A Clustering Approach for S&P 500 Index Based on Environmental,

Social and Governance Ratings of Multiple Agencies

Celma de Oliveira Ribeiro and Gabriela Curti Geraldo

Departamento de Engenharia de Produção, Escola Politécnica, Universidade de São Paulo, Brazil

Keywords: ESG, Cluster Analysis, Responsible Investing, Ratings.

Abstract: This article addresses the lack of standardization in the assessment of companies' environmental, social and

governance (ESG) practices. To avoid implicit bias in selecting a specific rating, this study suggests using

multiple assessment sources simultaneously to categorize companies as good or bad from an ESG perspective.

Even with the differences in scope, measurement, and weighting between the agencies' methodologies, when

applying the clustering algorithm to the ratings of companies within the S&P 500 index, it was possible to

observe that the groups formed exhibited significantly different average scores for ESG practices. In this way,

this article offers an alternative to mitigate the impact of rating plurality on the results of empirical studies

and on the analysis process conducted by investors.

1 INTRODUCTION

Socially Responsible Investing stands out from other

investment approaches because its investors consider

environmental, ethical, and social impacts, as well as

the corporate governance of the companies they

invest in during the process of analyzing and

evaluating capital applications. Pax World Fund, for

example, was one of the first funds established with

this focus: its investors, opposed to the Vietnam War,

avoided investing in arms and ammunition companies

(Renneboog et al., 2008).

From the 1970s to the present, the industry of so-

called sustainable investments has evolved

significantly, driven not only by legislation but also

by “ethical consumption,” where consumers are

willing to pay a higher price for products that align

with their personal values. The growth of total capital

managed with a socially responsible perspective has

given investors greater influence over the financial

market, while requiring companies to take a clearer

stance on their social, environmental, and governance

practices (Sparkes & Cowton, 2004). The report

“Who Cares Wins” (2004), published by the United

Nations Global Compact, not only officially

introduced the term ESG (Environmental, Social, and

Governance) but also provided guidelines on how to

integrate each of these pillars into portfolio

management processes.

The integration of these aspects into the analyses

conducted by investors was also promoted through

the Principles for Responsible Investment (PRI). The

institution assigned investors the role of main

promoters of the culture of responsible investments

within the financial market and investee companies;

the network of associates is committed to

incorporating practices that consider socio-

environmental and governance aspects into their

investment processes (Hoepner et al., 2021;

Principles For Responsible Investment, 2021).

The incorporation of ESG aspects into the

investment decision-making process occurs in several

ways: ESG Integration, which involves the explicit

inclusion of environmental, social, and governance

aspects in the financial analysis of companies, is the

most widely used method globally, followed by

negative screening, which consists of excluding

certain countries or sectors from the universe of

investable stocks (Ciciretti et al., 2023; Global

Sustainable Investment Alliance, 2020; van Duuren

et al., 2016; Kotsantonis et al., 2016). Another form

of integration, derived from the latter, is positive

screening. Also called “best in class,” this strategy

involves investing only in companies with exemplary

ESG practices compared to others (Bertelli &

Torricelli, 2024). Corporate engagement is the third

most widely used strategy. It involves engaging with

the top management of companies to address

environmental, social, and governance issues

(Dimson et al., 2015; Barko et al., 2022).

Ribeiro, C. O. and Geraldo, G. C.

A Clustering Approach for S&P 500 Index Based on Environmental, Social and Governance Ratings of Multiple Agencies.

DOI: 10.5220/0013211200003956

In Proceedings of the 7th International Conference on Finance, Economics, Management and IT Business (FEMIB 2025), pages 29-37

ISBN: 978-989-758-748-1; ISSN: 2184-5891

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

29

The effectiveness, from the perspective of

investor returns, of these ways of incorporating

environmental and social aspects of governance into

portfolio management is widely debated. Bertelli &

Torricelli (2024), when analyzing screening

strategies (both positive and negative) in the

European stock market from 2007 to 2021, conclude

that to achieve significant returns using this strategy,

investors need to focus on a longer investment time

horizon and be willing to relax the rigor of their

exclusions.

Still on the application of the screening strategy,

Wang et al. (2022) observe that, in the Chinese stock

market, portfolios constructed using this method have

a worse Sharpe ratio and return compared to others.

The authors also conclude that screening translates

into a more conservative approach to investing, which

ends up accommodating the preferences of investors

who are averse to high levels of risk.

In contrast to incorporating ESG aspects into the

investment process through screening which, by

limiting the universe of potential investments, ends

up compromising the portfolio diversification process

(Bertelli & Torricelli, 2024), the engagement strategy

with companies tends not to cause this “damage” to

the investor, since in this approach, the investor

generally uses his influence as a shareholder to

encourage senior management to implement changes

within the company (Adebowale & Onipe Adabenege

Yahaya, 2024; Schanzenbach & Sitkoff, 2020).

Regardless of the approach used, incorporating

socio-environmental and governance factors into the

investment analysis process involves evaluating non-

financial elements of companies, such as the impact

of their activities and the efficiency of their practices

in ESG dimensions (van Duuren et al., 2016). The

difficulty in obtaining standardized information about

companies’ socio-environmental conduct, coupled

with the discrepancies between the methodologies

and attributes considered by each financial market

agent, can make assessment from this perspective

controversial. The lack of consensus on the best way

to qualify (or disqualify) a company’s environmental,

social, and governance practices diminishes the effect

of allocations made by socially responsible investors

and, consequently, reduces the impact on the financial

performance of investments (Billio et al., 2021).

When analyzing the relationship between investor

behavior and uncertainty regarding the quality of

socio-environmental and governance practices of

potential investees, Avramov et al. (2020)

corroborate the idea that the variability of valuations

can distort the relationship between risk and return on

assets. They conclude that uncertainty is related to a

reduction in demand for risky assets and an increase

in the market premium required by investors.

The development of the sustainable investment

market has made agents in this universe prepare to

meet demands related to this topic. Rating agencies

began to include ESG aspects in their analyses and

subsequently started publishing specific scores for

each of the dimensions considered (environmental,

social and governance). However, each rating agency

developed its own methodology for evaluating ESG

practices, using the data and information they deemed

appropriate for this purpose. Furthermore, the scale

used to rank companies also differs depending on the

rating provider, making it even more difficult for

investors to compare assessments (Billio et al., 2021).

When investigating the reasons for the

discrepancy between assessments, Berg et al. (2022)

identified three sources of dissonance: Scope,

Measurement, and Weighting. The first refers to the

fact that ratings can be generated from different sets

of attributes; for example, to evaluate the

Environmental sphere, one agency may consider the

amount of energy used per unit of product produced,

while another may use the amount of carbon emitted

per unit of revenue generated. The second source of

divergence (Measurement) concerns how agencies

use different indicators to evaluate the same attribute;

the quality of the Company’s internal policies can be

assessed based on the number of labor actions it has

open or based on employee turnover, for example.

The third source (Weighting) consists of differences

in perception about the relevance of attributes to a

company’s score — in one assessment, the weight

attributed to waste management may be greater than

that attributed to water consumption, for example,

and vice versa for another agency.

By comparing the ratings assigned by six

agencies, Avramov et al. (2020) confirmed the

variation in scores from different providers, finding

an average correlation between them of just 0.48.

Considering some other agencies, Berg et al. (2022)

observed that the average correlation between the

grades awarded was 0.54, also finding that

measurement was the main source of divergence

between grades, followed by scope and weighting.

Regardless of their origins, the discrepancies

observed make it difficult to analyze the performance

(from an ESG perspective) of companies and harm

the market reading carried out by companies

regarding how their initiatives on the topic are being

perceived by the investment industry. Furthermore,

the dissonance between ratings is an obstacle to

empirical studies, as the choice of which assessment

will be used can significantly impact the results and

FEMIB 2025 - 7th International Conference on Finance, Economics, Management and IT Business

30

conclusions obtained (Berg et al., 2022). From De

Spiegeleer et al. (2023), for example, when

comparing the results obtained using the ratings of

two different agencies (MSCI and Sustainalytics) in

the mean-variance model with restrictions, concluded

that the impact of including ESG aspects on portfolio

performance depends on the source of the rating used

to measure the restrictions.

In the literature, there are records of different

ways to address the lack of standardization in the

assessments of companies’ environmental, social,

and governance aspects. Some researchers choose to

select ESG ratings from a specific agency ((López

Prol & Kim, 2022), (Shanaev & Ghimire, 2022),

(Broadstock et al., 2021)); others, in addition to using

rating providers, create their own assessments of

socio-environmental and governance practices: Chen

et al. (2021), for example, used a data envelope

analysis model (Data Envelopment Analysis – DEA)

to recalculate companies’ ESG scores. Pedersen et al.

(2021) chose to use, in addition to the ratings

provided by a specialized agency (MSCI), specific

assumptions for each of the dimensions considered

(environmental, social and governance).

In the context of the impact of the lack of

standardization of ratings, this work aims to

contribute to the debate by offering a solution through

clustering companies based on the ESG ratings

assigned to them by multiple agencies. By using the

clustering method presented, it is possible to

categorize companies as good or bad from an ESG

perspective, while simultaneously avoiding implicit

bias in selecting ratings from a specific agency. In this

way, this article suggests an alternative approach to

mitigate the impact of rating plurality both on the

results of empirical studies and on the decision-

making process of investors.

2 METHODOLOGY

Based on the ESG scores of listed companies, the K-

means algorithm was used to classify stocks as good

or bad — an approach similar to that seen in Sariyer

& Taşkın (2022) and Pranata (2023).

2.1 K-Means Clustering

Clustering techniques allow data to be separated so

that it is possible to observe similarities among

members of the same set and differences between

those belonging to different groups. Grouping

elements based on a similar characteristic can help

identify other common characteristics among

members of the same group (James et al., 2013).

Among the methodologies employed in

combinatorial clustering algorithms, there are two

widely applied methods: the partition-based method

and the hierarchy-based method. According to Jain

(2010) and Reddy & Vinzamuri (2018), the first one

iteratively searches for groups aiming to optimize an

objective function, in order to improve the quality of

the grouping performed. The hierarchical method, in

turn, has two major approaches: the top-down

approach, where all data starts in a large group and is

recursively partitioned into smaller groups until each

analyzed data is assigned to a cluster; and the

agglomeration method, in which each data is a group;

iteratively, pairs of groups are merged, until a

hierarchy of groups is formed.

The variables used in the grouping process are

distributed into two large groups: quantitative and

qualitative. The distinction between these two types

is crucial in choosing the methodology to be applied,

as methods efficient for one category of data may be

less effective for the other (McCullagh, 1980); the

ratings used in this study are examples of ordinal

qualitative data.

One way to resolve the issue of the absence of a

distance metric between ordinal data is to treat them

as numerical data, that is, as consecutive integers, to

preserve the information that certain values are better

than others (Gentle et al., 1991; Zhang & Cheung,

2020). In this study, qualitative ratings were

converted to a numerical scale, so that the lowest

score of each rating provider was assigned the value

1, and to this value, one unit per notch was added up

to the highest existing score on each agency’s scale.

Once a way of measuring the distance between the

data was established, it was possible to use the K-

means algorithm to perform the partition.

The K-means method aims to separate the data

into a predetermined number of groups, with the

objective of obtaining the minimum desirable

distance between the data and the centroid of each

group. Given the number of desired clusters (𝐾) and

an initial set of centroids, the algorithm calculates, at

each iteration, the distance between each data and

each of the centers. In K-means clustering, the

objective function (𝑭) to be minimized is generally

the sum of the squared errors; that is, for each point

belonging to each group (𝐺

):

𝑭(𝑮) =

(

𝑔

−𝑥

)

∈

(1)

A Clustering Approach for S&P 500 Index Based on Environmental, Social and Governance Ratings of Multiple Agencies

31

Where the midpoint of cluster K is 𝑔

. Once the

defined convergence condition is not met, the

algorithm updates the position of each group's

centroid to the average of the points belonging to it

and performs the distance calculation again until

minimizing its objective function (Hastie et al., 2001;

Reddy & Vinzamuri, 2018; Jain, 2010). The

algorithm is summarized below:

Algorithm 1: K-means method algorithm.

Defining the number of clusters (K) used in the

classification algorithm is one of the main challenges

in the data separation process. One of the metrics used

to assess clustering quality is the Silhouette Score,

which measures how close each element in a cluster

is to an element in another cluster. The score in

question varies from [-1,1], with results closer to 1

indicating a better classification of the data

(Shahapure & Nicholas, 2020; Sariyer & Taşkın,

2022; Dudek, 2020). The Silhouette Score was used

in this work to assess whether the classification of

data into two large groups was indeed the best

possible for the sample used.

Thus, using the ratings provided by various

agencies for the environmental, social, and

governance aspects of companies, it was possible to

divide the analyzed shares into two groups: 𝐾

,

formed by 𝑁

shares of companies considered good

from an ESG perspective, and 𝐾

, formed by 𝑁

companies considered bad from the same angle;

companies that did not have an ESG rating from at

least one of the agencies considered were removed

from the universe of shares analyzed in this study.

2.2 ESG Ratings

To classify the companies, ratings from three

agencies were used: MSCI, S&P Global, and

Bloomberg. Each rating provider has its own set of

scope, measurement, and weighting for granting the

ESG score.

The MSCI agency uses public data to feed its

methodology, which assesses not only each

company’s exposure to socio-environmental and

governance risks that are material to its sector of

activity, but also the way in which the company

manages these risks. The topics evaluated are

weighted according to their impact and urgency

within each sector. The final score reflects how the

company is positioned (either as a leader or a laggard)

relative to others in its sector. Thus, even companies

operating in sectors that generate greater negative

externalities can obtain a good score if their practices

and their socio-environmental and governance risks

are considered better than others in the sector (MSCI

Inc, 2020).

The ratings provided by Bloomberg are also

derived from public data. However, the agency’s

methodology seeks to assess how each company

manages socio-environmental and governance issues

that are financially material to the continuity of its

activities. In addition, the agency analyzes the

magnitude, probability, and timing of the impact of

these issues on the company being evaluated. The

final ESG score is a combination of the scores for

each of the dimensions (Environmental, Social, and

Governance). The weight assigned to the

Environmental and Social pillars varies according to

the relevance of each of them for each industry

evaluated. The weight of the Governance score, in

turn, is the same for all sectors, as the agency

considers that country-specific factors in which each

company operates are more relevant to the evaluated

dimension than the sector in which the company

operates (Bloomberg, 2023).

Finally, S&P Global uses, when available, its own

questionnaire, (The S&P Global Corporate

Sustainability Assessment (CSA)), together with

public data when assigning its ratings. The agency’s

methodology also considers the materiality (impact,

probability, and timing) of each issue for the company

being evaluated, the ecosystem it comprises, and its

stakeholders. The indicators analyzed are

standardized across sectors and aggregated in a

weighted manner to form the final rating, which then

undergoes new standardization (S&P Dow Jones

Indices, 2023; S&P Global, 2022).

3 RESULTS AND DISCUSSION

The initial steps in applying the proposed

methodology involve data collection and processing.

The ESG scores from the S&P, MSCI, and

Bloomberg agencies were extracted from the

Bloomberg terminal, along with the market data of

the analyzed companies (price, total return, volatility,

and market capitalization). Stocks that had ratings

from only one or two of the agencies were excluded

from the analysis.

1. Define the number K of groups.

2. Make an initial guess about the position of the K- centroids.

3. Calculate the distance of each point to the corresponding centroid of its group.

4.

As long as the distance between each point and its centroid exceeds the

convergence criterion:

Calculate the average of the points in each group and update the value of

the K-centroids;

Determine K groups, allocating each data point to its closest centroid;

FEMIB 2025 - 7th International Conference on Finance, Economics, Management and IT Business

32

In order to separate the impact of the COVID-19

pandemic, two-time intervals were analyzed, namely:

January 2016 to December 2019 and January 2020 to

December 2023. In both periods, the initial universe

of shares considered in the analysis comprised all

companies that were part of the S&P 500 during the

analyzed interval; those companies that became part

of (or ceased to be part of) the index at any point

during these time windows were also excluded from

the analysis.

3.1 Obtained Clusters

The groups were obtained using the Scikit-learn

library in Python. After preparing the database, the

ESG ratings from three agencies were used as input

for 360 companies in the first period (January 2016 to

December 2019) and 420 companies in the second

period (January 2020 to December 2023).

The grouping was carried out in order to classify

the shares into two groups: one group with the shares

of companies considered good from an

environmental, social, and governance perspective,

and another with those considered bad in this regard.

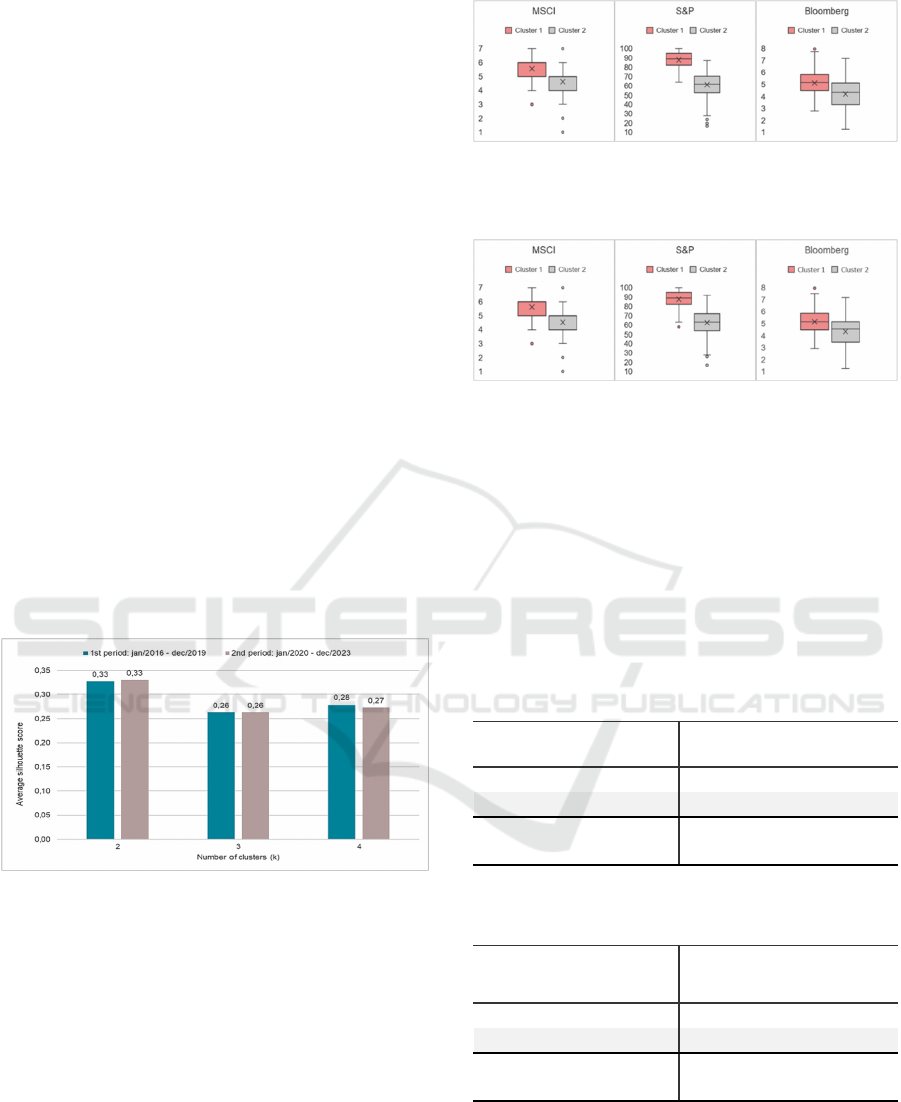

The Silhouette Score, used to indicate the optimal

number of clusters, confirmed that partitioning into

two groups would be ideal (Figure 01).

Figure 1: Silhouette score for different numbers of clusters.

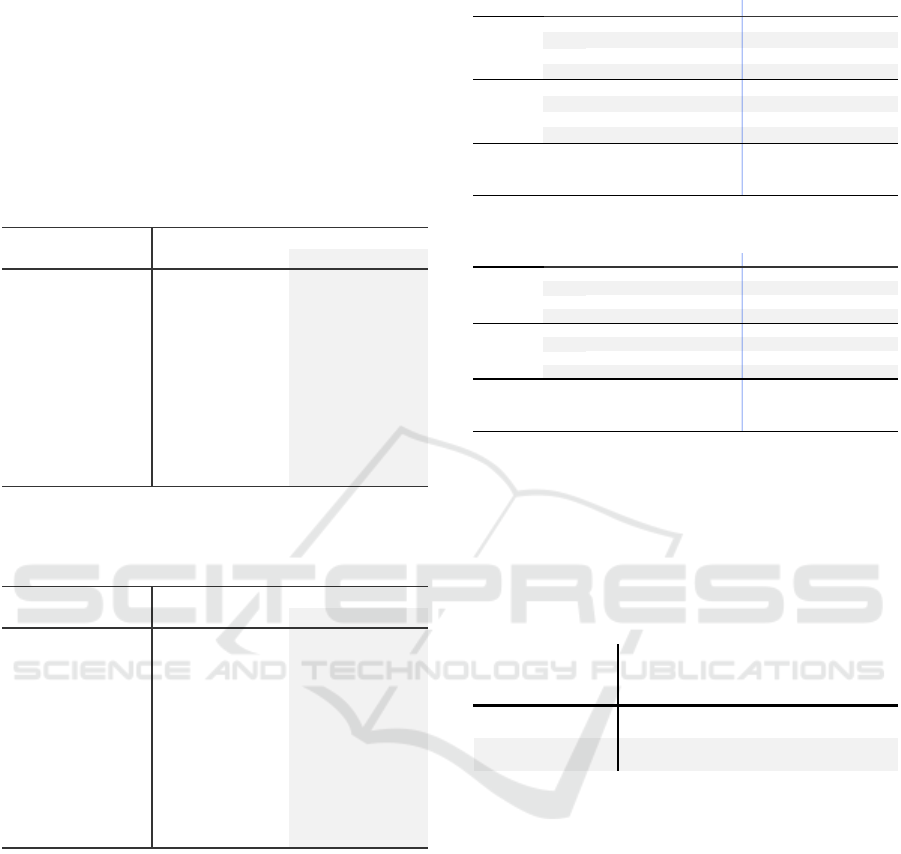

Thus, two clusters were constructed for each

evaluated period. Although it is possible to note an

overlap between the ratings of the groups — a

consequence of the difficulty in grouping companies

based on the evaluations of the different agencies —

a distinction between the clusters can also be

observed based on their average scores (Figures 2 and

3); the grouping carried out based on the ESG scores

of the shares resulted in statistically different groups

(Tables 1 and 2).

Figure 2: Distribution, by agency, of the scores of each

cluster of the shares considered in the period from

January/2016 to December/2019.

Figure 3: Distribution, by agency, of the scores of each

cluster of the shares considered in the period from

January/2020 to December/2023.

In both periods analyzed, cluster 1 (defined as

𝐾

) presents, for the three agencies considered, an

average score than cluster 2 (defined as 𝐾

), in

addition, in both intervals, the number of shares

classified as better from an ESG perspective was

greater than those classified as worse (Tables 1 and

2).

Table 1: Average agency scores by cluster from

January/2016 to December/2019.

Table 2: Average agency scores by cluster from

January/2020 to December/2023.

Regarding the sectors in which the companies

operate, those belonging to the sectors (based on the

classification established by The Global Industry

Classification Standard (MSCI and S&P Dow Jones

Indices LLC, 2023)) of healthcare, industry (capital

goods), technology, basic consumption, materials,

MS CI S &P Bloomberg

1 (Kgood)

254 5,6 87,8 5,1

2 (Kbad)

174 4,6 61,3 4,2

Significance of the

difference

p-val ue

0,00 0,00 0,00

Agencies

Number of

shares

Cluster

MS CI S &P Bloomberg

1 (Kgood)

221 5,6 87,4 5,2

2 (Kbad)

139 4,5 62,6 4,3

Significance of the

difference

p-val ue

0,00 0,00 0,00

Cluster

Number of

shares

Agencies

A Clustering Approach for S&P 500 Index Based on Environmental, Social and Governance Ratings of Multiple Agencies

33

communication services and real estate were

predominantly allocated to the cluster with the best

average socio-environmental and governance scores,

while most of the companies analyzed from the

utilities, discretionary consumption, and energy (oil

and gas) sectors were assigned to the cluster with the

worst ESG performance (Tables 3 and 4).

Table 3: Number of companies belonging to each cluster by

sector of activity for the first period (January/2016 to

December/2019).

Table 4: Number of companies belonging to each cluster by

sector of activity for the second period (January/2020 to

December/2023).

The group formed by shares with the best ESG

ratings (𝐾

) showed, in relation to the group

composed of shares with the worst ESG ratings

(𝐾

), a higher average return between the years

2016 and 2020 (Table 4); however, from 2021

onwards, this behavior changed, and the so-called bad

cluster began to show greater profitability. A similar

dynamic occurred with the risk indicator (volatility)

of the groups (Table 5), indicating a shift in behavior

during the second period analyzed: the group with

companies holding the worst ESG scores exhibited

the highest average volatility in the period. Despite

these observations, the groups do not show

statistically significant differences when compared in

terms of average volatility and average return.

Table 5: Total Return at the end of the year.

Table 6: Volatility.

The average correlation within each group also

increased from the first to the second period analyzed

(Table 6), even though 80% of the shares considered

were present in both periods’ samples. This change in

the metric level hinders the diversification process

and results in more risk for efficient portfolios.

Table 7: Average correlation of each group by period.

4 CONCLUSION

The sustainable investment industry has evolved

significantly, driven by legislation, consumer

demand, and the investors themselves. Including

socio-environmental and governance factors in the

investment analysis process often implies assessing

non-financial elements of companies, which, in turn,

makes it challenging to reach a consensus on the best

way to qualify (or disqualify) a company’s ESG

practices.

The lack of standardization of metrics for

evaluating companies’ environmental, social and

governance practices, and the challenges in

comparing the scores given by evaluators, were

addressed in this work by grouping stocks based on

the ratings provided by multiple agencies.

Cluster 01 (K

good

) Cluster 02 (K

bad

)

Communication Services 9

7

Consumer Discretionary 18

19

Consumer Staples 18 15

Ene rgy 9

10

Financials 28

28

Health Care 40

5

Industrials 31

22

Information Technology 30

9

Materials 12

7

Real Estate 16

5

Utilities 10 12

1

st

period: jan/2016 - dec/2019

Sector

Cluster 01 (Kgood) Cluster 02 (Kbad)

Communication Services 11

9

Consumer Discretionary 23

21

Consumer Staples 20 15

Ene rgy 9

11

Financials 30

33

Health Care 45

10

Industrials 34

30

Information Technology 39

13

Materials 14 11

Real Estate 19

5

Utilities 10 16

Sector

2

nd

period: jan/2020 - dec/2023

2016 2017 2018 2019 2020 2021 2022 2023

Me an

17% 24% -5% 33% 19% 30% -10% 15%

Mi n

-41% -24% -53% -21% -44% -37% -65% -48%

Ma x

227% 100% 47% 119% 302% 142% 94% 246%

Std. Dev.

26% 23% 20% 21% 35% 26% 26% 32%

Me an

16% 22% -7% 29% 14% 32% -6% 18%

Mi n

-27% -43% -57% -28% -57% -37% -68% -44%

Ma x

72% 133% 41% 91% 743% 196% 119% 184%

Std. Dev.

17% 24% 19% 22% 63% 34% 29% 32%

Significance of the

difference

(for mean)

p-value 0,79 0,47 0,30 0,07 0,30 0,62 0,22 0,35

Clus ter 1 (K

good

)

Cluster 2 (K

bad

)

2016 2017 2018 2019 2020 2021 2022 2023

Me an

27% 21% 25% 26% 45% 29% 32% 29%

Mi n

15% 12% 16% 15% 27% 15% 17% 15%

Ma x

66% 42% 46% 49% 99% 61% 72% 69%

Std. Dev.

9% 6% 6% 7% 12% 8% 9% 8%

Me an

27% 21% 25% 25% 48% 30% 33% 30%

Mi n

15% 11% 14% 14% 22% 14% 20% 17%

Ma x

83% 45% 47% 50% 107% 66% 72% 61%

Std. Dev.

9% 6% 6% 7% 14% 10% 10% 8%

Significance of the

difference (for

mean)

p-value 0,64 0,66 0,94 0,66 0,02 0,03 0,38 0,64

Clus ter 1 (K

good

)

Cluster 2 (K

bad

)

Clus ter

1st Period

(2016 - 2019)

2ºnd Period

(2020 - 2023)

1 (Kgood)

0,281 0,428

2 (Kbad)

0,276 0,438

FEMIB 2025 - 7th International Conference on Finance, Economics, Management and IT Business

34

The groups formed exhibited significantly

different average scores for ESG practices. Thus,

despite the differences in methodologies, metrics, and

scales used by the rating agencies, it was possible to

differentiate between the good companies and the bad

ones (from an ESG perspective). While there is some

overlap between the ratings of the groups — due to

the challenge of grouping companies based on

evaluations from different agencies, a clear

distinction between the clusters could still be

observed. Therefore, this study contributes to the

literature and the investment process by offering an

alternative that reduces the impact caused by

choosing to use assessments from a single ratings

provider.

Regarding the sectors in which the companies

operate, those in healthcare, industry, technology,

consumer staples, materials, communication services,

and real estate were mainly allocated to the cluster

with the highest average socio-environmental and

governance scores. In contrast, most of the companies

from the utilities, consumer discretionary, and energy

(oil and gas) sectors were assigned to the cluster with

the poorest ESG performance.

Future research could investigate other attributes,

such as market capitalization, cost of capital, or

metrics related to companies' operational

performance, to identify the characteristics common

to the members of each cluster. Additionally, it could

explore how these characteristics compare between

companies operating in the same sector but belonging

to different clusters. Upcoming work could also

investigate the particularities of each sector

(especially those dominated by stocks from a specific

group) to understand what makes a sector and a

company good from environmental, social and

governance point of view.

Another dilemma concerning socially responsible

investments is whether a portfolio built around

sustainable guidelines can still deliver a good risk and

return relationship to the investors. When considering

the average volatility and return of the shares in each

cluster, the groups were not statistically significantly

different. However, the results pointed to a change in

the behavior of assets during and after the coronavirus

pandemic.

The group of stocks with the highest ESG ratings

showed a higher average return between 2016 and

2020 compared to the group with the lowest ESG

ratings. From 2021 onward, this pattern shifted, and

the 'worst' cluster started to slightly outperform in

terms of the group's average profitability. A similar

pattern was observed with the risk indicator (average

volatility) across the groups, reflecting a shift in

behavior during the second period analyzed: the

group of companies with the lowest ESG scores

showed the highest average volatility. In addition to

that, the results of this study revealed that the average

correlation within each group also increased from the

first to the second period analyzed – this shift could

have negatively impacted the portfolio diversification

dynamics at the time.

In this context, future research could investigate

how portfolios made up of these assets would behave,

over a range of time periods or in specific moments

of high market stress, in order to try to verify whether

assets considered good from an ESG perspective

could offer better returns or lower risks to the

investor. In addition to that, upcoming work could

explore the shift in dynamics during and after the

COVID-19 pandemic and how it impacted the risk

and return relationship of portfolios.

REFERENCES

Adebowale, M., & Onipe Adabenege Yahaya. (2024). The

Impact of Shareholder Activism on Firm Value.

Organizations and Markets in Emerging Economies, 15,

209–250.

Avramov, D., Cheng, S., Lioui, A., & Tarelli, A. (2020).

Investment and Asset Pricing with ESG Disagreement.

SSRN Electronic Journal. https://doi.org/10.2139/ssrn.3

711218.

Barko, T., Cremers, M., & Renneboog, L. (2022).

Shareholder Engagement on Environmental, Social, and

Governance Performance. Journal of Business Ethics,

180(2), 777–812. https://doi.org/10.1007/s10551-021-

04850-z.

Berg, F., Kölbel, J. F., & Rigobon, R. (2022). Aggregate

Confusion: The Divergence of ESG Ratings. Review of

Finance, 26(6), 1315–1344. https://doi.org/10.1093/

rof/rfac033.

Bertelli, B., & Torricelli, C. (2024). The trade-off between

ESG screening and portfolio diversification in the short

and in the long run. Journal of Economics and Finance.

https://doi.org/10.1007/s12197-023-09652-9.

Billio, M., Costola, M., Hristova, I., Latino, C., & Pelizzon,

L. (2021). Inside the ESG ratings: (Dis)agreement and

performance. Corporate Social Responsibility and

Environmental Management, 28(5), 1426–1445.

https://doi.org/10.1002/csr.2177.

Bloomberg. (2023). Bloomberg ESG Scores - Overview &

FAQ. https://hr.bloombergadria.com/data/files/Pitanja%

20i%20odgovori%20o%20Bloomberg%20ESG%20Sco

reu.pdf.

Broadstock, D. C., Chan, K., Cheng, L. T. W., & Wang, X.

(2021). The role of ESG performance during times of

financial crisis: Evidence from COVID-19 in China.

Finance Research Letters, 38, 101716. https://doi.org/

10.1016/j.frl.2020.101716.

A Clustering Approach for S&P 500 Index Based on Environmental, Social and Governance Ratings of Multiple Agencies

35

Chen, L., Zhang, L., Huang, J., Xiao, H., & Zhou, Z. (2021).

Social responsibility portfolio optimization incorporating

ESG criteria. Journal of Management Science and

Engineering, 6(1), 75–85. https://doi.org/10.1016/j.jm

se.2021.02.005.

Ciciretti, R., Dalò, A., & Dam, L. (2023). The contributions

of betas versus characteristics to the ESG premium.

Journal of Empirical Finance, 71, 104–124.

https://doi.org/10.1016/j.jempfin.2023.01.004.

De Spiegeleer, J., Höcht, S., Jakubowski, D., Reyners, S., &

Schoutens, W. (2023). ESG: a new dimension in

portfolio allocation. Journal of Sustainable Finance &

Investment, 13(2), 827–867. https://doi.org/10.1080/2

0430795.2021.1923336.

Dimson, E., Karakaş, O., & Li, X. (2015). Active Ownership.

Review of Financial Studies, 28(12), 3225–3268.

https://doi.org/10.1093/rfs/hhv044.

Dudek, A. (2020). Silhouette Index as Clustering Evaluation

Tool (pp. 19–33). https://doi.org/10.1007/978-3-030-

52348-0_2.

Gentle, J. E., Kaufman, L., & Rousseuw, P. J. (1991). Finding

Groups in Data: An Introduction to Cluster Analysis.

Biometrics, 47(2), 788. https://doi.org/10.2307/2532178.

Global Sustainable Investment Alliance. (2020). Global

Sustainable Investment Review 2020.

Hastie, T., Friedman, J., & Tibshirani, R. (2001). The

Elements of Statistical Learning. Springer New York.

https://doi.org/10.1007/978-0 387-21606-5.

Hoepner, A. G. F., Majoch, A. A. A., & Zhou, X. Y. (2021).

Does an Asset Owner’s Institutional Setting Influence Its

Decision to Sign the Principles for Responsible

Investment? Journal of Business Ethics, 168(2), 389–

414. https://doi.org/10.1007/s10551-019-04191-y.

Jain, A. K. (2010). Data clustering: 50 years beyond K-

means. Pattern Recognition Letters, 31(8), 651–666.

https://doi.org/10.1016/j.patrec.2009.09.011.

James, G., Witten, D., Hastie, T., & Tibshirani, R. (2013). An

Introduction to Statistical Learning (Vol. 103). Springer

New York. https://doi.org/10.1007/978- 1-4614-7138-7.

Kotsantonis, S., Pinney, C., & Serafeim, G. (2016). ESG

Integration in Investment Management: Myths and

Realities. Journal of Applied Corporate Finance 28.2

(2016), 28(2), 10–16.

López Prol, J., & Kim, K. (2022). Risk-return performance

of optimized ESG equity portfolios in the NYSE.

Finance Research Letters, 50, 103312.

https://doi.org/10.1016/j.frl.2022.103312.

McCullagh, P. (1980). Regression Models for Ordinal Data.

Journal of the Royal Statistical Society: Series B

(Methodological), 42(2), 109–127.

https://doi.org/10.1111/j.2517-6161.1980.tb01109.x.

MSCI and S&P Dow Jones Indices LLC. (2023, March 17).

Global Industry Classification Sector (GICS®).

https://www.msci.com/documents/1296102/11185224/

GICS+Sector Definition s+2023.Pdf/822305c6-F821-

3d65-1984-6615ded81473 T=1679088764288.

MSCI Inc. (2020). MSCI ESG Ratings. https://www.msci.

com/documents/1296102/21901542/MSCI+ESG+Ratin

gs+Brochur e-cbr-en.pdf.

Pedersen, L. H., Fitzgibbons, S., & Pomorski, L. (2021).

Responsible investing: The ESG-efficient frontier.

Journal of Financial Economics, 142(2), 572–597.

https://doi.org/10.1016/j.jfineco.2020.11.001.

Pranata, K. S., Gunawan, A. A. S., & Gaol, F. L. (2023).

Development clustering system IDX company with k-

means algorithm and DBSCAN based on fundamental

indicator and ESG. Procedia Computer Science, 216,

319–327. https://doi.org/10.1016/j.procs.2022.12.142.

Principles For Responsible Investment. (2021). Principles

For Responsible Investment.

Reddy, C., & Vinzamuri, B. (2018). Data Clustering (C. C.

Aggarwal & C. K. Reddy, Eds.). Chapman and

Hall/CRC. https://doi.org/10.1201/9781315373515.

Renneboog, L., Ter Horst, J., & Zhang, C. (2008). Socially

responsible investments: Institutional aspects,

performance, and investor behavior. Journal of Banking

& Finance, 32(9), 1723–1742. https://doi.org/10.1016/

j.jbankfin.2007.12.039.

Sariyer, G., & Taşkın, D. (2022). Clustering of firms based

on environmental, social, and governance ratings:

Evidence from BIST sustainability index. Borsa Istanbul

Review, 22, S180–S188. https://doi.org/10.1016/j.bir.20

22.10.009.

Schanzenbach, M. M., & Sitkoff, R. H. (2020). ESG

Investing: Theory, Evidence, and Fiduciary Principles.

Journal of Financial Planning.

Shahapure, K. R., & Nicholas, C. (2020). Cluster Quality

Analysis Using Silhouette Score. 2020 IEEE 7th

International Conference on Data Science and Advanced

Analytics (DSAA), 747–748. https://doi.org/10.1109/

DSAA49011.2020.00096.

Shanaev, S., & Ghimire, B. (2022). When ESG meets AAA:

The effect of ESG rating changes on stock returns.

Finance Research Letters, 46, 102302.

https://doi.org/10.1016/j.frl.2021.102302.

S&P Dow Jones Indices. (2023). S&P DJI ESG Score

Methodology. https://www.spglobal.com/spdji/en/docu

ments/methodologies/methodology-sp-esg-index-series.

pdf.

S&P Global. (2022). S&P Global ESG Scores. Ahead of

disclosures, in front of standards. https://www.spglobal.

com/esg/documents/sp-global-esg-scores-brochure-202

2.pdfutm_medium=cpc&utm_source=google&utm_ca

mpaign=Brand_ESG_Search&utm_term=s&p&global

&esg&ratings&methodology&utm_conent=534418150

272&gclid=CjwKCAjw5v2wBhBrEiwAXDDoJdEJ7O

MAjETcU0VF1xaukkJ9RJTPFqLoaB7ENO2ZmMCqz

2z0t2OUBoC36kQAvD_BwE.

Sparkes, R., & Cowton, C. J. (2004). The Maturing of

Socially Responsible Investment: A Review of the

Developing Link with Corporate Social Responsibility.

Journal of Business Ethics, 52(1), 45–57.

https://doi.org/10.1023/B:BUSI.0000033106.43260.99.

UN Global Compact Initiative. (2004). Who Cares Wins —

Connecting Financial Markets to a Changing World.

van Duuren, E., Plantinga, A., & Scholtens, B. (2016). ESG

Integration and the Investment Management Process:

Fundamental Investing Reinvented. Journal of Business

FEMIB 2025 - 7th International Conference on Finance, Economics, Management and IT Business

36

Ethics, 138(3), 525–533. https://doi.org/10.1007/s10551-

015-2610-8.

Wang, Z., Liao, K., & Zhang, Y. (2022). Does ESG

Screening Enhance or Destroy Stock Portfolio Value?

Evidence from China. Emerging Markets Finance and

Trade, 58(10), 2927–2941. https://doi.org/10.1080/

1540496X.2021.2014317.

Zhang, Y., & Cheung, Y. (2020). An Ordinal Data Clustering

Algorithm with Automated Distance Learning.

Proceedings of the AAAI Conference on Artificial

Intelligence, 34(04), 6869–6876. https://doi.org/10.1609/

aaai.v34i04.6168.

A Clustering Approach for S&P 500 Index Based on Environmental, Social and Governance Ratings of Multiple Agencies

37