CNY EX Rate Prediction Based on LSTM and Machine Learning

Methods

Jiaqi Lu

School of Economics and Management, Tongji University, 1239 Siping Road, Shanghai, China

Keywords: Foreign Exchange Rate, LSTM, Machine Learning, Commodity Features, Technical Features.

Abstract: The foreign exchange market is volatile and unpredictable and the foreign exchange rate is challenging to

forecast in almost all the regions. With the maturity of the foreign exchange market, more and more traders

make transactions on foreign exchange products. The ability to estimate this foreign exchange rate has

therefore become crucial in the financial market. In this study, machine learning methods are used to predict

the exchange rate of the Chinese yuan (CNY). The feature inputs include three categories, which is

respectively technical features, commodity features, and forex features. The technical features include some

powerful technical factors. The commodity features include gold price, oil price, and stock index. The forex

features include some frequently traded currency. The models include Linear Regression, Lasso Regression,

Ridge Regression, long short-term memory (LSTM), Random Forest, and XG-Boost. In conclusion, this study

finds that the Long Short-Term Memory model has the best performance and the tech features are the best

inputs for predicting the CNY exchange rate.

1 INTRODUCTION

With the maturity of the financial system, foreign

exchange plays a more important role in global

trading and it becomes more urgent to have a forecast

of the trend of the exchange rate. However, the

exchange rate prediction has been one of the most

challenging tasks for long. It is necessary to

comprehend the intricacies of global political

economy, sociological and economic infrastructures,

and occasional political and social events since they

have a comprehensive impact on the exchange rate. It

means too many complex factors need to be taken into

consideration.

In the past, emphasis was placed on employing

macroeconomic indicators such as spot rates,

unemployment rates, or inflation rates to discern

long-term trends in exchange rates. However, these

approaches offered only broad predictions based on

empirical observations and were insufficient for

providing concise, short-term investment or business

advice. Statistical models like integrated moving

averages and auto-linear regression were also utilized

for financial time series predictions, but they were

constrained by their inability to transcend historical

data. With advancements in computational

capabilities, machine learning algorithms have

emerged as transformative tools for financial

forecasting (Singh et al, 2009). Going beyond

traditional qualitative analysis, this paper uses

machine learning methods to predict the Chinese

Yuan (CNY) exchange rate. Notably, different from

traditional macro features, this paper introduces a

series of tech, commodity, and forex feature inputs,

thereby enhancing the model's capacity to capture

nuanced market dynamics.

Section II of this paper discusses related works.

Section III discusses data analysis, feature

engineering, and modeling. Section IV discusses the

results and analysis.

2 LITERATURE REVIEW

Conventional econometric models predict exchange

rates using underlying economic circumstances,

assuming that long-term patterns are determined by

economic fundamentals. However, Meese and

Rogoff demonstrate the failure of econometric

models to anticipate short-term exchange rates

(Meese et al, 1983). Two popular time series models

for predicting currency rates are exponential

Lu, J.

CNY EX Rate Prediction Based on LSTM and Machine Learning Methods.

DOI: 10.5220/0012818800004547

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Data Science and Engineering (ICDSE 2024), pages 453-458

ISBN: 978-989-758-690-3

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

453

smoothing (ETS) models and autoregressive

integrated moving average (ARIMA) models.

ARIMA models can handle nonstationary data by

differences. ETS models can take seasonality and

trends into account (Galeshchuk et al, 2017). The

more powerful methods are machine learning

approaches which have developed over the years.

Qian and Rasheed use several inductive machine-

learning classifiers to get a prediction accuracy of up

to 67% (Amat et al, 2018). Amat et al. constructs

sequential ridge regression and the exponentially

weighted average strategy, both with discount factors.

They do not estimate an underlying model but

combine the fundamentals to directly output forecasts

(Amat et al, 2018). Pradeepkumar and Ravi update

the Quantile Regression Neural Network to predict

the volatility of financial time series (Pradeepkumar

& Ravi, 2017). Fischer and Krauss demonstrate that

the long short-term memory (LSTM) network can

extract relevant information from financial time

series data that is noisy (Fischer et al, 2018).

Gyamerah and Moyo capture the exchange rate

uncertainty using probability density forecasting

functions (Gyamerah, 2020). Wang and Guo propose

a hybrid model which has good approximation and

generalization ability, greatly improving the

performance (Wang & Guo, 2020). Cao et al.

developed a new deep-coupled LSTM method, to

capture the complex couplings for exchange rate

prediction (Cao et al, 2020).

In this study, several popular machine learning

methods are constructed to compare their

performance on three categories of feature inputs,

trying to find the best model and feature combination

to predict the CNY exchange rate.

3 METHODOLOGY

3.1 Data Analysis

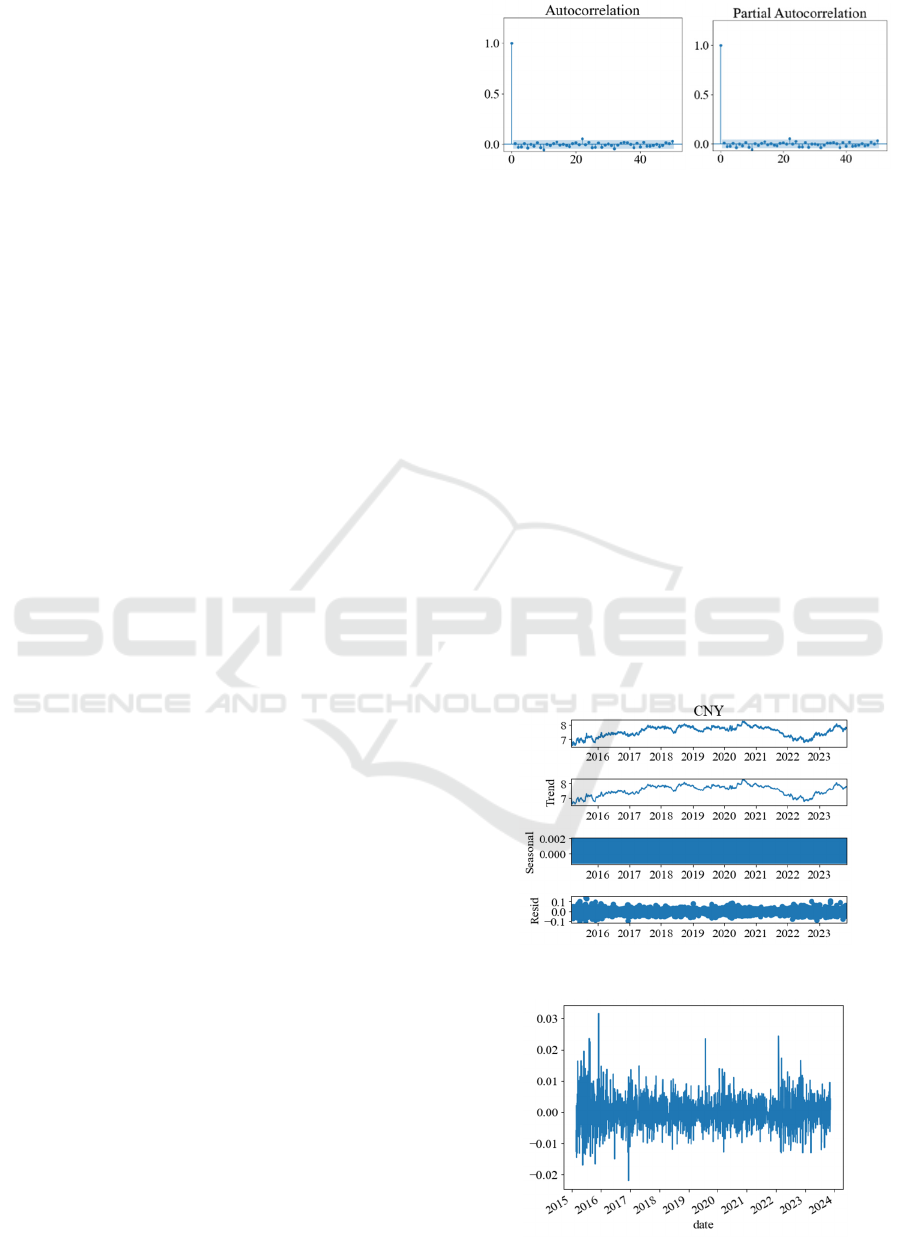

Both the autocorrelation function and partial

autocorrelation function of returns exhibit a cutoff at

the one-day lag, indicating weak correlation and

stochastic behaviour in the daily returns of CNY. This

leads to the conclusion that using CNY daily returns

alone may not be sufficient for accurate predictions.

Further feature construction is imperative for

enhancing predictive capabilities in the model (Fig.

1).

(a) (b)

Figure 1: ACF and PACF of return (Picture credit:

Original).

Time series decomposition serves as a valuable

technique for disentangling various components

within a dataset. Time series data typically exhibits

three fundamental components: seasonality, trend,

and noise. In Fig. 2. and Fig. 3., the decomposition of

CNY reveals a notable stochastic nature. The

observed fluctuations can be predominantly

attributed to the trend factor, with minimal

discernible influence from seasonal components. The

absence of a significant seasonal factor suggests that

regular and predictable patterns over specific time

intervals are not evident in the exchange rate

dynamics. In conclusion, the CNY exchange rate

changes are predominantly driven by external factors

that can’t be explained by time series models. In this

sense, the traditionally empirical rule is usually out of

action and researchers should resort to machine

learning methods.

Figure 2: Seasonal decomposition (Picture credit: Original).

Figure 3: First-order difference (Picture credit: Original).

ICDSE 2024 - International Conference on Data Science and Engineering

454

The study finds that foreign exchange rates have

a strong correlation. Fig. 4. shows that CNY has a

very strong correlation with the Canadian dollar

(CAD) 0.75 and the Great Britain Pound (GBP) 0.73

as well as the Australian dollar (AUD) 0.63 and USD

0.61, which is because of the implementation of a

fixed exchange rate policy. It indicates that the price

of such currency may grow with the increase of the

corresponding currency. It can be used for prediction

empirically. However, the JPY seems to have little

correlation with the other five currencies. This may

be partly due to the macroeconomic trilemma. The

Japanese government clings to monetary

independence and the free movement of capital and

gives up the fixed exchange rate. The result is that the

Japan Yen (JPY) changes stochastically. In the

feature engineering session, JPY is abandoned for its

weak correlation with CNY, and the other four

currencies which are USD, CAD, GBP, and AUD are

selected as the forex features.

Figure 4: Correlation matrix (Picture credit: Original).

3.2 Feature Engineering

This section introduces the feature inputs of the

models. In general, there are three categories of inputs

in this study which are respectively the tech features,

the commodity features, and the forex features. The

raw data are the daily price for CYN, USD, JPY,

CAD, GBP, and AUD (direct quotation by Euro),

Crude Oil Prices (West Texas Intermediate), Global

Gold Price, and Shanghai Composite Index ranging

from 2015.3 till 2023.11. The CNY daily price data

are used to construct technical indicators such as

Exponential Moving Average, Relative Strength

Index, Momentum, Commodity Channel Index,

Bollinger Bands, and Moving Average Convergence

Divergence. Crude Oil Prices WTI, Global Gold

Prices, and the Shanghai Composite Index constitute

the commodity features. The last category of forex

features consists of USD, CAD, GBP, and AUD’s

daily returns. The label is the daily return of CNY.

The dataset is then split in the time series order so that

the former 80% of the data was used for training the

models and the latter 20% was used for testing the

predictions.

The Exponential Moving Average (EMA) gives

the most weight to the recent values in a period. Thus,

past values have a decreasing contribution, while

more recent values dominate. This technique allows

the moving average to be more responsive to

variations. The 12-day and 26-day EMA are selected

in the tech features to consider both the long and short

factors.

2

(1)

K

n

=

+

(1)

1

(1 )EMA K close K EMA

−

=× +− × (2)

The Relative Strength Index (RSI) determines a

ratio of the upward price changes to the absolute price

changes in a period. The value ranges from 0 to 100.

The most popularly used 14-day RSI is selected in the

tech features.

()

()

1

1

max , 0

max , 0

i

i

up close close

dn close close

−

−

=−

=−

(3)

1

n

i

i

up

upavg

n

=

=

(4)

1

n

i

i

n

dn

dnavg

=

=

(5)

100

upa g

RSI

upa g dna g

ν

νν

=×

+

(6)

The Commodity Channel Index (CCI) is intended

to identify initial and final market trends. The value

normally ranges from -100 to 100. The 14-day CCI is

selected in the tech features.

()

(,)

(0.015 )

TP SMA TP n

CCI

MD

−

=

×

(7)

3

nn

high low close

TP

++

=

(8)

1

(,)

n

i

i

TP SMA TP n

MD

n

=

−

=

(9)

CNY EX Rate Prediction Based on LSTM and Machine Learning Methods

455

The Momentum (MOM) is a gauge of the

acceleration and deceleration of prices. 1-day, 5-day,

and 14-day MOM are selected in the tech features.

n

M

omentum close close

−

=− (10)

Bollinger Band contains three lines. A

straightforward moving average of the average price

makes up the middle band. F standard deviations

above and below the middle band correspond to the

upper and lower bands. The distance between the

upper and lower Bollinger Bands measures volatility

which is known as the Bollinger Band Width

indicator. When volatility is high, the Band Width

value is higher; when volatility is low, it is lower. The

Band Percent value indicates the location of the close

price. 20-day Band Width and Band Percent are

selected in the tech features.

3

high low close

TP

++

=

(11)

SimpleMovingAverage( )

M

idBand TP= (12)

()UpperBand MidBand F TP

σ

=+× (13)

()LowerBand MidBand F TP

σ

=−× (14)

2()BandWidth F TP

σ

=× × (15)

close LowerBand

BandPercent

UpperBand LowerBand

−

=

−

(16)

The Moving Average Convergence Divergence

(MACD) is the difference between two Exponential

Moving Averages. It forecasts trend shifts and the

beginning of a new trend direction. 12-26 days

Difference (DIF) and Difference Exponential

Average (DEA), 9 days MACD are selected in the

tech features.

12 26

() ()DIF EMA close EMA close=− (17)

9

()DEA EMA DIF= (18)

M

ACD DIF DEA=− (19)

Crude Oil Prices WTI refers to a specific grade of

crude oil that serves as a key benchmark for oil

pricing globally. Changes in Crude Oil Prices WTI

have broad macroeconomic implications. They affect

inflation rates, transportation costs, and the overall

economic health of oil-producing and oil-consuming

nations. The daily return of Crude Oil Prices WTI is

selected in the commodity features.

Gold serves as both a commodity and a financial

asset, and its price is a key indicator in the global

financial markets. The price of gold is of paramount

significance due to its role as a safe-haven asset

against inflation and economic uncertainty. Investors

and central banks closely monitor gold prices as part

of their risk management and wealth preservation

strategies. The daily return of Global Gold Price is

selected in the commodity features.

The Shanghai Composite Index (SCI) is a key

stock market benchmark in China, representing the

performance of a diverse range of equities listed on

the Shanghai Stock Exchange (SSE). The SCI covers

companies across various sectors, providing a

comprehensive snapshot of the performance of the

Chinese stock market. The daily return of the

Shanghai Composite Index is selected in the

commodity features.

3.3 Models

This study uses six different machine learning models

to train the dataset including Linear Regression,

Lasso Regression, Ridge Regression, Long Short-

Term Memory, Random Forest, and XG-Boost.

Linear regression is a fundamental statistical

method. Lasso regression and Ridge regression are

two extensions of linear regression with Lasso

introducing a penalty term of the absolute values of

the coefficients and Ridge introducing a penalty term

of the squared values of the coefficients. It is effective

for feature selection and can lead to sparse models.

LSTM is a type of recurrent neural network,

particularly effective in modelling sequences and

time-series data due to its ability to capture long-term

dependencies. The LSTM architecture includes

memory cells with gating mechanisms, allowing it to

selectively remember or forget information. To be

specific, the LSTM structure is composed of the cell

state, hidden state, input gate, forget gate, and output

gate. Cell state runs along the entire sequence,

allowing them to absorb and retain information over

time. Input Gate updates the cell state with new data.

Forget gate determines what information from the cell

state should be retained or deleted. The output gate

generates the final output depending on the current

cell state. The hidden state transmits information

from the past to the present, allowing the model to

consider historical data. This architecture enables the

model to capture and utilize information over time,

making it suitable for time-series prediction. In this

study, the architecture starts with an LSTM layer with

100 neurons, using the ‘ReLU’ activation function. It

is followed by three fully connected dense layers with

respectively 50 neurons, 10 neurons, and one neuron

output.

1

([,] )

titti

iWhxb

σ

−

=⋅ + (20)

ICDSE 2024 - International Conference on Data Science and Engineering

456

1

([,] )

tfttf

fWhxb

σ

−

=⋅ +

(21)

11

tanh( [ , ] )

ttt t ctt c

cfc i Whxb

−−

=⋅ +⋅ ⋅ +

(22)

11

([,] )

totto

oWhxb

σ

−−

=⋅ +

(23)

tanh( )

tt t

ho c=⋅

(24)

Random Forest is an ensemble learning method

that constructs numerous decision trees during

training and aggregates their predictions through

averaging or voting. Each tree is trained on a random

subset of the data and features, introducing diversity

and reducing the risk of overfitting. In this study, the

architecture consists of 500 decision trees, with a

maximum depth of 10 and minimum node samples of

15.

XG-Boost is a gradient-boosting algorithm that

builds an ensemble of weak learners and sequentially

refines their predictions. XG-Boost minimizes a loss

function by iteratively adding weak learners, each

compensating for the errors of the existing ensemble.

It uses gradient descent optimization to find the best

parameters for weak learners. In this study, the

architecture consists of 500 decision trees, with a

learning rate of 0.001.

4 RESULTS

4.1 Model Performance

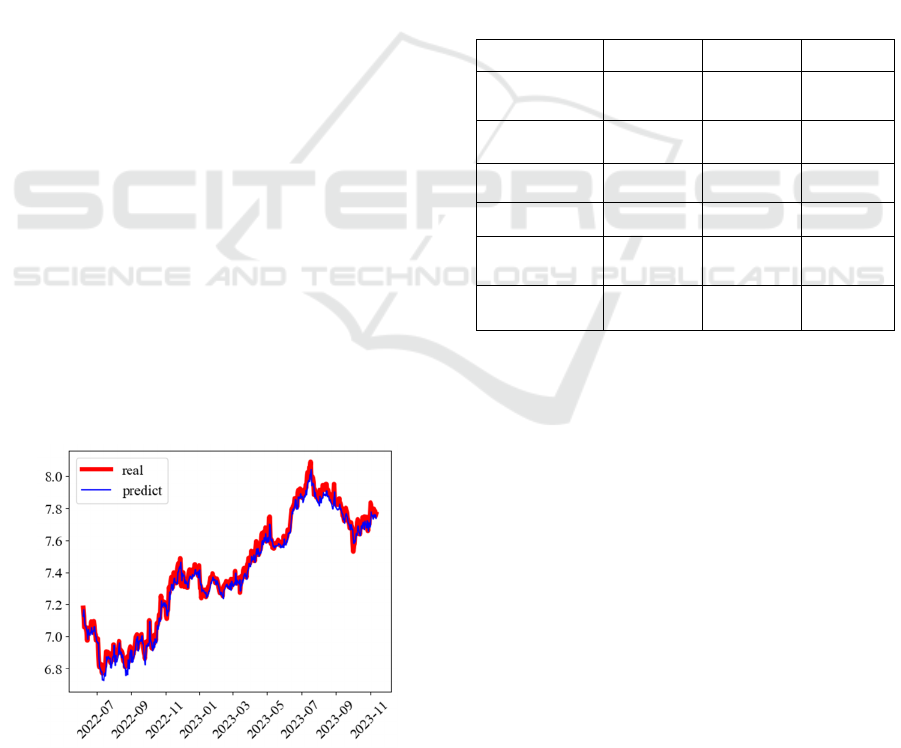

The predictions for the CNY exchange rate generated

by the six machine learning models are visually

presented in Figure 5. Notably, the predicted price

trajectories across all six models align closely with

the actual price movements, indicating a robust fit

between the predicted and observed values.

Figure 5: CNY prediction by LSTM (Picture credit:

Original).

Table 1 presents the average performance scores

of six distinct models employed in the study. The

LSTM model demonstrates superior performance

with a remarkably low RMSE of 0.063. This

outstanding result underscores the effectiveness of

LSTM in capturing long-term dependencies. The

exceptional performance of the LSTM model can be

attributed to its utilization of memory cells, which

enable the model to selectively retain or discard

information over extended temporal sequences.

Following the LSTM model, the Ridge regression,

linear regression, and random forest models exhibited

commendable performance, though with slightly

higher RMSE values. These results highlight the

competitive nature of these traditional regression and

ensemble models in the context of the conducted

time-series predictions.

Table 1: Regression metrics of different models.

Model MAE MSE RMSE

Linear

Regression

0.062783 0.005129 0.071596

Lasso 0.068414 0.005955 0.077168

Ridge 0.062589 0.005095 0.071346

LSTM 0.049589 0.004117 0.063395

Random

Forest

0.062491 0.005296 0.071757

XG-Boost 0.067127 0.005844 0.075878

Table 2 provides an overview of the average

performance scores across different feature inputs

utilized in the study. The analysis reveals that the

forex features exhibit the most favourable

performance, achieving the lowest error with an

RMSE of 0.067. The preference for forex features in

training predictive models can be attributed to their

ability to provide nuanced and comprehensive

information about market dynamics. The forex

market's inherent characteristics, including liquidity

and global interconnectivity, contribute to the

robustness of features derived from this domain. The

observed success of utilizing forex features is further

substantiated by the strong intercorrelation inherent

in foreign exchange variables. The inherent

relationships between these features contribute to a

more coherent and representative model, leading to

more accurate predictions.

CNY EX Rate Prediction Based on LSTM and Machine Learning Methods

457

Table 2: Regression metrics of different features.

Category MAE MSE RMSE

Tech 0.065612 0.00585 0.076233

Commodit

y

0.063677 0.005335 0.072361

Forex 0.057208 0.004533 0.066976

5 CONCLUSION

In this research, a synergy of six distinct models and

three feature categories is designed to formulate a

predictive framework for forecasting the daily return

of the CNY exchange rate. The outcomes

unequivocally affirm the efficacy of each model in

forecasting the CNY exchange rate, thereby

underscoring their collective predictive capabilities.

The optimal model is LSTM which showcases its

prowess in handling intricate temporal patterns and

reinforces its role as a preferred choice for time-series

prediction tasks. As for feature engineering, forex

features minimize prediction errors due to their

reflection of market dynamics and strong correlation

with CNY. In a word, the findings give a more

strategic approach to model training, contributing to

the advancement of predicting exchange rates.

REFERENCES

Y. Singh, A. S. Chauhan. J. Theor. Appl. Inf. Technol. 5(1)

(2009)

R. Meese, K. Rogoff. J. Frenkel. Chi. U - Chi. P (1983)

S. Galeshchuk, S. Mukherjee. In. Sys. in Acc. Fin. Mgmt,

24(4), 100-110 (2017)

B. Qian, K. Rasheed. Journal of Forecasting, 29(3), 271-

284 (2010)

C. Amat, T. Michalski, G. Stoltz. Journal of International

Money and Finance, 88, 1-24 (2018)

D. Pradeepkumar, V. Ravi. App. Sof. Comp., 58, 35-52

(2017)

T. Fischer, C. Krauss. Eur. J. Oper. Res. 270(2), 654-669

(2018)

S. A. Gyamerah, E. Moyo. Comp. 1-11 (2020)

Y. Wang, Y. Guo. Chn. Comm. 17(3), 205-221 (2020)

W. Cao, W. Zhu, W. Wang, Y. Demazeau, C. Zhang. IEEE

Intel. Sys. 35(2), 43-53 (2020)

ICDSE 2024 - International Conference on Data Science and Engineering

458