Integrating Traditional Technical Analysis with AI: A Multi-Agent

LLM-Based Approach to Stock Market Forecasting

Michał Wawer

a

and Jarosław A. Chudziak

b

Institute of Computer Science, Warsaw University of Technology, Warsaw, Poland

Keywords:

Multi-Agent Systems, Elliott Wave Principle, Large Language Models (LLMs), Investment Strategies, Deep

Reinforcement Learning (DRL).

Abstract:

Traditional technical analysis methods face limitations in accurately predicting trends in today’s complex

financial markets. This paper introduces ElliottAgents, an multi-agent system that integrates the Elliott Wave

Principle with AI for stock market forecasting. The inherent complexity of financial markets, characterized by

non-linear dynamics, noise, and susceptibility to unpredictable external factors, poses significant challenges

for accurate prediction. To address these challenges, the system employs LLMs to enhance natural language

understanding and decision-making capabilities within a multi-agent framework. By leveraging technologies

such as Retrieval-Augmented Generation (RAG) and Deep Reinforcement Learning (DRL), ElliottAgents

performs continuous, multi-faceted analysis of market data to identify wave patterns and predict future price

movements. The research explores the system’s ability to process historical stock data, recognize Elliott wave

patterns, and generate actionable insights for traders. Experimental results, conducted on historical data from

major U.S. companies, validate the system’s effectiveness in pattern recognition and trend forecasting across

various time frames. This paper contributes to the field of AI-driven financial analysis by demonstrating how

traditional technical analysis methods can be effectively combined with modern AI approaches to create more

reliable and interpretable market prediction systems.

1 INTRODUCTION

The development of AI, including LLMs, has signifi-

cantly increased interest in multi-agent systems (Zhao

et al., 2023; Weng, 2023). These advancements en-

able each agent to specialize in a specific area, en-

hancing the overall capability and performance of

multi-agent systems beyond what was previously pos-

sible.

Traditional methods of predicting future stock

prices using AI have often yielded unsatisfactory re-

sults due to limitations in processing vast amounts of

data (Gamil et al., 2007; Luo et al., 2002) and adapt-

ing to rapidly changing market conditions.

How can a multi-agent system enhanced by LLMs

improve the interpretability and efficiency of finan-

cial market trend analyses using the technical anal-

ysis method - Elliott Wave Principle (EWP)? Uti-

lizing framework for orchestrating AI agents, com-

bined with advanced technologies like Retrieval-

Augmented Generation (RAG) (Lewis et al., 2021),

a

https://orcid.org/0009-0004-2717-1616

b

https://orcid.org/0000-0003-4534-8652

Deep Reinforcement Learning (DRL) and dynamic

context management (Wittkampf, 2024), we have cre-

ated ElliottAgents, a system designed to analyze stock

market using LLM-based agents and EWP.

The EWP is a form of technical analysis that in-

vestors use to forecast markets trends, which are pre-

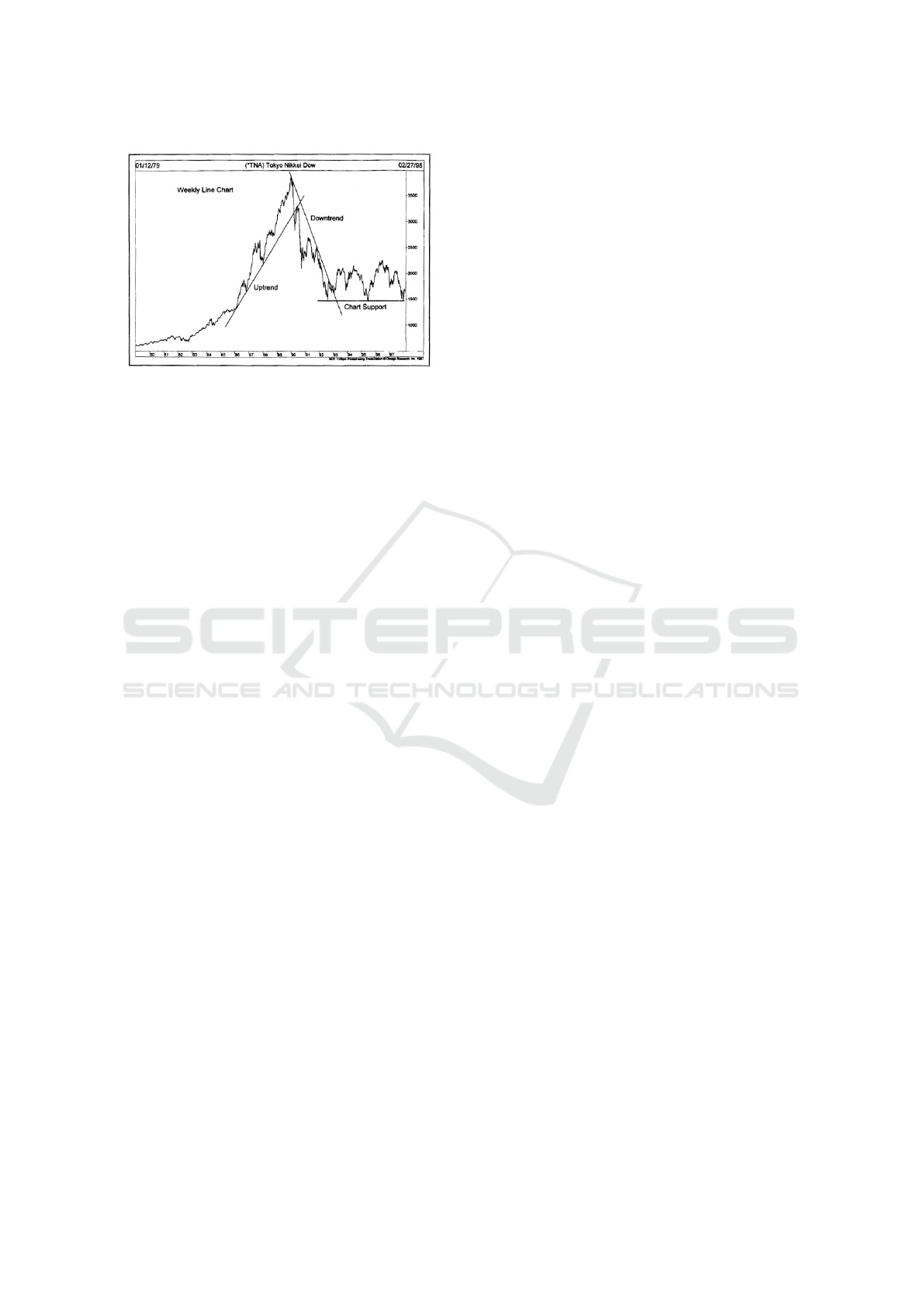

sented on basic stock market chart on Fig. 1. This the-

ory identifies extremes in investor psychology, highs

and lows in prices, and other collective factors by

recognizing patterns described by Elliott Ralph Nel-

son (Frost et al., 2001). By applying EWP through

agents, it is possible to analyze these patterns more

efficiently than traditional agent systems or manual

analysis (Tirea et al., 2012). Additionally, agents can

learn from previous interactions and, over time, re-

fine their strategies to determine what works best for

a given company. This enables more accurate stock

market forecasts, creating new opportunities for in-

vestors and analysts. By combining classical and con-

temporary approaches, we aim to create a platform for

traders that can support them with multi-aspect anal-

ysis in the investment-making process.

The experiments demonstrate that agents are capa-

100

Wawer, M. and Chudziak, J. A.

Integrating Traditional Technical Analysis with AI: A Multi-Agent LLM-Based Approach to Stock Market Forecasting.

DOI: 10.5220/0013191200003890

In Proceedings of the 17th International Conference on Agents and Artificial Intelligence (ICAART 2025) - Volume 1, pages 100-111

ISBN: 978-989-758-737-5; ISSN: 2184-433X

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

Figure 1: Basic trends in stock market, presented in (Mur-

phy, 1999).

ble of recognizing wave patterns and analyzing them

based on their knowledge, creating forecasts of future

stock prices that can be utilized by traders and ana-

lysts. The results indicate that these agents can adapt

to changing financial markets, achieving profits in the

medium and long term. Furthermore use of DRL

(Kabbani and Duman, 2022; Lussange et al., 2020)

can improve these results by implementing continu-

ous learning mechanism to constantly adapt to chang-

ing market conditions. However, their effectiveness

in short-term is limited due to large minute-to-minute

fluctuations and the presence of other high-frequency

trading algorithms in the market.

2 BACKGROUND

2.1 Prior Work

The integration of AI and multi-agent systems in

stock market analysis has been a subject of ongo-

ing research over the past two decades. An early at-

tempt to combine traditional technical analysis with

AI-driven approaches resulted in a multi-agent rec-

ommendation system (Tirea et al., 2012). This system

utilized a Java Agent Development (JADE) frame-

work to implement a multi-agent architecture, demon-

strating the potential of distributed analysis in finan-

cial forecasting. However, this early implementation

was limited by the computational capabilities of its

time and lacked the advanced natural language pro-

cessing (NLP) capabilities now available.

The use of fuzzy logic within a multi-agent frame-

work for technical analysis was explored in previous

research (Gamil et al., 2007). This approach intro-

duced a flexibility in decision-making processes, al-

lowing for better handling of market uncertainties.

While innovative, the system’s reliance on static rules

and fuzzy logic constrained its adaptability to rapidly

changing market conditions, a limitation that more re-

cent AI technologies have sought to overcome.

Earlier work on multi-agent decision support sys-

tems for stock trading highlighted the potential of col-

laborative agent-based approaches in financial anal-

ysis (Luo et al., 2002). This research emphasized

the importance of integrating diverse data sources

and decision-making strategies within a multi-agent

framework. However, the system’s effectiveness was

limited by the absence of advanced machine learn-

ing techniques that have since become integral to AI-

driven financial analysis.

More recent advancements have seen the inte-

gration of neural networks and deep learning in

stock market prediction systems (Szydlowski and

Chudziak, 2024). The potential of deep neural net-

works in enhancing profit through stock price predic-

tion has been demonstrated in recent studies (Abr-

ishami et al., 2019). This work showcased the abil-

ity of neural networks to capture complex patterns

in financial data, yet it did not fully address the in-

terpretability challenges often associated with deep

learning models in financial decision-making con-

texts.

2.2 Research Gap

Despite advancements in the integration of AI and

multi-agent systems, existing stock market analysis

tools exhibit several limitations.

Firstly, many AI-driven financial forecasting

tools, such as those leveraging neural networks, ex-

cel in recognizing complex patterns but fail to pro-

vide interpretable results. This lack of interpretability

undermines trader trust and limits actionable insights.

Secondly, early implementations, such as fuzzy logic-

based systems (Gamil et al., 2007), introduced flexi-

bility in decision-making but were hindered by static

rule sets that could not adapt to rapidly changing mar-

ket conditions. Thirdly, while some studies (Tirea

et al., 2012) attempted to incorporate the EWP into

multi-agent frameworks, these efforts were limited

by outdated computational capabilities and lacked ad-

vanced tools for automated wave pattern recognition.

Furthermore, existing tools often focus exclusively on

either technical analysis or purely data-driven meth-

ods.

To address these gaps, we introduce ElliottA-

gents system (Chudziak and Wawer, 2024). By in-

tegrating the EWP into its core framework, Elliot-

tAgents ensures that market analyses are grounded

in well-established financial theories, making predic-

tions more transparent and interpretable for traders.

Integrating Traditional Technical Analysis with AI: A Multi-Agent LLM-Based Approach to Stock Market Forecasting

101

The system employs LLMs for improved natural lan-

guage understanding and decision-making, and RAG

to access external knowledge bases, ensuring up-to-

date and contextually relevant analyses.

In addition, ElliottAgents leverages DRL to incor-

porate a continuous learning mechanism that refines

strategies based on historical data, allowing it to adapt

to evolving market conditions. The system’s architec-

ture also enables specialized agents to collaborate dy-

namically, each focusing on distinct tasks such as data

processing, pattern recognition, and strategy formula-

tion. This collaborative approach ensures efficiency

and scalability.

3 THEORETICAL

FOUNDATIONS

3.1 Elliott Wave Principle (EWP)

The EWP, introduced by Ralph Nelson Elliott, is a

technical analysis framework that suggests market

prices follow identifiable patterns influenced by col-

lective investor behavior and psychology (Frost et al.,

2001; Murphy, 1999). According to this principle,

market trends alternate between periods of optimism

and pessimism, producing consistent wave-like price

movements. Elliott categorized these patterns into

thirteen recurring structures, referred to as ”waves”

which are broadly divided into two primary types: im-

pulsive waves and corrective waves.

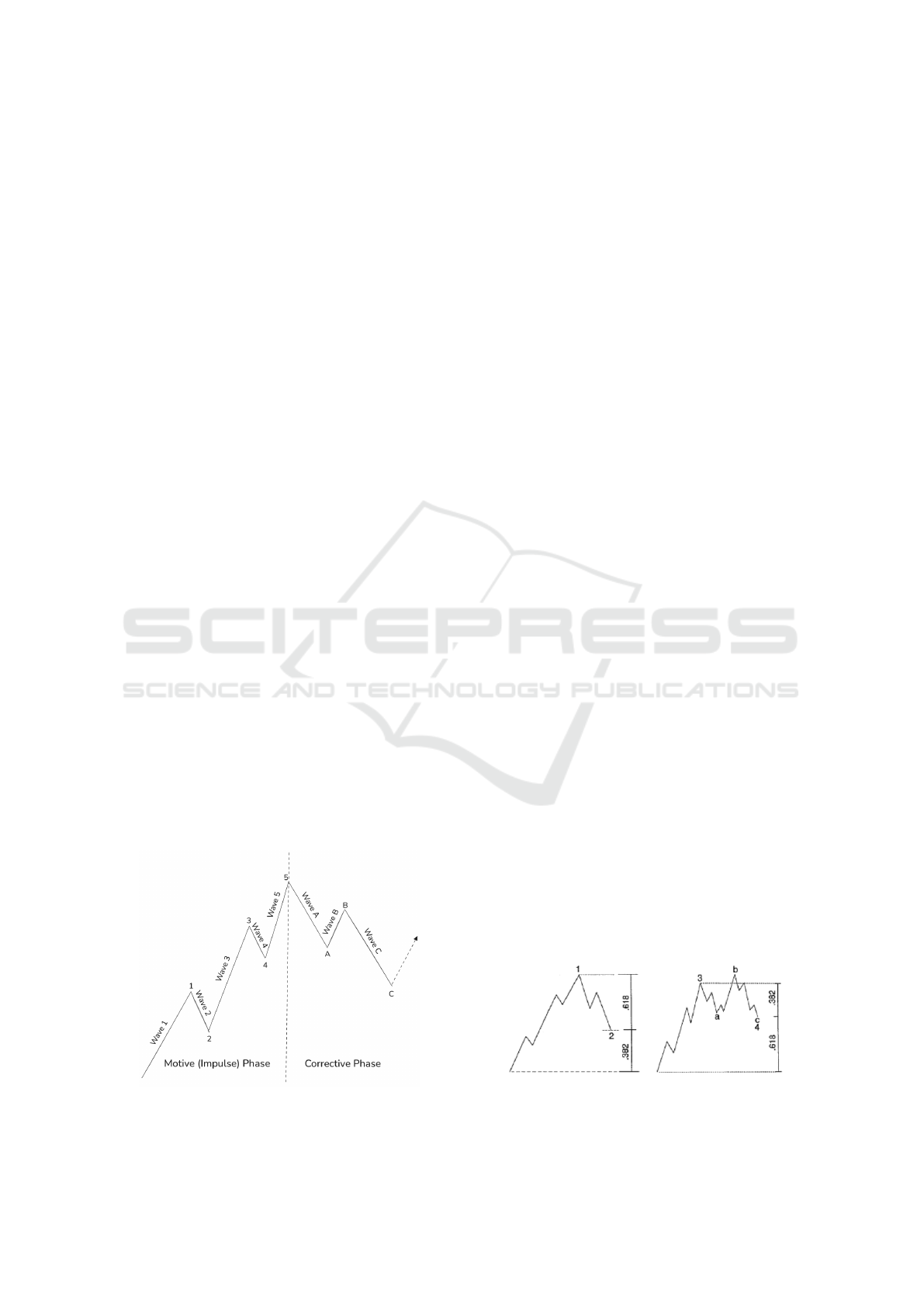

Motive (impulsive) waves, presented on Fig. 2,

are the driving force behind market trends and con-

sist of five sub-waves. These five sub-waves move in

the direction of the overall trend. Within an impul-

sive wave, waves 1, 3, and 5 are the main movement

waves, while waves 2 and 4 are corrective and move

against the trend. The structure of an impulsive wave

Figure 2: Impulse and corrective waves patterns, adapted

from Prechter and Frost, 1978 (Frost et al., 2001).

ensures progress in the direction of the primary trend,

with Wave 3 typically being the strongest and longest

of the three impulsive waves. Corrective waves, move

against the main trend and consist of three sub-waves

labeled A, B, and C. These corrective waves provide

a counterbalance to the impulsive waves, retracing a

portion of the preceding trend.

Market movements can be broken down into

larger and smaller waves, creating a fractal-like struc-

ture named wave degrees. Smaller waves combine

to form larger waves, which in turn combine to form

even larger waves, creating a nested pattern. This

fractal nature allows the EWP to be applied to differ-

ent time frames, from short-term market movements

to long-term trends.

The EWP does not offer certainty but provides a

framework for assessing the probabilities of different

market scenarios. It helps traders understand the cur-

rent market context and predict potential future paths,

making it a valuable tool for technical analysis.

3.2 Fibonacci Approach in EWP

The Fibonacci sequence is integral to the EWP, pro-

viding a mathematical framework that enhances the

predictability and structure of market movements.

The Fibonacci sequence is a series of numbers where

each number is the sum of the two preceding ones.

This sequence is known for its prevalence in nature,

art, and architecture, and it similarly manifests in the

financial markets.

In the context of the EWP, the Fibonacci sequence

helps to quantify the relationships between different

waves in the market (Boroden, 2008). Elliott ob-

served that market waves often unfold in a pattern that

aligns with Fibonacci ratios (Frost et al., 2001). Based

on Fig. 3, the length of one wave might be 1.618

times the length of another, reflecting the Golden Ra-

tio, which is approximately 1.618. This ratio, also

known as Phi (ϕ), is fundamental to the proportional-

ity observed in wave patterns.

The fractal nature of Elliott waves means that Fi-

bonacci relationships apply across different degrees

of trend, from minute charts to long-term market cy-

cles (Boroden, 2008). This fractal characteristic en-

Figure 3: Fibonacci retracements in corrective waves (Frost

et al., 2001).

ICAART 2025 - 17th International Conference on Agents and Artificial Intelligence

102

sures that patterns observed on smaller scales can be

seen on larger scales, maintaining the same Fibonacci

proportionality. For instance, a complete market cy-

cle might consist of a series of waves that adhere to

Fibonacci ratios, creating a cohesive and predictable

structure throughout the market’s evolution.

3.3 LLMs in Time Series Prediction

Time series prediction using LLMs has emerged as

a powerful approach in financial forecasting, integrat-

ing the latest advancements in AI to improve the accu-

racy and reliability of predictions. At its core, time se-

ries analysis aims to understand the underlying struc-

ture and function that produce the observed data. This

understanding is then used for forecasting future val-

ues of the series.Traditional time series analysis meth-

ods, such as ARIMA and exponential smoothing, fo-

cus on decomposing a series into trend, seasonal, and

residual components to identify patterns and predict

future values (Tsay, 2010). These models rely on his-

torical data and linear assumptions, often struggling

with non-linear and complex temporal dependencies

inherent in financial markets.

LLMs, on the other hand, leverage deep learning

techniques and extensive datasets to understand and

predict time series data. These models leverage their

capability to understand and generate sequential data,

which is crucial for accurate forecasting of time series

characterized by trends and seasonal patterns.

Methods such as natural language paraphrasing

and incorporating external knowledge into prompts

have been demonstrated to enhance their performance

further (Jin et al., 2024). However, challenges re-

main, particularly with multi-period datasets where

LLMs struggle to recognize distinct periods (Tan

et al., 2024), similar problems apply to all other meth-

ods (Chudziak, 2023). Despite their computational

demands, LLMs often perform on par with simpler

models, suggesting that they hold potential but more

research is needed to prove their effectiveness. The

use of agents may be a factor that will greatly im-

prove the results of time series prediction by distribut-

ing tasks among agents, enabling a more robust anal-

ysis of complex big sets of data.

3.4 Deep Reinforcement Learning

(DRL)

As a subset of machine learning, called DRL inte-

grates principles of deep learning and reinforcement

learning (RL). In RL, an agent learns to make sequen-

tial decisions by interacting with an environment to

maximize cumulative rewards. This process involves

observing the current state, selecting actions, and re-

ceiving feedback in the form of rewards, iterating this

cycle to improve the agent’s policy, which is the strat-

egy for choosing actions (Lapan, 2020).

Deep learning, which uses neural networks with

multiple layers, enhances RL by enabling the han-

dling of high-dimensional state and action spaces.

Key DRL algorithms include Deep Q-Networks

(DQN), which use neural networks to estimate Q-

values (expected rewards for actions), and Policy Gra-

dient methods, which directly optimize the policy

(Kabbani and Duman, 2022). DRL leverages tech-

niques like experience replay, where past experiences

are stored and reused during training, and target net-

works, which help stabilize training by providing con-

sistent target values.

In the backtesting process, we use DRL to ana-

lyze historical market data (Lussange et al., 2020).

A DRL agent can learn which patterns are effective

for a given company and understand how each pattern

can affect future price movements. This enables the

agent to make informed buy, sell, or hold decisions,

optimizing long-term returns. By continuously learn-

ing and adapting, DRL agent will increase accuracy

in dynamic and uncertain environments.

3.5 Multi-Agent Architecture

Multi-agent systems (MAS) have a longstanding role

in modeling complex systems, where autonomous

agents interact with each other and their environment

(Minsky, 1988). These systems were traditionally

built using rule-based systems, symbolic equations,

stochastic modeling, and early machine learning tech-

niques (Russell and Norvig, 1995).

The integration of LLMs, such as ChatGPT, has

significantly enhanced MAS by equipping agents

with advanced NLP capabilities (Guo et al., 2024).

NLP enables agents to comprehend complex instruc-

tions, collaborate effectively, and explain their ac-

tions, thereby increasing transparency and trust within

the MAS. LLMs allow agents to operate more au-

tonomously, dynamically perceiving and responding

to changes in their environment while learning from

experiences to adapt to new situations without explicit

instructions (Zhao et al., 2023). This learning process

mirrors human behavior, allowing for more realistic

simulations.

LangChain is a framework that facilitates the

chaining of different components within an LLM ap-

plication, including agents (Auffarth, 2023). Our

system utilizes LangGraph, a LangChain compo-

nent, to visualize and manage relationships between

agents, enhancing clarity and interpretability in com-

Integrating Traditional Technical Analysis with AI: A Multi-Agent LLM-Based Approach to Stock Market Forecasting

103

plex multi-agent interactions. Agents in an LLM-

powered MAS collaborate, performing sequential and

hierarchical tasks that culminate in a comprehensive

analysis. Some agents utilize advanced tools that en-

hance their analytical capabilities, allowing for the

generation of more precise and accurate results.

3.6 ReAct Agent

The ReAct paradigm (Yao et al., 2023) represents a

significant advancement in leveraging LLMs for com-

plex problem-solving tasks. ReAct, which stands

for ”Reasoning + Acting,” combines the strengths

of chain-of-thought reasoning (series of intermediate

steps to arrive at a solution) with the ability to interact

with external environments, creating a more robust

and adaptable system for tackling diverse challenges.

At its core, ReAct prompts LLMs to generate both

verbal reasoning traces and task-specific actions in an

interleaved manner (Yao et al., 2023). This approach

allows the model to perform dynamic reasoning to

create, maintain, and adjust high-level plans for act-

ing (reason to act), while also interacting with exter-

nal environments to incorporate additional informa-

tion into its reasoning process (act to reason).

4 ElliottAgents SYSTEM

ARCHITECTURE

The development of ElliottAgents aims to integrate

traditional financial analysis with modern AI capabil-

ities. This section outlines the basic assumptions and

design principles underlying the platform’s architec-

ture and implementation.

4.1 ElliottAgents Design Approaches

The increasing complexity of financial markets, cou-

pled with recent advances in AI, presents both op-

portunities and challenges for developing new market

analysis tools. ElliottAgents system’s architecture is

designed to support these functions:

1. Configurable Analysis Parameters. The plat-

form implements a flexible parametrization that

allow user to specify the asset, timeframe, and

data granularity.

2. Dynamic Data Integration. ElliottAgents incor-

porates real-time market data through an external

yfinance API, enabling analysis of large collec-

tions, the most recent data.

3. Pattern Recognition and Analysis. The plat-

form implements algorithms for identifying El-

liott Wave patterns across multiple timeframes as

a tool for agents. Then results of this tool are in-

terpreted by LLM-based agents. The integration

of AI enables more nuanced pattern recognition

than traditional technical analysis methods.

4. Multi-Agent Collaboration. A crew of spe-

cialized agents works in concert to analyze mar-

ket data. Each agent maintains specific exper-

tise, from data processing to pattern recogni-

tion and strategy formulation. The collaborative

framework enables comprehensive market anal-

ysis through the synthesis of multiple analytical

perspectives.

5. Continuous Learning and Optimization. The

platform incorporates continuous learning mech-

anisms that enable it to refine its analytical ca-

pabilities over time. This includes real-time data

processing, strategy backtesting, and performance

optimization through DRL implementation.

4.2 Agents Definition

At the core of ElliottAgents is a multi-agent archi-

tecture that orchestrates specialized agents, each re-

sponsible for distinct aspects of the analysis process.

These agents can dynamically perceive and respond

to changes in their environment, learning from their

experiences to improve future responses. The ar-

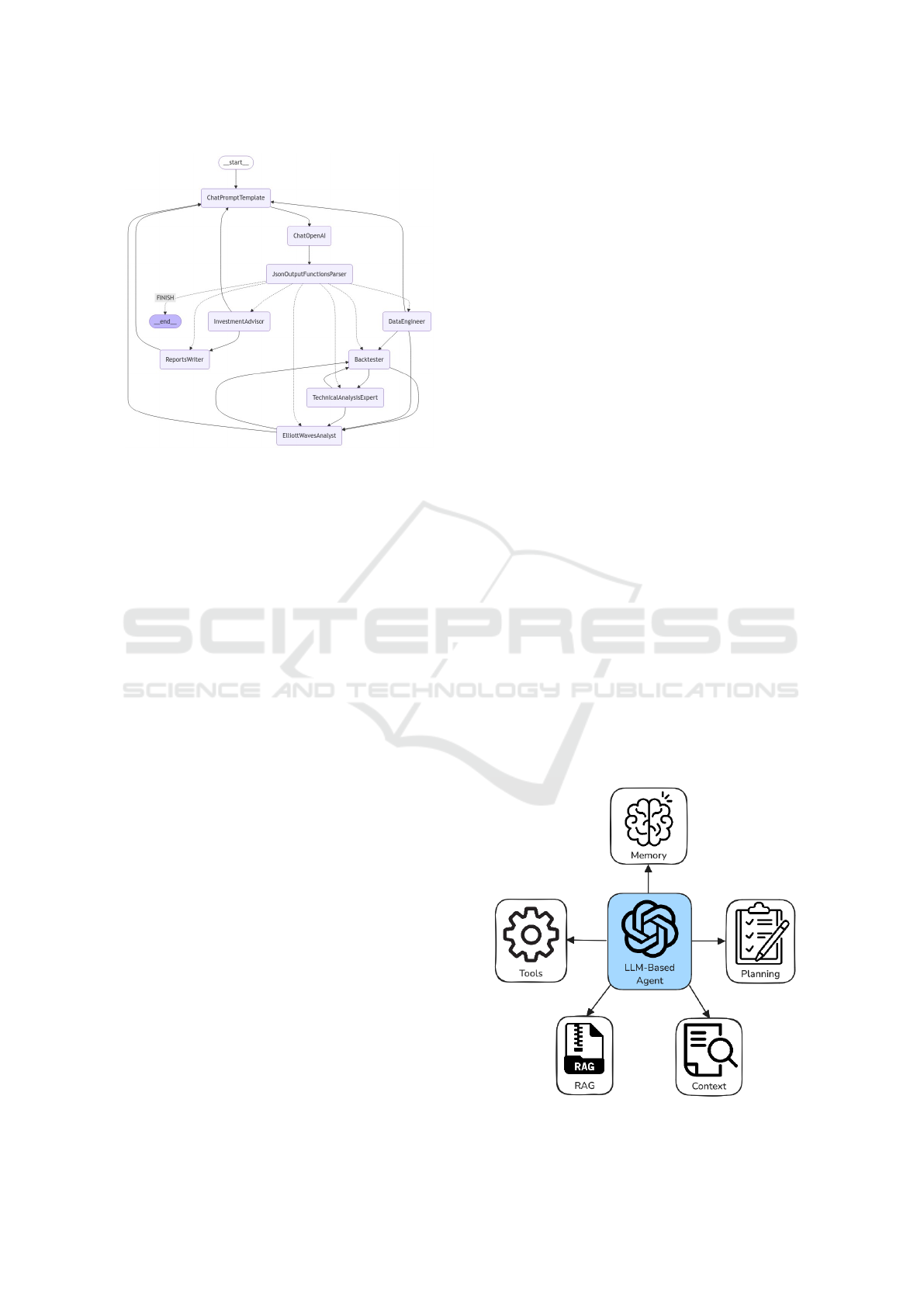

chitecture of ElliottAgents consists of 7 agents who

communicate with each other in a structured way, as

shown in the Fig. 4.

The Coordinator agent orchestrates the entire pro-

cess. It begins by receiving user input, including the

desired stock symbol and analysis timeframe. This in-

formation is then passed to the Data Engineer, which

gathers the necessary historical stock data. Next,

the Coordinator triggers the Elliott Waves Analyst,

equipped with a specialized tool to identify and clas-

sify Elliott Wave patterns within the historical data.

These patterns are visually represented through auto-

matically generated charts. The Backtester agent then

receives the identified patterns and employs DRL to

validate them against historical trends, assessing their

effectiveness. The Technical Analysis Expert then

steps in, combining the Elliott Wave patterns with the

backtesting results. This agent determines the most

probable pattern for the current market conditions,

providing a refined prediction. This refined predic-

tion, along with the original data and wave patterns,

is then forwarded to the Investment Advisor. This

agent synthesizes all the information, incorporating

insights from a RAG tool, to formulate a comprehen-

sive investment strategy. This strategy includes spe-

cific buy/sell signals, price targets, and contingency

ICAART 2025 - 17th International Conference on Agents and Artificial Intelligence

104

Figure 4: Graph presenting data flow between agents, gen-

erated in LangGraph framework.

plans. Finally, the Reports Writer receives all the

compiled information and generates a clear, concise

report for the end-user. This report presents the in-

vestment strategy in an easily understandable format,

ensuring the user has actionable insights based on the

latest data and analysis.

Each agent in the system is provided with a spe-

cific context through a natural language prompt, en-

abling it to perform its designated role effectively.

The following prompt defines the context and respon-

sibilities of the Investment Advisor agent, focusing

on synthesizing analyses into actionable investment

strategies.

You are the Investment Advisor. Your role is

crucial in synthesizing the analyses provided

by other agents and formulating actionable

investment advice. Your tasks include:

1. Interpret the Elliott Wave patterns

identified by the Elliott Waves Analyst.

2. Consider the backtesting results provided

by the Backtester agent.

3. Integrate information from the rag tool

to provide context to your recommendations.

4. Formulate a comprehensive investment strategy

that includes:

- Buy, sell, or hold recommendations

- Price targets for entry and exit points

- Stop-loss levels

- Time frames for the transactions

5. Highlight any potential risks or limitations

in the analysis, ensuring a balanced view of

the investment opportunity.

6. Provide any additional insights that could

be valuable for decision-making, such as

correlations with broader market trends.

Remember, your advice should be based on the

collective intelligence of the multi-agent

system. Aim to present your investment advice

in a structured format that can be easily

understood the end users.

4.3 Agents Customization

As presented on Fig. 5 agent is build using different

components, technologies used by our agents are de-

scribed below:

• Memory: preserve and regulate knowledge, ex-

periential data, and historical information (Li

et al., 2024). It typically consists of short-term

memory (for immediate context and task-related

information) and long-term memory (for storing

substantial volumes of knowledge and past expe-

riences). Memory mechanism helps agents gener-

ate responses based on past interactions, improv-

ing decision-making and context-awareness over

time (Weng, 2023).

• Planning: is a ability to devise action sequences

based on set objectives and environmental con-

straints (et al., 2024). For LLM-based agents,

planning often utilizes in-context learning meth-

ods like Chain of Thought (CoT), Tree of Thought

(ToT), or external capabilities. It involves task

analysis, action anticipation, and optimal action

selection to address complex problems.

• Context: refers to the ability of AI agents

to adaptively adjust their contextual understand-

ing based on real-time information (Wittkampf,

2024). Agents can utilize various types of con-

text, including tools, documents accessed through

RAG, the history of conversations, and the ability

to reflect and plan future actions. This approach

Figure 5: Overview of a LLM autonomous agent.

Integrating Traditional Technical Analysis with AI: A Multi-Agent LLM-Based Approach to Stock Market Forecasting

105

leverages ongoing interactions and updates the

context dynamically, enabling the agent to main-

tain relevance and accuracy throughout a session.

By incorporating new data as it becomes avail-

able, dynamic context helps agents refine their re-

sponses and improve decision-making processes.

• Retrieval-Augmented Generation (RAG): im-

proves the factual reliability of generative AI by

integrating external information retrieval into its

workflow (Lewis et al., 2021). Instead of relying

solely on pre-trained parameters, RAG dynami-

cally fetches relevant data from external knowl-

edge bases, which enhances both the accuracy and

relevance of generated responses. This process

involves encoding user queries as embeddings,

comparing them against a vectorized database,

and incorporating the retrieved information into

the model’s output (Larson and Truitt, 2024). By

reducing hallucinations and providing traceable

sources, RAG addresses common challenges in

AI-driven content generation.

In our system, a knowledge graph-based RAG

framework is employed. This structure organizes

data into interconnected graphs, allowing for pre-

cise query disambiguation and improved contex-

tual relevance. Leveraging these structured rela-

tionships, our approach supports advanced tasks

like interpreting the mathematical underpinnings

of the EWP while ensuring accuracy and consis-

tency in the generated responses.

• Tools: LLM-based agents often integrate various

tools to enhance their problem-solving abilities

and interact with external environments or data

sources. The tools component presents specific

instruments that were created for our system to

adjust it for analysis of finncial markets:

– Stock Market Data: provides access to real-

time and historical market information, essen-

tial for informed decision-making.

– Elliot Waves Reader: tool for technical analy-

sis, helping the agent identify and interpret El-

liot wave patterns in price movements.

– Chart Generator: allows the agent to vi-

sualize market data, especially Elliott waves,

creating graphical representations of detected

waves. This tool is directly connected to Elliott

waves reader tool.

– Database connector: enables the agent to ac-

cess and manage structured data of backtesting

results.

4.4 Continous Learning Agent

The ElliottAgents platform implements a continuous

learning process (Wang et al., 2024) that enables

agents to adapt and refine their knowledge over time

(Hu et al., 2024). This process is designed to enhance

the system’s predictive capabilities without relying

on traditional fine-tuning methods. Instead, agents

learn organically through their interactions and obser-

vations of the stock market environment.

At the core of this process is the Backtester agent,

which plays a crucial role in accumulating and lever-

aging historical knowledge. The Backtester’s work-

flow begins with a query to determine if relevant re-

sults are already available in the backtesting knowl-

edge base. If not, the agent initiates a analysis by

fetching the necessary data, performing EWP anal-

ysis, and interpreting the results. These findings are

then stored in the Neo4j graph database for future ref-

erence. This iterative process allows the system to

build a repository of analyzed patterns and outcomes

over time. This approach ensures that the system’s

predictions are grounded in a historical data and pre-

viously observed market behaviors.

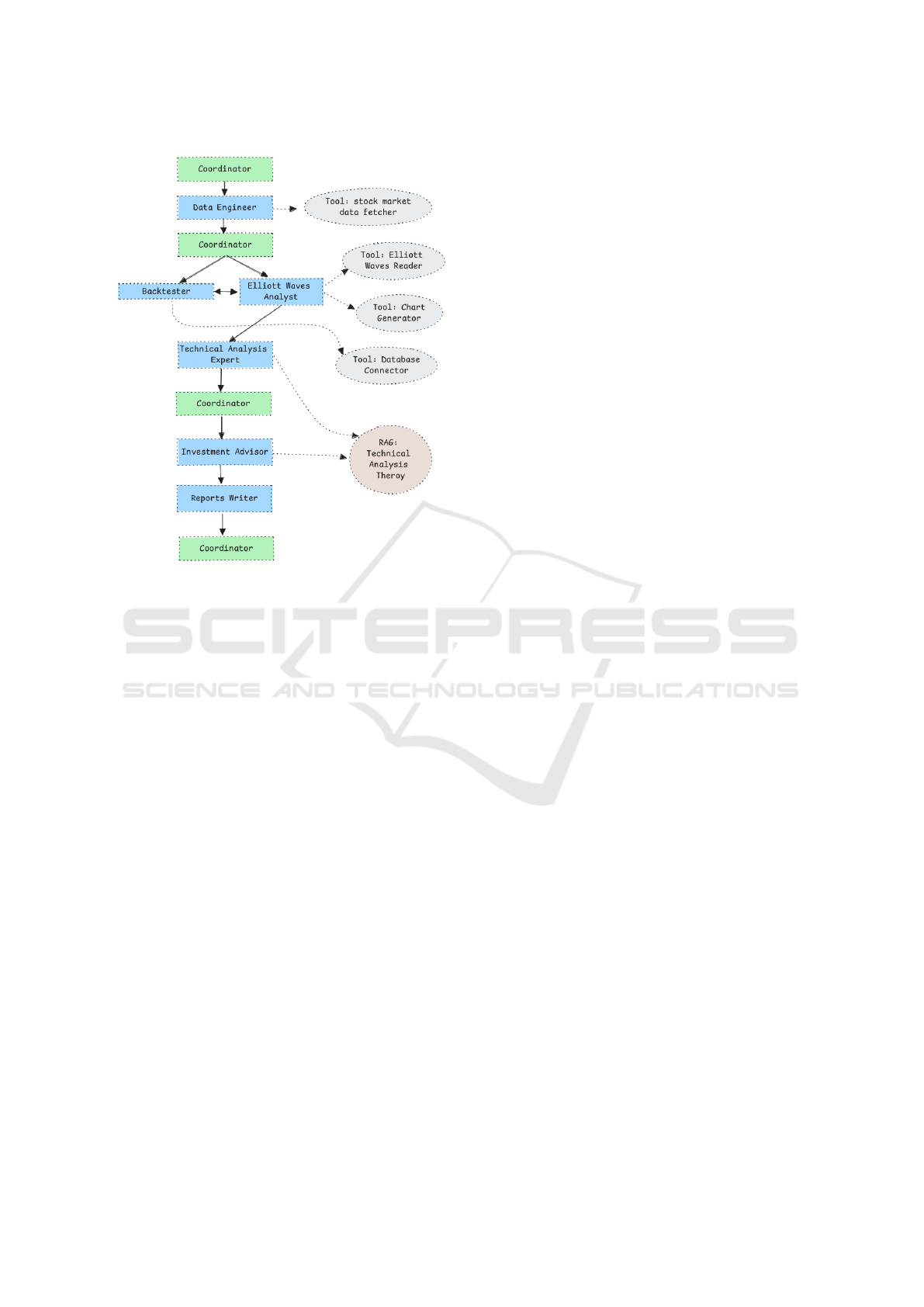

4.5 Agents Flow Engineering

The orchestration of the system is designed to facil-

itate seamless collaboration among agents, ensuring

an efficient workflow. The system employs a hierar-

chical structure wherein each agent is assigned a spe-

cialized role (Guo et al., 2024), contributing to scala-

bility. The coordinator is the agent who manages the

whole flow of information in the system, distributes

the tasks and ensures their execution, as presented on

Fig. 6.

Asynchronous task execution enables agents to

operate in parallel, mitigating bottlenecks and en-

hancing throughput (Li et al., 2024). Tasks such

as backtesting and wave analysis, which do not re-

quire immediate interdependence, are executed con-

currently. This asynchronous design is further sup-

ported by the system’s capacity for dynamic scaling,

instantiating additional agents when computational

demands increase.

Task decomposition and memory management

are fundamental to the system’s architecture (Chen,

2024). Complex tasks are divided into smaller,

manageable subtasks, allowing agents to focus on

well-defined objectives. Memory management en-

sures continuity through memory identifiers, enabling

agents to retain context across tasks. For example,

outputs from the Elliott Wave Analyst inform sub-

sequent validation by the Technical Analysis Expert,

ICAART 2025 - 17th International Conference on Agents and Artificial Intelligence

106

Figure 6: Interactions between agents and tools.

leading to actionable strategies devised by the Invest-

ment Advisor and finalized in reports by the Reports

Writer under the coordinator’s supervision.

The designed flow is integral to its efficiency, scal-

ability, and resilience. By delegating tasks to spe-

cialized agents and leveraging dynamic scaling, the

system adapts to varying demands without compro-

mising performance. The asynchronous execution re-

duces latency, while the collaborative interactions be-

tween agents ensure the production of accurate out-

puts (Chi-Min Chan, 2023). These design principles

collectively enable the system to perform complex an-

alytical tasks with precision, speed, and adaptability.

5 EXPERIMENTAL SETUP AND

METHODOLOGY

The experiments conducted on the created platform

were designed to test its use in the real market, ef-

fectiveness of pattern recognition and to study the

impact of the backtesting process on the final result.

Historical The data on which we conducted our tests

came from the yfinance library, we focused on 2 time

intervals: daily and hourly. In the performed tests,

our agents used the gpt-4o-mini model from OpenAI.

Currently, ElliottAgents allows the detection of only

a few wave patterns, there are more patterns discov-

ered and described in Elliott Wave Theory, and in our

study we focused on describing only a few selected

ones. Current state of our system is able to recognize

impulse and corrective patterns, with additional wave

extensions. By recognizing these patterns we are able

to determine support, resistance and target price lev-

els.

The experimental evaluation of the ElliottAgents

platform was conducted in two distinct phases, each

designed to assess different aspects of the system’s

performance and reliability in stock market predic-

tion.

The initial phase of our experimentation focused

on demonstrating the practical application of the El-

liottAgents system through a detailed case study. We

selected a specific company and time frame to show-

case a complete analysis cycle. This phase aimed

to illustrate the inter-agent communication process,

highlighting how different specialized agents collab-

orate to produce a comprehensive market analysis.

It also demonstrated the step-by-step reasoning and

decision-making process employed by the agents.

Furthermore, this analysis provided insights into the

potential real-world applicability of the system’s out-

puts, including the identification of Elliott Wave pat-

terns and the generation of trading signals.

The second phase of our experimentation was de-

signed to assess the system’s pattern recognition capa-

bilities and the accuracy of its predictions. This eval-

uation utilized a cross-validation method applied to

a substantial dataset of historical market price move-

ments. We utilized 1,000 samples each representing

a one candlestick from the price charts of selected

stocks in daily and hourly interval.

Our tests focused on two key Elliott Wave forma-

tions: incomplete impulsive waves (1-2-3-4) consist-

ing of four sub-waves, and complete impulsive waves

(1-2-3-4-5) comprising all five sub-waves. In both

cases, we enforced the EWP rule that waves must not

overlap. To evaluate the effect of our DRL compo-

nent, we conducted parallel tests with and without

the DRL backtesting process. The DRL model was

trained on 10 years of historical data for each com-

pany under examination.

For each identified pattern, the system generated

a prediction for the subsequent price movement (up-

ward or downward). We evaluated these predictions

using specific criteria. For incomplete waves (1-2-

3-4), a prediction was deemed correct if the average

price over the next n candlesticks (where n is calcu-

lated to approximate 1.62 times the length of the first

wave) moved in the predicted direction. For complete

waves (1-2-3-4-5), a prediction was considered accu-

rate if the subsequent corrective wave A exhibited a

Integrating Traditional Technical Analysis with AI: A Multi-Agent LLM-Based Approach to Stock Market Forecasting

107

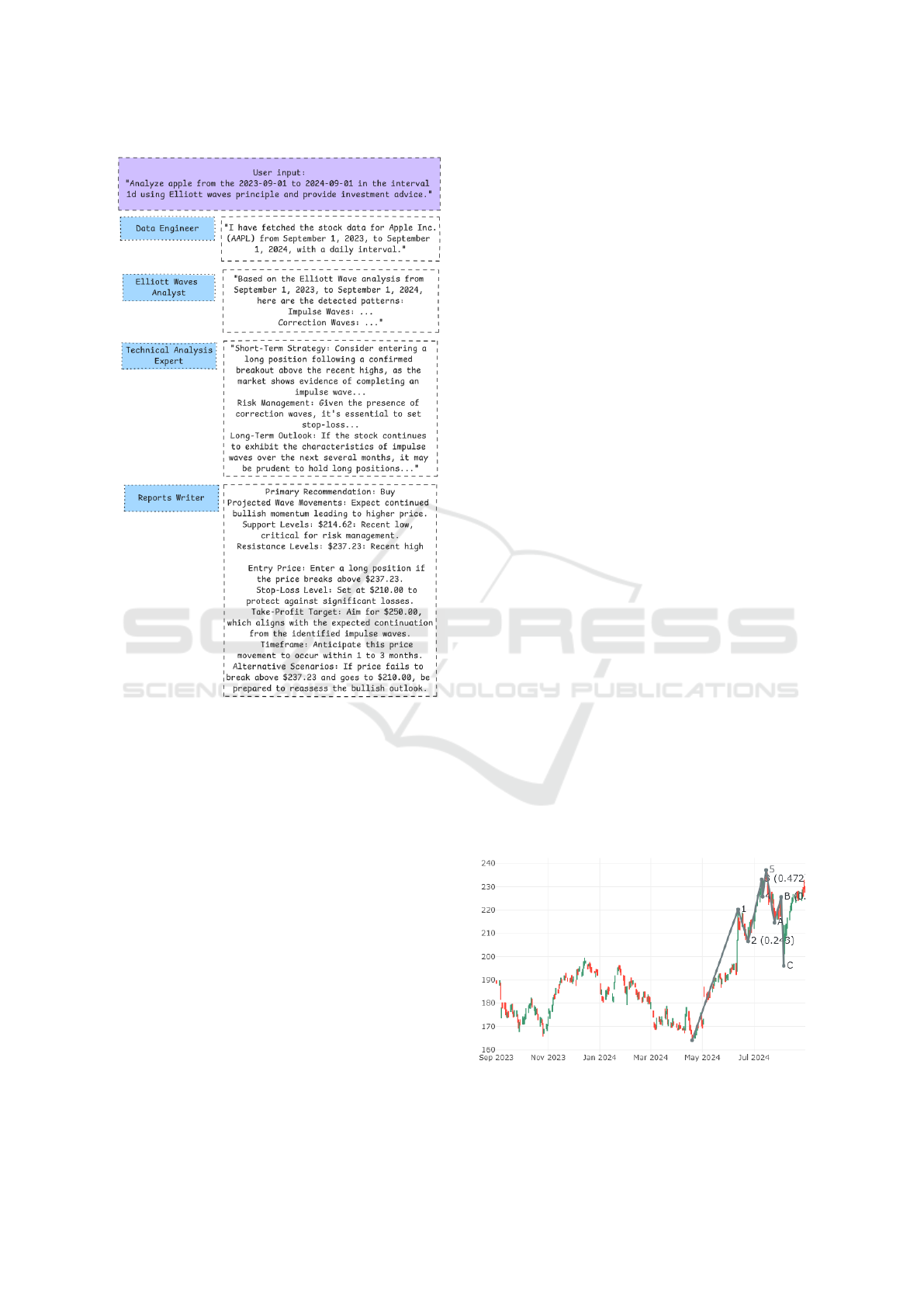

Figure 7: Example interactions between agents analyzing

Apple stock, with messages returned by each agent.

exact same length to that of wave 5, moving in the

opposite direction.

6 RESULTS AND ANALYSIS

The first phase of the experiments was performed on

Apple (AAPL) price data from September 2023, to

September 2024. The system was run on limited his-

torical data from to recognize all waves pattern and

identify possible buy or sell signals. Based on them,

we could simulate transactions and calculate theoret-

ical investment returns, proving the effectiveness of

predictions of future prices. Here we’ll describe just

one example of the analysis by presenting the mes-

sage exchange between agents and the final analysis

with the result of the simulated transaction.

The interaction between agents is depicted in

Fig. 7, while Fig. 8 illustrates a chart with analysis

of Apple stock over a one-year period, with data ag-

gregated at a daily interval. During this period, Elliot-

tAgents successfully identified an impulsive wave se-

quence labeled 1-2-3-4-5 and a subsequent corrective

wave pattern denoted as A-B-C. According to estab-

lished wave theory, the occurrence of this configura-

tion indicates a likely reversal surpassing the peak of

the fifth wave.

Upon identifying this wave structure and confirm-

ing the initiation of a reversal, ElliottAgents issued a

buy recommendation at a price of $232 per share. The

target price was set at $250 per share, correspond-

ing to the peak of the fifth wave. This price also

considered the resistance level observed at the peak

of wave B ($225), resulting in a dual-target strategy.

Such a strategy aims to ensure an optimal exit point

while providing a buffer for potential resistance at

critical levels. As illustrated in the chart, the predic-

tion proved accurate, with the stock price stabilizing

near the $250 mark—aligned with the peak of the fifth

wave—where it encountered notable resistance.

The second part of the experiment focus on quan-

tity tests for the correctness of the detected pattern and

the impact of DRL on results. Test was conducted us-

ing a cross-validation method on 1000 samples (can-

dlesticks) with a daily interval for the stocks. We

compared the results with and without a DRL back-

testing process.

Table 1 presents the results of the cross-validation

experiments for 1000 data samples in two time inter-

vals. As we can see, the identification of a complete

impulsive wave pattern contributes to better predic-

tions of subsequent price movements than incomplete

impulse wave pattern. In case of hourly intervals our

system detected smaller number of patterns, mainly

because price changes on the hourly interval were

smaller. The use of DRL resulted in a improvement

in prediction, showing that agents are able to use the

learning process on historical data in better interpre-

tation of patterns.

Figure 8: Impulsive and corrective waves found on Apple

stock on 1d interval.

ICAART 2025 - 17th International Conference on Agents and Artificial Intelligence

108

Table 1: Comparison of pattern recognition with and without backtesting.

Stock

1-2-3-4 Patterns 1-2-3-4-5 Patterns

N

Without

backtesting

With

backtesting

N

Without

backtesting

With

backtesting

Daily Interval

AMZN 24 58.34% 66.67% 18 66.67% 77.78%

GOOG 28 53.57% 67.86% 23 65.22% 82.61%

INTC 19 57.89% 73.68% 15 60.00% 73.34%

CSCO 12 58.34% 66.67% 9 66.67% 88.89%

ADBE 20 60.00% 65.00% 12 50.00% 66.67%

META 22 59.09% 63.64% 14 57.14% 64.29%

Hourly Interval

AMZN 10 50.00% 70.00% 8 62.50% 75.00%

GOOG 13 53.84% 61.54% 9 77.78% 77.78%

INTC 12 58.34% 66.67% 9 66.67% 88.89%

CSCO 9 44.45% 55.56% 8 50.00% 50.00%

ADBE 10 50.00% 70.00% 8 62.50% 75.00%

META 12 58.34% 58.34% 9 66.67% 88.89%

N: number of patterns found.

7 DISCUSSION

Multi-agent architectures have been utilized in stock

price prediction systems for many years (Akintola and

Oyetunji, 2021; Gamil et al., 2007; Luo et al., 2002).

However, advancements in AI over recent years have

significantly enhanced the capabilities of these sys-

tems. The introduction of fuzzy logic in earlier sys-

tems provided a foundation for integrating qualita-

tive judgments with quantitative analysis. Neverthe-

less, these systems required further optimization to

improve their decision-making processes. While it re-

mains challenging to directly compare the profitabil-

ity of our system with other stock price prediction sys-

tems currently available, experimental results indicate

that our approach effectively detects and interprets

wave patterns with greater accuracy than comparable

systems utilizing EWP (Tirea et al., 2012). Further-

more, the analyses generated by our agents present a

clear investment plan, including actionable price lev-

els, which can be directly applied by traders in real-

world scenarios.

The experiments conducted on ElliottAgents have

yielded several insights:

1. Pattern Recognition Accuracy: The system

demonstrated a high accuracy in identifying im-

pulsive and corrective waves patterns across vari-

ous time frames. Experiments conducted on his-

torical stock market data validate the system’s ca-

pability to recognize and interpret intricate market

structures effectively.

2. Impact of Backtesting: The implementation of

DRL for backtesting significantly enhanced the

system’s predictive accuracy. Across different

companies and time intervals, backtesting im-

proved pattern recognition validity by up to 16%,

demonstrating the importance of historical data

analysis in refining predictive models.

3. Multi-Agent Architecture Effectiveness: The

distributed approach of ElliottAgents, where spe-

cialized agents handle different aspects of anal-

ysis, proved highly effective. This architecture

allowed for more efficient processing of complex

data and improved the overall accuracy of predic-

tions.

The system’s ability to dynamically update con-

text and integrate EWP, significantly improves the ac-

curacy and reliability of the predictions. Backtesting

capabilities usind DRL further allow for the continu-

ous refinement of strategies.

The development and testing of ElliottAgents

have successfully addressed the primary research

question posed at the outset of this study. The plat-

form has demonstrated that it is indeed possible to

integrate the EWP into a multi-agent architecture to

more quickly and accurately predict future stock price

movements.

The development and testing of ElliottAgents

have successfully addressed the primary research

question posed at the outset of this study. The plat-

form has demonstrated that it is indeed possible to

integrate the EWP into a multi-agent architecture to

Integrating Traditional Technical Analysis with AI: A Multi-Agent LLM-Based Approach to Stock Market Forecasting

109

more quickly and accurately predict future stock price

movements. By leveraging AI technologies, the sys-

tem enhances both interpretability and efficiency, ad-

dressing the limitations of traditional methods. The

collaborative multi-agent design ensures scalability

and adaptability, making ElliottAgents a robust tool

for modern financial analysis. Furthermore, the re-

search has made substantial progress on several key

objectives:

1. Multi-Faceted Analysis: ElliottAgents have

shown the ability to perform comprehensive anal-

yses and present results in a user-friendly manner,

making complex financial data accessible to both

professional traders and individual investors.

2. LLMs in Time Series Prediction: The research

has provided valuable insights into the perfor-

mance of LLMs in time series prediction, particu-

larly in the context of stock market trends. While

challenges remain, the integration of LLMs with

traditional technical analysis methods has shown

promising results.

3. Real-Time Data Integration: The system has

demonstrated the ability to effectively utilize the

most recent stock market data, adapting to rapidly

changing market conditions in near real-time.

4. Agent Customization: The use of advanced tech-

nologies such as RAG, and memory management

techniques has allowed for better customization

of agents for specific tasks, enhancing the overall

performance of the system.

5. Multi-Agent Cooperation: The research has

shown that the multi-agent approach improves

performance compared to single-agent systems,

particularly in complex market scenarios.

8 FUTURE WORK AND

CONCLUSION

8.1 Future Work

Currently, our work has focused primarily on only

few patterns recognized by EWP. Expanding plat-

form to include additional wave formations such as

truncations, zigzags, flat corrections, triangles, and

other patterns could improve our predictive capabil-

ities (Frost et al., 2001). Following the successful in-

tegration of EWP, we could further improve our sys-

tem by incorporating other technical analysis methods

(Murphy, 1999), such as moving averages. This ex-

pansion could enhance our ability to determine more

accurate buy or sell signals, potentially improving sig-

nal reliability and profitability. Multi-agent architec-

ture allows us to easily expand our team of agents to

include new members with unique skills needed for

financial analysis.

The next big step could be to integrate Large Ac-

tion Models (LAMs) into the system. LAMs are de-

signed to understand and execute human intentions

by combining perception and action (Thomas, 2024).

The advanced understanding and action capabilities

of LAMs have the potential to fully automate the

trading process. Based on ElliottAgents analyses,

LAMs could automatically perform trades and adapt

to rapidly changing market conditions. However,

LAMs are currently in the early stages of adoption,

making their implementation in such systems chal-

lenging.

8.2 Conclusion

ElliottAgents represents a significant advancement in

the field of financial technology, bridging the gap be-

tween traditional technical analysis and AI method-

ologies. The platform’s success in combining the

EWP with multi-agent AI systems opens new area for

research in algorithmic trading. By demonstrating the

effectiveness of this integrated approach, this research

contributes to the ongoing evolution of intelligent fi-

nancial systems.

The proposed system, ElliottAgents, integrates

traditional financial analysis methods with AI tech-

nologies to enable a deeper and more precise analy-

sis of historical data for accurate future price predic-

tions. This research presents a system design capable

of thoroughly analyzing various American stock mar-

ket companies across different time frames and inter-

vals. While the system primarily focuses on medium

to long-term analysis, it can be customized for shorter

intervals like 5 minutes. However short team effec-

tiveness is limited due to price swings and the pres-

ence of other algorithms for high frequency trading.

It’s important to note that unforeseen market events,

such as rapid crashes or unexpected news, can signif-

icantly impact the accuracy of short-term predictions.

By demonstrating the effectiveness of this inte-

grated approach, this research contributes to the ongo-

ing evolution of intelligent financial systems. While

the current system demonstrates the feasibility of our

approach, future work will focus on incorporating ad-

ditional features and refining the system’s predictive

capabilities.

ICAART 2025 - 17th International Conference on Agents and Artificial Intelligence

110

REFERENCES

Abrishami, S., Turek, M., Choudhury, A. R., and Kumar,

P. (2019). Enhancing profit by predicting stock prices

using deep neural networks. In 2019 IEEE 31st In-

ternational Conference on Tools with Artificial Intel-

ligence (ICTAI), Portland, OR, USA.

Akintola, K. and Oyetunji, O. (2021). Development of an

agent-based framework for stock market trading. IRE

Journals, 4(9).

Auffarth, B. (2023). Generative AI with LangChain, Build

large language model (LLM) apps with Python, Chat-

GPT, and other LLMs. Packt Publishing.

Boroden, C. (2008). Fibonacci Trading: How to Master the

Time and Price Advantage. McGraw Hill.

Chen, H. (2024). Understand the llm agent orchestration.

https://medium.com/scisharp/understand-the-llm-a

gent-orchestration-043ebfaead1f. Accessed: Jun. 1,

2024.

Chi-Min Chan, Weize Chen, Y. S. J. Y. W. X. S. Z. J. F. Z. L.

(2023). Chateval: Towards better llm-based evalua-

tors through multi-agent debate. arXiv:2308.07201v1

[cs.CL].

Chudziak, A. (2023). Predictability of stock returns using

neural networks: Elusive in the long term. Expert Sys-

tems with Applications, 213.

Chudziak, J. A. and Wawer, M. (2024). Elliottagents: A

natural language-driven multi-agent system for stock

market analysis and prediction. In Proceedings of the

38th Pacific Asia Conference on Language, Informa-

tion and Computation, Tokyo, Japan, (in press).

et al., Y. C. (2024). Exploring large language model

based intelligent agents: Definitions, methods, and

prospects. arXiv:2401.03428v1 [cs.AI].

Frost, A. J., Jr., R. R. P., and Collins, C. J. (2001). Elliott

Wave Principle: Key to Market Behavior. Wiley.

Gamil, A. A., El-fouly, R. S., and Darwish, N. M. (2007).

Stock technical analysis using multi agent and fuzzy

logic. In Proceedings of the World Congress on Engi-

neering, WCE 2007, London, UK.

Guo, T. et al. (2024). Large language model based

multi-agents: A survey of progress and challenges.

arXiv:2402.01680v2 [cs.CL].

Hu, B., Zhao, C., Zhang, P., Zhou, Z., Yang, Y., Xu, Z., and

Liu, B. (2024). Enabling intelligent interactions be-

tween an agent and an llm: A reinforcement learning

approach. arXiv:2306.03604v8 [cs.AI].

Jin, M., Tang, H., Zhang, C., Yu, Q., Liu, C., Zhu, S.,

Zhang, Y., and Du, M. (2024). Time series forecasting

with llms: Understanding and enhancing model capa-

bilities. arXiv:2402.10835v2 [cs.CL].

Kabbani, T. and Duman, E. (2022). Deep reinforcement

learning approach for trading automation in the stock

market. IEEE Access, 10.

Lapan, M. (2020). Deep Reinforcement Learning Hands-

On Second Edition. Packt.

Larson, J. and Truitt, S. (2024). Graphrag: Unlocking llm

discovery on narrative private data. https://www.micr

osoft.com/en-us/research/blog/graphrag-unlocking-l

lm-discovery-on-narrative-private-data. Accessed:

May. 10, 2024.

Lewis, P. et al. (2021). Retrieval-augmented generation for

knowledge-intensive nlp tasks. arXiv:2005.11401v4

[cs.CL].

Li, J., Zhang, Q., Yu, Y., Fu, Q., and Ye, D. (2024). More

agents is all you need. arXiv:2402.05120v1 [cs.CL].

Luo, Y., Liu, K., and Davis, D. N. (2002). A multi-agent

decision support system for stock trading. IEEE Net-

work, 16(1).

Lussange, J., Lazarevich, I., Bourgeois-Gironde, S.,

Palminteri, S., and Gutkin, B. (2020). Modelling stock

markets by multi-agent reinforcement learning. Com-

putational Economics. hal-03055070.

Minsky, M. (1988). The Society of Mind. Simon & Schuster.

Murphy, J. J. (1999). Technical Analysis of the Financial

Markets: A Comprehensive Guide to Trading Methods

and Applications. New York Institute of Finance.

Russell, S. and Norvig, P. (1995). Artificial Intelligence: A

Modern Approach. Prentice Hall.

Szydlowski, K. L. and Chudziak, J. A. (2024). Toward pre-

dictive stock trading with hidformer integrated into

reinforcement learning strategy. In Proceedings of

the 36th International Conference on Tools for Arti-

ficial Intelligence (ICTAI 2024), Herndon, VA, USA,

(in press).

Tan, M., Merrill, M. A., Gupta, V., Althoff, T.,

and Hartvigsen, T. (2024). Are language mod-

els actually useful for time series forecasting?

arXiv:2406.16964v1 [cs.LG].

Thomas, R. J. (2024). The rise of large action models, lams:

How ai can understand and execute human intentions?

https://medium.com/version-1/the-rise-of-large-act

ion-models-lams-how-ai-can-understand-and-execu

te-human-intentions-f59c8e78bc09. Accessed: Jun.

20, 2024.

Tirea, M., Tandau, I., and Negru, V. (2012). Stock market

multi-agent recommendation system based on the el-

liott wave principle. In International Conference on

Availability, Reliability, and Security, Prague, Czech

Republic.

Tsay, R. S. (2010). Analysis of Financial Time Series Third

Edition. Wiley.

Wang, L., Zhang, X., Su, H., and Zhu, J. (2024). A compre-

hensive survey of continual learning: Theory, method

and application. arXiv:2302.00487 [cs.LG].

Weng, L. (2023). Llm-powered autonomous agents. lilian-

weng.github.io.

Wittkampf, F. (2024). Next-level agents: Unlocking the

power of dynamic context. https://towardsdatascience

.com/next-level-agents-unlocking-the-power-of-dyn

amic-context-68b8647eef89. Accessed: Jun. 1, 2024.

Yao, S., Zhao, J., Yu, D., Du, N., Shafran, I., Narasimhan,

K., and Cao, Y. (2023). React: Synergizing reason-

ing and acting in language models. arXiv:2210.03629

[cs.CL].

Zhao, P., Jin, Z., and Cheng, N. (2023). An in-depth survey

of large language model-based artificial intelligence

agents. arXiv:2309.14365v1 [cs.CL].

Integrating Traditional Technical Analysis with AI: A Multi-Agent LLM-Based Approach to Stock Market Forecasting

111