Decision of Production Combinations Based on Cournot Model and

Linear Programming

Hanyang Li

1, *

, Yuxuan Li

2

and Xiaoti Wu

3

1

College of Liberal Arts and Sciences, University of Illinois at Urbana-Champaign, Champaign, 61820, U.S.A.

2

School of Business Administration, South China University of Technology, Guangzhou, 510641, China

3

School of Arts and Sciences, Syracuse University, Syracuse, NY,13202, U.S.A.

Keywords: Cournot Model, Linear Programming, Market Competition, Strategic Decisions.

Abstract: This paper explores production strategies for micro electric vehicle manufacturers in small cities using a

revised Cournot model and linear programming. Focusing on cities like Liuzhou, Nanyang, and Shangqiu,

where market dynamics favour oligopolies, the traditional Cournot model is adapted to emphasize cost-based

strategies. By integrating unit costs as variables representing service levels, the model examines competition

among manufacturers providing different service levels within the same market. A payoff matrix and linear

programming determine optimal strategies for maximizing profits while maintaining market stability. The

study highlights the importance of strategic decisions in cost control, brand positioning, and supply chain

management. Results indicate that both firms should adopt mixed strategies to enhance competitiveness and

profitability. The paper suggests future research to refine the model for more complex market scenarios,

including additional competitors and dynamic market conditions. This research provides insights into market

competition strategies and lays the groundwork for more nuanced economic and mathematical analyses.

1 INTRODUCTION

In recent years, the surge in popularity of micro

electric vehicles in smaller cities has presented a

unique set of market dynamics, particularly evident in

cases such as Liuzhou, Nanyang and Shangqiu, which

usually emerges in small cities. From 9.7% in 2017 to

53.3% in 2022, Liuzhou's new energy vehicle market

penetration rate has been steadily increasing

(Yunjing, 2023). Where a monopolistic trend is

emerging. In many of these cities, oligopoly and even

monopoly market is observed.

This phenomenon has sparked interest among

researchers aiming to understand the implications of

such market structures. On the on hand, for

companies, which strategies they should adopt to

achieve their goals, like maximize their profits and

put the competitors at a disadvantage, need to be

clarified. On the other hand, for the market, whether

a stable state, or technically, a Nash equilibrium exist

is essential to define whether this market is efficient.

The Cournot model, a classic economic

framework for analyzing oligopoly markets, becomes

highly relevant in this context. The Cournot duopoly

model, or Duopoly model, is another name for the

Cournot model. An early example of an oligopoly is

the Cournot model. The French economist Cournot

first put up the idea in 1838 (Yan, Da and Pei, 2013).

The first use of the Nash equilibrium is the Cournot

model, which is frequently utilized as a jumping off

point for oligopoly theory study (Tang, 1997).

According to the Cournot model, there are just two

sellers of a product in the market, and they don't

cooperate with one another. Instead, they anticipate

each other's actions and decide on the best output to

maximize profits (Du, 2005). The Cournot model's

conclusions can be applied with ease to situations

involving three or more oligopolistic manufacturers

(Zhang and Xiao, 2003). Studies such as those by

prominent scholars have applied it to similar markets,

emphasizing the strategic behaviors of oligopolies.

Given the niche nature of micro electric vehicle

markets in smaller cities, the sales volume tends to be

relatively stable due to the limited market size.

Despite the homogeneity in product characteristics,

manufacturers can still strategize by varying the level

of services provided with their products. For example,

in the case of similar models, companies can achieve

product differentiation by providing customization

service, such as customized auto parts. Shortening

Li, H., Li, Y. and Wu, X.

Decision of Production Combinations Based on Cournot Model and Linear Programming.

DOI: 10.5220/0013001000004601

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Innovations in Applied Mathematics, Physics and Astronomy (IAMPA 2024), pages 119-125

ISBN: 978-989-758-722-1

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

119

delivery time can also enhance the competitiveness of

enterprises. However, higher service level requires

higher cost. These costs will be shared into the cost of

every car. Hence, the service level is quantified in

terms of cost. It suggests a significant shift in market

modeling, moving from quantity-based variables to

cost-based ones. In the traditional Cournot model,

two producers have identical items with linear

demand curves, and one decides how to maximize

profit by varying the volume of sales dependent on

the other's actions (Yuan et al., 2003). Thus, the

traditional Cournot model with sales volume as

variable is no longer applicable. A research based on

revised Cournot model is both necessary and timely,

aiming to delve deeper into how these cost-based

strategies affect market dynamics and competition

among few but powerful players in small yet pivotal

market segments.

Actually, the researchers have noticed these cases

and made some attempts. A famous model named the

Bertrand model was proposed by French economist

Joseph Bertrand in 1883. Unlike the Cournot model,

the Bertrand model describes price competition rather

than quantity competition (Tremblay and Tremblay,

2019). In this model, it is assumed that there are two

or more firms selling identical or non-differentiated

products and that they compete on price. When

setting prices, firms must consider their competitors'

reactions and anticipate their potential pricing

strategies. Consumers will buy from the firm offering

the lowest price. In equilibrium, each firm's price

equals its marginal cost. If a firm's price is above its

marginal cost, it will lose market share.

There are also researchers combines the Cournot

model with Bertrand model. They believe that firms

can decide to compete in both cost and quantity. It

appeared in early studies as “mixed oligopoly", a

model with a “mixed equilibrium”, or a “mixed

strategy setting" (Bylka and Komar, 1976 & Singh

and Vives, 1084). In some later studies, it is referred

as “Cournot–Bertrand Model” discussed a duopoly

where competitors can adjust their output or price

(Sato, 1996 & Correa-Lopez, 2007). However, these

models do not fit the market discussed by this paper

very well, either. On the one hand, customers’ choices

are not always the products with the lowest price.

Customers have various preference based on the

quality and the brand of the products. On the other

hand, to maintain the brand image, there exists a

satisfied threshold of customers a firm should keep.

Therefore, a revised model is needed (Maggi, 1996).

The objective of this paper is to build a revised

model based on Cournot model model to calculate the

best strategies for companies in a market segment and

analyze the Nash equilibrium of it. In this model, Unit

costs of the products are regarded as variables, which

is able to measure the service level of similar

products. To achieve this goal, a payoff matrix of a

firm in this market is derived first based on the revised

model. Then, a linear programming model is built,

considering the satisfaction constraints. To solve this

model, duality theory is considered. The dual problem

not only ensures the primal problem can be solved,

but at the same time derives a Nash equilibrium.

Finally, examples which are closed to reality, related

data and python algorithms will be used to assess the

validity and reliability of the models. The model can

help provide valuable advice and insights for

companies to make informed decisions and estimate

the final balance of a certain market segment.

2 METHODOLOGY

2.1 Data Source

There are many factors in the market model that are

difficult to analyze with available data. It is difficult

to do regression analysis to obtain continuous

quantified factors. Thus, to facilitate the

establishment of mathematical models and

calculations, this paper quantifies the factors involved

in this model based on the basic rule of the market,

instead of using certain direct data. To ensure the

authority and accuracy of the data, current prices and

strategies in the market are also considered as

reference (Ma et al., 2018). This paper especially

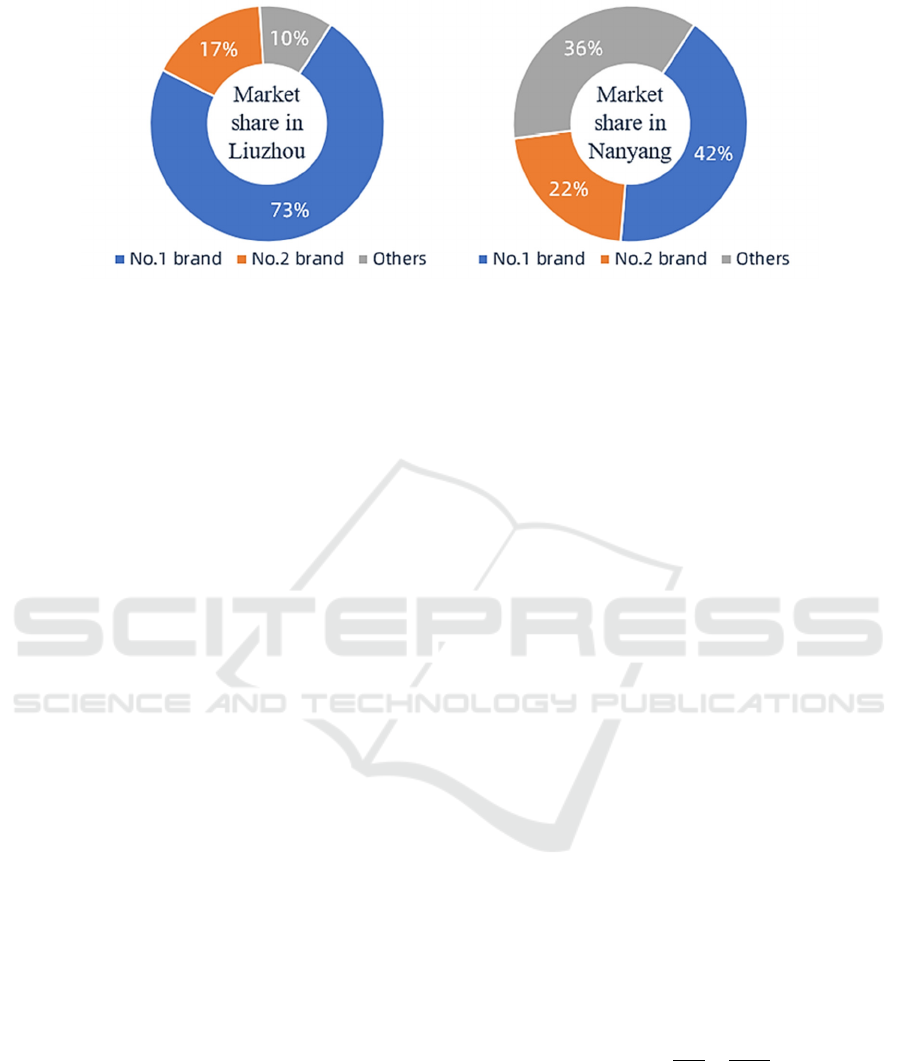

refers to the markets of Liuzhou and Nanyang, and

get the picture in Figure1 after investigation, the top

two brands, which are the blue and orange parts,

occupy the majority of the market share in both

Liuzhou and Nanyang.

IAMPA 2024 - International Conference on Innovations in Applied Mathematics, Physics and Astronomy

120

Figure 1: Market Shares in Liuzhou and Nanyang.

2.2 Variable Introduction

Firstly, In the oligopolistic market, similar but

different products are selling. The differences

between these products are not indicated in the

product itself, but in the related service level. For

instance, the products with higher level of

customization, quick response and excellent after-

sales service will be the high-end product in this

market. In this model, there are two firms. Firm 1

focuses on high-end products while Firm 2 focuses

on the low-end ones. The firm's investment in

service levels is spread over each product.

Therefore, the service level of the product is

measured by the unit product cost.

Secondly, due to the different positioning of the

firms, customers have certain expectations for the

strategies adopted by the firm. Part of that

expectation is not adjustable. The non-adjustable

part represents the bottom line of the company's

image maintenance, which the company must meet.

For example, once a company with a high-end

positioning sells a product with a very low

positioning, old customers who pursue high quality

will be disappointed and stop buying the company's

products. The other part of expectations is elastic.

Although the company will face the loss of certain

expectations that are not met, the company can

make up for the loss with the profit resulting from

this adjustment. In addition, the budgets of the firms

are different since the sizes of them are different.

2.3 Method Introduction

To make the description clear, the example of Firm

1 producing Product 1 is considered. Since the

objective of a firm is to maximize their profit, a

system of functions needs to be built. The

researchers considered different parameters for the

firm and the product, such as the firm's production

budget, the product's unit price, and the market

expectation.

For Firm 1, the budget 𝑏 that it has for

production is a constant. If it only produces Product

1, the relation between the cost of Product 1 and the

quantity of them can be represented as below. In the

equation (1), 𝑐

is the cost of Product 1. The

quantity of Product 1 is 𝑞

.

𝑏=𝑐

𝑞

(1)

The price of Product 1 (𝑃

) is affected by its unit

cost 𝑐

and its expected production 𝑞

. Specifically,

if the firm produced more products than it is

expected, the price of the product will drop, and vice

versa. The researchers consider these effects to be

linear, respectively controlled by two coefficients

𝜆

and 𝑘

.

𝑃

=𝜆

𝑐

−𝑘

𝑞

−𝑞

(2)

The profit of the firm by selling only Product 1(𝜋

)

can be calculated as below.

𝜋

=𝑃

𝑞

−𝑐

𝑞

(3)

Then, by solving the simultaneous equations, the

final expression of 𝜋

is obtained.

𝜋

=𝑏𝜆

−

+

−𝑏 (4)

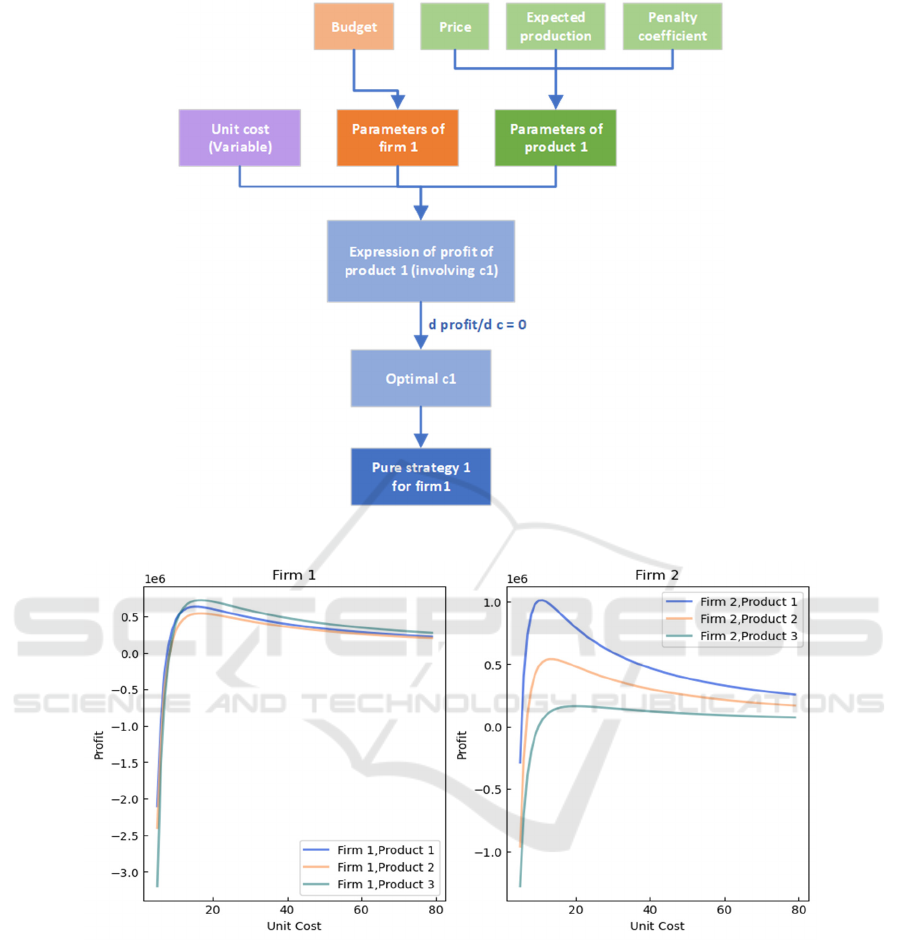

The profit function is of unit cost. Thus, the

researchers set the derivative of the function equal

to zero to find the optimal unit cost that maximizes

profit. This represents the optimal pure strategy for

Product 1. The whole process is shown in Figure 2.

Decision of Production Combinations Based on Cournot Model and Linear Programming

121

Figure 2: Pure Strategy Model.

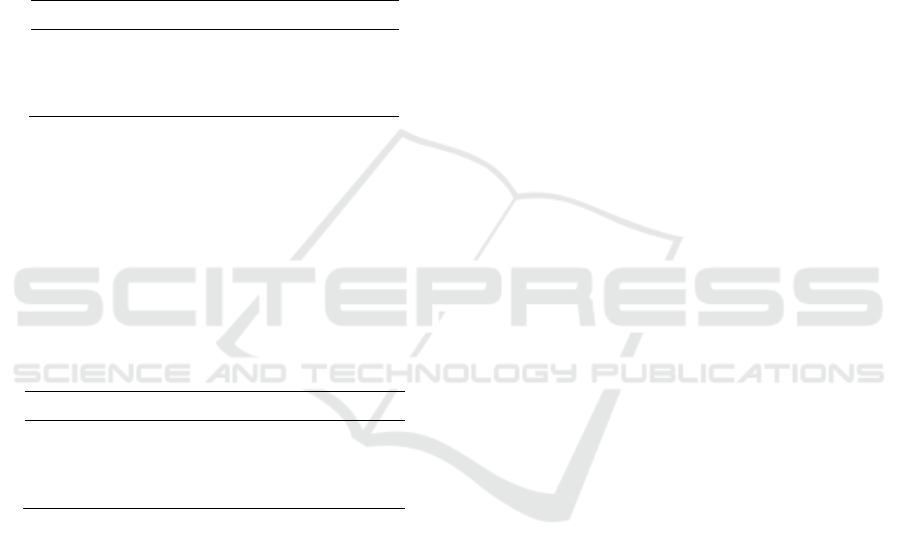

Figure 3. Relationship Between Unit Cost and Profit.

3 RESULTS AND DISCUSSION

3.1 Preliminary Work

Similarly, other pure strategies can be calculated. In

the model, Firm 1 is high-end and Firm 2 is low-end.

The differences between them are reflected in the

parameter. For instance, the budgets of the firms are

different since the volume of them are different. The

customers’ expectation of different products is

different since the firm’s image determines their

market. By changing the parameters, the pure

strategies for Firm 2 can be found. How the profits of

companies producing different products vary with

changes in cost are shown by Figure 3. For a certain

product, the cost that corresponds to the highest profit

point is the best pure strategy.

Recognizing that a company wouldn't produce

just one type of product, the researchers mixed these

pure strategies in proportion to form mixed strategies.

IAMPA 2024 - International Conference on Innovations in Applied Mathematics, Physics and Astronomy

122

The proportions of the mixed strategies are shown in

Table 1. The first row indicates that in strategy 1, 20%

of the budget is allocated to producing Product 1,

40% to Product 2, and the remaining 40% to Product

3. Similar for the rest.

It is important to point out that the unit cost of

Product 1 is the lowest, Product 2’s is middle and

Product 3’s is the highest. This means that the quality

of the products is higher with the increase of their

index. Thus, mixed strategy 1 with emphasis on

production of Product 2 and Product 3 is a high-end

strategy.

Table 1: Mixed Strategy.

Product 1 Product 2 Product 3

Strategy 1 0.2 0.4 0.4

Strategy 2 0.3 0.5 0.2

Strategy 3 0.5 0.3 0.2

As mentioned earlier, a firm's goal is to maximize

profits while putting their competitors at a

disadvantage. The payoff is defined as their profit

minus the competitor's profit.

𝑃𝑎𝑦𝑜𝑓𝑓 𝑜𝑓 𝐹𝑖𝑟𝑚 1 = 𝜋

−𝜋

(5)

With the previously derived profit expression, the

payoff matrix of Firm 1 is obtained.

Table 2: Payoff Matrix.

Strategy 1 Strategy 2 Strategy 3

Strategy 1 1484540 254760 -689600

Strategy 2 1214890 -14890 -959250

Strategy 3 1401590 171810 -772500

Using the data above, the researchers came up

with the following linear programming model (Table

2). 𝐴

is the payoff matrix of Firm 1. By pre-

multiplying transpose of Firm 1’s strategy vector 𝑥

and post-multiplying Firm 2’s strategy vector 𝑦, the

payoff of Firm 1( 𝑢 ) under certain strategies are

determined.

For Firm 2, not knowing which strategy Firm 1

will take, it also in the face of determine a strategy-

choosing problem. For a given 𝑥, Firm 2 will take the

strategy that minimizes 𝑢 to put Firm 1 at

disadvantage. Thus, the objective of Firm 2 is to

minimize 𝑢 by choosing 𝑦.

𝑀𝑖𝑛𝑖𝑚𝑖𝑧𝑒 𝑢 = 𝑥

𝐴

𝑦 (6)

In addition, 𝑦 is under several constraints:

Summation of the proportions of the strategies equals

1. The strategy Firm 2 take should meet the

satisfaction constraint. The proportions of the

strategies should be greater than or equal to 0.

The satisfaction matrix of Firm 2 is 𝑆

. The

satisfied threshold of customers for Firm 2 is 𝑐

. Then

the constrains of the linear programming model can

be written as, subject to:

∑

𝑦

=1 (7)

𝑆

𝑦≥𝑐

(8)

𝑦≥0 (9)

For Firm 1, it will choose the strategy that will

maximize its payoff. With the model above, 𝑥 can be

estimated. However, 𝑢 is not a linear function. To

solve the problem, linear programming duality is

used.

The dual problem is obtained by using linear

programming duality as below:

𝑀𝑎𝑥𝑖𝑚𝑖𝑧𝑒 𝑣 = 𝑥

+𝑐

𝑥

(10)

Subject to,

⎣

⎢

⎢

⎢

⎡

00111

1𝑆

_

−𝐴

_,

−𝐴

_,

−𝐴

_,

1𝑆

_

−𝐴

_,

−𝐴

_,

−𝐴

_,

1𝑆

_

−𝐴

_,

−𝐴

_,

−𝐴

_,

00 𝑆

_

𝑆

_

𝑆

_

⎦

⎥

⎥

⎥

⎤

⎣

⎢

⎢

⎢

⎡

𝑥

𝑥

𝑥

𝑥

𝑥

⎦

⎥

⎥

⎥

⎤

=

≥

≥

≥

≥

⎣

⎢

⎢

⎢

⎡

1

0

0

0

𝑐

⎦

⎥

⎥

⎥

⎤

(11)

𝑥

≤0 (12)

𝑥

,,

≥0 (13)

In the dual problem, Firm 1 maximizes its own payof

f while meeting its own market satisfaction criteria, r

epresented by the satisfaction matrix 𝑆

. 𝑆

_

represe

nts the 𝑗𝑡ℎ element in 𝑆

. 𝐴

_,

represents the elemen

t in 𝐴

that is in the 𝑖𝑡ℎ row and the 𝑗𝑡ℎ column. No

w, the problem can be solved by calling linprog in

Python.

3.2 Sensitivity Analysis

In this analysis, researchers performed a sensitivity

analysis on a Cournot competition model

implemented using linear programming. The primary

goal was to understand how small changes in key

parameters affect the model's outcomes. Specifically,

researchers increased and decreased certain

parameters by 10% to observe the impact on the

model's results.

Decision of Production Combinations Based on Cournot Model and Linear Programming

123

After adjusting the parameters and rerunning the

model, the results showed minimal changes in the

outcomes. Below are the comparative results for the

original parameters, +10% adjustment, and -10%

adjustment. The Cournot competition model used

here is a linear programming model, which means it

optimizes a linear objective function subject to linear

constraints. Linear models tend to be more stable and

less sensitive to small parameter changes compared to

non-linear models. Adjusting parameters by 10%

might not be significant enough to push the system

into a different region of the feasible solution space.

In other words, the feasible region defined by the

constraints may not change much with these small

adjustments, resulting in similar optimal solutions.

The Nash equilibrium in the Cournot model

represents a stable state where firms have optimized

their strategies given the strategies of their

competitors. This equilibrium tends to be robust to

small perturbations in parameters, meaning that small

changes in costs or budget do not significantly alter

the strategic interactions and outcomes.

3.3 Payoff Matrix and Mixed Strategy

Solving the problem with the payoff matrix and

mixed strategy, the final strategies are shown in Table

3. As a result, Firm 1 will choose mixed strategy 2,

and Firm 2 will choose mixed strategy 1.

3.4 Competitive Strategies Analysis

In today's fiercely competitive business environment,

companies employ well-crafted competitive

strategies to enhance their market position and

profitability. These strategies not only impact a

company's immediate benefits but also shape its long-

term development. For example, Firm 1 employs a

Cost Leadership and Price War Strategy, which has

its advantages and disadvantages. The advantages

include economies of scale, where scaling production

spreads fixed costs over more units, reducing the cost

per unit and gaining a competitive edge in price-

sensitive markets, and rapid market penetration,

where lower price points attract a large customer base

quickly, effectively expanding market share.

However, the risks involve profit margin

compression, as long-term low pricing can lead to

sustained decreases in profit margins, especially

when raw material or production costs rise, and brand

value dilution, where continuous price wars may

degrade the brand's perceived value, making it

difficult to raise prices or expand into higher-end

product lines later.

On the other hand, Firm 2's Brand Positioning and

Customer Loyalty Strategy also comes with its own

set of advantages and risks. The advantages include

the ability to charge a premium for products due to

strong brand influence, achieving higher profit

margins, and enhanced customer retention, where

increased customer satisfaction and emotional

connection lead to repeat purchases and new

customer referrals. However, the risks include high

costs associated with maintaining a brand image and

improving customer service, involving significant

marketing and advertising expenses, and poor market

adaptability, where an overemphasis on a specific

brand position may limit the company's ability to

adapt to market changes.

Lastly, the importance of supply chain

management cannot be overlooked. Advantages

include cost efficiency, where optimized supply chain

operations reduce the cost of acquiring raw materials

and enhance production efficiency, and market

responsiveness, where a flexible and efficient supply

chain allows for quick adaptation to market demand

changes, reducing inventory backlog and increasing

customer satisfaction. However, risks include supply

chain disruptions, where dependence on single or key

suppliers includes risks of production halts and

logistical delays, and raw material price volatility,

where uncertainty in raw material costs can lead to

budget overruns.

Table 3: Final Strategies.

𝑥

𝑥

Mixed Strategy 1Mixed Strategy 2Mixed Strategy 3

Firm1

1.22 × 10

0 0 1 0

Firm2

1.95 × 10

−3.15 × 10

1 0 0

IAMPA 2024 - International Conference on Innovations in Applied Mathematics, Physics and Astronomy

124

4 CONCLUSION

This research provides a comprehensive examination

of strategic approaches within micro electric vehicle

markets, utilizing a modified Cournot model

alongside linear programming to assess competition

dynamics in small cities. By integrating service levels

and costs into the Cournot framework, researchers

reveal that firms can enhance their competitive edge

and profitability through strategic diversification. The

study confirms that both high-end and low-end

market strategies can coexist successfully by

balancing service quality and cost-effectiveness. This

paper’s findings also suggest that mixed strategies,

blending different levels of service and pricing, allow

firms to optimize their market presence and financial

performance effectively. Looking ahead, further

refinement of this model is recommended to include

a broader range of competitors and dynamic market

conditions, which would provide deeper insights into

the complexities of market competition and strategy

optimization. This research not only underscores the

utility of advanced economic and mathematical tools

in market analysis but also sets the stage for future

studies aimed at evolving these methodologies for

more comprehensive market scenarios.

AUTHORS CONTRIBUTION

All the authors contributed equally and their names

were listed in alphabetical order.

REFERENCES

Yunjing C 2023 Research on the Competitiveness

Evaluation of New Energy Vehicle Industry in Liuzhou

City. Master's thesis Guangxi University of Science and

Technology.

Yan A, Da Q L and Pei F 2013 Research on long-term

output solution of dynamic Cournot model for

simultaneous game of multiple firms. Journal of

Management Engineering 27(001) 94-98.

Tang XW 1997 Cournot model study under the condition

of two manufacturers. Journal of University of

Electronic Science and Technology of China 26(1) 83-

88.

Du D C 2005 Integrated application of Cournot model.

Journal of Jianghan University: Natural Science

Edition 33(1) 3.

Zhang M S He D Q and Xiao F P 2003 Dynamic Cournot

model analysis for multiple manufacturers. Journal of

Southwest University for Nationalities: Natural Science

Edition 29(1) 9.

Yuan ZQ, Hou Z J, Jiang C W N and Tai N L 2003

Equilibrium analysis of Cournot model of power

market. Power Grid Technology 27(12) 4.

Tremblay C H and Tremblay V J 2019 Oligopoly games

and the Cournot-A survey. Journal of Economic

Surveys 33(5) 1555-1577.

Bylka S and Komar J 1976 Cournot-Bertrand mixed

oligopolies. In M.W, Los, J. Los and A. Wieczorek(eds),

Warsaw Fall Seminars in Mathematical Economics.

22-33.

Singh N and Vives X 1984 Price and quantity competition

in a differentiated duopoly. Journal of Economics 15(4)

546-554.

Sato T 1996 On Cournot-Bertrand mixed duopolies.

Japanese Economic Review 47(4) 412-420.

Correa-Lopez M 2007 Price and quantity competition in a

differentiated duopoly with upstream suppliers. Journal

of Economics and Management Strategy 16(2) 469-505.

Maggi G 1996 Strategic trade policies with endogenous

mode of competition. American Economic Review

86(1) 237-258.

Ma J, et al. 2018 Complexity study on the Cournot –

Bertrand mixed duopoly game model with market share

preference. Chaos: An Interdisciplinary Journal of

Nonlinear Science 28(2) 23101.

Decision of Production Combinations Based on Cournot Model and Linear Programming

125