The Investigation of Real-Time Credit Card Fraud Detection

(RTCCFD) Based on Machine Learning and Apache Spark

Jiacheng He

a

Big Data Management and Application, China University of Mining and Technology, Xuzhou, China

Keywords: Apache Spark, Credit Card Fraud Detection, Machine Learning.

Abstract: This paper presents a comprehensive review of the advancements in Real-time Credit Card Fraud Detection

(RTCCFD), leveraging machine learning algorithms and Apache Spark. With financial fraud, particularly

credit card fraud, posing significant losses to society and becoming increasingly prevalent due to the advent

of new internet technologies, there is a pressing need for efficient detection systems. This study highlights the

critical role of machine learning algorithms, such as Random Forest and Neural Networks, which, when

integrated with Apache Spark, offer substantial improvements in processing speed and detection accuracy.

Through an analysis of various research efforts, including the use of ensemble models and real-time

processing frameworks, this paper demonstrates the effectiveness of these technologies in identifying

fraudulent transactions. However, it also addresses the significant challenges that remain, including the lack

of model interpretability, the need for models to generalize across evolving fraud tactics, and the imperative

of ensuring data privacy and security in sensitive financial contexts. By discussing potential solutions like

Federated Learning for enhancing privacy and suggesting directions for future research, this review aims to

outline the progress made in the field while acknowledging the hurdles that lie ahead in the quest for more

secure and trustworthy financial transactions.

1 INTRODUCTION

Financial fraud which could cause much loss to

society has troubled people significantly especially

obtaining property from people easily through the

Internet. According to the China Judicial Big Data

Research Institute report, credit card fraud cases

accounted for 50.4% of all financial fraud cases in

China from 2019 to 2021, totalling 3,375 instances,

making it the most prevalent type (Zeng, 2022).

Additionally, companies reliant on credit card

transactions spend a substantial amount annually to

prevent such incidents. However, as new Internet

technologies develop, new fraud means are getting

more day by day and harder to be detected. Typically,

there are two main categories of credit card fraud: the

first is off-line fraud, which involves the unauthorized

use of a purloined card in physical locations such as

retail stores, and the second is on-line fraud, which

transpires via digital channels like the web,

telephonic transactions, e-commerce platforms, or

any situation where the card owner is not physically

a

https://orcid.org/0009-0008-8827-4618

present to authorize the transaction (Chaudhary,

2012).

Considering the instantaneous nature and

terrifying consequences of credit card fraud cases, the

detection system must receive and process all the

real-time data then send an alarm to cardholder

immediately. Apache Spark is a distributed, general-

purpose computing platform which is similar to

Hadoop. However, Spark differentiates itself by

allowing large amounts of data to be kept in memory,

which offers significant performance improvements,

making it up to 100 times faster than MapReduce in

some scenarios. MLlib is a module of Apache Spark

frame, enabling users to run machine learning

algorithms on big data with higher efficiency to speed

up all the process.

Training credit card fraud detection models with

Spark and machine learning has become the

mainstream method. Many scholars utilized various

machine learning algorithms which are realized by

Mllib to predict credit card fraud and proved many

benefits with Spark. Madhavi et al. used random

52

He, J.

The Investigation of Real-Time Credit Card Fraud Detection (RTCCFD) Based on Machine Learning and Apache Spark.

DOI: 10.5220/0012900800004508

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Engineering Management, Information Technology and Intelligence (EMITI 2024), pages 52-56

ISBN: 978-989-758-713-9

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

forest ensemble model with Mllib and real-time

processing using Kafka and Spark streaming jobs

delivered the optimal results (Madhavi, 2021). Armel

et al. compared the performance of simple anomaly

detection algorithm, the naïve bayes algorithm,

decision trees classifier algorithm and random forest

algorithm further showing that random forest is a

strong algorithm to handle credit card fraud (Armel,

2019). Ananthu et al. also provided a comparison of

machine learning techniques and focused on

recognizing fraudulent transactions through the

analysis of previous transaction records (Ananthu,

2021). On the other hand, Cornelius et al. investigated

prior spending habits to detect fraud in real-time

transactions, utilizing distributed frameworks like

Spark and Kafka and Cassandra for scalability

(Nwankwo, 2023). Preprocessing with Spark

Machine Learning Pipeline Stages for efficient fraud

detection was emphasized. Alshammari and

colleagues explored the swift proliferation and

development of digital transactions, which have

propelled credit cards to become the predominant

method of payment (Alshammari, 2022).

Contemporary research in the realm of credit card

fraud detection has extensively examined the

selection of machine learning algorithms, aiming to

identify which could offer enhanced privacy and a

heightened sense of security for businesses, as well as

methods to increase the promptness of fraud

surveillance. This paper seeks to summarize the

progress made in this field, identify areas of weakness

that require enhancement, and explore new potential

fraud scenarios that need to be addressed. This article

is organized into four main sections. Following the

introduction, Section 2 delves into the framework of

machine learning-based credit card fraud detection,

detailing the methodology and various algorithms

employed. Section 3 discusses the current challenges

and limitations in the field and suggests potential

directions for future research. The final section,

Section 4, summarizes the key findings and

underscores the importance of advancing these

technologies for more effective fraud detection.

2 METHOD

2.1 Framework of Machine

Learning-Based Credit Card

Detection

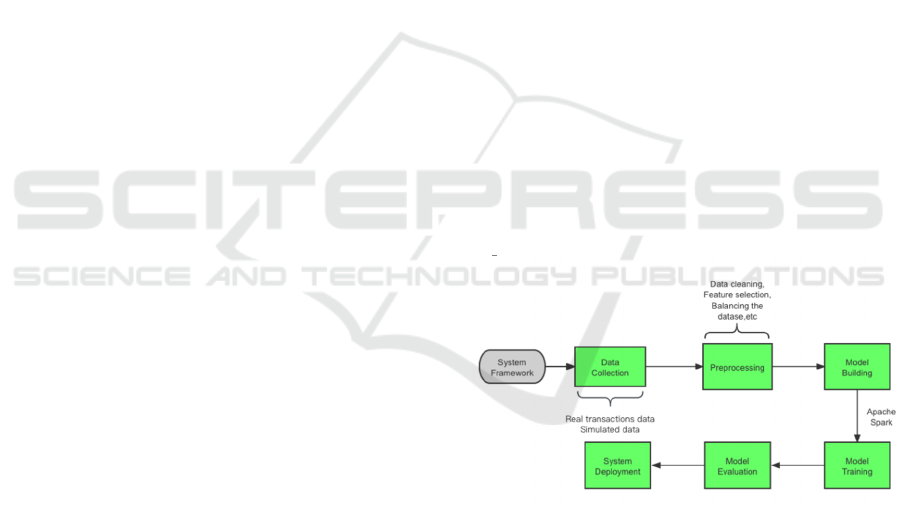

The usual steps to build a system to detect credit card

detection include data collection, preprocessing,

model building etc shown in Figure 1. The first

module is data collection which is the most basic step.

For instance, Varmedja et al found some real

transactions datasets which are helpful to model

training and prediction but cause much error because

of its imbalance (Alshammari, 2022). ARMEL et al.

simulated the datasets by some kinds of distribution

to test their models without prediction (Madhavi,

2021). Preprocessing includes data cleaning, feature

selection, balancing the dataset etc. Various

techniques have been implemented. For instance, D.

Varmedja et al. used Synthetic Minority

Oversampling Technique (SMOTE) technique for

oversampling (Varmedja, 2019). Many Internet

factories have published their ways to develop models

to detect anomalies. Google, Twitter, and Netflix

employ machine learning and statistical methods for

anomaly detection in data streams. Google uses

TensorFlow to train models like Deep Neural

Networks (DNNs), Recurrent Neural Networks

(RNNs), and Long Short-Term Memories (LSTMs)

for regression and anomaly detection, combining two

methods for effective anomaly identification.

Twitter’s approach utilizes the Seasonal Hybrid

Extreme Studentized Deviate test (S-H-ESD) for

detecting both global and local anomalies,

considering seasonality. Netflix’s Robust Anomaly

Detection (RAD) leverages Robust Principal

Component Analysis (RPCA) to handle high

cardinality datasets, enabling quick anomaly

identification and response, enhancing customer

experience.

Figure 1: The architecture of machine learning-based credit

card detection (Photo/Picture credit: Original).

Apache Spark is an open-sourced distributed

engine which can accelerate machine learning

algorithms to handle real-time big data. Figure 2

provides its components and principle. At its core,

Spark uses Resilient Distributed Datasets (RDDs), an

immutable collection of objects that can be processed

in parallel. Each RDD can be partitioned across the

cluster, allowing Spark to execute operations on each

partition in parallel, significantly speeding up

processing. The structural design of Spark

incorporates a driver program responsible for

The Investigation of Real-Time Credit Card Fraud Detection (RTCCFD) Based on Machine Learning and Apache Spark

53

initiating the user’s primary function and performing

a range of concurrent operations across the computing

cluster. The cluster manager allocates resources

across applications, while worker nodes execute tasks

assigned to them. This model enables efficient data

processing and analysis at scale. Deploying the

detection system with Spark after passing the model

evaluation is the last step which is the hardest and

needs huge resources.

Figure 2: Components and principle of Apache Spark

(Photo/Picture credit: Original).

2.2 Random Forest-Based Detection

The Random Forest approach employs an ensemble

of learning models, specifically for tasks involving

classification and regression. It operates through a

collection of decision trees at the training phase and

delivers the class median or the average prediction

from the trees. It has been widely used to predict

credit card fraud, almost the most popular, because

this algorithm has been proved that it is very suitable

to handle fraud detection. Armel et al. and Ananthu et

al. gave their results of comparative of experiments

proving random forest indeed a great choice to handle

this (Armel, 2019; Ananthu, 2021). Furthermore,

Mehvish proposed a strategy for detecting credit card

transactions by employing a hybrid approach that

integrates Random Forest with Extreme Learning

Machine algorithms (Mehvish, 2023). They provided

a foundation for the development for algorithms that

could perform better. Rajesh PK et al. used Bayesian

optimized random forest classifier on big dataset

before feature engineering gaining 99.545% such

high accuracy (PK, 2023). Contemporary research

indicates that while Random Forest algorithms yield

positive results in identifying credit card fraud,

integrating them with other foundational algorithms

could further improve detection effectiveness.

2.3 Neural Network-Based Detection

Drawing inspiration from the human brain's

architecture and operational principles, neural

networks serve as sophisticated computational

constructs that excel at pattern recognition and

problem-solving. These networks are comprised of

multiple neuron-like units arranged in layers, with

each linkage reflecting a synaptic weight. Diverse

forms of neural networks exist, distinguished by their

specialized features. Convolutional Neural Networks,

for instance, are adept at analyzing visual information

through their layered pattern identification

capabilities, whereas Recurrent Neural Networks are

tailored for time-sequenced data such as time series

analysis or language processing, owing to their ability

to retain information from earlier inputs. Deep

Learning involves networks with many layers,

enabling the extraction of high-level features from

raw input. Atchaya used Artificial Neural Network

(ANN), Support Vector Machine (SVM) and K

Nearest Neighbors (KNNs) in predicting showing

that ANN has the best accuracy 99.92% (Atchaya,

2024). Karthika et al. introduced a smart fraud

detection utilizing a dilated CNN combined with a

sampling technique, focusing on enhancing the

detection accuracy of fraudulent transactions

(Karthika, 2023). Berhane et al. also tried to develop

a hybrid model which combines CNN and SVM

called CNN-SVM (Berhane, 2023). As he said, CNN-

SVM is more capable of handling fraud detection.

3 DISCUSSIONS

Based on the research progresses mentioned above

limitations and challenges like model interpretability,

model generalizability and data privacy and security

can be identified and will be discussed in this part.

This study has demonstrated the efficacy of machine

learning algorithms, especially Random Forest and

Neural Networks, in real-time detecting credit card

fraud, leveraging the computational power of Apache

Spark. However, one significant limitation of

EMITI 2024 - International Conference on Engineering Management, Information Technology and Intelligence

54

employing machine learning models like them is their

lack of interpretability. They always be used to handle

some actual and complex problems as “black boxes”,

making it challenging to understand the rationale

behind their predictions (Qiu, 2024). Molnar

emphasizes the importance of model interpretability

for ensuring transparency and accountability in

machine learning applications, suggesting that

interpretable models are crucial for gaining

stakeholder trust and facilitating wider adoption

(Molnar, 2020).

The generalizability of machine learning models,

particularly in the context of fraud detection, is a

critical concern. Models trained on historical data

may not perform well on unseen data or adapt to

evolving fraud patterns, leading to decreased

detection accuracy over time. Domingos highlights

the importance of creating models that not only learn

from past data but also adapt to new patterns

dynamically (Domingos, 2012). Furthermore,

Goodfellow et al. discuss the concept of adversarial

examples that can exploit model vulnerabilities,

underscoring the need for robust machine learning

models capable of generalizing across a broad

spectrum of fraud tactics (Goodfellow, 2016).

Addressing these concerns requires continuous model

evaluation and updating, alongside the development

of algorithms that can learn and adapt in real-time to

maintain effectiveness in fraud detection.

The integration of machine learning in sensitive

domains, such as financial fraud detection, raises

significant privacy and security concerns. Traditional

machine learning approaches often require

centralized data collection, posing risks to user

privacy and data security. To mitigate these issues,

some machine learning algorithms, take Federated

Learning (FL) for example. It emerges as a promising

solution by enabling model training on decentralized

data sources without needing to share the data itself.

McMahan and colleagues pioneered the use of

Federated Learning, a technique that allows for model

training across several devices without centralizing

data, thereby bolstering data privacy and system

security (McMahan, 2017). Besides, Bonawitz et al.

discuss advancements in secure aggregation

protocols within FL, ensuring that individual updates

cannot be inspected by the server, thus offering an

additional layer of privacy (Bonawitz, 2019). These

developments in Federated Learning not only address

privacy concerns but also open new avenues for

secure, decentralized machine learning applications.

However, challenges remain in ensuring robustness

against adversarial attacks and maintaining model

performance with non-Independently and Identically

Distributed (IID) data across devices. Addressing

these challenges is crucial for the widespread

adoption of FL in privacy-sensitive applications.

4 CONCLUSIONS

In conclusion, this paper has explored the application

of machine learning algorithms, particularly Random

Forest and Neural Networks, in conjunction with

Apache Spark for RTCCFD. This investigation

highlights the significant potential of these

technologies to enhance the speed and accuracy of

fraud detection systems, thereby offering a more

secure transaction environment for both companies

and consumers. However, this study also

acknowledges the inherent challenges associated with

these technologies, including issues of model

interpretability, generalizability, and data privacy and

security.

Future research should focus on addressing these

challenges by developing more interpretable machine

learning models, enhancing their adaptability to new

fraud patterns, and ensuring the privacy and security

of sensitive data. Collaborative efforts between

academia, industry, and regulatory bodies will be

essential in advancing these technologies and

ensuring their effective and ethical application in

combating credit card fraud.

REFERENCES

Alshammari, A., Alshammari, R., Altalak, M., &

Alshammari, K. 2022. Credit-card Fraud Detection

System using Big Data Analytics. In 2022 International

Conference on Electrical, Computer, Communications

and Mechatronics Engineering (ICECCME) (pp. 1-7).

IEEE.

Ananthu, S., Sethumadhavan, N., & AG, H. N. 2021. Credit

card fraud detection using Apache Spark analysis. In

2021 5th International Conference on Trends in

Electronics and Informatics (ICOEI) (pp. 998-1002).

IEEE.

Armel, A., & Zaidouni, D. 2019. Fraud detection using

apache spark. In 2019 5th International Conference on

Optimization and Applications (ICOA) (pp. 1-6). IEEE.

Berhane, T., Melese, T., Walelign, A., & Mohammed, A.

2023. A Hybrid Convolutional Neural Network and

Support Vector Machine-Based Credit Card Fraud

Detection Model. Mathematical Problems in

Engineering, 2023.

Bonawitz, K., Eichner, H., Grieskamp, W., Huba, D.,

Ingerman, A., Ivanov, V., ... & Roselander, J. 2019.

The Investigation of Real-Time Credit Card Fraud Detection (RTCCFD) Based on Machine Learning and Apache Spark

55

Towards federated learning at scale: System design.

Proceedings of Machine Learning and Systems, 1, 374-

388.

Chaudhary, K., Yadav, J., & Mallick, B. 2012. A review of

fraud detection techniques: Credit card. International

Journal of Computer Applications, 45(1), 39-44.

Domingos, P. 2012. A few useful things to know about

machine learning. Communications of the ACM,

55(10), 78-87.

Goodfellow, I., Bengio, Y., & Courville, A. 2016. Deep

learning. MIT Press.

Karthika, J., & Senthilselvi, A. 2023. Smart credit card

fraud detection system based on dilated convolutional

neural network with sampling technique. Multimedia

Tools and Applications, 1-18.

Madhavi, A., & Sivaramireddy, T. 2021. Real-Time Credit

Card Fraud Detection Using Spark Framework. In

Machine Learning Technologies and Applications:

Proceedings of ICACECS 2020 (pp. 287-298). Springer

Singapore.

McMahan, B., Moore, E., Ramage, D., Hampson, S., & y

Arcas, B. A. 2017. Communication-efficient learning of

deep networks from decentralized data. In Artificial

Intelligence and Statistics (pp. 1273-1282). PMLR.

Mehvish. 2023. Random Forest and Extreme Learning

Machine Algorithms for High Accuracy Credit Card

Fraud Detection. https://www.ijraset.com/best-

journal/credit-card-fraud-detection-using-ann

Molnar, C. 2020. Interpretable machine learning. Lulu.com.

Muhammad, K., Ullah, A., Lloret, J., et al. 2020. Deep

learning for safe autonomous driving: Current

challenges and future directions. IEEE Transactions on

Intelligent Transportation Systems, 22(7): 4316-4336.

Nwankwo, U. C., Onuora, J. N., Obi, J. N., Obiukwu, E. N.,

& Okore, U. E. 2023. Detection of Credit Card Fraud in

Real Time Using Spark ML. International Journal of

Computer Science and Mobile Computing, 12(12).

https://dx.doi.org/10.47760/ijcsmc.2023.v12i12.006

PK, R. 2023. Enhanced Credit Card Fraud Detection: A

Novel Approach Integrating Bayesian Optimized

Random Forest Classifier with Advanced Feature

Analysis and Real-time Data Adaptation. International

Journal for Innovative Engineering & Management

Research, Forthcoming.

Qiu, Y., Hui, Y., Zhao, P., Cai, C. H., Dai, B., Dou, J., ... &

Yu, J. 2024. A novel image expression-driven modeling

strategy for coke quality prediction in the smart

cokemaking process. Energy, 130866.

EMITI 2024 - International Conference on Engineering Management, Information Technology and Intelligence

56