Multimodal Stock Price Prediction

Furkan Karadaş

1

, Bahaeddin Eravcı

2

and Ahmet Murat Özbayoğlu

2

1

Department of Computer Engineering, TOBB University of Economics and Technology, Ankara, Turkey

2

Department of Artificial Intelligence Engineering, TOBB University of Economics and Technology, Ankara, Turkey

Keywords: Financial Forecasting, Stock Market Prediction, Deep Learning, Deep Neural Networks,

Multimodal Machine Learning, Large Language Models.

Abstract: In an era where financial markets are heavily influenced by many static and dynamic factors, it has become

increasingly critical to carefully integrate diverse data sources with machine learning for accurate stock price

prediction. This paper explores a multimodal machine learning approach for stock price prediction by

combining data from diverse sources, including traditional financial metrics, tweets, and news articles. We

capture real-time market dynamics and investor mood through sentiment analysis on these textual data using

both ChatGPT-4o and FinBERT models. We look at how these integrated data streams augment predictions

made with a standard Long Short-Term Memory (LSTM model) to illustrate the extent of performance gains.

Our study's results indicate that incorporating the mentioned data sources considerably increases the forecast

effectiveness of the reference model by up to 5%. We also provide insights into the individual and combined

predictive capacities of these modalities, highlighting the substantial impact of incorporating sentiment

analysis from tweets and news articles. This research offers a systematic and effective framework for applying

multimodal data analytics techniques in financial time series forecasting that provides a new perspective for

investors to leverage data for decision-making.

1 INTRODUCTION

In the modern world of finance today, investors and

fund managers find themselves confronting

considerable challenges in making the most

appropriate investment decisions possible in

complicated and dynamic environments. From

immediate-impact global economic events to political

development market reflections and transformative

industrial changes brought about by technological

advancement, there have been so many continuous

influences on financial markets that make predicting

investments all the more difficult. Because of these

reasons, traditional analysis methods often fail, and

investors latch on to promising tools and frameworks

that offer accurate and reliable forecasting.

Das et al. (Das, Behera, & Rath, 2018) and Peng

et al. (Peng & Jiang, 2015) have focused on individual

tweet content to predict stock prices using social

media sentiment. This work is outstanding in terms of

including broader data sources, news articles, and

tweet sentiment data. However, unlike these studies,

we enrich our sentiment analysis by incorporating

engagement metrics such as tweet likes, retweets,

comments and the tweeter's follower count into our

feature extraction process. These processes provide a

much more detailed view of market sentiment.

This study focuses on multimodal stock price

prediction by integrating traditional financial metrics

with data acquired from tweets from Twitter (now

X.com) and news articles from The New York Times.

We aim to capture real-time market dynamics and

gauge investor sentiment by analyzing these data

sources. Tweets provide non-moderated, real-time

insights from the public, while news articles from The

New York Times offer moderated, expert information.

To measure market sentiment and excitement, we

conducted sentiment analysis using both ChatGPT-

4o and FinBERT to include (Araci, 2019). ChatGPT-

4o is a recent, large-scale language model, whereas

FinBERT is a specialized, smaller model tailored for

financial text analysis. Our study evaluates the

predictive models on three stocks representing

various market states, including bull, bear, and

neutral markets. We compare results from these

integrated data sources with predictions made by a

standard Long-Short-Term Memory (LSTM) model

utilizing only price data as input. Then, we highlight

Karada¸s, F., Eravcı, B. and Özbayo

ˇ

glu, A. M.

Multimodal Stock Price Prediction.

DOI: 10.5220/0013174500003890

In Proceedings of the 17th International Conference on Agents and Artificial Intelligence (ICAART 2025) - Volume 3, pages 687-694

ISBN: 978-989-758-737-5; ISSN: 2184-433X

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

687

the performance enhancements achieved through data

diversity and advanced sentiment analysis.

Experimental results show that integrating social

media data, such as tweets and news articles, with

technical indicators significantly enhances the

model's predictive accuracy, outperforming price data

alone. Additionally, sentiment analysis using

FinBERT and ChatGPT-4o produced very similar

results, further validating the robustness of sentiment

integration.

The following sections will provide a detailed

methodology, including the experimental setup and

analysis of results. We will also discuss the potential

implications of multimodal data processing in

financial predictions.

2 RELATED WORKS

Deep learning-based machine learning methods are

successfully applied in various fields, such as

medicine, computer vision, and telecommunications

(Ahmedt-Aristizabal, Armin, Denman, Fookes, &

Petersson, 2021). Due to their success in these areas,

machine learning and deep learning have recently

become popular among the methods used in finance,

especially in financial forecasting. The application of

machine learning and artificial intelligence

techniques to financial data analysis and statistical

analyses of temporal data (Boginski, Butenko, &

Pardalos, 2005; Keskin, Yilmaz, & Ozbayoglu, 2021;

Sezer, Gudelek, & Ozbayoglu, 2020; Tsay, 2005)

provides investors with insights and

recommendations when forming their portfolios.

LSTM (Hochreiter, 1997) is a variant of RNN

capable of retaining short-term and long-term

information. Deep learning researchers frequently

choose LSTM networks for sequence learning. These

models are mainly applied to time-series data and are

employed across various domains, including Natural

Language Processing (NLP), language modelling,

translation, speech recognition, sentiment analysis,

predictive analytics, and financial time series analysis

(Gao, Chai, & Liu, 2017; Greff, Srivastava, Koutník,

Steunebrink, & Schmidhuber, 2016; Wu, 2016).

A review of studies in the literature highlights the

complexity and dynamism of financial markets,

emphasizing that analyses based on a single feature

can be misleading (Saha, Gao, & Gerlach, 2022).

Pearson correlation reveals linear relationships but

overlooks the diversity of financial data across

different times. A single feature usually gives only a

particular indication, while the interaction of several

factors shapes financial markets. For example,

focusing solely on stock prices can lead to paying

attention to significant aspects such as the company's

financial condition, management quality, industry

trends, economic conditions, and competition.

Wang et al. (Wang, Yu, & Shen, 2020) utilize

online financial reviews to determine the daily

sentiment for each stock, finding a strong correlation

between positive sentiment and an increase in the

closing stock price. Akita et al. (Akita, Yoshihara,

Matsubara, & Uehara, 2016) present a method for

predicting stock prices using financial data metrics

and text-based information. It introduces a strategy

for forecasting stock prices that involves using

distributed representations of news articles and

examining the relationships between various

companies operating within the same industry.

Lavrenko et al. (Lavrenko et al., 2000) integrated

stock price trends with financial news articles to

predict market directions based on news content

before these trends materialized. Another study

analysed newspaper articles' sentiment added to the

dataset and concluded that incorporating a sentiment-

measuring feature improved model performance for

the testing dataset (Forecast, 2021).

Besides news articles, social media is used in an

array of studies (Cam, Cam, Demirel, & Ahmed,

2024; Das et al., 2018; Peng & Jiang, 2015). These

implemented sentiment analyses on crawled tweets

from Twitter along with stock data for forecasting in

the stock market and concatenated with price data.

While social media data, specifically tweets, has been

incorporated into stock market forecasting models,

these studies have typically limited their sentiment

analysis to the textual content of tweets themselves.

Recent studies (Avramelou, Nousi, Passalis, &

Tefas, 2024; Farimani, Jahan, & Fard, 2024; Taylor

& Ng, 2024) examined multimodal deep learning for

predicting financial markets, each using distinct

methods and data types. Avramelou et al. (Avramelou

et al., 2024) present a novel multimodal approach for

deep reinforcement learning in financial trading. This

specifically addresses the challenge of effectively

combining diverse online data sources like news

articles and social media websites. Their approach

leverages embeddings to merge price and sentiment

data, allowing the model to discover the best

combinations of these elements for enhanced trading

decisions. Taylor et al. (Taylor & Ng, 2024) explore

a multimodal approach to stock price prediction,

integrating news headlines and article sources with

stock price percentage change data. Their study

mainly examines how percentage change compares to

raw price values in effectiveness, while also

exploring how different combinations of these data

ICAART 2025 - 17th International Conference on Agents and Artificial Intelligence

688

types contribute to prediction accuracy. Farimani et

al. (Farimani et al., 2024) propose an adaptive

multimodal learning model for market price

prediction, leveraging diverse data modalities to

address the financial time series. The data sources for

their models fetched from news content, sentiment

from specialized newsgroups, and technical

indicators.

3 METHOD

3.1 Dataset

The dataset for this study comprises three selected

stocks: Walmart Inc., Walt Disney Co., and

Microsoft. Despite analyzing a few stocks, we

ensured a more representative dataset by selecting

companies with significantly different market

capitalizations, sectors, and behaviors in market

states. Table 1 lists each stock's sector information,

market state, and capitalization.

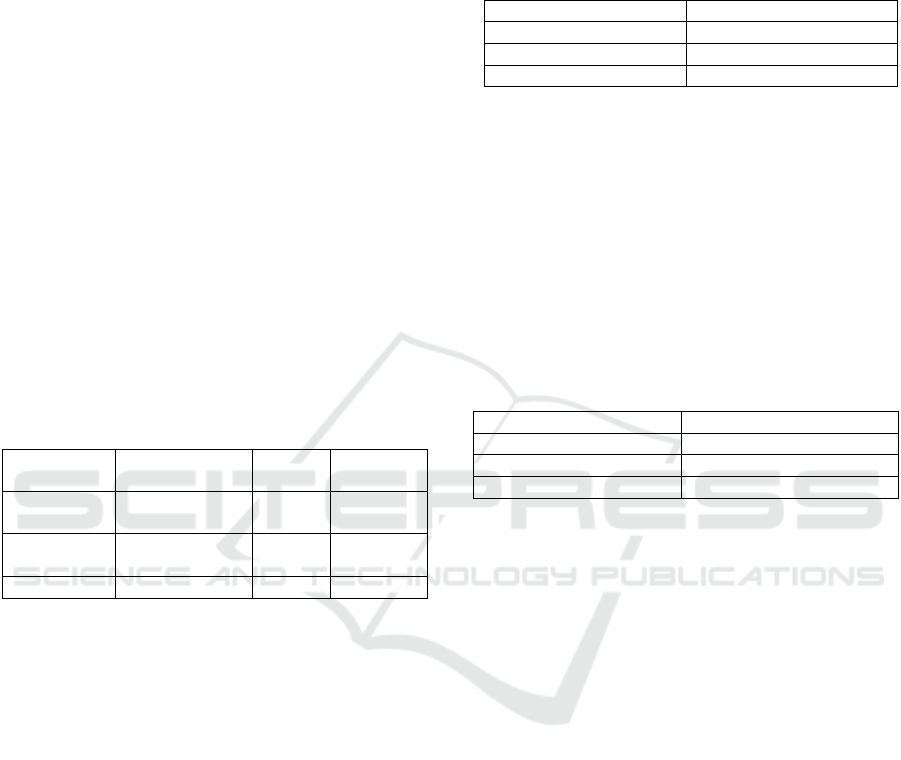

Table 1: Selected Stocks.

Stock

Name

Sector State Market

Ca

p

2024

Walmart

Inc.

Consume

Defensive

Neutral

643.86B

$

Walt Disney

Co.

Communication

Services

Bear

170.71B

$

Microsoft Technolog

y

Bull 3.09T $

With their different market conditions, these

stocks represent bull, bear, and neutral states. Bull

market stocks include rising prices and investors'

confidence while falling prices and economic

challenges characterize bear market stocks. Neutral

market stocks have a stable nature with a moderate

fluctuation in price to give a balanced perspective.

These stocks represent various market dynamics and

how those dynamics may play into investment

strategy. We collected comprehensive financial data

for each company from Yahoo Finance, including

historical price movements and other relevant

financial indicators. The data gathered for each stock

ranges from 2018 to 2023. The parameters chosen for

analysis are Date, Open, High, Low, Close, Adjusted

Close, and Volume.

We collected tweets relevant to each stock to

understand public opinion on market dynamics by

filtering for specific keywords. Keywords included

the company name or stock ticker symbol, such as

"Microsoft or MSFT." We required each tweet to

have at least 100 likes to prioritize tweets with higher

engagement. Table 2 shows the total number of

tweets for each stock. These tweets and the stock

price data were gathered from 2018 to 2023.

Table 2: Number of Tweets for Stocks.

Stock Number of Tweets

Walmart Inc. 31.555

Walt Disne

y

Co. 183.406

Microsoft 53.446

We included another data source for analyzing

market insights with expert and moderated opinions

to augment our market understanding. We collected

news articles from The New York Times using its

API to access news articles about each stock's

significant events and developments that may affect

market sentiment or stock performance. We filtered

the news articles using the exact keywords used for

the tweets. Table 3 presents the total number of news

articles for each stock collected over the same period

as the tweet data.

Table 3: Number of News Articles for Stocks.

Stock Number of Tweets

Walmart Inc. 2.930

Walt Disne

y

Co. 5.821

Microsoft 3.629

3.2 Preprocessing Data

In the preprocessing data phase, due to the non-

uniform range of values in the historical trading data,

Min-Max normalization will be applied to scale the

data to a range between 0 and 1 before inputting it

into the LSTM model.

We cleaned the data using various techniques to

ensure the quality and relevance of text within tweets

and news articles. This step removed unnecessary

content or text around URLs, hashtags, mentions,

reserved words, emojis, and smileys. Additionally,

we eliminated stop words, punctuation, special

characters, and numbers, as they do not contribute

meaningful information to the text. Further, we

removed any extra spaces while converting all text to

lowercase. These steps were essential for the dataset,

making it suitable for the subsequent analysis.

To address missing data, we applied a data-filling

method to ensure the continuity and completeness of

the dataset. Using forward-filling techniques, we

effectively imputed missing values while preserving

the dataset's integrity.

Multimodal Stock Price Prediction

689

3.3 Feature Extraction

Firstly, we selected two models to analyse the

sentiment of the tweets and news: FinBERT (Araci,

2019) and ChatGPT-4o. These two models bring

significant innovations to natural language

processing (NLP). FinBERT is an adaptation of the

BERT architecture and is specifically trained to

process financial texts, which means it allows better

and quicker insights from financial documents like

market analyses. The other model is ChatGPT-4o,

which is a general language model used to answer

many different kinds of questions effectively. Besides

FinBERT, it is trained not only on financial data but

in more and larger open-source data for human

interaction; hence, it will generate creative solutions

during conversations. Each tweet was input into these

models to assess its sentiment, assigning a score

ranging from -1 to 1. A score of -1 represents a highly

negative sentiment, 0 signifies a neutral sentiment,

and 1 denotes a highly positive sentiment.

Additionally, the models provided an accuracy

percentage for the sentiment evaluation, allowing us

to quantify the models' confidence in classifying

sentiment accurately.

Furthermore, we introduced a weighted sentiment

score to enhance our sentiment analysis. This method

considers not only the sentiment score of each tweet

but also additional engagement metrics: likes,

retweets, and comments for tweets, along with the

follower count of the user who posted the tweet. We

defined the tweet interaction ( 𝑇

) such that

𝑇

= 𝛼∗𝑇

+𝛽∗𝑇

+𝛾∗𝑇

(1)

where 𝑇

number of retweets for the tweet, 𝑇

,

number of likes for the tweet, 𝑇

, and number of

comments for the tweet and also 𝛼,𝛽,𝛾 are

hyperparameters reflecting the weights assigned to

each metric. In this study, we set these parameters to

0.3 as an initial estimate without any optimization.

To account for the impact of the user who posted

the tweet, we calculated the user influence (𝑈

) based

on their follower count, capturing the potential reach

of their messages. This is expressed as

𝑈

= 𝛿∗𝐹

(2)

where 𝐹

number of followers for the user who

posted the tweet, 𝛿 is a hyperparameter determining

the influence of follower counts, chosen as 0.1 in this

study.

The sentiment (𝑆) is derived by multiplying the

sentiment label (𝑆

) with the accuracy percentage of

the sentiment classification (𝑆

), ensuring that the

calculated sentiment reflects both its evaluated value

and the confidence level.

𝑆=𝑆

∗𝑆

(3)

Total tweet interaction (𝑇𝑇

) aggregates the total

engagement across retweets, likes, and comments to

assess each tweet's overall impact

𝑇𝑇

=𝑇

+𝑇

+𝑇

(4)

where 𝑇

number of retweets for the tweet, 𝑇

,

number of likes for the tweet, 𝑇

, number of

comments for the tweet.

By employing these comprehensive formulas, we

could reflect not just the content of the tweets but also

their potential influence and effectiveness within the

social media landscape. The weighted sentiment

( 𝑊𝑆 ) formula integrates all these factors and is

calculated as follows:

𝑊𝑆=

∗

∗

(5)

Our approach incorporates weighted sentiment

analysis, which augments tweet sentiments by

considering tweet engagement (retweets, likes,

comments) and user influence (follower count). This

is represented by the hyperparameters α, β, γ, and δ

which are tuned to optimize model performance and

provide a more nuanced assessment of market

sentiment, as high engagement and influential users

are weighted more heavily. This approach is expected

to more accurately reflect the true impact of the

influence and engagement of tweets on stock prices

compared to just tweet content's sentiment.

To enhance our dataset, we incorporated financial

technical indicators and sentiment analysis. These

features include the Relative Strength Index (RSI)

and the Simple Moving Average (SMA), both of

popular in financial analysis. The RSI measures the

speed and change of price movements to determine

whether a stock is overbought or oversold, while the

SMA smooths price data to help identify trends over

specified time periods.

To integrate the news articles, tweets, and price

data, we faced the challenge of aligning datasets that

operate on different timeframes. Given that the price

data is recorded daily, while there can be hundreds of

tweets and news articles within a single day, we

needed to synchronize these varying data frequencies.

We calculated the average sentiment label and

accuracy percentage for all tweets and news articles

generated daily to achieve this. Additionally, we

included the number of tweets and news articles for

the respective day in the dataset. This approach

allowed us to convert all data into a daily format,

ICAART 2025 - 17th International Conference on Agents and Artificial Intelligence

690

ensuring that each stock's sentiment analysis

corresponds accurately with the price movements and

providing a cohesive dataset for our analysis.

3.4 Model

Our predictive model uses a standard Long-Short-

Term Memory (LSTM) architecture, chosen

specifically for its general applicability in handling

sequential data and its robustness in time series

forecasting. We focused on predicting stock closing

prices, which are crucial indicators in financial

decision-making.

The LSTM model consists of a single layer with

256 units. We employed the ReLU activation

function and the Adam optimizer with a learning rate

0.001. To optimize computational resources and

facilitate effective learning, we selected a batch size

of 128. The model was trained over 100 epochs.

4 PERFORMANCE EVALUATION

AND DISCUSSIONS

4.1 Training Strategy

Our model was trained using data from 2018 to 2022,

while data from 2023 was reserved for testing. This

temporal split allows the model to learn from a

substantial period of historical data before being

evaluated on more recent data patterns and unseen

market dynamics. We selected the Mean Squared

Error (MSE) for the loss function. To enhance the

reliability of our findings, we trained the model 10

times for both the training and testing phases and then

averaged the results. This iterative approach

minimizes the effects of any random variances or

anomalies in the data, ensuring that the performance

metrics reflect a more stable and generalized model

performance.

4.2 Computational Model Performance

In evaluating the performance of our model, designed

to predict stock closing prices, we utilized two key

metrics: R-squared (R2) and Mean Absolute Error

(MAE). Both metrics were calculated using the

predicted and actual closing prices for each stock.

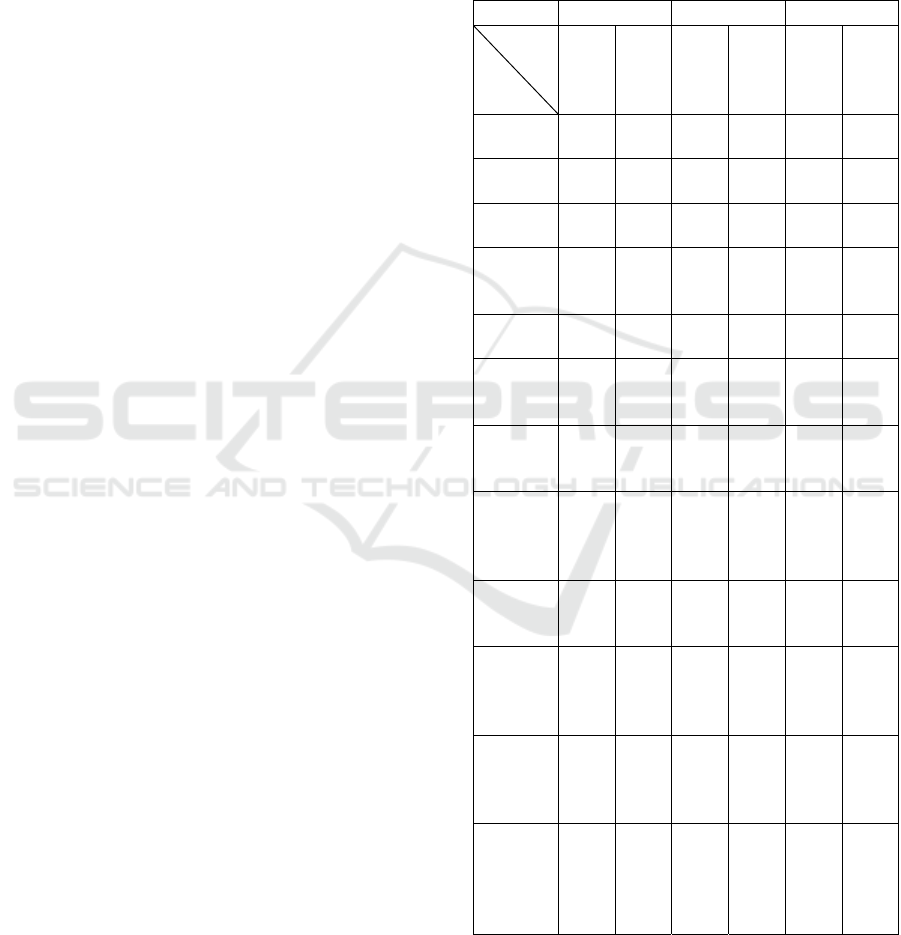

Table 4 presents the performance of stock price

prediction models using FinBERT sentiment

analysis, evaluated across various feature

combinations.

For Walmart, the combination of price data with

RSI and SMA yielded the best results (R² = 0.936,

MAE = 0.017). Similar observations were made for

Microsoft. The highest performance was achieved

using price data combined with RSI and SMA (R² =

0.964, MAE = 0.020).

Table 4: Model Performance R² and MAE Scores

(FinBERT Sentiment).

Walmart Disney Microsoft

Metrics

Features

𝑹

𝟐

MAE

𝑹

𝟐

MAE

𝑹

𝟐

MAE

Prices

(Baseline)

0.928 0.018 0.892 0.017 0.950 0.023

Prices-

RSI-SMA

0.936 0.017 0.890 0.017 0.964 0.020

Prices-

News

0.889 0.023 0.860 0.019 0.812 0.036

Prices-

News-RSI-

SMA

0.904 0.021 0.829 0.021 0.960 0.021

Prices-

Tweets

0.891 0.023 0.889 0.017 0.949 0.023

Prices-

Tweets-

RSI-SMA

0.917 0.019 0.850 0.020 0.960 0.021

Prices-

Tweets-

News

0.889 0.023 0.829 0.022 0.940 0.025

Prices-

Tweets-

News-RSI-

SMA

0.904 0.021 0.846 0.020 0.964 0.019

Prices-

Weighted-

Tweets

0.872 0.026 0.909 0.015 0.952 0.023

Prices-

Weighted-

Tweets-

RSI-SMA

0.884 0.024 0.798 0.023 0.961 0.020

Prices-

Weighted-

Tweets-

News

0.873 0.025 0.871 0.018 0.943 0.025

Prices-

Weighted-

Tweets-

News-RSI-

SMA

0.910 0.021 0.863 0.019 0.946 0.024

In contrast, incorporating sentiment features

improved model performance for Disney predictions.

For instance, the model that combined price data with

the weighted sentiment score of tweets achieved

Multimodal Stock Price Prediction

691

higher R² scores (R² = 0.909, MAE = 0.015) than just

using price data (R² = 0.892, MAE = 0.017),

suggesting that sentiment data captures valuable

information about market perceptions and investor

sentiment specific to Disney.

It should be noticed that for Microsoft, the model

with combined data achieved better results with

tweets, news articles, and technical indicators (R² =

0.964, MAE = 0.019) compared to using only price

data (R² = 0.950, MAE = 0.023). This highlights the

significance of sentiment analysis for Microsoft's

stock predictions. Sentiment data can be beneficial

when combined with price data, enhancing the

model’s ability to capture market trends more

effectively.

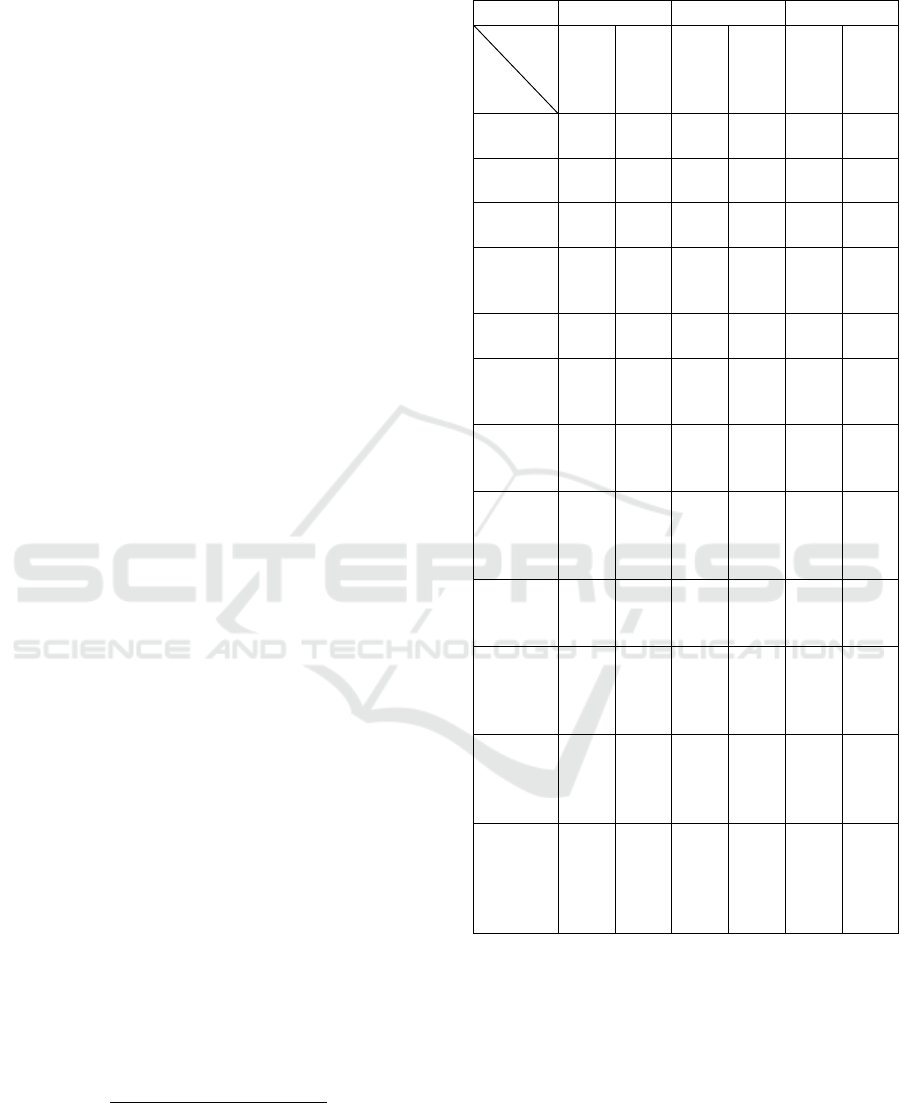

Table 5 summarizes the performance of models

utilizing ChatGPT-4o sentiment analysis features

across different stocks, revealing notable variations

depending on the features used.

For Walmart, the best results were again

achieved with technical indicators like RSI and SMA

(R² = 0.942, MAE = 0.016). Despite this being the

optimal outcome, when tweet sentiment data and

technical indicators are added, it yields better results

(R² = 0.935, MAE = 0.017) than using only price data

(R² = 0.892, MAE = 0.023). For Disney, it was

observed that using only price data was more

effective than including other features, such as

sentiment features from tweets, for improving the

overall model performance. The model performed

best for Microsoft using traditional technical

indicators with tweet sentiment data (R² = 0.959,

MAE = 0.021).

Both demonstrated strong performance when

comparing the FinBERT and ChatGPT-4o sentiment

analysis features. These indicators consistently led to

predictive performance across all stocks in both

models. Adding sentiment data, like news and tweets,

contributed positively in both models, though the

improvements were modest. FinBERT and ChatGPT-

4o performed well, with technical indicators playing

the dominant role and sentiment features adding

subtle yet consistent value.

4.3 Market Simulation

We implemented real-world stock trading using the

strategy outlined by Lavrenko et al. (Lavrenko et al.,

2000), which is defined as follows

𝑟

(𝑡)=

(

)

()

()

(6)

𝑔𝑎𝑖𝑛

(𝑡)=

𝑏𝑢𝑦→𝑠𝑒𝑙𝑙 (𝑟

(

𝑡

)

>0)

𝑠𝑒𝑙𝑙→𝑏𝑢𝑦 (𝑟

(

𝑡

)

<0)

(7)

Table 5: Model Performance R² and MAE Scores

(ChatGPT Sentiment).

Walmart Disney Microsoft

Metrics

Features

𝑹

𝟐

MAE

𝑹

𝟐

MAE

𝑹

𝟐

MAE

Prices

(Baseline)

0.892 0.023 0.916 0.014 0.947 0.024

Prices-

RSI-SMA

0.942 0.016 0.875 0.018 0.953 0.023

Prices-

News

0.876 0.025 0.878 0.018 0.932 0.028

Prices-

News-RSI-

SMA

0.893 0.023 0.749 0.027 0.955 0.022

Prices-

Tweets

0.893 0.023 0.903 0.016 0.953 0.023

Prices-

Tweets-

RSI-SMA

0.935 0.017 0.861 0.019 0.959 0.021

Prices-

Tweets-

News

0.876 0.025 0.836 0.021 0.935 0.026

Prices-

Tweets-

News-RSI-

SMA

0.899 0.022 0.739 0.027 0.956 0.022

Prices-

Weighted-

Tweets

0.921 0.020 0.898 0.016 0.951 0.023

Prices-

Weighted-

Tweets-

RSI-SMA

0.917 0.019 0.873 0.018 0.947 0.024

Prices-

Weighted-

Tweets-

News

0.881 0.024 0.799 0.023 0.948 0.023

Prices-

Weighted-

Tweets-

News-RSI-

SMA

0.909 0.021 0.715 0.029 0.951 0.023

where buy → sell denotes a transaction

purchasing stocks at the opening price, and sell →

buy denotes a transaction selling at the opening price.

Furthermore, shares are purchased at the closing price

if the opening price decreases by 2% relative to the

predicted closing price. In other cases, if a profit of

2% is achieved based on the price at which the stock

was initially bought, shares are sold at either the

opening or closing price, depending on which offers

the realized gain.

ICAART 2025 - 17th International Conference on Agents and Artificial Intelligence

692

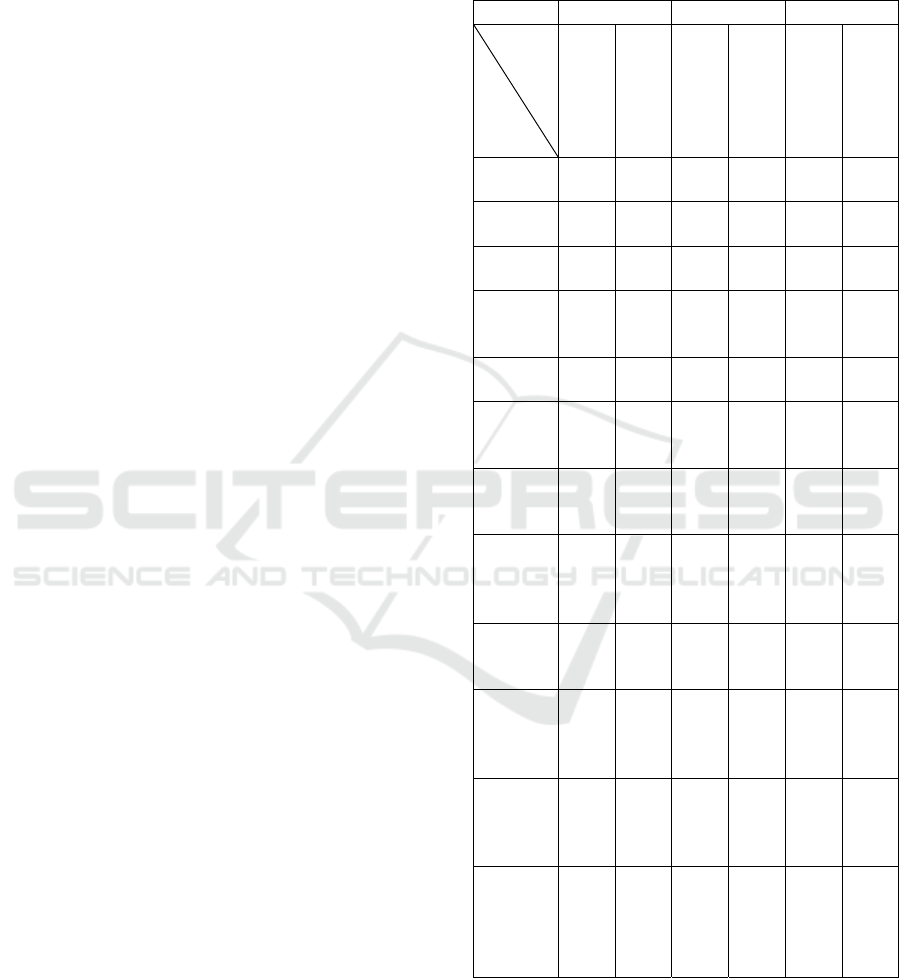

The market simulation results in Table 6 illustrate

the percentage gains achieved in various feature

combinations, starting with an initial capital of 1

million dollars for each stock. The table shows the

results of the profit we made at the end of the year.

Prices and news articles features achieved the

highest score, 12.4%, for Walmart using FinBERT

sentiment. For Disney, we observe that the tweets

obtained the highest score, 1.62% when weighted

sentiment analysis was used, which was done using

FinBERT sentiment analysis. When we look at the

Microsoft results, tweets, news articles, and technical

indicators, we see that they reached a peak score of

42.11% with sentiment analysis using FinBERT.

These results demonstrate that incorporating

technical indicators such as RSI and SMA and

sentiment analysis (especially news articles and

tweets) leads to higher returns than price data. While

price data provides a strong baseline, combining

technical indicators and sentiment analysis allows the

models to capture market trends more effectively and

generate higher profits. Thus, feeding the models with

these additional features proves to be a more effective

strategy for maximizing gains in the simulation.

Considering the results obtained in the market

simulation, FinBERT was the sentiment model with

the highest return among all three stocks. The results

indicate that FinBERT outperforms ChatGPT-4o in

sentiment analysis, particularly in stock price

prediction contexts. Although FinBERT is a small

model compared to ChatGPT-4o, it is considered to

provide better results since it is a domain-specific

model.

5 CONCLUSIONS

This paper has demonstrated how the use of

traditional financial data in conjunction with multiple

sources of text-based data, like tweets or news

articles, lead to more accurate financial forecasting.

By using insights from sentiment analysis of text-

based resources like tweets and news, this study also

emphasizes how crucial it is to comprehend market

sentiment and how it affects changes in stock prices.

In other words, a multimodal approach to financial

data analysis can enhance prediction accuracy and

result in more effective trading strategies.

To improve profit-making capacities, we want to

include macroeconomic information in future work,

such as GDP growth rates, inflation rates, and

unemployment statistics. In addition to incorporating

these information’s, we plan to explore advanced

embedding and fusion techniques with the integration

of LLMs (Large Language Models), to enhance our

model's performance compared to traditional LSTM

models.

Table 6: Market Simulation Score.

Walmart Disney Microsoft

Sentiment

Type

Features

FinBERT

ChatGPT-4o

FinBERT

ChatGPT-4o

FinBERT

ChatGPT-4o

Prices

(Baseline)

9.01 10.47 -0.67 -0.8 27.58 24.89

Prices-

RSI-SMA

5.24 6.19 -10.6 -11.4 30.92 26.33

Prices-

News

12.4 7.55 -2.72 -3.59 28.25 15.28

Prices-

News-RSI-

SMA

5.22 6.06 -2.53 -6.02 30.93 28.49

Prices-

Tweets

7.4 6.98 -2.94 -6.54 23.87 26.13

Prices-

Tweets-

RSI-SMA

6.84 7.91 -6.16 -8.17 30.73 27.82

Prices-

Tweets-

News

10.65 9.25 -2.15 -4.33 35.56 29.18

Prices-

Tweets-

News-RSI-

SMA

5.87 6.94 -6.24 -6.22 42.11 29.65

Prices-

Weighted-

Tweets

3.7 3.88 -2.03 -3.33 23.39 21.21

Prices-

Weighted-

Tweets-

RSI-SMA

2.80 7.79 -9.2 -8.73 33.69 22.66

Prices-

Weighted-

Tweets-

News

11.79 10.5 1.62 -1.39 27.7 19.76

Prices-

Weighted-

Tweets-

News-RSI-

SMA

5.78 6.59 -3.51 -4.8 25.5 29.77

REFERENCES

Ahmedt-Aristizabal, D., Armin, M. A., Denman, S.,

Fookes, C., & Petersson, L. (2021). Graph-based deep

Multimodal Stock Price Prediction

693

learning for medical diagnosis and analysis: past,

present and future. Sensors, 21(14), 4758.

Akita, R., Yoshihara, A., Matsubara, T., & Uehara, K.

(2016). Deep learning for stock prediction using

numerical and textual information. Paper presented at

the 2016 IEEE/ACIS 15th International Conference on

Computer and Information Science (ICIS).

Araci, D. (2019). FinBERT: Financial Sentiment Analysis

with Pre-trained Language Models. arXiv preprint

arXiv:1908.10063.

Avramelou, L., Nousi, P., Passalis, N., & Tefas, A. (2024).

Deep reinforcement learning for financial trading using

multi-modal features. Expert Systems with

Applications, 238, 121849.

Boginski, V., Butenko, S., & Pardalos, P. M. (2005).

Statistical analysis of financial networks.

Computational statistics & data analysis, 48(2), 431-

443.

Cam, H., Cam, A. V., Demirel, U., & Ahmed, S. (2024).

Sentiment analysis of financial Twitter posts on Twitter

with the machine learning classifiers. Heliyon, 10(1).

Das, S., Behera, R. K., & Rath, S. K. (2018). Real-time

sentiment analysis of twitter streaming data for stock

prediction. Procedia computer science, 132, 956-964.

Farimani, S. A., Jahan, M. V., & Fard, A. M. (2024). An

Adaptive Multimodal Learning Model for Financial

Market Price Prediction. IEEE Access.

Forecast, P. (2021). LSTM-based Sentiment Analysis for

Stock.

Gao, T., Chai, Y., & Liu, Y. (2017). Applying long short

term momory neural networks for predicting stock

closing price. Paper presented at the 2017 8th IEEE

international conference on software engineering and

service science (ICSESS).

Greff, K., Srivastava, R. K., Koutník, J., Steunebrink, B. R.,

& Schmidhuber, J. (2016). LSTM: A search space

odyssey. IEEE transactions on neural networks and

learning systems, 28(10), 2222-2232.

Hochreiter, S. (1997). Long Short-term Memory. Neural

Computation MIT-Press.

Keskin, M. M., Yilmaz, M., & Ozbayoglu, A. M. (2021). A

deep neural network model for stock investment

recommendation by considering the stock market as a

time graph. Paper presented at the 2021 2nd

International Informatics and Software Engineering

Conference (IISEC).

Lavrenko, V., Schmill, M., Lawrie, D., Ogilvie, P., Jensen,

D., & Allan, J. (2000). Mining of concurrent text and

time series. Paper presented at the KDD-2000

Workshop on text mining.

Peng, Y., & Jiang, H. (2015). Leverage financial news to

predict stock price movements using word embeddings

and deep neural networks. arXiv preprint

arXiv:1506.07220.

Saha, S., Gao, J., & Gerlach, R. (2022). A survey of the

application of graph-based approaches in stock market

analysis and prediction. International Journal of Data

Science and Analytics, 14(1), 1-15.

Sezer, O. B., Gudelek, M. U., & Ozbayoglu, A. M. (2020).

Financial time series forecasting with deep learning: A

systematic literature review: 2005–2019. Applied soft

computing, 90, 106181.

Taylor, K., & Ng, J. (2024). Natural Language Processing

and Multimodal Stock Price Prediction. arXiv preprint

arXiv:2401.01487.

Tsay, R. S. (2005). Analysis of financial time series. John

Eiley and Sons.

Wang, G., Yu, G., & Shen, X. (2020). The effect of online

investor sentiment on stock movements: an LSTM

approach. Complexity, 2020(1), 4754025.

Wu, Y. (2016). Google’s neural machine translation

system: Bridging the gap between human and machine

translation. arXiv preprint arXiv:1609.08144.

APPENDIX

We used a specific prompt to fetch the sentiment in

tweets and news articles from ChatGPT-4o. Below is

the prompt used to guide the ChatGPT-4o:

“You are an experienced financial analyst tasked

with analyzing tweets and news related to a specific

stock to gauge the overall sentiment and potential

impact on the stock's price. For each given tweet or

news snippet about the target stock, please:

1. Carefully consider the sentiment expressed,

looking at factors like: Positive or negative

language and tone; Mentions of financial

performance, profits/losses, business

developments; Discussion of stock price

movements, investor confidence; Overall

implications of the content for the stock.

2. Based on your analysis, provide the

sentiment label (positive, negative, or

neutral) and a sentiment score (between 0 and

1) representing the probability of the

sentiment label (e.g., a score of 0.8 for a

negative label means there is an 80%

probability that the tweet is negative).

3. Provide the sentiment score for each text

item, along with a one-sentence explanation

for your score.

Please look at the 'Content' column and analyze

each row. Then, add columns for sentiment label and

scoring (between 0 and 1) in the file. You should add

the sentiment label and score in the current file.

Remember to consider the financial and investing

context carefully, not just generic sentiment. Focus on

how the information may impact the stock and

investor perceptions.”

ICAART 2025 - 17th International Conference on Agents and Artificial Intelligence

694