Evaluating the Predictive Proficiency of Machine Learning

Algorithms: Progressive Developments in Diamond Price Forecasting

Ying Zhang

University of Leeds, Leeds, LS27FD, U.K.

Keywords: Python, Price, Prediction, Diamond.

Abstract: Distinguished for their global recognition as the most resilient mineral and enduring allure as coveted

gemstones, diamonds have captivated human fascination for centuries. The popularity of diamonds extends

beyond the intrinsic properties, encompassing optical brilliance and unparalleled hardness which is influenced

by durability, tradition, fashion, and robust marketing strategies employed by industry producers. Despite

inherent qualities, the demand for diamonds is intricately tied to perceived rarity and exclusivity. Forecasting

diamond pricing presents a unique set of challenges primarily rooted in nonlinear relationships within crucial

attributes like carat, cut, clarity, table, and depth. In response to the complexity, the research conducts a

comprehensive comparative analysis, utilizing diverse supervised machine-learning models for precise

prediction via classification and regression approaches. Meticulous evaluation of eXtreme Gradient Boosting,

Random Forest, Multiple Linear Regression, k-Nearest Neighbors, and Decision Tree Regressor reveals that

the eXtreme Gradient Boosting algorithm emerges as the most optimal choice, boasting an impressive R²

score of 98.07% through rigorous evaluation. This research encompasses critical phases, including data

preprocessing, exploratory data analysis, model training, accuracy assessment, and result interpretation. Not

only sheds light on the intricacies of diamond pricing but also contributes valuable insights for leveraging

advanced machine learning techniques in the realm of gemstone valuation and prediction.

1 INTRODUCTION

The Gemological Institute of America (GIA)

introduced Cut, Carat, Color, and Clarity. They were

providing a standardized framework for assessing and

grading diamonds based on their distinct attributes in

the 1940s.

The burgeoning global appetite for diamonds has

precipitated an imperative for pricing paradigms

characterized by both accuracy and transparency.

Conventional methodologies, tethered to venerable

compendia like the Rapaport Price List, grapple with

the intricate challenge of assimilating and mirroring

the multifarious dynamism inherent in the diamond

market. The idiosyncratic attributes of diamonds

manifest in diverse morphologies, dimensions, and

gradations of clarity, which introduce a compounding

layer of complexity in discerning their intrinsic

market value.

The realm of diamond price prognostication,

delving into the realm of machine learning,

orchestrates a symphony of analytical prowess. This

entails the meticulous training of models, leveraging

historical datasets and meticulously considering

variables such as carat weight, cut quality, color

gamut, and clarity. These trained models, having

imbibed historical intricacies, extrapolate

overarching patterns to venture predictions into

uncharted territories of new diamond valuations. A

methodological bastion grounded in data-driven

acuity, this approach finds an organic alignment with

the evolving contours of the gemstone market,

cherishing the imperatives of transparency,

efficiency, and razor-sharp precision.

In summation, the rubric of diamond price

prognostication not only dovetails with age-old

valuation paradigms but also interfaces seamlessly

with the kaleidoscopic shifts characterizing the

contemporary market milieu. In catering to the

discerning exigencies of a modern consumer cohort,

this predictive discipline emerges as a linchpin,

bestowing sagacious insights unto stakeholders,

investors, and consumers alike. This predictive

accuracy serves as a potent instrument, galvanizing

investors with informed decision-making

capabilities, charting the course for sagacious

448

Zhang, Y.

Evaluating the Predictive Proficiency of Machine Learning Algorithms: Progressive Developments in Diamond Price Forecasting.

DOI: 10.5220/0012818500004547

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Data Science and Engineering (ICDSE 2024), pages 448-452

ISBN: 978-989-758-690-3

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

industry blueprints, mitigating risks for

manufacturers and retailers, offering a compass for

consumer choices, enlightening market analyses,

fine-tuning pricing strategies for retailers, optimizing

the logistics of the supply chain, ensuring the sanctity

of transactions through fairness, propelling the

frontiers of technological innovation, and charting the

course for judicious policy formulation and

regulatory oversight. In the crucible of diamond price

prognostication, market dynamics are thus infused

with a potent elixir that enhances market efficiency,

fortifies risk management, and upholds the edifice of

equitable transactions, thereby exerting a pervasive

influence upon the holistic vigor and equilibrium of

the diamond market.

2 LITERATURE REVIEW

Statistical Models: Exploration of statistical models

within the realm of diamond price prognostication

constitutes a pivotal facet of scholarly inquiries. This

corpus of literature, poised at the vanguard of

intellectual inquiry, embarks on an expedition into

classical statistical models, an odyssey that

encompasses the labyrinthine terrain of regression

analysis and other intricately woven econometric

techniques. The incisive examination of these

models, resplendent in their mathematical

complexity, unveils a panoply of methodological

nuances intrinsic to the predictive tapestry of

diamond valuations.

Feature Importance: Studies that traverse the

expanse of feature importance within the precincts of

diamond price prediction exemplify another facet of

erudite discourse. This corpus of scholarly

exploration contemplates the salience of diverse

features in the predictive matrix, casting an eloquent

spotlight upon the integral role played by each facet

of the renowned 4Cs. Moreover, the discourse unfurls

into the realm of speculative contemplation,

entertaining the prospect of introducing additional

variables into the predictive equation

Time Series Analysis: Temporal considerations,

woven into the fabric of diamond prices like an

intricate tapestry, beckon the scholarly gaze toward

the frontier of time series analysis. This intellectual

endeavor, steeped in analytical sagacity, endeavors to

decipher the cryptic language of temporal dynamics

inherent in diamond valuations.

Ensemble Methods: The intellectual crucible

expands further into the province of ensemble

methods, where the alchemy of knowledge

metamorphoses into predictive prowess. In this

domain, the erudite fraternity contemplates the

efficacies of illustrious ensemble methods, including

the arboreal complexity of Random Forests and the

orchestrated ascent of Gradient Boosting.

Evaluation Metrics: The compendium of

literature, marked by its incisive scrutiny, engages in

an erudite discussion on the myriad metrics adorning

the evaluative tapestry. From the pragmatic expanse

of Mean Absolute Error to the geometric profundities

of Root Mean Squared Error and the metric

symphony of R-squared, the scholarly discourse

undertakes a comprehensive survey, offering a

lexicon that encapsulates the multifaceted dimensions

of predictive model performance assessment.

3 PROBLEM STATEMENT

3.1 Dataset & Dimensional Proportions

of Diamond

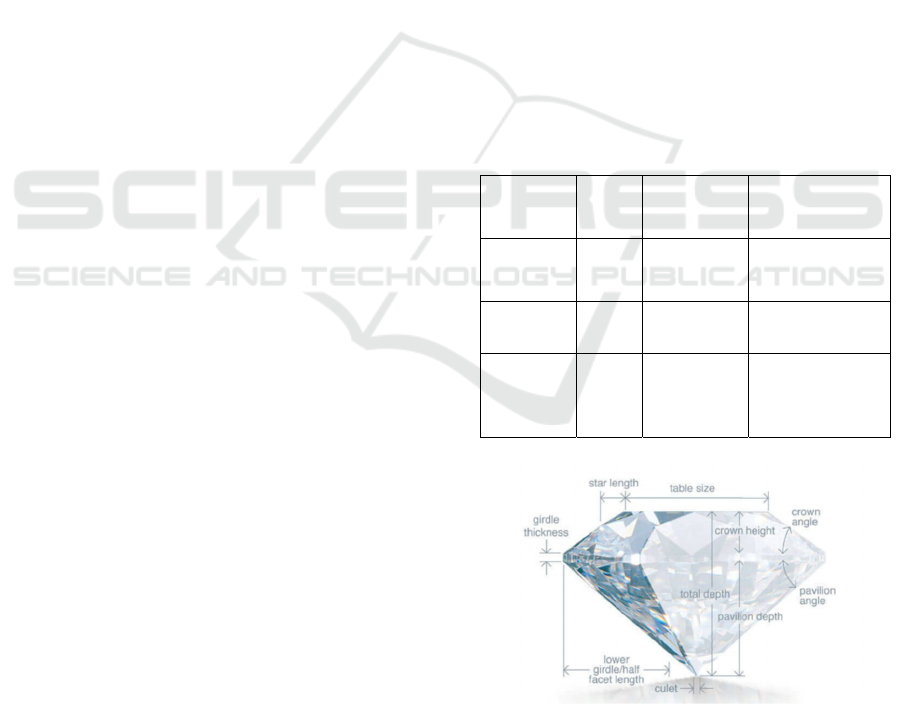

According to the index of cut, carat, color, and clarity

as shown in Figure 1, Table 1.

Table 1: Dataset overview (from Kaggle) (Mirzaei).

Diamond

weight in

carat

carat 0.2-5.01 Dimensions(mm)

Diamond

cutting

p

recision

cutting

Fair, Good,

Very Good,

Ideal

X length (0-

10.74)

Diamond

colour

color From J to D Y width (0-58.9)

A measure

of diamond

clarity

clarity

(I1, SI2, SI1,

VS2, VS1,

VVS2,

VVS1, IF

)

Z depth (0-31.8)

Figure 1: Dimensional proportions of diamond (from

Kaggle) (Karnika Kapoor).

Evaluating the Predictive Proficiency of Machine Learning Algorithms: Progressive Developments in Diamond Price Forecasting

449

3.2 Objectives of the Study & Research

Question

The objective is to evaluate the forecasting efficacy

of Python models in predicting diamond prices.

The research question seeks to understand the

predictive performance of these models in the

complex domain of diamond pricing.

4 MATHEMATICAL

METHODOLOGY AND

EQUATIONS

4.1 Multiple Linear Regression (MLR)

Multiple linear regression (MLR), also known

simply as multiple regression, is a statistical

technique that uses several explanatory variables to

predict the outcome of a response variable (Hayes ).

i01i12i2 pip

yxx x

ββ β β

=+ + +…+ +ò

(1)

4.2 Extreme Gradient Boosting

(XGBoost)

The objective function J, encompassing both training

loss and regularization is a pivotal component in

various tasks like regression, classification, and

ranking, wherein the paramount goal is to optimize

the parameters (denoted as θ) for optimal alignment

with training data (X

i

) and corresponding labels (Y

i

).

Training the model entails the meticulous definition

of this objective function, serving as a yardstick to

gauge the model's efficacy in fitting the training data

(T. Chen, 2014).

4.3 K-Nearest Neighbors (KNN)

It is a non-parametric and instance-based method that

makes predictions based on the similarity of input

data points (Larose & Larose, 2014).

4.4 Random Foreast (RFs)

A random forest is an ensemble learning technique in

machine learning, specifically designed for both

classification and regression tasks. It operates by

constructing a multitude of decision trees during the

training phase and outputs the average (for regression

problems) or the mode (for classification problems)

of the individual trees' predictions (Rigatti, 2017).

4.5 Means Squared Error (MSE)

Average squared difference between the estimated

values and the actual value (Error, 2010):

()

2

Σ

ii

yp

MSE

n

−

=

(2)

where y

i

is the ith observed value, p

i

is the

corresponding predicted value for y

i

, and n is the

number of observations (Error, 2010).

4.6 Root Mean Squared Error (RMSE)

RMSE calculates the average difference between

observed outcomes and the model's predictions.

Lower RMSE values indicate superior predictive

performance. f = forecasts(expected values or

unknown results), o = observed values, (known

results), (zf i −zoi) 2 = differences, squared and N =

sample size (Chai & Draxler, 2014).

()

1

2

2

1

/

N

fo fi oi

i

R

MSE z z N

=

= −

(3)

4.7 Mean Absolute Error (Mae)

MAE is a robust and intuitive metric for model

accuracy, calculating the total error by summing

magnitudes and dividing by n. Lower MAE values

indicate superior model performance and enhanced

prediction accuracy (Hodson, 2022).

Average of all absolute errors between paired

observations expressing the same phenomenon

(Hodson, 2022):

1

1

MAE

n

i

i

ne

−

=

=

(4)

4.8 R Squared (R^2)

R-squared (R²), is a statistical measure that assesses

the proportion of variability in the dependent variable

(target) explained by the independent variables

(features) in a regression model. It provides insights

into the goodness of fit of the model to the observed

data (Kigo et al, 2023).

4.9 Adjusted R^2

R² that adjusts for the number of predictors in a

regression model. While R-squared measures the

proportion of variability in the dependent variable

explained by the independent variables, the adjusted

R-squared penalizes models with unnecessary

ICDSE 2024 - International Conference on Data Science and Engineering

450

variables, providing a more reliable measure of

goodness of fit (Kigo et al, 2023).

4.10 the Results from the Models

LinearRegression: -1333.321776;

DecisionTree: -759.075442;

RandomForest: -550.501632;

KNeighbors: -828.945611;

XGBRegressor: -558.378097.

5 SIMULATED DATA ANALYSIS

As Figure 2(1), "Ideal" diamond cuts are the most

number while the "Fair" is the least—more diamonds

of all of such cuts for the lower price category.

As Figure 2(2), "J" color diamonds which are the

worst are most rare however, "H" and "G" are in

number even though they're of inferior quality as

well.

As the Figure 2(3), Diamonds of "IF" clarity

which is best as well as "I1" which is worst are very

rare and the rest are mostly in-between clarities.

Figure 2: List of categorical variables. (1. Diamond Cut for

Price; 2. Diamond Colors for Price; 3. Diamond Clarity for

Price), (Picture credit: Original).

In Figure 3, "x", "y" and "z" show a high

correlation to the target "price", "depth", "cut" and

"clarify" show a low correlation (<|0.1|), dropping

though due to presence of only a few selected

features.

Cross Validation: using the negative root mean

squared error: The higher the score the better the

model.

Figure 3: Correlation matrix (Picture credit: Original).

Figure 4: Comparison of Actual Price and Predicted Price

(Picture credit: Original).

(1)

(3)

(2)

Evaluating the Predictive Proficiency of Machine Learning Algorithms: Progressive Developments in Diamond Price Forecasting

451

Figure 4 illustrates that XGBoost yielded optimal

results in predicting diamond prices through

regression, establishing itself as the preeminent tool

for proficient diamond price prediction.

6 RESULTS

The model comparison results are shown in Table 2.

Table 2. Comparison of models.

R^2

XGB Pipeline 0.9806573031144777

Random Forest 0.9805528549055725

Linear Re

g

ression 0.9176167819635159

KNN Regression 0.9256053449796051

Decision Tree Regresso

r

0.9787072279719632

7 CONCLUSION

The findings highlight that the eXtreme Gradient

Boosting (XGBoost) algorithm emerges as the top

performer, excelling not only in diamond

classification based on cut but also in regression-

based diamond price prediction. The robustness and

accuracy demonstrated by XGBoost position it as the

preferred tool for predicting diamond prices,

showcasing its efficacy across different

methodologies.

Establish an Online Interactive Space for Transparent

Pricing:

The study proposes the creation of an online

interactive platform, where diamond attributes can be

inputted. The model would then generate the most

accurate cut category, a key determinant of diamond

prices. By providing justifiable price estimates based

on transparent and data-driven criteria, such a

platform could contribute to eliminating information

asymmetry in the diamond market. This

recommendation aims to address issues of price

obfuscation by various diamond retailers, promoting

transparency and empowering consumers with

accurate pricing information.

In conclusion, this study not only contributes

insights into effective algorithms for diamond price

prediction but also provides practical

recommendations for further research and policy

considerations to enhance transparency in the

diamond market. The prominence of XGBoost in

both classification and regression scenarios suggests

its potential applicability and reliability in real-world

diamond pricing scenarios.

REFERENCES

Mirzaei, Diamond Price Prediction https://www.kaggle.

com/code/amirhosseinmirzaie/diamond-price-predictio

n/notebook

Karnika Kapoor, Diamond Price Prediction,

https://www.kaggle.com/code/karnikakapoor/diamond

-price-prediction

Hayes, Multiple Linear Regression (MLR) Definition,

Formula, and Example, https://www.investo

pedia.com/terms/m/mlr.asp

T. Chen, University of Washington Computer Science,

22(115), 14-40 (2014)

D. T. Larose, C. D. Larose, k‐nearest neighbor algorithm

(2014).

S. J. Rigatti, Journal of Insurance Medicine, 47(1), 31-39

(2017)

M. S. Error, MA: Springer US, 653-653 (2010)

T. Chai, R. R. Draxler, Geoscientific model development,

7(3), 1247-1250 (2014)

T. O. Hodson, Geoscientific Model Development, 15(14),

5481-5487 (2022)

S. N. Kigo, E. O. Omondi, B. O. Omolo, Scientific Reports,

13(1), 17315 (2023)

ICDSE 2024 - International Conference on Data Science and Engineering

452