The Effect of Price on E-Commerce Platforms: Statistical Evaluation

of Amazon's Pricing Strategy

Xinguo Luo

a

Institute of Problem Solving, University of Toronto, 27 King’s College Cir, Toronto, Canada

Keywords: Amazon, Online Retailing, Sales, Customer Rating, Pricing Strategy.

Abstract: This present study is meant to explain whether Amazon’s pricing strategies, like providing discounts or not,

have some benefits for product sales and consumer ratings (i.e., customers’ satisfaction with the products).

The original dataset was downloaded from the Kaggle platform, and it contains sales records of about 1.4

million products during September 2023. However, in order to fit this present study better, a simplified dataset

with 166,481 samples was filtered from the 1.4 million samples of the original dataset according to the average

monthly consumption of Americans. The method of this study was simple linear regression, which can be

used to understand the association between two variables. Then, two linear models were generated with Excel.

After all, the results showed that the p-values are statistically significant for both discounts and sales and

discount and customer ratings. In more detail, discounted products have better sales than regular goods, and

they have better customer evaluation.

1 INTRODUCTION

1.1 Background

With the growth of the Internet and electronic devices

in recent years, online retail platforms have

experienced significant development in many aspects.

More and more people like to browse and buy what

they want through e-commerce platforms. According

to Jap et al. (2022), in 2020, some famous online

marketplaces such as Amazon, Taobao, and T-mall

earned $2.7 trillion in global sales, which held the

majority of global online sales of that year. Besides

selling things, Amazon has entered even more

different areas these years, such as education. All of

this shows that e-commerce platforms like Amazon

have already become a substantial part of the global

economy.

1.2 Literature Review

Studies indicate that many people visit shopping

websites several times a week and shop at online

retail stores at least once a month (Menon, 2023).

Each platform has different advantages, and it is

a

https://orcid.org/0009-0001-3926-6151

important to build suitable and customized sales

strategies to develop an online sales platform (Kwak

et al., 2019; Zhang et al., 2023). For example, some

products sold on Amazon.com always remain at a low

price or with a high discount rate (Reimers &

Waldfogel, 2017).

Pricing is an important but complex part of retail,

especially for online retailing. Unlike traditional

offline stores, people can see the price of products

more directly when shopping online and may be more

sensitive to price. Online retail prices relate to many

aspects, such as customer satisfaction, sales, and

profit (Nataraja et al., 2017). In this case, although the

price of goods may change frequently according to

market conditions, many e-commerce platforms still

implement computer algorithms to set prices

automatically to increase profits (Aparicio et al.,

2024). Some companies even rely on high sales to

stay afloat at extremely low prices (Sussman, 2019).

Consequently, this study will mainly focus on

Amazon's pricing strategy and its potential influence.

It seems that lower and discounted prices can help

increase customer satisfaction and sales.

Luo, X.

The Effect of Price on E-Commerce Platforms: Statistical Evaluation of Amazon’s Pricing Strategy.

DOI: 10.5220/0012925300004508

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Engineering Management, Information Technology and Intelligence (EMITI 2024), pages 239-242

ISBN: 978-989-758-713-9

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

239

2 METHOD

2.1 Data

The original dataset found on the Kaggle website

includes extensive information about Amazon's

product sales in September 2023. It contains the

records of 1,426,337 Amazon products, each with a

product ID, a title, links to product images, official

links to the products, rating, number of reviews,

present price, primary price, category, bestseller

status, and number of products sold on Amazon in

September 2023 (Asaniczka, 2023). In these 1.4

million samples, the price of the products ranges

widely from $0.01 to $19,700. However, according to

the U.S. Bureau of Labour Reports (2023), the 2022

annual expenditures for all consumers in the United

States averaged $72,967, and only 15.2% of that

spending is likely to be related to online shopping. In

other words, Amazon consumption will be at most

$924.25 per month for most American consumers.

The products sold for over $924.25 seem less familiar

for daily purchases and were removed from the

dataset. Also, products under $50 are deleted since

the discount rate is too small. In addition, because

some of the product information is incomplete, those

products will not be analyzed.

Therefore, the simplified dataset has 166,481

products in 270 categories. The price interval

becomes $50 to $924.25, with some discounts and

some not. Besides, product ratings range from 0 to 5

stars, with an average rate of 3.8 (SD = 1.51), which

shows that most customers are satisfied with the

goods. The top seller in September 2023 was a

refrigerator filter that sold 40,000 pieces in a month

and had never been a best seller before.

2.2 Design

2.2.1 Pricing Strategy and Sales

A linear regression model will be generated through

Excel. The independent variable is the pricing

strategy, which determines whether the product is

discounted. It is a dummy variable that was created

for non-quantitative classification. If the present price

is greater or equal to the original listed price, it is

considered to have no discount (i.e., discount equals

0). Otherwise, if the current price is smaller than the

primary one, a discount was implemented and could

be represented by 1. The response variable is the

number of sales in September 2023 collected from

Amazon.com. This model aims to find the

relationship between price discounting activity and

sales volume.

The original formula for this linear regression

model is:

𝑦

∗

(1)

where 𝑦1 refers to the number of sales, 𝑥1 refers

to whether there is a discount or not, 𝛽1 shows how

the sales will change with the discount, 𝛽0where 𝑦

refers to the number of sales, 𝑥

refers to whether

there is a discount or not, 𝛽

shows how the sales will

change with the discount, 𝛽

is the number of sales

when there is not any account, and 𝜖

is the influence

of other confounding factors.

2.2.2 Pricing Strategy and Customer Rating

This study analysed whether discounts impact

customers’ satisfaction with the products they buy.

Whether there is a discount is an independent

variable, and the response variable is the stars of the

products. To be more specific, the stars are the scores

the products got that aim to evaluate customers'

satisfaction with the products. The statistical method

used is also the linear regression model:

𝑦

∗

(2)

𝑦

is the customer rating of products ranging from

0 to 5, 𝑥

refers to whether there is a discount or not,

𝛽

explains how the rating will change with the

discount, 𝛽

means the scores the products got when

there is not any account, and 𝜖

is the potential

random factors.

3 RESULTS

3.1 Pricing Strategy and Sales

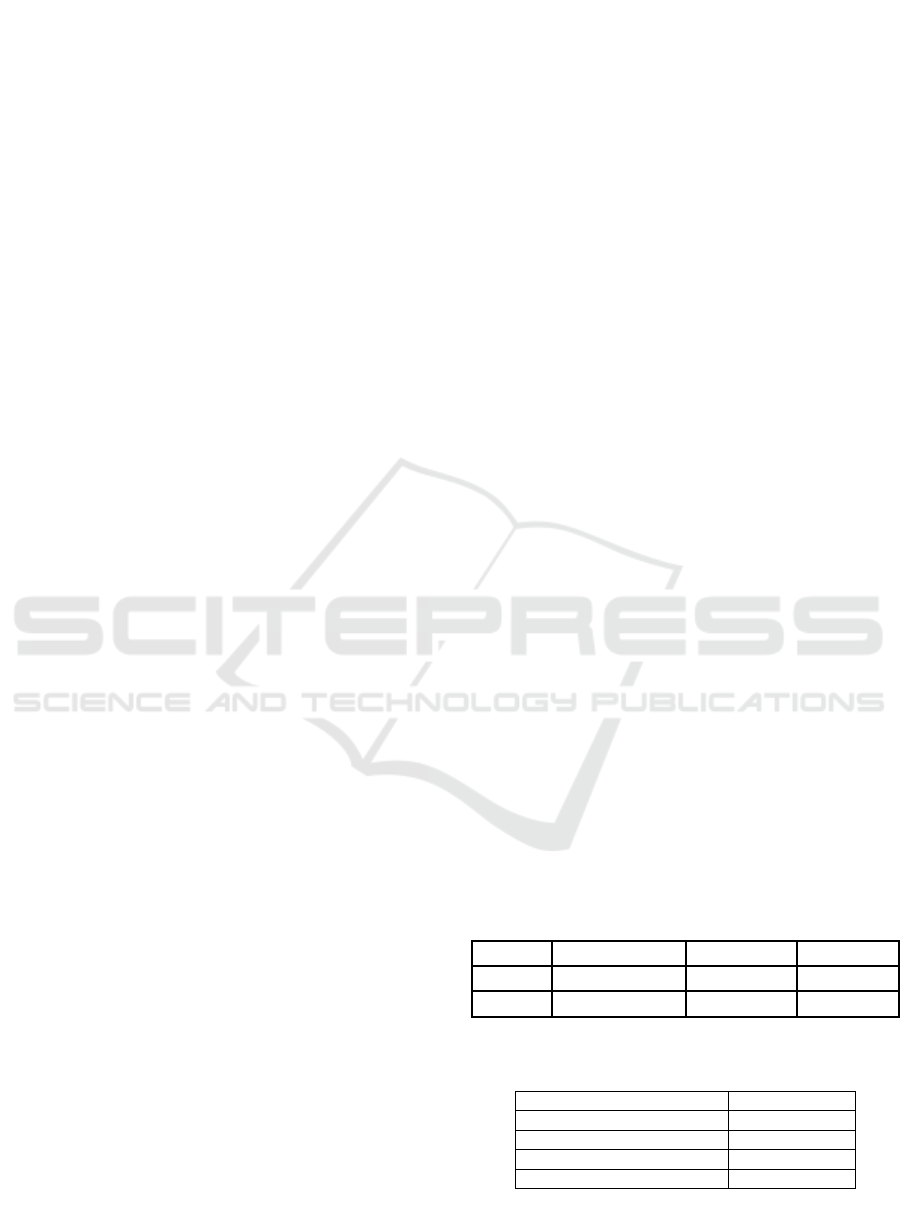

Table 1: The linear model of pricing strategy and sales.

Coefficients t Stat P-value

Intercept 48.46824613 44.03809732 0

Discount 56.7219767 26.77102313 1.5201E-157

Table 2: The regression statistics of pricing strategy and

sales.

Multiple R .06547152

R Square .00428652

Adjusted R Square .00428054

Standard Erro

r

383.728542

Observations 166481

EMITI 2024 - International Conference on Engineering Management, Information Technology and Intelligence

240

Table 3: ANOVA test of pricing strategy and sales.

df SS MS F

Significa

nce F

Regressi

on

1

10553053

6.3

10553053

6.3

716.6876

787

1.5201E-

157

Residual

16647

9

24513632

187

147247.5

939

Total

16648

0

24619162

723

According to the regression model in Table 1, some

statistical relationships between the price strategy and

the sales quantity demonstrated that:

𝑦

. .

(3)

Table 2 exhibits that the R-squared value for the

linear regression is about 0.004, suggesting that the

model could only explain a small portion of the sales

variability and that there are many other factors

affecting sales the model did not include. However,

the p-value in Table 1 is much smaller than the

significant level, p < .001, representing that the

influence of discount for sales is statistically

significant. Since the coefficient is greater than 0,

there is a positive association between the pricing

strategy and sales, which means the sales will

increase as the discount gets bigger. Also, the model

is a good fit for the data because Table 3 represents

the significance of the F-statistic is less than 0.05.

3.2 Pricing Strategy and Customer

Rating

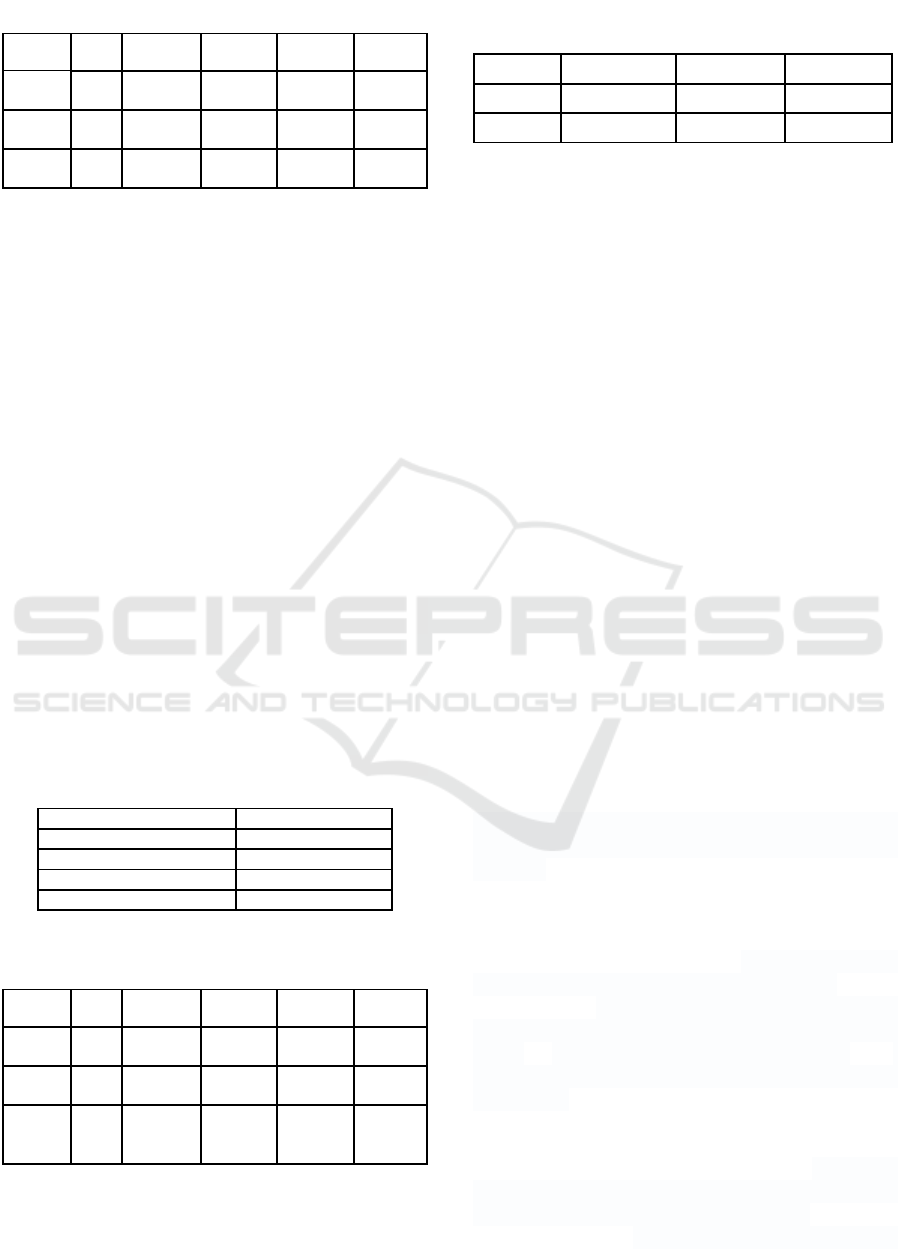

Table 4: The regression statistics of pricing strategy and

starts of products.

Multiple R .06547152

R Square .00428652

Adjusted R Square .00428054

Standard Erro

r

383.728542

Observations 166481

Table 5: ANOVA test of pricing strategy and starts of

products.

df SS MS F

Significa

nce F

Regressi

on

1

10553053

6.3

10553053

6.3

716.6876

787

1.5201E-

157

Residual

16647

9

24513632

187

147247.5

939

Total

16648

0

24619162

723

Table 6: The linear model of pricing strategy and starts of

products.

Coefficients t Stat P-value

Intercept 48.46824613 44.03809732 0

Discount 56.7219767 26.77102313 1.5201E-157

According to the tables above, the linear regression

model of pricing strategy and customer rating shows

a formula:

𝑦

. .

(4)

The statistical data in Table 6 exhibits a statistical

significance between the variables, p < .001. Because

of the positive coefficient, the product rating would

increase with the increase in the discount. Although

the R-square in Table 4 indicates that only 1.299% of

the variable could be explained by the model, the F-

statistic result (i.e., significance F) of the ANOVA

test in Table 5 is less than 0.05, indicating that the

model can significantly fit the collected data.

Based on the analysis of two linear regression

models above, because the two p-values in Table 1

and Table 6 are less than 0.01, there is a statistically

significant association between the pricing strategy

and the sales, as well as the pricing strategy and rating.

According to the coefficients, the higher the discount,

the higher the sales will increase significantly, and the

customer's evaluation of the product will also

increase. A suitable pricing strategy is vital for

Amazon to operate better.

4 DISCUSSION

True to the original assumption, the discount and low-

price strategy can improve product sales and ratings.

Firstly, discounts can easily stimulate people's

consumption. On the one hand, lower prices would

make consumers more willing to order the target item.

On the other hand, excitement may push consumers

to make some purchases that are not in their primary

plan, especially when discounts are high (Kim &

Tanford, 2021). Secondly, because the price is low,

the consumers’ tolerance for the product has become

higher. Although the goods may have some flaws,

people will also feel satisfied because of the relatively

lower price.

A proper promotion can bring many a lot of

benefits to a company. Amazon understood this idea

early on and provided a practical example. In the field

of online book retailing, Amazon has beaten many

competitors with the low prices they set (Reimers &

Waldfogel, 2017). Amazon has never raised book

The Effect of Price on E-Commerce Platforms: Statistical Evaluation of Amazon’s Pricing Strategy

241

prices in the past two decades, even though few

competitors have left (Reimers & Waldfogel, 2017).

While most companies trying to compete with low

prices have gone bankrupt, Amazon has already

passed the deficit stage (Sussman, 2019) and

increased revenue every year (Reimers & Waldfogel,

2017). Amazon has found a pricing strategy that

works best for it.

However, although the results may match

Amazon’s actual situation, this present study has

some limitations. Firstly, the dataset used in this study

only includes Amazon's sales in the United States

over a one-month period, which means it may not be

a good interpretation for other countries or times. For

example, some American holidays in September, like

Labor Day, may become a factor that leads people to

buy more items than usual for celebrating. Secondly,

by refining the limited dataset, the study only

discussed the influence of pricing strategies through

the data collected but did not pay much attention to

the products or the consumers themselves. Just as

people are influenced by shopping values and price

awareness, transactional tendencies, and coupons

when shopping at the mall (Khare et al., 2014), so are

they when shopping online. There are many

environmental and personal factors that may affect

the relationship between price, rating, and sales, but

it is hard to collect and define them.

5 CONCLUSION

In conclusion, the preliminary analysis has been

solved with the available variables: a promotion

strategy positively affects Amazon’s online retail

store, both for sales and customer satisfaction with the

products. Nevertheless, more potential variables are

involved in the interaction in real life, and the pricing

strategy may have a broader effect. As people

continue to do more studies in wider fields and

connect them with each other, more personal factors

can be added to the discussion, allowing people to

understand the pricing strategy and the customers

better.

REFERENCES

Aparicio, D., Metzman, Z., & Rigobon, R. (2024). The

pricing strategies of online grocery retailers.

Quantitative Marketing and Economics, 22(1), 1–21.

https://doi.org/10.1007/s11129-023-09273-w

Asaniczka. (2023). Amazon Products Dataset 2023 (1.4M

Products) [Data set]. Kaggle. https://doi.org/

10.34740/KAGGLE/DS/3798081

Jap, S. D., Gibson, W., & Zmuda, D. (2022). Winning the

new channel war on Amazon and third-party platforms.

Business Horizons, 65(3), 365–377. https://doi.org/

10.1016/j.bushor.2021.04.003

Khare, A., Achtani, D., & Khattar, M. (2014). Influence of

price perception and shopping motives on Indian

consumers’ attitude towards retailer promotions in

malls. Asia Pacific Journal of Marketing and

Logistics, 26(2), 272–295.

https://doi.org/10.1108/APJML-09-2013-0097

Kwak, J., Zhang, Y., & Yu, J. (2019). Legitimacy building

and e-commerce platform development in China: The

experience of Alibaba. Technological Forecasting &

Social Change, 139, 115–124. https://doi.org/1

0.1016/j.techfore.2018.06.038

Menon, S. (2023). Amazon Consumer Behaviour Dataset

[Data set]. Kaggle. https://www.kaggle.com/datasets/

swathiunnikrishnan/amazon-consumer-behaviour-data

set

Myers, S., Paulin, G. D., & Thiel, K. (2023). Consumer

expenditures in 2022. U.S. Bureau of Labor Statistics.

https://www.bls.gov/opub/reports/consumer-expenditu

res/2022/home.htm

Natarajan, T., Balasubramanian, S. A., & Kasilingam, D. L.

(2017). Understanding the intention to use mobile

shopping applications and its influence on price

sensitivity. Journal of Retailing and Consumer

Services, 37, 8–22. https://doi.org/10.1016/j.jret

conser.2017.02.010

Reimers, I., & Waldfogel, J. (2017). Throwing the Books at

Them: Amazon’s Puzzling Long Run Pricing

Strategy. Southern Economic Journal, 83(4), 869–885.

https://doi.org/10.1002/soej.12205

Sussman, S. (2019). Prime predator: Amazon and the

rationale of below average variable cost pricing

strategies among negative-cash flow firms. Journal of

Antitrust Enforcement, 7(2), 203–219. https://doi.org/

10.1093/jaenfo/jnz002

Zhang, T., Li, G., & Tayi, G. K. (2023). A strategic analysis

of virtual showrooms deployment in online retail

platforms. Omega (Oxford), 117, 102824-.

https://doi.org/ 10.1016/j.omega.2022.102824

EMITI 2024 - International Conference on Engineering Management, Information Technology and Intelligence

242