Research on the Impact of Expanding Cross-Border e-Commerce

Business on e-Commerce Enterprises: A Case Study of

Pinduoduo and Jingdong

Ruikang Gong

a

School of Economics and Management, Anhui Jianzhu University, Hefei, Anhui Province, 230009, China

Keywords: Cross-Border e-Commerce, Pingduoduo, Temu, Jingdong, Stock Price.

Abstract: As an emerging business model, rapid development has occurred on cross-border e-commerce in recent

decades, not only providing businesses with a broader market space but also bringing new opportunities and

challenges. Pinduoduo's (PDD) quick development and the meteoric rise in its market value have garnered

significant public attention during these years. Team, a cross-border e-commerce retail store owned by PDD,

was a remarkable success within a year of its launch, which may be one of the reasons for PDD’s rapid

development. This paper has conducted a series of data collection and analysis on how international e-

commerce affects enterprises, aiming to reveal its actual influence on business operations. In this paper, the

data of PDD and Jingdong(JD) was analyzed to investigate the effects of expanding cross-border e-commerce

business on e-commerce enterprises. It discovered that expanding cross-border e-commerce business will not

significantly improve the net income of e-commerce enterprises. However, the stock prices of e-commerce

enterprises have boosted significantly after expanding cross-border e-commerce business. After further

conjectures and summaries, it reveals that although expanding cross-border e-commerce business cannot

significantly improve net income in the short term, it can significantly increase stock prices, which benefits

boost investors' confidence and attract their attention and support. These results can provide suggestions and

guidance for e-commerce enterprises when they decide whether to expand cross-border e-commerce business.

1 INTRODUCTION

As Internet technology advanced quickly, the cross-

border e-commerce business grew significantly in the

world, supported by advanced technologies, growing

demand, and favorable policies(Ding, F., Huo, J., &

Campos, J. K., 2017, September). This emerging

business model is efficient enough compared with

traditional transaction modes and facilitates fast

transactions (Zhang, X., 2019). It has been rapidly

expanding, offering companies a more extensive

market space and presenting both opportunities and

challenges along the way. The growth and

development of e-commerce businesses have made

the decision of whether to develop cross-border e-

commerce become an important issue. The booming

development of cross-border e-commerce has also

attracted the increasing attention of the Chinese

government. Following the implementation of

a

https://orcid.org/0009-0000-1270-6949

numerous policies by the Chinese government to

encourage the growth of international e-commerce, e-

commerce businesses like JD and PDD had

successively established cross-border e-commerce

platforms(Wang, Y., Wang, Y., & Lee, S. H.,

2017).In recent years, the market value of PDD has

grown enormously, which has attracted the attention

of many stock investors and researchers.PDD and JD,

as two representative e-commerce businesses in

China, also have a prominent position in the domain

of international e-commerce. They respectively

developed cross-border e-commerce in September

2022 and April 2015. In 2023, Danmian Li et al.

raised research about the success of temu, which is a

platform for international e-commerce established by

PDD. Temu achieved great success within a year of

launch due to the right operational decisions and

market positioning (Li, D., 2023).This paper observed

the start of market value growth enormously of PDD

coincides with the launch of temu. Previous studies

Gong, R.

Research on the Impact of Expanding Cross-Border e-Commerce Business on e-Commerce Enterprises: A Case Study of Pinduoduo and Jingdong.

DOI: 10.5220/0012926500004508

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Engineering Management, Information Technology and Intelligence (EMITI 2024), pages 269-277

ISBN: 978-989-758-713-9

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

269

have shown that developing cross-border e-commerce

had a noteworthy favorable effect on promoting

international trade in China (Wang, Y., Wang, Y., &

Lee, S. H., 2017). In this paper, the conjecture was

proposed:expanding cross-border e-commerce

business is conducive to the development of e-

commerce enterprises.To verify this conjecture, this

paper took PDD and JD as the research objects and

explored the effects of developing international e-

commerce on them through data analysis. By

studying the influence of JD and PDD on developing

international e-commerce, it is beneficial to have a

thorough awareness of the e-commerce industry's

current state of development and trends. This paper

collected and analyzed revenue and income data from

the official quarterly reports of PDD and JD as well

as stock price data from Yahoo Finance. In terms of

data analysis, the data were first modeled and then

subjected to regression analysis and difference in

difference analysis (DID analysis). For the analysis of

these three types of data, different results were

obtained. Regarding the analysis of revenue, results

indicated that developing international e-commerce

didn’t have a significant effect on the revenue of JD,

but it has significantly improved PDD's revenue. In

the analysis of net income, results indicated that there

is no discernible effects of developing international e-

commerce on PDD and JD's net income. The analysis

results in both sections are contrary to the initial

conjecture. However, in the analysis of net income,

results indicated that developing international e-

commerce boosted PDD and JD’s stock prices

significantly. It is the same as the original conjecture.

Through data analysis, this paper verified that the

growth of e-commerce businesses is positively

impacted by expanding cross-border e-commerce

business, which has contributed to the research on the

operation and development of international e-

commerce. This research revealed that developing

international e-commerce cannot significantly

improve the profitability of e-commerce enterprises

in the short term, but it can significantly boost the

market value of enterprises.

2 LITERATURE REVIEW

2.1 Birth and Development of

Cross-Border e-Commerce Business

The term cross-border e-commerce began to appear in

2011, which refers to a novel pattern of international

trade, in which transaction subjects in different border

regions reach transactions in the way of e-commerce,

order online, pay and settle, deliver goods through

cross-border logistics, clear customs, and finally

deliver, and complete transactions(Xue, W., Li, D., &

Pei, Y., 2016).As an emerging trade pattern, cross-

border e-commerce is the technology foundation for

advancing trade globalization and economic

integration, which is quite significant from a strategic

perspective. International e-commerce has greatly

altered the global economy and trade by promoting

borderless trade and international trade.(Shuai, Q., Li,

Z., & Zhang, Y., 2023).In cross-border trade, long

supply chains with numerous middlemen allow

consumers to buy goods from overseas.(Qi, X., Chan,

J. H., Hu, J., & Li, Y., 2020).This emerging trade

pattern is smaller, more often, and faster than before,

which has been rapidly expanding, offering Cross-

border e-commerce enterprises a more extensive

market space and presenting both opportunities and

challenges along the way. Although many large e-

commerce enterprises throughout the globe have

developed international e-commerce businesses, most

studies do not provide the specific effects of

developing international e-commerce on the

development of enterprises, and merely a few

research analyze some successful cases of e-

commerce enterprises in developing international e-

commerce business. The purpose of this paper is to

obtain a thorough understanding of the ways in which

cross-border e-commerce impacts cross-border e-

commerce firms.

2.2 Success of Temu Attracted

Attention

Temu is a platform for international e-commerce

established by PDD. Since Temu was formally

launched in the US on September 1, 2022, it has

achieved success with its main selling point of low

prices. Subsequently, Temu quickly entered markets

such as Canada and Australia. By April 2023, Temu

officially landed in the UK and rapidly expanded to

other European markets such as Germany, France,

Italy, the Netherlands, New Zealand, and Spain. It

then entered Japan, South Korea, and some Southeast

Asian countries. By September 2023, Temu's website

covered Europe, North America, Oceania, Latin

America, and Asia. Temu uses digital marketing

techniques to increase its reach and discount pricing

to attract customers. In addition, it leveraged data

management practices to gain valuable customer

insights. These strategies have allowed teum to

expand rapidly and achieve remarkable results(Li, D.,

2023).The success of temu has attracted attention of

investors, it has been seen as beneficial to PDD's rapid

EMITI 2024 - International Conference on Engineering Management, Information Technology and Intelligence

270

growth, which has led investors to look to PDD.

Therefore, this paper took the impact of tume's

success on PDD as part of the research.

2.3 PDD and JD are Selected as the

Research Objects

In China, platforms like PDD and JD stand out as key

players in the e-commerce industry, particularly in the

realm of cross-border trade. Through a thorough

examination of these platforms, valuable insights can

be gained into the current status and future trends of

e-commerce. PDD, known for its pseudo-self-

operated model, has revolutionized the market

through social e-commerce and group buying

strategies, embodied in its motto "Team Up, Price

Down." The success of Tume after its launch has led

to further development of PDD. On the other hand, JD

has established itself as a trustworthy platform by

combining self-operated services with a robust

logistics system. Through financing, M&A and self-

construction, JD had also established a cross-border

e-commerce company, which had achieved some

success(Xu, H., 2023).Engaging in outbound M&A

also has a positive impact on Chinese firms achieving

their main objectives(Edamura, K., Haneda, S., Inui,

T., Tan, X., & Todo, Y., 2014).They represent

different operating models and market positioning in

the e-commerce industry. By analyzing the effects of

developing cross-border e-commerce on PDD and JD,

the impact of developing cross-border e-commerce on

e-commerce enterprises can be further indicated.

Therefore, PDD and JD were selected as the research

objects in this paper.

3 MATERIALS AND TOOLS

This section gathered the data on quarterly financial

statements of PDD and JD from Q1 2015 to Q3

2023.Through the selection of numerous data,

revenue and net income was finally selected as the

research objects.The stock price was also collected

from Yahoo Finance.This paper used simple linear

regression analysis to explore the correlation between

the variables that are independent and dependent, and

further investigate the impact of Temu's launch

through DID analysis.

3.1 Data Object of the Research

In this paper, revenue, net income and stock price

were selected as data objects for research. One crucial

financial metric for businesses is revenue, which is

crucial for their financial management. With an

increase of revenue, the market share of the enterprise

will expand accordingly, which helps to improve the

position and influence of the enterprise in the

industry. So this research chose it as a research

object.Net income is the net operating income

realized by an enterprise in a certain period of time. It

reflects the net operating income realized by an

enterprise in a certain period of time, which is one of

the important indicators of the operating status of an

enterprise. The growth of net income can directly

indicate the enhancement of enterprise profitability.

So this research chose it as a research object. An

increase in stock prices can increase the market value

of a business, which helps the company attract the

attention and support of investors. Investors will

believe that the company has greater potential for

growth and development. So this research chose it as

a research object.

3.2 Tools and Analytical Methods of

the Research

In order to verify the conjecture, this paper uses

regression analysis, DID analysis and logarithmic

transformation.Regression analysis is a statistical tool

that is used to determine the relationship between two

or more variables and to establish mathematical

models to represent this relationship.It is commonly

used to determine the causal effect of one variable on

another(Sykes, A. O., 1993).By calculating the

correlation coefficient, regression analysis can

evaluate and measure the closeness of the relationship

between variables.

4 DATA ANALYSIS OF PDD AND

JD

4.1 Regression Analysis of Revenue

In this section, this paper conducted a simple linear

regression analysis using revenue data from the

official quarterly reports from PDD and JD to explore

the correlation between independent and dependent

variables. This section selected revenue as dependent

variables and developing cross-border e-commerce as

an independent indicator variable. Considering that

revenue is quarterly data, it will be affected by

different time Settings. The data models also

introduced trend effect based on year factors to

eliminate the influence of time in the data. Sample

size of data is 27 for both PDD and JD. Time horizon

Research on the Impact of Expanding Cross-Border e-Commerce Business on e-Commerce Enterprises: A Case Study of Pinduoduo and

Jingdong

271

of data is from Q1.2017 to Q3.2023 on PDD and from

Q1.2013 to Q3.2019 on JD. The regression equation

is (1).Part of the data models details are presented in

Table 1.Then regression analysis was done separately,

the results of PDD were presented in Table 2, and

JD’s were presented in Table 3 .In the results, the

coefficients of “Temu’s online” is positive and p-

value is lower than 0.05 in Table 2.Coefficients of

developing international e-commerce is negative and

p-value is higher than 0.05.Results indicate that

“ Temu ’ s online ” significantly boosted the

revenue of PDD, but developing international e-

commerce did not have a noteworthy effect on the

revenue of JD. It prompts further contemplation.

revenue = α+β*Developing cross-border

e-commerce+γ*Year +ε.

(1

)

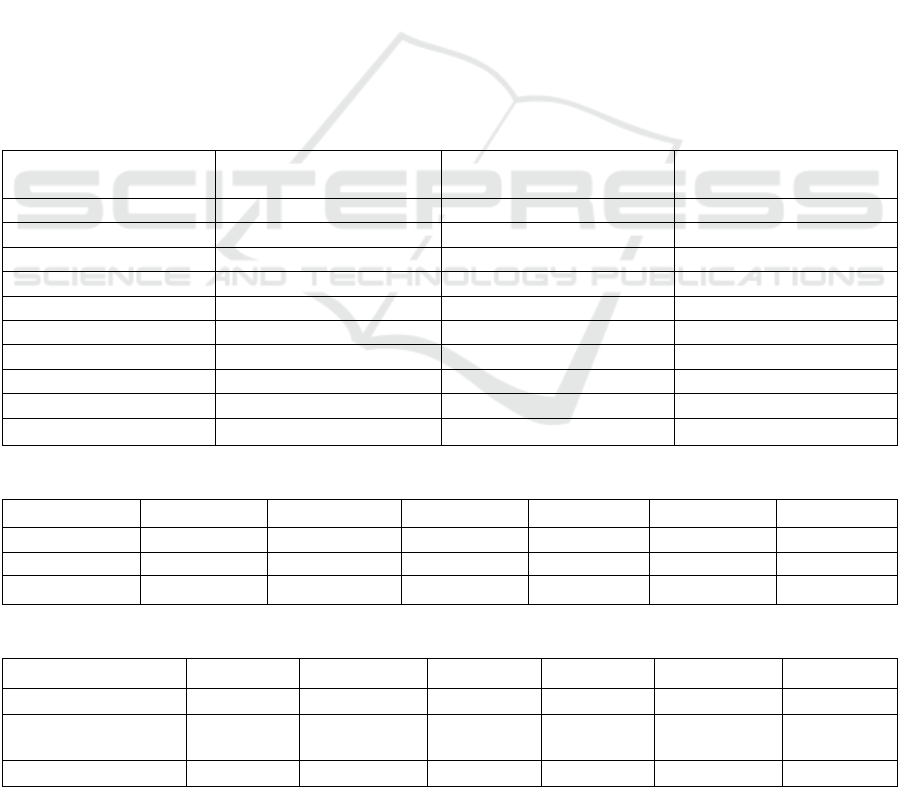

4.2 Regression Analysis of Net Income

In this section, net income was selected as dependent

variable, a line chart of net income data was drawn in

Figure 1.Sample size of data is 38.Time horizon of

data is from Q1.2019 to Q3.2023.As shown in

Figure1, the blue line represents net income of PDD,

the orange line represents net income of JD, red dot

represents the time node of developing cross-border

e-commerce of PDD, all numbers are in 100 million

RMB.In the line chart, it reveals that net income of

PDD has increased obviously and continued to be

higher than JD’s at the red node and after.Before the

regression analysis, some of the data are observed that

they do not follow a normal distribution.So the net

income data was performed a logarithmic

transformation.The transformation equation is (2).

The number A is 44.79 billion RMB.After testing, the

logarithmic transformation successfully normalized

the data that originally did not follow a normal

distribution.Data models were built and part of it is

presented in Table 4.Then the DID analysis was done,

analysis result are presented in Table 5.In the result,

It can be observed that the coefficient is negative and

p-value is smaller than 0.05 about the interaction.

Y=ln(X+A). (2)

Table 1: Part of the Data Models Details.

Time Revenue

Developing cross-border

e-commerce

Trend Effect

2017Q1 37, 019 0 0

2017Q2 104, 617 0 0

2017Q3 423, 038 0 0

2018Q2 2, 709, 046 0 1

2018Q3 3, 372, 418 0 1

2019Q1 4, 545, 204 0 2

2019Q2 7, 290, 008 0 2

2022Q3 35, 504, 304 1 5

2022Q4 39, 820, 028 1 5

2023Q1 37, 637, 050 1 6

Table 2: Revenue Analysis Results of PDD.

Coefficients Standard Error t Stat P-value Lower 95% Upper 95%

Intercept -2114271.869 2320682.759 -0.911055964 0.371326199 -6903925.676 2675381.939

Temu’s on-line 15308932.73 4176144.393 3.665805414 0.001220194 6689794.322 23928071.14

Trend Effect 6003899.882 831907.876 7.217024932 1.85829E-07 4286926.414 7720873.351

Table 3: Revenue Analysis Results of JD.

Coefficients Standard Error t Stat P-value Lower 95% Upper 95%

Intercept 10370082.29 3930397.469 2.638430941 0.014394193 2258140.608 18482023.97

Developing cross-

border e-commerce

-4560525.272 7711996.72 -0.59135467 0.559812002 -20477304.21 11356253.67

Trend Effect 21275327.23 1864351.217 11.41165197 3.51287E-11 17427495.44 25123159.03

EMITI 2024 - International Conference on Engineering Management, Information Technology and Intelligence

272

Figure 1: Net Income Comparison Between PDD and JD.

Table 4: Part of Data Models Details of DID Analysis.

Time Ln(X+A) Before/After Treatment Interaction Trend Effect

2019Q1 3.16800349 0 0 0 0

2019Q2 3.403528 0 0 0 0

2019Q3 2.8361502 0 0 0 0

2019Q4 3.16209381 0 0 0 0

2020Q1 0 0 0 0 1

2020Q2 3.35235722 0 0 0 1

2020Q3 3.24688002 0 0 0 1

2020Q4 3.19826487 0 0 0 1

2021Q1 1.25276297 0 0 0 2

2021Q2 4.17346377 0 0 0 2

2021Q3 4.19509447 0 0 0 2

2021Q4 4.73654926 0 0 0 2

Table 5: DID Analysis Results.

Coefficients Standard Error t Stat P-value Lower 95% Upper 95%

Intercept 2.63732057 0.3439089 7.66866052 7.8944E-09 1.93763266 3.33700848

Before/After 0.76055276 0.56030895 1.35738108 0.18387137 -0.3794044 1.90050988

Treatment 0.76480205 0.29685893 2.57631478 0.01464873 0.16083801 1.36876609

Interaction -1.0894113 0.64698904 -1.6838173 0.10165485 -2.4057204 0.22689776

Trend effect 0.09376054 0.03405205 2.7534473 0.00951397 0.02448111 0.16303997

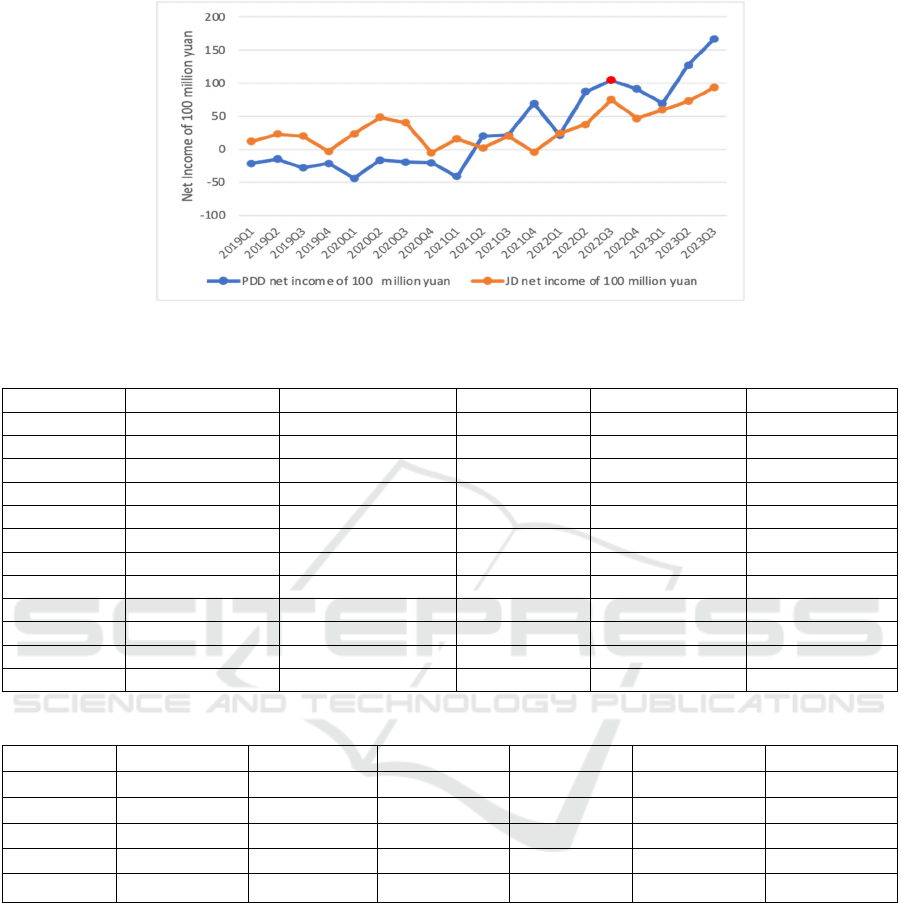

4.3 Regression Analysis of Stock Price

This section will explore the impact of developing

cross-border e-commerce on e-commerce firms by

focusing on changes in stock prices. Data on stock

prices was collected from Yahoo Finance. First, a

separate regression analysis was conducted on the

stock price data of PDD and JD. It is considered that

time may have a trend effect on changes in stock

prices, so trend effect factors in months were also

introduced to eliminate the influence of time in the

data. The sample size of data is 70 for both PDD and

JD. The time horizon of data is from 1st Jan. 2022 to

28th Apr. 2023 on PDD and from 8th Aug. 2014 to

14th Dec. 2015 on JD. The data models of PDD and

JD were built separately. Part of PDD is presented in

Table 6 and part of JD’s is presented in Table 7.

Then the regression analysis was done separately. The

results of PDD were presented in Table 8 and JD’s

were presented in Table 9. In the results, it can be

observed that the coefficient of “Temu’s on-line”

is positive and the p-value of “Temu’s on-line” is

smaller than 0.05 on PDD. The coefficient of

developing cross-border e-commerce is positive and

the p-value of developing cross-border e-commerce is

smaller than 0.05 on JD. These results demonstrate

Research on the Impact of Expanding Cross-Border e-Commerce Business on e-Commerce Enterprises: A Case Study of Pinduoduo and

Jingdong

273

that developing cross-border e-commerce can boost

the stock price of e-commerce enterprises

significantly. Further, the line chat was drawn

presented in Figure 2. Sample size of data is 140. The

time horizon of data is from 1st Jan. 2022 to 28th Apr.

2023. As shown in Figure 2, the dark blue line

represents the stock price of JD, the red dot represents

the time node of developing cross-border e-commerce

of PDD, and all numbers are in one RMB. Through

the line chart, It could be observed that the stock price

of PDD has a significant premium to JD's at the red

node and after. To investigate the relationship

between developing international e-commerce and

stock price changes more thoroughly. After data

models were built, a part of which is presented in

Table 10.DID analysis was done and the results were

presented in Table 11. In the analysis results, the

coefficient of interaction is positive and the p-value of

interaction is smaller than 0.05. It demonstrated that

"Temu's Online" provided a driving force for PDD's

stock price, significantly and positively influencing it,

helping to provide momentum for stock price growth.

Table 6: Part of the Data Models Details of PDD.

Time Stock Price Temu's Online Trend Effect

2022/1/1 55.900002 0 0

2022/1/8 60.41 0 0

2022/1/15 62.41 0 0

2022/1/22 53.049999 0 0

2022/1/29 55.849998 0 0

2022/2/5 60 0 1

2022/2/12 56.029999 0 1

2022/2/19 51.650002 0 1

2022/2/26 41.27 0 1

2022/3/5 32.130001 0 2

Table 7: Part of the Data Models Details of JD.

Time Stock Price Developing cross-border e-commerce Trend Effect

2014/8/18 30.959999 0 0

2014/8/25 31.92 0 0

2014/9/1 29.030001 0 1

2014/9/8 29.25 0 1

2014/9/15 28.35 0 1

2014/9/22 26.93 0 1

2014/9/29 25.98 0 1

2014/10/6 25.01 0 2

Table 8: Regression Analysis Results of PDD.

Coefficients Standard Erro

r

t Stat P-value Lower 95% U

pp

er 95%

Intercept 45.59727 2.919575 15.61778 5.11E-24 39.76978 51.42477

Temu’s on-line 14.1512 5.701079 2.482196 0.01557 2.771797 25.5306

Trend effect 1.503681 0.613849 2.449594 0.016922 0.278433 2.728929

Table 9: Regression Analysis Results of JD.

Coefficients Standard Error t Stat P-value Lower 95% Upper 95%

Intercept 28.0950383 0.86980692 32.300316 1.4175E-42 26.3588964 29.8311802

Developing cross-border

e-commerce

6.41571516 1.55710811 4.12027598 0.0001063 3.30771436 9.52371595

Trend effect -0.312331 0.16757438 -1.8638352 0.06672726 -0.6468109 0.02214883

EMITI 2024 - International Conference on Engineering Management, Information Technology and Intelligence

274

Figure 2: Stock Price Comparison Between PDD and JD.

Table 10: Part of Data Models Details of DID Analysis.

Stock Price Before/Afte

r

Treated/Control Interaction Trend Effect

68.239998 0 0 0 0

73.720001 0 0 0 0

73.459999 0 0 0 0

69.339996 0 0 0 0

73.769997 0 0 0 0

73.980003 0 0 0 1

71.860001 0 0 0 1

72.5 0 0 0 1

63.59 0 0 0 1

47.990002 0 0 0 2

65.129997 0 0 0 2

59.919998 0 0 0 2

59.09 0 0 0 2

56.540001 0 0 0 3

56.560001 0 0 0 3

Table 11: DID Analysis Results of Stock Price.

Coefficients Standard Erro

r

t Stat P-value Lower 95% U

p

per 95%

Intercept 62.07933847 2.204042144 28.16613042 2.22405E-58 57.72042135 66.4382556

Before/Afte

r

-12.10263393 3.962372074 -3.054391083 0.00271772 -19.93898658 -4.266281279

Treatment -11.12942834 2.495506747 -4.459786918 1.71122E-05 -16.06477276 -6.194083922

Interaction 38.72857111 3.529179487 10.97381736 2.0093E-20 31.7489401 45.70820213

Trend Effect -0.044602112 0.381996165 -0.116760627 0.907223267 -0.800072978 0.710868754

5 RESULT AND DISCUSSION

Considering the analysis above, this research detected

the following conclusions:For PDD and JD,

developing cross-border e-commerce cannot

significantly improve net income in the short term,

but it could significantly boost stock

prices.Developing cross-border e-commerce can

significantly improve revenue for PDD, but cannot

for JD.Considering the data performance analysis of

JD and PDD, this research also has proposed several

speculations regarding the differences between the

0

20

40

60

80

100

120

01/01/2022

01/02/2022

01/03/2022

01/04/2022

01/05/2022

01/06/2022

01/07/2022

01/08/2022

01/09/2022

01/10/2022

01/11/2022

01/12/2022

01/01/2023

01/02/2023

01/03/2023

01/04/2023

Stock Price of yuan

JD close stock price(in RMB one) PDD close stock price(in RMB one)

Research on the Impact of Expanding Cross-Border e-Commerce Business on e-Commerce Enterprises: A Case Study of Pinduoduo and

Jingdong

275

two. First, this paper has highlighted that differences

in company positioning and market strategies may

result in varying responses to overseas e-

commerce.The distinct market positions of JD and

PDD could significantly influence their performance

in the international e-commerce landscape. Second,

disparities in market conditions may lead to

differences in revenue and stock price

performances.JD and PDD may encounter unique

challenges and opportunities due to differing market

conditions, thus impacting their financial

performances differently. Last, differences in

operational management strategies could be a

significant factor driving the disparities in data

outcomes. Variances in how the companies handle

business operations may contribute to differences in

their data performances.Taking into account these

diverse aspects and giving precedence to sustained

expansion over transient variations is essential while

investigating the growth of international e-

commerce.Finally, If the goal of e-commerce

enterprises is to enhance a company’s market value

in the short term, then embarking on international e-

commerce development is a favorable

option.However, it’s essential to bear in mind while

exploring international e-commerce, a thorough

consideration of various factors is crucial. Prioritize

long-term growth over short-term fluctuations. If e-

commerce enterprises are aiming for long-term

business benefits, it ’ s imperative to take into

account a broader spectrum of factors beyond

immediate gains.

6 CONCLUSION

The effects of international e-commerce on e-

commerce businesses was investigated in this

study.In light of above analysis, the following

conclusions were draw:Although expanding

international e-commerce business may not

significantly improve e-commerce enterprises’

revenue and profitability in the short term, it can

significantly increase the stock price of enterprises,

which is helpful to attract more investors.According

to the findings of the JD and PDD data study, several

speculations were proposed regarding the differences

between the two:First, differences in company

positioning and market strategies may result in

varying responses to cross-border e-

commerce.Second, disparities in market conditions

may lead to differences in revenue and stock price

performances. JD and PDD may encounter unique

challenges and opportunities due to differing market

conditions, thus impacting their financial

performances differently.Last, differences in

operational management strategies could be a

significant factor driving the disparities in data

outcomes. Variances in how the companies handle

business operations may contribute to differences in

their data performances.In expending international e-

commerce business, it is imperative to consider these

various factors and prioritize long-term growth over

short-term fluctuations.Lastly, this study makes some

recommendations for e-commerce enterprises:If the

goal is to enhance company’s market value in the

short term, then embarking on developing

international e-commerce would be a wise

move.However, it’s essential to bear in mind while

exploring international e-commerce, a thorough

consideration of various factors is crucial. Prioritize

long-term growth over short-term fluctuations.If

enterprises are aiming for long-term business

benefits, it ’ s imperative to take into account a

broader spectrum of factors beyond immediate gains.

The limitation of this paper mainly lies in the

different operational decisions and market positioning

of different e-commerce enterprises when developing

cross-border e-commerce.Due to the limitation of

tume's launch time, only the existing short-term

effects are studied in this paper.More detailed

questions were left to future researchers.

REFERENCES

Ding, F., Huo, J., & Campos, J. K. 2017, September. The

development of Cross border E-commerce. In

International Conference on Transformations and

Innovations in Management, ICTIM 2017, pp. 487-500.

Atlantis Press.

Edamura, K., Haneda, S., Inui, T., Tan, X., & Todo, Y.

2014. Impact of Chinese cross-border outbound M&As

on firm performance: Econometric analysis using firm-

level data. China Economic Review, 30, 169-179.

Li, D. 2023. E-commerce Retailer Marketing Strategies and

Rapid Growth: A Case Study of Temu. Highlights in

Business, Economics and Management, 23, 668-673.

Qi, X., Chan, J. H., Hu, J., & Li, Y. 2020. Motivations for

selecting cross-border e-commerce as a foreign market

entry mode. Industrial Marketing Management, 89, 50-

60.

Shuai, Q., Li, Z., & Zhang, Y. 2023. Cross-Border E-

Commerce. In E-commerce industry chain: Theory and

practice, pp. 319-363. Singapore: Springer Nature

Singapore.

Sykes, A. O. 1993. An introduction to regression analysis.

Wang, Y., Wang, Y., & Lee, S. H. 2017. The effect of cross-

border e-commerce on China’s international trade: An

EMITI 2024 - International Conference on Engineering Management, Information Technology and Intelligence

276

empirical study based on transaction cost analysis.

Sustainability, 9, 11, 2028.

Xu, H. 2023. ANALYSIS OF JINGDONG MALL ’ S

INTERNATIONALIZATION STRATEGY. Теория и

практика современной науки, 10, 100, 5-14.

Xue, W., Li, D., & Pei, Y. 2016. The Development and

Current of Cross-border E-commerce.

Zhang, X. 2019. Investigation of e‐commerce in China in

a geographical perspective. Growth and Change, 50, 3,

1062-1084.

Research on the Impact of Expanding Cross-Border e-Commerce Business on e-Commerce Enterprises: A Case Study of Pinduoduo and

Jingdong

277