Reviewing Machine Learning Techniques in Credit Card Fraud

Detection

Ibtissam Medarhri

1 a

, Mohamed Hosni

2 b

, Mohamed Ettalhaoui

2

, Zakaria Belhaj

1

and Rabie Zine

3 c

1

MMCS Research Team, LMAID, ENSMR-Rabat, Morocco

2

MOSI Research Team, LM2S3, ENSAM, Moulay Ismail University of Meknes, Meknes, Morocco

3

School of Science and Engineering, Al Akhawayn University in Ifrane, Ifrane, Morocco

Keywords:

Credit Card Fraud, Machine Learning, Classification, Systematic Mapping Study.

Abstract:

The growing use of credit cards for transactions has increased the risk of fraud, as fraudsters frequently at-

tempt to exploit these transactions. Consequently, credit card companies need decision support systems that

can automatically detect and manage fraudulent activities without human intervention, given the vast volume

of daily transactions. Machine learning techniques have emerged as a powerful solution to address these chal-

lenges. This paper provides a comprehensive overview of the knowledge domain related to the application

of machine learning techniques in combating credit card fraud. To achieve this, a review of published work

in academic journals from 2018 to 2023 was conducted, encompassing 131 papers. The review classifies the

studies based on eight key aspects: publication trends and venues, machine learning approaches and tech-

niques, datasets, evaluation frameworks, balancing techniques, hyperparameter optimization, and tools used.

The main findings reveal that the selected studies were published across various journal venues, employing

both single and ensemble machine learning approaches. Decision trees were identified as the most frequently

used technique. The studies utilized multiple datasets to build models for detecting credit card fraud and ex-

plored various preprocessing steps, including feature engineering (such as feature extraction, construction, and

selection) and data balancing techniques. Python and its associated libraries were the most commonly used

tools for implementing these models.

1 INTRODUCTION

The advancement of technology has significantly

influenced the transition from traditional payment

methods to online transactions (Mienye et al., 2023),

(Taha and Malebary, 2020). Modern banking sys-

tems are now offering a wide array of payment op-

tions to enhance customer experience, including card

payments, internet banking, and various e-services.

Globally, credit cards remain the most widely used

payment method. According to the Nil Report (Re-

port, 2023), there are 1,103 credit card issuers world-

wide. In 2021, the combined purchase volume of the

top 150 portfolios reached 12.695 trillion, reflecting a

9.4% increase compared to 2020.

a

https://orcid.org/0009-0003-0052-8702

b

https://orcid.org/0000-0001-7336-4276

c

https://orcid.org/0000-0002-0882-1327

While credit cards offer convenience for online

purchases of goods and services, they also expose

users to the risk of fraudulent transactions (Kim et al.,

2019). In 2021 alone, 32.34 billion payment cards

were compromised globally due to fraud (Report,

2023). Projections estimate that fraud-related losses

will reach 408 billion over the next decade.

Current fraud detection systems predominantly

rely on manually designed rules, which are often inef-

ficient, subjective, and vulnerable to manipulation by

fraudsters (Kim et al., 2019; Carcillo et al., 2018). As

a result, there is a pressing need for automated detec-

tion systems. The growing adoption of electronic pay-

ment systems provides credit card issuers with exten-

sive customer data, which can be leveraged to develop

data-driven models that effectively detect fraud and

minimize losses (Carcillo et al., 2018; Cheon et al.,

2021; Pozzolo et al., 2018).

Machine Learning (ML) techniques have emerged

Medarhri, I., Hosni, M., Ettalhaoui, M., Belhaj, Z. and Zine, R.

Reviewing Machine Learning Techniques in Credit Card Fraud Detection.

DOI: 10.5220/0013072500003838

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 16th International Joint Conference on Knowledge Discovery, Knowledge Engineering and Knowledge Management (IC3K 2024) - Volume 1: KDIR, pages 179-187

ISBN: 978-989-758-716-0; ISSN: 2184-3228

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

179

as a powerful tool for tackling credit card fraud (Poz-

zolo et al., 2018; Leevy et al., 2023; Salekshahrezaee

et al., 2023). ML models, once deployed, can ef-

ficiently process large volumes of transactions in

real-time, assuming the appropriate infrastructure is

in place. The success of ML techniques has been

demonstrated across various domains.

This paper presents a systematic mapping study

aimed at gaining insights into the use of ML tech-

niques in developing decision support systems for de-

tecting fraudulent credit card transactions. The study

examines key aspects, including publication trends

and venues, ML approaches and techniques, datasets

used for constructing Credit Card Fraud (CCF) mod-

els, evaluation frameworks, preprocessing techniques,

hyperparameter optimization methods, and tools em-

ployed in model development.

The structure of the paper is as follows: Section 2

outlines the research protocol used in the study. Sec-

tion 3 presents and discusses the findings for each

mapping question. Finally, Section 4 concludes the

paper and offers suggestions for future research.

2 RESEARCH PROTOCOL

This study aims to consolidate existing research on

the application of ML in developing automated sys-

tems for credit card fraud management. To ac-

complish this, a systematic mapping study was con-

ducted following the methodology outlined by (Pe-

tersen et al., 2008), which has been widely adopted

in various research fields, including software engi-

neering (Hosni and Idri, 2018), medical informatics

(Hosni et al., 2019), and urban flood hazard mapping

(El baida et al., 2024). The mapping process consists

of several steps, which are described in detail in the

following subsections.

2.1 Mapping Questions

The goal of this review is to provide a comprehen-

sive understanding of how ML techniques, particu-

larly classification methods, are utilized in the devel-

opment of CCF systems. To fulfill this objective, we

formulated eight research questions (MQs), each de-

signed to explore specific aspects of ML application

in CCF. Table 1 lists these MQs along with the moti-

vations behind each question.

2.2 Search Strategy

This step aims to identify candidate papers relevant to

the topic of this study. The primary sources of papers

are digital libraries that index research published by

leading publishers worldwide. For this study, we se-

lected the Scopus digital library as our primary source

of candidate papers. The initial task was to construct a

search string to be used as input for the Scopus search

engine.

The search string was formulated based on the au-

thors’ expertise and knowledge. The search query

used was:

TITLE-ABS-KEY((fraud OR ”Fraud de-

tection” OR ”Fraud Analyt-

ics”) AND (”credit card” OR ”card pay-

ment*” OR ”Transaction Fraud”) AND (”Ma-

chine learning”))

The searches were conducted on metadata of ti-

tles, abstracts, and keywords of research works be-

tween the years 2018 and 2023. We have limited our

search to articles in peer-reviewed journals. We set

this limitation to ensure that the papers selected have

undergone a satisfactory peer-reviewing process and

hence command a high level of academic integrity

and reliability.

2.3 Study Selection

The pool of candidate papers obtained through the

Scopus search needed further filtering based on pre-

defined inclusion and exclusion criteria. This step was

crucial to ensure that only relevant papers addressing

our MQs were included. To maintain accuracy, three

researchers independently performed the filtering pro-

cess. A paper was included if it met at least one in-

clusion criterion and none of the exclusion criteria. If

the decision was unclear based on the metadata, the

researcher proceeded to read the full paper. The in-

clusion and exclusion criteria were as follows:

Inclusion Criteria:

• Papers that specifically focus on building credit

card fraud detection systems using ML tech-

niques.

• Papers that aim to enhance existing ML tech-

niques for credit card fraud detection.

• Papers that compare different ML techniques in

the context of credit card fraud detection.

Exclusion Criteria:

• Papers not written in English.

• Papers that do not utilize ML techniques for credit

card fraud detection.

• Papers that focus on detecting fraudulent transac-

tions unrelated to credit cards.

KDIR 2024 - 16th International Conference on Knowledge Discovery and Information Retrieval

180

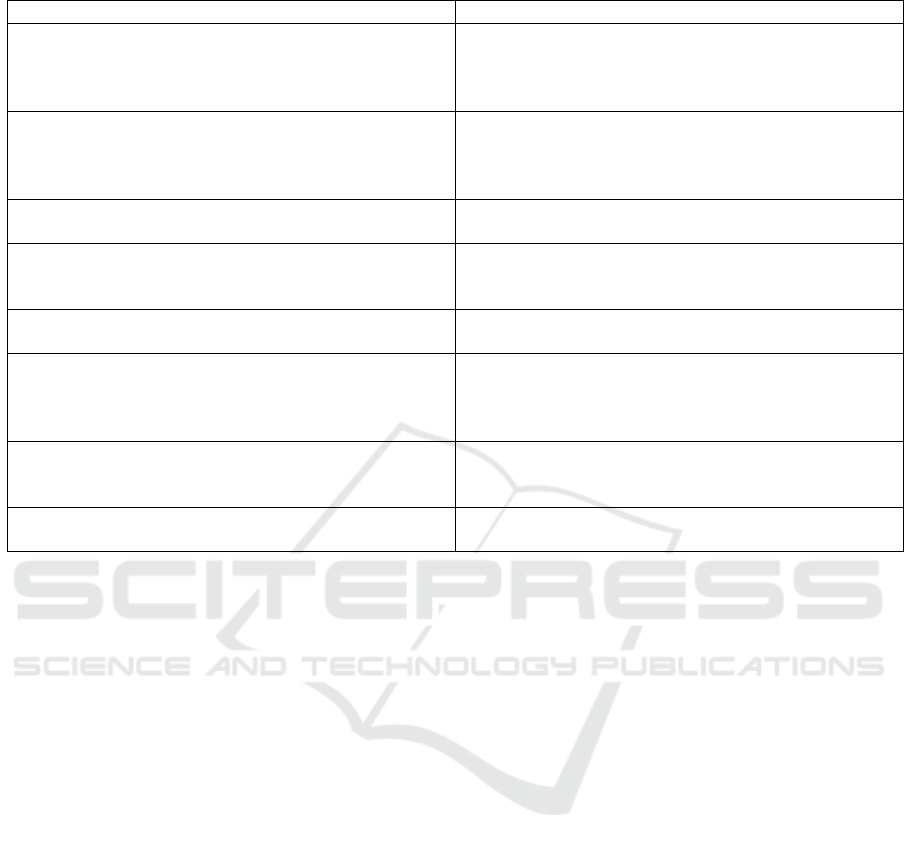

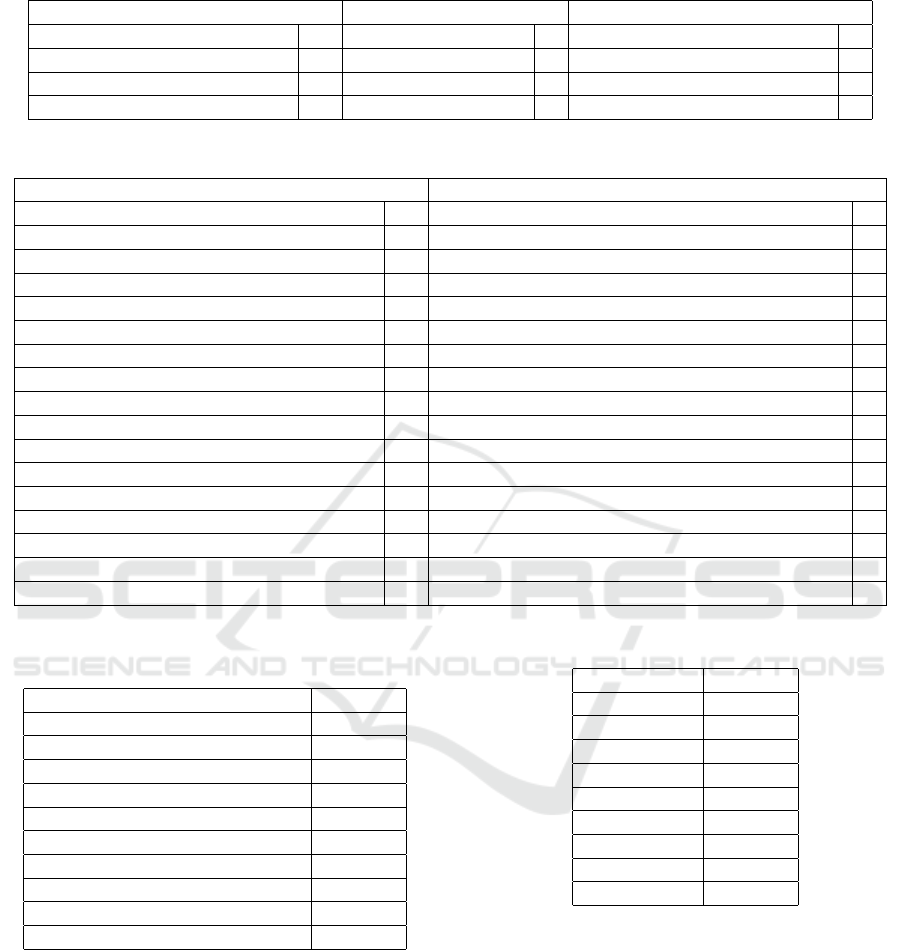

Table 1: Mapping Questions and their Motivations.

Mapping Questions Motivations

Which journal venues are the primary targets for the use

of ML techniques in credit card fraud detection? And

what is the frequency of publication has changed over

time?

To identify the specific journal venues where research

related to ML techniques in credit card fraud detection is

being published and discover the publication trend over

time.

What are the ML approaches used in credit card fraud

detection? Additionally, which specific ML techniques

are commonly utilized?

To identify the various types of ML techniques used in

CCFD systems and provide an enumeration of specific

ML techniques that have been adopted in building these

systems.

What are the main datasets used in credit card fraud de-

tection?

To identify the prevalent datasets that researchers rely on

when developing and evaluating CCFD systems.

What are the performance frameworks used to build and

assess the credit card fraud detection model?

To identify the evaluation methods used to build the

CCFD systems and enumerate the performance indica-

tors used to assess the built models.

What techniques are used to handle the balancing prob-

lem in credit card fraud detection?

To identify the techniques used to handle the balancing

problem present in CCF datasets.

What feature engineering stages have been investigated

in the context of credit card fraud detection? Addition-

ally, what are the techniques that have been used in each

of these stages?

To identify the feature engineering stages that have been

treated in literature. Furthermore, enumerate the tech-

niques used in each of the identified stages.

What are the optimization techniques used to fine-tune

the hyperparameters of the ML techniques in credit card

fraud detection systems?

To identify the optimization techniques used to fine-tune

the hyperparameters of the ML techniques in credit card

fraud detection.

What tools are used to build credit card fraud detection

models?

To identify the tools used to build credit card fraud de-

tection models.

2.4 Data Extraction and Synthesis

After selecting the papers relevant to our MQs, data

extraction was performed independently by three re-

searchers. The extracted data were systematically

recorded in detailed forms, ensuring alignment with

each MQ.

Following a comprehensive review of the ex-

tracted data, synthesis was conducted by summariz-

ing and aggregating the findings for each MQ from

all selected papers. Two synthesis methods were em-

ployed: narrative synthesis and the counting method,

which allowed for the consistent tabulation of data in

line with the MQs. Visualization tools, such as bar

charts and pie charts, were used to present the aggre-

gated data.

3 RESULTS AND DISCUSSION

This section presents and discusses the results ob-

tained from the mapping study, organized according

to the research questions listed in Table 1.

3.1 Results Overview

A total of 790 candidate papers were retrieved

through the automatic search in the Scopus database

using the search string specified in Section 2.2. The

search was restricted in two ways: first, by time

frame, including only papers published between 2018

and 2023, and second, by selecting only journal ar-

ticles. The search was conducted on June 24, 2024.

The primary reason for limiting the search to 2023

is to facilitate the replication of the search results, as

the likelihood of additional papers being indexed for

that year is minimal. In contrast, selecting an ongoing

year could pose challenges since the indexing process

for papers published within the same year may take

time to complete.

Following the study selection process and the ap-

plication of inclusion and exclusion criteria, 131 pa-

pers were selected. Relevant information was then

extracted from these papers to address the research

questions (MQs). It is worth noting that both the se-

lection and data extraction processes were performed

independently by three researchers. Additionally, not

all 131 papers provided answers to all the research

questions. Details of the selected papers and extracted

data are available upon request.

Reviewing Machine Learning Techniques in Credit Card Fraud Detection

181

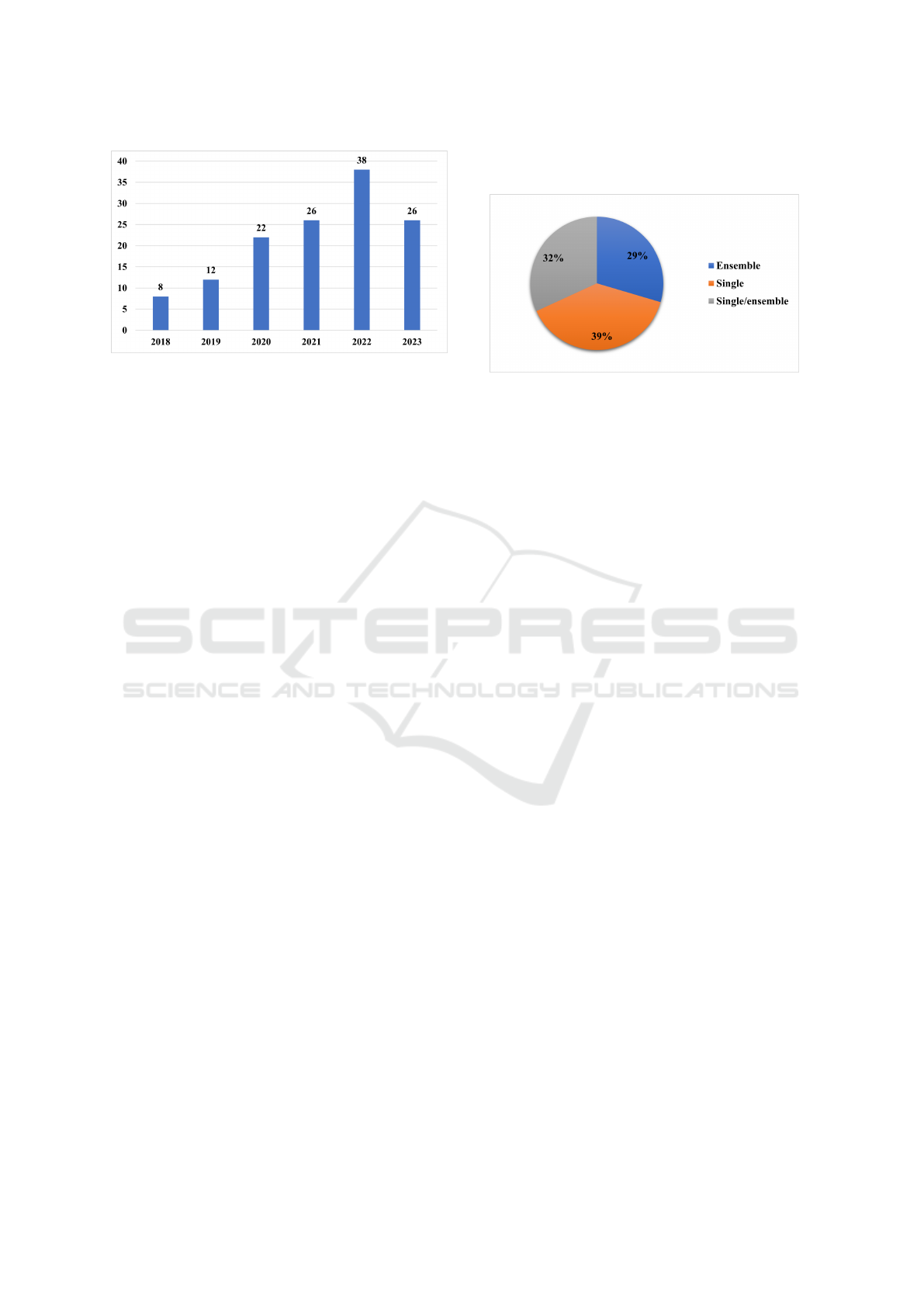

Figure 1: Publication Trends over Time.

3.2 Publication Venues and Trends

(MQ1)

This review identified 86 different venues where the

131 selected papers were published. The IEEE Ac-

cess journal had the highest number of publications,

with 13 papers, followed by the Journal of Theoretical

and Applied Information Technology with five publi-

cations and the Journal of Big Data with four. Seven

journals published three papers each, while thirteen

journals published two papers each. Additionally, 63

venues published only one paper each. Table 2 lists

the main sources that published more than three pa-

pers.

Regarding publication trends, an upward trajec-

tory in the number of publications was observed over

time. It is important to note that only papers pub-

lished in journals over the last five years were in-

cluded in this review. The highest number of publi-

cations occurred in 2022, with 38 papers published

across 28 different venues. IEEE Access led with

four papers, followed by seven journals that published

two papers each, while the remaining papers were dis-

tributed among 20 other journals, each publishing one

paper. Figure 1 illustrates the publication trends over

the search period.

3.3 Machine Learning: Approaches and

Techniques (MQ2)

The objective of the MQ2 is to identify the most

prevalent ML approaches used by researchers and to

catalog the specific ML techniques employed in the

selected studies.

Figure 2 illustrates the distribution of ML ap-

proaches used in the reviewed papers. The findings

show that 39% of the selected studies (51 out of 131

papers) focused exclusively on single ML approaches.

Meanwhile, 29% of the papers (39 out of 131) ex-

plored ensemble ML approaches alone. Notably, 32%

of the papers (42 out of 131) investigated both single

and ensemble approaches.

Figure 2: Publication Trends over Time.

Table 3 provides a comprehensive list of ML tech-

niques that have been applied in developing decision

support systems for detecting fraudulent credit card

transactions (CCFD). The review identified 11 sin-

gle classification techniques commonly explored in

CCFD literature. Among these, Decision Tree (DT)

was the most frequently used technique, appearing

in 82 instances. Artificial Neural Networks (ANN)

were investigated 67 times, while Regression tech-

niques were utilized 47 times. Support Vector Ma-

chines (SVM) were employed in 32 instances. No-

tably, four techniques were each used only once.

Out of the 131 selected papers, 60 focused on in-

vestigating a single ML technique, and nine papers

examined two ML techniques. The study that ex-

plored the highest number of ML techniques, totaling

31, was (Randhawa et al., 2018).

Ensemble methods were explored in 113 instances

within the selected studies. The primary type of en-

semble investigated was homogeneous, particularly

the combination of a single base technique with a

meta ensemble technique. Among the meta ensemble

techniques, Boosting was the most commonly used,

with XGBoost being the most extensively studied, ap-

pearing in 22 cases. Other meta ensemble techniques,

such as Random Subspace and Bagging, were also ex-

plored. Additionally, heterogeneous ensembles were

investigated in the selected studies (Baker, 2022).

3.4 Datasets Used (MQ3)

The construction of CCF models primarily relies on

historical transaction data. This MQ aims to iden-

tify and catalog the datasets used in the selected stud-

ies for building CCF models. A total of 29 different

datasets were identified across the selected studies.

Table 4 lists the datasets that were utilized more than

four times. Notably, the ”Credit Card Fraud Dataset,”

containing 284,807 records, was the most frequently

KDIR 2024 - 16th International Conference on Knowledge Discovery and Information Retrieval

182

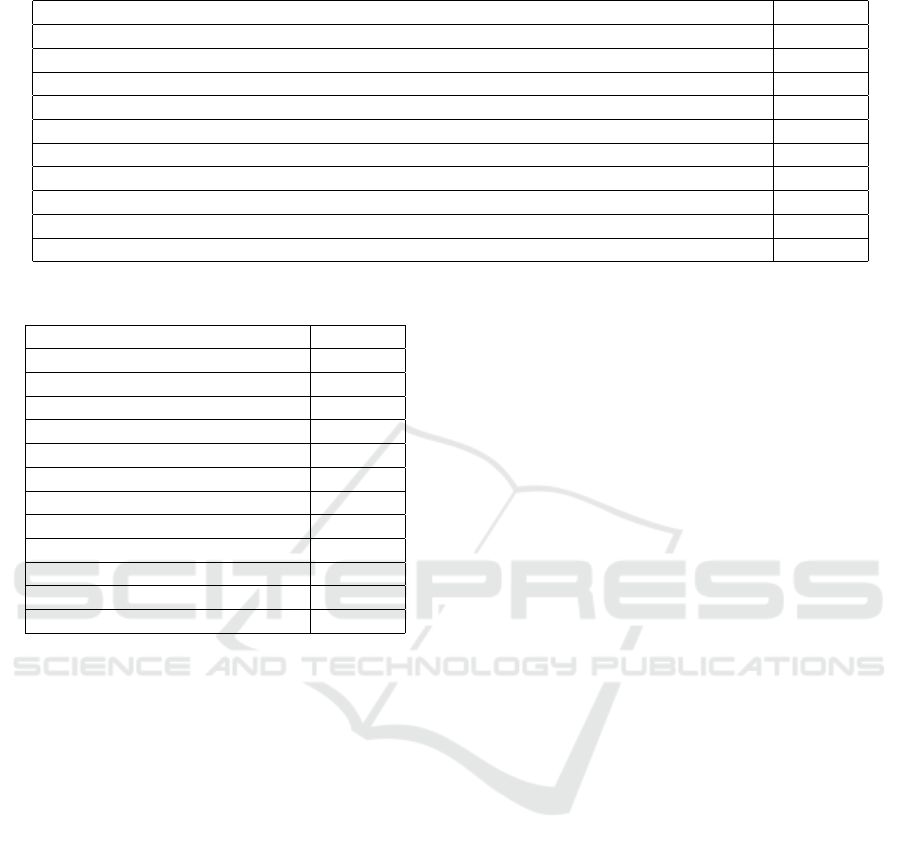

Table 2: Publication Venues.

Journal Number

IEEE Access 13

Journal of Theoretical and Applied Information Technology 5

Journal of Big Data 4

Multimedia Tools and Applications 3

International Journal of Intelligent Engineering and Systems 3

International Journal of Interactive Mobile Technologies 3

International Journal on Recent and Innovation Trends in Computing and Communication 3

Applied Sciences (Switzerland) 3

Electronics (Switzerland) 3

Mathematics 3

Table 3: ML techniques used in the Selected Studies.

Technique Number

Ensemble 113

DT 82

ANN 67

Regression 47

SVM 32

KNN 25

NB 23

Rule 3

Independent component analysis 1

K-means 1

Local Outlier Factor 1

PCA 1

used, appearing in 85 out of the 131 selected papers.

This dataset is publicly available on the Kaggle plat-

form. Additionally, 16 papers employed more than

one dataset, with the maximum number of datasets

used in a single study being three, as reported in three

papers (Arora et al., 2020; de Zarz

`

a et al., 2023; Zhu

et al., 2020).

The review also identified several studies that uti-

lized private datasets, including those collected from

organizations in China (Zheng et al., 2020; Li et al.,

2021b), various European countries (Marco et al.,

2022), and financial institutions in South Korea (Kim

et al., 2019), among others. It is important to note

that most of the datasets used suffered from the prob-

lem of data imbalance, where the fraudulent class was

significantly underrepresented compared to the non-

fraudulent class.

3.5 Evaluation Framework: Evaluation

Methods and Performance Metrics

(MQ4)

The MQ4 aims to identify the evaluation frameworks

used to assess CCF models in the selected studies.

It specifically focuses on the evaluation methods em-

ployed to develop CCF models and the performance

indicators used to measure their predictive capabili-

ties. The review identified 38 different performance

criteria. Table 5 lists the nine performance indicators

that were used more than ten times to evaluate the pre-

dictive capabilities of the ML techniques applied in

the selected studies.

The most frequently used performance criterion

was Sensitivity, appearing in 115 instances. Preci-

sion and Accuracy were used 95 and 89 times, respec-

tively. The F1-score and ROC AUC were also com-

monly adopted, appearing 79 and 69 times, respec-

tively. One of the selected studies utilized ten per-

formance indicators to assess the proposed models.

Notably, 121 out of the 131 selected papers employed

more than one performance criterion to evaluate their

models.

Regarding the validation techniques used in build-

ing the ML models, Table 6 lists the different vali-

dation approaches investigated in the literature along

with their frequency of use. A total of four validation

approaches were identified. The Holdout validation

technique was the most frequently used, appearing in

61 research papers. It was followed by the K-fold

cross-validation technique, employed in 42 papers.

Among these, 10-fold cross-validation was the most

common, appearing in 21 papers, followed by 5-fold

cross-validation. Notably, four papers did not spec-

ify the number of folds used. The stratified K-fold

and cross-validation techniques were each adopted in

six papers. It is also worth noting that some papers

did not provide details about the validation technique

used to develop their models.

3.6 Handling Balancing Problem (MQ5)

This MQ aims to explore how the issue of imbalanced

datasets is addressed in the selected studies. Imbal-

anced datasets, where the number of fraudulent trans-

Reviewing Machine Learning Techniques in Credit Card Fraud Detection

183

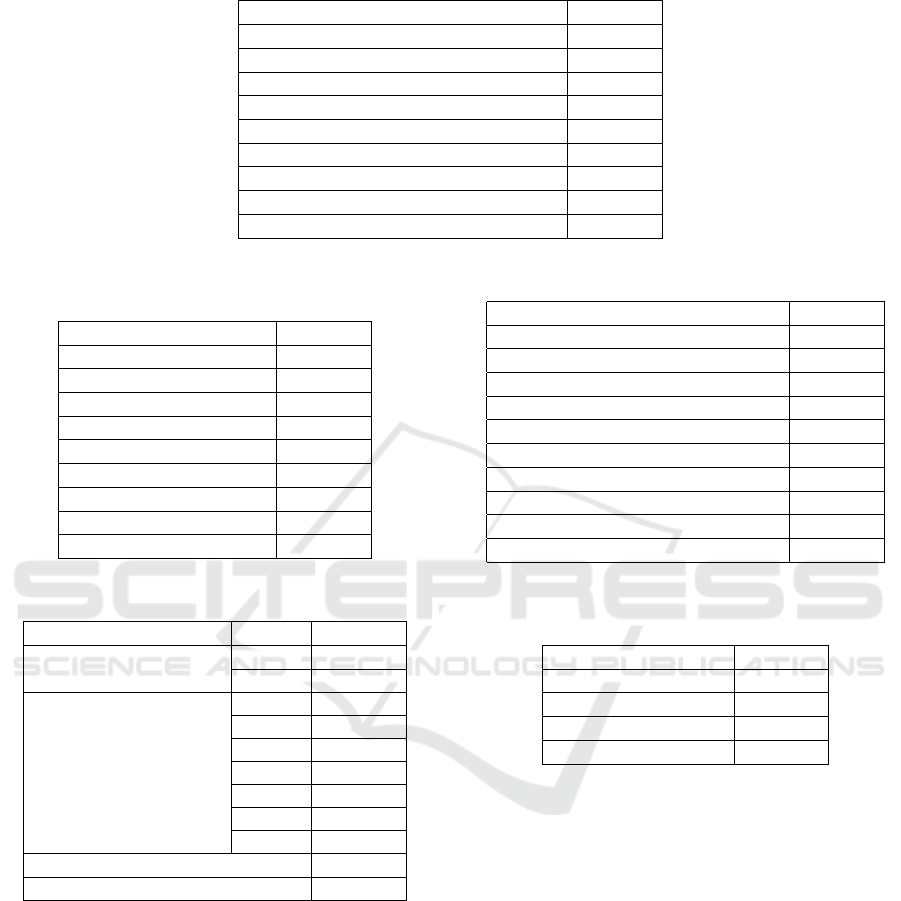

Table 4: Datasets used in the selected studies.

Dataset Number

Credit Card Fraud Detection Dataset 85

Default of Credit Card Clients Dataset 7

Vesta IEEE-CIS 5

Financial company in China 5

BankSim 4

Generated Dataset 4

Dataset emerges from Kaggle 4

cc Fraud dataset 4

UCSD-FICO dataset 4

Table 5: Performance indicators used in the selected stud-

ies.

Performance Criterion Number

Sensitivity 115

Precision 95

Accuracy 89

F1-score 79

AUC 69

Specificity 41

MCC 17

AUC-PR 15

False Positive Rate 15

Table 6: Validation techniques used in the selected studies.

Validation techniques K Number

Stratified

5 fold 3

10 fold 3

K-cross validation

K-fold 4

2 fold 1

3 fold 1

4 fold 1

5 fold 13

10 fold 21

15 fold 1

Holdout 61

Cross validation 6

actions is significantly lower than that of legitimate

transactions, pose challenges in training ML models

effectively. Table 7 lists the balancing techniques that

were used more than three times to handle class im-

balance in the selected papers. A total of 32 tech-

niques were identified.

The most widely adopted technique was SMOTE

(Synthetic Minority Over-sampling Technique),

which was used in 24% of the selected papers (31

out of 131). Following SMOTE, Random Under

Sampling, Under Sampling, and Over Sampling

techniques were utilized in 12, 11, and 10 papers,

respectively. It is worth noting that four papers

Table 7: Imbalanced techniques used in the selected studies.

Technique Number

SMOTE 31

Random Under sampling 12

Under Sampling 11

Over Sampling 10

SMOTE-Edited Nearest Neighbors 7

Random Oversampling 5

SMOTE-Tomek 4

Addressed 4

Borderline SMOTE 3

Near Miss 3

Table 8: Feature Engineering aspects investigated in the se-

lected studies.

Aspect Number

Extraction 16

Feature Importance 4

Feature selection 41

Feature Construction 1

addressed the class imbalance problem without

explicitly specifying the technique used (Bakhtiari

et al., 2023), (Sadgali et al., 2021; Rakhshaninejad

et al., 2022; Trisanto, 2021).

3.7 Feature Engineering: Steps

Investigated, and Techniques Used

(MQ6)

This MQ aims to explore the feature engineering ap-

proaches investigated by researchers in the selected

studies and to identify the techniques employed at

each step. Out of the 131 selected papers, 44 con-

sidered feature engineering as a crucial preprocessing

step. Four key aspects of feature engineering were ex-

amined: feature construction, extraction, importance,

and selection.

Among these aspects, feature selection was the

KDIR 2024 - 16th International Conference on Knowledge Discovery and Information Retrieval

184

Table 9: Feature Extraction, Construction and Importance techniques used in the selected studies.

Extraction Construction Importance

PCA 10 Feature Construction 1 XGBoost 2

Auto Encoder 4 LightGBM 1

Convolutional Neural Network 1 Shapley addictive explanations 1

Linear Discriminant Analysis 1

Table 10: Feature Selection Techniques investigated in the selected studies.

Filter Techniques Wrapper Techniques

Correlation 10 Genetic Algorithm 2

Information Gain 5 Recursive Feature Elimination 2

Random Forest 3 Stepwise 2

Chi2 1 Rock Hyrax Swarm Optimization 1

Correlation based Feature Selection 1 SVM Recursive Elimination 1

Decision Tree 1 Quantum Algorithm Feature Selection by Q-SVM 1

Degree Centrality 1

Distance based Feature Selection 1

Entropy 1

Extra Tree Ensemble 1

Gain Ration 1

LASSO 1

Mutual Information 1

ReliefF 1

Factorial Analysis of Mixed Data 1

Rough set 1

standardized murals with ANOVA F-values 1

Table 11: Hyperparameters Optimization techniques used

in the selected studies.

Optimization technique Number

Grid Search 27

Adam 9

Given 7

Bayesian 4

Genetic Algorithm 3

Particle Swarm Optimization 3

Randomized Search CV 2

Default Parameters 2

Differential Evolution Algorithm 2

Firefly Algorithm 2

most extensively studied, appearing in 41 experi-

ments. Feature extraction was explored in 16 experi-

ments, as detailed in Table 8.

Four feature extraction techniques were identi-

fied, as listed in Table 9. The most commonly used

technique was Principal Component Analysis (PCA),

which appeared in 10 instances. This was followed

by the Auto Encoder technique, used four times. Re-

garding feature construction, only one study specif-

ically focused on this aspect, utilizing both domain

knowledge and statistical methods to create new fea-

Table 12: ML tools used in the selected papers.

Tool Number

Python 71

Weka 11

MATLAB 4

Java 4

R 3

LibSVM 1

Orange 1

RapidMiner 1

SAS E-miner 1

tures (Wu et al., 2019). For feature importance, three

techniques were employed: XGBoost was used twice,

while LightGBM and the Shapley Additive Explana-

tions (SHAP) model were each used once.

Regarding feature selection techniques, as de-

tailed in Table 10, this review identified two main cat-

egories: filter and wrapper techniques. Among the fil-

ter techniques, 17 different methods were used across

the experiments in the selected papers. The most fre-

quently employed filter technique was the correlation

coefficient, such as Pearson correlation, which was

used in 10 experiments. Information Gain and Ran-

dom Forest were utilized in 5 and 3 experiments, re-

Reviewing Machine Learning Techniques in Credit Card Fraud Detection

185

spectively, while the remaining 14 techniques were

each explored once.

For wrapper techniques, six methods were identi-

fied in the selected studies. The Genetic Algorithm,

Recursive Feature Elimination, and Stepwise tech-

niques were each explored twice, while the other three

techniques were used once.

3.8 Hyperparameters Optimization

Techniques (MQ7)

Hyperparameter optimization is crucial for enhanc-

ing the performance and generalization ability of ML

models. This question aims to identify the hyperpa-

rameter optimization techniques employed in the se-

lected studies.

In this review, 20 different optimization tech-

niques were identified, used to fine-tune the hyperpa-

rameters of ML models. These techniques are listed

in Table 11. Notably, Grid Search was the most fre-

quently adopted optimization method, appearing in

27 research papers. The Adam optimizer was ex-

plored in 9 papers. Additionally, seven papers explic-

itly listed the parameter values of their employed ML

techniques, while two papers used the default param-

eters provided by the tools used.

It is important to highlight that only 57 out of the

131 selected papers considered the hyperparameter

optimization step. Moreover, seven studies employed

multiple optimization techniques (Zhu et al., 2020; Li

et al., 2021b; Tayebi and El, 2022; Li et al., 2021a;

Yara et al., 2020; Grossi et al., 2022; Sharma et al.,

2021). The study with the most comprehensive explo-

ration of optimization techniques investigated seven

different methods (Tayebi and El, 2022).

3.9 ML Tools (MQ8)

This question aims to identify the tools used to

build decision support systems for detecting fraudu-

lent credit card transactions. Table 12 provides a list

of the nine identified tools.

The Python programming language was the most

widely used, appearing in 71 papers. The Weka tool

was utilized in 11 papers, while MATLAB and Java

were each employed in four papers. Additionally,

four tools were used in only one paper each.

The identified tools can be categorized into two

groups: those with a user interface, such as Rapid-

Miner, Orange, SAS E-miner, and Weka, and those

that provide a programming environment, such as

MATLAB, Java, R, Python, and the Weka API.

4 CONCLUSIONS AND FUTURE

WORK

This paper presents a systematic mapping study that

structures the body of knowledge on the use of ML

techniques in developing decision support systems

for detecting fraudulent credit card transactions. The

study reviewed papers published in journal venues in-

dexed in the Scopus database between 2018 and 2023.

After applying the study selection process, including

specific inclusion and exclusion criteria, 131 papers

were selected to address eight mapping questions.

The main findings related to each mapping question,

as outlined in Table 1, are summarized below:

• The selected papers were published across 86 dif-

ferent journal venues.

• Both single ML approaches and ensemble ap-

proaches were investigated, with single ML ap-

proaches being the most prevalent.

• A total of 29 different datasets were utilized to

build credit card fraud detection systems.

• Various performance indicators were used to eval-

uate the predictive capabilities of the models, with

the Holdout validation technique being the most

frequently employed.

• A total of 32 balancing techniques were identi-

fied, with SMOTE being the most commonly used

method.

• Feature extraction, construction, and selection

steps were explored in the selected studies.

• Only 27 studies optimized the hyperparameter

settings of the ML techniques used.

• Nine tools were identified for building credit card

fraud detection systems in the selected studies.

Future research directions could include exploring

the construction and effectiveness of ensemble tech-

niques in credit card fraud detection systems. An-

other promising area of investigation is identifying the

most effective ML models for distinguishing between

fraudulent and legitimate transactions, which could be

systematically explored through a comprehensive lit-

erature review.

REFERENCES

Arora, V., Leekha, R. S., Lee, K., and Kataria, A. (2020).

Facilitating user authorization from imbalanced data

logs of credit cards using artificial intelligence. Mo-

bile Information Systems, 2020(1):8885269.

KDIR 2024 - 16th International Conference on Knowledge Discovery and Information Retrieval

186

Baker, M. R. (2022). Ensemble learning with supervised

machine learning models to predict credit card fraud

transactions.

Bakhtiari, S., Nasiri, Z., and Vahidi, J. (2023). Credit card

fraud detection using ensemble data mining methods.

Multimedia Tools and Applications, 82(19):29057–

29075.

Carcillo, F., Dal Pozzolo, A., Le Borgne, Y.-A., Caelen, O.,

Mazzer, Y., and Bontempi, G. (2018). Scarff: a scal-

able framework for streaming credit card fraud detec-

tion with spark. Information fusion, 41:182–194.

Cheon, M.-j., Lee, D., Joo, H. S., and Lee, O. (2021). Deep

learning based hybrid approach of detecting fraudu-

lent transactions. Journal of Theoretical and Applied

Information Technology, 99(16):4044–4054.

de Zarz

`

a, I., de Curt

`

o, J., and Calafate, C. T. (2023). Op-

timizing neural networks for imbalanced data. Elec-

tronics, 12(12):2674.

El baida, M., Hosni, M., Boushaba, F., Chourak, M., et al.

(2024). A systematic literature review on classifica-

tion machine learning for urban flood hazard mapping.

Water Resources Management, pages 1–42.

Grossi, M., Ibrahim, N., Radescu, V., Loredo, R., Voigt,

K., and Altrock, C. V. O. N. (2022). Mixed quan-

tum – classical method for fraud detection with quan-

tum feature selection. IEEE Trans. Quantum Eng.,

3(October):1–12.

Hosni, M., Carrillo-de Gea, J. M., Idri, A., Fern

´

andez-

Alem

´

an, J. L., and Garc

´

ıa-Bern

´

a, J. A. (2019). Using

ensemble classification methods in lung cancer dis-

ease. In 2019 41st Annual International Conference

of the IEEE Engineering in Medicine and Biology So-

ciety (EMBC), pages 1367–1370. IEEE.

Hosni, M. and Idri, A. (2018). Software development effort

estimation using feature selection techniques. In New

trends in intelligent software methodologies, tools and

techniques, pages 439–452. IOS Press.

Kim, E. et al. (2019). Champion-challenger analysis for

credit card fraud detection: Hybrid ensemble and deep

learning. Expert Syst. Appl., 128:214–224.

Leevy, J. L., Johnson, J. M., Hancock, J., and Khoshgoftaar,

T. M. (2023). Threshold optimization and random un-

dersampling for imbalanced credit card data. J. Big

Data.

Li, C., Ding, N., Zhai, Y., and Dong, H. (2021a). Compara-

tive study on credit card fraud detection based on dif-

ferent support vector machines. Intelligent Data Anal-

ysis, 25(1):105–119.

Li, Z., Huang, M., Liu, G., and Jiang, C. (2021b). A hybrid

method with dynamic weighted entropy for handling

the problem of class imbalance with overlap in credit

card fraud detection. Expert Syst. Appl., 175(Febru-

ary):114750.

Marco, G. et al. (2022). The role of diversity and ensem-

ble learning in credit card fraud detection. Adv. Data

Anal. Classif.

Mienye, I. D., Sun, Y., and Member, S. (2023). A deep

learning ensemble with data resampling for credit card

fraud detection. IEEE Access, 11(February):30628–

30638.

Petersen, K., Feldt, R., Mujtaba, S., and Mattsson, M.

(2008). Systematic mapping studies in software

engineering. In 12Th International Conference on

Evaluation and Assessment in Software Engineering,

page 10.

Pozzolo, A. D., Boracchi, G., Caelen, O., and Alippi, C.

(2018). Credit card fraud detection: A realistic model-

ing and a novel learning strategy. IEEE Trans. Neural

Networks Learn. Syst., 29(8):3784–3797.

Rakhshaninejad, M., Fathian, M., Amiri, B., and Yazdan-

jue, N. (2022). An ensemble-based credit card fraud

detection algorithm using an efficient voting strategy.

The Computer Journal, 65(8):1998–2015.

Randhawa, K., Loo, C. H. U. K., and Member, S. (2018).

Credit card fraud detection using adaboost and major-

ity voting. IEEE Access, 6:14277–14284.

Report, N. (October 2023). The world’s top card issuers and

merchant acquirers.

Sadgali, I., Sael, N., and Benabbou, F. (2021). Hu-

man behavior scoring in credit card fraud detection.

IAES International Journal of Artificial Intelligence,

10(3):698.

Salekshahrezaee, Z., Leevy, J. L., and Khoshgoftaar, T. M.

(2023). The effect of feature extraction and data sam-

pling on credit card fraud detection. J. Big Data.

Sharma, P., Banerjee, S., Tiwari, D., and Patni, J. C.

(2021). Machine learning model for credit card fraud

detection- a comparative analysis. The International

Arab Journal of Information Technology, 18(6):789–

796.

Taha, A. A. and Malebary, S. J. (2020). An intelligent ap-

proach to credit card fraud detection using an opti-

mized light gradient boosting machine. IEEE access,

8:25579–25587.

Tayebi, M. and El, S. (2022). Performance analysis

of metaheuristics based hyperparameters optimization

for fraud transactions detection. Evol. Intell., page

0123456789.

Trisanto, D. (2021). Modified focal loss in imbalanced xg-

boost for credit card fraud detection. Int. J. Ind. Eng.

Syst., 14(4):350–358.

Wu, Y., Xu, Y., and Li, J. (2019). Feature construction for

fraudulent credit card cash-out detection. Decis. Sup-

port Syst., page 113155.

Yara, A., Albatul, A., and A, R. M. (2020). A financial

fraud detection model based on lstm deep learning

technique. J. Appl. Secur. Res., 0(0):1–19.

Zheng, L., Liu, G., Yan, C., Jiang, C., Zhou, M., and Li,

M. (2020). Improved tradaboost and its application

to transaction fraud detection. IEEE Transactions on

Computational Social Systems, 7(5):1304–1316.

Zhu, H., Liu, G., Zhou, M., Xie, Y., and Abusorrah, A.

(2020). Optimizing weighted extreme learning ma-

chines for imbalanced classification and application to

credit card fraud detection. Neurocomputing, 407:50–

62.

Reviewing Machine Learning Techniques in Credit Card Fraud Detection

187