Research on Pricing of Automatic Redemption Structured Deposit

Products Based on Monte Carlo Simulation

Wenlu Chen

School of Economics and Finance, Tianjin University of Finance and Economics, 300222, Tianjin, China

Keywords: Automatic Redemption Structured Deposit Products, Research on Pricing, Monte Carlo.

Abstract: Structured deposit is one of the priorities today. It provides better options for investors and fills a gap in the

market. However, due to his short development in the market, it lacks a unified understanding. Therefore,

the topic of this paper is the pricing of structured deposit products. The research methods of this paper are as

follows: First of all, the paper simulates the income of the product and introduces the basic information and

income of a product to better explain the structured deposit product. Then, nine different market

environments and various parameters are assumed, and the Monte Carlo method is used to simulate the

price path of assets. According to the circumstances of nine different market environments, the annual

expected return rate and annual volatility and estimated, and their sensitivity analysis is carried out. Finally,

it is concluded which market environment has the highest product return, and the annual expected return is

positively correlated with exercise price 1, and negatively correlated with exercise price 2, and the annual

volatility has nothing to do with the exercise price.

1 INTRODUCTION

In 2002, China Everbright Bank launched a foreign

currency structured deposit product. In 2005, it

issued China’s first structural deposit structure of

RMB after becoming the first bank in China to be

eligible to trade cross-currency derivatives of RMB

(Zhang 2022 & Qin 2023). In April 2018, the

People’s Bank of China issued on its official website

the “Guiding Opinions on Regulation the Asset

Management Business of Financial Institutions”

(referred to as the “New Regulations”), article 6 of

which stipulated that financial institutions should

pass on the of “seller is responsible, buyer is

responsible” to investors, break the rigid payment,

and guide financial products to realize the

transformation to net worth products (Li 2023). This

means that investors who are more inclined to

capital-prot protection financial products will

gradually withdraw from the market. Based on the

characteristics of structural deposits, breaking

through the interest rate ceiling to give investors

higher benefits than general deposits are also in line

with the reform requirements of relevant policies,

which can fill the vacancy of capital protection

products of commercial banks, and has a good

market demand and market prospects.

Structured deposit refers to the deposit of RMB

or foreign currency funds legally held by investors in

banks, and the bank can embed financial derivatives

(including but not limited to forwards, swaps,

options or futures, etc.) based on ordinary deposits

(Zhao 2022). Financial products with certain risks

link investors’ returns to interest rates, exchange

rates, stock prices, commodity prices credit indices,

and other financial or non-financial subjects (Zhao

2022). Structured deposits are not ordinary deposits

and are different from bank wealth management.

Structured deposits are embedded in financial

derivatives based on deposits, and are linked to the

fluctuations of interest rates, exchange rates, indices,

etc., so that depositors can obtain higher returns

based on bearing certain risks.

The pricing method is one of the important

problems in the study of structured products, and

also one of the difficulties in the study of structured

products. Domestic scholars have adopted different

research methods to analyze the pricing situation and

influencing factors of products. In 2007, Li Chang

selected two foreign currency range products issued

by different banks, applied the GARCH model and

Monte Carlo simulation, and studied the pricing

methods, income characteristics, and the sources of

price differences of the two products based on

Chen, W.

Research on Pricing of Automatic Redemption Structured Deposit Products Based on Monte Carlo Simulation.

DOI: 10.5220/0012815500004547

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Data Science and Engineering (ICDSE 2024), pages 17-21

ISBN: 978-989-758-690-3

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

17

modern option pricing theory (Zhang 2022). In 2011,

Liu Fengqin decomposed the value of structured

foreign exchange deposits based on the combination

decomposition principle of financial engineering and

believed that the value of the ordinary

interest-bearing part could be calculated by the

Monte Carlo simulation method, while the part that

could be redeemed in advance should be priced by

the improved least squares Monte Carlo simulation

method (Zhang 2023). In 2012, Ma Ying took a

structured product of Everbright Bank as an

example, conducted a pricing analysis with the

Monte Carlo simulation method, found that it was

issued at a premium, and concluded that the reason

for this was caused by the procedure fees charged by

the bank and the compensation charged to cover its

risks (Wang 2023). In 2018, Chen Tingting et al.

studied the pricing of exchange-linked structured

deposits, used the principle of no arbitrage to

construct a partial differential equation suitable for

product value, and gave the pricing formula in the

paper (Sang 2022). In 2020, Feng Ling et al.

calculated the theoretical value of equity-linked

products based on quantum field theory, and the

results showed that the forward interest rate

calculated by the quantum field theory model was

closer to the Chinese financial market with better

goodness-of-fit (Zhang 2022).

Due to the release of new regulations on capital

management, capital protection financial products

have gradually withdrawn from the market, while

structured deposits can fill the gap in the market and

meet the needs of investors. However, the

development time of structural deposits in China is

relatively short, and investors do not have a good

understanding of structural deposits, and the income

of structural deposits, which leads to blind

investment.

This paper will study the pricing of a class of

self-redemption structured deposits in a variety of

market environments to give investors a more

comprehensive perspective. The purpose of this

paper is to provide some help for investors’ deposit

selection.

2 GUANGFA BANK

ZZGYCAO1613 STRUCTURAL

DEPOSIT DETAILS

2.1 Product Introduction

The product has two exercise prices,

1

K

and 𝐾

;

There are three expected annualized returns, namely

1

r , 𝑟

and

3

r (𝑟

> 𝑟

> 𝑟

); There are i

observation days and the fixing price of the

underlying object on observation day (i) is denoted

as

1 n

ii− ; The product principal is C . Structured

deposit income is

R

. The actual term of structured

deposits is

t . There are two revenue scenarios for

the product:

1. The structured deposit will automatically

terminate and stop observation, and the structured

deposit will in principle return the principal and the

corresponding structured deposit income to the

investor on the first early termination maturity date.

The calculation is as follows:

1

R=C r t/365×× (1)

2. The structured deposit matures naturally, and

in principle returns the principal and the

corresponding structured deposit income to the

investor on the maturity date of the structured

deposit. The calculation is as follows:

12 2

,R=C r t/365

n

iK

+

≥×× (2)

12 3

,R=C r t/365

n

iK

+

<×× (3)

2.2 Case Product Introduction

The selected case product is the bullish automatic

redemption 276 days structured deposit

ZZGYCAAO1613 product of Guangfa Bank. As

shown in Table 1, the basic information of bullish

automatic redemption 276 days structured deposit

ZZGYCAAO1613 product of Guangfa Bank.

Table 1: Basic Product Information.

product name

“Guangyin Wealth creation” section D The 362 RMB structural deposit in 2023

hook mar

k

China Securities 500 Index

subscription

¥10,000.00, the amount above the subscription starting point should be an

integral multiple of ¥1,000.00

earnings

It is linked to the price level of the CIS 500

expected annualized rate of return

0.5% or 2.7% or 3.9%

issuance size

The lower limit is ¥10,000,000.00

The upper limit is ¥100,000,000.00

ICDSE 2024 - International Conference on Data Science and Engineering

18

subscri

p

tion Perio

d

2023.11.20-2023.11.26

launch da

y

2023.11.28

due day 2024.08.30

de

p

osit term 276 da

y

s

structured de

p

osit tradin

g

da

y

186 da

y

s

exercise

p

rices 1 O

p

enin

g

p

rice*100.01%

exercise prices 2 Opening price*97.0%

early termination triggers the condition

The fixing price of the underlying object on the observation date (i) (

8i ≤

)

is higher than or equal to the exercise prices 1

earnings are calculated on a basis A/365

Data source: Guangfa Bank official website collation

As shown in Table 2, Guangfa Bank’s call automatic

redemption 276 days structured deposit

ZZGYCAAO1613 product observation date and

structured deposit trading day.

Table 2: Product Observation Date and Structured Deposit

Trading Day.

i observation date trading day

1 2024.01.03 26

2 2024.01.30 45

3 2024.02.20 55

4 2024.03.19 75

5 2024.04.23 99

6 2024.05.21 116

7 2024.06.25 138

8 2024.07.29 162

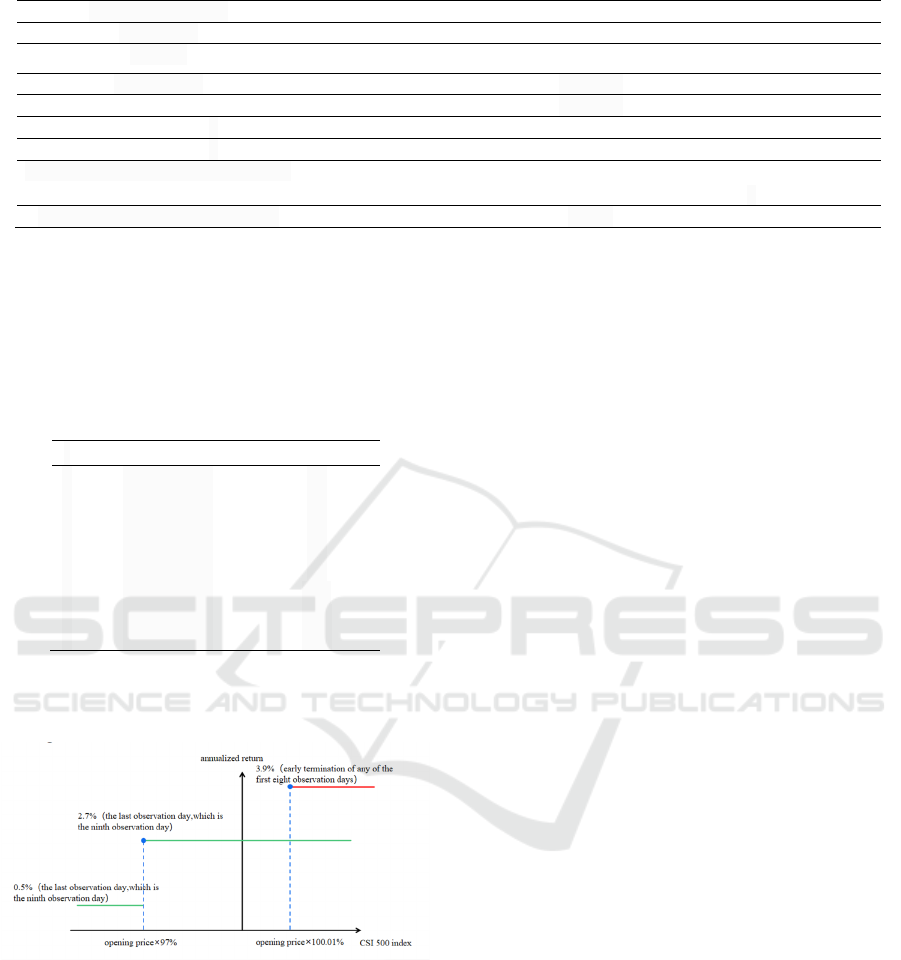

As shown in Figure 1, the income information of

the 276-day structured deposit ZZGYCAAO1613 of

Guangfa Bank.

Figure 1: Product Revenue Information (Original).

The yield of this product is linked to the price of

China Securities 500.

On the i (i = 1,2,3,4,5,6,7,8) observation day, if

an early termination trigger event occurs, the

structured deposit will automatically terminate and

stop observation, in principle, the structured deposit

will return the principal and corresponding

structured deposit income to the investor on the i (l)

early termination maturity date. Investors’ return on

structured deposits is calculated as follows:

Expected annualized returns = 3.9000%.

Revenue = principal × 3.9000% × the actual term

of structured deposits / 365.

If no early termination trigger event occurs for

the structured deposit, the structured deposit matures

naturally, and in principle, the principal and the

corresponding structured deposit income will be

returned to the investor on the maturity date of the

structured deposit. The calculation is as follows:

If on the product observation date (i = 9), the

underlying closing price is greater than or equal to

the exercise prices 2, expected annualized returns =

2.7000%.

If on the product observation date (i = 9), the

underlying closing price is less than or equal to the

exercise prices 2, expected annualized returns =

0.5000%.

Revenue = principal × 3.9000% × the actual term

of structured deposits / 365.

3 MONTE CARLO SIMULATION

This paper will simulate nine different market

environments in Monte Carlo. The parameters are:

μ

is the expected annual return on the underlying

asset,

123

2%, 0%, 2%

μμμ

=− = =

;

σ

is the annual volatility of the underlying asset,

12 3

1%, 5%, 10%

σσ σ

===

.

01 2 123

100, 110 /100, 90 /100, 4%, 3%, 0.5%SK K rrr== = ===

.

A total of 250 days were simulated, with

observation days 26, 46, 66, 86, 106, 126, 146, 166

and 186.

The main idea of Monte Carlo simulation is to

classify the price movement of the underlying asset

into different computation values (

12

, ...

T

SS S

). At

time within the term, the underlying asset price at

each time node is predicted by the following price

formula (Li 2022):

Research on Pricing of Automatic Redemption Structured Deposit Products Based on Monte Carlo Simulation

19

2

exp[( )

2

tt t t

SS t t

σ

μσε

+Δ

=−Δ+Δ

(4)

Using the Monte Carlo simulation method to

simulate the underlying asset price steps are as

follows:

1. Generate random numbers through Python

software, and calculate the closing price of the

second trading day according to the formula (4), and

obtain the closing price of the second day. Based on

this, the closing price of each trading day within the

term of the product is obtained.

2. Repeat Step 1 for 10,000 times. According to

the return determination method in the above part,

the probability, annual expected return rate, and the

annual volatility of the three scenarios are

determined.

4 RESULT

4.1

Monte Carlo Simulation Result

Based on the methodology described above, the

results obtained are shown in Table 3.

When

μ

remains the same and

σ

continues

to rise, the expected annual rate of return will decline,

but when

3

μμ

=

, the expected annual rate of return

will first rise and the decline. The annual volatility

decreases gradually, but when 𝜇𝜇

, the annual

volatility increases gradually.

When

σ

remains the same and

μ

continues

to rise, the expected annual rate of return will first

rise and then decline. the annual volatility also goes

up and then down.

In these nine market environments, the annual

expected annual rate of return is highest when 𝜇

𝜇

0%, 𝜎𝜎

1%.

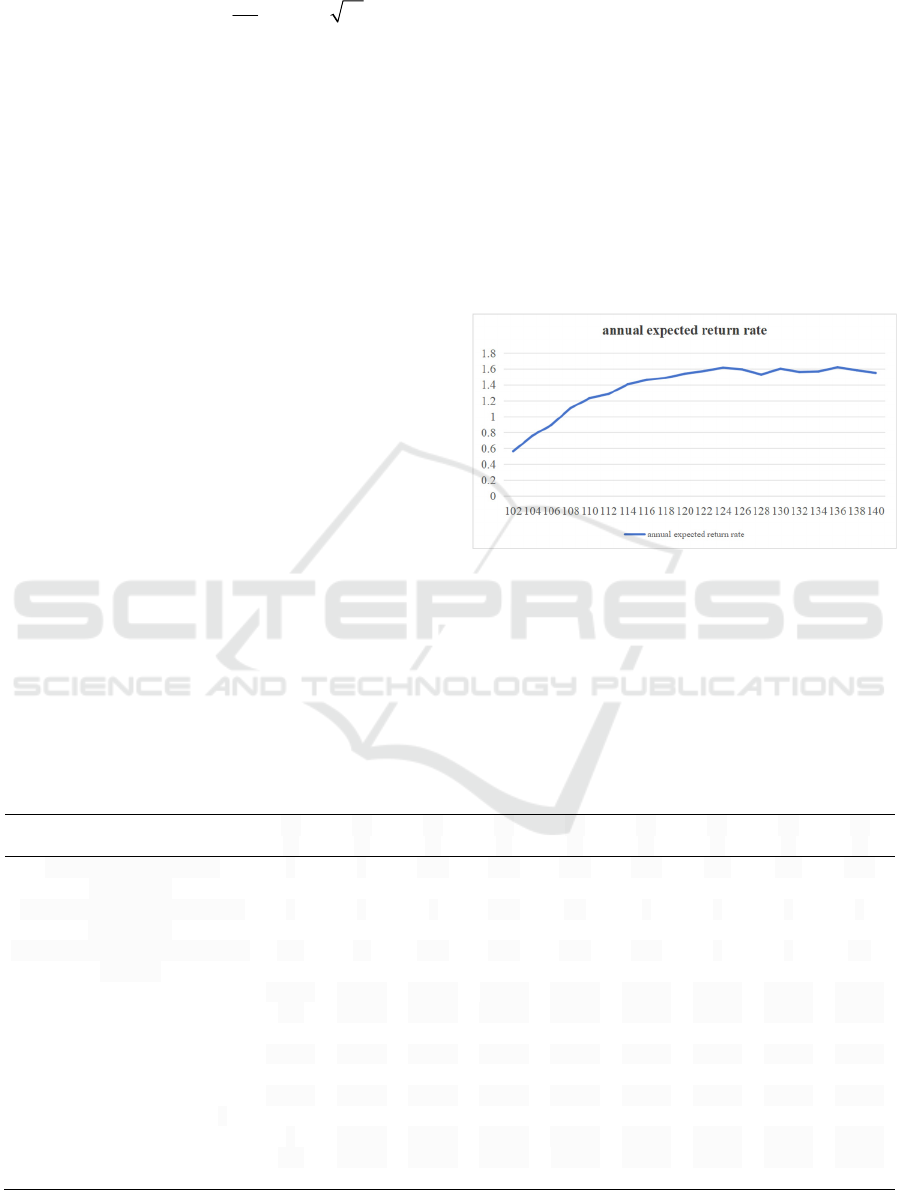

4.2 Sensitivity Analysis

By changing the values of

1

K

and

2

K

, the annual

expected rate of return and annual volatility are

observed, and the sensitivity analysis is carried out.

As shown in Figure 2, the annual expected return

rate of

1

K

.

Figure 2: The annual expected return rate of 𝐾

(Original).

As shown in figure 3, the annual volatility of 𝐾

.

Table 3: Simulation Result.

μ

1

,

σ

1

μ

1

,

σ

2

μ

1

,

σ

3

μ

2

,

σ

1

μ

2

,

σ

2

μ

2

,

σ

3

μ

3

,

σ

1

μ

3

,

σ

2

μ

3

,

σ

3

The probability of early

termination

0 7 28.4 49.6 77.5 75.1 100 100 99.9

The probability of a high yield

on maturit

y

0 0 0 22.9 0.7 0 0 0 0

The probability of a low yield on

maturit

y

100 93 71.6 27.5 21.8 24.9 0 0 0.1

Expected annual rate of return

0.3425 0.3262 0.2828 1.2311 0.4389 0.3175 0.0792 0.1098 0.1852

Expected annual rate of return

u

p

on earl

y

termination

nan 0.1096 0.1324 1.3436 0.4514 0.3092 0.0792 0.1098 0.1852

Expected annual rate of return

for hi

g

h

y

ield at maturit

y

2.0548 2.0548 2.0548 2.0548 2.0548 2.0548 2.0548 2.0548 2.0548

Expected annual rate of return

for low

y

ield at maturit

y

0.3425 0.3425 0.3425 0.3425 0.3425 0.3425 0.3425 0.3425 0.3425

Annual volatilit

y

0 0.0639 0.1276 0.8568 0.5397 0.4405 0.0272 0.0831 0.2327

Annual volatility upon early

termination

nan 0.0888 0.1604 0.8464 0.5911 0.5081 0.0272 0.0831 0.2327

ICDSE 2024 - International Conference on Data Science and Engineering

20

Figure 3: The annual expected return rate of

𝐾

(Original).

As shown in figure 4, the annual expected return rate

of

2

K

.

Figure 4: The annual expected return rate of

𝐾

(Original).

As shown in figure 5, the annual volatility of 𝐾

.

Figure 5: The annual volatility of 𝐾

(Original).

The results show that the annual expected rate of

return is positively correlated with 𝐾

and

negatively correlated with 𝐾

. and it have no

significant impact on the annual volatility, indicating

that 𝐾

and 𝐾

have no linear relationship with the

annual volatility.

The sensitivity analysis of this paper is mainly to

study how the annual expected rate of return and the

annual volatility of structured deposit products are

affected by single factor fluctuations. After a single

factor sensitivity analysis, investors should pay

special attention to certain factors when buying

structured deposit products. In the above analysis of

the return of structured deposit products, it can be

seen that the exercise price 1 and exercise price 2 of

the product are relatively analysis of this paper takes

these two factors as research objects.

5 CONCLUSION

This paper selects nine different market

environments, uses Monte Carlo method to simulate

the structured deposit products in different market

environments, and obtains its the annual rate of

return and the annual volatility. The sensitivity

analysis of exercise price 1 and exercise price 2

shows that exercise prices 1 is positively correlated

to the annual expected rate of return, and exercise

price 2 is negatively correlated to the annual

expected rate of return, and the two are unrelated to

the annual volatility. Therefore, both investors and

banks need to pay more attention to the impact of the

exercise price on the annual expected return. This

paper first makes a brief introduction to the income

methods of structured deposit products, so the

investors can better understand structured deposit

products. Secondly, results are obtained under

different market conditions, and sensitivity analysis

is carried out so that banks can refer to them when

designing products. Finally, this study is only a

single linked object, which can analyzed in different

investment portfolios in the future, to obtain greater

benefits.

REFERENCES

Y. D. Zhang, Suzhou University of Science and

Technology, pp. 1 (2022).

H. Qin, Shihezi University, pp. 1 (2023).

Q. Y. Li, South China University of Technology, pp. 1

(2023).

Y. S. Zhao, Beijing Jiaotong University, pp. 12 (2022).

B. B. Zhang, Anhui University, pp. 5 (2022).

J. W. Zhang, Southwest University, pp. 9 (2023).

Z. L. Wang, Anhui University of Finance and Economics,

pp. 4 (2023).

Y. Sang, South-Central Minzu University, pp.6 (2022).

Q. Zhang, Zhongnan University of Economics and Law,

pp. 4 (2022).

Z. J. Li, Shihezi University, pp. 32 (2022).

Research on Pricing of Automatic Redemption Structured Deposit Products Based on Monte Carlo Simulation

21