Data Network Game: Enabling Collaboration via Data Mesh

Bove Lucaleonardo

1,2 a

, Totaro Nicol

`

o G.

1,2 b

and Massimiliano Gervasi

1,2 c

1

Department of Engineering for Innovation, University of Salento, Lecce, Italy

2

Centre for Applied Mathematics and Physics for Industry (CAMPI), University of Salento, Lecce, Italy

Keywords:

Data Sharing, Big Data Analytics, Data Value, Data Network, Cooperative Game Theory, Data Mesh.

Abstract:

Organizations aim to transform raw data into valuable insights using advanced analytical methods. Since

data can be replicated and shared, multiple actors can simultaneously utilize the same information. This study

presents the Data Network, a theoretical framework representing potential collaborations among organizations

sharing data in large-scale big data projects, using Data Mesh as a supporting architecture. The Data Network

Game (DNG) extends this model by applying game theory to analyze inter-organizational collaborations, in-

corporating market-imposed constraints that limit compatibility. Various scenarios, defined by distinct benefit

and cost functions, are explored to understand their impact on coalition formation and market dynamics. A

simplified theoretical example shows how coalitions can achieve greater value through collaboration than by

acting independently. This model serves as a practical tool for assessing the trade-offs of cooperation and

offers insights into managing emerging data-driven markets.

1 INTRODUCTION

Data are raw informational assets that organizations

can transform into value to enhance business process

knowledge and support strategic decision-making

(Ylijoki and Porras, 2019; Ramchand and Mahmood,

2022; Wu et al., 2022; Gervasi et al., 2023b; An-

gelelli et al., 2024b; Catalano et al., 2024; Corallo

et al., 2023). Data that exceed specific thresholds in

characteristics such as velocity, variety, and volume

are designated as big data (Laney, 2001). Organiza-

tions extract value from big data primarily through

big data analytics (Gervasi et al., 2023b; Corallo

et al., 2023; Catalano et al., 2024), typically within

initiatives described in the literature as big data

initiatives (Braganza et al., 2017) or big data projects

(Tiefenbacher and Olbrich, 2015; Huang et al., 2015;

Louati and Mekadmi, 2019; Grander et al., 2022).

In fact, data can be considered the fundamental

resource for big data projects and, consequently, for

big data analytics (Ylijoki and Porras, 2019; Gupta

and George, 2016; Gervasi et al., 2023b; Catalano

et al., 2024). However, data and the information

derived from it differ from traditional resources as

they are non-exclusive, allowing multiple actors to

simultaneously utilize them (Hensler and Huq, 2005).

Consequently, organizations might collaborate by

a

https://orcid.org/0009-0000-1927-5037

b

https://orcid.org/0009-0001-0845-538X

c

https://orcid.org/0000-0001-6114-1454

sharing their data (Bertsekas and Gallager, 2021)

to generate greater value than each could achieve

independently (Dong and Yang, 2020). For this

reason, data sharing across organizations must be

well-regulated, requiring suitable data architectures

that facilitate multi-actor data sharing, such as Data

Vault for data integration (Lindstedt et al., 2009) or

Data Mesh (Dehghani, 2022). Moreover, data may be

associated with a price that organizations would need

to pay in order to access and utilize it. In a dynamic

context, this price fluctuates based on supply and

demand within what is defined as a Data Market

(Koutroumpis et al., 2020).

To model collaboration among organizations

wishing to share data for common objectives, it is

necessary to calculate potential incentives arising

from such collaborations. This involves defining

different types of values associated with data, such as

the potential value of data (Angelelli et al., 2024b;

Corallo et al., 2023), the extractable value of data,

and the related business value (Gervasi et al., 2023b;

Angelelli et al., 2024b), while also understanding

how these values might change through sharing and

collaboration among multiple organizations. In this

study, we define a Data Network as the complex

structure of potential collaborations between or-

ganizations within the data market. To formalize

potential coalitions among organizations and analyze

the various interactions within the Data Network,

Bove, L., Totaro, N. G. and Gervasi, M.

Data Network Game: Enabling Collaboration via Data Mesh.

DOI: 10.5220/0013283800003944

In Proceedings of the 10th International Conference on Internet of Things, Big Data and Security (IoTBDS 2025), pages 81-92

ISBN: 978-989-758-750-4; ISSN: 2184-4976

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

81

we apply formalism and results from game theory

(Badewitz et al., 2020). Similar approaches have

been used for data markets (Agarwal et al., 2019)

to model data pricing (Bi et al., 2024; Liang et al.,

2018), trading, and protection (Liang et al., 2018).

Finally, the proposed model introduces con-

straints that limit coalitions between organizations,

addressing privacy, security (Van Panhuis et al., 2014;

Angelelli et al., 2024a; Gervasi et al., 2023a), data

valuation (Coyle and Manley, 2024; Angelelli et al.,

2024b), regulatory (Kathuria and Globocnik, 2020;

Graef et al., 2019), and market concerns.

The structure of the paper is as follows: The im-

portance of collaboration in big data projects is cov-

ered in Section 2, which also highlights the choice

of data mesh as an enabling architecture for inter-

organizational data sharing. The Data Network Game

concept is theoretically formalized in Section 3. Sec-

tion 4 offers an in-depth analysis of the model’s com-

ponents, underlying assumptions, and potential im-

plications. Lastly, a real-world examples from the

healthcare industries is presented in Section 5, which

also examine possible model expansions.

2 THE IMPORTANCE OF

COOPERATION IN BIG DATA

PROJECTS

According to the various analogies in the literature,

we consider data as a raw resource with a potential

extractable value, such as metallic ores or oil (Ack-

off, 1989; Ylijoki and Porras, 2019; Saltz, 2015).

Thus, it is possible to associate data with the same

characteristics as other resources, following the VRIO

(Valuable, Rare, costly to Imitate, Organizationally

embedded) model (Barney, 1991). Like traditional

resources, even data are associated with facilitating

factors that enable a company to establish a com-

petitive advantage, such as exclusive access to data,

and exploitative access to data (Fast et al., 2021).

Moreover, while data have all the characteristics of

the VRIO model, the ease of duplicating and shar-

ing it with other actors is an atypical characteristic

compared with other resources, which often enjoy ex-

clusivity properties (Gervasi et al., 2023a). Beyond

data, the knowledge they generate can be consumed

by multiple actors, not only by its creator (Hensler

and Huq, 2005). This feature opens up positive con-

siderations regarding mutual data sharing for greater

value creation. Some challenges, such as the unavail-

ability of specific data or the lack of high-quality data,

could be overcome by architectures that can accom-

modate, manage, and make available a wide variety

of data from diverse sources and organizations (Chen

et al., 2017; Chen et al., 2014; Gervasi et al., 2023a).

Sharing expertise not only within firms but also across

firms, clearly under assumptions of complementarity

and connectivity, could lead to an evolution of the

classic big data value chain towards a value network

triggered by big data (Wu et al., 2022). System The-

ory, and in particular the concept of synergy, explains

how well-orchestrated and shared resource utilization

can generate greater value than the sum of the indi-

viduals; namely, the value is a super-additive set func-

tion:

Value(d

1

∪ d

2

) ≥ Value(d

1

) + Value(d

2

), (1)

with d

1

and d

2

being sets of shareable data/resources

(Dong and Yang, 2020). These aspects have signifi-

cant and tangible effects on firm performance (Dong

and Yang, 2020; Tanriverdi and Venkatraman, 2005).

The proliferation of interactions and the growing im-

portance of stakeholders become fundamental in the

distributed co-creation of value, accompanied by the

formation of ad-hoc ecosystems (Del Vecchio et al.,

2018; Malthouse et al., 2019; Roos, 2018). This leads

to a network of collaborations that produces value for

the involved entities. The definition of value network

we provide aims at formalizing the super-additivity

property (1) into a broader context of interdependence

and symbiosis among different actors. This collabora-

tion among the network’s members fosters additional

value that could not be derived from the mere effort

of organizations if they acted alone (Malthouse et al.,

2019; Roos, 2018). In practical terms, organizations

require the adoption of new data architectures that

enable such collaboration to establish a data-driven

strategy that can be implemented by multiple actors.

2.1 Data Mesh: A New Paradigm for

Data Sharing

The development of new data architectures for the

sharing and management of data across multiple

organizations is essential to preserve their potential

value, facilitate sharing among diverse actors, ensure

privacy and security, and support analytical processes

(Priebe et al., 2021; Hechler et al., 2023). In a data-

driven market, one of the key challenges is therefore

to preserve data quality without reducing its potential

(Reggio and Astesiano, 2020), which requires select-

ing the most suitable data architecture for specific

goals. We have identified and adopted the data mesh

as an enabling architecture for multi-actor data shar-

ing within the Data Network and the framework we

IoTBDS 2025 - 10th International Conference on Internet of Things, Big Data and Security

82

define as the Data Network Game, as it decentralizes

data ownership, enhances scalability, and ensures

domain-driven accountability. This architecture is de-

signed for sharing data between domains that own it,

unlike other architectures, such as, data vault, which

focuses on historical data integration (Lindstedt et al.,

2009), or data fabric, which emphasizes centralized

orchestration of distributed data (Sharma et al., 2023).

The data mesh approach is particularly effective in

contexts of data sharing and reuse (Dehghani, 2022;

Azeroual and Nacheva, 2023), and it is based on four

foundational principles:

• Domain Ownership: each dataset is labeled with

the relevant information, including who is respon-

sible for its content.

• Data as a Product: data are treated as products,

which require investment and whose value is di-

rectly linked to their quality.

• Self-Serve Data Platform: data are stored on a

user-friendly platform, allowing each actor to lo-

cate accessible data that is ready for use without

requiring pre-analytics processing.

• Federated Computational Governance: decen-

tralized approach combining domain autonomy

with global standards, ensuring data security,

compliance, quality, and interoperability.

The principle of domain ownership aims to

decentralize the ownership of analytical data by

assigning it to business domains that are closest

to the data sources or primary consumers, thereby

segmenting the data and managing its life cycle

within each domain (Dehghani, 2022).

Assuming the adoption of a cross-domain data

mesh architecture for inter-organizational data shar-

ing, the big data value chain demands a fundamen-

tal redefinition. The linear value chain can evolve

into a graph structure by reusing the same data prod-

uct across multiple analytics processes (Gervasi et al.,

2023a).

2.2 Cooperative Game Theory for Data

Sharing

In the literature, among related models, we find ex-

amples such as the Data Provision Game (Badewitz

et al., 2020) and the Data Marketplace (Agarwal

et al., 2019), which focus on data pricing and revenue

sharing. Notably, the Data Network Game moves

beyond the concept of directly assigning a specific

price to a data domain. Instead, the model proposes

that individual organizations select others with which

to share their data, thereby recognizing value even

potential value in such data. The selection of do-

mains, and consequently of organizations, becomes

an integral part of the decision-making process,

serving as a guarantee for security, reliability, and,

above all, data quality. In this context, adopting a

data mesh as an enabling architecture for multi-actor

data sharing unlike the traditional big data value

chain (Badewitz et al., 2020; Gervasi et al., 2023b)

represents an innovative approach.

The total benefit generated by a coalition depends

on the combined resources and efforts of its mem-

bers. In the context of data sharing, these benefits of-

ten display increasing returns to scale, meaning that

the value derived from the shared data grows more

than proportionally as the amount or diversity of data

shared increases (Konsynski and McFarlan, 1990).

A key question in this context is how to fairly dis-

tribute the collective benefits among the members of

a coalition in a way that encourages active partici-

pation. Various methods for distributing payoffs are

found in cooperative game theory, such as in profit-

sharing games (Kleinberg and Oren, 2022; Bil

`

o et al.,

2023b; Bil

`

o et al., 2023a), where each player (e.g., a

domain) selects a resource (e.g., a coalition) to max-

imize their individual payoff. Our model adopts a

mechanism where each agent’s payoff is proportional

to their data contribution. Specifically, each agent’s

reward is calculated based on the relative value of

their data compared to the total data value within the

coalition. This proportional distribution ensures that

agents are compensated according to the value they

add to the coalition, motivating them to share valu-

able data and engage in collaborative efforts. How-

ever, agents may face certain incompatibility con-

straints that prevent them from collaborating with oth-

ers. These constraints could stem from legal restric-

tions, privacy concerns, or competitive interests (My-

erson, 1980). Such limitations reduce the pool of fea-

sible coalitions and must be taken into account when

modeling coalition formation. For a coalition struc-

ture to be sustainable, it must be stable, meaning no

agent or group of agents has any incentive to leave

and form a new coalition.

3 DATA NETWORK GAME

The Data Network Game is a conceptual frame-

work designed to represent collaborations among

organizations that share their data. As previously

discussed, we posit that the data mesh serves as

Data Network Game: Enabling Collaboration via Data Mesh

83

an enabling data architecture for multi-actor data

sharing and management. Within the context of the

Data Network Game, the domains of the data mesh

are thus considered as players, or “actors”, engaged

in a cooperative or competitive game system aimed

at maximizing the value derived from data sharing.

In the foundational version of the Data Network

Game presented in this study, we assume that each or-

ganization owns only one data domain. Consequently,

each domain is viewed as representing an individual

organization that operates autonomously but is incen-

tivized to collaborate with other domains (organiza-

tions) to increase the total value generated. In this

model, domain coalitions enable each participant to

achieve a potential gain greater than what could be

realized independently, reflecting the principles of co-

operative game theory. The primary assumptions un-

derlying the model are as follows:

• Single-Domain Ownership: each organization is

associated with a single domain.

• Incompatibility Constraints: the model ac-

counts for market-imposed incompatibility con-

straints that limit coalition formation between do-

mains. These constraints represent legal, ethical,

or competitive limitations, ensuring that the Data

Network Game reflects realistic conditions for co-

operation.

• Coalition Formation: domains are permitted to

form coalitions, provided they adhere to incom-

patibility constraints.

• Incremental Value Through Coalition: it is as-

sumed that participation in a coalition generates

incremental value for the involved domains, ex-

ceeding the sum of values they would achieve in-

dependently.

The cost function associated with coalition for-

mation considers configuration costs, data integration

expenses, and compliance requirements. The bene-

fit function reflects the added value from data sharing

and access to larger and more diverse datasets. Fi-

nally, the distribution of gains among coalition mem-

bers is proportional to each domain’s contribution,

fostering balanced and sustainable collaboration. Un-

der these assumptions, the Data Network Game seeks

to model a collaborative network of domains that

maximizes the value of shared data while respecting

market restrictions and promoting fair and dynamic

competition among actors.

3.1 Domains and Market Structure

We consider a market M as a set of n organizations,

M = {O

1

,O

2

,... ,O

n

} where each organization O

i

manages a set of domains D

i

. In the model presented

we assume that each organization has only one

domain. Consequently, the total set of domains

in the market is D = {d

1

,d

2

,. .. ,d

n

}. Specifically,

a domain d

i

∈ D is a business entity within an

organization responsible for managing a certain

quantity of data, and v(d

i

) ≥ 0 denotes the value of

the data owned by d

i

. Therefore, we identify each

d

i

with the set of data it manages and v(d

i

) with its

overall value. Table 1 provides the nomenclature used

in the modeling of the Data Network Game for clarity.

The market imposes incompatibility constraints

(I ), where I ⊆ {{d

i

,d

j

} : d

i

,d

j

∈ D, i ̸= j}. When-

ever {d

i

,d

j

} ∈ I , it means that domains d

i

and d

j

cannot belong to the same coalition due to legal,

ethical, or other competitive considerations. These

constraints prevent certain domains from collaborat-

ing and must be respected when forming coalitions.

In realistic scenarios, constraints that limit the free

sharing of data among organizations are imposed to

protect competition, consumers, and their personal

data (Graef et al., 2019). Although the replicability

of data is an incentive for building a confederate, it

is clear that multiple incompatibility factors related,

for example, to privacy and security must be taken

into account (Cavanillas et al., 2016; Gervasi et al.,

2023a). Indeed, incompatibility constraints include

legal and political issues, such as restrictive policies,

data ownership, and privacy protection. Incompati-

bility constraints derive from rules that are external

to organizational choices, as they are the responsi-

bility of public authorities (Kathuria and Globocnik,

2020; Graef et al., 2019), which ensure compliance

with laws, both administrative and financial. In the

context of collaborative settings, partial information

availability about sensitive data is also a source of un-

certainty that may influence decision-making regard-

ing security constraints and prioritization of interven-

tions, which requires appropriate methodologies for

their evaluation (Angelelli et al., 2024a). Lastly, it

is important to highlight that technical, economic, or

technological issues due to inefficient data manage-

ment or lack of resources are not constraints of in-

compatibility.

3.2 Game Structure

Each domain d

i

∈ D is treated as a player in the coop-

erative game. The objective of each domain is to max-

IoTBDS 2025 - 10th International Conference on Internet of Things, Big Data and Security

84

imize its payoff by joining a coalition that adheres to

the market-imposed incompatibility constraints. For

this reason, we consider a feasible coalition structure

C = {C

1

,C

2

,. .. ,C

k

} as a partition of D, where each

coalition C

h

satisfies the incompatibility constraints

(namely, each coalition C

h

is feasible). Here, k is

the total number of coalitions in the structure, while h

(with 1 ≤ h ≤ k) is simply an index denoting the h-th

coalition within the partition. So, the feasible strategy

space S

i

of each domain d

i

consists of all coalitions

C ⊆ D that include d

i

and respect the incompatibility

constraints:

S

i

= {C ⊆ D | d

i

∈ C,∀d

j

∈ C {d

i

,d

j

} /∈ I }. (2)

This set represents all possible coalitions d

i

that can

feasibly join, given the incompatibility constraints.

Table 1: DNG: Terminological Foundations.

Description

M Market: set of organizations

D Set of domains in M

O

i

i-th organization

d

i

Domain of i-th organization

v(d

i

) Value by domain d

i

C Coalition structure

C

i

i-th coalition

S

i

i-th strategy

b(C

i

) Benefit function for coalition C

i

c(C

i

) Cost function for coalition C

i

u

i

(C

j

) Payoff of i-th domain in coalition C

j

3.3 Benefit and Cost Functions

Once some domains are part of the same coalition,

we need to define a function capable of expressing

the individual return to each individual domain as a

function of its own value and that generated by the

coalition. This return will depend on the domains of

the same coalition. In the first step, we define a benefit

function b(C

j

) for a coalition C

j

as:

b(C

j

) = f

∑

d

i

∈C

j

v(d

i

)

!

, (3)

where f : R

≥0

→ R

≥0

is a non-decreasing convex

function with f (0) = 0 that depends on the big data

characteristics, such as volume, variety, velocity, and

other factors (Geerts and O’Leary, 2022). This for-

malizes the super-additivity property (1) and ensures

increasing returns as the quantity of data increases,

capturing the power of data value generation. There-

fore, the total benefit of the market for a coalition

structure C = {C

1

,C

2

,. .. ,C

k

} is:

SUM

b

(C ) =

k

∑

j=1

b(C

j

). (4)

This represents the aggregated benefit generated by

all coalitions in the market.

Regarding the costs for domains to participate in

the coalition, including configuration, data integra-

tion, and compliance costs, we define a cost function

c(C

j

) for a coalition C

j

as:

c(C

j

) = c

0

+ c

k

· |C

j

|

γ

, (5)

where c

0

is a fixed cost, c

k

is the marginal cost for

domains in the coalition C

j

, |C

j

| denotes the number

of domains in coalition C

j

, and γ > 0 is a parameter

that adjusts cost growth as a function of coalition size.

This captures both the coalition formation costs and

the incremental cost of adding new domains to the

coalition. The total cost of the market for a coalition

structure C = {C

1

,C

2

,. .. ,C

k

} is:

SUM

c

(C ) =

k

∑

j=1

c(C

j

). (6)

3.4 Payoff Function and Stability

Considering that each coalition produces a benefit for

all the participating domains, it is interesting to deter-

mine a feasible way to distribute the benefit among all

of them. To take into account the contribution given

by each domain d

i

in coalition C

j

to the total benefit,

we propose the following payoff function:

u

i

(C

j

) = w

i

(C

j

) · [b(C

j

) − c(C

j

)], (7)

where w

i

(C

j

) :=

v(d

i

)

∑

d

h

∈C

j

v(d

h

)

∈ [0, 1] is the weight

that models the fraction of total value produced by

domain d

i

in coalition C

j

.

The inclusion of such payoff functions defines an

interaction among agents that could potentially lead to

stable coalition structures, where no player (or group

of players) has any incentive to deviate. The resulting

strategic interaction can be modeled by resorting to

some tools from cooperative game theory. We point

out that our model fits in the general structure of hedo-

nic games (Bogomolnaia and Jackson, 2002). Then,

we propose to apply to our model two notions of sta-

bility widely adopted for the general class of hedonic

games: the core stability and the Nash stability.

Definition 1 (Core-stability). A coalition structure

C = {C

1

,. .. ,C

k

} is core-stable if, for any subset

C

′

⊆ D that respects the incompatibility constraints,

Data Network Game: Enabling Collaboration via Data Mesh

85

there exists at least one domain d

i

∈ C

′

such that

u

i

(C(d

i

)) ≥ u

i

(C

′

), where C(d

i

) denotes the coalition

of C containing d

i

.

A coalition structure is core-stable if, for any

possible subset of domains C

′

that decides to form a

separate feasible coalition, there exists at least one

domain in C

′

whose individual payoff would not

increase by deviating. This means that the coalition

structure is resilient to group deviations because no

subset of domains can collectively break away to

form a new coalition that would make all its members

strictly better off. Therefore, in a core-stable struc-

ture, there is no incentive for any group of domains

to leave and form a better arrangement.

If the strategic environment among agents is not

highly cooperative, it might happen that agents inde-

pendently choose which coalitions to join. In such a

scenario, we can adopt a (often weaker) stability con-

dition by assuming that a coalition structure is stable

if no domain can improve its utility through unilateral

deviations only (i.e., by moving from its current coali-

tion to another). This form of stability is typically

referred to as Nash-stability (or individual stability),

and it suggests that, while domains might not be able

to prevent group deviations, they have no incentive

to leave their coalition individually to join another, as

doing so would not improve their utility.

Definition 2 (Nash stability). A coalition structure

C = {C

1

,. .. ,C

k

} is Nash-stable if, for any domain

d

i

∈ D, (i) u

i

(C(d

i

)) ≥ u

i

(C

j

∪ {d

i

}) holds for any

C

j

∈ C and (ii) u

i

(C(d

i

)) ≥ u

i

({d

i

}), where C(d

i

) de-

notes the coalition of C containing d

i

.

We observe that the first condition of the above

definition ensures that no domain has an incentive

to leave its current coalition to improve its utility

by joining another group (i.e., jumping into another

coalition). The second condition states that no

domain can improve its utility by forming a coalition

where it is the sole participant. This implies that

being alone, or acting independently, would not

provide a better outcome compared to remaining

in the current coalition. Together, these conditions

ensure that the coalition structure is stable with

respect to both unilateral shifts to other groups and

complete isolation.

In the literature related to hedonic games, it has

been shown that core-stable or Nash-stable coalition

structures do not always exist, and their computa-

tion can be intractable (see, for instance, (Woeginger,

2013b; Woeginger, 2013a; Peters and Elkind, 2015;

Sung and Dimitrov, 2010)). Nevertheless, investigat-

ing the existence and computation of stable coalition

structures within our specific model remains worth-

while, as this research could lead to a deeper under-

standing of cooperative behavior in our strategic en-

vironment and its implications for overall system ef-

ficiency (e.g., measured by total benefit or total cost).

3.5 Theoretical Case Study

In Table 2 we present a theoretical case in which there

are 10 domains D = {d

0

,d

1

,. .. ,d

9

} and their incom-

patibility constraints. For illustrative purposes, the

value of each domain, denoted v(d

i

), is assigned ran-

domly from a predefined range (e.g., via a uniform

distribution) to capture variability in data quality, vol-

ume, and synergy potential.

Table 2: The value and the incompatibility constraints of

each domain in the market.

Domain Value Constraints

d

0

42.33 d

1

,d

6

,d

7

d

1

32.57 d

0

,d

3

,d

8

d

2

43.49 d

3

,d

9

d

3

51.41 d

1

,d

2

,d

4

,d

5

d

4

70.23 d

3

,d

6

,d

9

d

5

30.13 d

3

,d

7

,d

9

d

6

40.22 d

0

,d

4

,d

7

,d

8

d

7

49.40 d

0

,d

5

,d

6

,d

9

d

8

69.85 d

1

,d

6

d

9

44.30 d

2

,d

4

,d

5

,d

7

The fixed costs c

0

used in this example are equal

to 5, γ = 0.3, and the marginal costs c

k

related to

the coalitions that will form were considered as

uniformly random amounts in the range [1, 30]. The

cost function used is c(C

j

) = 5 + c

k

| C

j

|

0.3

. The

selection of γ = 0.3 ensures scalability across do-

mains, emphasizing shared architectures’ efficiency.

Its general applicability requires empirical parameter

estimation based on defined data and enabling

technologies. For the benefit function relative to

coalition C

j

, we used a non-decreasing and convex

function b(C

j

) =

∑

d

i

∈C

j

v(d

i

)

1.2

. The benefit

function f (x) = x

1.2

satisfies the super-additivity

property of data value and grows with the number of

organizations in the coalition under ideal conditions.

In real-world scenarios, however, a threshold may

emerge beyond which the benefits significantly

decrease.

Finally, the incentive for each domain d

i

∈ D to

participate in coalitions is determined by the pay-

off function u

i

defined in (7). In Table 3, we report

for each organization the respective benefit, cost, and

IoTBDS 2025 - 10th International Conference on Internet of Things, Big Data and Security

86

payoff, assuming that each organization is a coalition

in its own right.

Table 3: The benefits, costs, and payoffs referred to coali-

tions formed by a single domain.

Coalition Benefit Cost Payoff

{d

0

} 89.52 21.99 67.53

{d

1

} 65.36 34,70 30.66

{d

2

} 92.50 29.44 63.06

{d

3

} 113.05 21.04 92.01

{d

4

} 164.37 13.45 150.92

{d

5

} 59.54 12.17 47.37

{d

6

} 84.20 31.63 52.57

{d

7

} 107.75 18.59 89.16

{d

8

} 163.30 12.52 150.78

{d

9

} 94.56 17.36 77.20

Given the above parameters, all possible coalition

structures were evaluated. Among all admissible

coalition structures, a core-stable coalition structure

C

E

= ({d

2

,d

4

,d

7

,d

8

},{d

1

},{d

3

,d

6

,d

9

},{d

0

,d

5

})

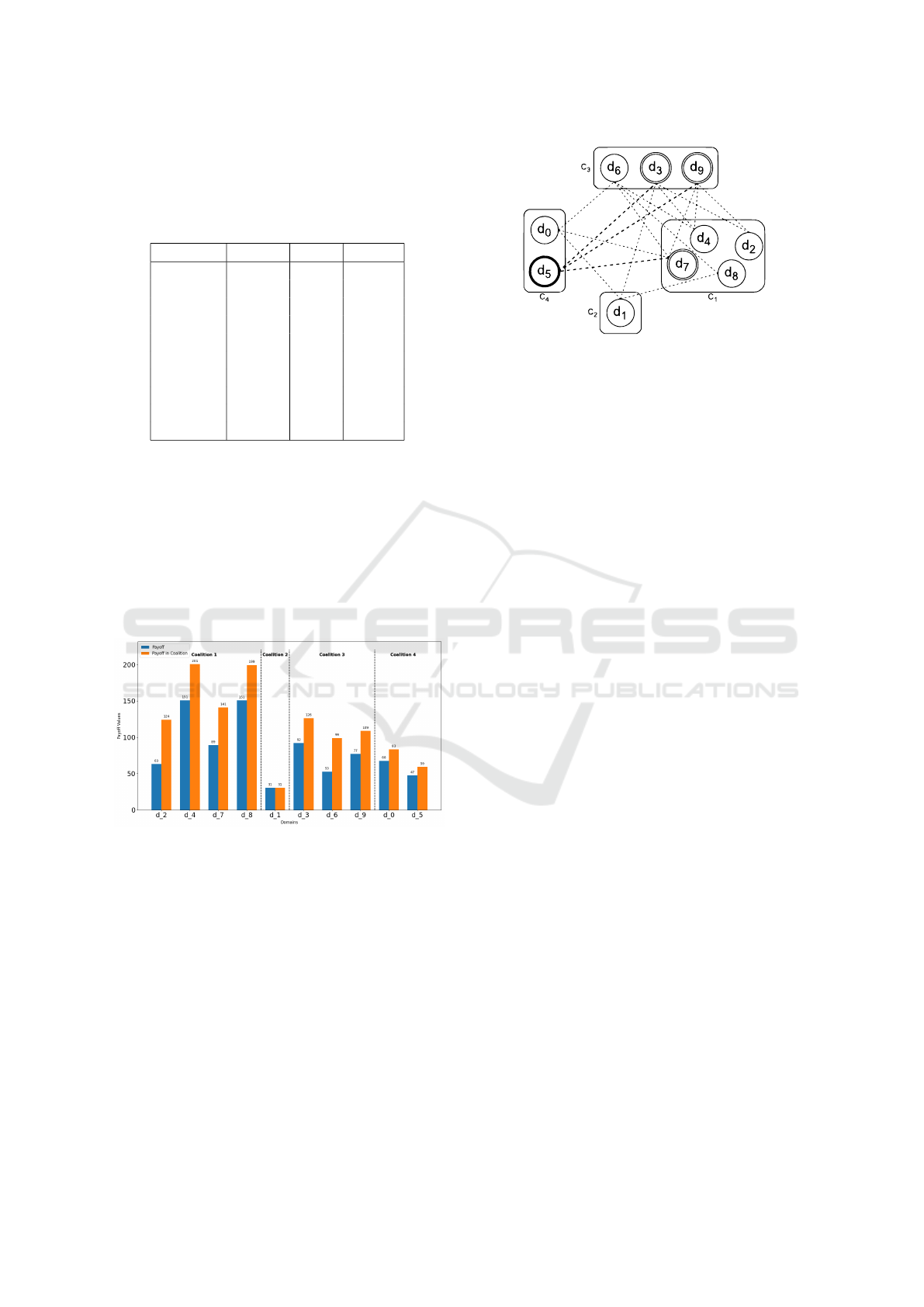

was identified. In Figure 1, for each domain d

i

,

the payoff without participating in any coalition is

compared with the payoff generated by the same

domain within the coalition C

E

that includes it,

showing that the payoff is greater when the domain is

part of a coalition.

Figure 1: Comparison of Payoffs Inside and Outside Coali-

tions.

Clearly, the value of data is extractable, quantifi-

able, and realizable only in the presence of a big data

initiative. It is not possible to think of data value as

agnostic and not contextualized. In this sense, the in-

tangible nature of data value relates to value percep-

tion by those involved in the Data Network; in spe-

cific contexts, such perception can be quantified, e.g.,

through information-theoretic notions (Corallo et al.,

2020). Thus, in the example, we assume that each

coalition is engaged in a set of big data initiatives

where the data they share are recognized as having

potential and extractable value.

Figure 2 represents the core-stable coalition struc-

Figure 2: Core-stable coalition structure of the example.

ture identified in the example. The configuration

is C

E

= {C

1

,C

2

,C

3

,C

4

}, where C

1

= {d

2

,d

4

,d

7

,d

8

},

C

2

= {d

1

}, C

3

= {d

3

,d

6

,d

9

}, and C

4

= {d

0

,d

5

}. The

dotted lines represent the incompatibility constraints

between the various domains. The constraints of do-

main d

5

have been highlighted as an example.

4 DISCUSSION

The Data Network Game models the dynamics

of potential collaborations between organizations

interested in data sharing. At the core of this model,

the concept of data mesh emerges as a key element

for data sharing, promoting domain-oriented man-

agement, the use of a self-serve data platform, the

adoption of shared governance among all members

of the coalition, and the view of data as products

(Dehghani, 2022). A potential extension of the model

could include the sharing of additional resources. Be-

yond data, the sharing of technologies (Technology

Mesh) could further increase the value extracted from

the data, fostering greater interoperability between

domains (Gervasi et al., 2023a). In addition to the

exchange of digital resources, the model could be

extended to include the sharing of human resource

skills available to each domain, with a mutual knowl-

edge transfer (Angelelli et al., 2024b) and exchange

of abilities.

Within the Data Network Game, there exists a

wide range of possible configurations due to the

numerous parameters that characterize it, such as the

potential value attributed to the data, the extractable

or generable value, the corresponding business value

(Angelelli et al., 2024b), benefit and cost functions,

and incompatibility constraints. Organizations are

therefore called upon to analyze various scenarios

and assess the utility of collaborations, considering

not only specific big data initiatives but also the pos-

sible temporal evolution of the coalitions themselves.

Data Network Game: Enabling Collaboration via Data Mesh

87

Indeed, a coalition should not be understood as a

temporary collaboration between organizations with

a common and defined goal. Rather, a coalition in the

market should be viewed as a stable strategic alliance

that exists within the market, aimed at consolidating

its position or emerging as a new key player.

In the Data Network Game, each domain aims to

maximize its own yield, namely the value generated

through the strategic sharing and utilization of data

via targeted collaborations with other domains, in

line with the principles of hedonic games. For

simplicity, the proposed model assumes a one-to-one

correspondence between organizations and domains,

treating them almost as synonyms. However, it is

plausible to extend this representation by assuming

that an organization may manage multiple domains

(or business units) and consequently participate

simultaneously in multiple coalitions. A crucial

constraint of the model establishes that each domain

can share its data exclusively with one coalition at a

time, ensuring the exclusivity of the data within each

coalition. However, it is possible for two domains

belonging to the same organization to be part of the

same coalition. This scenario opens new perspectives

for the model, where organizations do not merely

optimize the performance of individual domains but

aim at maximizing the overall returns derived from

all the domains under their control.

Within the Data Network Game, data are con-

ceived as products that organizations seek to enhance

and combine strategically. While in the data mesh

paradigm the principle of data as a product empha-

sizes data quality and usability, in the Data Network

Game the focus shifts to the value generated by the

data itself. The value of a domain depends on the

intrinsic potential of the data it contains and on the

opportunities to integrate them with data from other

domains, thereby increasing their overall information

value. Therefore, it is essential to formally define a

value function associated with the data, considering

both its raw form and the transformation processes

it may undergo. Additionally, it is necessary to

understand how the value of data may evolve over

time and in relation to market dynamics (Angelelli

et al., 2024b). For example, in the theoretical case

study, the value function was not explicitly defined,

nor was a temporal dependency considered. Such a

dependency is crucial in big data initiatives to model

the obsolescence of extracted information in relation

to the market and its impact. In this context, domains,

based on the value recognized by the market, can be

assimilated to stocks in a data market (Agarwal et al.,

2019). The value of these stocks could fluctuate

based on the number of coalitions interested in

integrating that domain, and the value attributed to it

by those coalitions.

It thus becomes crucial to identify the factors that

influence the formation and stability of coalitions so

that the potential value extracted from the data can

be maintained over time and across multiple big data

initiatives. The theoretical example presented was

constructed to show how domains benefit more by

participating in coalitions C

E

rather than operating

independently. An aspect that could be useful to

analyze and possibly model concerns the dynamics

that could generate market polarization, favoring

some players over others. For instance, in a Data Net-

work Game, the market rules might favor coalitions

between smaller organizations, but it is also possible

that they could favor larger organizations (e.g.,

superstar firms (Fast et al., 2021)). In the latter case,

collaboration among market-leading organizations

could result in the creation of an almost monopolistic

market. However, antitrust authorities are placing

an increasing amount of emphasis on preventing

the concentration of knowledge and market power

in the hands of a few strong corporations, as this

could impede innovation and limit consumer choice

(Spulber, 2023). Therefore, the market rules, and

hence those of the Data Network Game, must be

refined to ensure a market that does not polarize and

does not favor any particular category of organization

in advance.

In the context of the Data Network Game, ad-

hering to strict data security and protection standards

plays a fundamental role. Although privacy and se-

curity are critical considerations for data sharing, it

is essential to integrate concrete methodologies to

strengthen the framework of the Data Network Game,

such as federated learning for model training with-

out sharing raw data and differential privacy for con-

fidentiality ensures robust practices and data gover-

nance compliance (Faroukhi et al., 2020). It is plau-

sible that such standards could become a key fac-

tor in coalition formation, potentially evolving into

a new type of incompatibility constraint. This con-

straint would no longer be imposed solely by market

regulators but would arise directly from the organiza-

tions themselves, which could set stricter security re-

quirements to access certain collaborations. This be-

havior could encourage organizations to adopt higher

and more restrictive security measures to avoid ex-

clusion from strategic coalitions. The federated com-

putational governance of the data mesh is pivotal in

IoTBDS 2025 - 10th International Conference on Internet of Things, Big Data and Security

88

regulating coalitions and their associated constraints,

ensuring adherence to shared standards both within

coalitions and at the market level. Furthermore, it

enables the effective management of control issues,

a key challenge in coalition conflicts (Inkpen, 2005;

Gervasi et al., 2023a).

5 FUTURE WORK

The Data Network Game presents significant

prospects for development, aimed at refining the

theoretic model and enhancing its ability to represent

complex and evolving contexts. Among the proposed

extensions, a notable one is the possibility of allowing

each organization to participate in the Data Network

through a plurality of domains, thus providing a

more accurate modeling of the operational reality of

large multi-sector organizations. This generalization

would enable capturing the diversity and specificity

of the benefits arising from interactions between

distinct domains. Simultaneously, it becomes nec-

essary to introduce formal constraints regulating

the possibility for an organization to affiliate with

multiple coalitions simultaneously, specifying the

assumptions and operational conditions under which

such multiple affiliations are permissible in the

market while ensuring consistency in competitive

and collaborative dynamics within the model. Hy-

pergraphs of incentives and constraints, which

each represent the possible advantages of coalition

relationships and the restrictions imposed by the

market, might be used to expand the model in this

way.

Additional potential extensions of our model

might result from investigating potentially more

realistic payoff functions, in which payoffs are es-

tablished using a network that simulates the efficacy

of interactions within the same coalitions. Therefore,

investigating new generalizations of the Data Net-

work Game that incorporate graphs or hypergraphs

into their payoff structure (e.g., in (Aloisio et al.,

2020; Aloisio et al., 2021; Aloisio et al., 2024; Apt

et al., 2017; Bil

`

o et al., 2022; Bogomolnaia and

Jackson, 2002)) would be a valuable direction for

further research. The formalization of constraints

is crucial to prevent excessive concentrations of

informational power within coalitions, reducing the

risk of non-competitive or asymmetric configura-

tions. Constraints define the restrictions that the

Data Network Game must adhere to. These can be

external, such as regulatory requirements related to

privacy and security, or internal, aimed at ensuring

market balance. External constraints may result in

incompatible configurations within the model, while

internal constraints can take the form of penalties

or incentives designed to promote specific coali-

tions over others. The implementation of external

constraints or the definition of mechanisms such as

penalties must be overseen by a designated authority

acting as the regulator and governor of the data

market. Consequently, the model must incorporate a

dynamic representation of constraints, capable of

adapting to new regulations without destabilizing the

market game, and integrating them into the cost and

benefit functions of participating organizations. Ad-

ditionally, the model must identify network structures

that violate fair play principles and detect coalitions

that may create power imbalances.

A final central aspect in the generalization of the

Data Network Game concerns the possibility of struc-

turing a dynamic data market in which the data and

information generated are treated as tradable assets,

and their value fluctuates over time based on key pa-

rameters such as quality, rarity, and utility value. In

such a configuration, the value of data can be quanti-

fied through information metrics well suited to a dy-

namic setting (Angelelli et al., 2020), enabling real-

time evaluation of the effectiveness of coalitions and

monitoring the evolution over time of the benefits

generated by the big data projects implemented by or-

ganizations (Angelelli et al., 2024b). This approach

provides a flexible and adaptive framework capable

of optimizing the management of informational re-

sources and supporting strategic decisions based on

variations in value and demand in the market. Regard-

ing competition and cooperation strategies between

coalitions, the model could be enriched to account for

the balance between incentives for collaboration and

competitive pressures. This would allow for the ex-

ploration of more complex scenarios in which coali-

tions do not only operate as cooperative entities but as

actors in a strategic competition.

5.1 Healthcare Case Study: Insights

and Implications

The theoretical framework of the Data Network

Game requires validation through real-world appli-

cations, particularly in sectors such as healthcare,

finance, and public services. These domains face

significant challenges in balancing privacy, security

risks, and the benefits of data sharing among various

entities and actors (Cavanillas et al., 2016; Pellegrino

et al., 2024). For instance, Systems-of-Systems

approaches have been applied to hospital facility

Data Network Game: Enabling Collaboration via Data Mesh

89

management across districts or regions to handle

events like pandemics (Pellegrino et al., 2024; Cheng

et al., 2022). In this context, extending the model to

multi-domain scenarios becomes essential. Despite

the advantages of data sharing in healthcare (Shen

et al., 2019), numerous barriers persist, especially

regarding the risks associated with sharing sensitive

data (Van Panhuis et al., 2014). These obstacles are

not always rooted in incompatibility constraints but

must be addressed to foster a high-quality, relevant

data ecosystem that generates community-wide value.

Defining a realistic value function for data do-

mains is a key challenge. Building on collabora-

tions with stakeholders and analyses of real-world use

cases, future work will propose and evaluate: (1) A set

of value functions centered on data quality, character-

ized across multiple dimensions (Xiang et al., 2013);

(2) constraints based on a multilayer approach for se-

curity issues (Faroukhi et al., 2020); and (3) modeling

and quantifying the information extracted from data

along with its temporal evolution, including obsoles-

cence. In particular, these aspects were selected be-

cause data quality is crucial in analytics, and the cost

associated with achieving specific quality standards is

offset by the benefits such data provide to the overall

system (Badewitz et al., 2020). Meanwhile, informa-

tion extracted from data often loses value over time.

Temporal effects on information can be effectively

addressed when data are collected over time, using

information-theoretic methods (e.g., cross-entropy-

based approaches) designed to balance previously ac-

quired information with newly collected data (An-

gelelli et al., 2020; Angelelli and Konopelchenko,

2021). This, in turn, could provide deeper insights

into how coalitions might evolve over time and, con-

sequently, how the data market itself may transform.

6 CONCLUSIONS

In conclusion, the Data Network Game provides an

advanced theoretical framework for modeling and

representing potential collaborations between orga-

nizations focused on data sharing within big data

projects. The model emphasizes the importance of

structuring stable strategic coalitions, in compliance

with regulatory, security, and market constraints, in-

tegrating both competitive and collaborative dynam-

ics. The potential value of data, treated as tradable

assets, and the informational value generated from

these, through the big data projects conducted by

the coalitions, are key elements of the Data Network

Game. The model is applicable both in community-

oriented sectors, such as public administrations and

healthcare institutions, and in profit-driven contexts,

such as through the creation of data markets. Future

perspectives include the expansion of the model to in-

clude multi-sector organizations, the creation of a dy-

namic data marketplace, the integration of adaptive

mechanisms to align constraints based on evolving

regulatory requirements, and the introduction of mul-

tivariate dynamic incentives and constraints within

the model. The ultimate goal is to identify market

configurations within real-world scenarios that ensure

an optimal balance between cooperation and com-

petition, promoting the stability and effectiveness of

coalitions in the long term and, therefore, the market

itself.

REFERENCES

Ackoff, R. L. (1989). From data to wisdom. Journal of

applied systems analysis, 16(1):3–9.

Agarwal, A., Dahleh, M., and Sarkar, T. (2019). A market-

place for data: An algorithmic solution. In Proceed-

ings of the 2019 ACM Conference on Economics and

Computation, pages 701–726.

Aloisio, A., Flammini, M., Kodric, B., and Vinci, C. (2021).

Distance polymatrix coordination games. In Proceed-

ings of the Thirtieth International Joint Conference on

Artificial Intelligence, IJCAI 2021, pages 3–9.

Aloisio, A., Flammini, M., and Vinci, C. (2020). The

impact of selfishness in hypergraph hedonic games.

In The Thirty-Fourth AAAI Conference on Artificial

Intelligence, AAAI 2020, Proceedings, pages 1766–

1773.

Aloisio, A., Flammini, M., and Vinci, C. (2024). General-

ized distance polymatrix games. In Theory and Prac-

tice of Computer Science - 49th International Con-

ference on Current Trends in Theory and Practice

of Computer Science, SOFSEM 2024, Proceedings,

pages 25–39.

Angelelli, M., Arima, S., Catalano, C., and Ciavolino, E.

(2024a). A robust statistical framework for cyber-

vulnerability prioritisation under partial information

in threat intelligence. Expert Systems with Applica-

tions, 255:124572.

Angelelli, M., Ciavolino, E., and Pasca, P. (2020). Stream-

ing generalized cross entropy. Soft Computing,

24(18):13837–13851.

Angelelli, M., Gervasi, M., and Ciavolino, E. (2024b).

Representations of epistemic uncertainty and aware-

ness in data-driven strategies. Soft Computing,

https://doi.org/10.1007/s00500-024-09661-8.

Angelelli, M. and Konopelchenko, B. (2021). Entropy

driven transformations of statistical hypersurfaces.

Reviews in Mathematical Physics, 33(02):2150001.

Apt, K. R., de Keijzer, B., Rahn, M., Sch

¨

afer, G., and Si-

mon, S. (2017). Coordination games on graphs. Int.

J. Game Theory, 46(3):851–877.

IoTBDS 2025 - 10th International Conference on Internet of Things, Big Data and Security

90

Azeroual, O. and Nacheva, R. (2023). Data mesh for man-

aging complex big data landscapes and enhancing de-

cision making in organizations. In KMIS, pages 202–

212.

Badewitz, W., Kloker, S., and Weinhardt, C. (2020). The

data provision game: researching revenue sharing in

collaborative data networks. In 2020 IEEE 22nd

Conference on Business Informatics (CBI), volume 1,

pages 191–200. IEEE.

Barney, J. (1991). Firm resources and sustained competitive

advantage. Journal of management, 17(1):99–120.

Bertsekas, D. and Gallager, R. (2021). Data networks.

Athena Scientific.

Bi, Y., Wu, Y., Liu, J., Ren, K., and Xiong, L. (2024).

When data pricing meets non-cooperative game the-

ory. In 2024 IEEE 40th International Conference on

Data Engineering (ICDE), pages 5548–5559. IEEE.

Bil

`

o, V., Bove, L., and Vinci, C. (2023a). Utility-sharing

games: How to improve the efficiency with limited

subsidies. In Proceedings of the 24th Italian Confer-

ence on Theoretical Computer Science, 2023, volume

3587, pages 314–327.

Bil

`

o, V., Ferraioli, D., and Vinci, C. (2022). General opin-

ion formation games with social group membership.

In Proceedings of the Thirty-First International Joint

Conference on Artificial Intelligence, IJCAI 2022,

pages 88–94.

Bil

`

o, V., Gourv

`

es, L., and Monnot, J. (2023b). Project

games. Theor. Comput. Sci., 940(Part):97–111.

Bogomolnaia, A. and Jackson, M. O. (2002). The stability

of hedonic coalition structures. Games and Economic

Behavior, 38(2):201–230.

Braganza, A., Brooks, L., Nepelski, D., Ali, M., and Moro,

R. (2017). Resource management in big data initia-

tives: Processes and dynamic capabilities. Journal of

Business Research, 70:328–337.

Catalano, A. A., Catalano, C., Del Vecchio, V., and Lazoi,

M. (2024). Big Data Analytics and Visualization So-

lutions in Industry: a Literature Review. Proceedings

IFKAD 2024.

Cavanillas, J. M., Curry, E., and Wahlster, W. (2016). The

big data value opportunity. New horizons for a data-

driven economy: A roadmap for usage and exploita-

tion of big data in Europe, pages 3–11.

Chen, H.-M., Kazman, R., Garbajosa, J., and Gonzalez,

E. (2017). Big data value engineering for business

model innovation. In 50th Hawaii International Con-

ference on System Sciences, HICSS 2017, Hawaii,

USA. ScholarSpace / AIS Electronic Library (AISeL).

Chen, M., Mao, S., and Liu, Y. (2014). Big data: A survey.

Mobile networks and applications, 19:171–209.

Cheng, W., Lian, W., and Tian, J. (2022). Building the

hospital intelligent twins for all-scenario intelligence

health care. Digital Health, 8:20552076221107894.

Corallo, A., Crespino, A. M., Del Vecchio, V., Gervasi, M.,

Lazoi, M., and Marra, M. (2023). Evaluating maturity

level of big data management and analytics in indus-

trial companies. Technological Forecasting and Social

Change, 196:122826.

Corallo, A., Fortunato, L., Massafra, A., Pasca, P., An-

gelelli, M., Hobbs, M., Al-Nasser, A. D., Al-Omari,

A. I., and Ciavolino, E. (2020). Sentiment analysis of

expectation and perception of MILANO EXPO2015

in twitter data: a generalized cross entropy approach.

Soft Computing, 24:13597–13607.

Coyle, D. and Manley, A. (2024). What is the value of data?

a review of empirical methods. Journal of Economic

Surveys, 38(4):1317–1337.

Dehghani, Z. (2022). Data mesh: Delivering data-driven

value at scale. O’Reilly Media, Inc., 1.ed - preview

version.

Del Vecchio, P., Di Minin, A., Petruzzelli, A. M., Panniello,

U., and Pirri, S. (2018). Big data for open innovation

in smes and large corporations: Trends, opportunities,

and challenges. Creativity and Innovation Manage-

ment, 27(1):6–22.

Dong, J. Q. and Yang, C.-H. (2020). Business value

of big data analytics: A systems-theoretic approach

and empirical test. Information & Management,

57(1):103124.

Faroukhi, A., El Alaoui, I., Gahi, Y., and Amine, A. (2020).

A multi-layer big data value chain approach for secu-

rity issues. Procedia Computer Science, 175:737–744.

The 17th International Conference on Mobile Systems

and Pervasive Computing (MobiSPC),The 15th Inter-

national Conference on Future Networks and Commu-

nications (FNC),The 10th International Conference on

Sustainable Energy Information Technology.

Fast, V., Schnurr, D., and Wohlfarth, M. (2021). Data-

driven competitive advantages in digital markets: An

overview of data value and facilitating factors. In

Ahlemann, F., Sch

¨

utte, R., and Stieglitz, S., editors,

Innovation Through Information Systems, pages 454–

454, Cham. Springer International Publishing.

Geerts, G. and O’Leary, D. (2022). V-matrix: A wave the-

ory of value creation for big data. International Jour-

nal of Accounting Information Systems, 47:100575.

Gervasi, M., Totaro, N. G., Fornaio, A., and Caivano, D.

(2023a). Big data value graph: Enhancing security

and generating new value from big data. In Pro-

ceedings of the Italian conference on cyber security

(ITASEC 2023), volume 3488. CEUR-WS, Bari.

Gervasi, M., Totaro, N. G., Specchia, G., and Latino, M. E.

(2023b). Unveiling the roots of big data project

failure: a critical analysis of the distinguishing fea-

tures and uncertainties in evaluating big data potential

value. In Proceedings of the 2nd Italian conference

on big data and data science (ITADATA 2023), vol-

ume 3606. CEUR-WS, Naples.

Graef, I., Tombal, T., and De Streel, A. (2019). Limits

and enablers of data sharing. an analytical framework

for eu competition, data protection and consumer law.

SSRN Electronic Journal.

Grander, G., Da Silva, L. F., Gonzalez, E. D. R. S., and

Penha, R. (2022). Framework for structuring big data

projects. Electronics, 11(21):3540.

Gupta, M. and George, J. F. (2016). Toward the develop-

ment of a big data analytics capability. Information &

Management, 53(8):1049–1064.

Data Network Game: Enabling Collaboration via Data Mesh

91

Hechler, E., Weihrauch, M., and Wu, Y. (2023). Evolution

of data architecture. In Data Fabric and Data Mesh

Approaches with AI: A Guide to AI-based Data Cat-

aloging, Governance, Integration, Orchestration, and

Consumption, pages 3–15. Springer.

Hensler, D. A. and Huq, F. (2005). Value creation:

knowledge flow, direction, and adaptation. Interna-

tional Journal of Learning and Intellectual Capital,

2(3):278–287.

Huang, T., Lan, L., Fang, X., An, P., Min, J., and Wang, F.

(2015). Promises and challenges of big data comput-

ing in health sciences. Big Data Research, 2(1):2–11.

Inkpen, A. C. (2005). Strategic alliances. The Blackwell

handbook of strategic management, pages 403–427.

Kathuria, V. and Globocnik, J. (2020). Exclusionary

conduct in data-driven markets: limitations of data

sharing remedy. Journal of Antitrust Enforcement,

8(3):511–534.

Kleinberg, J. M. and Oren, S. (2022). Mechanisms

for (mis)allocating scientific credit. Algorithmica,

84(2):344–378.

Konsynski, B. R. and McFarlan, F. W. (1990). Information

partnerships–shared data, shared scale. Harvard Busi-

ness Review, 68(5):114–120.

Koutroumpis, P., Leiponen, A., and Thomas, L. D. (2020).

Markets for data. Industrial and Corporate Change,

29(3):645–660.

Laney, D. (2001). 3-D Data Management: Controlling

Data Volume, Velocity, and Variety. Technical report,

META Group Res. Note.

Liang, F., Yu, W., An, D., Yang, Q., Fu, X., and Zhao, W.

(2018). A survey on big data market: Pricing, trading

and protection. Ieee Access, 6:15132–15154.

Lindstedt, D., Graziano, K., and Hultgren, H. (2009). The

business of data vault modeling. Lulu. com.

Louati, R. and Mekadmi, S. (2019). Toward a conceptual-

ization of big data value chain: From business prob-

lems to value creation. In Business Transformations

in the Era of Digitalization, pages 76–92. IGI Global.

Malthouse, E. C., Buoye, A., Line, N., El-Manstrly, D.,

Dogru, T., and Kandampully, J. (2019). Beyond re-

ciprocal: the role of platforms in diffusing data value

across multiple stakeholders. Journal of Service Man-

agement, 30(4):507–518.

Myerson, R. B. (1980). Conference structures and fair al-

location rules. International Journal of Game Theory,

9:169–182.

Pellegrino, G., Gervasi, M., Angelelli, M., and Corallo,

A. (2024). A conceptual framework for digi-

tal twin in healthcare: Evidence from a system-

atic meta-review. Information Systems Frontiers,

https://doi.org/10.1007/s10796-024-10536-4.

Peters, D. and Elkind, E. (2015). Simple causes of complex-

ity in hedonic games. In Proceedings of the Twenty-

Fourth International Joint Conference on Artificial In-

telligence, IJCAI 2015, pages 617–623.

Priebe, T., Neumaier, S., and Markus, S. (2021). Finding

your way through the jungle of big data architectures.

In 2021 IEEE International Conference on Big Data

(Big Data), pages 5994–5996. IEEE.

Ramchand, S. and Mahmood, T. (2022). Big data archi-

tectures for data lakes: A systematic literature review.

In 2022 IEEE 46th Annual Computers, Software, and

Applications Conference (COMPSAC), pages 1141–

1146. IEEE.

Reggio, G. and Astesiano, E. (2020). Big-data/analytics

projects failure: a literature review. In 2020 46th Eu-

romicro Conference on Software Engineering and Ad-

vanced Applications (SEAA), pages 246–255. IEEE.

Roos, G. (2018). Resource deployment system implica-

tions of migrating the firm into a digital value creation

paradigm. Knowledge Management Research & Prac-

tice, 16(3):281–291.

Saltz, J. S. (2015). The need for new processes, methodolo-

gies and tools to support big data teams and improve

big data project effectiveness. In 2015 IEEE Inter-

national Conference on Big Data (Big Data), pages

2066–2071. IEEE.

Sharma, V., Balusamy, B., Thomas, J. J., and Atlas, L. G.

(2023). Data Fabric Architectures: Web-Driven Ap-

plications. Walter de Gruyter GmbH & Co KG.

Shen, B., Guo, J., and Yang, Y. (2019). Medchain: Effi-

cient healthcare data sharing via blockchain. Applied

sciences, 9(6):1207.

Spulber, D. F. (2023). Antitrust and innovation competition.

Journal of Antitrust Enforcement, 11(1):5–50.

Sung, S.-C. and Dimitrov, D. (2010). Computational com-

plexity in additive hedonic games. European Journal

of Operational Research, 203(3):635–639.

Tanriverdi, H. and Venkatraman, N. (2005). Knowledge re-

latedness and the performance of multibusiness firms.

Strategic management journal, 26(2):97–119.

Tiefenbacher, K. and Olbrich, S. (2015). Increasing the

value of big data projects–investigation of indus-

trial success stories. In 2015 48th Hawaii Interna-

tional Conference on System Sciences, pages 294–

303. IEEE.

Van Panhuis, W. G., Paul, P., Emerson, C., Grefenstette, J.,

Wilder, R., Herbst, A. J., Heymann, D., and Burke,

D. S. (2014). A systematic review of barriers to data

sharing in public health. BMC public health, 14:1–9.

Woeginger, G. J. (2013a). Core stability in hedonic coalition

formation. In SOFSEM 2013: Theory and Practice of

Computer Science, 39th International Conference on

Current Trends in Theory and Practice of Computer

Science, Proceedings, pages 33–50. Springer.

Woeginger, G. J. (2013b). A hardness result for core sta-

bility in additive hedonic games. Math. Soc. Sci.,

65(2):101–104.

Wu, X., Liang, L., and Chen, S. (2022). How big data alters

value creation: Through the lens of big data compe-

tency. Management decision, 60(3):707–734.

Xiang, J., Lee, S., and Kim, J. K. (2013). Data quality and

firm performance: Empirical evidence from the ko-

rean financial industry. Information Technology and

Management, 14.

Ylijoki, O. and Porras, J. (2019). A recipe for big data

value creation. Business Process Management Jour-

nal, 25(5):1085–1100.

IoTBDS 2025 - 10th International Conference on Internet of Things, Big Data and Security

92