Knowledge Sharing in Financial Institutions to Assist with IT Service

Management: A Thematic Analysis

Cornelius JP Niemand

1a

and Josef Langerman

2b

1

Department of Information and Knowledge Management, School of Consumer Intelligence and Information Systems,

College of Business and Economics, University of Johannesburg, Gauteng, South Africa

2

Department of Applied Information Systems, School of Consumer Intelligence and Information Systems,

College of Business and Economics, University of Johannesburg, Gauteng, South Africa

Keywords: Service Management, Applications, Knowledge, Knowledge Sharing, Financial Institutions.

Abstract: The applications and services provided by financial institutions are important to individuals and economies.

These applications and services are fragile because of service failures that are inherent in technology. The

purpose of this article is to show how knowledge management can mitigate service disruption in financial

institutions. By using bibliometric analysis and a structured literature review based on the PRISMA 2020

guidelines, we identified five major themes that drive knowledge management (KM) practices in information

technology (IT) management in financial institutions. These themes identified are centered on the organiza-

tional environment, the motivation of employees, the people profile for example gender and race, and lastly

the use of technology. By bolstering these KM practices in the IT service management (ITSM) of financial

institutions we hope to shorten the time between system failures and shorten the actual time to repair failures.

Knowledge management in IT management and especially ITSM is under-researched in financial institutions,

and the KM themes identified provide some signposts to improved collaboration and better theorisation.

1 INTRODUCTION

Digital systems go down. The results range from mild

irritation to catastrophic failure. In today's financial

institutions most, interactions are through digital

channels, be that the web, phone, or ATM. Invisible

to the users are all the back-end systems that glue

everything together and integrate the banking

ecosystems of countries and the world (Khiaonarong

et al., 2022; Klee, 2010; Merrouche & Schanz, 2010;

Mishchenko et al., 2022).

It is not only a single financial organization that is

prone to these types of outages but the financial

ecosystem. For example, a system outage at a payment

provider (that could be a bank or non-bank) is

amplified in unexpected ways as the outage at one

provider interacts with other providers as the

technology outage ripples through the payment

ecosystem. In worst-case scenarios, a cascading outage

could cause significant parts of retail payment systems

to shut down and eventually, that could harm the

a

https://orcid.org/0000-0002-8582-0328

b

https://orcid.org/0000-0003-1984-0205

broader economy (Allen, 2021; Sillito & Kutomi,

2020).

System failures are not only mentioned in

academic literature but also in popular literature.

During black Friday in 2016, one of the payment

providers to the largest online shopping portal in

South Africa had an outage because of a high load.

The payment processing was then passed to another

bank as a fall-back mechanism. The new bank then

had to process its payments, together with the

payments of the original bank which caused a

payment outage at the new bank. Eventually, the

online platform had to shut down until these issues

could be resolved (MyBroadband, 2017). Thousands

of customers of Halifax, Bank of Scotland, and

Lloyds were prevented from accessing their accounts

for eight hours on New Year’s Day 2020 because of

a system outage. The system outages at financial

firms have increased since a series of high-profile

problems at companies like TSB and Visa in 2018.

The UK Treasury also noted that there was an

Niemand, C. and Langerman, J.

Knowledge Sharing in Financial Institutions to Assist with IT Service Management: A Thematic Analysis.

DOI: 10.5220/0012998600003838

In Proceedings of the 16th International Joint Conference on Knowledge Discovery, Knowledge Engineering and Knowledge Management (IC3K 2024) - Volume 3: KMIS, pages 305-315

ISBN: 978-989-758-716-0; ISSN: 2184-3228

Copyright © 2024 by Paper published under CC license (CC BY-NC-ND 4.0)

305

“unacceptable” level of IT failures among banks

(Binham, 2020).

Software and hardware faults are inherent

properties of computer systems. The huge complexity

of software and hardware makes statistical outages

unavoidable. Modern software consists of millions of

lines of code and in many cases reaches a hundred

million lines of code. (Domingos et al., 2021). Even

though software complexity causes issues the main

reason for software failure is change caused by

human error. Sillito et al (2020) report that the major

causes of software outages (in order of frequency) are

deployments (software changes), infrastructure

changes, exceeding scaling limits, and software and

hardware failure. A major theme in their analysis is

that incidents grow in scope as an initial failure

cascades through a system exposing ways systems are

not resilient to failure. (Sillito & Kutomi, 2020).

For clarity, an incident is when a software system

experiences an outage or is degraded in functionality

or performance, and engineers are notified to

investigate and mitigate the problem. The work of the

engineers in this context is seen as incident response.

After the incident is resolved or mitigated a post-

mortem is generally conducted (ISO, 2015; Sillito &

Kutomi, 2020). The ISO 27043 standard divides the

process into pre-incident response, during-incident

response, and post-incident response. (ISO, 2015)

The current process frameworks that guide this in

the financial sector are the IT Infrastructure Library

(ITIL) and to a lesser extent Google’s Site Reliability

Engineering (SRE) framework (Langerman &

Joseph, 2023). ITIL focuses primarily on processes

and SRE on automation to reduce human error

(Axelos, 2020; Beyer et al., 2016).

Both frameworks incorporate aspects of

knowledge management, for example, ITIL 4

advocates for the capturing of knowledge at the

source of an incident. This allows organizations to

build a repository of institutional knowledge that may

be of use for future incident resolution and problem-

solving activities. Unfortunately, the implementation

and use of the core knowledge management

principles as outlined by the frameworks are limited.

In the context of the brief discussion of the

frameworks guiding the financial sector, knowledge

may be regarded as a strategic resource to assist

managers and engineers in decision-making during

the pre-incident, during-incident, and post-incident

response cycle and can help mitigate the effect of an

outage. Knowledge management can enhance the

process of incident management, by ensuring the

availability and accessibility of accurate and reliable

information when required, through effective lesson

learning (Ammirato et al., 2021). Ammirato et al

(2021) and Seneviratne et al (2010) make the case for

the importance of knowledge management during a

disaster. Similarly, the researchers make the case in

this paper for the use of knowledge management

during an IT disaster or system outage. Despite the

critical role of knowledge management in IT service

management that can inform and enable decision-

makers the literature on this is poor. Service

management is addressed in IT journals but only

marginally addressed by the knowledge management

fraternity. A significant exception to this is the work

of Baradari et al. (2023) which focus specifically on

the role of knowledge management in ITIL. ITIL as a

methodology is not specific to any industry but covers

service management across all information

technology industries.

As literature on the overlap between knowledge

management, service management and information

technology is so scant we restricted our literature

survey to that of knowledge management and

information technology in financial services. As

service management is a subset of IT management

(MacLean & Titah, 2023), this broadening makes

sense for this research project.

1.1 Knowledge and the Sharing of

Knowledge

The Merriam–Webster dictionary defines knowledge

as “fact or condition of knowing something with

familiarity gained through experience or association”.

For this research, two types of knowledge may be

identified, i.e., tacit knowledge and explicit

knowledge.

According to Polanyi, (1967) in Khan and Zaman

(2020:2), “Tacit knowledge is embedded in the minds

of people, accumulated during their career through

experience, and is only visible through their

actions…the other type is explicit knowledge which

exists in written or other transferrable form”. Some

examples of explicit knowledge dimension are any

form of knowledge that is in a written form, like

policies, organizational strategies, operating

procedures, vision, and mission statements with

related rules governing them.

It should be noted that capturing and sharing

explicit knowledge is deemed easier than capturing

and sharing tacit knowledge. The capturing of explicit

knowledge usually takes the form of a simplified and

structured approach. The management of the two

types of knowledge results in the concept of

knowledge management.

KMIS 2024 - 16th International Conference on Knowledge Management and Information Systems

306

Asrar-Ul-Haq & Anwar, 2016; Yeboah, 2023 in

Kim and Hang (2024:1) state that “One essential

element of the knowledge management system is

knowledge sharing.” For this research, knowledge

sharing may be defined as the process of both internal

and external transfer of both tacit and explicit

knowledge for decision-making to ensure the

longevity and profitability of the organization. The

aforementioned is confirmed by Abbas, Hussain,

Hussain, Akram, Shaheen, and Niu (2019:2) stating

that “… knowledge-sharing strategies significantly

influence a firm’s success through their innovative

performance processes.” The aforementioned is

echoed by Darroch and McNaughton (2003) in

Alshwayat et al

. (2021), stating that employing

knowledge-sharing activities in an organization will

create more creativity resulting in better economic

performance, i.e. profitability.

Financial institutions are not exempt from the

current economic climate and thus also be proactive in

their stance to remain competitive in an ever-changing

business environment. According to Abbas, Hussain,

Hussain, Akram, Shaheen, and Niu (2019:2)

“Realizing the importance of knowledge management,

especially knowledge sharing, the banking sector has

initiated the development of knowledge management

(KM) teams in their institution.”

2 METHODOLOGY

The current economic perspective is an economy based

on knowledge, where individual, group, and societal

existence are dependent on the use of and sharing of

knowledge. Within modern-day organizations,

knowledge sharing may be regarded as the new core

capability that can increase the longevity of the

organization as a provider of goods and services.

The main research question focuses on

understanding the themes driving research in

knowledge sharing, specifically in financial

institutions, considering that these institutions and

functions within the institutions are often

characterized by individuals hoarding and not willing

to share what they know.

To this end, the researchers adopted a pragmatic

ontological stance, based on the practical application

of the results of the study to achieve what Sekaran and

Bougie (2013:30) coin as “intelligent practice”.

As stated, pragmatism is the chosen ontological

stance for the study and pragmatism may be attributed

to Charles Sanders Peirce, the nineteenth-century

American mathematician and logician. In an attempt

to understand how researchers come to know, Jacobs

(2010:725) postulates that “Peirce argued for

abduction” as an epistemological assumption.

Reichertz (2014:126-127) points out that the research

activity starts when the researcher realizes that there

is an imbalance between expectation and reality. The

imbalance between expectation and reality can be

described as the “surprise” factor, necessitating the

researcher to de- and re-contextualize data and

understanding about a specific phenomenon, and in

so doing arrive at a new idea about the phenomenon

under investigation.

The premise of this study is based on the fact that

there is an imbalance between organizations’

expected ability to manage knowledge sharing and

the reality thereof. Abductive reasoning as an

epistemological stance therefore makes sense in

terms of this study.

The methodological assumptions focus on the

process of research design. Kelemen and Rumens

(2011) state that “by pragmatism’s theoretical

cornerstone, the pragmatist researcher is most likely

to adopt research practices that will allow him/her to

solve a practical problem efficiently”. From the

epistemological stance of the study, it is evident that

the pragmatist researcher needs to be able to

acknowledge all interactions between knowledge and

action within a specific area of investigation. This

research employed a systematic literature review

approach, which is considered popular in qualitative

research studies. The actual methodology employed

in the review followed the PRISMA 2020 updated

guideline for reporting on systematic reviews

allowing for the reporting of “sufficient detail to

allow users to assess the trustworthiness and

applicability of the review findings (Page et al 202).

The protocol provides clear steps for the

identification, screening, and inclusion of literature as

part of the systematic literature review. Each of the

following main points will be elaborated on:

inclusion and exclusion criteria,

the search strategy,

The data sources, and

the analysis and reporting elements.

2.1 Inclusion and Exclusion Criteria

The selection criteria identified in this section define

what to include and what to exclude in the review of

the sources. It should be noted that the inclusion and

exclusion criteria aim to identify relevant research that

will answer the main research question as postulated in

section 2. The review was limited to scholarly peer-

reviewed journal articles on the topic of knowledge

sharing in the domain of financial institutions.

Knowledge Sharing in Financial Institutions to Assist with IT Service Management: A Thematic Analysis

307

It should be noted that resources in the form of

books, book chapters, and grey literature were not

considered for inclusion in the review.

2.2 The Search Strategy

The identification of keywords and use of Boolean

operators governed the creation of a search string that

was used in searching for relevant sources to include

in the review.

The search string used was:

(("knowledge sharing")) (Title) and (("financial

institution*")) or (("bank*")) or (("financial service

provider*")) (All Fields) and (("information

technolog*")) or ((IT)) or ((system*)) (All Fields).

2.3 The Data Source/s

The search string as identified in section 2.2 was used

to conduct a search for scholarly literature on the

Clarivate Web of Science. The use of Clarivate Web

of Science was deemed suitable for the database is a

multi-disciplinary database covering a variety of

different subjects within a large data range.

2.4 The Analysis and Reporting

Elements

Applying the search string identified in section 2.2

yielded the following results (based on the Prisma

2020 protocol).

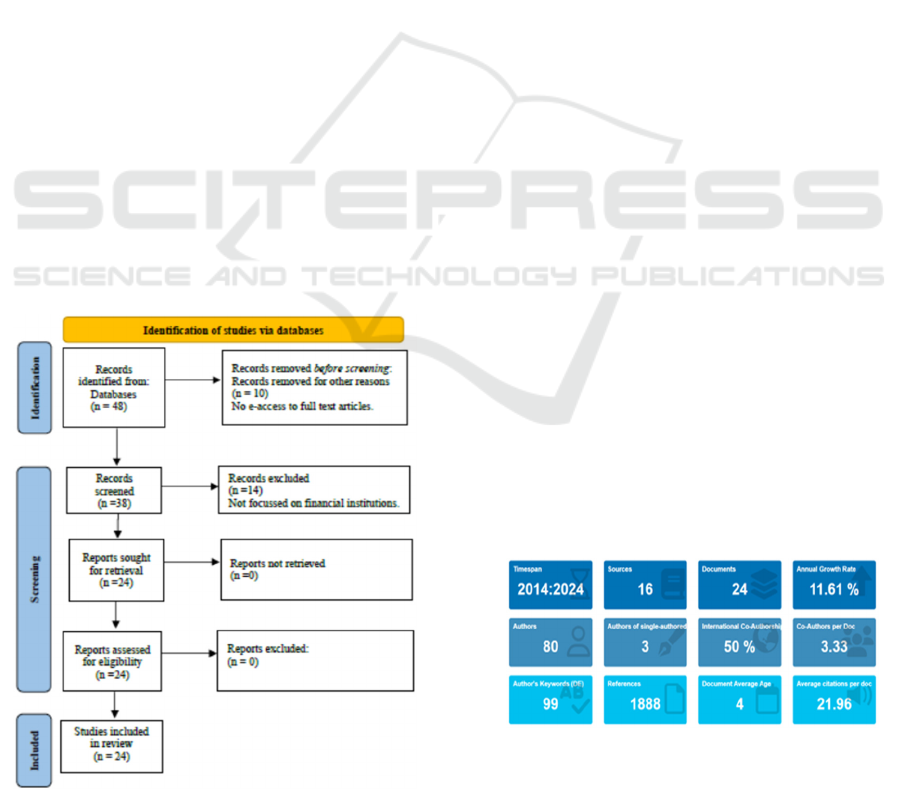

Figure 1: The analysis and reporting elements.

A total of 48 scholarly peer-reviewed journal

articles were retrieved utilizing the identified search

string. It should be noted that ten articles were

removed before the screening process. The

researchers did not have full-text access to the

identified articles and were subsequently removed

from the review process.

The resulting sources, i.e. the 38 articles were

screened for inclusion in the review. Of the 38

articles, 14 articles were not deemed to fit into the

review due to a lack of focus on knowledge sharing

in financial institutions. The 14 articles were

subsequently removed from the review.

The resulting 24 articles were downloaded and

stored for further analysis.

2.4.1 Bibliometric Analysis of the Results of

the Systematic Literature Identified

To position and enhance the relevance of the

systematic literature review based on the Prisma 2020

protocol, the researchers conducted a bibliometric

analysis of the results of the sources identified for

inclusion in the review.

As identified in section 2.3, 24 scholarly peer-

reviewed journal articles were identified for inclusion

in the systematic literature review.

The researchers employed Bibliometrix, a

powerful R package designed specifically for

bibliometric analysis of sources. At its core,

Bibliometrix analyzes three types of knowledge

structures in the sources. These include:

conceptual structure

Intellectual structure, and

Social structure.

Because Bibliometrix relies heavily on code

commands a more user-friendly interface, i.e.

Biblioshiny, which is an extension of Bibliometrix

was employed to provide a more visual and

interactive approach to the bibliometric analysis of

the sources. Some of the main results of the

bibliometric analysis are presented below:

Figure 2: Bibliometric overview of sources included in the

review.

KMIS 2024 - 16th International Conference on Knowledge Management and Information Systems

308

The most important findings from Figure 2 are:

The sources included in the review cover a 10-

year time frame, from 2014-2024

80 authors contributed to the topic at hand

There is an average of 21.96 citations per

article.

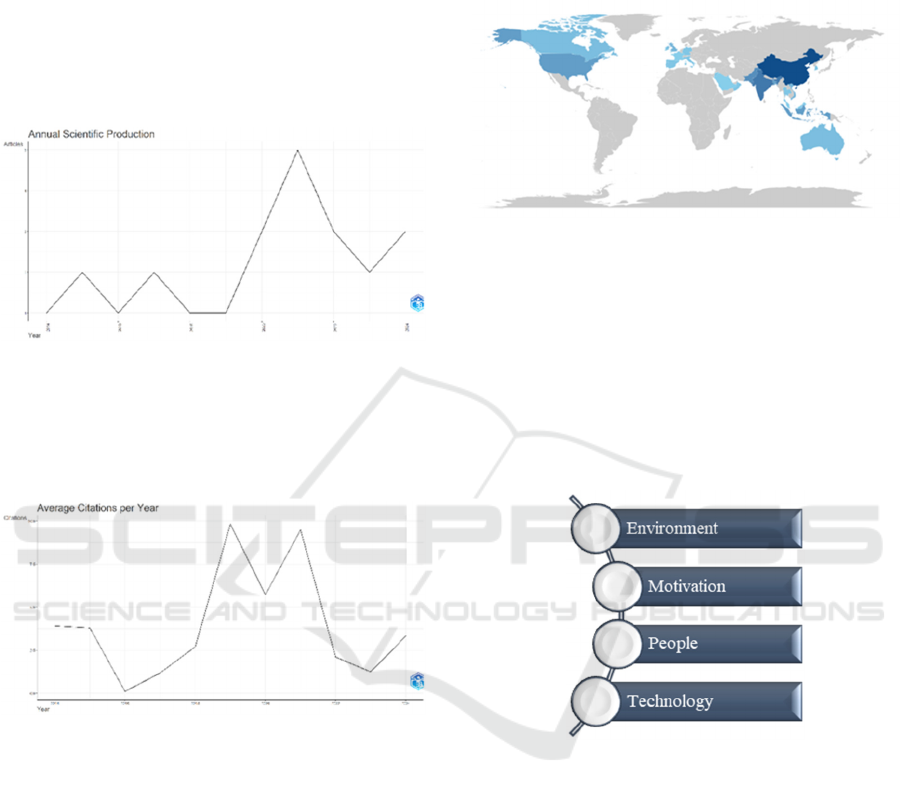

The annual scientific production per year during

the said period reached a peak in 2021 with a total of

five units produced. This is evident in Figure 3 below.

Figure 3: Annual scientific production.

The average article citations per year also

followed a similar trend as in Figure 3, with peak

citations in 2019 and 2021. These trends are

illustrated in Figure 4.

Figure 4: Average citations per year.

One of the most important elements to consider in

a bibliometric analysis is the “vehicles” of

dissemination of the research results, i.e. the sources

of publications. The bibliometric analysis of the 24

articles revealed that the top 5 most relevant sources

of publications are:

Journal of Knowledge Management = 6

publications

Employee relations = 2 publications

Journal of Public Affairs = 2 publications

Sustainability = 2 publications

Applied Psychology – an International

Review = 1 publication

When considering the countries where the

scientific production originates from, it is interesting

to note that Asia and India are the leaders in

producing research on the topic.

A visual overview of the countries contributing to

the scientific production on the topic is offered in

Figure 5.

Figure 5: Countries' scientific production.

The following section will provide a discussion of

the results of the systematic literature review.

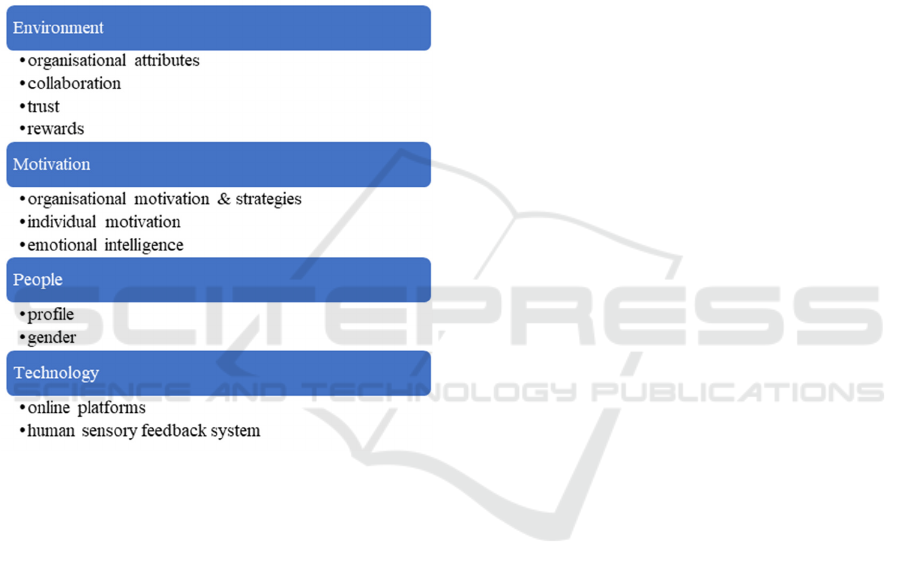

3 ANALYSIS OF THE RESULTS

Out of the systematic literature review, five clear

themes emerged. The themes are represented in

Figure 6.

Figure 6: Results of the thematic literature review.

Each of the themes will be described in more

detail to align the themes to answer the main research

question as outlined in section 2.

3.1 Environment

The most prominent theme identified in the literature

review is the creation of a suitable knowledge-sharing

environment in financial institutions.

The driving concepts identified in this theme include

but are not limited to:

organizational attributes

collaboration

trust

rewards

Knowledge Sharing in Financial Institutions to Assist with IT Service Management: A Thematic Analysis

309

According to Kim and Hang (2024:2), the major

catalyst for creating an environment fostering

knowledge sharing is the organizational commitment

and support towards creating such an environment for

the staff members. Enwereuzor (2021) in Kim and

Hang (2024:2) furthermore postulates that the

commitment and support from organizational

management be accompanied by elements and

constructs such as diversity, respect, and engagement,

specifically shown and driven by the management of

the organization.

Abbas, Hussain, Hussain, Akram, Shaheen, and

Niu (2019:2) extend the notion of organizational

attributes to the extent that the organization should

become a learning organization resulting in

“…enhance knowledge sharing among employees

within the organizations and empowering business

firms to initiate critical actions and behaviors to gain

the organizational settings to identify the real

situation.”

Gold et al (2001) believe that collaborations

within the organizational environment should

constitute interactions between the staff members of

the organization. The authors furthermore state that

collaboration is the result of open communication

channels, participative activities, and interactions

among the staff members.

This sentiment is echoed by Abbas, Hussain,

Hussain, Akram, Shaheen, and Niu (2019:2) stating

that “…new employees tend to develop relations with

colleagues, creating a channel for knowledge

sharing”

Von Krogh, Nonaka, and Rechsteiner (2012)

believe that although management might create and

facilitate an environment that enables collaboration,

communication, and sharing of ideas, without trust in

this collaborative space staff members will not be

willing to share any knowledge. The lack of trust is

highlighted by other authors including Bock et al.,

2005, who states that a lack of trust in the

organizational environment may be regarded as the

main barrier to knowledge sharing and transfer.

Kim and Hang (2024:10) clearly state that

although monetary and other rewards might not be a

focal point for managers of knowledge, the impact

thereof to stimulate the sharing of knowledge should

not be underestimated.

3.2 Motivation

Motivation in terms of the literature reviewed may be

considered as a descriptive concept, defining

motivation within the construct of knowledge,

knowledge sharing, and the environment. Nguyen

and Malik (2022:1987) state that “motivation

theorists posit that motivation drives employees’

behavior”

The driving concepts identified in this theme

include but are not limited to:

Organizational motivation and strategies

individual motivation

emotional intelligence

Organizational motivation and strategies are

driven by the formulation, implementation, and

management of performance appraisals.

Fong et al (2011) in Gillani, Iqbal, Akram, and

Rasheed (2017:180) believe that the use of

performance appraisals may be regarded as positive

reinforcement to shape the behaviors of the staff

members of the organization. If knowledge sharing is

defined as a key performance area and indicator, can

contribute to staff members' improved performance in

this specific area and contribute to the organizational

environment and culture of sharing of knowledge.

It should be noted that the use of performance

appraisals should be handled with great care and

responsibility. According to Currie and Kerrin,

(2003) in Gillani, Iqbal, Akram, and Rasheed (2017:

180) performance appraisals can hamper and choke

the sharing of knowledge within the organizational

context because there might be conflicts between the

different individuals, and functional departments, and

or sections in the organization.

One way to mitigate the negative impact of

performance appraisals is to ensure that fair feedback

is provided to the staff members thus strengthening

the desired outcomes (Gillani, Iqbal, Akram, and

Rasheed, 2017:180).

Motivation on an individual level is very closely

related to organizational motivation. The literature

reviewed for this research indicates that individual

motivation is influenced and defined by various

intrinsic and extrinsic factors.

When considering the intrinsic factors, it is

important to note that each staff member's intrinsic

motivation will differ based on their frame of

reference, i.e. background. Furthermore, the literature

indicates that intrinsically motivated staff members

are more prone to sharing knowledge for the

satisfaction it brings to the education of others.

Sathitsemakul and Calabrese (2017:81) identified

the following examples of intrinsic factors:

interpersonal trust,

organizational commitment,

and self-efficacy.

In contrast to intrinsic motivation, extrinsic

motivation may be defined when external reasons

KMIS 2024 - 16th International Conference on Knowledge Management and Information Systems

310

drive an individual to perform a specific task. These

reasons include but are not limited to:

reward in any form,

negative consequences or punishment,

to increase individual self-worth and

importance,

or goal-orientated.

It should, however, be noted that according to

Muqadas et al. (2017) in Kim and Hang (2024:2)

believe that an over-emphasis on rewarding extrinsic

motivation does not necessarily stimulate knowledge-

sharing activities within the organizational context.

Emotional Intelligence (EI) may be regarded as a

very important motivating factor. Sathitsemakul and

Calabrese (2017:82) indicated that emotional

intelligence “…is the ability to perceive emotions and

cognitive processes such as reasoning with emotions,

understanding their meaning, assimilating and

locating relationships between the emotions”.

Research indicates that EI can potentially influence

both the intrinsic and extrinsic motivation of staff

members. It should be noted that EI has proven to

develop individual motivation which influences

knowledge-sharing behavior Sathitsemakul and

Calabrese (2017:82). Shyh et al., (2006) contend that

EI has the ability and impact to raise the propensity to

share knowledge even if the individual is reluctant to

do so.

3.3 People

Inkpen and Tsang, (2005) state that in essence an

organization and more specifically financial

institutions may be regarded as a social network

where the organizational hierarchy will influence the

social capital, i.e. the staff members. According to the

authors, it is the social capital of the organization that

underpins all knowledge-sharing activities and

exchanges and the communication thereof.

The driving concepts identified in this theme

include but are not limited to:

profile

gender

An interesting observation from the systematic

literature review, reveals a close relationship to

individual staff member profiles and knowledge

sharing. Abbas, Hussain, Hussain, Akram, Shaheen,

and Niu (2019:2) state that “qualifications, work

experience, working relationships, and individual

income might meaningfully impact knowledge

sharing, motivation, and willingness” .

In addition to the initial observations from Abbas

et al (2019), it should also be interesting to note that

staff members with little job experience and staff

members with an established and a “...greater

professional level...” will have a higher propensity

towards knowledge sharing activities.

Although most of the academic literature about

knowledge, knowledge management, and knowledge

sharing perceives that the activity of sharing

knowledge is a gender-neutral activity, research

suggests a negative imbalance towards female

knowledge-sharing activities. According to Colley,

2003; Meelissen and Drent, 2008; Volman et al., 2005

in Nguyen and Malik (2022:1997) this imbalance

may be attributed to assumed higher levels of

technology anxiety among women. This assumed

technological anxiety will impact of perceived

usefulness of knowledge-sharing activities using

knowledge-sharing online platforms in the

organizations resulting in less knowledge being

shared.

3.4 Technology

As alluded to in the introduction, (section 1),

technology, specifically in the financial sector, plays

a mission-critical role in facilitating financial

transactions. The researchers would even state that no

financial transactions in the current hyper-connected

business environment will be possible without the use

of the information technology backbone. The nature

of the review did not focus on specific elements,

specifications, or requirements of technology, but

rather on what basic features or characteristics will

enhance the use of technology for knowledge sharing.

In considering and analyzing the literature from a

financial institution perspective the following main

technological agnostic themes that drive research in

technology were identified:

online platforms

human sensory feedback system

Nguyen and Malik (2022:1986) state that

“…online platforms in an organization refers to using

social networking, intranet, and other platforms to

enhance knowledge sharing via communication and

collaboration.” It should be noted that the online

platforms and integration of applications via the

platforms (for example the Internet) form the

backbone of all interaction and communication in

modern business. Financial institutions are not

exempt from the use of online platforms in every form

or protocol, with more and more emphasis on the

integration of Artificial Intelligence (AI) as an

advanced communication and workflow platform.

The authors contend that the use of AI and AI-

enabled technologies has resulted in a higher level of

management of people, experiences, and talent

Knowledge Sharing in Financial Institutions to Assist with IT Service Management: A Thematic Analysis

311

management specifically within the financial sector.

Thus, it may be deduced that AI and the related

technologies on the agnostic platforms are not only

used for knowledge sharing, but without said agnostic

platforms knowledge sharing cannot happen.

An interesting theme emerged from the

systematic literature review on knowledge sharing in

financial institutions, with specific reference to

technology, i.e. the delicate interplay between human

information processing and technology. According to

Chen, Ye, and Huang (2022:1) “Knowledge-sharing

through ICT is a form of computer-mediated

communication (CMC).” Scholl et al., 2020 in Chen,

Ye, and Huang (2022:1) think that the notion of CMC

provides a substantial advantage of communicating

across vast distances but limits the sensory feedback

for humans in this communication process.

According to Freitas-Magalhaes (2020) in Chen,

Ye, and Huang (2022:1) sensory feedback may be

defined as the non-verbal cues that humans add to the

communication process, i.e. facial expressions, body

language, or changes in emotions.

The non-verbal communication cues may be

regarded as an essential part of the knowledge-

sharing process, specifically in the financial sector. A

lack of sensory feedback in this context may leave the

communicating partners with a lack of trust in the

communication process and what is shared in the

communication, i.e. the knowledge that should be

transferred. “Consequently, this situation constrains

knowledge-sharing, leading to poor resilience”.

Chen, Ye, and Huang (2022:3).

A possible solution to the sensory deprivation

issue that is a by-product of the use of current-day

technology, is the incorporation of the notion of a

virtual world, a metaverse, using a combination of

Artificial Reality, Virtual Reality, and Artificial

Intelligence elements.

4 CONCLUSION

Considering the main research problem as discussed

in section 2, i.e. understanding the themes driving

research in knowledge sharing, specifically in

financial institutions, considering that these

institutions and functions within the institutions are

often characterized by individuals hoarding and not

willing to share what they know, the systematic

literature review conducted, yielded the following

main themes, i.e. environment, motivation, people

and technology.

The authors further analyzed each of the main

themes to understand the concepts in each of the

elements and their link to the notion of sharing

knowledge in financial institutions, with specific

emphasis on the use of technology.

The resulting analysis revealed that the concepts

of organizational attributes, collaboration, trust, and

rewards drive the research in terms of the

environment. In summary, the management of

organizations and more specifically the financial

sector should create and maintain an environment that

allows for the alignment of organizational and

personal objectives, while fostering collaboration

between staff members, based on mutual trust. This

environment should be driven by a combination of

both monetary and non-monetary rewards.

The next main theme identified by the researcher

was that of motivation, i.e. what drives an individual

staff member to participate in knowledge-sharing

activities. The main concepts driving the theme of

motivation are organizational motivation and

strategies, individual motivation, and emotional

intelligence.

Motivation may be regarded as one of the

fundamental drivers of knowledge sharing within

financial institutions. Organizations should endeavor

to align organizational objectives with staff member

motivation, both on an intrinsic and extrinsic level.

Extending the notion of intrinsic and extrinsic

motivation, the literature revealed that both factors

may be influenced by the individual staff members'

emotional intelligence. It is postulated that individual

staff members with a higher EI will have a greater

propensity to share knowledge within the

organizations with specific reference to the financial

sector, employing highly intellectual capital.

When considering the theme of people in the

analysis of the literature, two interesting concepts in

terms of knowledge sharing in financial institutions

were identified, i.e. profile and gender.

According to the literature, the profile of the

individual staff member within the financial

institution will be a good indicator of the individual’s

willingness to participate in knowledge-sharing

activities. The profile of the individual staff member

refers specifically to the individual’s qualifications,

work experience, working relationships, and

individual income.

Although knowledge sharing is considered a

gender-neutral activity, some research suggests that

there might still be some imbalance in the use of

technology by females to share knowledge.

The final theme identified relates to technology

and its use in financial institutions for knowledge-

sharing purposes. The researcher identified two

concepts that are deemed important considerations in

KMIS 2024 - 16th International Conference on Knowledge Management and Information Systems

312

driving research in this specific theme, i.e. online

platforms and human sensory feedback systems.

The two concepts, as identified in the literature are

closely related. The online platforms provide the

necessary backbone to support daily activities with a

specific emphasis on communication. Although the

platforms provide and facilitate communication and

connection over great distances, they cannot provide

essential sensory feedback that allows individual staff

members to trust the communication and knowledge-

sharing activity.

Visually the results of the analysis may be

presented in figure 7.

Figure 7: Conclusion of the study.

The constant changes in Information

Technologies and the necessity for managing them

especially in financial institutions, ITSM would

benefit from KM to address the demands of the fourth

industrial revolution.

The following section will provide an overview of

future research directions.

5 FUTURE RESEARCH

DIRECTIONS

The researchers propose that the identified themes be

tested and confirmed in a financial institution. The

test and confirmation should focus on institutions in

both developing and developed countries. The results

of the proposed future research should then be

extrapolated to other sectors and environments.

ETHICAL CONSIDERATIONS

Ethical clearance for the proposed research was

reviewed by the School of Consumer Intelligence and

Information Systems Research Ethics Committee of

the University of Johannesburg. Ethical clearance

was granted with ethical clearance code

2024SCiiS011, with a rating CODE 01(Approved).

REFERENCES

Abbas, J., Hussain, I., Hussain, S., Akram, S., Shaheen, I.,

& Niu, B. (2019). The Impact of Knowledge Sharing

and Innovation on Sustainable Performance in Islamic

Banks: A Mediation Analysis through a SEM Ap-

proach. Sustainability, 11(15).

https://doi.org/10.3390/su11154049

Ahmad, F., Karim, M. (2019). Impacts of knowledge shar-

ing: A review and directions for future research. Jour-

nal of Workplace Learning, 31(3), 207–230.

https://doi.org/10.1108/JWL-07-2018-0096

Allen, H. J. (2021). Payments Failure. Boston College Law

Review, 62(2), 453–514.

Alshwayat, D., MacVaugh, J., & Akbar, H. (2021). A multi-

level perspective on trust, collaboration and knowledge

sharing cultures in a highly formalized organization.

Journal Of Knowledge Management, 25(9), 2220–

2244. https://doi.org/10.1108/JKM-05-2020-0354

Axelos. (2020). Service continuity management: ITIL 4

practice guide.

Ammirato, S., Linzalone, R., & Felicetti, A. M. (2021).

Knowledge management in pandemics. A critical liter-

ature review. Knowledge Management Research &

Practice, 19(4), 415–426.

https://doi.org/10.1080/14778238.2020.1801364

Babcock, P. (2004). Shedding light on knowledge manage-

ment. HR Magazine, 49(5), 46–50.

Baradari, I., Maryam S., & Navid N. (2023). Defining the

relationship between IT Service management and

knowledge management: towards improved perfor-

mance. Knowledge Management Research & Prac-

tice 21(2): 384-396.

Beyer, B., Jones, C., Petoff, J., & Murphy, N. R. (2016). Site

reliability engineering: How google runs production

systems. O’Reilly Media, Inc.

Binham, C. (2020, January 1). Lloyds Banking Group cus-

tomers hit by system outage. https://www.ft.com/con-

tent/22387a94-2ca6-11ea-bc77-65e4aa615551

Bock, G.-W., Zmud, R. W., & Kim, Y.-G. (2005). Behav-

ioral intention formation in knowledge sharing: Exam-

ining the roles of extrinsic motivators, social-psycho-

logical forces and organizational climate. MIS Quar-

terly, 29(1), 87–11.

Bock, G.-W., Kim, Y.-G. (2002). Breaking the Myths of

Rewards: An Exploratory Study of Attitudes about

Knowledge Sharing. Information Resource Manage-

ment Journal, 15, 14–21.

Knowledge Sharing in Financial Institutions to Assist with IT Service Management: A Thematic Analysis

313

Chen, P., Ye, Y., & Huang, X. (2023). The metaverse in

supply chain knowledge sharing and resilience con-

texts: An empirical investigation of factors affecting

adoption and acceptance. Journal Of Innovation &

Knowledge, 8(4).

https://doi.org/10.1016/j.jik.2023.100446

Chauhan, C., Parida, V., & Dhir, A. (2022). Linking circu-

lar economy and digitalization technologies: A system-

atic literature review of past achievements and future

promises. Technological Forecasting & Social Change,

177, 121508. https://doi.org/10. 1016/j.tech-

fore.2022.121508

Domingos, J., Barbosa, R., & Madeira, H. (2021). Why is it

so hard to predict computer systems failures? 2021 17th

European Dependable Computing Conference (EDCC),

41–44.

https://doi.org/10.1109/EDCC53658.2021.00013

Gold, A.H., Malhotra, A., Segars, A.H. (2001). Knowledge

management: an organizational capabilities perspec-

tive. Journal of Management Information Systems,

18(1), 185-214.

Gillani, S., Iqbal, S., Akram, S., & Rasheed, M. (2018).

Specific antecedents of employees’ knowledge sharing

behavior. Vine Journal Of Information And Knowledge

Management Systems, 48(2), 178–198.

https://doi.org/10.1108/VJIKMS-05-2017-0023

Inkpen, A.C., Tsang, E.W. (2005). Social capital, networks,

and transfer. Academy of Management Review, 30(1),

146-165.

ISO. (2015). ISO/IEC 27043:2015: Information technol-

ogy—Security techniques—Incident investigation prin-

ciples and processes. https://www.iso.org/stand-

ard/44407.html

Jacobs, D.C. (2010). Pragmatism. In Encyclopaedia of Case

Study Research. Edited by Mills, A.J., Durepos, G. &

Wiebe, E. doi: 10.4135/ 9781412957397

Kelemen, M.L. & Rumens, N. (2011). Critical perspectives

on qualitative research. In An introduction to critical

management research. doi: 10. 4135/9780857024336

Khan, M., & Zaman, U. (2022). Bankers’ knowledge shar-

ing behavior: The role of personality and perceived or-

ganizational incentives. Journal of Public Affairs,

22(1). https://doi.org/10.1002/pa.2340

Khiaonarong, T., Rizaldy, R., & Leinonen, H. (2022). Pay-

ment outages: Experiences and issues. Journal of Pay-

ments Strategy & Systems, 16(2), 170–180.

Kim, N., & Hang, N. (2024). Rewards, knowledge sharing

and individual work performance: An empirical study.

Cogent Business & Management, 11(1).

https://doi.org/10.1080/23311975.2024.2359372

Klee, E. (2010). Operational outages and aggregate uncer-

tainty in the federal funds market. Journal of Banking

& Finance, 34(10), 2386–2402.

https://doi.org/10.1016/j.jbankfin.2010.03.002

Langerman, J., & Joseph, N. (2023). Information Systems

Resilience: An African Banking Case Study. 2023 In-

ternational Conference on Electrical, Computer and

Energy Technologies (ICECET)

, 1–8.

Lin, K.-Y., Lu, H.-P. (2011). Why people use social net-

working sites: an empirical study integrating network

externalities and motivation theory. Computers in Hu-

man Behavior, 27(3), 1152-1161.

López-Nicolás, C., Meroño-Cerdán, Á.L. (2011). Strategic

knowledge management, innovation, and performance.

International Journal of Information Management, 31,

502–509.

MacLean, D., & Ryad, T. (2023). Implementation and im-

pacts of IT Service Management in the IT function. In-

ternational Journal of Information Management 70:

102628.

McNaughton, R., Darroch, J. (2003). Beyond market orien-

tation: Knowledge management and the innovativeness

of New Zealand firms. European Journal of Marketing,

37, 572–593.

Merrouche, O., & Schanz, J. (2010). Banks’ intraday liquid-

ity management during operational outages: Theory and

evidence from the UK payment system. Journal of

Banking & Finance, 34(2), 314–323.

https://doi.org/10.1016/j.jbankfin.2009.07.024

Mishchenko, V., Naumenkova, S., Grytsenko, A., &

Mishchenko, S. (2022). Operational risk management

of using electronic and mobile money. Banks and Bank

Systems, 17(3), 142–157.

https://doi.org/10.21511/bbs.17(3).2022.12

MyBroadband. (2017, November 24). Takealot down

minutes into Black Friday 2017. MyBroadband.

https://mybroadband.co.za/news/business/239352-

takealot-down-minutes-into-black-friday-2017.html

Nguyen, T., & Malik, A. (2022). Employee acceptance of

online platforms for knowledge sharing: Exploring dif-

ferences in usage behaviour. Journal Of Knowledge

Management, 26(8), 1985–2006.

https://doi.org/10.1108/JKM-06-2021-0420

Page, M. J., McKenzie, J. E., Bossuyt, P. M., Boutron, I.,

Hoffmann, T. C., Mulrow, C. D., Shamseer, L., Tetz-

laff, J. M., Akl, E. A., Brennan, S. E., Chou, R., Glan-

ville, J., Grimshaw, J. M., Hróbjartsson, A., Lalu, M.

M., Li, T., Loder, E. W., Mayo-Wilson, E., McDonald,

S., McGuinness, L. A., Stewart, L. A., Thomas,

J., Tricco, A. C., Welch, V. A., Whiting, P. & Moher,

D., (2021). The PRISMA 2020 statement: An updated

guideline for reporting systematic reviews. The

BMJ. 372(71), 8.

Reichertz, J. (2014). Induction, deduction, abduction. In

The SAGE Handbook of Qualitative Data Analysis. Ed-

ited by Flick, U. doi: 10.4135/9781 446282243

Sathitsemakul, C., & Calabrese, F. (2017). The Influence of

Emotional Intelligence on Employees’ Knowledge

Sharing Attitude: The Case of a Commercial Bank in

Thailand. Journal Of Integrated Design & Process Sci-

ence, 21(1), 81–98. https://doi.org/10.3233/jid-2017-

0007

Sekaran, U., & Bougie, R. (2013). Research methods for

business: A skill-building approach, John Wiley,

United Kingdom, 6

th

edition.

Seneviratne, T. K. K., Amaratunga, D., Haigh, R., &

Pathirage, C. P. (2010, May). Knowledge management

for disaster resilience: Identification of key success fac-

tors [Conference]. CIB 2010, University of Salford.

https://www.hud.ac.uk/news/

KMIS 2024 - 16th International Conference on Knowledge Management and Information Systems

314

Shyh, R. F., Shin, C. F., Ming, C. C. (2006). The impact of

internal marketing mechanism on KS motivation and

KS behavior. Department of Business Administration,

National Chung Hsing University, Taiwan.

Sillito, J., & Kutomi, E. (2020). Failures and Fixes: A Study

of Software System Incident Response. 2020 IEEE In-

ternational Conference on Software Maintenance and

Evolution (ICSME), 185–195.

https://doi.org/10.1109/ICSME46990.2020.00027

Von Krogh, G., Nonaka, I., Rechsteiner, L. (2012). Leader-

ship in organizational knowledge creation: a review and

framework. Journal of Management Studies, 49(1),

240-277.

Knowledge Sharing in Financial Institutions to Assist with IT Service Management: A Thematic Analysis

315