A Comparative Study on the Influencing Factors of the Large

Chinese and Foreign Shipping Companies’ Stock Price

Haining Qian

a

College of Transportation Engineering, Dalian Maritime University, Dalian, China

Keywords: Shipping Industry, Shipping Companies, Stock Price, Comparative Study.

Abstract: The shipping industry is an important pillar of international trade and has a significant impact on global

economy. The share price performance of Chinese and foreign large-scale shipping companies, as the leading

companies in industrial. not only reflects the company's operating conditions and profitability, but also the

development of international trade and world economies. In this study, two representative shipping companies,

COSCO Shipping Holdings and Maersk been selected to conduct time series analysis, linear regression

analysis, and correlation analysis on their stock price and profit data. The results of the study find the share

prices of COSCO Shipping Holdings and Maersk are correlated with their profits. Between the profit and

share price data, two companies are also highly positively correlated. At the same time, two companies share

price volatility level, as well profit time synchronization and other aspects of the differences reflecting the

company itself and differences in the development environment. Therefore, which can be concluded by:

shipping industry is a mature industry, the company's profit is the main factor to affect the company's share

price. By observing the share price can judge the development of the company and the industry. Shipping

industry is a highly internationalized industry, the share price of similar shipping companies can be compared

with references. The above conclusions can provide investors with references for decision-making and a

perspective to observe the development of the shipping industry.

1 INTRODUCTION

The shipping industry playing an important role in

international trade, and the statistics of the United

Nations Conference on Trade and Development in

2023 shows the volume of international shipping

transportation accounts more than 80% of the world

merchandise trade (UNCTAD, 2023), so the

development of the shipping industry reflects the

development of international trade as a certain extent.

The shipping industry is an industry with very high

degree of internationalization and marketization,

forming a relatively stable market pattern in long-

term market competition. Among the world's

shipping enterprises, Mediterranean Shipping,

Maersk, Duffy Shipping, COSCO Shipping Holdings,

and Hapag-Lloyd are forefronts. Influenced by world

economic, trade development, capacity supply and

other factors. the international shipping industry is

characterized by cyclicality, which is clearly reflected

in the shipping price index, also fully reflected in the

a

https://orcid.org/0009-0006-6623-2009

stock prices of shipping companies (JingMing, 2023).

A comparative study of the factors influencing the

stock prices of large Chinese and foreign shipping

companies, not only provides valuable reference

information for investors, but also helps to gain a

deeper understanding of overall operation in shipping

market and international trade.

The influence of company's stock price is more

factors, according to general economic principles,

which company's stock price reflects company's value,

the main influencing factors include the company's

profitability, growth, asset quality, etc., also by

political factors, natural disasters, quality accidents

and other incidental factors. Shipping industry more

like mature industry, the head of company's

development in general is relatively stable, overall

quality of assets is better, there will be no explosive

growth, so the quality of assets and growth are not the

main factors affecting of stock price, this paper

intends to take profitability as the main factory, study

the relationship between the company's profitability

762

Qian, H.

A Comparative Study on the Influencing Factors of the Large Chinese and Foreign Shipping Companies’ Stock Price.

DOI: 10.5220/0012972400004508

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Engineering Management, Information Technology and Intelligence (EMITI 2024), pages 762-769

ISBN: 978-989-758-713-9

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

and stock price, and at the same time on comparison

of Chinese and foreign shipping company stock

prices analyze and observe the correlation between

the stock price of Chinese and foreign shipping

companies.

This paper selects two representative shipping

companies in and out China: COSCO Shipping

Holdings and Maersk as the research targets. Both

companies are listed companies, COSCO listed in

Shanghai Stock Exchange and Hong Kong Stock

Exchange, and Maersk listed in New York Stock

Exchange. By checking the annual reports of listed

companies to obtain the company's profit data, and at

the same time checking of corresponding stock price

information, linear regression analysis is performed

on the data of same company to observe the

relationship between two variables; and correlation

analysis is used to compare the similarities and

differences between the data of two companies. This

study adopts a combination of quantitative and

qualitative methods, using time series analysis,

regression analysis, correlation analysis and other

research methods (Shanghao, 2020). By analyzing the

relationship between the share price and profit of

Chinese and foreign shipping companies, finding the

factors affecting share price of shipping companies,

analyzing the similarities and differences of the

influencing factors of domestic as well foreign

shipping companies, this study provides investors

with a reference for decision-making, a perspective

for observing the development of the shipping

industry, and a basis for subsequent in-depth research.

2 OVERVIEW OF THE CHINESE

AND FOREIGN SHIPPING

INDUSTRY

2.1 Shipping Industry Overview

The shipping industry has a long history, with its

origins dating back to the beginning of human

civilization. Owing to its advantages of large capacity,

low freight rates, economy and environmental

protection, maritime transport has become the most

important mode of trade and transportation in the

world, carrying more than 80 per cent of the world's

trade volume. With the development of globalization,

the shipping industry has played an important role in

promoting international trade and regional economic

development, at same time the shipping industry has

become one of the important pillars of global

economic development. The shipping industry and

related industries also be an important part of

national economy. Related industries including

shipbuilding, port construction and operation,

logistics and transportation, shipping services,

financial and legal services. These industries provide

a large number of employment opportunities and

great significance development of the national

economy.

In addition, with the rapid development of science

and technology, new technologies such as smart ships,

automated terminals and clean energy have been

gradually promoted in the shipping industry, pushing

it in the direction of greater intelligence, greenness

and efficiency. The application of these technologies

not only improves the operational efficiency and

environmental protection of the shipping industry,

but also reduces costs and enhances the quality of its

services.

2.2 Status of the Domestic Shipping

Industry and Profiles of Domestic

Shipping Companies

The "2021 China Maritime Day Main Forum" pointed

out that about 95% of China's international trade

cargo volume is completed by sea (China Maritime

Day activities organization Working Committee,

2021). According to China's General Administration

of Customs and the data from the Clarkson database

in the United Kingdom website, in recent years, the

proportion of import and export of the three typical

bulk commodities in China's foreign trade, namely

crude oil, iron ore and grain, 91% of volume of trade

accounted by sea transportation to the total. 98% and

94% respectively. These data fully illustrate that the

shipping industry has a dominant position in China's

foreign trade transportation, and has made great

contributions to the promotion of national economic

growth and the development of foreign trade. In

recent years, China's shipping industry has

maintained a steady development trend, and overall

maritime cargo turnover has shown an upward trend,

with data from the National Bureau of Statistics

showing that China's foreign trade cargo throughput

will reach 5 billion tons in 2023, a year-on-year

increase of 9.5% (National Bureau of Statistics,

2024). On the other hand, unfavourable factors such

as adjustments in global trade patterns, trade wars,

and rising ship operating costs have also brought

certain challenges to China's shipping industry.

Incorporated in March 2005, COSCO Shipping

Holdings Co., Ltd., one of the world's largest

comprehensive shipping enterprises, focusing on

shipping business and port business. The company

A Comparative Study on the Influencing Factors of the Large Chinese and Foreign Shipping Companies’ Stock Price

763

has a container fleet of 493 vessels, ranking 4th all

over the world in terms of size, and has a well-

developed route network around the world.

2.3 Status of Foreign Shipping

Industry and Profiles of Foreign

Shipping Companies

In recent years the foreign shipping industry has

largely shown a trend of growth, shipping market

demand is strong. 2023 United Nations Conference

on Trade and Development statistics show that in

2022 the global seaborne trade volume reached

12.027 billion tons, the global ship capacity of about

2.2 billion deadweight tons. The future of

international shipping industry is also facing

considerable challenges, the global economic will

slowdown, trade protectionism and other factors have

brought adverse effects to the shipping industry, in

addition to the continuing war by shipping industry

will bring great uncertainty.

Maersk one of the world's largest container

shipping company, with a container fleet size of 683

ships, with world No. 2 ranked , has its own route

network all over the world, covering the world's

major ports.

3 RESEARCH DESIGN

3.1 Data Analysis

Maersk and COSCO Shipping Holdings as two

representative Chinese and foreign shipping

companies, have been selected for analysis in this

study for the period Q1 2016 to Q3 2023.The revenue

and profit figures of 2 companies are obtained from

public company reports, and the share price is based

on the closing price of the company's stock on the first

day of each quarter.

3.2 Data Analysis

First of all, time series analysis and correlation

analysis are conducted on the stock price and profit

data of COSCO (Chunyu, Wenjun, 2022). Since the

company's stock price and profit have a close

relationship, and a large part of the pricing in stock

market reflects future expectations (Shouxi, Wei 'an,

2004). Therefore, the author conducts regression

analysis with the company stock price and profits of

the corresponding time point: the previous quarter,

the previous half year, the previous three quarters and

the previous year respectively, in order to obtain the

relationship between the company stock price and

profits.

3.2.1 Comparison of Price and Profit of

COSCO Shipping Holdings

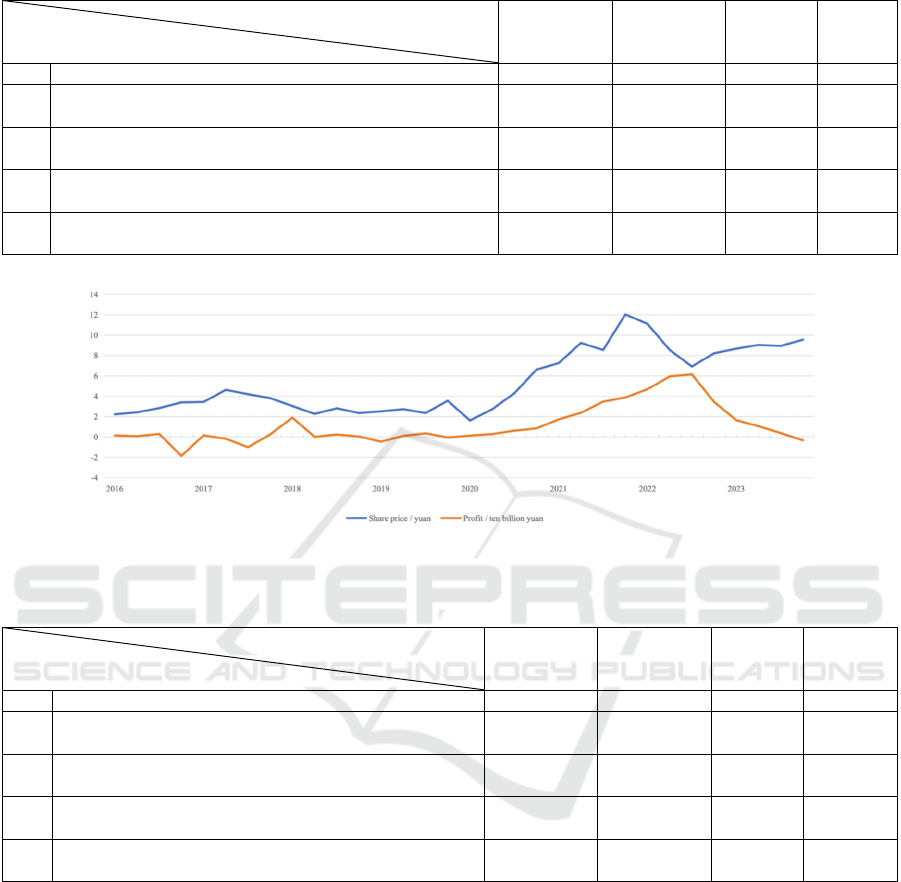

First of all, the time series analysis of COSCO

Shipping Holdings stock price and profit data, (Fig.1),

Shows the two curves are more similar to the trend of

change, there is a certain degree of correlation.

Continuing with the linear regression analysis of

data, the results in Table 1 shows that the R Square of

the first four items of the table are greater than 50%,

indicating a good fit of the data. All regression

equations F-test, P < 0.05, indicating the regression

equations are all significant, the independent variable

can significantly affect the dependent variable. The

regression coefficients of five items in the table are

all greater than 0, and the second regression

coefficient is 0.4447, which is the largest among five

items, and the significance level is P<0.01, which

indicates that the correlation between price of

COSCO and profit of the quarter before

corresponding time point is the most significant.

Figure 1: COSCO’s share price and profit over time.

(Picture credit: Original).

EMITI 2024 - International Conference on Engineering Management, Information Technology and Intelligence

764

Table 1: COSCO share price and profit regression analysis results.

Regression analysis results

Stock Price

and Profit Relationship

Coefficients P-value R Square F

1 Stock Price and Corresponding Point-in-Time Profit 0.4099 3.7469E-08 0.6537 54.7496

2

Stock price and profit for the quarter before the

corresponding point in time

0.4447 2.3457E-10 0.7670 92.1815

3

Share price and half-yearly profit before the corresponding

p

oint in time

0.4061 1.7669E-07 0.6420 48.4273

4

Stock price and profits for the three quarters prior to the

corresponding point in time

0.3635 1.5805E-05 0.5180 27.9463

5

Stock price and profit for the year before the corresponding

p

oint in time

0.2883 0.0017 0.3290 12.2592

Figure 2: Maersk's share price and profits over time.

(Picture credit: Original).

Table 2: Maersk share price and profit regression analysis results.

Regression analysis results

Stock Price

and Profit Relationship

Coefficients P-value R Square F

1 Stock Price and Corres

p

ondin

g

Point-in-Time Profit 1.0438 6.3030E-05 0.4185 21.5935

2

Stock price and profit for the quarter before the

corresponding point in time

1.1582 2.2278E-06 0.5437 34.5496

3

Share price and half-yearly profit before the

corres

p

ondin

g

p

oint in time

1.2025 3.4798E-07 0.6104 43.8683

4

Stock price and profits for the three quarters prior to the

corres

p

ondin

g

p

oint in time

1.0978 6.1838E-06 0.5369 31.3078

5

Stock price and profit for the year before the

corresponding point in time

0.8626 0.0017 0.3201 12.2384

3.2.2 Comparison of Maersk's Share Price

and Profits

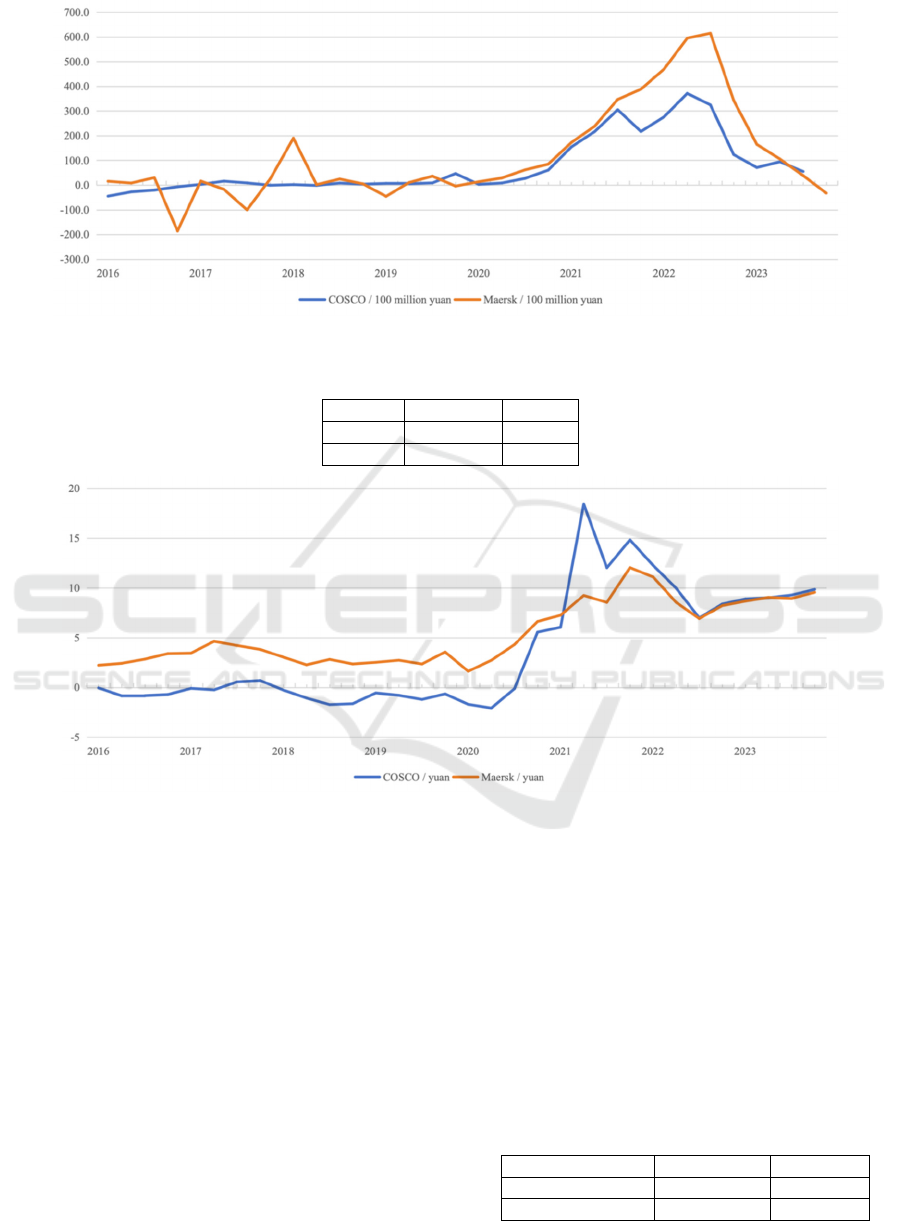

A time series analysis of Maersk stock price and

profit data, as shown in Figure 2, reveals that the stock

price changes before the profit and the trend is

similar.

Further linear regression analysis was conducted,

and the results are shown in Table 2. The R Square

of items 2, 3 and 4 of the table is greater than 50%,

which indicates that the data are well fitted. The F test

of all regression equations, P<0.05, which indicates

that the regression equations are all significant.

Which means that the independent variable is able to

significantly affect the dependent variable. The

regression coefficient of item 3 in the table is 1.2025,

which is the largest among five items and significance

level of P<0.01. This indicates that Maersk's stock

price is significantly correlated with the company's

profit in six months prior to the corresponding time

point.

To summarize, there is some correlation between

share prices and profits for both Chinese and foreign

shipping companies. However, since the stock price

has an expected component in future, the correlation

between the stock price and the profits at

A Comparative Study on the Influencing Factors of the Large Chinese and Foreign Shipping Companies’ Stock Price

765

.

Figure 3: Line graph of profit over time between COSCO and Maersk.

(Picture credit: Original).

Table 3: Profit Correlation Analysis between COSCO and Maersk.

COSCO Maers

k

COSCO 1

Maers

k

0.9160653 1

Figure 4: Line graph of COSCO and Maersk share prices over time.

(Picture credit: Original).

corresponding time point will not be the best.

COSCO's stock price has the most significant

correlation with the profit of quarter before

corresponding time point, while Maersk's stock price

has the highest fit with the company's profit of the

half year before the corresponding time point. This

may be related to the company's assets, politics and

other factors.

3.2.3 Inter-Firm Comparisons

This study also conducts time series analysis and

correlation analysis of stock price data and profit data

between two companies. Analysing their

characteristics over time to understand the similarities

and differences in the impact of shipping market by

shipping companies.

First of all, the profit data of Chinese and foreign

two shipping companies are plotted as line graphs, as

in Figure 3, and it shows Maersk's profit has a large

fluctuation, but the two sets of data show a similar

trend. So then the two sets of data for correlation

analysis, the results are shown in Table 3, the

correlation coefficient is 0.9160653, the correlation

coefficient is greater than 0 and close to 1, indicating

that the two companies' profit data are positively

correlated and the degree of correlation is high.

Table 4: Share price correlation analysis between COSCO

and Maersk.

COSCO Maers

k

COSCO 1

Maers

k

0.9514304 1

EMITI 2024 - International Conference on Engineering Management, Information Technology and Intelligence

766

By plotting the relationship between the share

prices of two companies by time, as shown in Figure

4, it shows that the change of the share prices of two

companies before 2021 is relatively smooth, and the

share price of Maersk has higher than COSCO

Shipping Holdings. The share price of COSCO

Shipping Holdings started to rise significantly from

the first quarter of 2021 and exceeded that of Maersk;

and the share prices of the two companies started to

decline after the fourth quarter of 2021. In addition,

the changes and trends of the two sets of data are

roughly same. Therefore, this study continues to

conduct correlation analysis between the two sets of

data, the results are shown in Table 4. The correlation

coefficient is 0.9514304, which is greater than 0 and

close to 1. It shows that the stock price data of the two

companies are positively correlated with a high

degree of correlation.

The results of the correlation analysis show that

the profits of the two companies and the share prices

of the two companies have high correlation. This

shows that the shipping industry is an international

and fully competitive industry, and the characteristics

of the industry determined the performance and the

share prices of the two companies are affected by

same factors. Examples include the global

macroeconomic environment, trade policies, oil

prices, shipping demand, etc., In addition, as leading

companies in shipping industry, COSCO and Maersk

have both competitive relationships and may

cooperate in certain areas, which may also make the

share prices of the two companies show a certain

degree of correlation.

4 FACTORS AFFECTING THE

SHARE PRICE OF SHIPPING

COMPANIES

4.1 Similarities in the Factors Affecting

the Share Price of Domestic and

Foreign Shipping Companies

As a highly internationalized industry, the shipping

industry is characterized by full market competition

and obvious cyclicality (Shuhan, 2014). Shipping

market demand and shipping capacity supply

determine the freight rate, which greatly affects the

profitability of the companies. Combine the

company's earnings and market's expectations of the

company's future earnings together, will determine

the stock price of the shipping company.

At First, shipping company share prices are

affected by changes in international trade. When the

global economy is growing, international trade

activity will be more activity. The shipping industry

usually be benefited, with profits and share prices

rising. When the economy is unstable, international

trade is constrained, and the shipping industry will be

impacted. When indicators such as GDP, imports and

exports, and exchange rates change, global trade will

be affected, which in turn affects the shipping

industry.

Secondly, supply and demand will affect the

profits and share prices of shipping companies. When

the scale of global trade increases, the demand of the

shipping industry increases, and the shipping

company's capacity is relatively insufficient, freight

rates rising, profits and share prices will

correspondingly increase. On the other hand, it will

also encourage shipping companies to increase

capacity and expand scale. The increase in capacity

will eventually lead to lower freight rates, which will

lead to lower profits and stock prices. On the contrary,

when there is insufficient demand, the shipping

market will face a situation of excess capacity.

Shipping companies will eliminate outdated capacity

or mothballing some excess capacity to bring freight

rates back to reasonable levels. The interaction of

supply and demand leads to periodic fluctuations in

shipping companies' profits and stock prices, with

high profits at the peak and even large losses at the

trough. Cyclical fluctuations are also a significant

feature of the shipping market.

Thirdly, international trade policies and

emergencies have a direct impact on the shipping

market. First of all, trade policy will affect the degree

of activity of world trade activities. Free trade

agreements, tariff reduction and other policies are

conducive to promoting the free flow of goods, thus

driving the increase in shipping demand, shipping

company profits, stock prices will increase. Trade

barriers and trade wars have a significant adverse

impact on international trade, and have a negative

impact on shipping companies' profits and stock

prices. Emergencies including natural disasters,

epidemics, wars, major accidents, etc., these

emergencies will disrupt the normal trade order or

transportation environment, interference in

international trade, the shipping industry, resulting in

a certain period of significant fluctuations in freight

rates. During the New Crown Epidemic, the global

supply chain was affected, resulting in a significant

increase in shipping prices and a sharp increase in the

profits and share prices of shipping companies, which

gradually returned to a steady state after the epidemic.

A Comparative Study on the Influencing Factors of the Large Chinese and Foreign Shipping Companies’ Stock Price

767

The Suez Canal container ship grounding incident

and the war in the Red Sea also caused disruptions to

international shipping, resulting in increased

distances and time and price volatility.

4.2 Differences in the Factors Affecting

the Share Price of Domestic and

Foreign Shipping Companies

First of all, there are differences between companies,

including the quality of the company's assets,

operating strategy, management level, etc., which

have a direct impact on the company's share price.

The quality of the company's assets has a direct

impact on company's operating quality, which in turn

affects the stock price. The company's business

strategy determines the company's market layout and

market competitiveness. The company's investment

strategy affects the increase or decrease of

transportation capacity and the quality of market

operation ability. Whether the capacity scale matches

the market demand will affect the company's business

performance, and then affect the stock price.

Management level includes safety management, cost

control, etc., Safety accidents can cause economic

and reputational losses, and cost control can affect

profit levels, all of which will also have an impact on

the company's share price.

Secondly, companies in the industry are affected

by the environment of the countries in which they

operate. The government's shipping policy directly

affects the pattern and development direction of

China's shipping market, which in turn affects the

competitiveness and profitability of companies. The

degree of openness will affect the development of

international shipping. Positive trade policies, such as

tariff reduction and expansion of development, will

promote the prosperity of the shipping industry and

increase the stock price of the shipping market. On

the contrary, trade protection and tariff increases will

discourage trade enthusiasm, and shipping companies

will reduce profits and share prices. There are also

differences in the stock market. China's stock market

has a short development time and still has a

significant "government-driven" characteristics (Bin

Liu, Liang Yao, 2003). The government plays an

important role in China's stock market, so the share

price of China's shipping companies by the impact of

policy news is more obvious (Jingwen, Hui Liu,

2022).

In addition, there are certain differences in the

structure of the domestic and international shipping

markets. Chinese market has huge potential, the

international shipping market is highly concentrated,

the domestic shipping market is more competitive,

and the competition in the domestic and international

markets will form mutual influence. The foreign

shipping market is more reflective of international

competition, and after years of development, the

stability and maturity will stronger, and the

corresponding stock price volatility is relatively low.

5 CONCLUSION

By analysing the stock price and profit data of

COSCO Shipping Control and Maersk from the first

quarter of 2016 to the third quarter of 2023. This

study finds that there is a certain correlation between

the stock price and profit of both companies.

COSCO's share price has the most significant

correlation with the profit of the quarter prior to the

corresponding time point, while Maersk's share price

has the most correlation with the profit of the six

months prior to the corresponding time point. This

suggests that for a mature industry like shipping,

company profits are the main factor affecting of

company's share price, and the development of the

company and the industry can be judged by observing

the share price.

Comparing the correlation between the profit and

stock price of the two companies, it can be seen that

the profit data and stock price data of the two

companies are positively correlated, and the

correlation is high. This indicates that the shipping

industry is a highly internationalized industry, and the

share prices of the companies are greatly affected by

common influencing factors. The share prices of

similar shipping companies at home and abroad can

be compared for reference.

The study found that although there are obvious

similarities in the stock price changes of domestic and

foreign shipping companies, there are also some

differences in earnings and stock price levels,

volatility levels, and stock price and profit

correlations. This is related to the political

environment, economic environment, market

structure, the quality of the company's own

development, operational strategy and other factors

that reflect the differences in the development of

different companies.

This study focuses on a comparative study of two

large shipping companies, and the conclusions can

provide a reference for investors to make decisions

and a perspective to observe the development of the

shipping industry. However, the content,

methodology and conclusions of the study still have

some limitations. This study provides a basis for

EMITI 2024 - International Conference on Engineering Management, Information Technology and Intelligence

768

further research. In the future, the scope of research

can be extended to more countries and shipping

companies of different sizes. More influencing

factors can be introduced, and more perfect analysis

as well prediction models can be established. So as to

have a more comprehensive understanding of the

operation law and development trend of the global

shipping market.To provide more reliable reference

information for industry development research and

investor decision-making.

REFERENCES

Bin, L., 2003. WTO and Shipping Lecture Series (XVII)

Characteristics of Stock Prices of Listed Companies in

Hong Kong and Shipping. World Shipping, 06, 51-52.

China Maritime Day activities organization Working

Committee, 2021, Announcement of China Maritime

Day 2021

,

https://www.miit.gov.cn/jgsj/zbes/cbgy/art/2021/art_3deef

bdc5f1a4632b3dab2c368824e10.html

Chunyu, X., 2022. Analysis of Influencing factors of stock

price in secondary market: Multiple linear regression

based . China Daily, 15, 99-102.

JingMing, Zh, 2023. An empirical study on the correlation

between reported profit information and cumulative

excess return of stock prices of Listed companies:

Based on Logit model . Shanghai Management Science,

02, 68-72.

Jingwen, Zh., 2022. Analysis of the financial status of the

maritime industry under the Harvard framework--

Taking COSCO Shipping Control (601919) as an

example. Logistics Science and Technology, 45, 55-58.

National Bureau of Statistics, 2024, Statistical Bulletin of

the People's Republic of China on National Economic

and Social Development in 2023,

https://www.gov.cn/lianbo/bumen/202402/content_69349

35.htm

Shanghao, X., 2020.Comparison Study on the Impacts of

Main Macro-economic Variables on the Net Profit and

Stock Price of China-Korea Steel Industry. University

of International Business and Economics.

Shouxi, X., 2004. On the Influencing factors of the

Relationship between Stock price and Profit and its

implications for financial managers. Shanghai

Comprehensive Economy, 05, 53-56.

Shuhan, S., 2014. Empirical study on the impact of Baltic

freight Index on the stock price of listed shipping

companies in China . Southwest University of Finance

and Economics.

United Nations Conference on Trade and Development,

2023, Review of maritime transport 2023,

https://unctad.org/publication/review-maritime-transport-

2023

A Comparative Study on the Influencing Factors of the Large Chinese and Foreign Shipping Companies’ Stock Price

769