Research on Traffic Violation Factors in Vehicle Insurance Pricing

Based on Generalized Linear Model

Zhanhong Mu

Department of Mathematics, Imperial College London, London, SW7 2AZ, U.K.

Keywords: Traffic Violation Factor, Auto Insurance Pricing, Heterogeneity, Generalized Linear Model.

Abstract: Automobile insurance plays a pivotal role within the property insurance market. A meticulous examination

of diverse factors influencing the pricing of automobile insurance holds profound significance for insurance

companies in mitigating operational risks, drivers in actively cultivating better driving habits, and fostering a

secure and orderly traffic milieu. Presently, despite the inclusion of traffic violation factors in China's auto

insurance pricing, the coefficient often defaults to 1 in practice, thus lacking widespread implementation. To

effectively leverage the incentivizing and constraining effects of traffic violation factors on auto insurance

premiums, this study utilizes data encompassing traffic violations and auto insurance claims of vehicles within

a Chinese province from 2021 to 2023 as research samples. It delineates vehicle type, traffic violation

frequency, and traffic violation type as explanatory variables. Mindful of multicollinearity and vehicle type

heterogeneity, a generalized linear model is employed to scrutinize the correlation between traffic violations

and the intensity and frequency of auto insurance claims. The findings underscore that vehicle traffic

violations positively influence both claim intensity and frequency, with distinct vehicle types exhibiting

varying sensitivities to different types of traffic infractions.

1 INTRODUCTION

Auto insurance has an important position in the

property insurance market, not only because it

accounts for a high proportion of market size, but also

related to the operating efficiency of insurance

companies. Because it is closely related to people's

lives, especially the third party liability insurance

plays a special role in stabilizing social relations and

maintaining social order. Based on this background,

more and more insurance companies pay attention to

the pricing research of auto insurance products,

especially the premium determination has always

been a research hotspot of non-life insurance actuarial

pricing (Denuit M et al., & Klein N et al.). Whether

its calculation is accurate, reasonable and fair is of

great significance to all levels of society. A large

number of research results show that insurance

companies in developed countries such as for the

United States and Britain, in the process of

determining the vehicle insurance rate, the risk

factors are divided into three categories: from the

vehicle, from people, from the environment; and it

will give more consideration to the impact of the

driver's "from the person". China is currently based

on the model pricing, comprehensive consideration of

independent pricing coefficient, no compensation

preferential coefficient, traffic law coefficient of 3

floating factors, and finally complete the auto

insurance pricing. Although the traffic violation

coefficient has been introduced as an important

human factor, it is restricted by subjective and

objective factors in practice, and the coefficient is

default to 1 and not really used. The current pricing

factors in China are still dominated by vehicle type,

purchase price, vehicle age, use nature, number of

historical accidents, number of traffic violations and

other vehicle factors, which fails to fully match the

pricing of auto insurance with the underwriting risk.

Although existing literature studies have paid

attention to the impact of driving behavior on auto

insurance pricing, for example, Peng et al. (2016)

scored drivers' driving behavior and calculated

premiums based on it, and analyzed the dynamic

premium mechanism based on drivers' driving

behavior to realize the differentiation of insurance

premiums for auto insurance holders. Wang (2016)

found that it is a more scientific and reasonable way

to analyze auto insurance rates by taking driving

68

Mu, Z.

Research on Traffic Violation Factors in Vehicle Insurance Pricing Based on Generalized Linear Model.

DOI: 10.5220/0012993100004601

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Innovations in Applied Mathematics, Physics and Astronomy (IAMPA 2024), pages 68-77

ISBN: 978-989-758-722-1

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

behavior as a determining factor. Gao (2018)

analyzed the data of the Internet of vehicles and

established a Poisson generalized additive model to

predict the claim frequency. He believed that the

second principal component based on the estimation

of the velocity acceleration kernel density had a very

significant nonlinear influence on the claim

frequency and defined the principal component as a

driving behavior factor. However, there is no analysis

of the correlation between driving behaviors

involving traffic violations and vehicle claims, nor

does it consider the difference in sensitivity of

different models to traffic violations in real life.

Generalize Linear Model (GLM) is the mainstream

model used in current research on auto insurance

pricing. After summarizing the shortcomings of

traditional pricing, Zhang (2013) made a brief

introduction to GLM and pointed out the necessity of

applying GLM to auto insurance pricing. Moreover,

through detailed analysis of the data of auto insurance

claims of a European insurance company, it is proved

that GLM is indeed superior to traditional pricing

methods in auto insurance premium determination.

Wu (2018) demonstrated that GLM has a better effect

in the calculation of risk factors.

So, in order to give a solution to the above

problem, this paper analyzes and demonstrates the

necessity of introducing traffic violation factors into

auto insurance pricing through the generalized linear

model, aiming to promote the full consideration of the

use of traffic violation factors in auto insurance

pricing, reduce the accident rate and reduce the

operating risk of insurance companies through

scientific pricing, and guide vehicle drivers to

actively comply with traffic rules and develop good

driving habits.

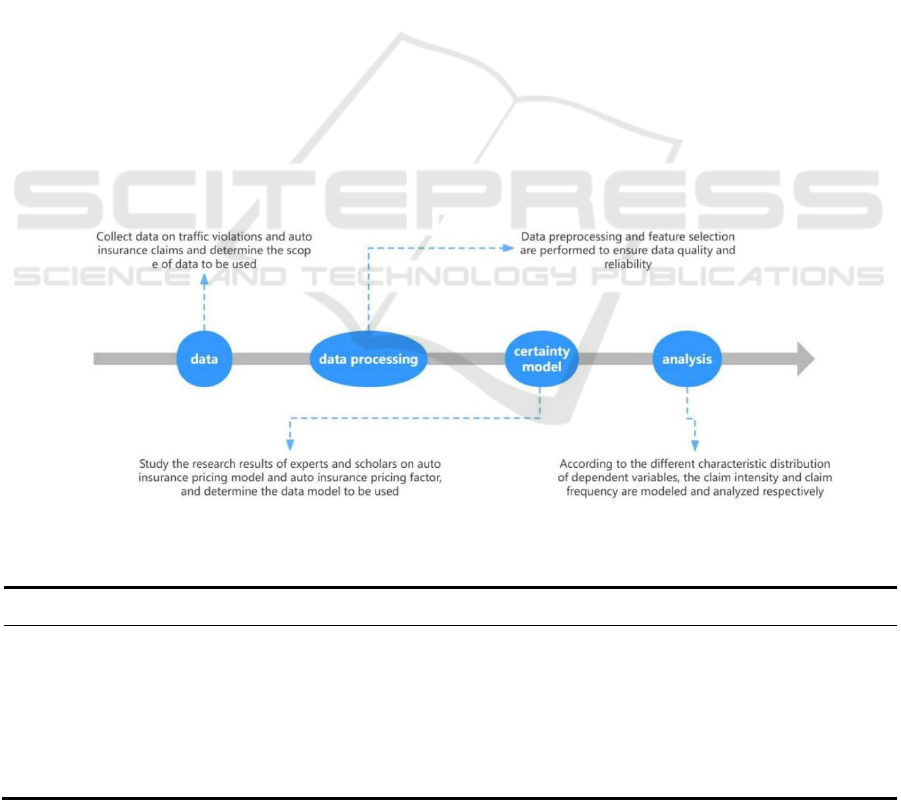

2 RESEARCH DESIGN

This study is carried out according to the following

design steps, as shown in Figure 1.

2.1 Data Description (Source and

Description)

This paper uses the real traffic violations and auto

insurance claims data of a certain province in China

from 2021 to 2023, and the relevant data is divided into

a total of 60,000 valid data in 8 fields, including vehicle

type, number of traffic violations, type of traffic

violations, year of claims occurrence, location,

whether claims occur, number of claims, and amount

of claims. A selection of the data is presented in Table

1.

Figure 1: Research flow chart (Picture credit: Original).

Table 1: Partial claim data.

Vehicle

type

Number of

violations

Types of traffic

violations

Year of the

claim

Location

Whether a claim has

occurred

Claim frequency

Total

claims

1 3 A、B1 2021 A City 1 3 2300

1 1 B1 2022 B City 1 2 1200

2 0

/

2022 C City 00 0

3 0

/

2023 D City 00 0

4 2 B1、G 2023 D City 1 3 12000

4 1 G 2021 E City 1 1 2000

5 0

/

2021 F City 00 0

5 1 G 2021 E City 1 1 2000

6 0

/

2021 G City 00 0

Research on Traffic Violation Factors in Vehicle Insurance Pricing Based on Generalized Linear Model

69

Table 2: Variable names and descriptions.

variable name Assi

g

nment and descri

p

tion

vehicle type Family car =1, business bus =2, non-business bus =3, business truck =4,

non-

b

usiness truck =5, special vehicle =6

Vio_num Number of violations (times)

Vio_type

Types of traffic violations: A (violation of traffic lights, etc.); B1 (exceeding 10% speed but

not reaching 50%), B2 (exceeding 50% speed, etc.); C (load exceeding the approved load

mass, etc.); D (not in accordance with the provisions of the installation of motor vehicle

plates, etc.); E (without a driving license, being revoked, driving a motor vehicle during the

suspension, etc.); F1 (driving a motor vehicle after drinking, etc.), F2 (driving a motor vehicle

after drunkenness, drug driving, etc.); G (fleeing after a traffic accident, etc.); H (failure to

use seat belts as required, make or receive phone calls while driving, fail to participate in

regular safety technical inspection, carry more than the approved number of passengers,

violate traffic markings or signs, park vehicles in violation of regulations, drive in the opposite

direction and other ille

g

al t

yp

es

)

Yea

r

Year of the claim

Location Where the traffic violation occurre

d

Whether a claim has occurred

(Y1)

Claim occurrence =1; No claims =0

Claim frequency(Y2)

The number of claims

Claim intensity(Y3)

Total claims/number of claims

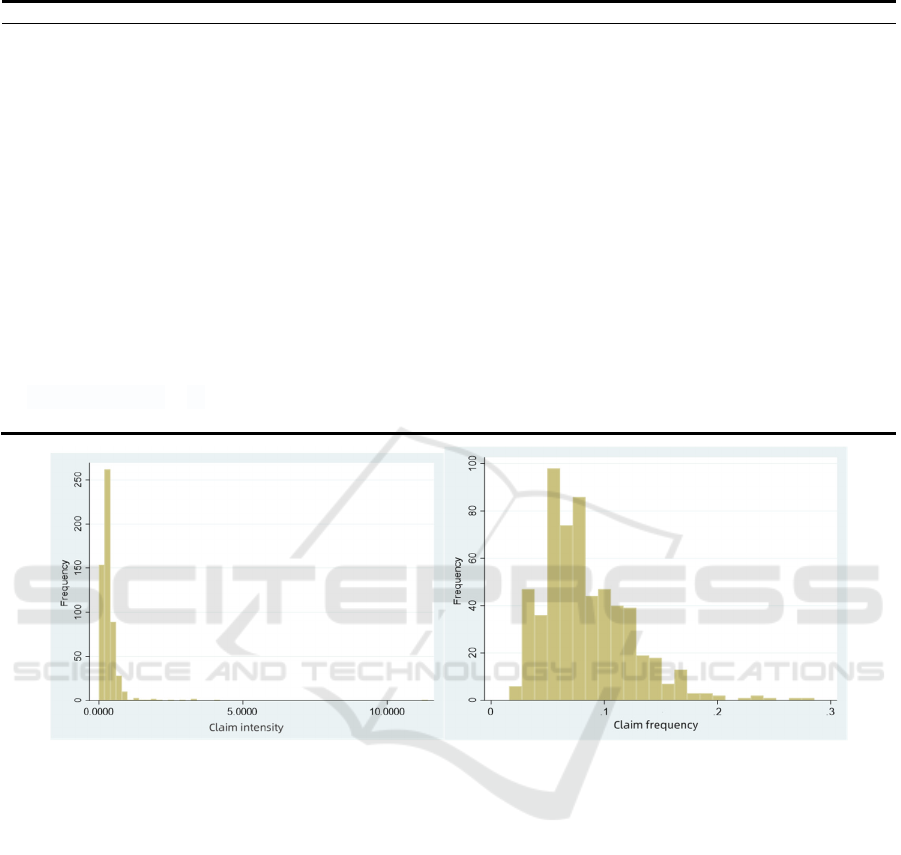

Figure 2: Frequency distribution of claim intensity and Frequency distribution of claim frequency (Picture credit: Original).

According to Table 1, the type of vehicle, the

number of traffic violations, and the type of traffic

violations are determined as independent variables,

and the type of vehicle and the type of traffic

violations are subdivided. The type of vehicle is

divided into six categories: family car, business bus,

non-business bus, business truck, non-business truck,

and special vehicle, which are represented by

numbers 1-6 respectively. Traffic violations are

divided into 10 categories of violating traffic lights,

speeding, carrying more than the approved load mass,

not installing motor vehicle plates according to

regulations, not obtaining A driving license, driving a

motor vehicle during the suspension or suspension of

driving license, driving after drinking alcohol,

escaping after traffic accidents, and other violations,

respectively, expressed by letters A-H. Among them,

class B and class F are subdivided into B1, B2 and F1

and F2. The associated variable names, assignments,

and descriptions are shown in Table 2.

2.2 Data Processing

2.2.1 Analyze the Characteristics of

Dependent Variables

In auto insurance pricing, actuaries predict potential

losses based on available historical claims data, and

thus calculate the insurance premium ( 𝜋

). The

premium may be the product of the frequency of the

claim and the intensity of the claim by the following

formula:

𝜋

𝐸𝑓

𝐸𝑠

(1)

Where Ef

is the mean of the prediction of claim

frequency and Es

is the mean of the prediction of

IAMPA 2024 - International Conference on Innovations in Applied Mathematics, Physics and Astronomy

70

claim intensity. Claim frequency refers to the number

of claims under the unit exposure policy; Claim

intensity refers to the average amount of a single

claim under the conditions under which the claim is

made. Therefore, the data characteristics of two

dependent variables, claim intensity and claim

frequency, need to be analyzed before modeling.

According to Figure 2, both claim intensity data

and claim frequency data present a skewed

distribution pattern, with the data in the middle

declining rapidly and the data on the right declining

slowly. The gaps in the data on the right indicate that

the probability of high claims intensity cases and high

claims intensity cases is very low respectively, which

accords with the characteristics of loss data under

normal circumstances. Therefore, the claim intensity

data can be applied to the gamma distribution, and the

claim frequency data can be applied to the Poisson

distribution.

2.2.2 Test Multicollinearity

Table 3: Multicollinearity test.

Variable VIF 1/VIF

Vio_num 2.16 0.462902

A 2.87 0.348153

B1 2.87 0.348153

B2 1.88 0.531626

C 1.88 0.531626

D 1.88 0.531626

E 1.88 0.531626

F1 1.88 0.531626

F2 1.88 0.531626

G 1.88 0.531626

H 12.65 0.079052

Testing multicollinearity refers to check whether

there is a high correlation between independent

variables in statistical modeling. When there is a high

correlation between independent variables, it will

lead to instability and inaccuracy of the model, so it

is necessary to conduct a multicollinearity test to

confirm whether this is the case. Variance inflation

factor (VIF) is a statistic used to measure the severity

of multicollinearity between multiple linear

independent variables. Generally speaking, when

VIF<10, indicating that there is no multicollinearity.

The number of traffic violations and the type of traffic

violations were selected for multicollinearity test, and

the classification variable of the type of violations

was converted into a dummy variable in the model.

Since the VIF value of H variable was 12.65, it could

be considered that it had a high degree of

multicollinearity, so the variable was deleted before

modeling. After H variable was deleted, the VIF

value between the variables was much less than 10. It

can be considered that there is no multicollinearity

between variables, and the specific test results are

shown in Table 3. The following empirical analysis

only conducted modeling analysis on nine types of

traffic violations: A, B1, B2, C, D, E, F1, F2 and G.

2.3 Model Determination

The generalized linear model is an extension of the

ordinary linear regression model. Its characteristic is

that the natural measure of the data is not forcibly

changed, and the data is allowed to have a nonlinear

and unsteady variance structure. Different association

functions can be used for modelling, so as to deal with

the relatively complex relationship between

dependent variables and independent variables

(Wang 2023). Therefore, the generalized linear model

is more suitable to explore the impact of traffic

violation factors on the frequency and intensity of

claims, so as to determine the traffic violation factors

with high impact.

The model is usually composed of random

components, system components, and connection

functions. Random components refer to the

probability distribution of the dependent variable Y,

system components are linear combinations of

independent variables, and the relationship between

random components and system components is

constructed by connection function (Wang & Wang,

2013). Therefore, the dependent variable of a

generalized linear model is a function transformation

form of the linear combination of independent

variables. Its basic form is as follows:

+===

−−

)()(][

11

iijiii

XggYE

ξβημ

(2)

iii

uVYVar

ω

ϕ

/)()( =

(3)

Where g represents the connection function and

Var (x) is the variance function. The research of auto

insurance pricing usually adopts gamma distribution

for continuous data, Poisson distribution and negative

binomial distribution for discrete data.

3 EMPIRICAL ANALYSIS

In this paper, Stata17 software tool is applied to

ordinary laptop computer for data empirical analysis,

and the relationship between nine types of traffic

violations except H and the intensity and frequency

of claims is analyzed by generalized linear model, and

the influence of traffic violations frequency and

Research on Traffic Violation Factors in Vehicle Insurance Pricing Based on Generalized Linear Model

71

illegal types on the intensity of claims under different

vehicle types is further analyzed (Meng, Li & Gao,

2017). This paper studies the sensitivity of different

vehicle types to different types of traffic violations

and analyzes the reasons, and then draws the

conclusion that the analysis of traffic violations is

necessary to determine the pricing of auto insurance.

3.1 Analyze the Relationship Between

the Intensity of Claims and the

Number and Types of Traffic

Violations

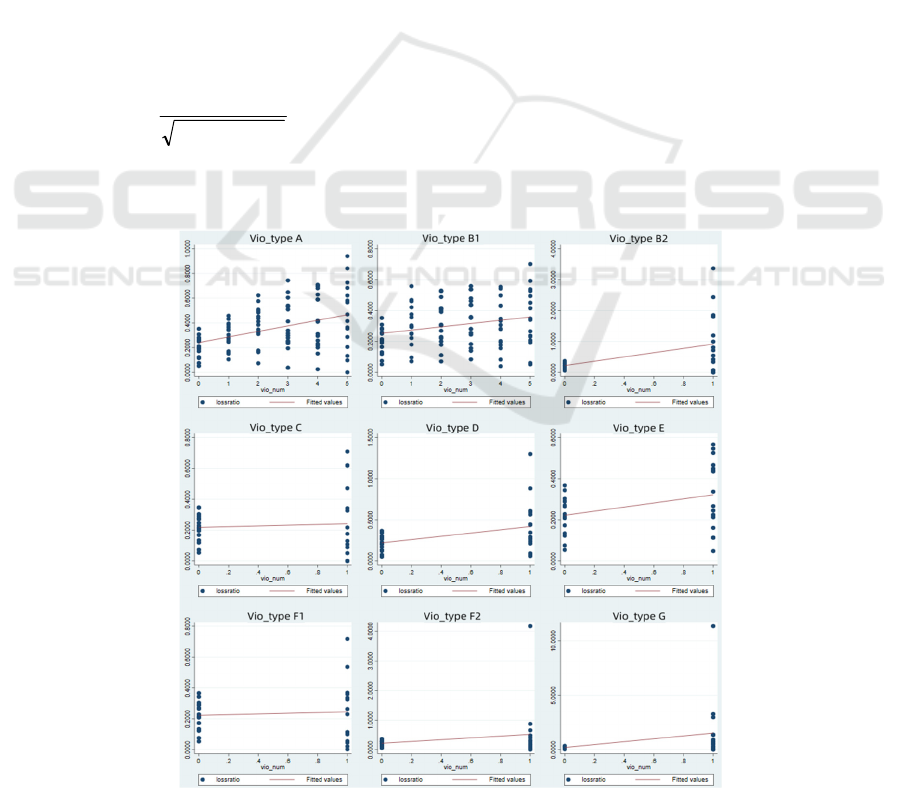

3.1.1 Single Factor Analysis

To help build the model, this paper first analyzes the

single-factor relationship between nine types of

traffic violations and the intensity of claims through

graphical analysis. The correlation coefficient is a

quantity used to study the degree of linear correlation

between variables, generally denoted by the letter r.

The formula is as follows:

(4)

Where, Cov(X,Y) refers to the covariance of X

and Y, Var[X] represents the variance of X, and

Var[Y] is the variance of Y.

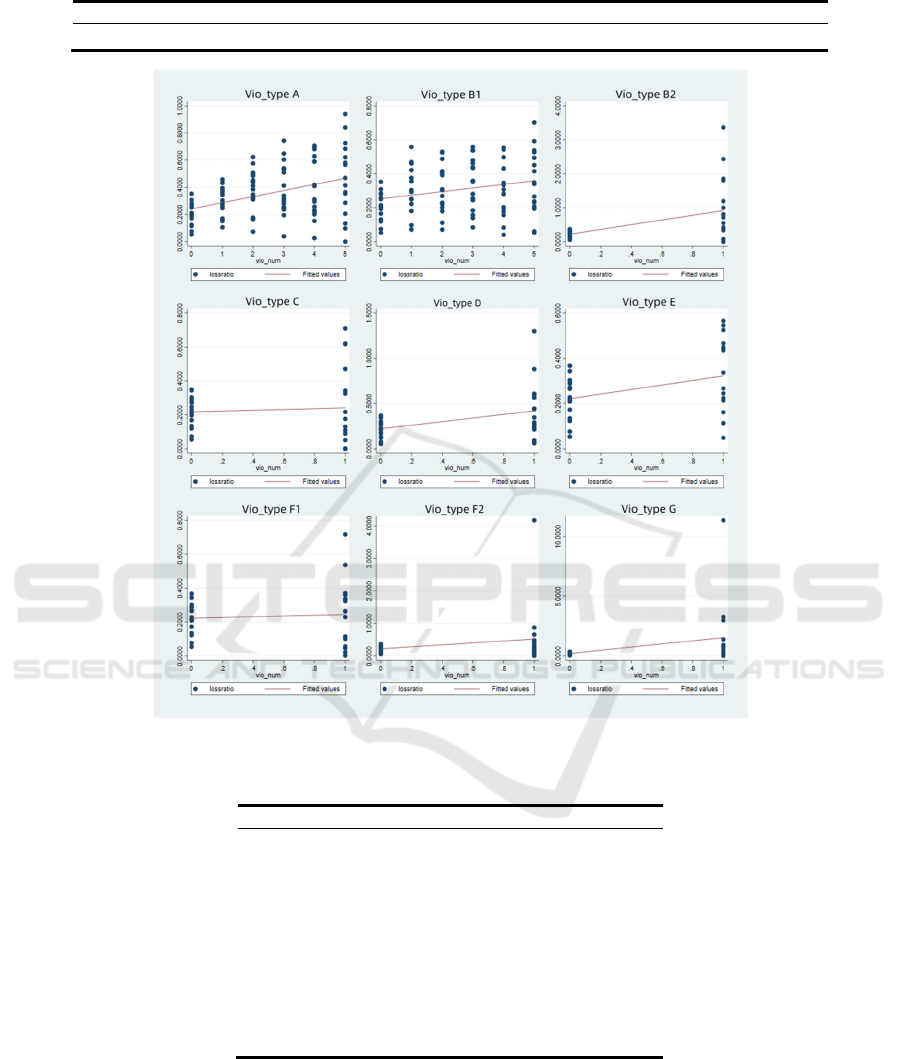

Through the analysis of Figure 3 and Table 4, it

can be concluded that except for H traffic violations,

other traffic violations have a certain positive

correlation with the intensity of claims.

3.1.2 Claim Strength Analysis

According to the distribution characteristics of claim

intensity, combined with existing relevant studies, a

generalized linear model is adopted to analyze the

factors affecting claim intensity. The connection

function is logarithmic function, assuming that claim

intensity follows gamma distribution, the model

expression is as follows:

)()(][

2211

11

iiiiii

XXggYE

ξββημ

++===

−−

(5)

Where, Y

represents the claim intensity, X

is the

variable that affects the claim intensity, including the

number of traffic violations and the type of traffic

violations.

Based on Stata17 software, maximum likelihood

estimation and probability distribution and

parameters of observed values were applied to

determine the degree of influence of each variable on

the dependent variable.

Figure 3: Scatter plot of single factor analysis between claim intensity and traffic violation type (Picture credit: Original).

()

()

[] []

YVarXVar

YXCov

YXr

,

, =

IAMPA 2024 - International Conference on Innovations in Applied Mathematics, Physics and Astronomy

72

Table 4: Parameter estimation results of the claim intensity model.

A B1 B2 C D E F1 F2 G

Lossratio\Vio_type 0.3936 0.2411 0.4533 0.0664 0.3943 0.3532 0.0762 0.2141 0.3266

Table 5: Parameter estimation results of the claim intensity model.

parameter Vio_type Estimate z p-value

Vio_num 0.037 3.98 0.000***

Vio_type A 0.5598273 3.23 0.001***

Vio_type B1 0.4342636 2.49 0.013 **

Vio_type B2 1.125105 4.95 0.000 ***

Vio_type C 0.2272258 0.99 0.320

Vio_type D 0.5231742 2.30 0.022**

Vio_type E 0.3800192 1.67 0.096*

Vio_type F1 0.2635232 1.15 0.249

Vio_type F2 0.7862879 3.46 0.001***

Vio_type G 1.476298 6.51 0.000***

Cons -1.714876 -10.34 0.000***

Note:***, ** and * respectively represent significant at the 1%, 5% and 10% levels, the same below.

As can be seen from Table 5, there is a significant

positive correlation between the number of traffic

violations and the intensity of claims. Among the

classification variables of traffic violation types, A,

B2, F2 and G are significant.

3.1.3 Heterogeneity Analysis of Vehicle

Types

Considering the different factors affecting the

occurrence of traffic violations and insurance claims of

different car types in real life, it is necessary to conduct

empirical research on the data of six groups of car

types, analyze the impact of the number and types of

traffic violations under different car types on the

intensity of claims, and study the sensitivity and causes

of different car types to different traffic violations.

Based on the data in Table 6, it can be observed

that there is a strong positive association between the

number of traffic violations for family cars, business

buses, and non-business buses and the frequency of

insurance claims. Conversely, there is no significant

correlation between the number of violations for

business trucks, non-business trucks, and special

vehicles and the intensity of claims. This could be

attributed to the fact that business trucks, non-

business trucks, and special vehicles are influenced

by their specific job roles and carry inherent risks. As

a result, even in the absence of traffic violations, these

vehicle types may still experience high levels of

insurance claims.

The data presented in Table 6 indicates that traffic

violations A, B1, B2, and G have a substantial impact

on the frequency of auto insurance claims for family

cars. This observation is consistent with the

prevalence of these violations in everyday life, such

as speeding, running red lights, drunk driving, and

hit-and-runs.In contrast, buses—whether business or

non-business — are less sensitive to various traffic

violations due to their primary function of passenger

transportation. Given the high driving risk and

involvement of multiple parties in case of accidents

associated with bus operations (e.g., public

transportation and tourism), there are stringent

requirements for driver quality. Consequently, this

results in lower rates of traffic violations and

subsequent insurance claims. For trucks and special

vehicles, specific types of traffic violations

significantly impact claim intensity. Notably, illegal

type B2 and F2 infractions are particularly impactful

for business trucks; illegal type G infractions have a

significant effect on non-business trucks; while

illegal type B2 infractions notably influence claim

intensity for special vehicles.

Research on Traffic Violation Factors in Vehicle Insurance Pricing Based on Generalized Linear Model

73

3.2 Examine How the Frequency of

Claims, the Quantity of Violations,

and the Categories of Traffic

Violations Are Interconnected

3.2.1 Single Factor Analysis

To facilitate model construction, this study initiates

with a graphical analysis of the relationship between

the nine categories of traffic violations and claim

frequency prior to modeling. As depicted in Figure 4

and detailed in Table 7, it is evident that all nine types

of traffic violations demonstrate a positive correlation

with claim frequency.

3.2.2 Analysis of Claim Frequency

Based on the distribution characteristics of claim

frequency and in conjunction with existing relevant

studies, a generalized linear model is employed to

analyze the factors affecting claim frequency. The

connection function takes the form of a logarithmic

function, assuming that the claim intensity follows a

gamma distribution. The model expression is as

follows:

)()(][

2211

11

iiiiii

XXggYE

ξββημ

++===

−−

In this context, Y

represents the frequency of

claims, while X

denotes the variable affecting the

intensity of claims, including both the number and

type of traffic violations.

In Stata17, you can use the maximum likelihood

estimation method to estimate the probability

distribution and parameters of your data as well as

observed values. Additionally, you can determine the

extent to which each variable influences the

dependent variable through this approach.

Table 8 demonstrates a notable positive

correlation between the frequency of claims and the

quantity of traffic violations. Notably, when

examining specific types of traffic violations,

categories A, B2, D, and G exhibit heightened

significance among the categorical variables.

Table 6: Heterogeneity analysis of vehicle types.

Variable

Family car

coefficient value

Business bus

coefficient value

Non-business bus

coefficient value

Business truck

coefficient value

Non-business truck

coefficient value

Special vehicle

coefficient value

vio_num

0.047 *** 0.045*** 0.034 *** 0.027* 0.022 0.029

(4.08) ( 3.06 ) (3.23) (1.83) (1.13) (1.77)

vio_type

A

0.634*** 0.462 0.589*** 0.455 0.369 0.752

(2.96 ) ( 1.56 ) (3.09 ) (1.55 ) ( 1.09 ) (2.08 )

B1

0.5562005*** 0.381 0.4233** 0.4040943 0.282 0.404

(2.59 ) (1.28 ) ( 2.20 ) ( 1.38 ) (0.83 ) ( 1.11 )

B2

0.8697436*** 0.933 0.504 1.521*** 1.101** 1.744 ***

( 3.08 ) ( 2.41 ) ( 2.01 ) (3.99 ) (2.51 ) ( 3.69 )

C

0.6119962 ** -0462 -0.29 0.351 0.2303469 0.414

(2.16 ) (-1.17 ) (-1.15 ) ( 0.94 ) ( 0.52 ) ( 0.87)

D

0.7756737*** 0.359 0.567** 0.311 0.3577837 0.384

( 2.75 ) ( 0.92 ) ( 2.26 ) ( 0.81 ) ( 0.81 ) (0.81 )

E

0.437 0.361 0.3435804 0.423 0.2179347 0.377

( 1.54 ) ( 0.93 ) ( 1.37 )

( 1.10 )

( 0.49 ) (0.79 )

F1

0.271 -0.185 0.204 0.599 0.2159492 0.199

(0.96 ) ( -0.47 ) (0.81 ) ( 1.57 ) (0.49 ) ( 0.42 )

F2

0.482* 0.282 0.2111087 2.065*** 0.1681821 0.218

(1.70 ) ( 0.72 ) (0.84 ) (5.43 ) ( 0.38 ) (0.46 )

G

1.49 *** 0.437 0.859*** 0.701* 2.244422 *** 0.889*

(5.29 ) ( 1.12 ) ( 3.44 ) (1.83 )

(5.13 )

( 1.88 )

Intercept

-1.564 *** -1.874 *** -1.425 *** -1.975 *** -1.337639*** -2.201 ***

(-7.64 ) (-6.70 ) (-7.72 ) (-7.15 ) (-4.03 ) (-6.42 )

Note: Figures in () are standard error, the same below.

IAMPA 2024 - International Conference on Innovations in Applied Mathematics, Physics and Astronomy

74

Table 7: Parameter estimation results of the claim intensity model.

A B1 B2 C D E F1 F2 G

claimintensity\Vio_num 0.614 0.634 0.503 0.012 0.680 0.536 0.185 0.402 0.583

Figure 4:Scatter plot of single factor analysis between claim frequency and traffic violation type (Picture credit: Original).

Table 8: Parameter estimation results of the claim frequency model.

Paramete

r

Vio_type Estimate z

p

-value

Vio_num 0.172 15.62 0.000***

Vio

_

t

yp

e A 0.408 8.51 0.000***

Vio_type B1 0.07 -1.60 0.11

Vio

_

t

yp

e B2 0.23 3.24 0.001***

Vio

_

t

yp

e C 0.116 1.42 0.154

Vio_type D 0.107 1.68 0.068*

Vio

_

t

yp

e E 0.005 0.07 0.944

Vio_type F1 -0.119 -1.51 0.13

Vio

_

t

yp

e F2 0.046 0.62 0.537

Vio_type G 0.166 2.33 0.02**

Cons -2.731 -61.13 0.000***

Research on Traffic Violation Factors in Vehicle Insurance Pricing Based on Generalized Linear Model

75

Table 9: Results of heterogeneity analysis of vehicle types.

Variable

Family car

coefficient value

Business bus

coefficient

value

Non-business

bus coefficient

value

Business truck

coefficient

value

Non-business

truck coefficient

value

Special vehicle

coefficient

value

vio_num

0.204*** 0.151*** 0.170*** 0.131*** 0.194*** 0.203***

(12.23) (8.04) (9.54) (6.08) (9.96) (5.24)

vio_type

A

0.319*** 0.360*** 0.274*** 0.531*** 0.333*** 0.689***

(4.47) (4.42) (3.61) (5.41) (3.97) (4.05)

B1

-0.022 -0.066 -0.072 -0.005 -0.018 -0.235

(-0.34) (-0.87) (-1.00) (-0.06) (-0.24) (-1.58)

B2

0.265** 0.140 0.189 0.109 0.475*** 0.324

(2.44) (1.07) (1.63) (0.79) (4.04) (1.34)

C

-0.080 -0.092 -0.388*** 0.015 -0.065 0.013

(-0.65) (-0.51) (-2.71) (0.11) (-0.46) (0.05)

D

0.112 0.163 0.082 0.107 0.100 0.075

(0.98) (1.36) (0.68) (0.77) (0.75) (0.31)

E

0.012 -0.009 -0.025 0.069 -0.102 0.046

(0.11) (-0.07) (-0.20) (0.49) (-0.72) (0.18)

F1

-0.119 -0.232* -0.071 -0.075 -0.161 -0.079

(-0.95) (-1.68) (-0.56) (-0.51) (-1.11) (-0.31)

F2

-0.008 -0.158 -0.020 0.011 -0.131 0.442**

(-0.07) (-1.17) (-0.16) (0.08) (-0.91) (2.04)

G

0.197* 0.085 0.247** 0.045 0.163 0.253

(

1.77

)

(

0.69

)

(

2.17

)

(

0.32

)

(

1.26

)

(

1.10

)

Cons

-2.931*** -2.571*** -2.528*** -2.583*** -3.160*** -2.758***

(

-42.29

)

(

-33.92

)

(

-34.63

)

(

-30.05

)

(

-39.32

)

(

-18.27

)

3.2.3 Analysis of Heterogeneity in Vehicle

Types

In order to comprehensively understand the factors

influencing traffic violations and insurance claims

across various car types, empirical research was

conducted. This involved analyzing the frequency of

traffic violations for six distinct car categories, as well

as assessing the impact of these violations on claim

frequency. Additionally, the study aimed to

investigate the sensitivity and underlying causes of

different car types in relation to various traffic

violations. The analysis outcomes are presented in

Table 9.

As indicated in Table 9, the number of traffic

violations across all vehicle types demonstrates a

significant correlation with claim frequency at the 1%

test level. This suggests that a higher incidence of

traffic violations may reflect diminished adherence to

traffic regulations and more aggressive driving

tendencies among motorists. Consequently, this

heightened risk behavior is associated with an

increased likelihood of traffic accidents and

subsequent insurance claims. These findings are

consistent with empirical observations within the

field.

According to the heterogeneity test, it was found

that traffic violation types A, B2 and G for family cars

significantly affect claim frequency. Claim frequency

for business buses is significantly influenced by

traffic violation categories A and F1, while non-

business buses are impacted by categories A and B2.

Business trucks experience an impact on claim

frequency from categories A, B2, and F2; whereas

non-business trucks are affected by categories A, B2,

and G. Special vehicles demonstrate a notable effect

on claim frequency with categories A and F2.

4 CONCLUSION

In light of the shortcomings in current practices, such

as the inadequate integration of traffic violation

factors into auto insurance pricing, insufficient

analysis of relevant data in existing research, and the

oversight of variations in vehicle sensitivity to

different violation types, this study employs empirical

analysis to construct a generalized linear model. This

model, based on single-factor analysis of claim

intensity and frequency, explores the relationship

between these parameters and the number and nature

of traffic violations. Our findings indicate a positive

correlation between the frequency and severity of

insurance claims and the incidence of traffic

violations. Specifically, violations of types A, B1, B2,

D, and G exhibit a significant impact on claim

IAMPA 2024 - International Conference on Innovations in Applied Mathematics, Physics and Astronomy

76

severity, while types A, B2, D, and G are associated

with higher claim frequencies.

To address these insights, it is recommended that

insurance rate determinations consider the varying

sensitivity of vehicle types to different violations.

Implementing differentiated pricing based on these

factors would more accurately reflect the risk profile

associated with each vehicle-violation combination,

enhancing the fairness and effectiveness of the

insurance pricing model. While our study enhances

the alignment between traffic violation data and

insurance claims through the introduction of

connection functions and nonlinear transformations

in the generalized linear model, limitations persist.

These include the reliance on specific independent

variables and the inability to quantify analysis results

due to model assumptions. Building on these insights,

we explore alternative methodologies to refine our

analysis. By utilizing indicators such as auto

insurance rates, claim frequency, and severity as

labels, and incorporating parameters such as vehicle

type, violation count, violation category, claim

occurrence year, location, and claim frequency, we

identify traffic violation types with the greatest

impact on claim intensity and frequency.

We employ advanced machine learning

algorithms such as xgboost and lightGBM to train and

validate models, while employing Bayesian methods

for parameter adjustment to enhance the accuracy of

auto insurance premium predictions. Through these

efforts, we aim to further optimize the relationship

between traffic violations and insurance claims,

ultimately improving the robustness of insurance

pricing models.

REFERENCES

Denuit M, Maréchal X, Pitrebois S. Actuarial Modelling of

Claim Counts: Risk Classification , Credibility and

Bonus-malus System. West Sussex: John

Wiley&Sons,2007.

Klein N, Denuit M, Lang S. Non-life Rate-making and Risk

Management with Bayesian Generalized Additive

Models for Location Scale and Shape. Insurance:

Mathematics and Economics,2014,55.

Peng J., Liu N., Zhao H. et al. Research on intelligent UBI

System. Computer Technology and Development,

2016(1):26.

Wang T.i, Hu Y., Xiao Y. Research on Innovation of

China's Auto Insurance Rate Determination Method --

Empirical Analysis of Auto Insurance rate

Determination based on Driving behavior. Price Theory

and Practice,2016(11):4.

Gao G., Meng S. Auto insurance rate factor analysis based

on big data of Internet of Vehicles. Insurance

Research,2018(1):11.

Zhang L., Lu D. Application of Generalized linear Model

in Non-life insurance premium Analysis. Mathematical

Statistics and Management.2013.05.011.

Wu Y., Luo Yeye. Empirical Study of Generalized linear

Model in actuarial Pricing of Auto Insurance. Internal

Combustion Engines and Accessories.2018.15.096.

Wang Z. Research on Auto Insurance rate Determination

based on double layered Generalized linear Model.

Chongqing Technology and Business

University,2023:53-55.

Wang X., Wang Y. Study on classification rate

determination of automobile insurance based on

Generalized linear Model, Insurance Research, 2013

(09):2-3.

Meng S., Li T., Gao G. Auto insurance claim probability

and cumulative loss prediction based on Machine

learning algorithm. Insurance Research,2017(10).

Research on Traffic Violation Factors in Vehicle Insurance Pricing Based on Generalized Linear Model

77