The Investigation of the Application of Apache Spark in Stock

Analysis

Yuxi Liu

a

Department of Computing, Chengdu University of Technology, Chengdu, China

Keywords: Apache Spark, Streaming Data, Resilient Distributed Dataset, Hadoop Distributed File System.

Abstract: Due to the complexity and scale of data increasing rapidly in nowadays, and the requirements of effectiveness

and accuracy to stock market analysis on processing data. Some ways based on Apache Spark become widely

accepted by a lot of financial companies and organizations. This paper summarized two useful and satisfactory

methods of how to enhance the accuracy and reliability of stock market forecast. For Nowcasting the financial

time series with streaming data analytics under Apache Spark, this method integrates Apache Spark and

various real-time data, through monitoring these data, system can recognise the trends, then put the results

into model training to get more rigorous model. In Sentiment analysis and machine learning model, through

combining Resilient Distributed Dataset (RDD) and Hadoop Distributed File System (HDFS), efficient data

preprocessing, feature extracting and model training can be achieved. Furthermore, Resilient Distributed

Dataset as the core of Apache Spark, provides memory management and fault tolerance to it. Meanwhile, the

Hadoop Distributed File System offers a dependable method for distributed storage of large-scale textual data.

The integration of Resilient Distributed Datasets and the Hadoop Distributed File System significantly

enhances the accuracy of analytical outcomes. In conclusion, this paper demonstrates how forecasting

financial time series using streaming data analytics within Apache Spark, alongside sentiment analysis and

machine learning models, enhances the reliability and precision of stock market analyses. These approaches

contribute to making the results of stock analyses more trustworthy and accurate for users.

1 INTRODUCTION

With the increasing of the financial market and the

explosive growth of data, the stock market

forecasting has become one of the popular topics in

the financial field. Moreover, with the coming of the

era of big data, the scale of data is growing fast, and

the demand for big data analysis and processing is

becoming higher and higher. Apache spark is a fast,

versatile big data engine, which has become one of

the choices for lots of financial enterprises and

organizations.

In recent years, the research of stock market

prediction based on big data has gradually increased.

Researchers use machine learning algorithms and

statistical analysis to analyse historical stock data to

predict future stock price movements. However, the

traditional data processing and analysis methods

often face the problems of low computing efficiency

and long processing time in the face of large-scale

stock data.

a

https://orcid.org/0009-0005-7803-9946

In the past few decades, the research of stock

predictive analysis has made progress. Earlier studies

mainly relied on traditional econometric methods

such as time series analysis and statistical regression.

These methods are mainly based on historical price

data and use the statistical properties of time series to

build forecasting models. However, these methods

are often limited in forecasting accuracy in the face of

complex and non-linear stock markets (Lo, 2004).

With the rise of big data and machine learning

technology, the research of stock predictive analysis

has entered a new stage. Researchers are beginning to

use large-scale historical data, combined with

machine learning algorithms such as Support Vector

Machines (SVMS), Random Forest, and deep

learning, to build more powerful predictive models.

These models can better capture the complexity and

nonlinear relationship of the stock market and

improve the accuracy of the forecast (Zhang, Liu and

Yu, 2019). In addition, some studies have explored

hybrid forecasting models that combine fundamental

and technical analysis. These models combine a

Liu, Y.

The Investigation of the Application of Apache Spark in Stock Analysis.

DOI: 10.5220/0012957600004508

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Engineering Management, Information Technology and Intelligence (EMITI 2024), pages 501-505

ISBN: 978-989-758-713-9

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

501

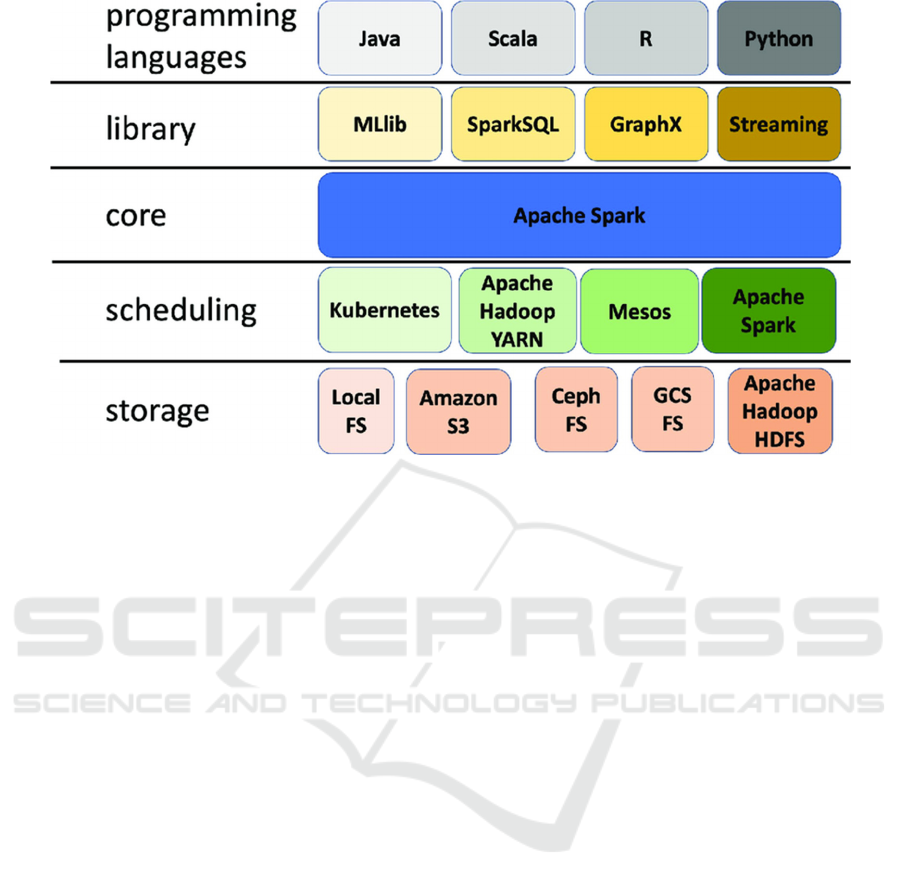

Figure 1: The Apache Spark layered architecture (Chicco, 2023).

company's financial data, market trends, investor

sentiment and other multi-dimensional information to

provide a more comprehensive predictive analysis.

These methods not only improve forecasting

accuracy, but also provide investors with deeper

market insight (Neely, Rapach and Tu, 2014). Despite

the continuous advances in techniques and methods

of stock predictive analysis demonstrated in past

papers, many challenges and problems remain. The

impact of data quality and integrity on the prediction

results, the generalization ability of the model, and

overfitting problems are still key problems that need

to be solved (Liu, Zhou and Xiao, 2021).

Apache Spark is a distributed computing

framework, Apache Spark can process massive data,

and provides a machine learning library and data

processing tools, which provides a new solution for

stock market prediction, such as combining Apache

Spark with financial time series with streaming data

analytics (Khan et al, 2022) and combining Apache

Spark with the data that generated from historical

price and social events (Seif, Ramzy Hamed and

Abdel, 2018).

In this paper, there are two methods Nowcasting

the financial time series with streaming data analytics

under Apache Spark and Sentiment analysis and

machine learning model will be mentioned in section

2, to give more details to readers. What is more, the

section 3 is discussion, talking about some current

limitation, challenges, possible solutions of

limitations and future prospects in stock and Apache

Spark field. Followed by discussion section is

conclusion.

2 METHODS

In this section, nowcasting with streaming data

analysis and sentiment analysis for stock data based

on Apache spark were investigated.

2.1 Nowcasting the Financial Time

Series with Streaming Data

Analytics Under Apache Spark

Nowcasting is a term of market analysis, which helps

a market predict future state by high frequency data

(Khan et al, 2022). In today’s big data era, the

practicality and relevance have become more

obvious. With the rapid generating and updating data

of market, to control the dynamics of the market in

real time and accurately to make wise invest decision,

and Nowcasting is the key technology to meet this

demand.

Spark streaming can handle a large amount of live

data resultful and spark streaming is the core

extension of Spark Application Programming

Interface (API), which is suitable to process live data

stream like unstructured data, semi-structured data

and highly structured data in a high throughput, fault

tolerance and highly scalable manner (Khan et al,

2022), which make Spark Streaming become ideal

choice of handling real-time in stock market.

EMITI 2024 - International Conference on Engineering Management, Information Technology and Intelligence

502

In Khan, A. A. M., et al (2022)’ s research

discussed the approach of how to combine Apache

spark data analysis with nowcasting. In this research,

Spark Streaming is responsible for collecting data and

putting collected data into different batches. Using

Lasso, Ridge, RF, GBT and GLM models to test data,

researchers found that in the index for Symmetric

Mean Absolute Percentage Error, GLM is superior to

other methods. Then Spark Streaming come with the

results of stream data by batch processing (Khan et al,

2022), which develops the efficiency of processing

data, and also more accuracy and more timely

information can be provided to investors.

2.2 Sentiment Analysis and Machine

Learning Model

Seif et al. found that traditional stock analysis only

using historical price does not have the ability of

emergency handling, in other words, traditional stock

market analysis cannot guarantee the accuracy when

real market events taken place. So, combining

sentiment analysis with machine learning can help

improve accuracy (Seif, Ramzy Hamed and Abdel,

2018).

This model is combined with Hadoop Distributed

File System, Apache Spark framework and Resilient

Distributed Dataset. Hadoop Distributed File System

is responsible for storing data, Apache Spark working

on processing data and Resilient Distributed Dataset

is to parallelize data processing (Seif, Ramzy Hamed

and Abdel, 2018). Apache spark mainly works on

Information acquisition stage, data storage stage, and

data analysis stage. In data Acquisition Phase,

Apache Spark uses its ability of data integration, get

data from different sources efficiently. And use

different models to test data, then single out the most

accurate model Random Forest, which accuracy is

90.23, which is higher than traditional stock analysis

to predict data. Thanks to Apache Spark can store

data in worker’s memory, which ensures the integrity

and accuracy of data (Seif, Ramzy Hamed and Abdel,

2018).

In data analysis phase, data is deposited in Hadoop

Distributed File System, which provides data

redundancy and error tolerance and has the capability

to process large data (Shvachko, 2010). Then, achieve

efficient parallelize data processing (Seif, Ramzy

Hamed and Abdel, 2018). Apache Spark combines

machine learning and sentiment analysis to enhance

stock market analysis accuracy. In Seif, Ramzy

Hamed and Abdel’s research, mentioned that in

offline database, the accuracy of data mining tools

with sentiment analysis compared with without

sentiment analysis were improved by 0.5 on average.

In real-time database, the accuracy of data mining

tool with sentiment analysis increased nearly 2 on

average. The MLlib provides abundant algorithms

and tools, which offers support for stock market

predictions and decisions (Seif, Ramzy Hamed and

Abdel, 2018). What is more, sentiment analysis

technology can catch investors’ perspective and

expectation of market. Through the combination of

sentiment analysis and machine learning, the trend

prediction of market will be more and more accuracy.

Furthermore, Resilient Distributed Dataset also plays

an important role in Apache Spark (Seif, Ramzy

Hamed and Abdel, 2018). It allows Spark to

parallelize processing data on different nodes to

guarantee stability and performance (Zaharia, 2012).

3 RESULTS AND DISCUSSIONS

This section focuses primarily on analysing the

experimental results of methods mentioned in the last

section and challenges they face and the future

prospects. The two ways, combination of nowcasting

techniques and the strong data processing ability of

Apache spark and Sentiment analysis and machine

learning model, which are scalable and flexible offer

advantages for stock market analysis. Investors can

make full use of the instantaneity of high-frequency

and the ability of batch processing in Spark

Streaming, to make the most sensible decision.

Figure 2: The performance of different models (Seif,

Ramzy Hamed and Abdel, 2018).

The Investigation of the Application of Apache Spark in Stock Analysis

503

Furthermore, the models can meet different

complexity and scale of stock analysis market

requirement. Specifically, for the more complex data

come from BSE, NSE and BTC-INR, the SMAPE

value of GLM are 0.06754, 0.06497 and 0.04921,

which stand for more reliable and closer prediction to

actual data, then leads investors can get more valuable

information, so as to achieve revenue maximization

and stand out in drastic marketing competition.

Based on the Seif’s et al. studies (Seif, Ramzy

Hamed and Abdel, 2018), the first bar chart compares

the accuracy of two models for sentiment analysis

using Logistic Regression, SVM, and Random Forest

algorithms. The 'Data Mining tool with Sentiment

Analysis' shows slightly lower accuracy rates

(72.13%, 71.42%, and 77.88%, respectively)

compared to the 'Proposed Model with Sentiment

Analysis' (71.8%, 70.32%, and 75.8%, respectively).

The second chart contrasts the accuracy of the same

models without sentiment analysis. Here, the 'Data

Mining tool' has higher accuracies for Logistic

Regression and SVM (71.56%, 70.63%) but a lower

one for Random Forest (72.87%) compared to the

'Proposed Model' (70.68%, 69.52%, and 75.95%,

respectively). This demonstrated the importance of

sentiment analysis in the domain of stock price

prediction.

With the constant development of artificial

intelligence and machine learning, people could

foresee a more automated and intelligent stock market

analysis. Through using the Apache Spark to analyse

streaming live data and the combination of the

Nowcasting technique and advanced machine

learning algorithm (Das, 2024; Qiu, 2024),

developers can build more stronger and accuracy

prediction model, which provide a deeper market

insight and more personalized investment advice.

Moreover, the constant evolution of distributed

computing frames like the Apache Spark will give

more support on processing on the larger scale and

more complex dataset.

But at the same time, development comes with

limitations and challenges, such as interpretability

and data skew. For interpretability, it is a one of

important indicators to evaluate machine learning

model, which makes model more reliable and

explains how model works. So, add Shapley Value

(SHAP) is a good choice to help ameliorate

interpretability (Jia, 2019; Sundararajan, 2020).

Shapley Value is an explanatory method based on

game theory, which is utilized to measure the weight

of each feature to the model analysis results. And it

evaluates the importance of feature by calculating the

average contribution of a feature across all possible

feature subsets, which makes the results have

uniqueness, local accuracy and consistency.

Furthermore, data skew is a normal problem in

distributed computing environment. In stock analysis,

if some stocks trade much more than others, then it is

possible to meet data skew. Preprocessing data and

adjusting parallelization are two possible ways to

figure out this problem. Preprocessing data can filter

out some keys that skew the data. Like if there are lot

of useless null values, then these values can be

filtered out before shuffle. To adjust parallelize,

which means to adjust the parallelize of shuffle, the

reduce tasks quantity can be increased by doing this,

then release the data skew. The future prospects of

Apache Spark in stock analysis will be brighter and

brighter. The tools in Apache Spark like MLlib, Spark

SOL and GraphX make it can handle more complex

data in stock market analysis, Apache Spark's

potential should be efficiently used in stock market

analysis.

4 CONCLUSIONS

In this work, in order to improve the accuracy in stock

market analysis, two ways under Apache Spark and

machine learning are proposed. The Nowcasting the

financial time series with streaming data analytics

under Apache Spark and Sentiment analysis and

machine learning model are two effective ways to

enhance the reliability in stock market. Nowcasting

technology offset the inadequacy of Apache Spark

processing real-time data and by using the strong

streaming data analysis ability, more larger data scale

can be handled easily and rapidly. The sentiment

analysis assists machine learning model to recognize

emotional tendency, which provides greater

advantage on catch the market by referring the events

happening in real-time that may cause volatility to

stock market. In the future, we need to optimize the

performance of Apache Spark by making research on

interpretability and data skew then deal with these

kinds of problems which could be barriers on

enhancing development of model.

REFERENCES

Chicco, D., Ferraro Petrillo, U., & Cattaneo, G. 2023. Ten

quick tips for bioinformatics analyses using an Apache

Spark distributed computing environment. PLOS

Computational Biology, 19(7), e1011272.

Das, N., Sadhukhan, B., Chatterjee, R., & Chakrabarti, S.

2024. Integrating sentiment analysis with graph neural

EMITI 2024 - International Conference on Engineering Management, Information Technology and Intelligence

504

networks for enhanced stock prediction: A

comprehensive survey. Decision Analytics Journal,

100417.

Jia, R., Dao, D., Wang, B., Hubis, F. A., Hynes, N., Gürel,

N. M., ... & Spanos, C. J. 2019. Towards efficient data

valuation based on the shapley value. In The 22nd

International Conference on Artificial Intelligence and

Statistics (pp. 1167-1176). PMLR.

Khan, M. A. A., Bhushan, C., Ravi, V., Rao, V. S., & Orsu,

S. S. 2022. Nowcasting the financial time series with

streaming data analytics under apache spark. arXiv

preprint arXiv:2202.11820.

Liu, Y., Zhou, X., and Xiao, J. 2021. Stock price prediction

based on deep learning: A literature review. Journal of

Big Data, 8(1), 1-23.

Lo, A. W. 2004. The adaptive markets hypothesis. Journal

of Portfolio Management, 30(5), 15-29.

Neely, C. J., Rapach, D. E., & Tu, J. 2014. Forecasting the

equity risk premium: The role of technical indicators.

Management Science, 60(7), 1772-1791.

Qiu, Y., Hui, Y., Zhao, P., Cai, C. H., Dai, B., Dou, J., ... &

Yu, J. 2024. A novel image expression-driven modeling

strategy for coke quality prediction in the smart

cokemaking process. Energy, 130866.

Seif, M. M., Ramzy Hamed, E. M., & Abdel Ghfar Hegazy,

A. E. F. 2018. Stock market real time recommender

model using apache spark framework. In The

International Conference on Advanced Machine

Learning Technologies and Applications

(AMLTA2018) (pp. 671-683). Springer International

Publishing.

Shvachko, K., Kuang, H., Radia, S., & Chansler, R. 2010.

The hadoop distributed file system. In 2010 IEEE 26th

Symposium on mass storage systems and technologies

(MSST) (pp. 1-10). IEEE.

Sundararajan, M., & Najmi, A. 2020. The many Shapley

values for model explanation. In International

conference on machine learning (pp. 9269-9278).

PMLR.

Zaharia, Matei, et al. 2012. Resilient distributed datasets: A

fault-tolerant abstraction for in-memory cluster

computing. 9th USENIX Symposium on Networked

Systems Design and Implementation (NSDI 12).

Zhang, G., Liu, H., & Yu, L. 2019. Stock price prediction

using statistical and machine learning techniques: A

review and evaluation. Journal of Financial Markets,

22(1), 1-28.

The Investigation of the Application of Apache Spark in Stock Analysis

505