Predicting Agricultural Product and Supplies Prices Using Artificial

Intelligence

Ioannis Dionissopoulos

1 a

, Fotis Assimakopoulos

2 b

, Dimitris Spiliotopoulos

2 c

,

Dionisis Margaris

3 d

and Costas Vassilakis

1 e

1

Department of Informatics and Telecommunications, University of the Peloponnese, Tripoli, Greece

2

Department of Management Science and Technology, University of the Peloponnese, Tripoli, Greece

3

Department of Digital Systems, University of the Peloponnese, Sparta, Greece

Keywords: Agricultural Products, Price Forecasting, Machine Learning, Deep Learning, Data Integration, Forecasting

Models.

Abstract: This work focuses on the prediction of agricultural product and supply prices using historical data and

artificial intelligence methods. Agricultural product and supply prices are important for the economy and

growth of agriculture. Using modern data analysis and deep learning methods, a forecasting model was

developed to help us predict future price trends. The data used include the sales prices of crop products and

the purchase prices of agricultural inputs. The developed forecasting methods exhibit high accuracy for

predicting the actual prices of products and supplies, with error margins ranging from 0.29% to 9.8%, while

they can also predict price rises and falls, with respective success rates ranging from 73.29% to 84.96%.

1 INTRODUCTION

In recent years there has been an explosion in data

collection. Developments in internet technology have

led more and more organisations, both private and

public, to organise the collection and dissemination

of their data. Some of this data is posted on open-data

portals for public use.

Machine learning (ML) frameworks offer a clear

knowledge of the process by analysing the massive

amounts of data and interpreting the information

extracted. These technologies are employed in the

construction of models that delineate the connections

between elements and actions. Furthermore, ML

models can be utilised to predict future actions in a

specific scenario (Rashid et al., 2021).

Precision farming uses algorithmic approaches

and data to improve productivity, by predicting

weather conditions, soil analysis, crop

recommendations, and fertilizer and pesticide usage.

It uses advanced technologies like IoT, Data Mining,

a

https://orcid.org/0009-0003-2482-5322

b

https://orcid.org/0009-0006-1888-6411

c

https://orcid.org/0000-0003-3646-1362

d

https://orcid.org/0000-0002-7487-374X

e

https://orcid.org/0000-0001-9940-1821

and Machine Learning (ML) to collect data and train

the respective systems. This approach reduces manual

labour and increases productivity. Farmers face

challenges like crop failure and soil infertility (Durai

& Shamili, 2022).

Artificial Intelligence (AI) is being used in

agriculture to improve crop production, disease

prediction, supply chain management, operational

efficiency, and water waste reduction (Pallathadka et

al., 2023). Machine learning (ML) and deep learning

(DL) are commonly used for data prediction, disease

prediction, water irrigation optimisation, sales

growth, profit maximisation, inventory management,

security, fraud detection, and portfolio management.

Various ML approaches can be utilised for crop

price prediction, including regression-based methods,

time series forecasting techniques, ensemble

methods, DL strategies, and hybrid models (Singh &

Sindhu, 2024). ML approaches have strengths,

limitations, and practical applications. However,

there are challenges like data accessibility, feature

Dionissopoulos, I., Assimakopoulos, F., Spiliotopoulos, D., Margaris, D. and Vassilakis, C.

Predicting Agricultural Product and Supplies Prices Using Artificial Intelligence.

DOI: 10.5220/0013071600003838

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 16th International Joint Conference on Knowledge Discovery, Knowledge Engineering and Knowledge Management (IC3K 2024) - Volume 3: KMIS, pages 371-379

ISBN: 978-989-758-716-0; ISSN: 2184-3228

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

371

selection, model interpretability, scalability, and

generalisation (Cravero et al., 2022).

Many works provide insights for researchers,

practitioners, and policymakers, facilitating informed

decision-making in agricultural contexts

(Assimakopoulos et al., 2024). ML and IoT-enabled

farm machinery are key components of the next

agriculture revolution. ML applications in agriculture

focus on soil parameters, crop yield prediction,

disease detection, and species detection. ML with

computer vision can monitor crop quality and yield

assessment. This approach can enhance livestock

production, predict fertility patterns, diagnose eating

disorders, and reduce human labour. Knowledge-

based agriculture improves sustainable productivity

and product quality (Sharma et al., 2021).

Smart farming, utilising AI, addresses

agricultural sustainability challenges (Akkem et al.,

2023). ML, DL, and time series analysis are crucial

for crop selection, yield prediction, soil compatibility

classification, and water management. These

algorithms classify soil fertility, crop selection, and

forecast production. Time series analysis helps

predict demand, commodity price, and crop yield. As

population growth increases, crop production

forecasting is crucial to overcome food insufficiency.

Using ML and DL techniques, crop recommendations

can be made based on time series analysis to reduce

future food insufficiency (Benos et al., 2021).

The purpose of this paper is to develop a model

for forecasting agricultural commodity prices using

historical data. The development includes the entire

process flow, from data collection to the evaluation of

the results using performance metrics of our

forecasting model. Data analysis and the use of

advanced ML techniques will enable the prediction of

future prices of these products and the future

agricultural production.

For the purposes of this work, data from Eurostat

were used, as well as ancillary data of other

parameters from other internet sources. Eurostat's

open data portal offers us in a user-friendly and

structured way information relating to the European

Union and figures concerning a wide range of sectors

and activities in its area of competence, including data

relating to agricultural production.

In the remainder of the paper, Section 2 discusses

the related work in ML and other related technologies

for precision agriculture. Section 3 presents the data

used and the preprocessing and integration methods

that were applied to construct the training dataset.

Section 4 presents the price forecasting methods that

were implemented, while section 5 presents and

discusses the results obtained. Finally, section 6

concludes the paper and outlines future work.

2 RELATED WORK

Agricultural data, economy data (market, local

economy, wholesale), and world data are but a few

domains that are useful for price prediction of

agricultural goods. The data provide a strong

foundation for innovative agricultural economic

management and contributes to scientifically sound

price prediction, as well as decision making in

precision agriculture (Su & Wang, 2021).

Kumar et al. researched crop yield prediction

using historical data to forecast crop yields,

considering factors like temperature, humidity, and

rainfall. The approach found that the Random Forest

(RF) algorithm provides the best predictions,

considering the least number of models, making it

useful in the agriculture sector (Kumar et al., 2020).

Zhao used a wavelet method to smooth multiple

sources of data and build a model to process the

hierarchical information after signal decomposition

(Zhao, 2021). Another study compared predictive

accuracies of various ML techniques, focusing on

GRNN, with the Autoregressive integrated moving

average (ARIMA) model (Paul et al., 2022). Results

showed GRNN outperforms other techniques in all

seventeen markets, while RF is comparable in four.

The Diebold-Mariano test confirmed these superior

performances. Other techniques like SVR, GBM, and

ARIMA are not as effective.

Xu & Zhang investigated corn cash price

forecasting using univariate neural network (NN)

modelling and bivariate NN modelling with futures

prices. Results show high accuracy for one-day ahead

horizons, with futures prices benefiting cash price

forecasting. The framework was deemed easy to

deploy and can be generalised to other commodities

(Xu & Zhang, 2021).

Oktoviany et al. proposed a two-step hybrid

model using ML methods to incorporate external

factors in price changes (Oktoviany et al., 2021). The

model assigns price states to historical prices and

predicts future price states using short-term

predictions. The model is applied to real corn futures

data and generates price scenarios through Monte

Carlo simulations. The simulations can be used to

assess price risks in risk management systems or

support trading strategies under different price states.

Another research used supervised ML for

intelligent information prediction analysis to improve

farming efficiency and profitability (Shakoor et al.,

KMIS 2024 - 16th International Conference on Knowledge Management and Information Systems

372

2017). The approach suggests area-based beneficial

crop rankings, based on static data from previous

years. This happens before the cultivation process. It

indicates the crops that are cost effective for

cultivation for a particular area of land. The study

used Decision Tree Learning-ID3 and K-Nearest

Neighbours Regression algorithms.

Time-series and ML models have also been

deployed to predict monthly areca nut prices using

SARIMA, Holt-Winter's Seasonal method, and

LSTM neural networks (NNs). The LSTM NN model

was found to be the best fit for the data (Sabu &

Kumar, 2020). ANNs have also been used to predict

soybean harvest area, yield, and production,

comparing it with classical methods of Time Series

Analysis (Abraham et al., 2020).

The work in (Purohit et al., 2021) proposed two

additive hybrid methods and five multiplicative

hybrid methods to predict the monthly retail and

wholesale prices of three commonly used vegetable

crops in India: tomato, onion, and potato (TOP).

Extensive statistical analyses confirmed the

superiority of the hybrid methods against existing

statistical models, ML models, and existing hybrid

methods in predicting TOP prices.

An alternative method that addresses the

nonlinearity problem if time series approaches is

wavelet transformation in generating hybrid models

for predicting monthly prices markets. This hybrid

model approach significantly improved over

conventional techniques, utilising a combination of

ANN and ML techniques (Paul & Garai, 2021).

Xu & Zhang investigated the use of nonlinear

autoregressive neural networks (NARNN) and

NARNN with exogenous inputs (NARNN–X) for

price forecasting soybeans and soybean oil for

periods that spanned over fifty years. The models

exhibited accurate and stable performance, with

relative root mean square errors of 1.701% and

1.777% for soybeans and 1.757% for soybean oil,

respectively. Also, the approach can be generalised

for other similar commodities (Xu & Zhang, 2022).

Menculini et al. examined various techniques for

forecasting sale prices in an Italian food wholesaler,

comparing ARIMA models, Prophet, which is a

scalable forecasting tool from Facebook, and deep

learning models, such as LSTM and CNNs. Results

showed that ARIMA models and LSTM neural

networks perform similarly, while the combination of

CNNs and LSTMs achieved the best accuracy but

requires more tuning time. Prophet was quick and

easy to use but less accurate (Menculini et al., 2021).

3 DATA AND PREPROCESSING

Agricultural price prediction is a highly complex task,

due to the fact that prices depend on numerous

factors, both within the agricultural value chain and

in the macroeconomic environment. Besides building

a comprehensive dataset, encompassing the widest

possible range of factors affecting prices, the quality

and trustworthiness of data are of critical importance,

in order to achieve high prediction accuracy. In the

following paragraphs we describe the data sources

used, as well as the integration and preprocessing

methods used to formulate the training datasets.

3.1 Data Sources

Two key datasets for this research were obtained from

Eurostat. These datasets are as follows:

1. Selling prices of crop products. These data

cover the historical dimension of agricultural

sales, supporting the dimension of analysis,

which assumes that future patterns of

agricultural prices will follow similar

patterns, already been observed in the past.

2. Purchase prices of agricultural production

means. The analysis considers this data, since

the selling prices of agricultural products

obviously depend on the prices of the means

used for their production.

These datasets contain information spanning from

1969 to 2023; each dataset is provided in two parts,

with the first covering the period 1969-2000 and the

second spanning from 2001 to 2023. Since our price

data is sourced from Eurostat, they contain only data

for EU countries, hence price predictions in our

experiments are limited to member states of the EU.

Energy cost is an important factor in the cost of

agricultural production since oil is extensively used to

operate motorised equipment, such as tractors and

tillers, and is thus involved in the production cost.

Consequently, we take Brent oil prices into account,

in our predictions. It is considered as the most

important indicator of energy spent in agricultural

production, since its two main fuels, diesel and

gasoline, are used to drive motorised equipment with

internal combustion engines. Data concerning Brent

oil prices were obtained from statista.com. At this

stage of our research, Brent oil price is used as an

overall indicator for energy cost. The inclusion of

more detailed energy costs, notably electricity costs,

is considered as part of our future research.

Land use data, from the World In data website,

were also considered in our work. This dataset

provides information on overall land use, cropland

Predicting Agricultural Product and Supplies Prices Using Artificial Intelligence

373

land use, grazing land use and built-up area, per

country and year.

The availability of human resources in

agricultural production is also a factor impacting the

prices of agricultural production. These data were

obtained from Eurostat and cover the period from

1973 to 2023. The dataset provides a detailed

breakdown of the total labour force to salaried and

non-salaried workers. In our work, we consider all

types of employees and hence we maintained only the

sum of these two categories.

In our work, we also consider indicators of

economic nature, concerning agriculture. From the

Economic Accounts for Agriculture dataset, sourced

from Eurostat, we extract and use the following data:

(a) Production Value at Basic Price, (b) Subsidies on

Products, (c) Tax on Products, and (d) Production

Value at Producer Price.

3.2 Preprocessing and Integration

The data obtained from the above listed data sources

were not directly utilisable for model training,

necessitating preprocessing and integration activities.

Preprocessing activities concern the handling of

missing data, noisy data, inconsistent data, encoding

and value range discrepancies, and handling of

textual data. In the following paragraphs, we outline

the specific activities taken to address these issues.

Missing Data. Some attribute values may be

missing due to an error, either in the registration

process or because they were not provided by the

relevant agency. For these cases, we considered

firstly to find supplemental datasets that provided the

missing values and integrate them into our dataset.

Values that were still missing, we applied

imputers to fill in the missing values. For each data

element, different imputers were considered and the

effectiveness of the use of each imputer to predict a

data element on the accuracy of the predictions was

assessed. Experimental results demonstrated that the

most accurate results were obtained by using the

following imputers: (a) for Brent oil prices, backward

fill (i.e. if a price is missing, use the price for the next

known data point); (b) for the labour workforce,

linear regression. For the agricultural economic

accounts, a KNN-based imputer was applied, using

N=20 (N denotes the number of nearest neighbours

considered for computing a missing value).

For the cases which after the use of imputers data

were still missing (because the imputers could not

calculate the missing data due to the sparsity of the

original dataset), the relevant records were dropped.

Noisy data: Data containing errors or outliers,

which are highly deviant from the normal pattern,

were discarded, since their use affected negatively the

accuracy of predictions. The interquartile distance

method (Vinutha et al., 2018) was used for

identifying potential outliers and subsequently visual

verification was conducted using graphs.

Inconsistent Data. Either duplicate values or data

providing different values for a specific data element,

for the same country and period. Data that were

verified to be duplicates were discarded.

Differences in Units. Due to the currency change

in many European countries, our data contained

prices in both Euros and the previous local currency.

For the algorithm to have comparable data at its

disposal, price conversions to Euro were performed

for countries that underwent currency changes.

Differences in Encoding. The price datasets

obtained from Eurostat used different codes for

agricultural products and supplies for the period

1969-2000 than for the period 2001-2023. To produce

the integrated dataset, the product/supplies codes for

the data concerning the period 1969-2000 were

replaced by the respective codes used for the period

2001-2023. A fuzzy match on the names of the

products was used to perform the mapping.

Handling of Textual Data. AI-based regression

methods that were used for price prediction mainly

work with numeric data and not textual data. Our

datasets contain multiple cases where textual data are

present, e.g., country names/codes and agricultural

products/supplies names and codes For these cases,

label encoding was employed, i.e., each distinct value

of the respective data element was mapped to a

unique integer, and only the mapped value was

considered in the prediction process.

Different Scales. Different data elements had

highly divergent scales (e.g. land availability and

Brent oil prices), and this aspect negatively affected

the accuracy of the predictions, due to overfitting. To

mitigate this issue, each data column (except encoded

labels and prices) was normalized to the range [0,1]

using the Min Max Scaler; the normalized value NV

produced by the Min Max Scaler for a value V is

computed as

, where MinVal and

MaxVal are the minimum and maximum values for

the specific column, respectively.

KMIS 2024 - 16th International Conference on Knowledge Management and Information Systems

374

4 PRICE FORECASTING

METHODS

In the previous section we presented the data

collection, preprocessing and integration process.

Following the above, all input data have been

formulated in two comprehensive datasets:

• The crop products selling prices dataset,

• The agricultural production means dataset.

Each of these two datasets contains records with

the following data elements: (i) country, (ii)

agricultural product or means of production, (iii) year,

(iv) price, (v) availability of labor in agricultural

production, (vi) purchase and rental prices of the land,

(vii) Brent oil prices and (viii) economic indicators of

agricultural production (production value at basic

price, subsidies on products, tax on products, and

production value at producer price). These datasets

can be used to train ML algorithms to perform

predictions.

Since multiple AI-based methods and

configurations are available for performing

predictions, and each of these can be tuned through a

number of hyperparameters, we resorted to the use of

automatic machine learning (autoML) toolkits which

underpin the tasks of method selection and

hyperparameter tuning. To this end, the Autokeras

and the TPOT autoML toolkits were used.

AutoKeras (https://autokeras.com/) is an open-

source ML library, based on Keras and Tensorflow,

which aims to build and optimise NNs automatically.

In its basic function, the user only specifies whether a

classification or a regression model is required, and

the columns that are used for training, designating the

target column for prediction.

TPOT (https://epistasislab.github.io/tpot/) is an

open-source library that explores the performance of

ML models in an automatic way, as well. It allows to

search for the most efficient ML algorithm for the

dataset used each time.

The hyperparameters used for the

autoconfiguration process performed by the

AutoKeras toolkit are as follows:

• Tries. The number of attempts AutoKeras

will perform to arrive at the most efficient

model. In this work we will experiment with

25 attempts for each dataset.

• Test Size. The percentage of training data that

we will use for testing, in order to avoid

Overfitting. In this work we will experiment

with 30% of the data.

• Number of Training Epochs: i.e. the number

of iterations in which each of our models is

trained to approach the best result. In this

work we will experiment with 30 seasons.

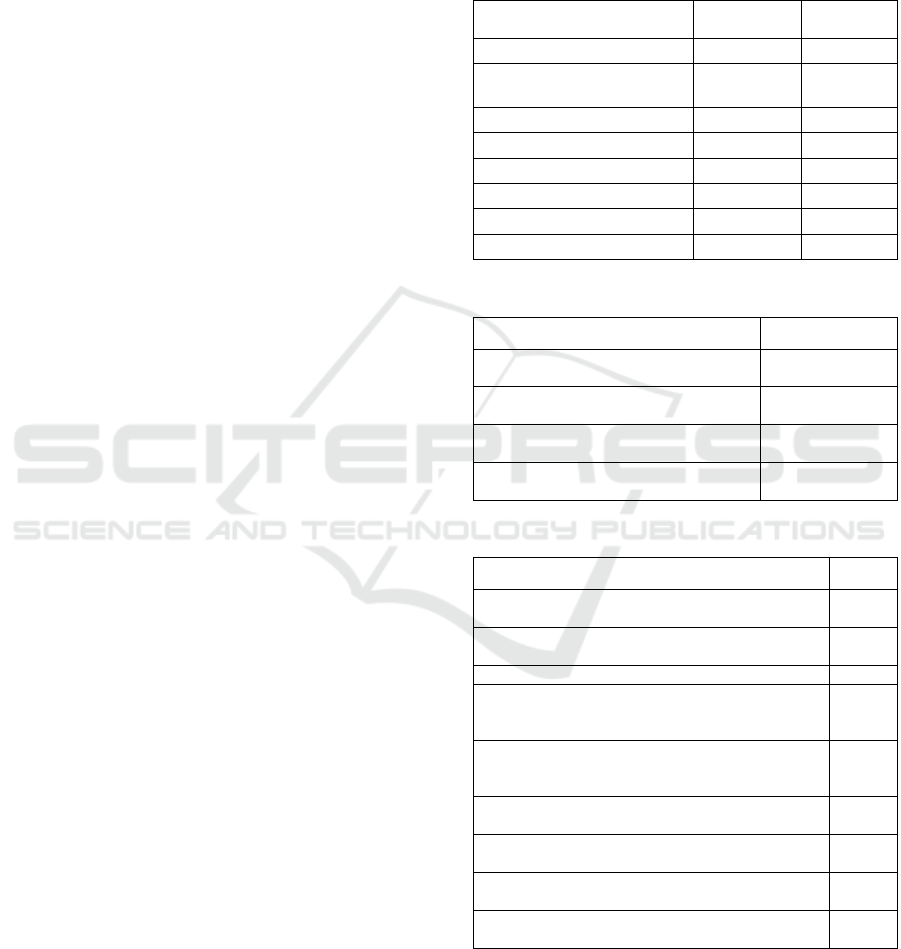

Table 1 illustrates the topology of the NN. This

topology is designated as optimal for both price

prediction tasks (agricultural products and supplies).

Table 1: The topology of the neural network.

Layer (type)

Output Shape

Parameter

value

input_1 (InputLayer)

(None, 20)

0

multi_category_encoding

(MultiCategoryEncoding)

(None, 20)

0

normalization (Normalization)

(None, 20)

41

dense (Dense)

(None, 32)

672

re_lu (ReLU)

(None, 32)

0

dense_1 (Dense)

(None, 128)

4224

re_lu_1 (ReLU)

(None, 128)

0

regression_head_1 (Dense)

(None, 1)

129

Table 2: Parameters for the Random Forest regressor.

Parameter

Value

n_estimators (The number of trees in the

forest)

100

max_features (number of features to

consider when looking for the best split)

75% of the number

of input features

min_samples_leaf (τhe minimum number of

samples a leaf node must contain)

7

min_samples_split (minimum number of

samples required to split an internal node)

19

Table 3: Parameters for the Gradient Boosting regressor.

Parameter

Value

loss (Loss function used in optimization; the value

huber combines squared error and absolute error)

huber

alpha (The alpha-quantile of the huber loss function

and the quantile loss function)

0.8

learning_rate (moderates the contribution of each tree)

0.1

max_depth (moderates the maximum number of nodes

in a tree, setting the maximum depth of the individual

regression estimators)

7

max_features (number of features are considered in

each split; value 1 indicates that all features are taken

into account)

1.0

min_samples_leaf (the minimum number of samples a

leaf node must contain)

1

min_samples_split (minimum number of samples

required to split an internal node)

11

n_estimators (number of boosting stages that will be

performed)

100

Subsample (percentage of samples used for fitting the

individual base learners)

0.65

For the TPOT toolkit, the number of generations

was set to 15, while the population size was set to 15.

The population size refers to the number of

individuals in each generation that retain their

characteristics, as compared to the previous

Predicting Agricultural Product and Supplies Prices Using Artificial Intelligence

375

generation. The output of the TPOT toolkit

determined that the optimal prediction method for

agricultural product price prediction would be the

random forest regression method, under the

parameters illustrated in Table 2. Agricultural

supplies prices, on the other hand, are more

accurately predicted using Gradient Boosting, under

the parameters listed in Table 3.

In the following section, the results and evaluation

of this work will be presented and analysed.

5 RESULTS AND EVALUATION

In this section, the results and evaluation of this work

are presented and analysed.

The prediction accuracy of our model can be

assessed using performance metrics, which evaluate

the closeness between the prediction result and the

actual result. The metrics used in this work, are

widely used in related research works that measure

prediction The metrics are illustrated in Table 4,

along with their respective formulas.

Table 4: The performance metrics used in our work.

Metric Name

Formula

Root Mean Square Error

(RMSE)

Mean Average Error (MAE)

Normalized MAE (NMAE)

The RMSE metric boosts the significance of large

deviations between the prediction result and the

actual result, while the MAE handles all errors

uniformly. The NMAE has the property of amortizing

differences in the scale of the predicted variables,

however, when the actual values are very small,

errors are over-emphasised. In all the aforementioned

metrics, lower values indicate smaller divergence and

hence more accurate predictions.

In addition to the above, in this work, we include

an additional performance metric, namely the

Percentage of Successful Predictions (PSP); this

metric computes the percentage of predictions that are

deemed to be ‘successful’, and a price prediction

for time point i is considered successful iff

where

and

are the actual prices at time points

i and i-1, respectively. Effectively, a prediction is

considered to be successful iff either (a) a rise in the

price is predicted and a rise actually occurred or (b) a

drop in the price is predicted and a drop actually took

place, otherwise the prediction is deemed

unsuccessful. The percentage of successful

predictions metric can be useful for assessing the

utility of the approach for investment decisions, e.g.,

to invest on a particular product.

Tables 5 and 6 depict the accuracy metrics

obtained from our experiments regarding the

prediction of agricultural product sale prices and

agricultural supplies, respectively.

In Table 5 we can observe that the NN optimised

and proposed by AutoKeras achieves predictions that

deviate from the actual prices by 6.6% on average (c.f.

the NMAE metric), surpassing the accuracy of the

Random Forest predictor proposed by TPot (average

deviation 9.8%). The AutoKeras NN also achieves

superior performance in predicting price rises or

drops (80.96% vs. 73.29%).

In Table 6 we notice that both the AutoKeras NN

and the gradient boosting predictor, proposed by TPot,

formulate predictions with very small deviations from

the actual prices (2.7% and 0.29%, respectively).

While the gradient boosting predictor estimates actual

prices better than the AutoKeras NN, it lags behind

concerning the prediction of price rises or drops.

Table 5: Prediction accuracy for agricultural product sale

prices.

Metric

Neural network

(AutoKeras)

Random forest (Tpot)

RMSE

28.66

29.69

MAE

11.76

11.49

NMAE

0.0659

0.098

PSP

80.96%

73.29%

Table 6: Prediction deviation agricultural supplies prices.

Metric

Neural network

(AutoKeras)

Gradient boosting

(TPot)

RMSE

10.60

10.08

MAE

3.66

2.84

NMAE

0.0269

0.0029

PSP

84.96%

79.34%

The performance recorded for price predictions in

our experiment surpasses the price prediction

accuracy recorded for the works surveyed in section

2, which exhibit deviations from actual prices ranging

from 12% to 26%. Since our experiment is limited to

EU countries only, involving only countries for which

historical data of high accuracy and ample time depth

are available, more experimentation is required to

fully compare the proposed algorithm against

approaches proposed in the literature. This is

considered a part of our future work.

KMIS 2024 - 16th International Conference on Knowledge Management and Information Systems

376

Finally, in our experiments we can observe that

prices of the means of agricultural production are

predicted with higher accuracy than prices of

agricultural products. This may be attributed to a

dependence of agricultural product prices to

additional factors than the ones considered in our

work, while these factors suffice for the prediction of

prices of means of agricultural production; this aspect

will also be examined in our future work.

6 CONCLUSION

In this paper, we have presented a model for

forecasting agricultural product and supply prices

using historical data. We analysed the entire process

flow, including data selection, preprocessing and

integration, model training and algorithm tuning, as

well as performance metrics and model evaluation.

The proposed model exhibits high accuracy for

price predictions, especially for agricultural supplies,

while it is also able to predict price rises or drops.

Thus, the proposed algorithm can be used for

budgeting production, estimating earnings and

investment planning.

As richer datasets become available, especially

with the advent of IoT, additional data can be taken

into account for performing price predictions. Yet,

developing countries are still challenged regarding

the availability and accuracy of data. These aspects

will be surveyed in our future work, elaborating on

methods and techniques that are able to achieve high

prediction accuracy over more sparse datasets.

ACKNOWLEDGEMENTS

This research was funded by project SODASENSE

(https://sodasense.uop.gr) under grant agreement No.

MIS 6001407 (co-financed by Greece and the EU

through the European Regional Development Fund).

REFERENCES

Abraham, E. R., Mendes Dos Reis, J. G., Vendrametto, O.,

Oliveira Costa Neto, P. L. D., Carlo Toloi, R., Souza,

A. E. D., & Oliveira Morais, M. D. (2020). Time Series

Prediction with Artificial Neural Networks: An

Analysis Using Brazilian Soybean Production.

Agriculture, 10(10), 475. https://doi.org/10.3390/

agriculture10100475

Akkem, Y., Biswas, S. K., & Varanasi, A. (2023). Smart

farming using artificial intelligence: A review. Eng.

Appl. of Artificial Intelligence, 120, 105899. DOI:

10.1016/j.engappai.2023.105899

Assimakopoulos, F., Vassilakis, C., Margaris, D., Kotis, K.,

& Spiliotopoulos, D. (2024). The Implementation of

“Smart” Technologies in the Agricultural Sector: A

Review. Information, 15(8), 466.

https://doi.org/10.3390/info15080466

Benos, L., Tagarakis, A. C., Dolias, G., Berruto, R., Kateris,

D., & Bochtis, D. (2021). Machine Learning in

Agriculture: A Comprehensive Updated Review.

Sensors, 21(11), 3758. DOI: 10.3390/s21113758

Cravero, A., Pardo, S., Sepúlveda, S., & Muñoz, L. (2022).

Challenges to Use Machine Learning in Agricultural

Big Data: A Systematic Literature Review. Agronomy,

12(3), 748. https://doi.org/10.3390/agronomy12030748

Deepa, S., Alli, A., Sheetac, & Gokila, S. (2023). Machine

learning regression model for material synthesis prices

prediction in agriculture. Materials Today: Procs., 81,

989–993. https://doi.org/10.1016/j.matpr.2021.04.327

Durai, S. K. S., & Shamili, M. D. (2022). Smart farming

using Machine Learning and Deep Learning

techniques. Decision Analytics Journal, 3, 100041.

https://doi.org/10.1016/j.dajour.2022.100041

Falah, R. A., & Rachmaniah, M. (2022). Price Prediction

Model for Red and Curly Red Chilies using Long Short

Term Memory Method. Indonesian Journal of Statistics

and Its Applications, 6(1), 143–160.

https://doi.org/10.29244/ijsa.v6i1p143-160

Ge, Y., & Wu, H. (2020). Prediction of corn price

fluctuation based on multiple linear regression analysis

model under big data. Neural Computing and

Applications, 32(22), 16843–16855.

https://doi.org/10.1007/s00521-018-03970-4

Ghutake, I., Verma, R., Chaudhari, R., & Amarsinh, V.

(2021). An intelligent Crop Price Prediction using

suitable Machine Learning Algorithm. ITM Web of

Conf., 40, 03040. DOI: /10.1051/itmconf/20214003040

Hegde, G., Hulipalled, V. R., & Simha, J. B. (2021). Price

Prediction of Agriculture Commodities Using Machine

Learning and NLP. 2021 Second International

Conference on Smart Technologies in Computing,

Electrical and Electronics (ICSTCEE), 1–6.

https://doi.org/10.1109/ICSTCEE54422.2021.9708582

Im, J.-J., Kim, T.-W., Lim, J.-S., Kim, J.-H., Yoo, T.-Y., &

Lee, W. J. (2022). A Design and Implement of Efficient

Agricultural Product Price Prediction Model. Journal of

the Korea Society of Computer and Information, 27(5),

29–36. https://doi.org/10.9708/JKSCI.2022.27.05.029

Kumar, Y. J. N., Spandana, V., Vaishnavi, V. S., Neha, K.,

& Devi, V. G. R. R. (2020). Supervised Machine

learning Approach for Crop Yield Prediction in

Agriculture Sector. 2020 5th Intl. Conf. on Comm. and

Electronics Systems (ICCES), 736–741.

https://doi.org/10.1109/ICCES48766.2020.9137868

Kurumatani, K. (2020). Time series forecasting of

agricultural product prices based on recurrent neural

networks and its evaluation method. SN Applied

Sciences, 2(8), 1434. https://doi.org/10.1007/s42452-

020-03225-9

Predicting Agricultural Product and Supplies Prices Using Artificial Intelligence

377

Lanjewar, M. G., Parate, R. K., & Parab, J. S. (2022).

Machine Learning Approach with Data Normalization

Technique for Early Stage Detection of

Hypothyroidism. In M. K. Ahirwal, N. D. Londhe, &

A. Kumar, Artificial Intelligence Applications for

Health Care (1st ed., pp. 91–108). CRC Press.

https://doi.org/10.1201/9781003241409-5

Li, J., Li, G., Liu, M., Zhu, X., & Wei, L. (2022). A novel

text-based framework for forecasting agricultural

futures using massive online news headlines.

International Journal of Forecasting, 38(1), 35–50.

https://doi.org/10.1016/j.ijforecast.2020.02.002

Luo, J., Zhao, C., Chen, Q., & Li, G. (2022). Using deep

belief network to construct the agricultural information

system based on Internet of Things. The Journal of

Supercomputing, 78(1), 379–405.

https://doi.org/10.1007/s11227-021-03898-y

Mahto, A. K., Alam, M. A., Biswas, R., Ahmed, J., & Alam,

S. I. (2021). Short-Term Forecasting of Agriculture

Commodities in Context of Indian Market for

Sustainable Agriculture by Using the Artificial Neural

Network. Journal of Food Quality, 2021, 1–13.

https://doi.org/10.1155/2021/9939906

Mamoudan, M. M., Mohammadnazari, Z., Ostadi, A., &

Esfahbodi, A. (2024). Food products pricing theory

with application of machine learning and game theory

approach. International Journal of Production

Research, 62(15), 5489–5509. https://doi.org/10.1080/

00207543.2022.2128921

Menculini, L., Marini, A., Proietti, M., Garinei, A., Bozza,

A., Moretti, C., & Marconi, M. (2021). Comparing

Prophet and Deep Learning to ARIMA in Forecasting

Wholesale Food Prices. Forecasting, 3(3), 644–662.

https://doi.org/10.3390/forecast3030040

Mohanty, M. K., Thakurta, P. K. G., & Kar, S. (2023).

Agricultural commodity price prediction model: A

machine learning framework. Neural Computing and

Applications, 35(20), 15109–15128.

https://doi.org/10.1007/s00521-023-08528-7

Oktoviany, P., Knobloch, R., & Korn, R. (2021). A machine

learning-based price state prediction model for

agricultural commodities using external factors.

Decisions in Economics and Finance, 44(2), 1063–

1085. https://doi.org/10.1007/s10203-021-00354-7

Pallathadka, H., Mustafa, M., Sanchez, D. T., Sekhar Sajja,

G., Gour, S., & Naved, M. (2023). Impact of Machine

Learning on Management, Healthcare and Agriculture.

Materials Today: Proceedings, 80, 2803–2806.

https://doi.org/10.1016/j.matpr.2021.07.042

Paul, R. K., & Garai, S. (2021). Performance comparison of

wavelets-based machine learning technique for

forecasting agricultural commodity prices. Soft

Computing, 25(20), 12857–12873.

https://doi.org/10.1007/s00500-021-06087-4

Paul, R. K., Yeasin, Md., Kumar, P., Kumar, P.,

Balasubramanian, M., Roy, H. S., Paul, A. K., & Gupta,

A. (2022). Machine learning techniques for forecasting

agricultural prices: A case of brinjal in Odisha, India.

PLOS ONE, 17(7), e0270553. https://doi.org/10.1371/

journal.pone.0270553

Purohit, S. K., Panigrahi, S., Sethy, P. K., & Behera, S. K.

(2021). Time Series Forecasting of Price of

Agricultural Products Using Hybrid Methods. Applied

Artificial Intelligence, 35(15), 1388–1406.

https://doi.org/10.1080/08839514.2021.1981659

Rashid, M., Bari, B. S., Yusup, Y., Kamaruddin, M. A., &

Khan, N. (2021). A Comprehensive Review of Crop

Yield Prediction Using Machine Learning Approaches

With Special Emphasis on Palm Oil Yield Prediction.

IEEE Access, 9, 63406–63439. https://doi.org/10.1109/

ACCESS.2021.3075159

Ribeiro, M. H. D. M., & Dos Santos Coelho, L. (2020).

Ensemble approach based on bagging, boosting and

stacking for short-term prediction in agribusiness time

series. Applied Soft Computing, 86, 105837.

https://doi.org/10.1016/j.asoc.2019.105837

Sabu, K. M., & Kumar, T. K. M. (2020). Predictive

analytics in Agriculture: Forecasting prices of

Arecanuts in Kerala. Procedia Computer Science, 171,

699–708. https://doi.org/10.1016/j.procs.2020.04.076

Shakoor, Md. T., Rahman, K., Rayta, S. N., & Chakrabarty,

A. (2017). Agricultural production output prediction

using Supervised Machine Learning techniques. 2017

1st International Conference on Next Generation

Computing Applications (NextComp), 182–187.

https://doi.org/10.1109/NEXTCOMP.2017.8016196

Sharma, A., Jain, A., Gupta, P., & Chowdary, V. (2021).

Machine Learning Applications for Precision

Agriculture: A Comprehensive Review. IEEE Access,

9, 4843–4873. DOI: 10.1109/ACCESS.2020.3048415

Singh, N., & Sindhu, R. (2024). Crop Price Prediction

Using Machine Learning. Journal of Electrical

Systems, 20(7s), 2258–2269. DOI: 10.52783/jes.3961

Su, Y., & Wang, X. (2021). Innovation of agricultural

economic management in the process of constructing

smart agriculture by big data. Sustainable Computing:

Informatics and Systems, 31, 100579.

https://doi.org/10.1016/j.suscom.2021.100579

Vinutha, H. P., Poornima, B., & Sagar, B. M. (2018).

Detection of Outliers Using Interquartile Range

Technique from Intrusion Dataset. In S. C. Satapathy,

J. M. R. S. Tavares, V. Bhateja, & J. R. Mohanty (Eds.),

Information and Decision Sciences (Vol. 701, pp. 511–

518). Springer Singapore. https://doi.org/10.1007/978-

981-10-7563-6_53

Wang, J., Wang, Z., Li, X., & Zhou, H. (2022). Artificial

bee colony-based combination approach to forecasting

agricultural commodity prices. International Journal of

Forecasting, 38(1), 21–34. https://doi.org/10.1016/

j.ijforecast.2019.08.006

Wang, L., Feng, J., Sui, X., Chu, X., & Mu, W. (2020).

Agricultural product price forecasting methods:

Research advances and trend. British Food Journal,

122(7), 2121–2138. DOI: 10.1108/BFJ-09-2019-0683

Xu, X. (2020). Corn Cash Price Forecasting. American

Journal of Agricultural Economics, 102(4), 1297–

1320. https://doi.org/10.1002/ajae.12041

Xu, X., & Zhang, Y. (2021). Corn cash price forecasting

with neural networks. Computers and Electronics in

KMIS 2024 - 16th International Conference on Knowledge Management and Information Systems

378

Agriculture, 184, 106120. https://doi.org/10.1016/

j.compag.2021.106120

Xu, X., & Zhang, Y. (2022). Soybean and Soybean Oil

Price Forecasting through the Nonlinear Autoregressive

Neural Network (NARNN) and NARNN with

Exogenous Inputs (NARNN–X). Intelligent Systems

with Applications, 13, 200061. https://doi.org/10.1016/

j.iswa.2022.200061

Yin, H., Jin, D., Gu, Y. H., Park, C. J., Han, S. K., & Yoo,

S. J. (2020). STL-ATTLSTM: Vegetable Price

Forecasting Using STL and Attention Mechanism-

Based LSTM. Agriculture, 10(12), 612.

https://doi.org/10.3390/agriculture10120612

Zhang, D., Chen, S., Liwen, L., & Xia, Q. (2020).

Forecasting Agricultural Commodity Prices Using

Model Selection Framework With Time Series Features

and Forecast Horizons. IEEE Access, 8, 28197–28209.

https://doi.org/10.1109/ACCESS.2020.2971591

Zhao, H. (2021). Futures price prediction of agricultural

products based on machine learning. Neural Computing

and Applications, 33(3), 837–850.

https://doi.org/10.1007/s00521-020-05250-6

Predicting Agricultural Product and Supplies Prices Using Artificial Intelligence

379