Research on the Influencing Factors of GDP in Anhui Province Based

on Statistical Analysis

Kaifeng Zhou

Faculty of Science, Wuhan University of Technology, Wuhan, 430070, China

Keywords: Influencing Factors, Correlation Analysis, Factor Analysis, Multiple Linear Regression Analysis, GDP.

Abstract: This article is based on the statistical data of Anhui Province from 2003 to 2022, aiming to explore the

influencing factors of Anhui Province’s GDP. The data comes from the Anhui Provincial Bureau of Statistics,

and five impact indicators are selected: total import and export volume, number of colleges and universities,

per capita consumption expenditure of urban residents, general budget revenue, and highway mileage. First,

Pearson correlation analysis was performed on the data set and it was found that there is a strong correlation

between different indicators. Then the factor analysis method was used to reduce the dimensionality of the

above indicators, and two factors, social finance and social construction, were obtained. Finally, a binary

linear regression model with standardized GDP as the dependent variable and the above two factors as

independent variables was established through multiple linear regression analysis. These analyzes provide an

important basis for an in-depth understanding of the influencing factors of Anhui Province's GDP, identify

the main factors and put forward guiding suggestions, which will help relevant departments formulate targeted

policies to promote economic growth in Anhui Province.

1 INTRODUCTION

Regional GDP refers to the final results of the

production activities of all resident units in the region

within a certain period of time. The GDP of a region

is equal to the sum of the added value of various

industries and is usually used to reflect the level of

economic development of a region (Dynan and

Sheiner 2018). The Anhui Provincial National

Economic and Social Development Statistical

Bulletin in 2022 stated that the province's gross

product (GDP) for the whole year was 4.5045 billion

yuan, an increase of 3.5% over the previous year

(Wang et al 2023). Anhui's economy has achieved a

historic transformation from "being in the middle in

terms of total volume but lagging behind in per

capita" to "being in the forefront in terms of total

volume and being in the middle on per capita", and its

economic strength has achieved a major leap (Wang

and Shi 2021). However, compared with other

economically developed provinces and cities in the

"Yangtze River Delta" region, there is still a large gap

(Ren and Zhou 2022). Additionally, Anhui Province's

digital economy has developed rapidly in recent

years, but there is still the problem of unbalanced

development between the north and the south (Luo

2019). In order to implement comprehensive high-

quality development and build a modern and beautiful

Anhui, Anhui's economy must maintain a stable and

positive development trend. Therefore, it is of great

significance to explore the influencing factors of GDP

in Anhui Province, and to adopt and implement

relevant effective economic measures to promote the

economic development of Anhui Province.

There is no shortage of statistical research on the

factors influencing Anhui Province’s economic

vitality in China. For example, by establishing a

stepwise regression model, Ren and Zhou proposed

that per capita consumption expenditure and

technology contract turnover have a greater impact on

Anhui Province's GDP (Wang et al 2021). In addition,

Jingyu Luo established a factor analysis model on the

comprehensive urban strength of 16 cities in Anhui

Province and concluded that social welfare

investment and sustainable development capabilities

affect economic development to a certain extent

(Wang and Cai 2022). Wang et al. established

evaluation indicators through emergy models and

obtained that the slow improvement of ecological

civilization caused by the large proportion of the

secondary industry is a major obstacle to Anhui's

economic development. Thus, there is an urgent need

Zhou, K.

Research on the Influencing Factors of GDP in Anhui Province Based on Statistical Analysis.

DOI: 10.5220/0012820200004547

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Data Science and Engineering (ICDSE 2024), pages 267-274

ISBN: 978-989-758-690-3

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

267

Table 1: Variable names.

variable name impact indicators (unit)

𝑦

GDP of Anhui Province (100 million yuan)

𝑥

total import and export volume (100 million U.S. dollars)

𝑥

number of colleges and universities

𝑥

per capita consumption expenditure of urban residents (yuan)

𝑥

general budget revenue (100 million yuan)

𝑥

highway mileage (thousand kilometers)

to optimize the industrial structure and develop a

circular economy (Trani and Holsworth 2010).

Moreover, Wang and Cai also acquired good results

by establishing the entropy weight TOPSIS model.

They concluded that the main factors affecting

regional economic vitality are the four categories of

economic efficiency, science and technology and

education, opening up to the outside world, and the

living standard of residents. Among them, the two

aspects of science and technology, education

investment and opening up have greater weight

(Zhang et al 2020). Based on the existing research

results, this article selects five indicators: total import

and export volume, number of colleges and

universities, per capita consumption expenditure of

urban residents, general budget revenue, and highway

mileage to explore the statistical data of relevant

indicators from 2003 to 2022. This article

innovatively selects the number of colleges and

universities and highway mileage as some of the

impact indicators. As the development of higher

education and highway construction can greatly

affect the local economy (Cheng 2023). It is planned

to conduct a series of statistical analyzes based on the

inherent relationship between the data.

2 METHODOLOGY

2.1 Data Source

The data used in this article all come from the Anhui

Statistical Yearbook published by the Anhui

Provincial Bureau of Statistics over the years. The

data on the five impact indicators released by it from

2003 to 2022 were integrated to obtain the data set

used in the study.

2.2 Data Preprocessing

This article takes Anhui Province’s GDP as the

explained variable and the five selected impact

indicators as explanatory variables. Since the selected

unit of the original highway mileage data is 10,000

kilometers, all data are decimals. Now it is expanded

ten times and the unit of 1,000 kilometers is selected

to ensure the readability and beauty of the data. The

variables are named as shown in Table 1 below.

2.3 Descriptive Statistical Analysis

First, SPSS was used to conduct descriptive statistical

analysis on the data, and the following Table 2 was

obtained. It can be seen from Table 2: (1) The

skewness of general budget revenue is close to 0, and

it is basically symmetrically distributed; the skewness

of GDP and total import and export volume are both

large positive values, and they are right-skewed data.

Except for the total import and export volume, the

kurtosis of the rest of the data is negative, indicating

that the data is more distributed in parts farther from

the mean. (2) For the number of colleges and

universities and highway mileage, the standard

deviation and coefficient of variation of these two

data are small, indicating that the growth of these two

data is relatively gentle; the coefficient of variation

and standard deviation of other data are large,

indicating that the data distribution is highly discrete.

The above data can illustrate that Anhui

Province's economy has been developing steadily and

for the better in the past 20 years, and residents'

quality of life has improved.

In view of the obvious differences between the

various indicators used in this article and the

measurement units of GDP, direct statistical analysis

will be inconsistent with the actual situation, making

the conclusion erroneous. Therefore, before

subsequent analysis, the data were first standardized

by Z-score. Record the standardized GDP as 𝑦

∗

, and

the five standardized impact indicators are

𝑥

∗

,𝑥

∗

,𝑥

∗

,𝑥

∗

,𝑥

∗

.

In the following, correlation analysis, factor

analysis and multiple linear regression analysis will

be carried out in sequence according to the internal

relationship of the data.

ICDSE 2024 - International Conference on Data Science and Engineering

268

Table 2: Descriptive statistics.

variable

name

maximum

value

minimum

value

mean

standard

deviation

median kurtosis skewness

coefficient of

variation (CV)

𝑦

45045.02 4307.8 20863.02 13255.162 19462.85 -1.097 0.417 0.635

𝑥

1131.27 59.43 426.152 314.033 418.295 0.259 0.897 0.737

𝑥

121 73 107.7 16.442 117.5 -0.408 -1.104 0.153

𝑥

26832 5064.34 15185.98 7037.696 15559.365 -1.225 0.149 0.463

𝑥

3589.1 220.75 1828.154 1192.308 1933.895 -1.575 0.009 0.652

𝑥

5.5 1.1 3.405 1.39 3.35 -1.249 -0.193 0.408

3 RESULTS AND DISCUSSION

3.1 Correlation Analysis

Since the data taken are all continuous numerical

data, the Pearson correlation coefficient can be used

for correlation analysis. Pearson correlation analysis

is a statistical method used to measure the strength

and direction of a linear relationship between two

variables. This method is based on the concept of

covariance, which measures whether the changing

trends of two variables are consistent. To facilitate the

use of notation, let 𝑦

∗

=𝑥

∗

.

And let 𝑥

∗

,𝑥

∗

(

𝑖,𝑗=0,1,2,⋯,5,𝑖≠𝑗

)

be a

two-dimensional population. Obtain observation data

from it: 𝑥

,

∗

,𝑥

,

∗

,𝑥

,

∗

,𝑥

,

∗

,⋯,𝑥

,

∗

,𝑥

,

∗

(

𝑛=

20

)

. Denote,

𝑥̅

()

=

∑

𝑥

,

∗

,𝑥̅

()

=

∑

𝑥

,

∗

(1)

Correlation Coefficient is usually represented by

𝑟, and its calculation formula is:

𝑟

∗

∗

=

∗

∗

∗

∗

∗

∗

(2)

In formula (2),

𝑆

∗

∗

=

∑

𝑥

,

∗

−𝑥̅

()

𝑥

,

∗

−𝑥̅

()

(3)

𝑆

∗

∗

=

∑

𝑥

,

∗

−𝑥̅

()

,

𝑆

∗

∗

=

∑

𝑥

,

∗

−𝑥̅

()

(4)

They represent the covariance of 𝑥

∗

,𝑥

∗

and the

variance of 𝑥

∗

,𝑥

∗

respectively.

It is generally believed that when the absolute

value of the Pearson correlation coefficient is greater

than 0.5, it is considered that there is a strong linear

relationship between the two variables; when the

absolute value of the Pearson correlation coefficient

is between 0.3 and 0.5, it is considered that there is a

moderate degree of linear relationship between the

two variables. linear relationship; when the absolute

value of the Pearson correlation coefficient is less

than 0.3, it is considered that the linear relationship

between the two variables is weak and there is no

linear relationship.

Perform hypothesis testing on correlation,

assuming the null hypothesis is 𝐻

:𝜌

∗

∗

=0, and

the alternative hypothesis is 𝐻

: 𝜌

∗

∗

≠0. When

𝑋

,𝑋

is a two-dimensional normal population, and

𝐻

is true, the statistic 𝑡=

∗

∗

√

∗

∗

~𝑡

(

𝑛−2

)

.

Assuming that the 𝑡 value obtained from actual

observation data is 𝑡

, then 𝑝=𝑃

(|

𝑡

|

≥𝑡

)

. At the

significance level 𝛼=0.05, 𝐻

is rejected when 𝑝<

𝛼. And it is considered that 𝑥

∗

,𝑥

∗

are related and the

calculated correlation coefficient reflects the strength

of the linear correlation between the two variables.

The correlation coefficients between pairs of

𝑦

∗

,𝑥

∗

,𝑥

∗

,𝑥

∗

,𝑥

∗

,𝑥

∗

are obtained by solving. The

obtained correlation coefficient matrix is shown in

Table 3 below.

It can be seen from the correlation coefficient

matrix in Table 3 that the 𝑝 values of the correlation

coefficient test between each variable are all less than

the significance level 𝛼=0.05. Therefore, the null

hypothesis is rejected. Therefore, it can be supposed

that there is a correlation between variables, and the

calculated correlation coefficient reflects the strength

of the linear correlation between the two variables.

Research on the Influencing Factors of GDP in Anhui Province Based on Statistical Analysis

269

Table 3: Correlation coefficient matrix.

𝒚

∗

𝒙

𝟏

∗

𝒙

𝟐

∗

𝒙

𝟑

∗

𝒙

𝟒

∗

𝒙

𝟓

∗

𝑦

∗

1 0.974** 0.808** 0.992** 0.985** 0.967**

𝑥

∗

1 0.754** 0.959** 0.939** 0.914**

𝑥

∗

1 0.86** 0.868** 0.905**

𝑥

∗

1 0.993** 0.984**

𝑥

∗

1 0.985**

𝑥

∗

1

Note: ** indicates significant correlation at the 0.05 level

Noting that the values of the correlation

coefficients are all greater than 0.5, it can be

considered that there is a strong positive linear

relationship between the variables. This shows that

there is strong collinearity among the five different

impact indicators selected in this article. In order to

further select factors that influence GDP with greater

weight, the five influencing indicators need to be

dimensionally reduced to eliminate strong

collinearity and make the final conclusion accurate

and effective. The purpose is achieved through factor

analysis below.

3.2 Factor Analysis

Since the number of selected impact indicators is

small, it is determined that the number of public

factors to be selected in the factor analysis of this

article is 2, recorded as 𝐹

,𝐹

. That is, the five impact

indicators 𝑥

∗

𝑥

∗

are dimensionally reduced into

two public factors 𝐹

,𝐹

through factor analysis to

facilitate subsequent multiple linear regression

analysis.

The orthogonal factor analysis model based on

this study is,

𝑥

∗

=𝑎

𝐹

+𝑎

𝐹

+𝜀

𝑥

∗

=𝑎

𝐹

+𝑎

𝐹

+𝜀

⋮

𝑥

∗

=𝑎

𝐹

+𝑎

𝐹

+𝜀

(5)

Expressed in matrix as:

𝑥

∗

𝑥

∗

⋮

𝑥

∗

=

𝑎

𝑎

𝑎

𝑎

⋮

𝑎

⋮

𝑎

𝐹

𝐹

+

𝜀

𝜀

⋮

𝜀

, abbreviated as 𝑥

×

∗

=𝐴

×

𝐹

×

+𝜀

×

. In

addition, equation (2) should also satisfy: ①

𝐶𝑜𝑣

(

𝐹,𝜀

)

=𝑂, that is, 𝐹 and 𝜀 are uncorrelated; ②

𝐹

,𝐹

are uncorrelated and both have variances of 1;

③ 𝜀

,𝜀

,…,𝜀

are uncorrelated and have different

variances. The corresponding steps and results of

factor analysis are as follows:

Applicability test: The test results are shown in

Table 4 below.

From Table 4, it can be seen that the KMO value

is 0.83 greater than 0.6, and the Bartlett sphericity test

shows that the 𝑝 value is equal to 0.000 and less than

0.05, which is significant. Therefore, this problem can

be considered suitable for factor analysis.

Table 4: Applicability test results.

KMO and Bartlett's test

KMO 0.83

Bartlett's test of

sphericity

Approximate chi-square 211.514

𝑑𝑓

10

𝑝

0.000***

Note: *** represents the 1% significance level

Table 5: variance explained.

component

% of Variance (Unrotated) % of Variance (Rotated)

Eigen

Value

% of

Variance

Cumulative % of

Variance

Eigen

Value

% of

Variance

Cumulative % of

Variance

1 4.671 93.417 93.417 286.373 57.275 57.275

2 0.264 5.278 98.695 207.102 41.42 98.695

3 0.05 1.01 99.705

4 0.011 0.213 99.918

5 0.004 0.082 100

ICDSE 2024 - International Conference on Data Science and Engineering

270

Factor extraction: The variance explanation table

obtained from data processing is shown in Table 5

above.

It can be observed from Table 5 that the

cumulative contribution rate of the first two

components reaches 98.695%, which is higher than

95%, and the contribution rate of the last three

components can be approximately ignored.

Therefore, it is feasible to select two public factors.

Factor rotation and naming: Further process the

data to obtain the rotated factor loading coefficient

table, as shown in Table 6 below.

Table 6: Rotated component matrix.

Factor loading (Rotated)

𝐹

𝐹

𝑥

∗

0.909 0.387

𝑥

∗

0.432 0.897

𝑥

∗

0.821 0.567

𝑥

∗

0.796 0.593

𝑥

∗

0.737 0.665

Note that in Table 6, the public factor 𝐹

in the

rotated component matrix has large loadings on the

three indicators 𝑥

(total import and export volume),

𝑥

(per capita consumption expenditure of urban

residents), and 𝑥

(general budget revenue). It

reflects relevant information at the macroeconomic

and trade levels, so 𝐹

can be named the social

financial factor. The other public factor 𝐹

has large

loadings on the two indicators 𝑥

(number of colleges

and universities) and 𝑥

(highway mileage), which

reflects relevant information at the level of social

infrastructure construction, so 𝐹

can be named the

social construction factor.

Factor score calculation: The calculated component

score coefficient matrix is shown in Table 7 below:

Table 7: Component score coefficient matrix.

𝑭

𝟏

𝑭

𝟐

𝑥

∗

0.847 -0.7

𝑥

∗

-0.852 1.325

𝑥

∗

0.382 -0.126

𝑥

∗

0.294 -0.021

𝑥

∗

0.068 0.25

From Table 7, the linear combination expression

of the two public factors regarding each indicator is

obtained, namely:

𝐹

=0.847𝑥

∗

− 0.852𝑥

∗

+ 0.382𝑥

∗

+ 0.294𝑥

∗

+ 0.068𝑥

∗

𝐹

=−0.7𝑥

∗

+ 1.325𝑥

∗

− 0.126𝑥

∗

− 0.021𝑥

∗

+0.25𝑥

∗

(6)

3.3 Multiple Linear Regression

Analysis

In order to avoid severe collinearity affecting the

analysis results, the social financial factor 𝐹

and

social construction factor 𝐹

after factor analysis

dimensionality reduction are selected as independent

variables, and the standardized GDP data 𝑦

∗

is used

as the dependent variable to conduct multiple linear

regression analysis.

Through the above analysis, it can be roughly

concluded that 𝐹

,𝐹

and 𝑦

∗

have a strong linear

relationship. Under this premise, a multiple linear

regression model can be established:

𝑦

∗

=𝛽

+𝛽

𝐹

+𝛽

𝐹

+𝜀

,

𝜀~𝑁

(

0,𝜎

)

(7)

In equation (3), 𝛽

(

𝑖=1,2

)

represents the

regression coefficient, and 𝛽

represents the

intercept. Then use the least squares method to

estimate 𝛽

(

𝑖=1,2

)

,𝛽

. Find the optimal function by

minimizing the sum of squared errors. Solve the

approximate solution 𝛽

of the coefficient matrix 𝛽=

(

𝛽

,𝛽

,𝛽

)

through matrix operations 𝛽

=

(

𝐹

𝐹

)

𝐹

𝑌

∗

. where 𝑌

∗

=

𝑦

∗

𝑦

∗

⋮

𝑦

∗

, 𝐹=

1𝑓

𝑓

1𝑓

𝑓

⋮

1

⋮

𝑓

,

⋮

𝑓

,

. The results of the multiple linear

regression analysis are shown in Table 8 below:

Table 8: Regression coefficient.

Beta

t Significance

(constant)

0.000 1.000

𝐹

0.871 45.455 0.000

𝐹

0.485 25.324 0.000

It can be concluded from Table 8 that the

approximate solution 𝛽

=(0,0.871,0.485)

of the

coefficient matrix. Subsequent model testing will be

performed on this model to ensure that the model is

successfully established. 𝐻

: 𝛽

=𝛽

=𝛽

=0, 𝐻

:

Research on the Influencing Factors of GDP in Anhui Province Based on Statistical Analysis

271

There is at least one 𝛽

≠0. Under the condition of

𝐻

, construct the test statistic 𝐹=

=

/()

/()

~𝐹

(

3 − 1,20 −3

)

. In the above formula.

Where 𝑆

=

∑(

𝑦

∗

−𝑦

∗

)

is the regression sum of

squares, 𝑆

=

∑(

𝑦

∗

−𝑦

∗

)

is the residual sum of

squares.

It can be obtained from the ANOVA table in SPSS

that the 𝑝 value of this test is approximately 0.000<

𝛼=0.05. It means that the regression coefficient

corresponding to at least one independent variable is

not equal to 0, that is, there is a linear relationship

between at least one independent variable and the

dependent variable, and the model is successfully

established.

Meanwhile, it is not difficult to find from Table 8

that the calculated 𝑝 values corresponding to 𝛽

,𝛽

are all 0.000 and less than 𝛼=0.05, indicating that

the model is well established and has a reasonable

binary linear relationship. The linear regression effect

of independent variables 𝐹

,𝐹

on 𝑦

∗

is significant.

The resulting binary linear regression equation is as

follows,

𝑦

∗

=0.871𝐹

+ 0.485𝐹

(8)

𝑦

∗

is the approximate estimate of the dependent

variable. For multiple linear regression, the modified

multiple determination coefficient is used to

determine the degree of linear regression, as shown in

the following formula, where 𝑆

=𝑆

+𝑆

, and

𝑅

=1−

⁄

⁄

.

Since the basic assumption of the linear regression

model also requires that each random error 𝜀

(

𝑖=

1,2,…,20

)

is independent of each other, the Durbin-

Watson test is used to test the independence of the

errors. Construct the DW statistic as shown in the

following formula:

𝐷𝑊=

∑(

)

∑

(9)

The results of the goodness-of-fit judgment and

Durbin-Watson test are obtained as shown in Table 9

below:

Table 9: Model summary.

Model R R S

q

uare Ad

j

usted R S

q

uare DW

1 0.997 0.994 0.993 0.964

From Table 9, the calculated 𝑅

=0.994 is very

close to 1, which demonstrates that the linear fitting

effect is very good. The model is reasonably

established and can make more effective predictions.

The obtained Durbin-Watson test result is 0.964,

which conforms to the value range of 0<DW<4.

However, there is a weak positive correlation

between the residuals of two adjacent points, which

can be approximately regarded as the absence of

serial autocorrelation, that is, each random error can

be considered independent of each other.

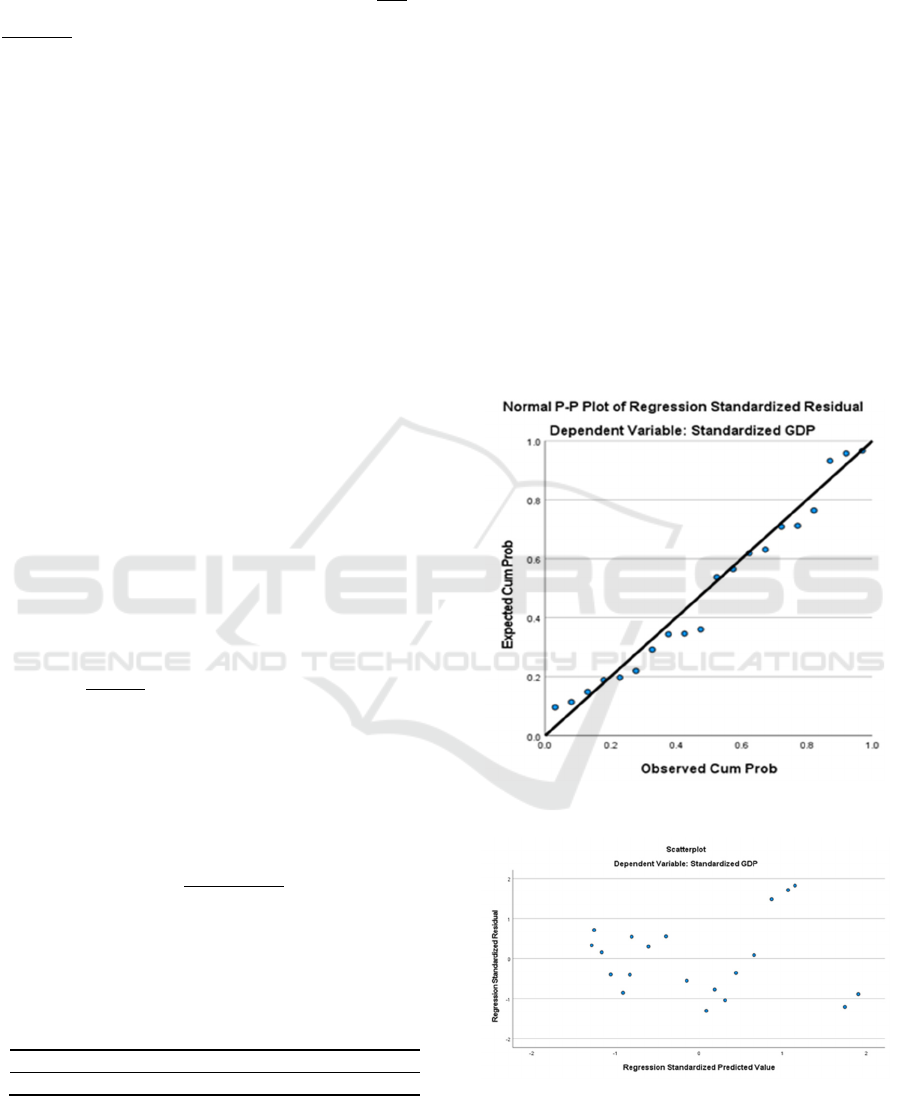

Finally, residual analysis is performed. In order to

test whether the studentized residuals, that is, the

regression standardized residuals, obey the standard

normal distribution, a normal P-P plot is made for the

regression standardized residuals, as depicted in

Figure 1. In order to test that the variances of the

normal distributions obeyed by the random errors

𝜀

(

𝑖=1,2,…,20

)

are the same, in other words, they

have variance consistency. Make a residual scatter

plot with the fitted value of the dependent variable 𝑌

as the abscissa, as depicted in Figure 2.

Figure 1: Normal P-P diagram (Picture credit: Original).

Figure 2: Residual scatter plot (Picture credit: Original).

As can be seen from Figure 1, the residual points

are basically distributed along the diagonal straight

line, indicating that the expected cumulative

ICDSE 2024 - International Conference on Data Science and Engineering

272

probability closely matches the observed cumulative

probability. Therefore, it follows the normal

distribution. It can be found in Figure 2 that the

standardized residual scatter points are distributed

around the 0 value, roughly within a band-shaped

area, and there is no obvious trend. This means that

the variances of the random errors are homogeneous,

there is no heteroscedasticity problem, and the fit is

good.

4 CONCLUSION

This article obtains a series of research results

through statistical data analysis of Anhui Province’s

GDP and five impact indicators. After conducting

descriptive statistics on the data, it was found through

correlation analysis that there is strong correlation

and collinearity between the indicators. In order to

eliminate the impact of collinearity on the results, the

five indicators were dimensionally reduced through

factor analysis and finally two common factors were

obtained. These two public factors are named social

financial factors and social construction factors

respectively. Finally, by establishing a multiple linear

regression model, the binary linear regression

equation of standardized GDP with respect to the

above two factors was obtained. After testing, it can

be proved that the equation has a good fitting degree.

It can be seen from the obtained regression

equation that Anhui Province's GDP has a certain

positive linear correlation with social

macroeconomics, such as consumption, trade, and

social infrastructure, such as school and highway

construction. Therefore, in order to implement

economic construction as the center and promote

high-quality economic development in Anhui

Province, the following guiding opinions are put

forward for reference.

Deepen opening to the outside world and expand

foreign trade cooperation: Promote the in-depth

integration of Anhui Province with the international

market and strengthen economic and trade

cooperation with countries along the Belt and Road.

It is recommended to formulate more flexible trade

policies, attract foreign investment and technology

introduction, and improve the level of opening up to

the outside world. At the same time, we will

strengthen the development of cross-border e-

commerce and digital economy and improve the

efficiency of import and export.

Stimulate residents’ consumption vitality:

Stimulate residents' consumption by increasing

residents' income levels and improving employment

rates. Encourage the development of cultural tourism,

health care and other consumer fields, and cultivate

new consumption growth points. In addition, promote

consumer confidence, strengthen brand building, and

improve product and service quality.

Increase public budget investment: Increase

government financial investment, especially in the

fields of education, medical care, science and

technology and other social undertakings. Increase

support for innovative enterprises and scientific

research institutions to promote technological

innovation and industrial upgrading. At the same

time, the fiscal expenditure structure should be

optimized to ensure the effectiveness and

sustainability of capital investment.

Accelerate the construction of transportation

infrastructure and improve the connectivity of the

province: Improve infrastructure levels and shorten

transportation time between urban and rural areas and

between provinces. Accelerate the planning and

construction of transportation infrastructure such as

highways and railways, promote smooth logistics,

and promote coordinated development of industries.

This will help reduce logistics costs, improve

production efficiency, and enhance Anhui Province’s

competitiveness in the global value chain.

Optimize the education system and promote talent

cultivation: Increase investment in higher education

and improve the overall level of educational

resources. At the same time, enterprises are

encouraged to cooperate with universities to

strengthen the integration of industry, education,

research and application, and improve the practicality

and employment rate of higher education. Cultivate

more high-quality talents, provide intellectual support

for upgrading the economic structure, and build an

innovation highland.

REFERENCES

K. Dynan and L. Sheiner, Hutchins Center Working Paper,

(2018).

C. Wang, F. Liu and Y. Wang, Environmental Engineering

Research 28(1), (2023).

Z. Wang and P. Shi, Complexity, 1-8 (2021).

J. Ren and Z. Zhou, International Journal of Education and

Humanities 2(1), 7-11 (2022).

J. Luo, Tourism Management and Technology Economy

2(1), 13-21 (2019).

C. Wang, Y. Zhang, C. Liu, et al., Sustainability 13(5), 2988

(2021).

W. Wang and X. Cai, Journal of Natural Sciences of Harbin

Normal University 38(3), 9-19 (2022).

Research on the Influencing Factors of GDP in Anhui Province Based on Statistical Analysis

273

E. P. Trani and R. D. Holsworth, R&L Education, 9-11

(2010).

X. Zhang, Y. Hu and Y. Lin, Journal of Transport

Geography 82, 102600 (2020).

H. L. Cheng, Cooperative Economy and Technology 23,

30-32 (2023).

ICDSE 2024 - International Conference on Data Science and Engineering

274