Analysis of Luckin's Brand Joint Strategy

Xinyu Liu

a

School of Economics, Zhongnan University of Economics and Law, Wuhan, China

Keywords: Luckin Coffee, Brand Joint Strategy, Marketing Strategy.

Abstract: With more and more brands in the market, customer segmentation is becoming more and more refined, and

brand joint strategies are increasingly being used. At the same time, China's coffee market demand becomes

vigorous, the competition in the coffee track is fierce, and many coffee companies have begun to adopt a co-

branding strategy. Luckin is one of the most frequently co-branded beverage companies. This study mainly

uses causal attribution analysis and regression analysis to explore Luckin's brand joint strategy and its specific

results. According to the study, Luckin's sales growth is mainly due to the rapid expansion of stores, frequent

new product launches, and global digital marketing strategies, and the co-branding strategy has helped Luckin

too little to increase sales and exposure, and has been masked by the traffic brought by new product launches.

This article advises Luckin to streamline its co-branding activities as much as possible, and does not

recommend that other small companies invest too much in co-branding.

1 INTRODUCTION

In recent years, the hierarchical segmentation of users

has become more and more refined. The customer

acquisition cost of each brand has also risen. Brand

joint strategy is a strategy that allows the two brands

to integrate their influence and audience segments,

and cut the marketing costs of both parties. Juhua.,

2023. Therefore it has become more and more

popular in various industries, especially in the

increasingly competitive coffee market. Recently,

China's coffee market has been expanding, and

consumer demand has become more and more

diverse, which has intensified the complexity of

competition in the coffee industry. SPDB

International Securities., 2024. This has prompted

coffee shops in China to adopt a co-branding strategy

to increase market share. However, not everyone can

achieve proportional results, even Luckin, which has

always been keen on co-branding. Most of Luckin's

co-branding activities did not bring large traffic

fluctuations to Luckin, and only festivals and some

special co-branding strategies such as Moutai brought

remarkable outcome. GROWTH BOX., 2023.

Previous studies have focused more on the layout of

a

https://orcid.org/0009-0004-6737-8603

Luckin co-branding itself and the results brought by

co-branding, but have not deeply analyzed the overall

marketing strategy layout of Luckin and the position

and role of co-branding in the overall layout. This

study explores the overall marketing strategy layout

of Luckin and the main factors that increase Luckin's

sales and traffic. The study also analyzes the

implementation process of Luckin's co-branding

strategy through causal attribution analysis and

regression analysis.

2 THE STATUS OF LUCKIN'S

BRAND JOINT ACTIVITIES

Luckin has always been known for its frequent brand

joint activities. In 2023, Luckin has carried out 24 co-

branding, as shown in Table 1. At this year, Luckin

has co-brand 7 times with comic, 4 times with

celebrities, 3 times with brands, twice with bands,

banks, and sports teams, and once with variety shows,

e-sports, music festivals, and art exhibitions. The

most popular in this series of co-branding are Cat and

Mouse, Moutai and Line Puppy. Co-branding with

Moutai has brought millions of profits to Luckin.

440

Liu, X.

Analysis of Luckin’s Brand Joint Strategy.

DOI: 10.5220/0012939900004508

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Engineering Management, Information Technology and Intelligence (EMITI 2024), pages 440-446

ISBN: 978-989-758-713-9

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

Table 1: Overview of the 2023 Luckin's co-branded events.

Luckin 2023 co-

b

rande

d

b

ran

d

Comic

Meilin the spring festival series

Line

p

uppy "Repai

r

the dog love story"

The

p

rickl

y

rose of doraemon: Nobita an

d

the ideal lan

d

of the sky

Animation "Dart man-kunlun

b

oile

d

snow " latte

Line dog tanabata "Blac

k

p

ineapple"

Tom an

d

jerry-first anniversary of the raw cheese latte

Tom an

d

jerry-the christmas special edition

Celebrity

Meilin the spring festival series

Line

p

uppy "Repai

r

the dog love story"

The

p

rickl

y

rose of doraemon: Nobita an

d

the ideal lan

d

of the sky

Animation "Dart man-kunlun

b

oile

d

snow " latte

Brand

Line dog tanabata "Blac

k

p

ineapple"

Tom an

d

jerry-first anniversary of the raw cheese latte

Tom an

d

jerry-the christmas special edition

Bank

Meilin the spring festival series

Line

p

uppy "Repai

r

the dog love story"

Sports team

The

p

rickl

y

rose of doraemon: Nobita an

d

the ideal lan

d

of the sky

Animation "Dart man-kunlun

b

oile

d

snow " latte

Others

Line dog tanabata "Blac

k

p

ineapple"

Tom an

d

jerry-first anniversary of the raw cheese latte

Tom an

d

jerry-the christmas special edition

Meilin the spring festival series

Line

p

uppy "Repai

r

the dog love story"

The

p

rickl

y

rose of doraemon: Nobita an

d

the ideal lan

d

of the sky

Animation "Dart man-kunlun

b

oile

d

snow " latte

However, Luckin's frequent co-branding activities

did not bring him matching result. Luckin mainly

relied on major festival activities to increase

exposure. The correlation between co-branding and

the number of active people in Mini Programs was not

strong. GROWTH BOX., 2023. Therefore, the later

part of this article will explore the factors that really

increase Luckin's exposure, as well as the specific

role of co-branding and its operational strategy.

3 LUCKIN'S OPERATION

LAYOUT

3.1 Luckin's Operation and

Management Layout

Luckin's sales channels cover both online and offline.

It has a very large number of stores, which provides

strong support for its offline sales. At the same time,

Luckin has also laid out its own APP and WeChat

mini-program to provide users with online ordering

and delivery services. Its marketing approach also

covers online and offline channels. Yejing,Yongquan

& Anyi., 2023. Through online official channels such

as WeChat official account, Tiktok official account,

Micro-blog official account and Bilibili official

account, it can achieve promotion and drainage and

improve brand exposure. At the same time, Luckin

will also place offline advertisements in office

buildings, campuses and other places with dense

consumers to achieve offline promotion and improve

offline exposure. In addition to expanding the scope

of its offline promotion, ubiquitous stores also helped

it achieve the conversion process from exposure to

sales.

Luckin's core resources include brand awareness,

a large user base and data scale, a sound supply chain

management system, stores and equipment. Luckin's

brand awareness is one of its most important assets.

Luckin's young, fashionable and convenient brand

image created through multiple channels has attracted

many young users and established a good reputation

and reputation in the hearts of consumers. Luckin's

huge user base has attracted many brands to

cooperate. At the same time, Luckin has a large

number of data resources, including user preferences,

sales data, etc., which also help Luckin make better

decisions. Wei & Shiwei., 2022. It has a complete

coffee production, processing and distribution

system, which can better control the entire supply

chain and ensure the quality and stability of products.

Luckin has more than 1,600 offline stores, providing

physical support for it to develop the offline market

and provide goods and services.

Analysis of Luckin’s Brand Joint Strategy

441

Luckin's revenue sources include sales revenue

from beverages, food, and peripheral products, as

well as income from franchise fees and service fees.

Luckin's offline stores sell products including various

types of drinks, sandwiches and other meals. At the

same time, Luckin will also sell peripheral products

such as cups and hanging ear coffee through online e-

commerce platforms to provide diversified products

and improve the brand stickiness of consumers.

Luckin's stores are mainly divided into directly

operated stores and affiliated stores. The franchise

deposit and operating commission collected from the

affiliated stores also form a part of its revenue.

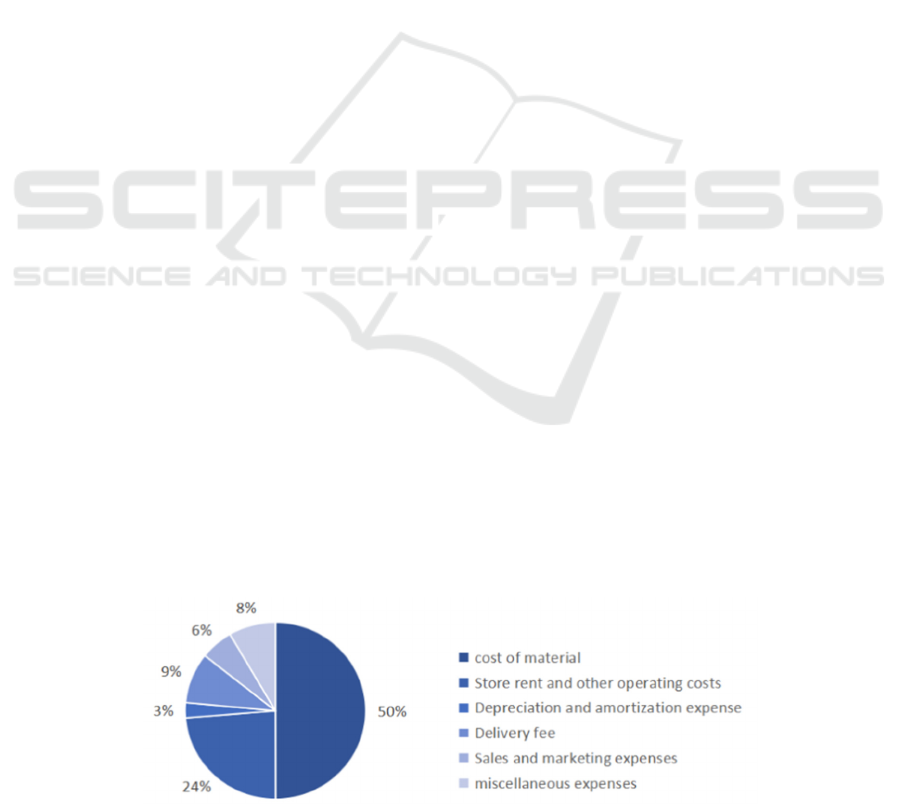

Luckin's operating costs mainly include material

costs, store rents and operating costs, depreciation

and amortization expenses, delivery expenses, sales

and marketing expenses, and general and

administrative expenses. As shown in Fig 1, Luckin's

material costs in 2023 were RMB 10,892,214, store

rental and other operating costs were RMB 5,167,482,

depreciation and amortization expenses were RMB

604,580, delivery expenses were RMB 2,010,699,

selling and marketing expenses were RMB

1,286,523, general and administrative expenses were

RMB 1,829,651, and other expenses were RMB

1,829,651.

Luckin's partners include three parties, namely

suppliers, delivery companies and franchisees.

Luckin has established close cooperative relations

with suppliers of coffee beans, milk tea and other

suppliers to ensure the stability and controllability of

Luckin's raw material supply. Luckin has established

a supply network covering five of the world's largest

coffee bean producing regions, including Colombia,

Brazil, Ethiopia, Guatemala and Yunnan, China. On

the basis of controllable origin of coffee beans,

Luckin has also increased investment in the

construction of roasting bases to improve the ability

to control the whole process of coffee. At the same

time, Luckin has also formed a "blue partner" alliance

with major suppliers to establish a strict raw material

management mechanism to ensure the

professionalism and quality of raw materials. Luckin

has formed a close cooperation with the distribution

company. In terms of warehouse-to-warehouse and

warehouse-to-store transportation, Luckin mainly

cooperates with two logistics and distribution

companies and three well-known third-party

warehousing and logistics service providers in China

to ensure the timeliness and stability of raw material

transportation. In terms of product delivery business,

Luckin mainly cooperates with third-party platforms

such as Meituan and Ele.me to provide customers

with delivery services. Luckin adopts the franchise

model to expand the scale of the store, and shares

profits while improving brand awareness by jointly

operating the store with the franchisee.

3.2 Luckin's Main Source of Sales

Growth

Based on the above analysis of Luckin co-branding

and its business model, this paper argues that the sales

growth of Luckin is not closely related to the frequent

daily co-branding. This paper argues that the main

sources of Luckin's sales growth are Luckin's rapidly

expanding stores, frequent new product launches,

Luckin's social media operations, and discount

strategies.

Luckin's rapidly expanding number of stores has

boosted Luckin's sales. Luckin's store can be divided

into two types, namely self-operated stores and

associated stores. Luckin's affiliated store franchise

model is currently divided into three types, the

franchise model with stores, the directional point

franchise model and the new partner franchise model.

The joint store opening model is an important way for

Luckin to carry out market sinking and scale

expansion. Through the store franchise model Luckin

can continue to expand in the existing market.

Through partners, increase market share. Through the

directional point franchise model and new partner

franchise model, Luckin can quickly expand the scale

of stores in the market that is not yet saturated or just

entered, improve Luckin's local popularity and

quickly enter the market.

Figure 1: Luckin operating costs in 2023 (Picture credit: Original).

EMITI 2024 - International Conference on Engineering Management, Information Technology and Intelligence

442

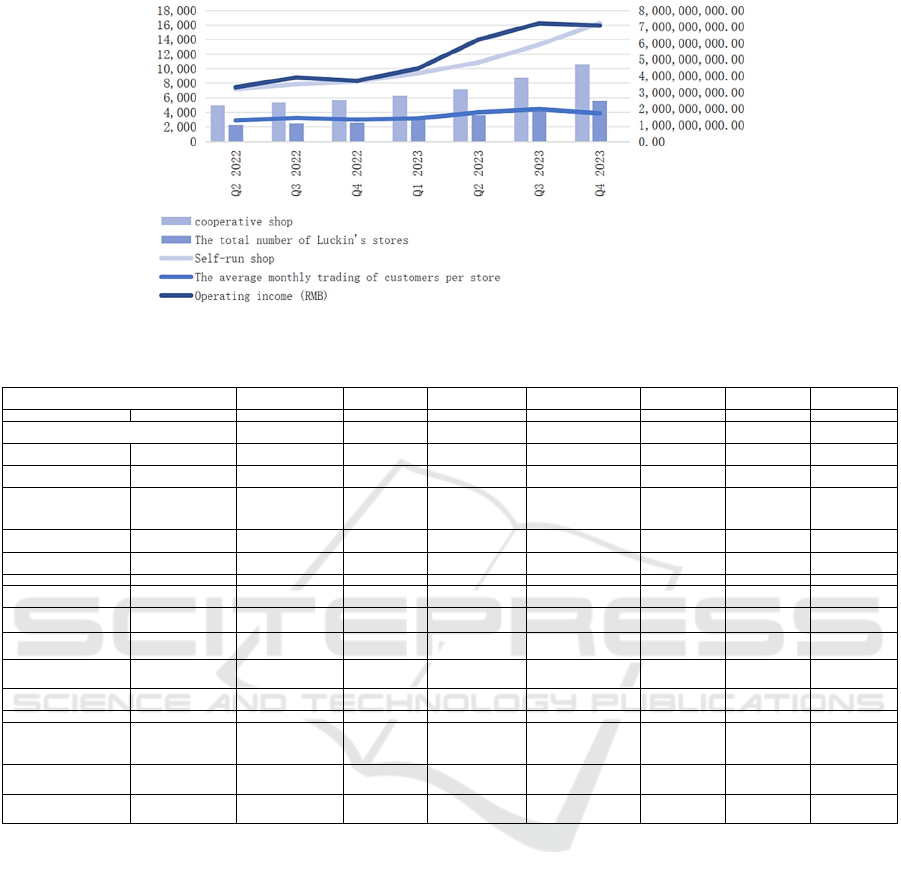

Figure 2: Luckin store expansion (Picture credit: Original).

Table 2: Regression results of Luckin's operating income and the number of stores.

SUMMARY OUTPUT

Regression Statistics

Multiple R 0.930119

R Square 0.865121

Adjusted R

S

q

uare 0.838146

Standar

d

Erro

r

6.69E+08

Observations 7

ANOVA

df SS MS F Si

g

nificance F

Regression 1 1.44E+19 1.44E+19 32.0704 0.002387

Residual 5 2.24E+18 4.48E+17

Total 6 1.66E+19

Coefficients

Standard

Erro

r

t Stat P-value Lower 95%

Upper

95%

Lower

95.0%

Upper

95.0%

Intercept 2.26E+08 8.99E+08 0.25163 0.811342 -2.1E+09 2.54E+09 -2.1E+09 2.54E+09

X Variable 1 468835.7 82788.22 5.663073 0.002387 256021.8 681649.6 256021.8 681649.6

As shown in Fig 2, with the official release of

Luckin's joint store plan in May 2022, the number of

Luckin stores has greatly increased. By the end of

2023, the number of Luckin stores has reached

16,248, covering the entire central and eastern regions

of China. At the same time, the average monthly

transaction customers of Luckin stores have not been

lowered because of this, and have been in a stable

area, that is, Luckin has developed stores in most of

China under the condition that the sales of existing

stores are not affected. In order to further confirm the

impact of store expansion on Luckin's total sales, this

paper conducts a regression analysis on the sum of the

number of stores and operating income of Luckin, and

the results are shown in the figure above.

According to the regression analysis results in

Table 2, it can be found that the P-value of the fitting

results of the two sides is 0.81, which is higher than

0.5, which means that the number of stores has a

strong correlation with the total turnover of Luckin. It

can be inferred from this that the rapid expansion of

Luckin's sales is related to its market layout strategy

in the country. Luckin has rapidly increased the

number of offline stores in various high-demand

markets, thereby expanding its market share in the

existing market at a relatively fast rate. At the same

time, Luckin opens up new markets through

directional point franchise and other models, and

opens up new markets through the phased layout of

store distribution in the market, so as to expand the

overall market scale of Luckin.

Luckin's frequent new product launch speed has

increased the repurchase rate of customers and

attracted new customers to buy. In 2021, 2022, and

Analysis of Luckin’s Brand Joint Strategy

443

2023, Luckin will launch 113, 108, and 102 new

products respectively, which is much higher than the

level of its peers. It covers a wide range of products,

from the traditional classification of categories,

Luckin's products can be divided into freshly brewed

coffee, tea, baked meals and various peripheral

products. In the classification of freshly brewed

coffee, Luckin broke the traditional practice of

dividing the coffee product line into food, latte, etc.,

Luckin focus on the "milk coffee" drink and adopts

the "big latte" strategy. Luckin created four major

product series, including the thick milk latte, raw

coconut latte, velvet latte and raw cheese latte. At the

same time, after last year's sales of tea and coffee

products, Luckin opened up a tea and coffee product

line. In general, Luckin's product launch will not be

confined to the conventional coffee classification. It

adopts a horse racing mechanism for the R&D

department. One department conducts the research

and development of classic coffee, and the other four

departments compete with each other on the basis of

classic coffee to launch beverage-based coffee. And

then precipitate explosive products through internal

testing and external trial sales screening. At the same

time, in order to help new products better meet and

feedback market demand, Luckin uses algorithm

technology to link the new product delivery strategy,

automatic ordering strategy, smart warehouse

network planning and allocation model, etc., to

achieve end-to-end full business flow node

connection. Luckin Coffee., 2022.

Luckin's global digital marketing network layout

has improved user awareness and private domain

conversion rate. Luckin's rapid expansion is

inseparable from its comprehensive marketing

network layout. It vigorously deploys its private

domain, and achieves considerable private domain

traffic conversion. Wenyi,Jiaxing & Yaorui., 2024.

Luckin's private domain undertaking tools are mainly

APP, official account, mini program, enterprise

WeChat, circle of friends and enterprise WeChat

group. In order to maximize the expansion of private

domain traffic and conversion rate, Luckin has

carried out a comprehensive and multi-means layout

in drainage, fission and conversion. New customers

will get a large amount of discounts when they place

an order for the first time. And there will be a discount

reminder button, users only need to click the allow

notification button, and the event message of Luckin

will be automatically transmitted to users in the

future. If users want to get more discounts, they can

enter the community through WeChat. Therefore,

Luckin uses discounts to attract traffic and expand

private domain traffic. By allowing old users who

have entered the private domain to share links with

friends to get coupons, gift cards to friends, multi-

person package discounts, etc., Luckin can quickly

achieve the fission of private domain traffic and

expand its user scale. (Yanrong, Wei,Yunxian &

Yuru., 2023). For existing users, Luckin will continue

to attract users' purchase interest, increase user

stickiness and private domain conversion rate by

means of frequent new launches, regular preferential

activities, multi-platform and multi-channel

promotional activities, medal tasks, research and

development of peripheral products, and high-

frequency co-branding.

4 THE OVERALL LAYOUT OF

THE CO-BRANDING

STRATEGY

Combined with the above, it can be found that the

drainage effect of most of Luckin's co-brands is not

good, and more often it is the new stores, new

products developed and multi-channel promotional

discounts that bring traffic. This section will explore

the strategic layout and operation mechanism of

Luckin's co-branding strategy from the overall layout

of its co-branding strategy.

4.1 Luckin Co-Branded Marketing

Implementation Path

Luckin's co-branded activities are carried out to

promote new products, so many times the traffic

growth brought by co-branding will be hidden in the

sales of new products. There are two matching

mechanisms between new products and co-branding,

namely new products looking for co-branding and

partners guiding new products.

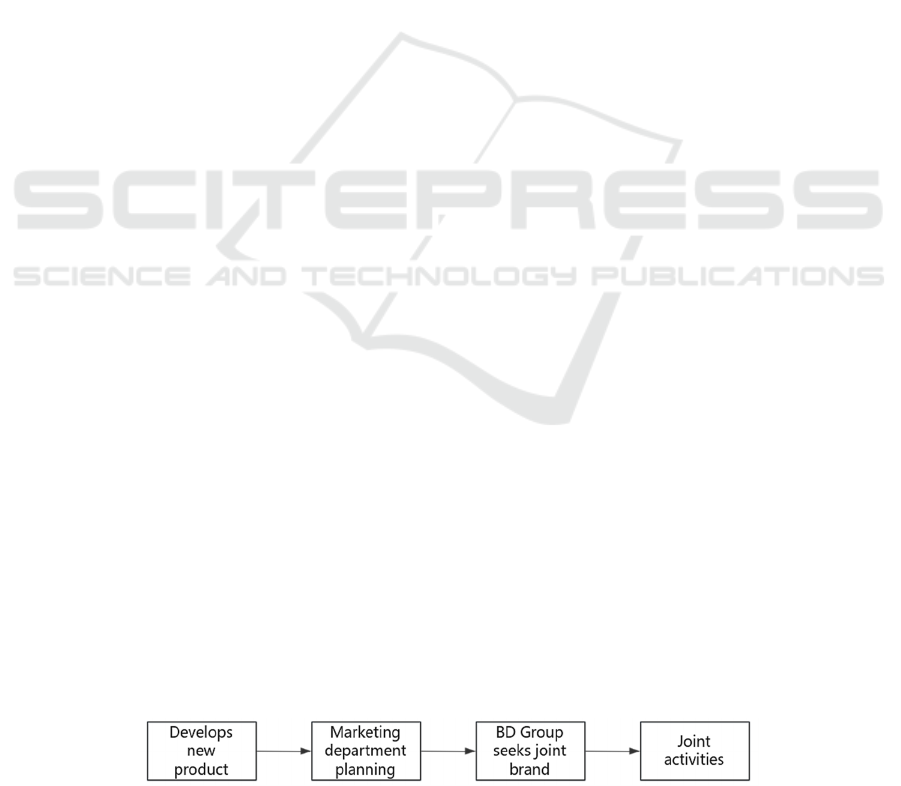

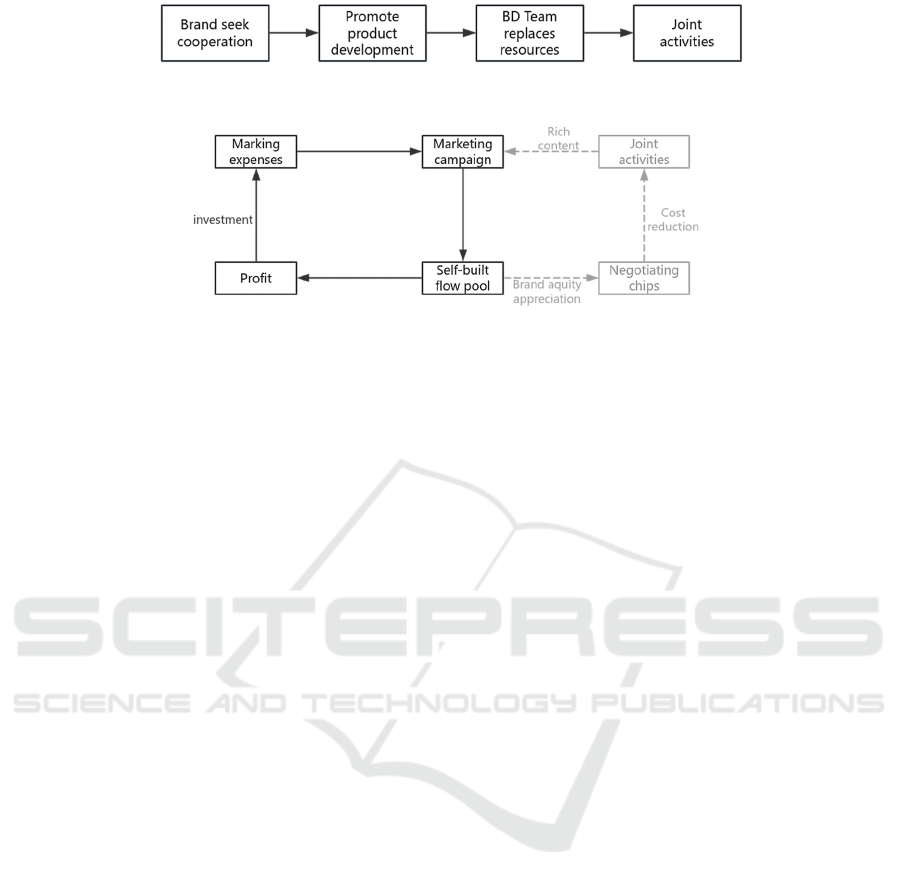

As shown in Fig 3, Luckin's product department

will develop new products every month according to

market demand and user taste preferences, and the

new products will be handed over to the marketing

Figure 3: New products looking for co-branding process (Picture credit: Original).

EMITI 2024 - International Conference on Engineering Management, Information Technology and Intelligence

444

Figure 4: Partners lead the development of new products (Picture credit: Original).

Figure 5: Luckin Co-branded Compounding Process (Picture credit: Original).

department to prepare for all aspects of new product

promotion activities. If a co-branded party is found,

the marketing department will join the co-branding

activities in the new promotion activities, and if a

suitable co-branding party is not found, it will not

affect the original promotion activities planned by the

marketing department.

As shown in Fig 4, in addition to Luckin taking

the initiative to seek new product promotion

cooperation from the brand, there will also be brands

taking the initiative to seek cooperation, the

marketing department will promote product research

and development according to the partner, and the BD

team will carry out private domain publicity and other

resource replacement with the partner, and the joint

activity will be launched after the product is

developed and the marketing departments of both

sides communicate the promotion plan.

The above two co-branded cooperation models

can show that in fact, Luckin puts co-branding in a

more casual position, and in most cases does not

spend too much energy to seek co-branding, co-

branding is just an additional activity of Luckin to the

existing promotion activities, and no co-branding will

not affect Luckin's new product launch and

promotion. This is one of the reasons why previous

studies have found that most co-branding does not

bring much traffic fluctuation. The traffic growth

brought by Luckin's new product itself will mask the

effect of most co-branded activities, and only

explosive co-branding like Moutai can bring a more

obvious traffic impact.

Combined with Luckin's co-branding partner

selection process and Luckin's rich history of co-

branding and product launch, this paper argues that

Luckin's co-branding is not so much a new product

promotion activity, but rather a publicity means for

Luckin to maintain the youthfulness of its own brand

and the image of its products keeping pace with the

times. It's just that Luckin's own new product

promotion has already reflected Luckin's

advancement with the times, and most of the co-

branded activities seem to be somewhat repetitive.

4.2 Luckin's Co-Branding Costs and

Benefits

Luckin's high frequency of co-branding is related to

its lower co-branding expenses. As shown in Fig 5,

Luckin has mainly relied on its rapidly expanding

store size, diversified social media promotion

methods, large discounts, and high-frequency new

promotion activities to expand and stabilize its self-

built traffic pool. On this basis, Luckin uses its own

huge user base as a bargaining chip to negotiate with

partners and reduce co-branding fees. The high-

frequency activities enriched its marketing activities,

further improved the breadth of Luckin's drainage,

increased its user base, achieved brand equity

appreciation, and further reduced its co-branding

fees.

Although Luckin's co-branded activities are also a

kind of publicity and promotion of Luckin's drainage

methods, combined with the dismantling of the

effectiveness of its co-branding effect in previous

articles, this article argues that Luckin's co-branded

activities may not necessarily increase more exposure

on the basis of the traffic brought by the new

promotion, after all, Luckin's other promotion

measures have done everything they need. However,

combined with Luckin's low-cost investment in co-

branding activities, co-branding can be added to the

promotion of new products greatly. Runqing., 2021.

But for the large amount of co-branding investment

of other companies, imitation of Luckin is not

supported here.

Analysis of Luckin’s Brand Joint Strategy

445

5 CONCLUSION

Combined with the research in this paper and

previous research, it can be found that Luckin's co-

branding strategy has not brought breakthrough

traffic growth in most cases, although Luckin has not

made too large a cost investment in co-branding, but

too frequent co-branding will sometimes cover up the

characteristics and highlights of the new product

itself, and sometimes too many unnecessary co-

brandings will make users tired and constantly push

new advertisements to swipe the screen, improve the

user's co-branding threshold, which is not conducive

to the truly excellent co-branding to exert its own

charm and drainage value. Therefore, this article still

recommends that Luckin appropriately cut

unnecessary co-branded activities and not develop its

own brand into an advertising booth.

Excellent co-branding can indeed bring super

high traffic to enterprises, but in this period of cross-

border co-branding, users have become tired of all

kinds of co-branding, and the probability of explosion

that co-branding can bring is becoming less and less.

Zuobin,Shaochen & Linji., 2023. Co-branding is not

a panacea, and it is recommended that other small and

medium-sized enterprises should still focus on

building their own traffic pools, and then consider

adopting co-branding activities on this basis.

This article deeply explores the main supporting

factors of Luckin's sales growth, the role of the co-

branding strategy in the overall promotion of Luckin

and the layout of the strategy, and provides

suggestions for Luckin and other similar companies

on the co-branding strategy. Finally, although this

paper studies the impact of co-branding on Luckin,

because its impact is hidden in the traffic growth

brought by the new product, this paper only conducts

qualitative analysis and does not quantitatively

distinguish between them. In the future, further

quantitative analysis of the effect of co-branding may

be carried out in order to quantitatively analyze the

impact of co-branding on sales.

REFERENCES

Juhua, Ch., 2023. Why is brand cross-border co-branding

so popular?.Zhongguancun, 10,30-32.

Growth, B., 2023. Dismantling of Luckin Co-branded

Marketing Strategy.

Wenyi, L., 2024. Analysis of Luckin Coffee's brand

marketing strategy under the new "4P" theory. China

Business Review, 06, 65-68.

Luckin Coffee., 2022. Transformation and Reinvention -

Luckin Coffee 2020-2022 Corporate Governance

Report.

Yanrong, L., Wei, L., 2023. Research on the Problems and

Countermeasures of the Operation and Development of

Enterprises' Private Domain Traffic from the

Perspective of New Consumption: A Case Study of

Luckin Coffee. Modern Business, 13, 7-10.

Zuobin, L., 2023. Research on the Strategy of Brand Co-

branding Marketing in the New Consumption

Environment: A Case Study of Luckin Co-branded

Moutai. Modern Marketing (Late Edition) (12), 47-49.

SPDB International Securities., 2024. Break the tradition,

drive innovation, and follow the trend to create a new

pattern of China's coffee industry.

Wei, W., Shiwei, H., 2022. Research on the commercial

design of Luckin Coffee brand. Creative Design Source,

2, 59-66.

Yejing, W., Yongquan, H., 2023. Research on the

Counterattack Model of Digital Marketing of Coffee

Enterprises. Cooperative Economy and Science and

Technology ,24, 70-72.

Runqing, Z., 2021. Cross-border co-branding

communication strategy of new and old brands.

Cooperative Economy and Science and Technology ,23,

86-87.

EMITI 2024 - International Conference on Engineering Management, Information Technology and Intelligence

446