Framework for Decentralized Data Strategies in Virtual Banking:

Navigating Scalability, Innovation, and Regulatory Challenges in

Thailand

Worapol Alex Pongpech

1 a

and Pasd Putthapipat

2 b

1

Faculty of Applied Statistics, NIDA, Bangkok, Thailand

2

Head of Analytics and AI Innovation Engineering, SCB Data X, Bangkok, Thailand

Keywords:

Virtual Banking, Centralized, Data Strategy, Data Mesh, Distributed Data Strategy, Data Governance,

Decentralized Data Architecture, Scalability in Banking, Data Privacy in Finance, Regulatory Compliance.

Abstract:

In the rapidly advancing realm of virtual banking, a robust data strategy is crucial for competitiveness and

meeting growing customer demands. In 2025, the Bank of Thailand will be issued three virtual banking li-

censes, marking a pivotal shift in the financial landscape. This paper outlines key components of a virtual

banking data strategy, focusing on real-time service delivery, innovative financial products, enhanced cus-

tomer support, and strong data governance. This research offers strategic insights into the navigation of these

complexities and the driving force of successful digital transformation in the banking sector.

1 INTRODUCTION

In 2024, the Bank of Thailand (BOT) took a major

step toward advancing the country’s financial land-

scape by stating that BOT will be granting three vir-

tual banking licenses. The BOT has set stringent re-

quirements for virtual banking applicants, including a

paid-up registered capital of at least 5 billion baht. By

2025, these virtual banks are expected to start offer-

ing a range of dynamic financial solutions, leveraging

technology to streamline services like loan approvals

and account management while reducing costs asso-

ciated with traditional banking infrastructure. We al-

ready have seen a number of virtual banking operating

in Asia (Curtis et al., 2022) (Nguyen and McCahery,

2020) (Analytica, 2020).

A well-structured data strategy is a critical tool in

enabling banks to meet these demands, transforming

not only the way they deliver services but also how

they design financial products, support customers,

and ensure compliance with regulatory frameworks

(Hadi and Hmood, 2020). These elements are inter-

linked, collectively enabling banks to respond to the

dynamic needs of the digital marketplace while main-

taining regulatory compliance and protecting cus-

tomer trust (Kraiwanit et al., 2024).

a

https://orcid.org/0000-0003-2938-2877

b

https://orcid.org/0009-0006-6994-4298

Financial institutions are increasingly relying on

real-time data processing and AI-driven automation

to deliver such services, enabling them to meet cus-

tomer expectations of speed and convenience (Oru-

ganti, 2020) (Mori, 2021). Financial data products

represent a new frontier in banking innovation. Using

customer data in conjunction with external financial

indicators, banks can offer customized solutions that

meet individual needs, improving customer loyalty

and driving revenue growth (Schatt, 2014) (Boshkov,

2019).

The cost structure of virtual and traditional bank-

ing also contrasts sharply. Virtual banking typically

has lower operational costs due to the lack of physical

branches and automation of most services. This cost-

efficiency often translates to lower fees for customers,

making it an attractive option for those seeking af-

fordable financial solutions (Chaimaa et al., 2021).

Traditional banking, on the other hand, incurs higher

operational costs due to the need for physical infras-

tructure and staff. These additional expenses are of-

ten passed on to customers in the form of higher fees,

making traditional banking more expensive in many

cases (Wewege et al., 2020).

In terms of customer interaction and service de-

livery, virtual banking is heavily based on digital

tools such as chatbots, AI, and email support (Win-

dasari et al., 2022). This can offer quick responses

Pongpech, W. A. and Putthapipat, P.

Framework for Decentralized Data Strategies in Virtual Banking: Navigating Scalability, Innovation, and Regulatory Challenges in Thailand.

DOI: 10.5220/0013194500003950

In Proceedings of the 15th International Conference on Cloud Computing and Services Science (CLOSER 2025), pages 111-118

ISBN: 978-989-758-747-4; ISSN: 2184-5042

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

111

to straightforward queries but may lack the personal

touch that some customers value. Furthermore, reg-

ulatory uncertainty and evolving policies, especially

in fintech, could create hurdles for new entrepreneurs

looking to operate fully virtual banking models (Nian

and Chuen, 2024) (Wewege et al., 2020) (Lehmann,

2020). Furthermore, political instability or changes

in government policies can lead to changes in regu-

latory frameworks, increasing uncertainty for virtual

banks operating in the country.

This paper aims to explore these critical ele-

ments of a virtual banking data strategy, focusing

on how they interconnect to drive competitive advan-

tage in a highly regulated and customer-centric indus-

try. Through an examination of industry best prac-

tices, case studies, and technological innovations, we

will provide two frameworks for how banks can de-

velop and implement comprehensive data strategies

that enable fast services, innovative products, excep-

tional customer support, and strong governance. In

Section 2, we discussed the virtual banking land-

scape, data strategy, and approaches. In Section 3,

we presented distributed concepts for virtual banking

focused on key components and critical operational

linkages and flows. In Section 4, we present the mi-

gration and transformation frameworks for moving to

virtual banking. We also discussed the difficulties of

moving physical banking toward virtual banking. We

then present our highlight in the conclusion.

2 THAILAND VIRTUAL

BANKING LANDSCAPE, DATA

STRATEGY, AND

APPROACHES

The role of data in virtual banking is pivotal, as it

underpins nearly every aspect of the service deliv-

ery. Unlike traditional banks, which rely heavily on

face-to-face interactions and manual processes, dig-

ital banks leverage data analytics and AI to person-

alize customer experiences, detect fraud, and stream-

line operations. Data enables digital banks to offer

tailored financial products, such as personalized loan

options or spending insights, based on a customer’s

transaction history and financial behavior.

2.1 Virtual Banking Approaches

We observed that virtual banking can be constructed

through three different approaches: digital native,

digital migration, and digital transformation.

1. The Digital Native Approach approach refers

to banks that are born purely online, with no

legacy systems or physical branches. These banks

leverage cutting-edge technology, from mobile-

first strategies to advanced AI, to provide seam-

less digital experiences. Examples include fintech

companies like Revolut and Monzo, which were

designed with internet generation in mind and of-

fer fast, customer-centric services using big data

and analytics.

2. The Digital Migration Approach involves tradi-

tional banks moving their services to digital plat-

forms without completely abandoning their phys-

ical operations. This gradual migration helps tra-

ditional banks like JPMorgan Chase and HSBC

provide digital banking services alongside brick-

and-mortar ones, appealing to a broader customer

base. These institutions often start by offering

mobile banking apps and online portals to extend

their services digitally. Research supports this mi-

gration as a way to retain long-time customers

while attracting tech-savvy users. Migrating to

digital platforms requires overcoming legacy sys-

tem challenges. Still, it allows traditional banks to

build on their established trust and brand recogni-

tion while slowly transitioning customers to more

digital interactions.

3. The Digital Transformation Approach involves

a holistic revamp of a traditional bank’s entire

operating model, transitioning from legacy sys-

tems to a fully integrated digital framework. This

process is more than just digitizing services; it

often involves redesigning products, retraining

staff, and adopting cloud technologies, AI, and

automation. Major players such as BBVA and

ING are undertaking digital transformation strate-

gies, which have invested heavily in reshaping

their business models around data-driven insights

and customer experience. Research indicates

that while this approach is more complex and

resource-intensive, it allows for the creation of ag-

ile, scalable systems that can adapt to changing

market dynamics and consumer demands, ensur-

ing long-term competitiveness in the digital bank-

ing space

No matter which virtual bank approach is pur-

sued, data strategy is still central to the success of

virtual banking, as the entire model depends on the

ability to process, analyze, and secure vast amounts of

real-time data. Virtual banks operate without physical

branches, meaning every transaction, interaction, and

customer request must be managed digitally. This re-

quires a well-structured data strategy that ensures ef-

ficient data flow, from customer onboarding to trans-

action processing and service personalization. Virtual

CLOSER 2025 - 15th International Conference on Cloud Computing and Services Science

112

banks must prioritize data accessibility, ensuring that

all necessary data is available to the right teams at the

right time to deliver seamless customer experiences.

Additionally, the data strategy must focus heavily on

cybersecurity, as digital-first banks are prime targets

for cyber threats. Strong encryption, multi-factor au-

thentication, and real-time fraud detection algorithms

are key components of a robust virtual banking data

strategy.

2.2 Decentralized Data: Components,

Linkages, and Flows

Virtual banking operates 24/7 across digital plat-

forms, often processing large volumes of transactions

and interactions simultaneously. Since virtual bank-

ing relies heavily on AI-driven, real-time analytics

for services such as personalized recommendations,

fraud detection, and customer support, having a dis-

tributed data strategy ensures that these services are

not impacted by data silos or delays in accessing crit-

ical information. A distributed data strategy like data

mesh (Dehghani, 2019) could be an ideal choice for

virtual banking due to the decentralized nature of its

operations and the need for real-time, scalable data

management (Machado et al., 2022).

A data mesh strategy, which decentralizes data

ownership to individual domain teams, allows for

better scalability and flexibility (Dolhopolov et al.,

2024). Instead of relying on a centralized data team,

each business unit (such as payments, customer ser-

vice, or fraud detection) can manage its own data

pipeline and infrastructure. This aligns perfectly with

virtual banking’s need for rapid decision-making,

agility in service delivery, and continuous data avail-

ability across multiple services. By decentralizing

data ownership, virtual banks can ensure each domain

has direct access to the data they need to drive im-

provements without being bottlenecked by a central-

ized data architecture. We provide key components of

a decentralized data platform, such as a data mesh, to

illustrate the concept of using it for virtual banking in

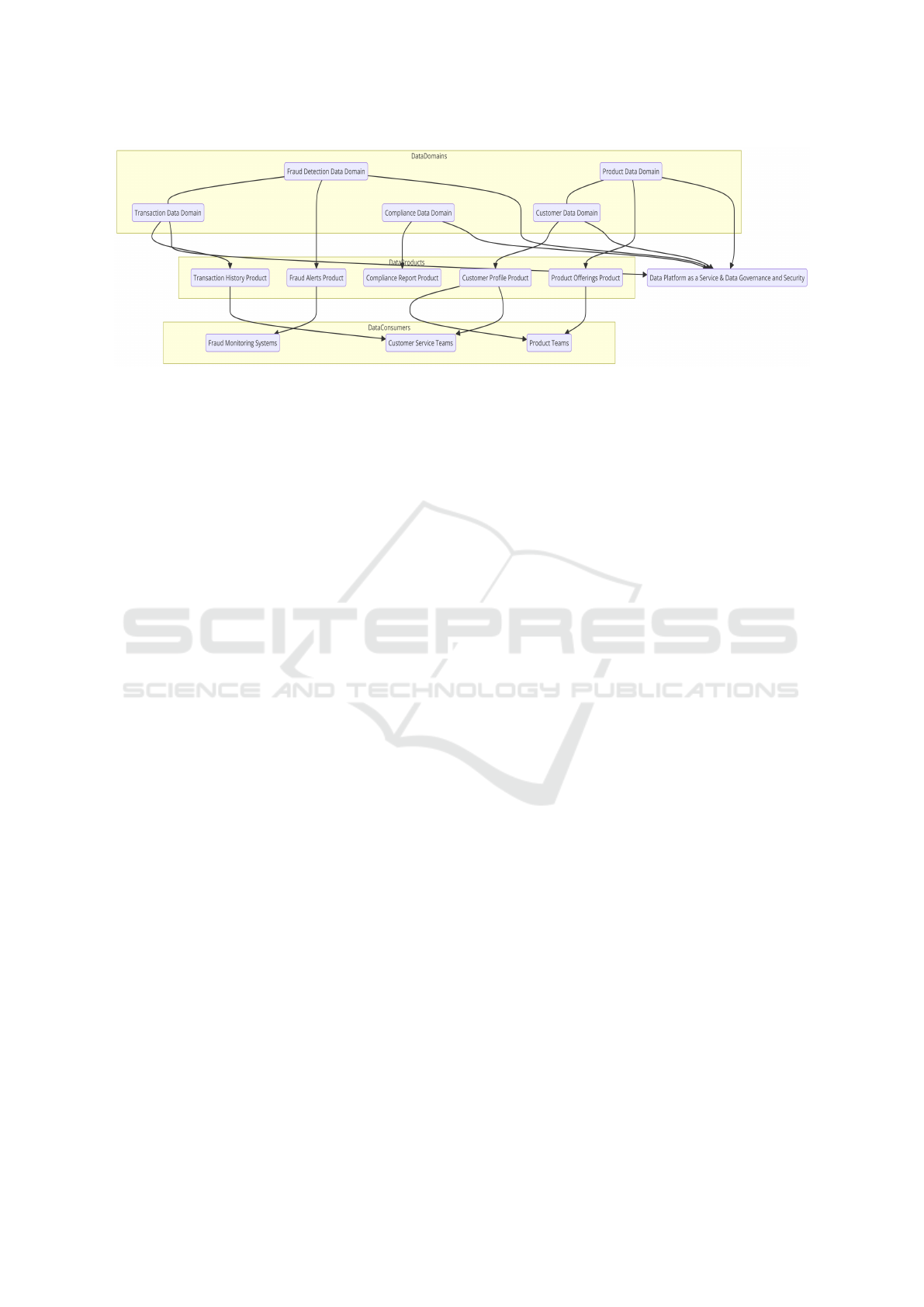

figure 1.

2.3 Key Components

1. Data Domains & Products: Virtual banking op-

erates with decentralized data domains, each re-

sponsible for its own data and producing specific

data products:

• Customer Data Domain: Manages personal and

account data, producing customer profiles.

• Transaction Data Domain: Handles transaction

records, creating transaction history products.

• Fraud Detection Data Domain: Monitors fraud,

generating fraud alerts.

• Product Data Domain: Covers banking prod-

ucts like loans, credit cards, and mortgages.

• Compliance Data Domain: Ensures regulatory

adherence (e.g., KYC, AML).

• Data Consumers: Various services and stake-

holders consume data:

2. Customer Service Teams: Access customer pro-

files and transaction histories.

• Fraud Monitoring Systems: Use transaction

data to detect fraud.

• Product Teams: Leverage customer and prod-

uct data for personalized offerings.

3. Infrastructure Layer:

• Data Platform as a Service: Scalable cloud in-

frastructure for data management.

• Data Governance & Security: Ensures data

policies, security, and compliance.

• Decentralized Ownership: Domains manage

their data as products with APIs or catalogs.

• Cross-Domain Collaboration: Insights are gen-

erated by combining data across domains (e.g.,

transaction data with fraud patterns for risk as-

sessments).

2.4 Linkages and Flows

In the decentralized data domain architecture, each

data domain operates independently but remains in-

terconnected through a central infrastructure. Let’s

break down the key linkages and flows within this sys-

tem:

1. Central Infrastructure: Data Platform as a Service

(DPaaS)

• Role: The core of the system is the central in-

frastructure labeled “Data Platform as a Service”

(DPaaS). It includes aspects like data governance

and security and serves as the integration layer for

all data domains.

• Flows: Each data domain (Customer Data,

Transaction Data, Fraud Detection Data, Prod-

uct Data, and Compliance Data) connects to the

DPaaS, where data is securely managed, gov-

erned, and potentially processed. This central

layer ensures that decentralized data remains co-

herent, adheres to compliance requirements, and

is accessible for broader organizational needs.

2. Data Domains and Their Products: Each data do-

main produces specific outputs (data products) as

a result of the data it manages:

Framework for Decentralized Data Strategies in Virtual Banking: Navigating Scalability, Innovation, and Regulatory Challenges in Thailand

113

Figure 1: Decentralized.

• Customer Data Domain produces the Customer

Profile Product.

• Transaction Data Domain generates Transaction

History Product.

• Fraud Detection Data Domain provides Fraud

Alerts Product.

• Product Data Domain offers the Product Offer-

ings Product.

• Compliance Data Domain produces the Compli-

ance Report Product.

• Flows: Each of these products flows out of the

respective data domains, representing processed

and refined data outputs. External teams or sys-

tems then consume these.

3. Data Consumers

• The Customer Service Teams are linked to the

Customer Data Domain and Transaction Data Do-

main, consuming the Customer Profile Product

and Transaction History Product to improve cus-

tomer interactions and insights.

• Fraud Monitoring Systems connect to the Fraud

Detection Data Domain to consume Fraud Alerts

Product for real-time fraud detection and preven-

tion.

• Product Teams link with both the Customer Data

Domain and the Product Data Domain, consum-

ing the Customer Profile Product and Product Of-

ferings Product to tailor product development and

offerings.

4. Cross-Domain Collaboration

• Dotted or dashed arrows between data domains

indicate collaboration:

• Transaction Data Domain and Fraud Detection

Data Domain are interconnected, sharing data

for fraud prevention. Transaction history feeds

into fraud detection mechanisms, allowing for the

identification of suspicious patterns.

• The Product Data Domain and the Customer

Data Domain share insights to improve product

offerings based on customer profiles and behav-

iors. This enables better product personalization

and market targeting.

5. Decentralization but with Centralized Coordina-

tion

• While each domain is decentralized and respon-

sible for its data, all domains are connected to the

central DPaaS. This ensures coordination without

centralizing the data itself. Each domain can oper-

ate autonomously, but the shared platform allows

for consistent governance, security, and cross-

domain data sharing when necessary.

Summary of Data Flows:

• Domain to DPaaS: All data flows into the central

platform for governance, processing, and accessibil-

ity.

• Domain to Products: Each data domain produces

specialized data products that are consumed by vari-

ous teams.

• Cross-Domain Collaboration: Domains share

data (e.g., transaction and fraud detection) to enhance

functionality, such as fraud prevention or personal-

ized product offerings.

Virtual banking operates in a 24/7 digital environ-

ment, requiring a robust and scalable data strategy

to handle the high volume of transactions and inter-

actions. The distributed data approach, such as data

mesh, aligns well with the decentralized needs of vir-

tual banking. By decentralizing data ownership to in-

dividual domain teams, a data mesh provides scalabil-

ity, flexibility, and real-time analytics essential for vir-

tual banking operations, from fraud detection to per-

sonalized services. Each domain, such as customer

data or transaction data, produces specific data prod-

ucts, which are shared across the organization to en-

sure collaboration and functionality without compro-

mising autonomy. As we move forward, exploring

CLOSER 2025 - 15th International Conference on Cloud Computing and Services Science

114

the framework for migration and transformation, it

becomes essential to understand how these decentral-

ized structures can transition from traditional to vir-

tual banking.

3 MIGRATION AND

TRANSFORMATION

FRAMEWORKS

Migration from a centralized to a decentralized data

platform is a more incremental and controlled process

compared to transformation, which involves a fun-

damental overhaul of the banking infrastructure and

operations. Migration typically follows a phased ap-

proach where traditional banking systems continue to

operate while specific components are gradually tran-

sitioned to a decentralized platform. This approach

is focused on minimizing disruptions by allowing for

coexistence between old and new systems, ensuring

operational stability during the transition.

A major advantage of migration is that it al-

lows organizations to leverage existing investments

in legacy systems while gradually adopting new tech-

nologies, such as data mesh or cloud-native architec-

tures. Additionally, migration focuses heavily on inte-

gration with hybrid infrastructures that bridge central-

ized and decentralized environments, making it easier

to manage regulatory compliance, data governance,

and customer expectations. However, the gradual na-

ture of migration can lead to longer timelines, often

requiring more complex management to avoid friction

between legacy systems and the emerging decentral-

ized infrastructure.

In contrast, transformation entails a complete

reimagining of the banking architecture, where de-

centralized data platforms are integrated as the core

backbone of operations right from the onset. Unlike

migration, transformation is not about coexistence

but about a comprehensive shift towards a digital-

first, data-centric operational model. Transformation

is often driven by a visionary approach that seeks to

enable agility, real-time decision-making, and deep

customer personalization, which traditional central-

ized systems often struggle to deliver. The transfor-

mation framework embraces cutting-edge technolo-

gies such as cloud-native applications, microservices,

blockchain, and AI to support decentralized data gov-

ernance and domain autonomy fully.

However, transformation also comes with signifi-

cant challenges. It requires leadership commitment, a

cultural shift within the organization, and substantial

investments in talent, technology, and change man-

agement. The risks are higher, as it involves more

rapid change, which can lead to operational disrup-

tions if not managed carefully. Ultimately, while mi-

gration focuses on minimizing disruption and mod-

ernizing gradually, transformation aims for rapid, rev-

olutionary change that positions the bank for long-

term digital dominance.

In conclusion, migration and transformation offer

two distinct pathways for transitioning from central-

ized to decentralized data platforms in banking. Mi-

gration is more incremental and risk-averse, focusing

on minimizing operational disruption. At the same

time, transformation is a complete, visionary over-

haul that seeks to rebuild the organization’s data in-

frastructure for future growth and competitiveness.

The choice between these approaches depends on the

bank’s risk appetite, leadership vision, and the ur-

gency of digital adoption in the competitive land-

scape.

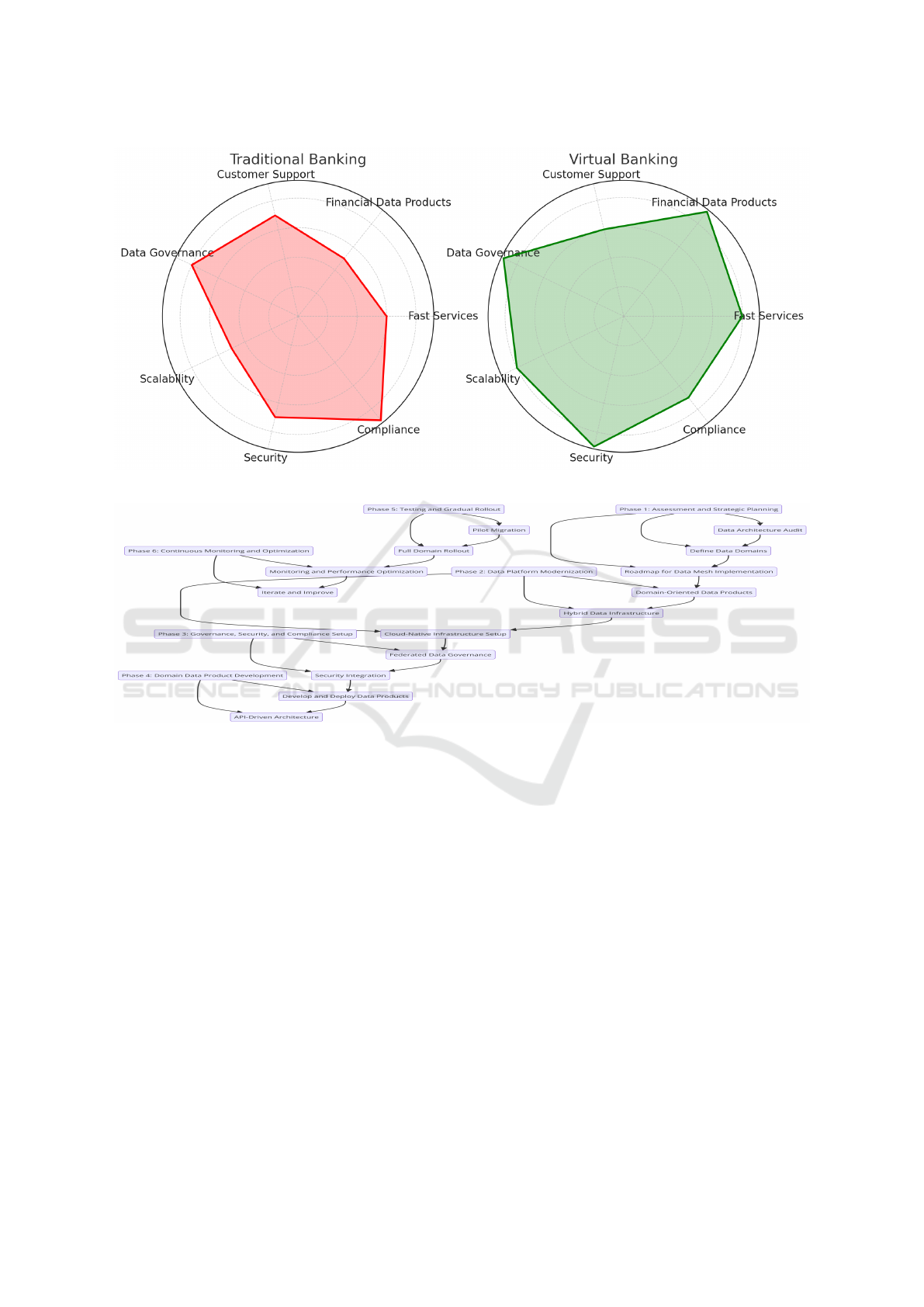

3.1 Migration Framework

This framework, illustrated in figure 3, focuses on

incremental migration from a traditional, centralized

data platform to a decentralized platform, ensuring

minimal disruption to existing operations while grad-

ually adopting new data paradigms.

1. Phase 1: Assessment and Strategic Planning

• Data Architecture Audit: Assess the cur-

rent state of centralized data architecture (data

warehouses, monolithic systems). Identify crit-

ical data silos, bottlenecks, and inefficiencies in

the centralized system.

• Define Data Domains: Identify key business

domains (e.g., Customer, Transaction, Fraud

Detection, Product) to map decentralized data

ownership. Assign ownership of data domains

to respective business units (following data

mesh principles).

• Roadmap for Data Mesh Implementation: Cre-

ate a migration roadmap for transitioning each

domain from centralized data warehouses to

decentralized data products. Prioritize domains

based on business criticality and ease of migra-

tion.

2. Phase 2: Data Platform Modernization

• Introduce Domain-Oriented Data Products:

Start with key domains (e.g., Customer and

Transaction) and develop decentralized data

products. Data products must have well-

defined APIs for easy consumption by other

services.

Framework for Decentralized Data Strategies in Virtual Banking: Navigating Scalability, Innovation, and Regulatory Challenges in Thailand

115

Figure 2: Traditional Banking vs Virtual Banking.

Figure 3: Migration Framework.

• Hybrid Data Infrastructure: Initially, a hybrid

infrastructure should be set up to support both

centralized (legacy) and decentralized plat-

forms (cloud—or microservices-based). Use

data replication and sync mechanisms to ensure

data consistency across systems during migra-

tion.

• Cloud-Native Infrastructure Setup: Migrate the

existing centralized data platform (data lakes,

warehouses) to cloud-based storage, introduc-

ing decentralized storage solutions (e.g., S3,

data buckets). Set up a scalable cloud environ-

ment to host domain-specific data products.

3. Phase 3: Governance, Security, and Compliance

Setup

• Implement Federated Data Governance: Estab-

lish a federated governance model in which

each domain is responsible for ensuring data

quality, security, and compliance (e.g., GDPR,

KYC/AML, and PDPA). Create global data

policies for privacy, access control, and encryp-

tion and ensure they are enforced across all do-

mains.

• Security Integration: Deploy security protocols

such as encryption, access control, and logging

for each data domain. Ensure decentralized

platforms comply with banking security stan-

dards and data protection laws.

4. Phase 4: Domain Data Product Development

• Develop and Deploy Data Products: Develop

customer-facing data products (e.g., customer

profiles and transaction histories) that can be

consumed via APIs by virtual banking services.

Deploy data mesh infrastructure (e.g., domain-

oriented microservices) that allows seamless

access to decentralized data.

• API-Driven Architecture: Introduce API gate-

ways to allow seamless interaction between de-

CLOSER 2025 - 15th International Conference on Cloud Computing and Services Science

116

centralized data products and virtual banking

systems. Enable interoperability between de-

centralized data domains and third-party ser-

vices (e.g., payment gateways, fintechs).

5. Phase 5: Testing and Gradual Rollout

• Pilot Migration: Perform pilot migrations for

individual data domains, starting with non-

critical services to validate the decentralized

approach. Monitor data integrity, access speed,

and reliability before expanding the migration

process.

• Full Domain Rollout: Gradually roll out decen-

tralized data products to all business domains,

ensuring full decoupling from the centralized

data platform.

6. Phase 6: Continuous Monitoring and Optimiza-

tion

• Monitoring and Performance Optimization: Set

up real-time monitoring for each data domain’s

performance, ensuring scalability, latency, and

fault tolerance. Continuously optimize the data

platform for improved virtual banking opera-

tions and customer experience.

• Iterate and Improve: Gather feedback from do-

main owners and data consumers to refine data

products and governance policies. As the sys-

tem matures, retire the centralized data plat-

form, leaving a fully decentralized structure.

3.2 Transformation Framework

This framework focuses on radical transformation

from a traditional, centralized platform to a fully de-

centralized data platform.

1. Phase 1: Executive Leadership and Cultural Shift

• Leadership Commitment: Obtain leadership

commitment to transform data architecture to a

decentralized platform as part of a larger virtual

banking transformation.

• Cultural Shift to Data-Driven Decision Mak-

ing: Encourage every department to see them-

selves as data producers and consumers.

2. Phase 2: Redesign Data Architecture for Decen-

tralization

• Domain-Oriented Data Ownership: Restruc-

ture the organization into domain-driven teams

responsible for their respective data products

(Customer, Transaction, Product, etc.)

• Move to Cloud-Native and Distributed Sys-

tems: Rebuild the infrastructure to be fully

cloud-native, leveraging distributed systems

like Kubernetes, serverless computing, and mi-

croservices.

3. Phase 3: Building a Decentralized Data Platform

• Full Adoption of Data Mesh Principles: Design

the entire data platform around data mesh prin-

ciples, focusing on domain autonomy, data as a

product, and decentralized governance.

• Data Product Development: Each domain de-

velops, manages, and publishes its data prod-

ucts (e.g., real-time transaction analytics and

fraud detection insights) with full operational

responsibility.

4. Phase 4: Advanced Data Governance and Com-

pliance

• Decentralized Governance and Security: Es-

tablish federated data governance, where each

domain adheres to global standards but retains

control over local security, access, and compli-

ance mechanisms.

• Regulatory Compliance: Using automated gov-

ernance workflows, ensure that each domain

maintains compliance with data regulations

(GDPR, PDPA, KYC, AML).

5. Phase 5: Implementation of Virtual Banking Ser-

vices

• Integration with Virtual Banking Systems: Vir-

tual banking services such as online accounts,

digital loans, and payments are built on top of

decentralized data products.

• API-First Strategy: Adopt an API-first strategy

where every virtual banking service is powered

by APIs exposed by the decentralized data plat-

form.

6. Phase 6: Advanced Analytics and AI Integration

• Data Democratization for AI and Analytics:

Empower data scientists and analysts to access

decentralized data products for real-time ana-

lytics, machine learning, and artificial intelli-

gence.

• Real-Time Decision-Making: Implement AI-

driven predictive analytics across decentral-

ized data products to enable real-time decision-

making, such as dynamic loan pricing and per-

sonalized financial products.

7. Phase 7: Full Transformation and Continuous In-

novation

• Monitoring, Automation, and Scaling: Contin-

uously monitor data platform performance and

automate operations, scaling decentralized sys-

tems based on demand.

Framework for Decentralized Data Strategies in Virtual Banking: Navigating Scalability, Innovation, and Regulatory Challenges in Thailand

117

• Virtual Banking as a Fully Decentralized

Ecosystem: Transform into a fully decen-

tralized virtual banking ecosystem where cus-

tomers experience seamless, data-driven ser-

vices without reliance on centralized infrastruc-

ture.

3.3 Implement Difficulties

In the migration framework, the organization would

be in a state that is close to the opposite of the native

framework. Its key obstacles would be highly con-

trolled legacy legal contracts and conservative con-

trol processes, which highly introduce time and re-

sources to the data-sharing process. Also, the data

model might not be ready for data sharing. The key

strong advantage of this would also be a large amount

of data, in terms of the number of customers and rich-

ness of customer behavior to the organization. The

key focus on driving open data for migration organi-

zations should be on bringing high-impact use cases,

especially on data sharing with other big players from

other industries. This would drive the usage and mi-

gration to be faster, especially from business impact.

In the transformation approach, which focuses on

the transformation of the organization in parallel with

the revamping data model and stack, the key advan-

tage would be that the early adopters in organizations

are graving for the new business impact, which also

includes an open data use case. The key principles

that would help drive this would be focusing on No-

bel solutions and use cases by drawing the advantage

of a huge legacy number of customers. The concerns

that organizations should be aware of the matrix pro-

cess in evaluating cases

4 CONCLUSION

We have highlighted the critical role of data strategy

in the successful implementation and operation of vir-

tual banking. As virtual banks operate entirely on-

line, they require a robust data infrastructure capable

of handling real-time transactions, customer data, and

service requests around the clock. A well-structured

data strategy focusing on scalability, real-time analyt-

ics, and customer-centricity is essential to meet the

growing demand for instant and personalized finan-

cial services. By leveraging cutting-edge technolo-

gies like AI and big data analytics, virtual banks can

offer tailored financial products, enhance fraud detec-

tion, and improve operational efficiency compared to

their traditional banking counterparts.

REFERENCES

Analytica, O. (2020). Singapore will lead in south-east

asian fintech. Emerald Expert Briefings, (oxan-db).

Boshkov, T. (2019). Virtual banking and financial inclusion.

Chaimaa, B., Najib, E., and Rachid, H. (2021). E-banking

overview: concepts, challenges and solutions. Wire-

less Personal Communications, 117:1059–1078.

Curtis, H., Hogeveen, B., Kang, J., Le Thu, H., Ra-

jagopalan, R. P., and Ray, T. (2022). Digital southeast

asia. Australian Strategic Policy Institute.

Dehghani, Z. (2019). How to move beyond a monolithic

data lake to a distributed data mesh. Martin Fowler

Website.

Dolhopolov, A., Castelltort, A., and Laurent, A. (2024). Im-

plementing federated governance in data mesh archi-

tecture. Future Internet, 16(4):115.

Hadi, A. and Hmood, S. (2020). Analysis of the role of

digital transformation strategies in achieving the edge

of financial competition. 10:19–40.

Kraiwanit, T., Shaengchart, Y., Limna, P., Thetlek, R., and

Moolngearn, P. (2024). The strategy of virtual bank-

ing adoption in the digital economy. Thetlek, R., Krai-

wanit, T., Limna, P., Shaengchart, Y., & Moolngearn,

P.(2024). The strategy of virtual banking adoption

in the digital economy [Special issue]. Corporate &

Business Strategy Review, 5(1):264–272.

Lehmann, M. (2020). Global rules for a global mar-

ket place?-regulation and supervision of fintech

providers. BU Int’l LJ, 38:118.

Machado, I. A., Costa, C., and Santos, M. Y. (2022). Ad-

vancing data architectures with data mesh implemen-

tations. In Lecture Notes in Business Information Pro-

cessing, pages 34–49. Springer, Cham.

Mori, M. (2021). Ai-powered virtual assistants in the realms

of banking and financial services. Virtual assistant,

1:65–93.

Nguyen, T. V. and McCahery, J. (2020). Virtual bank

by fintech firms–global trending, challenges, solutions

and experience of regulating virtual banks in vietnam.

Technical report, Working Paper. Tilburg University,

the Netherlands.

Nian, L. P. and Chuen, D. L. K. (2024). A light touch of reg-

ulation for virtual currencies. In Handbook of Digital

Currency, pages 291–308. Elsevier.

Oruganti, S. C. (2020). Virtual bank assistance: An ai based

voice bot for better banking. International Journal of

Research, 9(1):177–183.

Schatt, D. (2014). Virtual banking: a guide to innovation

and partnering. John Wiley & Sons.

Wewege, L., Lee, J., and Thomsett, M. C. (2020). Disrup-

tions and digital banking trends. Journal of Applied

Finance and Banking, 10(6):15–56.

Windasari, N. A., Kusumawati, N., Larasati, N., and

Amelia, R. P. (2022). Digital-only banking experi-

ence: Insights from gen y and gen z. Journal of Inno-

vation & Knowledge, 7(2):100170.

CLOSER 2025 - 15th International Conference on Cloud Computing and Services Science

118