The Prediction of Google Stock Closing Price Based on Linear

Regression Model and Random Forest Model

Zixuan Luo

Guangdong University of Technology, Guangzhou, China

Keywords: Linear Regression, Random Forest, Stock Price Prediction.

Abstract: Price prediction in the stock market has always been a matter of great concern. Due to the unstable and

nonlinear nature of the stock market, predicting stock prices is a very challenging task. To improve the

efficiency of stock price prediction, many machine learning algorithms and deep learning models have been

developed. These machine learning models have better performance compared to traditional prediction

methods. In this study, the stock prices of Google Inc. for the last five years downloaded from Kaggle website

are used as experimental data. Linear regression model and random forest model are used to predict the closing

price of Google Inc. and are evaluated and compared using three different metrics. The results show that these

two machine learning algorithm models are effective in predicting the closing price of a stock and that the

linear regression model performs better than the random forest model in the given cases.

1 INTRODUCTION

Since the birth of the stock market, financial scientists

and sociologists all over the world have customarily

taken the degree of development of the stock market

as one of the evaluation indexes when evaluating the

prosperity and level of development of a certain

country or a certain region, so it is clear that the study

of the stock market is of practical significance. Price

prediction in the stock market has always been a great

concern to people and a very challenging task in

itself. Because the stock market is characterized by

instability and non-linearity, and its formation

mechanism is quite complex. Stock price volatility is

the result of a combination of factors. Frequent stock

price fluctuations amplify speculative activities in the

stock market, as speculators tend to take advantage of

short-term price fluctuations to make profits. Such

speculative activities increase the risk of the stock

market, as price fluctuations may lead to losses for

speculators. In addition, speculative activities may

lead to increased market instability and volatility,

creating uncertainty and risk for other investors.

In order to maximize gains and minimize losses,

more and more researchers are involved in the

practice of stock market price forecasting methods.

For stock price analysis, because it has a huge amount

of data and most of them are non-linear, in response

to the diversity of data, numerous effective machine

learning algorithms and deep learning models have

been created to address the intricate relationships

present in stock data. These models and algorithms

have been proven over time and practice to be more

efficient than traditional prediction methods (Vijh et

al 2020). Most of the classical machine learning

algorithms in the field today are linear regression,

RWT, MACD and random forest.

Linear regression has been around for a long time

and it is generally used as a model to predict

quantitative responses. It is popular in machine

algorithms because of its easy-to-interpret model

parameters and is a very useful and widely used

statistical learning method (Su et al 2012). Cakra et

al. conducted a prediction of stock prices in 2015, and

they concluded that the sentiment of the stockholders

affects the purchasing of stocks, which leads to

fluctuations in the price of stocks. Therefore, they

linked sentiment analysis with stock prices and

predicted the Indonesian stock market. In this study,

Cakra et al. used linear regression to build a

prediction model and the results of the model gave a

good prediction (Cakra and Trisedya 2015). Ali et al.

researchers also predicted the price of bitcoin for the

next 7 days in 2020 also using linear regression

model. They extracted the relevant features in the

dataset with strong relation to Bitcoin price and

trained the linear regression model with appropriate

data chunks and ended up with a good result of

Luo, Z.

The Prediction of Google Stock Closing Price Based on Linear Regression Model and Random Forest Model.

DOI: 10.5220/0012805600004547

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Data Science and Engineer ing (ICDSE 2024), pages 229-233

ISBN: 978-989-758-690-3

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

229

96.97% accuracy (Ali and Shatabda 2020). Nguyen et

al. defined the authors' age prediction as a regression

problem, which is a relatively new line of research.

They used a linear regression model and ended up

with a correlation of 0.74 (Nguyen et al 2011).

Random forest models are also frequently used with

prediction efforts when people use linear regression

for predicting quantitative responses.

Random forests have demonstrated remarkable

accuracy, which has made them a widely adopted

method for numerous machine learning applications.

Additionally, they are relatively straightforward to

comprehend and can efficiently manage extensive

datasets with high dimensionality. Nevertheless, they

can be computationally demanding during the

training process and might not yield optimal

performance when dealing with extremely small

datasets (Rigatti 2017). Kumar and Manish et al. in

2006 used both Support Vector Machines and

Random Forests algorithms for stock market

prediction and compared the effectiveness of the two

algorithms (Kumar and Thenmozhi 2006). Mei and

He et al. predicted the de facto prices in the New York

electricity market by using Random Forests models

and evaluated the effectiveness of the models (Mei et

al 2014). Gupta et al. in 2019 used a total of five

algorithmic models such as Random Forests, etc.,

respectively, for the diagnosed cases, dead cases and

cured cases of novel coronavirus were analysed and

predicted, in which random forest model

outperformed the other models (Gupta et al 2021).

Song et al. also predicted pressure ulcer nursing

adverse event in 2022 using SVM, DT, RF and ANN

respectively, and finally got the conclusion that

random forest is the best performance among these

four models (Song et al 2021).

The aim of this study is to predict the closing price

of stocks using linear regression model and random

forest model and compare the two models to find a

more effective model for predicting stock prices.

2 METHODS

2.1 Data Source and Description

The historical data for the stock price of Google has

been downloaded from Kaggle. The dataset includes

historical data on the stock price of Google, spanning

a period of 5 years from 6/11/2018 to 10/11/2023

(table 1).

To facilitate a more comprehensive observation of

the information in the dataset, Table 2 show some

descriptive statistical information of the dataset.

Table 1: A portion of the dataset.

Date Open High Low Close

2018/11/16 52.971 53.350 52.449 53.074

2018/11/19 52.860 53.040 50.813 51.000

2018/11/20 50.000 51.587 49.801 51.287

2018/11/21 51.838 52.428 51.673 51.880

2018/11/23 51.500 51.879 51.119 51.194

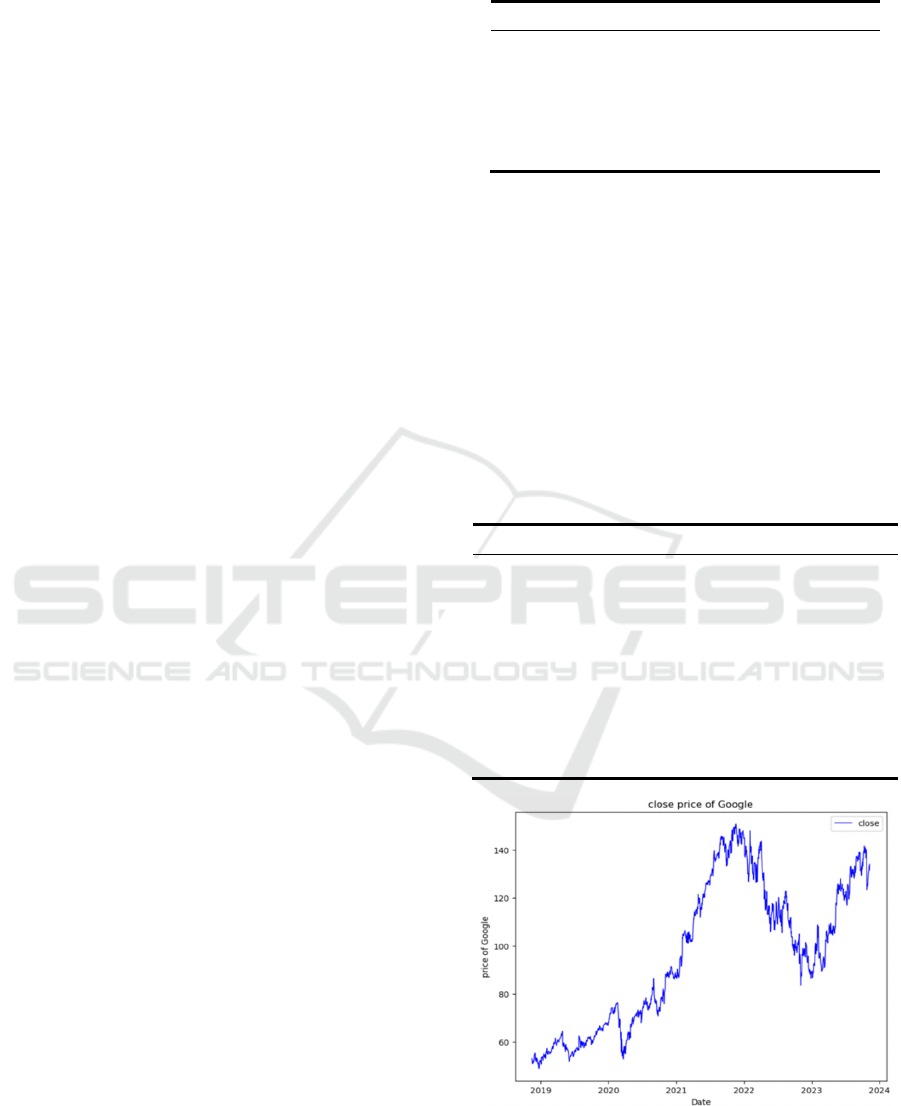

The objective of this study is to forecast the

closing price of stocks. Therefore, the historical data

trends of stock closing prices have reference

significance for research. Fig. 1 demonstrates the

trend of historical data on the closing price of stock.

By observing the trend of Google's stock closing

price, some simple conclusions can be drawn. Firstly,

it is evident that the closing price of Google's stock

showed a significant upward trend over the three-year

period from 2019 to 2022. Despite experiencing a

period of downturn from 2022 to early 2023, it

ultimately rebounded to a higher price.

Table 2: Descriptive statistical information of the dataset.

Open High Low Close

count 1254.000 1254.000 1254.000 1254.000

mean 96.534 97.666 95.521 96.614

std 30.312 30.599 29.997 30.285

min 48.695 50.176 48505.000 48.811

25% 67.298 67.879 66.679 67.237

50% 97.189 99.114 95.697 97.139

75% 123.966 125.231 122.697 123.865

max 151.863 152.100 149.887 150.709

Figure 1: The trend of historical data on the closing price of

stock (Picture credit: Original).

ICDSE 2024 - International Conference on Data Science and Engineering

230

2.2 Variables Introduction

In order to help the model better understand the trends

and patterns of stock prices and thus improve the

accuracy of the predictions, this study creates seven

new variables to train the model for the prediction of

stock closing prices, which are the closing prices of

the stock for each of the previous seven days.

2.3 Methods Introduction

Linear regression is an algorithm in supervised

machine learning. The regression problem mainly

focuses on the relationship between the dependent

variable (which can be one or multiple values to be

predicted) and one or more numerical independent

variables (predictive variables).

Random forest regression is an ensemble learning

technique that consolidates multiple decision trees to

generate predictions. In this method, each decision

tree within the forest is trained using a distinct,

randomly chosen subset of the data. This approach

aids in mitigating overfitting and enhances

generalization capabilities. To obtain the ultimate

prediction for a specific input, the average or

weighted average of the predictions derived from all

the decision trees within the forest is computed.

3 RESULTS AND DISCUSSION

3.1 Divide Dataset

During the model training process, overfitting or

underfitting can be seen as an inevitable event, and

whether overfitting or underfitting occurs, it can

cause significant errors between the predicted results

of the algorithm model and the actual results. To

alleviate this phenomenon, our approach is to divide

the original dataset into training and testing datasets.

Since the dataset of this study uses time series data,

we use TimeSeriesSplit() to divide the dataset. Table

3 presents the statistical information of the dataset

utilized for both training and testing.

Table 3: Descriptive statistical information of the dataset.

Dataset

Training

Dataset

Testing

Dataset

Time

Interval

6/11/2018-

10/11/2023

6/11/2018-

17/1/2023

18/1/2023-

10/11/2023

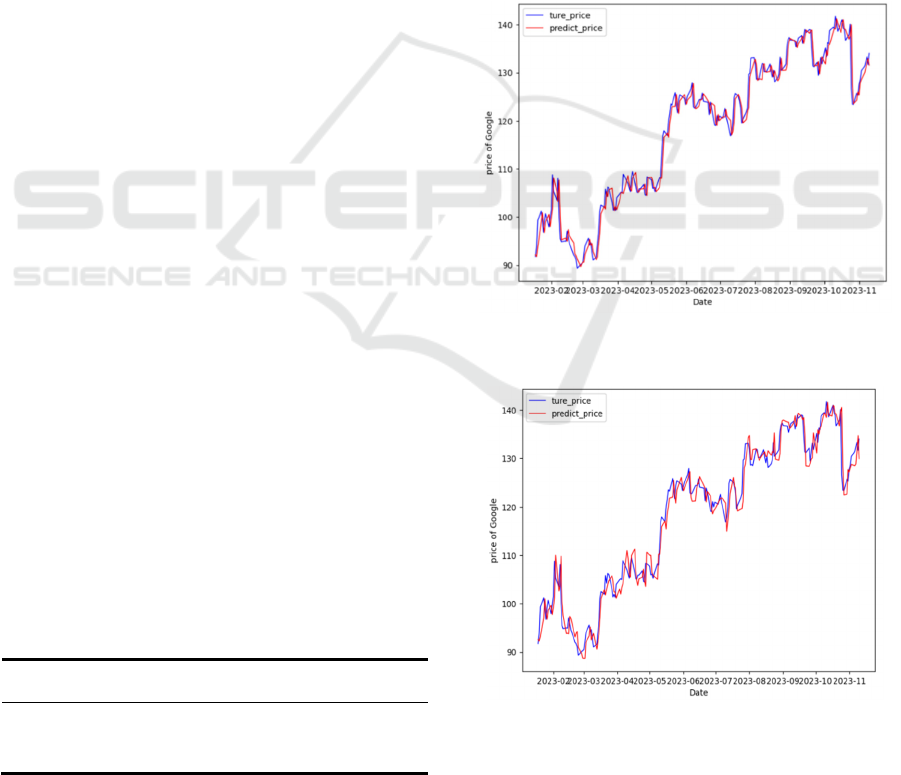

3.2 Forecasting Results

To evaluate the comparative effectiveness of the two

models, we brought the testing dataset into the two

models for testing and constructed two graphs to

visualize the results predicted by the two models. Fig.

2 represents the comparison between the true stock

closing price and the stock closing price predicted

using the linear regression model, and Fig. 3

represents the comparison between the true stock

closing price and the stock closing price predicted

using the Random Forest model.

We can see that both the random forest model and

the linear regression model are very good at

predicting known data, and the linear regression

model may be better. However, we can't accurately

judge which one is better just by the graph, so we will

use to specific evaluation index to compare.

Figure 2: Predicted vs true closing stock price using Linear

regression (Picture credit: Original).

Figure 3: Predicted vs true closing stock price using

Random Forest (Picture credit: Original).

The Prediction of Google Stock Closing Price Based on Linear Regression Model and Random Forest Model

231

3.3 Comparative Results

To assess the effectiveness of the models, we

compare the performance of the linear regression

model and the random forest model in predicting the

closing price of Google Inc. We use three different

evaluation metrics to measure the final minimisation

error of the predicted price. Table 4 shows the results

of the comparative analysis obtained using the linear

regression model and the random forest model.

Table 4: Comparative analysis of the model evaluation.

Linear Regression Random Forest

RMSE 2.346 2.771

MSE 5.505 7.676

MAE 1.716 2.142

The result shows that the RMSE of Linear

Regression is 2.346 and the RMSE of Random Forest

is 2.771. The MSE of Linear Regression is 5.505 and

the MSE of Random Forest is 7.676. The MAE of

Linear Regression is 1.716 and the MAE of Random

Forest is 2.142. Based on the evaluation metrics, it

can be observed that the Linear Regression model

shows better prediction results for stock prices

compared to the Random Forest model. This is

because the values of evaluation metrics for Linear

Regression are all lower than those of Random Forest.

3.4 Discussion

Although it is difficult to predict the closing price of

a stock, it is possible to increase the precision of the

forecast and improve the forecasting efficiency with

the aid of machine learning. In order to predict the

closing price of Google's stock, this study took the

closing price of Google's stock in the previous seven

days as the independent variable and finally obtained

that the closing price of Google's stock will have a

stable and continuous upward trend. By comparing

with the real trend of the closing price of Google's

stock, it can be found that the two algorithmic models

used in this study predicted the results very close to

the real stock trend. The efficiency and high accuracy

of the two algorithmic models demonstrate that both

the linear regression model and the random forest

model are efficient deep learning models that can be

used to predict stock prices.

The linear regression model has a better

performance than the random forest model in the

comparison based on the three evaluation metrics of

RMSE, MSE and MAE, which may be due to several

factors. Firstly, the dataset of this experiment is small

and the linear regression model is likely to converge

more quickly and get better results, since it is not

necessary to build a lot of decision trees; Secondly,

the random forest model is an integrated learning

method, but it also brings an increase in computation.

Therefore, it is better to use linear regression model

when the computational power is limited; in addition

to that, if there is a certain linear relationship between

the characteristics of the data and the target variables,

linear regression usually provides more concise and

easy-to-interpret results. Although the results of this

study do not show that the linear regression model is

a more efficient deep learning model than the random

forest model, but we can know that the linear

regression model may be a better choice in the above

cases.

4 CONCLUSION

Although predicting stock prices is not an easy task,

machine learning techniques have facilitated the field

of stock price prediction nowadays. The aim of this

paper is to test the effectiveness of machine learning

algorithmic models in predicting stocks, while

comparing the efficiency of two different machine

learning algorithmic models.

First of all, this study uses the stock price

information of Google Inc. in the past five years

provided by Kaggle website, and predicts the closing

price of Google Inc. stock using linear regression

model and random forest model respectively, and the

consequences show that both machine learning

algorithmic models have good prediction results,

which are very close to the real results.

In addition to this, this study also compared the

efficiency of the two machine algorithm models using

three evaluation metrics, and the results revealed that

the linear regression model outperformed the random

forest model in certain circumstances, specifically.

For future work, more machine learning

algorithms can also be included at the same time for

comparison in addition to the two methods mentioned

above. It is believed that deeper learning of machine

learning algorithmic models can lead to better results

in the future in the field of stock prediction.

REFERENCES

M. Vijh, D. Chandola, V. A. Tikkiwal, A. Kumar, Procedia

comp. sci., 167, 599-606 (2020)

X. Su, X. Yan, C. L. Tsai, Wiley Interdisciplinary Reviews:

Comp. Stat., 4(3), 275-294 (2012)

ICDSE 2024 - International Conference on Data Science and Engineering

232

Y. E. Cakra, B. D. Trisedya, ICACSIS, 147-154 (2015)

M. Ali, S. Shatabda, ICAICT, 330-335 (2020)

D. Nguyen, N. A. Smith, C. Rose, ACL-HLT, 115-123

(2011)

S. J. Rigatti, J. Insur. Med., 47(1), 31-39 (2017)

M. Kumar, M. Thenmozhi, Indian inst. Cap. Mark., (2006)

J. Mei, D. He, R. Harley, T. Habetler, G. Qu, Gen. Meet.

Conf. Exp., 1-5 (2014)

V. K. Gupta, A. Gupta, D. Kumar, A. Sardana, Big Data

Mini. Ana., 4(2), 116-123 (2021)

J. Song, et al. Risk Mana. Heal. Pol., 1175-1187 (2021)

The Prediction of Google Stock Closing Price Based on Linear Regression Model and Random Forest Model

233