The Web Unpacked: A Quantitative Analysis of Global Web Usage

Henrique S. Xavier

a

NIC.br, Av. das Nac¸

˜

oes Unidas, 11541, 7º Andar, S

˜

ao Paulo, SP, Brazil

Keywords:

World Wide Web, Traffic Share, Website Visits, Web Browsing, Web Usage, Platforms.

Abstract:

This paper presents an analysis of global web usage patterns based on data from 250,000 websites monitored

by SimilarWeb. We estimate the total web traffic and investigate its distribution among domains and industry

sectors. We detail the characteristics of the top 116 domains, which comprise an estimated one-third of all web

traffic. Our analysis scrutinizes their content sources, access requirements, offline presence, and ownership

features, among others. Our analysis reveals that a diminutive number of top websites captures the majority

of visits. Search engines, news and media, social networks, streaming, and adult content emerge as primary

attractors of web traffic, which is also highly concentrated on platforms and USA-owned websites. Much of

the traffic goes to for-profit but mostly free-of-charge websites, highlighting the dominance of business models

not based on paywalls.

1 INTRODUCTION

The World Wide Web (also called the Web) is an on-

line decentralized and owner-free information system

released to the public domain in 1993 (CERN, 1993).

It is an application of the Internet protocol suite, a

computer communication protocol that is also decen-

tralized and owner-free. The Web itself has no mod-

eration or gatekeepers and, for a long time, had al-

most no governmental regulation. Currently, the Web

is the best-known and most pervasive Internet appli-

cation. Web browsing is a dominant computer activity

(Crichton et al., 2021), and Web-based companies fig-

ure among the largest and most valuable companies in

the World (Evans and Gawer, 2016).

The importance of the Web, its lack of explicit

management, and its vast potential have raised ques-

tions on what are its realized, actual characteristics in

terms of main uses, applications, and content types,

how visits are distributed among websites, who are

the content publishers, how is the content typically

produced, and much more. Answering these ques-

tions can provide valuable insights for developing

public policies related to the Web, such as regulating

new activities, relationships, and business models to

promote positive outcomes and reduce negative im-

pacts on society.

In the past, the Web has been thoroughly ana-

lyzed in terms of its content and graph properties

a

https://orcid.org/0000-0002-9601-601X

(e.g., the number of webpages covering a given topic

(Chakrabarti et al., 2002; Huizingh, 2000) and the

number of hyperlinks connecting them (Adamic and

Huberman, 2000b; Huberman, 2001)). However, pre-

vious accounts about the characteristics of the Web

have primarily been based on metrics other than us-

age (e.g., link structure, number of websites, or com-

panies’ market value) or were built on anecdotal ac-

counts and non-quantitative data. Some exceptions

are: (Adamic and Huberman, 2000a; Webster and

Lin, 2002) that showed for a restricted subset of users

and websites that visitors are distributed among web-

sites in a power-law-like fashion; and (Agarwal and

Sastry, 2022), that used Alexa’s ranking list to se-

lect the 100 most visited domains, Google trends to

estimate their popularity and Fortiguard’s classifica-

tion to verify the popularity of different topics, among

other things.

This paper aims to provide a data-driven general

picture of web usage. Based on data about the number

of monthly visits to web domains, we aim to estimate:

1. the number of domains (and which ones) required

to form a representative picture of global web us-

age;

2. the importance of topics explored on the Web; and

3. the prevalence of broad website characteristics

(e.g., access barriers, content sources, and own-

ership) typically encountered in web visits.

Our complete analysis can be accessed at

Xavier, H. S.

The Web Unpacked: A Quantitative Analysis of Global Web Usage.

DOI: 10.5220/0012905900003825

In Proceedings of the 20th International Conference on Web Information Systems and Technologies (WEBIST 2024), pages 183-190

ISBN: 978-989-758-718-4; ISSN: 2184-3252

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

183

http://github.com/cewebbr/web-unpacked.

2 DATA SET

The data analyzed in this paper are from SimilarWeb’s

Starter Plan, covering August to October 2023. Sim-

ilarWeb is a company that measures visits to numer-

ous websites by combining different user monitoring

methods. Other companies that provide similar data

include Semrush and Ahrefs. The Starter Plan pro-

vides data about the most visited domains in each of

the 210 industry segments specified by SimilarWeb,

limited to 10,000 domains per industry. During the

covered period, data was available for 1,336,963 do-

mains. For each domain, SimilarWeb estimates the

average monthly visits, month-over-month visit vari-

ation, and average visit duration, among other met-

rics. Due to limited accuracy, data is not provided

for domains with less than 5,000 monthly visits. In

general, subdomains are not distinguished from their

parent domains (e.g., visits to docs.google.com are

accounted for as part of visits to google.com along

with visits to other Google subdomains), and transi-

tions from one subdomain to another do not count as

an extra domain visit, just as a single one.

The quality of SimilarWeb data has been evaluated

in previous academic works and is considered good

enough for relative ballpark measurements between

domains. Jansen et al. used Google Analytics for 86

websites as a truth table and identified a systematic

bias of 20% in SimilarWeb’s monthly visits estimates

(Jansen et al., 2022). Prantl compared monthly vis-

its from SimilarWeb and NetMonitor

1

for 485 Czech

websites and found an average absolute difference of

about 42% between these two sets of measurements

(Prantl and Prantl, 2018). Enterprise reports have in-

dicated similar scenarios (Hardwick, 2018; Diachuk

et al., 2021). However, given that our data on monthly

visits cover over seven orders of magnitude (from 5

thousand to 86 billion), the reported deviations do

not significantly affect the overall distribution of visits

among websites. The data still provides precise ranks,

with a Pearson correlation of 95% between monthly

visit estimates from SimilarWeb and Google Analyt-

ics (Jansen et al., 2022) and a Spearman correlation of

96% between SimilarWeb’s and NetMonitor’s ranks

(Prantl and Prantl, 2018). Also, the present work re-

lies only on relative measurements, so any systematic

biases are irrelevant.

It is important to note that web traffic exhibits

annual patterns that could impact the representative-

1

https://www.spir.cz/projekty/netmonitor/

ness of our three-month data sample (Liu et al.,

2017; Liu et al., 2018). By analyzing five years

of Google Trends data for the most visited do-

main names across various industries, we found

that Western e-commerce sites like amazon.com and

walmart.com see increased searches before Christ-

mas, while searches for weather-related websites like

weather.com and accuweather.com rise during school

vacations. Assuming these annual patterns in Google

Trends reflect similar patterns in actual domain visits,

we estimate that our data may deviate from its annual

average by up to 24%, as seen in the case of espn.com.

However, major domains like youtube.com, insta-

gram.com, and xvideos.com show only minor vari-

ations (i.e., less than 5%). These estimates suggest

that, while seasonality is a factor, it is unlikely to af-

fect our findings significantly.

For each industry, we assumed that SimilarWeb is

complete up to a certain threshold (the domain with

the lowest average monthly visits). In other words,

we assumed that domains missing from an industry’s

list must have average monthly visits lower than the

least visited domain in the list. However, it is essential

to note that being complete in a given industry sector

does not imply the entire dataset is complete, as Sim-

ilarWeb’s Starter Plan limits the number of domains

per industry to 10,000. To ensure completeness in the

entire dataset, we must enforce a threshold on aver-

age monthly visits of 140,484, the largest individual

industry threshold. This complete dataset, considered

in our analysis, contains 254,661 domains and will be

ranked by average monthly visits.

3 ANALYSIS

3.1 Traffic Distribution

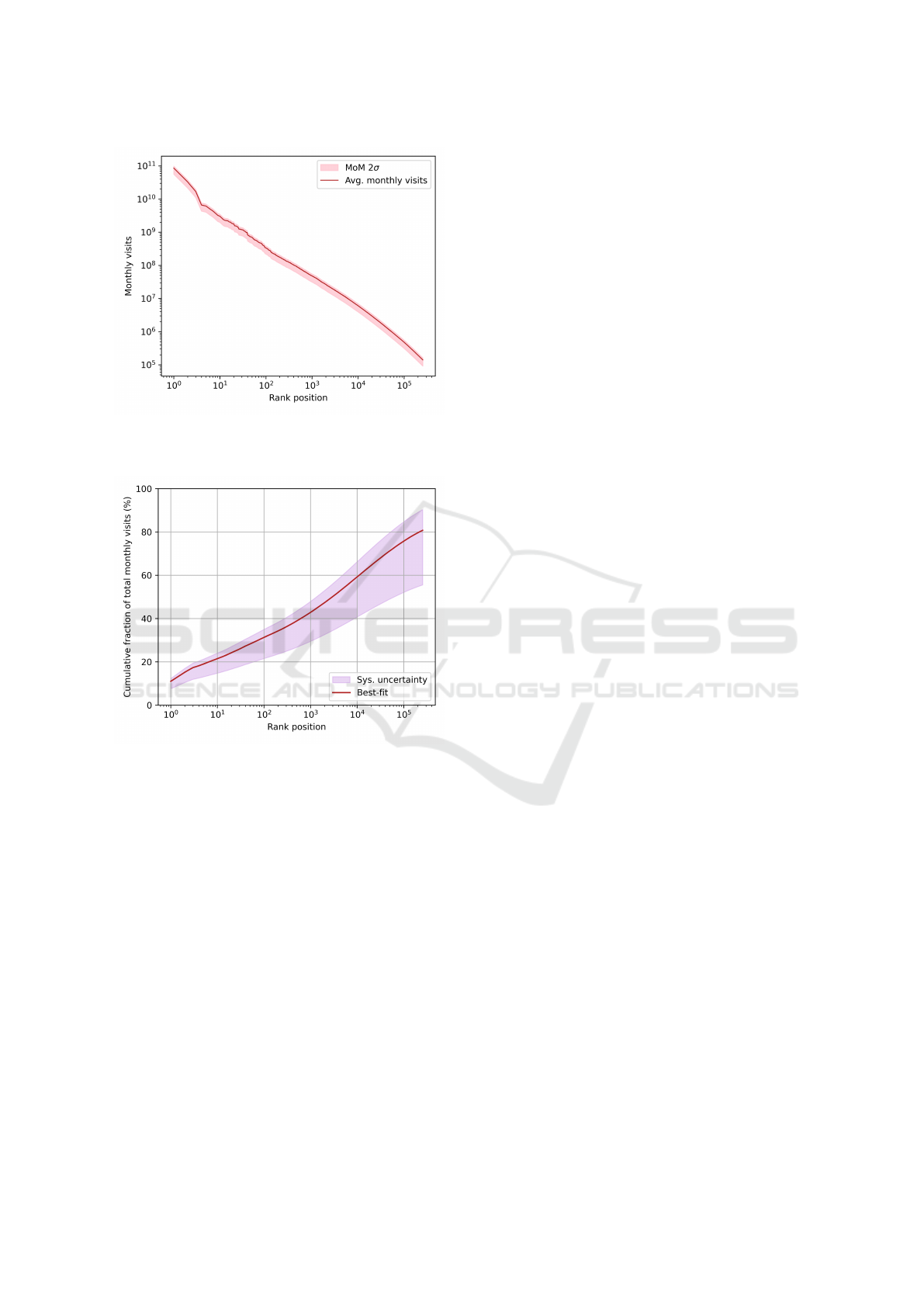

Fig. 1 shows a log-log plot of the monthly visits V

vs. rank position p for the domains in our dataset. A

power-law V (p) = V

0

p

β

appears as a straight line in

such a plot. We obtain a best-fit model to our data

with V

0

= 4.1 × 10

11

and β = −1.19. The pink bands

represent a 2σ-equivalent interval (i.e., from the 2nd

to the 98th percentile) for the month-over-month visit

variation measured by SimilarWeb. The narrowness

of the bands demonstrates that the properties of the

traffic distribution should be reasonably stable over

time (at least for a few months) and that the over-

all ranking of the domains is not dramatically altered

from on month to the next.

To calculate the share of the total web traffic cap-

tured by each domain in our dataset, we first need an

estimate of this total traffic. For that, we extrapo-

WEBIST 2024 - 20th International Conference on Web Information Systems and Technologies

184

Figure 1: Average monthly visits as a function of the do-

main’s position in the rank. Light bands represent a 2σ vari-

ation in the visits from month to month.

Figure 2: Best estimate of the cumulative traffic share of

domains as a function of position in the rank (red line). The

violet band represents the systematic uncertainty.

lated the best-fit power law to position 354 million,

the number of registered domains as of June 2023

(Verisign, 2023), and aggregated the measured traf-

fic along with the estimated traffic beyond position

254,661, resulting in a total of 781 billion visits per

month. With 5.35 billion internet users as of January

2024 (Petrosyan, 2024), this amounts to 4.9 domain

visits per person per day, a reasonable ballpark figure:

previous work has shown that users from a metropoli-

tan area in the United States visited an average of

20.1 websites per day on their computers, while the

least active user (out of 257) visited an average of 2.9

(Crichton et al., 2021). Including rural regions and

other countries should lead to a lower average. Fig. 2

shows the estimated traffic share for the 254,661 do-

mains in our data.

To estimate a systematic uncertainty on the shares

of total monthly web traffic, we fitted a power law

up to position p

i

= 10(p

last

/10)

i/99

, with i = 0,.. ., 99

and p

last

= 254,661, representing several hypothetical

cases where we have data only for the first p

i

domains.

The smallest and largest β obtained, along with the re-

spective power-law scaling factor V

0

= V (p

last

)/p

β

last

,

were used as alternative extrapolations to estimate a

systematic uncertainty interval on the total monthly

web traffic. The resulting interval for the traffic shares

is shown as a violet band in Fig. 2.

Our analysis reveals a significant concentration of

web traffic in a few domains. Our best estimate sug-

gests that 50% of all web traffic is directed to the top

3,000 domains, and 80% is allocated to domains in

our dataset. Table 1 presents values for our best traf-

fic extrapolation and for the systematic uncertainty

boundaries with the smallest and largest traffic con-

centration, denoted as Sys. − and Sys. +. These val-

ues are: the power-law exponent, β; the total monthly

web traffic,

∑

V ; the average number of domain visits

per person per day, ¯u; the extrapolated traffic for the

last domain in the rank (among 354 million), V

min

; the

number of top domains that accumulate 50% of total

web traffic, p

50%

; and the Gini inequality coefficient.

The V

min

value for the Sys. − boundary is im-

plausibly large, indicating that the traffic share must

decline faster at the end of the rank, making the ac-

tual total traffic likely closer to our best estimate. The

fact that the domains in our dataset likely represent

the destination of 80% of all web traffic makes them

an excellent sample of the current state of the Web, at

least in terms of content access rate.

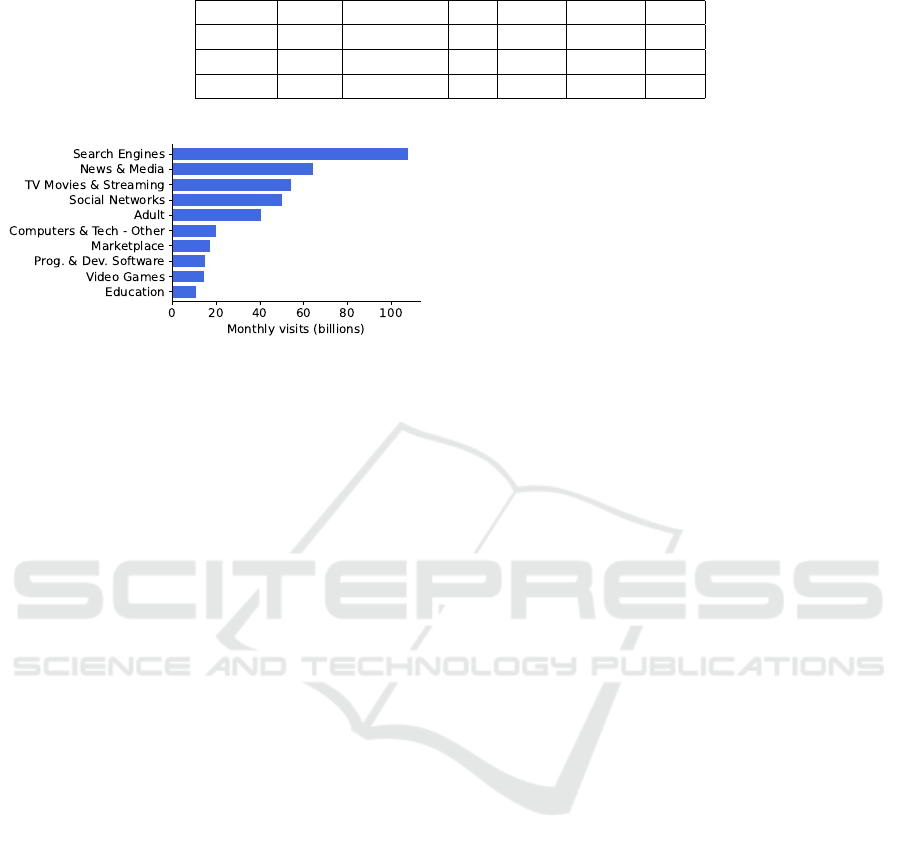

3.2 Popular Web Industries

In order to estimate the most popular industries on the

Web, we aggregated the monthly visits into 187 non-

overlapping categories defined by SimilarWeb. Our

analysis shows that traffic coalesces in a few indus-

tries, with 50% directed to just five segments and

80% directed to 26 segments. In most cases, despite

the power-law distribution of traffic within industries,

monthly visits are not monopolized by a single do-

main or company, and the most popular domains ac-

cumulate at most 15% of their industry’s traffic. How-

ever, there are exceptions, as noted below.

Figure 3 demonstrates the prevalence of “Search

Engines” as the most visited industry. This preva-

lence is expected due to the lack of a built-in index

on the Web, making search engines entry points for

most users. This trend is further amplified by the in-

tegration of address and search bars in web browsers,

leading users to search even for known websites in-

stead of directly typing their URLs (Cannon, 2008).

The Web Unpacked: A Quantitative Analysis of Global Web Usage

185

Table 1: Main monthly traffic share attributes under different traffic extrapolations.

Extrap. β

∑

V ¯u V

min

p

50%

Gini

Sys. − -0.83 1.14 · 10

12

7.1 341.1 62,621 82%

Best -1.19 7.81 · 10

11

4.9 27.3 2,938 97%

Sys. + -1.52 6.98 · 10

11

4.3 2.4 1,342 99%

Figure 3: Monthly visits to the top 10 industries. We short-

ened some industry names to save space on the plot.

In this industry, google.com dominates with 79% of

the traffic (considering the top 10,000 domains in the

segment). The following competitors are the Chinese

search engine baidu.com, with 4.7%, and the Russian

search engine yandex.ru, with 3.0%.

In the ”TV Movies and Streaming” segment,

youtube.com (owned by Alphabet, like google.com)

captures 61% of the industry’s traffic. This seg-

ment is succeeded by “Social Networks and On-

line Communities,” another case where the indus-

try’s traffic predominantly flows to a single company.

When combining facebook.com, instagram.com, and

whatsapp.com, Meta receives 52% of the segment’s

traffic. Among the remaining top 26 industries,

only “Dictionaries and Encyclopedias” has a domain

(wikipedia.org) with more than half (56%) of the total

industry’s traffic.

It is essential to observe that domains catego-

rized as “Search Engines,” such as google.com, yan-

dex.ru, and baidu.com, offer more services than just

web search. Consequently, a portion of the traffic

attributed to the “Search Engines” segment pertains

to other industries listed in SimilarWeb’s classifica-

tion, such as “Email” and “File Sharing and Hosting.”

For google.com, ignoring its subdomains unrelated to

search results in a 15% reduction in traffic, maintain-

ing the integrity of our rankings and keeping search

as Google’s main service. Conversely, the traffic di-

rected to these subdomains would place Google as

the main player in several industries had SimilarWeb

classified them properly. This is the case of “Email”,

with mail.google.com; “Programming and Developer

Software’, with docs.google.com; and “File Sharing

and Hosting”, with drive.google.com.

3.3 Manual Inspection of Top Domains

SimilarWeb data provides no other information about

the domains besides visitation metrics and the do-

main’s industry. To address this gap, the author manu-

ally inspected and researched the 116 most visited do-

mains, which collectively capture between 22% and

36% of the total web traffic (with a best estimate of

32%). The objective was to answer the following

questions about them:

1. Does the website primarily offer Software as a

Service (SaaS)?

2. Does the website produce its content? For market-

places, does the domain owner sell its own prod-

ucts on the site?

3. Does the website function as a platform for user-

generated content? For e-commerce platforms,

does the site allow third-party sellers to list their

products? Comments on original content (such as

those found on some news websites) were insuffi-

cient to classify the site as a platform. We did not

consider news aggregators or similar sites that cu-

rate content from the Web as platforms since the

content is not user-provided.

4. Does the website require users to log in before ac-

cessing its main content?

5. Does the website charge users for access to its

main content and features? We ignored charges

for additional features and, for marketplaces, the

charges imposed on sellers.

6. Is the domain owner’s primary business or activity

related to the Web, or is a significant portion of

their business conducted offline? We considered

news websites primarily web-related, but not e-

commerce sites that sell their own products.

7. According to Wikipedia, who is the ultimate

owner of the domain? In the case of subsidiaries,

we identified the ultimate parent company as the

domain’s final owner. For partial ownership, we

only considered parent companies that owned at

least 50% of the subsidiaries.

8. Is the ultimate owner of the domain a for-profit

organization?

9. According to Wikipedia, in which country is the

domain’s ultimate owner located?

WEBIST 2024 - 20th International Conference on Web Information Systems and Technologies

186

We have made our annotations regarding these ques-

tions available online

2

. While the analysis of this sub-

set of domains does not guarantee a comprehensive

representation of total Web traffic, the trends observed

within it are likely to extend to the following several

thousand domains, thus reflecting the characteristics

of a significant portion of Web usage.

Among the top 116 listed domains, Microsoft is

the largest owner with 11 domains. These include

linkedin.com, openai.com

3

, bing.com, github.com,

and several others associated with Microsoft itself and

its SaaS products like office365.com. Following is

Amazon, the owner of twitch.tv, imdb.com, and five

Amazon-related domains. Alphabet holds ownership

of five domains, including youtube.com and various

Google domains, while Meta possesses four (face-

book.com, instagram.com, whatsapp.com, and mes-

senger.com). The first non-US company in terms of

top domains is the Russian VK, which owns dzen.ru,

vk.com, mail.ru, and ok.ru, followed by the Japanese

SoftBank Group Corp., which owns three domains.

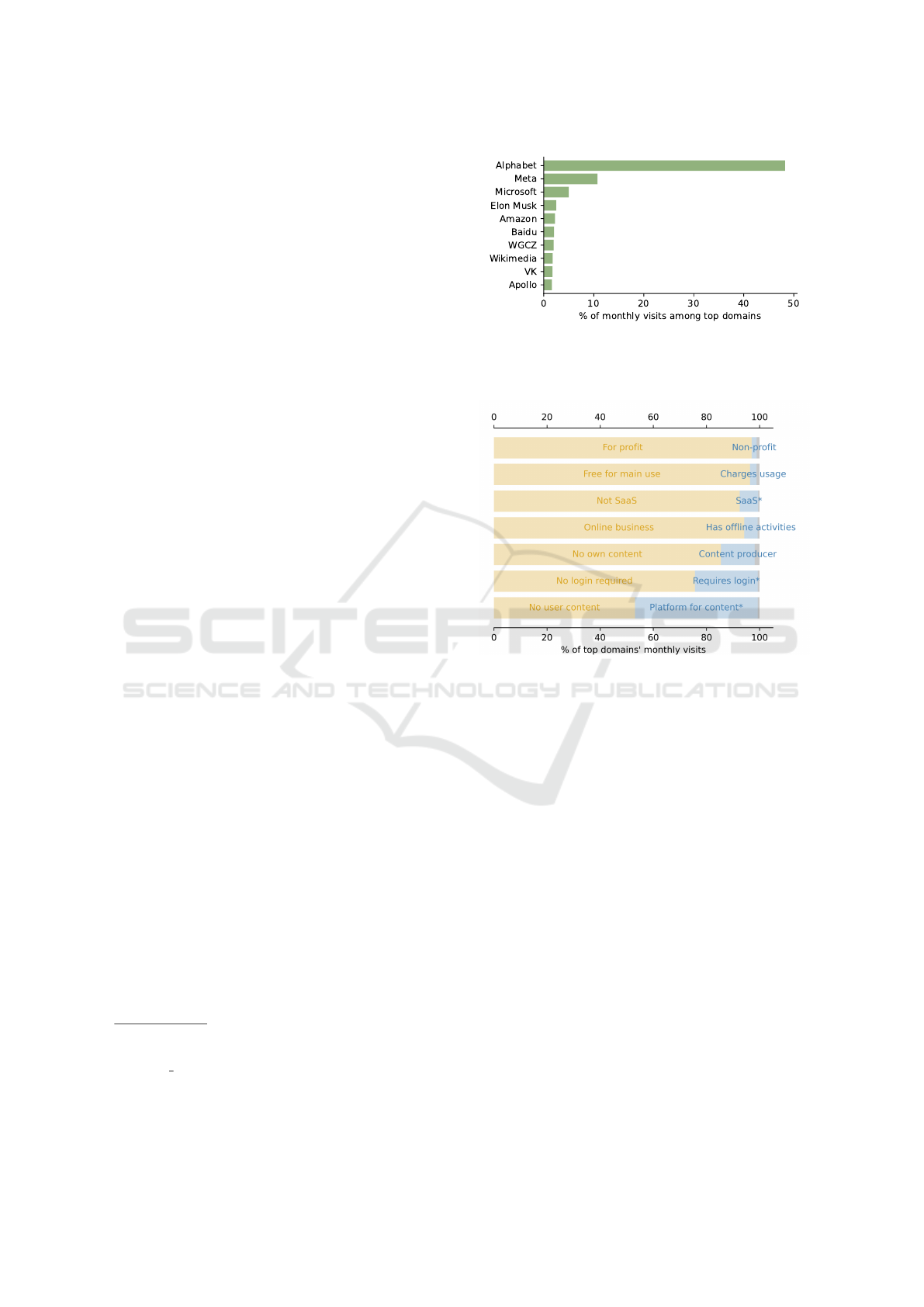

Suppose we rank the final owners by their ag-

gregated traffic. In that case, Alphabet receives 120

billion visits monthly, accounting for almost 50%

of the total traffic of the top 116 domains (see Fig.

4). This ranking also roughly follows a power-

law distribution, but its best-fit exponent, β, is more

negative than the best-fit for the disaggregated top

116 domains: -1.22 versus -0.98. It is important

to note that this decrease in β is not an artifact

caused by the aggregation itself. Randomly aggre-

gating domains would typically blend famous and

less known domains, evening out the traffic and re-

sulting in a less negative β. Thus, there must be a

socio-economic explanation for why the same com-

panies own highly visited domains. Although ad-

vancing such an explanation is beyond the scope of

this paper, we conjecture that this phenomenon par-

tially stems from large companies acquiring popular

websites (e.g., youtube.com, linkedin.com, dzen.ru,

twitch.tv, imdb.com, and github.com were indepen-

dent websites later purchased by their current own-

ers).

When we aggregate the top domains’ visits by the

ultimate owner’s country, the concentration becomes

even more pronounced. The best-fit power-law expo-

nent reaches β = −2.00, with the United States cap-

turing 80% of the total traffic of the top 116 domains.

2

https://github.com/cewebbr/web-

unpacked/blob/main/data/cleaned/domains-

annotated v03.csv

3

While we attribute ownership of OpenAI to Microsoft,

the precise nature of their relationship remains a topic of

debate.

Figure 4: Fraction of the top 116 domains’ total traffic ag-

gregated by final owner. The plot shows only the top 10

final owners.

Figure 5: Fraction of the top 116 domains’ total traffic di-

rected to domains classified under seven binary properties.

The gray segments denote traffic directed to unclassified do-

mains. Segments marked with * would be larger depending

on how we deal with large search engines (see text).

This dominance is followed by China (4.5%), Rus-

sia (3.7%), Japan (2.6%), the Czech Republic (2.1%),

and South Korea (0.97%).

Fig. 5 summarizes the traffic shares associated

with the binary answers to the remaining questions

(1 to 6 and 8). Each bar in the plot illustrates how

the traffic is distributed among domains subjected to

a specific binary classification. Notably, the vast ma-

jority (97%) of the traffic to the top 116 domains

flows to domains owned by profit-seeking compa-

nies. Interestingly, among these 116 domains, only

two are not-for-profit: wikipedia.org and archiveo-

fourown.org. This observation is intriguing, espe-

cially considering that 96% of the top traffic goes to

websites that do not charge for access or their main

functionalities. This seeming contradiction under-

scores emerging business models that rely on other

forms of making a profit (Lee et al., 2006; Georgieva

et al., 2015; Hermes et al., 2020b).

Figure 5 emphasizes that 85% of the total traffic

The Web Unpacked: A Quantitative Analysis of Global Web Usage

187

to top domains flows to platforms that do not gen-

erate their content, such as social media platforms,

marketplaces, news aggregators, and search engines.

Conversely, 46% of the traffic goes to websites where

users themselves create content. Excluding traffic to

search engines, which neither produce content nor al-

low users to post content, the proportion of traffic al-

located to user-generated content platforms rises to

77%, with minimal impact on the distribution across

other domain categorizations. This large percentage

underscores the central role of user-content platforms

in the Web’s contemporary landscape. Finally, it is

essential to highlight that while large search engines

were annotated as not SaaS and as not requiring a lo-

gin, they may provide other services that would be

classified differently.

We employed clustering techniques to categorize

the top 116 domains into four groups. We aimed to

minimize the average Hamming distances within each

group across a 7-dimensional binary feature space

constructed from our questionnaire responses. The

domains within each cluster exhibit similar character-

istics, allowing us to delineate the clusters using the

following archetypes:

1. SaaS: This group comprises domains primarily

characterized by SaaS offerings, devoid of of-

fline activities and requiring user authentication.

While some domains charge users for their core

services, many do not. Examples include ope-

nai.com, zoom.us, office365.com, and canva.com.

Our clustering process assigned 12 domains to

this group.

2. Open Content Providers: Domains in this clus-

ter serve as content producers, offering access

to their content without imposing a paywall or

requiring user authentication. Notably, this is

the only group to include businesses with offline

operations. Examples encompass samsung.com,

walmart.com, bbc.co.uk, weather.com, and ya-

hoo.com. Amazon.com was categorized within

this group by our clustering algorithm, along with

other 31 domains.

3. Platforms: This cluster encompasses domains

whose activities are confined to the online realm,

where users contribute the entirety of the content,

and access to the websites is free. Prominent

examples comprise youtube.com, roblox.com,

chaturbate.com, tiktok.com, wikipedia.org, and

booking.com. Interestingly, search engines and

messaging web services such as telegram.org and

discord.com were assigned to this group by our

clustering method. In total, 67 domains were clas-

sified under this archetype.

Figure 6: Fraction of the top 116 domains’ total traffic di-

rected to each of the 4 clusters. Search engines were manu-

ally removed from cluster group “Platforms”.

4. Subscription Content Providers: Domains in this

category are online content producers that man-

date user authentication and levy charges for

accessing their content. Examples include ny-

times.com, espn.com, netflix.com, and disney-

plus.com. Our clustering process identified five

domains within this group.

Figure 6 shows that the cluster designated as

“Platforms” is the primary destination for traffic

among the top 116 domains, even when excluding

search engines from consideration. While some traf-

fic directed toward search engines could be labeled as

SaaS due to their supplementary services, the preem-

inence of the Platforms cluster remains unassailable.

4 CONCLUSIONS

To the best of our knowledge, our estimation of web

usage concentration is the only published one to date.

Its implications for web studies are profound, as it un-

derscores, through quantitative data, that the charac-

teristics of the Web, particularly in terms of usage,

can be reasonably inferred from a minimal fraction

of all registered domains. While our dataset covers a

mere 0.07% of all domains, it is likely to encapsulate

around 80% of total web traffic.

Our in-depth analysis of the 116 most visited

domains, collectively responsible for approximately

one-third of all web traffic, reveals that nearly all of

this traffic goes towards websites owned by for-profit

digital tech companies. This observation highlights

the Web primarily as a vehicle for commercial enter-

prise. Notably, this enterprise predominantly mani-

fests as purely online ventures rather than online ex-

tensions of offline activities. Originally conceived as

an open and uncharted domain, the Web has evolved

into a realm ripe for commercial exploitation.

Furthermore, it is noteworthy that almost all of the

116 domains analyzed do not charge users for access

or the core functionalities offered by them. This lack

of paywalls highlights prevalent business models on

the Web, which rely on alternative revenue streams.

WEBIST 2024 - 20th International Conference on Web Information Systems and Technologies

188

Such revenue generation methods may include charg-

ing for supplementary features, as observed in do-

mains like google.com, youtube.com, roblox.com,

amazon.com, and github.com. Additionally, some

companies secure venture capital funding to pursue a

“growth at all costs” strategy, as exemplified by plat-

forms such as whatsapp.com and quora.com (Kutcher

et al., 2014; Ernst & Young LLP, 2014; Constine,

2013). Moreover, certain companies engage in two-

sided markets, where the user base serves more as

an asset than traditional customers, providing valu-

able data, customers, and audiences for the other side

of the market. Prominent examples of this approach

include facebook.com, booking.com, ebay.com, and

youtube.com (Zuboff, 2019).

Most traffic to top domains goes towards websites

that do not generate their content. Instead, this con-

tent originates from various sources, including users

(e.g., instagram.com, xvideos.com, github.com, and

messenger.com), sellers (ebay.com, booking.com,

and aliexpress.com), or other external websites (such

as search engines and news aggregators). We named

websites that exhibit these predominant characteris-

tics as “Platforms.” Platforms compose most of the

top domains (67 out of 116) and collectively capture

over 80% of its traffic (refer to Fig. 6), underscoring

their significance in scholarly discourse (Hein et al.,

2020; Hermes et al., 2020b; Zuboff, 2019).

While our platform identification efforts focused

on approximately one-third of the web traffic, our

data suggests that platform hegemony could extend

to more significant portions of web usage. Several

prominent industries outlined in Fig. 3 primarily

consist of such websites. For instance, “Search En-

gines,” “Social Networks and Online Communities,”

and “Adult” industries are mostly comprised of plat-

forms. Additionally, “TV Movies and Streaming,”

although primarily constituted by subscription con-

tent providers, sees its traffic largely dominated by

youtube.com, a platform. While platform dominance

has been previously acknowledged in the financial

realm (Evans and Gawer, 2016) and may be read-

ily observed through personal experience, we are un-

aware of former quantitative evidence of its preva-

lence over web traffic.

The concentration of web visits on platforms can

be seen as a form of privatization of the Web, par-

ticularly concerning its usage dynamics. Despite the

abundance of domain names and websites – publish-

ing an independent website remains straightforward

and accessible to many – visits are a scarce resource

that platforms have enclosed. Within the web context,

visits represent more than mere audience numbers, as

visitors actively contribute to the content hosted on

platforms. Web usage, encompassing activities such

as viewing, posting, and interacting, predominantly

occurs within these platforms, which dictate the rules

governing these activities and determine the fate of

the content and data generated through these visits.

Additionally, we observe that a staggering 80%

of the traffic to the top domains flows to compa-

nies in the United States. This substantial concen-

tration, which could potentially characterize the Web

as predominantly an American enterprise, has been

previously highlighted in terms of companies’ mar-

ket value (Evans and Gawer, 2016), but not in terms

of traffic distribution. As discussed in Section 3.3,

the accumulation of traffic on specific countries ne-

cessitates a socio-economic and political explanation.

Hermes et al. took a step in this direction by inter-

viewing European experts and top managers to glean

insights into the reasons behind the dominance of

American platforms in terms of market value (Her-

mes et al., 2020a). Their findings suggest that factors

such as a results-oriented mindset, willingness to take

risks, a sizable domestic market, state investment,

early-mover advantage, the establishment of technol-

ogy hubs (such as Silicon Valley), close collabora-

tions with universities, and access to venture capital

collectively contribute to American dominance in the

web landscape.

The utilization of the Web exhibits, of course, sig-

nificant diversity, varying among different individu-

als, social groups, and countries. However, our analy-

sis indicates that, currently, on a global scale, the Web

is predominantly characterized by the overwhelming

presence of for-profit American platforms with busi-

ness models not reliant on subscription fees. This ob-

servation provides quantitative support for common

descriptions of the digital realm, such as “Platform

capitalism” (Srnicek, 2016), “Surveillance capital-

ism” (Zuboff, 2019), and “Technofeudalism” (Varo-

ufakis, 2024). While these descriptions often focus on

corporate giants like Alphabet, Meta, Microsoft, and

Amazon, potentially conveying that their findings are

specific to these companies, our analysis suggests oth-

erwise. These companies not only command a signif-

icant portion of web usage but also exhibit character-

istics mirrored by numerous smaller entities, indicat-

ing that their descriptions may reflect broader trends

across the web ecosystem.

ACKNOWLEDGEMENTS

The artificial intelligence systems ChatGPT and

Grammarly were used to revise the text for orthog-

raphy, grammar, and style.

The Web Unpacked: A Quantitative Analysis of Global Web Usage

189

REFERENCES

Adamic, L. A. and Huberman, B. A. (2000a). The

nature of markets in the world wide web.

https://ssrn.com/abstract=166108.

Adamic, L. A. and Huberman, B. A. (2000b). Power-

law distribution of the world wide web. Science,

287(5461):2115–2115.

Agarwal, V. and Sastry, N. (2022). “way back then”: A

data-driven view of 25+ years of web evolution. In

Proceedings of the ACM Web Conference 2022, pages

3471–3479.

Cannon, R. (2008). More people are using

google to navigate, not just search [data].

https://www.searchenginejournal.com/is-google-

trumping-the-url/6820. Acessed on 2024-02-29.

CERN (1993). Software release of www into public do-

main. https://cds.cern.ch/record/1164399.

Chakrabarti, S., Joshi, M. M., Punera, K., and Pennock,

D. M. (2002). The structure of broad topics on the

web. In Proceedings of the 11th International Confer-

ence on World Wide Web, pages 251–262.

Constine, J. (2013). Quora signals it’s favoring search ads

for eventual monetization, launches author stats tool.

http://techcrunch.com/2013/11/12/quora-confirms-

its-favoring-search-ads-for-eventual-monetization-

launches-author-stats-tool. Acessed on 2024-04-10.

Crichton, K., Christin, N., and Cranor, L. F. (2021). How do

home computer users browse the web? ACM Trans.

Web, 16(1).

Diachuk, O., Loba, P., and Mirgorodskaya, O. (2021).

Comparing accuracy: Semrush vs similarweb.

http://www.owox.com/blog/articles/semrush-vs-

similarweb. Acessed on 2024-04-18.

Ernst & Young LLP (2014). What-

sapp inc. financial statements.

http://www.sec.gov/Archives/edgar/data/1326801/

000132680114000047/exhibit991auditedwhatsappi

.htm. Acessed on 2024-04-10.

Evans, P. and Gawer, A. (2016). The rise of

the platform enterprise: A global survey.

http://www.thecge.net/app/uploads/2016/01/PDF-

WEB-Platform-Survey

01 12.pdf. Acessed on

2024-04-18.

Georgieva, G., Arnab, S., Romero, M., and de Freitas, S.

(2015). Transposing freemium business model from

casual games to serious games. Entertainment Com-

puting, 9-10:29–41.

Hardwick, J. (2018). Find out how much traf-

fic a website gets: 3 ways compared.

http://ahrefs.com/blog/website-traffic. Acessed

on 2024-04-18.

Hein, A., Schreieck, M., Riasanow, T., Setzke, D. S., Wi-

esche, M., B

¨

ohm, M., and Krcmar, H. (2020). Digital

platform ecosystems. Electron Markets, 30:87–98.

Hermes, S., Clemons, E., Schreieck, M., Pfab, S., Mitre,

M., B

¨

ohm, M., Wiesche, M., and Krcmar, H. (2020a).

Breeding grounds of digital platforms: Exploring

the sources of american platform domination, china’s

platform self-sufficiency, and europe’s platform gap.

In Proceedings of the 28th European Conference on

Information Systems (ECIS).

Hermes, S., Hein, A., B

¨

ohm, M., Pfab, S., Weking, J., and

Krcmar, H. (2020b). Digital platforms and market

dominance: Insights from a systematic literature re-

view and avenues for future research. In Proceedings

of the 24th Pacific Asia Conference on Information

Systems: Information Systems (IS) for the Future.

Huberman, B. A. (2001). The Laws of the Web: Patterns in

the Ecology of Information. The MIT Press.

Huizingh, E. K. (2000). The content and design of web

sites: an empirical study. Information & Management,

37(3):123–134.

Jansen, B. J., Jung, S.-g., and Salminen, J. (2022). Measur-

ing user interactions with websites: A comparison of

two industry standard analytics approaches using data

of 86 websites. PLOS ONE, 17(5):1–27.

Kutcher, E., Nottebohm, O., and Sprague,

K. (2014). Grow fast or die slow.

http://www.mckinsey.com/industries/technology-

media-and-telecommunications/our-insights/grow-

fast-or-die-slow. Acessed on 2024-04-10.

Lee, E., Lee, J., and Lee, J. (2006). Reconsideration of the

winner-take-all hypothesis: Complex networks and

local bias. Management Science, 52(12):1838–1848.

Liu, J., Li, X., and Guo, Y. (2017). Periodicity analysis

and a model structure for consumer behavior on hotel

online search interest in the us. International Journal

of Contemporary Hospitality Management, 29.

Liu, Z., Yan, Y., and Hauskrecht, M. (2018). A flexi-

ble forecasting framework for hierarchical time se-

ries with seasonal patterns: A case study of web traf-

fic. In The 41st International ACM SIGIR Conference

on Research & Development in Information Retrieval,

pages 889–892.

Petrosyan, A. (2024). Number of internet and so-

cial media users worldwide as of january 2024.

http://www.statista.com/statistics/617136/digital-

population-worldwide. Acessed on 2024-02-27.

Prantl, D. and Prantl, M. (2018). Website traffic measure-

ment and rankings: competitive intelligence tools ex-

amination. International Journal of Web Information

Systems, 14(4):423–437.

Srnicek, N. (2016). Platform Capitalism. John Wiley &

Sons, 1 edition.

Varoufakis, Y. (2024). Technofeudalism: What Killed Cap-

italism. Melville House, 1 edition.

Verisign (2023). Verisign domain name industry brief:

354 million domain name registrations in the first

quarter of 2023. http://blog.verisign.com/domain-

names/verisign-q1-2023-the-domain-name-industry-

brief. Acessed on 2024-02-21.

Webster, J. G. and Lin, S.-F. (2002). The internet audience:

Web use as mass behavior. Journal of Broadcasting &

Electronic Media, 46(1):1–12.

Zuboff, S. (2019). The age of surveillance capitalism: the

fight for a human future at the new frontier of power.

Public Affairs, 1 edition.

WEBIST 2024 - 20th International Conference on Web Information Systems and Technologies

190