Real-Time Transaction Fraud Detection

via Heterogeneous Temporal Graph Neural Network

Hang Nguyen

1,2 a

and Bac Le

1,2 b

1

Faculty of Information Technology, University of Science, Ho Chi Minh City, Vietnam

2

Vietnam National University, Ho Chi Minh City, Vietnam

fi

Keywords:

Heterogeneous Graph Neural Network, Heterogeneous Temporal Graph Neural Network, Fraud Detection,

Transaction Fraud Detection, Spatial-Temporal Graph Neural Network, Real-Time Fraud Detection.

Abstract:

As digital transactions grow in prevalence, the threat of fraud has become a critical challenge for businesses

and individuals. Fraudsters increasingly employ sophisticated tactics, disguising malicious activities as le-

gitimate behavior, which renders traditional detection methods inadequate. This paper introduces a real-time

fraud detection framework leveraging Heterogeneous Temporal Graph Neural Networks (HTGNN) to address

these challenges. The proposed approach constructs a heterogeneous temporal graph from transaction data

and employs a neural network architecture that integrates spatial, temporal, and semantic information. This

allows for a comprehensive representation of transactions, entities, and their dynamic interactions over time.

Unlike static approaches, our method captures the temporal evolution of behaviors, ensuring deeper insights

into fraudulent patterns. The framework is designed to enhance detection accuracy while maintaining com-

putational efficiency for real-time applications. Through rigorous experimentation and analysis, we expect to

demonstrate that the proposed HTGNN framework significantly outperforms existing techniques in identify-

ing fraudulent transactions, ultimately contributing to more robust and effective fraud detection systems.

1 INTRODUCTION

The shift to online operations, accelerated by digital-

ization and the COVID-19 pandemic, offers benefits

like cost savings and accessibility but also heightens

the risk of digital fraud across platforms like online

banking, e-commerce, and social media. Such fraud

leads to financial losses, data breaches, and eroded

trust, driving urgent demand for advanced detection

technologies. With the global fraud prevention mar-

ket projected to reach $66.6 billion by 2028(Tumiwa

et al., 2024), real-time fraud detection systems have

become essential, enabling instant transaction moni-

toring to mitigate losses and protect customer trust.

However, the swift evolution of fraudulent activi-

ties poses significant challenges for current fraud de-

tection and prevention methods, as demonstrated in

studies such as (Awoyemi et al., 2017), (Zhou et al.,

2019), (Dornadula and Geetha, 2019), (Maniraj et al.,

2019), and (Sailusha et al., 2020). While traditional

machine learning models are often used for identify-

a

https://orcid.org/0009-0004-7181-1406

b

https://orcid.org/0000-0002-4306-6945

ing patterns in structured data, they often struggle to

capture the complex and dynamic nature of real-world

fraud scenarios. A particularly concerning trend is

the rise of hidden or camouflaged behaviors, where

malicious activities are deliberately masked to resem-

ble legitimate transactions, making them harder to de-

tect. To address these challenges, graph-based ma-

chine learning methods have emerged as promising

solutions due to their ability to model intricate rela-

tionships and interactions between entities.

To address these limitations, graph-based machine

learning methods have shown promise due to their

ability to model the intricate relationships between

entities and transactions. Graphs naturally represent

complex dependencies by organizing data into nodes

(representing entities such as users, transactions, and

accounts) and edges (representing relationships be-

tween them). This structure enables the modeling

of relationships that extend beyond simple transac-

tions, allowing for a more nuanced understanding of

fraud. In particular, heterogeneous temporal graphs

are especially powerful in capturing the spatial, tem-

poral, and semantic contexts of transactions and en-

tities. These graphs can provide a rich, multifaceted

364

Nguyen, H. and Le, B.

Real-Time Transaction Fraud Detection via Heterogeneous Temporal Graph Neural Network.

DOI: 10.5220/0013161300003890

In Proceedings of the 17th International Conference on Agents and Artificial Intelligence (ICAART 2025) - Volume 2, pages 364-375

ISBN: 978-989-758-737-5; ISSN: 2184-433X

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

view of fraud, integrating diverse data types to better

understand and detect malicious behavior. Temporal

information allows systems to track the evolution of

behaviors over time, spatial information reveals the

interactions between different entities, and semantic

data adds context to the meaning behind each transac-

tion. Together, these aspects provide a comprehensive

framework for fraud detection.

Despite significant advancements in graph-

based algorithms, such as Graph Neural Networks

(GNNs), Graph Convolutional Networks (GCNs),

and attention-based mechanisms (Rao et al., 2020),

(Xiang et al., 2022), (Xiang et al., 2023a), and (Xie

et al., 2023), most existing systems still focus on

leveraging one or two of these dimensions-spatial,

temporal, or semantic-often in isolation or in simple

combinations. While these methods offer im-

provements over traditional techniques, they remain

inadequate in capturing the full complexity of modern

fraudulent activities. More critically, there is a lack of

real-time systems that effectively integrate all three

dimensions simultaneously, which is essential for

timely fraud detection and prevention.

In this paper, we introduce a novel framework for

real-time fraud detection that integrates spatial, tem-

poral, and semantic information using heterogeneous

temporal graphs within an inductive setting. Our ap-

proach addresses the limitations of current models

by comprehensively analyzing fraud patterns across

these three types of information while dynamically

adapting to the evolving nature of fraudulent behav-

iors. By operating in real-time, our framework en-

hances the ability to detect and prevent fraudulent ac-

tivities as quickly as possible, minimizing potential

financial losses and mitigating risks before they esca-

late. The contributions of this paper include:

• We propose a methodology for transforming

transaction data into a heterogeneous temporal

graph structure, enabling the integration of spa-

tial, temporal, and semantic information for learn-

ing transaction representations.

• We design a robust heterogeneous temporal graph

neural network architecture and real-time system

to effectively capture and learn comprehensive

transaction representations.

• We conduct empirical experiments to evaluate the

proposed framework on both real-world and syn-

thesis datasets, demonstrating its effectiveness in

accurately detecting fraud and efficiently handling

real-time data processing.

The structure of this paper is as follows: Section 2

reviews the related work. Section 3 describes the de-

tails of the proposed method. Section 4 outlines the

experimental setup. Section 5 presents the corre-

sponding results and discussions. Section 6 concludes

the paper and discusses potential future work.

2 RELATED WORK

In recent years, a wide range of machine learning

techniques has been proposed to address the chal-

lenge of fraud detection. Early works primarily fo-

cused on traditional machine learning methods ap-

plied to real-world datasets. For instance, (Maes et al.,

2002) utilized Bayesian Belief Networks (BBN) and

Artificial Neural Networks (ANN) on a dataset ob-

tained from Europay International, demonstrating the

effectiveness of these models in identifying fraudu-

lent credit card transactions. Similarly, (Sahin and

Duman, 2011) employed decision trees and support

vector machines (SVMs) on a major national bank’s

dataset, showcasing the potential of these methods in

fraud detection tasks. Other studies, such as (Saputra

et al., 2019), (Maniraj et al., 2019), (Dornadula and

Geetha, 2019), (Sailusha et al., 2020), and (Varun Ku-

mar et al., 2020), have explored ensemble learning

methods to enhance detection accuracy. While these

approaches achieved reasonable success, they primar-

ily relied on static features and often lacked the abil-

ity to generalize well to more complex and dynamic

fraud patterns.

With the rise of deep learning, researchers began

exploring more sophisticated architectures to address

the limitations of traditional machine learning mod-

els. Studies like (Fu et al., 2016), (Alarfaj et al.,

2022), (Hasugian et al., 2023), and (Karthika and

Senthilselvi, 2023) applied deep learning techniques,

which outperformed earlier methods by learning in-

tricate patterns in transaction data. However, these

models typically focused on individual transactions

or cardholders, thereby missing the broader context

provided by the relationship between transactions and

the entities involved. This limitation, highlighted by

(Xiang et al., 2023b), indicated the need for models

that can exploit both labeled and unlabeled data, es-

pecially in large-scale, real-world scenarios.

As fraud detection systems evolved, graph-based

approaches began gaining attention due to their abil-

ity to model the complex relationships inherent in

transactional data. The novel work by (Wang et al.,

2019) and (Liu et al., 2020) laid the foundation for

using graph neural network (GNN) in fraud detection,

particularly for datasets with partial labels. These

methods leveraged the relational structure of trans-

actions to improve detection accuracy. Building on

this, (Dou et al., 2020) and (Peng et al., 2021) in-

Real-Time Transaction Fraud Detection via Heterogeneous Temporal Graph Neural Network

365

troduced GNN-based techniques that incorporated re-

inforcement learning for neighbor selection, tackling

the challenge of fraudsters’ camouflage. Further-

more, (Liu et al., 2021) proposed PC-GNN, which

effectively addressed the issue of imbalanced learn-

ing in graph-based fraud detection. These methods

demonstrated that graph-based models could uncover

patterns that traditional and deep learning models

missed, particularly when it came to exploiting the

relational data between transactions and entities.

One significant advancement in this domain was

xFraud (Rao et al., 2020), which utilized a hetero-

geneous GNN architecture to aggregate transaction

information and introduced a prediction result inter-

pretation module, improving both model transparency

and performance. (Xiang et al., 2022) proposed a

joint feature learning framework for capturing spatial

and temporal patterns in fraud detection, emphasiz-

ing the importance of modeling dynamic transaction

behavior over time. In their subsequent work, (Xi-

ang et al., 2023b) extended this by integrating entity

information into transaction node representations and

using temporal graph attention to aggregate historical

transactions within a homogeneous graph structure.

These studies highlight a growing trend towards more

graph-based fraud detection models.

The BRIGHT framework, introduced by (Lu et al.,

2022), represents one of the most significant attempts

at developing a real-time fraud detection system. It

leverages a Two-Stage Directed Graph (TD Graph)

to enable efficient real-time inference by restricting

message-passing to historical transaction data. This

approach dramatically reduces computational over-

head, making real-time detection feasible. Further-

more, BRIGHT employs the Lambda Neural Net-

work (LNN) architecture to decouple the inference

process into batch and real-time stages, improving

both speed and accuracy. However, while BRIGHT

makes strides in real-time detection, it focuses pre-

dominantly on spatial information using graph convo-

lutional networks, which may not be robust enough to

handle increasingly sophisticated fraud tactics. De-

spite the advancements, there remains a critical gap

in the literature: the lack of comprehensive real-time

fraud detection systems that fully leverage both tem-

poral and semantic information surrounding transac-

tions. Fraudsters continuously evolve their strategies,

utilizing techniques such as obfuscation, transaction

fragmentation, and exploiting security vulnerabilities,

which current models may fail to capture adequately.

Our proposal aims to build upon the BRIGHT frame-

work by incorporating richer temporal and semantic

data into the GNN-based fraud detection process. By

integrating all historical time windows and capturing

the contextual relationships between transactions and

entities over time, our model seeks to enhance de-

tection accuracy while maintaining the efficiency re-

quired for real-time applications.

3 METHODOLOGY

3.1 Heterogeneous Temporal Graph

Construction

In this research, we address the problem of transac-

tion fraud detection as a binary node classification

task within an inductive setting on a heterogeneous

temporal graph (HTG). Traditional fraud detection

methods, such as rule-based systems or models that

rely on static features, typically treat each transaction

as an independent event. These methods often over-

look the interconnected and dynamic nature of trans-

actions over time, which can result in missed patterns

or emerging fraud tactics. In reality, transactions are

part of a broader ecosystem where relationships be-

tween entities (e.g., users, devices, locations) evolve,

and fraud behaviors adapt. By failing to account for

these evolving and interconnected factors, traditional

approaches can struggle to detect sophisticated or hid-

den fraud. In contrast, our heterogeneous temporal

graph model captures the intricate relationships be-

tween entities (e.g., cardholders, merchants, devices)

and how these relationships evolve over time. This

enables deeper insights into both normal and fraudu-

lent behavior patterns, particularly in dynamic envi-

ronments where fraud tactics constantly adapt.

The key challenge in building an effective fraud

detection system lies in accurately modeling the rep-

resentations of transactions. Each transaction is com-

prised of a diverse set of attributes, including quanti-

tative data (e.g., transaction amount, timestamps) and

categorical or identity-based data (e.g., cardholder in-

formation, merchant details, device identifiers). Ba-

sic encoding techniques like one-hot or label encod-

ing are inadequate in capturing the complex, high-

dimensional relationships between these attributes,

leading to suboptimal model performance in detect-

ing fraudulent patterns. To address this limitation, we

propose the construction of a heterogeneous tempo-

ral graph (HTG), where various entities, such as card-

holders, merchants, and devices, are represented as

distinct node types. These node types interact with

each other across time, allowing the model to learn

more nuanced representations of how fraudulent be-

haviors evolve and how different entities interact.

Specifically, in the HTG, each node i is associated

with a node type φ(i) ∈ A, where A is the set of all

ICAART 2025 - 17th International Conference on Agents and Artificial Intelligence

366

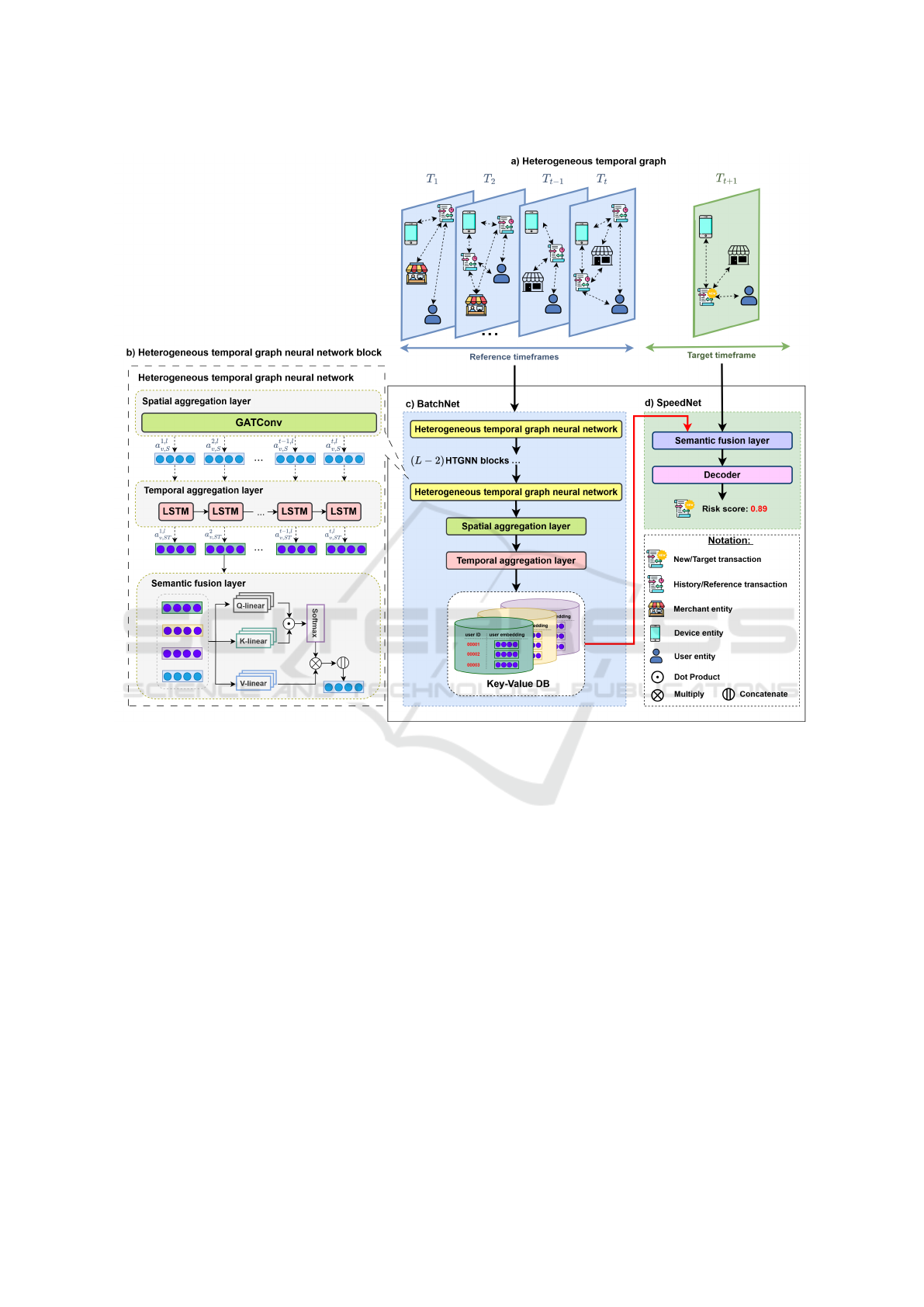

Figure 1: Proposed method: a) Illustration of a heterogeneous temporal graph: The graph depicts multiple timeframes labeled

T

1

, T

2

,. . . , T

t−1

, T

t

, which represent the reference time periods. These timeframes contain historical transaction data and

are used to generate insights from past interactions. The incoming timeframe T

t+1

is highlighted as the target timeframe,

containing all the transactions that require labeling. b) Depicting the HTGNN block components. c) Illustration of the

architecture of Batch Net. d) Illustration of the architecture of Speed Net.

possible types of nodes, including transactions, card-

holders, merchants, and devices. Depending on the

business domain, additional entity types can be incor-

porated into the model, such as shipping addresses,

payment tokens, or IP addresses, to enrich the graph

structure and enhance detection accuracy. Edges e ∈

E are used to represent relationships between transac-

tion nodes and these various entity nodes, forming a

dynamic graph that evolves over multiple timeframes.

Temporal dynamics play a critical role in detect-

ing fraud, as fraudulent activities often unfold gradu-

ally or are strategically hidden within patterns of le-

gitimate behavior. To capture these evolving patterns,

we introduce a temporal dimension to the graph by

constructing it over multiple timestamps j, resulting

in a temporal graph structure G = {G

j

}

t+1

j=1

, where

T = {1, 2, . . . , t − 1, t} denotes the reference time du-

ration and t + 1 denotes the timeframe that includes

the new transactions needing classification, as illus-

tration in Figure 1a. This temporal aspect allows the

model to not only analyze relationships at a single

point in time but also track how behaviors and inter-

actions shift over time.

In our framework, we categorize all transaction

nodes in a given timeframe (t + 1) as target nodes,

which represent new transactions or transactions that

need to be predicted. Other nodes are referred to as

reference nodes. The relationship between target and

reference nodes enables the model to leverage histor-

ical transaction data and identify abnormal patterns,

even in new or previously unseen transactions. To fa-

cilitate the classification task, fraudulent transactions

are labeled as 1, indicating they have been flagged or

Real-Time Transaction Fraud Detection via Heterogeneous Temporal Graph Neural Network

367

confirmed as fraudulent, while legitimate transactions

are labeled as 0. The relationship between target and

reference nodes enables the model to leverage histor-

ical transaction data and identify abnormal patterns,

even in new or previously unseen transactions. The

labels of transaction nodes are only used for refer-

ence nodes’ original features during the training pro-

cess without the risk of label leakage, ensuring the

integrity of the classification task.

3.2 Heterogeneous Temporal Graph

Neural Network (HTGNN)

Our approach stems from the observation that the

transaction volume in the system increases signif-

icantly over time, while each transaction remains

unique and lacks distinct temporal features. This

poses a challenge: extracting temporal information

from all transaction nodes can lead to resource in-

efficiencies and reduced performance, as each user’s

transaction will be different depending on their be-

havior. To address this issue, we propose to shift the

focus to entity nodes, which are more representative

of meaningful patterns in the data. Transactions ex-

hibit clear sequential characteristics, occur at specific

timestamps, and are often linked to previous and sub-

sequent transactions through shared entity attributes,

such as user identity, device type, or IP address. By

focusing on these entity nodes, we can efficiently ex-

tract temporal information directly linked to histori-

cal transactions associated with each entity. In this

context, we designed a heterogeneous temporal graph

neural network block with multiple layers, including a

spatial aggregation layer, temporal aggregation layer,

and semantic fusion layer, as in Figure 1b. In the fol-

lowing subsections, we will provide a detailed archi-

tecture of the layers within the l-th HTGNN block.

3.2.1 Spatial Aggregation Layer

In the proposed graph construction method, entity

nodes (e.g., cardholders, merchants, devices) are con-

nected to transaction nodes across multiple time-

frames. To effectively represent these entities, we

compute spatial embedding vectors by aggregating in-

formation from historical transactions associated with

them. However, not all are equally informative for the

entity’s final representation in the model. To address

this, we leverage a Graph Attention Network (GAT)

(Veli

ˇ

ckovi

´

c et al., 2017), which assigns attention co-

efficients that determine the importance of each trans-

action in relation to the entity node. This approach

helps to prioritize relevant transactions and reduce the

influence of noisy or less significant ones.

Each entity node v ∈ A

′

(where A

′

is the set of en-

tity types, A

′

⊂ A) is associated with a spatial embed-

ding that evolves over time. The embedding of node v

at timestamp t in the l-th HTGNN block is computed

by aggregating information from neighboring trans-

action nodes that occur at timestamp t. Specifically,

at each timestamp t and in the l-th HTGNN block, the

spatial embedding of an entity node v is computed as

follows:

a

t,l

v,S

= GATConv

φ(v)

(a

t,l−1

u

: u ∈ N

t

(v))

Here, a

t,l

v,S

∈ R

d

trans

represents the spatial embed-

ding of entity node v at timestamp t in the l-th HT-

GNN block, with d

trans

being the dimension of the

transaction node embedding. N

t

(v) denotes the set

of neighboring transaction nodes at timestamp t, and

a

t,l−1

u

∈ R

d

trans

is the embedding of transaction node u

at the previous block (l − 1). The initial embedding

a

t,0

u

is set to the raw feature vector of transaction node

u at timestamp t. GATConv

φ(v)

refers to the graph at-

tention layer specific to the type of entity node v. The

aggregation of information from neighboring transac-

tions for entity node v is expressed as:

a

t,l

v,S

=

∑

u∈N

t

(v)

α

v,u

W

u

a

t,l−1

u

where the attention coefficients α

v,u

, representing the

importance of transaction node u to entity node v, are

computed as:

e(u, v) =

LReLU

a

⊤

v

W

φ(v),v

a

t,l−1

v

+ a

⊤

u

W

u

a

t,l−1

u

α

u,v

=

exp(e(u, v))

∑

k∈N

t

(v)

exp(e(k, v))

Here, e(u, v) represents the score for the rela-

tionship between nodes u and v. W

φ(v),v

and W

u

are learnable linear transformations that map the fea-

ture vectors of entity node v and transaction node u

into the same space. The activation function used

is LeakyReLU, and a

v

and a

u

are learnable attention

weight vectors specific to the entity and transaction

nodes, respectively. Different transformation matri-

ces, W

φ(v),v

, are applied to different types of entity

nodes.

To ensure robustness and improve the model’s

ability to learn from complex graph data, we apply

multi-head attention. This technique runs multiple at-

tention mechanisms in parallel and aggregates their

outputs, providing a more stable and reliable repre-

sentation for each entity node. Moreover, the transac-

tion nodes act as source nodes, providing the raw in-

formation, while the entity nodes act as target nodes,

ICAART 2025 - 17th International Conference on Agents and Artificial Intelligence

368

whose spatial embeddings are updated based on the

aggregated transaction data. Importantly, we do not

include self-loops during aggregation, as the focus is

on the aggregation of transactions around them at the

specific timestamp. Finally, we concatenate the raw

entity features at timestamp t, a

t

v

, to form the com-

plete spatial embedding, as:

a

t,l

v,S

= CONCAT ENAT E(a

t,l

v,S

, a

t

v

)

In our experiments, raw entity features are con-

structed from several time-varying attributes. For in-

stance, for a user entity node, these features include

the total number of recorded fraudulent transactions,

the number of distinct IP addresses used, the average

transaction amount, and more. These dynamic fea-

tures capture the evolving behavior of entities over

time, enabling the model to represent temporal pat-

terns more effectively. The spatial embeddings of

entity nodes at each timeframe t are then combined

across multiple timestamps to generate temporal em-

beddings, forming a comprehensive spatial-temporal

representation for the entity node.

3.2.2 Temporal Aggregation Layer

After computing the spatial embeddings for each en-

tity node at individual timestamps, we move to the

temporal embedding phase. Temporal embeddings

are crucial in fraud detection, as they enable the model

to capture the evolving behavior of entities over time,

identifying patterns that may indicate fraudulent ac-

tivity. Once the spatial embeddings for entity nodes

are obtained across timeframes, we combine them

from timeframe 1 to timeframe t to derive the spatial-

temporal embeddings. This process not only captures

the evolving relationships and interactions among en-

tities but also provides deeper insight into their histor-

ical context.

The core idea is to maintain a persistent mem-

ory of previous time windows, allowing the model to

retain historical information as it progresses through

timeframes. To achieve this, we employ a Long Short-

Term Memory (LSTM) network, which is well-suited

for capturing temporal dependencies by maintaining

long-term memory through its hidden state and cell

state.

Specifically, after constructing the spatial embed-

dings for each entity node at each timeframe t, we

used these embeddings to represent temporal depen-

dencies. For each entity node v, we combine spatial

embeddings from timeframes 1 to t to generate a com-

prehensive spatial-temporal embedding. The LSTM

model is used to process these sequential embeddings:

a

t,l

v,ST

= LST M

φ(v)

(a

1,l

v,S

, a

2,l

v,S

, . . . , a

t,l

v,S

)

where a

t,l

v,S

represents the spatial embedding of entity

node v at time t and HTGNN block l-th, and a

t,l

v,ST

de-

notes the spatial-temporal embedding for node v that

captures information across all time windows up to

t. LST M

φ(v)

refers to the LSTM layer specific to the

type of entity node v.

3.2.3 Semantic Fusion Layer

In this module, we focus on extracting the contextual

feature of a transaction node u at timestamp t in the

HTGNN block l-th by the mutual information from its

neighboring entity nodes at timestamp t −1 in the HT-

GNN block l-th, as well as from its own features, to

create a comprehensive embedding for it. Before fus-

ing the semantic information, we project the spatial-

temporal embedding vector of each neighboring en-

tity node v at timestamp t − 1 in the HTGNN block

l-th and the transaction’s feature vector into the same

latent space. This ensures the vectors representing en-

tities and transactions are the same dimensions.

The fusion of semantic information is achieved by

applying scaled dot-product attention, inspired by the

Transformer model (Vaswani et al., 2017), which is

well-suited for capturing complex, multi-entity inter-

actions. For a given transaction node u, the spatial-

temporal embedding vectors of its neighboring entity

nodes are aggregated into a list, denoted as:

E := [a

t,l

u

, a

t−1,l

v,ST

] ∀v ∈ N

t

(u) and φ(v) ∈ A

′

where n is the number of entity types; a

t,l

u,A

0

is the fea-

ture vector of the transaction; and a

t−1,l

v,ST

represent all

the spatial-temporal embedding of all neighbor en-

tity node of node u at timestamp t − 1 in the HT-

GNN block l-th. This setup allows us to compute

the semantic relationship between the transaction and

its neighboring entity nodes. To capture the relation-

ships between these node types, we apply the follow-

ing procedure:

(1) Transform all vectors in the list E to a query, key,

and value vector.

q

A

i

= W

query

· E[i], ∀i = 0 → n

k

A

i

= W

key

· E[i], ∀i = 0 → n

v

A

i

= W

value

· E[i], ∀i = 0 → n

(2) Compute mutual attention weight by the dot

product between the query and key vector.

δ(A

i

, A

j

) =

exp([q

A

i

]

T

· [k

A

j

])

∑

n

j=0

exp([q

A

i

]

T

· [k

A

j

])

(3) The mutual information between node i and node

j is represented as a weighted sum of all value

Real-Time Transaction Fraud Detection via Heterogeneous Temporal Graph Neural Network

369

vectors v

A

j

and the computed mutual attention

value δ(A

i

, A

j

). This can be expressed mathe-

matically as:

s

A

i

=

n

∑

j=0

δ(A

i

, A

j

) · v

A

j

Where W

query

, W

key

, W

value

∈ R

d×d

and θ are the

learnable parameters shared across all entity node

types. The final embedding of transaction u is created

by concatenating those outputs and using W

trans

as the

linear transformation to ensure the length of the trans-

action node feature vectors’ dimension is maintained

through many layers, formulated as:

a

t,l

u

= [s

A

0

||s

A

1

||s

A

2

||. . . ||s

A

n

]

a

t,l

u

= W

trans

· a

t,l

u

In short, a

t,l

u

is the output of the HTGNN block

l-th. By enhancing the message-passing process,

HTGNN integrates both spatial and temporal di-

mensions, moving beyond the simplistic aggrega-

tion methods of conventional GNNs. The use of

transformer-based architectures for updating allows

HTGNNs to effectively capture the contextual infor-

mation, leading to richer node representations and im-

proved performance in the fraud detection system.

3.3 Real-Time Transaction Fraud

Detection System

While the stacked HTGNN blocks can provide high

accuracy in offline fraud detection by capturing com-

plex spatial, temporal, and semantic information,

their computational complexity makes them less suit-

able for real-time inference. Running full-batch HT-

GNN models in a real-time setting would introduce

significant latency, delaying fraud detection when im-

mediate decisions are required. To address this chal-

lenge, we implement a dual-model approach based

on Lambda architecture, which enables the system to

maintain both accuracy and efficiency by separating

the process into batch and speed layers.

The batch layer is designed to handle large-scale,

high-complexity computations offline. In this layer,

the stacked HTGNN blocks continuously process his-

torical transaction data to detect emerging fraud pat-

terns and update the model periodically. This ensures

that the model remains accurate by learning from

new data and adjusting to evolving fraudulent behav-

iors. In this layer, we design the BatchNet to learn

the embedding of all reference entity nodes. Batch-

Net consists of L stacked HTGNN blocks, one spa-

tial aggregation layer, and one temporal aggregation

layer, as in figure 1c. Each HTGNN block allows

transaction nodes to gather mutual information from

their own features as well as spatial-temporal embed-

dings of related entities at preceding timestamps. The

stacked architecture enhances message passing be-

tween blocks, allowing nodes to aggregate informa-

tion from further away in the graph, which enhances

their representations. Instead of utilizing all HTGNN

block at the end of BatchNet, we employ only the two

first layers to extract the spatial-temporal embedding

of entities, which are then stored as entity embeddings

in key-value databases for future use. We choose the

key-values database to store spatial-temporal of en-

tities nodes to optimize real-time fraud detection by

enabling quick retrieval, reducing database load, and

improving memory efficiency, which is crucial for

handling large datasets and ensuring rapid decision-

making.

To ensure real-time responsiveness, we designed

SpeedNet for the speed layer, a lightweight model fo-

cused on minimizing prediction latency. This layer

operates on streaming transaction data and leverages

the precomputed embeddings of all related entities

generated by the BatchNet. By utilizing these pre-

computed features, the SpeedNet can make rapid pre-

dictions without having to process the entire graph

structure for each incoming transaction in timestamp

t + 1. SpeedNet, illustrated in figure 1d, is built with

a semantic fusion layer that extracts mutual infor-

mation from the features of the target transaction at

timestamp t + 1 and the corresponding entity embed-

dings from timestamp t queried from the key-value

database. This process generates the final embedding

for the target transaction, which is then used to com-

pute the transaction’s risk score by the decoder layer.

In our environment, we used two multi-perceptron

layers and a softmax function. By combining these

two layers, the system strikes a balance between accu-

racy and efficiency. The batch layer ensures the model

remains effective by continuously learning from past

transactions, while the speed layer ensures that real-

time transactions are processed quickly enough to

meet the demands of a live fraud detection environ-

ment.

3.4 Training Process

In the training process of our fraud detection system,

both BatchNet and SpeedNet are trained across mul-

tiple time windows. This training method involves

sampling data from specific time intervals to create

mini-batches. Specifically, we consider all histori-

cal data from timestamp 1 to t

latest

for training, in

which t

latest

is the latest timestamp. However, due

ICAART 2025 - 17th International Conference on Agents and Artificial Intelligence

370

to the extensive nature of this interval, which can

result in a large volume of data, we divide it into

smaller, manageable time windows for training. Each

mini-batch corresponds to a time partition denoted as

T = {1, 2, . . . , t}, where each unit represents a times-

tamp, such as minutes, hours, or days. In our exper-

iments, we define each timestamp as a day. Specif-

ically, the reference subgraph covering timestamps

from 1 to t − 1, denoted as {G

j

}

t−1

j=1

, serves as the

input for BatchNet. In contrast, the target subgraph at

timestamp t, along with the spatial-temporal embed-

dings of all entities at timestamp t − 1, is provided as

input to SpeedNet.

Following the completion of training at time win-

dow T , the sliding window mechanism comes into

play. We incrementally shift the window to the next

unit, adjusting it to T = 2, 3, ..., t + 1. This step allows

us to integrate the most recent transactions into the

training set while continuing to leverage the historical

data encapsulated in previous timestamps. The slid-

ing window ensures that the model is exposed to new

transaction patterns over time, enabling it to adapt

to evolving fraud behavior. Moreover, instead of re-

training from scratch with each new window, we ini-

tialize the model with the parameters learned in the

previous training iteration. This transfer of knowl-

edge is crucial for refining the model’s understand-

ing of both short-term and long-term fraud dynam-

ics, as it incrementally builds upon insights gained

from earlier windows. By doing so, the model not

only achieves better generalization but also efficiently

handles large-scale datasets that span extended peri-

ods.Not only that, throughout the training process, the

labels of all transaction nodes in the target subgraph

at timestamp t are used to compute the loss function,

enabling the model to update its predictions. The loss

is calculated using a binary cross-entropy function:

L = −

N

∑

i=1

(y

i

log( ˆy

i

) + (1 − y

i

)log(1 − ˆy

i

))

Where y

i

represents the ground truth label (fraud-

ulent or normal) of transaction node i, and ˆy

i

denotes

the risk score of node i being fraudulent. By itera-

tively minimizing this loss function across multiple

sliding windows, our system continuously improves

its ability to detect fraudulent transactions, even as

new data arrives.

4 EXPERIMENTS

4.1 The Usage Datasets

We use a real-world transaction dataset, the IEEE

CIS Fraud Detection dataset (referred to as the Vesta

dataset), which was released for the IEEE CIS Fraud

Detection competition. This comprehensive dataset

includes 590,540 transaction records, each meticu-

lously labeled as either normal or fraudulent. Of

these, 20,663 transactions are fraudulent, compris-

ing approximately 3.5% of the dataset. The dataset

contains detailed information on transaction amounts,

payment methods, and device information, with 433

attributes available for each transaction, offering a

rich and diverse set of features for building machine

learning models for fraud detection. In addition to the

transaction labels, the IEEE dataset records transac-

tion information over time, spanning a 6-month pe-

riod.

In addition to using real-world datasets, we con-

duct further experiments using synthetic data. The

PAYSIM dataset is a synthetic dataset generated from

simulations that replicate real-world financial trans-

actions. It was designed to address privacy concerns

while retaining the statistical properties and trans-

actional behaviors observed in natural financial sys-

tems. This dataset is created by a sophisticated fi-

nancial simulator based on real transaction data. The

PAYSIM dataset includes 6,362,620 transactions, of

which 8,213 are fraudulent (the frau ratio approx-

imately 0.129%) each labeled as either normal or

fraudulent. In addition to the transaction labels,

this dataset records transaction information over time,

covering a 1-month period. The dataset provides de-

tailed attributes for each transaction, such as time

step, type, amount, sender name, receiver name, and

old and new balances for both sender and receiver. A

summary of the training and testing data statistics for

both datasets is presented in table 1.

Table 1: Training and Testing Data Statistics. Note: #Time-

frames is the number of timeframes used in the training

and testing phase. Similarly, #Transactions is the number

of transactions used.

Dataset

#Timeframes #Transactions

Train Test Train Test

CSI 145 36 487,837 102,703

Paysim 24 6 6,239,040 123,580

Real-Time Transaction Fraud Detection via Heterogeneous Temporal Graph Neural Network

371

4.2 Baseline

To evaluate the performance of our proposed method,

we compare it against several established baseline

models in fraud detection, including traditional ma-

chine learning algorithms, graph-based methods. Be-

low, we outline the baseline models used in our ex-

periments:

• LightGBM (LGB): is a fast, decision-tree-based

algorithm designed for large-scale datasets, mak-

ing it ideal for fraud detection. It handles both cat-

egorical and continuous features efficiently, sup-

ports imbalanced datasets, and offers quick train-

ing times.

• BRIGHT(Lu et al., 2022): is a proposed so-

lution designed to tackle challenges in deploy-

ing Graph Neural Networks (GNNs) for real-

time fraud detection. It utilizes historical trans-

action data to derive insights for new transactions

through a Graph Convolutional Network (GCN).

This method models relationships between trans-

actions and entities, allowing the network to ag-

gregate relevant information from past transac-

tions.

4.3 Implement Details

4.3.1 Feature Encoding

In our experiments, we begin by preprocessing each

dataset to create a clean version. We either retain the

original values or transform them based on our under-

standing of the relevant business domain, while also

encoding categorical attributes. Consequently, each

row in the feature matrix corresponds to a transac-

tion. For the LightGBM (LGB) model, we directly

use this feature matrix as input. In contrast, for graph-

based methods, we apply normalization before uti-

lizing the features. For BRIGHT, we also incorpo-

rate this matrix for the transaction node features in

the input graph, while setting the features of the en-

tity nodes to zero vectors, as suggested in the original

proposal. For our proposed approach, we selectively

extract components from the feature matrix to repre-

sent the transaction node features, with entity node

features derived from the same matrix but tailored

to reflect the unique characteristics of each entity, as

shown in Figure 2.

4.3.2 Experimental Setup

To identify the optimal hyperparameters, we utilize

grid search to determine the ideal configuration for

the graph neural network (GNN), specifically focus-

ing on the number of layers and hidden units. We

Figure 2: Illustration of the difference features are used in

experiments.

evaluate GNN layer counts from the set {1, 2, 3, 4,

6, 8, 16} and hidden unit options from {56, 128,

256, 512}. For the LightGBM model, we train it us-

ing 10,000 trees. We incrementally adjust the num-

ber of HTGNN blocks and time window size, select-

ing configurations that optimize model performance.

For the training process, we employ the Adam opti-

mizer with a learning rate of 10

−3

and a weight de-

cay of 10

−4

. The remaining hyperparameters include

a dropout rate of 0.2, a total of 10,000 epochs, and

an early stopping mechanism with a patience of 50

epochs. All experiments are conducted on a DGX

server equipped with four A100 GPUs.

4.4 Evaluation Metrics

In evaluating our proposed fraud detection method,

we use the following metrics:

• Average Precision (AP) evaluates binary classifi-

cation, especially on imbalanced data, by averag-

ing precision and recall over thresholds.

• AUC-ROC measures a model’s ability to distin-

guish classes, showing the balance between true

and false positives across thresholds.

• Prediction time (or Latency) is the time a model

takes to predict after input. Low latency is critical

for timely fraud detection.

5 RESULTS AND DISCUSSION

5.1 Experimental Results

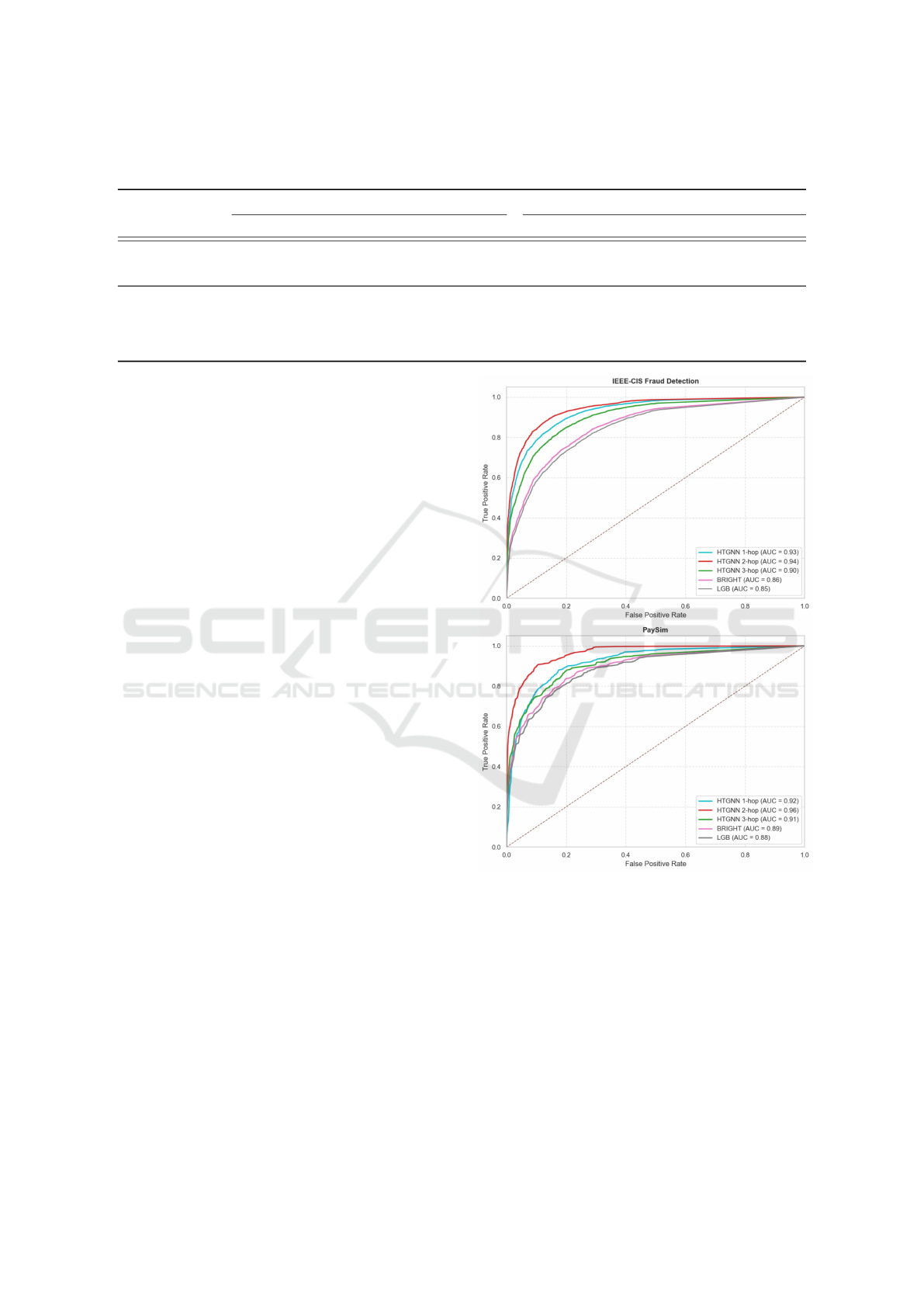

The comparative analysis of fraud detection methods

reveals the superior performance of the HTGNN 2-

hop model across both the IEEE-CIS and PAYSIM

datasets, as shown in Table 2 and Figure 3. On the

IEEE-CIS dataset, the HTGNN 2-hop achieved the

highest AUC-ROC score of 0.94, significantly outper-

forming traditional models like LGB, which recorded

ICAART 2025 - 17th International Conference on Agents and Artificial Intelligence

372

Table 2: The comparative performance of different models for fraud detection on IEEE-CIS Fraud Detection and PAYSIM

dataset. Notes: the prediction time is measured in milliseconds.

Method

IEEE-CIS PAYSIM

AUC-ROC AP Prediction time AUC-ROC AP Prediction time

LGB 0.851±0.003 0.361±0.025 0.69±0.019 0.882±0.013 0.454±0.011 0.52±0.019

BRIGHT 0.863±0.014 0.371±0.012 1.81±0.014 0.891±0.021 0.475±0.005 1.67±0.01

HTGNN 1-hop 0.931±0.013 0.611±0.007 1.85 ± 0.007 0.923±0.023 0.662±0.002 1.68±0.012

HTGNN 2-hop 0.940±0.010 0.641±0.008 1.80±0.013 0.956±0.003 0.682±0.011 1.67±0.041

HTGNN 3-hop 0.896±0.004 0.591±0.007 1.87 ± 0.001 0.907±0.003 0.623±0.003 1.69 ± 0.006

an AUC-ROC of 0.85, and BRIGHT, which scored

0.86. Additionally, the HTGNN 2-hop’s AP score

of 0.64 far exceeded that of LGB 0.36 and BRIGHT

0.37, underscoring its enhanced capability in identi-

fying true fraud cases.

On the PAYSIM dataset, the HTGNN 2-hop again

stood out with an impressive AUC-ROC of 0.96, out-

performing both LGB 0.88 and BRIGHT 0.89. Its AP

score of 0.68 on PAYSIM further reinforced its supe-

riority, surpassing LGB’s 0.45 and BRIGHT’s 0.48.

While the HTGNN 2-hop model required slightly

longer training times than the traditional models, its

prediction time of 1.8 milliseconds on IEEE-CIS and

1.67 milliseconds on PAYSIM remained comparable

to that of BRIGHT and manageable for real-time de-

ployment.

These results highlight that, while traditional

models like LGB and BRIGHT offer faster prediction

times, the HTGNN 2-hop model provides a substan-

tial boost in both AUC-ROC and AP, making it the

most effective method for capturing complex fraud

patterns and improving detection accuracy. As de-

picted in Figure 4, the histogram of risk scores for

normal transactions reveals that our proposed HT-

GNN 2-hop model concentrates the majority of nor-

mal transaction scores below 0.5 on both datasets. In

contrast, both the LGB and BRIGHT models show

a significantly higher number of normal samples with

risk scores above 0.5, indicating a higher likelihood of

misclassifications. This difference highlights that the

HTGNN 2-hop model generates more reasonable and

accurate risk scores, thereby reducing the chance of

false positives in fraud detection. The ability to push

genuine transactions into lower risk score ranges is

a clear indicator of the model’s superior calibration,

further solidifying its reliability in high-stakes fraud

detection environments. Overall, the HTGNN 2-hop

model demonstrates a commendable balance between

performance and efficiency, establishing it as a lead-

ing approach for fraud detection tasks within hetero-

geneous temporal graphs.

Figure 3: Receiver operating characteristic curve.

5.2 Discussion on the Application of

HTGNN to Real Fraud Detection

Systems

Training HTGNN across various product scenarios

offers both opportunities and challenges, especially

in data representation and feature extraction. With

heterogeneous data and transaction timelines, HT-

GNN efficiently captures relationships and temporal

dynamics. It adapts to fields like e-commerce, in-

surance, and telecommunications. For example, in

Real-Time Transaction Fraud Detection via Heterogeneous Temporal Graph Neural Network

373

Figure 4: The risk score histogram.

e-commerce, HTGNN can identify fraudulent activ-

ities by analyzing user behavior patterns, such as sud-

den changes in purchase frequency, unusually large

transactions, or abnormal browsing habits. However,

it struggles to predict transactions involving unseen

entities, as it assigns them a zero vector, limiting ac-

curacy due to the lack of historical data.

6 CONCLUSION

In this paper, we introduced a novel framework for

real-time fraud detection that leverages the power of

heterogeneous temporal graphs to integrate spatial,

temporal, and semantic information. By utilizing a

robust heterogeneous temporal graph neural network

(HTGNN) architecture, our approach captures com-

plex relationships and evolving patterns of fraud that

traditional models often miss, particularly those re-

lated to hidden or disguised fraudulent activities. Our

framework operates in real-time, enabling early de-

tection of fraudulent transactions, thereby minimiz-

ing financial losses and reducing operational risks for

organizations. The empirical results from our evalu-

ations on large, complex datasets demonstrate the ef-

fectiveness of the proposed model in accurately de-

tecting fraud and handling real-time data process-

ing. This work provides a significant advancement

in the field by offering a comprehensive and adap-

tive solution to the challenges posed by evolving

fraud tactics. Future work could explore extending

this framework by incorporating more sophisticated

graph-based models, with a focus on enhancing in-

terpretability and providing clearer insights into the

decision-making process.

ACKNOWLEDGEMENT

This research was partially funded by the Vingroup

Innovation Foundation (VINIF) under the grant num-

ber VINIF.2021.JM01.N2.

REFERENCES

Alarfaj, F. K., Malik, I., Khan, H. U., Almusallam, N.,

Ramzan, M., and Ahmed, M. (2022). Credit card

fraud detection using state-of-the-art machine learn-

ing and deep learning algorithms. IEEE Access,

10:39700–39715.

Awoyemi, J. O., Adetunmbi, A. O., and Oluwadare, S. A.

(2017). Credit card fraud detection using machine

learning techniques: A comparative analysis. In

2017 international conference on computing network-

ing and informatics (ICCNI), pages 1–9. IEEE.

Dornadula, V. N. and Geetha, S. (2019). Credit card fraud

detection using machine learning algorithms. Proce-

dia computer science, 165:631–641.

Dou, Y., Liu, Z., Sun, L., Deng, Y., Peng, H., and Yu, P. S.

(2020). Enhancing graph neural network-based fraud

detectors against camouflaged fraudsters. In Proceed-

ings of the 29th ACM international conference on in-

formation & knowledge management, pages 315–324.

ICAART 2025 - 17th International Conference on Agents and Artificial Intelligence

374

Fu, K., Cheng, D., Tu, Y., and Zhang, L. (2016). Credit

card fraud detection using convolutional neural net-

works. In Neural Information Processing: 23rd In-

ternational Conference, ICONIP 2016, Kyoto, Japan,

October 16–21, 2016, Proceedings, Part III 23, pages

483–490. Springer.

Hasugian, L. S. et al. (2023). Fraud detection for online

interbank transaction using deep learning. Journal of

Syntax Literate, 8(6).

Karthika, J. and Senthilselvi, A. (2023). Smart credit card

fraud detection system based on dilated convolutional

neural network with sampling technique. Multimedia

Tools and Applications, 82(20):31691–31708.

Liu, Y., Ao, X., Qin, Z., Chi, J., Feng, J., Yang, H., and He,

Q. (2021). Pick and choose: a gnn-based imbalanced

learning approach for fraud detection. In Proceedings

of the web conference 2021, pages 3168–3177.

Liu, Z., Dou, Y., Yu, P. S., Deng, Y., and Peng, H. (2020).

Alleviating the inconsistency problem of applying

graph neural network to fraud detection. In Proceed-

ings of the 43rd international ACM SIGIR conference

on research and development in information retrieval,

pages 1569–1572.

Lu, M., Han, Z., Rao, S. X., Zhang, Z., Zhao, Y., Shan,

Y., Raghunathan, R., Zhang, C., and Jiang, J. (2022).

Bright-graph neural networks in real-time fraud detec-

tion. In Proceedings of the 31st ACM International

Conference on Information & Knowledge Manage-

ment, pages 3342–3351.

Maes, S., Tuyls, K., Vanschoenwinkel, B., and Manderick,

B. (2002). Credit card fraud detection using bayesian

and neural networks. In Proceedings of the 1st inter-

national naiso congress on neuro fuzzy technologies,

volume 261, page 270.

Maniraj, S., Saini, A., Ahmed, S., and Sarkar, S. (2019).

Credit card fraud detection using machine learning

and data science. International Journal of Engineer-

ing Research, 8(9):110–115.

Peng, H., Zhang, R., Dou, Y., Yang, R., Zhang, J., and

Yu, P. S. (2021). Reinforced neighborhood selec-

tion guided multi-relational graph neural networks.

ACM Transactions on Information Systems (TOIS),

40(4):1–46.

Rao, S. X., Zhang, S., Han, Z., Zhang, Z., Min, W., Chen,

Z., Shan, Y., Zhao, Y., and Zhang, C. (2020). xfraud:

explainable fraud transaction detection. arXiv preprint

arXiv:2011.12193.

Sahin, Y. and Duman, E. (2011). Detecting credit card fraud

by decision trees and support vector machines. In Pro-

ceedings of the International MultiConference of En-

gineers and Computer Scientists, volume 1, pages 1–

6.

Sailusha, R., Gnaneswar, V., Ramesh, R., and Rao, G. R.

(2020). Credit card fraud detection using machine

learning. In 2020 4th international conference on

intelligent computing and control systems (ICICCS),

pages 1264–1270. IEEE.

Saputra, A. et al. (2019). Fraud detection using machine

learning in e-commerce. International Journal of Ad-

vanced Computer Science and Applications, 10(9).

Tumiwa, R. A. F., Purba, J. H. V., Zaroni, A. N., and Judi-

janto, L. (2024). Management of antifraud in the

era of banking digitization. International Journal,

5(10):2355–2367.

Varun Kumar, K., Vijaya Kumar, V., Vijay Shankar, A., and

Pratibha, K. (2020). Credit card fraud detection us-

ing machine learning algorithms. International jour-

nal of engineering research & technology (IJERT),

9(7):2020.

Vaswani, A., Shazeer, N., Parmar, N., Uszkoreit, J., Jones,

L., Gomez, A. N., Kaiser, Ł., and Polosukhin, I.

(2017). Attention is all you need. Advances in neural

information processing systems, 30.

Veli

ˇ

ckovi

´

c, P., Cucurull, G., Casanova, A., Romero, A., Lio,

P., and Bengio, Y. (2017). Graph attention networks.

arXiv preprint arXiv:1710.10903.

Wang, D., Lin, J., Cui, P., Jia, Q., Wang, Z., Fang, Y., Yu,

Q., Zhou, J., Yang, S., and Qi, Y. (2019). A semi-

supervised graph attentive network for financial fraud

detection. In 2019 IEEE international conference on

data mining (ICDM), pages 598–607. IEEE.

Xiang, S., Cheng, D., Shang, C., Zhang, Y., and Liang,

Y. (2022). Temporal and heterogeneous graph neural

network for financial time series prediction. In Pro-

ceedings of the 31st ACM international conference on

information & knowledge management, pages 3584–

3593.

Xiang, S., Zhu, M., Cheng, D., Li, E., Zhao, R., Ouyang,

Y., Chen, L., and Zheng, Y. (2023a). Semi-supervised

credit card fraud detection via attribute-driven graph

representation. In AAAI Conference on Artificial In-

telligence.

Xiang, S., Zhu, M., Cheng, D., Li, E., Zhao, R., Ouyang,

Y., Chen, L., and Zheng, Y. (2023b). Semi-supervised

credit card fraud detection via attribute-driven graph

representation. In Proceedings of the AAAI Con-

ference on Artificial Intelligence, volume 37, pages

14557–14565.

Xie, Y., Liu, G., Zhou, M., Wei, L., Zhu, H., and Zhou, R.

(2023). A spatial-temporal gated network for credit

card fraud detection. In 2023 IEEE International Con-

ference on Networking, Sensing and Control (ICNSC),

volume 1, pages 1–6. IEEE.

Zhou, X., Zhang, Z., Wang, L., and Wang, P. (2019). A

model based on siamese neural network for online

transaction fraud detection. In 2019 International

Joint Conference on Neural Networks (IJCNN), pages

1–7.

Real-Time Transaction Fraud Detection via Heterogeneous Temporal Graph Neural Network

375