Research on Microsoft Stock Price Prediction Based on Various

Models

Yuanhao Fu

School of Finance, Inner Mongolia University of Finance and Economics, Inner Mongolia, China

Keywords: Machine Learning Models, Linear Regression, Microsoft Stock Price, Time Series Models, LSTM.

Abstract: With the development of social economy, stock investment is more and more popular. In the process of

investing in stocks, people execute investment strategies in a quantitative trading manner, hoping to obtain

the highest return with the least risk. To be successful in quantitative investing, the key is to build excellent

mathematical models and grasp the accurate trading time node. The paper uses the dataset of Microsoft stock

prices from April 2015 to April 2021 to build Machine learning models such as Linear regression, Time series

models such as ARIMA, and LSTM model are used to fotcast the Microsoft’s stock price. This thesis provides

the theoretical knowledge of LSTM neural model and time series model, selects the actual stocks in the stock

market, conducts modeling analysis and predicts the stock price, and then uses RMSE to compare the

prediction results of several models. Since the time series model cannot get the utmost out of the non-linear

part of the data and cannot carry out long-term memory, the LSTM neural network can make full use of it and

long-term memory to obtain useful information in the stock data. In terms of root-mean-square error, LSTM

neural network is smaller than the time series model, which indicates that LSTM neural network is a better

method for prediction.

1 INTRODUCTION

Nowadays, people try to use computers to manage

investment transactions, and add trading strategies to

the instructions of computers quantitatively, which is

called quantitative investment trading. To be

successful in quantitative investing, the key is to build

excellent mathematical models and grasp the accurate

trading time node. One idea is to build mathematical

models to predict the rise and fall of stock prices,

timing them to buy on the rise and sell on the fall.

Financial data are affected by many factors and

are characterized by high complexity. With the

development of artificial intelligence, more people

have applied machine learning to the study of

financial stocks.

Stock volatility is influenced by many elements,

such as historic stock price data, social media

opinion, investor sentiment, etc. Stock text fusion is a

high-efficiency method for forecast, but there are still

some problems such as poor time dependence of

historical information, low availability of experiment

and insufficient validity of fusion features. The noise

database, low quality of it and incomplete abnormal

one in the existing situation leads to the inaccuracy of

the learned characteristics and the poor prediction

performance of the model. In addition, most of the

subsistent sets improve the usability of it by changing

the network structure of outcome, and lack in-depth

research on the uncertainty factors of datum.

Chowdhury et al. in 2020 adopted machine

learning methods to verify stock prediction based on

improved Black code option pricing model. Akhtar et

al used support vector to predict stocks in 2022.

Saranya et al. in 2019 compared the results of various

machine learning algorithms to predict stock price

volatility and found the best means to predict stock

price. Maqbool et al. used three ways to compute

multifarious view scores and used them in disparate

groups to comprehend the incidence of news on stock

prices and the impact of each sentiment scoring

method.

Keren et al. studied the virtues of CNN and LSTM

in improving the accuracy of stock prediction, used

the convolution idea of CNN to build a feature

extraction layer to extract features, and input the

extracted features into LSTM to better study the time

information of features. Akshit et al. integrated ANN

to establish ANN 's-MLP, GACH-MLP hybrid

Fu, Y.

Research on Microsoft Stock Price Prediction Based on Various Models.

DOI: 10.5220/0012807400004547

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Data Science and Engineering (ICDSE 2024), pages 11-16

ISBN: 978-989-758-690-3

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

11

model, and used the new method and new technology

of combining BP algorithm with multi-layer

feedforward network, which achieved good results in

stock prediction.

Ankit et al proposed that fusion can be considered

as a method to integrate data or features and enhance

prediction based on combination methods that can

help each other. Their fusion applied in various stock

markets is divided into information fusion, feature

fusion and model fusion. Nine new intraday stock

price synthesis models are proposed by Kumar to

improve the accuracy of intraday stock price

prediction (Chandar 2021).

2 METHODS

2.1 Data Source

The paper using the dataset of Microsoft stock prices

from April 2015 to April 2021 from Kaggle, selected

with 1511 observations.

2.2 Data Visualization

The on and off columns indicate the initiate and

eventual price at which the stock will trade on a given

day.

Observe Figure 1. Volume is the number of shares

bought or sold that day. Another vital thing to note

the market is closed on weekends and public holidays.

The count of profit or loss is usually decided by the

closing price of a stock for the day, so think about it

as the target variable (Cao et al 2022 & Huang and

Fang 2021).

Figure 1: Stock price of Microsoft over the years (Picture credit: Original).

2.3 Model Selection

2.3.1 Moving Average

In the financial world, the moving average (MA) is a

common stock indicator used in artistical analysis.

The reason for calculating it is to help smooth the

price data by creating a constantly updated mean

price.

By calculating it, it is possible to mitigate the

effects of tatted short-dated waves in stock prices

over a given time.

2.3.2 Linear Regression

The analysis mainly studies the relationship between

variables, using lines to fit all the data points, and then

studies how to minimize the distance difference

between the line and all data points. Linear regression

is our most common regression analysis algorithm, it

also has different names in different scenarios, such

as weighted average, multifactor model, and so on.

Linear regression processes the observed data to

obtain a mathematical model expression that is

relatively consistent with the law, it means that the

law between the independent variable data and the

dependent variable data can be found, so that

unknown data can be simulated.

2.3.3 KNN

k-nearest neighbour (KNN) is an elementary sort

management and regression methodology, a model

based on labeled drilling database. It's a surveillant

learning means of count.

ICDSE 2024 - International Conference on Data Science and Engineering

12

2.3.4 ARIMA

ARIMA: Autoregressive Moving Average Model.

The model used for time series forecasting is usually

suitable for single-column time series data analysis,

provided that the time series data is stable and there

is no obvious upward/downward trend, and the

stability can be tested using ADF.

2.3.5 Prophet

Prophet is an opensource time series prediction

algorithm from Facebook that can availably process

holiday message and fit the changing trend of data by

week, month, and year. According to the official

website, Prophet has a good fitting effect on historical

data with strong cyclical characteristics, which can

not only deal with some outliers in the time series, but

also deal with some missing values. The algorithm

provides two implementations based on Python and

R.

Prophet applies to business behaviour data with

obvious inherent laws, such as business problems

with the following characteristics:

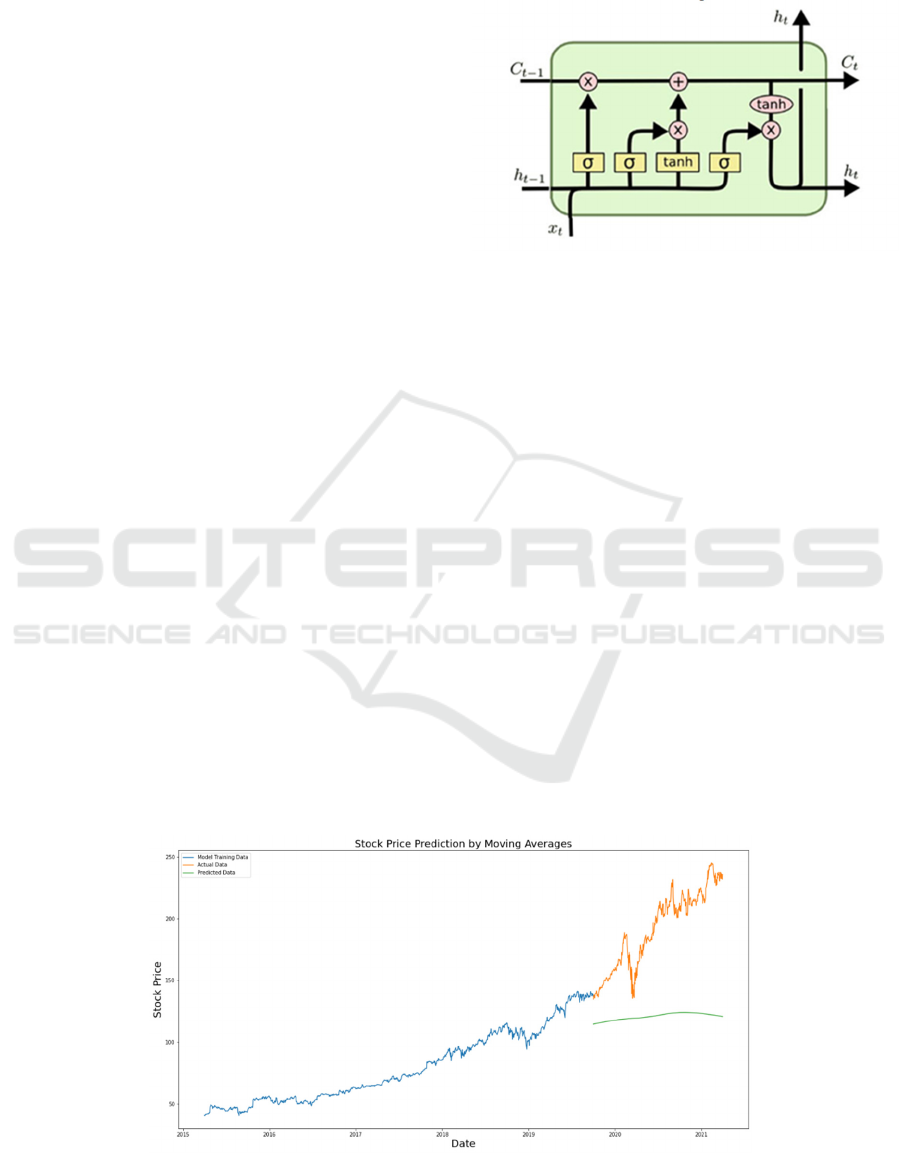

2.3.6 LSTM

Recurrent Neural Network (RNN) is a sort of time

sequence that can be preserved. The neural network

structure of column state, which can use previous data

to process current data, has the ability to capture

useful information in the time series during the cycle.

Parameters in RNN are learned by Back Propagation

algorithm. Nevertheless, as the number of network

layers and iterations increases during the learning

process, subsequent nodes of the RNN will gradually

forget the message before, leading to gradient

elimination loss or gradient explosion problem.

LSTM neural network introduces cell state and gating

mechanism inside, which can effectively solve the

problem of gradient disappearance or explosion. Its

unit structure is shown in Figure 2.

Figure 2: LSTM cell structure (Picture credit: Original).

The LSTM neural network proceeds from the

received sequence data by continuously repeating the

above data processing process extract useful

information and output the extracted information.

LSTM neural network will produce an output at each

moment. For the prediction task in this paper, only the

output at the last moment is used for prediction.

3 RESULTS AND DISCUSSION

3.1 Results

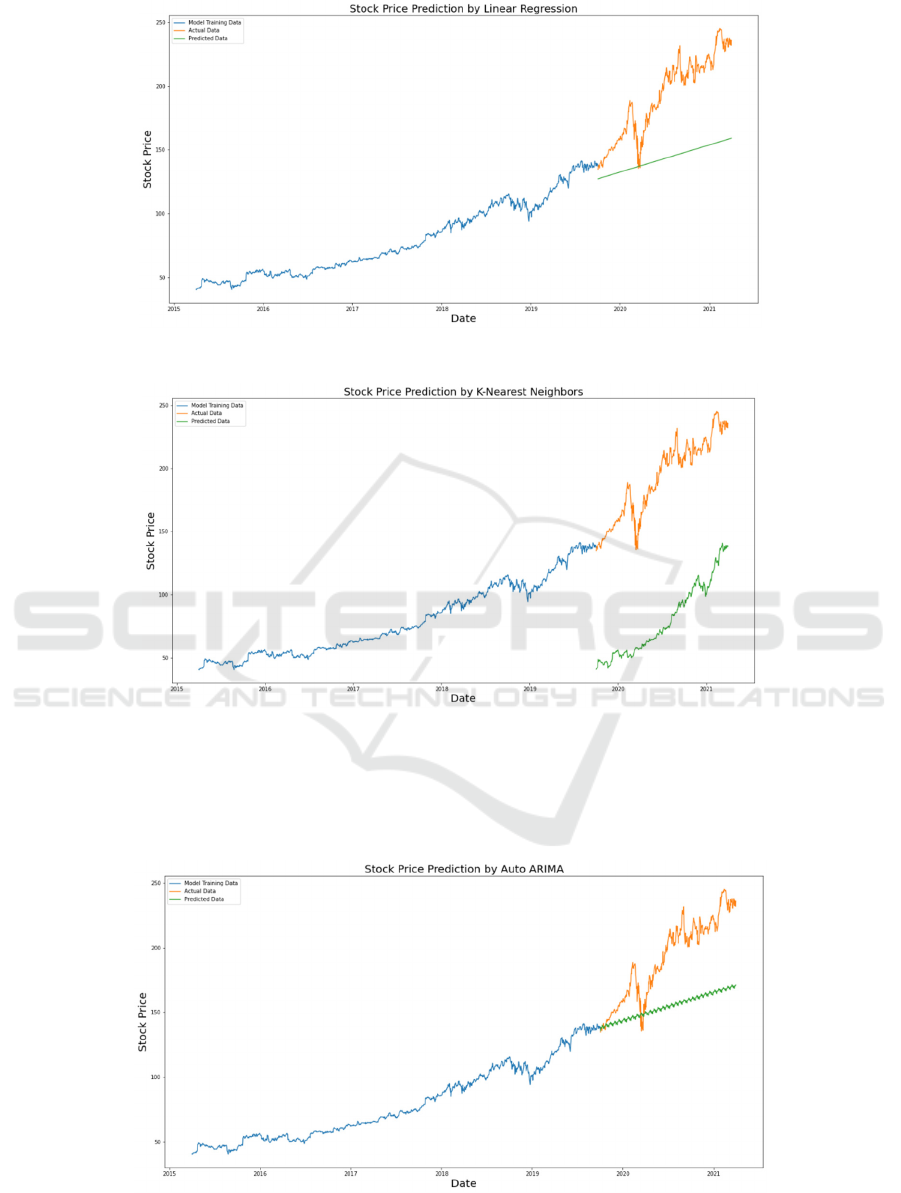

Looking at Figure 3, the value is about 76.62, but the

results are not hopeful (as can be gleaned from the

figure). The values that have been predicted have the

identical scope as the conscious values in the training

collection (up first and then down slowly).

The data set in Figure 4 is arranged in climbing

sequence, and then a separate one is invented so that

any new traits created do not influence the primordial

information.

Figure 3: Moving Averages (Picture credit: Original).

Research on Microsoft Stock Price Prediction Based on Various Models

13

Figure 4: Linear Regression (Picture credit: Original).

Figure 5: KNN (Picture credit: Original)

Observing Fig 5, The RMSE values are nearly

alike to the linear regression model. As this has been

the pattern for the past few years. It can be surely said

this way does not show good quality on this database.

Have a look at some time series forecasting

techniques and look forward how they represent when

in the face of the challenge.

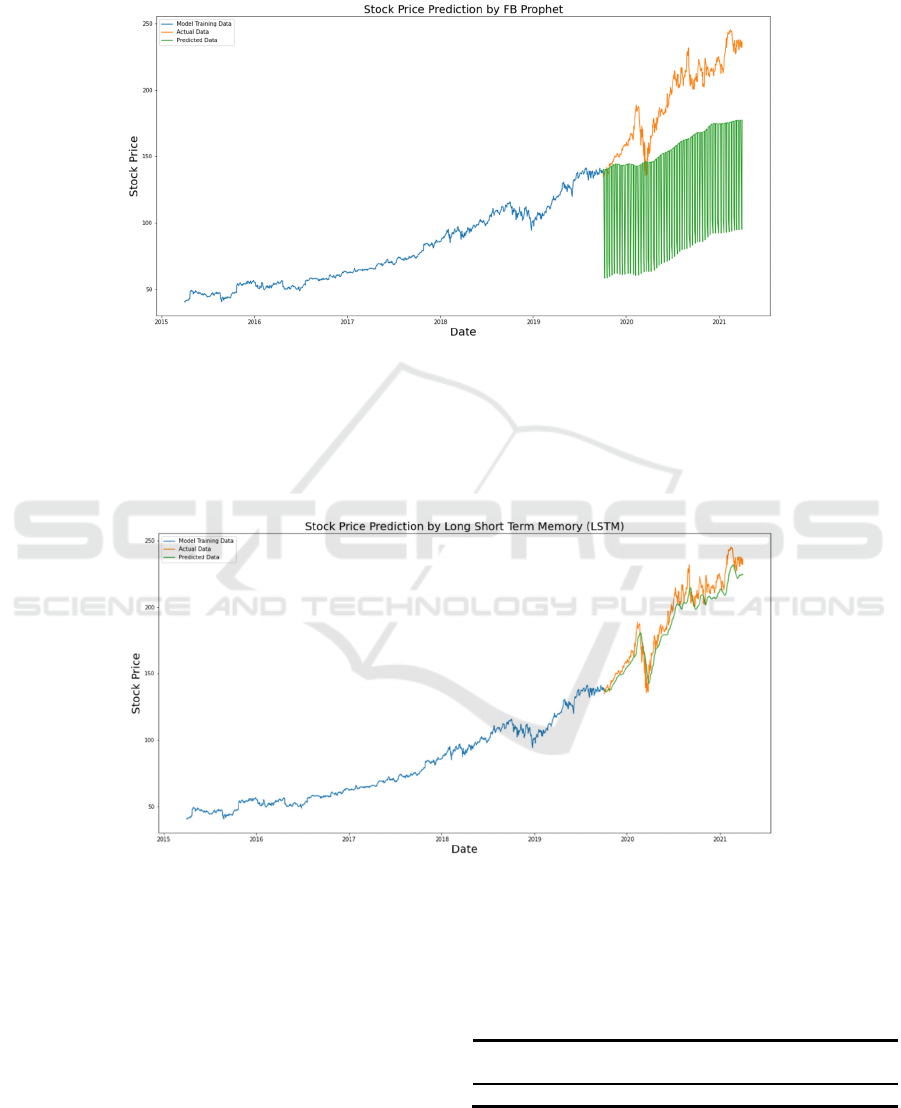

Figure 6 : Auto ARIMA (Picture credit: Original)

ICDSE 2024 - International Conference on Data Science and Engineering

14

Observing Fig 6, the model uses lapsed data to

make the pattern in the time series clear. Using these

numbers, it captured an incremental tendency in the

series. Although the predictions are much better, it is

still not close to the real one. Seeing it, the model has

exhibited a trend in the catena, but does not pay close

attention on seasonal sectors.

Figure 7: Prophet (Picture credit: Original).

Observing Fig 7, prophet (like others attempt to

obtain the seasonal characteristic of the past. In this

situation, it failed, which turns out that there is no

specific trend or seasonal characteristic to stock

prices. Much depends on what is happening in the

market at the moment, causing prices to fluctuate. So,

mantic techniques do not show good results for this

given question. Attempt to another advanced

technology next.

Figure 8: LSTM (Picture credit: Original).

3.2 Discussion

Looking at Figure 8, the LSTM model can be adjusted

by increasing the dropout value, or the epoch. But are

LSTM's forecasts sufficient to determine whether the

share price will rise or fall? Of course not! As talked

by the author at the beginning of the paper, stock

prices can be impressed by company journalism and

other factors such as demonetisation or merger/break-

up of a company. There are also intangible factors

that usually cannot be predicted in advance. The

model evaluation results can be seen as Table 1, and

the LSTM method has a better performance.

Table 1: Model Evaluation (RMSE).

Linear

Re

g

ression

KNN Auto

ARIMA

Prophet LSTM

58.366 112.947 43.470 69.194 9.465

Research on Microsoft Stock Price Prediction Based on Various Models

15

4 CONCLUSION

To sum up, it can be seen that LSTM prediction

model’s RMSE is smaller and more accurate than

other models. The results show that the LSTM is

better. However, In the real market, the elements that

can impress the movement of stock prices are

numerous and intricate. And these factors can also be

related, so try through the essay relatively simple

assumptions about trading conditions predict stock

prices and spot speculative opportunities seems

impossible. Stock price prediction model can be

proposed for stock market investors for reference,

improve the rationality of investors and increase the

effectiveness of the stock market, which can improve

the efficiency and dimension of stock market and

protect the stability of the stock market. State also

avoid stock market fluctuates abnormally through

rational policy, based on this.

REFERENCES

C. Reaz, M. R. C. Mahdy, T. N. Alam, G. D. Quaderi, M.

A. Rahman, Stat. Mech. Appl., 555, 124444 (2020).

M. D. Akhtar, Z. A. Sarwar, K. Shakir, S. A. S. Ali, D. Sara,

S. Faizan, J. King Saud Univer. Sci., 34(4), 101940

(2022).

A. Saranya, R. Anandan, Inter. J. Rec. Tech. Eng., 8, 280-

283 (2019).

M. Junaid, A. Preeti, K. Ravreet, M. Ajay, G. I. Ali, Pro.

Comp. Sci., 218, 1067-1078 (2023).

K. He, Q. Jiang, Acad. J. Comp. Inf. Sci., 5(12), 98-106

(2022).

A. Kurani, P. Doshi, A. Vakharia, M. Shah, Ann. Data Sci.,

10, 1-26 (2021).

A. Thakkar, K. Chaudhari, Inf. Fus., 65, 95-107 (2021).

S. K. Chandar, Pat. Rec. Let., 147(3), 124-133 (2021).

C. F. Cao, Z. N. Luo, J. X. Xie, L. Li, Comp. Eng. Appl.,

58 (5), 280-286 (2022).

Y. C. Huang, W. W. Fang, Mod. Comp. Sci., 27 (34), 6

(2021).

ICDSE 2024 - International Conference on Data Science and Engineering

16