Online Joint Optimization of Sponsored Search Ad Bid Amounts and

Product Prices on e-Commerce

Shoichiro Koguchi

1

, Kazuhide Nakata

1 a

, Ken Kobayashi

1 b

, Kosuke Kawakami

2

,

Takenori Nakajima

2

and Kevin Kratzer

2

1

Department of Industrial Engineering and Economics, Tokyo Institute of Technology, 2-12-1 Ookayama,

Meguro-ku 152-8550, Tokyo, Japan

2

HAKUHODO Technologies Inc., Akasaka Biz Tower, 5-3-1, Akasaka, Minato-ku, Tokyo, Japan

Keywords:

Bid Amount Optimization, Revenue Management, Dynamic Pricing, e-Commerce.

Abstract:

With the rapid development of the e-commerce market, sellers are increasingly required to devise effec-

tive strategies to maximize sales and profits within limited resources. This paper insists that demand on

e-commerce platforms can be partially controlled through advertising bid amounts. We examine the simulta-

neous control of demand and product pricing via advertising bids. Specifically, this study proposes a method

for the joint optimization of advertising bid amounts and product prices to maximize sellers’ sales and profits.

Previous research has often focused on either advertising bid amounts or product prices, with little considera-

tion of their simultaneous optimization. In contrast, our study develops an optimization method that accounts

for the interdependencies between advertising bid amounts, advertising budgets, product prices, and inventory

control. This comprehensive approach enables sellers to optimize advertising bid amounts and product prices

simultaneously by considering these interrelated factors. Moreover, the proposed method demonstrates high

scalability and is well-suited to real-world e-commerce markets, allowing for adaptation to various market

conditions. Simulation results indicate that the proposed method significantly enhances sales and profits com-

pared to approaches that do not incorporate price variability.

1 INTRODUCTION

The global e-commerce (EC) markets have been

growing, driven by advancements in information

technology and changing consumer behavior (Chen

et al., 2016).

As the market expands, sellers on e-commerce

platforms need to find more effective strategies.

Among the multitude of products available, it is es-

sential for sellers first to gain consumer awareness,

which requires effective advertising strategies. Addi-

tionally, setting an appropriate product price is crucial

to encouraging consumers to complete a purchase af-

ter being made aware of a product. In other words,

advertising strategies and product pricing are two key

elements that sellers must optimize. However, deter-

mining the appropriate settings for both of these ele-

ments is a complex task. Currently, both advertising

a

https://orcid.org/0000-0002-5479-100X

b

https://orcid.org/0000-0002-6609-7488

bid amounts and product prices are often set based on

specialists’ expertise or the sellers’ intuition and ex-

perience. Thus, this paper aims to support sellers in

effectively setting both advertising bid Amounts and

product prices.

This paper focuses on sponsored search ads, a type

of programmatic advertising commonly adopted on

many e-commerce platforms. Programmatic advertis-

ing refers to ads traded via bidding systems through

platforms like Google Ads or Amazon Ads. It is

popular due to its simplicity in allowing advertisers

to launch campaigns even with a small budget and

its flexibility to adjust ad bids, budgets, and deliv-

ery settings. In fact, in 2021, programmatic adver-

tising accounted for 87.4% of internet advertising ex-

penditures in Japan (DENTSU INC., 2024). Spon-

sored search ads are a form of programmatic advertis-

ing that appears on the search results pages of search

engines. When consumers enter a keyword into the

search engine, ads related to that keyword are dis-

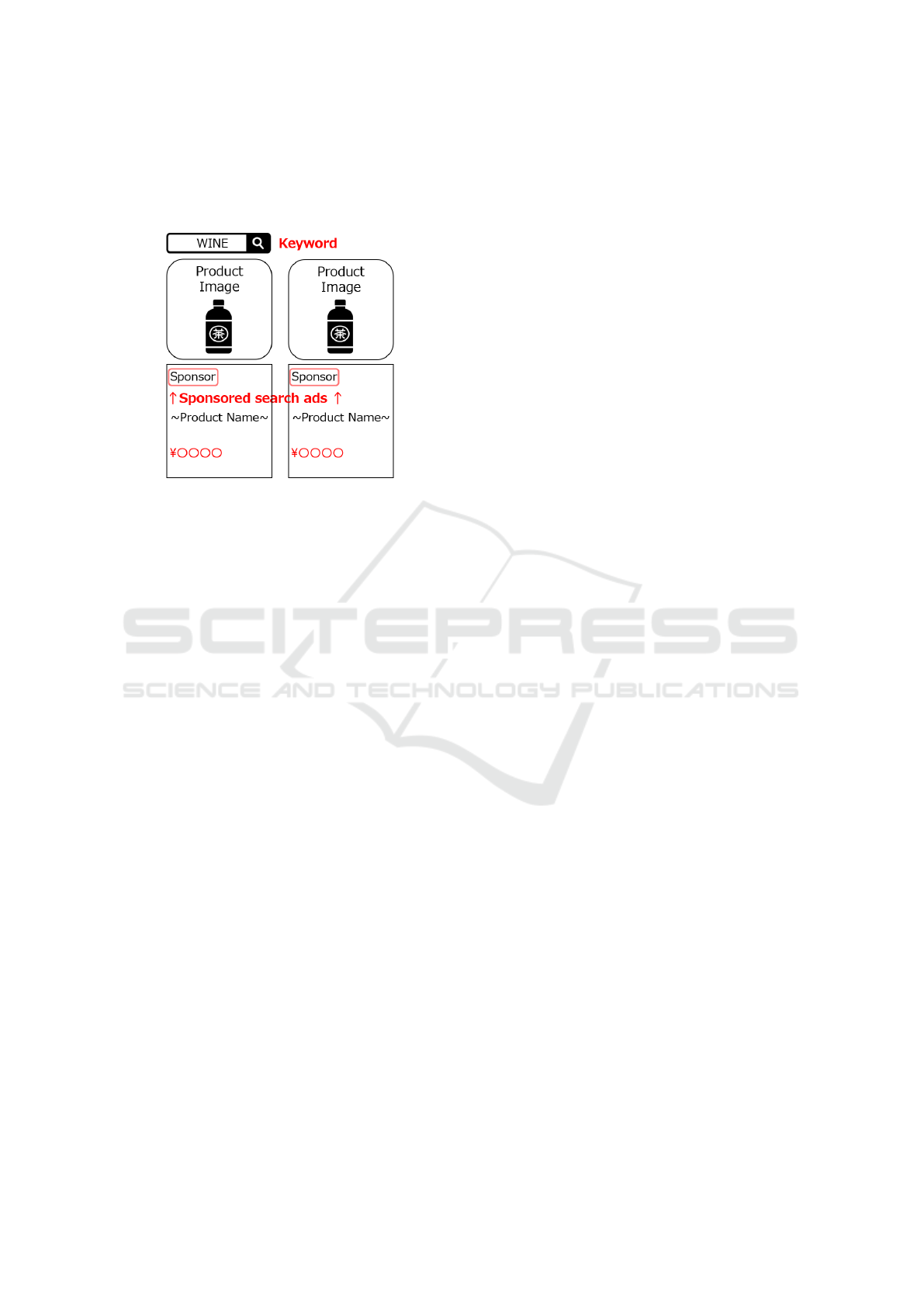

played at the top of the search results (Figure 1).

Koguchi, S., Nakata, K., Kobayashi, K., Kawakami, K., Nakajima, T. and Kratzer, K.

Online Joint Optimization of Sponsored Search Ad Bid Amounts and Product Prices on e-Commerce.

DOI: 10.5220/0013118300003893

In Proceedings of the 14th International Conference on Operations Research and Enterprise Systems (ICORES 2025), pages 67-78

ISBN: 978-989-758-732-0; ISSN: 2184-4372

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

67

Therefore, advertisers must set appropriate ad bids for

each potential keyword to ensure their ads are shown.

Keyword selection and bid settings are critical ele-

ments for sponsored search ads to function effectively.

Figure 1: Sponsored Search Advertising on Search Screens

in E-commerce.

On the other hand, appropriate revenue manage-

ment is necessary to encourage consumers to make

purchases. For example, according to the research

by Jamil et al. (2022), product pricing significantly

impacts consumers’ purchase intentions, and proper

price setting directly influences sales. Setting a high

product price increases the revenue per purchase, but

the number of consumers willing to buy the product

is expected to decrease due to the higher price. Con-

versely, setting a lower product price will likely result

in more purchases, but the revenue per purchase will

decrease. In addition to this trade-off, it is essential to

set an appropriate price that considers factors such as

inventory levels by each company’s objective.

Based on these considerations, this paper aims to

improve sellers’ sales and profits by examining the

online optimization of both ad bid amounts and prod-

uct prices over multiple periods. The contributions of

this paper are as follows:

• We mathematically model the optimization of bid

amounts and product prices in the context de-

scribed in Section 2. These two elements are

closely intertwined in the purchase process, mak-

ing it essential to account for their interdepen-

dence rather than treating them separately.

• Based on the related work (Majima et al., 2024),

we proposed a method that simultaneously op-

timizes ad bid amounts and product prices over

multiple periods using machine learning-based

predictions. The method reduces the problem

to a Mixed-Integer Programming (MIP) problem

through discretization, allowing for efficient com-

putational solving.

• The performance of the proposed method was val-

idated through simulations using real-world data

from Hakuhodo Technologies. These numerical

experiments demonstrated not only the effective-

ness of the proposed method but also its flexibility

and scalability.

The structure of this paper is as follows. Sec-

tion 2 explains revenue management in e-commerce

sites. Specifically, it describes the process of gener-

ating sales and profits in e-commerce and highlights

the necessity of simultaneously optimizing advertis-

ing bids and product prices. Section 3 reviews related

research. It introduces previous studies and theories

on advertising bid optimization and revenue manage-

ment, providing the background knowledge for this

study. Section 4 details this paper’s proposed method.

It explains the proposed approach’s modeling, the for-

mulation of the sales maximization problem, and the

formulation of the profit maximization problem. Sec-

tion 5 presents the results of numerical experiments

conducted to verify the effectiveness of the proposed

method. It discusses the construction of the simu-

lator, the experimental setup, and the simulation re-

sults, confirming that the proposed method achieves

superior outcomes compared to other models. Finally,

Section 6 provides the conclusion.

2 REVENUE MANAGEMENT ON

e-COMMERCE

2.1 Sales and Profit Generation Process

on e-Commerce Sites

In this paper, the terms related to advertising opera-

tions are defined as follows:

• Impression

When a user enters a keyword into a search en-

gine, the advertisement is displayed on the search

results page.

• Click

When the user clicks on the displayed advertise-

ment.

• Conversion

When the user purchases a product associated

with the clicked advertisement.

The sales and profit generation process in e-

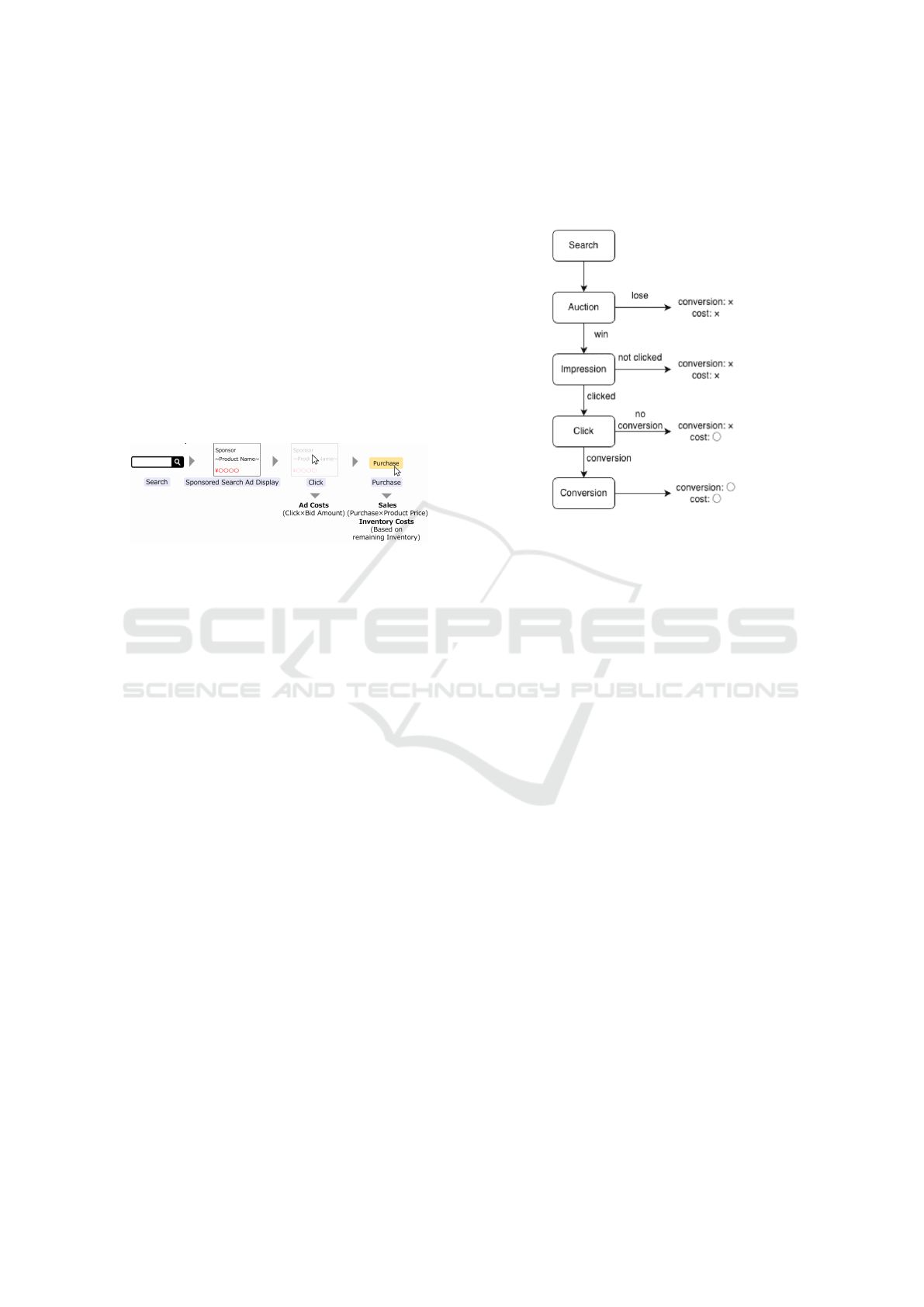

commerce sites is illustrated in Figure 2. First, an

advertisement is displayed on the search results page

after a user searches. Next, whether the user clicks

ICORES 2025 - 14th International Conference on Operations Research and Enterprise Systems

68

on the displayed advertisement depends on the click-

through rate. Similarly, whether the user purchases a

product after clicking on the ad depends on the con-

version rate. At this point, sales are the product of the

number of conversions and the product price, while

advertising costs are incurred based on the number of

clicks and the ad bid amount. Additionally, inventory

costs are incurred based on the remaining inventory.

Among these processes, the two variables that sell-

ers can control are the ad bid amount and the product

price.

In the next section, we will describe in detail the

mechanism by which the number of impressions and

advertising costs arises, as shown in Figure 2, and

clarify the impact that ad bids have on the sales and

profit generation process in e-commerce sites.

Figure 2: The flow until the seller generates profit.

2.2 Sponsored Search Ads

This section provides a detailed explanation of the

type of advertisements handled in this paper.

2.2.1 The Process by Which Sponsored Search

Ads Are Displayed

Sponsored search ads are displayed based on the key-

words users enter into a search engine. For example,

if a user searches for the keyword “wine,” advertise-

ments related to wine will be displayed.displaying the

ad that wins the auction

Next, the process by which sponsored search ads

are displayed is illustrated in Figure 3. When a user

inputs a keyword into a search engine, an auction is

held for the ads associated with that keyword. The

advertising platform conducts this auction automati-

cally, displaying the ad that wins the auction. How-

ever, many advertising platforms do not disclose the

detailed mechanisms of these auctions, making it dif-

ficult for advertisers to measure the competitiveness

of each ad and keyword precisely. For example, in

Google Ads and Amazon Ads, factors such as the bid

amount, the relevance of the ad text to the search,

the estimated click-through rate, and the quality of

the landing page contribute to a hidden score (quality

score) calculated by the platform, which influences

the auction results (AmazonAds, 2022; GoogleAds,

2024), but the specific algorithm is not disclosed.

As a result, advertisers must estimate the number

of clicks and conversions they can expect for a given

keyword and bid amount based on the limited infor-

mation available to them.

Figure 3: The process leading to the display of sponsored

search advertisements (quoted from Majima et al. (2024)).

2.2.2 Information Available to Advertisers

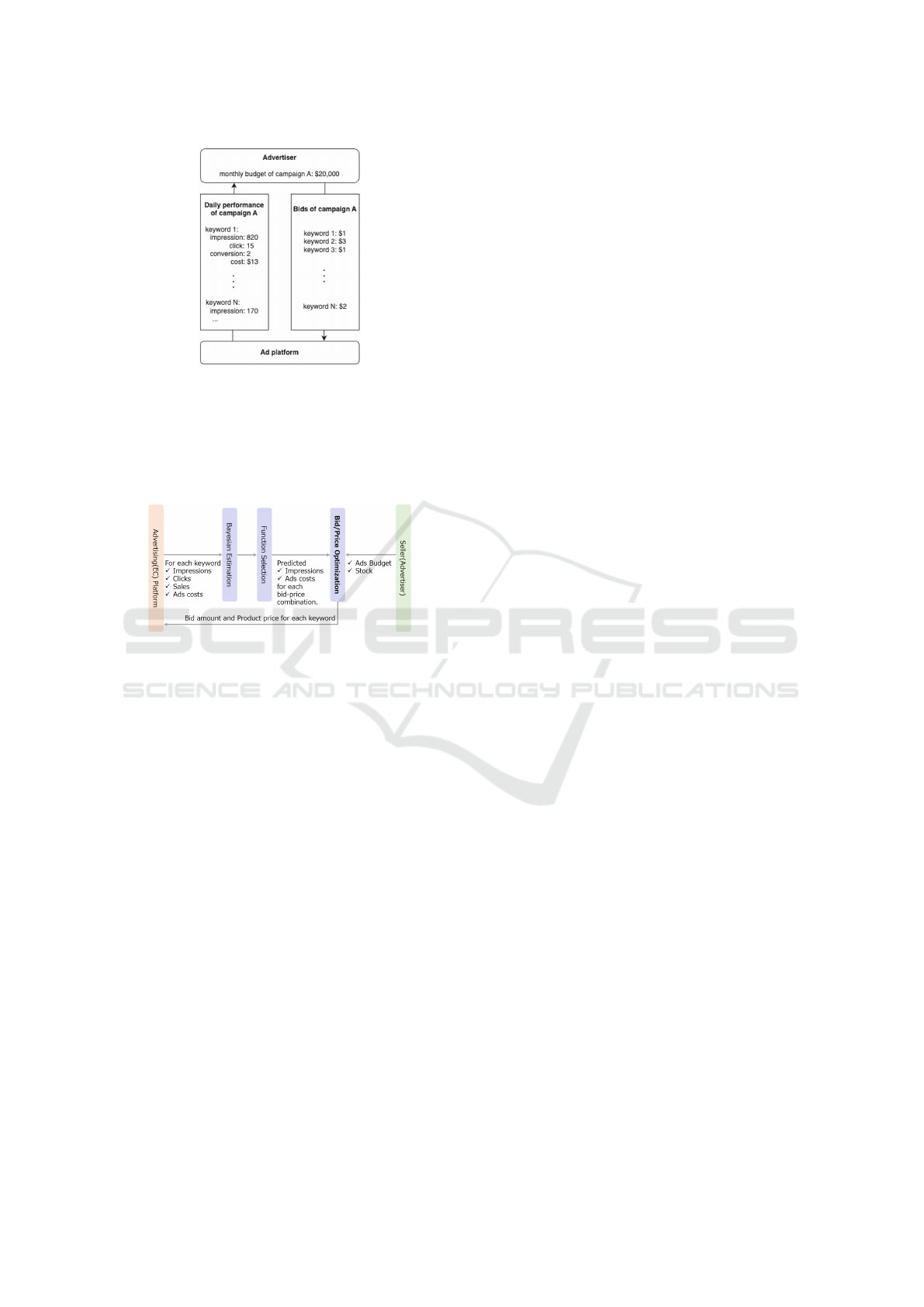

Figure 4 illustrates the interaction between advertis-

ers and the advertising platform. Advertisers set bid

amounts for each keyword associated with an adver-

tisement. Additionally, advertisers can flexibly adjust

bid amounts throughout the day. Although real-time

adjustments for each search and auction are impos-

sible, advertisers can access detailed data from the

advertising platform, allowing them to track impres-

sions, clicks, conversions, and advertising costs at a

more granular level than daily reports (Yang et al.,

2020).

Additionally, advertisers set a budget for each ad-

vertisement. If the budget is depleted during the cam-

paign period, the ad will no longer be displayed unless

the advertiser replenishes the budget.

2.3 The Necessity of Simultaneously

Determining Ad Bid Amounts and

Product Prices

Revenue management, focusing on price adjustments,

plays a crucial role in strategies for maximizing sales

and profits for sellers. Revenue management opti-

mizes the trade-off between product demand and pric-

ing to maximize both revenue and profits. Moreover,

it enables optimization that considers inventory lev-

els, allowing for more efficient profit maximization by

integrating inventory management with pricing strate-

Online Joint Optimization of Sponsored Search Ad Bid Amounts and Product Prices on e-Commerce

69

Figure 4: Interaction between advertisers and ad platforms

(quoted from Majima et al. (2024)).

gies. In practice, on e-commerce sites like Amazon,

sellers can set their product prices, and pricing deci-

sions are critical factors influencing the seller’s rev-

enue and profits (Schlosser and Richly, 2019).

Figure 5: Overview of the proposed method by Majima

et al. (2024).

However, several studies have highlighted the dif-

ficulty of demand forecasting in revenue management

(Besbes and Zeevi, 2015; Koupriouchina et al., 2014).

Therefore, this paper focuses on the fact that a signif-

icant portion of purchases on e-commerce platforms

occurs through advertisements and considers control-

ling product demand via ad bid amounts. Specifically,

by adjusting ad bid amounts, sellers can control the

number of ad impressions and advertising costs while

optimizing product prices, ultimately helping to im-

prove overall sales and profits.

3 RELATED WORK

3.1 Bid Amount Optimization

The optimization of bid amounts in Internet advertis-

ing has been studied under various conditions, such as

different advertising platforms, constraints, and sce-

narios. Nuara et al. (2022) formulated the problem

of optimizing bid amounts and daily budgets across

multiple platforms in cost-per-click advertising cam-

paigns as a semi-bandit problem (Chen et al., 2013).

Their study aims to maximize the expected revenue

of an advertiser while adhering to daily budget con-

straints across all campaigns. Their algorithm is

based on GP-UCB (Gaussian Process Upper Confi-

dence Bound) (Srinivas et al., 2010), predicting con-

versions and advertising costs for each bid amount

and performing optimization through dynamic pro-

gramming. GP-UCB is a Bayesian optimization tech-

nique that uses Gaussian processes.

Inspired by the work of (Nuara et al., 2022; Ma-

jima et al., 2024), proposed a method focusing on

keyword-level bid optimization over multiple periods.

Figure 5 illustrates the overall framework of their ap-

proach. They combine Bayesian inference with ban-

dit algorithms, modeling relationships between ad-

vertising metrics using Bayesian networks to predict

the conversions and advertising costs associated with

each keyword. Their method then solves an optimiza-

tion problem that maximizes the number of conver-

sions under budget constraints for each period, dy-

namically adjusting bid amounts while considering

uncertainty. The study by Majima et al. (2024) is

closely related to the advertising setup in this paper

and serves as a foundational approach.

However, these studies assume constant prod-

uct prices, equating the seller’s revenue maximiza-

tion with the maximization of conversions. This pa-

per proposes a method that simultaneously optimizes

both the bid amount and the product price, consider-

ing that click-through rates and conversion rates can

vary with product prices. To the author’s knowledge,

no previous research has explored the simultaneous

optimization of bid amounts and product prices, mak-

ing this problem setup a significant contribution to

this paper.

3.2 Revenue Management

Research on revenue management has become in-

creasingly active in recent years, driven by ad-

vancements in data analysis technologies and the

widespread use of the Internet. Since this paper fo-

cuses on setting product prices for each period, the

field of dynamic pricing within revenue management

is most relevant. Dynamic pricing is a pricing strategy

that continuously adjusts prices based on fluctuating

demand or available supply. This approach is com-

monly used in pricing for airlines, hotels, and event

tickets, as well as in e-commerce pricing.

A dynamic pricing framework using deep rein-

forcement learning was proposed by Liu et al. (2019)

for e-commerce platforms and demonstrated its ef-

fectiveness. They modeled the problem as a Markov

decision process and evaluated it through online ex-

ICORES 2025 - 14th International Conference on Operations Research and Enterprise Systems

70

periments on Tmall.com. However, appropriately

representing the complex relationship between bid

amounts and product prices using deep reinforcement

learning is challenging, making this method difficult

to apply to the current research.

In addition, Li and Zheng (2023) proposed a dy-

namic pricing model that combines external informa-

tion with inventory constraints. Their model explores

a method for dynamically setting prices under un-

known demand functions by utilizing newly observed

external information at the beginning of each period.

This study maximizes expected cumulative revenue

while balancing inventory management and pricing

decisions.

Gharakhani et al. (2022) proposed a model for

optimizing pricing, inventory management, and ad-

vertising frequency. Their model considers a time-

dependent inventory cost function and explores a

method for dynamically adjusting product prices and

inventory levels for each product. This approach

seeks to maximize revenue while accounting for the

impact of inventory costs.

These studies highlight that considering inventory

constraints and inventory costs plays a vital role in

maximizing revenue and improving the efficiency of

inventory management. This paper combines these

insights with the foundational work of Majima et al.

(2024) to explore the simultaneous optimization of

bid amounts and product prices.

4 PROPOSED METHOD

4.1 Modeling

In this section, we explain the proposed model. We

assume that the seller sells products over T discrete

periods and determines the optimal advertising bid

amount and product price for each period. The adver-

tising budget R is the total budget across all periods,

and the product stock is replenished at any quantity

for each period. Additionally, any remaining stock at

the end of a period will be carried over to the next

period.

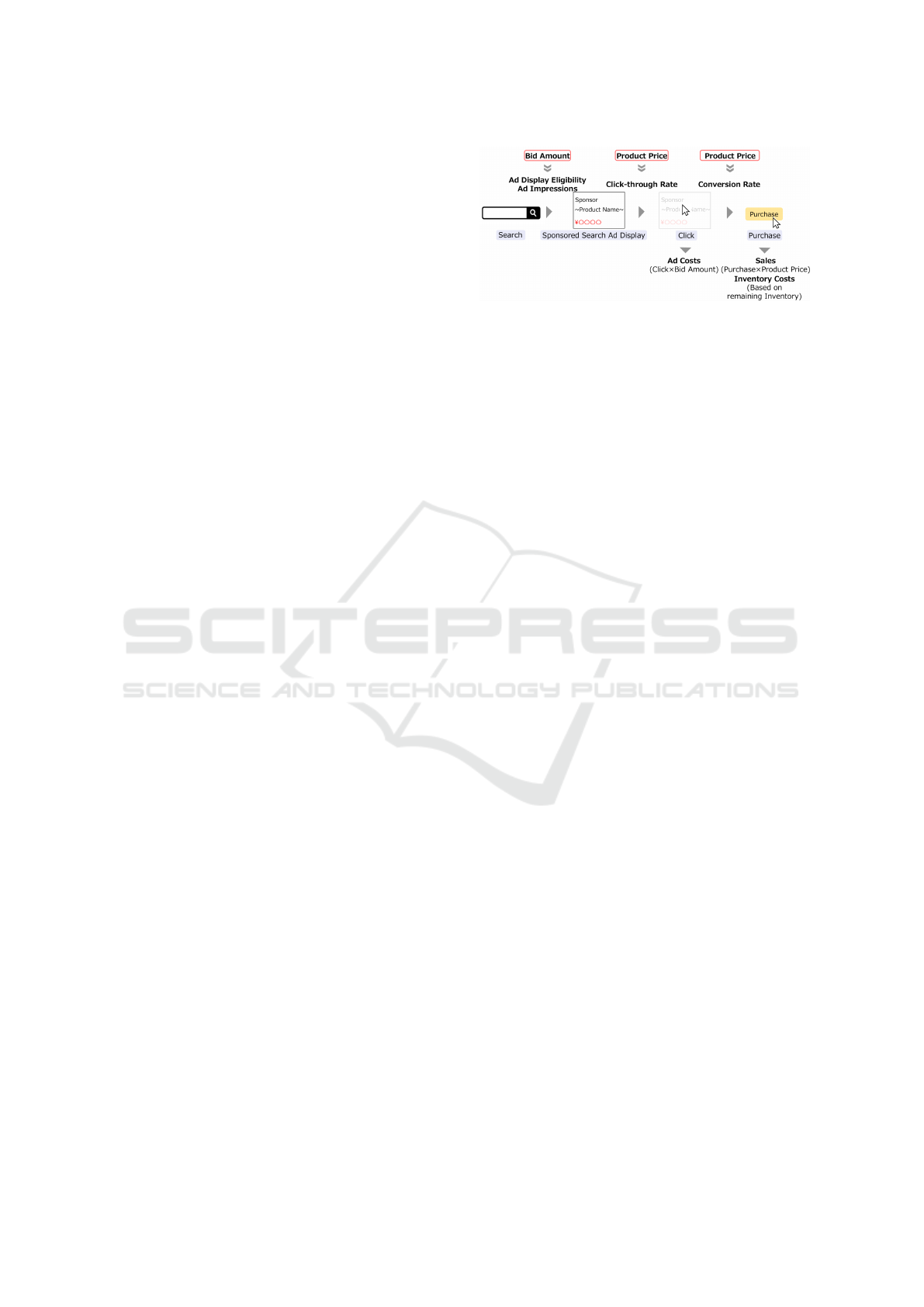

Based on these conditions, this paper considers

solving a multi-period optimization problem as an on-

line optimization problem for each period. In each

period, based on the process by which sales and profit

are generated on an e-commerce site (see Section

2.1), the flow through which the seller obtains sales

and profit is assumed as shown in Figure 6.

First, after a user performs a search, whether or

not an ad appears on the search results page and its

position depends on the bid amount (generally, ads

Figure 6: Flow until profit is generated for the seller.

displayed in higher positions tend to receive more im-

pressions). Next, whether the user clicks on the dis-

played ad depends on the click-through rate (CTR),

which is influenced by the product price. Similarly,

the conversion rate (CVR), which indicates whether

the user purchases the product after clicking, also de-

pends on the product price. Furthermore, advertis-

ing costs are incurred based on the number of clicks,

and sales are determined by multiplying the number

of conversions by the product price. Additionally, in-

ventory costs are incurred based on the remaining in-

ventory level.

Based on the above flow, the expected sales

u(b, p) for the seller is modeled as follows:

u(b, p) = p · φ

CTR

(p) · φ

CVR

(p) · v(b). (1)

In equation (1), b represents the bid amount, and p

represents the product price. The terms φ

CTR

(p) and

φ

CVR

(p) refer to functions for the click-through rate

and conversion rate, both of which are influenced by

the product price. Lastly, v(b) is a function represent-

ing the number of impressions determined by the bid

amount.

The expected profit for the seller is then modeled

as follows:

r(b, p) = u(b, p) − c(b, p). (2)

In equation (2), c(b, p) represents the cost in-

curred before the seller generates profit.

Additionally, budget constraints to ensure that ad-

vertising costs do not exceed the seller’s advertising

budget, as well as inventory constraints to ensure that

the number of conversions does not exceed the avail-

able inventory, are set as follows:

c(b, p) ≤ R, (3)

φ

CTR

(p) · φ

CVR

(p) · v(b) ≤ S. (4)

In equation (3,4), R and S represent the advertis-

ing budget and inventory quantity in period t, respec-

tively.

Online Joint Optimization of Sponsored Search Ad Bid Amounts and Product Prices on e-Commerce

71

4.2 Formulation of Sales Maximization

Based on Section 4.1 and previous research, we for-

mulate the sales maximization problem. In particular,

we construct a model suitable for the problem setting

of this paper concerning the study by Majima et al.

(2024).

However, since the number of impressions v(b)

and the advertising cost c(b, p) cannot be determined

a priori, it is necessary to predict these values. We

employ the Bayesian estimation method (Bayesian

AdComB-PT) used in Majima et al. (2024) to predict

the number of impressions and advertising costs.

Furthermore, as we cannot assume the convexity

of the functions for impressions and advertising costs,

it is difficult to obtain a globally optimal solution us-

ing continuous optimization methods. Therefore, we

treat these functions by discretizing them. The prob-

lem is formulated as a discrete optimization problem

by discretizing the combinations of bid amounts and

product prices.

4.2.1 Explanation of Parameters

We explain the parameters used in the formulation.

N denotes the number of keywords, representing

the total number of keywords used in advertising.

Next, P represents the number of price candidates,

indicating the number of possible product prices. B

is the number of bid candidates, which refers to the

number of potential advertising bid amounts. These

parameters are fundamental in building an advertis-

ing strategy.

The current inventory is represented by S, showing

the amount of stock on hand. The remaining advertis-

ing budget is denoted by R, representing the budget

left for advertising. The product price is expressed as

p

l

, representing the price set for each product.

v

i, j,l

refers to the predicted number of impressions

for keyword i, bid amount b

j

, and product price p

l

.

Similarly, c

i, j,l

represents the predicted advertising

cost under the same conditions. The sales volume

is denoted by u

i, j,l

, representing the number of units

sold for keyword i, bid amount b

j

, and product price

p

l

. x

i, j,l

is a binary variable, taking a value of 1 if the

combination of keyword i, bid amount b

j

, and prod-

uct price p

l

is selected, and 0 otherwise. Furthermore,

φ

CTR

(p

l

) represents the click-through rate (CTR) at

product price p

l

, and φ

CVR

(p

l

) represents the conver-

sion rate (CVR) at product price p

l

. The inventory

cost function is defined by h(·), which calculates costs

based on the inventory level. The functions for CTR,

CVR, and inventory costs will be discussed later. The

parameters introduced so far are summarized below:

N : Number of keywords

P : Number of price candidates

B : Number of bid candidates

S : Current inventory

R : Remaining budget

p

l

: Product price

v

i, j,l

: Predicted number of impressions

c

i, j,l

: Predicted advertising cost

u

i, j,l

: Sales volume

x

i, j,l

: Binary variable

φ

CTR

(p

l

) : Click-through rate at product price p

l

φ

CVR

(p

l

) : Conversion rate at product price p

l

h(·) : Inventory cost function

4.2.2 Objective Function

We now explain the objective function. Since the goal

of optimization is to maximize sales, the objective

function is the product of the predicted sales u

i, j,l

and

the decision variable x

i, j,l

:

N

∑

i=1

B

∑

j=1

P

∑

l=1

x

i, j,l

· u

i, j,l

· p

l

. (5)

Additionally, u

i, j,l

(the predicted number of con-

versions) is calculated as the product of the predicted

number of impressions, click-through rate, and con-

version rate:

u

i, j,l

= φ

CTR

(p

l

) · φ

CVR

(p

l

) · v

i, j,l

. (6)

4.2.3 Click-Through and Conversion Rate

Functions

Click-through rate (CTR) and conversion rate (CVR)

are defined as functions dependent on product price.

This reflects the assumption that when a product is

searched for on an e-commerce site, consumers make

click and conversion decisions based on the product

price.

Many studies (Li and Zheng, 2023; Bolton, 1989;

Lee et al., 2023) use a log-linear function to compute

price elasticity for their own products during specific

periods. This paper adopts a similar method. In this

case, the price elasticity of a product is equivalent to

the slope of the regression function’s β coefficient,

representing the change in sales volume for a given

change in price.

logQ

A

= α + β · log P

A

(7)

In equation (7), Q

A

represents the sales volume

of product A, α is the intercept, and β is the price

sensitivity of product A.

ICORES 2025 - 14th International Conference on Operations Research and Enterprise Systems

72

In this paper, we assume that each company can

calculate its products’ price elasticity. Therefore, we

treat the regression coefficients as parameters set by

each company.

Since both click-through rate and conversion rate

take values between 0 and 1, we use a sigmoid func-

tion to represent them. Based on this, the functions

for CTR and CVR are defined as follows:

φ

CTR

(p) = σ(α

CTR

+ β

CTR

log(p))

φ

CVR

(p) = σ(α

CVR

+ β

CVR

log(p))

(8)

In equation (8), σ(z) =

1

1+e

−z

is the sigmoid func-

tion, and α

CTR

, β

CTR

, α

CVR

, β

CVR

are parameters.

4.2.4 Constraints

This section explains the four types of constraints

used in the optimization.

• Budget Constraint

This constraint ensures that the advertising cost

c

i, j,l

stays within the given advertising budget for

each period. While it is possible to set a lower

limit as well as an upper limit on the budget, in

the sales maximization problem, the optimization

is expected to consume as much budget as possi-

ble, so no lower limit is set. To prevent the budget

from being exhausted at the start of the period, the

budget for each period is set as the remaining bud-

get divided by the number of remaining periods:

N

∑

i=1

B

∑

j=1

P

∑

l=1

x

i, j,l

· c

i, j,l

≤

R

T − t + 1

. (9)

• Inventory Constraint

This constraint limits the number of conversions

u

i, j,l

to stay within the available inventory for each

period:

N

∑

i=1

B

∑

j=1

P

∑

l=1

x

i, j,l

· u

i, j,l

≤ S. (10)

For simplicity, this paper sets only an upper in-

ventory limit, but depending on the objectives, the

problem can also be formulated to approach the

optimal inventory level.

• Same Price for Each Product Constraint

This constraint ensures that the same product

price is used across different keywords searched

by users for the same product. In equation (11),

p

′

l

is a binary variable indicating whether a spe-

cific price is applied to the product. The following

constraint holds under the assumption that each

keyword is assigned a single bid amount:

N · p

′

l

=

N

∑

i=1

B

∑

j=1

x

i, j,l

∀l ∈ {1, 2, . . . , P}. (11)

• Single Bid Amount and Product Price Selec-

tion per Keyword Constraint

This constraint ensures that only one combination

of bid amount and product price is selected for

each keyword:

B

∑

j=1

P

∑

l=1

x

i, j,l

= 1 ∀i ∈ {1, 2, . . . , N}. (12)

4.2.5 Formulation

Based on the above, the sales maximization problem

for each period handled in this paper can be summa-

rized as follows. The variables are x

i, j,l

and p

′

l

:

max

N

∑

i=1

B

∑

j=1

P

∑

l=1

x

i, j,l

· u

i, j,l

· p

l

subject to

N

∑

i=1

B

∑

j=1

P

∑

l=1

x

i, j,l

· c

i, j,l

≤

R

T − t + 1

,

B

∑

j=1

P

∑

l=1

x

i, j,l

= 1 ∀i ∈ [N],

N · p

′

l

=

N

∑

i=1

B

∑

j=1

x

i, j,l

∀l ∈ [P],

N

∑

i=1

B

∑

j=1

P

∑

l=1

x

i, j,l

· u

i, j,l

≤ S,

x

i, j,l

∈ {0, 1}, p

′

l

∈ {0, 1},

∀i ∈ [N], ∀ j ∈ [B], ∀l ∈ [P].

(13)

The optimization problem (13) is an integer pro-

gramming problem and can be solved using a general-

purpose integer programming solver. This model al-

lows finding the optimal combination of bid amount

and product prices to maximize sales while efficiently

utilizing the advertising budget.

4.3 Formulation of the Profit

Maximization Problem

In Section 4.2, we formulated the maximization prob-

lem to maximize the seller’s sales. The sales max-

imization problem is effective, especially when the

goal is to exhaust the budget within the period or re-

duce inventory as much as possible. This applies to

situations where the focus is on increasing product

awareness. On the other hand, in actual business, it

is often essential to consider the costs incurred before

generating sales and making efficient decisions re-

garding bid amount and product prices. Therefore, in

this chapter, the objective of the optimization is profit

maximization, balancing sales and costs. Specifically,

Online Joint Optimization of Sponsored Search Ad Bid Amounts and Product Prices on e-Commerce

73

based on the process of generating sales and profits on

e-commerce sites (2.1), the costs considered in this

paper include advertising costs and inventory costs.

Advertising costs depend on bid amounts and product

prices, while inventory costs depend on the duration

and size of product storage.

4.3.1 Objective Function

Since our goal is to maximize total profit, the objec-

tive function is defined as the predicted profit (pre-

dicted sales - advertising costs - inventory costs) mul-

tiplied by the decision variable x

i, j,l

, which is ex-

pressed as follows:

N

∑

i=1

B

∑

j=1

P

∑

l=1

x

i, j,l

u

i, j,l

· p

l

− c

i, j,l

− h

S − u

i, j,l

(14)

4.3.2 Inventory Cost Function

The inventory cost h(S) is defined as a linear function

of the inventory level. Specifically, the inventory cost

increases depending on the amount of goods held in

stock from this period to the next. The proportional

coefficient is proportional to the size of the product

and is a parameter that the seller can set. This reflects

the fact that e-commerce sites like Amazon set storage

fees based on the size and quantity of the inventory

(Amazon, 2024).

4.3.3 Formulation

Based on the above, the profit maximization problem

for each period handled in this paper is defined as

shown in (15), where the variables are x

i, j,l

and p

′

l

.

As in (13), the optimization problem (15) can also

be solved using a general-purpose integer program-

ming solver. This model allows one to find the opti-

mal combination of bid amount and product prices to

maximize sales and minimize inventory costs while

efficiently using the advertising budget.

5 NUMERICAL EXPERIMENTS

5.1 Experimental Setup

In this study, we evaluated the performance of the pro-

posed method using a simulation-based experimental.

max

N

∑

i=1

B

∑

j=1

P

∑

l=1

x

i, j,l

u

i, j,l

· p

l

− c

i, j,l

−h(S − u

i, j,l

)

subject to

N

∑

i=1

B

∑

j=1

P

∑

l=1

x

i, j,l

· c

i, j,l

≤

R

T − t + 1

,

B

∑

j=1

P

∑

l=1

x

i, j,l

= 1 ∀i ∈ [N],

N · p

′

l

=

N

∑

i=1

B

∑

j=1

x

i, j,l

∀l ∈ [P],

N

∑

i=1

B

∑

j=1

P

∑

l=1

x

i, j,l

· u

i, j,l

≤ S,

x

i, j,l

∈ {0, 1}, p

′

l

∈ {0, 1},

∀i ∈ [N], ∀ j ∈ [B], ∀l ∈ [P].

(15)

Since it was difficult to access a real-world opera-

tion, we adopted a simulation-based approach. The

simulator employed in this study was designed to

replicate the operational environment of e-commerce

platforms based on real advertising log data. Further-

more, the simulator was extended from the one pro-

posed in Majima et al. (2024) to align with the objec-

tives of this study. Specifically, while Majima et al.

(2024) assumes constant product prices, we modified

the simulator to account for the effects of price fluc-

tuations on sales, CTR, and CVR.

To the best of our knowledge, there are no exist-

ing methods that can be directly applied to our prob-

lem setting. Thus, we conducted comparative exper-

iments under various scenarios. We showed the spe-

cific experimental setting in Table 1. For everyday

items, we assume a low price elasticity. In contrast,

luxury goods are assumed to have high price elastic-

ity. This distinction is critical as it allows us to explore

various pricing patterns and evaluate their impact on

sales performance. In our experiments, we set the pa-

rameters to N = 10, B = 20, P = 20, and T = 10. The

Gurobi Optimizer (Optimization, 2022) was used to

solve mixed-integer programming problems. For the

current problem, it was solved within 10 seconds. Ad-

ditionally, even when increasing the values of N, B, P,

and T, Gurobi solved the problem without any issues.

Additionally, this paper compares and evaluates

the following six models:

• Model 1 (Proposed Method)

A model that optimizes both bid amounts and

product prices.

• Model 2 (Lowest Price Fixed Model)

A model that optimizes only the bid amounts, fix-

ing the product price at the lowest among the can-

didates.

ICORES 2025 - 14th International Conference on Operations Research and Enterprise Systems

74

Table 1: Experimental Settings.

Experimental Setting Assumed Product Objective Function Budget Supply Inventory per Period

Setting A Everyday Item Sales Maximization 5,000,000 200

Setting B Luxury Good Sales Maximization 2,000,000 50

Setting C Everyday Item Profit Maximization 5,000,000 100

Setting D Luxury Good Profit Maximization 2,000,000 25

• Model 3 (Highest Price Fixed Model)

A model that optimizes only the bid amounts, fix-

ing the product price at the highest among the can-

didates.

• Model 4 (Lowest Bid Fixed Model)

A model that optimizes only the product prices,

fixing the bid amount at the lowest among the can-

didates.

• Model 5 (Highest Bid Fixed Model)

A model that optimizes only the bid amounts, fix-

ing the bid amount at the highest among the can-

didates.

• Model 6 (Random Model)

A model that randomly selects bid amounts and

product prices.

5.2 Optimization Results

In this section, we present the simulation results for

the sales maximization problem and profit maximiza-

tion problems, demonstrating the proposed method’s

effectiveness.

The experimental results using the simulator are

illustrated in Tables 2, 3, 4, and 5. Tables 2 and 3

present the results for the sales maximization prob-

lem, while Tables 4 and 5 show the results for the

profit maximization problem. The results indicate the

improvement rates based on the metrics from the ran-

dom model (Model 6). Empty cells indicate that the

model was not executable.

The proposed method (Model 1) demonstrates that

optimizing both the bid amount and product price

can achieve the highest sales and profit. The random

model (Model 6) was found to be ineffective, as it

failed to utilize advertising budgets and inventory ef-

ficiently. Models 2 and 3 optimized bid amounts, but

Model 2’s low prices increased CTR and CVR while

leaving advertising budgets underutilized due to in-

ventory constraints. Model 3, with high prices, re-

duced CTR and CVR, limiting conversions. Models

4 and 5, which fixed bid amounts, either overspent

or underutilized advertising budgets. The proposed

method addressed these issues, overcame these chal-

lenges, and achieved improvements in both sales and

profits. The foundational research for this paper (Ma-

jima et al., 2024) focused on optimizing only the bid

amounts, but it has been demonstrated that optimizing

the product price in tandem further enhances overall

sales.

In the next sections, we will discuss the proposed

method’s optimal solution and validity. The experi-

mental results in these discussions will be based on

experimental settings A and C, but similar trends are

observed in experimental settings B and D.

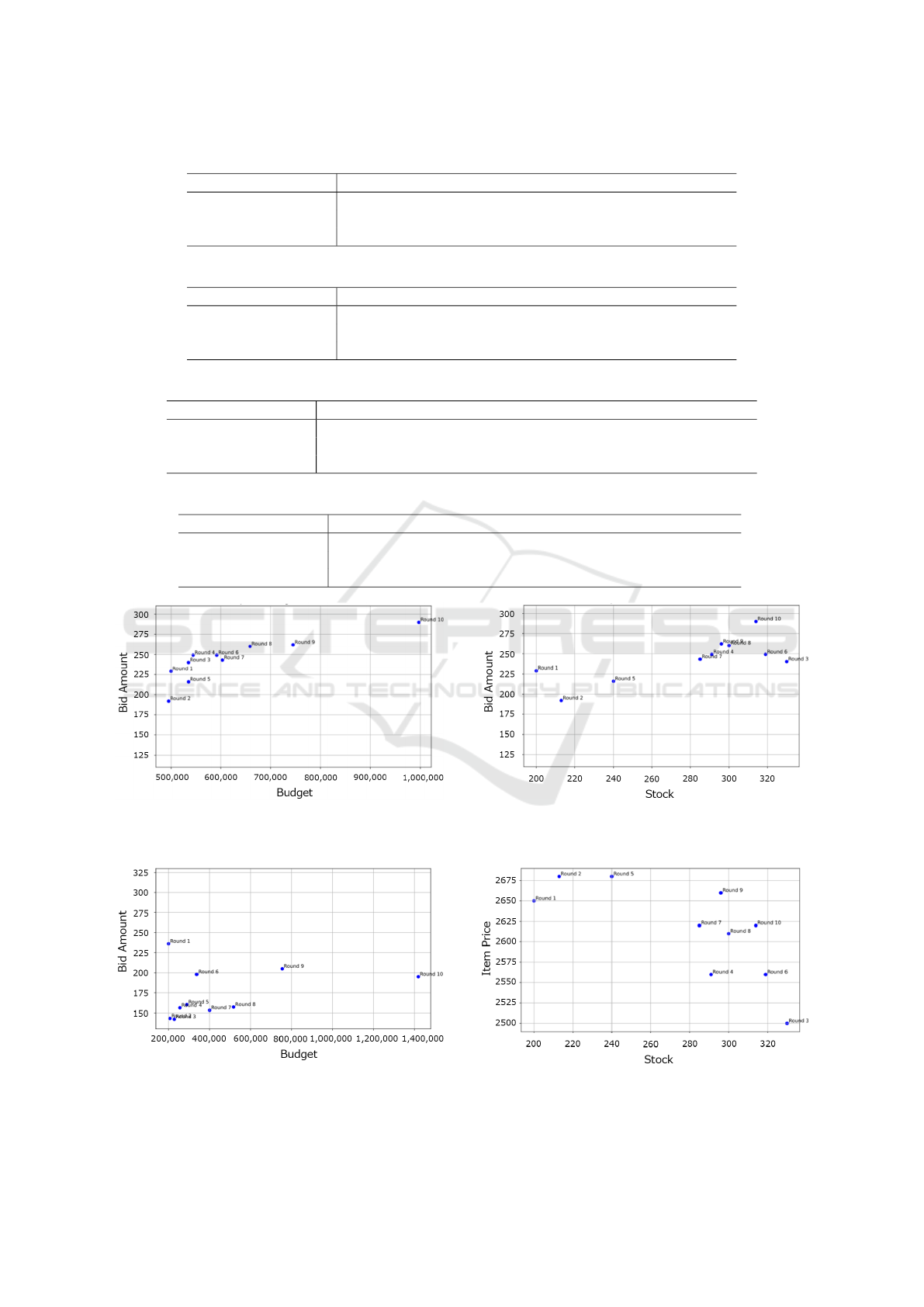

5.3 Validation of the Optimal Solution

of the Proposed Method

In this section, we will examine the optimal solu-

tion of the proposed method to validate its effec-

tiveness. First, we illustrate the scatter plots of the

remaining advertising budget and the optimized bid

amounts for each period in Figures 7 (sales maxi-

mization problem) and 8 (profit maximization prob-

lem). The figures’ notation “round n” represents the

points for the n-th period. As illustrated, both in the

sales maximization problem and the profit maximiza-

tion problem, a higher remaining advertising budget

corresponds to a higher bid amount. This can be in-

terpreted as an attempt to increase sales by improv-

ing the number of impressions when there is a suf-

ficient advertising budget. As a result, the proposed

method produced reasonable outcomes. However, in

the profit maximization problem, due to the optimiza-

tion considering advertising costs, there is a tendency

to choose lower bid amounts compared to the sales

maximization problem, which can also be deemed re-

alistic.

Next, we illustrate the relationship between inven-

tory levels(Stocks) and the optimized bid amounts as

well as product prices for each period in Figures 9

and 10 (sales maximization problem), and Figures 11

and 12 (profit maximization problem). As illustrated,

both in the sales maximization problem and the profit

maximization problem, it was observed that higher

inventory levels were linked to higher bid amounts

while also indicating a tendency to opt for lower prod-

uct prices. This aligns with realistic expectations and

confirms that valid results were obtained through the

proposed method.

Online Joint Optimization of Sponsored Search Ad Bid Amounts and Product Prices on e-Commerce

75

Table 2: Experimental Results for Setting A.

Model1 Model2 Model3 Model4 Model5 Model6

Remaining Budget −89% −73% −100% +130% - 0%

Remaining Inventory −93% −87% −71% +254% - 0%

Sales +47% +32% +32% −68% - 0%

Table 3: Experimental Results for Setting B.

Model1 Model2 Model3 Model4 Model5 Model6

Remaining Budget −20% −8% −35% +89% - 0%

Remaining Inventory −51% −45% +9% +95% - 0%

Sales +22% +16% 0% −44% - 0%

Table 4: Experimental Results for Setting C.

Model1 Model2 Model3 Model4 Model5 Model6

Remaining Budget +368% +354% +348% +524% - 0%

Remaining Inventory +8800% +10500% +20600% +52700% - 0%

Profit +32% +24% +16% +31% - 0%

Table 5: Experimental Results for Setting D.

Model1 Model2 Model3 Model4 Model5 Model6

Remaining Budget +1160% +1280% +680% +1590% - 0%

Remaining Inventory +550% +743% +493% +1243% - 0%

Profit +6% +2% +4% −20% - 0%

Figure 7: Relationship between the remaining advertising

budget (Budget) and the optimal solution (Bid Amount) for

each period (Sales Maximization Problem).

Figure 8: Relationship between the remaining advertising

budget and the optimal solution (Bid Amount) for each pe-

riod (Profit Maximization Problem).

Figure 9: Relationship between inventory levels (Stocks)

and the optimal solution (Bid Amount) for each period

(Sales Maximization Problem).

Figure 10: Relationship between inventory levels and the

optimal solution (Product Price) for each period (Sales

Maximization Problem).

ICORES 2025 - 14th International Conference on Operations Research and Enterprise Systems

76

Figure 11: Relationship between inventory levels and the

optimal solution (Bid Price) for each period (Profit Maxi-

mization Problem).

Figure 12: Relationship between inventory levels and the

optimal solution (Product Price) for each period (Profit

Maximization Problem).

6 CONCLUSION

In this paper, we proposed a joint optimization

method for advertising bid amounts and product

prices to maximize the sales and profits of sellers on

e-commerce platforms. Unlike previous studies that

focused on either bid amounts or product prices indi-

vidually, our approach aims to achieve a more realis-

tic and effective optimization by considering the inter-

dependence between the two. The proposed method

uses a machine learning model to predict the num-

ber of impressions and advertising costs, thereby op-

timizing the bid amounts, advertising budget, prod-

uct prices, and inventory control while considering

their mutual interdependencies. This enables sellers

to comprehensively optimize both bid amounts and

product prices simultaneously.

The results of numerical experiments illustrate

that the proposed method significantly improves sales

and profits compared to conventional methods that

only optimize bid amounts. In particular, the ef-

fective allocation of inventory management and ad-

vertising budget proves crucial, as properly handling

these factors leads to sales and profit maximization.

Specifically, the proposed method, which optimizes

both bid amounts and product prices, achieved higher

sales and profits than other models, such as fixed-

price models, fixed-bid models, and random models.

Furthermore, we explored the relationship between

bid amounts and product prices, illustrating that the

proposed method selects the optimal bid amounts and

product prices based on the remaining advertising

budget and inventory levels for each round.

Moreover, in the profit maximization problem, we

incorporated advertising costs and inventory holding

costs into the optimization, constructing a model that

is closer to real-world operations. We also examined

the differences in remaining inventory levels depend-

ing on the magnitude of inventory holding costs, fur-

ther illustrating the validity of the proposed method.

These results demonstrate that the proposed method

provides a practical and effective strategy for sellers

in the real e-commerce market.

As for future work, We think that constructing

more accurate demand functions is a potential direc-

tion. In this paper, demand is modeled as solely de-

pendent on price, but in reality, numerous factors in-

fluence demand. By incorporating these factors, it

will be possible to more accurately predict the base-

line demand and price sensitivity, thereby refining the

price elasticity curve. Specifically, following the ap-

proach used by Li and Zheng (2023), we will consider

incorporating customer demographics and real-time

market information (e.g., sales events) into demand

forecasting. For example, we can construct a demand

function that reflects these variables by collecting ex-

ternal data such as customer demographics, purchase

history, social media trends, and competitor pricing.

This approach allows us to express baseline demand

and price sensitivity as coefficients in a logarithmic-

linear function.

Additionally, a model that accounts for the uncer-

tainty in predicting impressions and advertising costs

could be explored. For this, applying robust opti-

mization methods may be effective. Robust optimiza-

tion considers the worst-case scenario for uncertain

parameters, enabling optimal decision-making even

under uncertainty. This approach would help miti-

gate the risks associated with inaccurate predictions

of advertising costs and impressions, ensuring stable

performance. Specifically, this approach sets a range

of uncertainty in determining bid amounts and prod-

uct prices and finds the optimal solution within that

range. This would help avoid extreme losses even if

predictions deviate from expectations.

Furthermore, there is room to improve budget

control methods. For instance, a strategy could be

devised to spend a more significant portion of the

Online Joint Optimization of Sponsored Search Ad Bid Amounts and Product Prices on e-Commerce

77

budget at the start of the period and intensively de-

ploy ads to boost future sales. This approach could

lead to early market share acquisition and long-term

profit increases while also ensuring the budget is fully

utilized. However, from another perspective, it may

be more optimal to allocate less of the budget at the

start of a period with high uncertainty and conserve

the budget until the situation becomes more apparent,

maximizing overall profits across the entire period.

More effective advertising strategies can be realized

by flexibly adjusting budget allocation within the pe-

riod.

By introducing these methods, we can construct

more accurate optimization models, contributing to

the maximization of sellers’ sales and profits on e-

commerce platforms. Extending the proposed method

and validating its effectiveness in real-world environ-

ments rather than through simulations could lead to

developing strategies that maximize sellers’ sales and

profits.

REFERENCES

Amazon (2024). Inventory Storage Fees in Amazon

Stores. https://sell.amazon.co.jp/en/pricing (Accessed

on 06/17/2024).

AmazonAds (2022). How Does Bidding

Work with Amazon Ads? https:

//advertising.amazon.com/en-us/library/videos/

campaign-bidding-sponsored-products (Accessed on

06/17/2024).

Besbes, O. and Zeevi, A. (2015). On the (surprising) suffi-

ciency of linear models for dynamic pricing with de-

mand learning. Management Science, 61(4):723–739.

Bolton, R. N. (1989). The relationship between mar-

ket characteristics and promotional price elasticities.

Marketing Science, 8(2):153–169.

Chen, L., Mislove, A., and Wilson, C. (2016). An empiri-

cal analysis of algorithmic pricing on amazon market-

place. In Proceedings of the 25th International Con-

ference on World Wide Web, pages 1339–1349.

Chen, W., Wang, Y., and Yuan, Y. (2013). Combinatorial

multi-armed bandit: General framework and applica-

tions. In Proceedings of the 30th International Con-

ference on Machine Learning, pages 151–159.

DENTSU INC. (2024). 2023 Advertising Expenditures in

Japan: Detailed Analysis of Expenditures on Inter-

net Advertising Media. https://www.dentsu.co.jp/en/

news/release/2024/0312-010705.html (Accessed on

06/17/2024).

Gharakhani, B., Ghandehari, M., and Ansari, A. (2022). A

mathematical model for optimizing pricing-inventory,

and advertising frequency decisions with a multivari-

ate demand function and a time-dependent holding-

cost function. International Journal of Management

Science and Engineering Management, pages 1–17.

GoogleAds (2024). About Ad Quality. https://support.

google.com/google-ads/answer/156066 (Accessed on

06/17/2024).

Jamil, D. A., Mahmood, R. K., and Ismail, Z. S. (2022).

Consumer purchasing decision: Choosing the market-

ing strategy to influence consumer decision making.

Journal of Marketing Research.

Koupriouchina, L., van der Rest, J.-P., and Schwartz, Z.

(2014). On revenue management and the use of occu-

pancy forecasting error measures. International Jour-

nal of Hospitality Management, 41:104–114.

Lee, K. H., Abdollahian, M., Schreider, S., and Taheri, S.

(2023). Supply chain demand forecasting and price

optimisation models with substitution effect. Mathe-

matics, 11(2502).

Li, X. and Zheng, Z. (2023). Dynamic pricing with exter-

nal information and inventory constraint. Technical

report, UC Berkeley IEOR Department.

Liu, J., Zhang, Y., Wang, X., Deng, Y., and Wu, X.

(2019). Dynamic pricing on e-commerce platform

with deep reinforcement learning. arXiv preprint

arXiv:1912.02572, pages 1–11.

Majima, K., Kawakami, K., Ishizuka, K., and Nakata, K.

(2024). Keyword-level bayesian online bid optimiza-

tion for sponsored search advertising. Operations Re-

search Forum, 5.

Nuara, A., Trov

`

o, F., Gatti, N., and Restelli, M. (2022).

Online joint bid/daily budget optimization of inter-

net advertising campaigns. Artificial Intelligence,

305:103663.

Optimization, G. (2022). Gurobi optimizer reference

manual. https://www.gurobi.com (Accessed on

06/17/2024).

Schlosser, R. and Richly, K. (2019). Dynamic pricing under

competition with data-driven price anticipations and

endogenous reference price effects. Journal of Rev-

enue and Pricing Management, 18:451–464.

Srinivas, N., Krause, A., Kakade, S., and Seeger, M. (2010).

Gaussian process optimization in the bandit setting:

No regret and experimental design. In Proceedings of

the 27th International Conference on Machine Learn-

ing, pages 1015–1022.

Yang, W., Xiao, B., and Wu, L. (2020). Learning and pric-

ing models for repeated generalized second-price auc-

tion in search advertising. European Journal of Oper-

ational Research, 282(2):696–711.

ICORES 2025 - 14th International Conference on Operations Research and Enterprise Systems

78