Ensembled Learning Based Model for Bank Churn Prediction

Jieyuan Deng

1

a

*

, Junda Huang

2

b

, Dongliang Liu

3

c

and Shaohan Yang

4

d

1

Nanjing University of Posts and Telecommunications, 9 Wenyuan Road, Qixia District, Nanjing, Jiangsu, China

2

South China University of Technology, 382 Waihuan Dong Road, Panyu District, Guangzhou, Guangdong, China

3

HDU-ITMO Joint Institute, Hangzhou Dianzi University, 1158 2nd Street, Qiantang District, Hangzhou, Zhejiang, China

4

Rosedale Global High School, 7030 Woodbine Ave #800, Markham, Canada

Keywords: Machine Learning, Ensemble Learning, Neural Network, Bank Customer Churn Rate.

Abstract: Predicting customer churn rate helps banks retain customers, stabilize their market position, and improve

services, providing a better customer experience for both parties, especially for developed countries. Although

various scholars have conducted different studies in various locations, there has been no rigorous research on

predicting bank customer churn. The purpose of this study is to develop a satisfactory predictive model to

forecast the probability of customer churn for banks, providing reliable references for numerous banks. This

paper implements various machine learning methods and deep learning models, including Logistic Regression,

Random Forest, Neural Network, XGBoost, Decision Tree, Gradient Boosting, and Ada Boost. Among all

models, the combination of Random Forest and Neural Network achieved the best results, with an adjusted

recall1 of 0.6 and precision0 of 0.9. In addition, we used insights obtained from these powerful ensemble

learning models to analyze factors leading to bank customer churn.

1 INTRODUCTION

In recent years, neural network models for customer

churn prediction have garnered attention due to their

superior nonlinear modeling capabilities. Neural

network models simulate the workings of the human

brain's neural system, possessing characteristics such

as adaptability, nonlinearity, and parallel processing,

which make them well-suited to handling the

complexities of customer churn prediction. By

training neural networks on bank customer data, we

can more accurately predict customer churn and

devise corresponding retention strategies (Tang,

2021).

This paper takes Germany, France, and Spain as

examples, three regions belonging to developed

countries with thriving economies and intensely

competitive financial service markets. These regions

offer a good case study for this research, given the

diverse and mature range of services provided by

banks to customers. The aim of this study is to

a

https://orcid.org/0009-0004-1145-4291

b

https://orcid.org/0009-0008-6833-795X

c

https://orcid.org/0009-0002-1145-3470

d

https://orcid.org/0009-0004-7455-7909

leverage machine learning technologies to construct

precise customer churn prediction models for banks.

The structure of this paper is as follows: Section 2

introduces peer-reviewed works related to customer

churn prediction by showcasing various categories.

Section 3 provides detailed insights into the methods

chosen, reasons for their selection, and theoretical

introductions to these methods. Subsequently, in

Section 4, experimental results are examined and

analyzed. Last but not least, the conclusions of this

study are outlined in Section 5, followed by

references.

2 RELATED

WORK

The customer churn rate is determined by many

factors such as credit score, tenure, balance and

estimated salary. With the continuous advancement

of new technologies, more and more machine

learning technology has been applied to the forecast

10

Deng, J., Huang, J., Liu, D. and Yang, S.

Ensembled Learning Based Model for Bank Churn Prediction.

DOI: 10.5220/0012887100004508

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Engineering Management, Information Technology and Intelligence (EMITI 2024), pages 10-15

ISBN: 978-989-758-713-9

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

model of customer churn (Li, 2019). Scholars around

the world have conducted a lot of inquiry in this

regard so that the models can predict more accurately

(Wang 2022, Chandar 2006).

Hu proposed that the problem of customer churn

of retail banks can be used for research and solution

with data mining technology. Chandar et al. used

three algorithms (CART, C5.0 and TreeNet) to

predict the churn of bank customers. It was found

ultimately that the classification prediction of the

CART algorithms was the best. To deal with

imbalanced data, Wangyu Liao (2012) used the

improved Boosting method, proving that the

improved Boosting method has enhanced the ability

of model processing imbalanced data, and reduced

the predictive deviation caused by the imbalance of

the data set (Liao, 2012). Huang et al. proposed

understandable support vector machine, and at the

same time, he used simple Bayez tree to build a

customer loss model, which has high accuracy in

prediction (Huang, 2014). On the basis of the use of

support vector machine algorithms, He et al. also

explored the prediction of commercial bank customer

churn. Focusing on data imbalances, the model is

further improved by random samples method, and the

results show that the method can significantly

improve the accuracy of the model forecast (He,

2017). Huang et al. proposed an algorithms that

combines Particle Swarm Optimization and Back

Propagation to establish a warning model of corporate

customer churn (Huang, 2018). However, the Back

Propagation has a lot of disadvantages, such as unable

to converge quickly, high possibility of caught in

local minimum. Swetha P and Dayananda B proposed

the Improvized-XGBOOST model with feature

functions for the prediction of customer churn. The

result illustrates that the model is more efficient and

it can be suitable for complex data sets (Swetha,

2020).

It can be seen from the above that many scholars

have conducted a series of related studies on customer

churn, while most of the studies used a variety of

single models to build the customer churn predictive

model, having achieved some results.

3 METHODOLOGIES

3.1 Data Preprocessing

The complexity of data types and their internal

correlations, and the disunity of data quality will have

a negative impact on data interpretation and analysis.

Data preprocessing is a crucial step in the process of

machine learning. The quality of the data greatly

affects the outcome of the machine learning model. It

includes data cleaning, data integration, data

conversion, data reduction and other steps. Through

these steps, the accuracy, interpretability and

robustness of the model can be improved. In this

research, the process of data preprocessing includes

five parts: deleting redundant features, performing

one-hot encoding of text information, processing

missing values, scaling features, and using SMOTE

method to balance the data set. In addition, the

original dataset is split into a training set (80%) and a

test set (20%).

Deleting Redundant Features

Redundant features will increase the computational

complexity of model training. Deleting redundant

features can reduce the computational cost and

improve the efficiency of the model. In this research,

Surname and CustomerID were removed from

features, because they duplicate RowNumber.

Performing One-Hot Encoding of Text

Information

The text information in the feature quantity is one-hot

encoded, aiming to convert the text information into

a numerical type. In addition, one-hot encoding can

prevent the model from having a preference for

values of different sizes, thus affecting the accuracy

of the model. In this research, one-hot encoding is

applied to the geographical location and gender in the

feature quantities to help the model better understand

and utilize classification information.

Processing Missing Values

Missing values will cause the model to lack effective

information during training and prediction, thereby

reducing model performance. Therefore, filling in

missing values in the data set can improve the

stability and interpretability of the model. In this

research, missing values only appear in

HasCreditCard and Is ActiveMember. Considering its

actual meaning, that is, whether the users have credit

cards and whether they are active users, 0 is used to

fill the missing values.

Scaling Features

Feature scaling can prevent some feature values from

being too large, causing these features to overly affect

the prediction results. In this research,

StandardScaler is used to normalize numerical

features to ensure they have the same scale.

Ensembled Learning Based Model for Bank Churn Prediction

11

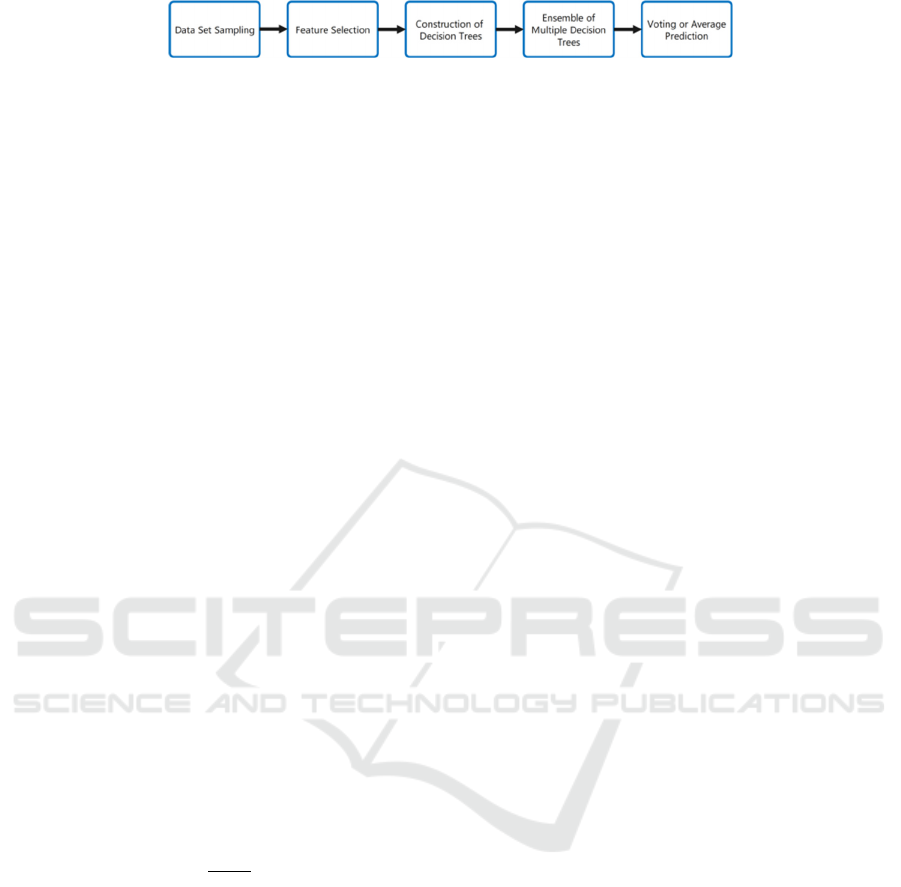

Figure 1: Random forest model training process (Photo/Picture credit : Original ).

SMOTE Method Balance the Dataset

In unbalanced data sets, SMOTE method can be used

to solve the overfitting problem of random

oversampling method. SMOTE mainly balances the

sample distribution of different categories by

synthesizing some new minority class samples. In

this research, through data analyzing, it is evident that

the number of people who have not exited is much

greater than the number of people who have quit.

Therefore, SMOTE method is used to balance the

dataset.

3.2 Model Selection and Construction

3.2.1 Logistic Regression

Logistic regression is a generalized linear regression

analysis model. In practical applications, it mainly

solves binary classification problems. The logistic

regression model first performs a weighted

summation of the input features and adds an offset

term (intercept term) to obtain a linear combination.

𝑧𝛽

𝛽

𝑥

𝛽

𝑥

...𝛽

𝑥

(1)

where z is the linear output, 𝛽

is the intercept,

𝛽

, 𝛽

,...,𝛽

are the feature weights, and

𝑥

, 𝑥

,...,𝑥

are the input features.

This linear combination is used to represent the

log odds of the dependent variable. It then transforms

the results obtained from the linear regression model

through a non-linear sigmoid function,

𝑝

(2)

where p is the probability of the event occurring,

and e is the base of the natural logarithm. Sigmoid

function produces values within the range [0, 1].

Setting the threshold to 0.5, achieving binary

classification by comparing the results with the

threshold.

3.2.2 Random Forest

Random forest is an algorithm that integrates multiple

decision trees using the idea of ensemble learning.

Relevant studies show that the random forest model

has a good performance in processing large-scale

data, and can handle both discrete data and continuous

data (Sandeepkumar, 2020). Due to attribute

perturbation, the initial performance of random forest

is inferior to that of decision tree. However, when the

number of base learners is large, the random forest

will converge to a lower generalization error. In

addition, random forest has stable performance and

good noise resistance, because each tree randomly

selects samples and its features. As for the dataset in

this research, which contains about 10,000 pieces of

data, using random forest model is an effective

method. The basic flow of random forest model is

shown in figure 1.

3.2.3 AdaBoost

AdaBoost is an ensemble learning algorithm used for

binary classification problems. It constructs a strong

classifier by combining multiple weak classifiers,

each of which is relatively simple and performs

slightly better than random guessing.

The basic principle of AdaBoost is to iteratively

learn a series of weak classifiers and combine them

based on their performance to obtain a more accurate

classifier. In each iteration, AdaBoost adjusts the

weights of the samples based on the classification

results of the previous models, focusing more on the

samples that were previously misclassified. Through

multiple iterations, AdaBoost gradually learns a

strong classifier with high classification accuracy.

3.2.4 XGBoost

XGBoost (eXtreme Gradient Boosting) is a powerful

machine learning algorithm widely used in regression

and classification problems. It is an ensemble learning

model based on decision trees that improves the

predictive capacity of the model through boosting.

Firstly, Since XGBoost employs parallel

computing techniques and optimized algorithms,

making it efficient in handling massive data and large-

scale features, it has high performance in both training

speed and model prediction speed. In addition,

XGBoost can handle various types of feature

variables, including discrete and continuous features.

It also supports custom loss functions, providing

flexibility to adapt to different problems and tasks.

Moreover, XGBoost introduces regularization terms

to control the model complexity and prevent

overfitting. The regularization terms include L1

regularization and L2 regularization, allowing the

model to generalize better to new data. XGBoost can

also calculate feature importance or weights, helping

EMITI 2024 - International Conference on Engineering Management, Information Technology and Intelligence

12

users understand the prediction process of the model.

By ranking feature importance, it can identify the

most influential features in predicting the outcome.

4 EXPERIMENT

4.1 Dataset Overview

This paper utilizes the Bank Customer Churn

Prediction from Kaggle, which contains information

on bank customers who either left the bank or

continue to be a customer. Each entry in the dataset

consists of 13 attributes (shown in Table 1).

Table 1: Description of Attributes in the Dataset.

Attribute Description

CustomerId

A unique identifier for each

custome

r

Surname

The customer's surname or last

name

CreditScore

A numerical value representing the

customer's credit score

Geography

The country where the customer

resides (France, Spain or Germany)

Gender

The customer's gender (Male or

Female

)

Age

The customer's age.

Tenure

The number of years the customer

has been with the bank.

Balance

The customer's account balance.

NumOfProducts

The number of bank products the

customer uses (e.g., savings

account, credit card).

HasCrCard

Whether the customer has a credit

card

(

1 =

y

es, 0 = no

)

.

IsActiveMember

Whether the customer is an active

member

(

1 =

y

es, 0 = no

)

.

EstimatedSalary

The estimated salary of the

customer.

Exited

Whether the customer has churned

(

1 =

y

es, 0 = no

)

.

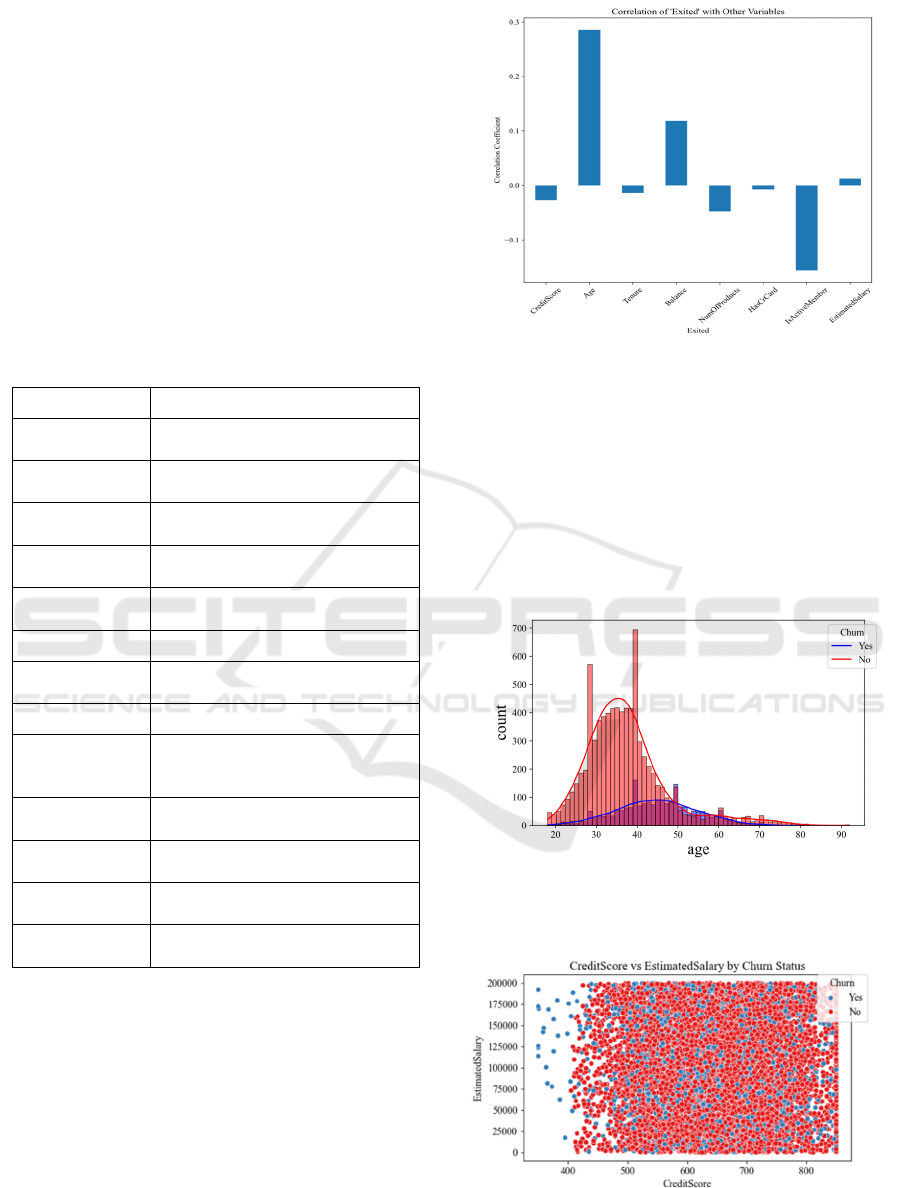

In the hope of selecting features that are

conducive to classification, correlation between

Exited and other attributes is explored.

Figure

2:

Correlation Between

‘

Exited’ and Other

Attributes (Photo/Picture credit: Original.

As is shown in figure 2, the four attributes—Age,

IsActiveMember, Balance, and NumOfProducts—

have a relatively high correlation with Exited.

4.2 Data Exploration

We conducted analysis of the dataset according to

the correlation (Figure 3 and figure 4).

Figure

3: The correlation between age and credit

(Photo/Picture credit : Original).

Figure 4:

Credit

Score vs Estimated Salary

(Photo/Picture credit: Original).

Ensembled Learning Based Model for Bank Churn Prediction

13

According to the figure 3 and figure 4, the age of

churned customers is concentrated between 40 and 50

years old. Customers with a credit score below 400

are all churned customers.

4.3 Experimental Settings

In this research, all models were implemented in

Python 3.9.13 environment, with Pandas, Scikit-

Learn, Tensorflow and XGBoost packages.

The parameter settings for each model we used are

as follows:

Logistic Regression

The LogisticRegression class implemented in

Python's scikit-learn library is utilized, with the

default parameters.

Random Forest

The Random Forest model took advantage of a

total of 100 trees, and the split criterion is gini.

Gini

D

1 𝑝

(3)

AdaBoost

Stagewise Additive Modeling using a Multiclass

Exponential loss function, Real version (SAMME.R)

is utilized in the model, with 50 estimators.

XGBoost

The booster we choose in the XGBoost model is

gbtree, and a total of 100 gradient boost trees are

utilized. The objective function is logistic.

Neural Network

In our research, a 3-layer deep neural network is

implemented.

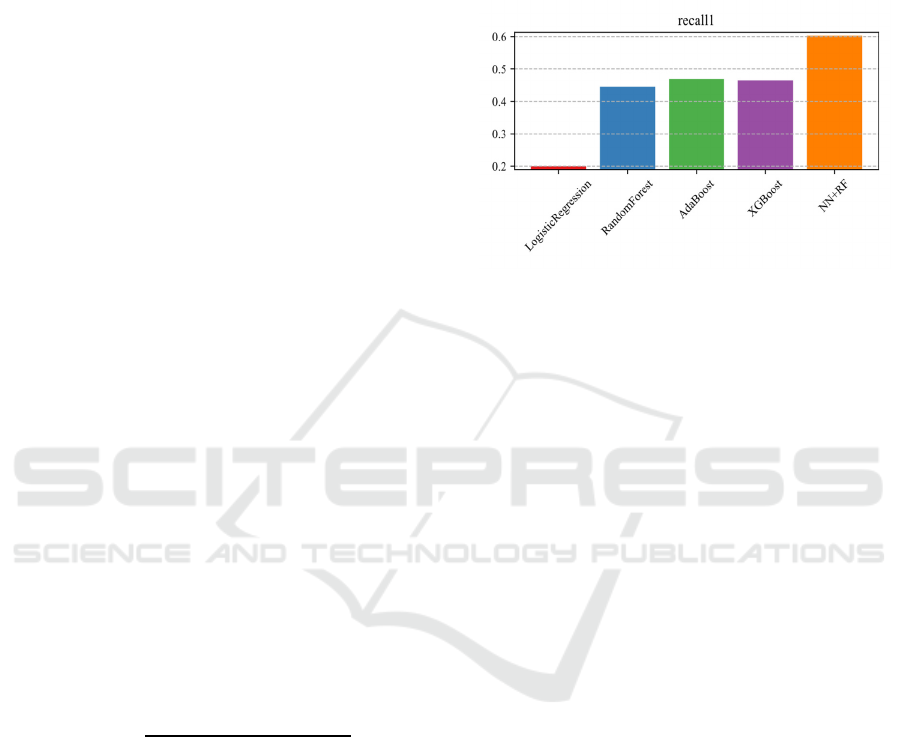

4.4 Modal Evaluation

The primary objective is to improve Recall 1 since

the goal is to predict customer churn.

𝑅𝑒𝑐𝑎𝑙𝑙

(4)

Among all the models, as expected, Logistic

Regression model performed the worst because of the

characteristic of the dataset (Figure 5). Even though

other three models (RandomForest, AdaBoost,

XGBoost) gained relative fair score, NN+RF yield

satisfying result, and outperform all other models

with respect to Recall 1. Deep-learning methods are

representation-learning methods with multiple levels

of representation, obtained by composing simple but

non-linear modules that each transform the

representation at one level (starting with the raw

input) into a representation at a higher, slightly more

abstract level (LeCun, 2015). Given that neural

networks consist of multiple neurons and hidden

layers, providing high flexibility and non-linear

expressiveness. They can learn complex patterns and

relationships, enabling better adaptation to training

data. In contrast, random forests, AdaBoost, and

XGBoost are decision tree-based methods with

relatively weaker performance.

Figure 5:

The

result of Recall1 (Photo/Picture credit :

Original).

5 CONCLUSION

In conclusion, this paper combines machine learning

and deep learning to seek an appropriate method for

predicting the probability of bank customer churn.

The models employed include Logistic Regression,

Random Forest, Neural Network, XGBoost, Decision

Tree, Gradient Boosting, and Ada Boost. Among all

these models, the ensemble learning approach

combining Random Forest and Neural Network

yielded the best results in predicting bank customer

churn rate, achieving satisfactory outcomes with a

recall1 value of 0.6 and a precision0 value of 0.9.

Another advantage of ensemble learning methods is

their ability to assess the relative importance of each

attribute during training. Experimental results

indicate that the customer's age, geographic location,

account balance, active membership status, and the

number of bank products used are the top five

significant features influencing bank customer churn.

The paper also explains how these factors can be

utilized to devise different strategies in real-world

scenarios to address bank customer churn.However,

the dataset only includes three regions and may not be

fully applicable to every country. Additionally,

obtaining relevant bank-related data can be quite

challenging, as it is only accessible through public

platforms. Therefore, predicting bank customer

behavior based on this dataset may not be

comprehensive enough. It is hoped that future

research will optimize existing problems and

algorithms to reduce sensitivity to class imbalance

data and improve churn prediction accuracy. churn.

EMITI 2024 - International Conference on Engineering Management, Information Technology and Intelligence

14

The paper also explains how these factors can be

utilized to devise different strategies in real-world

scenarios to address bank customer churn.

AUTHORS CONTRIBUTION

All the authors contributed equally and their names

were listed in alphabetical order.

REFERENCES

Chandar M., Laha A, Krishna P. 2006. Modeling Churn

Behavior of Bank Customers Using Predictive Data

Mining Tools, Business Intelligence Journal,5(1):96-

101.

He, B, L., Y. Shi, Q. Wan, et al. 2014. Prediction of

Customer Attrition of Commercial Banks Based on

SVM Model. Procedia Computer Science. 31(3),

423~430.

Huang, K.Z., D.Zheng, J.Sun, et al. 2014. Sparse Learning

for Support Vector Classification. Pattern Recognition

Letters,31(13),1944~1951.

Huang, J.F.and L.L.H, 2018. Application of Improved PSO-

BP Neural Network in Customer Churn Warning.

Procedia Computer Science,131.1238~1246.

LeCun, Y., Bengio, Y. & Hinton, G. 2015. Deep learning.

Nature 521, 436–444.

Li Y. X., Chai Y, Hu Y Q, et al. 2019, A review of

classification methods for unbalanced data(in

Chinese). Control and decision. 34(04). 673-688.

Liao W Y. 2012. The Credit Customers Churn Analysis

Based on Improved Boosting Decision Tree. Computer

Knowledge and Technology.8(18).4306-4307+4319.

Sandeepkumar,H. and M.R.Mundada. 2020. Optimized

Deep Neural Network Based Predictive Model for

Customer Attrition Analysis in the Banking Sector.

Recent Patents on Engineering,14(3), pp.412~421.

Tang C L, Chen H, Tang H C, et al. 2021, Research and

application of data preprocessing methods under the

background of big data(in Chinese). Information

recording material. 22(09). 199-200.

Wang L C, Liu S S. 2022. Research on improved random

forest algorithm based on mixed sampling and feature

selection(in Chinese). Journal of Nanjing University of

Posts and Telecommunications(Natural Science

Edition). 42(01), 81-89.

Ensembled Learning Based Model for Bank Churn Prediction

15