

data set described in Section 3.4. In particular, it is no-

table that the standard deviation for the MCMC calcu-

lation method is much smaller than the standard devi-

ation for the State-Space method. The small standard

deviations also indicate consistency across all organ-

isations, and independence from industry sector. The

mean values for the two methods are approximately

the same.

Figure 4 shows a view of the ”missing positive

sentiment” that encompasses all organisations anal-

ysed. There is a small difference between the evalua-

tions at 95% and 99% confidence, and in this case it

would be acceptable to value ’missing positive senti-

Table 4: Distributional Statistics for ’missing positive senti-

ment’, ˆx

M

, in equations 10 and 13. State-Space evaluation,

based on a 200-point scale [-100, 100].

State-Space

Organisation 95% 99%

Maximum 11.5 14.49

Minimum 3.48 4.59

Mean 6.36 8.4

SD 1.29 1.68

Table 5: Distributional Statistics for ”missing positive sen-

timent”, ˆx

M

, in equations 10 and 13. MCMC evaluation,

based on a 200-point scale [-100, 100].

MCMC

Organisation 95% 99%

Maximum 8.97 11.77

Minimum 6.16 8.07

Mean 6.42 8.41

SD 0.32 0.42

ment’ at ”between 6.5 and 8.5, based on the overall

sentiment range of [-100, 100].

Using the MCMC method (3.8, under the assump-

tion that reputation data is not necessarily Normally

distributed) provides a different view. It is very ap-

parent from Table 5 that there is a difference between

the 95% and 99% estimations. That difference is very

marked in Figure 5, since there is minimal intersec-

tion between the two histograms. MCMC evaluation

has also produced a distinct tail at both 95% and 99%

confidence, although the mean values are consistent

with the State-Space evaluation.

We now consider a particular organisation to il-

lustrate (Figure 6) the extended reputation profile, its

State-Space representation, and the confidence bound

used to calculate the ”missing positive sentiment”.

American Express is a typical profile, with frequent

peaks and troughs, a few downward plunges (rep-

resenting limited bad publicity) and high inter-peak

volatility. The state-space representation is close to

the observed values, although in some cases it falls

slightly below the observations. American Express

is unusual compared to other financial organisations,

which show largely negative sentiment.

5 DISCUSSION

The statistical analysis in this paper is based on

the presumption that negative sentiment predominates

over positive sentiment. The indications from the lit-

DATA 2024 - 13th International Conference on Data Science, Technology and Applications

78

Figure 4: ”Missing positive sentiment” distributions, all or-

ganisations, using the State-Space evaluation (3.7).

Figure 5: ”Missing positive sentiment” distributions, all or-

ganisations, using the MCMC evaluation (3.8).

Figure 6: Amex reputation profile. Black trace: observed

sentiment. Blue trace: smoothed observed. Red dotted

trace: upper 95% confidence bound for the State-Space rep-

resentation. Day range: October 2021 to September 2023

(730 days). The grey region marks the 95% error margin.

The lower confidence bound is not shown but is at the lower

boundary of the grey region.

erature review are that excess negative sentiment does

exist in many contexts. Its origin lies in an innate psy-

chological negative bias. An examination of reputa-

tion time series reveals a very mixed picture. It ap-

pears that factors such as the method of sampling, the

mode of analysis of the samples, and sample location

are all significant factors. Consider, first, the way in

which data are procured and processed. Data feeds

are set up to source texts targeted on particular key-

words. NLP is used to extract sentiment from each,

and an averaging process then determines daily senti-

ment from the texts received during the day. The en-

tire process is automatic and objective, and is geared

to corporate organisations by up-weighting sources

from ’traditional’ media (the press and broadcasting).

Social media, in many cases, is a minor component of

sentiment, except in contentious cases. This method

of data sourcing and analysis differs from the the stud-

ies in the literature review in the following ways.

• The type of sentiment sourced: corporate affairs,

product review, or social comment.

• The calculation method for opinion and senti-

ment.

• The sentiment source.

• The measurement period: one-off or extended.

The second significant determinant of ”missing posi-

tive sentiment” is sampling. The original sample for

this analysis (Section 3.4) was selected on the basis of

industry coverage, which was not a random sample.

The stock index results are derived from predefined

groups, which makes them representative of a partic-

ular class of corporates. It was not possible to draw

a truly random sample from all data available, since

a necessary part of downloading the data is to target

specific organisation names rather than unique identi-

fiers. Therefore, stock index constituents are as near

as we can get to a random sample.

A third factor is also apparent. There appears to

be a regional difference in measuring missing positive

sentiment in the context of reputation. The analysis

of the FTSE and Hang Seng data show precisely the

reverse ’missing’ sentiment compared to data from

other locations. This may indicate a more negative

economic outlook in the UK and Hong Kong/China.

The consequence of these differences is that we might

not expect consistency with previous analyses of neg-

ative bias.

The ”missing positive sentiment” figures in Tables

2 and 3 (Section 4.2) show that at the 95% signifi-

cance level, acceptable consistency is returned by the

State-Space and MCMC methods. Focussing on those

figures, the measured ”missing positive sentiment” is

approximately 6.5 (95% confidence), and 8.4 (99%

confidence), measured on a scale [-100,100]. In per-

centage terms, that scales to 3.25% with respect to

the measured sentiment, independent of scale. Us-

ing the 99% confidence figures, the equivalent fig-

ure is 4.2% of the measured sentiment, independent

of scale. We therefore propose a figure for ”miss-

ing positive sentiment” between 3.25% and 4.2%, and

suggest a ’round’ 4% to account for some long tails

with the MCMC assessment. A simple practical way

in which to apply the 4% figure for ”missing positive

Is Positive Sentiment Missing in Corporate Reputation?

79

sentiment” is to inflate all positive sentiment figures

by 4%, leaving negative sentiment figures unchanged.

The results of this study are significant for two rea-

sons. First, quantification of negative bias using au-

tomated methods coupled with exhaustive data min-

ing is a much more reliable than one-off survey meth-

ods. Therefore, we can place considerable reliance on

the final proposed figure of 4%. Second, the discrep-

ancy between the positive/negative sentiment balance

shows that the context in which measurement takes

place (sources and media), and geographical region

are both important. Generalisation to other contexts

and regions is unsafe.

ACKNOWLEDGEMENTS

We acknowledge the continuing support and assis-

tance of the staff of Penta Group.

REFERENCES

Antypas, D., P. A. and Camacho-Collados, J. (2023). Nega-

tivity spreads faster: A large-scale multilingual twitter

analysis on the role of sentiment in political commu-

nication. In Online Social Networks and Media 33.

doi:10.1016/j.osnem.2023.100242.

Bellovary, A., Y. N. and Goldenberg, A. (2021). Left-

and right-leaning news organizations’ negative tweets

are more likely to be shared. In PsyArXiv 24.

doi:10.31234/osf.io/2er67.

Carter, C. K. and Kohn, R. (1994). On gibbs sampling for

state space models. In Biometrika, 81(3), pp. 541–53.

doi:/10.2307/2337125.

Chomsky, N. (1957). Syntactic structures. Mouton.

Ferrara, E. and Yang, Z. (2015). Quantifying the effect

of sentiment on information diffusion in social media.

In Jnl. Compututer Science 1(51). doi:10.7717/peerj-

cs.26.

Finkelstein, S. R. and Fishbach, A. (2012). Tell me what i

did wrong: Experts seek and respond to negative feed-

back. In Journal of Consumer Research, 39(1), 22–38.

https://doi.org/10.1086/661934.

Fruehwirth-Schnatter, S. (1994). Data augmentation and

dynamic linear models. In Journal of Time Se-

ries Analysis, 15(2), pp. 183–202. doi:10.1111/j.1467-

9892.1994.tb00184.x.

Harvey, A. (1990). Forecasting, structural time series mod-

els and the kalman filter. In Cambridge University

Press.

Hu, N, . P. P. and Zhang, J. (2007). Why do online prod-

uct reviews have a j-shaped distribution? NYU Stern

Business School http://hdl.handle.net/2451/14951.

Liu, B. (2015). Sentiment Analysis: Mining Opinions, Sen-

timents and Emotions. CUP, New York, 1st edition.

Loke, R. and Kisoen, Z. (2022). The role of fake review

detection in managing online corporate reputation. In

Proc, 11th International Conference on Data Science,

Technology and Applications (DATA 2022), pp 245-

256. ScitePress doi:10.5220/0011144600003269.

Loke, R. and Vergeer, J. (2022). Exploring corporate repu-

tation based on sentiment polarities that are related to

opinions in dutch online reviews. In Proc, 11th Inter-

national Conference on Data Science, Technology and

Applications (DATA 2022), pp 423-431. ScitePress

doi:10.5220/0011285500003269.

Mitic, P. (2015). Improved goodness-of-fit tests for opera-

tional risk. In Journal of Operational Risk, 15(1), pp

77-126. Incisive Media doi:10.21314/JOP.2015.159.

Mitic, P. (2017). Standardised reputation measure-

ment. In IDEAL 2017, Guilin China (H. Yin

et al., eds.), LNCS 10585 534-542. Springer:

https://link.springer.com/chapter/10.1007/978-3-319-

68935-7 58.

Moe, W. and Schweidel, D. (2012). Online prod-

uct opinions: Incidence, evaluation and evolu-

tion. In Marketing Science, 31(3) , pp. 372–386.

https://doi.org/10.1287/mksc.1110.0662.

Moe, W. and Schweidel, D. (2013). Positive, negative

or not at all? what drives consumers to post (accu-

rate) product reviews? In Insights 5(2), pp. 8–12.

doi:10.2478/gfkmir-2014-0011.

OpenAI (2019). Better language models and their impli-

cations. https://openai.com/research/better-language-

models.

Park, K., C. M. and Rhim, E. (2018). Positiv-

ity bias in customer satisfaction ratings. In

Proc. WWW ’18, Lyon France, pp. 631-638.

doi.org/10.1145/3184558.3186579.

Powell, D., Y. J. D. M. and Holyoak, K. J. (2017). The

love of large numbers: A popularity bias in consumer

choice. In Psychological Science, 28(10), pp. 1432-

1442. doi.org/10.1177/0956797617711291.

Reichheld, F. F. (2003). The one number you need

to grow. In Harvard Business Review 81(12)

pp. 46–54. https://hbr.org/2003/12/the-one-number-

you-need-to-grow.

Rozin, P. and Royzman, E. B. (2001). Negativity bias,

negativity dominance, and contagion. In Personal-

ity and Social Psychology Review. 5(4) pp. 296–320.

doi:10.1207/S15327957PSPR0504 2.

Shumway, R. and Stoffer, D. (2016). Time Series Analy-

sis and Its Applications With R Examples: Chapter 6.

Springer.

Stieglitz, S. and Dang-Xuan, L. (2013). Emotions

and information diffusion in social media–sentiment

of microblogs and sharing behavior. In Jnl.

Management Info. Systems 29(4) pp. 217–247.

doi:10.2753/MIS0742-1222290408.

Tsugawa, S. and Ohsaki, H. (2017). On the relation be-

tween message sentiment and its virality on social me-

dia. In Social Network Analysis and Mining 7(1):19.

doi:10.1007/s13278-017-0439-0.

Yeo, I.-K. and Johnson, R. A. (2000). A new fam-

ily of power transformations to improve normal-

DATA 2024 - 13th International Conference on Data Science, Technology and Applications

80

ity or symmetry. In Biometrika, 87, pp. 954-959.

doi:10.1093/biomet/87.4.954.

Zendesk (2013). Customer service and Business results: a

survey of customer service from mid-size Companies.

Zendesk.com, http://cdn.zendesk.com/resources/wh

itepapersZendesk\ WP\ Customer\ Service//\ and

\ Business\ Results.pdf, 1st edition.

Is Positive Sentiment Missing in Corporate Reputation?

81