Comparative Analysis of Regression Models for Stock Price

Prediction: LSTM, ARIMA, SVM

Himani Deshpande, Vikas Talreja, Muskan Tolani, Harshvardhan Rijhwani and Rohit Sharma

Artificial Intelligence and Data Science, Thadomal Sahani Engineering College, Mumbai, Maharashtra, India

Keywords: Stock Price, Comparative Analysis, Long Short-Term Memory (LSTM), Autoregressive Integrated Moving

Average (ARIMA), Support Vector Machines (SVM), Regression.

Abstract: The research deals with a critical and challenging issue in the dynamic financial field. It critically evaluates

and predicts stock prices using three popular regression models: Long Short-Term Memory (LSTM),

Autoregressive Integrated Moving Average (ARIMA), and Support Vector Machine (SVM). Using a rich

dataset that spans market volatility over long-term trends, short-term fluctuations, and an unprecedented

period when COVID-19 struck, the research tries to determine which model gives the most accurate forecast

for stock prices. The data was meant to cover the economic giants such as HDFC, ONGC, Tata, and Adani to

give relevance and comprehensiveness to the study. This study gives an insight into time-based stock price

analysis. The findings are very helpful to the financial expert in that they provide critical insights helpful in

choosing the appropriate model based on the needs of the person carrying out analysis and thus aid in forecast

accuracy. Experimental analysis suggests that, among the selected methods, the ARIMA model has given the

highest prediction accuracy, which is approximately 95.26%. MSE and RMSE for the model come out to be

1.355 and 1.164 for Adani Ports, respectively, hence proving the model's performance to be very good even

on long-run datasets. Further, ARIMA performance on a short-run dataset, for HDFC, and on ONGC for a

novel COVID-19 set cements further that strength. Such practical evidence places ARIMA on the most

reliable procedure while walking through the ambiguity of financial market forecasting, providing financial

analysts with a very effective tool for strategic decision-making. Thus concludes that ARIMA helps to add

value to the predictive models and promotes strategic decisions in stock markets through forecasting.

1 INTRODUCTION

Stock price prediction has been the top priority in

financial research that needs paramount attention to

ensure that they remain economically relevant in their

investing and risk management. As it is critical for the

investor, traders and their respective strategies, there

are continuous efforts to develop and test high

predictive models in stock price.

In recent years, the advancements in technology

and the availability of financial data have sparked a

surge in exploring different modelling approaches for

stock price prediction. Machine learning algorithms

have attracted considerable interest for their ability to

identify complex patterns from previous data and

predict accurate results. Machine Learning algorithms

has been proved to be efficient in forecasting stock

prices in terms of precision and accuracy.

This study aims to perform an in-depth analysis of

selected Machine learning algorithms for predicting

stock price. Further, it aims to compare and analyze

the effectiveness of the selected methodologies. Thus,

helping to get better insights into the compatibility of

different machine-learning methodologies in the

financial domain. Along with the study of machine

learning methods, the time period also have a

significant role in stock market analysis, keeping the

same in mind, this study has focused on different time

frames while conducting experiments with special

focus on COVID-19 period data.

2 LITERATURE REVIEW

Cost estimation in financial markets has given rise to

very active and rigorous academic research that

applies from traditional statistical models to the most

advanced machine learning algorithms and hybrid

approaches. Early studies used, to a larger extent,

regression models in finding how stock prices are

Deshpande, H., Talreja, V., Tolani, M., Rijhwani, H. and Sharma, R.

Comparative Analysis of Regression Models for Stock Price Prediction: LSTM, ARIMA, SVM.

DOI: 10.5220/0013307600004646

In Proceedings of the 1st International Conference on Cognitive & Cloud Computing (IC3Com 2024), pages 215-221

ISBN: 978-989-758-739-9

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

215

related to essential factors like the macro-economic

indicators, financial ratios, and technical indicators

[2,9]. Given the complexity and instability facing

financial markets, there was a need to explore new,

more structured, and systematic models.

In the last decade, an application boom could be

observed when the use of machine learning

algorithms was concerned to analyze financial data or

to identify hidden patterns [4,7]. Amongst these, deep

learning models have been used, for example, Long

Short-Term Memory (LSTM) networks, and are

competent in capturing both the spatial and temporal

expectations that add to the accuracy of the prediction

[5, 10]. Various other studies have been conducted on

the effectiveness of the LSTM network in predicting

stock prices [1, 3]. The researchers have combined

historical price data with lots of indicators to give

insights to investors and traders. Several studies show

that the performance of LSTM models is more

advantageous to conventional other models, such as

autoregressive integrated moving average ARIMA

[3, 6]. Stock price prediction can also be performed

using ARIMA models, which are less accurate than

LSTM models due to their autoregressive and moving

average characteristics [6]. Another predictive

method that has gained popularity in predicting stock

prices is the Support Vector Machine (SVM), based

on the principle of maximizing profits by classifying

data points into two different categories [4]. Besides,

the SVM models for detecting complex patterns and

relationships in financial time series effectively boost

predictive power and robustness [7].

3 METHODOLOGY

This research evaluates the performance of popular

machine learning methods towards stock price

predictions in different scenarios. For analyzing the

capabilities of each method, four distinct datasets are

used namely Adani Ports, ONGC, Tata Motors, and

HDFC [15]. COVID-19 was a time of major changes

which had a major impact on financial markets as

well, keeping the same in mind selected methods are

evaluated on their predictive power on stock datasets

during the COVID-19 period. This study has also

analyzed Short term and long-term datasets to assess

the performance of the selected model.

3.1 Dataset

This research, aims to provide detailed insights into

the selected four datasets from the year 2000 to 2021,

which included vital financial data concerning four

promising organizations in the Indian business world

namely Adani Ports, ONGC, Tata Motors and HDFC.

Table 1. Statistics of selected four datasets

HDFC ONGC

Adani

Ports

Tata

Motors

count 5306 5306 3322 5306

mean 1283.664 491.138 344.20 409.45

std 709.25 385.197 193.04 272.47

Table 1, shows the statistics of the datasets, the

'count' value indicates the total number of data points

available for each stock. In Table 1, 'mean' value

represents the average closing price of the stocks over

the period studied. HDFC has the highest average

closing price at 1283.664, followed by ONGC at

491.138.

3.2 Dataset Pre-Processing

Data preprocessing has to be standardized, lest the

numerical values of different ranges compromise the

result. The range of the closing price value of the four

stocks differs greatly; hence, scaling is one of the

techniques used. This scaling method refers to "min-

max Scaling" technique, which is applied to make

data transformation as expressed using equation (1).

The original data, which in this case is the original

closing price 𝑋, still are retained in their normal form

during this technique. This makes the original

distribution of data adaptable for computational

analysis.

Scaled Value = X

scaled

= X-X

min

/ X

max

-X

min

(1)

By applying the scaling method, we made sure that

the closing prices for each stock were weighted

comparatively with the scaling method, hence making

relative analysis and drawing valid inferences

concerning the trend and pattern of the selected

companies.

3.3 Regression Methods

Long Short-Term Memory (LSTM), autoregressive

integrated moving average (ARIMA), and support

vector machine (SVM) are the other three regression

techniques used for the prediction of stock prices.

• Long Short-Term Memory (LSTM):

IC3Com 2024 - International Conference on Cognitive & Cloud Computing

216

Long-short-term memory (LSTM) is a kind of

recurrent neural network (RNN). It is giving

auspicious results with time-series data since it

possesses the capability of holding long-term

dependencies.

• Autoregressive Integrated Moving Average

(ARIMA):

ARIMA is, therefore, a compelling and widely used

statistical model in time series for modeling and

forecasting. It includes Autoregressive (AR) and

Moving Average (MA) models combined with

Integration (I) to attain stationarity of the data.

• Support Vector Machine (SVM):

Even though SVM is highly recognized for

classification, it can also be extended to regression

tasks through the Support Vector Regression (SVR)

model.

4 RESULT AND ANALYSIS

This section presents the investigation of the

performance of some of the predictive models against

the data of stocks of leading companies in India. The

result analysis gets its root from the assessment's

quantitative aspect, which presents a clear picture

concerning the market trend and performance

forecast. The insights gained here form a critical basis

for understanding the comprehensive trend analysis

that follows when graphical interpretations are used

to further explore and validate the findings

4.1 TREND ANALYSIS

The study considers the movement in stock prices of

4 Companies: Adani Ports, ONGC, Tata Motors, and

HDFC. The range of charts below has been computed

from the High, Low, Open, and Close prices of the

dataset, showing trends in stock prices across

different trading sessions. These graphical

illustrations are a reflection of the routine activities of

trading, while at the same time, they also provide

some insight into market tendency and investor

psychology. These statistical measures could be

helpful to us in evaluating the extent of fluctuations

in the financial markets: Standard Deviation and

Average True Range (ATR). Such metrics

contributed to comparing volatility and frequency of

the price changes, hence enhancing our evaluation

and understanding of the dangers and uncertainties in

the stock market.

We further identify essential market events and their

influence on the chosen stock while focusing on

particular times, like the COVID-19 pandemic in

2020. The turbulence brought about by the pandemic

in the market presented a unique opportunity to

observe how stocks react to sudden external shocks.

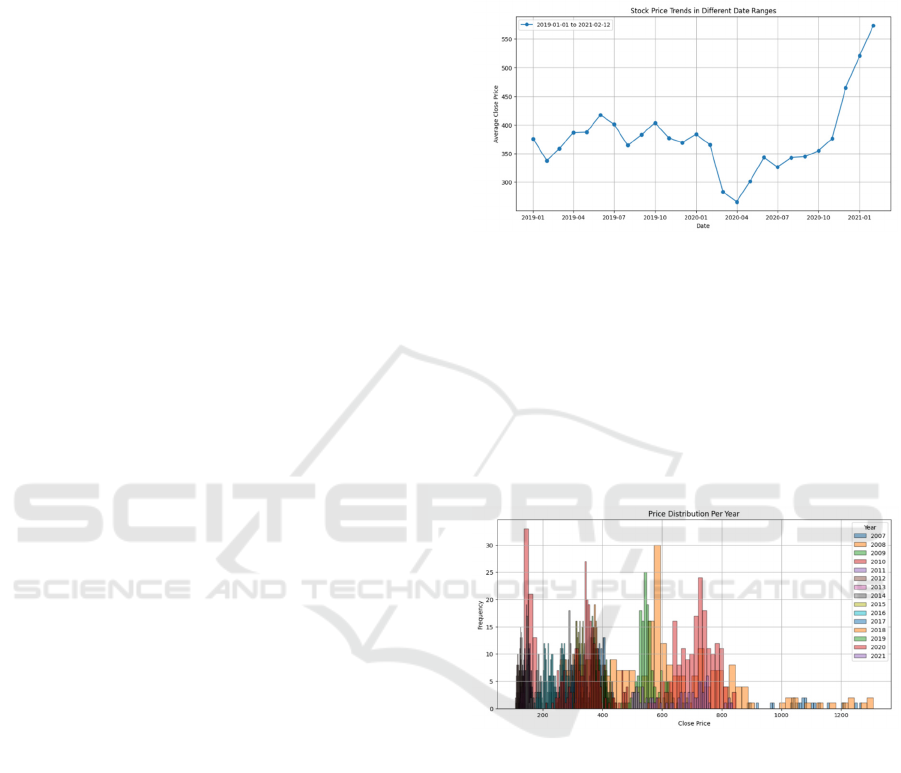

Fig. 1. Stock Price Trends in Different Date Ranges of

Adani Ports dataset.

Fig 1 represents the trend of stock prices concerning

different dates ranging from January 2019 to

February 2021. This generally means the average

increase of stock prices with remarkable fluctuation.

We, therefore, observe that the prices of the stocks

have risen sharply, especially from around October

2020, hence pointing out that it was a time frame of

really remarkable growth.

Fig. 2. Price Distribution per year on Adani Ports

dataset.

Fig 2 represents a histogram of the frequency

distribution of closing stock prices from 2007 to

2021, delineated by different colors for each year.

The X-axis details the closing price, while the Y-axis

represents the frequency of these prices occurring.

Notably, the year represented by the light purple

bars—indicating 2021—shows the highest frequency

of higher price ranges, suggesting an uptick in closing

prices during this year.

Comparative Analysis of Regression Models for Stock Price Prediction: LSTM, ARIMA, SVM

217

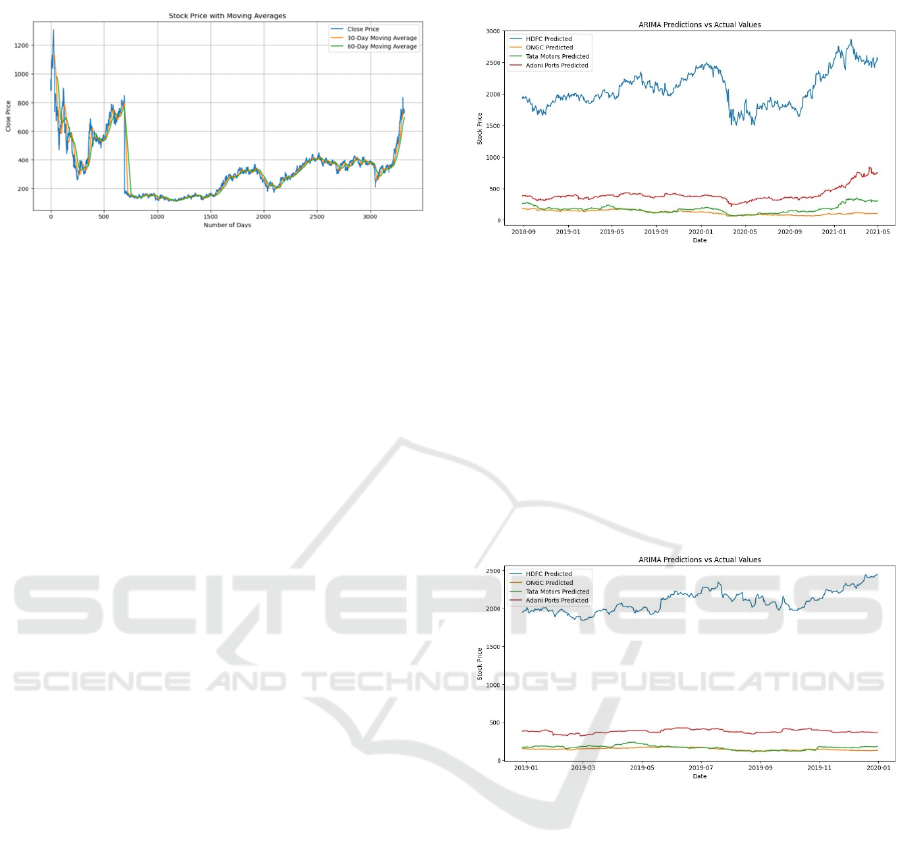

Fig. 3. Stock Price with moving averages on Adani Ports

dataset.

Fig 3 presents a time series analysis of closing stock

prices with the inclusion of 30-day and 60-day

moving averages, plotted against the elapsed number

of days on the X-axis. This chart demonstrates the

stock's price instability, with the moving averages

serving to mitigate the impact of short-term price

variances and to underscore sustained trends. The

convergence of the moving averages prior to a sharp

upward movement in the closing prices suggests a

period of market stability, succeeded by a

considerable increase, possibly indicative of a notable

market development influencing stock valuations.

4.2 TIME PERIOD ANALYSIS

This study’s investigation parses the fluctuations in

stock prices into three temporal categories—long-

term, short-term, and the COVID-19 period—each

offering distinct perspectives on the market behavior

of the stocks under review, which include Adani

Ports, ONGC, Tata Motors, and HDFC.

• Long-Term Period Analysis (2000 to 2021;

ADANIPORTS: 2007 to 2021): The long-

term analysis delves into the overarching

trends and the general progression of stock

prices over two decades. For

ADANIPORTS, the analysis commences

from 2007, aligning with its availability in

the marketplace.

Fig 4. ARIMA predictions on Long Term Period Analysis

•

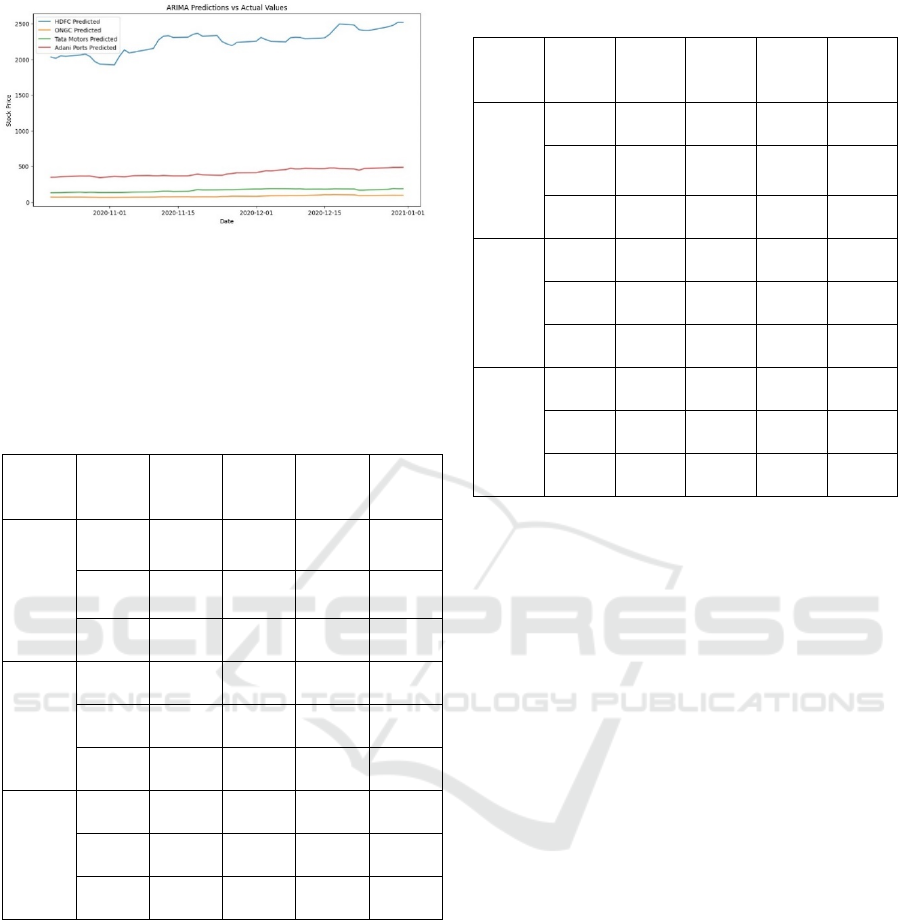

Short-Term Period Analysis (2015 to 2021):

The short-term analysis concentrates on a

more granular 6-year window, highlighting

investor responses to economic policies,

sectoral shifts, and global financial trends.

The graph below helps us to closely track the

agility of market responses and capture

investor sentiment with a narrower focus.

Fig 5. ARIMA predictions on Short Term Period Analysis

•

COVID-19 Period Analysis (January to

December 2020): The COVID-19 period

analysis homes in on the dramatic effects of

the pandemic on stock prices. The graph

below, illustrates the market’s resilience or

sensitivity to the extraordinary social and

economic disruptions experienced globally

during the year 2020.

IC3Com 2024 - International Conference on Cognitive & Cloud Computing

218

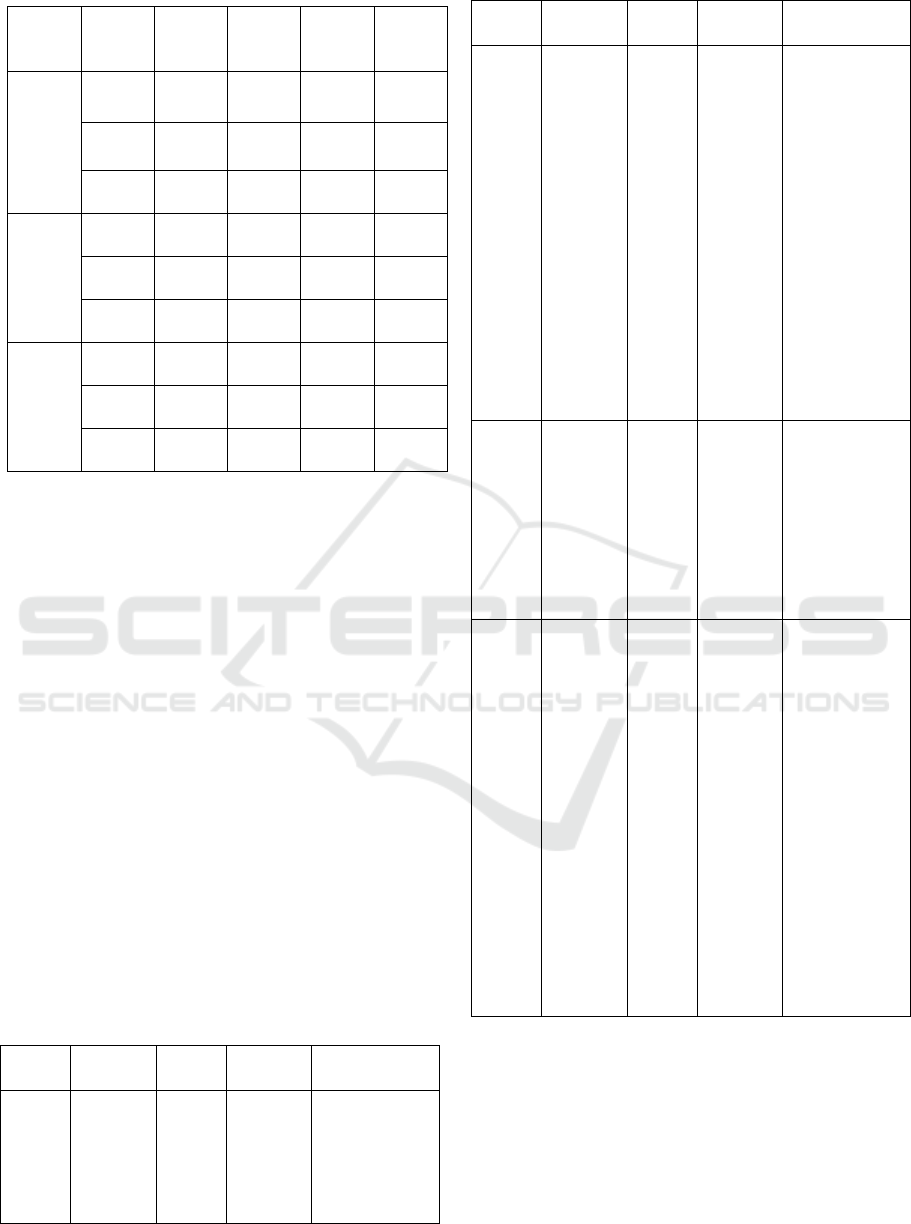

Fig 6. ARIMA predictions on Covid Period Analysis.

4.3 Regression Analysis

This section of the paper analyses the efficiency of

the three regression methods selected for study

namely LAST, SVM and ARIMA.

Table 2. Results on Long term datasets:

Table 2, provides a comparative summary of the

performance metrics for LSTM, SVM, and ARIMA

models across four companies for long-term stock

price prediction. For HDFC and Tata Motors, the

ARIMA model outperforms others with the highest

accuracy, whereas for ONGC and Adani Ports, SVM

and ARIMA show superior accuracy, respectively.

Table 3. Results on Short term datasets

Table 3, compares the short-term forecasting

accuracy of LSTM, SVM, and ARIMA models across

HDFC, ONGC, Adani Ports, and Tata Motors, using

MSE, RMSE, and Accuracy as metrics. ARIMA

model stands out with exceptionally high accuracy for

all companies, particularly excelling with ONGC

with 96.99% accuracy. SVM model, while

significantly better than LSTM, trails behind

ARIMA, with its accuracy hovering around 48%. The

LSTM model shows the least accuracy and high

errors, suggesting it may not be the optimal choice for

short-term stock price predictions in this data set.

For COVID-19 period dataset, Table 4 reflects the

comparative effectiveness of the SVM and ARIMA

models for stock price forecasting. The SVM model

shows lower accuracy across all companies, with

percentages ranging approximately from 37% to

49%. In contrast, the ARIMA model demonstrates

superior performance, with accuracy rates above 90%

for all companies, indicating its robust predictive

capability under the volatile conditions brought on by

the pandemic. This suggests that the ARIMA model

is particularly adept at handling the market instability

experienced during the COVID-19 crisis.

Parameters HDFC ONGC Adani Ports Tata Motors

LSTM

MSE 41139.1 21492.03 16529.35 69491.12

RMSE 202.82 146.60 128.56 263.61

Accuracy 10.1 8.63 9.11 6.30

SVM

MSE 0.494 0.5 0.53 0.523

RMSE 0.703 0.7 0.72 0.723

Accuracy 50.56 50 46.91 47.64

ARIMA

MSE 0.1739 0.301 0.044 0.458

RMSE 0.417 0.549 0.2101 0.677

Accuracy 98.47 99.53 99.04 99.72

Parameters HDFC ONGC

Adani

Ports

Tata

Motors

LSTM

MSE

438162.38 22183.7 14785.9 25967.75

RMSE

661.93 148.94 121.59 161.14

Accuracy 8.25 13.01 15.55 12.2

SVM

MSE 0.51 0.53 0.51 0.52

RMSE 0.71 0.73 0.71 0.72

Accuracy 48.58 46.15 48.58 47.77

ARIMA

MSE 0.030 0.162 1.355 0.2122

RMSE 0.175 0.402 1.164 0.460

Accuracy 95.37 96.99 95.77 89.84

Comparative Analysis of Regression Models for Stock Price Prediction: LSTM, ARIMA, SVM

219

5 COMPARATIVE ANALYSIS

The comparative research carried out in the contexts

and assessment of the analytical findings about those

of other related studies. We devise ways to find out

similarities, differences, and new insights that

contribute value to the collective understanding of the

subject through a review and analysis of several other

previously written research papers for the same

subject. Such an analysis permits a further

specification of what is unique within our study and

points of convergence and divergence between our

study and previous literature. This broadens our

understanding of the matter under research and offers

essential implications for further study and directions

for practical applications.

Table 5 summarizes the key aspects of these

comparative studies, elucidating the contributions

and limitations of each.

Table 5. Comparative Analysis of Research papers.

Study Dataset Models

Compared

Metrics Key Finding

1.Gao et

al.

SP500,

Nikkei225,

CSI300

MLP,

LSTM,

CNN, UA

RMSE, R,

MAPE

UA consistently

outperformed MLP,

LSTM, and CNN in

terms of RMSE

(25.4851-209.9719)

and MAPE (0.0067-

0.0091) across all

datasets.

3. Zhang

(2003)

Sunspot,

Lynx,

Exchange

rate

ARI

MA,

ANN,

Hybrid

MSE (×10³),

MAD

Hybrid model

showed the lowest

MSE and MAD for

Lynx and Sunspot

datasets. For the

exchange rate dataset,

Hybrid model also

had the lowest MSE

(2.67259-4.35907

×10⁻⁵) and MAD

(0.004146-

0.0051212). ARIMA

showed high

performance, but

Hybrid consistently

outperformed both

ARIMA and ANN.

14. Hong

& Jeon

(2018)

CSI-300

index (major

stocks)

LSTM,

LSTM-C,

DA-

RNN,

MI-

LSTM,

LSTM-

CN, MI-

LSTM-N

Min. MSE

(×10⁻³),

Avg. MSE

(×10⁻³)

MI-LSTM showed

the lowest average

MSE (0.996-1.012)

among the models

considered for stock

price prediction.

Our Study

For Long

term

dataset

(2024)

HDFC,

ONGC,

Adani Ports,

Tata Motors

LSTM,

ARIMA,

SVM

MSE,

RMSE,

Accuracy

ARIMA consistently

demonstrated the

highest accuracy

(98.47-99.72) and the

lowest RMSE

(0.2101-0.677).

LSTM showed higher

RMSE (128.56-

263.61) compared to

ARIMA but still

performed well in

stock price

prediction. SVM

showed intermediate

performance with

RMSE (0.7-0.723)

and accuracy (46.91-

50.56).

6 CONCLUSION

This study provides an in-depth analysis of the stock

prediction domain, focusing on analyzing the datasets

of four major Indian companies: HDFC, ONGC,

Adani Ports, and Tata Motors across three periods:

short-term, long-term, and the COVID-19 period.

Selected datasets over these three time periods were

experimented using LSTM, SVM, and ARIMA

Parameters HDFC ONGC Adani Ports Tata Motors

LSTM

MSE

53.73 0.15 74.61 1.66

RMSE

7.33 0.39 8.64 1.29

Accuracy 0.29% 0.37% 0.65% 1.54%

SVM

MSE 0.62 0.50 0.52 0.52

RMSE 0.79 0.71 0.72 0.72

Accuracy 37.25 49.01 47.05 47.05

ARIMA

MSE 1947.09 5.29 79.79 20.71

RMSE 44.125 2.30 8.93 3.10

Accuracy 92.35 96.44 96.77 94.92

IC3Com 2024 - International Conference on Cognitive & Cloud Computing

220

regression methods for prediction analysis. A

comparative analysis finds ARIMA as the most

efficient machine learning model, achieving over

90% accuracy on most datasets and exhibiting low

MSE and RMSE values. This level of performance

was sustained across long-term and short-term

datasets, and specifically during the COVID-19

period datasets, establishing ARIMA as the superior

model for handling the complexities inherent in

financial data and providing reliable forecasts. In

more specific cases, ARIMA does very well on the

Adani Ports dataset in the long-term series HDFC

data in the short-term series, and the ONGC dataset

in the COVID-19 period. On the other hand, the SVM

model is mediocre because the prediction accuracy

lies around 50%, where the predictions are more

volatile than with ARIMA. Although this is markedly

lower than that of the ARIMA model, the consistency

of SVM across different datasets implies its probable

reliability as a model to predict stock prices, mainly

due to its lower MSE and RMSE values compared

with LSTM.

The results reveal that ARIMA outperforms the

other models, achieving high accuracy. However, the

choice of model should align with the dataset's

characteristics and the specific demands of the

forecasting task. This investigation emphasizes the

importance of selecting a model that is carefully

tailored to the unique requirements of the forecasting

endeavor to enhance precision in predicting stock

market trends.

REFERENCES

Gao, P., Zhang, R., & Yang, X.:The Application of Stock

Index Price Prediction with Neural Network.

Mathematical and Computational Applications,

25(3),53(2020).

Tsai, C. F., Chen, M. Y., & Chiu, A. S. (2011). Stock price

prediction using hybrid models based on artificial

neural networks and multivariate adaptive regression

splines. Expert Systems with Applications, 38(3), 2177-

2186.

Zhang, G. P. (2003). Time series forecasting using a hybrid

ARIMA and neural network model. Neurocomputing,

50, 159-175

Chen, C. C., & Wei, C. H. (2017). Stock price forecasting

using ARIMA, ANN and SVM techniques. Journal of

Computer Science and Technology, 17(1), 41-49.

Li, C., Zheng, H., & Cheng, L. (2020). Stock price

prediction using LSTM, RNN and CNN-sliding

window model. Journal of Physics: Conference Series,

1467(1), 012052. https://doi.org/10.1088/1742-

6596/1467/1/012052

Bhattacharyya, S., & De, S. (2011). Forecasting stock price

index using hybrid ARIMA and feedforward neural

network. Computational Economics, 37(4), 439-457.

Zhang, G. P. (2003). Time series forecasting using a hybrid

ARIMA and support vector machines model.

Neurocomputing, 50, 159-175.

Zhang, G. P., & Patuwo, B. E. (1998). Forecasting with

artificial neural networks: The state of the art.

International Journal of Forecasting, 14(1), 35-62.

Ghiassi, M., Saidane, H., & Zimbra, D. K. (2005). Hybrid

genetic algorithms for ARMA time series forecasting.

Engineering Applications of Artificial Intelligence,

18(5), 547-554.

Hong, T., & Jeon, H. (2018). Stock price prediction using

attention-based multi-input LSTM. Expert Systems

with Applications, 114, 532-543.

Nitesh Pareek. (n.d.). Nifty 50 Stock Prices Case Study

[Data set].

Kaggle. Retrieved from https://www.kaggle.com/

code/niteshpareek98/nifty-50-stock-prices-case-study

Comparative Analysis of Regression Models for Stock Price Prediction: LSTM, ARIMA, SVM

221