Predictive Analysis of Tesla's Stock Closing Prices Utilizing LSTM

and GRU Deep Learning Models

Yiheng Chi

Haide College, Ocean University of China, Qingdao, China

Keywords: LSTM, GRU, Stock Closing Price, Deep Learning, Tesla.

Abstract: This study delves into advanced deep learning methods, namely Long Short-Term Memory (LSTM) and

Gated Recurrent Units (GRU), to predict Tesla's stock prices from 2013 to 2023, a period marked by notable

market volatility. It aims to analyze these models' abilities in capturing complex financial trends, particularly

in the rapidly evolving electric vehicle sector. The research employs a hybrid approach, combining LSTM

and GRU layers to leverage their respective strengths in long-term and short-term forecasting.

Methodologically, the study involves comprehensive data processing, model building, and validation using

historical stock data from the Nasdaq platform. The models are evaluated through various statistical metrics,

including RMSE, MSE, and MAE, to assess their predictive accuracy. The findings reveal that while GRU

models excel in short-term forecasting, the hybrid model demonstrates stronger capabilities in long-term trend

analysis. This suggests the need for tailored model selection based on specific forecasting timelines in

financial markets. The study's implications extend to the practical application of LSTM and GRU models,

recommending an integrated approach for more accurate and responsive market forecasting. It also highlights

the potential for future research to incorporate real-time market data, enhancing the models' relevance and

adaptability in a rapidly changing financial landscape.

1 INTRODUCTION

The pursuit of forecasting stock market trends has

consistently intrigued numerous analysts and

researchers (Shah et al 2019). Analyzing movements

and price behaviors in the stock market is highly

challenging due to its dynamic, nonlinear,

nonstationary, nonparametric, and chaotic

characteristics, coupled with inherent noise in the

data (Abu-Mostafa and Atiya 1996). For investors,

this predictive ability is crucial in planning

investment portfolios and maximizing returns. For

financial institutions and policymakers, accurate

forecasts of stock prices are essential for a better

understanding and management of market risks, as

well as for formulating policies in line with economic

trends. Throughout the years, both investors and

researchers have shown keen interest in creating and

evaluating models related to the behavior of stock

prices (Fama 1970).

With increasing attention to climate change and

the rapid evolution of electric vehicle technology, the

new energy industry, led by electric vehicles, has

rapidly developed and become a significant part of

the stock market. As a leader in the electric vehicle

and new energy industry, Tesla plays an important

role in the global stock market. Particularly, the high

volatility of Tesla's stock makes it an ideal case study

for understanding and predicting dynamic market

trends.

A notable characteristic of these new energy

industries is the high volatility of their stock prices in

recent years. As Pettinger pointed out, fluctuations in

the stock market significantly influence both national

economies and individual consumer finances, and a

significant drop in stock prices can cause extensive

economic disruptions (Pettinger 2023). Therefore,

researching the prediction of Tesla's stock price is

greatly beneficial for understanding the capital

movements and investor sentiments in the clean

energy market. The notable volatility of Tesla’s stock

prices in recent years underscores the importance of

conducting a thorough analysis. This study aims to

evaluate the effectiveness and adaptability of specific

models in forecasting stock market trends, and hopes

to provide a deeper understanding of future financial

market trends by capturing the market dynamics and

trends of Tesla's stock.

422

Chi, Y.

Predictive Analysis of Tesla’s Stock Closing Prices Utilizing LSTM and GRU Deep Learning Models.

DOI: 10.5220/0012807500004547

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Data Science and Engineering (ICDSE 2024), pages 422-428

ISBN: 978-989-758-690-3

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

Machine learning techniques have been

extensively researched to automatically process a

wealth of financial data, such as historical stock

prices, thereby supporting investment decisions

(Yoshihara et al 2014). In the realm of financial

market prediction, especially in stock market

forecasting, deep learning techniques such as LSTM

and GRU have emerged as significant research tools.

Touzani and Douzi, in the Journal of Big Data,

demonstrate the application of LSTM and GRU in

market forecasting, showcasing their potential in

handling sequential data (Touzani and Douzi 2021).

Moreover, a study by Gao et al. emphasized that

traditional analysis methods fall short in addressing

the complexities of stock market data, while LSTM

and GRU exhibit superior predictive accuracy (Gao

et al 2021). Soni et al. explored various techniques in

stock price prediction, ranging from traditional

machine learning and deep learning methods to neural

networks and graph-based approaches (Soni et al

2022). Venkatarao et al. further contributed to this

field by introducing a novel normalization approach

in their study 'Stock Price Prediction by Normalizing

LSTM and GRU Models,' underscoring the

importance of optimizing these deep learning

techniques for enhanced stock market prediction

accuracy (Venkatarao et al 2023). Additionally,

Mukherjee et al. employed deep learning algorithms

for an in-depth prediction of stock market prices,

achieving significant accuracy (Mukherjee et al 2023).

Long Short-Term Memory networks (LSTMs)

and Gated Recurrent Units (GRUs) have garnered

considerable attention due to their exceptional ability

to handle sequential data, a crucial aspect in the

complex field of stock price prediction. This study is

dedicated to employing LSTM and GRU, two

advanced deep learning techniques, to analyze and

predict the stock prices of Tesla, Inc.

This study employs cutting-edge deep learning

techniques, specifically Long Short-Term Memory

(LSTM) and Gated Recurrent Units (GRU), to

analyze and forecast the stock prices of Tesla, Inc.

Utilizing historical stock price data from November

29, 2013, to November 27, 2023, sourced from the

Nasdaq platform, our approach innovatively

combines both LSTM and GRU models. This

methodology aims to leverage the unique strengths of

each model for more accurate and robust predictions.

The data selection focuses on recent years to capture

the significant fluctuations in Tesla's stock, reflecting

the evolving dynamics of the electric vehicle and

clean energy sectors.

2 METHODS

2.1 Data Acquisition

The historical daily stock data of Tesla from

November 29, 2013, to November 27, 2023, were

downloaded from the Nasdaq platform. The data's

scientific rigor and accuracy were validated against

actual stock prices. The dataset comprises Date, Open,

Close, Volume, High, and Low. Initial data

visualization was conducted to check for consistency

and outliers.

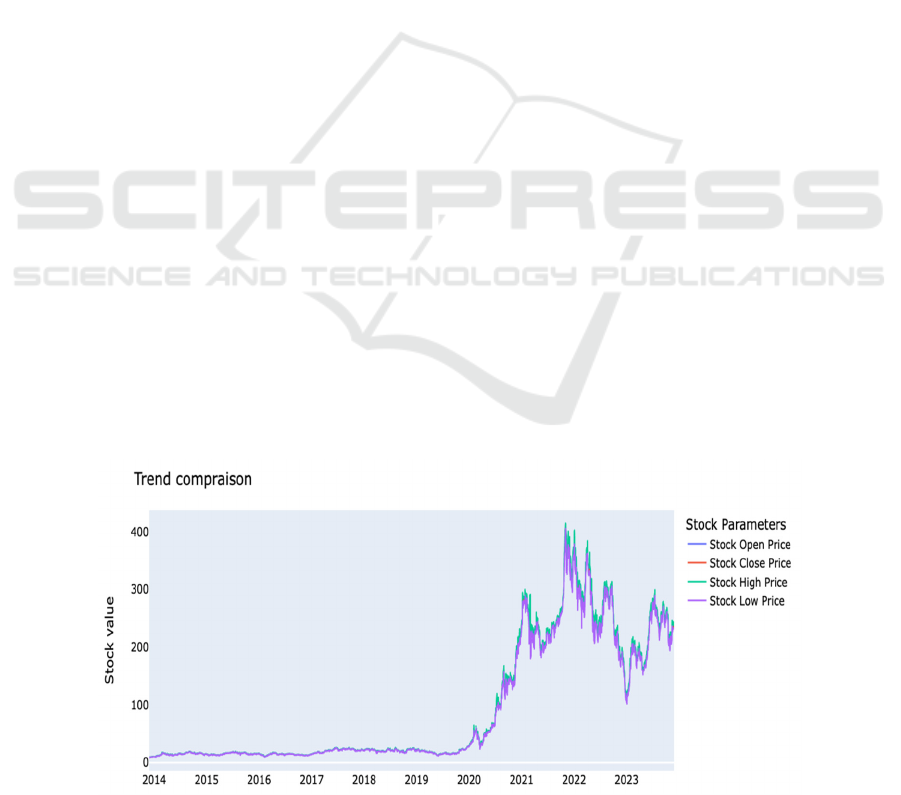

2.2 Data Visualization

The complete statistics of Tesla's stock prices over the

period are crucial for our research on time series

analysis. Therefore, understanding the changes in

Tesla's stock prices from November 29, 2013, to

November 27, 2023, is essential.

Figure 1: Stock Prices of TSLA (Picture credit: Original).

Predictive Analysis of Tesla’s Stock Closing Prices Utilizing LSTM and GRU Deep Learning Models

423

Fig. 1 illustrates the time series plot of Tesla's

daily stock values, comprising Date, Open, Close,

Volume, High, and Low. Observations from the

monthly time series plot of Tesla's stock prices reveal

key insights. Between 2013 and 2020, the stock price

remained relatively stable, demonstrating a degree of

steadiness. However, starting in 2020, a significant

shift occurred as the stock price began to exhibit

extreme volatility. Notably, from 2022 to 2023, there

was an overall upward trend, with the stock reaching

its peak in early 2022. Subsequently, a continuous

decline was observed until the beginning of 2023.

From early 2023 to the present, Tesla's stock price has

gradually recovered but has shown strong fluctuations.

Furthermore, no apparent seasonality or cyclical

pattern was demonstrated in this time series plot. These

observations not only highlight the dynamic changes in

Tesla's stock price but also provide valuable

perspectives for our time series analysis.

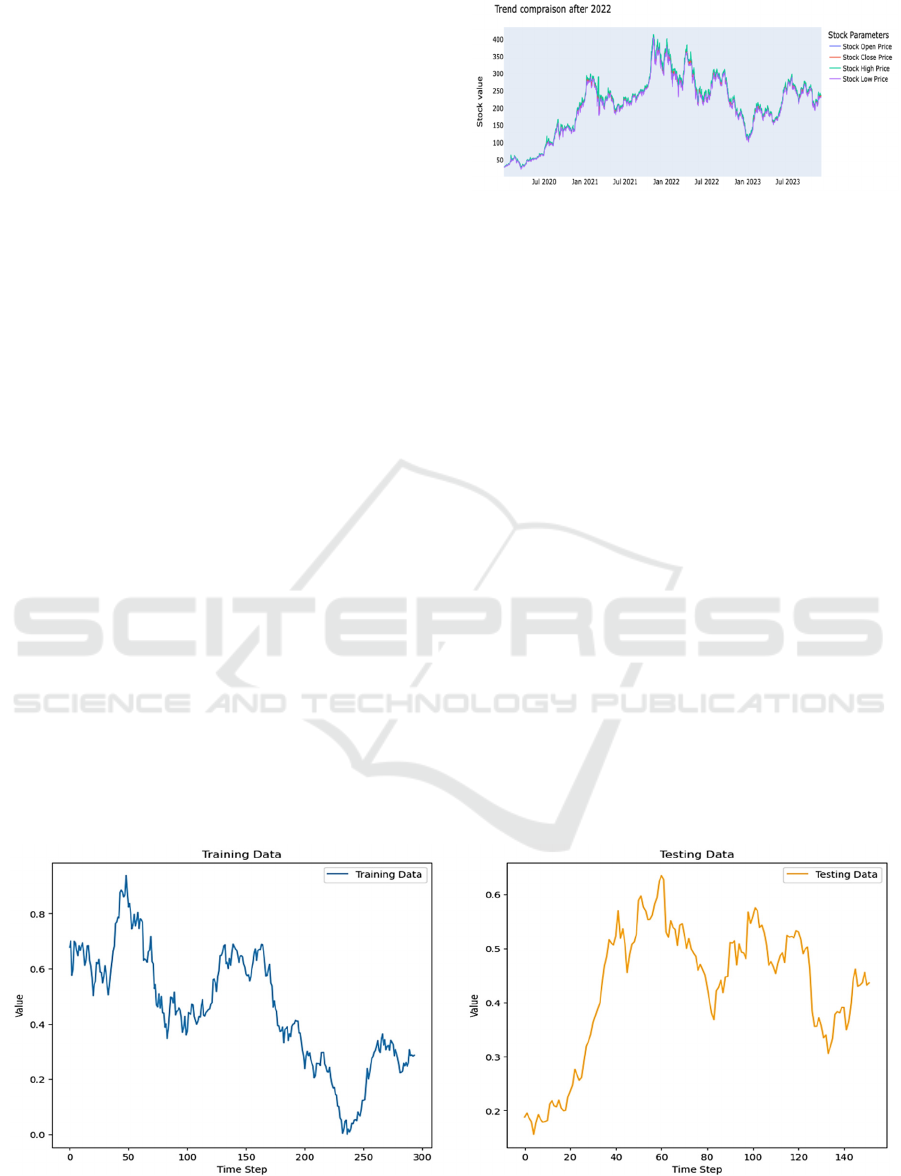

2.3 Data Cleaning and Selection

Data cleaning involved converting data types in the

Date column, setting it as an index, and checking for

null values. Given the continuity in stock closing

prices, missing values were filled using the mean of

adjacent days. Due to significant fluctuations in

Tesla's stock price since 2020, only data post-January

1, 2022, were selected for model training and testing

(Fig 2).

This subset of 478 data points was normalized to

a range of 0-1. The data was then split into training

(65%) and testing (35%) sets, and both sets were

visualized (Fig 3).

Figure 2: Stock Prices of TSLA after 2022 (Picture credit:

Original).

2.4 Model Building and Evaluation

Three models were built, trained, and evaluated:

LSTM, GRU, and an innovative model combining

LSTM and GRU layers. The models were assessed

using RMSE, MSE, MAE, MGD, MPD, and

regression R-squared coefficients for both training

and testing sets. This analysis aimed to comparatively

analyze the strengths and weaknesses of each model.

The predictive performance of each model was

visualized by plotting the predicted stock price trends.

2.5 Parameters Selection

LSTM, GRU and a combined models were selected.

Parameters of these models were carefully chosen to

ensure comparability across models (Table 1). All

models were trained with 200 epochs, using MSE as

the loss function, a batch size of 5, 32 nodes, and

'adam' optimizer. The LSTM model consisted of three

LSTM layers, the GRU model of four GRU layers,

and the innovative model of two LSTM layers

followed by two GRU layers.

Figure 3: Normalized Training set and Testing Set (Picture credit: Original).

ICDSE 2024 - International Conference on Data Science and Engineering

424

Table 1: Parameter Selection for Models.

Model Parameter Selection

LSTM

Epochs = 200

Batch = 5

loss = ‘MSE’

optimizer = ‘adam’

3 LSTM layers

with 32 nodes

GRU

Epochs = 200

Batch = 5

loss = ‘MSE’

optimizer = ‘adam’

4 GRU layers

with 32 nodes

LSTM & GRU

Epochs = 200

Batch = 5

loss = ‘MSE’

optimizer = ‘adam’

2 LSTM and 2 GRU layers with 32

nodes

2.6 Assumption and Limitation

As shown in Table 2, the model is based on the

following five assumptions to ensure its rigor.

Table 2: Assumption for Models.

Assumption Contents

Market Efficiency

Hypothesis

The stock market is semi-strong

efficient, meaning all publicly

available information is already

reflected in the current stock

p

rices.

Historical Trend

Repetition

Hypothesis

Historical price trends and

patterns are assumed to recur to

some extent in the future.

Locality of Market

Influence

Hypothesis

The primary factors influencing

stock prices are assumed to be

local and co

Ignoring Macro-

Economic and Non-

Structural Changes

Macro-economic factors and

policy changes are not quantified

in the model.

Non-Extreme Event

Hypothesis

The prediction period is assumed

not to include extreme market

events like financial crises or

significant political events.

The study primarily aimed to compare the

regression and predictive performance of LSTM,

GRU, and their combined model on a one-to-two-

year time series of tesla stock. The study's limitations

include a lack of consideration for various external

factors affecting the stock market, making real-world

applicability challenging. However, the approach is

viable for comparing LSTM and GRU through

statistical analysis and visualization, thereby

supporting the research's conclusions.

3 RESULTS AND DISCUSSION

3.1 Performance Metrics

In this study, a comprehensive analysis was

conducted on LSTM and GRU models for predicting

Tesla's stock prices. Key findings include (table 3):

Table 3: Evaluation Metrics of Models.

LSTM GRU

LSTM and

GRU

Metri

cs

Train Test Train Test Train Test

RMSE 9.8563 8.3645 9.5030 7.4402 9.0924 7.5828

MSE

97.146

0

69.965

5

90.306

6

55.356

9

82.672

0

57.499

0

MAE

7.5581 6.3781 7.4933 5.6884 7.1255 5.6682

MGD 0.0017 0.0012 0.0016 0.0010 0.0015 0.0010

MPD 0.3942 0.2899 0.3662 0.2342 0.3412 0.2396

0.9740 0.9447 0.9759 0.9563 0.9779 0.9546

EVR

Score

0.9764 0.9481 0.9765 0.9574 0.9781 0.9560

In comparing the performance of LSTM, GRU,

and the combined models, all displayed robust

regression. GRU and the combined models

demonstrated superior precision in predicting stock

price fluctuations. Despite higher MSE and MAE in

training, GRU showed more effective forecasting in

testing.

3.2 Major Findings

Comparing the performance of LSTM, GRU, and the

combined model, they all displayed robust regression.

GRU and the combined model demonstrated superior

precision in predicting stock price fluctuations.

Despite higher MSE and MAE in training, GRU

showed more effective forecasting in testing.

3.3 Minor Findings

The regression R-squared coefficients and explained

variance analysis indicate that LSTM

underperformed compared to GRU and the combined

model in both training and testing phases. Overall,

GRU excelled in forecasting Tesla's stock prices,

particularly in testing, whereas the combined model

showcased a robust predictive capacity.

Predictive Analysis of Tesla’s Stock Closing Prices Utilizing LSTM and GRU Deep Learning Models

425

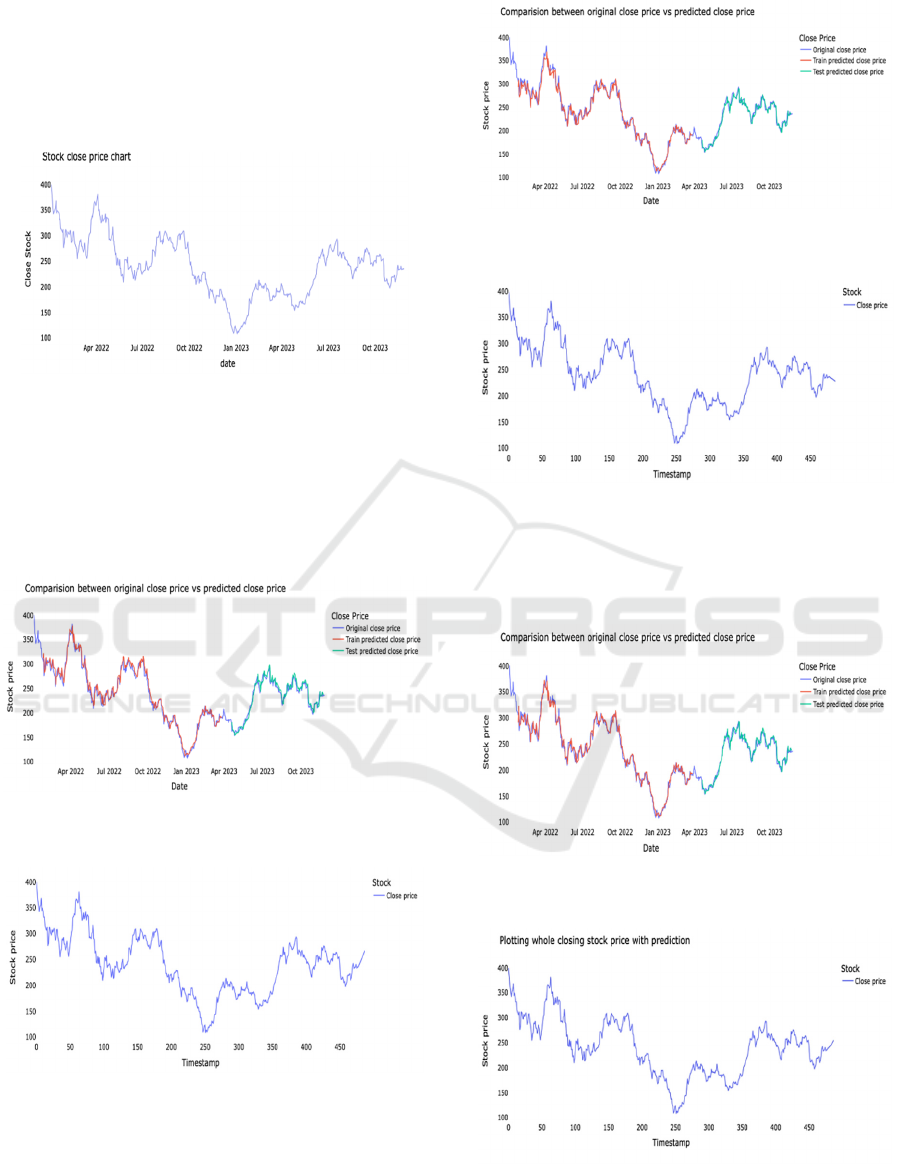

3.4 Visual Comparison Results

As illustrated in Fig. 4, the closing stock prices of

Tesla, exhibit significant fluctuations and lack clear

patterns, indicating the challenging nature of

accurately forecasting its stock prices.

Figure 4: Stock Close Price for Training and Testing

(Picture credit: Original).

Following this, we visualized the regression

results from three distinct models-LSTM, GRU, and

a combined approach, and also depicted their

predictions for the closing stock prices over the next

ten trading days following November 27, 2023.

Figure 5: Comparison Between Original Close Price and

Predicted Close Price for LSTM (Picture credit: Original).

Figure 6: Whole Close Stock Price Chart with Ten-Day

Predictions for LSTM (Picture credit: Original)

From Figure 5 and 6, it can be seen that the LSTM

predicts an upward trend for the next ten days.

Figure 7: Comparison Between Original Close Price and

Predicted Close Price for GRU (Picture credit: Original).

Figure 8: Whole Close Stock Price Chart with Ten-Day

Predictions for GRU (Picture credit: Original).

From Figure 7 and 8, it can be seen that the GRU

predicts a downward trend for the next ten days.

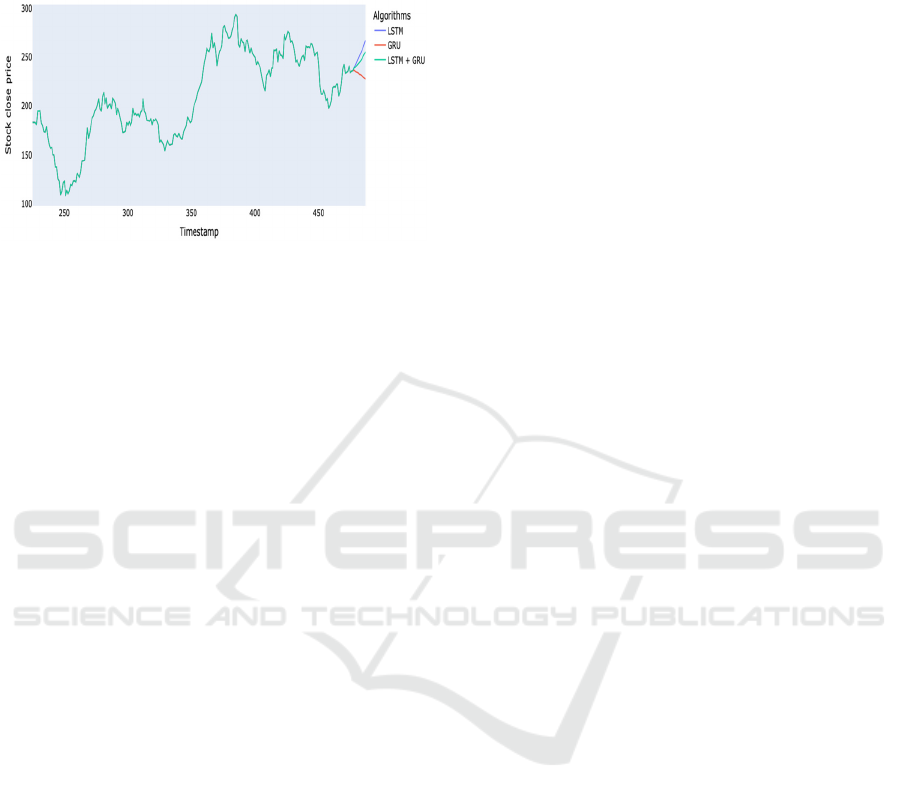

Figure 9: Comparison Between Original and Predicted

Close Price for LSTM and GRU (Picture credit: Original).

Figure 10: Whole Close Stock Price Chart with Ten-Day

Predictions for the Combined Model (Picture credit:

Original).

ICDSE 2024 - International Conference on Data Science and Engineering

426

From Figure 9 and 10, it can be seen that the

combined model predicts an upward trend for the next

ten days.

Figure 11: Comparison Chart of Ten-Day Future Stock

Price Predictions (Picture credit: Original).

As illustrated in Figure 11, the LSTM and combined

models predict an upward trend in Tesla's stock prices

over the next ten days. Conversely, the GRU model

anticipates a decline.

3.5 Discussion

Through the calculation of multiple statistical metrics,

this study has proven the GRU model's high precision

in short-term stock market forecasting. This aligns

with the findings of Touzani and Douzi, who also

emphasized the effectiveness of GRU in volatile

market conditions. Additionally, the combined model

has shown strong predictive power in long-term trend

analysis, which is an innovative aspect of this study.

The effectiveness of GRU in short-term predictions

provides a strategic tool for navigating rapid market

changes, while LSTM supports more extended-term

investment. This offers insights for practical stock

market applications based on the data range used in

training models: the shorter the time, the more layers

of GRU should be chosen; conversely, the longer the

time, the more layers of LSTM should be selected.

Firstly, a limitation is its reliance on historical data

without real-time insertion of new data, which may

hinder capturing real-time market dynamics.

Secondly, the study's focus solely on Tesla's stock

with a single data pattern might limit the model's

general applicability across different market

conditions. This study implies that when researching

highly volatile time-series data, an appropriate ratio

of GRU to LSTM should be chosen according to the

time range. In the future, first, more market factor

constraints should be added to enhance the model's

predictive ability. Second, research could explore the

combined model's capability in handling other stock

data, such as fluctuation ranges, differences between

closing and opening prices, etc., to help improve

overall fitting accuracy.

4 CONCLUSION

In the comparative analysis of predicting Tesla's

stock prices using LSTM and GRU models, this study

has garnered profound insights. Not only did it affirm

the effectiveness of these deep learning models in

processing complex financial time series data, but it

also explored their unique strengths in forecasting the

highly volatile Tesla stock market.

The findings indicate that while both models

demonstrated capability in capturing the essential

trends and fluctuations of stock prices, they exhibited

differences in specific areas. Notably, the GRU model

showed enhanced performance in the testing phase,

illustrating its superiority in real-world forecasting

applications. Additionally, the innovative model

combining LSTM and GRU layers, although not

excelling in every performance metrics, showed

robust predictive capacity overall. These discoveries

highlight the potential of GRU and the combined

models in volatile financial time series contexts.

In terms of visual comparison, the study presented

regression results of past Tesla stock prices for all

three models and predicted their closing stock prices

over the next ten trading days. The outcomes revealed

that both the LSTM and the combined LSTM & GRU

models predict an upward trend for the next ten days,

while the GRU model forecasts a downturn. This

further confirms the distinct characteristics and

advantages of different models in handling specific

financial data.

In conclusion, this research not only demonstrates

the significance of LSTM and GRU in stock market

prediction but also offers new perspectives and

methodological guidance for deep learning

technology in financial time series forecasting.

Furthermore, the study suggests that a combination of

LSTM and GRU models might be particularly

effective in predicting stock prices in highly volatile

markets like Tesla's.

REFERENCES

D. Shah, H. Isah, F. Zulkernine, Int. J. Financ. Stud. 7(2),

26 (2019).

Y. S. Abu-Mostafa, A. F. Atiya, Appl. Intell. 6, 205-213

(1996).

E.F. Fama, J. Finance 25, 383-417 (1970).

T. Pettinger, Econ. Help, (2023).

Predictive Analysis of Tesla’s Stock Closing Prices Utilizing LSTM and GRU Deep Learning Models

427

A. Yoshihara, F. Kazuki, S. Kazuhiro, U. Kuniaki, Pac.

Inter. Conf. Arti. Intel., (2014).

Y. Touzani, K. Douzi, J. Big Data, 126 (2021).

Y. Gao, R. Wang, E. Zhou, Sci. Prog., (2021).

P. Soni, Y. Tewari, D. Krishnan, J. Phys.: Conf. Ser., 28-30

(2022).

J. Venkatarao, D. V. D. Chakravarthy, S. Meadi, K. L.

Durga, K. Pranay, N. Purushotham, J. Surv. Fish. Sci.

10(1), 5326-5332 (2023).

S. Mukherjee, B. Sadhukhan, N. Sarkar, D. Roy, S. De,

CAAI Trans. Intell. Technol., 8(1), 82-94 (2023).

ICDSE 2024 - International Conference on Data Science and Engineering

428