Empirical Analysis of Convertible Bond Pricing and Arbitrage Based

on Black-Scholes Model

Simo Li

Sino-French Institute, Renmin University of China, Beijing, 100872, China

Keywords: Black-Scholes model; Convertible bond pricing; Arbitrage strategy; Bond value; Option value

Abstract: A convertible bond is a special financial instrument. In China, the size of the convertible bond market

continues to grow. However, due to the dual characteristics of stocks and bonds, there are complications in

pricing. There are currently a variety of convertible bond pricing methods, including the Black-Scholes

model, binary tree model, etc. This article uses the Black-Scholes model and takes the convertible bond

Chongda zhuan 2 as an example to research the pricing of convertible bonds, calculate the bond value and

option value of this convertible bond, and analyzes the investment opportunities of convertible bonds by

contrasting the variation between the theoretical value and the real price. The research on convertible bond

pricing in academic circles is biased towards theory. The efficiency of the convertible bond market can be

improved and investment possibilities in the convertible bond market can be explored with the aid of

data-based research on pricing.

1 INTRODUCTION

A convertible bond is a special financial instrument

that has the dual characteristics of stocks and bonds.

Convertible bondholders are entitled to convert their

bonds, at a price set at the time of issuance, into

shares. Holders of convertible bonds can also choose

to hold the bond and receive interest and principal,

or sell the bond in the market (Wenshi 2022).

According to the terms of the agreement, under

certain circumstances, When the price of the

underlying stock falls below a specific threshold, the

holder of the convertible bond has the option to call

the bond back to the issuer, and the issuer has the

option to redeem the bond when the price of the

underlying stock rises above a specific threshold

(Zhao 2022).

Therefore, convertible bonds can be viewed as a

hybrid of stocks and bonds. The bond value and the

conversion value make up the two components of a

convertible bond's value. Alternatively, a convertible

bond can be viewed as a combination of a regular

bond and a corresponding call option on a stock

(Junbo 2021). Convertible bond pricing theory,

which is based on the Black-Scholes option pricing

model, advanced quickly after the model's

introduction in the 1970s.

The launch of convertible bonds is of great

significance to listed companies. Convertible bonds

create a low-cost, long-term, and stable financing

channel. At the same time, listed companies can

improve their financial structure through convertible

bond financing (Zaiqiao 2023).

China's convertible bond market emerged

relatively late. In China, the first convertible bond

appeared in the early 1990s. As the Chinese capital

market has grown, the convertible bond market has

attracted more and more attention from institutions

and individuals, and the scale of financing has grown

rapidly. As of the end of 2021, the number of

convertible bonds issued in the Chinese market was

close to 700 (Leying 2022).

However, compared to the stock market, the

convertible bond market in China developed later

and has not gotten as much attention. The

convertible bond market is inefficient, and it is easy

for convertible bond prices to deviate from the

intrinsic reasonable value. Therefore, research on

convertible bond pricing will help adjust prices in

the convertible bond market and enhance its

effectiveness (Yu 2021).

132

Li, S.

Empirical Analysis of Convertible Bond Pricing and Arbitrage Based on Black-Scholes Model.

DOI: 10.5220/0012829300004547

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Data Science and Engineering (ICDSE 2024), pages 132-136

ISBN: 978-989-758-690-3

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

This article will introduce in detail how to use

the B-S model to value convertible bonds and verify

the feasibility of the investment method based on the

B-S model based on real historical data.

2 CALCULATING THE VALUE

OF CONVERTIBLE BONDS

Convertible bond pricing can be divided into two

parts: bond value and option value.

For the calculation of bond value:

Assume that the value of the convertible bond is

B, the bond interest is I, n is the term of the

convertible bond, F is the maturity redemption price

of the convertible bond, and the discount rate d is the

interest rate of ordinary bonds in the same industry

and with the same credit rating. The following is the

calculation of the value of the convertible bond

bond:

1

(1 d ) (1 )

T

tt

t

IF

B

d

=

=+

++

(1)

For the calculation of option value:

Assume model parameters: S is the underlying

stock price, X is the option exercise price, σ is the

stock price volatility, and T is the relative remaining

period of the option (T=remaining period/365). C is

the option value of the convertible bond. According

to the B-S model, the following is the calculation of

the convertible bond option value:

)N(d*e* X–

)(

dN*S

2

-rT

1

=C (2)

[]

)/()2/()/ln(d

2

1

TTrXS

σσ

++=

(3)

Td *d

12

σ

−=

(4)

(N(d) is the cumulative possibility distribution

function of normally distributed variables)

For convertible bonds, X is the conversion price.

Each unit of convertible bonds corresponds to A

units of options. A is called the conversion ratio,

A=100/conversion price.

Convertible bond value = bond value +

option value ∗ conversion ratio

3 ANALYSIS OF CONVERTIBLE

BOND ARBITRAGE

STRATEGY

3.1 Convertible Bond Arbitrage

Strategies

Long strategy: When convertible bonds are

undervalued, buy convertible bonds and choose to

convert them to make profits if there is a profit

during the convertible period (Jinhua & Yujuan

2023).

Overnight spread arbitrage: When the underlying

stock of a convertible bond is allowed to short-sell

through securities lending if the conversion price of

the convertible bond is underestimated relative to the

stock price, the underlying stock can be obtained

through securities lending and sold, and a

corresponding amount of convertible shares can be

purchased. Then the bonds are converted into shares

and the stocks borrowed are returned the next day

(Zefeng 2023).

Other strategies: Arbitrage based on different

delta volatilities of financial products related to

convertible bonds.

3.2 Arbitrage Strategy Based on the

Black-Scholes Model

The Black-Scholes model-based arbitrage strategy is

long. Determine the convertible bond's theoretical

value using the Black-Scholes model. It is a sign that

a convertible bond is undervalued when its

theoretical price is higher than its actual market

price. It is believed that the convertible bond has a

large room for growth and can be purchased to build

a position. Conversely, convertible bonds can be

sold to reduce positions if the theoretical price is less

than the market price, which indicates that the bonds

are overvalued by the market.

4 EMPIRICAL RESEARCH ON

ARBITRAGE STRATEGY-

TAKING CONVERTIBLE BOND

CHONGDA ZHUAN 2 AS AN

EXAMPLE

To verify the effectiveness of the B-S model pricing,

starting from 2021/1/04, the data on the 4th of each

Empirical Analysis of Convertible Bond Pricing and Arbitrage Based on Black-Scholes Model

133

month for 6 consecutive months will be calculated

(postponed if the market is closed).

4.1 Calculation of Bond Value

In the bond value calculation part, Chongda

Technology, the issuer of Chongda zhuan 2, is an

electronic product manufacturing company. Select

the average interest rate of general corporate bonds

found by companies with the same credit rating in

the same industry as the discount rate (4.3%).

According to the Chongda zhuan 2 issuance

information, the interest rates of the convertible bond

within 6 years are 0.30%, 0.60%, 1.00%, 1.50%,

1.80%, and 2.00% respectively. The redemption

price at maturity is 110(This means B=110 not 100).

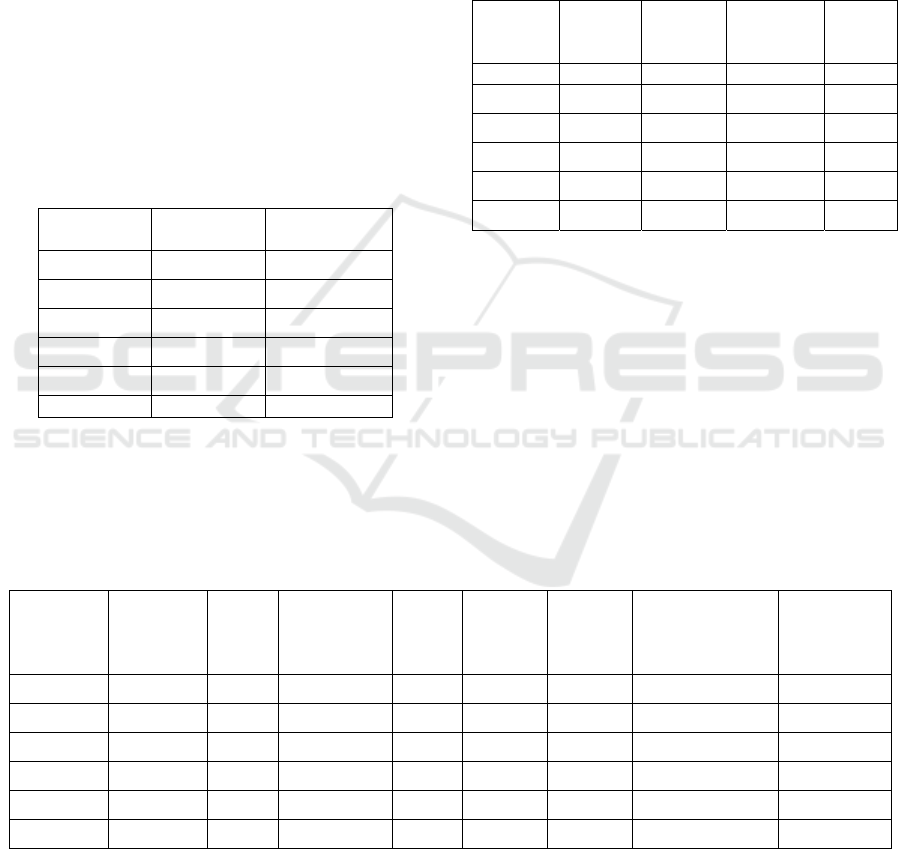

As shown in Table 1, the bond value of the

convertible bond is calculated.

Table 1: Bond value of Chongda Zhuan 2.

Chongda

Zhuan 2

Remaining

p

eriod

Bond value

2021/1/4 5.68 91.13

2021/2/4 5.59 91.46

2021/3/4 5.52 91.75

2021/4/6 5.42 92.09

2021/5/6 5.34 92.42

2021/6/4 5.26 92.72

4.2 Calculation of Option Value

In the option value calculation part, the 3-year

Chinese government bond interest rate (3%) for the

same period is chosen to be the risk-free interest rate.

According to historical information of the wind

database, the annualized volatility rate of Chongda

Technology (002815) is 30.09%. The corresponding

conversion price from 2021/1/4 to 2021/5/6 is 19.54,

and the corresponding conversion price on June 4,

2021 is 19.29.

As shown in Table 2, the option value is

calculated.

Table 2: Option value of Chongda Zhuan 2.

Chongd

a Zhuan

2

Remain

ing

p

eriod

Stock

price

Conversi

on price

Optio

n

value

2021/1/4 5.68 13.55 19.54 2.89

2021/2/4 5.59 11.09 19.54 1.68

2021/3/4 5.52 11.84 19.54 1.97

2021/4/6 5.42 11.53 19.54 1.8

2021/5/6 5.34

11.10

19.54 1.59

2021/6/4 5.26

11.40

19.38 1.71

4.4 Convertible Bond Value

Calculation

As convertible bonds' conversion prices change, it is

necessary to consider the conversion ratios

corresponding to different conversion prices

(conversion ratio = 100/conversion price).

As shown in Table 3, the theoretical value of

convertible bonds is calculated.

Table 3. The theoretical value of the convertible bond

Chongda

Zhuan 2

Remainin

g period

Stock

price

Conversion

price

Bond

value

Option

value

Conver-

sion

ratio

The theoretical

value of the

convertible

bond

Actual

price of

convertible

bond

2021/1/4 5.68 13.55 19.54 91.13 2.89 5.118 105.916 106.5

2021/2/4 5.59 11.09 19.54 91.46 1.68 5.118 100.054 94.4

2021/3/4 5.52 11.84 19.54 91.75 1.97 5.118 101.828 98

2021/4/6 5.42 11.53 19.54 92.09 1.8 5.118 101.306 99.9

2021/5/6 5.34

11.10

19.54 92.42 1.59 5.118 100.553 99.9

2021/6/4 5.26

11.40

19.38 92.72 1.71 5.160 101.548 102.3

4.3 Verification of Arbitrage Strategy

Since the actual price of Chongda Zhuan 2 on

2021/1/4 is higher than the theoretical value, for the

convenience of calculation, it is assumed that on

January 4, 2021, 100 units of Chongda Zhuan 2 are

held, totaling 10,650 yuan. Due to the high actual

price Based on the theoretical value, it is believed

that the price is overvalued by the market and the

bonds should be sold. On February 4, 2021, the

ICDSE 2024 - International Conference on Data Science and Engineering

134

actual price was lower than the theoretical value, and

the price was greatly underestimated. The bonds

should be bought again, a total of 112.82 units.

During the period from 2021/3/4 to 2021/5/6,

because the theoretical value is higher than the actual

price, continue to hold the bonds. On June 4, 2021,

the actual price was higher than the theoretical value.

So sold the bonds and received a total of 11,541.49

yuan. Then from 2021/1/4 to 2021/6/4, the total

income from the above operations is 8.37%

((11541.49-10650)/10650=8.37%).

Observing the above data, the pricing of

convertible bonds based on the B-S model is

generally consistent with the actual price, and the

actual difference is small. There is a large difference

between the theoretical value and the actual price on

2021/2/4 (As marked in Figure 1), and there is an

obvious arbitrage opportunity. According to the

K-line chart, the actual price is close to a local low,

and rebounded on the second trading day, heading

towards theoretical value.

Figure 1: K-line of Chongda Zhuan 2 (Wind database 2024).

4.5 Limitations Analysis

In the empirical analysis based on historical data, no

transaction costs were considered. Therefore, the

actual rate of return drops when transaction costs are

considered. Furthermore, a tiny discrepancy between

the real price and the theoretical value does not

always indicate an opportunity for arbitrage because

the Black-Scholes model cannot adequately capture

the inherent value of convertible bonds (Zhenghang

2020).

The market price of convertible bonds is

influenced by numerous factors, including corporate

development status, market supply and demand,

alternative financial products, market sentiment, and

other factors that are difficult to quantify (Wind

database 2024). Therefore, pricing and arbitrage

strategies based on the Black-Scholes model cannot

perfectly describe the price and changing trends of

convertible bonds. Therefore, specific issues need to

be analyzed in detail. For convertible bonds that

have a high probability of triggering a forced

redemption clause, it is also necessary to consider

the impact of the forced redemption clause on the

price of convertible bonds.

5 CONCLUSION

Convertible bond values are separated into two

categories: option values and pure bond values.

Thus, convertible bonds can be priced and arbitraged

using the Black-Scholes model. The primary

determining elements in the BS model-based

convertible bond pricing model are the stock price,

stock price volatility, conversion price, remaining

term, risk-free interest rate, etc. This article verifies

that this model has a reference value for investors to

find convertible bond investment targets by taking

the convertible bond Chongda zhuan 2 as an

example. Although the theoretical value calculated

by this model cannot perfectly correspond to the

actual value, it is of reference significance for

predicting the price change trend of convertible

bonds.

REFERENCES

L. Wenshi, Master's thesis, Hunan University, (2022).

Z. Zhao, Master's thesis, Huazhong University of Science

and Technology (2022).

J. Junbo, Master's thesis, Dalian University of Technology,

(2021).

L. Zaiqiao, Business Accounting, (06), 32-38, (2023).

T. Leying, Master's thesis, East China Normal University,

(2022).

L. Yu, Finance and Financial, (01), 16-23, (2021).

L. Jinhua, L. Yujuan, Management and Administration,

(12),6-13, (2023).

Z. Zefeng, Master's thesis, Zhejiang University, (2023).

Wind database, “K-line of Chongda Zhuan”, 2024,

available at http://www.wind.com.cn/

Empirical Analysis of Convertible Bond Pricing and Arbitrage Based on Black-Scholes Model

135

X. Zhenghang, Master's thesis, Zhejiang University,

(2020).

T. Cuicui, Master's thesis, Hebei University of

Technology, (2022).

ICDSE 2024 - International Conference on Data Science and Engineering

136