Deep Reinforcement Learning for Auctions: Evaluating Bidding

Strategies Effectiveness and Convergence

Luis Eduardo Craizer

1 a

, Edward Hermann

1 b

and Moacyr Alvim Silva

2 c

1

Pontif

´

ıcia Universidade Cat

´

olica, 22451-900, Rio de Janeiro, RJ, Brazil

2

Fundac¸

˜

ao Getulio Vargas, 22250-145, Rio de Janeiro, RJ, Brazil

Keywords:

Auction Theory, Nash Equilibrium, Deep Reinforcement Learning, Multi-Agent Systems.

Abstract:

This paper extends our previous work on using deep reinforcement learning, specifically the MADDPG al-

gorithm, to analyze and optimize bidding strategies across different auction scenarios. Our current research

aims to empirically verify whether the agents’ optimal policies, achieved after model convergence, approach

a near-Nash equilibrium in various auction settings. We propose a novel empirical strategy that compares

the learned policy of each agent, derived through the deep reinforcement learning algorithm, with an optimal

bid strategy obtained via an exhaustive search based on bid points from other participants. This comparative

analysis encompasses different auctions, revealing various equilibrium scenarios. Our findings contribute to a

deeper understanding of decision-making dynamics in multi-agent environments and provide valuable insights

into the robustness of deep reinforcement learning techniques in auction theory.

1 INTRODUCTION

1.1 Problem Statement

Building on our previous work, this study delves

deeper into applying deep reinforcement learning

(DRL) to improve bidding strategies in various auc-

tion formats, specifically focusing on the Multi-Agent

Deep Deterministic Policy Gradient (MADDPG) al-

gorithm.

1

Our current research seeks to empiri-

cally determine whether the optimal policies devel-

oped through agent convergence align with a near-

Nash equilibrium

2

in these auction environments. To

this end, we introduce an innovative empirical strat-

egy that compares DRL-derived policies with opti-

mal bidding strategies obtained by exhaustive search

for bids from other participants. By examining dif-

ferent auction types, this study aims to evaluate the

a

https://orcid.org/0009-0001-5112-2679

b

https://orcid.org/0000-0002-4999-7476

c

https://orcid.org/0000-0001-6519-1264

1

This section was written with grammatical and lexical

revisions made with the help of ChatGPT-3.

2

”Near-Nash equilibrium” refers to a situation in which

the strategies of the players are close to a Nash equilibrium,

meaning that while the strategies are not perfectly balanced,

they are sufficiently close such that deviations would not

significantly improve any player’s outcome.

effectiveness of DRL in achieving equilibrium bid-

ding behaviors and to provide a comprehensive anal-

ysis of its adaptability across various auction scenar-

ios. Our findings show that the proposed evaluation

method aligns with theoretical expectations of near-

Nash equilibrium convergence in several auction set-

tings. However, we also identify instances where

agents stabilize without fully converging to optimal

strategies, particularly in more complex environments

like all-pay auctions. These cases, where agents may

tend to bid zero, highlight the importance of metrics

that measure deviations from equilibrium. With its

challenging equilibrium structure, the all-pay auction

format serves as a key motivator for developing this

tool to diagnose these deviations and guide future im-

provements. A significant contribution of this study is

the development of a diagnostic tool designed to eval-

uate agent behavior in auction settings, offering in-

sights into both convergence to equilibrium strategies

and deviations from them. By benchmarking agents’

strategies against exhaustive search results, the tool

provides a practical framework for assessing the ro-

bustness of DRL algorithms in multi-agent environ-

ments. Beyond its immediate application, this tool

holds broader potential by enabling analysis of auc-

tion settings where analytical solutions for equilib-

rium strategies are unknown. Validating its effective-

ness in auctions with established theoretical bench-

Craizer, L. E., Hermann, E. and Silva, M. A.

Deep Reinforcement Learning for Auctions: Evaluating Bidding Strategies Effectiveness and Convergence.

DOI: 10.5220/0013146400003890

In Proceedings of the 17th International Conference on Agents and Artificial Intelligence (ICAART 2025) - Volume 1, pages 367-376

ISBN: 978-989-758-737-5; ISSN: 2184-433X

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

367

marks builds confidence in its applicability to more

complex and less-explored scenarios. Ultimately, this

approach bridges the gap between theoretical auction

models and real-world applications, empowering the

study of diverse auction formats in multi-agent learn-

ing contexts.

1.2 Related Work

Deep Reinforcement Learning (DRL), which com-

bines deep learning and reinforcement learning, ad-

dresses decision-making problems without direct su-

pervision by training agents to maximize cumulative

rewards through trial and error in an environment, as

described by Sutton and Barto (Sutton, 2018). Sig-

nificant contributions from OpenAI and DeepMind,

including tools like Gymnasium and models like

DQN (Mnih et al., 2015), AlphaZero (Schrittwieser

et al., 2020), A3C (Mnih, 2016), and PPO (Schul-

man et al., 2017), have advanced the field consider-

ably. The evolution from single-agent to multi-agent

reinforcement learning (MARL) has introduced algo-

rithms like MADDPG and MAPPO, which address

non-stationarity and partial observability challenges,

showing promise in applications ranging from co-

operative multi-robot systems to competitive games.

Recent research in auction dynamics has extensively

utilized Deep Reinforcement Learning. Studies by

Kannan and Luong et al. employ computational agent

simulations to explore human decision-making in

auctions using DRL algorithms (Kannan et al., 2019)

and (Luong et al., 2018). Gemp’s work, which simu-

lates all-pay auctions, aligns closely with our research

by addressing scenarios where game-theoretic equi-

librium analysis is intractable (Gemp et al., 2022).

D

¨

utting and Feng contribute to auction theory with

neural networks for multi-item auctions, effectively

bridging expected and empirical regret gaps (D

¨

utting

et al., 2021). Notably, Bichler’s NPGA (Neural

Pseudo-Gradient Ascent) algorithm estimates equilib-

rium in symmetric auctions and identifies equilibria in

all-pay auctions, focusing on settings without explicit

equilibrium functions (Bichler et al., 2021) and (Ew-

ert et al., 2022). Bichler’s work is particularly relevant

as it tests deviations from neutral to risk equilibrium

in human agents, paralleling our study’s observations

in all-pay auctions and validating DRL’s applicability

in complex auction environments.

2 BACKGROUND

Auctions, often depicted as glamorous events featur-

ing rare items, actually encompass various formats

and purposes.

3

These platforms facilitate the ex-

change of numerous goods and services, ranging from

art to government bonds. Auctions can be classified

according to various factors, such as the number of

participants, the types of bid, the payment rules, and

the nature of the auctioned items. A fundamental dis-

tinction is between private value auctions and com-

mon value auctions, based on participants’ informa-

tion about the items. In private value auctions, each

participant has a personal subjective valuation of the

item, influenced by individual preferences or private

information. The winner, who submits the highest

bid, typically pays an amount that may be less than

their valuation, leading to diverse and strategic bid-

ding behaviors. Conversely, in common value auc-

tions, the item’s value is consistent across all bid-

ders but not fully known to any participant. The true

value depends on external factors that affect all bid-

ders equally, such as the potential for land develop-

ment in a land auction. Participants must make in-

formed bids based on their assessments and the avail-

able information, navigating the uncertainty of the

item’s true value. Our study focuses particularly on

sealed-bid private value auctions, where bids are con-

fidential, and participants aim to maximize their util-

ity by balancing the item’s perceived value against the

price paid. The specific reward calculations for each

auction type will be detailed in the following sections,

drawing from fundamental principles outlined in au-

thoritative texts such as (Klemperer, 1999), (Krishna,

2009) and (Menezes and Monteiro, 2008).

2.1 Algorithm Design

This research examines sealed-bid auctions that in-

volve a single item. Here, the auctioneer determines

the winning bid from the participating agents N. We

conduct n auction rounds to observe the agents’ be-

havior and learning patterns, seeking convergence in

their bids for each given value or signal over time.

Each player i has a value v

i

for the item. In pri-

vate value auctions, these values differ among par-

ticipants, while in common value auctions, all val-

ues are equal (v

1

= v

2

= ... = v

N

= v). The profit

function for each agent is defined based on their bids:

π

i

: B → R, where B is the vector space of possible

bids b = (b

1

, . . . , b

N

) of all agents. For example, in

a sealed first-price auction of private values, a (risk-

neutral) participant i’s profit function is:

π

i

(b

i

, b

i

) =

v

i

− b

i

if b

i

> max(b

i

)

0 otherwise

(1)

3

This section was written with grammatical and lexical

revisions made with the help of ChatGPT-3.

ICAART 2025 - 17th International Conference on Agents and Artificial Intelligence

368

where b

i

represents the bids of other participants, ex-

cluding b

i

.

2.2 The Rational Bid

Each participant i receives a signal s

i

, representing

their belief about the item’s value. In private value

auctions, s

i

directly reflects the true value v

i

for par-

ticipant i. Based on this signal, participant i formu-

lates a bid b

i

. The expected payoff for participant i is

given by:

E[u

i

|s

i

] =

Z

B

u(π(b

i

(s

i

), y)) f

b

i

(y|s

i

)

dy

Here, f

b

i

(y|s

i

)

is the probability density function of the

vector y, which contains the bids of other participants

given that participant i received signal s

i

. If values

are independent, the signal does not affect the density

function ( f

b

i

(y|s

i

)

= g

b

i

(y)). Participants aim to max-

imize their expected reward, which requires knowl-

edge of the function f

b

i

(y|s

i

)

, dependent on other play-

ers’ policies.

2.3 Types of Auctions

2.3.1 First Price Auction

In a first-price auction, the participant with the high-

est bid wins and pays the amount of their bid. The

winner’s reward is the difference between the item’s

value and the bid amount, while the other participants

receive no reward, as shown below:

Π

i

=

(

v

i

− b

i

if b

i

> max

j̸=i

(b

j

)

0 otherwise

(2)

where v

i

is player i’s valuation, b

i

is their bid, and

b

j

are the bids of other players. We aim to deter-

mine the optimal strategy for maximizing expected

profit. In a first-price auction with two risk-neutral

players with private values independently and identi-

cally distributed (i.i.d) in a uniform distribution [0, 1],

the bids

1

2

v

1

,

1

2

v

2

form a Nash equilibrium (Shoham

and Leyton-Brown, 2008). The optimal bid generally

follows the formula, especially for risk-neutral partic-

ipants, as shown in (Krishna, 2009)

b

∗

i

=

(N − 1)v

i

N

.

Interestingly, the optimal strategy in an English auc-

tion—a widely used format in real-world settings—is

equivalent to that of a first-price auction under cer-

tain conditions. In an English auction, participants

openly bid in ascending order until only one bidder

remains, who then pays the highest bid. This process

results in the same equilibrium bidding strategies as

the first-price auction when bidders are risk-neutral

and possess private values, as mentioned in (Dragoni

and Gaspari, 2012). This similarity demonstrates how

auction theory provides a unified framework to un-

derstand and compare different auction formats com-

monly used in practice.

2.3.2 Second Price Auction

Also known as a Vickrey auction, named after

economist William Vickrey, the second price auction

awards the item to the highest bidder, who pays the

amount of the second-highest bid. The winner’s re-

ward is the difference between their valuation and

the second-highest bid, as demonstrated in (Krishna,

2009):

Π

i

=

(

v

i

− b

2

if b

i

> max

j̸=i

(b

j

)

0 otherwise

(3)

where b

2

is the second-highest bid. Regardless of the

number of players N in this auction, agents are incen-

tivized to bid their true valuations, reaching a Nash

equilibrium where b

∗

i

= v

i

for each player i. Notably,

the Dutch auction—a descending-price auction where

the auctioneer lowers the price until a participant ac-

cepts it—yields the same outcomes as a first-price

auction when players are risk-neutral and have private

values, as described in (Frahm and Schrader, 1970).

While the Dutch auction operates differently from

the second-price auction, it shares similar theoretical

foundations, resulting in equivalent equilibrium out-

comes under certain conditions. This highlights the

flexibility of auction theory in comparing various auc-

tion formats and understanding their strategic equiva-

lences.

2.3.3 All-Pay Auction

In an all-pay auction, all participants pay their bids

regardless of winning, introducing a unique strategic

dimension. The highest bidder wins the item, with

their reward being the difference between the item’s

value and bid, while other participants incur the cost

of their bids. The payoff function for participant i is:

Π

i

=

(

v

i

− b

i

if b

i

> max

j̸=i

(b

j

)

−b

i

otherwise

(4)

The Nash equilibrium strategy for risk-neutral partic-

ipants in an all-pay auction, considering optimal bid

calculation, is:

b

∗

i

=

(N − 1)

N

v

N

i

.

Deep Reinforcement Learning for Auctions: Evaluating Bidding Strategies Effectiveness and Convergence

369

This formula captures the strategic balance of maxi-

mizing expected profit while considering the cost of

bids (Riley and Samuelson, 1981).

3 METHODOLOGY

3.1 Training the Agents

Our research investigates the effectiveness of deep

reinforcement learning (DRL) algorithms in learn-

ing bidding strategies for various auction scenar-

ios.

4

DRL combines reinforcement learning princi-

ples with deep learning techniques to enable agents

to learn optimal behaviours through interaction with

their environment. Agents receive a state representing

their current situation, act based on that state, and sub-

sequently change the environment, which provides

feedback in the form of rewards, as shown in Figure

1. Using neural networks, DRL algorithms can ap-

proximate complex value functions and policy distri-

butions, allowing agents to handle high-dimensional

state and action spaces. This flexibility makes DRL

particularly suitable for dynamic environments like

auctions, where strategies must adapt based on the ac-

tions of competing agents. In this study, we specif-

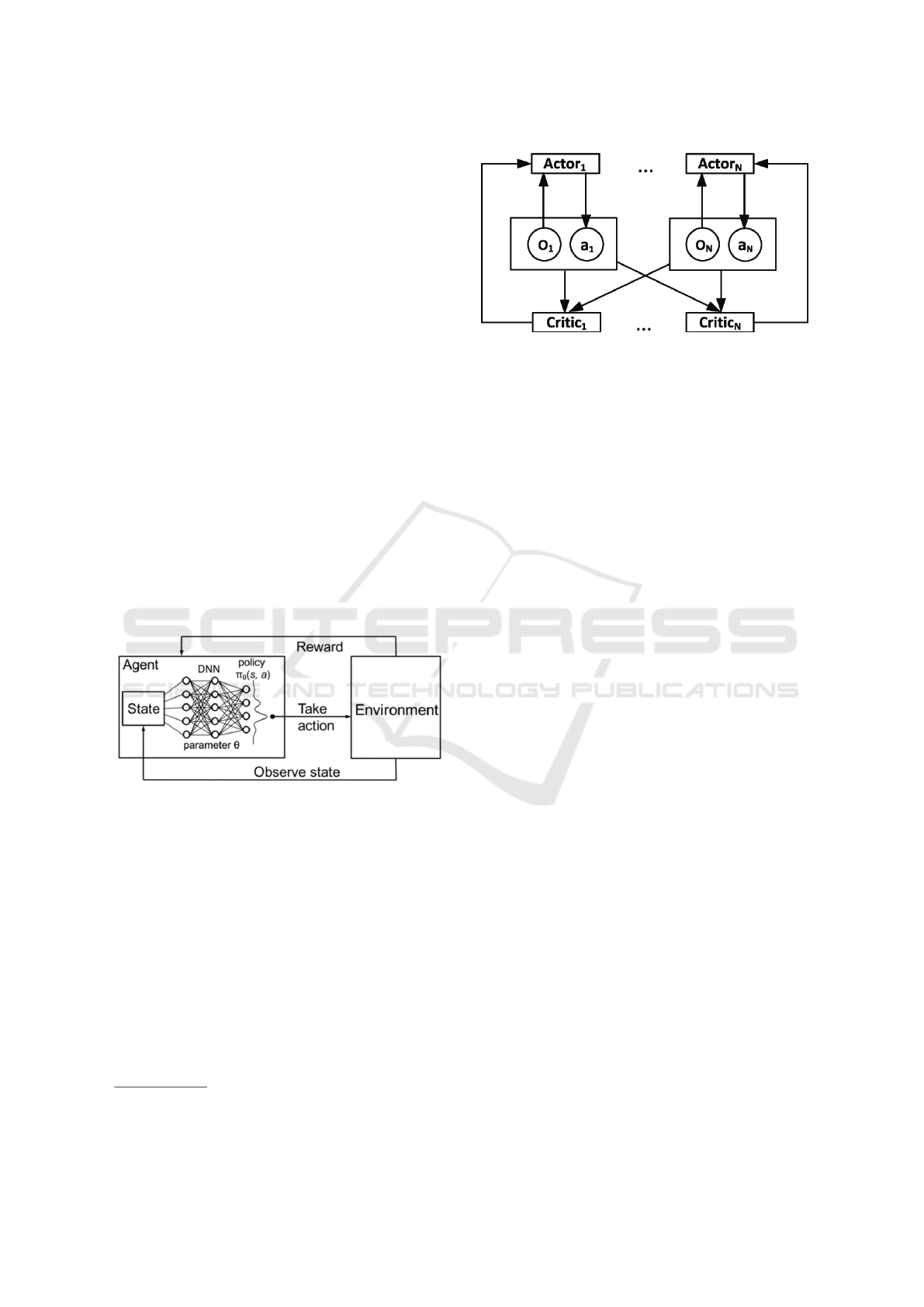

Figure 1: Deep Neural Network architecture in Reinforce-

ment Learning.

ically employ the Multi-Agent Deep Deterministic

Policy Gradient (MADDPG) algorithm, a variant of

the actor-critic method tailored for continuous ac-

tion spaces. In MADDPG, each agent has its own

actor and critic networks, but the training of the

critic networks incorporates the actions and obser-

vations of all agents, reflecting the interdependent

nature of multi-agent environments, as illustrated in

Fig. 2. This setup is well-suited to our auction

framework, where each auction round is treated as a

single-iteration episode, focusing on developing opti-

mal bidding strategies within that context. We imple-

ment a Replay Buffer to ensure stable training, storing

4

This section was written with grammatical and lexical

revisions made with the help of ChatGPT-3.

Figure 2: MADDPG Architecture - Figure taken from

(Zheng and Liu, 2019).

the agents’ interactions and experiences. This buffer

helps mitigate the correlation between consecutive

experiences, enhancing the training process. We ex-

plore various configurations, including the Combined

Experience Replay Buffer, which balances historical

and recent experiences, thus adapting to the evolving

policies of the agents. Additionally, we introduce dy-

namic noise into the agents’ actions to navigate the

exploration-exploitation trade-off, gradually reducing

it throughout the training process. This approach fa-

cilitates early exploration and later exploitation, fos-

tering adaptability and stability in learning. The train-

ing process involves iterative learning, where agents

aim to maximize their expected utility across multiple

auction instances. At the beginning of each iteration,

agents receive a random state, representing their pri-

vate value, and select actions corresponding to bids.

Rewards are assigned based on the auction’s payment

rules, guiding the agents in refining their policies to

optimize expected utility. The actor and critic net-

works are designed with two layers of 100 neurons

each, using sigmoid activation functions. Training pa-

rameters include a batch size of 64, an actor learning

rate of 0.000025, and a critic learning rate of 0.00025,

with a decrease factor of 0.99 to aid learning.

3.2 Equilibrium Evaluation

To evaluate the effectiveness of the trained agents,

we compare the optimal bids generated by the neural

network models with those obtained through an ex-

haustive search strategy. This strategy considers the

bid distributions of other participants to determine an

agent’s optimal bids. Specifically, we calculate the

probability of an agent winning the auction by count-

ing the times its bid is higher than the other partici-

pants. This measures how frequently the agent’s bid

would win the auction. Furthermore, we calculate

the expected payoff for each private value by sum-

ming the expected returns for each agent. We obtain a

comprehensive measure of each agent’s performance

ICAART 2025 - 17th International Conference on Agents and Artificial Intelligence

370

by integrating these probabilities into the expected re-

turn formula. We generate metrics to quantify the dif-

ferences between the optimal bids produced by the

neural network agents and those obtained through ex-

haustive searches. For precise calculations, we uti-

lize 200 private values for each agent, evenly dis-

tributed between 0 and 1, which is adequate to cap-

ture the variations in optimal bidding strategies. A

minimal difference indicates that the agent’s learned

policy closely aligns with the optimal bidding strat-

egy. When this difference is sufficiently small, the

agents have little incentive to deviate from their cur-

rent strategy, suggesting that they are approaching a

Nash equilibrium. This empirical method is designed

to verify equilibrium in auction settings, evaluating

the effectiveness of deep reinforcement learning algo-

rithms in achieving equilibrium bidding behaviours.

By analyzing these dynamics, we aim to gain valu-

able insights into the robustness and applicability of

the MADDPG algorithm and potentially other deep

reinforcement learning algorithms within auction the-

ory and multi-agent environments.

4 RESULTS

In this section, we present and analyze the outcomes

of our experiments, demonstrating the efficacy of our

proposed method in empirically verifying near-Nash

equilibrium convergence across different auction sce-

narios.

5

To evaluate the results, we measured both

the average and maximum deviations between the op-

timal bids—obtained through exhaustive search—and

those achieved by the neural network agents. By an-

alyzing both metrics, we ensure that no agent signif-

icantly deviates from the equilibrium, as a high error

from even a single agent would suggest an incentive

for strategy adjustment. Table 1 provides an overview

of the results, capturing key statistics across auction

types and different agent counts. It highlights whether

the agents converged to their optimal strategies and

also includes both the average and maximum error

observed for each scenario, giving a comprehensive

understanding of the convergence performance. Fig-

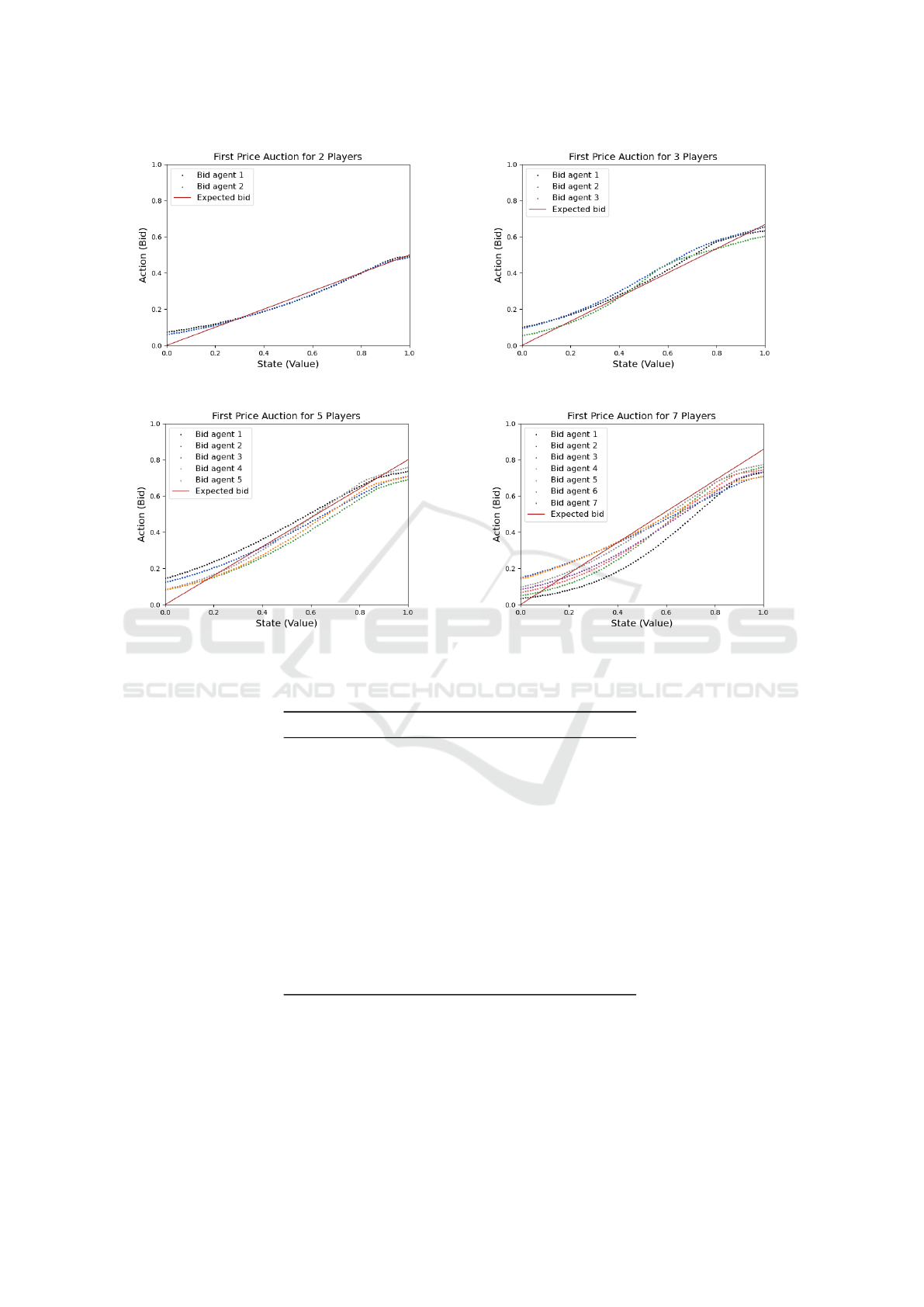

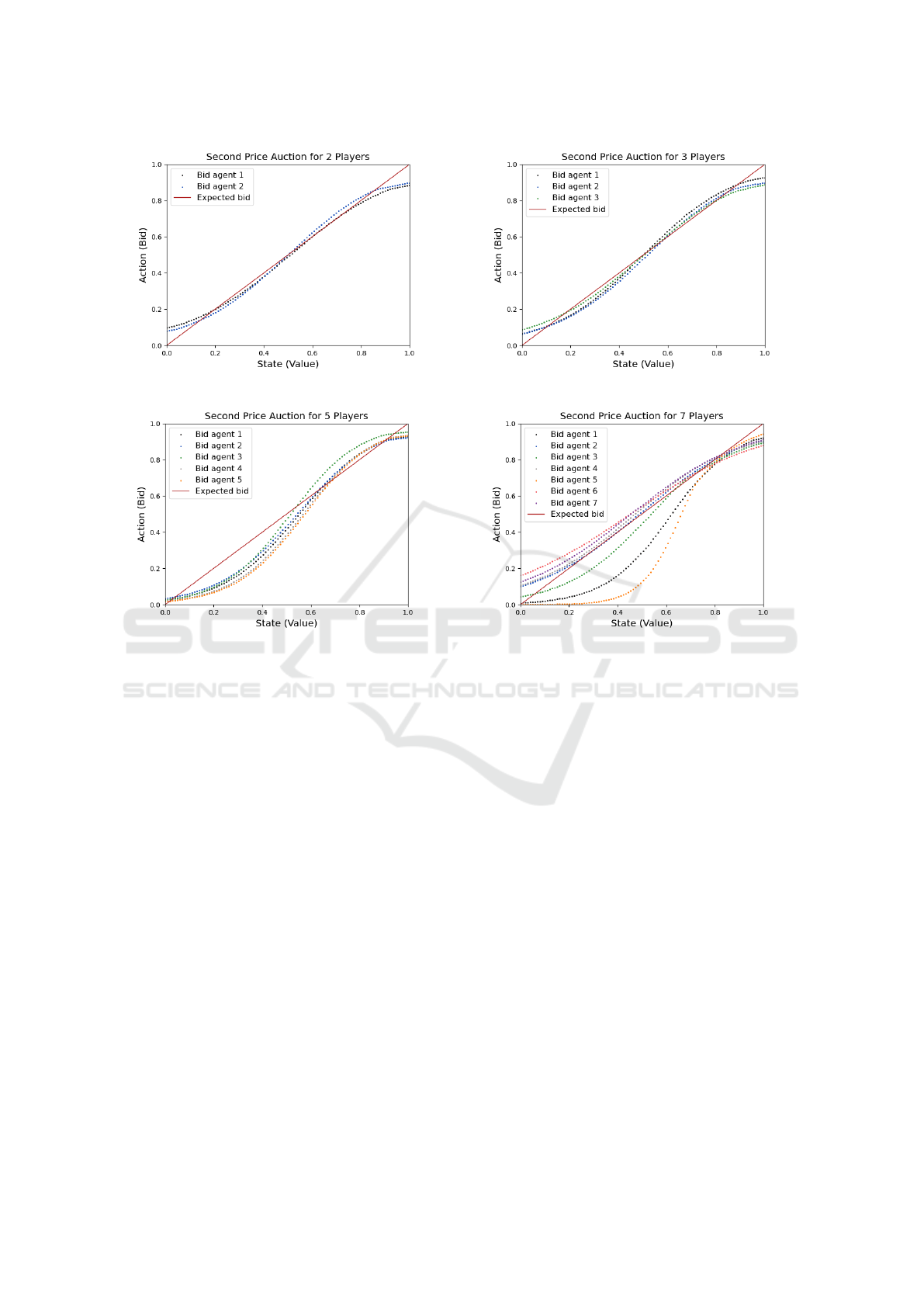

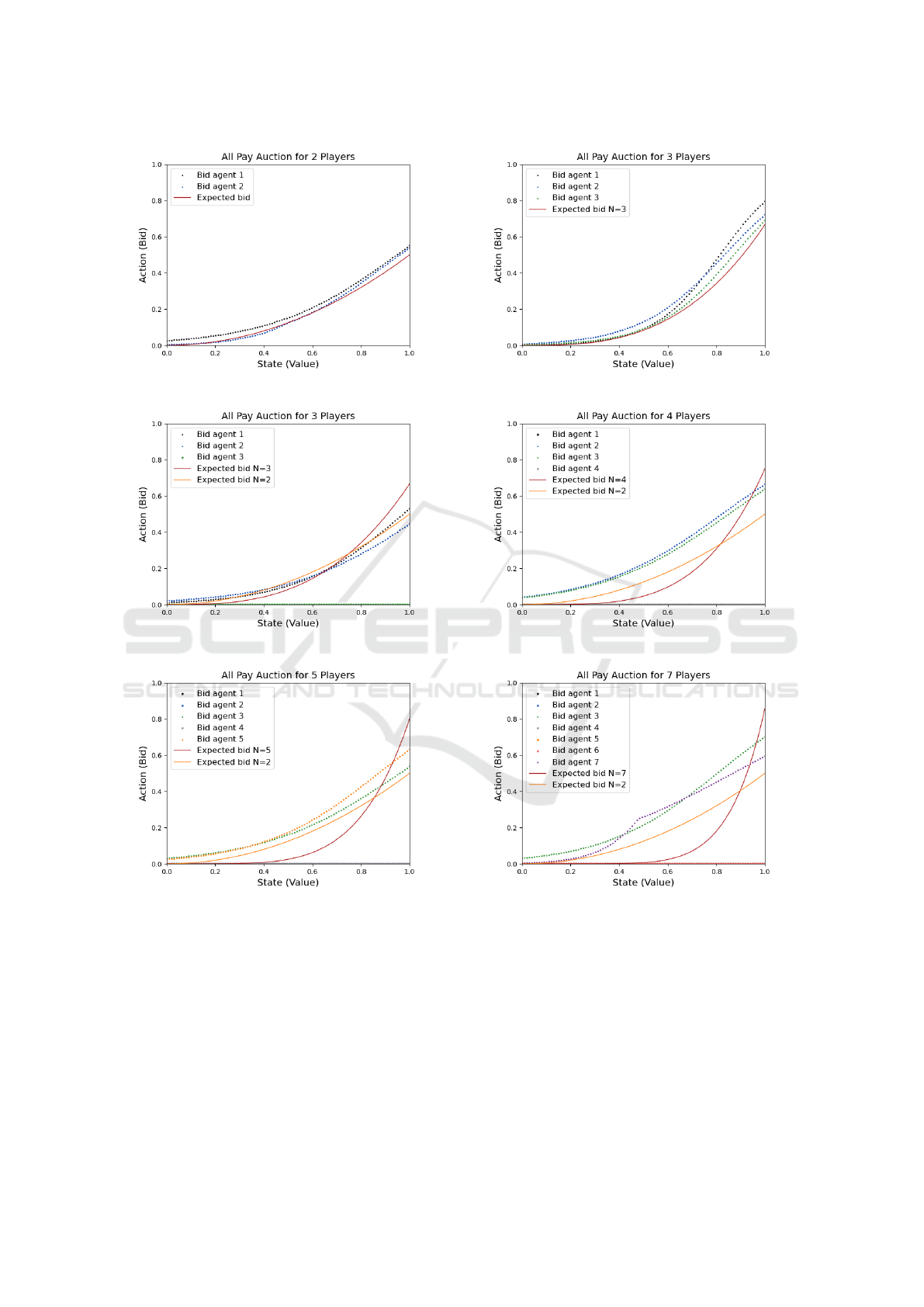

ures 3, 4, and 5 depict results for first-price, second-

price, and all-pay auctions, respectively, showcasing

the performance across various agent counts. Each

graph displays the expected optimal bid—shown as a

red line—and the agents’ actual bids, illustrating the

extent of convergence in each case. Smaller differ-

ences between the actual bids and the red curve repre-

sent successful convergence, while larger discrepan-

5

This section was written with grammatical and lexical

revisions made with the help of ChatGPT-3.

cies indicate sub-optimal performance. For instance,

in the first-price auction with N = 3 (Fig. 3b), the

optimal bid, derived from the equilibrium formula,

is

2

3

of the private value. The average deviation of

0.046 and maximum error of 0.051 refer to the differ-

ences between the bids generated by the neural net-

work agents and those obtained through exhaustive

search, as described in Section 3.2. These differences

capture how closely the DRL model approximates the

optimal strategy. For example, with a private value

of 0.6, the optimal bid is 0.4, and a maximum er-

ror of 0.051 means that the actual bid would range

from 0.349 to 0.451, which closely aligns with the

theoretical target. This small deviation suggests that

the agent’s learned policy closely adheres to the Nash

equilibrium, providing little incentive for strategy de-

viation. In contrast, in scenarios with higher maxi-

mum errors (e.g., second-price auctions with N = 7,

as shown in Fig. 4d), agents exhibit more significant

deviations from the Nash equilibrium. Here, a maxi-

mum error of 0.206 indicates a wider range of bids, far

from the theoretical optimum. For example, a private

value of 0.6 could lead to bids varying between 0.394

and 0.806, reflecting a significant departure from the

equilibrium strategy. As the number of agents N in-

creases, the complexity of interactions grows expo-

nentially, making it increasingly difficult for the mod-

els to converge. This complexity leads to a higher

likelihood of divergence from optimal strategies and

results in more agents bidding sub-optimally, as ob-

served in cases with larger N. Such challenges are in-

herent in reinforcement learning models when scaling

to higher agent counts, and are typical across many

heuristic and optimization methods. Table 1 further

illustrates the range of outcomes, with some auction

types and agent counts achieving near-perfect conver-

gence, while others show a clear divergence. This

comparison helps pinpoint which auction settings and

agent configurations tend to converge reliably to equi-

librium and which might need further refinement in

training or strategy adaptation. Our previous research

demonstrated equilibrium in multiple auction scenar-

ios, including first-price and second-price auctions,

which are relatively straightforward due to their linear

optimal bidding functions. We also observed equilib-

rium in all-pay auctions; however, for N > 2, we occa-

sionally encountered cases where agents converged to

a local equilibrium rather than the global Nash equi-

librium. For instance, in the case of N = 3, we ob-

served both the scenario where all agents played their

best responses, reaching the Nash equilibrium, and a

distinct local equilibrium. In this local equilibrium,

one of the agents consistently bid 0.0 for any private

value, effectively opting out of the competition, while

Deep Reinforcement Learning for Auctions: Evaluating Bidding Strategies Effectiveness and Convergence

371

(a) First Price with 2 agents. (b) First Price with 3 agents.

(c) First Price with 5 agents. (d) First Price with 7 agents.

Figure 3: First Price Auction.

Table 1: Results.

Auction N Avg difference Max difference

First Price 2 0.034 0.039

First Price 3 0.046 0.051

First Price 5 0.075 0.093

First Price 7 0.087 0.102

Second Price 2 0.024 0.025

Second Price 3 0.031 0.033

Second Price 5 0.054 0.062

Second Price 7 0.111 0.206

All-Pay 2 0.057 0.070

All-Pay 3 0.083 0.107

All-Pay 3 0.122 0.257

All-Pay 4 0.183 0.286

All-Pay 5 0.190 0.286

All-Pay 7 0.230 0.300

the other two agents followed the optimal bidding

strategy for N = 2, as if the zero-bidding player was

absent. This effectively reduced the dynamics of the

game to a smaller two-player Nash equilibrium, elim-

inating the influence of the zero-bidder. This pattern

of local equilibrium extended to larger agent counts

as well. In these cases, we observed instances where

some agents adhered to the Nash equilibrium strate-

gies for smaller games, while others bid 0.0, simi-

lar to the N = 3 case. For example, in the case of

N = 4, we often observed two distinct patterns: in

one, two agents followed the Nash equilibrium for

ICAART 2025 - 17th International Conference on Agents and Artificial Intelligence

372

(a) Second Price with 2 agents. (b) Second Price with 3 agents.

(c) Second Price with 5 agents. (d) Second Price with 7 agents.

Figure 4: Second Price Auction.

N = 2, while the remaining two consistently bid 0.0,

effectively splitting the game into two independent

two-player auctions; in another, three agents adhered

to the Nash equilibrium for N = 3, while the last agent

bid 0.0, reducing the game to a three-player interac-

tion. Likewise, for N = 5, there were instances where

three agents followed the Nash equilibrium for N = 3,

with the remaining two agents bidding 0.0, leading to

a division of strategy similar to the smaller cases, and

so on. In the all-pay auction with N = 3, we obtained

two distinct sets of results (Fig. 5b and Fig. 5c). In

the first result, where all agents played according to

the Nash equilibrium for N = 3, we observed an aver-

age deviation of 0.083 and a maximum error of 0.107,

indicating that the agents closely adhered to the opti-

mal strategy. Conversely, in the second result, where

two agents followed the Nash equilibrium for N = 2

and the third agent consistently bid 0.0, the average

deviation increased to 0.122 and the maximum error

to 0.257. This significant deviation from the expected

equilibrium for N = 3 is consistent with the local

equilibrium pattern we discussed earlier, where one

agent effectively drops out of the auction, reducing

the interaction to a two-player Nash equilibrium for

the remaining agents. The same phenomenon is ob-

served in larger auctions, such as those with N = 5 and

N = 7 (Figs. 5e and 5f), where many agents bid 0.0,

significantly deviating from the Nash equilibrium. As

mentioned earlier, as the number of participants in-

creases, the complexity of the interactions between

agents grows, leading to a higher tendency for agents

to adopt sub-optimal strategies, such as zero-bid be-

havior, and causing a breakdown of the equilibrium

strategy. Our findings show that the proposed evalu-

ation method not only aligns with theoretical expec-

tations but also provides a clear empirical framework

to assess convergence in a variety of auction types.

As the number of players increases, the average dif-

ference between the neural network-trained strategy

and the exhaustive search strategy may smooth out,

potentially giving a misleading impression of con-

vergence. While using the maximum error between

agents is a good starting point for evaluation, it high-

lights the need for more robust techniques to ensure

accurate assessments in larger and more complex auc-

tion scenarios. Looking ahead, we aim to explore al-

ternative approaches to address the challenges of local

minimum convergence observed in higher N auctions.

Deep Reinforcement Learning for Auctions: Evaluating Bidding Strategies Effectiveness and Convergence

373

(a) All-Pay with 2 agents. (b) All-Pay with 3 agents.

(c) All-Pay with 3 agents (one always bids 0.0). (d) All-Pay with 4 agents.

(e) All-Pay with 5 agents. (f) All-Pay with 7 agents.

Figure 5: All-Pay Auction results.

One promising strategy we are currently investigating

is the transfer learning approach. In this method, we

initialize agents with prior knowledge of the optimal

bidding strategy derived from smaller player auctions.

Although the analytical formula must adapt from N to

N, this initialization offers a more advantageous start-

ing point compared to our current random initializa-

tion method. By leveraging the learned weights from

previous training, we expect this approach to enhance

the agents’ ability to converge on optimal strategies

more effectively in larger auction scenarios.

5 DISCUSSION

The goal of this study is to empirically validate

whether agents trained using deep reinforcement

learning (DRL) can converge to near-Nash Equilib-

ICAART 2025 - 17th International Conference on Agents and Artificial Intelligence

374

rium strategies across different auction scenarios.

6

Our method demonstrates strong results for simpler

auction types like first-price and second-price auc-

tions, where agent behaviours closely align with the-

oretical expectations. In these cases, agents effec-

tively learn optimal bidding strategies, evidenced by

the small errors between learned policies and the an-

alytical benchmarks. Crucially, the tool we develop

excels at detecting errors in complex scenarios, such

as all-pay auctions with multiple participants, where

deviations from optimal strategies are more common.

For example, when agents persist in submitting zero

bids for any private value, the tool identifies signif-

icantly higher errors, signalling a clear divergence

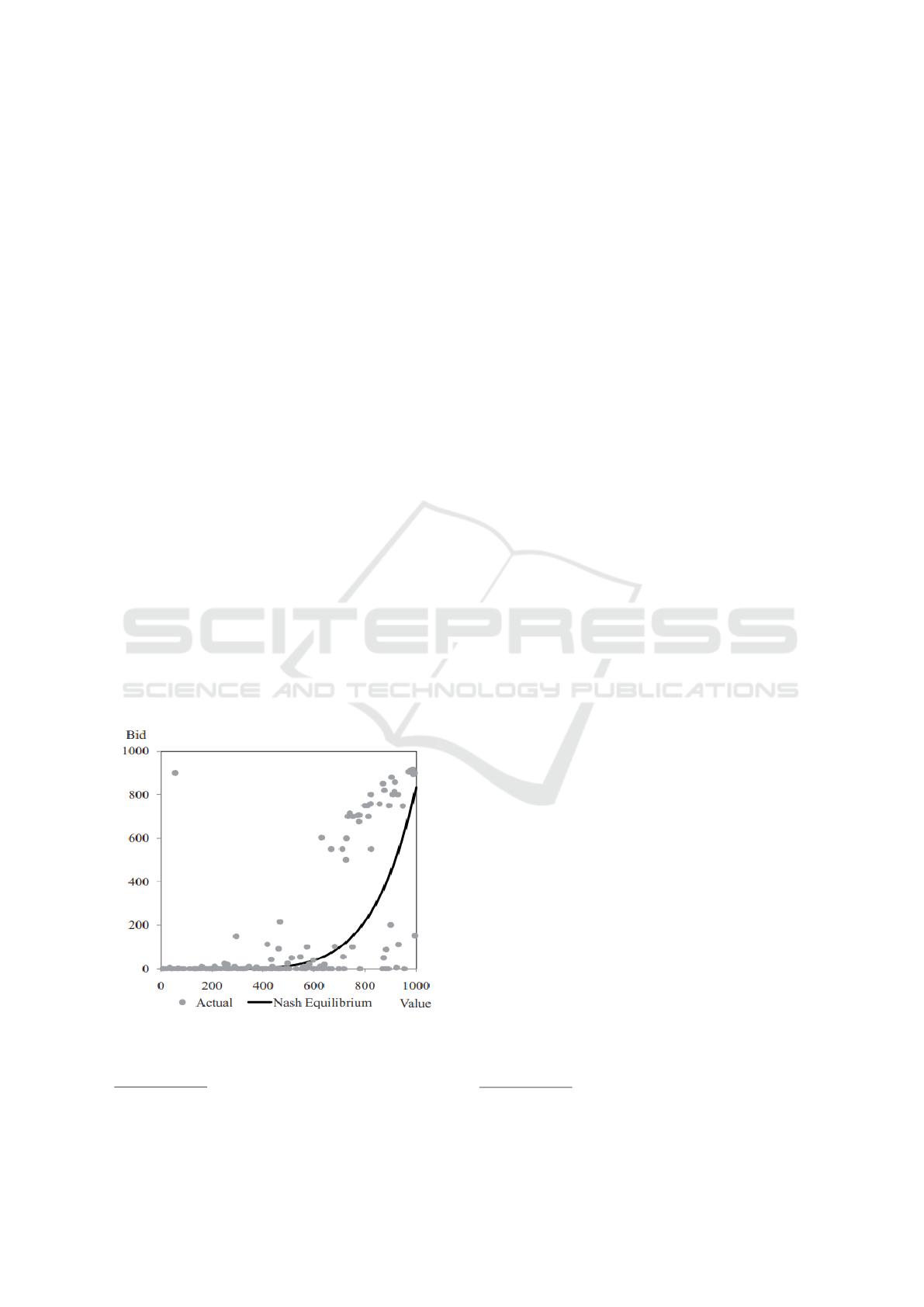

from equilibrium. These results align with human be-

haviour in similar experimental settings, such as those

described in (Dechenaux et al., 2015), where multiple

participants bid zero, as illustrated in Figure 6. This

raises an important question: are the agents behaving

rationally, given that they lack knowledge of the opti-

mal bidding strategies for all-pay auctions? Without

clear guidelines on bid optimality, agents appear to

adopt a conservative strategy, opting to bid 0.0 to min-

imize potential losses. This mirrors the behaviour ob-

served in human experiments, where, although some

individuals may take higher risks and bid more ag-

gressively, the majority gravitate toward bids close

to 0.0. The tool’s capacity to detect such behaviours

highlights its strength in providing diagnostic insights

into learning failures, offering an empirical means to

evaluate whether agents adhere to equilibrium strate-

gies. A limitation of our current approach is that

Figure 6: Results from human experiments in All-Pay Auc-

tions - Data extracted from (Noussair and Silver, 2006).

6

This section was written with grammatical and lexical

revisions made with the help of ChatGPT-3.

it does not address correlated bids between players.

This assumption of independence becomes problem-

atic in real-world auctions, where players’ bids may

depend on one another due to strategic considerations

or shared information. Addressing these bid depen-

dencies becomes critical for maintaining computa-

tional efficiency as the number of agents increases.

However, the main advantage of the tool lies in its

ability to validate convergence in auction types with

known Nash equilibrium, serving as a robust bench-

mark. This capability gives us confidence to extend

the tool’s application to auctions where no analytical

solution exists for optimal bidding. By first verifying

the tool in settings with established equilibrium strate-

gies, we lay the groundwork for applying it to more

complex and less understood auction formats, ulti-

mately broadening its applicability to diverse multi-

agent environments.

6 CONCLUSIONS

This study presents an empirical method to evalu-

ate whether multi-agent reinforcement learning algo-

rithms can converge to near-Nash equilibrium strate-

gies in auction settings.

7

While other DRL algorithms

may also be applied, we chose the Multi-Agent Deep

Deterministic Policy Gradient (MADDPG) algorithm

for this study due to its effectiveness in continuous

action spaces and its ability to handle the interde-

pendent nature of multi-agent environments. Our ap-

proach is validated in simple auction types, where

agents demonstrated effective convergence, and more

challenging auctions, like all-pay auctions, where er-

rors were larger, and deviations from optimal strate-

gies were more frequent. A key contribution of this

work is the development of a tool that not only iden-

tifies when agents align with equilibrium strategies

but highlights divergence, offering a clear diagnos-

tic of multi-agent learning outcomes. By comparing

agents’ strategies against exhaustive search bench-

marks, we have provided a practical framework for

verifying the robustness of DRL algorithms in auction

environments. Future work will extend this method to

more complex auction formats, such as multi-unit and

multi-stage auctions, where no analytical solution ex-

ists for the optimal bid. Additionally, we will investi-

gate the incorporation of risk aversion and strategic

dependencies between bids to enhance the model’s

applicability. To address the challenges of local min-

imum convergence observed in higher N auctions,

one promising strategy we are currently exploring is

7

This section was written with grammatical and lexical

revisions made with the help of ChatGPT-3.

Deep Reinforcement Learning for Auctions: Evaluating Bidding Strategies Effectiveness and Convergence

375

the transfer learning approach, where agents will be

initialized with prior knowledge of optimal bidding

strategies derived from smaller player auctions. This

initialization will provide a better starting point than

random initialization, as the agents will inherit the

learned weights from previous training. An important

direction for future research is the application of this

methodology to scoring auctions, which have signifi-

cant practical implications, particularly in the Brazil-

ian context. For example, scoring auctions have been

used in Brazil to allocate oil exploration rights, as de-

tailed in (Sant’Anna, 2017). In these auctions, bid-

ders submit multidimensional bids, including a mon-

etary bonus and an exploratory program, with a non-

linear scoring rule determining the winner. This for-

mat introduces unique challenges and opportunities

for modeling and evaluation, as estimating the dis-

tribution of primitive variables—such as tract values

and exploration commitment costs—enables counter-

factual analysis of revenue under alternative bidding

schemes. By adapting our tool to this context, we

aim to explore its ability to handle the complexities of

multidimensional scoring rules and assess its utility in

evaluating and optimizing such auction mechanisms.

Addressing these complexities will be crucial to ad-

vancing our understanding of multi-agent dynamics

and improving auction design.

REFERENCES

Bichler, M., Fichtl, M., Heidekr

¨

uger, S., Kohring, N., and

Sutterer, P. (2021). Learning equilibria in symmetric

auction games using artificial neural networks. Nature

machine intelligence, 3(8):687–695.

Dechenaux, E., Kovenock, D., and Sheremeta, R. M.

(2015). A survey of experimental research on con-

tests, all-pay auctions and tournaments. Experimental

Economics, 18:609–669.

Dragoni, N. and Gaspari, M. (2012). Declarative speci-

fication of fault tolerant auction protocols: The en-

glish auction case study. Computational Intelligence,

28(4):617–641.

D

¨

utting, P., Feng, Z., Narasimhan, H., Parkes, D. C.,

and Ravindranath, S. S. (2021). Optimal auctions

through deep learning. Communications of the ACM,

64(8):109–116.

Ewert, M., Heidekr

¨

uger, S., and Bichler, M. (2022). Ap-

proaching the overbidding puzzle in all-pay auctions:

Explaining human behavior through bayesian opti-

mization and equilibrium learning. In Proceedings

of the 21st International Conference on Autonomous

Agents and Multiagent Systems, pages 1586–1588.

Frahm, D. G. and Schrader, L. F. (1970). An experimental

comparison of pricing in two auction systems. Amer-

ican Journal of Agricultural Economics, 52(4):528–

534.

Gemp, I., Anthony, T., Kramar, J., Eccles, T., Tacchetti, A.,

and Bachrach, Y. (2022). Designing all-pay auctions

using deep learning and multi-agent simulation. Sci-

entific Reports, 12(1):16937.

Kannan, K. N., Pamuru, V., and Rosokha, Y. (2019). Us-

ing machine learning for modeling human behavior

and analyzing friction in generalized second price auc-

tions. Available at SSRN 3315772.

Klemperer, P. (1999). Auction theory: A guide to the liter-

ature. Journal of economic surveys, 13(3):227–286.

Krishna, V. (2009). Auction theory. Academic press.

Luong, N. C., Xiong, Z., Wang, P., and Niyato, D. (2018).

Optimal auction for edge computing resource man-

agement in mobile blockchain networks: A deep

learning approach. In 2018 IEEE international con-

ference on communications (ICC), pages 1–6. IEEE.

Menezes, F. and Monteiro, P. (2008). An introduction to

auction theory: Oxford university press.

Mnih, V. (2016). Asynchronous methods for deep rein-

forcement learning. arXiv preprint arXiv:1602.01783.

Mnih, V., Kavukcuoglu, K., Silver, D., Rusu, A. A., Ve-

ness, J., Bellemare, M. G., Graves, A., Riedmiller, M.,

Fidjeland, A. K., Ostrovski, G., et al. (2015). Human-

level control through deep reinforcement learning. na-

ture, 518(7540):529–533.

Noussair, C. and Silver, J. (2006). Behavior in all-pay auc-

tions with incomplete information. Games and Eco-

nomic Behavior, 55(1):189–206.

Riley, J. G. and Samuelson, W. F. (1981). Optimal auctions.

The American Economic Review, 71(3):381–392.

Sant’Anna, M. C. B. (2017). Empirical analysis of scoring

auctions for oil and gas leases.

Schrittwieser, J., Antonoglou, I., Hubert, T., Simonyan, K.,

Sifre, L., Schmitt, S., Guez, A., Lockhart, E., Hass-

abis, D., Graepel, T., et al. (2020). Mastering atari,

go, chess and shogi by planning with a learned model.

Nature, 588(7839):604–609.

Schulman, J., Wolski, F., Dhariwal, P., Radford, A., and

Klimov, O. (2017). Proximal policy optimization al-

gorithms. arXiv preprint arXiv:1707.06347.

Shoham, Y. and Leyton-Brown, K. (2008). Multiagent sys-

tems: Algorithmic, game-theoretic, and logical foun-

dations. Cambridge University Press.

Sutton, R. S. (2018). Reinforcement learning: An introduc-

tion. A Bradford Book.

Zheng, S. and Liu, H. (2019). Improved multi-agent deep

deterministic policy gradient for path planning-based

crowd simulation. Ieee Access, 7:147755–147770.

ICAART 2025 - 17th International Conference on Agents and Artificial Intelligence

376