Prediction of Bank Fixed Deposits Based on Logistic Regression

Fei Xie

School of Accounting, The Australian National University, Canberra, 2601, Australia

Keywords: Prediction, Fixed Deposits, Logistic Regression.

Abstract: Fixed deposits, as the main source of bank funds, are also a prerequisite for the safety of bank operations and

good market liquidity. Having more deposits is more conducive to the various investments of banks and the

stable development of the national economy, and whether customers will participate in the fixed deposit

business has become a focus of research by scholars from various countries. Logistic regression, as a typical

binary discrimination method, is highly favored by scholars from various countries in terms of accuracy and

interpretability. This article uses logistic regression to analyze the factors of customers themselves and the

effectiveness of telemarketing and establishes a mathematical model, achieving good results with an accuracy

of 89%, which has the significance of guiding customer selection. Meanwhile, this article believes that if more

accurate data can be obtained and psychological data on personality, emotions, and other aspects can be added,

the model's accuracy will be further improved.

1 INTRODUCTION

Deposits are a prerequisite for ensuring the safety of

bank operations and good market liquidity. For banks,

customer deposits are the main source of funds and

the foundation for conducting other businesses.

Having more deposits means that banks can have

more funds to invest and lend to various types of

income, which is beneficial for the banks themselves

and the stable development of the national economy

(Yang, 2014).

With the development of the Internet and

computer hardware, banks have more and more

customer information and data. To provide customers

with better and more considerate services, banks can

use this big data to identify customers with deposit

intentions and preferences, abandon targeted

marketing for some unwilling customers, and focus

on targeted marketing for willing customers. This not

only preserves the majority of deposit customer

sources, allowing bank deposits to remain stable but

also reduces the consumption of human and material

resources on unintended customers, thereby

improving the bank's efficiency (Deng 2023).

Telemarketing, as a product of technological

development, is a two-way communication method

that uses the phone to communicate with target

customers. People can accurately convey information

or requests to each other through the phone, which

has now become an essential marketing method for

major enterprises. Major commercial banks also

established telephone service projects as early as the

late 1990s. This year, major commercial banks have

mainly divided their telephone marketing methods

into two types: one is to actively contact customers

for telephone marketing, and the other is to passively

wait for customers to contact them before conducting

telephone marketing. The first marketing method is

mainly initiated by banks, promoting products based

on pre-acquired customer information and further

understanding customer needs; The second type is

initiated by the customers themselves, such as

product inquiries, confirmations, and complaints.

Telemarketing is believed to have been proposed

by American scholar Juic Freestone in the 1970s.

Since its development, it has become a research focus

for domestic and foreign scholars to achieve precision

marketing. At first, research on telemarketing focused

on theory and techniques. Cain summarized

regulatory legal norms related to telemarketing and

regulated marketing contract issues (Cain 1996).

Mann provided a detailed introduction to the specific

process of telemarketing (Mann 2006). Hurst

proposed nine tips for telemarketing in 2008.

Subsequently, with the development of data mining

technology, more and more researchers began to

combine telemarketing with data mining.

Accordingly, they proposed many research methods,

Xie, F.

Prediction of Bank Fixed Deposits Based on Logistic Regression.

DOI: 10.5220/0012842900004547

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Data Science and Engineering (ICDSE 2024), pages 189-195

ISBN: 978-989-758-690-3

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

189

further improving the success rate of telemarketing.

Hyeon used Bayesian network models to predict

customer responses to bank telemarketing and

designed a decision system to provide real-time

decision support (Hurst 2008, Ahn & Ezawa 1997).

Elsalamony applied logistic regression, a naive

Bayesian algorithm, and a neural network model to

analyze marketing effectiveness (Elsalamony 2014).

Kim classified customers and used convolutional

neural network models, decision tree models, and

logistic regression models to predict the probability

of successful customer marketing under different

classifications, to find the optimal model for

predicting telemarketing effectiveness (Kim et al.

2016). Jiang compared the predictive performance of

various models on bank deposit data and found that

the Forest model is one of the best-performing models

in predicting this type of data (Jiang 2021). Liu

proposed a fuzzy support vector machine (SVM)

model and compared it with traditional SVM models

regarding prediction performance. The results

showed that the newly proposed fuzzy SVM model

had better prediction performance (Liu et al. 2017).

Jiang used various classification models such as

Bayesian and logistic regression to predict the

optimal consumer group for telemarketing and

provided some suggestions for refined management

and services of banks (Jiang 2018). Chun improved

the unsupervised learning Kohonen network and

proposed a Kohonen-supervised learning network

model for telemarketing prediction (Yan et al. 2020).

2 METHODOLOGY

2.1 Data Sources

The data in this article is taken from the direct

marketing activity data of bank fixed deposits on the

Kaggle website, including two datasets: the training

set and the test set, with 45211 pieces of data in the

training set and 4521 pieces of data in the test set. This

data includes data related to direct telemarketing

activities carried out by Portuguese banking

institutions and a collection of various customer

information data. This article will perform logistic

regression on the training set to determine the model,

and then use the test set to test the accuracy of the

model in determining whether customers will choose

to engage in fixed deposit business.

2.2 Variable Selection

This study aims to predict whether customers will

engage in fixed deposit business. Therefore, the

dependent variable y is whether customers choose a

fixed deposit business, and it is a 0-1 variable. The

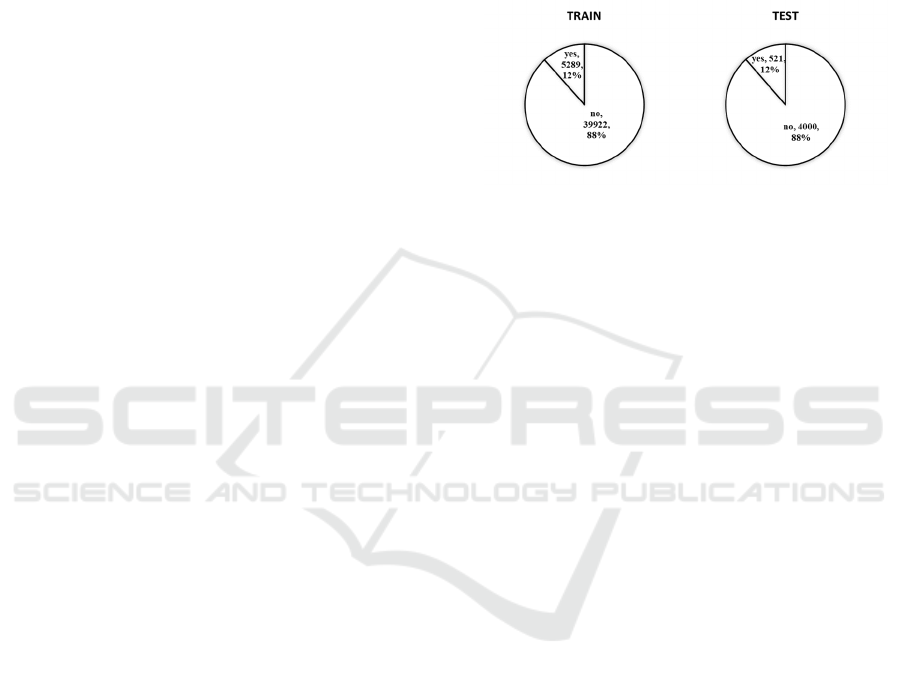

proportion of y in the two datasets is shown in Figure

1.

Figure 1: The proportion of fixed deposits (Picture credit:

Original).

From the above figure 1, it can be seen that the

majority of customers refuse to make fixed deposits,

and the distribution of the proportion in the training

and testing sets remains consistent. The independent

variables are divided into two parts. The first part is

customer-related data, including 8 items such as age,

work, and marital status, as shown in Table 1.

From the below table, it can be seen that there are

more middle-aged people aged 30 to 40 in terms of

age distribution. In terms of year-end deposit balance

in banks, there are both large deposits and large

liabilities, and overall, customers have a positive

year-end deposit balance. In terms of work, there are

more Blue-collar and Management, both exceeding

20%, and almost all have stable sources of income. In

terms of marital status, more than half of married

individuals have a relatively happy overall family

situation. In terms of education, there is almost no

illiteracy, and more than half of the clients have

reached the secondary level with a high level of

education. In terms of credit, only a few customers

have default records. At the same time, the number of

customers with or without housing loans remains

relatively stable, while the majority of customers do

not have personal loans.

The second part is the telemarketing data for the

customer, including the customer's contact

information, the month and date of the last contact of

the year, and a total of 8 items of data. The interval

between the previous two marketing activities is -1,

indicating that they have not been contacted before,

as shown in Table 2.

ICDSE 2024 - International Conference on Data Science and Engineering

190

Table 1: Customer Related Data.

Index

Descri

p

tive Statistics

Mean Mode Maximum Minimum

A

g

e 40.94 32 95 18

Balance/€

(

Avera

g

e annual account balance

)

1362 0 102127 -8019

Job

Admin (11.44%); Blue-collar (21.53%); Entrepreneur (3.29%);

Housemaid (2.74%); Management (20.92%); Retired (5.01%);

Self-employed (3.49%); Services (9.19%); Student (2.07%);

Technician

(

16.80%

)

; Unem

p

lo

y

ed

(

2.88%

)

; Unknown

(

0.64%

)

Marital

Divorced (11.52%); Married (60.19%); Single (28.29%)

Education Primar

y

(

15.15%

)

; Secondar

y

(

51.32%

)

; Tertiar

y

(

29.42%

)

; Unknown

(

4.11%

)

Default

(If having a record of breach of contract)

N

o (98.18%); Yes (1.82%)

Housing

(If having a housing loan)

N

o (44.42%); Yes (55.58%)

Loan

(If having a personal loan)

N

o (83.98%); Yes (16.02%)

Table 2: Telemarketing Data.

Index

Descriptive Statistics

Mean Mode Maximum Minimum

Day

(The last contact date of the year)

15.81 20 31 1

Duration/second

(Last communication time)

258.16 124 4918 0

Campaign

(The number of contacts)

2.76 1 63 1

Pdays/day

(Time interval between last contact)

40.18 -1 871 -1

Previous

(Accumulated contact times)

0.58 0 275 0

Contact Cellular

(

64.77%

)

; Tele

p

hone

(

6.43%

)

; Unknown

(

28.80%

)

Month

(The month of the last contact of the year)

Jan (3.10%); Feb (5.86%); Mar (1.06%); Apr (6.49%);

May (30.45%); Jun (11.81%); Jul (15.25%); Aug (13.82%);

Se

p

t

(

1.28%

)

; Oct

(

1.63%

)

; Nov

(

8.78%

)

; Dec

(

0.47%

)

Poutcome

(

The results of the last marketin

g

cam

p

ai

g

n

)

Failure (10.84%); Other (4.07%); Success (3.34%); Unknown (81.75%)

From the table above, it can be seen that the bank's

telemarketing time can reach 2 to 4 minutes, allowing

for simple introductions and communication with

customers. For this telemarketing client, there are

many new customers. For old customers, banks

usually maintain contact once a month or so to

maintain customer stickiness. Overall, banks will

make 2-3 contacts with each customer to ensure that

marketing activities are communicated to them. In

terms of contact information, most customers are

accustomed to using cellular, which is more

convenient and also makes it easier for the bank to

contact the customers themselves. In terms of contact

months, banks prefer to contact customers in May,

with much more contact times than in other months.

From the previous marketing results, it can be seen

that the number of customer rejections to marketing

activities is much higher than the number of

acceptances. At the same time, the vast majority of

the previous marketing results are unknown,

indicating that it is highly likely that these customers

have refused to contact the bank, so they will no

longer handle any business with the bank in the

future.

2.3 Model Selection

Because the data results in this article are only binary

data for "accepting fixed deposit projects" and "not

accepting fixed deposit projects", the direct linear

regression method does not apply to the data in this

article, and the logistic regression method should be

used instead.

Prediction of Bank Fixed Deposits Based on Logistic Regression

191

Logic functions were initially introduced by

Belgian mathematician Pierre François Verhulst in

the mid-19th century as a tool for modeling the

growth of biological numbers. Logistic regression, as

a method of processing binary data, usually performs

well and is the most commonly used and simplest

analysis method. The formula for the logistic

regression model is as follows:

𝑃𝑟

𝑌=1

|

𝑋

=

⋯

⋯

(1)

By transforming it, it can be concluded that:

𝑌=1

𝑋

𝑌=1

𝑋

=𝑒

⋯

(2)

At this point,

𝑌=1

𝑋

𝑌=1

𝑋

is called the

probability ratio. By taking the logarithm of both ends

of the equation, it will become to:

𝑙𝑜𝑔

𝑌=1

𝑋

𝑌=1

𝑋

=𝛽

+𝛽

𝑥

+⋯+

𝛽

𝑥

(3)

At this point, the right end of the equation

becomes a general linear model, and its coefficients

can be explained. Meanwhile, the random forest

method has relatively better results in data

classification, so this article selects random forest as

a method for comparison.

Random forest generates a large number of

decision trees by sampling sample units and

variables. For each sample unit, all decision trees

classify it sequentially. The mode of all decision tree

prediction categories is the prediction result of the

random forest for that unit.

3 RESULTS AND DISCUSSION

3.1 Data Processing

Because the data selected in this article as

independent variables such as Job and Education are

categorical data, which is not conducive to the

process of logistic regression, this article will number

Job, Marital, Education, Contact, Month, and

Poutcome, with the unknown item numbered as 0.

The remaining projects are gradually numbered

according to their importance under this

classification, and the detailed numbering is shown in

Table 3.

From Table 3, it can be seen that the Poutcome

indicator is different from other indicators in that it

includes two situations: Failure and Other, so it is not

possible to simply sort them in natural number order.

This article believes that Failure should maintain the

same weight as Success, and the Other situation

should be better than Unknown. Therefore, the value

assigned to Failure is -2, while others are still

assigned normally.

Table 3: Number of Each Index.

Index Number Situation

Job

Unknown (0); Unemployed (1); Student

(2); Retired (3); Housemaid (4); Blue-

collar (5); Services (6);

Self-employed (7); Technician (8);

Management (9); Admin (10);

Entrepreneur (11)

Marital Divorced

(

1

)

; Sin

g

le

(

2

)

; Married

(

3

)

Education

Unknown (0); Primary (1); Secondary

(

2

)

; Tertiar

y

(

3

)

Contact

Unknown (0); Telephone (1); Cellular

(

2

)

Month

Jan (1); Feb (2); Mar (3); Apr (4); May

(5); Jun (6); Jul (7); Aug (8); Sept (9);

Oct (10); Nov (11); Dec (12)

Poutcome

Failure (-2); Unknown (0); Other (1);

Success (2)

3.2 Model Evaluation

The results obtained from logistic regression of the

above numerical variables are shown in Table 4:

Table 4: Logistic Regression Results for All Variables.

Index Coefficients z value Pr(>

|

z

|

)

(

Interce

p

t

)

-3.464 -26.628 0.000***

Age 0.003 2.241 0.025*

Job -0.022 -3.186 0.001**

Marital -0.155 -6.295 0.000***

Education 0.166 6.774 0.000***

Defaultyes -0.328 -2.029 0.042*

Balance 0.00002 4.679 0.000***

Housingyes -0.960 -25.268 0.000***

Loan

y

es -0.668 -11.640 0.000***

Contact 0.587 22.171 0.000***

Da

y

-0.005 -2.193 0.028*

Month -0.011 -1.699 0.089

Duration 0.004 64.387 0.000***

Campaign -0.131 -13.015 0.000***

Pda

y

s 0.003 16.927 0.000***

Previous 0.050 6.204 0.000***

Poutcome 0.524 27.433 0.000***

Note: *** ‘p<0.001’; ** ‘p<0.01’; * ‘p<0.05’

From the above table, it can be seen that at a 95%

confidence interval, only the Month indicator does

not meet the test criteria. This article believes that the

possible reason is that during the last time the bank

contacted customers, the number of contacts in mid-

May was much higher than in other months. As the

ICDSE 2024 - International Conference on Data Science and Engineering

192

month is close to the middle of the year, May is also

close to the middle position in the numbering system.

Therefore, its impact on the entire model is difficult

to explain with a simple linear trend and is not

significant in the test. The solution to this article is to

delete the indicator and rebuild the model to ensure

that all used indicators pass the test.

Table 5 shows the model validation results after

deleting Month: From table 5, it can be seen that in

the model after removing Month, the p-values of all

indicators are less than 0.05, indicating that the model

has passed the test and fits the data well. Chi-square

tests will be conducted on these two models to ensure

that the model still has the same degree of fit as the

full indicator model. The test results are shown in

Table 6.

From the chi-square test results in table 6, it can

be seen that the p-value is 0.08934, which is greater

than 0.05, and the result is not significant. Therefore,

it can be considered that the fitting degree of the

model without the Month indicator is as good as that

of the model with all indicators.

Table 5: Logistic Regression Results without Month.

Index Coefficients z value Pr(>|z|)

(Intercept) -3.506 -27.452 0.000***

A

g

e 0.003 2.113 0.035*

Job -0.023 -3.279 0.001**

Marital -0.156 -6.361 0.000***

Education 0.165 6.738 0.000***

Default

y

es -0.332 -2.051 0.040*

Balance 0.00002 4.573 0.000***

Housin

gy

es -0.953 -25.229 0.000***

Loanyes -0.670 -11.669 0.000***

Contact 0.582 22.108 0.000***

Day -0.005 -2.283 0.022*

Duration 0.004 64.382 0.000***

Campaign -0.132 -13.098 0.000***

Pda

y

s 0.003 17.112 0.000***

Previous 0.051 6.204 0.000***

Poutcome 0.523 27.409 0.000***

Note: *** ‘p<0.001’; ** ‘p<0.01’; * ‘p<0.05’

Table 6: The Chi-square Test

Df Deviance Pr(>Chi)

1 2.886 0.089

To ensure that the above logistic regression does

not have excessive deviation, which leads to singular

standard error tests and imprecise significance tests,

this article conducts an excessive deviation test on the

data after removing the Month indicator, with a value

of 0.52, which is far less than 1. Therefore, the above

logistic regression does not have excessive deviation,

and its results are reliable.

3.3 Explain Model Parameters

In logistic regression, the logarithmic odds ratio of the

response variable is y=1. Therefore, the meaning of

its regression coefficient is the change in the

logarithmic odds ratio of the response variable that

can be caused by a change in one unit of the predictor

variable when other predictor variables remain

unchanged. Due to the poor interpretability of the

logarithmic odds ratio, this article exponentiates it,

and the results are shown in Table 7:

Table 7: Exponential Coefficient.

Index Ex

p

onential Coefficient

(

Interce

p

t

)

0.0300

Age 1.0033

Job 0.9772

Marital 0.8554

Education 1.1790

Defaultyes 0.7178

Balance 1.0000

Housin

gy

es 0.3854

Loanyes 0.5118

Contact 1.7900

Day 0.9952

Duration 1.0040

Campaign 0.8767

Pda

y

s 1.0030

Previous 1.0518

Poutcome 1.6875

From the above table, it can be seen that the

impact of each indicator on whether the customer will

choose a fixed deposit project can be roughly divided

into three categories: almost no impact, slight impact,

and significant impact. Among them, the indicators

with almost no impact are Age, Job, Balance, Day,

Duration, Pdays, and Previous, and only Day has the

opposite direction of influence. These indicators are

data that are difficult to artificially change, such as

Age, and unpredictable data, such as Duration, which

have little impact on the final results. The indicators

with a slight impact are Marital, Education, Default,

and Campaign, which will subjectively affect the

judgment of customers. For example, if expenses

increase after marriage, customers are more willing to

choose current deposits for future needs. If the

number of contacts is too frequent within a certain

period, customers may feel bored, etc. The indicators

that have a significant impact are Housing, Loan,

Contact, and Poutcome, which are data that are highly

correlated with fixed deposits. If a customer has both

Prediction of Bank Fixed Deposits Based on Logistic Regression

193

a housing loan and a personal loan, it is almost

difficult for them to make a fixed deposit.

3.4 Model Prediction

Apply the above model parameters to the test set, and

mark the final calculation results less than or equal to

0.5 as 0 and the rest as 1. The confusion matrix can

be obtained as shown in Table 8:

Table 8: Confusion Matrix.

Prediction Cate

g

or

y

Real

Category

0 1

No 3916 84

Yes 390 131

According to the above table, the accuracy of the

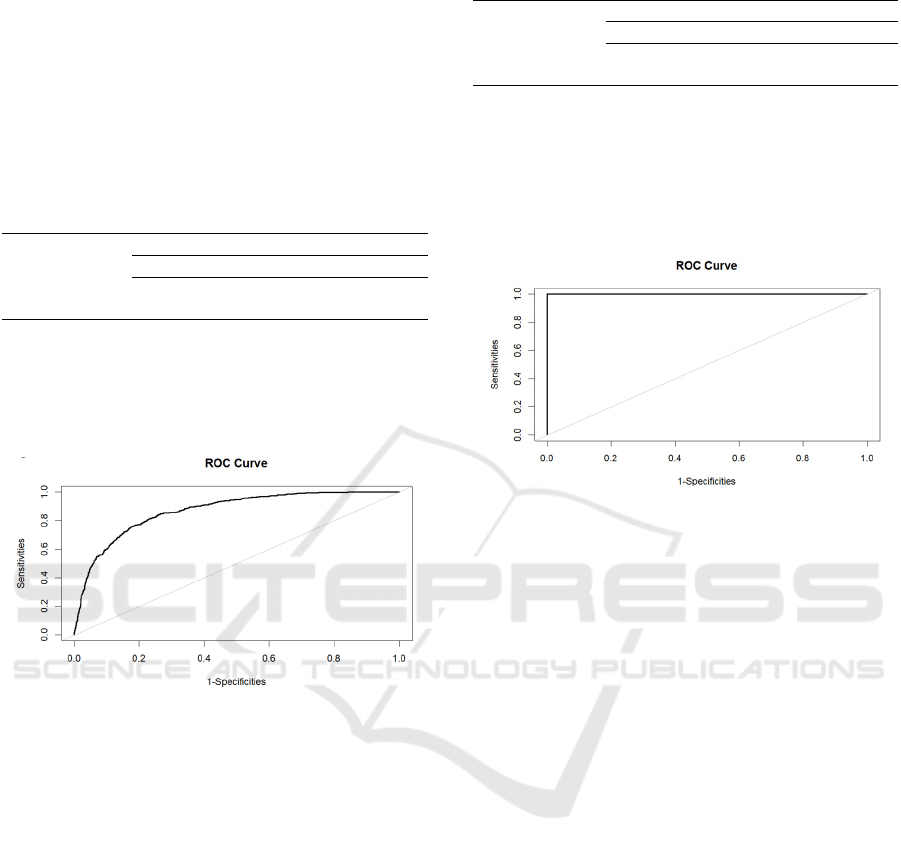

model is 89.52%, indicating strong predictive ability.

Meanwhile, based on this test, draw the receiver

operating characteristic (ROC) curve, as shown in

Figure 2:

Figure 2: The ROC Curve (Picture credit: Original).

The above figure 2 shows that the model has a

good prediction performance, with an area under the

curve (AUC) of 0.87, which is close to 1. Therefore,

it can be considered that the model has a good fitting

classification effect.

3.5 Random Forest

Meanwhile, this article also compared the random

forest method with logistic regression. Among them,

the random forest method in this article is to randomly

select 5 variables from each node of each tree and

generate 500 decision trees. The following is the

result of the operation using the random forest

algorithm. The confusion matrix is shown in Table 9:

Table 9: Confusion Matrix from Random Forest.

Prediction Cate

g

or

y

Real Category

0 1

No 4000 0

Yes 15 506

From the above table, it can be seen that the

random forest method has significantly improved the

prediction of results, with an accuracy of 99.67%. At

the same time, the ROC curve can also be obtained as

shown in Figure 3:

Figure 3: The ROC Curve from Random Forest (Picture

credit: Original).

The ROC curve shown in the above figure

indicates that the accuracy of the random forest

method is very good, and its AUC is almost 1.

Therefore, it can be said that this method perfectly

solves the problem of determining whether customers

will engage in a fixed deposit business.

Overall, the random forest method is superior to

ordinary logistic regression methods. On the

confusion matrix, the random forest method did not

make any errors in determining whether customers

would make fixed deposits, indicating that the model

believes that customers who make fixed deposits will

make fixed deposits, and there are very few

unclassified customers. Its model has high accuracy

and can be used to accurately determine whether

customers will engage in fixed deposit projects.

3.6 Discussion

Although the above model has passed the test and

achieved good accuracy in testing, there are still some

issues that have not been resolved in this article.

Firstly, the effectiveness of individual indicators is

insufficient. Due to the customer's desire to protect

their privacy and the bank's respect for their privacy

rights, there is always an unknown situation in the

collection results of many indicators, and even under

the Poutcome indicator, the proportion of Unknown

ICDSE 2024 - International Conference on Data Science and Engineering

194

exceeds 80%. Although this article believes that the

situation of Unknown is inevitable and cannot be

simply removed from the results to ensure the validity

of all information, if the information contained in the

collected indicators can be ensured as much as

possible, the model will also be more accurate and

credible. Secondly, the data collection is not

comprehensive enough. Whether to engage in fixed

deposit business is a subjective choice, which is easily

influenced by subjective factors such as the

customer's personality and emotions. However, the

indicators selected in this article are mostly objective

data. Although the data in this article has good

detection results, if this aspect of data can be added,

the model should have better accuracy. Third, the

model is not universal. Since the data selected in this

article is from a Portuguese bank, it may only apply

to that bank or country. For other banks or countries,

it only guides at the modeling level and cannot truly

be used for customer identification.

4 CONCLUSION

Based on the research results of this article, the

following conclusion can be drawn: using logistic

regression to analyze customer data of Portuguese

banks can provide a guiding model to determine

whether customers will handle fixed deposit business.

At the same time, among the selected indicators,

whether there is a housing loan, whether there is a

personal loan, contact information, and the results of

the last marketing activity have the greatest impact on

whether to handle fixed deposit business. Customers

who have housing loans and personal loans are less

likely to apply for fixed deposit services, while

customers who use convenient communication

devices and participated in the last marketing

campaign are more willing to apply for fixed deposit

services.

Through the research in this article, some

suggestions can be provided. For banks, the focus of

engaging customers in the fixed deposit business is

not on obvious indicators such as fund-related data,

but on how to make good use of factors that are not

easy to detect but can affect the results, such as the

number of contacts. For old customers, more contact

times can provide stronger customer stickiness, while

for new customers, more phone calls may only lead

to boredom. Only in this way can banks retain old

customers as much as possible while seizing potential

customers, increasing their fixed deposits, and thus

gaining more benefits. In addition, whether customers

will handle fixed deposit business is a subjective

choice, and factors such as emotions and personality

can be considered to obtain a more accurate model.

REFERENCES

B. Deng, Science Technology and Industry 23(10), 151-157

(2023).

C. G. Hurst, Direct Marketing An International Journal 2(2),

111-124 (2008).

C. Yan, M. X. Li and W. Liu, Applied Soft Computing

Journal 92(2), 106-109 (2020).

H. A. Elsalamony, International Journal of Computer

Applications 85(7), 12-22 (2014).

J. H. Ahn and K. J. Ezawa, Decision Support Systems 21(1),

21 (1997).

J. N. Mann, Process for telemarketing: US, (2006).

J. R. Yang, Financial Regulation Research 12, 12 (2014).

K. H. Kim, et al., IEEE 25(7), 314-317 (2016).

M. Liu, Y. M. Yan and Y. D. He, Springer International

Publisher 6(1), 190-197 (2017).

R. M. Cain, Journal of Public Policy and Marketing 15(1),

135-141 (1996).

X. X. Jiang, Jiangsu Communication 6, 72-74 (2021).

Y. Y. Jiang, International Journal on Data Science and

Technology 4(1), 35-41 (2018).

Prediction of Bank Fixed Deposits Based on Logistic Regression

195