Modelling Defence Planning as a Sequential Decision Problem

Carolyn Chen

a

, Mark Rempel

b

and Kendall Wheaton

Centre for Operational Research and Analysis, Defence Research and Development Canada,

60 Moodie Dr., Ottawa, Canada

Keywords:

Defence Planning, Sequential Decision Problem, Mathematical Modelling, Military.

Abstract:

Defence planning in a nation’s defence organization is a complex process that requires considering hundreds

of projects and billions of taxpayer dollars. While a variety of methods, such as integer programming and

genetic algorithms, are used in practice to help decision makers select in which projects to invest, their appli-

cation tends to not account for the fact that these decisions are made sequentially and under uncertainty. In this

paper, we present the first steps towards developing a sequential decision model of the Canadian Department

of National Defence’s multi-gate Project Approval Process that addressed both issues. Our contributions are

twofold. First, using the universal modelling framework for sequential decisions we present a mathematical

model that accounts for the sequential nature of project selection, arrival of new projects over time, and un-

certainty in future budgets. In addition, we extend this model to account for the uncertainty in how a project’s

cost changes over time when its selection is delayed. Second, we demonstrate how these models may be

used to compare the effectiveness of three project selection decision policies, namely a ranked list approach, a

knapsack approach, and a knapsack approach that reserves a contingency fund for future projects.

1 INTRODUCTION

Defence planning is a critical activity that aims to

help nations achieve both their short- and long-term

defence and security objectives. However, selecting

the right capabilities, and thus projects, in which to

invest is not always a straightforward process. This

is due to a variety of factors—financial constraints,

regulatory constraints, multiple conflicting objectives,

interdependence between projects, cost uncertainty,

etc.—that often introduce a high-degree of complex-

ity to the selection process. In addition, the planning

process often must consider various project types si-

multaneously, including those focused on information

technology, equipment, infrastructure, as well as sup-

port contracts (Rempel and Young, 2017). As a result,

the project delivery timelines considered may vary

significantly. For example, the Canadian Defence In-

vestment Plan 2018 included projects with both near-

and long-term delivery dates ranging from 2022 to

2038 (Government of Canada, 2019).

In order to accommodate the wide range of time-

lines, planning processes “must consider a temporal

dimension including immediate activities to possible

a

https://orcid.org/0000-0003-0209-1666

b

https://orcid.org/0000-0002-6248-1722

demands a few decades into the future”, and as a re-

sult occur in “an inherently uncertain and often un-

stable external environment where defence organisa-

tions are required to reorganise for, and respond to,

unpredicted turns of events” (Filinkov and Dortmans,

2014, p. 76). With this in mind, many defence plan-

ning problems may be aptly described as sequential

decision making problems under uncertainty. Fur-

thermore, when decision makers are seeking a port-

folio, the defence planning problem may be described

as a multi-period portfolio optimization problem (Salo

et al., 2024) and modelled as a knapsack problem (Lo-

catelli, 2023).

The classic approach to solve a sequential deci-

sion problem is to model it as a Markov Decision

Process (MDP) (Puterman, 2005) and use Dynamic

Programming (DP) (Bellman, 1957) to find a decision

policy—“a rule (or function) that determines a deci-

sion given the information available” (Powell, 2011,

p. 221)—that makes decisions which result in the sys-

tem performing optimally with respect to a given cri-

terion or objective. However, in many real-world sit-

uations this is not feasible due to the curse of dimen-

sionality (Kuo and Sloan, 2005) and the curse of mod-

elling (Bertsekas and Tsitsiklis, 1996).

Given these limitations, alternative approaches

such as linear programming (and its variants—integer

156

Chen, C., Rempel, M. and Wheaton, K.

Modelling Defence Planning as a Sequential Decision Problem.

DOI: 10.5220/0013248200003893

In Proceedings of the 14th International Conference on Operations Research and Enterprise Systems (ICORES 2025), pages 156-164

ISBN: 978-989-758-732-0; ISSN: 2184-4372

Copyright © 2025 by Paper copyright by his Majesty the King in Right of Canada as represented by the Minister of National Defence

programming, mixed-integer programming, etc.), ge-

netic algorithms, tabu search, and other novel heuris-

tics have been used to provide decision support. This

is evidenced by a recent review of 54 application-

based articles that described the use of such ap-

proaches for portfolio optimization in a defence con-

text (Harrison et al., 2020, see Table 1). Further anal-

ysis of these articles reveals that while many address

sources of uncertainty in their respective problems,

only five articles (Crawford et al., 2003; Tsaganea,

2005; Fisher et al., 2015; Shafi et al., 2017; Moallemi

et al., 2018) account for both uncertainty and new

arriving projects which are selected for investment

over time—thus, modelling their respective problems

as sequential decision problems. Inspired by Fisher

et al. (2015), who studied a capital investment plan-

ning problem in the context of the Royal Canadian

Navy, this paper presents the first steps towards de-

veloping a sequential decision model of the Canadian

Department of National Defence (DND)’s multi-gate

Project Approval Process (PAP).

This paper’s main contributions are twofold. First,

using the universal modelling framework for sequen-

tial decisions (Powell, 2022), two sequential deci-

sion models are presented: (i) a model that accounts

for the sequential nature of project selection, the ar-

rival of new projects over time, and uncertainty in fu-

ture budgets; and (ii) an extension of the first model

which incorporates the uncertainty in how a project’s

cost changes over time when its selection is delayed.

Both the uncertainty in the future years’ budgets and

changes in a project’s costs were not represented in

Fisher et al. (2015), and thus this paper extends the

existing research in terms of modelling. Second, we

demonstrate how these models may be used to com-

pare the effectiveness of three project selection deci-

sion policies, namely a ranked list approach, a knap-

sack approach, and a knapsack approach that reserves

a contingency fund for new projects arriving in future

years.

The remainder of this paper is organized as fol-

lows. Section 2 presents relevant background infor-

mation. Section 3 describes the defence planning

scenario considered in this paper. The mathemati-

cal model that formulates the scenario as a sequen-

tial decision problem and its extension are given in

Section 4. The results from a series of computational

experiments that demonstrate how these models may

be used to provide decision support are given in Sec-

tion 5. Lastly, a conclusion is provided in Section 6.

2 BACKGROUND

Within the Canadian DND/Canadian Armed Forces

(CAF), hereafter referred to as DND/CAF, strategic

planning is performed by the Chief of Force Develop-

ment (CFD) on behalf of the Vice Chief of Defence

Staff (VCDS) (Government of Canada, 2024b). This

process requires the preparation of long-range plans

that identify future requirements for defence. Project

and force development staff across the DND/CAF

then prepare project proposals to address these fu-

ture requirements. The major capital project propos-

als (>$10 million CAD) are evaluated through the

Capital Investment Program Plan Review (CIPPR)

process for continuation through the PAP. This is de-

scribed in further detail in subsection 2.1.

The time required to bring a proposal through the

strategic planning process can vary significantly due

to both internal and external reasons. The future

requirements upon which proposals are based will

evolve over time and a requirement may change sig-

nificantly while a project proposal is being developed

or during the PAP. These uncertainties are discussed

in subsection 2.2.

2.1 Project Approval Process

The steps a major capital project must follow through-

out its life-cycle within the DND/CAF are depicted

in Figure 1.

A project starts with a proposal submitted to the

annual CIPPR process by its internal sponsoring or-

ganization. The sponsoring organization (henceforth

referred to as sponsors) can be military (e.g., Army,

Navy, Air Force) or a supporting organization (e.g.,

Materiel, Defence Research and Development, Infras-

tructure and Environment). In this intake process,

projects identify the capability gaps they address, pro-

vide cost estimates and tentative project timelines,

and the project is evaluated by subject matter ex-

perts to determine its overall value (i.e., benefit) to

the DND/CAF. At the end of the CIPPR process, a

decision is made whether to allow the project to con-

tinue through to the first phase of the PAP (Identifi-

cation), to place the project on a waiting list, or to

remove the project from consideration. Decision sup-

port tools, such as the Visual Investment Optimiza-

tion and Revision (VIPOR) or Strategic Portfolio An-

alyzer with Re-configurable Components (SPARC),

are used to support this decision process (Rempel

and Young, 2017; Chen and Wheaton, 2024). As the

project continues through the PAP, the project is as-

sessed at the end of each phase and a decision is made

on the project’s continuation by a designated govern-

Modelling Defence Planning as a Sequential Decision Problem

157

Implementation

Close-out

DefinitionIdentification

CIPPR

Options

Analysis

Options

Analysis

Project Approval Process

Army

Navy

Air Force

etc.

Figure 1: Project pathway from inception within the sponsoring organization, to the intake process (CIPPR), and through the

five phases of the PAP.

ing board (Balkaran, 2021). This creates a multi-gate,

sequential decision process. The project is complete

once it finishes the Close-out phase.

2.2 Uncertainties in Defence Planning

It is important to understand the uncertainties associ-

ated with long-term planning in defence as they can

have a large impact on the delivery of new capabil-

ities. Uncertainties are caused by many factors—

the evolving nature of warfare as new technolo-

gies emerge and new tactics are devised (Roncolato,

2022), the plans and policies of Canada’s close Allies

and the North Atlantic Treaty Organization (NATO)

(North Atlantic Treaty Organization, 2022, 2024),

and the strategic threats to the peace, security and

sovereignty of the nation (Government of Canada,

2024a)—often causing projects to require more time

and cost than originally estimated. Inflation alone will

change a project’s cost if planning takes years longer.

Changes in the project scope can also happen, affect-

ing the cost. Finally, it is often the case that the cost

estimates for projects tend to be optimistic (U.S. Gov-

ernment Accountability Office, 2020, Ch. 1).

Consider the example of the Maritime Helicopter

project. Planning for a new maritime helicopter be-

gan in the 1980’s, a contract was signed in 1992, and

the project was subsequently cancelled in 1993 after a

change in the federal government (Rossignol, 1998).

New planning in the 1990’s led to a contract being

signed in 2004. The delivery of the new helicopter

commenced in 2015 (Government of Canada, 2022).

This shows how political uncertainties caused a sig-

nificant increase in a project’s timeline.

The Canadian Surface Combatant (CSC) project

is an example of cost uncertainty. In a recent

study (Office of the Parliamentary Budget Officer,

2021), the estimated cost for the CSC was reported

to be $26.2 billion in 2008, almost $62 billion in

2017, and to $69.8 billion in 2019. After awarding

the contract in 2019, this 2021 study estimated the

cost at $77.3 billion, a 295% increase from the initial

amount.

3 PROBLEM DEFINITION

The defence planning scenario in this paper is based

on Fisher et al. (2015) and the CIPPR process de-

scribed in subsection 2.1. While the PAP includes

multiple decisions through which a project must pro-

ceed, by focusing on the CIPPR process, this paper

limits the defence planning scenario to a single stage

process in which projects are either approved or not

approved.

For this scenario, given Canada’s defence policy

(Government of Canada, 2024a) and recent defence

capability plans (Government of Canada, 2019), sup-

pose that at the start of a given fiscal year a set of

candidate projects are put forth by sponsors. Each

project is seeking multi-year funding from the avail-

able defence budget. To help decision makers select

which candidate projects to fund, information on each

project is collected from its sponsor: its value to de-

fence, and its purchase cost which is distributed over a

number of fiscal years. In addition, the available bud-

get for 20 years is provided by the Assistant Deputy

Minister (Finance) organization.

With this information, a decision policy (see Sec-

tion 4) is used by decision makers to select those can-

didate projects that will be funded, and those that will

not. Following this decision, the funding associated

with the selected projects is removed from the avail-

able budget in both the current and respective future

fiscal years, and projects that were not selected are

added to the set of candidate projects for the next

fiscal year—albeit with their value reduced due to

their implementation being delayed. This reduction in

value may be caused by a variety of reasons, including

improvement of adversarial capabilities rendering the

project less effective, a shift in defence policy render-

ing the project less important, or investment in similar

capabilities by other sponsors or Allies reducing the

project’s value by making it redundant.

At the start of the next fiscal year, sponsors pro-

pose new candidate projects, each with their own

value and cost, which are added to the set of unse-

lected projects from the previous year. In addition,

changes to the remaining uncommitted budget are

provided by the Finance organization, which may be

due to a variety of factors, such as Government-wide

cost cutting measures or the addition of new funds due

ICORES 2025 - 14th International Conference on Operations Research and Enterprise Systems

158

to changes in the defence policy. Decision makers

must again apply a decision policy, like in the pre-

vious fiscal year, to select which candidate projects

to allocate funding. The cycle then continues as de-

scribed above.

Given the uncertain number of candidate projects

put forth each fiscal year, lack of knowledge of their

value and cost beforehand, and that investment de-

cisions are made throughout the planning horizon,

this problem is aptly described as a sequential de-

cision making problem under uncertainty. The fol-

lowing section formulates two models using the uni-

versal modelling framework for sequential decisions

(Powell, 2022). Section 5 presents a hypothetical case

study which demonstrates how the models may be

used to provide decision support.

4 SEQUENTIAL DECISION

PROBLEM FORMULATION

This section formulates the defence planning sce-

nario introduced in the previous section as a se-

quential decision problem. To do so, the universal

modelling framework for sequential decisions is em-

ployed. This framework consists of three components

(Powell, 2022, pp. 10-14):

• a sequential decision model that describes the

state variable, decision variables, exogenous in-

formation that arrives after a decision is made, a

transition function that defines the dynamics of

how the system evolves from one state to the next,

and an objective function;

• the stochastic modelling that describes the uncer-

tain information contained within the problem’s

initial state and exogenous information; and

• the decision policies to be explored.

The remainder of this section presents these three

components applied to the problem described in Sec-

tion 3.

4.1 Sequential Decision Model

Throughout the defence planning horizon, typically

20 years, there are a set of decision epochs T

D

in

which decisions are made regarding projects, and a

set of budget epochs T

B

in which budget constraints

are enforced, where T

D

⊂ T

B

. For this problem, an

epoch occurs every year throughout the planning pe-

riod. The size of the set T

B

is determined by the

length of the funding requirements of the candidate

projects and generally exceeds the number of deci-

sion epochs. This aims to address end effects associ-

ated with defence planning in terms of financial com-

mitments, thus eliminating “outrageous behavior at

the end of the planning horizon” (Brown et al., 2004,

p. 422).

At each decision epoch t ∈ T

D

there exists a set of

candidate projects P

t

. For each project i ∈ P

t

, there is

an associated information vector p

t,i

that contains two

elements: the value of the project v

t,i

; and the yearly

cost of the project c

t,i

= (c

t,i,t

′

)

t

′

≥t,t

′

∈T

B

.

The state variable is then defined as

S

t

= (P

t

, B

t

), (1)

where P

t

= (p

t,i

)

i∈P

t

with element p

t,i

being defined

as above, and B

t

= (b

t,t

′

)

t

′

≥t,t

′

∈T

B

is a vector of bud-

gets.

At each decision epoch t, the decision regarding

which candidate projects are selected is defined as

x

t

= (x

t,i

)

i∈P

t

: x

t,i

= 1 if project i is selected, and

0 otherwise. The decision vector at epoch t is con-

strained by the available budgets,

∑

i∈P

t

x

t,i

c

t,i,t

′

≤ B

t

′

, t

′

≥ t, t

′

∈ T

B

, (2)

collectively labelled as X (S

t

).

The state transition function is defined as S

t+1

=

S

M

(S

t

, x

t

,W

t+1

), where W

t+1

is exogenous informa-

tion that arrives after the decision x

t

is made. This

includes new candidate projects

ˆ

P

t+1

, where for each

project i ∈

ˆ

P

t+1

there is an associated vector ˆp

t+1,i

defined as ( ˆv

t+1,i

, ˆc

t+1,i

) with the components being

defined as those in p

t,i

. Thus, W

t+1

is given as

W

t+1

= (

ˆ

P

t+1

,

ˆ

B

t+1

), (3)

where

ˆ

P

t+1

= ( ˆp

t+1,i

)

i∈

ˆ

P

t+1

is a vector of new project

information vectors as described above, and

ˆ

B

t+1

=

(

ˆ

b

t+1,t

′

)

t

′

≥t+1,t

′

∈T

B

is a vector of changes in the re-

maining uncommitted budgets in upcoming years. It

should be noted that the exogenous information de-

pends on the decision at time t; that is, W

t+1

de-

pends on the post-decision state S

x

t

= S

x

(S

t

, x

t

) (Pow-

ell, 2022, p. 580).

Given x

t

and W

t+1

, the transition function then:

reduces the value of projects not selected in year t by

10%; combines the set of unselected projects with the

newly arrived projects to determine the set of candi-

date projects in year t + 1; and updates the budgets in

year t +1 onward.

When a decision x

t

is made, a contribution (or re-

ward) is received and is defined as

C(S

t

, x

t

) =

∑

i∈P

t

v

t,i

x

t,i

. (4)

Modelling Defence Planning as a Sequential Decision Problem

159

Given this contribution function, the objective is

then to maximize the expected cumulative value of

the selected projects. The objective is given as

max

π∈Π

E

∑

t∈T

D

C(S

t

, X

π

(S

t

))|S

0

!

, (5)

where: π is a label that carries information about a

decision policy; Π is the set of all decision policies

considered; X

π

(S

t

) represents the implementation of

a decision policy that returns the decision x

t

for each

state S

t

∈ S and is bounded by the constraints X

t

(S

t

);

S

0

is the initial state that includes the initial budgets

B

0

and projects P

0

; and E is an expectation operator

that is over all uncertainties within the problem.

This model, labelled as Model-I, describes the

problem discussed in Section 3. However, this for-

mulation can be extended to include a range of addi-

tional uncertainties, such as: injection of additional

funding beyond yearly fluctuations due to political

uncertainty, new defence policies, etc.; cancellation

of projects from the set of previously selected projects

due to advancement of adversarial capabilities, geo-

political changes, etc.; and updates to the cost of pre-

viously unselected projects due to inflation, changes

in project scope, etc. These additions require changes

to the state transition function and exogenous infor-

mation, and in the case of the cancellation of projects

the state variable as well.

In this paper we focus on extending Model-I by

updating the costs of projects not selected at epoch t

and using these updates in epoch t + 1. This model,

labelled as Model-II, requires that W

t+1

to be modi-

fied such that

W

t+1

= (

ˆ

P

t+1

,

ˆ

C

t+1

,

ˆ

B

t+1

), (6)

where

ˆ

C

t+1

= ( ˆc

t+1,i,t

′

)

t

′

≥t+1,t

′

∈T

B

is a vector of up-

dated yearly costs for the set {i|i ∈ P

t

, x

t,i

= 0}. In

addition, the transition function must be modified to

update the costs of projects not previously selected.

4.2 Stochastic Modelling

As described in the previous section, in Model-I the

exogenous information that arrives after a decision is

made includes two stochastic components: the arrival

of new projects, and changes in the future years’ bud-

gets.

In this study,

ˆ

P

t+1

is based on a data set of

198 projects collected in the 2022 CIPPR process and

includes the project value, total cost, and duration.

Three variations of each project were added to the

original data set (total of 792 sample projects), each

with their own value, total cost, and duration such that

each was scaled using a random value from a uni-

form distribution ranging between ±20%. This set

was then randomly sampled with replacement to cre-

ate the new projects arriving in both the initial state S

0

and exogenous information W

t+1

.

The number of new projects arriving in a given

year was modelled using a binomial distribution, with

a maximum of 20 projects and each having a 50%

probability of arriving. Distribution parameters are

notional. While project data was available for years

2018-2022, inconsistencies in annual data collection

methods made it difficult to determine the number of

new projects arriving. Each project’s total cost was

then split over the duration of the project using a tri-

angular distribution. The peak of the triangular distri-

bution occurs at half of the duration of the project. In

the case of odd numbered durations, the peak occurs

at half of the duration rounded down to the closest

year.

Lastly,

ˆ

B

t+1

is notionally determined. After

projects are selected using a policy X

π

(S

t

) and their

costs removed from the current and future years’ bud-

gets, each remaining future year’s budget is scaled by

a random value from a uniform distribution ranging

between ±10%.

Regarding Model-II, the costs of unselected

projects (x

t,i

= 0) that are propagated to the next

epoch t +1 have their costs adjusted prior to doing so.

Each project’s annual costs are scaled by a single ran-

dom value which is sampled from a uniform distribu-

tion ranging from zero to 3.7%. The upper bound was

calculated as a yearly inflation percentage to achieve

a 20% increase in total cost over a five year period.

The random value is then multiplied by: -1 (cost de-

crease) or +1 (cost increase), with a 10% probability

of being -1, and a 90% probability of being +1, there-

fore creating a higher likelihood of a project’s costs

increasing over time.

4.3 Decision Policies

The purpose of the objective function in Equation 5

is to find the decision policy that maximizes the ex-

pected value of the projects selected. In this paper we

limit the policies considered to three myopic project

selection policies.

The first policy, labelled as the Ranked list pol-

icy and given as X

Rl

(S

t

), is a Policy Function Ap-

proximation (PFA) that “directly [returns] an action

given a state, without resorting to any form of imbed-

ded optimization, and without using any forecast of

future information” (Powell, 2011, p. 221). This pol-

icy ranks candidate projects by value, and selects the

top-ranked projects that fit within the available bud-

ICORES 2025 - 14th International Conference on Operations Research and Enterprise Systems

160

get. The second policy, labelled as the Knapsack pol-

icy and given as X

K

(S

t

), is a Cost Function Approxi-

mation (CFA) that aims to maximize the value of se-

lected projects in a given year and “[does] not make

any effort at approximating the impact of a decision

now on the future” (Powell, 2022, p. 535). The third

policy, labelled as the Contingency fund policy and

given as X

C f

(S

t

, θ), is similar to the Knapsack pol-

icy with the exception that it is parameterized by a

single scalar θ (ranging between zero and one) that

limits the amount of budget that can be used in future

years when making a decision at epoch t. For exam-

ple, θ = 0.4 represents a 40% contingency fund. This

policy requires an adjustment to the constraints X (S

t

)

listed in Equation 2, specifically

∑

i∈P

t

x

t,i

c

t,i,t

≤ B

t

, (7)

∑

i∈P

t

x

t,i

c

t,i,t

′

≤ (1 −θ)B

t

′

, ∀t

′

≥ t + 1, t

′

∈ T

B

, (8)

where Equation 7 enables the full budget to be used in

epoch t and Equation 8 ensures that only a portion of

the future budgets are used. Note that the Knapsack

policy is a special case of the Contingency fund pol-

icy when θ = 0. As a Knapsack policy is commonly

known, the two policies are included separately to dis-

tinguish the results.

5 RESULTS

In this section, we demonstrate how the mathematical

models presented in the previous section may be used

to provide decision support. While many questions

may be posed by both planners and decision makers

during the defence planning process, in this section

we consider the following:

• Given Model-I, how do the decision policies de-

scribed in subsection 4.3 perform relative to the

Ranked list policy as a function of the planned an-

nual budget?

• How does the inclusion of project cost uncertainty

(for projects that are not selected and are propa-

gated to the next decision epoch) in Model-II im-

pact the results when compared to Model-I?

To answer these questions, the two models

and the decision policies were implemented in

Python v3.12.6. Given either Model-I or Model-II,

an initial state S

0

, and decision policy, 50 trials were

executed and the expected cumulative portfolio value

(see Equation 5) and associated 95% Confidence In-

terval (CI) were computed. All trials were exe-

cuted on an AMD Ryzen 5 4500U CPU with Radeon

Graphics running at 2.38 GHz with 16 GB RAM and

using the Windows 10 64-bit operating system.

The aim of the first question is to provide deci-

sion makers with insights on: which of the policies

studied maximizes the expected cumulative portfolio

value given an initial yearly budget for a 20-year pe-

riod (B

0

); and the robustness the recommended policy

to changes in the initial budgets. The results of the

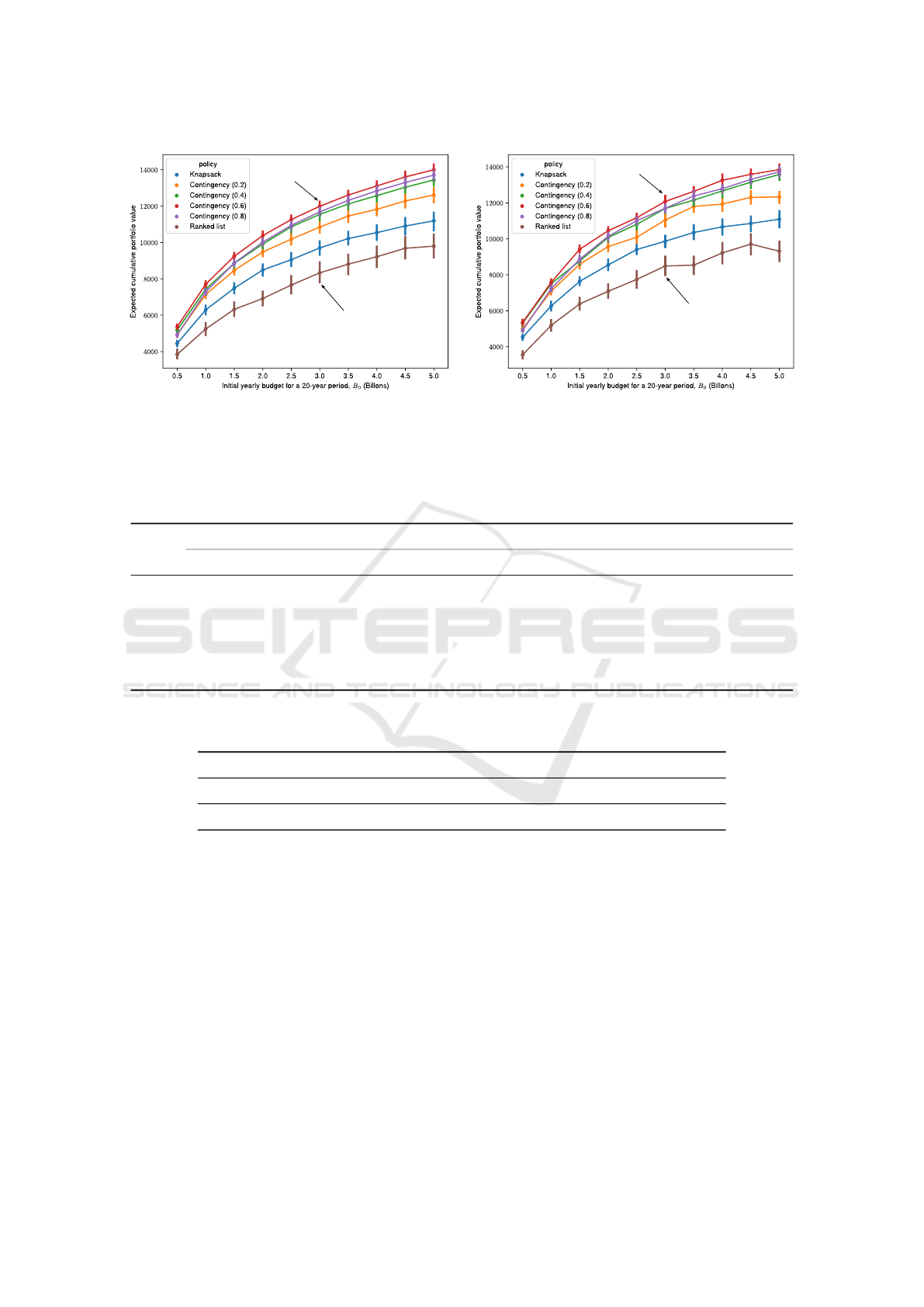

trials are depicted in Figure 2a and the 95% CIs are

listed in Table 1.

The results demonstrate that all policies outper-

form the benchmark Ranked list policy, and the Con-

tingency fund (θ = 0.6) policy performs the best

across all initial budgets studied. While the Contin-

gency fund policy with θ = 0.8 performed similar to

same policy with θ = 0.6, the latter consistently out-

performed the former as listed in Table 2. However,

it is worth noting that as the initial yearly budget in-

creases, the difference between the two policies be-

comes negligible.

The project selection results for each policy were

also examined to investigate why the Contingency

fund policies with higher reserves (θ = 0.6,θ = 0.8)

outperformed the other policies. It was noted that

these policies selected fewer high cost projects since

the available future budgets were limited by the re-

served funding. The total costs in the sample project

data ranged from 10s of millions to 10s of billions

of dollars. Therefore, the selection of a single high

cost project significantly reduces the number of lower

cost projects that can be selected in future years. Ad-

ditionally, the project values range less significantly

when compared to the total costs and are only mod-

erately correlated to the logarithm of the total cost.

As such, the selection of a high cost project does not

necessarily result in a significant increase in the cu-

mulative portfolio value. While all tested policies are

myopic and do not consider future effects, the Contin-

gency fund policy begins to mimic forward-looking

policies by forcing the reservation of funding for fu-

ture projects.

It may therefore be concluded that, for the sce-

nario and policies studied, using a knapsack-based

policy that reserves 60% of the available budget in

future years will provide the most value to defence.

While our scenario differs from that studied by Fisher

et al. (2015)—different project values, different cost

profiles, uncertainty in future budgets—our results

generally agree with their conclusion that holding

back budget results in a higher cumulative portfolio

value.

The aim of the second question is to evaluate the

impact that incorporating project cost uncertainty, of

delayed projects (Model-II), has on the policy recom-

Modelling Defence Planning as a Sequential Decision Problem

161

Ranked list

Contingnecy (0.6)

(a) Model-I.

Ranked list

Contingnecy (0.6)

(b) Model-II.

Figure 2: Expected cumulative portfolio value and 95% CI as a function of initial yearly budget for a 20-year period (B

0

) for

each decision policy described in subsection 4.3.

Table 1: Summary of 95% CIs for the percentage difference between each policy and the benchmark Ranked list policy when

using Model-I. Key: Rl = Ranked list, K = Knapsack, Cf (θ) = Contingency fund with a specific value of θ. All values are

rounded to two significant figures.

Policy Initial yearly budget for a 20-year period B

0

(Billions)

0.5 1.0 1.5 2.0 2.5 3.0 3.5 4.0 4.5 5.0

Rl - - - - - - - - - -

K [14, 30] [18, 31] [16, 28] [20, 30] [16, 28] [15, 25] [14, 25] [12, 21] [11, 19] [12, 23]

Cf (0.2) [27, 44] [35, 53] [31, 47] [35, 49] [32, 49] [29, 43] [28, 43] [27, 40] [25, 41] [27, 43]

Cf (0.4) [33, 51] [40, 60] [38, 53] [41, 56] [41, 59] [37, 55] [36, 52] [35, 50] [33, 50] [36, 54]

Cf (0.6) [38, 56] [45, 66] [44, 62] [48, 65] [46, 66] [42, 61] [41, 59] [40, 57] [39, 57] [41, 62]

Cf (0.8) [26, 44] [37, 58] [38, 55] [43, 59] [42, 62] [40, 58] [38, 56] [38, 54] [36, 54] [39, 59]

Table 2: Summary of 95% CIs for the percentage difference between the Contingency fund (θ = 0.6) policy and the Contin-

gency fund (θ = 0.8) policy when using Model-I. All values are rounded to one significant figure.

Initial yearly budget for a 20-year period B

0

(Billions)

0.5 1.0 1.5 2.0 2.5 3.0 3.5 4.0 4.5 5.0

[8, 10] [5, 7] [3, 5] [3, 5] [2, 4] [2, 4] [2, 3] [1, 3] [1, 3] [1, 3]

mendation. The results for the trials are depicted in

Figure 2b. Although a detailed analysis is not pre-

sented here, the results (similar to those in Figure 2a)

suggest that the Contingency fund (θ = 0.6) policy

outperforms the benchmark Ranked list policy across

all initial yearly budgets studied and performs better

than when other values of θ are used. The Model-II

results provide further evidence that for the scenario

and policies studied, the Contingency fund (θ = 0.6)

policy is robust with respect to different initial yearly

budgets, changes in future budgets, as well as changes

in costs of those projects there are delayed.

6 CONCLUSION

This paper presented initial work on the develop-

ment of a sequential decision model of the DND/CAF

multi-gate PAP. The objective was to investigate the

impact of different decision policies in a sequential

decision model that explicitly includes uncertainties

in budgets and the project information in each new

epoch.

The results from Model-I support the conclusion

that a Contingency fund policy that reserves 60% of

the available budget for future years performs the

best. A policy that reserves 80% of the available bud-

ICORES 2025 - 14th International Conference on Operations Research and Enterprise Systems

162

get performs almost as well when the initial yearly

budgets are large. Regardless, the Contingency fund

policies outperform both the benchmark Ranked list

policy and Knapsack policy. Model-II demonstrates

that the same decision policy, the Contingency fund

policy that reserves 60%, remains robust to cost un-

certainty in delayed projects and continues to outper-

form the other tested policies.

This initial model demonstrates the potential of a

sequential decision model to determine better deci-

sion policies for defence planning. Three areas of fu-

ture development have been identified. The first area

covers improvements to the sequential model to bet-

ter reflect the real-world dynamics of the DND/CAF

PAP. The initial model only covered the first step

of the PAP, therefore the model can be expanded

to cover the multiple gates of the PAP. Addition-

ally, the awarding of the value can be delayed to

when the project is delivered, rather than when the

project is selected. The modelled uncertainties can

also be expanded to capture changes in project value

and scheduling over time, as well as uncertainties that

may force the selection or cancellation of a project.

The second area of development covers the deci-

sion policies. The set of policies can be expanded

to include future-looking policies, and reinforcement

learning can be explored as a method for determining

an optimal decision policy. The last area of develop-

ment aims to improve the project dataset. The current

dataset is limited to a single year of projects. This

dataset can be expanded to include additional years

of historical data. Tools, such as natural language

processing, can be explored for extracting data from

historical project documentation. Data augmentation

techniques can also be explored for supplementing the

real project dataset.

The results presented here are encouraging, and

the completion of this investigation should pro-

vide more information to guide the management of

projects under uncertainty in defence planning.

ACKNOWLEDGMENTS

The authors would like to acknowledge the con-

tributions of Ammar Lakdawala, who implemented

an initial version of the sequential decision mod-

els in Python and conducted extensive testing in

spring 2024.

ACRONYMS

CAF Canadian Armed Forces

CI Confidence Interval

CIPPR Capital Investment Program Plan Review

CFA Cost Function Approximation

CFD Chief of Force Development

DND Department of National Defence

DP Dynamic Programming

MDP Markov Decision Process

NATO North Atlantic Treaty Organization

PAP Project Approval Process

PFA Policy Function Approximation

SPARC Strategic Portfolio Analyzer with Re-

configurable Components

VCDS Vice Chief of Defence Staff

VIPOR Visual Investment Optimization and Revi-

sion

REFERENCES

Balkaran, R. R. (2021). Process alignment: An assess-

ment of dnd project approval process in the 2019

project approval directive. Master’s thesis, Canadian

Forces College, Toronto, Ontario. Retrieved from:

https://www.cfc.forces.gc.ca/259/ 290/23/286/Balka-

ran.pdf.

Bellman, R. (1957). Dynamic Programming. Princeton

University Press.

Bertsekas, D. and Tsitsiklis, J. (1996). Neuro-Dynamic

Programming. Athena Scientific, Belmont, Mas-

sachusetts, First edition.

Brown, G. G., Dell, R. F., and Newman, A. M. (2004).

Optimizing military capital planning. Interfaces,

34(6):415–425.

Chen, C. and Wheaton, K. (2024). Investigating the Im-

pact of Project Dependencies on Capital Investment

Decisions in Defence. In 17th NATO Operations Re-

search and Analysis (OR&A) Meeting Proceedings.

NATO Science and Technology Organization. STO-

MP-SAS-OCS-ORA-2023.

Crawford, J., Do, J., Leduc, C., Malik, A., Gormley, K.,

Luebke, E., and Scherer, W. (2003). SWORD: the lat-

est weapon in the project selection arsenal. In IEEE

Systems and Information Engineering Design Sympo-

sium, 2003, pages 95–100.

Filinkov, A. and Dortmans, P. J. (2014). An enterprise port-

folio approach for defence capability planning. De-

fense & Security Analysis, 30(1):76–82.

Modelling Defence Planning as a Sequential Decision Problem

163

Fisher, B., Brimberg, J., and Hurley, W. (2015). An ap-

proximate dynamic programming heuristic to support

non-strategic project selection for the Royal Canadian

Navy. The Journal of Defense Modeling and Simula-

tion, 12(2):83–90.

Government of Canada (2019). Defence Investment

Plan 2018. Retrieved 22 October, 2024, from

https://www.canada.ca/en/ department-national-

defence/corporate/reports-publications/defence-

investment-plan-2018.html.

Government of Canada (2022). Status re-

port on transformational and major crown

projects. Retrieved 23 October, 2024 from

https://www.canada.ca/en/department-national-

defence/corporate/reports-publications/departmental-

plans/departmental-plan-2022-23/supplementary-

information/report-crown-project1.html#toc14.

Government of Canada (2024a). Our North, Strong

and Free: A Renewed Vision for Canada’s

Defence. Retrieved 15 October, 2024, from

https://www.canada.ca/en/ department-national-

defence/corporate/reports-publications/north-strong-

free-2024.html.

Government of Canada (2024b). Vice Chief of the Defence

Staff (VCDS). Retrieved 22 October, 2024, from

https://www.canada.ca/en/ department-national-

defence/corporate/organizational-structure/vice-

chief-defence-staff.html.

Harrison, K. R., Elsayed, S., Garanovich, I., Weir, T., Galis-

ter, M., Boswell, S., Taylor, R., and Sarker, R. (2020).

Portfolio optimization for defence applications. IEEE

Access, 8:60152–60178.

Kuo, F. and Sloan, I. (2005). Lifting the curse of

dimensionality. Notices of the American Mathemat-

ical Society, 52(11):1320–1328. Retrieved from:

https://www.ams.org/journals/notices/200511/ fea-

sloan.pdf?adat=December%202005&trk=200511fea-

sloan&cat=feature&galt=feature.

Locatelli, A. (2023). Optimization methods for knapsack

and tool switching problems. 4OR, 21:715–716.

Moallemi, E. A., Elsawah, S., Turan, H. H., and Ryan, M. J.

(2018). Multi-objective decision making in multi-

period acquisition planning under deep uncertainty.

In 2018 Winter Simulation Conference (WSC), pages

1334–1345.

North Atlantic Treaty Organization (2022). NATO

2022 Strategic Concept. Retrieved 23 Octo-

ber, 2024, from https://www.act.nato.int/wp-content/

uploads/2023/05/290622-strategic-concept.pdf.

North Atlantic Treaty Organization (2024). Washing-

ton Summit Declaration. Retrieved 23 October,

2024, from https://www.nato.int/cps/en/natohq/ offi-

cial texts 227678.htm.

Office of the Parliamentary Budget Officer (2021). The cost

of Canada’s surface combatants: 2021 update and

options analysis. Retrieved 22 October, 2024, from

https://www.pbo-dpb.ca/en/publications/RP-2021-

040-C–cost-canada-surface-combatants-2021-update-

options-analysis–cout-navires-combat-canadiens-

mise-jour-2021-analyse-options.

Powell, W. (2011). Approximate dynamic programming:

Solving the curses of dimensionality. Wiley, Hoboken,

New Jersey, Second edition.

Powell, W. (2022). Reinforcement learning and stochastic

optimization: A unified framework for sequential de-

cisions. Wiley, Hoboken, New Jersey.

Puterman, M. (2005). Markov Decision Processes: Discrete

stochastic dynamic programming. Wiley, Hoboken,

New Jersey.

Rempel, M. and Young, C. (2017). VIPOR: A visual analyt-

ics decision support tool for capital investment plan-

ning. Scientific Report DRDC-RDDC-2017-R129,

Defence Research and Development Canada.

Roncolato, G. (2022). The character of war is

constantly changing: Organizations and peo-

ple who can rapidly and effectively adapt are

more likely to prevail. U.S. Naval Institute

Proceedings, 148/5/1.431. Retrieved from:

https://www.usni.org/magazines/proceedings/2022/may

/character-war-constantly-changing.

Rossignol, M. (1998). Replacement of shipborne and

rescue helicopters. Retrieved 23 October, 2024,

from https://www.publications.gc.ca/Collection-

R/LoPBdP/CIR/943-e.htm.

Salo, A., Doumpos, M., Liesi

¨

o, J., and Zopounidis, C.

(2024). Fifty years of portfolio optimization. Euro-

pean Journal of Operational Research, 318(1):1–18.

Shafi, K., Elsayed, S., Sarker, R., and Ryan, M. (2017).

Scenario-based multi-period program optimization for

capability-based planning using evolutionary algo-

rithms. Applied Soft Computing, 56:717–729.

Tsaganea, D. (2005). Appropriation of funds for anti-

ballistic missile defence: a dynamic model. Kyber-

netes, 34(6):824–833.

U.S. Government Accountability Office (2020). Cost esti-

mating and assessment guide: Best practices for de-

veloping and managing program costs. Technical Re-

port GAO-20-195G, U.S. Government Accountability

Office.

ICORES 2025 - 14th International Conference on Operations Research and Enterprise Systems

164